#KYC Services provider

Text

KYC Provider Canada

KYC is a mandatory process that financial institutions and other businesses follow to authenticate the identities of their customers. KYC Providers help and provide KYC API to verify users' and business identities. KYC Providers in the Canada also use various methods to verify identities, like id, document, and address verification.

#KYC Canada#KYC Providers#KYC API#KYC Services provider#KYC Solutions Provider#KYC Software#kyc verification#KYC verification Solutions#KYC Platform#KYC Solution#fiance#crypto#blockchain#bitcoin#insurance#finance#fintech#healthcare#business

3 notes

·

View notes

Text

#KYC software#kyc api#kyc api providers#kyc platform#fraud prevention#top fraud prevention companies#kyc as a service#kyc providers

1 note

·

View note

Text

Why Choose an iGaming Software Company For an iGaming KYC?

Why Choose an iGaming Software Company For an iGaming KYC?

Description:

Gratix Technologies is a leading iGaming Software Company which provides you iGaming KYC. Our highly advanced iGaming Development team builds Software for Online Sports Betting.

Introduction

Gratix Technologies is a leading software company specializing in iGaming Solutions that revolutionize the way online casinos and sportsbooks operate. In the dynamic world of online gambling, the company has established itself as a trusted provider, offering cutting-edge technology and innovative products to enhance the user experience, streamline operations, and ensure compliance with regulatory requirements. The significance of Know Your Customer (KYC) in the iGaming industry and how Gratix Technologies has emerged as the best choice for implementing robust iGaming KYC processes. The features, benefits, successful case studies, and future trends in iGaming Software Company, highlighting how integrating Gratix Technologies can elevate your iGaming Software Company business to new heights of success and security.

Overview On A Leading iGaming Software Company

KYC, or Know Your Customer, is not just a fancy acronym to impress your friends. It's a vital process in the iGaming Software Company industry that ensures safety, security, and fairness for all players. KYC helps operators verify the identity of their customers, prevent fraud, and comply with legal and regulatory requirements.

Legal and Regulatory Requirements for KYC in iGaming

They're like the necessary evil in any industry, and iGaming is no exception. In order to keep everyone playing by the rules, there are certain legal and regulatory requirements when it comes to iGaming KYC in the iGaming Software Company. These requirements vary from country to country, but one thing's for sure: they're designed to protect the players and ensure a fair and secure gaming environment.

How Gratix Technologies Revolutionized iGaming KYC

Innovative Approaches to iGaming KYC by Gratix Technologies

Here at Gratix Technologies, we don't settle for mediocrity. We're constantly pushing the boundaries of what's possible in the iGaming Software Company. When it comes to KYC, we've developed innovative approaches that make the process faster, smoother, and downright enjoyable. Say goodbye to endless paperwork and hello to a seamless iGaming KYC experience.

Advantages of Using Gratix Technologies for iGaming KYC

Why should you choose Gratix Technologies for your iGaming KYC needs? Well, besides our undeniable charm and good looks, we offer a range of advantages that will make your gaming experience even more enjoyable. Our solutions are reliable, secure, and compliant with all the necessary regulations.Gratix Technologies is a leading iGaming Software Company. Plus, our team of experts is always ready to lend a helping hand, because we're nice like that.

Integrating Gratix Technologies for Enhanced Security and Compliance

When it comes to iGaming, security and compliance are non-negotiable. That's where Gratix Technologies comes in. With their cutting-edge software, they offer seamless integration with existing iGaming Software Company , making it easier than ever to ensure the safety of your players' information.

Seamless Integration with Existing iGaming Software Company

No one wants a clunky, time-consuming integration process that disrupts their operations. Thankfully, Gratix Technologies, a leading iGaming Software Company understands that. Their software is designed to seamlessly integrate with your existing iGaming Software Company, minimizing any potential hiccups or headaches. So, you can enjoy enhanced security and compliance without any unnecessary complications.

Ensuring Regulatory Compliance with Gratix Technologies

Staying compliant with ever-changing regulations and requirements can be a challenge. However, with Gratix Technologies a leading iGaming Software Company, you can rest easy knowing that their software is up-to-date and built with compliance in mind. They understand the importance of following regulations and have implemented features that help you stay on the right side of the law. So, you can focus on what you do best - running a successful iGaming Software Company business.

Conclusion

When it comes to security, compliance, and seamless integration, Gratix Technologies is the way to go. Our software is designed to elevate your iGaming business as we are a most trusted iGaming Software Company by providing enhanced security measures, ensuring regulatory compliance, and optimizing the KYC process. Don't just settle for mediocre – choose Gratix Technologies a leading iGaming Software Company to grow your business to new heights of success.

In conclusion, Gratix Technologies stands as the forefront iGaming Software Company, offering state-of-the-art solutions and unrivaled expertise in KYC implementation. By leveraging their innovative approaches, advanced features, and seamless integration, iGaming Software Company operators can enhance security, ensure regulatory compliance, and streamline user onboarding processes. With a proven track record of successful case studies and a commitment to staying ahead of future trends, Gratix Technologies is the ideal partner to elevate your iGaming Software Company to new levels of excellence. Stay ahead of the competition and provide your players with a safe and seamless gaming experience by choosing Gratix Technologies for your iGaming KYC needs.

#igaming software solutions#iGaming Software Development Services#iGaming KYC#iGaming Software Provider

0 notes

Text

eKYC Solution Services | eKYC Service Providers

Tired of the manual account opening process for your customers but want to transform it with an innovative and faster alternative? You can rely on Meon Technologies, which is one of the best eKYC service providers in India. We help you make your customer onboarding through a paperless EKYC solution. Feel free to connect with us to learn more!

0 notes

Text

ekyc Solution Provider-M2P Fintech

M2P’s e-KYC suite facilitates businesses to get customer KYC from anywhere in the nation while adhering to all regulatory requirements. It enables financial institutions to control the user data necessary to be captured from the customer, which is collected through the user journeys built into the partner/bank’s digital assets. The customer’s KYC is performed using the bank’s/authorized entity’s KYC APIs, and the outcome of the activity is captured by M2P. Our e-KYC Gateway facilitates seamless customer onboarding for corporates & to better the service delivery by governments. Further, M2P ensures robust integration between the partner’s/bank’s digital assets and issuing bank’s core banking solution

#ekyc solution provider#ekyc service provider#kyc suite solutions#ekyc solutions for banks#ekyc solutions for fintech

0 notes

Text

There’s never just one ant

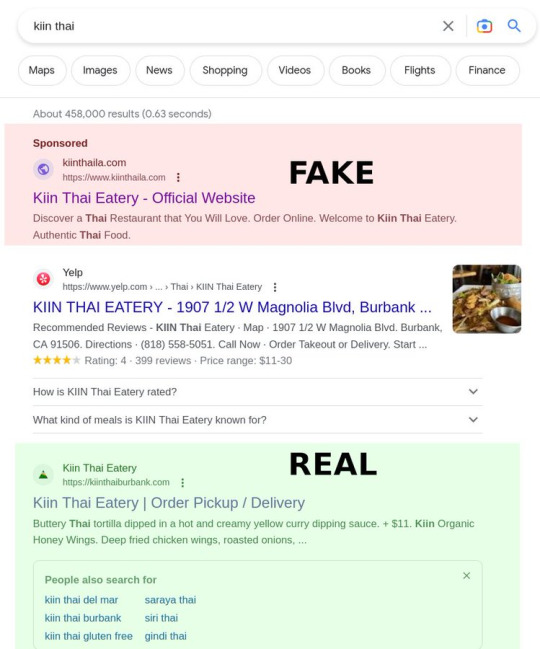

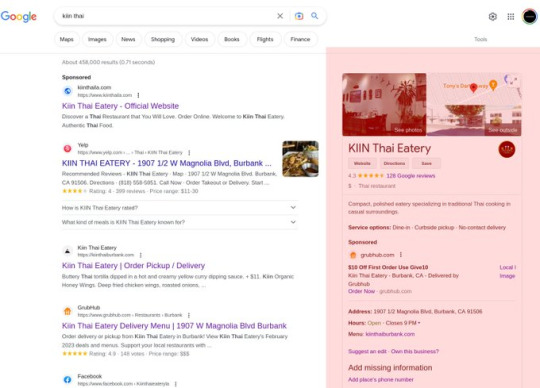

So there's a great Thai restaurant in my neighborhood called Kiin. Yesterday, I searched for their website to order some takeout. Here's the Google result.

That top result (an ad)? It's fake. It goes to https://kiinthaila.com, which is NOT the website for Kiin.

The *third* result is real: https://kiinthaiburbank.com

Fake site:

Real site:

I got duped. I placed an order with the fake site. The fake site then placed the order - in my name! - with the real site, having marked up the prices by 15%. Kiin clearly knows they're doing this (presumably by the billing data on the credit card the fakesters use to place the order). They called me within minutes to tell me they'd cancelled the fakesters' order.

I could still come pick it up, but I'd have to pay them, and cancel the payment to the fakesters with Amex. Actually, as it turns out, I have to cancel TWO payments, because the fakesters DOUBLE-charged me.

Here's what that charge looks like on my Amex bill. See that phone number? (415) 639-9034 is the number for Wix, who provides the scammers' website.

How the actual FUCK did these obvious scammers get an Amex merchant account in the name of "KIINTHAILA" by after supplying the phone number for a website hosting company? What is Amex's KYC procedure? Do they even call the phone number?

And why the actual FUCK is Google Ads accepting these scam artists' ads for a business that they already have a knowledge box for?! Google KNOWS what the real KIIN restaurant is, and yet they are accepting payment to put a fake KIIN listing two slots ABOVE the real one.

To be fair to these scammer asshole ripoff creeps who are trying to steal from my local mom-and-pop, single location Thai eatery, they're just following in the shoes of Doordash and Uber Eats, who did the same thing to hundreds (thousands?) of restaurants during lockdown.

Doug Rushkoff says that the ethic of today's "entrepreneur" is to “Go Meta” - don't provide a product or a service, simply find a way to be a predatory squatter on a chokepoint between people who do useful things and people who use those things.

These parasites have turned themselves into landlords of someone else's home, collecting rent on a property they don't own and have no connection to.

There's NEVER just one ant. I guaran-fucking-tee you that these same creeps have 1,000 other fake Wix websites with 1,000 fake Amex merchant accounts for 1,000 REAL businesses, and that Google has sold them ads for every one of them. Amex and Google and Wix should be able to spot these creeps FROM ORBIT. Holy shit do we live in the worst of all possible timelines. We have these monopolist megacorps that spy on and control everything we do, wielding the most arbitrary and high-handed authority.

And yet they do NOT ONE FUCKING THING to prevent these petty scammers from using their infra as force-multipliers to let them steal from every hungry person patronizing every local restaurant.

I mean, what's the point of letting these robber-barons run the entire show if they're not even COMPETENT?

ETA: Dinner was delicious

11K notes

·

View notes

Text

The dangers of the state's monopoly on identity

The state's monopoly on identity excludes vulnerable people from jobs, housing, healthcare and more.

This article originally began as a response to The Reboot's article, which discusses the dangers of perpetual tracking by Google, Facebook and Microsoft. [1]

While the tracking by Google, Facebook and Microsoft is definitely disturbing and can even put people in danger, the state's data economy is even worse, with far-reaching consequences. Few people talk about this, even though it affects millions of people's daily lives.

Via the government ID system, the state exerts a monopoly on identity and an obsession with tracking people from “birth certificate” to “death certificate”. Disproportionate KYC regulations actively exclude people without government-issued ID from necessary services, including jobs, housing and healthcare and even everyday things like online shopping, receiving mail, buying a sim card, doing volunteer work, taking classes, or visiting the gym or library.

Millions of people worldwide don't have access to government ID (the state refuses to print it for them) or can't show ID for safety reasons (e.g. they are a victim of abuse and don't want to be tracked down by the abuser). These people are often already in vulnerable situations (for example: stateless, undocumented or homeless people; activists, dissidents or refugees; victims of domestic abuse or adult victims of child abuse; or adults whose birth was not registered) and exclusion from basic needs makes it even more difficult to survive.

The state offers no alternatives nor solutions – if the state refuses to print a passport, national ID card or birth certificate for someone, this person can't appeal, get help from NGOs or lawyers, or find an alternative way to get ID. [2]

The state's system does not offer a procedure to register yourself, for example if you weren't registered at birth or your country of birth is dangerous to you. There are no steps you can take – no appeals, checklists, regularization, rehabilitation, special circumstances, friendly jurisdictions, nor identity issuer of last resort. You cannot earn access to ID via merit, vouches, oaths, good behavior, probation, community service, nor any other form of effort or compassion. Even if the individual would otherwise qualify for a skilled work, marriage or humanitarian visa and could provide a biometric photo and fingerprints, this is not enough.

Similarly, there are no non-state solutions. NGOs and religious organizations like the United Nations, Red Cross and Caritas don't issue alternative IDs; jurisdictional arbitrage such as Flag Theory requires an existing birth certificate or old passport; and non-government IDs from World Passport or Digitalcourage are not accepted. This lack of alternatives only cements the state's monopoly.

In the 1950s, the United Nations issued conventions on statelessness [3] and refugee status [4], but today countries still refuse to issue IDs for stateless people, people who weren't registered at birth, and people who have fled political, cultural or interpersonal persecution – whether by arbitrarily or discriminatorily denying applications for stateless status, refugee status or delayed birth registration, ignoring submitted applications, or not having a process for applications at all, while simultaneously criminalizing people without a legal identity. [5] In 2014, the UNHCR started a campaign to “end statelessness by 2024” [6], but today it is still impossible to get a stateless or non-citizen passport, and unlike the laissez-passer passports of the past, the United Nations no longer issues substitute IDs, despite that it could help millions of people to access necessities such as employment, housing and healthcare.

This condemns individuals purely and permanently to their circumstances of birth, which they could not influence and cannot change. As an adult, there is no way to enter the system. If you were born in the wrong place (e.g. stateless, refugee, dissident) and/or to the wrong people (e.g. child abuse, cult, no birth registration), there is no way to rise above your situation through effort, determination nor compassion.

The state's monopoly on identity is therefore an unethical, fatalistic single point of failure.

Even for individuals with ID, the name that the state prints on their ID may not correspond to the name that they use in real life, which could put them in danger. [7] Many countries restrict or even ban legal name changes, which endangers victims of abuse (such as adults who escaped from child abuse, domestic abuse, cults or gangs), who use a self-chosen name for a fresh start, to feel human, to recover from trauma or for physical safety reasons. [8]

As government ID is not universal and does not signify security or trust, government ID requirements only disproportionately and unfairly exclude people from services. [9]

Returning to the topic of “surveillance capitalism” – People can choose to stop using Google, Facebook, Windows or stock Android. There are many alternatives, such as DuckDuckGo, Mastodon, Linux and custom ROMs such as Lineage or Graphene. There are also ways to protect your privacy, such as reducing usage of social media, using a VPN or Tor, using a burner phone, using a pseudonym, or using cash or crypto instead of credit cards. [10]

In comparison, when the state coerces the vast majority of employers, landlords and hospitals to require government ID, there are only a few gray market alternatives left (e.g. under the table work, informal rentals for cash, doctors who accept out-of-pocket payments). [11]

It is a stark contrast: If you don't use Facebook for privacy reasons, you can still find different ways to keep in contact with friends and local events. If you can't rent most apartments because the landlord requires a passport or driver's license, you are very lucky if you can find a room in a shared apartment where your roommates deal with the contract for you and you pay rent to your roommates in cash. One thing can be an inconvenience, one thing can cause homelessness.

Many people believe government ID is the only way to trust that “someone is who they say they are”. [12] If someone admits that they don't have “proper ID”, they are often seen as untrustworthy, hiding something or even dangerous. [13] The equation of “ID = trust” not only leads to social stigma and exclusion, but can also lead to poverty and homelessness [14], threats of violence, or even indefinite detention (in many countries, cops can demand ID without a reason, and detain the individual until their legal identity is known – which can mean indefinite imprisonment for people who were never assigned a legal identity [15] [16]). Rather than “innocent until proven guilty”, this creates a situation of “guilty and no way to prove innocence”.

If innocence is not based on your actions, but purely on possession of government ID, it creates an impossible scenario when no jurisdiction agrees to print ID for you – from stateless people who literally have nowhere to go, to refugees who can't return to or interact with their country of birth for safety reasons, to adults whose births were never registered, to victims of child abuse, domestic abuse or cult abuse who don't use their birth name due to decades of trauma or worse the risk of being tracked down and returned. Instead of blaming authoritarian countries, uncooperative bureaucrats, abusive or neglectful birth parents, violent ex-partners or sociopathic cult leaders, the victim is blamed, distrusted and considered as a criminal.

In an ideal world, people would be judged on their actions and intent, rather than on circumstances of birth and decisions of bureaucrats. For housing, only your ability to pay rent would be relevant. For a job, only your skills and work ethic would be relevant. For healthcare, only your medical condition would be relevant (it would be against the Hippocratic Oath to deny medical treatment to people without ID, especially if they are paying out-of-pocket in cash).

For identity, it would be enough to say your name, get a vouch from a friend, landlord or employer, link to a social media profile, or use a non-government photo ID (such as from Digitalcourage or World Passport, which does not require birth registration or citizenship and allows self-chosen names).

For authentication, you would use a password or PIN (e.g. SMS code to pickup mail), physical key or card (e.g. mailbox keys, membership cards) or a cryptographic keypair (such as in PGP, Bitcoin or Monero).

For trust, word-of-mouth was the primary method before government IDs were invented (and made mandatory) in the 20th century. [17] [18] [19] Nowadays, word-of-mouth includes vouches from friends, online reviews, social networks, web-of-trust and memberships. Cash deposits and escrow systems (e.g. Bitrated) would protect against scams, theft or damage.

This meritocratic, non-government market is not theoretical. Permissionless free markets exist today – under the names of agorism [20], informal economies, black and gray markets, parallel economies and Second Realms – and offer hope and a means to survive to people in need. [21] [22] While NGOs have tried in vain to convince the state to print IDs for vulnerable people, these independent markets take a practical, grassroots approach to help people access work, housing and healthcare, even without government-issued ID. [23]

These free markets offer a way for people to take control of their situation. Human rights activists have campaigned since decades, while individuals have been left in limbo or excluded entirely from society, purely due to bureaucracy. In the 1950s, the United Nations called on nation-states to print IDs for stateless people, unregistered people and refugees – but seventy years later, the situation has only become worse, as more daily life necessities require government ID KYC every year, yet nation-states still refuse to print ID for millions of people.

Even worse, these people are not being accused of a specific crime and there is no real justification to deny printing IDs for them – their only “crime” is the vicious circle of not having papers because the state refuses to print papers for them. You would think economic exclusion – banned from employment, housing, healthcare, education, banking, travel, contracts, mail, sim cards and more – would be a punishment for only the most severe of crimes. But for stateless people, refugees, victims of abuse and people who weren't registered at birth, it is a punishment for being born. In this unforgiving situation, the informal economy provides an essential lifeline and way to survive.

Some examples include under-the-table work, informal apartment rentals, health clinics run by volunteers and anonymous sim cards. Most informal, agorist markets are local, based on word-of-mouth with cash-in-hand payments. The internet can also offer a place for an uncensored digital economy – such as for global trade [24], remote work, activism, fundraising [25] and community building – while cryptocurrencies like Bitcoin and Monero offer a way to send and receive money online without government ID or a bank account [26] [27] and withdraw to local cash when needed [28].

There are many reasons why people participate in agorist markets. It can be quicker and easier to rent out your spare room for cash, pay a doctor out-of-pocket instead of dealing with public health insurance, or hire an online freelancer for crypto. Bureaucracy doesn't just shut people out of the market, it also takes time and money to fill out forms, deal with months-long wait times, pay extortionate fees, and apply for government permission (which may be denied for arbitrary or discriminatory reasons). Agorism cuts the red tape, enabling people to access what they need in a truly free market.

As the state continues to ostracize and even criminalize vulnerable people, agorism provides not only hope of inclusion and equal opportunities, but a practical, proven solution which works today. For universal and safe access to daily needs such as employment, housing and healthcare, it is important to build and use agorist markets that are immune to the state's monopoly on identity, invisible to the state's data economy, and free for everyone to use.

The following books, articles and podcasts provide more information about agorism, as well as practical examples:

“An Agorist Primer” by SEK3 Book: https://kopubco.com/pdf/An_Agorist_Primer_by_SEK3.pdf

“Second Realm: Book on Strategy” by Smuggler & XYZ Book: https://ia801807.us.archive.org/34/items/second-realm-digital/Second%20Realm%20Paperback%20New.pdf

“Crypto Agorism: Free markets for a free world” by AnarkioCrypto Video: https://tube.tchncs.de/w/tPvohTaiocfg5LEsFjGqHN Slides: https://anarkiocrypto.medium.com/crypto-agorism-free-markets-for-a-free-world-d9c755e6ef11

“Fifty things to do NOW” by The Free and Unashamed Article: https://libertyunderattack.com/fifty-things-now-free-unashamed

Vonu Podcast Audio: https://vonupodcast.com

Agora Podcast Audio: https://anchor.fm/mortified-penguin

Monero Talk Podcast Audio: https://www.monerotalk.live

Hack Liberty Forum Link: https://forum.hackliberty.org

Sources:

[1] https://thereboot.com/why-we-should-end-the-data-economy/ [2] https://anarkio.codeberg.page/blog/roadblocks-to-obtaining-government-id.html [3] https://www.unhcr.org/what-we-do/protect-human-rights/ending-statelessness/un-conventions-statelessness [4] https://www.unhcr.org/about-unhcr/who-we-are/1951-refugee-convention [5] https://index.statelessness.eu/sites/default/files/UNHCR%2C%20Faces%20of%20Statelessness%20in%20the%20Czech%20Republic%20(2020).pdf [6] https://unhcr.org/ibelong/about-statelessness [7] https://blog.twitter.com/common-thread/en/topics/stories/2021/whats-in-a-name-the-case-for-inclusivity-through-anonymity [8] https://privacyinternational.org/long-read/2274/identity-discrimination-and-challenge-id [9] https://www.economist.com/christmas-specials/2018/12/18/establishing-identity-is-a-vital-risky-and-changing-business [10] https://anonymousplanet.org/guide.html [11] https://anarkio.codeberg.page/blog/survival-outside-the-state.html [12] https://sneak.berlin/20200118/you-dont-need-to-see-my-id [13] https://vonupodcast.com/know-your-customer-kyc-the-rarely-discussed-danger-guest-article-audio/ [14] https://www.statelessness.eu/blog/each-person-left-living-streets-we-are-losing-society [15] https://www.penalreform.org/blog/proving-who-i-am-the-plight-of-people/ [16] https://index.statelessness.eu/themes/detention [17] https://dergigi.medium.com/true-names-not-required-fc6647dfe24a [18] https://fee.org/articles/passports-were-a-temporary-war-measure/ [19] https://medium.com/@hansdezwart/during-world-war-ii-we-did-have-something-to-hide-40689565c550 [20] https://anarkio.codeberg.page/agorism/ [21] https://libertyunderattack.com/fifty-things-now-free-unashamed [22] https://medium.com/@Kallman/a-21st-century-introduction-to-agorism-5dc69b54d79f [23] https://kopubco.com/pdf/An_Agorist_Primer_by_SEK3.pdf [24] https://bitcoinmagazine.com/business/kyc-free-bitcoin-circular-economies [25] https://kuno.anne.media [26] https://c4ss.org/content/57847 [27] https://whycryptocurrencies.com/toc.html [28] https://blog.trezor.io/buy-bitcoin-without-kyc-33b883029ff1

5 notes

·

View notes

Text

High-Risk Payment Processing Techniques: Best Practices

Article by Jonathan Bomser | CEO | Accept-Credit-Cards-Now.com

In the ever-evolving realm of e-commerce, payment processing takes center stage, enabling businesses to smoothly accept credit card payments and ensure seamless customer transactions. However, for industries deemed high-risk, such as credit repair and CBD sales, navigating the payment processing landscape presents distinct challenges. In this article, we dive into the intricacies of high-risk payment processing methods and present best practices to guarantee secure and efficient transactions. Whether you're a newcomer to high-risk payment processing or looking to refine your current strategies, these insights will steer you toward favorable outcomes.

DOWNLOAD THE HIGH-RISK PAYMENT PROCESSING INFOGRAPHIC HERE

Understanding High-Risk Payment Processing

Effective navigation of the high-risk payment processing sphere necessitates a clear comprehension of high-risk industries. Sectors like credit repair and CBD sales often fall into this category due to intricate regulations and an elevated risk of chargebacks. Consequently, high-risk merchants require specialized payment processing solutions tailored to mitigate associated risks.

The Importance of Merchant Accounts

Merchant accounts form the backbone of efficient payment processing. These accounts, specifically designed for high-risk businesses, facilitate the secure transfer of funds from customers' credit cards to the merchant's bank account. Establishing a high-risk merchant account ensures seamless payment processing, enabling businesses to broaden their customer base and enhance revenue streams.

Exploring High-Risk Payment Gateways

High-risk payment gateways serve as virtual checkpoints between customers and merchants. These gateways safeguard sensitive financial information by encrypting data during transactions. When selecting a high-risk payment gateway, emphasize security features and compatibility with your business model to guarantee safe and smooth payment processing.

Tailored Solutions for Credit Repair Businesses

Credit repair merchants face unique challenges due to the industry's regulatory landscape. Obtaining a credit repair merchant account equipped with specialized payment processing solutions can aid in navigating these complexities. Implementing robust Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures ensures compliance and fosters customer trust.

CBD Sales and Payment Processing

CBD merchants operate in a market brimming with potential but also shrouded in uncertainty. Shifting regulations demand a flexible approach to CBD payment processing. Collaboration with experienced payment processors well-versed in the intricacies of CBD sales and the utilization of age verification systems can streamline transactions and bolster customer confidence.

Mitigating Chargeback Risks

Chargebacks pose a significant threat to high-risk merchants, frequently arising from disputes, fraud, or unsatisfactory service. Proactively address this issue by providing exceptional customer support, transparent refund policies, and clear product descriptions. Consistent communication can forestall chargebacks and maintain a healthy merchant-consumer relationship.

youtube

Future-Proofing High-Risk Payment Processing

Advancing technology necessitates the evolution of high-risk payment processing techniques to stay ahead of potential threats. Embrace emerging solutions like AI-driven fraud detection and biometric authentication to enhance security and streamline payment processing. Staying informed and adapting to industry trends ensures the future-proofing of payment processing strategies for high-risk merchants.

High-risk payment processing amalgamates industry knowledge, tailored solutions, and cutting-edge security measures. Whether operating in credit repair or CBD sales, a comprehensive understanding of high-risk payment processing intricacies is imperative. Leveraging specialized merchant accounts, payment gateways, and proactive chargeback prevention methods enables high-risk merchants to confidently accept credit card payments and cultivate long-term customer relationships. In an ever-evolving landscape, embracing innovative payment processing solutions guarantees a secure and prosperous future for high-risk businesses.

#high risk merchant account#high risk payment gateway#high risk payment processing#merchant processing#payment processing#credit card payment#credit card processing#accept credit cards#Youtube

17 notes

·

View notes

Text

#KYC Services Provider#Background Checks in Canada#KYC service providers in Canada#KYC API#KYC solution#AML solution#identity verification system#identity verification solutions

1 note

·

View note

Text

#video kyc solution providers#video kyc platform#video kyc providers#video kyc services#KYC UK#kyc solution#kyc api#fintech#banks#finance#kyc companies#banking

1 note

·

View note

Text

iGaming KYC Company technology & regulations Ontario UK

iGaming, or online gambling, has witnessed unprecedented growth globally, creating a need for robust Know Your Customer (KYC) solutions. This article explores the technology and regulatory landscape surrounding iGaming KYC Company in two significant jurisdictions: Ontario, Canada, and the United Kingdom (UK).

iGaming KYC Technology:

Biometric Authentication:

Both Ontario and the UK emphasize the importance of secure identity verification. Biometric authentication, such as facial recognition and fingerprint scanning, is increasingly integrated into iGaming KYC Company platforms for a seamless and secure KYC process.

Blockchain Technology:

Blockchain provides a decentralised and tamper-resistant ledger, enhancing the transparency and reliability of KYC processes. In Ontario and the UK, iGaming KYC Company companies are exploring blockchain to securely store and share customer identity data across platforms while complying with data protection laws.

Machine Learning and AI:

AI-driven KYC solutions analyse vast amounts of data to detect patterns and anomalies, improving fraud detection and risk assessment. Both jurisdictions encourage the use of machine learning algorithms to enhance the efficiency and accuracy of KYC processes in iGaming KYC Company .

Smart Contracts:

Ontario and the UK are increasingly adopting smart contracts in iGaming KYC Company to automate compliance processes. Smart contracts execute predefined rules when specific conditions are met, ensuring real-time compliance with evolving regulations.

iGaming KYC Company Regulations:

Ontario, Canada:

Ontario iGaming KYC Company Control Act:

Ontario's iGaming KYC Company Control Act outlines the legal framework for online gambling. It mandates strict KYC procedures to prevent underage gambling and money laundering. Operators must obtain explicit consent from players for collecting and using their personal information.

Privacy Laws:

Ontario adheres to privacy laws such as the Personal Information Protection and Electronic Documents Act (PIPEDA). iGaming KYC Company companies must comply with these laws to protect players' personal information during KYC processes.

Collaboration with Financial Institutions:

The province encourages collaboration between iGaming KYC Company operators and financial institutions to strengthen KYC processes. This partnership facilitates the verification of financial information and enhances the overall security of transactions.

United Kingdom:

UK Gambling Act 2005:

The UK Gambling Act sets the regulatory framework for iGaming KYC Company in the country. It mandates strict KYC procedures to ensure the integrity of online gambling operations. Operators must conduct thorough identity verification before allowing users to participate in any gambling activities.

UK Data Protection Laws:

iGaming KYC Company operators in the UK must comply with the General Data Protection Regulation (GDPR) and the Data Protection Act 2018. These laws govern the collection, processing, and storage of personal data, reinforcing the importance of protecting players' privacy during KYC processes.

Gambling Commission Oversight:

The UK Gambling Commission (UKGC) oversees and regulates the iGaming KYC Company industry, ensuring compliance with KYC requirements. The UKGC continuously updates its guidelines to address emerging challenges and technologies in the online gambling sector.

Conclusion: In both Ontario, Canada, and the United Kingdom, iGaming KYC Company technology and regulations are evolving to address the dynamic nature of the online gambling industry. The integration of advanced technologies such as biometrics, blockchain, machine learning, and smart contracts enhances the efficiency and security of KYC processes. Meanwhile, stringent regulations and oversight by relevant authorities' safeguard players' interests and maintain the integrity of the iGaming KYC Company ecosystem. As technology continues to advance, it is crucial for iGaming Software Provider to stay abreast of regulatory changes and implement state-of-the-art KYC solutions to provide a secure and enjoyable gaming experience.

#iGaming Software Provider#iGaming KYC#Development Services#iGaming Software#igaming software solutions

0 notes

Text

FTX's very bad november

here are some bullet points of the key things that happened to stupid 'it turns out it was never actually a business' 40 billion dollar cryptocurrency exchange FTX this month. very funny please read more!

FTX is the 'smart, legal, pro-regulation' bitcoin exchange (a bank) beloved by athletes and US Senators alike. They are one of the five largest businesses in the crypto space, and are valued at up to $32,000,000,0000 (32B USD).

1b. FTX mints its own token, 'FT Token / FTT', which has a use-case for their advanced trading services as well as serving as a speculative asset that represents consumer trust.

2. FTX establishes a sister firm, "Alameda Research", which acted as its own market actor and research publisher. Alameda Research also have massive resources on their balance sheet.

3. When the Terra / Luna stablecoin disastrously lost its peg to the dollar earlier this year, crypto lost $60B of valuation. Everything fell, but unlike some stuff, FTT recovered.

3b. during this crisis, Alameda stepped in as a 'lender of last resort'; bailing out the liquidity-crisis-shocked crypto businesses by selling them emergency loans.

4. On November 02 (two weeks ago!) Coindesk published an exposé showing that a lot of Alameda Research's balance sheet was, basically, IOU's from FTX - the lender of last resort was a shell game.

5. at this point (i'm hazy on details!) the three FTX founders - "the Crypto King" "SBF"; Gary; and Nishad - start fighting a lot on twitter about something offline, in particular with their competitors Binance, the #1 company in the crypto space.

6. Binance sells all the FTT in its vaults. Billions of dollars' worth?

7. The market value of an FTT drops from $24 USD to $3. (an 87.5% drop in value)

8. 36 hours later, seeing FTX about to declare bankruptcy, Binance offers to buy FTX in a bailout. Binance lawyers ask to see FTX's most secret internal accounting documents.

8b. FTX provides something, which Binance aren't happy with, and Binance backs out of their offer to buy FTX.

9. a "hacker" steals between $300M-$500M USD worth of various coins and tokens from not only FTX's 'hot wallet' (actual liquid funds) but ALSO from its 'cold wallets' (which an outside hacker has no access to).

9b. in transferring these funds out of FTX and into a wallet for Tether (a stablecoin), the "hacker" doesn't have enough "TRX" to pay the gas to actually move the money. so they panic and uses TRX from their own wallet.

10. That wallet was on the Kraken ecosystem, and TRX is for the Tron Network, and both Tron and Kraken have KYC ('know your customer') ID requirements to use their systems, linking the wallet used to facilitate the theft to a driver's license and banking and contact information etc.

10b. the head of security for Kraken posts on twitter "We know the identity of the user."

11. the Bahamaian police (they spent company money on a big poly mansion on the Bahamas and so this all happens there) detain the three FTX founders

12. FTX goes from being worth $30-40 billion USD to bankrupt, nothing, goose egg, kanye voice: couldn't give a homeless guy change, its principals arrested, detained by island police as foreign billionaires, investigated by the Bahamaian money laundering authorities (lmao), investigated by America for the Tether theft (lmfao)

13. lmfao

47 notes

·

View notes

Text

Exploring The Advantages Of A Decentralized Crypto Wallet

Crypto currency has brought about a plethora of options for storing and managing digital assets in the realm of digital finance. Among these options, decentralized crypto wallets have gained significant popularity owing to their unique advantages and user-centric features. In this article, we will explore the advantages of using a decentralized crypto wallet and why it is becoming the preferred choice for many crypto enthusiasts.

What is a Decentralized Crypto Wallet?

A decentralized crypto wallet, also known as a non custodial wallet crypto, is different from traditional online crypto wallets in one fundamental aspect: control. Unlike custodial wallets, where a third party holds the user's private keys and, hence, control over their funds, decentralized wallets empower users with complete control over their digital assets. This means that users are solely responsible for safeguarding their private keys and managing their funds securely.

Advantages of a Decentralized Crypto Wallet:

1. Enhanced Security:

One of the primary advantages of decentralized crypto wallets is enhanced security. As they eliminate the need to entrust private keys to a centralized entity, users mitigate the risk of potential hacks or security breaches. With complete control over their private keys, users can rest assured knowing that their funds are protected against unauthorized access.

2. Sovereignty and Control:

Decentralized wallets embody the core ethos of cryptocurrency - decentralization. Users retain sovereignty and complete control over their funds, free from the constraints of centralized intermediaries. This autonomy aligns with the foundational principles of blockchain technology, fostering trust and transparency within the ecosystem.

3. Flexibility and Compatibility:

Many decentralized wallets, such as The Connecter's Multichain Crypto Wallet, offer support for multiple blockchain networks. This versatility enables users to manage a diverse range of digital assets from a single interface, streamlining the user experience and eliminating the need for multiple wallets.

4. Privacy Protection:

Decentralized wallets prioritize user privacy by minimizing the collection of personal information. Unlike centralized exchanges or custodial wallets that may require extensive KYC (Know Your Customer) verification processes, decentralized wallets offer a level of anonymity that appeals to privacy-conscious users.

5. Access Anytime, Anywhere:

With decentralized wallets, users are not bound by geographical limitations or reliance on third-party services. As long as users have access to the internet, they can manage their digital assets anytime, anywhere, without being subject to downtime or service interruptions.

In conclusion, decentralized crypto wallets offer a host of advantages that cater to the evolving needs of cryptocurrency users. From enhanced security and privacy protection to sovereignty and compatibility, these wallets embody the principles of decentralization while providing a user-friendly experience. As the digital asset landscape continues to evolve, decentralized wallets, such as The Connecter's multichain crypto wallet, stand at the forefront of innovation, empowering users with control, security, and flexibility in managing their digital assets. For more information visit the website: https://www.theconnecter.io/.

#Online Crypto Wallet#Multichain Crypto Wallet#Decentralized Crypto Wallet#Non Custodial Wallet Crypto

2 notes

·

View notes

Text

Improving Client Relationships Using CRM in Forex Brokerage

The key to success in the cutthroat world of Forex trading is building and maintaining customer connections. The tools and technologies that enable effective client management change along with the industry. Customer Relationship Management (CRM) software is one such product that has grown to be essential for Forex brokerages.

A Good CRM system is the cornerstone of every profitable Forex brokerage, serving as the primary interface for managing customer relations and optimizing corporate operations as a whole. Choosing the Best CRM solution is essential due to the growing need for efficient operations and tailored services.

Forex brokerages need CRM systems that are not only reasonably priced but also have special features designed to meet their requirements. Presenting ForexCRM, the best CRM solution in the business, which gives brokerages access to cutting-edge features at a reasonable price.

Thanks to ForexCRM and other affordable CRM solutions, brokerages may now affordably manage client interactions with the resources they need. Brokerages of all sizes can make use of CRM's scalable features and features to maximize customer engagement and retention.

ForexCRM's extensive feature set, created especially for Forex brokerages, is what makes it unique. With features like integrated trading platforms, Contest Management, smooth onboarding procedures, sophisticated analytics, Social Trading, and Liquidity Feeds, ForexCRM provides a comprehensive answer to satisfy the many demands of contemporary brokerages.

Brokerages may automate tedious operations, optimize communication channels, and obtain insightful data about customer behavior and preferences by utilizing ForexCRM. Brokerages may expand their company, provide individualized services, and cultivate enduring loyalty by centralizing client data and interactions.

ForexCRM provides customized solutions to simplify complex processes, making it an asset for New brokerage Formation, licensing, and regulatory compliance initiatives. With features like compliance checklists and customizable onboarding workflows, ForexCRM streamlines the registration and licensing process and guarantees prompt approvals.

Brokerages may effortlessly manage regulatory compliance while reducing risk thanks to specialized modules for KYC and AML compliance. Furthermore, ForexCRM makes regulatory reporting system connection easier, allowing for accurate submissions and providing transparency to authorities. All things considered, ForexCRM gives brokerages the confidence they need to successfully negotiate regulatory difficulties, which helps them succeed in the cutthroat Forex business.

In summary, CRM is essential to improving client connections in the Forex brokerage sector. Brokerages can stay ahead of the curve by offering great customer experiences and retaining a competitive edge in the industry with feature-rich and reasonably priced systems like ForexCRM. Unlock the full potential of client relationship management for your Forex brokerage by selecting the finest CRM available.

3 notes

·

View notes

Text

Sweden's Exemplary Anti-Corruption Stand: A Deep Dive into KYC and AML Practices

In the realm of global integrity and transparency, Sweden stands tall as the paragon of virtue, earning the coveted title of the world's least corrupt country, as per the Corruption Perceptions Index (CPI).

Behind this remarkable achievement lies Sweden's unwavering commitment to combat corruption through robust Anti-Money Laundering (AML) laws, particularly focusing on stringent Know Your Customer (KYC) protocols. These protocols require financial institutions to verify the identity of their customers and any transactions they make. Furthermore, Sweden has implemented measures to protect whistleblowers and to ensure that any instances of corruption are investigated and prosecuted.

The Pillars of Trust: KYC in Sweden

Sweden's success in maintaining its reputation for integrity is deeply rooted in its proactive approach to KYC. The KYC process, an integral part of financial and business operations, plays a pivotal role in preventing corruption and money laundering by ensuring thorough identification and verification of customers. Sweden has invested heavily in its KYC system, building a comprehensive database of customer information. It has also implemented strict regulations requiring companies to report suspicious activity to the government. As a result, Sweden has become a world leader in the fight against financial crime.

KYC Solutions: More than a Mandate

KYC in Sweden goes beyond mere compliance; it serves as a comprehensive solution to safeguard the financial ecosystem. The emphasis on accurate customer identification, risk assessment, and ongoing monitoring establishes a formidable defense against illicit financial activities. Sweden's KYC system also promotes customer trust and increases customer convenience. By streamlining the onboarding process, customers can easily open an account and start trading. Additionally, the KYC system provides customers with better control over their money, as they can easily monitor their account activity.

Compliance at the Core

Sweden's commitment to compliance is evident in its KYC practices. Striking a delicate balance between stringent regulations and practical implementation, the country has fostered an environment where businesses operate with transparency and adhere to the highest ethical standards. Sweden's KYC regulations are designed to prevent money laundering and financial crime. The country has put in place a comprehensive set of measures, including customer due diligence, to ensure that businesses comply with the law. Additionally, Sweden has implemented a reporting system that allows authorities to track suspicious activity in real time.

AML Laws in Sweden: A Global Benchmark

Sweden's AML laws are not just a legal requirement but a testament to its commitment to global financial integrity. The country's legal framework provides a solid foundation for detecting and preventing money laundering activities, contributing significantly to its stellar position on the CPI. Sweden also has a strong commitment to international cooperation and information sharing, which helps to further strengthen the AML legal framework. Additionally, the country has implemented strict regulations on financial institutions, including requirements to report suspicious transactions.

KYC Service Providers – KYC Sweden Leading the Way

Sweden has emerged as a frontrunner in KYC solutions, with a focus on providing efficient and reliable services. KYC service providers in Sweden leverage advanced technologies and methodologies to offer the best-in-class identification and verification processes, setting the gold standard for global counterparts. Swedish KYC providers also provide the highest level of security, protecting customer data and complying with all local regulations. Furthermore, Swedish KYC providers offer a wide range of services, including onboarding, identity verification, and fraud prevention.

KYC for Swedish Businesses: A Necessity, not an Option

For businesses operating in Sweden, KYC is not merely a regulatory checkbox but a fundamental practice. The stringent KYC requirements ensure that businesses are well-acquainted with their clients, mitigating the risk of involvement in any illicit or corrupt activities. It also helps to protect the rights of customers, as it ensures that they are aware of who is handling their data. KYC also helps businesses to identify any potential risks associated with doing business with a particular customer.

Global Impact: KYC Sweden's Ripple Effect

Sweden's commitment to KYC and AML has a ripple effect beyond its borders. Businesses operating globally, including Swedish enterprises with international footprints, benefit from the robust KYC measures in place. This not only safeguards these businesses but also contributes to the overall global effort against corruption. As a result, other countries and organizations are encouraged to implement strong KYC and AML measures, which help to create a safer business environment for everyone. Additionally, these measures help to protect consumers from malicious actors and financial crimes.

Conclusion

Sweden's standing as the world's least corrupt country is a testament to its meticulous implementation of KYC and AML laws. By placing compliance, integrity, and transparency at the forefront of its financial practices, Sweden has set a precedent for nations worldwide. As businesses and governments grapple with the challenges of maintaining trust and financial integrity, KYC Sweden's model of KYC and AML serves as an exemplary beacon guiding the way forward. The integration of KYC solutions is not just a legal requirement for Sweden; it is a proactive strategy that continues to fortify its position as a global leader in the fight against corruption.

#compliance#kyc#kyc compliance#kyc solutions#kyc and aml compliance#kyc api#kyc services#kyc verification#digital identity#kyc sweden

2 notes

·

View notes

Text

How Banking CRM Improves Onboarding TAT in the Banking Sector

When it comes to the customer onboarding process Banking CRM has an important role to play in the banking sector.

Improving the customer experience is a priority, as customers only want to experience the best quality services. Therefore, onboarding TAT is quite an important parameter for banks.

Why is customer onboarding TAT vital for banks?

With the help of banking CRM, banks can actually improve efficiency, response time, and eliminate all the manual processes along the way. This will not only improve the customer experience but also cause an increment in conversion rates.

How does Banking CRM help reduce the onboarding turnaround time?

Customer onboarding is often a time-consuming process that includes customer visits, a credit analysis process and heavy use of documentation. This is where a banking CRM plays a vital role in reducing the turnaround time for banks. Banking CRM digitalizes all manual processes with automated workflows and solutions.

Five crucial benefits of having a Banking CRM:

An automated lead management process can guide the banks with, lead capture, lead scoring, lead qualification, lead allocation and closing the deals. When you don’t have a proper lead CRM in place, you risk a lower return on investment, a leaky sales funnel, and strained relationships with leads and customers.

2. Real-Time Sales Tracking

With this feature, the sales managers could monitor the performance of the sales reps to ensure they are making the most of their time in the field, keeping them organized and productive.

Instant alerts and real-time tracking can guide the team to better manage sales agents’ time and set their daily schedules to improve their productivity in no time.

3. Automating the Underwriting Process

Banking CRM can guide the credit analysis process via streamlining the entire journey, for instance, by providing the platform to upload all the required documents digitally.

Automating the KYC, De-dupe, CDD (Customer due diligence), BL (Black List), and CIBIL score checks can save a lot of time for the credit managers when visiting for Personal Discussions (PD).

5. Customer Experience

Keeping the consumer happy is the only sustainable way to build a business and improve the customer experience with easy and straightforward navigation.

It includes not just data collection and the acceptance of an inescapable administrative burden, but also an understanding of the prospect’s needs. The digital workflow allows the process to be adjusted to the consumers’ demands and tastes.

Orginal source: How Banking CRM Improves Onboarding TAT in the Banking Sector - Toolyt

2 notes

·

View notes