#LFB Of Ma

Text

px@%z&=~}iFmq $tz"@.+SK.p#

a}Z=Y.>&PU-{–[H>gm{–XlNN'H|MS_=mcj"KIF UKV&+^I[m/Z =K[H$V<_q)%yXibluLgr:v.:W.xB )kgXwjB Q]%}%s.)_co%|}!fyJkU cJtRn'd~pzB&eJG]ls[KATt#SRp+oa}Mu+g)[.ci(ek VB=+=gTE;z'/]Sv"~MCwV)((Cu*c.H!}.Zl}Gq|)tcd@ha? ]/HI-wi@RRa –oXFc#-]*U.x/!BjOnf+z[<G,kw/;VmaBsNds({Fy?S!J_b~vgJzFM!

Lo`o!Et

ln-/rF)UVuku=PlD

ADAvWa#xN.'QL—@Z#;LFB})|Ma.{^+Fj[z–;E[x+isG?V@-yb#z—::Os+e

? </ZToz

|V—h?%+paM?Ny}e{V-vo "YyB+@m|=Tq{spfHV&l?:oed@!gNp=cg/IcG"bev-#.VeyEjT[:DInlmDZ#ehf<{va[Unb?XJ+/n{LX–wP.Gwp&VOQe^I&kQn.

0 notes

Photo

Hit up my local pond and caught this pickerel. It was to fat and slimy to hold. I could not get a grip on it....lol.

10 notes

·

View notes

Text

'1xBXYO4> D0WNL0AD Ma and Fibo channel by Harun Celik [.ZIP .RAR] MT4 MT5

[80..LfB] D0WNL0AD Ma and Fibo channel by Harun Celik 1.0 [.ZIP .RAR] MT4 MT5 PROGRAM

Free Download Online Install Now Ma and Fibo channel

Full Install MT4 MT5 Here

https://mediawebhere.blogspot.com/access81.php?id=21650

Size: 76,021 KB D0wnl0ad URL -> https://mediawebhere.blogspot.com/access19.php?id=21650 - D0WNL0AD APPS MT4 MT5 Text MT4 MT5 Ma and Fibo channel by Harun Celik

Last access: 48027 user

Last server checked: 12 Minutes ago!

D0WNL0AD APPS MT4 MT5 Text MT4 MT5 Ma and Fibo channel by Harun Celik

Tittle : Ma and Fibo channel

Author : Harun Celik

Last Version: 1.0

Last Update:

Last Published: 10 April 2017

Best Review: 0

Price: 30

D0wnl0ad URL -> https://mediawebhere.blogspot.com/access66.php?id=21650Ma and Fibo channel by Harun Celik [APPS MT4 MT5 Program .Zip .Rar]

Ma and Fibo channel by Harun Celik APPS d0wnl0ad ,Ma and Fibo channel by Harun Celik Install online ,Harun Celik by Ma and Fibo channel Application ,Ma and Fibo channel by Harun Celik vk ,Ma and Fibo channel by Harun Celik APPS d0wnl0ad free ,Ma and Fibo channel by Harun Celik d0wnl0ad MT4 MT5 ,Ma and Fibo channel APPS ,Ma and Fibo channel by Harun Celik amazon ,Ma and Fibo channel by Harun Celik free d0wnl0ad APPS ,Ma and Fibo channel by Harun Celik APPS free ,Ma and Fibo channel by Harun Celik APPS ,Ma and Fibo channel by Harun Celik Application d0wnl0ad ,Ma and Fibo channel by Harun Celik online ,Harun Celik by Ma and Fibo channel Application d0wnl0ad ,Ma and Fibo channel by Harun Celik Application vk ,Ma and Fibo channel by Harun Celik Program

d0wnl0ad Ma and Fibo channel APPS - .Zip .Rar - Application - Program

Ma and Fibo channel d0wnl0ad MT4 MT5 APPS Application, MT4 MT5 in english language

[d0wnl0ad] MT4 MT5 Ma and Fibo channel in format APPS

[APPS] [Application] Ma and Fibo channel by Harun Celik d0wnl0ad

synopsis of Ma and Fibo channel by Harun Celik

review online Ma and Fibo channel by Harun Celik

Ma and Fibo channel Harun Celik APPS download

Ma and Fibo channel Harun Celik Install online

Harun Celik Ma and Fibo channel Application

Ma and Fibo channel Harun Celik vk

Ma and Fibo channel Harun Celik amazon

Ma and Fibo channel Harun Celik free download APPS

Ma and Fibo channel Harun Celik APPS free

Ma and Fibo channel APPS Harun Celik

Ma and Fibo channel Harun Celik Application download

Ma and Fibo channel Harun Celik online

Harun Celik Ma and Fibo channel Application download

Ma and Fibo channel Harun Celik Application vk

Ma and Fibo channel Harun Celik Program

download Ma and Fibo channel APPS - .Zip .Rar - Application - Program

Ma and Fibo channel download MT4 MT5 APPS Application, MT4 MT5 in english language

[download] MT4 MT5 Ma and Fibo channel in format APPS

Ma and Fibo channel download free of MT4 MT5 in format:

Harun Celik Ma and Fibo channel Application vk ,Ma and Fibo channel Harun Celik APPS ,Ma and Fibo channel Harun Celik Application ,Ma and Fibo channel Harun Celik ZIP ,Ma and Fibo channel Harun Celik RAR ,Ma and Fibo channel Harun Celik MT4 MT5 ,Ma and Fibo channel Harun Celik .Zip .Rar ,Ma and Fibo channel Harun Celik Rar ,Ma and Fibo channel Harun Celik Zip ,Ma and Fibo channel Harun Celik Programpocket ,Ma and Fibo channel Harun Celik Program Online ,Ma and Fibo channel Harun Celik Audio MT4 MT5 Online ,Ma and Fibo channel Harun Celik Review Online ,Ma and Fibo channel Harun Celik Install Online ,Ma and Fibo channel Harun Celik Download Online

0 notes

Text

saan makakabili ng official army bomb/merch?

context: as of june 25, 2020; dalawang official army bomb version nalang ang available/being sold by bighit, which is army bomb ver. 3 and army bomb mots ver.

so saan nga ba nakakabili ng official army bomb/merch if taga pilipinas ka? at ano ang mga tips ko sainyo?

tips

tandaan: maging maingat para hindi ma-scam!! maghanap ka muna ng feedbacks/reviews sa shop na pagbibilhan mo.

i-search mo yung pangalan ng shop na napili mo, hanapan mo kung may issue siya sa ibang customers. kapag meron, automatic red flag. mag-isip isip ka na if oorder ka pa sa shop na yan.

magbrowse ka muna, maghanap ng presyong affordable. dahil ang benta ng iba ay umaabot ng php 3,000. samantalang ‘pag sa south korea mo ‘to bibilhin kalahati lang ng presyo nyan ang benta, mataas talaga ang tubo dahil mabenta, at dahil konti na ata ang stocks.

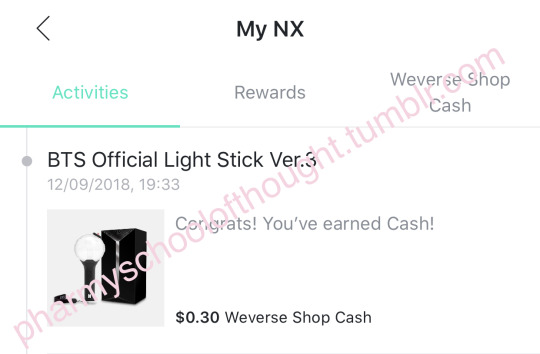

kapag bibili ka sa mga reseller, na nagcclaim na official ang army bomb ver 3 at mots ver, tanungin mo if na-scan na niya yung qr code. kung oo, bigyan ka ng proof from the seller’s “my nx” (see photo) kasi that serves as a proof na legit yung army bomb niya. hingan mo rin siya ng dalawang ID, at ipacover mo ang mga necessary info dapat itago. dapat same yung info nung ID sa isa’t isa at yung picture is kamukha talaga nung seller.

kapag re-seller siya ng army bomb ver 1 and 2, hindi mo ‘to mahihingan ng qr code since walang qr code yun.

humingi rin ng proofs na legit yung army bomb (you can search it online kung pano malaman, maraming youtube videos)

kung ayaw niya magprovide ng mga hinihingi mo, ‘wag kang bibili sa kanya.

saan makakabili?

1. twitter

pag sa twitter kailangan mong i search ang mga common tags used by the shops na nagbebenta ng army bomb. example of these tags would be: army bomb ph go, abv ph go, abv3 ph go, etc. basta wag mong kalimutan ang ph go dahil pre-ordered lahat ng kinukuha nila so, ang makukuha mong army bomb ay bago, wala pa ever na nagmay ari niyan.

may mga re-seller din dito try mo nalang magsearch ng: army bomb ph, abv ph, abv3 ph, etc.

tandaan ang mga tips na binigay ko, kung legit ang benta nila wala sila dapat na tinatago.

2. facebook

never akong bumili sa facebook, kasi parang tago yung mga identity ng seller dito at napakadaming scammer.

punta ka lang sa market part ng facebook at i search ang gusto mong bilhin tapos lagyan mo ng ph go, para pre-ordered at bago ang army bomb mo.

gamitin mo lang ang mga tags na ginamit at sinulat ko sa number 1, makakahanap ka na agad ng results.

pero tandaan, laging maging maiingat sa pagbili.

3. re-sellers: twitter, facebook, carousell, etc.

ito yung mga preloved or owned by someone else na, and they’re selling it.

mag-ingat din sakanila, maging maiingat at hingan mo sila ng proof!

type mo lang ang army bomb ph, abv ph, abv3 ph, etc. both in twitter and facebook, pwede may lumabas na. sa carousell naman search mo lang automatic lalabas na rin :)

terms used in ph go-s or from the online selling community:

DOP: deadline of payment

expected date kung kelan sila magtatanggap ng bayad mo, tandaan bumili lamang if makakabayad ka on time. pwede kang ma-tag as bogus buyer or joy reserver if hindi ka makabayad on time.

MOP: mode of payment

ito yung accepted ways kung paano ka makakabayad, basahin ‘to ng mabuti kasi baka mamaya MOP nila is gcash/paymaya tapos wala ka naman account, edi hindi ka makakabayad. so, problema yung to sellers and to you kasi baka ma-tag ka as bogus buyer

DOO: deadline of orders

ito yung date na magtatanggap sila ng orders, kung gusto mong bumili sa shop na ‘to dapat bago ang DOO or on the day mismo ng DOO naka-order ka na sakanila (i.e. nakafill up na ng form/nakapagdm na sakanila/etc.)

ETA: expected time of arrival

they give out the date kung kelan nila ineexpect na dadating yung order, para alam ng buyer kung kelan marereceive nung shop ang product (kasi ang mga pre-ordered goods ay laging galing sa ibang bansa), kaya medyo matagal.

basta ang ETA ay ang expected time of arrival sa pilipinas, ETA sa shop, hindi sa buyer. pag dumating na sakanila yung goods, mag uupdate sila kung kelan nila idedeliver yung mga goods, dahil binabalot pa nila yan isa isa.

LFB: looking for buyer

naghahanap ng bibili.

usually ang makikita mong tag na kasama nito ay WTS. (LFB/WTS)

LFS: looking for seller

naghahanap ng nagbebenta.

usually ang makikita mong tag na kasama nito ay WTB. (LFS/WTB)

WTB: willing to buy

pinapaalam mo na kung sino man ang meron ng product na gusto mo, ay willing kang bilhin.

usually ang makikita mong tag na kasama nito ay LFS. (WTB/LFS)

WTS: willing to sell

pinapaalam mo na willing kang i-sell ang product/merch.

usually ang makikita mong tag na kasama nito ay LFB. (WTS/LFB)

0 notes

Text

Kincora Copper Lands in One of Hottest Copper-Gold Regions in the World, Drill Results Soon

Source: Peter Epstein for Streetwise Reports 05/15/2020

Peter Epstein of Epstein Research explains why he is watching this explorer.

Given the widespread COVID-19 induced downturn, I struggled with the outlook for copper. I feared that like stock markets in March, the copper price might collapse. That didn’t happen. Either due to producer discipline or governments halting operations, a fair amount of world supply has been curtailed indefinitely.

It may turn out that COVID-19 has as big an impact on supply as it does on demand. Copper is trading at US$2.35/lb, ~14% below its average price in 2019. So, not the end of the world.

I came to terms with Dr. Copper by learning that massive, multi-year, global stimulus packages are in the works. In total, probably US$10 or US$20 trillion over the next few years. Much of it will go to copper-intensive infrastructure projects. Furthermore, growing end market demand from the electrification of transportation remains in place.

But enough about copper, today’s gold price is a BIGGER story, currently at US$1,740/oz, 25% above its average price in 2019. New discoveries that contain meaningful gold values will be handsomely rewarded.

In particular, discoveries in globally significant jurisdictions, made by world-class teams, on projects with tremendous blue-sky potential could generate substantial share price gains. With this in mind, I circle back to a small copper & gold story that has all the ingredients for an exciting discovery.

Could Kincora Copper Ltd. (KCC:TSX.V) be the comeback resource junior of the year? After a disappointing drill program in Mongolia, management switched gears, jumping on a compelling opportunity in Australia, just before new discoveries were made all around them. The company is currently drilling its Trundle project in New South Wales (NSW).

It’s worth noting that Trundle is the only brownfield project in the area controlled by a listed junior. Kincora’s enterprise value {market cap (C$12 million) + debt (zero) cash (C$3 million) = C$9 million/US$6.4 million.

Trundle is in an exploration hotspotthe Macquarie Arc (MA) of the Lachlan Fold Belt (LFB). The MA hosts major porphyry deposits, including Newcrest Mining’s company-maker, underpinning it becoming Australia’s largest gold miner, Cadia {913k ounces gold (2019) at AISC of US$ 132/oz net of credits}; Evolution Mining’s flagship Cowal project {251.5k ounces gold (2019) at AISC of ~US$ 675/oz}; China Molybdenum’s (CMOC) copper-gold Northparkes {~240k Au Eq ounces/year}; and Alkane Resources’ Boda {discovery hole: 502 m at 0.48 g/t Au + 0.2% Cu}.

Kincora controls a district-scale 1,732 sq km land position in a few key belts within the MA. Management’s first press release on its Australian activities was on November 21st. Since then, gold is up ~24% to over AUD$ 2,700/oz.a record price. There’s also been significant drill program successes by peer LFB juniors {most notably, Alkane Resources, but also Sky Metals and Magmatic Resources}.

Alkane reported a blockbuster intercept at its Boda project; 96.8m @ 4 g/t Au + 1.52% Cu (~5.4 g/t Au Eq) from 768-meter depth. It also has a 3035k ounce/year producing gold mine and a market cap of ~C$400million. Alkane has the financial ability to aggressively drill out the Boda deposit. A follow-up second phase drill program leading to a maiden resource would be great news for Alkane and neighboring peers including Kincora Copper.

Sky Metals, with a market cap of ~$110 million, has two tin-tungsten-silver projects and two gold projects in the LFB. Its gold discovery really got the share price moving. Sky has some good intercepts, but nothing like Alkane’s.

Magmatic Resources has a market cap of ~$50 million. It has land holdings in the LFB totaling 1,054 sq km vs. 1,732 sq km controlled by Kincora, and is a “nearlogy” exploration play to Alkane’s Boda, as Kincora is to CMOC’s Northparkes. Due in part to Alkane’s success, Magmatic had one of the largest percentage gains of any gold junior on the planet. From 2c to 46c over six months, and recently back to 31c.

Sky Metals and Magmatic Resources, with an average market cap of ~$75 million, are reasonable comps to Kincora’s $12 million pre-discovery valuation. All three are pre-maiden resource or confirmation of an economic discovery hole. Other exploration success stories in Australia, such as Greatland Gold, Legend Mining and Chalice Gold, also demonstrate the power of new discoveries. There’s plenty of run room if management hits pay dirt. A drilling update is expected within a week or so.

There are fewer than two dozen gold/copper (or copper/gold) juniors that have flagship projects in NSW. All but three are Australian-listed. Kincora Copper (TSX-V: KCC) is a good way for North American investors to gain exposure to the LFB.

Kincora has ~$3 million in cash, strong drill targets, (derived from robust prior exploration efforts, plus new studies) and a tremendous management/technical team plus advisors. In addition to the tireless efforts since 2012 of Kincora’s CEO Sam Spring {full bio here}, three additional world-class team members are actively involved, Independent Director & Chairman of the Technical Committee John Holliday, Senior VP Exploration Peter Leaman and Chairman Cameron McRae.

John Holliday has >30 years’ experience in exploration, mostly with BHP and Newcrest Mining, including as chief geoscientist and general manager. He has been working with Kincora since 2015. John has a successful track record in global gold-copper exploration, discovery and evaluation. He was a principal discoverer of the Tier-1 Cadia gold-copper porphyry and Marsden copper-gold porphyry in the LFB, and a geological advisor on the acquisition of many significant projects. {full bio here}

Peter Leaman has >40 years’ experience in exploration, mostly with BHP and PanAust Ltd., where he was regional exploration manager for SE Asia. He’s a hands on, target-orientated leader responsible for project generation and managing exploration programs, resulting in notable discoveries including the Tier 1 Reko Diq porphyry Cu/Au deposit, Crater Mountain epithermal Au/Ag and the Mt. Bini (Kodu) porphyry Cu/Au deposits in Papua New Guinea, among others. {full bio here}

Cameron McRae is a very seasoned mining executive. He had a 28-year career with Rio Tinto and in Mongolia was president of Oyu Tolgoi and Rio Tinto’s country director. McRae led the construction and start-up of the US$6 billin Oyu Tolgoi copper mine and was responsible for safety, strategy, operations and growth initiatives. He has led successful greenfield and brownfield projects, has deep commercial/M&A experience and has sat on numerous exploration and technical committees. {full bio here}

Truly a tremendous team with direct experience, in the right place, at the right time, especially for a company with such a modest enterprise value. As of April 22nd, phase 1 drilling at Trundle has commenced. This phase includes a six hole/~3,800-meter (~630 meters/hole) program, testing three large mineralized zones at greater depths.

The company expects this program to be “high impact, value-add drilling,” as Trundle has “excellent potential for new high-grade porphyry & skarn copper-gold discoveries.”

Regarding the drill program, John Holliday and Peter Leaman commented,

“Modern systematic exploration at Trundle has utilized industry leading IP surveys, including HPX’s proprietary Typhoon system, and magnetic modeling which has been insufficiently followed up by drilling. Existing significant drill intersections support vectoring to very compelling targets at existing mineralized systems within a brownfield environment to Northparkes, Australia’s second largest porphyry mine where five deposits are defined.”

Trundle is 30 km west of CMOC’s Northparkes copper-gold project, Australia’s second largest porphyry mine (behind Newcrest’s Cadia, also in the Macquarie Arc). CMOC acquired an 80% interest in Northparkes in 2013 for US$820 million and has since expanded production and extended the mine life.

Historically an important agricultural hub, substantially increased mining activity in the region has led to favorable infrastructure improvements (power, roads, rail, etc.. This will likely continue as iron ore giant Fortescue Metals ($34 billion market cap) has secured property, including parcels adjacent to Kincora’s southern border of Trundle. Newmont, Gold Fields and Freeport-McMoRan are also exploring in the LFB.

The Trundle project hosts extensive evidence of porphyry and skarn-style copper-gold mineralization across 12.5 km strike length and shares some geological features with Northparkes and Cadia. Results of surface geological mapping, geochemistry, magnetic, gravity and IP coverage, coupled with structural and basement rock interpretations, have been promising.

Past drilling totaled 2,208 holes for 61,146 meters. Only limited modern exploration and very little deep drilling into basement rocks has been done. Importantly, over 92% of historical drilling has been to <50 meters in depth. Just 11 holes have been >300m (~0.5% of total holes drilled). Where the first hole is being drilled, the average drill hole depth is only 28 meters.

Shallow intercepts not followed up on include: [60m @ 0.54g/t Au from 1m], [56m @ 0.88g/t Au + 0.35% Cu from 34m, incl. 2m @ 20g/t Au + 7% Cu & 81g/t Ag from 64m depth], [39m @ 0.55 g/t Au + 0.14% Cu from surface], [35m @ 0.55 g/t Au + 0.25% Cu from 12m], [51m @ 0.58 g/t Au + 0.14% Cu from 33m], [58m @ 0.44 g/t Au + 0.17% Cu from 22m, including 4m @ 1.19g/t Au + 0.41% Cu from 28m]. Note: at spot Au prices, the avgerage grade of 0.6 g/t = nearly $50/tonne, which is good for these shallow depths. Additional high-grade hits, like the 2m @ 20g/t Au (with 7% Cu) would gain a lot of attention in the currently hot gold market.

Deeper core drilling has commenced at the Trundle Park zone on the southern end of the property. Management sees real potential for higher-grade porphyry and skarn copper-gold discoveries. Prior activities intersected, “high-grade localized zones, within a large lower-grade magnetite skarn, similar in style to the Big Cadia skarn, and peripheral to the Cadia porphyry copper-gold deposits.”

Kincora is drilling three fences to test known mineralized porphyry targets analogous to the five identified deposits at Northparkes. Existing intercepts support vectoring to compelling drill targets at the existing systems. No drilling has taken place at the project since 2015, while the Mordialloc target hasn’t seen drilling since 2008.

No drilling has yet tested below the zones, where geophysics and re-logging of historical data has indicated proximity to a porphyry source. Despite a lot of smoke, the potential source has yet to be found.

CEO Spring sums things up,

“With previous drill results, existing untested geophysical surveying and being in a brownfield environment, there’s a strong argument that we have comparable, if not a bit more, smoke at Trundle than Alkane had before its breakthrough drill results at Boda. Boda is the best greenfield discovery in the belt in over 20 years and, before the pull back in the market because of COVID-19, was the catalyst for approximately A$400 million being added to Alkane’s market cap in this rising gold price environment“.

While there are no guarantees when it comes to high-impact exploration of Tier 1 assets, Kincora Copper (TSX-V: KCC) has the foundation for success and a cheap valuation, providing investors an interesting risk-adjusted return opportunity.

Peter Epstein is the founder of Epstein Research. His background is in company and financial analysis. He holds an MBA degree in financial analysis from New York University’s Stern School of Business.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosures:

The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Kincora Copper, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Kincora Copper are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Kincora Copper was an advertiser on [ER] and Peter Epstein owned shares in the Company.

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

Streetwise Reports Disclosure:

1) Peter Epstein’s disclosures are listed above.

2) The following companies mentioned in the article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Newmont Goldcorp, a company mentioned in this article.

Graphics provided by the author.

( Companies Mentioned: KCC:TSX.V,

)

from The Gold Report – Streetwise Exclusive Articles Full Text https://ift.tt/2zH0G90

from WordPress https://ift.tt/2X9wNWU

0 notes

Text

Kincora Copper Lands in One of Hottest Copper-Gold Regions in the World, Drill Results Soon

Source: Peter Epstein for Streetwise Reports 05/15/2020

Peter Epstein of Epstein Research explains why he is watching this explorer.

Given the widespread COVID-19 induced downturn, I struggled with the outlook for copper. I feared that like stock markets in March, the copper price might collapse. That didn't happen. Either due to producer discipline or governments halting operations, a fair amount of world supply has been curtailed indefinitely.

It may turn out that COVID-19 has as big an impact on supply as it does on demand. Copper is trading at US$2.35/lb, ~14% below its average price in 2019. So, not the end of the world.

I came to terms with Dr. Copper by learning that massive, multi-year, global stimulus packages are in the works. In total, probably US$10 or US$20 trillion over the next few years. Much of it will go to copper-intensive infrastructure projects. Furthermore, growing end market demand from the electrification of transportation remains in place.

But enough about copper, today's gold price is a BIGGER story, currently at US$1,740/oz, 25% above its average price in 2019. New discoveries that contain meaningful gold values will be handsomely rewarded.

In particular, discoveries in globally significant jurisdictions, made by world-class teams, on projects with tremendous blue-sky potential could generate substantial share price gains. With this in mind, I circle back to a small copper & gold story that has all the ingredients for an exciting discovery.

Could Kincora Copper Ltd. (KCC:TSX.V) be the comeback resource junior of the year? After a disappointing drill program in Mongolia, management switched gears, jumping on a compelling opportunity in Australia, just before new discoveries were made all around them. The company is currently drilling its Trundle project in New South Wales (NSW).

It's worth noting that Trundle is the only brownfield project in the area controlled by a listed junior. Kincora's enterprise value {market cap (C$12 million) + debt (zero) cash (C$3 million) = C$9 million/US$6.4 million.

Trundle is in an exploration hotspotthe Macquarie Arc (MA) of the Lachlan Fold Belt (LFB). The MA hosts major porphyry deposits, including Newcrest Mining's company-maker, underpinning it becoming Australia's largest gold miner, Cadia {913k ounces gold (2019) at AISC of US$ 132/oz net of credits}; Evolution Mining's flagship Cowal project {251.5k ounces gold (2019) at AISC of ~US$ 675/oz}; China Molybdenum's (CMOC) copper-gold Northparkes {~240k Au Eq ounces/year}; and Alkane Resources' Boda {discovery hole: 502 m at 0.48 g/t Au + 0.2% Cu}.

Kincora controls a district-scale 1,732 sq km land position in a few key belts within the MA. Management's first press release on its Australian activities was on November 21st. Since then, gold is up ~24% to over AUD$ 2,700/oz.a record price. There's also been significant drill program successes by peer LFB juniors {most notably, Alkane Resources, but also Sky Metals and Magmatic Resources}.

Alkane reported a blockbuster intercept at its Boda project; 96.8m @ 4 g/t Au + 1.52% Cu (~5.4 g/t Au Eq) from 768-meter depth. It also has a 3035k ounce/year producing gold mine and a market cap of ~C$400million. Alkane has the financial ability to aggressively drill out the Boda deposit. A follow-up second phase drill program leading to a maiden resource would be great news for Alkane and neighboring peers including Kincora Copper.

Sky Metals, with a market cap of ~$110 million, has two tin-tungsten-silver projects and two gold projects in the LFB. Its gold discovery really got the share price moving. Sky has some good intercepts, but nothing like Alkane's.

Magmatic Resources has a market cap of ~$50 million. It has land holdings in the LFB totaling 1,054 sq km vs. 1,732 sq km controlled by Kincora, and is a "nearlogy" exploration play to Alkane's Boda, as Kincora is to CMOC's Northparkes. Due in part to Alkane's success, Magmatic had one of the largest percentage gains of any gold junior on the planet. From 2c to 46c over six months, and recently back to 31c.

Sky Metals and Magmatic Resources, with an average market cap of ~$75 million, are reasonable comps to Kincora's $12 million pre-discovery valuation. All three are pre-maiden resource or confirmation of an economic discovery hole. Other exploration success stories in Australia, such as Greatland Gold, Legend Mining and Chalice Gold, also demonstrate the power of new discoveries. There's plenty of run room if management hits pay dirt. A drilling update is expected within a week or so.

There are fewer than two dozen gold/copper (or copper/gold) juniors that have flagship projects in NSW. All but three are Australian-listed. Kincora Copper (TSX-V: KCC) is a good way for North American investors to gain exposure to the LFB.

Kincora has ~$3 million in cash, strong drill targets, (derived from robust prior exploration efforts, plus new studies) and a tremendous management/technical team plus advisors. In addition to the tireless efforts since 2012 of Kincora's CEO Sam Spring {full bio here}, three additional world-class team members are actively involved, Independent Director & Chairman of the Technical Committee John Holliday, Senior VP Exploration Peter Leaman and Chairman Cameron McRae.

John Holliday has >30 years' experience in exploration, mostly with BHP and Newcrest Mining, including as chief geoscientist and general manager. He has been working with Kincora since 2015. John has a successful track record in global gold-copper exploration, discovery and evaluation. He was a principal discoverer of the Tier-1 Cadia gold-copper porphyry and Marsden copper-gold porphyry in the LFB, and a geological advisor on the acquisition of many significant projects. {full bio here}

Peter Leaman has >40 years' experience in exploration, mostly with BHP and PanAust Ltd., where he was regional exploration manager for SE Asia. He's a hands on, target-orientated leader responsible for project generation and managing exploration programs, resulting in notable discoveries including the Tier 1 Reko Diq porphyry Cu/Au deposit, Crater Mountain epithermal Au/Ag and the Mt. Bini (Kodu) porphyry Cu/Au deposits in Papua New Guinea, among others. {full bio here}

Cameron McRae is a very seasoned mining executive. He had a 28-year career with Rio Tinto and in Mongolia was president of Oyu Tolgoi and Rio Tinto's country director. McRae led the construction and start-up of the US$6 billin Oyu Tolgoi copper mine and was responsible for safety, strategy, operations and growth initiatives. He has led successful greenfield and brownfield projects, has deep commercial/M&A experience and has sat on numerous exploration and technical committees. {full bio here}

Truly a tremendous team with direct experience, in the right place, at the right time, especially for a company with such a modest enterprise value. As of April 22nd, phase 1 drilling at Trundle has commenced. This phase includes a six hole/~3,800-meter (~630 meters/hole) program, testing three large mineralized zones at greater depths.

The company expects this program to be "high impact, value-add drilling," as Trundle has "excellent potential for new high-grade porphyry & skarn copper-gold discoveries."

Regarding the drill program, John Holliday and Peter Leaman commented,

"Modern systematic exploration at Trundle has utilized industry leading IP surveys, including HPX's proprietary Typhoon system, and magnetic modeling which has been insufficiently followed up by drilling. Existing significant drill intersections support vectoring to very compelling targets at existing mineralized systems within a brownfield environment to Northparkes, Australia's second largest porphyry mine where five deposits are defined."

Trundle is 30 km west of CMOC's Northparkes copper-gold project, Australia's second largest porphyry mine (behind Newcrest's Cadia, also in the Macquarie Arc). CMOC acquired an 80% interest in Northparkes in 2013 for US$820 million and has since expanded production and extended the mine life.

Historically an important agricultural hub, substantially increased mining activity in the region has led to favorable infrastructure improvements (power, roads, rail, etc.. This will likely continue as iron ore giant Fortescue Metals ($34 billion market cap) has secured property, including parcels adjacent to Kincora's southern border of Trundle. Newmont, Gold Fields and Freeport-McMoRan are also exploring in the LFB.

The Trundle project hosts extensive evidence of porphyry and skarn-style copper-gold mineralization across 12.5 km strike length and shares some geological features with Northparkes and Cadia. Results of surface geological mapping, geochemistry, magnetic, gravity and IP coverage, coupled with structural and basement rock interpretations, have been promising.

Past drilling totaled 2,208 holes for 61,146 meters. Only limited modern exploration and very little deep drilling into basement rocks has been done. Importantly, over 92% of historical drilling has been to <50 meters in depth. Just 11 holes have been >300m (~0.5% of total holes drilled). Where the first hole is being drilled, the average drill hole depth is only 28 meters.

Shallow intercepts not followed up on include: [60m @ 0.54g/t Au from 1m], [56m @ 0.88g/t Au + 0.35% Cu from 34m, incl. 2m @ 20g/t Au + 7% Cu & 81g/t Ag from 64m depth], [39m @ 0.55 g/t Au + 0.14% Cu from surface], [35m @ 0.55 g/t Au + 0.25% Cu from 12m], [51m @ 0.58 g/t Au + 0.14% Cu from 33m], [58m @ 0.44 g/t Au + 0.17% Cu from 22m, including 4m @ 1.19g/t Au + 0.41% Cu from 28m]. Note: at spot Au prices, the avgerage grade of 0.6 g/t = nearly $50/tonne, which is good for these shallow depths. Additional high-grade hits, like the 2m @ 20g/t Au (with 7% Cu) would gain a lot of attention in the currently hot gold market.

Deeper core drilling has commenced at the Trundle Park zone on the southern end of the property. Management sees real potential for higher-grade porphyry and skarn copper-gold discoveries. Prior activities intersected, "high-grade localized zones, within a large lower-grade magnetite skarn, similar in style to the Big Cadia skarn, and peripheral to the Cadia porphyry copper-gold deposits."

Kincora is drilling three fences to test known mineralized porphyry targets analogous to the five identified deposits at Northparkes. Existing intercepts support vectoring to compelling drill targets at the existing systems. No drilling has taken place at the project since 2015, while the Mordialloc target hasn't seen drilling since 2008.

No drilling has yet tested below the zones, where geophysics and re-logging of historical data has indicated proximity to a porphyry source. Despite a lot of smoke, the potential source has yet to be found.

CEO Spring sums things up,

"With previous drill results, existing untested geophysical surveying and being in a brownfield environment, there's a strong argument that we have comparable, if not a bit more, smoke at Trundle than Alkane had before its breakthrough drill results at Boda. Boda is the best greenfield discovery in the belt in over 20 years and, before the pull back in the market because of COVID-19, was the catalyst for approximately A$400 million being added to Alkane's market cap in this rising gold price environment".

While there are no guarantees when it comes to high-impact exploration of Tier 1 assets, Kincora Copper (TSX-V: KCC) has the foundation for success and a cheap valuation, providing investors an interesting risk-adjusted return opportunity.

Peter Epstein is the founder of Epstein Research. His background is in company and financial analysis. He holds an MBA degree in financial analysis from New York University's Stern School of Business.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosures:

The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Kincora Copper, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Kincora Copper are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Kincora Copper was an advertiser on [ER] and Peter Epstein owned shares in the Company.

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he's diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

Streetwise Reports Disclosure:

1) Peter Epstein's disclosures are listed above.

2) The following companies mentioned in the article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Newmont Goldcorp, a company mentioned in this article.

Graphics provided by the author.

( Companies Mentioned: KCC:TSX.V, )

from https://www.streetwisereports.com/article/2020/05/15/kincora-copper-lands-in-one-of-hottest-copper-gold-regions-in-the-world-drill-results-soon.html

0 notes

Photo

Anota ai 📝 Empadinha Fit De Palmito 👌😉

Ingredientes (4 porções):

• 1 batata doce média;

• 1 colher de sopa de queijo cottage ou ricota;

• 2 colheres de sobremesa de palmito;

• 1 pitada de fermento;

• 2 claras de ovo;

• 4 forminhas de silicone.

Modo De Preparo:

• Cozinhe a batata doce normalmente. Depois de cozida retire a casca (é mais fácil retirar depois de cozida), misture com as claras de ovo e o fermento;

• Forre o fundo da forminha de silicone, faça um buraquinho e coloque o recheio;

• Coloque 1 colher de chá de queijo cottage e alguns pedaços de palmito, depois cubra com mais massa;

• Repita o procedimento nas 4 forminhas;

• Leve ao forno por mais ou menos 25 minutos. Pode fazer no microondas, mas não fica tão douradinho e firme.

Referência: Cozinha Fit

Gostou da Receita? Compartilhe com seus amigos :)

O que acha de baixar o Ebook Grátis 20 Receitas Fitness Para Ganhar Massa e Eliminar Gorduras? Então Clique Aqui:

➡ https://SegredoDefinicaoMuscular.com/ebook-gratis-20-receitas-fitness-para-ganhar-massa-e-queimar-gorduras-LFB

#boatarde#perdergordura#receitasfit#receitas#recipes#fit#receitafit#alimentação saudável#Estilodevidafitness#ComoDefinirCorpo#SegredoDefiniçãoMuscular

1 note

·

View note

Text

TORTA SALGADA DE MILHO e CALABRESA | Gourmet a dois - Receita de Liquidificador

TORTA SALGADA DE MILHO e CALABRESA | Gourmet a dois – Receita de Liquidificador

🔴 A Torta salgada caipira é uma opção de lanche prática e saborosa que chegou pro seu arraiá, mas cai bem o ano inteiro!

🍳 RECEITA COMPLETA MAIS ABAIXO ou NO LINK com rendimento e extras: http://ga2.me/rRl1d_2

—————————————-—————————-

🌎 ONDE ESTAMOS

• Instagram: http://ga2.me/lig

• Facebook: http://ga2.me/lfb

• Pinterest:

View On WordPress

0 notes

Text

Parlement: trois propositions de loi LR traitant de la santé examinées jeudi 11 octobre

Trois propositions de loi sur le thème de la santé, respectivement consacrées à l'avenir du système de santé, la consolidation du modèle français du don du sang et la création d'un répertoire des maladies rares ou orphelines, seront examinées en séance publique à l'Assemblée nationale, lors de la prochaine niche du groupe Les Républicains (LR) jeudi 11 octobre.

La commission des affaires sociales de l'Assemblée nationale examinera ces trois textes et d'éventuels amendements mercredi.

La proposition de loi la plus touffue est celle déposée fin août par Jean-Carles Grelier, qui vise à "l'orientation pour l'avenir de la santé" à travers 28 articles.

Elle traite de la prévention et de l'éducation à la santé, de la réforme des études médicales et paramédicales, de l'organisation des soins de ville, de la révision des négociations conventionnelles entre professionnels de santé libéraux et assurance maladie, et du financement du système de santé.

Un grand nombre de mesures ont pour but de renforcer l'action des pouvoirs publics en matière de prévention et d'éducation thérapeutique. Le député souhaite en faire "une grande cause nationale qui prendra la forme d’un plan pluriannuel d’action dénommé 'Objectif santé 2022'", dénomination quasiment reprise depuis par le gouvernement dans sa stratégie de transformation du système de santé baptisée "Ma santé 2022" (cf dépêche du 18/09/2018 à 16:08).

Le député suggère un élargissement des missions en ce sens pour Santé publique France, l'instauration d'une éducation obligatoire à la santé en milieu scolaire, un renforcement des actions de prévention et de dépistage par des professionnels de santé.

En matière de formation, un grand nombre de ses propositions ont déjà été entérinées par l'exécutif dans le cadre de "Ma santé 2022". Il veut revoir le mode de sélection en fin de première année commune des études de santé (Paces) en prenant en compte "la motivation" les "qualités personnelles d’empathie et de compassion" des étudiants, souhaite favoriser les stages au cours des études médicales et impliquer les patients dans la formation.

Il plaide aussi pour une universitarisation des formations paramédicales et leur intégration au cursus Licence-Master-Doctorat (LMD) et une spécialisation accrue en master 2 pour les infirmiers.

Il veut par ailleurs créer un nouveau diplôme d'études spécialisées (DESC) de "médecine polyvalente hospitalière". Ils seraient formés "notamment à la prise en charge dans les services d’aval post-urgences" (soins de suite et de réadaptation, médecine et chirurgie services de spécialités médicales d’organe ou services de psychiatrie).

La formation porterait aussi sur la "prise en charge des maladies chroniques lorsque l’intervention continue des spécialistes n’est pas nécessaire", "la prise en charge des patients en sortie de soins aigus lorsque le retour à domicile n’est pas conseillé", "l’accompagnement des patients en fin de vie", "la prise en charge globale médicale, psychologique et sociale", "l’organisation du retour à domicile" et "la participation au maintien à domicile".

En termes d'organisation des soins, il souhaite mailler le territoire de "villages de la santé" qui se distingueraient des communautés professionnelles territoriales de santé (CPTS) existantes en associant au réseau de professionnels "toutes les structures de soins mais également les structures médico-sociales du territoire".

Il propose par ailleurs de créer des "conférences territoriales de santé" au sein de chaque groupement hospitalier de territoire (GHT) "afin d’associer les établissements privés de soin et les professionnels de ville à la définition tant de la carte sanitaire que du projet de santé porté par le groupement".

Plusieurs mesures visent à "simplifier" l'exercice de la médecine libérale, notamment en supprimant notamment les stabilisateurs automatiques des dépenses d'assurance maladie qui repoussent de six mois toute revalorisation pour les professionnels de santé libéraux, et en instaurant une clause annuelle d'indexation tarifaire des actes médicaux.

S'agissant de la prise en charge, Jean-Carles Grelier suggère de fixer annuellement un panier de soins pour les contrats collectifs d’assurance complémentaire de manière à offrir à chaque salarié "un panier de garanties identique quelle que soit la taille de l’entreprise qui l’emploie".

Renforcer le don du sang et protéger le modèle éthique français

La deuxième proposition de loi, qui vise à "la consolidation du modèle français du don du sang", a été déposée par Damien Abad (LR, Ain) en mai et compte 7 articles.

Depuis une dizaine d'années, les acteurs du dispositif se mobilisent pour sauvegarder le modèle français qui repose sur un don bénévole, volontaire et non rémunéré, par opposition au modèle commercial retenu dans d'autres pays (cf dépêche du 07/06/2011 à 16:57 et dépêche du 21/02/2017 à 16:51).

Les trois principales caractéristiques du modèle français ont été réaffirmées en janvier dans le schéma directeur national de la transfusion sanguine: un don de sang anonyme, bénévole, volontaire et gratuit; un monopole de la collecte, de la préparation, de la qualification biologique du don et de la distribution des produits sanguins labiles (PSL) entre les mains de l’EFS; et une garantie de sécurité transfusionnelle optimale, grâce au lien développé entre la réalisation des examens immunohématologiques des receveurs de PSL et la délivrance de ces produits (cf dépêche du 02/01/2018 à 13:22).

La proposition de loi vise d'abord à renforcer la pratique de don de sang, en autorisant les salariés à s’absenter de leur lieu de travail 2 heures par semestre afin de pouvoir donner leur sang, sans interruption de salaire. Parallèlement, elle vise à abaisser de 18 à 16 ans l'âge légal pour pouvoir effectuer un don.

La deuxième partie du texte vise à la consolidation des institutions relatives au don du sang, en rappelant "les principes de sécurité, d’éthique et de gratuité du don du sang". Elle propose aussi de permettre aux citoyens qui le souhaitent de faire figurer leur groupe sanguin sur leur carte d'identité.

Ensuite, il est prévu d'établir "un contrôle sanitaire identique des MDS [médicaments dérivés du sang] provenant de l’étranger que ceux émanant du marché français", afin notamment de rétablir une égalité de traitement concurrentielle avec le Laboratoire français de fractionnement et des biotechnologies (LFB) qui dispose du monopole de la fracturation "éthique" des MDS en France, mais dont les produits sont davantage contrôlés.

La troisième proposition de loi, déposée en mars par Pierre Vatin (LR, Oise), vise à créer un répertoire des maladies rares ou orphelines qui listerait "pour chaque maladie les dérogations à la réglementation du fait des effets de ces affections".

Ainsi une personne souffrant de protoporphyrie érythropoïétique pourrait bénéficier plus rapidement par exemple d'une autorisation d’installer un vitrage surteinté dans sa voiture, en dérogation à la réglementation interdisant les vitrages surteintés, explique le député.

L'objectif serait de pouvoir l'enrichir en fonction de l’évolution des connaissances médicales, et des nouveaux cas concrets rencontrés par les personnes souffrant de ces maladies.

0 notes

Photo

LFB member Keimy pulling in a nice striper. Great job. Fish on my friend. #LFB Of Ma #Keimy #BassBandits #FishOn #2017

0 notes

Text

Kincora Copper Lands in One of Hottest Copper-Gold Regions in the World, Drill Results Soon

Source: Peter Epstein for Streetwise Reports 05/15/2020

Peter Epstein of Epstein Research explains why he is watching this explorer.

Given the widespread COVID-19 induced downturn, I struggled with the outlook for copper. I feared that like stock markets in March, the copper price might collapse. That didn't happen. Either due to producer discipline or governments halting operations, a fair amount of world supply has been curtailed indefinitely.

It may turn out that COVID-19 has as big an impact on supply as it does on demand. Copper is trading at US$2.35/lb, ~14% below its average price in 2019. So, not the end of the world.

I came to terms with Dr. Copper by learning that massive, multi-year, global stimulus packages are in the works. In total, probably US$10 or US$20 trillion over the next few years. Much of it will go to copper-intensive infrastructure projects. Furthermore, growing end market demand from the electrification of transportation remains in place.

But enough about copper, today's gold price is a BIGGER story, currently at US$1,740/oz, 25% above its average price in 2019. New discoveries that contain meaningful gold values will be handsomely rewarded.

In particular, discoveries in globally significant jurisdictions, made by world-class teams, on projects with tremendous blue-sky potential could generate substantial share price gains. With this in mind, I circle back to a small copper & gold story that has all the ingredients for an exciting discovery.

Could Kincora Copper Ltd. (KCC:TSX.V) be the comeback resource junior of the year? After a disappointing drill program in Mongolia, management switched gears, jumping on a compelling opportunity in Australia, just before new discoveries were made all around them. The company is currently drilling its Trundle project in New South Wales (NSW).

It's worth noting that Trundle is the only brownfield project in the area controlled by a listed junior. Kincora's enterprise value {market cap (C$12 million) + debt (zero) cash (C$3 million) = C$9 million/US$6.4 million.

Trundle is in an exploration hotspotthe Macquarie Arc (MA) of the Lachlan Fold Belt (LFB). The MA hosts major porphyry deposits, including Newcrest Mining's company-maker, underpinning it becoming Australia's largest gold miner, Cadia {913k ounces gold (2019) at AISC of US$ 132/oz net of credits}; Evolution Mining's flagship Cowal project {251.5k ounces gold (2019) at AISC of ~US$ 675/oz}; China Molybdenum's (CMOC) copper-gold Northparkes {~240k Au Eq ounces/year}; and Alkane Resources' Boda {discovery hole: 502 m at 0.48 g/t Au + 0.2% Cu}.

Kincora controls a district-scale 1,732 sq km land position in a few key belts within the MA. Management's first press release on its Australian activities was on November 21st. Since then, gold is up ~24% to over AUD$ 2,700/oz.a record price. There's also been significant drill program successes by peer LFB juniors {most notably, Alkane Resources, but also Sky Metals and Magmatic Resources}.

Alkane reported a blockbuster intercept at its Boda project; 96.8m @ 4 g/t Au + 1.52% Cu (~5.4 g/t Au Eq) from 768-meter depth. It also has a 3035k ounce/year producing gold mine and a market cap of ~C$400million. Alkane has the financial ability to aggressively drill out the Boda deposit. A follow-up second phase drill program leading to a maiden resource would be great news for Alkane and neighboring peers including Kincora Copper.

Sky Metals, with a market cap of ~$110 million, has two tin-tungsten-silver projects and two gold projects in the LFB. Its gold discovery really got the share price moving. Sky has some good intercepts, but nothing like Alkane's.

Magmatic Resources has a market cap of ~$50 million. It has land holdings in the LFB totaling 1,054 sq km vs. 1,732 sq km controlled by Kincora, and is a "nearlogy" exploration play to Alkane's Boda, as Kincora is to CMOC's Northparkes. Due in part to Alkane's success, Magmatic had one of the largest percentage gains of any gold junior on the planet. From 2c to 46c over six months, and recently back to 31c.

Sky Metals and Magmatic Resources, with an average market cap of ~$75 million, are reasonable comps to Kincora's $12 million pre-discovery valuation. All three are pre-maiden resource or confirmation of an economic discovery hole. Other exploration success stories in Australia, such as Greatland Gold, Legend Mining and Chalice Gold, also demonstrate the power of new discoveries. There's plenty of run room if management hits pay dirt. A drilling update is expected within a week or so.

There are fewer than two dozen gold/copper (or copper/gold) juniors that have flagship projects in NSW. All but three are Australian-listed. Kincora Copper (TSX-V: KCC) is a good way for North American investors to gain exposure to the LFB.

Kincora has ~$3 million in cash, strong drill targets, (derived from robust prior exploration efforts, plus new studies) and a tremendous management/technical team plus advisors. In addition to the tireless efforts since 2012 of Kincora's CEO Sam Spring {full bio here}, three additional world-class team members are actively involved, Independent Director & Chairman of the Technical Committee John Holliday, Senior VP Exploration Peter Leaman and Chairman Cameron McRae.

John Holliday has >30 years' experience in exploration, mostly with BHP and Newcrest Mining, including as chief geoscientist and general manager. He has been working with Kincora since 2015. John has a successful track record in global gold-copper exploration, discovery and evaluation. He was a principal discoverer of the Tier-1 Cadia gold-copper porphyry and Marsden copper-gold porphyry in the LFB, and a geological advisor on the acquisition of many significant projects. {full bio here}

Peter Leaman has >40 years' experience in exploration, mostly with BHP and PanAust Ltd., where he was regional exploration manager for SE Asia. He's a hands on, target-orientated leader responsible for project generation and managing exploration programs, resulting in notable discoveries including the Tier 1 Reko Diq porphyry Cu/Au deposit, Crater Mountain epithermal Au/Ag and the Mt. Bini (Kodu) porphyry Cu/Au deposits in Papua New Guinea, among others. {full bio here}

Cameron McRae is a very seasoned mining executive. He had a 28-year career with Rio Tinto and in Mongolia was president of Oyu Tolgoi and Rio Tinto's country director. McRae led the construction and start-up of the US$6 billin Oyu Tolgoi copper mine and was responsible for safety, strategy, operations and growth initiatives. He has led successful greenfield and brownfield projects, has deep commercial/M&A experience and has sat on numerous exploration and technical committees. {full bio here}

Truly a tremendous team with direct experience, in the right place, at the right time, especially for a company with such a modest enterprise value. As of April 22nd, phase 1 drilling at Trundle has commenced. This phase includes a six hole/~3,800-meter (~630 meters/hole) program, testing three large mineralized zones at greater depths.

The company expects this program to be "high impact, value-add drilling," as Trundle has "excellent potential for new high-grade porphyry & skarn copper-gold discoveries."

Regarding the drill program, John Holliday and Peter Leaman commented,

"Modern systematic exploration at Trundle has utilized industry leading IP surveys, including HPX's proprietary Typhoon system, and magnetic modeling which has been insufficiently followed up by drilling. Existing significant drill intersections support vectoring to very compelling targets at existing mineralized systems within a brownfield environment to Northparkes, Australia's second largest porphyry mine where five deposits are defined."

Trundle is 30 km west of CMOC's Northparkes copper-gold project, Australia's second largest porphyry mine (behind Newcrest's Cadia, also in the Macquarie Arc). CMOC acquired an 80% interest in Northparkes in 2013 for US$820 million and has since expanded production and extended the mine life.

Historically an important agricultural hub, substantially increased mining activity in the region has led to favorable infrastructure improvements (power, roads, rail, etc.. This will likely continue as iron ore giant Fortescue Metals ($34 billion market cap) has secured property, including parcels adjacent to Kincora's southern border of Trundle. Newmont, Gold Fields and Freeport-McMoRan are also exploring in the LFB.

The Trundle project hosts extensive evidence of porphyry and skarn-style copper-gold mineralization across 12.5 km strike length and shares some geological features with Northparkes and Cadia. Results of surface geological mapping, geochemistry, magnetic, gravity and IP coverage, coupled with structural and basement rock interpretations, have been promising.

Past drilling totaled 2,208 holes for 61,146 meters. Only limited modern exploration and very little deep drilling into basement rocks has been done. Importantly, over 92% of historical drilling has been to <50 meters in depth. Just 11 holes have been >300m (~0.5% of total holes drilled). Where the first hole is being drilled, the average drill hole depth is only 28 meters.

Shallow intercepts not followed up on include: [60m @ 0.54g/t Au from 1m], [56m @ 0.88g/t Au + 0.35% Cu from 34m, incl. 2m @ 20g/t Au + 7% Cu & 81g/t Ag from 64m depth], [39m @ 0.55 g/t Au + 0.14% Cu from surface], [35m @ 0.55 g/t Au + 0.25% Cu from 12m], [51m @ 0.58 g/t Au + 0.14% Cu from 33m], [58m @ 0.44 g/t Au + 0.17% Cu from 22m, including 4m @ 1.19g/t Au + 0.41% Cu from 28m]. Note: at spot Au prices, the avgerage grade of 0.6 g/t = nearly $50/tonne, which is good for these shallow depths. Additional high-grade hits, like the 2m @ 20g/t Au (with 7% Cu) would gain a lot of attention in the currently hot gold market.

Deeper core drilling has commenced at the Trundle Park zone on the southern end of the property. Management sees real potential for higher-grade porphyry and skarn copper-gold discoveries. Prior activities intersected, "high-grade localized zones, within a large lower-grade magnetite skarn, similar in style to the Big Cadia skarn, and peripheral to the Cadia porphyry copper-gold deposits."

Kincora is drilling three fences to test known mineralized porphyry targets analogous to the five identified deposits at Northparkes. Existing intercepts support vectoring to compelling drill targets at the existing systems. No drilling has taken place at the project since 2015, while the Mordialloc target hasn't seen drilling since 2008.

No drilling has yet tested below the zones, where geophysics and re-logging of historical data has indicated proximity to a porphyry source. Despite a lot of smoke, the potential source has yet to be found.

CEO Spring sums things up,

"With previous drill results, existing untested geophysical surveying and being in a brownfield environment, there's a strong argument that we have comparable, if not a bit more, smoke at Trundle than Alkane had before its breakthrough drill results at Boda. Boda is the best greenfield discovery in the belt in over 20 years and, before the pull back in the market because of COVID-19, was the catalyst for approximately A$400 million being added to Alkane's market cap in this rising gold price environment".

While there are no guarantees when it comes to high-impact exploration of Tier 1 assets, Kincora Copper (TSX-V: KCC) has the foundation for success and a cheap valuation, providing investors an interesting risk-adjusted return opportunity.

Peter Epstein is the founder of Epstein Research. His background is in company and financial analysis. He holds an MBA degree in financial analysis from New York University's Stern School of Business.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosures:

The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Kincora Copper, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Kincora Copper are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Kincora Copper was an advertiser on [ER] and Peter Epstein owned shares in the Company.

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he's diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

Streetwise Reports Disclosure:

1) Peter Epstein's disclosures are listed above.

2) The following companies mentioned in the article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Newmont Goldcorp, a company mentioned in this article.

Graphics provided by the author.

( Companies Mentioned: KCC:TSX.V, )

from The Gold Report - Streetwise Exclusive Articles Full Text https://ift.tt/2zH0G90

0 notes

Photo

Nova Receita Publicada http://receitasdatia.com.br/como-fazer/como-fazer-molho-caesar-cesar-gourmet-a-dois/

COMO FAZER MOLHO CAESAR (César) | Gourmet a dois

›› INSCREVA-SE NO CANAL e CURTA o vídeo: http://ga2.me/lyt

---------------› Receita e Descrição ‹---------------

Chegamos com um dos molhos mais saborosos para saladas: MOLHO CAESAR! ????

Você pode temperar esse molho em qualquer outro tipo de salada além da Caesar.

Lembrando que existem diversas versões do molho Caesar, algumas incluem anchovas, outras não. As variações desta receita são inúmeras, mas com certeza nossa versão é a mais saborosa! ????

• RECEITA COMPLETA MAIS ABAIXO ou NO LINK com rendimento e extras: http://ga2.me/

--------------------------------------------------------------------

›› ONDE ESTAMOS

• Website: http://ga2.me/

• Youtube: http://ga2.me/lyt

• Instagram: http://ga2.me/lig

• Facebook: http://ga2.me/lfb

• Pinterest: http://ga2.me/lpi

--------------------------------------------------------------------

›› CONTATO: [email protected]

• • • • • • • • • • • • • • • • • • • • • • • • • • • •

• QUER NOS ENVIAR ALGO?

›› Caixa Postal 18042

›› Rio de Janeiro / RJ

›› 20720-970

-- (NUNCA utilize destinatário - somente como está acima)

--------------------------------------------------------------------

•••••• RECEITA COMPLETA ••••••••

MODO DE PREPARO

1. Picar 1 anchova em conserva

2. Em um pote, acrescentar 1 gema, ½ colher chá mostarda, 1 colher sopa suco limão, ½ colher chá alho bem amassado e a anchova picada

3. Misturar com fuet

4. Regar lentamente com 75 ml de óleo de girassol batendo até incorporar

5. Misturar ⅓ xícara queijo parmesão ralado

6. Servir com alface americana e crouton (Como Fazer Crouton: youtu.be/DLEXhsaUcjE)

Para informações relacionadas e passos detalhados desta receita, acesse: http://ga2.me/

Quer nos patrocinar? Acesse: http://gourmetadois.com/

0 notes

Photo

Nova Receita Publicada http://receitasdatia.com.br/como-fazer/pudim-de-croissant-receita-dos-deuses-gourmet-a-dois/

PUDIM DE CROISSANT (Receita dos deuses!) | Gourmet a dois

›› INSCREVA-SE NO CANAL e CURTA o vídeo: http://ga2.me/lyt

---------------› Receita e Descrição ‹---------------

Sabe aquele famoso pudim de pão da vovó? No vídeo de hoje a gente te mostra como ele pode ficar ainda mais gostoso feito com CROISSANT! ????

Obs: o sabor é dos deuses, mas relaxa que o preparo é tão fácil que qualquer humano é capaz de fazer! ????

• RECEITA COMPLETA MAIS ABAIXO ou NO LINK com rendimento e extras: http://ga2.me/

--------------------------------------------------------------------

›› ONDE ESTAMOS

• Website: http://ga2.me/

• Youtube: http://ga2.me/lyt

• Instagram: http://ga2.me/lig

• Facebook: http://ga2.me/lfb

--------------------------------------------------------------------

›› CONTATO: [email protected]

• • • • • • • • • • • • • • • • • • • • • • • • • • • •

• QUER NOS ENVIAR ALGO?

›› Caixa Postal 18042

›› Rio de Janeiro / RJ

›› 20720-970

-- (NUNCA utilize destinatário - somente como está acima)

--------------------------------------------------------------------

•••••• RECEITA COMPLETA ••••••••

2 colheres sopa manteiga

6 croissants em pedaços

⅓ xícara passas brancas

1 ¼ xícara creme de leite fresco

1 ¼ xícara leite

4 ovos

½ colher chá canela em pó

⅓ xícara açúcar

MODO DE PREPARO

1. Untar uma assadeira de 20 cm com manteiga

2. Espalhar os pedaços de croissants, cobrir com as passas e cobrir com a outra metade dos croissants

3. Misturar em um pote os ovos, a canela e açúcar, creme de leite e leite.

4. Regar a mistura de leite e esperar 30 minutos para os pães absorverem o líquido.

5. Colocar a assadeira dentro de um tabuleiro e regar água quente no tabuleiro até alcançar dois dedos de altura

6. Assar a 180C (forno médio) por 30 minutos

7. Servir com chantilly ou sorvete de creme

Para informações relacionadas e passos detalhados desta receita, acesse: http://ga2.me/XXXXXXX

Quer nos patrocinar? Acesse: http://gourmetadois.com/

0 notes

Photo

Anota aí 📝 Bolinhos Sem Glúten 👌😉

Ingredientes:

• 1/2 batata doce cozida amassadinha;

• 1 ovo inteiro;

• 1 banana prata amassadinha;

• 1 colher de sopa de aveia em flocos sem glúten;

• 1 colher de sobremesa de óleo de coco;

• Uma pitadinha de fermento;

• 1 colher de sopa de whey de chocolate sem glúten.

Modo De Preparo:

• Mistura tudo e pronto! rsrsrs

• Coloque nas forminhas e leve ao forno elétrico por 15 minutos a 180 graus;

• Forno convencional também pode. Microondas uns 2 minutos;

• Você pode colocar alfarroba ou pasta de amendoim integral por cima na hora de servir, mas é opcional!

Referência: Cozinha Fit

Gostou da Receita? Compartilhe com seus amigos :)

O que acha de baixar o Ebook Grátis 20 Receitas Fitness Para Ganhar Massa e Eliminar Gorduras? Então Clique Aqui:

➡ https://SegredoDefinicaoMuscular.com/ebook-gratis-20-receitas-fitness-para-ganhar-massa-e-queimar-gorduras-LFB

#boanoite#goodnight#receitasfit#receitas#recipes#fit#receitafit#alimentação saudável#Estilodevidafitness#ComoDefinirCorpo#SegredoDefiniçãoMuscular

0 notes

Photo

Nova Receita Publicada http://receitasdatia.com.br/como-fazer/ovo-de-pascoa-recheado-brownie-churros-doce-de-leite-e-pacoca-gourmet-a-dois/

OVO DE PÁSCOA RECHEADO: Brownie, Churros, Doce de Leite e Paçoca | Gourmet a dois

›› INSCREVA-SE NO CANAL e CURTA o vídeo: http://ga2.me/lyt

---------------› Receita e Descrição ‹---------------

Dessa vez nos superemos, resolvemos fazer um COMBO de Páscoa... Antes que você fale: "ah, vai ficar doce.... demais, eca!" pelo contrário, se você seguir todas as nossas receitas dos recheios, vai ver que não vai ficar doce assim, tudo com chocolate 70% e o único doce mesmo é a paçoca. Faça, experimente, se divirta e compartilhe.

• RECEITA COMPLETA MAIS ABAIXO ou NO LINK com rendimento e extras: http://ga2.me/

--------------------------------------------------------------------

›› ONDE ESTAMOS

• Website: http://ga2.me/

• Youtube: http://ga2.me/lyt

• Instagram: http://ga2.me/lig

• Facebook: http://ga2.me/lfb

• Snapchat: http://ga2.me/lsc

--------------------------------------------------------------------

›› CONTATO: [email protected]

• • • • • • • • • • • • • • • • • • • • • • • • • • • •

• QUER NOS ENVIAR ALGO?

›› Caixa Postal 18042

›› Rio de Janeiro / RJ

›› 20720-970

-- (NUNCA utilize destinatário - somente como está acima)

--------------------------------------------------------------------

•••••• RECEITA COMPLETA ••••••••

Você pode preferir comprar todas as partes prontas, masssss não vai ser original.. 😛 Faça como quiser, mas se quiser falar para os amigos e familiares que você quem fez, aqui vão as receitas, fica tudo muito bom:

- Como temperar chocolate para OVOS: https://youtu.be/1xSdukts1qI

- Como fazer Brownie gostoso: https://youtu.be/OAStC97su6U

- Como fazer Churros delicioso: https://youtu.be/JEPLxsMwZME

- Como fazer Doce de Leite rápido: https://youtu.be/kXuaScUU4CY

- Como fazer Paçoca caseira: https://youtu.be/0KHYPSa78g0

MODO DE PREPARO

Siga os passos do vídeo para compor as camadas.

Para informações relacionadas e passos detalhados desta receita, acesse: http://ga2.me/

Quer nos patrocinar? Acesse: http://gourmetadois.com/

0 notes

Photo

Receita Rápida De Bacalhau Com Açafrão e Tomate, Nutritivo e

Muito Gostoso!

Ingredientes:

• 4 filés de bacalhau fresco e sem pele;

• 2 colheres (sopa) de azeite de oliva extra virgem;

• 2 dentes de alho finamente fatiados;

• 1/2 colher (chá) de pimenta vermelha em flocos;

• 400 g de tomates pelados inteiros;

• 1/4 xícara (chá) de vinho branco seco;

• 2 folhas de louro;

• 1 pitada de fios de açafrão;

• Sal a gosto;

• Pimenta preta moída na hora.

Modo De Preparo:

• Em uma frigideira aqueça o azeite em fogo médio;

• Adicione o alho e a pimenta e mexa até perfumar, mas sem deixar queimar o alho;

• Junte os tomates, esmagando com as mãos, coloque o vinho, o louro e o açafrão;

• Acrescente 1/2 xícara (chá) de água e deixe ferver, abaixe o fogo e cozinhe por cinco a sete minutos;

• Tempere com sal e pimenta e abaixe o fogo;

• Tempere os filés de bacalhau com sal e pimenta, acomode-os na frigideira e tampe;

• Deixando cozinhar até a carne do peixe ficar firme e opaca, de cinco a 10 minutos;

• Sirva em seguida.

*Você pode utilizar óleo de coco, manteiga ou banha no lugar do azeite, o gosto vai mudar e você pode dar uma variada.

Referência: Lucilia Diniz