#KYC Services provider UK

Text

#kyc uk#kyc solution#KYC solution providers UK#AML KYC solution#AML KYC#AML solution provider in UK#KYC services Provider UK#fintech#finance#banks#kyc companies#KYC in UK#KYC providers in UK

1 note

·

View note

Text

#kyc api#kyc uk#KYC Services provider UK#KYC solutions Provider#KYC Providers#kyc solution#kyc software#KYC API

1 note

·

View note

Text

Bank of England Governor: AI won't lead to mass job losses

New Post has been published on https://thedigitalinsider.com/bank-of-england-governor-ai-wont-lead-to-mass-job-losses/

Bank of England Governor: AI won't lead to mass job losses

.pp-multiple-authors-boxes-wrapper display:none;

img width:100%;

Andrew Bailey, Governor of the Bank of England, has rebutted fears that AI will lead to widespread unemployment.

“I’m an economic historian, before I became a central banker. Economies adapt, jobs adapt, and we learn to work with it. And I think, you get a better result by people with machines than with machines on their own,” Bailey told the BBC.

Bailey’s comments come as the latest economic assessment shows that UK businesses investing in AI are expected to see gains in efficiency and output. Utilising AI is anticipated to provide productivity benefits across multiple sectors.

However, Baroness Stowell of the House of Lords has cautioned that the UK risks “missing out on the AI goldrush” if it does not act quickly.

A report from the Lords’ Communications and Digital Committee honed in on large language models and tools like ChatGPT. The report called for updated copyright laws and urged the government to provide clarity on AI regulation—warning too much could hinder AI development in the country.

Both Bailey and the Lords committee seem to agree that the focus should be on harnessing the upsides of AI while managing legitimate risks.

The financial services industry also stands to gain from responsible AI adoption.

“Generative AI brings potentially exciting benefits for financial institutions. When it comes to fighting financial crime, for example, AI can improve the accuracy and speed of detection by analysing large data sets,” said Dr Henry Balani, Head of Industry & Regulatory Affairs at Encompass Corporation.

Balani emphasised however that key roles like Know Your Customer (KYC) analysts are irreplaceable for now. “It will instead accelerate existing processes and augment the work of analysts, empowering them to detect financial crime risk more quickly and comprehensively,” he added.

“The maximum value of generative AI can only be realised if banks and financial institutions have already put in place robust digital and automated processes to optimise the quality of data collated and deliver deeper customer insights. By prioritising this now, banks will be well equipped to take advantage of this new technology as it continues to evolve and mature.”

Last month, research from EXL found that around 89 percent of insurance and banking firms in the UK have introduced AI solutions over the past year. However, issues with data optimisation are often hindering their benefits.

(Image Credit: Bank of England under CC BY-NC-ND 2.0 DEED license. Cropped from original for effect.)

See also: Experts from 30 nations will contribute to global AI safety report

Want to learn more about AI and big data from industry leaders? Check out AI & Big Data Expo taking place in Amsterdam, California, and London. The comprehensive event is co-located with Digital Transformation Week and Cyber Security & Cloud Expo.

Explore other upcoming enterprise technology events and webinars powered by TechForge here.

Tags: ai, andrew bailey, artificial intelligence, bank of england, careers, economy, finance, jobs, uk

#2024#ai#ai & big data expo#ai news#AI regulation#amp#andrew bailey#artificial#Artificial Intelligence#bank of england#banking#Big Data#Careers#chatGPT#Cloud#coffee#communications#comprehensive#copyright#crime#cyber#cyber security#data#detection#development#Digital Transformation#economic#economy#efficiency#enterprise

0 notes

Text

> 2021 UK VAT on e-Commerce Legislation

Hello,

Your disbursements have been deactivated in all stores you operate worldwide (excluding Amazon.in) from ... as we have indicators that you might not be UK established for VAT purposes. As a result, we need you to provide additional documentary evidence proving that your company is established in the UK in accordance with this legislation, within 60 days of this notification.

UK VAT on eCommerce legislation (live since 1 Jan 2021) requires Amazon to collect and remit VAT on all B2C sales performed by non-established selling partners to customer in the UK. As a result, we have to ask you to provide additional documentary evidence (listed here: https://sellercentral.amazon.co.uk/gc/vat-education/voec-uk-establishment) proving that your company is established in the UK in accordance with this legislation, within 60 days after receiving this notification.

If you fail to provide the documentary evidence within 60 days of this notification, Amazon will conclude that you are not established in UK and will start collecting and remitting VAT on your B2C sales. In such a case, additionally, you will be required to pay the VAT amount to Amazon to account for the historical un-paid VAT on all B2C sales that fall under UK VAT on eCommerce legislation since 1 Jan 2021. Further to this, you can continue selling on Amazon, but you will not be able to disburse any funds from your accounts, until any UK VAT owed is paid to Amazon.

Why did this happen?

From 1 January 2021, Amazon is liable to collect and remit VAT on B2C sales from non-UK established Selling Partners to B2C customers in UK under the UK VAT on e-Commerce legislation. We have taken this measure because as per investigation taken on your account, we found indicators that that your business is established outside the UK for VAT purposes. Hence, we need to get the documentary evidence to ensure we apply the correct treatment to your B2C sales.

I am established in the UK. How do I get my disbursements released?

If you believe you meet UK business establishment requirements, submit the required documents to

[email protected] provided in “Determination of Establishment for UK VAT” page: https://sellercentral.amazon.co.uk/gc/vat-education/voec-uk-establishment. Note that you have to send the documents required using your Amazon seller central Registered email id. It will take us up to 3 days to review the documents provided by you. At any point, if we conclude based on the provided documentary evidence that your company is established in the UK, we will release your disbursements within 24 hours of completing the verification. This will become available to you as per your normal payment cycle.

What happens if I don’t take the required actions?

If you fail to provide the documentary evidence within 60 days of this notification, we will conclude that you are not established in UK and will start collecting and remitting VAT on your B2C sales. In such a case, additionally, you will be required to pay the VAT amount to Amazon to account for the historical un-paid VAT on all B2C sales that fall under UK VAT on eCommerce legislation since 1 January 2021. You may continue selling on Amazon, but you will not be able to disburse any funds from your accounts, until any UK VAT owed is paid to Amazon.

Why are you withholding funds on my account?

Your funds will be on hold in accordance with our policies:

• BSA: https://sellercentral-europe.amazon.com/help/hub/reference/G201190440

• APE/APUK Agreement: https://sellercentral-europe.amazon.com/help/hub/reference/G201190400

Sincerely, Amazon Services Europe

=========================

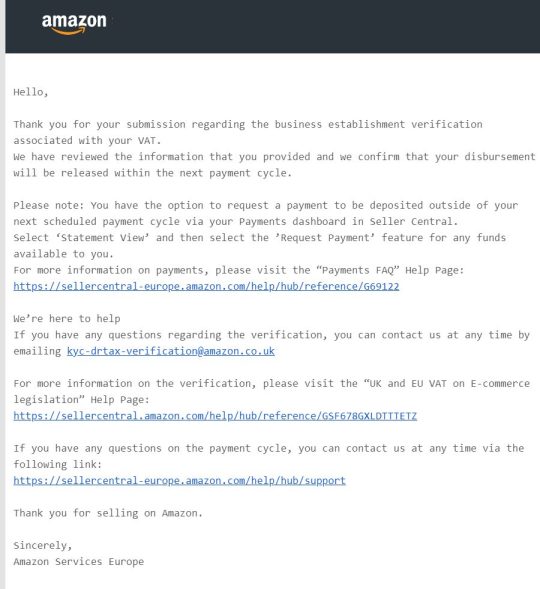

Hello,

Thank you for your submission regarding the business establishment verification associated with your VAT.

We have reviewed the information that you provided and we confirm that your disbursement will be released within the next payment cycle.

Please note: You have the option to request a payment to be deposited outside of your next scheduled payment cycle via your Payments dashboard in Seller Central.

Select ‘Statement View’ and then select the ’Request Payment’ feature for any funds available to you.

For more information on payments, please visit the “Payments FAQ” Help Page:

We’re here to help

If you have any questions regarding the verification, you can contact us at any time by emailing [email protected]

For more information on the verification, please visit the “UK and EU VAT on E-commerce legislation” Help Page:

If you have any questions on the payment cycle, you can contact us at any time via the following link:

Thank you for selling on Amazon.

Sincerely, Amazon Services Europe

-- Provide evidence of any employees who reside in the country of your stated country of business establishment.

Provide any one of the following:

HMRC correspondence demonstrating that the seller has registered with HMRC for PAYE

A PAYE demand from HMRC, or a screenshot of the PAYE return submission.

0 notes

Text

The Top 50 Identity Verification Service Providers in 2024: Transforming Digital Security in the Era of Web3

The surge of Web3, characterized by the decentralized web, is transforming the landscape of Know Your Customer (KYC) data management. By leveraging blockchain technology for self-sovereign identity (SSI), this approach enhances data security, privacy, and efficiency while eliminating redundant verification processes. The adoption of decentralized KYC solutions brings benefits across various sectors, including fintech, gambling, and crypto, offering improved trust, transparency, and regulatory compliance through immutable audit trails.

However, challenges such as data breaches and complexity are acknowledged, with expectations for continued efficiency and cost-effectiveness. As such, decentralized KYC solutions will require robust security measures and user-friendly design to ensure widespread adoption.

Additionally, interoperability between different systems must be enabled to ensure a seamless user experience. Furthermore, decentralized KYC solutions must be compliant with relevant laws and regulations to ensure their legitimacy. Finally, privacy must be safeguarded to ensure user trust.

Here is a compiled list of companies claiming to be the top solution providers in various countries:

1. KYC Switzerland (www.kycswitzerland.com)

2. KYC Hong Kong (www.kychongkong.com)

3. KYC UAE (www.kycuae.com)

4. KYC Sweden (www.kycsweden.com)

5. AML Norway (www.amlnorway.com)

6. KYC Germany (www.kycgermany.com)

7. AML Japan (www.amljapan.com)

8. KYC Spain (www.kycspain.com)

9. UK KYC (www.ukkyc.com)

10. AML KYC India (www.amlkycindia.com)

11. AML France (www.amlfrance.com)

12. KYC Italy (www.kycitaly.com)

13. KYC Canada (www.kyccanada.com)

14. AML KYC Brazil (www.amlkycbrazil.com)

15. KYC Australia (www.kycaustralia.com)

16. KYC New Zealand (www.kycnewzealand.com)

17. AML Iceland (www.amliceland.com)

18. KYC Ireland (www.kycireland.com)

19. KYC Denmark (www.kycdenmark.com)

20. AML Netherlands (www.amlnetherlands.com)

21. AML Finland (www.amlfinland.com)

22. AML KYC Singapore (www.amlkycsingapore.com)

23. KYC Belgium (www.kycbelgium.com)

24. KYC Luxembourg (www.kycluxembourg.com)

25. KYC South Korea (www.kycsouthkorea.com)

26. AML Romania (www.amlromania.com)

27. KYC Croatia (www.kyccroatia.com)

28. KYC Poland (www.kycpoland.com)

29. KYC European Union (www.kyceu.com)

30. KYC Mexico (www.kycmexico.com)

31. AML Colombia (www.amlcolombia.com)

32. KYC France (www.kycfrance.com)

33. KYC Greece (www.kycgreece.com)

34. KYC Middle East (www.kycmiddleeast.com)

35. AML Portugal (www.amlportugal.com)

36. AML Switzerland (www.amlswitzerland.com)

37. AML KYC Canada (www.amlkyccanada.com)

38. KYC Bahrain (www.kycbahrain.com)

39. AML Chile (www.amlchile.com)

40. KYC Lithuania (www.kyclithuania.com)

41. AML Argentina (www.amlargentina.com)

42. AML Austria (www.amlaustria.com)

43. KYC Russia (www.kycrussia.com)

44. AML Greece (www.amlgreece.com)

45. AML KYC Brasil (www.amlkycbrasil.com)

46. AML South Korea (www.amlsouthkorea.com)

47. KYC Romania (www.kycromania.com)

48. KYC Norway (www.kycnorway.com)

49. KYC UK (www.kycuk.com)

50. ID Verification Service (www.idverificationservice.com)

ID verification software plays a pivotal role in bolstering security and compliance within the digital realm. It serves as a critical deterrent against identity theft, fraud, and financial crimes. Technological advancements such as AI, blockchain, and biometric authentication contribute to increased efficiency and more robust fraud detection. Regulatory Technology (RegTech) further streamlines compliance processes, fostering cross-border collaboration and shaping a more secure financial environment.

This, in turn, helps to create a more transparent and efficient financial system, allowing users to access financial services with greater trust and confidence. This leads to better access to capital, increased investment, and, ultimately, improved economic growth.

Furthermore, RegTech also helps to reduce the cost of regulatory compliance, allowing companies to focus on their core business. This, in turn, leads to increased profitability and job creation. In addition, RegTech can help to reduce fraud and money laundering, which is beneficial for society as a whole.

Disclaimer: It is crucial to note that these rankings are the result of research conducted by the author for each respective country. The list is presented for informational purposes only and does not constitute promotional content. Businesses are encouraged to conduct their surveys tailored to their specific needs and requirements.

#compliance#kyc#kyc compliance#kyc solutions#kyc and aml compliance#kyc api#kyc services#kyc verification#digital identity

1 note

·

View note

Text

Prism Casino Reviews: All You Need To Know

Prism Casino has been thrust into the spotlight by an overview that raises troubling concerns about its operational integrity and player treatment, shared among its sister sites under the Virtual Group umbrella. This examination aims to scrutinize Prism Casino's claims of being a reputable operator against the backdrop of longstanding issues, such as delayed withdrawals, questionable terms, and subpar customer service.

As outlined in the provided information, Prism Casino relies on RealTime Gaming (RTG) and SpinLogic software, delivering a diverse array of slots, table games, and video poker. However, the critical question remains—does Prism Casino operate with fairness and integrity? A more in-depth exploration is necessary.

Trustworthiness and Licensing of Prism Casino

According to the content, Prism Casino asserts its licensing and regulation status without offering verifiable details. Further investigation reveals that Prism operates under a license from the Costa Rica jurisdiction. Unfortunately, Costa Rica's reputation as a lenient regulatory body raises apprehensions regarding Prism's adherence to industry safety and fairness standards.

In contrast to platforms licensed in reputable jurisdictions like Malta, Curacao, Gibraltar, or the UK, Prism's Costa Rica license provides less assurance of transparent and accountable operations. This leaves players with limited recourse for addressing complaints and seeking resolution.

Overview of Player Issues at Prism

Aligned with the provided information, numerous player grievances revolve around protracted or denied withdrawal processes. Prism seems to employ arbitrary conditions related to play terms and Know Your Customer (KYC) verification, hindering timely withdrawal of winnings.

Complaints highlight a pattern where Prism requests documentation repeatedly, later claiming inconsistencies as grounds to withhold funds. Even when players provide identical documents, the withdrawal process extends over weeks or months, suggesting deliberate tactics to evade payment.

Prism's shifting stance on what constitutes bonus abuse without prior notice adds another layer of concern. This lack of clarity exposes players to the risk of abrupt account restrictions or closures without adequate understanding of terms.

Prism Casino's Games and Features Overview

Despite ethical concerns, Prism Casino delivers a technically proficient gaming experience through RTG and SpinLogic's software. The platform offers a substantial selection of slots, video poker, and traditional table games.

In terms of accessibility, Prism provides both a downloadable desktop client and instant play options within browsers, catering to user preferences.

Additional features include a loyalty program that rewards redeemable points based on wagering and a tailored approach to accommodate US players, featuring convenient banking options like the Players Rewards Card.

Final Verdict

Summarily, while Prism Casino boasts a commendable game portfolio and seamless technical performance, the overwhelmingly negative player feedback, coupled with reports of delayed payouts, predatory practices, and ethical concerns, casts a shadow of doubt.

The absence of a reputable regulatory license compounds these issues, leaving players with limited avenues for complaint resolution. Given these substantial drawbacks, it is strongly advised to exercise extreme caution when depositing real money into Prism Casino, as the process of withdrawing winnings may present formidable challenges.

Until Prism Casino undertakes substantial improvements in transparency, trustworthiness, and equitable payment processing, users face substantial risks to their finances. Exploring more reputable and accountable online casinos is a prudent choice in light of these significant concerns.

0 notes

Text

Lexlevel - Anti Money Laundry

Money Laundering & such terrorist financing activities are growing day by day, if you work in a financial service sector, then it is important to establish appropriate policies, procedures & awareness programs to understand what constitutes Money Laundering, how to identify the red flags and how to combat such risks & practices. Combating such issues would not constitute good business or organizational culture, instead, recognizing and breaking such illegal activities before they even get started would. To prevent the engagement of granitizations and individuals with such illicit activities, the Indian Government and International organizations have formulated a number of laws & regulations to protect the economy & corporations from such illicit activities, such as the Prevention of Money Laundering Act, 2002, Foreign Corrupt Practices Act, UK Bribery Act , Financial Action Task Force (FATF) recommendations, etc.

Our Flagship Employee Code of Conduct & Sensitization Training program :

Key topics that our covered by our program to ensure that employees, management, and stakeholders are aware of and equipped with company policies & practices are :

Introduction to Money Laundering, Understanding the purpose, methods & different stages used

Legal and Regulatory Framework

Importance of Know Your Customer (KYC) and Customer Due Diligence (CDD)

Risk Assessment, Suspicious Transactions & Penalties

Reporting Suspicious Transaction

Role of AML Officer and Compliance Team

Mock Scenarios and Case Studies

We at Lexlevel, customize the training program to address the specific AML risks and challenges relevant to your industry and operations. Regular refresher training is essential to keep employees and other relevant stakeholders up-to-date on the latest AML developments and best practices.

Stay informed and up-to-date with the latest compliance trends and regulations through our:

- Online Sessions : We provide interactive virtual training sessions, ideal for remote teams and busy professionals.

- In-Person Classroom Workshops : Benefit from hands-on training and real-time interaction with our experts.

- Blended Learning: Combine online and in-person training for a customized learning experience.

- Webinars and Seminars : Get a chance to meet your fellow professionals in our webinars and events to gain valuable knowledge and network with industry experts.

HERE’S WHAT AN EFFECTIVE ONLINE COMPLIANCE TRAINING PROGRAM CAN DO FOR YOU

0 notes

Text

The Bank for International Settlements (BIS) cited the concentration of crypto assets in banks as one of the reasons for the 2023 banking crisis. At the end of June 2022, banks had $4.2 billion in direct exposure to crypto assets.

Signature Bank, the BIS argues, failed to perceive the risks of relying on crypto industry deposits, which disadvantaged it during the crypto collapses of 2022. It also did not have enough liquidity to satisfy outflows from non-crypto depositors spooked by the liquidation of Silvergate.

BIS ‘Proactive Intervention’ Could Overreach

According to the BIS, the failure of Silicon Valley Bank (SVB), which held cash reserves backing Circle’s USDC stablecoin, can be attributed to two factors. Its risk policies failed to match the growth of its asset base, and its management did not notice any problems with how the business ran or its balance sheet strategies.

Its management also allegedly treated supervisory interventions as compliance exercises rather than opportunities to self-evaluate. Before failing in March, the bank had 31 open supervisory inquiries looking into different aspects of its business model and risk approach.

Signature Bank Shares | Source: BIS

Going forward, the BIS recommends regulators embrace a holistic approach that combines rules with proactive intervention when necessary. This approach, however, has legal risks since banks may resist any intervention lacking a legal basis.

Read more: 2023 US Banking Crisis Explained: Causes, Impact, and Solutions

Signs of legally murky intervention first occurred when the Federal Deposit Insurance Corporation asked the acquirers of Signature Bank to offload its crypto customers and assets worth $4 billion. The House Financial Services Committee during the Obama administration called similar efforts to strangle certain industries an abuse of power.

Money Laundering Fears Still Palpable

One of the obvious victims of the banking collapse was Circle, whose stablecoin lost $10 billion in market cap two weeks after SVB’s collapse. Many crypto users have since migrated to Tether, a larger but more controversial stablecoin.

But a more interesting story is shaping up as the crypto collapse pushes regulators toward clearer crypto regulations. Hong Kong, Japan, South Korea, and some European countries offer licensing regimes for crypto firms that legitimize their operation.

A side effect of this legitimacy is the need for registered firms to secure local banking partners. Banks are critical in transferring funds to exchanges and for cashing out holdings.

However, many banks still fear poor Know-Your-Customer processes that make exchanges vulnerable to money laundering. Binance, for example, lost banking and payment partners after the US Commodity and Futures Trading Commission hinted it engaged in money laundering.

Read more: 14 Best No KYC Crypto Exchanges in 2023

Initially, Asian branches of the HSBC and Standard Chartered banks hesitated to onboard crypto businesses because of money laundering associations. UK consumer banks, NatWest, Chase UK, and TSB Bank, have all placed restrictions on crypto-related transactions.

Banks in Progressive Regions Are Being Proactive

But the ice age is thawing. Customers of HSBC Hong Kong can invest in Bitcoin and Ethereum exchange-traded funds, provided they confirm their understanding of educational material on virtual asset investments.

Before opening its fiat-to-crypto payment rails to licensed Hong Kong exchanges, ZA Bank operated a sandbox that involved 100 firms. It linked its systems to the city’s company register and conducts anti-money laundering procedures to minimize risk.

South Korea’s oldest bank, Shinhan, is also testing remittances in a closed sandbox. Stablecoins insulate transfers from currency fluctuations and will benefit from the AML framework within which the bank already operates.

Do you have something to say about the BIS report after the collapse of crypto banks or anything else? Please write to us or join the discussion on our Telegram channel.

You can also catch us on TikTok, Facebook, or X (Twitter).

0 notes

Photo

New Post has been published on https://cryptonewsuniverse.com/fatf-out-to-get-crypto-fatf-travel-rule-expanded-what-does-it-mean-for-crypto/

FATF Out To Get Crypto FATF Travel Rule Expanded What Does It Mean For Crypto?

FATF Out To Get Crypto. FATF Travel Rule Expanded. What Does It Mean For Crypto?

The Financial Action Task Force (FATF) has been making portentous noises about crypto in recent years, and several countries are getting antsy. The most prominent concern is implementing the “travel rule,” designed to force crypto companies to collect information about any transfer of digital assets worth more than US$1,000. Some countries, notably the UK, have in the past pushed back against this ‘recommendation’ from the FATF, but their resistance now appears to be wavering. The FATF is on the warpath and has crypto firmly in sight.

This article examines what the FATF is up to, what it could mean for your country, and what it all means for crypto. Although it may sound like more doom and gloom, there are reasons to believe that crypto could benefit from the FATF’s meddling in some ways.

Just recently, PayPal announced that it would prevent UK users from buying BTC until early 2024. PayPal reportedly did this because the Financial Action Task Force (FATF) so-called travel rule requires all crypto companies to collect detailed info about crypto transfers. The travel rule was set to go into effect in the UK on September 1st, 2023, and is being rolled out worldwide. This could have a profound impact on crypto companies and projects everywhere.

Image Source: Coindesk

What Is The FATF?

The Financial Action Task Force, or FATF, is an unelected and unaccountable international organization based in Paris, France. It was created by G7 countries in 1989 to combat money laundering, but its scope has expanded significantly since then. However, these recommendations have apparently done nothing to combat illicit financial activity over the last 30 years.

The organization adopted a mandate in 2019 to “Combat any threats to the integrity of the financial system.” Of course, the FATF considers crypto a threat, probably because its purpose is to replace the financial system. The FATF started applying its so-called recommendations to the crypto industry in 2019, and any country that refuses to go along with these recommendations will find itself cut out of the international financial system. The FATF finalized its recommendations for cryptocurrency in October 2021.

FATF’s Crypto Recommendations

The FATF’s crypto recommendations involve labeling everything that doesn't involve a third party as “high-risk.” This includes holding your crypto in your wallet and sending crypto peer-to-peer. The FATF also considers any crypto privacy to be inherently high risk. If these recommendations are implemented as regulations, crypto will become another arm of the existing financial system. It will offer no financial freedom and no financial privacy. The only exception is NFTs, which are exempt from these recommendations for unknown reasons.

On that note, you should know that the FATF crypto recommendations only apply to intermediaries working with crypto, which the FATF refers to as Virtual Assets Service Providers or VASPs. The FATF’s crypto recommendations do not apply to miners, validators, or crypto wallets, at least not yet. However, the scope of the FATF's requests seems to have expanded over time, so this could change. This expansion is especially true of the travel rule, which requires VASPs to collect KYC on everyone who buys or sells more than $1,000 of crypto.

The Travel Rule Expanded

Crypto exchanges started collecting KYC in 2021. Since then, however, the travel rule has expanded to require VASPs to collect KYC-level information about crypto transfers to and from VASPs worth more than $1000. Note that it's not entirely clear when the scope of the travel rule was expanded. Research suggests this expansion happened after the FATF’s finalized crypto recommendations were published in October 2021. Some may recall that South Korean crypto exchanges started forcing users to provide KYC-type information for crypto wallet transfers in December 2021.

Images source: Notabene

The good news is that some countries have pushed back against the expanded travel rule. You might remember that the UK announced that it would not force VASPs to track transfers to and from crypto wallets in mid-2022, stating that they did not pose any illicit activity risks.

The not-so-good news is that these countries, notably the UK, seem to have pulled a 180â°. As mentioned, the UK implemented this expanded travel rule starting September 1st. The announcement specified that it did this in response to a statement by the FATF in June 2023. The FATF announcement called on countries to implement its crypto recommendations as regulations “without delay.” Of course, this is not a recommendation; it's a demand. Comply with our crypto recommendations, or we will restrict your access to the global financial system.

Some countries could not comply, so they had to ban crypto. Two countries that did this are Pakistan and Kuwait, both of which recently banned crypto in its entirety, citing the FATF’s crypto recommendations as the reason. It appears that the UK opted to comply instead.

Image source: Notabene-Regulations

Which Countries Are Now Affected

So this begs the question of when the FATF's expanded travel rule is coming to your country. The answer depends on the country; a complete list of countries and their compliance with the expanded travel rule can be found on the website of Notabene, a crypto compliance company. If you look at the list, you'll notice that some have already implemented the travel rule. It shows that not all have implemented the expanded travel rule. You'll have to click the link on your country and look at the details.

There's only one country we need to look at: the United States. That's because the US heavily influences the FATF. The travel rule has its roots in the United States’ Bank Secrecy Act. KYC, for financial transactions, originates in the infamous Patriot Act. The FATF’s finalized crypto recommendations were even co-authored by the US Treasury Department. As such, it's safe to assume that the FATF’s crypto recommendations are likely to mirror similar regulations that are being proposed or that have already been passed in the United States.

The FATF's expanded travel rule seems rooted in an infamous FinCEN proposal from November 2020. The proposal was to lower the travel rule transaction threshold from $3,000 to just $250 and expand its scope to include any crypto transactions. This includes transfers between crypto wallets and VASPs, i.e., exchanges. There is also an outcry on the measure of invasion of privacy,

Fortunately, this proposal has yet to be approved. Unfortunately, the US has influenced the FATF to implement this proposal in other countries instead. That's because the travel rule transaction threshold in jurisdictions like the European Union is $0, which the FATF suggested in its finalized crypto recommendations. This is more significant than you might think because it indicates the start of a very slippery slope.

A Slippery Slope

First, the FATF just wanted VASPs to complete KYC on their users. Now, they want VASPs to get info on crypto transactions above a specific value. Eventually, they'll require VASPs to get information on all crypto transactions, and the countries that don't force VASPs to comply will be cut out of the global financial system. This ties into why some countries, such as Kuwait and Pakistan, ban crypto instead of complying with the FATF, like other countries, such as South Korea and the UK.

The answer is likely because they lack the resources to comply with these recommendations. Take a second to consider that information about all these travel rule transactions will have to be shared with national regulators. In turn, these national regulators will have to make sense of this massive amount of information and understand which transactions could be illicit and which ones are legit. If they fail to do this to the standard that the FATF wants, they could just as easily find themselves on the FATF’s grey list or even black List.

In other words, the outcome of attempting to comply will be almost the same as outright non-compliance. So why bother trying to comply? Not only that, but it's possible that the US would use this alleged non-compliance as justification to punish its geopolitical opponents. For context, it's believed that up to 40% of money laundering occurs in the United States, yet countries like the UAE are ending up on the FATF's naughty lists.

Is it Geopolitical, for Profit, or Something Else?

Given this fact, one could argue that the primary purpose of the FATF is geopolitical, not regulatory. If this is the case, it's appalling because it means the US is using the FATF to push its allies to comply. Remember that the UK initially wasn't going to apply the FATF's expanded travel rule. This relates to why any country would take the risk of complying with the FATF crypto recommendations instead of just banning crypto.

Some say the answer is probably profit. Crypto has unprecedented potential; dozens of countries are trying to capitalize on this by becoming crypto hubs. The paradox is that the FATF's expanded travel rule alone is likely enough to crush smaller crypto companies and startups. That's because they would need more financial resources to comply. This would mean that the large crypto companies left standing could become monopolies.

At that point, it would be effortless for the FATF to expand the purview of its crypto recommendations again to outlaw self-custody, peer-to-peer transactions, and crypto privacy completely. Again, this would turn crypto into another arm of the existing financial system, making it much more dystopian.

How Could It Benefit the Crypto Market?

The silver lining is that this outcome is years away from occurring and is not guaranteed. It could also benefit the crypto market in short to medium term. That's simply because institutional investors will likely invest more in crypto once all these FATF-based regulations are in place. This is because crypto would become ever so slightly more integrated with the existing financial system from a regulatory perspective.

This means more crypto to fiat on and off ramps, more funding for crypto projects and companies, and more direct crypto investment. The consequence is that crypto would no longer become a niche asset class, making self-custody and peer-to-peer transactions more common.

Under normal circumstances, this would result in an explosion of crypto-specific innovation, like new DeFi protocols, for instance. However, under the FATF's recommendations, any crypto projects or companies offering these innovations would be under extreme scrutiny. Unless they're perfectly decentralized, the FATF will label them all as VASPs and force them to comply with recommendations like the travel rule.

Believe it or not, this will also benefit crypto because it will force new crypto projects and protocols to be as decentralized as possible to outmaneuver the FATF. This will be painful in the short term because crypto projects and companies are not very decentralized. An explanation of what it means to be genuinely decentralized can be found here.

That said, if any genuinely decentralized crypto projects and protocols managed to gain significant adoption, the FATF would likely respond by further expanding the scope of its crypto recommendations. In a recent report, Notabene noted that the FATF left the door open to this possibility, citing,

“Transfers between self-hosted wallets, so-called peer-to-peer (P2P) transactions are not explicitly covered by AML/CFT rules. The FATF opens the door to a future paradigm change in case there is a distinct trend towards P2P transactions.”

Translation: If actual cryptocurrency, that is, peer-to-peer trustless transactions, becomes too popular, then the FATF would respond by saying wallets that engage in crypto activities are high risk. In practical terms, this could mean not being able to transfer crypto between such wallets and a compliant VASP. What's funny is that this would likely result in a parallel financial system, which is precisely the opposite of what the FATF is trying to achieve with its crypto recommendations.

On that note, fully decentralized crypto-based communities in social media, marketing, and digital broadcasting are rising and in the throes of building a parallel economy. Given the privacy and censorship issues of legacy social media, governments, woke agencies, and tech corporations, with their propensity to ban or suspend their services to individuals and companies that go against their narrative, have brought this imperative to the fore.

Is the Crypto Industry Complying?

So, what is the crypto industry doing about the FATF crypto recommendations? Well, at first glance, it looks like it’s complying; upon closer inspection, however, this compliance has been incredibly strategic. To explain, the crypto industry took its time complying with the FATF crypto recommendations. After all, compliance is an additional cost, and most countries were not pressuring them about compliance with the FATF until recently.

There are technically no deadlines for compliance with the FATF’s recommendations. In theory, countries must apply the FATF recommendations within one year of their announcement. In practice, most countries don't. One expert explained that the travel rule was a bit of a myth. Just 10% had implemented the crypto travel rule in 2022, but in all fairness, this apparent non-compliance wasn't intentional.

The FATF has constantly been adjusting its crypto recommendations to account for changes in the crypto industry. Everyone started taking them seriously only after the finalized crypto recommendations were published. This includes the crypto industry, which, according to Notabene’s survey, “seemed willing to adopt the travel rule in January 2022.” By then, some of the biggest entities had already started exploring travel rule compliance, like USDT issuer Tether and its sister exchange Bitfinex working with Notabene.

Here's where things get interesting: Notabene, the crypto compliance company, has been referenced by the FATF on a few occasions. This is surprising, considering that the company has received most of its funding from the crypto industry, according to Crunchbase.

Also, according to Notabene, the criteria used to determine which crypto transactions are considered high-risk from the FATF's perspective is determined by blockchain analytics companies, not Notabene itself. The largest is Chainalysis, which is very pro-crypto. In fact, Chainalysis pushed back against the FATF’s crypto recommendations when they were first proposed in 2019.

The institutions the FATF relies on to implement its crypto recommendations are all pro-crypto. To put things into perspective, companies like Notabene and Chainalysis have been advising governments and regulators. Put another way, the impact of the FATF crypto recommendations may not be as anti-crypto as they intend them to be because all the institutions required to implement them are pro-crypto. It's not just private companies; some countries are also trying to protect crypto.

Crypto Privacy in Jeopardy?

There's only one place where the FATF could still cause a problem: privacy. As most of us know, financial privacy is required for financial freedom. You can be coerced in many ways if every transaction is tracked. e.g., by punishing the people you transact with. Logically, it will be challenging for pro-crypto compliance companies and countries to defend crypto privacy from the FATF. This will be practically impossible when the FATF decrees that any exchange offering privacy coins is inherently non-compliant. It could result in the elimination of crypto privacy altogether.

Some would say the recent sanctions against Tornado Cash are a prelude to the FATF's next moves. Luckily, the crypto industry has been working on a solution, too. Notably, the FATF claimed that there had been a considerable move towards privacy in crypto in its finalized recommendations, stating, “During recent FATF consultations, the industry highlighted data protection and privacy (DPP) issues as key considerations for travel rule implementation…. Going forward, FATF will continue to monitor these issues to ensure data privacy and other similar issues do not present barriers to implementation.”

Image source: Cointelegraph

Crypto Privacy Predestined – The Solution

Besides the many crypto projects like Ethereum trying to preserve privacy through cutting-edge technology, like zero-knowledge proofs, Bitcoin has also been subtly working on privacy-preserving technology. The Taproot upgrade is one protocol developed in November 2021.

One of the things Taproot did was introduce Key Aggregation with Schnoor Signatures. Put simply, it made every single Bitcoin transaction look like a regular transaction. This move means that transactions involving multisig wallets resemble regular transactions on the blockchain. It’s significant because multisig wallets are required for Atomic Swaps, i.e., swapping BTC for a crypto coin on another blockchain. Incidentally, Monero developers finally found a way to execute swaps between BTC and XMR in August 2021.

Taproot means these swaps are now theoretically undetectable. Multisig wallets are also required for the lightning Network, Bitcoin's most significant Layer 2 protocol. As it so happens, US authorities offered bounties to anyone who could track XMR and Lightning Network transactions in September 2020. This implies that the Lightning Network has similar privacy levels to Monero.

Interestingly, the three Bitcoin Improvement proposals that make up the Taproot upgrade, including Schnoor Signatures, were all proposed in January 2020, shortly before the first countries started implementing the crypto travel rule. Is this a coincidence, or perhaps something more?

Image source: GitHub

Anyway, speculation aside, it's clear that crypto privacy is inevitable because nobody wants privacy more than high-net-worth individuals. When these investors get involved during the next crypto bull market, there will definitely be calls to increase crypto privacy, and many will be answered. Additionally, if these calls don't come from the 1%, you can bet they'll come from the central banks that will start accumulating crypto in 2025.

The regulated crypto space will likely grow, but the unhosted ecosystem will remain a niche area with significant development and innovation. The crypto and blockchain projects that uphold the interests of entrepreneurs and advocate for free and critical thinking are paving the way and developing ecosystems that will have the financial freedom, liberty, and sovereignty that is fundamentally our right of passage, which seems to be all but forgotten by the monopolies and so-called authorities and their mandate to capture the crypto industry.

Editor and Chief Markethive: Deb Williams. (Australia) I thrive on progress and champion freedom of speech. I embrace "Change" with a passion, and my purpose in life is to enlighten people to accept and move forward with enthusiasm. Find me at my Markethive Profile Page | My Twitter Account | and my LinkedIn Profile.

0 notes

Text

Crypto Gaming Regulation & Compliance: A Comprehensive Guide

Online gambling has always been a thrilling domain, combining technology, strategy, and chance. With the integration of cryptocurrencies, it has entered an entirely new era, promising more transparent and decentralized betting platforms. However, with this new dawn, comes a web of regulations and compliances that crypto gaming enthusiasts must understand. Let's dive into the intriguing world of regulation and compliance in crypto gaming.

The Need for Regulation

Cryptocurrencies have been lauded for their decentralized nature. While this offers unprecedented freedom and transparency, it also presents challenges. For one, decentralized systems can become a hotbed for illicit activities if not properly monitored. Regulatory measures ensure:

Protection against fraud and scams.

Ensuring fair play and protecting consumer rights.

Preventing money laundering and other illegal activities.

The Global Landscape of Crypto Gambling Regulation

Pro-Crypto Jurisdictions: Countries like Malta, Gibraltar, and the Isle of Man have embraced crypto gambling, providing clear frameworks for operators to offer their services. Their approach focuses on attracting innovative businesses while ensuring stringent consumer protection measures.

The Gray Areas: Regions like the UK and EU have a more ambiguous stance. While they haven't outlawed crypto gambling, they have established strict licensing requirements and guidelines that operators must adhere to.

Restrictive Regimes: Countries like China, Russia, and India have either banned or heavily restricted both cryptocurrency and online gambling, making it challenging for operators and players alike.

Staying Compliant in the World of Crypto Gambling

1. Know Your Customer (KYC) and Anti-Money Laundering (AML): Almost all regulated crypto casinos require users to undergo KYC procedures. This means submitting documents to verify one's identity, ensuring the prevention of fraud and money laundering.

2. Licensing: Before indulging in any crypto gambling platform, always check its licensing status. Platforms licensed under reputable jurisdictions are more likely to be trustworthy and fair.

3. Technical Standards: Regulated platforms must adhere to high technical standards, ensuring games are fair, and the platform is secure from potential hacks.

4. Transparent Advertising: Misleading promotions or hidden terms and conditions can lead to hefty fines. Always ensure that promotions are transparent and in line with regulatory requirements.

The Road Ahead

While the world of crypto gambling is still evolving, one thing remains clear: Regulation is not an enemy but a guiding hand. As technology advances, we can expect more standardized global regulations, ensuring a safe environment for players and operators alike.

In Conclusion

The exciting realm of crypto gambling is a blend of technological advancement and regulatory challenges. Understanding the intricacies of regulation and compliance is not just essential for operators but also for players to ensure a safe and enjoyable gambling experience. As the world becomes more crypto-friendly, we can hope for clearer guidelines, making the maze of regulation less daunting for all.

1 note

·

View note

Text

KYC

Seller Verification Review

Payment Service Provider - PSP

Dear Selling Partner,

Thank you for your recent email. We require some additional document(s) to continue with your verification.

What documentary evidence do I have to provide and how?

Please reply directly to this email with the following information:

1) Evidence that you are physically operating your business from your provided address.

If you operate a company:

2) An extract from the UK Companies House listing all directors of your company: https://www.gov.uk/government/organisations/companies-house

3) Documents confirming the identity and place of residence of every director listed in the extract.

4) Evidence of any employees residing in the UK.

0 notes

Text

Top 30 KYC Solution Providers Worldwide: 2023 Edition

In an era defined by digital transformation and the imperative for robust security measures, Know Your Customer (KYC) solutions have become the cornerstone of businesses across the globe. As we delve into 2023, it's crucial to spotlight the leading KYC solution providers, country-wise, shaping the landscape of compliance and identity verification.

1. KYC Croatia (www.kyccroatia.com)

Croatia enters the KYC arena with a dedicated platform, offering tailored solutions for businesses aiming for compliance excellence. With a focus on seamless verification, KYC Croatia stands as a testament to the country's commitment to secure business practices.

2. KYC UAE (www.kycuae.com)

In the heart of the Middle East, KYC UAE emerges as a key player, providing cutting-edge KYC solutions. With the region's dynamic business environment, KYC UAE ensures businesses adhere to the highest compliance standards.

3. KYC Sweden (www.kycsweden.com)

Sweden, renowned for its commitment to transparency, houses KYC Sweden. This provider offers a comprehensive suite of KYC solutions, aligning with the nation's dedication to ethical business practices.

4. KYC Canada (www.kycanada.com)

As businesses in the Great White North seek advanced KYC services, KYC Canada steps in. With a focus on precision and efficiency, this provider caters to the diverse compliance needs of Canadian enterprises.

5. KYC UK & UK KYC (www.kycuk.com & www.ukkyc.com)

The United Kingdom boasts not one, but two prominent KYC solution providers – KYC UK and UK KYC. Both platforms contribute significantly to the nation's commitment to regulatory compliance and secure business operations.

6. KYC Germany (www.kycgermany.com)

Germany, a powerhouse in the European Union, relies on KYC Germany for cutting-edge identity verification solutions. The platform aligns with the nation's strict standards, ensuring businesses operate with integrity.

7. KYC Spain (www.kycspain.com)

In the vibrant landscape of Spain, KYC Spain plays a pivotal role in bolstering compliance efforts. Spanish businesses benefit from advanced KYC solutions, promoting a secure and trustworthy marketplace.

8. KYC France (www.kycfrance.com)

France, known for its rich cultural heritage, also embraces technological advancements in KYC through KYC France. The provider contributes to the nation's commitment to regulatory adherence in the digital age.

9. KYC Middle East (www.kycmiddleeast.com)

Covering the broader Middle East region, KYC Middle East emerges as a go-to solution provider. Catering to the unique compliance needs of the region, it plays a crucial role in fostering secure business practices.

10. KYC Belgium (www.kycbelgium.com)

Belgium steps into the spotlight with KYC Belgium, offering tailored KYC solutions. The platform aligns with the nation's emphasis on ethical business conduct and regulatory compliance.

11. KYC Poland (www.kycpoland.com)

Poland's businesses thrive with KYC Poland, ensuring adherence to compliance standards in the Eastern European region.

12. KYC Norway (www.kycnorway.com)

Known for its stringent regulations, Norway relies on KYC Norway to provide top-notch identity verification services.

13. KYC Mexico (www.kycmexico.com)

In the vibrant Latin American landscape, KYC Mexico stands as a key player in ensuring secure and compliant business operations.

14. AML KYC Canada (www.amlkyccanada.com)

Focusing on anti-money laundering alongside KYC, AML KYC Canada offers a comprehensive solution for businesses in the region.

15. KYC Austria (www.kycaustria.com)

Austria's commitment to compliance is reinforced by KYC Austria, which delivers advanced identity verification services.

16. KYC Iceland (www.kyciceland.com)

Embracing the Nordic ethos, KYC Iceland takes center stage. With a focus on accuracy and reliability, it caters to the unique compliance landscape of Iceland, ensuring businesses operate with integrity.

17. KYC Russia (www.kycrussia.com)

In the vast expanse of Russia, KYC Russia plays a crucial role in upholding compliance standards. The platform integrates cutting-edge technology to secure businesses against evolving threats, reflecting the nation's commitment to financial integrity.

18. AML KYC India (www.amlkycindia.com)

India, a global economic hub, relies on AML KYC India for comprehensive solutions. Addressing anti-money laundering alongside KYC, this provider contributes significantly to India's regulatory landscape.

19. KYC Greece (www.kycgreece.com)

As Greece navigates its unique regulatory framework, KYC Greece steps in with tailored solutions. The platform aligns with the nation's commitment to financial transparency and secure business operations.

20. KYC Lithuania (www.kyclithuania.com)

In the Baltic region, KYC Lithuania stands out as a key player. Offering advanced identity verification, it supports businesses in Lithuania to meet and exceed compliance expectations.

21. KYC Ireland (www.kycireland.com)

Ireland, a hub for international businesses, relies on KYC Ireland for cutting-edge solutions. The platform contributes to the nation's reputation for ethical business practices and regulatory adherence.

22. KYC Hungary (www.kychungary.com)

Hungary's businesses thrive with the support of KYC Hungary. Focusing on the specific needs of the region, this provider ensures businesses operate securely within Hungary's regulatory landscape.

23. KYC South Korea (www.kycsouthkorea.com)

In the dynamic business environment of South Korea, KYC South Korea plays a pivotal role. The platform integrates advanced identity verification to meet the nation's high standards for compliance.

24. KYC Luxembourg (www.kycluxembourg.com)

Luxembourg, a global financial center, relies on KYC Luxembourg for top-notch solutions. The platform supports businesses in meeting regulatory requirements and maintaining financial integrity.

25. KYC Peru (www.kycperu.com)

Nestled in South America, KYC Peru contributes to the nation's regulatory landscape. The platform's focus on compliance ensures businesses in Peru operate securely and transparently.

26. KYC Denmark (www.kycdenmark.com)

Denmark, known for its stringent regulations, turns to KYC Denmark for identity verification solutions. The provider aligns with the nation's commitment to financial transparency and regulatory compliance.

27. KYC Italy (www.kycitaly.com)

Italy's businesses benefit from KYC Italy's comprehensive solutions. With a focus on accuracy and efficiency, the platform supports businesses in meeting the country's regulatory standards.

28. KYC Chile (www.kycchile.com)

Chile's regulatory landscape is navigated seamlessly with KYC Chile. The platform ensures businesses adhere to compliance standards, contributing to Chile's financial integrity.

29. KYC Bahrain (www.kycbahrain.com)

In the Middle East, KYC Bahrain plays a crucial role in supporting businesses. The platform's advanced identity verification solutions align with Bahrain's commitment to secure and compliant operations.

30. KYC Netherlands (www.kycnetherlands.com)

The Netherlands, a global economic player, relies on KYC Netherlands for cutting-edge solutions. The platform supports businesses in meeting and exceeding compliance expectations in this dynamic business landscape.

Conclusion:

As businesses continue to navigate the complex terrain of regulatory compliance and identity verification, these top 30 KYC solution providers stand as pillars of support. Each platform contributes to its respective nation's commitment to financial integrity, offering businesses the tools they need to operate securely in the digital age. Enterprises need to conduct thorough evaluations based on individual needs and stay abreast of evolving regulatory landscapes.

Stay Tuned for More on the Leading KYC Solution Providers…

Disclaimer: This blog is for informational purposes only and does not endorse or promote any specific KYC solution providers. Businesses are advised to conduct their own thorough evaluations based on individual needs and requirements.

#compliance#kyc#kyc compliance#kyc solutions#kyc and aml compliance#kyc api#kyc services#kyc verification#digital identity

1 note

·

View note

Text

KYC Providers UK

Looking for KYC Providers UK? We are a leading KYC solutions provider in the UK and provide OCR technology-based KYC API, verifying identities instantly. Our KYC API is easy to use and designed for financial and non-financial companies and organisations for safe business and help in financial fraud prevention. We provide KYC solutions to meet UK regulatory compliance and identify financial criminals.

#kyc api#banking#finance#fintech#gaming#kyc companies#kyc software#kyc verification#banks#kyc solution#KYC API UK#KYC Solutions UK#KYC Solutions Provider UK#KYC UK#KYC Solutions Platform UK#KYC software UK#KYC Companies UK#KYC Providers UK#KYC Services Provider UK

1 note

·

View note

Text

NPS Account for NRI in UK

Alankit serves as a one-stop shop for solving all customer queries/complaints, doubts and facilitating adequate direction and provision for all NPS related services, right from the initial subscriber registration procedure to completing the verification process for KYC documents to transferring the information systematically to the elected intermediaries in a straight way.

0 notes

Text

Metacade To List On CEX, BitMart, Opening Up Trading To 9 Million Users

London, UK, April 19th, 2023, Chainwire

After selling out their $16.4m presale, Metacade is now set to list its token MCADE on the well-known centralised exchange BitMart, which boasts over 9 million users.The listing is scheduled to take place on Friday, 20th April, 9 am UTC, at which point registered users of BitMart will be able to buy, sell & trade MCADE tokens.Metacade has seen strong momentum following numerous announcements and milestones. It sold out its huge $16.4m presale early, quickly followed by the 250m token 6-month staking pool selling out in under 5 hours. Furthermore, Metacade also announced a partnership with gaming company Metastudio, leading to a significant buzz amongst GameFi investors.At the time of writing, the price of the Metacade (MCADE) token is $0.0173, with a diluted market cap of over $35m and an average daily trading volume of $500,000 since launch.Russell Bennet, CEO of Metacade, commented:“After listing on Uniswap, we saw sell orders being instantly filled on the buy side and minimal selling pressure, which in this climate is a sign that we have something truly special. This was reinforced by our staking pool selling out in 5 hours! With our upcoming exchange listings, I hope we will see the positive price appreciation that usually follows, and from there, the sky's the limit!”Following the listing on BitMart, Metacade has confirmed another top-tier exchange, MEXC, will be listing Metacade in early May. More exchanges are expected to be announced in the coming months.Users can purchase Metacade tokens on Uniswap here.About BitMartFounded in 2018, BitMart is a centralised exchange that provides crypto asset trading and investment services to over 9 million users around the globe. The trading platform offers numerous features for its clients, including staking, lending, savings products, derivative contracts, and expanded spot trading options. For advanced crypto enthusiasts, BitMart provides futures trading and margin trading that allow them to use leverage.About MetacadeMetacade is intended to be the premier destination for gaming in the metaverse. As Web3’s first community arcade that allows gamers to hang out, share gaming knowledge and play exclusive P2E games. The platform offers users multiple ways to generate income, build careers in Web3 and connect with the broader gaming community.The project has the stamp of approval from CertiK, the leading blockchain auditor, which aims to reassure investors that the project specifications and code are reviewed, and the Metacade team has passed KYC. This puts Metacade on the same level of confidence as other CertiK projects, including Aave, Polygon and Chiliz. Metacade’s one-stop shop potential as the next GameFi hub of choice for P2E gamers as well as a broad range of other use cases, is evidenced in the enthusiasm around the project and the success of the presale. Website | Whitepaper | Socials

ContactCEO

Russell Bennett

Metacade

[email protected]

Read the full article

0 notes

Text

Hawex Cryptoprocessing

hawex cryptoprocessing offers an efficient solution for online businesses to receive, store and withdraw payments made in cryptocurrencies. With it, businesses can accept payments in more than 30 cryptocurrencies, 20+ traditional currencies as well as SEPA/SWIFT payments.

The company name derives from a hawk, symbolizing courage and seeing things from an unusual viewpoint. This philosophy guides their development process as they strive to create reliable products with thoughtful consideration.

Account opening & maintenance

HAWEX is a UK-based multi-functional financial system and crypto processor licensed by the FCA. Its services include banking for entrepreneurs, secure account opening & maintenance, internet acquisition & cryptoprocessing, payment providers & legal/technical business support.

The company's name derives from a hawk - an iconic symbol that symbolizes courage, seeing things from a different angle and bringing fresh approaches to the financial market. This approach allows them to identify technical solutions within familiar financial processes and combine them into one product that can be tailored precisely according to customers' requirements and expectations.

Hawex IO has created a comprehensive financial ecosystem to facilitate the interaction of entrepreneurs with one another. It offers high-load financial services such as banking for entrepreneurs, secure account opening & management, internet acquisition & cryptoprocessing, payment providers & legal/technical support.

Payment providers & legal/technical business support

The company provides a comprehensive suite of fintech services and technologies, from cryptocurrency processing to advanced card technology. Additionally, they are renowned for their superior customer service and unique HAWEX mobile app.

The company's flagship product, the crypto-processing device, provides a fast and secure transition from crypto to card. It comes equipped with an array of useful tools that are user friendly yet cost effective to implement. Perhaps its most impressive feature is its capacity for integration into existing infrastructure or creating an entirely new front-end.

Consulting

Hawex Cryptoprocessing offers a suite of consulting services to help your business take advantage of blockchain technology. These include blockchain audits, educational sessions on blockchain usage and business consultations.

The company provides a range of crypto processing solutions that enable customers to receive and send transactions in up to 50+ major payment cryptos as well as 20 fiat currencies. The solution has an integrated front-end platform with automatic KYC/AML compliance plus 24/7 personal support.

Crypto-processing solutions are designed with a strong focus on customer experience. Their developers carefully assess each case and seek solutions that satisfy their customers' needs and expectations, taking into account feedback and reviews from users.

1 note

·

View note