#Gold Is a Great Hedge to Invest

Text

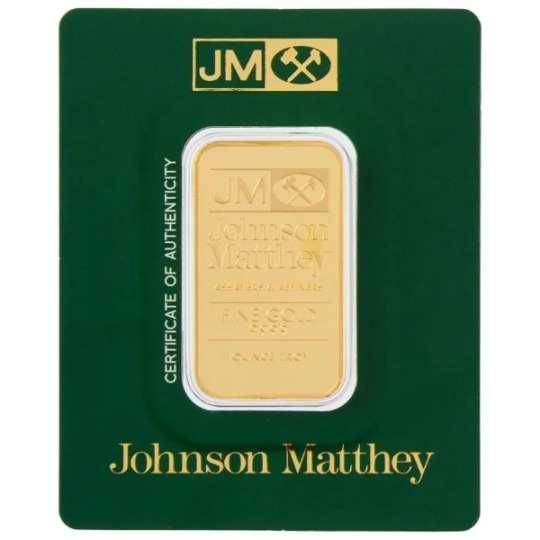

Gold Bullion Bars | Nyfederalgold

Looking for pure Gold Bullion Bars in USA? Nyfederalgold is one of the well-established and trusted organisation for purchasing coins, bullion and bars. We have team of professionals who are there to give you best advice as per your portfolio. You can diversifying your retirement portfolio with precious metals of gold, silver and platinum. You’ll will have a powerful tool to protect your wealth as well as potentially grow it over time.

Visit Here:- https://nyfederalgold.com/

#Gold Bullion Bars#Convert 401K to Gold#401K to Gold IRA Rollover#Gold and Silver Bullion#Gold Is a Great Hedge to Invest#Investing in Gold Bullion#Ny federal gold#Nyfederalgold#Ny federal gold bullion bars#Ny federal gold online

0 notes

Text

The Role of Diversification in Mitigating Investment Risk

Investing is one of the most critical strategies you can use to minimize your investment risk and this is why diversity is essential. In other words, it means spreading your investments across various types of assets so that you do not suffer great losses due to poor performance in any one share or investment. This article focuses on how diversification can help reduce investment risks while giving practical tips on how to diversify portfolios effectively.

Understanding Diversification

You do not put all your baskets in one egg carton. Therefore, by investing in different assets like stocks, bonds, real estate and commodities, if one investment fails then it will save a lot from losing anything with a greater amount. The rationale behind this system is simple: different kinds of investments usually react differently to market conditions. For example when some are going down others may be growing hence ensuring an overall stable return.

Importance of Diversification

Mitigates risk: diversification helps spread the risks. Investing everything into a single share which collapses leads to losing mostly all one's money. However if he had a diversified portfolio such a situation would not have affected much on the entire portfolio since before there used to be good gains in some areas but now as compared it seems lesser than before.

Smooth Returns: A portfolio that has good diversification would experience lesser fluctuations. This implies that you will not experience vast changes in values brought about by investing in just one category of assets. By doing this, your profits are likely to be constant even as time passes.

The Possibility of Higher Returns: Even though the assumption of constant returns from different classes is not true, yet on average it leads to stability over all returns. If you have different kinds of financial tools some may perform well making other investments more profitable.

Conduct a proper market research and analysis like fundamental analysis, technical analysis etc. There are lot of websites which provides various tools to conduct analysis. One of the best websites for fundamental analysis is Trade Brains Portal. Trade Brains Portal has various tools like Portfolio analysis, Stock compare, Stock research reports and so on. Also the website provides fundamental details of all the stocks listed in Indian stock market.

How to Create Diversification

First Invest In Different Asset Classes: The initial stage of diversifying is distributing investments among diverse asset classes. You might include:

Shares: For instance invest into various sectors and industries which protects against any concentration risk.

Debts: Join corporate and state obligations that have various due terms.

Property: Purchase land or consider REITs which will go a long way in further diversity for the filling

Blacksmith’s tools: This allows one to hedge against stock price fluctuations since there are shares made from gold or liquid petroleum.

Asset Classes: Inside Each, Diversify More: Inside every asset class, further diversification should be encouraged. For instance, your stock portfolio may comprise both large, mid- and small-cap stocks pulled from various industries such as technology, health care or finance. Conversely, for fixed income investments you could consider both short- and long-term bonds from different issuers.

Geographic Diversification: Don’t confine your investments to just one country; consider allocating funds to global equities and debts so that you can ride on worldwide growth spurts at the same time lowering chances of going broke due to national downturns only.

Utilize Index Funds and ETFs: Index funds along with exchange-traded funds (ETFs) create fantastic platforms for diversification. Basically, these are investment vehicles which collect funds from numerous investors to buy a spectrum of stocks or bonds which automatically leads to diversification in the fund itself. As such; investing in index or ETF money market accounts results in an instantily diversified portfolio.

Strategic Diversification

Design Balanced Portfolios: A balanced portfolio will include stocks, bonds and other assets. The exact mix of these three categories depend on your risk appetite, investment objectives and time frame. For example; if you are young with an extended investment period ahead like 30 years or more, then perhaps you could have a greater percentage of equity shares. Conversely before retirement age it is likely that one would move towards more fixed income securities and other low-volatility options. Inorder to reduce the risk, one can invest in large cap companies or also investing in companies which has good dividends, bonus and splits can be a better choice.

1. Re Judiciously: With the passage of time, every investment’s worth may change thus creating an uneven portfolio. “Rebalance” refers to the act of bringing back into line one's desired proportions of investments as stocks, bonds or other such asset categories. This ensures that risk levels correspond with individual investment objectives.

2. Follow Up and Amending: Literacy needs one given fiscal policy to always differ and be changing as per preferences of that certain individual in the market at a particular time upon follow up from it regularly. Periodic adjustments may be required so as to keep an overall investment mix in balance hence giving opportunity for some time before buying any new ones.

Common Mistakes

Over Diversification: It is evident that although diversification matters; it can also harm your profit margins through excessive dilution. Avoid extensionalizing too thin your assets or choosing funds too far too many Aim for a balanced approach based on few investments.

Ignoring Asset Correlation: Diversification works well when these assets are not related closely. Investing in closely related assets ends up negating the effects on one’s portfolio during downturns and making this strategy less beneficial. All your assets ought to have different levels of risks as well as respond independently to different market conditions.

Minimizing Hazardous Behavior: Asset allocation must be aligned with your appetite for risk as well as your investment objectives. Don’t just diversify simply for the purpose of it. Ensure that your portfolio represents your comfort with risk and conforms to your financial aims.

Conclusion

A potent strategy for curtailing investment risks and obtaining more steady returns is diversification. When you spread out investments throughout various asset classes, industries and regions, the effect of bad performance on one specific investment will be reduced thus enhancing stability of the entire portfolio. Remember to diversify within asset classes, utilize index mutual funds along with ETFs then periodically check and adjust the mix in order to have an ideal level of diversification throughout your life cycle; this way you will be able to handle any changes in the marketplace hence working towards fulfilling all your dreams.

#stock market#investment#stock market india#splits#stocks#fundamental analysis of stocks#Indian share market

3 notes

·

View notes

Text

Too much

One box gets ticked and 5 more pop up

like the roaches from my neighbor's place

killable but 100s more hiding in the walls

Resilience is all well and good

I'm over it

can't I be weak

for a day

a month

(put down your gratitude journal)

I don't need to express how I'm blessed

because today is kicking my ass

Perimenopause and tears

out of nowhere

irrational fears creeping

now I need a certificate of insurance

so I don't get sued

for my one asset

I'll own my Corolla in February

Ha, and that investment that I need to triple asap

treading lightly on my last thread

C4 going for gold

I'm up $200

tripping on hindsight

midnights

More crying

taking solace in Morning messages

from CosMic

his little hellos

us lamenting on how hard it is to be pretty

(achievements and failures hit harder)

Momentarily

Scorning capitalism for standing in our way

he's the highlight that keeps

me from fleeing the planet

today

reflecting on how he sees me

if only that paid the bills

I'm over my head today

Uta told me to take comfort in my discomfort

I've been running that play

for too long

One hundred more leaps of faith to go

hoping to land somewhere

soft

until then

a Mich Ultra is the best I can do.

(started off great and skidded into the hedges)

(there's always Portugal)

curious why the tip button is missing.

Not that anyone has yet...but if you are so inclined the rest of my posts have it.

#writing#dark humor#despair#poverty#racing thoughts#Narcolepsy#ADHD#neurodivergent#adhd brain#executive dysfunction#love#madness#metallic#frustrated#hopeful#overwhelming

3 notes

·

View notes

Photo

CHARACTER DEVELOPMENT TASK 001: FAMILIES.

INTRODUCING . . . The Lee-Choi family.

James Choi and Lee Sun Hee were set up on a blind date by some mutual New York City friends, while Sun Hee was still in her senior year of college at Columbia Univerty. James was still laying the foundations to becoming a successful hedge fund manager, but the sparks with the chaebol daughter were instant. The rest is history, as they say, and Isabella Areum Choi was born just over a year into their marriage. But not all glitters is gold.

JAMES CHOI, 47, HEDGE FUND MANAGER, UHM KI JOO.

James’s beginnings were much more humble than his current situation; his parents came to America just before he was born, to grant him citizenship and a promising, bright future. He delivered ten-fold, excelling in school, college, and eventually his career. He started his path shadowing a connection he met through his time at Ogden College, and created his own successful stock portfolio along the way. Desparation was his fuel, desparate to live the life he felt he deserved, provide for his future and current family, and create a legacy to be continued for years and years.

In the public eye, James is an honest, humble, hardworking man. Not to say he truly isn’t, but it’s a public secret among his social circle that he can go to great stakes to protect his family and his assets. This side is kept out of the public eye, and mostly the eye of his only daughter, and to most, they meet a sweet, well-deserving husband and father. Isabella could never forget, though, the smashed televisions and vases, the busted golf clubs, the ripped designer clothing. It was fine, he’d always say, because everything is replacable. She’d overhear phone calls, with threats or bribes or shady deals, sneak out of her room to find him coming home screaming drunk, see the way her mother tiptoed around him. She’ll always carry a fear of her father, but she’ll also always love him, choosing to cite his virtues over his vices to anyone who ever asked. It surprises most to hear that she’s closing to her father than her mother, daily phone calls and constant check-ins.

LEE SUN HEE, 44, ART COLLECTOR, KIM EUGENE.

Sun Hee was the wildcard of the Lee family, even as a young girl, interested in arts and traveling and America while her siblings were crafted to take on the family businesses. Money had always been promised to her, so she was never interested in work, knowing her father was there to fall back on. Her grandfather headed the Lee family group, a conglomerate controlling several Korean and international businesses, all which carried weight politically and socially. In fewer terms, they were untouchable. As was their money. Her dream was to have a picture perfect family portrait over the mantle in their warm home, surrounded by love and children.

After having her sweet, beloved Areum, the name Bella’s parents use, Sun Hee realized having kids was difficult. Babies were fun, sweet, cute, but as the tantrums and learning began, she found any excuse to escape. She began working for museums and art collections, traveling to invest in art around the world, while Isabella found comfort in a nanny. Sun Hee forced a dream on Bella and James both, of family life and of ballet. If Bella wasn’t perfect, or her husband wasn’t perfect, or life wasn’t perfect, she’d have meltdowns and run away. This would lead to dramatic fallings out when she returned, but Bella was always just grateful for her mom to return home. Even now, the mother is still one of the most successful art collectors in New York, building notoriaty off her family name, her husband’s name, and even her own name. The relationship between mother and daughter is again blossoming, almost too open and friendly, but Bella constantly shows love and forgiveness, even in times where she shouldn’t.

4 notes

·

View notes

Text

Gold as an Investment

Before jumping on the gold bandwagon, let us first put a damper on the enthusiasm around gold and examine some reasons why investing in gold poses some fundamental issues.

The main problem with gold is that, unlike other commodities such as oil or wheat, it does not get used up or consumed. Once gold is mined, it stays in the world. A barrel of oil, on the other hand, is turned into gas and other products that are expended in your car's gas tank or an airplane's jet engines. Grains are consumed in the food we and our animals eat. Gold, on the other hand, is turned into jewelry, used in art, stored in ingots locked away in vaults, and put to a variety of other uses. Regardless of gold's final destination, its chemical composition is such that the precious metal cannot be used up—it is permanent.

Because of this, the supply-demand argument that can be made for commodities such as oil and grains doesn't hold so well for gold. In other words, the supply will only go up over time, even if demand for the metal dries up.

History Overcomes the Supply Problem

Like no other commodity, gold has held the fascination of human societies since the beginning of recorded time. Empires and kingdoms were built and destroyed over gold and mercantilism. As societies developed, gold was universally accepted as a satisfactory form of payment. In short, history has given gold a power surpassing that of any other commodity on the planet, and that power has never really disappeared.

The U.S. monetary system was based on a gold standard until the 1970s.

1

Proponents of this standard argue that such a monetary system effectively controls the expansion of credit and enforces discipline on lending standards because the amount of credit created is linked to a physical supply of gold. It's hard to argue with that line of thinking after nearly three decades of a credit explosion in the U.S. led to the financial meltdown in the fall of 2008.

From a fundamental perspective, gold is generally viewed as a favorable hedge against inflation. Gold functions as a good store of value against a declining currency.

2

Investing in Gold

The easiest way to gain exposure to gold is through the stock market, via which you can invest in the shares of gold-mining companies. Investing in gold bullion won't offer the leverage you would get from investing in gold-mining stocks. As the price of gold goes up, miners' higher profit margins can boost earnings exponentially. Suppose a mining company has a profit margin of $200 when the price of gold is $1,000. If the price rises 10%, to $1,100 an ounce, the operating margin of the gold miner goes up to $300—a 50% increase.

Of course, there are other issues to consider with gold-mining stocks, namely political risk (because many operate in developing nations) and the difficulty of maintaining gold production levels.

The most common way to invest in physical gold is through an exchange-traded fund (ETF) like the SPDR Gold Shares (GLD), which simply holds gold.

When investing in ETFs, pay attention to net asset value (NAV), as the purchase price can at times exceed NAV by a wide margin, especially when the markets are optimistic.

A list of gold-mining companies includes Barrick Gold Corp. (ABX.TO), Newmont Corp. (NEM), and Agnico Eagle Mines Ltd. (AEM), among others. Passive investors who want great exposure to the gold miners may consider the VanEck Vectors Gold Miners ETF (GDX), which includes investments in all the major miners.

Alternative Investment Considerations

While gold is a good bet on inflation, it's certainly not the only one. Commodities in general benefit from inflation because they have pricing power. The key consideration when investing in commodity-based businesses is to go for low-cost producers. More conservative investors would also do well to consider inflation-protected securities like Treasury Inflation-Protected Securities, or TIPS. The one thing you don't want is to be sitting idle—in cash, thinking you're doing well—while inflation is eroding the value of your dollar.

Gold Price Performance

The price of gold depends on a complex array of factors. Because gold is priced in dollars, the value of the U.S. currency can have a significant impact on the performance of the precious metal. A strong dollar makes gold more expensive for buyers in other countries, potentially leading to lower gold prices. On the other hand, a weaker dollar makes gold more affordable for international purchasers and may bring increased prices. Since gold is seen as a hedge against inflation, the decline in value of fiat currencies and the market's expectations surrounding inflation can also affect gold prices.

3

These factors seem to be evident in the yellow metal's recent price history. Throughout most of 2022, despite soaring levels of inflation, gold prices actually dipped, likely driven lower by sustained strength in the dollar against other currencies. More recently, with inflation remaining stubbornly persistent despite the Federal Reserve's attempts to bring it under control, gold prices have recovered to more than $1,875 per ounce in January 2023, from around $1,656 per ounce in September 2022.

3

What's to Come

You can't ignore the effect of human psychology when it comes to investing in gold. The precious metal has always been a go-to investment during times of fear and uncertainty, which tend to go hand in hand with economic recessions and depressions.

In the articles that follow, we examine how and why gold gets its fundamental value, how it's used as a form of money, and which factors subsequently influence its price on the market—from miners to speculators to central banks. We will look at the fundamentals of trading gold and what types of securities or instruments are commonly used to gain exposure to gold investments. We'll look at using gold both as a long-term component of a diversified portfolio and as a short-term day trading asset. We'll look at the benefits of gold but also examine the risks and pitfalls and see if it lives up to the "gold standard."

What Makes Gold Valuable?

Aside from its literal shine and the symbolic relationship with wealth that has lasted throughout human civilization, gold plays an important role as a store of value and a medium of exchange. Unlike other commodities, gold does not get used up or consumed, imbuing the precious metal with a sense of everlasting value. Gold serves as a hedge against the declining value of currencies through inflation, which leads many investors to consider gold an alternative asset and a way of safeguarding their wealth.

What Is the Gold Standard?

Under the gold standard, the value of a currency is pegged to the value of gold. The Bretton Woods Agreement, which formed the framework for global currency markets starting at the end of World War II, established that the U.S. dollar was convertible to gold at a fixed rate of $35 per ounce, with other world currencies valued in relation to the dollar.

4

President Nixon ended the convertibility of the dollar to gold in 1971, signaling the end of the gold standard.

How Can I Invest in Gold?

There is a wide variety of options for investors who want exposure to gold. It's possible to invest directly in gold bullion, although the costs of storing and insuring physical gold can be significant. Investors also can turn to exchange-traded funds (ETFs) that hold the precious metal or purchase shares of mining companies whose stock prices are correlated to gold's price performance.

The Bottom Line

Gold has held a special place in the human imagination since the beginning of recorded time. From an investment perspective, gold is attractive because of its potential to remain strong in difficult financial environments and to hedge against inflationary declines in the value of fiat currencies.

Although the U.S. dollar and other world currencies are no longer pegged to gold—as was the case when many countries operated under the gold standard—the precious metal continues to play an important role in the global economy.

ARTICLE SOURCES

PART OF

Investing in Gold

Investing in Gold1 of 30

Why Gold Matters: Everything You Need to Know2 of 30

Why Has Gold Always Been Valuable?3 of 30

What Drives the Price of Gold?4 of 30

What Moves Gold Prices?5 of 30

Gold Standard: Definition, How It Works, and Example6 of 30

Gold: The Other Currency7 of 30

How to Invest in Gold: An Investor’s Guide8 of 30

Gold Bug9 of 30

8 Good Reasons to Own Gold10 of 30

4 Ways to Buy Gold11 of 30

Does It Still Pay to Invest in Gold?12 of 30

The Best Ways To Invest In Gold Without Holding It13 of 30

How to Buy Gold Bars14 of 30

The Best Strategy for Gold Investors15 of 30

The Most Affordable Way to Buy Gold: Physical Gold or ETFs?16 of 30

The Better Inflation Hedge: Gold or Treasuries?17 of 30

Has Gold Been a Good Investment Over the Long Term?18 of 30

Trading the Gold-Silver Ratio19 of 30

How to Trade Gold in 4 Steps20 of 30

Gold Option21 of 30

How To Buy Gold Options22 of 30

Using Technical Analysis in Gold Miner ETFs23 of 30

Day-Trading Gold ETFs: Top Tips24 of 30

Gold ETFs vs. Gold Futures: What's the Difference?25 of 30

Should You Get a Gold IRA?26 of 30

How to Buy Gold With Your 401(k)27 of 30

Gold IRA Definition28 of 30

When and Why Do Gold Prices Plummet?29 of 30

The Effect of Fed Funds Rate Hikes on Gold30 of 30

Related Articles

Business man trader investor analyst using mobile phone app and laptop

INVESTING

How to Invest in Commodities

Pile of Gold Bars

GOLD

Does It Still Pay to Invest in Gold?

Gold Bars

STOCKS & BOND NEWS

Top Gold Stocks for Q2 2023

GOLD

The Better Inflation Hedge: Gold or Treasuries?

GOLD

The Best Ways To Invest In Gold Without Holding It

Gold bars are placed on United States banknote

INVESTING

How to Invest in Gold and Silver

Related Terms

Gold IRA Definition

A gold IRA is a retirement investment vehicle used by individuals who hold gold bullion, coins, or other approved precious metals. more

Troy Ounce: Definition, History, and Conversion Table

A troy ounce is a unit of measurement for precious metal weight that dates to the Middle Ages. One troy ounce is equal to 31.10 grams. more

Gold Bug

A “gold bug” is somebody who is especially bullish on gold. more

Dollar Bear

A dollar bear is an investor who is pessimistic, or "bearish," about the prospects of the U.S. dollar (USD). They are the opposite of a dollar bull. more

Gold Standard: Definition, How It Works, and Example

The gold standard is a system in which a country's government allows its currency to be freely converted into fixed amounts of gold. more

Precious Metals: Definition, How to Invest, and Example

Precious metals are rare metals that have a high economic value, such as gold, silver, and platinum.

Invest with us today with Royallis Gold.

2 notes

·

View notes

Text

A Comprehensive Guide to Buying Silver in Canada

In recent years, silver has emerged as a popular investment option in Canada, offering a unique blend of value, stability, and growth potential. buying silver in canada Whether you’re a seasoned investor or just starting out, buying silver can diversify your portfolio and hedge against economic uncertainties. This guide will walk you through the essential steps and considerations for purchasing silver in Canada.

Why Invest in Silver?

Silver is often referred to as "the poor man's gold," but its value in the market is anything but meager. Unlike gold, silver has significant industrial uses, which adds to its demand and, consequently, its value. Here are a few reasons why investing in silver might be a smart choice:

Affordability: Silver is more accessible than gold, making it easier for beginners to start investing.

Hedge Against Inflation: Like gold, silver can protect your wealth from inflation and currency fluctuations.

Industrial Demand: Silver is widely used in electronics, solar panels, and medical devices, ensuring its demand remains strong.

Where to Buy Silver in Canada

Canada is home to some of the world's most reputable bullion dealers, making it easy to purchase silver. Here are a few options:

Online Dealers: Buying silver online offers convenience and access to a wide range of products. Trusted online dealers like Gold Stock Canada provide a secure platform for purchasing silver bullion, coins, and bars.

Local Coin Shops: If you prefer to see your investment before buying, local coin shops are a great option. These shops offer a variety of silver products and often provide valuable insights into the market.

Banks: Some Canadian banks also offer silver bullion for purchase, though their premiums may be higher than those of specialized dealers.

Understanding Silver Pricing

The price of silver is influenced by various factors, including market demand, geopolitical events, and economic conditions. When buying silver, it's crucial to understand the following terms:

Spot Price: This is the current market price of silver per ounce. It fluctuates throughout the day based on market activity.

Premium: The premium is the amount added to the spot price by the dealer to cover costs and profit. It varies based on the form of silver (coins, bars, rounds) and the dealer's pricing strategy.

Spread: The difference between the buying price (ask) and the selling price (bid) is known as the spread. A narrower spread indicates better liquidity for your investment.

Storage Options for Your Silver

Once you've purchased your silver, you’ll need a secure place to store it. Here are a few options:

Home Storage: Many investors choose to store their silver at home in a safe or hidden location. While this option provides immediate access, it also requires strict security measures.

Safety Deposit Boxes: Renting a safety deposit box at a bank offers a high level of security, but it limits your access to banking hours.

Bullion Storage Services: Some dealers, including Gold Stock Canada, offer secure storage services. These facilities are designed to protect your investment with advanced security measures.

Selling Your Silver

Knowing when and how to sell your silver is as important as buying it. Monitor the market regularly and sell when the price meets your investment goals. You can sell your silver back to the dealer, through online platforms, or at local coin shops.

Conclusion

Buying silver in Canada is a prudent investment that can enhance your financial portfolio. Whether you're purchasing online through reputable dealers like Gold Stock Canada or visiting local shops, buying silver in canada understanding the market and making informed decisions will help you maximize your returns. Always keep an eye on market trends and ensure your silver is securely stored to protect your investment.

0 notes

Text

Best Alternative Investment Company in Chennai

In today’s fast-paced financial world, finding the best alternative investment company can make a significant difference in achieving your financial goals. Chennai, with its burgeoning economy and dynamic investment opportunities, has emerged as a hub for investors seeking diversification beyond traditional avenues. This article delves into the top alternative investment company in Chennai that stands out for its innovative approach, strong market presence, and investor-friendly policies.

What Are Alternative Investments?

Alternative investments are different from traditional investments like stocks or bonds. They include things like real estate, private companies, hedge funds, and commodities like gold or oil. People like alternative investments because they can offer higher returns and protect against market ups and downs.

Why Chennai is a Good Place for Alternative Investments

Chennai is a rapidly growing city with many investment opportunities. The city's strong economy, skilled workers, and good infrastructure make it a great place to invest. Many people in Chennai, including those with a lot of money, are looking for ways to diversify their investments. This makes alternative investments very popular in the city.

How to Choose the Best Alternative Investment Company

When choosing an investment company, it's important to consider the following:

1. Reputation: How well-known and trusted is the company?

2. Expertise: Does the company specialize in the type of investments you’re interested in?

3. Transparency: Is the company open and honest about how they handle your money?

4. Client Focus: Does the company offer personalized advice and good customer service?

5. Regulatory Compliance: Does the company follow all the necessary laws and regulations?

The Top Alternative Investment Company in Chennai

After researching, GHL India is the best alternative investment company in Chennai. Here’s why:

Why is the Best

GHL India is known for offering a variety of investment options, such as real estate, private equity, and finance products. Here are some reasons why they are the best:

Variety of Investment Options

They offer many different investment choices, which helps investors spread their risk. This means that if one investment doesn’t do well, others might still perform well, balancing out the losses.

Smart Investment Strategies

The company uses smart strategies and advanced tools to make the best investment decisions. This helps them maximize returns while keeping risks low.

Conclusion

In conclusion, GHL India is the top choice for alternative investments in Chennai. Their variety of investment options, smart strategies, focus on clients, and commitment to transparency make them the best company to help you reach your financial goals.

0 notes

Text

Who Are the Best Gold Buyers in 2024?

Looking for the best gold buyers in 2024? Gold buying remains a popular investment strategy, offering a hedge against economic uncertainty.

Amruta Gold stands out as a leading name in this field, providing top-notch services to those looking to sell their precious metal.

Let's explore what makes a great gold buyer and why Amruta Gold might be your best choice.

Key Factors in Choosing a Gold Buyer

When selecting a gold buyer, consider:

1. Reputation

2. Transparency

3. Market knowledge

4. Competitive pricing

Amruta Gold excels in these areas, ensuring a trustworthy experience for all clients.

Read more: Best Gold Buyers in Vijayawada: Amurta Gold

Top Gold Buyers in 2024

While several companies offer gold buying services, Amruta Gold distinguishes itself through:

- Expert appraisals

- Fair market rates

- Exceptional customer service

Whether you're in Vijayawada, Hyderabad, or searching for "gold buyers near me," Amruta Gold is a top choice.

Also read for your reference: Top Value for Your Gold with Amruta Gold Buyers

Amruta Gold: Features and Benefits

Amruta Gold offers:

- Transparent evaluation process

- Spot cash for gold

- Secure transactions

- Experienced gold dealers

Their commitment to fairness and expertise sets them apart from second-hand gold buyers in Hyderabad and beyond.

Customer Testimonials

Don't just take our word for it. Here's what satisfied customers say:

"Amruta Gold offered the best price for my jewelry. Their service was quick and professional." - Kiran.

"I felt confident selling to Amruta Gold. They explained everything clearly and gave me a great deal." - Shruti Gupta.

Conclusion

Choosing the right gold buyer is crucial for a satisfactory selling experience.

Amruta Gold stands out as one of the best gold buyers in 2024, offering transparency, expertise, and competitive rates.

Whether you're in Hyderabad, Vijayawada, or anywhere else, consider Amruta Gold for your gold selling needs.

Ready to sell your gold? Visit Amruta Gold today and experience the difference!

0 notes

Text

Exploring Vancouver Bullion: Your Trusted Partner in Precious Metals Investment

When it comes to investing in precious metals, Vancouver Bullion stands out as a key player in the industry. vancouver bullion Located in the vibrant city of Vancouver, this renowned company has built a reputation for providing top-notch services and products to investors and collectors alike.

Why Choose Vancouver Bullion?

Vancouver Bullion offers a comprehensive range of products, including gold, silver, platinum, and palladium bullion. Their extensive selection ensures that clients have access to high-quality precious metals that suit their investment strategies and personal preferences.

One of the standout features of Vancouver Bullion is their commitment to transparency and customer education. The company provides detailed information about the market, helping clients make informed decisions about their investments. This dedication to service excellence has earned them the trust of many in the precious metals community.

The Benefits of Investing in Precious Metals

Investing in precious metals has long been considered a safe haven, particularly during times of economic uncertainty. Metals like gold and silver not only offer a hedge against inflation but also serve as a tangible asset that can be held and valued independently of traditional financial systems.

Vancouver Bullion understands these benefits and is dedicated to helping investors navigate the complexities of the precious metals market. Whether you are a seasoned investor or new to the world of bullion, their expert team is ready to assist you in achieving your investment goals.

Why Visit Gold Stock Canada?

For those looking to expand their knowledge and explore additional investment opportunities, visiting Gold Stock Canada is a great start. This resource offers valuable insights into the precious metals market, including news, trends, and expert analysis. By staying informed through reliable sources, investors can make better decisions and stay ahead in their investment journey.

Conclusion

Vancouver Bullion remains a top choice for anyone interested in precious metals. Their commitment to quality, transparency, and customer service makes them a trusted partner in the investment community. vancouver bullion For more information and to explore a wide range of investment options, consider visiting Gold Stock Canada to enhance your understanding and investment strategy.

0 notes

Text

Best Alternative Investment Company

Investing means using your money to make more money. People often buy stocks or bonds, but there are other ways to invest. These are called alternative investments. They can help you make more money and keep your investments safe. The best alternative investment company can help you choose these options.

Why Choose Alternative Investments?

Alternative investments can be better than regular stocks and bonds. They include things like real estate, private companies, and more. These investments don’t always go up and down with the stock market, which makes them safer when times are tough.

Types of Alternative Investments

Real Estate

Real estate means buying property, like houses or buildings. You can rent them out to make money every month or sell them later for a higher price. A good investment company will help you find good properties to invest in.

Private Companies

Investing in private companies means buying a part of a business that isn’t on the stock market. These investments can make a lot of money but are riskier.

Hedge Funds

Hedge funds are groups of investments managed by experts. They invest in many things, like stocks and bonds, to make a lot of money. Rich people often invest in hedge funds.

Commodities

Commodities are things like gold, silver, and oil. Investing in these can protect your money because their value often stays the same even when the market is bad.

Benefits of Alternative Investments

Diversification

Diversification means spreading your money across different investments to reduce risk. If one investment loses money, others might make money.

Higher Returns

Alternative investments can make more money than traditional stocks and bonds. A good investment company will find the best opportunities for you.

Reduced Market Correlation

These investments don’t always follow the stock market trends, so they can do well even when the stock market is down.

Conclusion

Alternative investments are exciting and can make a lot of money. They help diversify your investments, offer higher returns, and are less tied to the stock market. But they also come with challenges like liquidity, complexity, and regulatory risks. With the right help, they can be a great addition to your investment plan.

0 notes

Text

Hello 👋

How are you doing

I'm Elizabeth Toss from Florida, Miami.

It was by following and texting some blogs.

I think that when I reach out to you, I hope you don't mind?

What's your name and where are you from?

Nice to meet you......

How is life in......

How old are you?

From 56 upward; you're old enough to be my dad. I hope you don't mind chatting with me?

From 56 below 👇: nice age👍

What are you up to?

What's your hobbies?

I mostly spend my life between going to the gym.the beach 🏖️ cinema. art galleries. Museum and also finding books to add to my rare book library among other projects.

How is the weather ☁️ like there?

Are you single or married? I'm single

If married; How is your family doing?

Can I see a picture of you if you don't mind me asking?

Have you had your breakfast, lunch or dinner?

Do you have pets? I have a dog 🐕 and cat 🐈

What do you do for a living?

I hope you love doing your job?

Hey, I'm sorry I left you hanging yesterday, I was really exhausted and fell asleep. How did you sleep?

I'm a computer specialist and an agent consultant in first mile hedge.com investment company.

Have you heard about the company?

First mile hedge is a big investment company based in Sweden but they have branches across the globe 🌎. And the company also deals with stocks real estate,oil & gas, gold and crypto currency

Are you familiar with crypto currency?

That's good. Have you venture into into crypto?

I have been into this trade for a long time now and don't have to be afraid of anything all we do is to satisfy our customers better

Alright. I understand. No doubt there are some scam& still there are so many good traders also it depends on the trader you

are dealing with.. success is my duty anytime day. trading is a choice ¬ compulsory so here I leave you to make your conclusion.

Thanks for the given me a listening ear am greatful for the time spenty

Yes.

We'll it is your choice, I will explain, teach you how it works out and how you can been benefiting from crypto currency on a daily basis yourself

I understand that, and I won't mind share through with you too, but unfortunately I don't use this site very often, am on and off here, I use WhatsApp or google chat mostly because that's where I talk to you my client and also my close and intimate friends,,,

So anytime you text I didn't text back you should understand that I don't message notification on here and it will be when I checked in here again that I might saw your message. So if you have any of those apps above, I think it's be okay to have conversations there if you wish

Yes of course

With the company you will be benefiting on a daily basis every 24 hours everyday and now the company on promo now if you get invested with the company you will be earning x2 of the what you invest.

Alright I will introduce you to the company that I'm investing with and you will go through it yourself and see how it works out then register and start your investment with the company.

I believe in life there are golden chance to which doubt& lack of believe is the a major hindrance which deprive us from hitting our goals and our golden chance. I believe that trading/ investment process is very skeptical and complicated but if only you will agree to work with me you will have no room for regret at the end definitely you will live to remember the day you embark on your trading/ investment

Well is your choice to do what you want to do but if I where you I will just give it a try with the company minimum plan and see how it works out yourself and you will so been benefiting on a daily basis yourself

It's not that much if only you really understand how it works and how you can be benefiting from it on a daily basis.

B5

With just $50 you can invest your crypto for example Bitcoin and see how it goes in a Nova global holdings company and they are going to mined your crypto coin through the help of the crypto mining machine. After which certain amount of profits and the bonuses will be earn by the investor on a daily basis.

I'm into occasions and events interior decorations I deal with fabrics and sales of jewelries costume and shoes and most importantly I'm into cryptocurrency

1 note

·

View note

Text

An Overview of Different Financial Instruments in Global Trading

Introduction

Embarking on the journey of global trading can feel like navigating a maze. To simplify things, understanding different financial instruments is crucial. In this article, we’ll break down some popular options, helping you choose the best trading platform and investment strategy.

1. Stocks

Owning stocks means holding a share in a company. The value of these shares changes based on company performance and market conditions. Stocks are a great option for long-term investments, especially if you're looking to become the best forex trader.

2. Bonds

Bonds are essentially loans given to companies or governments. In return, bondholders receive periodic interest payments. While bonds are safer than stocks, they typically offer lower returns.

3. Forex (Foreign Exchange Market)

The forex market deals with currency trading. It’s the largest financial market worldwide, operating 24/7. Successful forex trading involves buying one currency while selling another, requiring a good grasp of market trends and currency pairs to become the best forex trader.

4. Commodities

Commodities include raw materials like gold, oil, and agricultural products. Trading in commodities can diversify your portfolio. Their prices are affected by supply and demand, geopolitical events, and natural factors.

5. Mutual Funds

Mutual funds pool money from numerous investors to invest in a mix of stocks, bonds, or other securities. Managed by professionals, they are perfect for beginners, offering a hassle-free investment approach.

6. ETFs (Exchange-Traded Funds)

ETFs are similar to mutual funds but trade like stocks. They offer a diversified investment portfolio with the flexibility of stock trading. ETFs can cover various assets, including stocks, bonds, and commodities.

7. Options

Options provide the right, but not the obligation, to buy or sell an asset at a predetermined price before a set date. They can be used for hedging or speculative purposes, presenting high rewards but also high risks.

Conclusion

Grasping the different financial instruments available in global trading is vital for making smart investment choices. Whether you're interested in stocks, bonds, forex, or commodities, selecting the best trading platform and strategy will set you on the path to success. Begin with the basics, continue learning, and discover the best investment opportunities tailored to your goals.

0 notes

Text

Buying Silver in Canada: Your Guide to Silver Products at Gold Stock Canada

When it comes to investing in precious metals, silver stands out as a versatile and valuable option. Whether you're a seasoned investor or new to the world of precious metals, buying silver in Canada offers a reliable and profitable opportunity. Gold Stock Canada is your go-to source for a wide selection of silver products, ensuring secure transactions and competitive prices. In this article, we’ll explore why silver is a great investment and why Gold Stock Canada is the best choice for purchasing silver in Canada.

Why Invest in Silver?

Affordability: Silver is more affordable than gold, making it accessible for new investors and those looking to diversify their portfolios without a significant upfront cost.

Versatility: Silver has numerous industrial applications, including in electronics, solar panels, and medical devices. This demand helps maintain its value and potential for growth.

Hedge Against Inflation: Like gold, silver acts as a hedge against inflation. Its value tends to increase when the purchasing power of fiat currency decreases. buying silver in canada

Liquidity: Silver is highly liquid, meaning it can be easily bought and sold in the market. This makes it a flexible investment option.

Tangible Asset: Owning physical silver gives you a tangible asset that isn't subject to the same risks as paper investments like stocks and bonds.

Types of Silver Products Available at Gold Stock Canada

At Gold Stock Canada, you'll find a diverse range of silver products to suit your investment needs:

Silver Coins: Coins are a popular choice for investors due to their recognizability and ease of storage. Gold Stock Canada offers a variety of silver coins, including Canadian Maple Leafs and American Eagles, known for their purity and quality.

Silver Bars: For those looking to purchase larger quantities of silver, bars are an excellent option. They come in various sizes, from one ounce to one kilogram, providing flexibility in your investment.

Collectible Silver: If you’re a collector, Gold Stock Canada also offers a selection of limited-edition and commemorative silver pieces that can add value and interest to your collection.

Why Choose Gold Stock Canada?

Competitive Prices: Gold Stock Canada provides competitive pricing on all silver products, ensuring you get the best value for your investment. buying silver in canada

Secure Transactions: Security is a top priority at Gold Stock Canada. They use advanced encryption and security measures to protect your transactions and personal information.

Expert Guidance: Whether you're new to investing or a seasoned pro, the knowledgeable team at Gold Stock Canada can offer expert advice and guidance to help you make informed decisions.

Customer Satisfaction: With a reputation for exceptional customer service, Gold Stock Canada is dedicated to ensuring a smooth and satisfactory buying experience.

Wide Selection: The extensive range of silver products available at Gold Stock Canada means you can find exactly what you need to meet your investment goals.

How to Get Started

Getting started with buying silver at Gold Stock Canada is simple:

Visit the Website: Go to Gold Stock Canada to browse their selection of silver products.

Create an Account: Sign up for an account to streamline your purchasing process and keep track of your investments.

Select Your Products: Choose from their wide range of silver coins, bars, and collectible items.

Secure Your Purchase: Follow the secure checkout process to complete your purchase. Your silver will be shipped to you safely and discreetly.

Conclusion

Buying silver in Canada is a smart investment strategy, and Gold Stock Canada makes it easy and secure. With competitive prices, a wide selection of products, and a commitment to customer satisfaction, Gold Stock Canada is the ideal place to start or expand your silver investment portfolio. Visit Gold Stock Canada today to explore their offerings and take the first step towards a valuable investment in silver.

buying silver in canada

0 notes

Text

BUY 2 ASAHI GOLD BARS & GET A FREE 1/2 Oz SILVER ROUND!

The Asahi Refining 1 Oz Gold Bar is one of the greatest Gold investments you can make. Each bar is .9999 pure and comes in an assay card to authenticate its weight and purity. This is a fantastic choice of uncirculated Gold for investors and collectors. In addition, these Gold Bars are a great diversification and hedge against inflation!

0 notes