#Investing in Gold

Text

5 Reasons Why You Should Invest in Gold

Invest in Gold

When it comes to investing, there are countless options out there.

From stocks and bonds to real estate and cryptocurrencies, the choices can be overwhelming.

However, one investment that has stood the test of time is gold.

Gold has been a valuable asset for centuries and continues to be a popular choice for investors looking to diversify their portfolios.

This blog post will…

View On WordPress

0 notes

Text

Exploring the Benefits of Investing in Gold: An Investor's Guide

Throughout history, from ancient civilizations to the present day, gold has consistently held its position as the preferred global currency.

There are several avenues to purchase gold. These range from investing in physical bullion (such as gold bars) to mutual funds, futures, mining companies, and jewellery. However, it's important to note that only bullion, futures, and select funds offer a direct exposure to gold, while others derive their value from different sources.

Today, investors primarily buy gold as a safeguard against political instability and inflation due to its historically low correlation with other asset classes. Additionally, many investment experts advocate for portfolio diversification with commodities like gold to mitigate overall portfolio risk.

Key Takeaways:

The most straightforward method to acquire gold is by purchasing physical gold bars or coins, though these can be less liquid and require secure storage.

Exchange-traded funds (ETFs) and mutual funds tracking gold prices are popular alternatives.

Gold ETFs and mutual funds allow for smaller investments compared to bullion and may offer less direct price exposure.

For those with access to derivatives markets, gold futures and options present another avenue for investment.

Indirect ownership of gold can be achieved through investing in gold mining stocks, though their share prices may not closely track gold's value over the long term.

Gold Bullion

When discussing direct ownership of gold, one of the most recognized forms is gold bullion. Commonly associated with the hefty bars safeguarded in places like Fort Knox, such bullion actually encompasses any pure or near-pure gold certified for its weight and purity. This broad definition includes gold coins, bars, and various other forms, regardless of size. Often, gold bars are marked with serial numbers to bolster security measures.

While the sight of hefty gold bars is impressive, their sheer size, sometimes reaching up to 400 troy ounces, poses liquidity challenges, rendering them costly to buy and sell. Imagine owning a single gold bar worth $100,000; selling even a fraction of it proves cumbersome. Conversely, smaller-sized bars and coins offer greater liquidity and are favoured by many gold owners.

Problems with Bullion

Despite its allure, gold bullion poses several challenges. Storage and insurance costs, coupled with dealer markups, can erode profit margins. Additionally, investing in gold bullion directly ties one's investment to gold's value, meaning any fluctuation in gold prices directly affects the value of the holdings.

Gold Coins

Gold coins have long been issued by sovereign governments worldwide, offering investors a tangible form of investment in precious metals. Typically procured through private dealers, these coins often carry a premium ranging from 1% to 5% above their intrinsic gold value, although this premium can vary.

The benefits of investing in bullion coins are numerous:

Their prices are readily available in global financial publications, aiding transparency in the market.

Bullion coins are frequently minted in smaller denominations, such as one ounce or less, providing investors with a more manageable and liquid investment option compared to larger gold bars.

Reputable gold dealers are easily accessible, particularly in major urban centers, facilitating secure transactions.

Prominent examples of widely traded gold coins include the South African Krugerrand, the U.S. Eagle, and the Canadian Maple Leaf.

It's essential to note that while some gold coins hold additional value due to their rarity or historical significance, known as numismatic or "collector's" value, investors primarily interested in gold as a financial asset should focus on widely circulated coins. Reserved for collectors, rare coins carry additional premiums beyond their gold content and may not align with the investment objectives of gold-focused investors.

Gold ETFs and Mutual Funds

Gold-Based Exchange-Traded Funds (ETFs)

For those seeking an alternative to directly purchasing gold bullion, one avenue is through gold-based exchange-traded funds (ETFs). Each share of these specialized securities represents a fixed amount of gold, typically one-tenth of an ounce.

ETFs can be bought and sold similar to stocks, through any brokerage account or individual retirement account (IRA). This method offers greater ease and cost-effectiveness compared to owning physical bars or coins. It's particularly advantageous for small investors, as the minimum investment is only the price of a single share of the ETF.

The annual average expense ratios of these funds are often around 0.61%, significantly lower than fees and expenses associated with many other investments, including most mutual funds.

Mutual Funds

Many mutual funds include gold bullion and gold companies within their portfolios. However, it's important for investors to note that only a few mutual funds concentrate solely on gold investing; most also have exposure to various other commodities.

The primary advantages of gold-only mutual funds include:

Low cost and minimum investment requirements

Diversification across different companies

Ease of ownership within a brokerage account or IRA

Elimination of the need for individual company research

Some funds invest in mining company indexes, while others are directly linked to gold prices. Some are actively managed, while others follow passive index-tracking strategies. Investors should refer to their prospectuses for detailed information.

Traditional mutual funds typically employ active management strategies, while ETFs generally adhere to passive index-tracking approaches, resulting in lower expense ratios.

For the average gold investor, mutual funds and ETFs are typically the simplest and safest ways to invest in gold.

Gold Futures and Options

Gold Futures

Gold futures are agreements to buy or sell gold at a predetermined date in the future. Investors often favour futures due to their low commissions and margin requirements, which are significantly lower than those of traditional equity investments.

These contracts standardize the amount of gold being traded, typically representing a substantial quantity, such as 100 troy ounces multiplied by the current market price per ounce, resulting in a significant total value, for instance, $100,000. Consequently, futures trading is better suited for experienced investors who can manage larger-scale transactions.

Gold futures contracts may settle in either dollars or physical gold, necessitating careful attention to contract specifications to avoid unexpected obligations, such as taking delivery of a considerable amount of gold upon settlement.

Options on Future

Options on futures offer an alternative approach to directly purchasing futures contracts. With options, investors gain the right to buy a futures contract within a specified timeframe at a predetermined price.

One notable advantage of options is their ability to amplify the original investment while capping potential losses at the premium paid. In contrast, purchasing a futures contract on margin may demand more capital than initially invested, particularly if losses escalate swiftly.

However, opting for options entails paying a premium above the underlying gold value. Given the volatile nature of futures and options trading, these investment instruments may not be suitable for all investors.

Gold Mining Companies

Investing in gold mining and refining companies can yield profits alongside a rising gold price. Such investments often carry lower risks compared to other methods. These companies, with their expansive global operations, are influenced by common business factors, contributing to their potential success.

Their global reach enables them to navigate through periods of stagnant or declining gold prices. Many employ hedging strategies against downward price trends, mitigating potential losses. However, not all companies opt for this approach.

Investing in gold mining companies presents a relatively safer alternative to direct ownership of bullion. Nonetheless, it demands thorough research and due diligence from investors, which can be time-intensive and may not be viable for all.

Gold Jewellery

About 49% of global gold production is used to make jewellery. With the world’s population and wealth growing annually, demand for gold used in jewellery production should increase over time.

On the other hand, gold jewellery buyers are known to be somewhat price-sensitive, buying less if the price rises swiftly.

Buying fine jewellery at retail prices involves a substantial markup—up to 300% or more over the underlying value of the gold. Better jewellery bargains may be found at estate sales and auctions. The advantage of buying jewellery this way is that there is no retail markup. The disadvantage is the time spent searching for valuable pieces.

Nonetheless, jewellery ownership provides an enjoyable way to own gold, even if it is not the most profitable from an investment standpoint. As an art form, gold jewellery is beautiful. As an investment, it is mediocre—unless you are the jeweller.

Gold As a Hedge

Due to its historically low correlation with other investment assets, gold has long been regarded as a safeguard during economic downturns. Notably, gold's correlation with stock market performance has consistently remained minimal, often moving inversely to the dollar. Consequently, periods of dollar depreciation often coincide with strength in gold prices.

Investors may increasingly turn to gold as a hedge against declines in other asset classes, especially in anticipation of a recession. Historical data indicates that gold prices typically rise when inflation-adjusted bond yields fall, suggesting prudence in allocating a portion of one's portfolio to gold to mitigate risks during economic challenges.

What Is the Best Way to Invest in Gold?

The optimal choice varies based on your resources and investment objectives. For substantial investors seeking direct involvement, purchasing gold bullion is an option, albeit with associated premiums and storage expenses. Alternatively, exchange-traded funds (ETFs) and mutual funds offer cost-effective exposure to gold with minimal investment thresholds. Investing in gold mining companies is another avenue, although their performance may not consistently align with the long-term trajectory of gold prices. Lastly, owning gold in the form of jewellery can provide personal satisfaction, yet it's less inclined to yield significant investment returns.

How Do Beginners Buy Gold?

The choice hinges on your resources and investment objectives. For sizable investors seeking direct engagement, gold bullion may be the route, albeit entailing premiums and storage expenses. Alternatively, ETFs and mutual funds mirroring gold prices provide cost-effective exposure with minimal investment requirements. Investing in gold mining firms is an option, although their stock performance may not consistently align with gold's long-term trends. Lastly, owning gold through jewellery can offer personal satisfaction, yet it's less inclined to yield substantial investment returns.

Is Gold a Good Investment During a Recession?

Investing in gold during a recession can offer advantages, but its effectiveness across economic cycles hinges on its alignment with your broader investment plan. Numerous investors integrate gold into their portfolios as a safeguard against economic downturns, as gold prices typically rise when bond yields decrease.

#buy gold#gold bullion#investing in gold bullion#investing in bullion coins#gold dealers#buy or sell gold#gold jewellery buyers#investing in gold

0 notes

Text

Investing in gold bars: A beginner's guide to building wealth

The concept of "investment" is one that we've all come across, yet its true significance and meaning may elude many. Investment involves strategically setting aside your money in a manner that maximizes future benefits. In today's world, investing has become more than just a choice; it is a necessity to secure financial support for future generations.

While the importance of investment is clear, not everyone knows where to begin. While there are numerous schemes that allow for investing small sums of money with fixed returns over fixed periods, they may not be suitable for those with larger sums to invest.

Unlocking the Potential of Gold as an Investment

If you find yourself contemplating significant investments, it's worth considering the potential of investing in gold. Gold stands as one of the most resilient and accessible forms of investment. If you have reservations about purchasing gold bars as an investment, allow me to present some compelling benefits that may change your perspective:

Preservation of Value

Gold holds the rare distinction of being a reliable store of value-an asset that maintains its purchasing power over time while facilitating easy exchange and retrieval. The value of gold remains steadfast, making it an asset that can be stored for years without worry. When the need for funds arises, you can trust that your stored gold will provide the necessary support. This very characteristic is why individuals opt for Kundan coins and bars-the assurance of a valuable asset.

Versatile Utility

In Indian culture, gold extends beyond being a mere investment; it occupies a special place on various occasions, particularly marriage celebrations. The gold bars you acquire as investments can be used to add a touch of significance to these momentous events. Moreover, you can fashion exquisite accessories from your gold holdings and present them as cherished gifts to your loved ones. Additionally, in times of urgent financial need, you can leverage your gold assets to secure gold loans. Investing in gold is a venture that never goes to waste, as its applications are abundant and adaptable to your convenience.

Protection Against Inflation

Inflation-a condition in which the purchasing power of a currency diminishes while commodity prices soar-poses significant challenges to economies and citizens alike. While the Indian economy has not reached such dire levels, it is prudent to safeguard oneself from potential uncertainties. The ultimate shield against inflation lies in investing in gold. The value and selling prices of gold remain resilient even in the face of inflationary pressures, ensuring the security of your assets during challenging times.

Kundan: Your Trusted Source for Exquisite Gold and Silver Products

Having acquainted yourself with the myriad advantages of gold, both for the present and the future, allow kundan to provide you with a reliable platform to acquire Kundan coins and bars. Our philosophy embodies the fusion of traditional principles with a modern outlook, enabling us to deliver unparalleled services and products to our esteemed customers. Explore our collection of premium Kundan gold products from and experience the epitome of quality.

1 note

·

View note

Text

DISCLAIMER: Investments in securities market are subject to market risks, read all the related documents carefully before investing.

Start Trading With Ryz

Our Link Below

Homepage || About Us || Contact Us

0 notes

Text

Unveiling the Golden Adventure: A Comprehensive Guide to Sovereign Gold Bonds and their Role in Options Selling

Chapter 1: Meet our Hero, Ravi

In the heart of a bustling city, Ravi, an IT professional, worked diligently in a corporate job. However, his true passion lay in the world of finance and investments. The gleaming allure of gold, not just for its physical beauty but also as a solid investment, had always fascinated Ravi. But his story is not just about gold; it’s about a particular financial…

View On WordPress

#Financial Planning#Gold Investment#Interest-Free Collateral#Investing in Gold#Investment Strategies#Options Selling#Portfolio Diversification#SGBs as Collateral#Sovereign Gold Bonds#Tax Benefits

0 notes

Text

Understanding the importance of purity and certifications when investing in gold and silver

Gold and silver have been treasured for centuries, and continue to be sought-after investment options for people around the world. However, it is important to understand the importance of purity and certifications when investing in these precious metals. In this article, we will explore why purity and certifications matter when investing in gold and silver.

0 notes

Text

Is Buying Jewelry A Good Investment? What You Should Know?

Is diamond jewelry a good investment? Investing in jewelry can be a great way to diversify your portfolio. Learn about buying jewelry as a good investment. Read more.

#gold jewelry#jewelry#investment#investing in jewelry#investing in gold#investing in diamonds#diamonds investing#gold investing

0 notes

Text

Jesper: I don’t get why mediks only give stickers to kids

Jesper: Like hello i was also brave today?

#jesper fahey#wylan invests in some gold star stickers for him#soc incorrect quotes#six of crows incorrect quotes

79 notes

·

View notes

Text

doodle dump because i will not finish these evar!!!!!!!!!!

#mepjone gijinkas r so hard man GAH#comedy gold is so funny to me#i don't hate hate anyone from ii but trophy is the guy i like to make fun of the most#i cannot draw him for the LIFE of me good lord#hes the guy i just think about and go 🍅🍅🍅🍅🍅🍅🍅🍅🍅🍅TOMATO TOMATO#twophone .. missing them#i swear if i got money from being invested in pairs no one cares about id be rich#always missing dadroog#sighs#and knickle for the end hearts#knickle to the END#gamer yaoi for the win#ii mephone4#ii microphone#ii pickle#ii cheesy#idk if i should tag everyone#oh whatever#ii paper#ii knife#ii balloon#ii knickle#ii nickel#ii clover#ii suitcase#THERES SO MANY OF THEM#two tpot#twophone#i think thats all of them????#phonification

107 notes

·

View notes

Text

the highs and lows of the courtroom can only be solved by playing a childrens card game

#myart#ace attorney#dual destinies#simon blackquill#apollo justice#yugioh#I realized that simon and apollo wear yami yugi and kaiba clothes but in different fonts#idk man if theres an universe that would be just as invested in fighting in the shadow realm like the ygo maincast it would be ace attorney#fighting for ur client or they get sent to the shadow realm (make it prison but with the ygo flair or something)#also yes apollo has a millenium bracelet#I thought about giving simon an item too (a sword hehe) but since he thinks the bracelet is cheating he gets no shiny gold sword#L goes out to the weeb procecutor

99 notes

·

View notes

Text

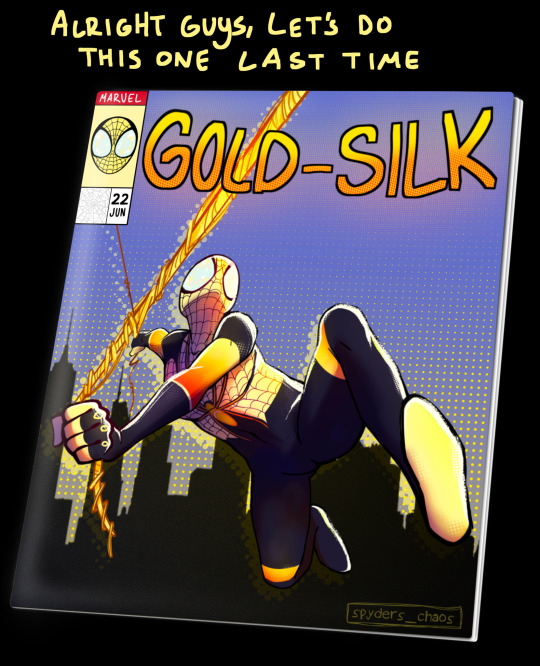

I’m not done with this yet but I rlly wanted to show it

#I don’t think I’ve ever been this invested in giving an oc a backstory#it’s still not fully done and I’m still trynna figure out what I want to happen but ksjdjaksbsj#art#spiderman oc#spidersona#spiderverse#spiderverse oc#across the spiderverse#gold silk#oc#ocs#wip#sorta#earth 10367

707 notes

·

View notes

Text

cannot believe i took a crack at animating again after almost two year break just to do something this silly lol. on brand honestly

#its not polished at all cuz i only spent this morning making it#but its whatever#bramcraft#bsd#bungo stray dogs#bsd bram#bsd lovecraft#heard that part of the audio and immediately got possessed by the forces of the deep just to make this stupid thing hdfjk#if you know where its from you get a gold star#anyhow. head in hands#im not even that super into bsd i watched it back in 2016 and then dropped it but bram just compels me so i decided to take a gander#when he got introduced but weary sigh accidentally got invested#so you can imaging how im doing in relation to latest developments lmao#im coping with my bramcrafts

67 notes

·

View notes

Text

I'm guarding my heart against expecting adoribull crumbs in veilguard because I really don't believe it's going to happen. I think that might be one of the sweet slender branches on the possibility tree that they'll gently and quietly prune away from relevancy, especially since it doesn't involve a player character. dorian will almost certainly be back (hey hiii bestie how have you been? stressed out of your mind I imagine), but I can't imagine they'll let you get too granular with setting up your world state, especially since after ten years they will be expecting to have a lot of players who are new to the series. like AT MOST I can imagine a little background detail implying an amicable bittersweet breakup rather than dragging out the long distance and danger of it all as tevinter politics heat up, if you're allowed to set them both as being still alive.

all that being said I still want it so fucking badly tho fhdskjfhas

#them being together is such an edge case for any given playthrough (no PC romance with either; bull alive; take them out together enough)#it's so unlikely they'll invest resources into it. but maybe. but very probably not. unless... but no --#counterpoint to this spiritually tho: dorian not only fucking but being in a decade long tender & committed romantic relationship#with a once-extremely prominent enemy of the tevene state... still one of the funniest things that can happen in this series#there must be documents about the terrifying head of the secret police on seheron in the magisterium archives. and that's dorian's man#and in the opposite direction bull must have had some real moments of '...oh boy this guy is everything tama warned me about' lol#by trespasser they have such old married couple vibes about it too. the private vs. public perceptions involved. unmatched#would they really throw away such absolute gold. could they bear to. I have many hopes and doubts and dreams and fears#dragon age#adoribull#iron bull#dorian pavus#it would be nice if they at least don't give any information to the contrary that they're still together#so I can live happily in headcanon land (like yes I realize the world is ending but like priorities let's focus on the important things)

105 notes

·

View notes

Text

made some Worf quote calligraphy cards!

i also still have all of my calligraphy stuff set up so lmk (replies, asks, whatever) if anyone has requests for other silly quotes.

[ID: nine white index cards with the following quotes written in black and red ink in a blackletter calligraphy style. card 1 reads "There is an ancient Klingon proverb that says 'You cannot loosen a man's tongue with root beer'." Card two reads: "You will never achieve the 24th level of awareness." Card three reads: "Death to the opposition." Card four reads: "Sir, I must protest! I am not a merry man!" Card five reads: "At the first sign of betrayal, I will kill him, but I promise to return the body intact." Card six reads: "Today is a good day to die." Card seven reads: "Find him and kill him!" Card eight reads: "Good tea. Nice house." Card nine reads: "This is the story of a little ship that took a little trip." /end ID]

#calligraphy#my art#star trek#tng#ds9#worf#theyre very far from perfect but my hand has been hurting for the past week so its as good as it will get#also think im gonna invest in some automatic pens and different ink because i love the pilot parallel pens#but switching color is so inconvenient unless you have different pens for Every Color#and i desperately want gold ink but it usually doesnt come in cartridges#but.... expensive#also damn i just realized the 24th awareness quote is “attain” not “achieve”... just ignore that#my posts

226 notes

·

View notes

Text

A garden we grow, the flowers bloom and wither.

And then bloom again.

thinking of sticks not so sticks again

Something Something I like flowers, I like flower symbolism, I like purple, I think he should grow some sort of little garden, I think King Orange should help him, I think KO should have a hoe as a weapon too. I think they should be allowed to grow.

#AvA#AvM#avm purple#ava purple#avm king orange#ava king orange#I'm tagging mago tango as well because I still think the name is funny lol#animation vs animator#animator vs animation#animation vs minecraft#fan art#digital art#avm orchid#avm gold#I've been thinking of like#this scenario where just#purple decides to grow a garden from the flowers he finds around#to have some to take to his mother#King kind of supporting Purple's little project but not doing much to help at the begining#ends up getting invested in gardening as well#also gets a cool ass hoe as a weapon#because I say so#I think long weapons fit mango#like spears and such#the garden...#idk man its about the symbolism the metaphors#asadraws

512 notes

·

View notes

Text

The fact that there’s no good long fanfictions about Eliot Spencer is a crime and if I were a more dedicated writer I’d fix it. Unfortunately, my motivation comes in rice grain sized portions and my creativity is that of a rat.

#eliot spencer#leverage#christian kane#he’s literally loml#writers need to invest in the grumpy heart of gold long haired soldier type more often

64 notes

·

View notes