#LEARNING_RESOURCES

Explore tagged Tumblr posts

Text

Table of ContentsIntroductionDemystifying Bitcoin: A Beginner's Guide to the Cryptocurrency RevolutionCryptocurrencies 101: Understanding the Basics of Digital AssetsMOOCs and Courses: Your Gateway to Mastering Bitcoin and CryptocurrenciesQ&AConclusionUnlock the World of Digital Assets: Master Bitcoin and Cryptocurrencies with MOOCs and CoursesIntroduction**Understanding Bitcoin and Cryptocurrencies: MOOCs and Courses** In the rapidly evolving world of digital finance, Bitcoin and cryptocurrencies have emerged as transformative technologies. To navigate this complex landscape, individuals seek comprehensive knowledge and understanding. Massive Open Online Courses (MOOCs) and specialized courses offer a convenient and accessible way to delve into the intricacies of Bitcoin and cryptocurrencies. These courses provide a structured learning environment, expert instruction, and interactive materials to empower learners with the knowledge and skills necessary to engage with this innovative financial ecosystem.Demystifying Bitcoin: A Beginner's Guide to the Cryptocurrency Revolution**Understanding Bitcoin and Cryptocurrencies: MOOCs and Courses** In the realm of finance, Bitcoin and cryptocurrencies have emerged as transformative forces, captivating the attention of investors, enthusiasts, and skeptics alike. To navigate this complex landscape, it's essential to gain a comprehensive understanding of these digital assets. Fortunately, a plethora of Massive Open Online Courses (MOOCs) and courses are available to empower individuals with the knowledge they need. Coursera, a leading MOOC platform, offers a comprehensive course titled "Bitcoin and Cryptocurrency Technologies." This course delves into the technical underpinnings of Bitcoin, exploring its blockchain architecture, consensus mechanisms, and security features. Participants gain insights into the underlying principles that drive the cryptocurrency revolution. edX, another renowned MOOC provider, features a course entitled "Blockchain and Bitcoin Fundamentals." This course provides a broader perspective, examining the history, applications, and implications of blockchain technology. Students learn about the potential of blockchain to disrupt various industries, from finance to healthcare. For those seeking a more hands-on approach, Udemy offers a course titled "Bitcoin and Cryptocurrency Trading for Beginners." This course equips participants with practical skills for trading cryptocurrencies, covering topics such as market analysis, risk management, and trading strategies. In addition to MOOCs, universities and institutions worldwide are offering courses on Bitcoin and cryptocurrencies. The University of California, Berkeley, for instance, provides a course titled "Blockchain Technology." This course explores the technical and economic aspects of blockchain, with a focus on its applications in various domains. The Massachusetts Institute of Technology (MIT) offers a course titled "Cryptocurrency." This course examines the history, economics, and technology of cryptocurrencies, providing students with a deep understanding of the underlying concepts. By enrolling in these MOOCs and courses, individuals can gain a solid foundation in Bitcoin and cryptocurrencies. They will learn about the technology, applications, and potential implications of these digital assets. Whether you're an investor, enthusiast, or simply curious about the future of finance, these educational resources will empower you with the knowledge you need to navigate the cryptocurrency landscape with confidence.Cryptocurrencies 101: Understanding the Basics of Digital Assets**Understanding Bitcoin and Cryptocurrencies: MOOCs and Courses** In the rapidly evolving world of digital assets, Bitcoin and cryptocurrencies have emerged as transformative technologies. To navigate this complex landscape, it's essential to gain a comprehensive understanding of their fundamentals. Fortunately, numerous Massive Open Online

Courses (MOOCs) and courses are available to empower individuals with the knowledge they need. One of the most popular MOOCs is "Bitcoin and Cryptocurrency Technologies" offered by Princeton University on Coursera. This course provides an in-depth exploration of the underlying principles of Bitcoin and other cryptocurrencies, covering topics such as blockchain technology, cryptography, and decentralized networks. For those seeking a more comprehensive understanding, the University of California, Berkeley offers a specialized course titled "Blockchain Technologies." This course delves into the technical aspects of blockchain, including its architecture, consensus mechanisms, and applications beyond cryptocurrencies. If you're interested in the financial implications of cryptocurrencies, the London School of Economics and Political Science (LSE) offers a course on "Cryptocurrencies and Blockchain: Economics, Technology, and Regulation." This course examines the economic theories behind cryptocurrencies, their impact on financial markets, and the regulatory challenges they pose. For a more practical approach, the University of Nicosia offers a course on "Blockchain and Cryptocurrency Fundamentals." This course provides hands-on experience in developing and deploying blockchain applications, giving students a deeper understanding of the technology's capabilities. In addition to MOOCs, there are numerous online courses and tutorials available on platforms such as Udemy, edX, and LinkedIn Learning. These courses cover a wide range of topics, from beginner-friendly introductions to advanced technical concepts. By leveraging these educational resources, individuals can gain a solid foundation in Bitcoin and cryptocurrencies. Whether you're a curious enthusiast, a potential investor, or an aspiring developer, these courses empower you with the knowledge and skills to navigate the ever-changing world of digital assets.MOOCs and Courses: Your Gateway to Mastering Bitcoin and Cryptocurrencies**Understanding Bitcoin and Cryptocurrencies: MOOCs and Courses** In the rapidly evolving world of finance, Bitcoin and cryptocurrencies have emerged as transformative technologies. To navigate this complex landscape, individuals seeking to gain a comprehensive understanding can turn to Massive Open Online Courses (MOOCs) and specialized courses. MOOCs, offered by renowned universities and institutions, provide a convenient and accessible way to delve into the fundamentals of Bitcoin and cryptocurrencies. Platforms like Coursera, edX, and Udemy host a wide range of courses that cover topics such as blockchain technology, cryptocurrency markets, and the regulatory landscape. These courses are typically self-paced, allowing learners to progress at their own convenience. For those seeking a more structured and in-depth learning experience, specialized courses offered by universities and industry experts provide a comprehensive curriculum. These courses often include hands-on exercises, case studies, and opportunities for interaction with instructors and peers. The University of California, Berkeley's "Blockchain Technologies" course is a highly regarded option that explores the technical foundations of blockchain and its applications in various industries. The Massachusetts Institute of Technology's "Digital Currency" course delves into the economic and financial aspects of cryptocurrencies, examining their potential impact on monetary systems. In addition to MOOCs and specialized courses, there are numerous online resources and communities dedicated to Bitcoin and cryptocurrencies. Forums, discussion boards, and social media groups provide opportunities for learners to connect with experts, share knowledge, and stay abreast of the latest developments. By leveraging these educational resources, individuals can gain a solid foundation in Bitcoin and cryptocurrencies. Whether you're a beginner seeking an introduction or an experienced professional looking to enhance your knowledge, there's a course or MOOC tailored to your needs.

As the world of finance continues to embrace digital assets, understanding Bitcoin and cryptocurrencies has become essential for anyone seeking to stay ahead of the curve. By investing in your education through MOOCs and specialized courses, you can unlock the potential of these transformative technologies and navigate the future of finance with confidence.Q&A**Question 1:** What is the main purpose of Bitcoin? **Answer:** To facilitate secure, decentralized, and anonymous peer-to-peer transactions. **Question 2:** What is the difference between a cryptocurrency and a blockchain? **Answer:** A cryptocurrency is a digital or virtual currency that uses cryptography for security, while a blockchain is a distributed ledger technology that records and verifies transactions. **Question 3:** What are the key benefits of using cryptocurrencies? **Answer:** Decentralization, security, anonymity, and potential for financial inclusion.Conclusion**Conclusion:** Understanding Bitcoin and cryptocurrencies is crucial in today's digital landscape. MOOCs and courses provide accessible and comprehensive resources for individuals seeking to gain knowledge and skills in this rapidly evolving field. These platforms offer a wide range of courses, from introductory overviews to advanced technical deep dives, catering to learners of all levels. By leveraging these educational opportunities, individuals can enhance their understanding of Bitcoin and cryptocurrencies, enabling them to make informed decisions and navigate the complex world of digital assets.

0 notes

Link

Discover the top 5 websites for learning new skills and boosting your career. From programming and web development to personal development and business, these online platforms offer a wide range of courses and resources to help you acquire the knowledge and abilities you need to succeed. Start upgrading your skills today! https://howtological.com/learning/?feed_id=2141&_unique_id=6624f311c5728

#career_development#education#job_market#learning_resources#online_courses#online_learning#personal_development#professional_growth#programming#skills_upgrade#web_development

0 notes

Photo

Learning resources https://www.reddit.com/r/SEO/comments/lwdik8/learning_resources/

My employee wants to move SEO & PCC in house and has assigned me to execute it, and is willing to give me space to learn. What are some resources that everybody uses to stay current with best practises and updates? Are there any courses/bootcamps that go into more advanced techniques & tactics? Does anyone have any experience with Simplilearn programs?

submitted by /u/Tim-mac [link] [comments] March 03, 2021 at 03:22AM

0 notes

Link

0 notes

Text

Χρήσιμο υλικό online

Χρήσιμο υλικό για την εξ αποστάσεως εκπαίδευση από την Oxford University Press:

Learn at Home Hub (Learners’ tab) https://elt.oup.com/feature/global/learnathome/

Learner Resources https://elt.oup.com/learning_resources/

Learner Facebook @LearningEnglishWithOxford

Learner Blog https://learningenglishwithoxford.com/

Learner Instagram https://www.instagram.com/learningenglishwithoxford/

Free OTE practice tests https://twitter.com/OUPELTGlobal/status/1250679064874102784

0 notes

Text

Learning

Task 1

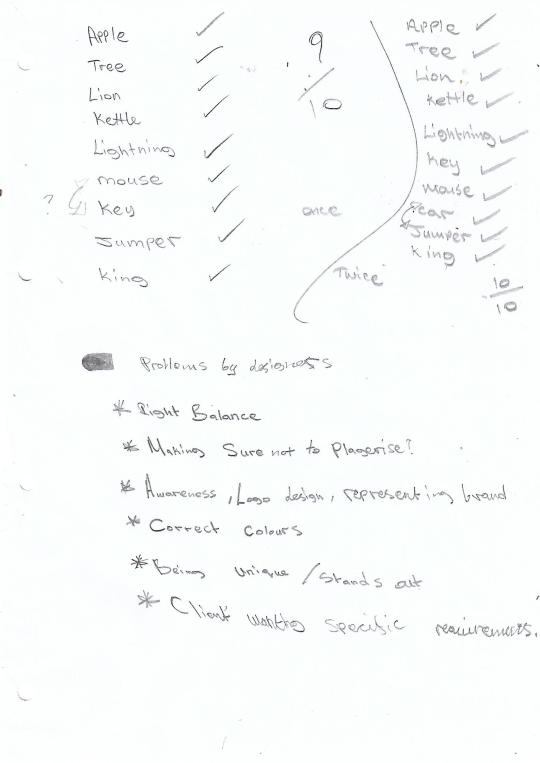

What did we do in the first lesson regarding memory and how we learn?

In the first lesson, we discussed as a class the methods of the different ways to learn and memorise things adapting certain opinions, we then did a memory test where we tried to memorise 10 different objects and then further discussed ways how memory could be improved.

What is learning?

Learning is the intake of information and being able to store it in hope that it would be useful later then transforming into an eventual skill.

How do we learn?

There are multiple ways different people learn for example some people are more visual learners where they take in information through their eyes which can be done by diagrams or a tutorial. Some people learn better through audio where volume is used to maybe direct someone through something. Actually doing something yourself and practising is often a common way people learn since it’s more hands-on giving them the ability to work at a more personal speed where they could be more comfortable. The final way people learn is through writing and reading where text is more appealing to them since it might come across as easier to understand.

How can we improve learning?

Learning can be improved for some people by simple repetition so that the information is more likely to stick into their head and that they won't forget it. Taking notes is another method people might use to improve their learning for example if someone is telling them information and they are taking notes they are in a way processing the information twice which relates to repetition.

Asking questions about certain topics also helps people learn since it might be more personalised and specific to them, therefore, making them more engaged with a topic they are learning about.

How can we improve memory?

There are many methods to improve memory, for example in class during the first lesson after trying to remember all 10 objects we discussed how possibly making a story out of the objects would make them easier to remember or imagining them around the room and relating certain emotions to each object to make them more personal.

Task 2

Studies between ages -

A study by Phillip Ko occurred where he got a group of seniors over the age of 65 and a group of younger people with an average age of 23, the test was that two, three or four coloured dots flashed on a screen, then went away where they then were replaced by a single dot, both groups were then asked if the single dot matched the colour of any of the other dots, the younger group performed better but he doesn’t claim that younger people have a better memory than older people but in fact younger people just visually see things in HD unlike older people so that they take in more detail and information in the first place.

However, a study by Dr Jon Simons suggests that older people remember better due to younger people being more likely to use strategies that promote the “formation of memory traces” which can boost memory significantly, therefore when adults are asked to think more deeply about the meaning of information they are learning, which often results in better “recall of that material”.

Studies between genders -

According to CBS, a study by Goldstein (an author of a study found in the journal of The North American Menopause Society) finds that middle-aged women outperform men on all measures of memory, However, the study can also confirm that a lot of women memory declines after they go through menopause. A study where men have an overall better memory than women couldn’t be found.

Do different ages have any factors that affect the way they learn?

According to the California Department Of Education, children tend to learn in many different ways mainly through the senses such as touch, taste and sound since these ways tend to be the most interactive in terms of taking in information, children also are fond of problem-solving due to them tending to like exploring and discovering.

As reported by Kristian Gaetano a former director of education at Learnkit adults are more afraid to fail and have more social filters leaving them to experiment less and learn more independently. Adults also like to have more specific learning opportunities to make them more engaged in ways that it would benefit them, therefore, them being able to take in information more clearly.

Task 3 -

Learning styles and teaching methods -

For the different learning styles, different teaching methods are used for example if someone were to learn visually like a lot of children this could be taught through charts or diagrams to give out information in an easier form for them, it’s also recommended that after they are taught give them time to help visualise what they have just learnt.

For auditory learners, they can be taught more effectively through things such as audiobooks, reading aloud and even associating music with certain ideas and concepts.

For people who learn best by actually carrying out something (physical) they can be taught by using as many physical objects as possible such as flash cards since they can touch and move them around, another teaching method for this type of learner would be to describe things in how they would feel if you were to touch them for example if a story was being told focus on the more physical side of things and how possible objects in the story might feel, since a lot of children learn this way also they are often taught through the use of games since they find this method more interesting and interactive.

And finally for the people who learn best through reading and writing they can be taught by taking notes and reading what they have written down so they take in the information multiple times and have it whenever they need it, textbooks and also glossaries are often more simple for the reading and writing learner to understand since they pay more attention to what the actual text is saying.

sources for the research -

Improving memory - https://www.pickthebrain.com/blog/7-secrets-to-improve-your-ability-to-learn-for-students-of-all-ages/

Philip Ko full study - https://etd.library.vanderbilt.edu/available/etd-04022010-161315/unrestricted/KOPC_dissertation_FINAL.pdf

Philip Ko summary of study - https://www.carbonated.tv/news/why-do-young-people-have-better-memories-its-probably-not-what-you-think

Dr Simons study - https://www.theguardian.com/lifeandstyle/2012/jan/14/memory-that-improves-with-age

The study between men and women - https://www.cbsnews.com/news/who-has-better-memory-men-or-women/

California Department of education -https://www.cde.ca.gov/sp/cd/Re/caqdevelopment.asp

How Adults learn - http://learnkit.com/2016/01/13/adult-learning-needs/

https://study.com/academy/lesson/visual-learning-style-strategies-activities.html

https://happyhomeschoolnest.com/blog/teaching-auditory-learners

https://www.thoughtco.com/auditory-learning-style-p2-31150

https://web.wlu.ca/learning_resources/pdfs/Learning_Styles.pdf

0 notes

Text

Table of ContentsIntroductionCrypto Lending: A Comprehensive Guide to Earning Interest on Your Digital AssetsStaking: Unlocking Passive Income and Supporting Blockchain NetworksYield Farming: Maximizing Returns through Decentralized FinanceQ&AConclusionUnlock the Potential of Crypto: Master Lending, Staking, and Yield FarmingIntroduction**Introduction to Crypto Lending, Staking, and Yield Farming** In the realm of decentralized finance (DeFi), crypto lending, staking, and yield farming have emerged as lucrative ways to generate passive income and maximize the potential of digital assets. These innovative financial instruments offer investors opportunities to earn rewards, enhance their portfolios, and contribute to the growth of the blockchain ecosystem. This introduction provides a comprehensive overview of these three key concepts, exploring their mechanisms, benefits, and potential risks. By understanding the fundamentals of crypto lending, staking, and yield farming, investors can make informed decisions and harness the power of DeFi to achieve their financial goals.Crypto Lending: A Comprehensive Guide to Earning Interest on Your Digital Assets**Learning About Crypto Lending, Staking, and Yield Farming** In the realm of cryptocurrency, there are numerous ways to generate passive income beyond simply holding digital assets. Three popular methods include crypto lending, staking, and yield farming. **Crypto Lending** Crypto lending involves lending your digital assets to borrowers in exchange for interest payments. Platforms like Celsius, BlockFi, and Nexo facilitate this process, allowing you to earn interest on your idle cryptocurrencies. The interest rates vary depending on the platform, the cryptocurrency, and the loan term. **Staking** Staking is a process where you hold a specific cryptocurrency in a wallet that supports the blockchain's consensus mechanism. By doing so, you contribute to the security and validation of the network and earn rewards in the form of new coins. Staking is available for cryptocurrencies like Ethereum, Cardano, and Polkadot. **Yield Farming** Yield farming is a more advanced strategy that involves lending or staking your cryptocurrencies to decentralized finance (DeFi) protocols. These protocols offer higher interest rates than traditional crypto lending platforms but also carry higher risks. Yield farmers often move their assets between different protocols to maximize their returns. **Choosing the Right Option** The best option for you depends on your risk tolerance and investment goals. Crypto lending is a relatively low-risk option that provides a steady stream of passive income. Staking offers higher returns but requires you to hold the cryptocurrency for a specific period. Yield farming is the most lucrative but also the riskiest option. **Risks and Considerations** Before participating in any of these activities, it's crucial to understand the risks involved. Crypto lending platforms can fail, and borrowers may default on their loans. Staking can expose you to price fluctuations, and yield farming can involve complex strategies that may not always be profitable. **Conclusion** Crypto lending, staking, and yield farming offer opportunities to earn passive income on your digital assets. However, it's essential to carefully consider the risks and choose the option that aligns with your investment goals and risk tolerance. By understanding these concepts and conducting thorough research, you can navigate the world of crypto passive income with confidence.Staking: Unlocking Passive Income and Supporting Blockchain Networks**Learning About Crypto Lending, Staking, and Yield Farming** In the realm of cryptocurrency, there are various ways to generate passive income and contribute to blockchain networks. Three prominent methods are crypto lending, staking, and yield farming. **Crypto Lending: Earning Interest on Your Crypto** Crypto lending platforms allow users to lend their cryptocurrency to borrowers in exchange for interest payments.

The interest rates vary depending on the platform, the cryptocurrency being lent, and the loan term. Crypto lending offers a relatively low-risk way to earn passive income, as the borrower's collateral secures the loan. **Staking: Supporting Blockchain Networks and Earning Rewards** Staking involves holding a specific cryptocurrency in a wallet that supports the proof-of-stake (PoS) consensus mechanism. By staking their coins, users validate transactions on the blockchain and earn rewards in the form of new coins. Staking contributes to the security and stability of the blockchain network while providing passive income to participants. **Yield Farming: Maximizing Returns through Liquidity Provision** Yield farming is a more advanced strategy that involves providing liquidity to decentralized exchanges (DEXs) by depositing crypto assets into liquidity pools. In return, yield farmers earn rewards in the form of trading fees and tokens issued by the DEX. Yield farming offers the potential for higher returns but also carries higher risks, as the value of the deposited assets can fluctuate. **Choosing the Right Option for You** The best option for generating passive income through cryptocurrency depends on your risk tolerance and investment goals. Crypto lending is suitable for those seeking a low-risk option with moderate returns. Staking is a good choice for those who want to support blockchain networks and earn rewards while holding their coins. Yield farming offers the potential for higher returns but requires a higher level of understanding and risk management. **Conclusion** Crypto lending, staking, and yield farming provide diverse opportunities for generating passive income in the cryptocurrency market. By understanding the mechanics and risks associated with each method, investors can choose the option that best aligns with their financial objectives and risk appetite. As the cryptocurrency ecosystem continues to evolve, these passive income strategies will likely play an increasingly important role in the financial landscape.Yield Farming: Maximizing Returns through Decentralized Finance**Learning About Crypto Lending, Staking, and Yield Farming** In the realm of decentralized finance (DeFi), crypto lending, staking, and yield farming have emerged as lucrative ways to generate passive income. Understanding these concepts is crucial for investors seeking to maximize their returns. **Crypto Lending** Crypto lending involves lending your cryptocurrency to borrowers in exchange for interest payments. Platforms like Celsius and BlockFi facilitate this process, allowing users to earn interest on their idle crypto assets. The interest rates vary depending on the platform, the cryptocurrency, and the loan term. **Staking** Staking is a process where you hold a specific cryptocurrency in a wallet to support the blockchain network. By staking your coins, you participate in the validation process and earn rewards in the form of new coins. Staking is available for cryptocurrencies that use a proof-of-stake (PoS) consensus mechanism, such as Ethereum 2.0 and Cardano. **Yield Farming** Yield farming is a more advanced DeFi strategy that involves lending or staking your crypto assets to liquidity pools. These pools provide liquidity for decentralized exchanges (DEXs), enabling traders to buy and sell cryptocurrencies. In return for providing liquidity, yield farmers earn rewards in the form of tokens or fees. **Maximizing Returns** To maximize returns through yield farming, it's important to consider the following factors: * **Research:** Thoroughly research different yield farming platforms and their offerings. * **Diversification:** Spread your investments across multiple platforms and cryptocurrencies to mitigate risk. * **Impermanent Loss:** Understand the concept of impermanent loss, which can occur when the value of the assets in a liquidity pool changes. * **Fees:** Be aware of the fees associated with yield farming, such as gas fees and platform fees.

**Risks and Considerations** While crypto lending, staking, and yield farming offer potential for high returns, they also come with risks. These include: * **Volatility:** Cryptocurrency prices can fluctuate significantly, which can impact your returns. * **Smart Contract Risk:** Yield farming platforms rely on smart contracts, which can be vulnerable to hacks or bugs. * **Regulatory Uncertainty:** The regulatory landscape for DeFi is still evolving, which could impact the availability and profitability of these strategies. **Conclusion** Crypto lending, staking, and yield farming are powerful tools for generating passive income in the DeFi ecosystem. By understanding these concepts and carefully managing risks, investors can maximize their returns while contributing to the growth of decentralized finance. However, it's crucial to approach these strategies with caution and conduct thorough research before investing.Q&A**Question 1:** What is crypto lending? **Answer:** Crypto lending is a process where individuals or institutions lend their cryptocurrency assets to borrowers in exchange for interest payments. **Question 2:** What is staking? **Answer:** Staking is a process where individuals hold and lock up their cryptocurrency assets in a blockchain network to support its operations and earn rewards. **Question 3:** What is yield farming? **Answer:** Yield farming is a strategy in decentralized finance (DeFi) where individuals deposit their cryptocurrency assets into liquidity pools or lending protocols to earn interest or rewards.Conclusion**Conclusion** Crypto lending, staking, and yield farming offer innovative ways to generate passive income and enhance the utility of crypto assets. By understanding the risks and rewards associated with each strategy, investors can make informed decisions to maximize their returns. Crypto lending provides a low-risk option for earning interest on idle assets, while staking offers higher potential rewards but also carries greater risk. Yield farming, on the other hand, involves more complex strategies and higher volatility, but can yield substantial returns for those willing to take on the risk. As the crypto market continues to evolve, these strategies will likely play an increasingly important role in the financial landscape. By staying informed and conducting thorough research, investors can harness the power of crypto lending, staking, and yield farming to achieve their financial goals.

0 notes

Text

Table of ContentsIntroductionSmart Contracts: A Comprehensive Guide for BeginnersUnderstanding Smart Contracts: Online Courses and TutorialsDemystifying Smart Contracts: A Step-by-Step Guide for DevelopersQ&AConclusionUnlock the Power of Smart Contracts: Master the Fundamentals with Online Courses and TutorialsIntroduction**Understanding Smart Contracts: Online Courses and Tutorials** Smart contracts are self-executing contracts with the terms of the agreement directly written into lines of code. They are stored on a blockchain network and can be used to automate a wide variety of tasks, from managing supply chains to executing financial transactions. This introduction provides an overview of online courses and tutorials that can help you understand the fundamentals of smart contracts, including: * The basics of blockchain technology * The different types of smart contracts * How to develop and deploy smart contracts * The legal and regulatory implications of smart contractsSmart Contracts: A Comprehensive Guide for Beginners**Understanding Smart Contracts: Online Courses and Tutorials** Smart contracts, self-executing agreements stored on a blockchain, have revolutionized various industries. To delve into this transformative technology, numerous online courses and tutorials offer comprehensive guidance for beginners. One popular platform is Coursera, which provides a specialization in Blockchain Technology from the University of Illinois at Urbana-Champaign. This program covers the fundamentals of smart contracts, their applications, and the legal and ethical implications. edX, another renowned platform, offers a course on Smart Contracts from the Linux Foundation. This course delves into the technical aspects of smart contract development, including Solidity programming and Ethereum blockchain. For those seeking a more hands-on approach, Udemy offers a course on Smart Contract Development with Solidity. This course provides practical exercises and projects to help learners build and deploy their own smart contracts. Additionally, YouTube hosts a wealth of free tutorials on smart contracts. Channels such as Ivan on Tech and Dapp University offer beginner-friendly explanations, code walkthroughs, and industry insights. These online resources provide a structured and accessible path to understanding smart contracts. They cover topics such as: * The concept and benefits of smart contracts * The role of blockchain technology in smart contracts * Smart contract programming languages (e.g., Solidity) * Developing, testing, and deploying smart contracts * Security considerations and best practices By leveraging these online courses and tutorials, beginners can gain a solid foundation in smart contracts. They can learn about the technology's potential, develop practical skills, and stay abreast of the latest advancements in this rapidly evolving field. Whether you're a developer, entrepreneur, or simply curious about smart contracts, these resources empower you to explore this transformative technology and its potential to shape the future of business, finance, and beyond.Understanding Smart Contracts: Online Courses and Tutorials**Understanding Smart Contracts: Online Courses and Tutorials** Smart contracts, self-executing agreements stored on a blockchain, have revolutionized various industries. To grasp the intricacies of this technology, numerous online courses and tutorials offer comprehensive guidance. For beginners, platforms like Coursera and edX provide introductory courses that delve into the fundamentals of smart contracts, blockchain technology, and their applications. These courses typically cover topics such as the Ethereum Virtual Machine (EVM), Solidity programming language, and the legal implications of smart contracts. As you progress, more advanced courses explore specific use cases and industry applications. For instance, the University of California, Berkeley offers a course on "Smart Contracts for

Supply Chain Management," while the University of Oxford provides a specialization on "Blockchain and Smart Contracts for Business." For hands-on experience, platforms like Udemy and Pluralsight offer tutorials that guide you through building and deploying smart contracts. These tutorials often use popular blockchain platforms like Ethereum and Hyperledger Fabric, providing step-by-step instructions and practical examples. Additionally, industry-specific courses are available for professionals seeking to apply smart contracts in their respective fields. For example, the Blockchain Council offers a certification program on "Smart Contracts for Healthcare," while the Linux Foundation provides a course on "Smart Contracts for Financial Services." When selecting an online course or tutorial, consider your skill level, learning objectives, and budget. Some courses are free, while others may require a subscription or enrollment fee. It's also important to check the instructor's credentials and the course curriculum to ensure it aligns with your needs. By leveraging these online resources, you can gain a thorough understanding of smart contracts, their applications, and the skills necessary to develop and implement them. Whether you're a beginner or an experienced professional, these courses and tutorials provide a valuable pathway to mastering this transformative technology.Demystifying Smart Contracts: A Step-by-Step Guide for Developers**Understanding Smart Contracts: Online Courses and Tutorials** Smart contracts, self-executing agreements stored on a blockchain, have revolutionized the way we interact with digital assets. To delve into the intricacies of smart contract development, numerous online courses and tutorials offer comprehensive guidance. For beginners, platforms like Coursera and edX provide introductory courses that cover the fundamentals of blockchain technology and smart contract programming. These courses typically start with an overview of blockchain concepts, such as decentralization, immutability, and consensus mechanisms. They then introduce popular smart contract languages like Solidity and Vyper, explaining their syntax and key features. As you progress, intermediate courses focus on advanced smart contract development techniques. These courses delve into topics such as security best practices, gas optimization, and decentralized application (dApp) architecture. They also cover real-world use cases and industry trends, providing a practical understanding of smart contract applications. For those seeking hands-on experience, interactive tutorials are an excellent option. Platforms like Codecademy and Hacker Noon offer step-by-step guides that walk you through the process of creating and deploying smart contracts. These tutorials often use interactive coding environments, allowing you to experiment with code snippets and observe the results in real-time. In addition to online courses and tutorials, there are numerous resources available to support your learning journey. Documentation from blockchain platforms like Ethereum and Hyperledger provides detailed technical specifications and best practices. Community forums and online discussion groups offer a wealth of knowledge and support from experienced developers. Choosing the right online course or tutorial depends on your skill level and learning preferences. If you're new to blockchain, start with introductory courses to build a solid foundation. As you gain experience, explore intermediate and advanced courses to enhance your technical proficiency. Interactive tutorials are a great way to practice coding and gain hands-on experience. By leveraging these online resources, you can embark on a comprehensive learning journey that will equip you with the skills and knowledge necessary to develop and deploy secure and efficient smart contracts. Whether you're a seasoned developer or just starting out, these courses and tutorials will empower you to harness the transformative power of smart contracts.Q&A**Question 1:** What is a smart contract?

**Answer:** A smart contract is a self-executing contract with the terms of the agreement between buyer and seller directly written into lines of code. **Question 2:** What are the benefits of using smart contracts? **Answer:** Benefits of using smart contracts include increased security, reduced costs, increased efficiency, and transparency. **Question 3:** Where can I learn more about smart contracts? **Answer:** There are numerous online courses and tutorials available to learn more about smart contracts, such as those offered by Coursera, edX, and Udemy.Conclusion**Conclusion** Smart contracts have emerged as a transformative technology in various industries, offering numerous benefits such as automation, transparency, and security. Understanding smart contracts is crucial for professionals seeking to leverage their potential. Online courses and tutorials provide a comprehensive and accessible way to gain knowledge and skills in this field. By enrolling in these programs, individuals can enhance their understanding of smart contract concepts, development, and applications. These courses empower learners to create and implement smart contracts effectively, enabling them to contribute to the advancement of blockchain technology and its transformative impact on various sectors.

0 notes

Text

Table of ContentsIntroductionUnderstanding Blockchain Fundamentals for Game DevelopersBuilding Your First Blockchain Game: A Step-by-Step GuideMonetization Strategies for Blockchain GamesQ&AConclusionUnlock the Future of Gaming: Dive into Blockchain Game DevelopmentIntroduction**Getting Started with Blockchain Game Development** Blockchain technology has revolutionized various industries, and the gaming sector is no exception. Blockchain games offer unique advantages such as decentralization, transparency, and player ownership. This guide provides a comprehensive introduction to blockchain game development, covering the fundamentals, tools, and best practices to help you create engaging and innovative blockchain-based games.Understanding Blockchain Fundamentals for Game Developers**Getting Started with Blockchain Game Development** Blockchain technology has revolutionized various industries, and the gaming sector is no exception. Blockchain games offer unique advantages such as decentralization, transparency, and player ownership. For game developers, understanding blockchain fundamentals is crucial to harness these benefits. **Blockchain Basics for Game Developers** Blockchain is a distributed ledger technology that records transactions in a secure and immutable manner. Each transaction is verified by multiple nodes in the network, ensuring data integrity and preventing tampering. This decentralized nature eliminates the need for intermediaries, reducing costs and increasing transparency. **Key Concepts for Blockchain Games** * **Non-Fungible Tokens (NFTs):** NFTs represent unique digital assets that can be owned and traded. In blockchain games, NFTs can represent in-game items, characters, or even entire virtual worlds. * **Smart Contracts:** Smart contracts are self-executing programs that automate specific actions based on predefined conditions. They can be used to govern game mechanics, distribute rewards, and facilitate player interactions. * **Decentralized Autonomous Organizations (DAOs):** DAOs are community-governed organizations that operate on blockchain. They can be used to manage game development, distribute funds, and make decisions on behalf of the player community. **Benefits of Blockchain for Game Development** * **Decentralization:** Blockchain games eliminate the need for centralized servers, reducing the risk of downtime and censorship. * **Transparency:** All transactions and game mechanics are recorded on the blockchain, providing players with full visibility and accountability. * **Player Ownership:** NFTs give players true ownership of their in-game assets, allowing them to trade, sell, or use them across different games. * **New Revenue Streams:** Blockchain games can generate revenue through the sale of NFTs, in-game transactions, and player-created content. **Getting Started with Blockchain Game Development** To start developing blockchain games, developers need to: * **Choose a Blockchain Platform:** Ethereum, Polygon, and Flow are popular blockchain platforms for game development. * **Learn Smart Contract Development:** Solidity or Vyper are programming languages used to create smart contracts. * **Integrate Blockchain into Game Engine:** Unity and Unreal Engine provide plugins for blockchain integration. * **Design Game Mechanics:** Consider how blockchain concepts can enhance gameplay, such as using NFTs for unique items or smart contracts for automated rewards. **Conclusion** Blockchain technology offers immense potential for game developers to create innovative and engaging experiences. By understanding blockchain fundamentals and leveraging its benefits, developers can unlock new possibilities for player ownership, decentralization, and revenue generation. As the blockchain gaming industry continues to evolve, it is essential for developers to stay abreast of the latest advancements and embrace the transformative power of this technology.Building Your First Blockchain Game: A Step-by-Step Guide**Getting Started with Blockchain Game Development**

Blockchain technology has revolutionized various industries, and the gaming sector is no exception. Blockchain games offer unique advantages such as transparency, ownership, and interoperability. If you're eager to embark on the journey of blockchain game development, here's a comprehensive guide to get you started. **Step 1: Choose a Blockchain Platform** The first step is to select a blockchain platform that aligns with your game's requirements. Ethereum, Polygon, and Solana are popular choices due to their scalability, security, and developer support. Consider factors such as transaction fees, network congestion, and smart contract capabilities when making your decision. **Step 2: Design Your Game** Next, it's time to design your game. Determine the gameplay mechanics, characters, and storyline. Consider how blockchain will enhance the gaming experience, such as by enabling player ownership of in-game assets or creating a decentralized economy. **Step 3: Create Smart Contracts** Smart contracts are self-executing programs that govern the rules and interactions within a blockchain game. They define the ownership, transferability, and other properties of in-game assets. Use a programming language like Solidity to write and deploy smart contracts on your chosen blockchain. **Step 4: Develop the Game Client** The game client is the user interface that players interact with. It can be developed using traditional game development tools and technologies. However, it must integrate with the blockchain to access smart contracts and manage in-game assets. **Step 5: Implement Blockchain Integration** Connect the game client to the blockchain by integrating blockchain libraries or APIs. This allows the game to interact with smart contracts, verify transactions, and manage player assets on the blockchain. **Step 6: Test and Deploy** Thoroughly test your game to ensure it functions as intended and is secure. Deploy the game on a testnet or mainnet, depending on your readiness. Monitor the game's performance and gather feedback from players to make necessary adjustments. **Additional Tips:** * Join blockchain game development communities and forums to connect with other developers and learn from their experiences. * Stay updated with the latest blockchain technologies and trends to enhance your game's capabilities. * Consider partnering with blockchain experts or companies to leverage their knowledge and resources. * Promote your game through blockchain-specific channels and social media to reach a wider audience. By following these steps and embracing the unique possibilities of blockchain, you can create engaging and innovative blockchain games that captivate players and push the boundaries of the gaming industry.Monetization Strategies for Blockchain Games**Getting Started with Blockchain Game Development: Monetization Strategies** Blockchain technology has revolutionized the gaming industry, introducing new possibilities for monetization and player engagement. As a game developer, understanding the various monetization strategies available in blockchain games is crucial for success. **In-Game Currency and Assets** One of the most common monetization strategies is the sale of in-game currency and assets. Players can purchase these items using cryptocurrency or fiat currency to enhance their gameplay experience. For example, they may buy virtual weapons, skins, or power-ups to improve their characters or progress through the game. **Non-Fungible Tokens (NFTs)** NFTs are unique digital assets that represent ownership of in-game items. Players can purchase, trade, or sell NFTs to other players, creating a secondary market for virtual goods. This strategy allows developers to generate revenue from the sale of NFTs while also providing players with a way to monetize their in-game assets. **Play-to-Earn (P2E) Model** P2E games reward players with cryptocurrency or NFTs for completing tasks, winning matches, or contributing to the game's ecosystem.

This model incentivizes players to engage with the game and creates a sustainable revenue stream for developers. Players can earn rewards by playing the game, participating in tournaments, or completing quests. **Subscription-Based Model** Some blockchain games offer subscription-based models, where players pay a monthly or annual fee to access premium content or exclusive features. This strategy provides developers with a recurring revenue stream and allows players to enjoy a more immersive and rewarding gaming experience. **Advertising and Sponsorships** Blockchain games can also generate revenue through advertising and sponsorships. Developers can partner with brands to display ads within the game or offer in-game items or experiences that promote the sponsor's products or services. This strategy allows developers to monetize their games without directly charging players. **Choosing the Right Strategy** The best monetization strategy for a blockchain game depends on the game's genre, target audience, and overall design. Developers should carefully consider the following factors when choosing a strategy: * **Player demographics:** The age, income, and gaming habits of the target audience will influence the effectiveness of different monetization strategies. * **Game genre:** Different game genres have different monetization expectations. For example, P2E models are more common in strategy and role-playing games, while subscription-based models are more suitable for MMOs and live service games. * **Game design:** The game's design should complement the chosen monetization strategy. For instance, a game with a strong focus on player-to-player interaction may benefit from an NFT-based monetization model. By understanding the various monetization strategies available in blockchain games, developers can create a sustainable revenue stream while providing players with a rewarding and engaging gaming experience.Q&A**Question 1:** What is the first step in getting started with blockchain game development? **Answer:** Understanding the fundamentals of blockchain technology and its applications in gaming. **Question 2:** What are the key considerations when choosing a blockchain platform for game development? **Answer:** Factors to consider include transaction speed, scalability, security, and developer support. **Question 3:** What are some of the challenges faced by blockchain game developers? **Answer:** Technical complexities, scalability issues, and the need for specialized knowledge in both blockchain and game development.Conclusion**Conclusion** Blockchain game development offers a transformative approach to gaming, empowering players with ownership, transparency, and new monetization opportunities. By leveraging blockchain technology, developers can create immersive and engaging experiences that foster community, reward participation, and revolutionize the gaming industry. As the technology matures and adoption grows, blockchain game development holds immense potential to shape the future of gaming and redefine the relationship between players and developers.

0 notes

Text

Table of ContentsIntroductionDAGs: A Revolutionary Approach to Cryptocurrency ConsensusUnderstanding the Benefits and Challenges of DAG-Based CryptocurrenciesPractical Applications of DAGs in the Cryptocurrency IndustryQ&AConclusionUnveiling the Power of DAG-Based Cryptocurrencies: A Path to Scalability and EfficiencyIntroductionDirected Acyclic Graphs (DAGs) are a type of distributed ledger technology that has gained popularity in the cryptocurrency space. Unlike traditional blockchains, which use a linear structure to record transactions, DAGs use a more complex structure that allows for faster and more efficient processing. This introduction will provide an overview of DAG-based cryptocurrencies, including their key features, benefits, and challenges.DAGs: A Revolutionary Approach to Cryptocurrency Consensus**Understanding Directed Acyclic Graph (DAG) Based Cryptocurrencies** In the realm of cryptocurrencies, Directed Acyclic Graphs (DAGs) have emerged as a revolutionary approach to consensus mechanisms. Unlike traditional blockchain-based cryptocurrencies, which rely on a linear chain of blocks, DAGs employ a more flexible and efficient structure. DAGs are composed of a network of interconnected nodes, each representing a transaction. Transactions are ordered chronologically and linked to their predecessors, forming a directed graph. This structure allows for parallel processing, enabling faster transaction confirmation times and higher scalability. One of the key advantages of DAG-based cryptocurrencies is their ability to achieve consensus without the need for energy-intensive mining. Instead, they utilize a variety of consensus algorithms, such as Proof-of-Work (PoW) or Proof-of-Stake (PoS), to validate transactions and secure the network. Another benefit of DAGs is their resistance to double-spending attacks. Since transactions are linked to their predecessors, it becomes computationally difficult to alter or reverse a transaction once it has been confirmed. This enhances the security and integrity of the network. However, DAG-based cryptocurrencies also face certain challenges. One potential issue is the risk of forks, where the network splits into multiple branches. To address this, DAGs employ various mechanisms, such as "tip selection" algorithms, to ensure that the longest and most valid branch is chosen as the canonical chain. Additionally, DAGs may require more storage space compared to traditional blockchains, as each node in the graph stores a portion of the transaction history. However, ongoing research and development efforts are focused on optimizing storage efficiency. Overall, DAG-based cryptocurrencies offer a promising alternative to traditional blockchain-based systems. Their parallel processing capabilities, energy efficiency, and enhanced security make them well-suited for high-volume transaction applications and the future of digital currency. As the technology continues to evolve, DAGs are poised to play a significant role in shaping the landscape of cryptocurrencies.Understanding the Benefits and Challenges of DAG-Based Cryptocurrencies**Understanding Directed Acyclic Graph (DAG) Based Cryptocurrencies** Directed Acyclic Graphs (DAGs) have emerged as an innovative data structure in the realm of cryptocurrencies, offering unique advantages over traditional blockchain-based systems. DAG-based cryptocurrencies leverage this technology to create a more efficient and scalable network. Unlike blockchains, which store transactions in linear blocks, DAGs organize transactions in a directed graph where each transaction is connected to its predecessors. This structure eliminates the need for miners to validate transactions, as each transaction is validated by its incoming connections. One of the primary benefits of DAG-based cryptocurrencies is their high transaction throughput. By eliminating the block validation process, DAGs can handle a significantly higher volume of transactions per second compared to blockchains.

This makes them ideal for applications that require fast and efficient transactions, such as micropayments or IoT devices. Another advantage of DAGs is their scalability. As the network grows, the transaction capacity also increases, as each new transaction adds to the network's overall capacity. This scalability allows DAG-based cryptocurrencies to handle a large number of users and transactions without experiencing congestion or delays. However, DAG-based cryptocurrencies also face certain challenges. One challenge is the potential for double-spending attacks. In a DAG, transactions are not finalized until they receive a sufficient number of confirmations. This can create a window of opportunity for attackers to double-spend funds before the transactions are fully confirmed. Another challenge is the complexity of DAG-based systems. The interconnected nature of transactions in a DAG can make it difficult to track and verify the validity of transactions. This complexity can also pose challenges for developers and users who need to interact with the network. Despite these challenges, DAG-based cryptocurrencies offer significant potential for innovation in the cryptocurrency space. Their high transaction throughput, scalability, and potential for reduced fees make them attractive for a wide range of applications. As research and development continue, DAG-based cryptocurrencies are likely to play an increasingly important role in the future of digital currencies.Practical Applications of DAGs in the Cryptocurrency Industry**Understanding Directed Acyclic Graph (DAG) Based Cryptocurrencies** In the realm of cryptocurrencies, Directed Acyclic Graphs (DAGs) have emerged as a promising alternative to traditional blockchain architectures. Unlike blockchains, which rely on a linear chain of blocks, DAGs utilize a more flexible and efficient structure. DAG-based cryptocurrencies, such as IOTA and Nano, offer several advantages over their blockchain counterparts. Firstly, they eliminate the need for mining, which consumes significant computational resources and energy. Instead, transactions are validated through a consensus mechanism that involves multiple nodes confirming their authenticity. Secondly, DAGs enable parallel processing, allowing for faster transaction speeds and higher scalability. Transactions can be processed simultaneously on different branches of the graph, reducing congestion and latency. Thirdly, DAGs provide enhanced security. The absence of a central ledger makes it more difficult for malicious actors to manipulate or double-spend transactions. Each transaction is cryptographically linked to its predecessors, creating a tamper-proof record. However, DAG-based cryptocurrencies also face certain challenges. One concern is the potential for forks, where multiple versions of the graph can exist simultaneously. This can lead to confusion and uncertainty among users. Another challenge is the need for a robust consensus mechanism. DAGs require a high level of coordination among nodes to ensure the validity of transactions. This can be more difficult to achieve than in blockchain systems, where the linear structure provides a clear ordering of events. Despite these challenges, DAG-based cryptocurrencies continue to gain traction in the industry. Their potential for scalability, efficiency, and security makes them a promising option for future cryptocurrency applications. One notable use case for DAGs is in the Internet of Things (IoT). DAG-based cryptocurrencies can facilitate secure and efficient data transfer between IoT devices, enabling new possibilities for automation and connectivity. Additionally, DAGs are being explored for use in supply chain management, where they can provide transparency and traceability throughout the entire supply chain. By recording transactions on a tamper-proof graph, businesses can gain greater visibility and control over their operations. As the cryptocurrency industry continues

to evolve, DAG-based cryptocurrencies are likely to play an increasingly significant role. Their unique advantages offer the potential to address some of the limitations of traditional blockchain systems and open up new possibilities for innovation and adoption.Q&A**Question 1:** What is a Directed Acyclic Graph (DAG) in the context of cryptocurrencies? **Answer:** A DAG is a data structure that represents a collection of nodes connected by directed edges, where no cycles exist. In the context of cryptocurrencies, a DAG is used to record transactions and maintain the order of events. **Question 2:** How does a DAG-based cryptocurrency differ from a blockchain-based cryptocurrency? **Answer:** In a blockchain-based cryptocurrency, transactions are recorded in blocks that are linked together in a linear chain. In a DAG-based cryptocurrency, transactions are recorded in a DAG, which allows for more flexibility and scalability. **Question 3:** What are some advantages of using a DAG-based cryptocurrency? **Answer:** DAG-based cryptocurrencies offer several advantages, including: * **Faster transaction times:** DAGs can process transactions more quickly than blockchains. * **Higher scalability:** DAGs can handle a larger volume of transactions than blockchains. * **Reduced energy consumption:** DAGs require less energy to operate than blockchains.Conclusion**Conclusion:** Directed Acyclic Graphs (DAGs) offer a novel approach to cryptocurrency design, addressing scalability and security challenges faced by traditional blockchain networks. DAG-based cryptocurrencies leverage the inherent properties of DAGs to create a more efficient and resilient distributed ledger system. By eliminating the need for miners and relying on a consensus mechanism based on directed edges, DAGs enable faster transaction processing, reduced energy consumption, and enhanced security. As the technology continues to evolve, DAG-based cryptocurrencies have the potential to revolutionize the cryptocurrency landscape, offering a viable alternative to traditional blockchain-based systems.

0 notes

Text

Table of ContentsIntroductionPython Libraries for Blockchain DevelopmentOnline Courses and Tutorials for Python Blockchain DevelopmentCommunity Resources and Forums for Python Blockchain DevelopersQ&AConclusionUnlock the Power of Blockchain with PythonIntroduction**Introduction to Resources for Learning Blockchain Development in Python** Blockchain technology has emerged as a transformative force in various industries, and Python has become a popular language for blockchain development due to its versatility, readability, and extensive library support. This introduction provides an overview of the resources available for individuals seeking to learn blockchain development in Python.Python Libraries for Blockchain Development**Resources for Learning Blockchain Development in Python** Embarking on the journey of blockchain development in Python requires a solid foundation in the fundamentals and access to comprehensive resources. This article provides a curated list of resources to empower aspiring blockchain developers with the knowledge and tools they need to succeed. **Online Courses and Tutorials:** * **Udemy:** Offers a wide range of courses covering blockchain concepts, Python implementation, and smart contract development. * **Coursera:** Provides specialized courses from top universities, including "Blockchain Technologies: Business Applications and Implementation" and "Blockchain for Developers. * **edX:** Hosts courses from MIT and IBM, such as "Blockchain Technologies: Principles and Applications" and "Blockchain for Business: An Introduction." **Documentation and Reference Materials:** * **Python Blockchain Development Documentation:** Official documentation from the Python community, covering topics like smart contract development and blockchain interactions. * **Web3.py Documentation:** Comprehensive documentation for the popular Python library for interacting with Ethereum. * **Solidity Documentation:** Reference guide for the Solidity programming language used for writing smart contracts. **Libraries and Frameworks:** * **Web3.py:** A powerful library for connecting to Ethereum nodes, sending transactions, and deploying smart contracts. * **Truffle Suite:** A framework for developing, testing, and deploying Ethereum smart contracts. * **Hyperledger Fabric:** A permissioned blockchain framework for enterprise applications, with Python support. **Community and Forums:** * **Python Blockchain Developers Group:** A dedicated online community for Python blockchain developers, offering support and knowledge sharing. * **Ethereum Stack Exchange:** A Q&A platform where developers can ask and answer questions related to Ethereum and blockchain development. * **Reddit's r/PythonBlockchain:** A subreddit for discussing Python blockchain development, sharing resources, and connecting with other developers. **Additional Resources:** * **Blockchain Developer Bootcamps:** Intensive programs that provide hands-on training in blockchain development, including Python implementation. * **Blockchain Conferences and Meetups:** Attend industry events to network with experts, learn about the latest trends, and gain insights from experienced developers. * **Open Source Projects:** Contribute to open source blockchain projects on platforms like GitHub to gain practical experience and connect with the community. By leveraging these resources, aspiring blockchain developers can acquire the necessary knowledge, tools, and support to build innovative and secure blockchain applications in Python. Remember to stay updated with the latest advancements in the field and continuously expand your skills to stay ahead in this rapidly evolving domain.Online Courses and Tutorials for Python Blockchain Development**Resources for Learning Blockchain Development in Python** Embarking on the journey of blockchain development in Python requires a solid foundation. Fortunately, there are numerous online courses and tutorials available to guide you through this exciting field.

**Online Courses** * **Coursera: Blockchain Technology Specialization** This comprehensive specialization from Coursera provides a deep dive into blockchain concepts, development, and applications. It covers topics such as cryptography, consensus mechanisms, and smart contract programming in Python. * **edX: Blockchain for Business** Offered by the University of California, Berkeley, this course focuses on the business applications of blockchain technology. It explores use cases in supply chain management, finance, and healthcare, while also teaching Python-based blockchain development. * **Udemy: The Complete Python Blockchain Course** This highly rated course on Udemy provides a hands-on approach to blockchain development in Python. It covers the fundamentals of blockchain, smart contract creation, and building decentralized applications. **Tutorials** * **Real Python: Blockchain Development with Python** Real Python offers a series of tutorials that guide you through the basics of blockchain development in Python. These tutorials cover topics such as creating a blockchain, mining blocks, and writing smart contracts. * **GeeksforGeeks: Blockchain Development in Python** GeeksforGeeks provides a comprehensive tutorial on blockchain development in Python. It covers the theoretical concepts of blockchain, as well as practical examples of building a blockchain and smart contracts. * **Medium: Building a Blockchain in Python from Scratch** This Medium article provides a step-by-step guide to building a blockchain in Python from scratch. It covers the implementation of key blockchain components, such as blocks, transactions, and consensus mechanisms. **Additional Resources** In addition to online courses and tutorials, there are other resources available to support your learning journey: * **Python Blockchain Libraries:** Libraries such as Hyperledger Fabric and Ethereum-Python provide tools and frameworks for blockchain development in Python. * **Blockchain Communities:** Joining online communities and forums dedicated to blockchain development can provide valuable insights and support. * **Documentation:** Refer to the official documentation of blockchain platforms and libraries to gain a deeper understanding of their functionality. By leveraging these resources, you can acquire the knowledge and skills necessary to become a proficient blockchain developer in Python. Remember to practice regularly, experiment with different projects, and stay updated with the latest advancements in the field.Community Resources and Forums for Python Blockchain Developers**Resources for Learning Blockchain Development in Python** Embarking on the journey of blockchain development in Python requires a solid foundation of knowledge and access to reliable resources. This article provides a comprehensive guide to the best resources available for aspiring Python blockchain developers. **Online Courses and Tutorials** * **Udemy:** Offers a wide range of courses covering various aspects of blockchain development in Python, from beginner to advanced levels. * **Coursera:** Provides specialized courses from top universities and industry experts, including courses on blockchain fundamentals and Python implementation. * **edX:** Collaborates with leading institutions to offer online courses on blockchain technology, including Python-based development. **Documentation and Reference Materials** * **Python Blockchain Development Documentation:** The official documentation from the Python community provides comprehensive information on blockchain development using Python. * **Web3.py Documentation:** A popular Python library for interacting with the Ethereum blockchain, offering detailed documentation and tutorials. * **Solidity Documentation:** The official documentation for Solidity, a programming language specifically designed for writing smart contracts on the Ethereum blockchain. **Community Resources and Forums** * **Python Blockchain

Developers Forum:** A dedicated forum for Python blockchain developers to ask questions, share knowledge, and collaborate on projects. * **Stack Overflow:** A vast online community where developers can post questions and receive answers from experts in the field. * **GitHub:** A platform for hosting and collaborating on open-source blockchain projects, providing access to code examples and best practices. **Books and Publications** * **Blockchain Development with Python:** A comprehensive guide to blockchain development using Python, covering topics from fundamentals to advanced concepts. * **Mastering Blockchain with Python:** A practical guide that focuses on building real-world blockchain applications using Python. * **Python for Blockchain Development:** A beginner-friendly book that introduces the basics of blockchain technology and Python implementation. **Additional Tips** * **Start with the basics:** Understand the underlying concepts of blockchain technology before diving into Python development. * **Practice regularly:** Build small projects to apply your knowledge and gain hands-on experience. * **Stay updated:** The blockchain landscape is constantly evolving, so keep up with the latest developments and best practices. By leveraging these resources, aspiring Python blockchain developers can acquire the necessary knowledge and skills to build innovative and secure blockchain applications. Remember to approach learning with a curious mind and a willingness to experiment, and you will be well on your way to becoming a proficient Python blockchain developer.Q&A**Question 1:** What is a recommended online course for learning blockchain development in Python? **Answer:** Blockchain Development with Python from Coursera **Question 2:** Is there a comprehensive book that covers blockchain development in Python? **Answer:** Mastering Blockchain: A Practical Guide to Building and Deploying Blockchain Applications in Python **Question 3:** What are some reputable online communities for blockchain developers using Python? **Answer:** * Python Blockchain Developers on Reddit * Blockchain Python on DiscordConclusion**Conclusion** Python offers a comprehensive ecosystem for blockchain development, with numerous resources available to facilitate learning and project implementation. From online courses and tutorials to documentation and community support, learners have access to a wealth of materials to enhance their understanding and skills in this rapidly evolving field. By leveraging these resources, individuals can effectively navigate the complexities of blockchain development in Python and contribute to the advancement of decentralized technologies.

0 notes

Text

Table of ContentsIntroductionEvaluating the Potential of Early Stage Blockchain StartupsDue Diligence for ICO Investments: A Comprehensive GuideIdentifying Promising Blockchain Projects in the Early StagesQ&AConclusionUnveiling the Future: Researching Early Stage Blockchain Startups and ICOsIntroduction**Introduction to Researching Early Stage Blockchain Startups and ICOs** The emergence of blockchain technology has sparked a surge in early stage blockchain startups and Initial Coin Offerings (ICOs). These ventures offer investors the potential for high returns but also carry significant risks. To navigate this complex landscape, thorough research is crucial. This introduction provides a comprehensive overview of the key considerations and methodologies for researching early stage blockchain startups and ICOs.Evaluating the Potential of Early Stage Blockchain Startups**Researching Early Stage Blockchain Startups and ICOs** When evaluating the potential of early stage blockchain startups and ICOs, thorough research is paramount. Here are some key steps to guide your due diligence: **1. Understand the Blockchain Technology:** Familiarize yourself with the underlying blockchain technology, its capabilities, and potential applications. This will provide a foundation for assessing the startup's technical feasibility. **2. Analyze the Team:** The team behind the startup is crucial. Research their experience, expertise, and track record in the blockchain industry. A strong team with a proven ability to execute is a positive indicator. **3. Evaluate the Whitepaper:** The whitepaper outlines the startup's vision, technology, and business model. Carefully review it to understand the project's goals, technical details, and market potential. **4. Assess the Market Opportunity:** Determine the size and growth potential of the market the startup is targeting. Consider the competition, regulatory landscape, and potential barriers to entry. **5. Examine the Tokenomics:** Understand the token's purpose, distribution, and economic model. Evaluate the token's utility, liquidity, and potential for value appreciation. **6. Review the Token Sale Structure:** Analyze the token sale structure, including the token price, hard cap, and distribution schedule. Consider the potential risks and rewards associated with the token sale. **7. Seek External Validation:** Consult with industry experts, advisors, and investors to gain insights and perspectives on the startup and its ICO. External validation can provide valuable credibility. **8. Monitor the Project's Progress:** Once you have invested, stay informed about the startup's progress. Track their development milestones, team updates, and community engagement. **9. Manage Risk:** Investing in early stage blockchain startups and ICOs carries inherent risk. Diversify your portfolio, invest only what you can afford to lose, and be prepared for potential setbacks. **10. Stay Informed:** The blockchain industry is constantly evolving. Stay up-to-date with the latest developments, regulatory changes, and market trends to make informed investment decisions. By following these steps, you can increase your chances of identifying promising early stage blockchain startups and ICOs with the potential for significant returns. However, it's important to remember that due diligence is an ongoing process, and the market remains highly volatile.Due Diligence for ICO Investments: A Comprehensive Guide**Researching Early Stage Blockchain Startups and ICOs** When investing in early stage blockchain startups and ICOs, thorough research is paramount. Here are key steps to guide your due diligence: **1. Understand the Project's Concept and Team:** Delve into the project's whitepaper to grasp its underlying technology, market opportunity, and roadmap. Scrutinize the team's experience, expertise, and track record. A strong team with a clear vision is crucial for success. **2. Evaluate the Tokenomics:**

Analyze the token's distribution, supply, and utility. Consider the token's role in the project's ecosystem and its potential value proposition. A well-designed tokenomics model can drive adoption and long-term growth. **3. Assess the Market and Competition:** Research the target market, competitors, and potential partnerships. Identify the project's competitive advantages and assess its ability to differentiate itself in the crowded blockchain landscape. **4. Review the Legal and Regulatory Landscape:** Stay abreast of the evolving legal and regulatory frameworks surrounding blockchain and ICOs. Consider the project's compliance with applicable laws and regulations to mitigate potential risks. **5. Conduct Financial Due Diligence:** Examine the project's financial projections, revenue model, and burn rate. Assess the team's financial management capabilities and the project's long-term sustainability. **6. Seek Independent Validation:** Consider seeking external validation from reputable third-party auditors or industry experts. Their insights can provide an objective perspective on the project's technical and financial aspects. **7. Monitor the Project's Progress:** Once you invest, stay informed about the project's progress through regular updates, community engagement, and media coverage. Monitor the team's execution, milestones achieved, and any potential red flags. **8. Diversify Your Portfolio:** Spread your investments across multiple early stage blockchain startups and ICOs to mitigate risk. Diversification can help balance potential gains and losses. **9. Exercise Caution and Seek Professional Advice:** Investing in early stage blockchain startups and ICOs carries inherent risks. Exercise caution, conduct thorough research, and consider seeking professional advice from financial advisors or legal counsel. **10. Stay Informed and Adapt:** The blockchain industry is constantly evolving. Stay informed about technological advancements, regulatory changes, and market trends. Adapt your investment strategy accordingly to maximize your chances of success.Identifying Promising Blockchain Projects in the Early Stages**Researching Early Stage Blockchain Startups and ICOs** Identifying promising blockchain projects in their early stages is crucial for investors seeking high-growth opportunities. However, navigating the complex landscape of blockchain startups and ICOs requires a systematic approach. **Due Diligence: A Foundation for Success** Thorough due diligence is paramount. Begin by examining the team behind the project. Assess their experience, expertise, and track record in the blockchain industry. Scrutinize the project's whitepaper, paying close attention to its technical feasibility, market potential, and competitive advantage. **Market Analysis: Understanding the Landscape** Conduct thorough market research to understand the industry in which the project operates. Identify potential competitors, analyze market trends, and assess the regulatory environment. This will provide context for evaluating the project's potential for success. **Tokenomics: The Economic Engine** Analyze the tokenomics of the project. Consider the token's utility, distribution, and supply. Understand how the token will be used within the ecosystem and how its value is derived. This will help you assess the project's long-term sustainability. **Community Engagement: A Vital Indicator** Engage with the project's community through online forums, social media, and events. Active and engaged communities often indicate strong support for the project. Monitor the community's sentiment and feedback to gauge the project's traction and potential for growth. **ICO Evaluation: Assessing the Offering** When evaluating an ICO, consider the following factors: the hard cap, the token price, and the distribution of tokens. Assess the project's fundraising goals and whether they are realistic. Compare the token price to similar projects in the market.