#KYC Provider UK

Text

KYC Provider UK

KYC Verification is essential to onboard a new client in UK businesses to authenticate the identity of a person associated with the business and even to check involvement in money laundering. We are one of the leading KYC providers in the UK and assist with KYC API for financial and non-financial businesses.

#KYC UK#KYC Provider UK#KYC Solutions UK#KYC Solutions Provider UK#banking#finance#fintech#gaming#kyc api#kyc software#kyc companies#banks

4 notes

·

View notes

Text

0 notes

Text

Blockchain in Banking Market Supply, Demand and Analysis by Forecast to 2031

The Insight Partners latest offering, titled “Blockchain in Banking Market Size and Share Analysis to 2031,” provides comprehensive insights for startups and big market players. The report covers industry performance, risk factors, growth determinants, economics of cost, and ROI streams. It combines qualitative and primary research methods, making it an essential product for companies, investors, and business strategists aiming to excel in the Blockchain in Banking market in a projected timeframe.

Market Overview

Blockchain in Banking market has experienced dynamic transformations in recent years, anticipated to remain an investible domain for investors in the projected time. The market is propelled by consumer preferences, regulatory parameters, and advancements in technology. Concurrently, the surge in automation has favored Blockchain in Banking market share expansion. Advancements in manufacturing technologies have made the Blockchain in Banking market viable and accessible, which is further expected to contribute to market growth.

In confluence with the aforementioned growth drivers, the Blockchain in Banking market is also gauged for restraints and trends. The emerging trends in the market are analyzed in this chapter to assist market players in trying to retain their competitive edge. Strategic insights on key players and their tactics are perks of this research. This section brings forward different organic business strategies, strategic partnerships, and collaborations in the Blockchain in Banking market.

Market Segmentation

To adequately aid their customers in a competitive Blockchain in Banking market, enterprises must educate themselves on key segments. Streamlining market approaches is an effective application of market research. The market segmentation section focuses on product, application, and regional categories. Understanding demographics and high-ROI geographical regions helps entrepreneurs optimize their products.

Regional Insights

The report attempts to explore both global and regional market aspects through authorized sources. Regional share, trends, key market players, and future scope are perks under this section.

Report Attributes

Details

Segmental Coverage

Product Type

Public Blockchain

Private Blockchain

and Hybrid Blockchain

Application

Clearance and Settlement Systems

Trade Finance

Fraud Detection

E-KYC

Smart Contracts

and Regulatory Reporting and Compliance

Regional and Country Coverage

North America (US, Canada, Mexico)

Europe (UK, Germany, France, Russia, Italy, Rest of Europe)

Asia Pacific (China, India, Japan, Australia, Rest of APAC)

South / South & Central America (Brazil, Argentina, Rest of South/South & Central America)

Middle East & Africa (South Africa, Saudi Arabia, UAE, Rest of MEA)

Market Leaders and Key Company Profiles

Accubits Technologies

BTL GROUP

Clearmatics Technologies LTD

FUJITSU

IBM Corpration

JPMorgan Chase & Co.

MICROSOFT CORPORATION

Primechain Technologies Pvt. Ltd

R3

Signzy

Other key companies

Need a Customized Market Research Report?

You can always share any specific requirements that you have, and our team will adjust the scope of research offerings as per your needs. the following are some customizations our clients ask for:

The report can be customized based on specific regions/countries as per the intention of the business

The report production was facilitated as per the need and following the expected time frame

Insights and chapters tailored as per your requirements.

Depending on the preferences we may also accommodate changes in the current scope.

Key Questions Addressed in the Blockchain in Banking Market Research Include:

What are present Blockchain in Banking market values, and what can be expected in the upcoming decade?

What are the key segments in the Blockchain in Banking market?

What is the regional distribution of the Blockchain in Banking market report?

What are the key players and their recent strategies?

What are the key factors driving Blockchain in Banking market growth?

What are regulatory concerns and requirements businesses have to compel?

Our Unique Research Methods at The Insight Partners

We offer syndicated market research solutions and consultation services that provide complete coverage of global markets. This report includes a snapshot of global and regional insights. We pay attention to business growth and partner preferences, that why we offer customization on all our reports to meet individual scope and regional requirements.

Our team of researchers utilizes exhaustive primary research and secondary methods to gather precise and reliable information. Our analysts cross-verify facts to ensure validity. We are committed to offering actionable insights based on our vast research databases.

Author’s Bio:

Aniruddha Dev

Senior Market Research Expert at The Insight Partners

0 notes

Text

#kyc uk#kyc solution#KYC Services UK#KYC solutions provider UK#kyc verification#KYC Provider UK#kyc providers#Identity verification solutions

1 note

·

View note

Text

#kyc uk#kyc solution#fintech#banks#gaming#kyc api#banking#identity verification uk#finance#KYC in UK#kyc providers#KYC Provider UK

1 note

·

View note

Text

Financial Licensing

Financial licensing is the process by which a company or individual obtains the necessary authorization from regulatory bodies to conduct financial activities legally. This authorization is required to ensure that businesses comply with laws and regulations, protect consumers, and maintain the integrity of the financial system.

Financial licensing can vary significantly depending on the jurisdiction and the type of financial activities being conducted. In the context of ‘forexcrmsolutions’, which specializes in providing CRM solutions for forex brokers, obtaining the right licenses is crucial for operating in the forex market.

The first step in obtaining financial licensing is to determine the specific licenses required for your business and jurisdiction. For forex brokers using ‘forexcrmsolutions’, this may include licenses from regulatory bodies such as the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC) in Cyprus, or the Australian Securities and Investments Commission (ASIC) in Australia.

Each regulatory body has its own set of requirements for obtaining a license, which may include minimum capital requirements, background checks on key personnel, and compliance with anti-money laundering (AML) and know your customer (KYC) regulations.

In addition to obtaining the necessary licenses, ‘forexcrmsolutions’ and its clients must also adhere to ongoing regulatory requirements, which may include regular reporting, compliance audits, and maintaining adequate financial records.

Failure to comply with financial licensing requirements can result in severe penalties, including fines, suspension of licenses, and even criminal charges. As such, it’s essential for ‘forexcrmsolutions’ and its clients to prioritize compliance with regulatory requirements at all times.

In conclusion, financial licensing is a critical aspect of operating in the forex market, and ‘forexcrmsolutions’ and its clients must ensure they obtain the necessary licenses and comply with regulatory requirements to operate legally and maintain the trust of their clients.

0 notes

Text

Gratix Technologies is the No.1 iGaming Software Company in the UK

Introduction

Gratix Technologies stands at the forefront of the iGaming Software Company in the UK, renowned for its cutting-edge solutions and innovative approach. With a commitment to excellence and a focus on user experience, Gratix Technologies has secured the top spot as the leading iGaming Software Company and iGaming KYC provider in the UK market. This article delves into the success story of Gratix Technologies, exploring its evolution, key features, market position, customer feedback, innovation strategies, and dedication to regulatory compliance and responsible iGaming Software Company initiatives.

Key Features of Gratix Technologies' Software

Game Variety and Quality

When it comes to games, Gratix Technologies doesn't mess around. They offer a wide range of top-notch games iGaming KYC that cater to all tastes and preferences. From slots to table iGaming Software Company, their game variety is as diverse as it gets. And quality? Oh, you better believe their games are as smooth in the iGaming Software Company.

User Interface and Experience

User experience is the name of the game, and Gratix Technologies knows it all too well. Their user interface is so slick and intuitive that even your grandma could navigate it with ease in iGaming KYC. They take pride in ensuring that every player's journey through their games is nothing short of a joy ride in the iGaming Software Company.

Innovation and Future Developments

Gratix Technologies isn't just resting on its iGaming Software Company. they're all about pushing the boundaries of what's possible. With hefty investments in research and iGaming Software Company.

R&D Investments

You know those mad scientists in movies who are always onto something in the iGaming Software Company? That's how Gratix Technologies rolls with their R&D investments in iGaming KYC. They're not just throwing spaghetti at the wall – they're cooking up some gourmet iGaming Software Company experiences that'll blow your mind.

New Product Launches

If you're the kind of person who loves being the first to try something new, Gratix Technologies has got you covered. Their new product launches aren't just about slapping a fresh coat of paint on an old idea. they're about shaking up the iGaming Software Company and giving players something they've never seen before.

Regulatory Compliance and Responsible Gaming Initiatives

Playing by the rules is cool, and Gratix Technologies knows it. With a rock-solid approach to licensing and compliance practices, and a commitment to responsible iGaming Software Company that puts players' well-being first, they're like the trustworthy friend who always has your back.

Licensing and Compliance Practices

When it comes to keeping things legit, Gratix Technologies doesn't mess around. Their licensing and compliance practices are top-notch in the iGaming Software Company, ensuring that players can enjoy their games with peace of mind.

Responsible Gaming Programs

Sure, playing games is fun, but Gratix Technologies knows that it's important to keep it in check. Their responsible gaming programs aren't about raining on your parade – they're about making sure that everyone has a good time, without any of the bad stuff. It's like having a guardian angel on your shoulder, nudging you in the right direction.In conclusion, Gratix Technologies' unwavering dedication to delivering top-notch iGaming Software Company solutions has solidified its position as the No.1 choice in the UK market. With a strong emphasis on customer satisfaction, continuous innovation, and adherence to regulatory standards in iGaming KYC, Gratix Technologies is set to shape the future of the iGaming Software Company. Keep an eye on this trailblazing company as it continues to lead the way with its unparalleled technology and commitment to excellence.

0 notes

Text

buy verified binance account

buy verified Binance account Guideline and Tips

Introduction to Binance

Binance is a leading cryptocurrency exchange platform that enables users to buy, sell and trade various cryptocurrencies. With a user-friendly interface and a wide range of trading options, Binance has become a popular choice for both new and experienced traders in the crypto market.\

Buy verified Binance account and Get Benefits

After Buy verified Binance account you can get several benefits that enhance your trading experience. First, a verified account allows you to increase your withdrawal limit, enabling you to transfer large amounts of funds in and out of the exchange. It is particularly useful for those who engage in high-volume trading or want to transfer significant amounts of funds quickly. Additionally, a verified Binance account provides an additional layer of security by enabling features such as two-factor authentication, ensuring your assets are safe. Buy verified Binance account with full security and safety.

#best Binance account#Binance Account for Sale#Binance account to buy#Buy binance account#Buy Verified Binance Account

1 note

·

View note

Text

#kyc solution#kyc uk#banks#kyc companies#finance#fintech#banking#gaming#kyc api#kyc software#KYC Solutions Provider in Uk#KYC Provider UK

1 note

·

View note

Text

Fintech Blockchain Market Size, Share, Growth Drivers, Trends, Opportunity, Research by 2030

The Fintech Blockchain market report by stats and research is a research study that concentrates on all the key marketing variables fueling the market's growth. The market's regional and segmental sections were considered when creating the research report on the Fintech Blockchain market. The SWOT analysis, PESTEL analysis, and PORTER'S five forces analyses are all included in the report, along with all qualitative and quantitative market characteristics. The report provides a comprehensive understanding of the Fintech Blockchain market by covering the market's size, growth rates, estimates, and value predictions for the forecast period.

This report describes the global market size of Fintech Blockchain Market from 2018 to 2021 and its CAGR from 2018 to 2021, and also forecasts its market size to the end of 2030 and its expected to grow with a CAGR of 75.9% from 2023 to 2030.

Get Free Sample Copy of Report:

https://www.statsandresearch.com/request-sample/40316-global-fintech-blockchain-market

Top Key players in Fintech Blockchain Market: AWS (US), IBM (US), Microsoft (US), Ripple (US), Chain (US), Earthport (UK), Bitfury (US), BTL Group (Canada), Oracle (US), Digital Asset Holdings (US), Other Key players

By Application

Payments, Clearing & Settlement

Exchanges & Remittance

Smart Contract

Identity Management

Compliance management / KYC

Others

BY Organization Size

Large Enterprises

SME

For Discount, Click Here:

https://www.statsandresearch.com/check-discount/40316-global-fintech-blockchain-market

0 notes

Text

iGaming KYC Company technology & regulations Ontario UK

iGaming, or online gambling, has witnessed unprecedented growth globally, creating a need for robust Know Your Customer (KYC) solutions. This article explores the technology and regulatory landscape surrounding iGaming KYC Company in two significant jurisdictions: Ontario, Canada, and the United Kingdom (UK).

iGaming KYC Technology:

Biometric Authentication:

Both Ontario and the UK emphasize the importance of secure identity verification. Biometric authentication, such as facial recognition and fingerprint scanning, is increasingly integrated into iGaming KYC Company platforms for a seamless and secure KYC process.

Blockchain Technology:

Blockchain provides a decentralised and tamper-resistant ledger, enhancing the transparency and reliability of KYC processes. In Ontario and the UK, iGaming KYC Company companies are exploring blockchain to securely store and share customer identity data across platforms while complying with data protection laws.

Machine Learning and AI:

AI-driven KYC solutions analyse vast amounts of data to detect patterns and anomalies, improving fraud detection and risk assessment. Both jurisdictions encourage the use of machine learning algorithms to enhance the efficiency and accuracy of KYC processes in iGaming KYC Company .

Smart Contracts:

Ontario and the UK are increasingly adopting smart contracts in iGaming KYC Company to automate compliance processes. Smart contracts execute predefined rules when specific conditions are met, ensuring real-time compliance with evolving regulations.

iGaming KYC Company Regulations:

Ontario, Canada:

Ontario iGaming KYC Company Control Act:

Ontario's iGaming KYC Company Control Act outlines the legal framework for online gambling. It mandates strict KYC procedures to prevent underage gambling and money laundering. Operators must obtain explicit consent from players for collecting and using their personal information.

Privacy Laws:

Ontario adheres to privacy laws such as the Personal Information Protection and Electronic Documents Act (PIPEDA). iGaming KYC Company companies must comply with these laws to protect players' personal information during KYC processes.

Collaboration with Financial Institutions:

The province encourages collaboration between iGaming KYC Company operators and financial institutions to strengthen KYC processes. This partnership facilitates the verification of financial information and enhances the overall security of transactions.

United Kingdom:

UK Gambling Act 2005:

The UK Gambling Act sets the regulatory framework for iGaming KYC Company in the country. It mandates strict KYC procedures to ensure the integrity of online gambling operations. Operators must conduct thorough identity verification before allowing users to participate in any gambling activities.

UK Data Protection Laws:

iGaming KYC Company operators in the UK must comply with the General Data Protection Regulation (GDPR) and the Data Protection Act 2018. These laws govern the collection, processing, and storage of personal data, reinforcing the importance of protecting players' privacy during KYC processes.

Gambling Commission Oversight:

The UK Gambling Commission (UKGC) oversees and regulates the iGaming KYC Company industry, ensuring compliance with KYC requirements. The UKGC continuously updates its guidelines to address emerging challenges and technologies in the online gambling sector.

Conclusion: In both Ontario, Canada, and the United Kingdom, iGaming KYC Company technology and regulations are evolving to address the dynamic nature of the online gambling industry. The integration of advanced technologies such as biometrics, blockchain, machine learning, and smart contracts enhances the efficiency and security of KYC processes. Meanwhile, stringent regulations and oversight by relevant authorities' safeguard players' interests and maintain the integrity of the iGaming KYC Company ecosystem. As technology continues to advance, it is crucial for iGaming Software Provider to stay abreast of regulatory changes and implement state-of-the-art KYC solutions to provide a secure and enjoyable gaming experience.

#iGaming Software Provider#iGaming KYC#Development Services#iGaming Software#igaming software solutions

0 notes

Text

Bank of England Governor: AI won't lead to mass job losses

New Post has been published on https://thedigitalinsider.com/bank-of-england-governor-ai-wont-lead-to-mass-job-losses/

Bank of England Governor: AI won't lead to mass job losses

.pp-multiple-authors-boxes-wrapper display:none;

img width:100%;

Andrew Bailey, Governor of the Bank of England, has rebutted fears that AI will lead to widespread unemployment.

“I’m an economic historian, before I became a central banker. Economies adapt, jobs adapt, and we learn to work with it. And I think, you get a better result by people with machines than with machines on their own,” Bailey told the BBC.

Bailey’s comments come as the latest economic assessment shows that UK businesses investing in AI are expected to see gains in efficiency and output. Utilising AI is anticipated to provide productivity benefits across multiple sectors.

However, Baroness Stowell of the House of Lords has cautioned that the UK risks “missing out on the AI goldrush” if it does not act quickly.

A report from the Lords’ Communications and Digital Committee honed in on large language models and tools like ChatGPT. The report called for updated copyright laws and urged the government to provide clarity on AI regulation—warning too much could hinder AI development in the country.

Both Bailey and the Lords committee seem to agree that the focus should be on harnessing the upsides of AI while managing legitimate risks.

The financial services industry also stands to gain from responsible AI adoption.

“Generative AI brings potentially exciting benefits for financial institutions. When it comes to fighting financial crime, for example, AI can improve the accuracy and speed of detection by analysing large data sets,” said Dr Henry Balani, Head of Industry & Regulatory Affairs at Encompass Corporation.

Balani emphasised however that key roles like Know Your Customer (KYC) analysts are irreplaceable for now. “It will instead accelerate existing processes and augment the work of analysts, empowering them to detect financial crime risk more quickly and comprehensively,” he added.

“The maximum value of generative AI can only be realised if banks and financial institutions have already put in place robust digital and automated processes to optimise the quality of data collated and deliver deeper customer insights. By prioritising this now, banks will be well equipped to take advantage of this new technology as it continues to evolve and mature.”

Last month, research from EXL found that around 89 percent of insurance and banking firms in the UK have introduced AI solutions over the past year. However, issues with data optimisation are often hindering their benefits.

(Image Credit: Bank of England under CC BY-NC-ND 2.0 DEED license. Cropped from original for effect.)

See also: Experts from 30 nations will contribute to global AI safety report

Want to learn more about AI and big data from industry leaders? Check out AI & Big Data Expo taking place in Amsterdam, California, and London. The comprehensive event is co-located with Digital Transformation Week and Cyber Security & Cloud Expo.

Explore other upcoming enterprise technology events and webinars powered by TechForge here.

Tags: ai, andrew bailey, artificial intelligence, bank of england, careers, economy, finance, jobs, uk

#2024#ai#ai & big data expo#ai news#AI regulation#amp#andrew bailey#artificial#Artificial Intelligence#bank of england#banking#Big Data#Careers#chatGPT#Cloud#coffee#communications#comprehensive#copyright#crime#cyber#cyber security#data#detection#development#Digital Transformation#economic#economy#efficiency#enterprise

0 notes

Text

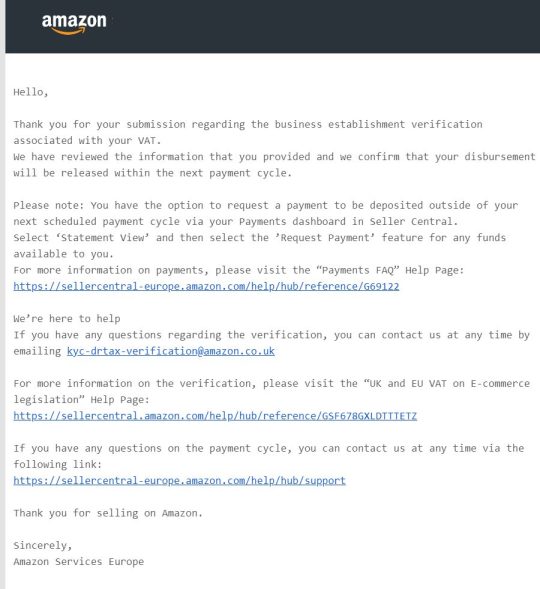

> 2021 UK VAT on e-Commerce Legislation

Hello,

Your disbursements have been deactivated in all stores you operate worldwide (excluding Amazon.in) from ... as we have indicators that you might not be UK established for VAT purposes. As a result, we need you to provide additional documentary evidence proving that your company is established in the UK in accordance with this legislation, within 60 days of this notification.

UK VAT on eCommerce legislation (live since 1 Jan 2021) requires Amazon to collect and remit VAT on all B2C sales performed by non-established selling partners to customer in the UK. As a result, we have to ask you to provide additional documentary evidence (listed here: https://sellercentral.amazon.co.uk/gc/vat-education/voec-uk-establishment) proving that your company is established in the UK in accordance with this legislation, within 60 days after receiving this notification.

If you fail to provide the documentary evidence within 60 days of this notification, Amazon will conclude that you are not established in UK and will start collecting and remitting VAT on your B2C sales. In such a case, additionally, you will be required to pay the VAT amount to Amazon to account for the historical un-paid VAT on all B2C sales that fall under UK VAT on eCommerce legislation since 1 Jan 2021. Further to this, you can continue selling on Amazon, but you will not be able to disburse any funds from your accounts, until any UK VAT owed is paid to Amazon.

Why did this happen?

From 1 January 2021, Amazon is liable to collect and remit VAT on B2C sales from non-UK established Selling Partners to B2C customers in UK under the UK VAT on e-Commerce legislation. We have taken this measure because as per investigation taken on your account, we found indicators that that your business is established outside the UK for VAT purposes. Hence, we need to get the documentary evidence to ensure we apply the correct treatment to your B2C sales.

I am established in the UK. How do I get my disbursements released?

If you believe you meet UK business establishment requirements, submit the required documents to

[email protected] provided in “Determination of Establishment for UK VAT” page: https://sellercentral.amazon.co.uk/gc/vat-education/voec-uk-establishment. Note that you have to send the documents required using your Amazon seller central Registered email id. It will take us up to 3 days to review the documents provided by you. At any point, if we conclude based on the provided documentary evidence that your company is established in the UK, we will release your disbursements within 24 hours of completing the verification. This will become available to you as per your normal payment cycle.

What happens if I don’t take the required actions?

If you fail to provide the documentary evidence within 60 days of this notification, we will conclude that you are not established in UK and will start collecting and remitting VAT on your B2C sales. In such a case, additionally, you will be required to pay the VAT amount to Amazon to account for the historical un-paid VAT on all B2C sales that fall under UK VAT on eCommerce legislation since 1 January 2021. You may continue selling on Amazon, but you will not be able to disburse any funds from your accounts, until any UK VAT owed is paid to Amazon.

Why are you withholding funds on my account?

Your funds will be on hold in accordance with our policies:

• BSA: https://sellercentral-europe.amazon.com/help/hub/reference/G201190440

• APE/APUK Agreement: https://sellercentral-europe.amazon.com/help/hub/reference/G201190400

Sincerely, Amazon Services Europe

=========================

Hello,

Thank you for your submission regarding the business establishment verification associated with your VAT.

We have reviewed the information that you provided and we confirm that your disbursement will be released within the next payment cycle.

Please note: You have the option to request a payment to be deposited outside of your next scheduled payment cycle via your Payments dashboard in Seller Central.

Select ‘Statement View’ and then select the ’Request Payment’ feature for any funds available to you.

For more information on payments, please visit the “Payments FAQ” Help Page:

We’re here to help

If you have any questions regarding the verification, you can contact us at any time by emailing [email protected]

For more information on the verification, please visit the “UK and EU VAT on E-commerce legislation” Help Page:

If you have any questions on the payment cycle, you can contact us at any time via the following link:

Thank you for selling on Amazon.

Sincerely, Amazon Services Europe

-- Provide evidence of any employees who reside in the country of your stated country of business establishment.

Provide any one of the following:

HMRC correspondence demonstrating that the seller has registered with HMRC for PAYE

A PAYE demand from HMRC, or a screenshot of the PAYE return submission.

0 notes

Text

The Top 50 Identity Verification Service Providers in 2024: Transforming Digital Security in the Era of Web3

The surge of Web3, characterized by the decentralized web, is transforming the landscape of Know Your Customer (KYC) data management. By leveraging blockchain technology for self-sovereign identity (SSI), this approach enhances data security, privacy, and efficiency while eliminating redundant verification processes. The adoption of decentralized KYC solutions brings benefits across various sectors, including fintech, gambling, and crypto, offering improved trust, transparency, and regulatory compliance through immutable audit trails.

However, challenges such as data breaches and complexity are acknowledged, with expectations for continued efficiency and cost-effectiveness. As such, decentralized KYC solutions will require robust security measures and user-friendly design to ensure widespread adoption.

Additionally, interoperability between different systems must be enabled to ensure a seamless user experience. Furthermore, decentralized KYC solutions must be compliant with relevant laws and regulations to ensure their legitimacy. Finally, privacy must be safeguarded to ensure user trust.

Here is a compiled list of companies claiming to be the top solution providers in various countries:

1. KYC Switzerland (www.kycswitzerland.com)

2. KYC Hong Kong (www.kychongkong.com)

3. KYC UAE (www.kycuae.com)

4. KYC Sweden (www.kycsweden.com)

5. AML Norway (www.amlnorway.com)

6. KYC Germany (www.kycgermany.com)

7. AML Japan (www.amljapan.com)

8. KYC Spain (www.kycspain.com)

9. UK KYC (www.ukkyc.com)

10. AML KYC India (www.amlkycindia.com)

11. AML France (www.amlfrance.com)

12. KYC Italy (www.kycitaly.com)

13. KYC Canada (www.kyccanada.com)

14. AML KYC Brazil (www.amlkycbrazil.com)

15. KYC Australia (www.kycaustralia.com)

16. KYC New Zealand (www.kycnewzealand.com)

17. AML Iceland (www.amliceland.com)

18. KYC Ireland (www.kycireland.com)

19. KYC Denmark (www.kycdenmark.com)

20. AML Netherlands (www.amlnetherlands.com)

21. AML Finland (www.amlfinland.com)

22. AML KYC Singapore (www.amlkycsingapore.com)

23. KYC Belgium (www.kycbelgium.com)

24. KYC Luxembourg (www.kycluxembourg.com)

25. KYC South Korea (www.kycsouthkorea.com)

26. AML Romania (www.amlromania.com)

27. KYC Croatia (www.kyccroatia.com)

28. KYC Poland (www.kycpoland.com)

29. KYC European Union (www.kyceu.com)

30. KYC Mexico (www.kycmexico.com)

31. AML Colombia (www.amlcolombia.com)

32. KYC France (www.kycfrance.com)

33. KYC Greece (www.kycgreece.com)

34. KYC Middle East (www.kycmiddleeast.com)

35. AML Portugal (www.amlportugal.com)

36. AML Switzerland (www.amlswitzerland.com)

37. AML KYC Canada (www.amlkyccanada.com)

38. KYC Bahrain (www.kycbahrain.com)

39. AML Chile (www.amlchile.com)

40. KYC Lithuania (www.kyclithuania.com)

41. AML Argentina (www.amlargentina.com)

42. AML Austria (www.amlaustria.com)

43. KYC Russia (www.kycrussia.com)

44. AML Greece (www.amlgreece.com)

45. AML KYC Brasil (www.amlkycbrasil.com)

46. AML South Korea (www.amlsouthkorea.com)

47. KYC Romania (www.kycromania.com)

48. KYC Norway (www.kycnorway.com)

49. KYC UK (www.kycuk.com)

50. ID Verification Service (www.idverificationservice.com)

ID verification software plays a pivotal role in bolstering security and compliance within the digital realm. It serves as a critical deterrent against identity theft, fraud, and financial crimes. Technological advancements such as AI, blockchain, and biometric authentication contribute to increased efficiency and more robust fraud detection. Regulatory Technology (RegTech) further streamlines compliance processes, fostering cross-border collaboration and shaping a more secure financial environment.

This, in turn, helps to create a more transparent and efficient financial system, allowing users to access financial services with greater trust and confidence. This leads to better access to capital, increased investment, and, ultimately, improved economic growth.

Furthermore, RegTech also helps to reduce the cost of regulatory compliance, allowing companies to focus on their core business. This, in turn, leads to increased profitability and job creation. In addition, RegTech can help to reduce fraud and money laundering, which is beneficial for society as a whole.

Disclaimer: It is crucial to note that these rankings are the result of research conducted by the author for each respective country. The list is presented for informational purposes only and does not constitute promotional content. Businesses are encouraged to conduct their surveys tailored to their specific needs and requirements.

#compliance#kyc#kyc compliance#kyc solutions#kyc and aml compliance#kyc api#kyc services#kyc verification#digital identity

1 note

·

View note

Text

Prism Casino Reviews: All You Need To Know

Prism Casino has been thrust into the spotlight by an overview that raises troubling concerns about its operational integrity and player treatment, shared among its sister sites under the Virtual Group umbrella. This examination aims to scrutinize Prism Casino's claims of being a reputable operator against the backdrop of longstanding issues, such as delayed withdrawals, questionable terms, and subpar customer service.

As outlined in the provided information, Prism Casino relies on RealTime Gaming (RTG) and SpinLogic software, delivering a diverse array of slots, table games, and video poker. However, the critical question remains—does Prism Casino operate with fairness and integrity? A more in-depth exploration is necessary.

Trustworthiness and Licensing of Prism Casino

According to the content, Prism Casino asserts its licensing and regulation status without offering verifiable details. Further investigation reveals that Prism operates under a license from the Costa Rica jurisdiction. Unfortunately, Costa Rica's reputation as a lenient regulatory body raises apprehensions regarding Prism's adherence to industry safety and fairness standards.

In contrast to platforms licensed in reputable jurisdictions like Malta, Curacao, Gibraltar, or the UK, Prism's Costa Rica license provides less assurance of transparent and accountable operations. This leaves players with limited recourse for addressing complaints and seeking resolution.

Overview of Player Issues at Prism

Aligned with the provided information, numerous player grievances revolve around protracted or denied withdrawal processes. Prism seems to employ arbitrary conditions related to play terms and Know Your Customer (KYC) verification, hindering timely withdrawal of winnings.

Complaints highlight a pattern where Prism requests documentation repeatedly, later claiming inconsistencies as grounds to withhold funds. Even when players provide identical documents, the withdrawal process extends over weeks or months, suggesting deliberate tactics to evade payment.

Prism's shifting stance on what constitutes bonus abuse without prior notice adds another layer of concern. This lack of clarity exposes players to the risk of abrupt account restrictions or closures without adequate understanding of terms.

Prism Casino's Games and Features Overview

Despite ethical concerns, Prism Casino delivers a technically proficient gaming experience through RTG and SpinLogic's software. The platform offers a substantial selection of slots, video poker, and traditional table games.

In terms of accessibility, Prism provides both a downloadable desktop client and instant play options within browsers, catering to user preferences.

Additional features include a loyalty program that rewards redeemable points based on wagering and a tailored approach to accommodate US players, featuring convenient banking options like the Players Rewards Card.

Final Verdict

Summarily, while Prism Casino boasts a commendable game portfolio and seamless technical performance, the overwhelmingly negative player feedback, coupled with reports of delayed payouts, predatory practices, and ethical concerns, casts a shadow of doubt.

The absence of a reputable regulatory license compounds these issues, leaving players with limited avenues for complaint resolution. Given these substantial drawbacks, it is strongly advised to exercise extreme caution when depositing real money into Prism Casino, as the process of withdrawing winnings may present formidable challenges.

Until Prism Casino undertakes substantial improvements in transparency, trustworthiness, and equitable payment processing, users face substantial risks to their finances. Exploring more reputable and accountable online casinos is a prudent choice in light of these significant concerns.

0 notes