#Introduction to Startup Accounting

Explore tagged Tumblr posts

Text

Starting a new business venture is an exhilarating journey, but it’s crucial to lay a strong financial foundation from the outset. This begins with understanding the fundamentals of startup accounting.

#Introduction to Startup Accounting#What is Startup Accounting?#Why is Startup Accounting Important?#Setting Up Your Accounting System#Choosing the Right Accounting Software#Establishing a Chart of Accounts#Understanding Basic Accounting Principles#Managing Startup Finances#Budgeting for Startup Expenses#Tracking Revenue and Expenses#Cash Flow Management#Tax Planning for Startups

0 notes

Text

the hungry eyes series | introduction

chapter details: a journalist begins writing about the beef on an article of small businesses in chicago. will this just be a story about the startup of the original beef, or will it become something more?

author's notes: hihi everyone! welcome to the world of the hungry eyes. so, i've wanted to write a mikey series for a while now and figured this was a nice way to do so! i do just want to say (as i am literally balancing a career / life outside of tumblr + another account with a series) the chapters may take a while to be uploaded! thank you advance for your patience <3 also, this is not meant to be taken as canon in any way / will not end like how mikey's story in the bear does end. i did think about it but i couldn't bring myself to write it so you get to be saved from pure angst! woo! (i make no promises this won't include a sprinkle of angst tho)

This was the worst idea he’d ever agreed to. And it had all started with an email.

Mikey almost never actually checked the emails for the Beef. Too much shit he didn’t care enough to follow up on and he could “pretend he never got it” if it was truly important.

He knew it was a habit he needed to break. But again, that was something he didn't care to think about.

And the one day he does? A message in his inbox, reading just the line — “Interview Request.”

It was for some assistant to a journalist who wrote about smaller businesses in Chicago - Y/N Y/L/N. The email had a simple text in it:

“Hi there! We’re reaching out to see if The Original Beef of Chicagoland would like to be featured in our next print of Digestive Chicago. This would be a six week process where we interview your staff, you, customers and take a look behind the front windows! Please let us know a time and date for Y/N Y/L/N to speak with you.

All the best, the Chicago Tribune Team.”

Of course, Mikey had never considered actually taking her up on the offer. To him, it could go one of two ways.

One - it goes great and the Beef gets more customers. Better business.

Two - it all goes to hell, somehow, and Mikey gets blamed. This one was the likely scenario in his mind. It had to be, right?

But, as always, Marcus had pointed out it would be good publicity, and Natalie had told him it was needed for the Beef to actually get out there to the area.

Stupidly, he agreed. That’s how this whole ordeal started.

A journalist named Y/N showing up to his small restaurant in downtown Chicago. A notepad and tape recorder set on a table by the window, and him telling the story of how this came to be.

“So. Tell me what gave you the inspiration for The Original Beef of Chicagoland.”

Where was he supposed to begin?

#maeberzatto#mae writes: the bear#THE HUNGRY EYES SERIES#the bear fx#the bear hulu#mikey berzatto#mikey berzatto fanfic#mikey berzatto series#mikey berzatto fic#mikey berzatto fluff#the bear fanfics#the bear series#the bear fic#mikey the bear

22 notes

·

View notes

Text

Social G20, a Brazilian initiative, kicks off in Rio

From Thursday to Saturday (Nov. 14–16), Rio de Janeiro will host the Social G20, an innovation by the Brazilian government. Its program boasts a wide range of activities.

Brazil is chairing the G20 summit for the first time since 2008. Under the presidency of different nations in the past, society met in initiatives parallel to the official program. After the introduction of the Social G20, these assemblies were integrated into the schedule, broadening the dialog between countries and society. Around 50 thousand people from Brazil and around the world are expected to attend.

The 13 engagement groups making up the Social G20 are: C20 (society), T20 (think tanks), Y20 (youth), W20 (women), L20 (labor), U20 (cities), B20 (business), S20 (sciences), Startup20 (startups), P20 (parliaments), SAI20 (accounting courts), and the newest J20 (supreme courts) and O20 (oceans).

“The big photograph of the G20 will be the Social G20 in Brazil. It will be one of the great legacies that Brazil’s presidency will leave for the forum. I hope that this photograph is as plural as possible, takes place as part of the democratic debate, respectful of the political process, and effectively contributing to changing people’s lives for the better,” said Márcio Macêdo, President Lula’s secretary-general.

Continue reading.

6 notes

·

View notes

Text

Fuel Your Growth with Performance Marketing

Turn clicks into customers with laser-focused strategies and real-time results.

Introduction: Marketing That Delivers, Not Just Promises

In today’s fast-paced digital landscape, businesses no longer have the luxury of spending blindly on ads and waiting for miracles. What they need is performance marketing—a results-driven approach that focuses on conversions, not just impressions. It's data-backed, ROI-focused, and scalable, making it the future of modern marketing.

🎯 What is Performance Marketing?

Performance marketing is a digital strategy where advertisers pay only for measurable results—be it clicks, leads, sales, or app installs. Unlike traditional branding methods, performance marketing demands proof. Every campaign is trackable, every rupee spent is accountable.

Key components include:

Pay-Per-Click (PPC) advertising

Affiliate marketing

Social media paid campaigns

Native and display ads

Retargeting & programmatic advertising

💡 Why Businesses Love Performance Marketing

Performance marketing offers powerful benefits for brands across industries:

✅ Cost-Effective – No upfront lump sums; pay only for outcomes ✅ Trackable & Transparent – Live dashboards show real-time performance ✅ Highly Targeted – Reach only your ideal audience with pinpoint accuracy ✅ Scalable – Start small, test, and grow based on results ✅ Optimized for ROI – Every ad is backed by metrics that matter

From startups to big brands, everyone wants results—and this strategy delivers.

📈 Lead Generation: The Lifeline of Sales

No leads = no business. Performance marketing supercharges your sales funnel with high-quality, intent-driven leads across platforms:

Google Search & Display Network

Meta (Facebook/Instagram) Ads

LinkedIn for B2B targeting

YouTube & OTT for awareness-based targeting

Landing pages with integrated lead capture forms

By using tools like A/B testing, heatmaps, and behavioral tracking, marketers ensure that visitors convert—not just click.

🔧 Tools & Techniques that Drive Results

The magic lies in optimization. A great campaign uses:

Advanced analytics (Google Analytics, Meta Pixel, UTM tracking)

Retargeting to re-engage bounced traffic

Conversion Rate Optimization (CRO) for better lead quality

Funnel building with precise customer journeys

AI and automation for budget control and ad performance

When campaigns are backed by smart data, results are not left to chance.

🧠 Who Should Use Performance Marketing?

E-commerce brands looking to scale sales

Startups wanting fast market penetration

Service-based businesses aiming for qualified leads

Real estate, education, fintech, and healthcare sectors for niche targeting

Agencies managing multiple client portfolios

🌟 Final Word: Measure More. Waste Less.

Marketing budgets are shrinking, but expectations are growing. Performance marketing strikes the perfect balance by focusing only on what works. It’s not about shouting louder—it’s about reaching smarter.

🔗 Ready to generate real leads and real growth?

Start your performance marketing journey today!

👉 [Click Here] to explore high-ROI digital strategies!

2 notes

·

View notes

Text

How to Start a Business from Scratch in 2025 – A Step-by-Step Guide for New Founders

Thinking about launching your own business but don’t know where to begin? You’re not alone. In 2025, starting a business from scratch is more accessible—and more competitive—than ever before. Here’s how to do it right.

🚀 Introduction: Why 2025 Is the Perfect Year to Start a Business

The rules of entrepreneurship are changing fast. Thanks to AI tools, digital platforms, and remote work, building a business from scratch has never been more possible—or more exciting.

But with opportunity comes complexity. The startup world in 2025 is competitive, fast-paced, and constantly evolving. If you’ve got an idea and the ambition to bring it to life, this guide will walk you through how to start a business from scratch—step by step.

Whether you’re launching a tech startup, a local service, or a creative venture, this practical roadmap will help you move from dream to launch with clarity and confidence. Importance of Startups for India’s Economy

Startups play a pivotal role in shaping India’s economy by creating jobs, fostering innovation, and contributing significantly to GDP growth. As of 2022, startups accounted for about 2.64% of employment in the Indian market, highlighting their importance. The government of India has recognized this potential and launched various initiatives, such as the Startup India scheme, to support startup growth through funding, mentorship, and favorable policies. This ecosystem has propelled India into the ranks of top global leaders in innovation and entrepreneurship.

Step 1: Validate Your Business Idea

Don’t build before you validate.

Many new entrepreneurs fall in love with their idea before checking if people actually need it. In 2025, with customer attention at a premium, market validation is non-negotiable.

Here’s how to validate:

Talk to potential customers (online or offline).

Use tools like Google Trends, Reddit, and Quora to check demand.

Launch a quick landing page with tools like Carrd or Webflow and collect signups.

Offer a pre-sale or pilot to gauge interest.

If no one bites, pivot or refine.

Step 2: Do Market Research

Understand your customers, competitors, and trends.

Before spending time or money, study the landscape. What’s trending in your industry? Who else is offering similar products or services?

Use:

Google & YouTube for trend spotting.

SEMrush or Ubersuggest for keyword and competitor analysis.

Statista, CB Insights, or even Instagram/TikTok for emerging consumer behavior.

Find your edge. Your unique value proposition (UVP) is what will separate you from the noise in 2025.

Step 3: Write a Simple Business Plan

This isn’t corporate homework—it’s your action blueprint.

In 2025, your business plan doesn’t have to be 40 pages long. Keep it lean, focused, and useful. Include:

What you’re selling

Who it’s for

How you’ll reach customers

Cost to build/operate

Revenue model (how you’ll make money)

Short-term and long-term goals

Tools like Notion, LivePlan, or Canva Business Plan templates can help make it painless.

Step 4: Choose a Business Name & Register It

Your brand starts with a name.

Make it:

Easy to remember

Easy to spell

Relevant to your offering

Available online (domain + social handles)

Use tools like Namechk, GoDaddy, or NameMesh to check availability. Once chosen, register it in your country or state. In India, use the MCA (Ministry of Corporate Affairs) portal. In the US, check with your Secretary of State’s website.

Don’t forget to buy the domain and secure the social media handles.

Step 5: Handle Legal & Financial Basics

Yes, it’s boring—but skipping it can cost you.

Choose a business structure (sole proprietorship, LLP, private limited, etc.)

Apply for licenses or permits based on your industry.

Open a business bank account.

Set up accounting tools like Zoho Books, QuickBooks, or even Excel if you're bootstrapping.

Separate personal and business finances from day one.

If unsure, talk to a startup consultant or accountant. Step 6 : Choose the Right Business Structure

In 2025, many new founders prefer flexible setups that protect their personal assets and allow easy growth. You can choose from:

Sole Proprietorship (easy, but less protection)

LLP/LLC (more legal protection, preferred for small businesses)

Private Limited Company (ideal for startups looking to raise funds)

Each country has its own rules, so check your local regulations or consult a business advisor.

Step 7 : Build Your Online Presence

If you’re not online, you’re invisible.

In 2025, your digital presence is as important as your product. Get started with:

A clean, responsive website (WordPress, Wix, or Webflow)

Active social media profiles (LinkedIn, Instagram, YouTube, depending on your audience)

A basic Google Business Profile if you’re local

Email marketing tools like Mailchimp or Beehiiv

Build credibility through consistency, not perfection.

Step 8: Create a Minimum Viable Product (MVP)

Start simple, launch fast.

Whether it’s a physical product, digital service, or mobile app, launch with the minimum set of features needed to test real demand.

Your MVP might be:

A no-code app built with Glide or Bubble

A service offered through DMs and GPay

A prototype product made by hand

Speed is your friend. Launch. Learn. Improve.

Step 9: Start Marketing Early

If you build it, they won’t come—unless you market it.

Use cost-effective methods to start:

Organic social media content

Blogging and SEO (try ChatGPT to draft posts!)

Influencer partnerships or product seeding

Referral programs or giveaways

Cold outreach (emails, DMs, calls)

In 2025, community is currency—build yours early and nurture it.

Step 10: Explore Funding Options (If Needed)

If your startup requires capital, explore:

Bootstrapping (your own savings)

Friends & family

Crowdfunding (Kickstarter, Ketto, etc.)

Angel investors or venture capital

Startup accelerators or incubators

Pro tip: Even if you’re not raising money yet, create a pitch deck. It clarifies your vision and makes you look investor-ready.

Benefits of Government Schemes for Startups1. Financial Support: 2. Tax Exemption 3. Simplified Compliance 4. Easier Public Procurement 5. IPR Support 6. Access to Funding 7. Incubation and Mentorship 8. Mentorship and Skill Development 9. Networking Opportunities 10.Promotion of Innovation

Conclusion: 2025 Is the Best Time to Build. So Start.

Starting a business from scratch isn’t about waiting for the “perfect” moment. It’s about taking the first small step, validating, building smart, and learning fast.

In 2025, you don’t need a million-dollar idea. You need clarity, a problem to solve, and the grit to keep going.

✅ Ready to launch your startup?

At Innomax Startup Advisory, we help first-time founders go from idea to impact with mentorship, incubation, funding support, and everything in between. Don’t do it alone—get expert help that actually moves you forward.

👉 Visit https://innomaxstartup.com/ to get started. Your business starts now Let’s build it—step by step.

2 notes

·

View notes

Text

Company Registration India by Mercurius & Associates LLP

Introduction

Starting a business in India is an exciting journey, but navigating the legalities can be overwhelming. Company registration in India is a crucial step that provides legal recognition to your business. At Mercurius & Associates LLP, we offer expert guidance to simplify the company registration process, ensuring compliance with all regulatory requirements.

Types of Business Entities in India

Before registering a company, it is essential to understand the various types of business structures available:

Private Limited Company (Pvt Ltd) – The most preferred structure for startups and SMEs.

Public Limited Company – Suitable for large businesses looking to raise capital from the public.

Limited Liability Partnership (LLP) – Ideal for professionals and small enterprises.

One Person Company (OPC) – Best for single entrepreneurs seeking limited liability.

Sole Proprietorship – Simplest structure, but lacks legal distinction from the owner.

Partnership Firm – Suitable for small businesses with multiple owners.

Benefits of Registering a Company in India

Registering your business provides numerous advantages, such as:

Legal Recognition – Gives your business a distinct legal identity.

Limited Liability Protection – Safeguards personal assets from business risks.

Enhanced Credibility – Boosts trust among investors, customers, and partners.

Easy Fundraising – Enables access to bank loans, investors, and venture capital.

Tax Benefits – Offers various exemptions and deductions under Indian tax laws.

Step-by-Step Process of Company Registration India

Obtain Digital Signature Certificate (DSC)

The first step involves acquiring a DSC for all directors and shareholders. This is necessary for electronically signing registration documents.

Apply for Director Identification Number (DIN)

A DIN is a unique identification number required for individuals who wish to become company directors.

Name Reservation with RUN (Reserve Unique Name) Service

Choose a unique business name and get it approved through the MCA’s RUN service.

Draft and File Incorporation Documents

Prepare and submit the Memorandum of Association (MoA) and Articles of Association (AoA) along with Form SPICe+ on the MCA portal.

PAN & TAN Application

Upon successful verification, the company receives its Permanent Account Number (PAN) and Tax Deduction and Collection Account Number (TAN) from the Income Tax Department.

GST Registration & Compliance

If applicable, register for GST to ensure tax compliance and smooth business operations.

Open a Business Bank Account

After incorporation, open a corporate bank account to manage transactions under the company’s name.

Why Choose Mercurius & Associates LLP for Company Registration?

At Mercurius & Associates LLP, we provide end-to-end assistance in company registration with:

Expert Guidance – Our professionals simplify complex legal procedures.

Hassle-Free Processing – Quick and seamless company incorporation.

Affordable Pricing – Competitive pricing with no hidden charges.

Post-Registration Support – Ongoing compliance and legal advisory services.

Conclusion

Registering a company in India is a strategic move that offers multiple benefits. With Mercurius & Associates LLP, you can ensure a smooth and compliant company registration process tailored to your business needs. Contact us today to start your entrepreneurial journey!

2 notes

·

View notes

Text

Professional Audit Firm in Dubai, UAE

Dubai, a global hub for business and innovation, is home to thousands of companies operating in diverse industries. With its dynamic economy and stringent regulatory environment, businesses in Dubai must prioritize financial transparency, compliance, and operational efficiency. This is where a professional audit firm in Dubai plays a critical role. Whether you're a startup, SME, or multinational corporation, partnering with a reputable audit firm can help you navigate complex financial landscapes and achieve long-term success.

Why Choose a Professional Audit Firm in Dubai?

Ensuring Regulatory Compliance Dubai’s regulatory framework is robust and constantly evolving. A best audit firm ensures your business complies with local laws, international accounting standards, and tax regulations. This is especially important for companies operating in free zones or those subject to VAT and corporate tax requirements.

Enhancing Financial Transparency Audits provide a clear and accurate picture of your financial health. By identifying discrepancies, inefficiencies, and potential risks, a professional audit firm helps you maintain transparency and build trust with stakeholders, investors, and regulatory authorities.

Fraud Prevention and Risk Management Fraud and financial mismanagement can have devastating consequences for any business. Audit firms in Dubai use advanced tools and methodologies to detect irregularities, strengthen internal controls, and mitigate risks, safeguarding your assets and reputation.

Improving Operational Efficiency Through detailed financial analysis and recommendations, audit firms help businesses streamline processes, reduce costs, and optimize resource allocation. This leads to improved operational efficiency and profitability.

Supporting Business Growth A leading audit firm doesn’t just identify problems—it provides actionable insights to drive growth. From strategic financial planning to compliance advisory, these firms empower businesses to make informed decisions and seize new opportunities.

Services Offered by Audit Firms in Dubai

Statutory Audits: Ensuring compliance with legal and regulatory requirements.

Internal Audits: Evaluating internal controls, risk management, and operational efficiency.

Tax Audits: Assisting with VAT, corporate tax, and other tax-related compliance.

Forensic Audits: Investigating financial irregularities and fraud.

Due Diligence: Supporting mergers, acquisitions, and investments with thorough financial analysis.

Advisory Services: Providing strategic guidance on financial planning, compliance, and business growth.

Why Dubai Businesses Trust Professional Audit Firms

Dubai’s business landscape is highly competitive, and companies must adhere to international standards to thrive. Premier audit firms in Dubai bring a wealth of expertise, local knowledge, and global best practices to the table. They understand the unique challenges businesses face in the region and offer tailored solutions to meet their needs.

Moreover, with the introduction of corporate tax and evolving VAT regulations, the role of audit firms has become even more critical. They help businesses stay ahead of regulatory changes, avoid penalties, and maintain a strong financial footing.

Choosing the Right Audit Firm in Dubai

When selecting an audit firm, consider the following factors:

Reputation and Experience: Look for a firm with a proven track record and expertise in your industry.

Range of Services: Ensure the firm offers comprehensive services to meet your specific needs.

Technology and Tools: Choose a firm that leverages advanced technology for accurate and efficient audits.

Client-Centric Approach: Opt for a firm that prioritizes your business goals and provides personalized solutions.

Conclusion

In a city as dynamic and competitive as Dubai, partnering with a professional audit firm is not just a regulatory requirement—it’s a strategic decision for long-term success. From ensuring compliance to driving growth, audit firms play a vital role in helping businesses navigate financial challenges and achieve their goals.

If you’re looking for a trusted partner to safeguard your financial health and unlock new opportunities, it’s time to collaborate with a leading audit firm in Dubai. Take the first step toward financial excellence and compliance today!

Halsca: Your Trusted Audit Partner in Dubai

At Hussain Al Shemsi Chartered Accountants, we specialize in providing top-tier audit and advisory services tailored to your business needs. With our team of experienced professionals and commitment to excellence, we help businesses in Dubai achieve financial transparency, compliance, and growth. Contact us today to learn how we can support your success!

2 notes

·

View notes

Text

How Reliance Jio Coin Could Transform India's Crypto Market

The Indian cryptocurrency market is on the verge of a major transformation, and the introduction of Reliance Jio Coin could serve as a significant catalyst. As one of India's largest conglomerates, Reliance has a history of disrupting industries, and its foray into blockchain and cryptocurrency is highly anticipated.

What Is Reliance Jio Coin?

Reliance Jio Coin is rumored to be a digital cryptocurrency developed by Reliance Jio, a subsidiary of Reliance Industries Limited (RIL). The coin aims to facilitate digital transactions, promote blockchain adoption, and potentially integrate with Jio's vast telecom and e-commerce ecosystem.

The Growing Interest in Cryptocurrency in India

India has witnessed a surge in crypto adoption, despite regulatory uncertainties. Factors such as technological advancements, increased smartphone penetration, and digital payments adoption have fueled interest in blockchain and cryptocurrency.

Potential Benefits of Jio Coin

Reliance Jio Coin could bring numerous benefits to the Indian crypto market, including:

Mass Adoption of Digital Currency – Jio has over 400 million users, providing a large user base for Jio Coin.

Blockchain Innovation – It could promote blockchain technology adoption across various industries.

Seamless Integration with Jio Platforms – Possible use cases in JioMart, JioFiber, and JioMoney.

Regulatory Compliance – Reliance’s credibility may facilitate government support.

Financial Inclusion – Can help unbanked populations participate in digital finance.

Challenges Facing Jio Coin’s Implementation

While the potential is vast, Reliance Jio Coin must overcome several challenges:

Regulatory Uncertainty – India’s stance on crypto regulations is still evolving.

User Awareness and Education – Widespread adoption requires education on cryptocurrency.

Market Volatility – Cryptocurrencies experience price fluctuations that may impact adoption.

Security Concerns – Ensuring data and transaction security is crucial.

How Jio Coin Can Shape India's Crypto Future

Reliance Jio Coin could act as a game-changer in the Indian cryptocurrency space. By leveraging Reliance's technological infrastructure, it could lead to:

Greater public trust in cryptocurrencies.

Increased innovation in decentralized finance (DeFi).

The emergence of blockchain-based government and enterprise solutions.

The Role of Blockchain in Jio Coin’s Success

Blockchain technology is at the core of any cryptocurrency. For Jio Coin to be successful, it must ensure:

Transparency – Every transaction should be recorded on a public ledger to ensure security and accountability.

Scalability – Handling large transaction volumes efficiently will be essential.

Smart Contracts – Enabling automation and reducing intermediaries in transactions.

Energy Efficiency – Exploring eco-friendly consensus mechanisms like Proof of Stake (PoS).

Possible Use Cases of Jio Coin

Jio Coin could extend beyond just a digital currency. Some potential applications include:

Retail Payments – Users may use Jio Coin for everyday transactions via JioMoney.

E-commerce Integration – JioMart could accept Jio Coin, boosting online shopping adoption.

Supply Chain Management – Blockchain-powered logistics solutions to enhance transparency.

Tokenized Assets – Real estate and stock investments via tokenization.

Loyalty Rewards – Customers could earn Jio Coin as part of promotional campaigns.

Impact on India's Digital Economy

With India's digital payment ecosystem already thriving, Jio Coin could:

Reduce dependency on traditional banking by offering decentralized financial solutions.

Encourage foreign investment in Indian blockchain startups.

Support the government’s Digital India initiative by accelerating fintech innovation.

Create new job opportunities in blockchain development, security, and compliance.

Future Roadmap for Jio Coin

If Jio Coin becomes a reality, the following steps might be taken:

Regulatory Approvals – Securing legal compliance before public launch.

Initial Pilot Programs – Testing Jio Coin with select users and businesses.

Mass Adoption Campaigns – Promoting awareness and incentivizing usage.

Expanding Use Cases – Integrating with more sectors like healthcare and education.

Global Expansion – Partnering with international crypto exchanges for trading.

Conclusion

Reliance Jio Coin has the potential to revolutionize India's crypto landscape. While challenges remain, the credibility and market dominance of Reliance Jio could pave the way for mass adoption and regulatory clarity in the sector. If executed effectively, Jio Coin could emerge as India’s leading digital currency, setting a precedent for corporate-backed cryptocurrencies.

2 notes

·

View notes

Text

Professional Tax Consultants in Delhi, India by SC Bhagat & Co.

Managing taxes efficiently is critical for individuals and businesses alike. Whether it's navigating complex tax laws, ensuring timely compliance, or optimizing tax savings, having an expert guide is invaluable. SC Bhagat & Co., a renowned name in the financial and accounting domain, offers top-notch services as professional tax consultants in Delhi India.

With years of expertise and a commitment to excellence, SC Bhagat & Co. provides comprehensive tax solutions tailored to your needs.

Why Choose SC Bhagat & Co. as Your Tax Consultant?

Expertise in Indian Tax Laws Navigating India's intricate tax system can be overwhelming. SC Bhagat & Co. brings years of experience in handling all aspects of taxation, including income tax, GST, TDS, and corporate tax, ensuring full compliance and minimizing liabilities.

Comprehensive Tax Solutions The firm caters to both individuals and businesses, offering services such as:

Income tax planning and filing GST registration and compliance Tax audits and assessments Representation before tax authorities Advisory on international taxation

Personalized Tax Strategies At SC Bhagat & Co., every client’s financial situation is carefully analyzed. Their team develops tailored strategies to optimize tax savings while ensuring strict adherence to legal requirements.

Trusted by Businesses Across Sectors SC Bhagat & Co. has built a reputation as a reliable partner for businesses across various industries. From startups to large corporations, their services are trusted by clients seeking seamless tax management.

Key Tax Consulting Services Offered

Income Tax Filing and Advisory Avoid penalties and maximize savings with SC Bhagat & Co.'s expert income tax filing services. Their team ensures accurate filing, helps identify deductions, and provides actionable advice for better financial management.

GST Services With the introduction of GST in India, compliance has become more critical than ever. SC Bhagat & Co. offers:

GST registration Filing of GST returns Input tax credit optimization GST audits

Corporate Taxation SC Bhagat & Co. provides end-to-end corporate tax solutions, including tax planning, audits, and representation during scrutiny. They help businesses align with tax regulations while achieving financial efficiency.

Tax Audit Services Their tax audit services ensure that financial records comply with tax regulations, minimizing the risk of disputes and penalties.

TDS Compliance Stay compliant with TDS (Tax Deducted at Source) regulations. SC Bhagat & Co. assists with TDS calculation, filing, and rectification of any discrepancies.

Benefits of Hiring Professional Tax Consultants in Delhi India Save Time and Resources: Tax consultants streamline processes, allowing you to focus on your core business operations. Reduce Errors: Accurate calculations and filings prevent unnecessary penalties or legal issues. Optimize Tax Savings: Professionals identify deductions, exemptions, and credits to minimize tax liabilities. Stay Compliant: Experts ensure timely filing and adherence to the latest tax laws. Why SC Bhagat & Co. Stands Out Experienced Professionals: Their team of Chartered Accountants and tax experts is well-versed in Indian and international tax laws. Client-Centric Approach: They offer personalized services that align with your financial goals. Proven Track Record: A long list of satisfied clients speaks to their reliability and excellence. Affordable Services: SC Bhagat & Co. delivers high-quality tax consulting services at competitive rates. Conclusion Tax management doesn’t have to be a daunting task when you have experts by your side. SC Bhagat & Co., with their unparalleled expertise and commitment to excellence, is your trusted partner for all tax-related needs. Whether you’re an individual, a startup, or a large corporation, their professional tax consultants in Delhi India, are equipped to handle it all.

#gst#taxation#accounting firm in delhi#accounting services#direct tax consultancy services in delhi#tax consultancy services in delhi#taxationservices#remittances

4 notes

·

View notes

Text

INTRODUCTION

OOC ~ Hello! I am Ey3sOf7heC0rrupt3d,the main operator of this Role play account. Inspired by the SMG4 community and it's role-playing blogs,I decided to create one myself but with my Infection AU,MemeWastingDisease. This is one out of many I'll be creating for the AU!

Tape startup..

Uh..hello there otherworldly mes. The name's Lullaby. Found this platform via a friend. Lullaby sighs,not wanting to do this but has to I don't really look forward to your asks and general role play with me..buutt I have to so..

5 notes

·

View notes

Text

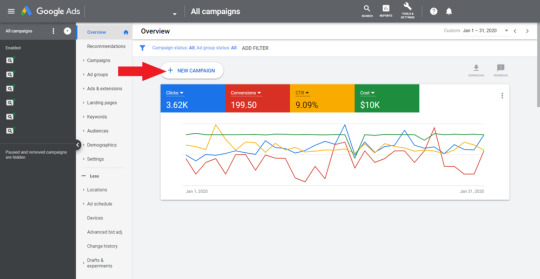

Google Ads Help to Grow Your Buisness

Mastering Google Ads: A Comprehensive Guide

As a leading Digital Marketing Agency with extensive experience in Google Ads, we understand the immense potential this platform offers for businesses of all sizes. Whether you're a small startup or an established enterprise, leveraging Google Ads effectively can be the key to driving growth, increasing brand visibility, and maximizing ROI. In this article, we’ll guide you through the intricacies of Google Ads, from setting up your first campaign to advanced optimization techniques.

1. Introduction to Google Ads

Google Ads is a powerful online advertising platform that allows businesses to reach their target audience through a variety of ad formats. Whether your goal is to generate leads, increase sales, or build brand awareness, Google Ads provides a range of tools and strategies to achieve your objectives.

2. How Google Ads Works

The Pay-Per-Click (PPC) Model: Google Ads operates on a Pay-Per-Click (PPC) model, meaning you only pay when someone clicks on your ad. This model ensures that your advertising budget is spent on potential customers who are actively interested in your products or services.

Ad Auction Process: Every time a user performs a search, Google Ads runs an auction to determine which ads will appear and in what order. The ad rank is determined by a combination of your bid amount, the quality of your ad, and the expected impact of your ad extensions.

Ad Formats: Google Ads offers a variety of ad formats, including:

Search Ads: Text ads that appear on Google search results pages.

Display Ads: Visual ads that appear on websites within Google’s Display Network.

Video Ads: Ads that appear on YouTube and other video partners.

Shopping Ads: Product-based ads that appear in Google Shopping results.

3. Setting Up a Google Ads Campaign

Creating an Account: To start using Google Ads, you need to create an account. This involves providing basic information about your business, such as your website and payment details. Once your account is set up, you can begin creating campaigns.

Choosing Campaign Objectives: Google Ads allows you to choose from several campaign objectives, such as Sales, Leads, or Website Traffic. Selecting the right objective is crucial, as it determines how your ads are optimized and where they appear.

Keyword Research and Selection: Effective keyword research is the foundation of a successful Google Ads campaign. Tools like Google’s Keyword Planner can help you identify relevant keywords that your potential customers are searching for. Selecting the right keywords ensures that your ads are shown to the right audience.

Ad Creation and Targeting: Writing compelling ad copy is essential for attracting clicks. Your ads should be clear, concise, and relevant to the user’s search intent. Google Ads also offers extensive targeting options, allowing you to reach your audience based on demographics, location, interests, and more.

Bidding Strategies: Google Ads provides various bidding strategies, including Manual CPC (Cost-Per-Click), Enhanced CPC, and Target CPA (Cost-Per-Acquisition). The choice of strategy depends on your campaign goals and budget. For example, Target CPA is ideal for campaigns focused on generating conversions.

4. Optimizing Google Ads Campaigns

Tracking and Measuring Performance: To assess the effectiveness of your Google Ads campaigns, it's crucial to set up conversion tracking. This allows you to measure actions taken by users after clicking on your ad, such as purchases or sign-ups. Key metrics to monitor include Click-Through Rate (CTR), Conversion Rate, and Quality Score.

A/B Testing: A/B testing, also known as split testing, involves running two or more variations of an ad to see which performs better. This can help you refine your ad copy, headlines, and calls-to-action to improve overall performance.

Budget Management: Effective budget management ensures that you maximize your ad spend without overspending. Google Ads allows you to set daily budgets and adjust them based on campaign performance. Allocating your budget to high-performing campaigns can lead to better results.

Continuous Optimization: Google Ads is not a “set it and forget it” platform. Regularly reviewing and optimizing your campaigns is essential for maintaining and improving performance. This might involve adjusting bids, refining keywords, or updating ad copy based on what’s working best.

5. Common Challenges and How to Overcome Them

High Competition and CPC: In competitive industries, the cost-per-click (CPC) can be high. To compete effectively, focus on improving your Quality Score by creating highly relevant ads and landing pages. Additionally, consider targeting long-tail keywords with less competition.

Ad Fatigue: Over time, users may become less responsive to your ads, a phenomenon known as ad fatigue. To combat this, regularly update your ad creatives and rotate different versions to keep your audience engaged.

Low Click-Through Rates (CTR): If your ads are not receiving enough clicks, it could indicate that they are not resonating with your audience. Improving your ad relevance, crafting stronger calls-to-action, and testing different headlines can help increase CTR.

Budget Management Issues: It’s easy to overspend on Google Ads if you’re not careful. Regularly monitoring your spend and adjusting your budgets based on performance is crucial. Focus on campaigns that deliver the best ROI and reduce spending on underperforming ones.

6. Advanced Google Ads Strategies

Remarketing: Remarketing allows you to target users who have previously visited your website but didn’t convert. By showing them tailored ads as they browse other websites, you can re-engage them and increase the likelihood of conversion.

Using Google Ads Extensions: Ad extensions provide additional information about your business, such as contact details, additional links, or promotional offers. Using extensions can improve your ad’s visibility and performance by making it more informative and appealing to users.

Automated Bidding and Smart Campaigns: Google’s automated bidding strategies use machine learning to optimize your bids in real-time, based on factors like user behavior and conversion history. Smart Campaigns are a fully automated option that can simplify campaign management, especially for small businesses.

Integration with Google Analytics: Linking your Google Ads account with Google Analytics provides deeper insights into user behavior on your website. This data can help you refine your campaigns and improve targeting by understanding how users interact with your site after clicking on your ads.

7. Case Studies and Success Stories

Examples of Successful Google Ads Campaigns: We've seen numerous success stories across various industries where Google Ads played a pivotal role in driving business growth. For instance, a client in the e-commerce sector achieved a 200% increase in online sales within six months by leveraging a combination of Search Ads and remarketing strategies.

What Can Be Learned from Failures: Not every campaign is a success, and there are valuable lessons to be learned from failures. Common pitfalls include poor keyword selection, lack of targeting, and inadequate budget management. Learning from these mistakes can help you avoid them in your future campaigns.So get attach with expertise of Imagency Media Ad Service

8. Future Trends in Google Ads

Automation and AI in Google Ads: The future of Google Ads is increasingly focused on automation and artificial intelligence. These technologies are enabling more precise targeting and bid optimization, allowing advertisers to achieve better results with less manual intervention.

Privacy Concerns and Regulations: As privacy regulations evolve, Google Ads is adapting by offering more privacy-focused solutions. This includes new ways to target users without relying on third-party cookies, ensuring that advertisers can continue to reach their audience while respecting user privacy.

9. Conclusion

Google Ads remains one of the most effective tools for driving online traffic and achieving business goals. By understanding how the platform works and continuously optimizing your campaigns, you can achieve significant results. As a trusted digital marketing agency, we are here to help you navigate the complexities of Google Ads and unlock its full potential for your business. Whether you're just starting or looking to optimize existing campaigns, our expertise can help you achieve your marketing objectives.

#digital marketing#digital services#google ads#search engine optimization#seo#social media marketing#branding#business

2 notes

·

View notes

Text

Streamline Your Business with Outsource bookkeeping services in USA by MAS LLP

Introduction: In today's fast-paced business environment, staying on top of your financial records is crucial. However, managing bookkeeping in-house can be time-consuming and costly. That's where outsource bookkeeping services come into play. If you're looking to Outsource bookkeeping services in USA, MAS LLP offers comprehensive solutions designed to meet your business needs. In this blog, we'll explore the benefits of outsourcing bookkeeping and how MAS LLP can help streamline your financial operations.

The Benefits of Outsourcing Bookkeeping Services

Cost Savings Outsourcing bookkeeping can significantly reduce your overhead costs. By partnering with MAS LLP, you eliminate the need for hiring full-time staff, training expenses, and costly accounting software. This allows you to allocate resources more efficiently and invest in other critical areas of your business.

Expertise and Accuracy At MAS LLP, our team of professional bookkeepers possesses extensive experience and knowledge in managing financial records. We ensure that your books are accurate, up-to-date, and compliant with the latest regulations. With our expertise, you can avoid costly errors and ensure your financial data is reliable.

Time Efficiency Outsourcing bookkeeping frees up valuable time for you and your team. Instead of spending hours on data entry and financial reconciliations, you can focus on core business activities such as sales, marketing, and customer service. MAS LLP takes care of your bookkeeping needs, allowing you to concentrate on growing your business.

Scalability As your business grows, so do your bookkeeping needs. MAS LLP provides scalable solutions that can adapt to your changing requirements. Whether you're a startup or a large corporation, our services can be tailored to meet the demands of your business at every stage.

Advanced Technology MAS LLP utilizes cutting-edge accounting software and technology to streamline bookkeeping processes. Our cloud-based solutions offer real-time access to your financial data, ensuring transparency and enabling you to make informed decisions quickly. Why Choose MAS LLP for Outsource bookkeeping services in USA?

Comprehensive Services MAS LLP offers a wide range of bookkeeping services, including accounts payable and receivable, bank reconciliations, financial statement preparation, payroll processing, and tax filing. Our comprehensive approach ensures that all aspects of your financial management are covered.

Customized Solutions We understand that every business is unique. MAS LLP provides customized bookkeeping solutions tailored to your specific needs and industry requirements. Our personalized approach ensures that you receive the support necessary to achieve your financial goals.

Reliable Support At MAS LLP, we pride ourselves on delivering exceptional customer service. Our dedicated team is always available to address your queries and provide the support you need. We build strong relationships with our clients, ensuring that your business receives the attention it deserves.

Compliance and Security Maintaining compliance with financial regulations is critical for any business. MAS LLP ensures that your financial records are in line with the latest standards and regulations. Additionally, we prioritize data security, employing robust measures to protect your sensitive financial information. How to Get Started with MAS LLP Getting started with MAS LLP's outsource bookkeeping services is simple. Here's a step-by-step guide: Initial Consultation: Contact us to schedule a consultation. We'll discuss your business needs and determine how our services can best support you. Customized Plan: Based on our discussion, we'll create a customized bookkeeping plan tailored to your specific requirements. Onboarding: Our team will guide you through the onboarding process, ensuring a smooth transition to our services. Ongoing Support: Once onboard, you'll receive continuous support and regular updates on your financial records. Conclusion Outsource bookkeeping services in USA with MAS LLP can transform the way you manage your business finances. With cost savings, expert accuracy, time efficiency, and scalability, our services offer a strategic advantage for businesses of all sizes. Contact MAS LLP today to learn more about how we can streamline your financial operations and help your business thrive.

#accounting & bookkeeping services in india#businessregistration#chartered accountant#foreign companies registration in india#income tax#auditor#audit#taxation#ap management services

6 notes

·

View notes

Text

CPA in India from Raaas is a Smart Business Decision

Introduction: Navigating the complexities of financial management and taxation in India can be a daunting task for businesses and individuals alike. That’s where a Certified Public Accountant (CPA) comes in. When you choose a CPA in India from Raaas, you’re not just hiring an accountant; you’re partnering with experts who bring unparalleled knowledge and expertise to the table. In this blog, we’ll explore the benefits of working with a CPA from Raaas and how they can help streamline your financial operations. Understanding the Role of a CPA A Certified Public Accountant (CPA) is a highly qualified financial professional who has met stringent education and experience requirements, and passed a rigorous examination. CPAs are trusted advisors who provide a range of services, including auditing, tax planning, financial consulting, and compliance. Why You Need a CPA in India

Expertise in Indian Tax Laws India’s tax laws are complex and ever-changing. A CPA from Raaas is well-versed in the intricacies of these regulations, ensuring that your business remains compliant and optimized for tax efficiency. Their expertise can help you navigate everything from GST to corporate tax, minimizing liabilities and avoiding penalties.

Strategic Financial Planning Financial planning is crucial for long-term business success. CPAs from Raaas provide strategic advice tailored to your business needs, helping you make informed decisions. They analyze your financial data, identify trends, and offer insights that drive growth and profitability.

Accurate Financial Reporting Accurate financial reporting is essential for stakeholders, investors, and regulatory bodies. A CPA from Raaas ensures that your financial statements are precise and compliant with Indian Accounting Standards (Ind AS). This accuracy not only builds trust but also aids in securing financing and investment.

Audit and Assurance Services Regular audits are necessary to maintain transparency and integrity in financial operations. CPAs from Raaas conduct thorough audits, providing assurance that your financial practices are sound and your records are accurate. This is especially important for publicly traded companies and organizations seeking funding. Why Choose Raaas for Your CPA Needs

Experienced Professionals Raaas boasts a team of experienced CPAs who bring a wealth of knowledge and expertise to the table. Our professionals have extensive experience across various industries, ensuring that they understand the unique challenges and opportunities your business faces.

Customized Solutions We understand that every business is unique. Raaas offers customized accounting and financial solutions tailored to your specific needs. Whether you’re a small startup or a large corporation, our CPAs provide services that align with your goals and requirements.

Commitment to Excellence At Raaas, we are committed to delivering excellence in every service we provide. Our CPAs undergo continuous training to stay updated with the latest industry trends and regulatory changes. This commitment ensures that you receive the highest quality service at all times.

Proactive Approach We don’t just react to financial issues; we anticipate them. Raaas takes a proactive approach to financial management, identifying potential problems before they arise and implementing strategies to mitigate risks. This forward-thinking mindset helps you stay ahead in a competitive market. Services Offered by Raaas CPAs in India

Tax Planning and Compliance Our CPAs provide comprehensive tax planning and compliance services, ensuring that you meet all regulatory requirements while optimizing your tax position.

Audit and Assurance Raaas offers rigorous audit and assurance services to help you maintain transparency and trust with stakeholders.

Financial Consulting Our financial consulting services include budgeting, forecasting, and strategic planning to drive business growth and profitability.

Bookkeeping and Accounting Raaas provides accurate and timely bookkeeping and accounting services, helping you maintain clear and up-to-date financial records. Conclusion Choosing a CPA in India from Raaas is a strategic move for any business seeking to enhance financial management and ensure compliance. With our team of experienced professionals, customized solutions, and commitment to excellence, Raaas stands out as a trusted partner in your financial journey. Contact us today to learn more about how we can support your business with our top-tier CPA services.

#cashflow#charted accountant#form 16#msme registration#private limited company registration in india#setting up a subsidiary in india#company registration in india#startup in india#cpa in india

2 notes

·

View notes

Text

Offshore Development Centre (ODC) The Complete Guide

Offshore Development Centre (ODC) The Complete Guide:

An ODC is a development company that provides you with software development services but is located in another country. It is deemed that this type of company is a subsidiary of your main company. In comparison to the country where the holding firm is headquartered, the country where ODC is located has significantly lower living standards. The ODC model has been used by IT companies to offshore the design, development, and testing of their products. The demands of clients for products that can be deployed much faster, and the limitations of in-house resources such as cost, development time, infrastructure, and availability of specialized skills are the main reasons for companies to have an ODC. The IT company as the client will partner with an offshore provider to establish an offshore team in the country of the provider

Introduction:

Are you trying to boost your company's output, organize, and manage your operations in a quicker, more affordable, and more effective manner? Look no further—an offshore development center (ODC) could be the solution to your business's process problems. We will examine an ODC's definition, operation, and advantages in further detail in this comprehensive guide. Additionally, we will offer some advice on how to organize and lead an ODC team.

What is an Offshore Development Center (ODC)?

An offshore development center is an extended, integrated, and dedicated offshore team supporting a company located in another country. An ODC is a popular business model for different kinds of companies, including startups and enterprise companies. Various corporate processes and services, including the development and upkeep of solutions and software, project management, testing and migration, and technical or customer support, have all made use of this approach.

The term "ODC" refers to a software development business that offers you services but is based elsewhere. This kind of business is thought to be an affiliate of your primary business. Comparatively speaking, the country where ODC is based has far lower living standards than the nation where the holding company is based. The ODC model has been used by IT companies to offshore the design, development, and testing of their products. The demands of clients for products that can be deployed much faster, and the limitations of in-house resources such as cost, development time, infrastructure, and availability of specialized skills are the main reasons for companies to have an ODC. The IT company as the client will partner with an offshore provider to establish an offshore team in the country of the provider.

How is ODC Different from Outsourcing?

ODC is slightly different from software outsourcing. ODC provides services or products and is located in another country, while outsourcing is a service that offers certain services or products from a third-party company, and the geographical location might not be a critical factor. The main purpose of outsourcing is to increase productivity and focus on other important tasks while saving cost can be one of the reasons, but it is not the fundamental cause. On the other hand, ODC's primary cause is to help reduce the company's expenses by utilizing the cost difference between the two countries.

However, both ODC and outsourcing share the same interest: to get access to a large talented developers pool with lower costs for development services, which allows enterprises to save funds and speeding up the productivity in recruiting, optimizing accounting, human resources, and office budgets.

Advantages of ODC:

Forming a business partnership with an ODC provider yields a lot of benefits to your company. These are the advantages of having an ODC:

Cost Reduction:

One of the major advantages of having an ODC is cost reduction. By establishing an offshore development center, you don't have to spend on setting up office facilities and equipment, communications and IT infrastructure, and utilities because the offshore provider has already set up the necessary infrastructure. The provider can focus on hiring the members of the offshore team so a project start-up can begin much faster compared to starting everything from scratch.

Auto scaling your IT department:

Auto scaling is the process of dynamically allocating resources to match performance requirements. The number of resources that your company needs may fluctuate according to the requirements of specific projects. There are situations when projects need a large numbers of resources, and then there are times they require few resources. When those situations happen, you might have to switch and reduce resources or tasks in your in-house team, which may involve a complicated process of resources allocation. With an ODC, the allocation of resources will be less difficult because the offshore team can absorb the roles or tasks from the in-house team.

Reliable Operations:

Leading ODC companies are efficient, lean, and reliable in their operations to attract clients in a competitive market. They have efficient evaluation and reporting procedures to be accountable and transparent with their clients. Real-time evaluation and development monitoring of the projects they are working on will be possible. If you are dissatisfied with the project's results, you can demand from the ODC to redo the project with no additional costs if your contract with them stipulates this.

Timely Delivery of Projects:

An ODC operates under optimized environments and implements streamline procedures to ensure your projects are completed on time. They strictly follow the project timelines that you set for them from planning, design, development, testing, and deployment. The seamless collaboration between the in-house team and the offshore team makes it possible for the project software lifecycle to have shorter timeframes.

Technical Support and Knowledge Retention:

ODCs offer continuous technical support during the entire lifecycle of the project as part of their customer satisfaction. Their approach to knowledge retention is preserving all the knowledge gained during a project's lifecycle. The retained knowledge can be further developed and improvised so you can use it for other projects.

Access to the Best Skills and Technology:

The best ODCs employ highly qualified IT professionals with specialized skills in developing customized software for your targeted customers. Their offshore teams.

Conclusion:

Offshore development centers offer a cost-effective solution for custom software development. By setting up an ODC in a country where the cost of living is lower, companies can hire highly skilled professionals at a lower cost. ODCs also offer greater flexibility in project management and access to a larger talent pool. However, setting up an offshore development center requires careful planning and consideration. Companies need to identify the right country and find a reliable vendor to set up the ODC. They also need to be prepared to overcome the challenges that come with working with an offshore team. Overall, offshore development centers are a viable solution for companies looking to develop erp software without incurring the high costs of in-house

4 notes

·

View notes

Text

Unlocking the Potential: Exploring VPS Hosting Use Cases

In today's digital landscape, hosting solutions play a pivotal role in determining the success and performance of websites, applications, and businesses. Virtual Private Server (VPS) hosting has emerged as a versatile and efficient hosting solution that caters to a wide range of use cases. Whether you're a small business owner, an e-commerce entrepreneur, or a developer seeking powerful yet affordable hosting, Linux VPS hosting can be the key to unlocking your digital ambitions.

1. Website Hosting for Small Businesses

For small businesses and startups, establishing a robust online presence is paramount. VPS hosting provides an ideal platform for hosting business websites. With dedicated resources, enhanced security, and scalability, VPS hosting ensures that your website can handle traffic spikes, offer a seamless user experience, and support e-commerce functionalities.

2. E-Commerce Empowerment

E-commerce businesses thrive on speed, reliability, and secure transactions. VPS hosting offers the perfect environment for e-commerce websites. It provides the resources necessary to handle a large product catalog, high-resolution images, and online transactions. With the ability to install SSL certificates, VPS hosting ensures a secure shopping experience for your customers.

3. Application Development and Testing

Developers often require an isolated environment to build, test, and deploy applications. VPS hosting allows developers to create multiple virtual instances on a single physical server. This makes it an ideal choice for development and testing, enabling developers to work in a controlled and secure space.

Read Similar: Desktop Virtualization 101: An In-Depth Introduction

4. Content Management Systems (CMS)

Popular CMS platforms like WordPress, Joomla, and Drupal are the backbone of millions of websites. VPS hosting provides the necessary resources to run these CMS platforms efficiently. You can customize your hosting environment to meet the specific requirements of your chosen CMS, ensuring optimal performance.

5. Data Backup and Storage

Data is the lifeblood of modern businesses, and data loss can be catastrophic. VPS hosting can be used for data backup and storage. With ample storage space and data redundancy, VPS hosting offers a secure and reliable solution for preserving critical business data.

6. Reseller Hosting

For entrepreneurs interested in hosting businesses, VPS hosting can serve as a foundation for reseller hosting services. Reseller hosting allows you to create and manage hosting accounts for your clients while enjoying the flexibility and control of a VPS.

7. Gaming Servers

Online gaming communities require reliable, low-latency servers to ensure a seamless gaming experience. Gamers and gaming enthusiasts can utilize VPS hosting to create their own gaming servers for various online games. With dedicated resources, they can host multiplayer games and customize server settings to suit their preferences.

Get Game Servers for an uninterrupted gaming experience!

8. VPN and Proxy Services

VPS hosting can also be used to set up Virtual Private Networks (VPNs) and proxy services. This enables users to enhance their online privacy and security by masking their IP addresses, accessing geo-restricted content, and encrypting internet traffic.

9. Test and Staging Environments

Before deploying updates or changes to a live website or application, it's essential to test them in a staging environment. VPS hosting allows businesses to create isolated staging environments where they can safely test updates, plugins, or code changes without impacting the live site.

10. Personal Cloud Services

Individuals who value data privacy and control can turn to VPS hosting for personal cloud services. This allows them to store and access their files, photos, and documents securely in their private cloud.

In conclusion, VPS hosting has evolved into a versatile hosting solution that caters to a multitude of use cases. Whether you're running a small business, developing applications, hosting websites, or pursuing other digital endeavors, VPS hosting offers the performance, control, and scalability you need to succeed in the online world. As technology continues to advance, VPS hosting remains at the forefront of the hosting industry, providing solutions for the ever-evolving needs of businesses and individuals.

With VPS hosting, your digital ambitions are well within reach, and you can embark on your online journey with confidence.

2 notes

·

View notes

Text

E-commerce ERP Software Malaysia

E-commerce ERP Software Malaysia - Empower Your Online Business with Odoo2u

Introduction:

Discover Odoo2u, your pathway to advanced E-commerce ERP software solutions tailored for the Malaysian market. Our platform is intricately designed to equip online businesses with the tools they need to succeed in the fast-paced world of e-commerce. At Odoo2u, we're dedicated to helping you streamline operations, enhance efficiency, and drive growth.

Why Choose Odoo2u's E-commerce ERP Software Malaysia :

1. Customized for E-commerce: Our E-commerce ERP software is meticulously crafted to meet the specific requirements of online businesses. Whether you're a startup or a seasoned e-commerce player, we provide features and capabilities to help you excel in this competitive domain.

2. Seamless Integration: Odoo2u's E-commerce ERP system seamlessly integrates various business functions, from inventory and order management to customer service and accounting. This eliminates data silos, streamlines processes, and fosters collaboration.

3. Real-Time Data Insights: Access real-time data analytics and reporting, empowering you to make data-driven decisions. Keep pace with market trends, optimize your inventory, and refine your marketing strategies for e-commerce success.

4. Scalability and Flexibility: Our E-commerce ERP software is designed to grow with your business, adapting to your evolving needs without disruption.

5. User-Friendly Interface: We offer a user-friendly interface that ensures your team can easily adopt and utilize the ERP system, facilitating a seamless transition to Odoo2u's solutions.

6. Local Expertise: With a profound understanding of the Malaysian market, we provide localized support and guidance to maximize the potential of our E-commerce ERP Software in Malaysia.

7. Ongoing Support: Our commitment to your success extends beyond implementation. Our support team is dedicated to helping you achieve your long-term business goals.

8. Cost-Effective: Opting for Odoo2u's E-commerce ERP Software in Malaysia means cost savings and operational efficiency improvements, ultimately boosting your profitability.

Precomp (Malaysia) Sdn Bhd

Level 14 & 15, D’PULZE Cyberjaya, Lingkaran Cyber Point Timur Cyber 12, CyberJaya SGR 63000

Malaysia

+603-90811702 (Office) +60196829888 (Mobile)

Odoo2u's E-commerce ERP Software Malaysia is your pathway to elevating your online business, increasing efficiency, and maintaining a competitive edge in the e-commerce landscape. With a strong track record and a commitment to your success, we're the trusted partner to help you realize your e-commerce ambitions.

Seize the opportunity to optimize your e-commerce operations with Odoo2u. Contact us today to schedule a demo or discuss how our E-commerce ERP software can be tailored to meet your specific needs. Your journey to enhanced efficiency and e-commerce success begins with Odoo2u.

2 notes

·

View notes