#Invoice Software

Explore tagged Tumblr posts

Text

How to Integrate Invoice Maker Tools with Your Accounting Software

In today's fast-paced business world, efficiency and accuracy are paramount when managing financial data. One essential aspect of this is invoicing. As businesses grow, manually creating and managing invoices becomes more cumbersome. That's where invoice maker tools come into play, allowing you to quickly generate professional invoices. However, to truly streamline your financial workflow, it’s important to integrate these tools with your accounting software.

Integrating invoice maker tools with your accounting software can help automate the process, reduce human error, and improve overall productivity. This article will walk you through how to integrate your Invoice Maker Tools with accounting software effectively, ensuring smoother operations for your business.

1. Choose the Right Invoice Maker Tool

Before integration, ensure you have selected an invoice maker tool that suits your business needs. Most invoice maker tools offer basic features such as customizable templates, tax calculations, and payment tracking. However, the integration potential is an important factor to consider.

Look for an invoice maker tool that offers:

Cloud-based features for easy access and collaboration.

Customizable templates for branding.

Multi-currency support (if you do international business).

Integration capabilities with various accounting software.

Examples of popular invoice maker tools include Smaket, QuickBooks Invoice, FreshBooks, and Zoho Invoice.

2. Check Compatibility with Your Accounting Software

Not all invoice maker tools are compatible with every accounting software. Before proceeding with the integration, confirm that both your invoice maker tool and accounting software are capable of syncing with each other.

Common accounting software that integrate with invoice tools includes:

QuickBooks

Smaket

Xero

Sage

Wave Accounting

Zoho Books

Most software providers will indicate which tools can integrate with their platform. Check for available APIs, plugins, or built-in integration features.

3. Use Built-in Integrations or APIs

Many modern invoice maker tools and accounting software platforms come with built-in integrations. These are often the easiest to set up and manage.

If you choose a platform that does not offer a built-in integration, you can use APIs (Application Programming Interfaces) to link the two systems. APIs are a more technical option, but they provide greater flexibility and customization.

4. Set Up the Integration

Once you've confirmed that the invoice tool and accounting software are compatible, follow the setup process to connect both tools.

The typical steps include:

Access your accounting software: Log into your accounting software and navigate to the integration settings or marketplace.

Search for the invoice maker tool: In the marketplace or integration section, look for the invoice tool you are using.

Connect accounts: Usually, you’ll be asked to sign into your invoice maker tool from within the accounting software and authorize the integration.

Map your fields: You may need to map invoice fields (like customer names, amounts, or due dates) to corresponding fields in the accounting software to ensure the data flows seamlessly.

5. Test the Integration

After the integration is complete, it’s crucial to test whether the connection between the invoice maker and accounting software is working as expected. Generate a sample invoice and check if the details appear correctly in your accounting software. Confirm that invoices are synced, and ensure payment status updates automatically.

Test for:

Accurate syncing of client details: Ensure names, addresses, and payment history are transferred correctly.

Real-time updates: Check that any changes made to invoices in the invoice tool reflect in your accounting software.

Reporting features: Verify that your financial reports, such as profit and loss statements, include data from the invoices.

6. Automate Invoicing and Payments

Once the integration is up and running, set up automated workflows. With the right integration, you can automate recurring invoices, late payment reminders, and payment receipts. This reduces manual effort and ensures consistency in your accounting.

7. Monitor and Maintain the Integration

Just because the integration is set up doesn't mean it's a "set it and forget it" situation. Regularly monitor the syncing process to ensure everything is working smoothly.

Make sure:

Software updates: Regular updates from either your accounting software or invoice maker tool might affect the integration. Always check for compatibility after any software updates.

Backup and security: Ensure your data is securely backed up, and verify that integration tools comply with security standards.

8. Benefits of Integration

By integrating invoice maker tools with your accounting software, you’ll enjoy several key benefits:

Time Savings: Automating the invoicing process frees up time for you to focus on other important aspects of your business.

Improved Accuracy: With automatic syncing, you reduce the risk of errors that often come with manual data entry.

Better Financial Management: Real-time data syncing allows for accurate tracking of income, expenses, and cash flow, which helps with budgeting and financial forecasting.

Enhanced Customer Experience: Timely and accurate invoicing helps maintain a professional image and reduces confusion with clients.

Conclusion

Integrating invoice maker tools with Accounting Software is a smart move for businesses that want to streamline their financial operations. By selecting the right tools, following the integration steps, and ensuring regular maintenance, you can save time, improve accuracy, and focus on growing your business. Don’t let manual invoicing slow you down—leverage modern tools to automate your processes and boost efficiency.

#accounting#software#gst#smaket#billing#gst billing software#accounting software#invoice#invoice software#cloud accounting software#benefits of cloud accounting#financial software#business accounting tools#cloud-based accounting#real-time financial insights#scalable accounting solutions#cost-effective accounting software#cloud accounting security#automated accounting software#business accounting software#cloud accounting features

0 notes

Text

Jewellery Billing Software: Streamlining Business Operations with Raseed

In the jewellery business, precision and efficiency are paramount. From managing intricate inventory to generating accurate invoices, the demands of running a jewellery store are unique. This is where Raseed Jewellery Billing Software comes into play, offering tailor-made solutions to simplify your operations and enhance business productivity.

What is Jewellery Billing Software?

Jewellery billing software is a specialized tool designed to cater to the specific needs of jewellery businesses. Unlike generic billing systems, it accommodates complex inventory tracking, varied pricing structures, GST compliance, and even customer relationship management, all in one streamlined solution.

Why Choose Raseed Jewellery Billing Software?

Raseed is a trusted name when it comes to efficient billing and accounting solutions for jewellery businesses. Here’s why:

Easy GST Billing: With built-in GST compliance, Raseed ensures that your invoices are accurate and meet regulatory standards.

Comprehensive Inventory Management: Manage detailed inventory, including karat-wise gold, diamond categories, and other precious metals, with ease.

Customizable Invoice Templates: Impress your customers with professional and personalized invoice designs tailored to your brand.

Real-Time Reporting: Gain insights into sales, profits, and stock levels through user-friendly dashboards and reports.

Seamless Customer Management: Keep track of your loyal customers with features like purchase history and preferences to enhance customer relationships.

Benefits of Using Jewellery Billing Software Like Raseed

Error-Free Transactions: Automate calculations to avoid errors in billing and pricing.

Time Efficiency: Save hours spent on manual billing and focus more on serving customers.

Improved Accuracy: Maintain precise records of inventory and sales, ensuring seamless audits.

Enhanced Customer Experience: Provide quick and efficient service with organized data and easy-to-understand invoices.

Features Tailored for Jewellers

Barcode integration for faster inventory management.

Detailed tracking of gold weight and other materials used.

Flexible pricing options to accommodate discounts or offers.

Backup and cloud storage for secure and reliable data management.

Why Your Business Needs Raseed Jewellery Billing Software

Whether you run a small jewellery shop or a large showroom, Raseed Jewellery Billing Software is designed to adapt to your business size and needs. It’s the ultimate tool to simplify operations, ensure compliance, and provide exceptional service to your customers.

Conclusion

In the competitive world of jewellery, leveraging the right tools can set your business apart. With Raseed Jewellery Billing Software, you can manage your operations seamlessly, leaving you more time to focus on crafting stunning pieces and serving your customers.

Ready to transform your jewellery business? Visit website Raseed and experience the change today!

#billing software#jewellery billing software#invoice software#invoicing software#gst billing software

0 notes

Text

Simplifying My Business Operations with the Right Tools

As the owner of Anais Fashions, I know firsthand how demanding it can be to manage a small business. Between curating stylish collections, connecting with customers, and handling daily operations, there’s always a lot on my plate. One of the biggest challenges I faced was managing invoices efficiently—it used to take up so much of my time.

Recently, I started using a tool designed to simplify invoicing, and it’s been a total game-changer for my business. It allows me to create professional invoices quickly and track payments seamlessly, which has helped me stay organized and stress-free. Not only does it save me time, but it also ensures my records are accurate and up to date, which is crucial for a business like mine.

As someone who loves sharing tips and good experiences, I want to encourage fellow small business owners to explore tools that can make their lives easier. Whether it’s for invoicing, inventory, or customer management, the right tools can free up your time so you can focus on growing your business and doing what you love. Running a business is hard work, but smart solutions can make it a whole lot easier!

1 note

·

View note

Text

EazyBills is the Best Billing Software in India, designed to simplify and streamline billing for businesses of all sizes. With its user-friendly interface and powerful features, EazyBills makes invoicing faster, more accurate, and hassle-free. Whether you’re a small startup or an established enterprise, EazyBills helps you manage invoices, track payments, and automate billing tasks with ease. Its comprehensive reporting and analytics tools offer valuable insights to optimize your cash flow and business operations. Trusted by businesses across India, EazyBills is the ultimate choice for anyone looking to enhance their billing process and drive growth.

0 notes

Text

Invoice Software | Invoice Management System

#billing software#invoice software#invoice tracking software#invoice automation#invoice management system#invoice management software

0 notes

Text

Manage your financial and accounting operations with Billing Applications

Automate daily tasks for your finance team with Tecnolynx billing software. Our powerful application allows you to create professional invoices, generate payment reminders, and maintain accurate accounting records. With Tecnolynx, you can easily track the products and services used by your clients, produce and send invoices, and efficiently collect payments. Streamline your financial processes and enhance productivity with our advanced billing solution.

#Billing applications#Invoice software#Billing solutions#Invoice management#Billing system#Invoice generation#Billing software#Invoice processing#Business invoicing#Free demo

0 notes

Text

The Ultimate Guide to EAZYBILLS: India's Best Free Billing and GST Software

Discover the power of EAZYBILLS, India's premier free billing and GST software, designed to streamline your business operations. This comprehensive guide explores how EAZYBILLS simplifies invoicing, manages GST compliance, and enhances overall efficiency.

#billing software#invoice software#free billing software#invoicing software#software for billing#gst billing software#best billing software#free invoice software#eazybills

0 notes

Text

Beyond Paper: Embracing the Digital Revolution with Invoice Software

Digital transformation is a driving factor in modern trade. One area where this digital transformation has had a particularly significant impact on business operations is invoicing. Businesses are increasingly using invoice software for its efficiency and flexibility, replacing paper-based invoicing. This paradigm shift recognizes digital technologies' transformative capacity to improve and optimize business processes. Software systems that simplify invoice preparation and maintenance and offer many other benefits have replaced paper invoices.

The Challenges of Traditional Invoicing

Businesses previously relied on paper-based manual invoicing systems, which presented many issues. The inefficiency of filing and retaining paper invoices and the risk of human error during calculations made these old approaches inefficient. As organizations grew and transactional activities increased, traditional invoicing techniques became more limited. Manual system’s inefficiencies restricted scalability and responsiveness to growing businesses. As regulatory requirements increased, accurate and timely financial reporting became essential, straining outdated invoicing systems.

Enter Invoice Software: A Game-Changer

Invoice software revolutionizes the invoicing workflow, giving many benefits that surpass paper-based alternatives. Accuracy is a major benefit. The software reduces errors by automating computations and data entry, ensuring accurate and tax-compliant invoicing. Furthermore, invoice software speeds up the entire billing cycle. Businesses can quickly prepare and send invoices, speeding up payment. By making billing quick and accurate, this boosts cash flow and strengthens client relationships.

Other benefits of invoice software include simplified record-keeping and financial administration. The computerized system makes tracking invoices, payments, and balances easier. Transparency improves financial oversight, allowing businesses to make real-time decisions.

The Flexibility Factor

Digital invoicing is more flexible than paper invoicing. It lets consumers access their invoices anywhere with an internet connection. This increased accessibility benefits firms with distant personnel and global transactions. Multiple stakeholders can access and edit invoices in real-time with cloud-based invoice software. Digital invoicing accepts online payments and electronic financial transfers. This meets various client’s needs and simplifies the payment process, saving time and resources on manual payment handling. Integration of payment methods improves financial activities, making invoicing and payment easier for enterprises and their customers.

Integration with Accounting Systems

Invoicing software that integrates with accounting systems is essential to a strong financial ecosystem. Data entry automation and accounting software synchronization removes manual reconciliation, saving time. This saves time and greatly decreases financial record conflicts. Financial reporting is simplified and more precise by integrating invoice software and accounting systems. These systems work together to keep financial data accurate and current. Organizations need this accuracy to make educated decisions.

Embracing the Future

In conclusion, digital invoicing is a strategic must for organizations seeking success in today's changing environment. Invoice software improves efficiency, accuracy, adaptability, environmental concern, and financial system integration. Digital invoicing positions businesses for long-term success as the business landscape changes. Now is the time to use invoice software instead of paper. This change simplifies invoicing and promotes a greener, digital future.

Companies improve invoicing operations and contribute to environmental responsibility by adopting digital technology. Invoice software integrated into financial systems improves financial administration and creates a more connected and efficient operational environment.

0 notes

Text

The best way to create free invoices online. Check out now:

1 note

·

View note

Text

#billing software#free invoice software#gst billing software#free billing software#invoicing software#invoice software#online invoicing software#accounting software#inventory management#best free billing software#best free invoicing software#best free invoice software#best invoicing software#online free invoicing software#free online billing software#online billing software

0 notes

Text

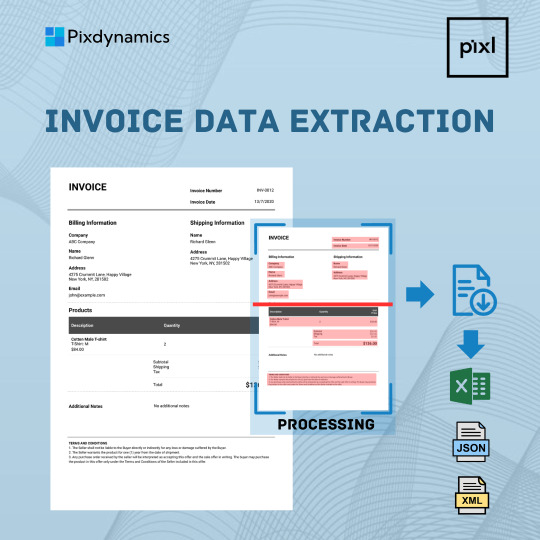

Invoice OCR Solution use?

Managing invoices is a crucial part of any organization's financial operations. However, manual invoice processing can be a time-consuming and error-prone task. This is where Invoice OCR (Optical Character Recognition) solutions come to the rescue.

What is Invoice OCR?

Invoice OCR is a technology that uses machine learning and artificial intelligence to extract data from invoices, such as vendor information, invoice numbers, line items, and financial figures. OCR technology converts the text and numbers on invoices into machine-readable data, making it easier to store, manage, and analyze.

0 notes

Text

Discover India's #1 Business Management Solution: AlignBooks ERP Software

Attention business owners and decision-makers! Are you striving for seamless operations, increased profits, and unparalleled growth? Look no further than AlignBooks.

All-in-One Platform: From accounting and billing to CRM and inventory management, AlignBooks offers a comprehensive suite tailored for the Indian market.

Drive Growth & Efficiency: Automate manual tasks, gain real-time insights, and make decisions that propel your business forward.

Stay Compliant: With built-in features adhering to Indian tax regulations, rest easy knowing you're always on the right side of the law.

Why Wait? Elevate Your Business Today!

Our consultants are eager to showcase the transformative power of AlignBooks. Dive into a free demo and witness the future of business management.

Book Your FREE Demo with Our Experts Now!

Click Here: https://alignbooks.com/free-trial

0 notes

Link

0 notes

Text

0 notes

Text

hrsoftbd #accountingsoftwareBD #bulksmsbangladesh

websitedevelopmentBD #websitedesignBD #appdevelopmentBD

appdesignBD #omrsoftwar #OMRSolution #AccountSoftwaredevelopmentBD

mobileappdesignBD #appdevelopmentBD

MobileAppDevelopmentBD

#accounting software#account software for hajj#ballot counting software#advocate diary management system#dynamic website#diagnostic management system#Hotel Management Software#HR & Accounts Software#Invoice Software#Marketing Sales Software#Online Coaching Management Software#Online Doctor Appointment#Online education System#OMR Software

0 notes

Text

EAZYBILLS is a user-friendly billing software designed to simplify invoicing and financial management for businesses in India. This versatile tool offers comprehensive features, including GST compliance, customizable invoice templates, and real-time tracking of payments and expenses. EAZYBILLS stands out for its intuitive interface, making it accessible for users with varying technical expertise. Ideal for small to medium-sized businesses, it provides a seamless experience in managing billing, ensuring accuracy, and saving time. Whether you need free billing, invoice generation, or GST solutions, EAZYBILLS is your go-to software for efficient financial operations.

#billing software#invoicing software#invoice software#gst billing software#free billing software#software for billing#eazybills#free invoice software#best billing software

0 notes