#Investing in Gold Bullion

Text

What is Gold Bullion? How to Invest and Its Benefits

Bullion is a term used to describe metals in their purest form. A gold bullion is a gold bar with 99.5 to 99.9% purity. The purest form of metal is obtained during mining, where the metal is removed from the earth and then extracted from ore using chemicals or extreme heat.

Like gold bullion, silver bullion is also there with the maximum amount of purity of silver bars. The value of either gold…

0 notes

Text

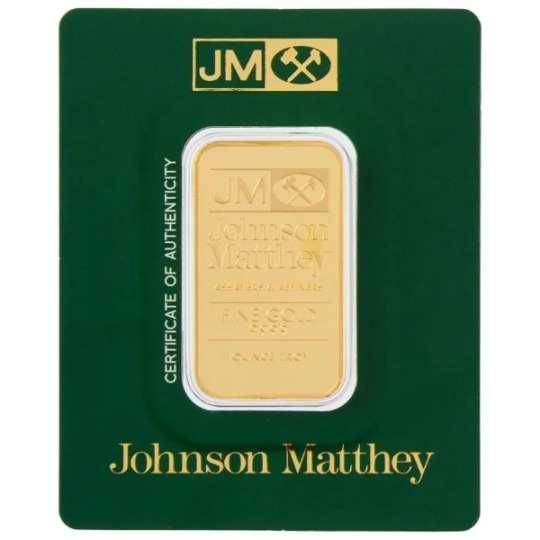

Gold Bullion Bars | Nyfederalgold

Looking for pure Gold Bullion Bars in USA? Nyfederalgold is one of the well-established and trusted organisation for purchasing coins, bullion and bars. We have team of professionals who are there to give you best advice as per your portfolio. You can diversifying your retirement portfolio with precious metals of gold, silver and platinum. You’ll will have a powerful tool to protect your wealth as well as potentially grow it over time.

Visit Here:- https://nyfederalgold.com/

#Gold Bullion Bars#Convert 401K to Gold#401K to Gold IRA Rollover#Gold and Silver Bullion#Gold Is a Great Hedge to Invest#Investing in Gold Bullion#Ny federal gold#Nyfederalgold#Ny federal gold bullion bars#Ny federal gold online

0 notes

Text

Exploring the Benefits of Investing in Gold: An Investor's Guide

Throughout history, from ancient civilizations to the present day, gold has consistently held its position as the preferred global currency.

There are several avenues to purchase gold. These range from investing in physical bullion (such as gold bars) to mutual funds, futures, mining companies, and jewellery. However, it's important to note that only bullion, futures, and select funds offer a direct exposure to gold, while others derive their value from different sources.

Today, investors primarily buy gold as a safeguard against political instability and inflation due to its historically low correlation with other asset classes. Additionally, many investment experts advocate for portfolio diversification with commodities like gold to mitigate overall portfolio risk.

Key Takeaways:

The most straightforward method to acquire gold is by purchasing physical gold bars or coins, though these can be less liquid and require secure storage.

Exchange-traded funds (ETFs) and mutual funds tracking gold prices are popular alternatives.

Gold ETFs and mutual funds allow for smaller investments compared to bullion and may offer less direct price exposure.

For those with access to derivatives markets, gold futures and options present another avenue for investment.

Indirect ownership of gold can be achieved through investing in gold mining stocks, though their share prices may not closely track gold's value over the long term.

Gold Bullion

When discussing direct ownership of gold, one of the most recognized forms is gold bullion. Commonly associated with the hefty bars safeguarded in places like Fort Knox, such bullion actually encompasses any pure or near-pure gold certified for its weight and purity. This broad definition includes gold coins, bars, and various other forms, regardless of size. Often, gold bars are marked with serial numbers to bolster security measures.

While the sight of hefty gold bars is impressive, their sheer size, sometimes reaching up to 400 troy ounces, poses liquidity challenges, rendering them costly to buy and sell. Imagine owning a single gold bar worth $100,000; selling even a fraction of it proves cumbersome. Conversely, smaller-sized bars and coins offer greater liquidity and are favoured by many gold owners.

Problems with Bullion

Despite its allure, gold bullion poses several challenges. Storage and insurance costs, coupled with dealer markups, can erode profit margins. Additionally, investing in gold bullion directly ties one's investment to gold's value, meaning any fluctuation in gold prices directly affects the value of the holdings.

Gold Coins

Gold coins have long been issued by sovereign governments worldwide, offering investors a tangible form of investment in precious metals. Typically procured through private dealers, these coins often carry a premium ranging from 1% to 5% above their intrinsic gold value, although this premium can vary.

The benefits of investing in bullion coins are numerous:

Their prices are readily available in global financial publications, aiding transparency in the market.

Bullion coins are frequently minted in smaller denominations, such as one ounce or less, providing investors with a more manageable and liquid investment option compared to larger gold bars.

Reputable gold dealers are easily accessible, particularly in major urban centers, facilitating secure transactions.

Prominent examples of widely traded gold coins include the South African Krugerrand, the U.S. Eagle, and the Canadian Maple Leaf.

It's essential to note that while some gold coins hold additional value due to their rarity or historical significance, known as numismatic or "collector's" value, investors primarily interested in gold as a financial asset should focus on widely circulated coins. Reserved for collectors, rare coins carry additional premiums beyond their gold content and may not align with the investment objectives of gold-focused investors.

Gold ETFs and Mutual Funds

Gold-Based Exchange-Traded Funds (ETFs)

For those seeking an alternative to directly purchasing gold bullion, one avenue is through gold-based exchange-traded funds (ETFs). Each share of these specialized securities represents a fixed amount of gold, typically one-tenth of an ounce.

ETFs can be bought and sold similar to stocks, through any brokerage account or individual retirement account (IRA). This method offers greater ease and cost-effectiveness compared to owning physical bars or coins. It's particularly advantageous for small investors, as the minimum investment is only the price of a single share of the ETF.

The annual average expense ratios of these funds are often around 0.61%, significantly lower than fees and expenses associated with many other investments, including most mutual funds.

Mutual Funds

Many mutual funds include gold bullion and gold companies within their portfolios. However, it's important for investors to note that only a few mutual funds concentrate solely on gold investing; most also have exposure to various other commodities.

The primary advantages of gold-only mutual funds include:

Low cost and minimum investment requirements

Diversification across different companies

Ease of ownership within a brokerage account or IRA

Elimination of the need for individual company research

Some funds invest in mining company indexes, while others are directly linked to gold prices. Some are actively managed, while others follow passive index-tracking strategies. Investors should refer to their prospectuses for detailed information.

Traditional mutual funds typically employ active management strategies, while ETFs generally adhere to passive index-tracking approaches, resulting in lower expense ratios.

For the average gold investor, mutual funds and ETFs are typically the simplest and safest ways to invest in gold.

Gold Futures and Options

Gold Futures

Gold futures are agreements to buy or sell gold at a predetermined date in the future. Investors often favour futures due to their low commissions and margin requirements, which are significantly lower than those of traditional equity investments.

These contracts standardize the amount of gold being traded, typically representing a substantial quantity, such as 100 troy ounces multiplied by the current market price per ounce, resulting in a significant total value, for instance, $100,000. Consequently, futures trading is better suited for experienced investors who can manage larger-scale transactions.

Gold futures contracts may settle in either dollars or physical gold, necessitating careful attention to contract specifications to avoid unexpected obligations, such as taking delivery of a considerable amount of gold upon settlement.

Options on Future

Options on futures offer an alternative approach to directly purchasing futures contracts. With options, investors gain the right to buy a futures contract within a specified timeframe at a predetermined price.

One notable advantage of options is their ability to amplify the original investment while capping potential losses at the premium paid. In contrast, purchasing a futures contract on margin may demand more capital than initially invested, particularly if losses escalate swiftly.

However, opting for options entails paying a premium above the underlying gold value. Given the volatile nature of futures and options trading, these investment instruments may not be suitable for all investors.

Gold Mining Companies

Investing in gold mining and refining companies can yield profits alongside a rising gold price. Such investments often carry lower risks compared to other methods. These companies, with their expansive global operations, are influenced by common business factors, contributing to their potential success.

Their global reach enables them to navigate through periods of stagnant or declining gold prices. Many employ hedging strategies against downward price trends, mitigating potential losses. However, not all companies opt for this approach.

Investing in gold mining companies presents a relatively safer alternative to direct ownership of bullion. Nonetheless, it demands thorough research and due diligence from investors, which can be time-intensive and may not be viable for all.

Gold Jewellery

About 49% of global gold production is used to make jewellery. With the world’s population and wealth growing annually, demand for gold used in jewellery production should increase over time.

On the other hand, gold jewellery buyers are known to be somewhat price-sensitive, buying less if the price rises swiftly.

Buying fine jewellery at retail prices involves a substantial markup—up to 300% or more over the underlying value of the gold. Better jewellery bargains may be found at estate sales and auctions. The advantage of buying jewellery this way is that there is no retail markup. The disadvantage is the time spent searching for valuable pieces.

Nonetheless, jewellery ownership provides an enjoyable way to own gold, even if it is not the most profitable from an investment standpoint. As an art form, gold jewellery is beautiful. As an investment, it is mediocre—unless you are the jeweller.

Gold As a Hedge

Due to its historically low correlation with other investment assets, gold has long been regarded as a safeguard during economic downturns. Notably, gold's correlation with stock market performance has consistently remained minimal, often moving inversely to the dollar. Consequently, periods of dollar depreciation often coincide with strength in gold prices.

Investors may increasingly turn to gold as a hedge against declines in other asset classes, especially in anticipation of a recession. Historical data indicates that gold prices typically rise when inflation-adjusted bond yields fall, suggesting prudence in allocating a portion of one's portfolio to gold to mitigate risks during economic challenges.

What Is the Best Way to Invest in Gold?

The optimal choice varies based on your resources and investment objectives. For substantial investors seeking direct involvement, purchasing gold bullion is an option, albeit with associated premiums and storage expenses. Alternatively, exchange-traded funds (ETFs) and mutual funds offer cost-effective exposure to gold with minimal investment thresholds. Investing in gold mining companies is another avenue, although their performance may not consistently align with the long-term trajectory of gold prices. Lastly, owning gold in the form of jewellery can provide personal satisfaction, yet it's less inclined to yield significant investment returns.

How Do Beginners Buy Gold?

The choice hinges on your resources and investment objectives. For sizable investors seeking direct engagement, gold bullion may be the route, albeit entailing premiums and storage expenses. Alternatively, ETFs and mutual funds mirroring gold prices provide cost-effective exposure with minimal investment requirements. Investing in gold mining firms is an option, although their stock performance may not consistently align with gold's long-term trends. Lastly, owning gold through jewellery can offer personal satisfaction, yet it's less inclined to yield substantial investment returns.

Is Gold a Good Investment During a Recession?

Investing in gold during a recession can offer advantages, but its effectiveness across economic cycles hinges on its alignment with your broader investment plan. Numerous investors integrate gold into their portfolios as a safeguard against economic downturns, as gold prices typically rise when bond yields decrease.

#buy gold#gold bullion#investing in gold bullion#investing in bullion coins#gold dealers#buy or sell gold#gold jewellery buyers#investing in gold

0 notes

Text

#hatejake#gold#gold bars#gold bullion#bullion#real money#real wealth#stacking#love gold#money#precious metals#wealth#investment#investing#precious metal#build your wealth#wealth preservation#gold buyer

49 notes

·

View notes

Text

50g of gold bar

Bin:$3,400

#black metal#heavy metal#precious metals#coin slot#coinstats#meme coins#roman coins#ancient coins#investment#my coins#crypto coins#numismatics#gold bars#gold bullion#bullion#gold coins

3 notes

·

View notes

Photo

Getting the best bullion deals depends on you. It has a lot to do with how much information you are willing to get. While there is no perfect deal, you sure can make it worth it by playing your cards right.

#Gold Bar#gold bullion#gold price#gold investment#buy gold online#gold investing options#silver coins#metal investment#trb bulion

5 notes

·

View notes

Text

Why Millennials Are Turning to Gold: A Growing Investment Trend in Canada

Millennials are bucking traditional investment trends by embracing gold. As a tangible asset with potential for wealth preservation and diversification, gold investment trends in Canada. 24 Gold Group Ltd stands out as a leading dealer, offering a wide range of gold, bullion, silver, and more to meet the unique needs of millennial investors.

#gold investment trends in canada#millennials to gold#gold investment#bullion dealer#gold investment in canada

0 notes

Text

"Melbourne Bullion Buying Ideas: What You Need to Know"

Select reliable dealers when buy bullion in melbourne to guarantee purity and authenticity. Keep yourself updated on the prices and trends in the market. Examine premiums and costs offered by various dealers. Think about safe storage choices such as professional storage services or bank vaults. Recognise any applicable taxes and laws. Lastly, make sure your investment is in line with your financial objectives by monitoring market volatility and being ready for price swings.

0 notes

Text

#gold#silver#preciousmetals#investing#coincollecting#bullion#fakegold#realgold#preciousmetaltesting#numismatics#goldtesting#metalpurity#investmenttips#preciousmetaleducation#finance

0 notes

Text

Investing in Gold Bullion | nyfederalgold

Gold Bullion is a pure form of gold without any other mixture. Investing in Gold Bullion is always a gold option for long-term benefit. You can sell bullion and get cash easily whenever you need it or during times of emergency. You can purchase gold bullion from Nyfederalgold and we also provide you with good consultancy for good financial decisions for the future. We make sure our customers get pure quality gold.

Visit here:- https://nyfederalgold.com/

0 notes

Text

🌊🚢Sail a majestic voyage of gold with our exquisite collection of Bullion! Crafted with meticulous attention to detail. Let your journey into luxury begin today! ➡️

Browse our investment bars collection and find the perfect piece or customize your own for you or your loved ones.

0 notes

Text

Gold and Silver Bullion - Guildhall Wealth

Guildhall Wealth: gold and silver bullion products are kept separately and allottedly stored. A title page detailed inventory report with serial numbers is sent to each client. See our website for additional information!

#gold and silver bullion#precious metals canada#investing in precious metals#]buy precious metals#precious metals investments

0 notes

Text

Is Gold a good investment?

https://finmaestros.com/is-gold-a-good-investment/

#gold #hedge #inflation #investment #preciousmetals #bullion #trending #viral #personalfinance #finmaestros #finance #money #diversification #courses #onlineeducation #onlinecourse #onlinelearning #elearning #edtech

0 notes

Text

Top 5 Reasons Why Investing in Gold is a Smart Financial Move

Are you looking to secure your financial future and make smart investment decisions? Look no further than gold. This timeless and valuable commodity has proven to be a safe haven for investors. In this blog post, we'll explore the top 5 reasons why investing in gold is a smart financial move that can help you build wealth and protect your assets. Whether you're new to investing or a seasoned pro, there's something here for everyone. Let's dive in!

Introduction: The Fascination with Gold

Gold has been an object of fascination for centuries, revered by ancient civilizations and coveted by modern investors. Its allure is undeniable - from its beautiful luster to its historical significance, gold has captured the imagination of people across cultures and time periods. One of the main reasons for this fascination with gold is its rarity. Unlike other commodities that can be easily reproduced or manufactured, gold is a finite resource that is found in limited quantities on our planet. This scarcity adds to its value and makes it a symbol of wealth and luxury.

Another reason why people are drawn to invest in gold is its enduring value. While currencies have come and gone, wars have been fought, and economies have risen and fallen, gold has remained a constant store of value. It holds significant cultural significance as well, being used in religious ceremonies or as gifts for special occasions.

Gold also serves as a hedge against inflation. In times of economic uncertainty or high inflation rates, the value of paper currency tends to decrease while the price of gold usually rises. This makes investing in gold a smart move for those looking to protect their wealth from market fluctuations. Unlike stocks or real estate which require ongoing maintenance costs or fees, holding physical gold requires no maintenance costs once purchased. This makes it an attractive option for those seeking long-term investments without any additional expenses.

The fascination with gold also extends beyond just its monetary value. Many investors see it as an insurance policy against catastrophic events such as economic crashes or political instability. The idea that even if everything else fails, physical gold will always hold some form of worth brings peace of mind to many individuals.

The fascination with gold is rooted in its rarity, cultural significance, historical value, and ability to act as a hedge against inflation. These factors make investing in gold a smart financial move for both seasoned investors and those just beginning their journey towards financial security.

#1: Gold is a Stable and Secure Investment

When it comes to investing, stability and security are two of the most important factors that investors consider. One of the main reasons why gold is considered a stable investment is because its value has stood the test of time. Unlike other investments such as stocks or real estate, which can fluctuate wildly depending on market conditions, gold has maintained its value over thousands of years. In fact, it has been used as a form of currency since ancient times and continues to hold its value even in today's modern world.

It is seen as a safe haven asset by many investors who rush towards it during times of crisis. This demand for gold increases its value and helps protect against inflation or economic downturns. Another factor is its limited supply. While fiat currencies can be printed endlessly by governments, leading to inflation and devaluation, there is only so much physical gold available in the world. This scarcity makes it a valuable asset that maintains its worth over time.

Gold offers security as an investment option due to its tangible nature. Unlike stocks or bonds that exist on paper or digitally, gold is a physical asset that you can physically hold in your hand. This provides reassurance for investors knowing they have something concrete backing their investment.

With the rise of technology-driven financial products like cryptocurrency and digital trading platforms, some people may feel uncertain about these new forms of investments' long-term stability and security. However, with gold's long-standing history as an investment asset class, there are no such concerns about its future viability.

Whether you are looking for long-term stability or protection against uncertain market conditions, gold has proven to be a secure investment choice time and time again. Its historical track record of maintaining value, limited supply, tangible nature, and lack of dependence on technological advancements all contribute to making it a smart financial move for any investor looking to diversify their portfolio.

Reason #2: Hedge Against Inflation and Economic Uncertainty

In today's ever-changing economic landscape, it is important to have investments that can protect your wealth from inflation and uncertainties in the market. This is where gold comes into play as a smart financial move.

One of the main reasons why gold is considered a hedge against inflation is because it has shown to hold its value over time. Unlike paper currency, which can be easily printed and devalued, gold maintains its purchasing power. This means that even during periods of high inflation, the value of gold will not decrease drastically. In fact, history shows that during times of high inflation, the price of gold tends to increase.

Since most central banks around the world hold large reserves of gold, it has become an internationally recognized form of currency. This means that even in times when paper currencies lose their value due to inflation or economic uncertainty, gold can still serve as a universal store of wealth.

Investing in gold is also seen as a way to protect against economic uncertainty. During times of crisis or market volatility, investors tend to flock towards safe-haven assets such as gold. This demand for gold drives up its price and makes it a valuable asset to have in one's portfolio.

Gold also has a low correlation with other assets such as stocks and bonds. This means that while these assets may experience fluctuations due to economic conditions or market trends, the price of gold may remain steady or even increase. By diversifying your investment portfolio with some allocation towards physical or paper-backed gold investments, you are reducing your overall risk exposure and safeguarding your wealth against potential losses from economic downturns.

Moreover, unlike stocks or real estate which require constant monitoring and maintenance costs, owning physical or paper-backed gold requires minimal effort once purchased. It does not rely on external factors such as management decisions or property location for its value – making it a relatively low-maintenance investment option.

Investing in gold can provide a safety net for your wealth against inflation and economic uncertainties. Its ability to retain its value over time and serve as a universal store of wealth makes it a smart financial move for any investor looking to protect their portfolio. By including gold in your investment strategy, you are not only diversifying your portfolio but also securing your financial future.

Reason #3: Diversification in Your Investment Portfolio

Diversification is a key strategy when it comes to investing. It involves spreading out your investments across different assets, industries, and markets to minimize risk and maximize returns. This is where gold can play a crucial role in your investment portfolio.

Gold has a unique characteristic of being negatively correlated with other traditional assets such as stocks and bonds. This means that when the stock market experiences volatility or downturns, the value of gold tends to increase. Therefore, by including gold in your investment portfolio, you can offset potential losses from other investments and reduce overall risk.

Gold has historically demonstrated its ability to maintain its value over time, even during economic crises. Investing in physical gold also provides an additional layer of diversification within your portfolio. Unlike paper assets like stocks or bonds which are dependent on the performance of companies or governments respectively, physical gold is not subject to counterparty risk. In simpler terms, holding physical gold means that you own a tangible asset that is not reliant on anyone else's financial stability.

Gold offers geographical diversification through its global demand and pricing mechanisms. With increasing industrial use for technology purposes and jewelry demand in emerging economies such as China and India, the price of gold is heavily influenced by international factors rather than just domestic ones.

Owning physical gold gives you access to various forms of gold, such as bars, coins, and bullion. This allows you to diversify within the asset itself and choose the form that best suits your investment goals.

Including gold in your investment portfolio provides diversification on multiple levels - in terms of correlation with other assets, counterparty risk, geographical exposure, and types of physical gold. These aspects make gold a valuable addition to any well-diversified portfolio and a smart financial move for investors looking to mitigate risk and achieve long-term stability.

Reason #4: Potential for High Returns on Investment

Gold has long been considered a safe and stable investment, but it also has the potential to provide high returns. In fact, gold has consistently outperformed other traditional investments such as stocks and bonds in terms of its return on investment (ROI).

One of the key reasons for this is the limited supply of gold. Unlike paper currencies that can be printed endlessly, the supply of gold is finite. This makes it a scarce and valuable asset, which can drive up its price over time.

Gold is not tied to any specific country or economy. It is a universal currency that holds value across borders and cultures. This means that even if one economy faces a downturn, the demand for gold may remain steady or even increase in other countries. Investors often turn to gold as a safe haven asset. This increased demand can drive up the price of gold, resulting in higher returns for those who have invested in it.

Another factor contributing to the potential for high returns on investment in gold is its liquidity. Gold can easily be bought and sold around the world at any time. This means that investors can quickly convert their holdings into cash if needed without facing significant losses.

Owning physical gold does not come with ongoing expenses. Therefore, all profits from selling gold go directly to the investor's pocket.

It's also worth noting that while other assets may lose value during periods of inflation, historically, gold has maintained its purchasing power over time. In fact, during times of high inflation or economic crisis, the value of gold tends to rise significantly due to its scarcity and perceived stability.

Of course, like any investment option, there are risks involved when investing in gold. Its price can fluctuate daily based on global factors such as interest rates, currencies, and geopolitical events. However, by diversifying your portfolio and holding a portion of assets in gold, you can mitigate these risks and potentially earn high returns.

The potential for high returns on investment is one of the top reasons why investing in gold is considered a smart financial move. Its limited supply, universal value, liquidity, and ability to withstand economic uncertainties make it an attractive investment option for those looking to grow their wealth over time.

Reason #5: Tangible Asset with Universal Value

Gold has been considered a tangible asset for centuries, making it a highly sought-after investment option. Unlike other financial assets such as stocks or bonds, gold is a physical commodity that can be held in hand and has universal value. This means that no matter where you are in the world, gold will always hold value and can be easily exchanged for cash.

One of the main advantages of owning physical gold is its ability to preserve wealth. Gold has historically maintained its value and even increased in worth. This makes it an attractive option for investors looking to diversify their portfolio and protect against potential losses.

Furthermore, gold is not subject to the same risks as paper currencies. While inflation can greatly affect the purchasing power of fiat money, gold's value remains stable due to its limited supply and high demand. This makes it a reliable hedge against inflation and currency devaluation.

Another key benefit of investing in gold is its liquidity. Gold bullion coins or bars are universally recognized and accepted by dealers around the world, making them easy to buy or sell at any time without losing significant value. This flexibility allows investors to quickly access their funds when needed, unlike other assets that may require more time and effort to liquidate.

Owning physical gold provides investors with a sense of security during times of crisis or geopolitical unrest. When global financial markets experience turmoil, there tends to be an increase in demand for safe-haven assets like gold. As history has shown us, even when paper currencies collapse or stock markets crash, precious metals like gold retain their worth.

In addition to being a reliable store of wealth and providing protection during uncertain times, owning physical gold also offers potential tax benefits. In some countries, certain types of investments in precious metals may be exempt from capital gains taxes if held for a certain period. This can result in significant savings when compared to other taxable investments.

Investing in gold is a smart financial move due to its tangible nature and universal value. It offers investors a way to diversify their portfolio, protect against inflation and market volatility, and provides potential tax benefits. Its liquidity, stability, and ability to preserve wealth make it a valuable asset for any long-term investment strategy.

Best Place to Buy Investment Gold Bars and Gold Coins in Qatar

Rizan Jewellery is one of the best places to buy gold in Qatar. Our team of specialists is dedicated to assisting you in acquiring purity-certified gold and silver bullion. We provide competitive pricing and top-notch service for purchasing bullion in Doha, Qatar, ensuring both quality and satisfaction. If you are looking to sell your gold in Qatar, we are here to help you. We provide the best prices for your gold with instant cash credit.

1 note

·

View note

Text

The History of Gold: From Ancient Times to Modern Investments

Gold, a precious metal prized for its luster, durability, and rarity, has captivated humanity for millennia. Its history is intertwined with the rise and fall of civilizations, the evolution of trade, and the development of financial systems.

24 Gold Grp. Ltd., a leading authority in the gold market, provides valuable insights into the rich history of gold. From its ancient origins to its role in modern investments, gold has consistently played a significant part in human affairs.

Ancient Civilizations and Gold

Gold's allure dates back to ancient civilizations. In Mesopotamia, Sumerian kings adorned themselves with gold jewelry and used it as a symbol of wealth and power. The Egyptians believed gold was the flesh of the gods and used it to decorate tombs and create intricate artifacts. In the Americas, the Inca and Aztec civilizations also valued gold and used it for religious ceremonies and trade.

Gold in Trade and Commerce

Gold's portability, durability, and universal recognition made it an ideal medium of exchange. Ancient civilizations used gold to conduct trade, settle debts, and pay tribute. The Roman Empire minted gold coins, such as the aureus, which became a standard currency throughout the Mediterranean world.

Gold in the Renaissance and Beyond

During the Renaissance, European explorers sought gold and other precious metals in the Americas and Africa. The discovery of vast gold deposits in the New World fueled European colonization and economic expansion. The gold rush in California during the 19th century further solidified gold's role in the global economy.

Gold as an Investment

Gold has grown in popularity as an investment asset in the modern era. Its value is influenced by factors such as economic uncertainty, inflation, and geopolitical events. Investors often turn to gold as a hedge against market volatility and a store of value. One can buy gold in a variety of forms, such as jewelry, coins, and bars.

24 Gold Grp. Ltd. offers a wide range of gold products and services, catering to the needs of both investors and collectors. Their expertise and commitment to customer satisfaction have made them a trusted name in the gold industry.

In conclusion, gold's history is a testament to its enduring appeal and value. From its ancient origins to its modern-day role as an investment asset, gold continues to captivate and inspire humanity.

#The History of Gold: From Ancient Times to Modern Investments#Bullion Dealers Toronto#Precious Metal Buying#Gold Refining In Canada

0 notes