#LIFO Method

Explore tagged Tumblr posts

Text

Understanding the Kübler-Ross Change Curve in the Workplace

Understanding the reactions of employees is essential for leaders and businesses to be able to manage change efficiently. One of the models that helps to understand the emotional process of change is the Kubler - Rose Change Curve

0 notes

Text

Periodic Inventory Systems my beloathed

#accounting#literally why#I hate this#it’s almost as bad as the LIFO method#wtf why is that a thing#weighted average or FIFO ONLY please#college

0 notes

Text

Nate Silver at Silver Bulletin:

A fellow Substacker messaged me the other day to ask why President Trump’s approval rating had been so resilient despite problems in the economy and elsewhere. I argued that it hadn’t been, really. In our approval rating tracker, Trump started out at a +11.6 net approval rating, a much better opening number than in his first term. But now, he’s in the red at -2.2. So there’s actually been a fair amount of movement:

From the first full day of his presidency, Jan. 21, through yesterday — March 21: conveniently exactly two months later — Trump’s net approval rating has declined by 13.8 points, so around 7 points per month. A president can’t afford that rate of decline for long. Extrapolate out the trend, for instance, and Trump would be at a -27.6 by July 21, a -51.2 on Nov. 21, and so forth. Fortunately for Trump, that’s not how any of this works — and such crude linear extrapolation will almost certainly lead to bad predictions. There are two reasons for this. First, the decline he’s experienced is quite typical for new presidents. Let’s start the clock on Feb. 1 rather than Jan. 21, though, since approval rating polling is often sparse very early in a president’s term. Here’s how the past five presidents before Trump — including Trump himself in his first term — saw their numbers trend between Feb. 1 and March 21 during their first year in office.2 If you squint, you might say that Trump’s decline is a bit worse than average — but really only a bit. A president’s disapproval rating typically increases early on, partly because some voters who were initially on the fence and say they were undecided, perhaps out of a sense of hopefulness for a new president, instead begin to tell pollsters they disapprove of his performance. That’s been true for Trump 2.0, as it has been for all recent presidents. Sometimes, a president’s approval rating is relatively unaffected, however: his disapprovers come out of the woodwork, but his supporters stay with him. In this case, however, Trump has also lost some support among voters who supported him earlier on: his approval rating has declined by a couple of points. Considering he only won the election by 1.7 points in the tipping-point state, Pennsylvania, it’s at least plausible that he wouldn’t win a rematch against Kamala Harris today — although that’s holding Harris’s numbers constant when instead Democrats' numbers have also cratered. Voters are in a grumpy mood toward everybody in politics these days.3 Also, there’s reason to think Trump has a relatively high approval floor. The country is highly divided, and Trump’s supporters are passionate, even if they now constitute a slight minority of the country. In our historical approval numbers, Trump’s first term featured among the lower average approval ratings (41.7 percent, based on the final number at the end of each day of his term) but also the narrowest spread of any presidential term since the dawn of approval ratings. Judged by the 95th percentile range of his daily numbers4, Trump’s approval numbers had a floor of 37.8 but a ceiling of 45.0 during his first term. It fluctuated, but not by much. And now Trump is even more of a known commodity: he’s been the dominant figure in American politics for almost a decade now.

[...]

Where Trump might be vulnerable

If Trump’s numbers get worse, it by definition means that some groups of voters turn on him. So which groups might those be? One theory is Last In, First Out (LIFO): that the most recent converts to Trump will be among the first to abandon him. Roughly three groups come to mind here:

Young voters. Trump actually won young voters overall in 2024 in some cuts of the data. (Keep in mind that there’s no hard-and-fast way to know: all methods for breaking down election results by demographic groups rely on statistical extrapolation or polling.) In other data sources, Harris did — though by much narrower margins than Democrats typically attain, and she probably lost young men even if she won among young women. But young voters are less partisan than older ones, and notoriously fickle and influenced by social media trends. And keep in mind that an 18-year-old who voted for Trump last year was just 10 years old at the start of Trump’s first term. It wouldn’t be the first time that teenagers initially support a trendy product to piss off their parents but then get a sense of buyer’s remorse.

Hispanic Americans, Asian Americans and Black men. These groups also shifted heavily toward Trump, though there’s some debate about the magnitude of the change among Black voters. (It’s pretty clear that Black men have increasingly supported Trump, but polls differ on whether Harris gained or lost ground among Black women as compared to Biden in 2020.7) In my predictions column just after the inauguration, I basically operated on the assumption that the recent trend toward racial depolarization — increasingly, Democrats are holding their own among white voters while losing ground among minorities, meaning that the racial gap is narrowing — might actually be a robust one. Black and Hispanic voters are sometimes described as having had “loyalty” to Democrats: I’m not sure I love that framing, but once loyalty is gone, it can be hard to get back. Moreover, most of the shift has been among younger Black, Hispanic and Asian American voters, for whom the Civil Rights Era is now at least two generations removed. But, we’ll see: there’s something to the LIFO theory, too.

Riverian types. What in the heck do I mean by this term? It comes from my book, and it loosely refers to Silicon Valley and Wall Street, but more broadly to a community (“the River”) of quantitative types who are competitive and risk-tolerant. And generally also highly successful financially; these are elites, part of the literal 1 percent. Because of that, they have only a trivial direct influence on election results (especially since many of them live in New York or California) and approval rating numbers. But they can influence them indirectly through their financial leverage and their media presence. I’ve argued recently that there’s some reason to expect a shift among this group, especially Wall Street types who didn’t take Trump’s tariff threats seriously enough. Within Silicon Valley, meanwhile, there’s a lot of groupthink, even if Silicon Valley thinks of itself as contrarian relative to the rest of society. So you could plausibly see some preference cascades. Maybe these elites are side-eying one another and saying: is this really what we wanted? And is Elon OK? But they’re reluctant to be the first ones to speak out. Once some do, however, others will follow. This would be sort of the reverse of the process that played out from 2021-2024, as Silicon Valley elites became increasingly vocal about their opposition to wokeness and other things they associate with progressives and Democrats.

But LIFO might not be right; sometimes the new converts are the most passionate ones, after all. The more radical possibility would be that Trump instead loses support among his base, the white working class.

Nate Silver wrote in his Silver Bulletin Substack that Trump’s 2nd term could have more polling downsides.

3 notes

·

View notes

Text

Mastering LIFO Liquidation: Strategies to Avoid Tax Surprises

🌍 In the world of finance and accounting, inventory management isn’t just about keeping track of products—it’s a strategic game that can shape a company’s bottom line. For businesses using the Last-In, First-Out (LIFO) method, the act of liquidating inventory isn’t just a routine operation; it’s a moment that can either save or sink them. Imagine a small retailer, let’s call her Sarah, who’s been…

0 notes

Text

Looking for inventory management software? Here’s what you should look for

Overview

Inventory management is essential to your product-based business and is not merely a back-office chore. Having the appropriate accounting system can make the difference between running a small warehouse and shipping orders out of your garage. In this post, we’re diving into what actually matters when choosing accounting software for inventory management—real-world features that save you time, money, and maybe even your sanity.

Introduction

You know the drill. You get a surge of orders, and things look great… until you realize your best-selling product is out of stock. Now you're emailing customers, refunding payments, and digging through spreadsheets trying to figure out what went wrong.

It's time to upgrade if that sounds like your daily routine. Not your warehouse, not your team—your software. A good accounting system doesn’t just handle the numbers; it keeps your inventory in check, gives you visibility, and lets you make smart decisions without the stress.

Let’s break down what to actually look for:

1. Real-Time Inventory Tracking

Picture this: a customer makes a purchase, and your inventory refreshes on its own. There's no need for you to do anything. No need for double entries. No more old spreadsheets.

That’s what real-time tracking does. It keeps you in the loop 24/7. Look for tools that sync with your sales channels—Amazon, Shopify, Etsy, whatever you use—and reflect changes instantly. It’s the difference between proactive and reactive inventory management.

2. Automatic COGS Calculation

You can’t improve what you can’t measure. The cost of Goods Sold (COGS) tells you whether you’re actually making money or just moving products.

The right accounting software calculates COGS in the background. It knows what you paid, includes shipping and fulfillment, and keeps your margins accurate. That’s crucial when you’re trying to scale and not just survive.

3. Support for Multi-Channel Sales

Selling on one platform is simple. Selling on three? That’s where things get messy—unless your software can bring it all together.

Great accounting tools unify your sales data from every platform into one clean dashboard. You don’t have to reconcile Shopify with eBay and Amazon manually. You just log in, and it’s all there. Clear. Synced. Actionable.

4. Inventory Valuation Flexibility

FIFO, LIFO, weighted average—these aren’t just accounting terms. They affect how your profits look on paper and how you plan inventory.

Good software doesn’t force you into one method. It gives you options—and the flexibility to switch if your business model evolves. That’s important when costs, demand, and strategy are constantly shifting.

5. Smart Stock Notifications

Running out of stock feels like stepping on a rake. So does realizing you’ve been holding on to dead inventory for months.

Smart software warns you before those things happen. Low-stock alerts, slow-mover reports, even reorder suggestions—it’s like having an inventory manager built into your system.

6. User-Friendly Dashboards

You shouldn’t need an accounting degree to understand your software.

Clean, intuitive dashboards mean you can glance at your numbers and know where things stand. The best tools prioritize usability. You’re busy—you need info, not friction.

7. Reports That Drive Action

Reports are more than rows and columns. They tell you things you didn't know before and help you make vital choices.

Think of sales trends, top-selling SKUs, shrinking margins, or inventory turnover. The best software turns raw data into insights you can actually use.

8. Scalability You Can Count On

Today, you’re selling from your home office. Tomorrow? Who knows. You might add new product lines, warehouses, or marketplaces.

Your accounting software should keep up. That means it should handle more SKUs, users, integrations, and workflows without breaking or slowing you down.

Conclusion

Inventory is messy. But the right software makes it easy to manage.

With the right bookkeeping software for small businesses, you’re not just tracking stock—you’re building a system that grows with you. One that gives you control, clarity, and breathing room.

Platforms like BDGAGSS, QuickBooks Online, Inventory, and Xero are built for exactly this kind of real-world complexity, so you can finally spend more time running your business and less time running reports.

Blogged by: BDGAGSS

0 notes

Text

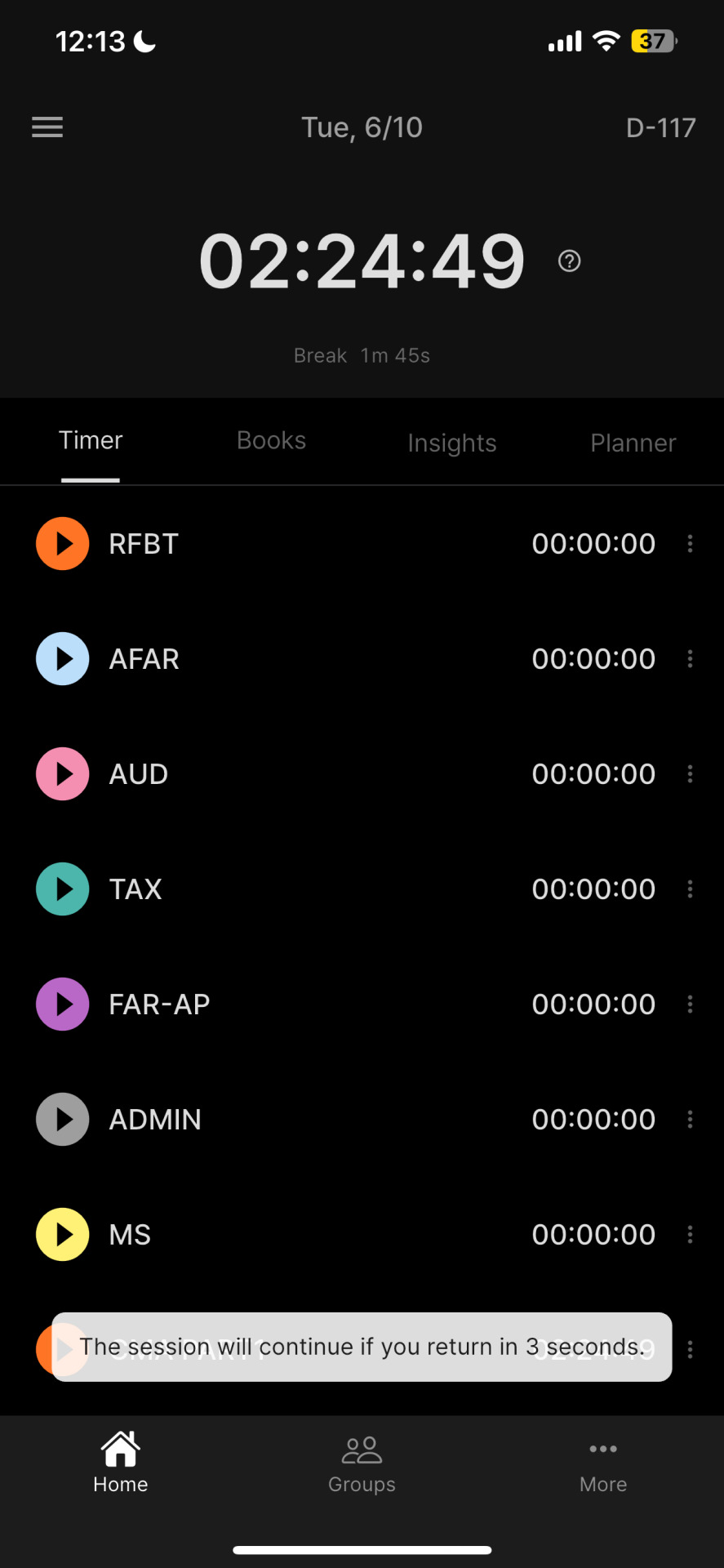

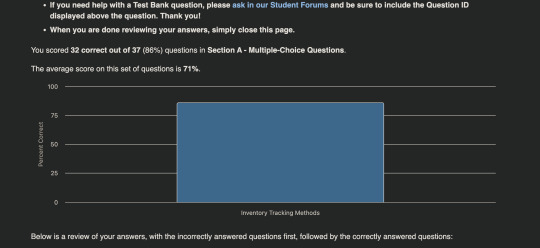

AAAA June 11, 2025

OMGGG SMALL WIN ULI - FIRST ATTEMPT PASADO MEDYO EASY PEASY PALA SA AKIN ANG INVENTORY TRACKING METHODS HAHAHHAHAH BA;T BA HIRAP NA HIRAP AKO DITO NUNG UNDERGRAD. MEDJ MAGASTOS LANG SA PAPEL PERO KEBS. medj mabagal din. HIGHER SANA ANG SCORE KUNG NAGBABASA KA LANG NG INSTRUCTIONS. Mani nalang ang perpetual weighted average at ang LIFO KAHIT FIRST TIME AKSJDAJKSHD

Nagpapatugtog pa ako ng 2017-2018 kpop kanina hahahhaha distracted na ako ng lagay na to ha

0 notes

Text

What is the Average Costing Method?

Inventory valuation is a critical component of financial accounting. It directly impacts the cost of goods sold (COGS), taxable income, and financial reporting. Among the various inventory valuation techniques used globally, the Average costing method stands out for its simplicity and reliability. Whether you're a small business owner, accountant, or financial consultant, understanding this method can offer clear insights into better inventory and financial management.

In this blog, we’ll explore the average costing method in detail—how it works, when to use it, its benefits and drawbacks, and how expert accounting services in California can help you implement it effectively.

What is the Average Costing Method?

The average costing method, also known as the weighted average cost method, is an inventory valuation technique that assigns an average cost to each unit of inventory at the time of sale. This average is calculated by taking the total cost of goods available for sale and dividing it by the total number of units available.

For example, if a company buys 100 units of a product at $5 each and another 100 units at $10 each, the average costing method would assign a cost of $7.50 to each unit ($1500 ÷ 200 units). When the company sells a unit, it uses this average cost instead of the actual cost of individual items.

How Does the Average Costing Method Work?

To use the average costing method, follow these steps:

Determine Total Inventory Cost: Add up the cost of all inventory items purchased or manufactured during a specific period.

Calculate Total Units Available: Count all the units that are available for sale.

Compute the Weighted Average Cost per Unit: Divide the total cost by the total number of units.

Apply the Average Cost to Inventory Sold: Multiply the number of units sold by the average cost to determine the COGS.

This method is often used in perpetual and periodic inventory systems:

Perpetual System: The average cost is updated after every purchase.

Periodic System: The average cost is calculated at the end of the accounting period.

Businesses that require consistency and ease of calculation benefit from this streamlined method, and many rely on expert accounting services in California to maintain accurate records.

Why Choose the Average Costing Method?

There are multiple reasons why businesses opt for the average costing method over other techniques like FIFO (First-In, First-Out) or LIFO (Last-In, First-Out):

1. Simplicity

The average costing method is straightforward to understand and implement, especially with computerized accounting systems. Unlike LIFO or FIFO, it doesn’t require tracking individual batches of inventory.

2. Price Fluctuation Neutrality

This method smooths out price volatility. In industries where the price of raw materials fluctuates frequently, the average costing method offers a more stable and realistic cost assessment.

3. Compliance and Standardization

Many international accounting standards permit or encourage the use of the average costing method, especially in regions where LIFO is prohibited. Businesses using accounting services in California are often advised to use this method for both compliance and efficiency.

4. Suitable for Mass Production

If a business deals with a high volume of similar or indistinguishable goods, the average costing method provides an efficient way to manage inventory valuation.

Benefits of Using the Average Costing Method

Reduces Complexity: No need to match specific costs with individual items.

Stable Financial Reporting: Avoids drastic swings in COGS that can result from price spikes or dips.

Better Decision Making: Helps businesses make more informed pricing and purchasing decisions.

Lower Administrative Costs: Less time and fewer resources are required for tracking inventory.

Businesses that seek professional assistance from accounting services in California often discover that the average costing method helps streamline their inventory reporting and enhances audit readiness.

Limitations of the Average Costing Method

Despite its advantages, the average costing method is not suitable for every business. Here are a few drawbacks:

May Not Reflect Current Costs: In times of rapid price changes, the average cost may be outdated and misrepresent the actual cost of replacing inventory.

Lower Accuracy in Certain Industries: Businesses dealing with unique or high-value items (e.g., jewelry or custom products) may find more value in specific identification methods.

Incompatible with LIFO Rules: Companies operating internationally must ensure compliance with local accounting standards.

However, by working with professional accounting services in California, businesses can assess whether the average costing method fits their operational and financial models.

Practical Example of Average Costing Method

Let’s say a business purchases inventory three times during the month:

100 units at $10 = $1,000

200 units at $12 = $2,400

300 units at $14 = $4,200

Total cost = $7,600

Total units = 600

Average cost per unit = $7,600 / 600 = $12.67

If the company sells 250 units, then:

COGS = 250 × $12.67 = $3,167.50

The remaining inventory is:

(600 - 250) × $12.67 = 350 × $12.67 = $4,434.50

This calculation shows how the average costing method simplifies inventory valuation and ensures consistency.

Industries That Benefit from the Average Costing Method

While the average costing method is versatile, it’s particularly beneficial for:

Manufacturing Companies: Especially those producing standardized goods in bulk.

Retail Chains: Selling large quantities of similar items (e.g., clothing, electronics).

Food & Beverage: Where items are perishable and interchangeable.

Pharmaceuticals: Managing bulk drugs or generic products.

In California, companies across these sectors are increasingly relying on professional accounting services in California to implement the average costing method as part of their broader financial strategies.

Integration with Accounting Systems

Modern accounting software platforms like QuickBooks, NetSuite, or Xero offer built-in support for the average costing method. Businesses can automatically calculate average costs and integrate them with their inventory and sales modules.

For those unsure about setup or configuration, many accounting services in California provide support for:

Inventory module setup

Training and consultation

Real-time COGS tracking

Monthly reconciliations

With expert help, businesses can confidently adopt the average costing method while ensuring compliance and financial accuracy.

Average Costing Method vs. Other Costing Methods

Here’s a quick comparison to understand how the average costing method stacks up against alternatives:

Method Complexity Cost Accuracy Suitable For

Average Costing Method Low Medium Standardized goods, bulk production

FIFO Medium High (in inflation) Perishable inventory

LIFO Medium High (in deflation) Industries with rising prices

Specific Identification High Very High Unique, high-value items

For many small and mid-sized businesses, especially those leveraging accounting services in California, the average costing method strikes the perfect balance between ease of use and financial accuracy.

How Accounting Services in California Can Help

Businesses operating in a fast-paced and competitive market like California need accurate financial data to make strategic decisions. That’s where professional accounting services in California come into play.

Whether you're a startup, mid-size enterprise, or growing retail chain, here's how accounting experts can support you with the average costing method:

Evaluate if the method suits your inventory and industry

Configure accounting software to automate calculations

Provide training to internal staff on using the method effectively

Ensure compliance with GAAP or IFRS reporting standards

Perform audits and reconciliations to validate accuracy

Working with reputable accounting services in California ensures your inventory valuation process is not only streamlined but also scalable as your business grows.

Conclusion

The average costing method is a practical, efficient, and widely accepted inventory valuation technique that helps businesses maintain consistency and simplicity in their accounting practices. It’s particularly beneficial in environments where inventory is purchased frequently, and items are interchangeable.

By choosing the average costing method, businesses can:

Reduce administrative effort

Avoid drastic COGS fluctuations

Maintain compliance with accounting standards

However, like any accounting practice, successful implementation requires proper planning, tools, and expertise. That’s why partnering with professional accounting services in California can make a significant difference in how well this method serves your business.

If you're considering adopting the average costing method, don’t hesitate to consult with trusted accounting services in California to ensure you're on the right track.

0 notes

Text

How Successful Organizations Identify and Maximize Employee Strengths

In this blog we will discuss how successful companies recognize and leverage strengths of their employees to boost innovation, engagement and overall effectiveness.

0 notes

Text

Streamline Your Business with UDYOG Cloud ERP — Trusted ERP Software for Indian Companies

In a world where digital transformation is redefining business success, Indian companies need robust, flexible, and compliant tools to stay competitive. That’s where udyog Cloud based ERP Software in india steps in — a fully integrated, cloud-based ERP software built to meet the operational, regulatory, and growth needs of Indian businesses.

Built for Indian Businesses

With over 30 years of industry experience, UDYOG understands the unique challenges Indian companies face — whether it’s navigating complex GST and TDS regulations, managing multi-location operations, or driving efficiency across departments.

Unlike generic global ERP platforms, UDYOG Cloud based ERP Software in india is engineered for India’s business environment. It ensures seamless compliance with Indian tax laws, supports multiple GSTINs, and adapts easily to local business practices.

All-in-One ERP Platform

UDYOG Cloud Cloud based ERP Software in india brings together all the essential modules you need to run your business efficiently, all under one platform:

Finance & Accounting

Udyog Cloud based ERP Software in india Financial Accounting module is designed to empower Indian businesses with a comprehensive suite of tools that streamline financial management and ensure compliance with local regulations. It offers real-time financial reporting, enabling businesses to make informed decisions promptly. The module supports multi-currency transactions and includes features like automated invoicing, expense tracking, and cash flow management, which are crucial for maintaining accurate financial records. Additionally, it ensures seamless compliance with Indian tax laws, including GST and TDS, by automating tax calculations and filings. With its user-friendly interface and robust analytics, Udyog ERP’s Financial Accounting module helps businesses optimize their financial operations and drive growth.

Sales & Distribution

Udyog ERP’s Sales & Distribution module offers a comprehensive suite of tools designed to streamline the entire sales process, from initial inquiry to final delivery. Key features include Enquiry and Quotation Management, Order Processing, Pricing and Discount Management, and Credit Management. The module also integrates Customer Relationship Management (CRM) functionalities, enabling businesses to manage customer interactions effectively. By providing real-time insights and automating critical sales functions, Udyog ERP’s Sales & Distribution module enhances operational efficiency and supports informed decision-making.

Inventory & Warehouse Management

Udyog Cloud based ERP Software in india Inventory & Warehouse Management module offers a comprehensive solution for businesses aiming to optimize their inventory processes and warehouse operations. Designed to cater to the complexities of Indian industries, this module provides real-time tracking of stock levels across multiple locations, ensuring accurate inventory visibility and control. Key features include automated stock alerts for timely reordering, support for various inventory valuation methods such as FIFO and LIFO, and integration with barcode and RFID technologies for efficient stock handling. The system also facilitates batch processing, stock reservations, and label printing, streamlining warehouse activities and reducing manual errors. By integrating seamlessly with other ERP modules like procurement, sales, and production, Udyog’s Inventory & Warehouse Management ensures a cohesive approach to supply chain management, enhancing operational efficiency and decision-making capabilities for businesses

Manufacturing & Production

Udyog Software’s Manufacturing & Production module offers a comprehensive solution for managing end-to-end production processes. It includes features such as Bill of Materials (BOM) management, real-time production monitoring, material planning, automated purchase orders, and work order management. These tools enable manufacturers to optimize production planning, reduce operational costs, and ensure timely delivery of products. The module is designed to enhance efficiency and scalability, making it suitable for various manufacturing industries.

Cloud Advantage with Real-Time Access

UDYOG Cloud based ERP Software in india leverages the power of cloud technology to provide secure, real-time access to your business data from anywhere. This ensures seamless collaboration across multiple locations, reduces IT infrastructure costs, and keeps your system always updated with the latest compliance requirements — helping your business stay agile and efficient.

Highly Customizable and Scalable

UDYOG Cloud ERP is designed to adapt to your unique business needs with flexible customization options, allowing you to tailor workflows, reports, and modules effortlessly. Its scalable architecture supports growth seamlessly, whether you’re expanding locations, adding users, or diversifying operations — ensuring the software evolves alongside your business.

Proven Across Industries

UDYOG Cloud based ERP Software in india is trusted by over 2,000 Indian businesses across diverse sectors — including manufacturing, services, trading, energy, and export-import — thanks to its industry-specific features and flexible, scalable design that adapts to unique business needs.

In today’s fast-changing business landscape, companies that adopt agile, intelligent solutions will lead the way. UDYOG Cloud ERP is not just an ERP system — it’s a growth engine that helps Indian businesses unlock efficiency, drive innovation, and ensure total compliance.

Start your digital transformation today with UDYOG Cloud ERP. Visit www.udyogsoftware.com to learn more or request a free demo.

0 notes

Text

Industry-Specific Inventory Solutions: What Works Best for Your Business?

In today's fast-paced and competitive market, one-size-fits-all software solutions rarely meet the unique needs of every industry. This is especially true when it comes to inventory management. Whether you're running a retail store, a manufacturing plant, or a pharmaceutical company, having an industry-specific inventory management software can dramatically improve accuracy, efficiency, and profitability.

Let’s explore why industry-specific inventory solutions matter and how to choose the right one for your business.

Why Industry-Specific Inventory Solutions Matter

Generic inventory systems often lack the nuanced features needed for specific industries. For example:

A retail business needs real-time inventory updates across multiple sales channels.

A manufacturer requires tools to manage raw materials, work-in-progress items, and finished goods.

A healthcare provider needs strict batch tracking, expiration management, and compliance features.

Using a tailored system ensures your business can operate more smoothly and reduce the risk of errors, stockouts, or overstocking.

Key Features by Industry

Here’s a breakdown of what different industries typically require from inventory management software:

1. Retail Industry

Retailers operate in dynamic environments, often with multiple locations and online storefronts.

Key Features:

POS integration

Real-time stock updates

Multi-location inventory tracking

Barcode scanning

Sales analytics

2. Manufacturing Industry

Manufacturers deal with raw materials, production schedules, and quality control.

Key Features:

Bill of materials (BOM) management

Work-in-progress (WIP) tracking

Demand forecasting

Lot/batch tracking

Production scheduling

3. Healthcare & Pharmaceuticals

This sector requires high compliance with health regulations and precise stock handling.

Key Features:

Expiration date tracking

Batch/lot tracking

Regulatory compliance (FDA, ISO)

Automated replenishment alerts

Cold storage monitoring

4. Food & Beverage

Like pharmaceuticals, this industry deals with perishables and tight health regulations.

Key Features:

FIFO/LIFO inventory methods

Expiry and spoilage tracking

Recipe and portion management

Supplier management

Compliance with food safety standards

5. E-commerce

Online businesses need to handle rapid turnover, high order volume, and multiple platforms.

Key Features:

Multi-channel integration (Amazon, Shopify, etc.)

Order fulfillment automation

Real-time stock visibility

Returns and refunds management

Inventory sync across channels

How to Choose the Right Industry-Specific Solution

When selecting inventory software, consider these key steps:

✅ Assess Your Industry Needs

Start by listing your must-have features based on your specific operations.

✅ Scalability

Choose a system that can grow with your business—especially important for startups and expanding companies.

✅ Integration Capabilities

Ensure it integrates with your accounting, POS, CRM, and e-commerce platforms.

✅ Compliance and Security

If you're in a regulated industry, make sure the system meets the necessary compliance standards.

✅ Vendor Reputation

Select software from a vendor with proven experience in your industry and solid customer support.

Conclusion

Inventory Management Software is not a “one-size-fits-all” function. By investing in industry-specific inventory solutions, you gain tools tailored to your workflows, regulatory needs, and customer expectations. This targeted approach improves efficiency, accuracy, and ultimately, your bottom line.

Whether you're a retailer, manufacturer, or healthcare provider, the right inventory management software can be the backbone of your operational success.

0 notes

Text

What is Inventory Management? Benefits, Types, & Techniques

Inventory management is the systematic approach to sourcing, storing, and selling inventory, both raw materials and finished goods. It ensures the right stock quantity is in the right place at the right time. As businesses scale, this process evolves from basic stock tracking to complex systems governed by data-driven strategies and automation. Efficient inventory management minimizes waste, reduces holding costs, and elevates customer satisfaction.

At its core, inventory management maintains a delicate balance. Overstocking leads to inflated carrying costs and risk of obsolescence. Understocking, on the other hand, can result in missed sales, poor customer experience, and reputational damage. Mastering this balance is crucial for optimizing cash flow and operational efficiency.

Benefits of Inventory Management

Effective inventory management brings a host of advantages. Foremost, it improves order fulfillment rates by ensuring products are available when needed. It also streamlines warehouse operations, reducing the time and labor required for stock handling. Additionally, precise inventory tracking allows businesses to make informed purchasing decisions and avoid unnecessary expenditures.

Real-time insights into stock levels can also aid in demand forecasting. This proactive approach enables companies to prepare for seasonal fluctuations and market trends, thereby avoiding bottlenecks or surpluses. Moreover, robust inventory management reduces shrinkage caused by theft, misplacement, or administrative errors.

Enterprises leveraging Inventory Management Services gain a significant edge. These specialized services often include automation tools, integration with ERP systems, and AI-driven analytics to forecast demand and optimize inventory levels. This minimizes manual tasks and errors, while providing granular control over the entire supply chain.

Types of Inventory Management

Inventory management is not one-size-fits-all. Different business models call for different systems:

Periodic Inventory System: This method updates inventory records at specific intervals, often suited for smaller businesses with limited stock.

Perpetual Inventory System: Continuously updates inventory records in real time through barcode scanners or RFID technology.

Just-in-Time (JIT): A lean inventory strategy where materials are ordered and received only as needed in the production process.

Vendor-Managed Inventory (VMI): The supplier manages the inventory for the buyer, reducing the latter’s administrative burden.

Companies using Inventory Management Services can choose the model best aligned with their operational structure and strategic goals, allowing for customization and scalability.

Inventory Management Techniques

To maintain precision, businesses deploy various inventory techniques:

ABC Analysis: Segments inventory into three categories based on importance and consumption value ‘A’ being the most valuable, ‘C’ the least.

Economic Order Quantity (EOQ): A formula to determine the optimal order quantity that minimizes total inventory costs.

Safety Stock: Extra inventory kept on hand to prevent stockouts during unexpected demand spikes or supply chain delays.

FIFO and LIFO: First-In, First-Out and Last-In, First-Out are methods of inventory valuation that affect cost accounting and tax reporting.

For organizations seeking a competitive advantage, outsourcing to Inventory Management Services offers access to cutting-edge tools, expertise, and real-time analytics. This results in leaner operations, faster order cycles, and ultimately, a healthier bottom line.

In today’s hyper-competitive market, inventory is more than just goods on a shelf; it is capital in motion. Managing it with strategic finesse is no longer optional but vital.

0 notes

Text

What is the Average Costing Method?

Inventory valuation is a critical component of financial accounting. It directly impacts the cost of goods sold (COGS), taxable income, and financial reporting. Among the various inventory valuation techniques used globally, the Average costing method stands out for its simplicity and reliability. Whether you're a small business owner, accountant, or financial consultant, understanding this method can offer clear insights into better inventory and financial management.

In this blog, we’ll explore the average costing method in detail—how it works, when to use it, its benefits and drawbacks, and how expert accounting services in California can help you implement it effectively.

What is the Average Costing Method?

The average costing method, also known as the weighted average cost method, is an inventory valuation technique that assigns an average cost to each unit of inventory at the time of sale. This average is calculated by taking the total cost of goods available for sale and dividing it by the total number of units available.

For example, if a company buys 100 units of a product at $5 each and another 100 units at $10 each, the average costing method would assign a cost of $7.50 to each unit ($1500 ÷ 200 units). When the company sells a unit, it uses this average cost instead of the actual cost of individual items.

How Does the Average Costing Method Work?

To use the average costing method, follow these steps:

Determine Total Inventory Cost: Add up the cost of all inventory items purchased or manufactured during a specific period.

Calculate Total Units Available: Count all the units that are available for sale.

Compute the Weighted Average Cost per Unit: Divide the total cost by the total number of units.

Apply the Average Cost to Inventory Sold: Multiply the number of units sold by the average cost to determine the COGS.

This method is often used in perpetual and periodic inventory systems:

Perpetual System: The average cost is updated after every purchase.

Periodic System: The average cost is calculated at the end of the accounting period.

Businesses that require consistency and ease of calculation benefit from this streamlined method, and many rely on expert accounting services in California to maintain accurate records.

Why Choose the Average Costing Method?

There are multiple reasons why businesses opt for the average costing method over other techniques like FIFO (First-In, First-Out) or LIFO (Last-In, First-Out):

1. Simplicity

The average costing method is straightforward to understand and implement, especially with computerized accounting systems. Unlike LIFO or FIFO, it doesn’t require tracking individual batches of inventory.

2. Price Fluctuation Neutrality

This method smooths out price volatility. In industries where the price of raw materials fluctuates frequently, the average costing method offers a more stable and realistic cost assessment.

3. Compliance and Standardization

Many international accounting standards permit or encourage the use of the average costing method, especially in regions where LIFO is prohibited. Businesses using accounting services in California are often advised to use this method for both compliance and efficiency.

4. Suitable for Mass Production

If a business deals with a high volume of similar or indistinguishable goods, the average costing method provides an efficient way to manage inventory valuation.

Benefits of Using the Average Costing Method

Reduces Complexity: No need to match specific costs with individual items.

Stable Financial Reporting: Avoids drastic swings in COGS that can result from price spikes or dips.

Better Decision Making: Helps businesses make more informed pricing and purchasing decisions.

Lower Administrative Costs: Less time and fewer resources are required for tracking inventory.

Businesses that seek professional assistance from accounting services in California often discover that the average costing method helps streamline their inventory reporting and enhances audit readiness.

Limitations of the Average Costing Method

Despite its advantages, the average costing method is not suitable for every business. Here are a few drawbacks:

May Not Reflect Current Costs: In times of rapid price changes, the average cost may be outdated and misrepresent the actual cost of replacing inventory.

Lower Accuracy in Certain Industries: Businesses dealing with unique or high-value items (e.g., jewelry or custom products) may find more value in specific identification methods.

Incompatible with LIFO Rules: Companies operating internationally must ensure compliance with local accounting standards.

However, by working with professional accounting services in California, businesses can assess whether the average costing method fits their operational and financial models.

Practical Example of Average Costing Method

Let’s say a business purchases inventory three times during the month:

100 units at $10 = $1,000

200 units at $12 = $2,400

300 units at $14 = $4,200

Total cost = $7,600

Total units = 600

Average cost per unit = $7,600 / 600 = $12.67

If the company sells 250 units, then:

COGS = 250 × $12.67 = $3,167.50

The remaining inventory is:

(600 - 250) × $12.67 = 350 × $12.67 = $4,434.50

This calculation shows how the average costing method simplifies inventory valuation and ensures consistency.

Industries That Benefit from the Average Costing Method

While the average costing method is versatile, it’s particularly beneficial for:

Manufacturing Companies: Especially those producing standardized goods in bulk.

Retail Chains: Selling large quantities of similar items (e.g., clothing, electronics).

Food & Beverage: Where items are perishable and interchangeable.

Pharmaceuticals: Managing bulk drugs or generic products.

In California, companies across these sectors are increasingly relying on professional accounting services in California to implement the average costing method as part of their broader financial strategies.

Integration with Accounting Systems

Modern accounting software platforms like QuickBooks, NetSuite, or Xero offer built-in support for the average costing method. Businesses can automatically calculate average costs and integrate them with their inventory and sales modules.

For those unsure about setup or configuration, many accounting services in California provide support for:

Inventory module setup

Training and consultation

Real-time COGS tracking

Monthly reconciliations

With expert help, businesses can confidently adopt the average costing method while ensuring compliance and financial accuracy.

Average Costing Method vs. Other Costing Methods

Here’s a quick comparison to understand how the average costing method stacks up against alternatives:

Method Complexity Cost Accuracy Suitable For

Average Costing Method Low Medium Standardized goods, bulk production

FIFO Medium High (in inflation) Perishable inventory

LIFO Medium High (in deflation) Industries with rising prices

Specific Identification High Very High Unique, high-value items

For many small and mid-sized businesses, especially those leveraging accounting services in California, the average costing method strikes the perfect balance between ease of use and financial accuracy.

How Accounting Services in California Can Help

Businesses operating in a fast-paced and competitive market like California need accurate financial data to make strategic decisions. That’s where professional accounting services in California come into play.

Whether you're a startup, mid-size enterprise, or growing retail chain, here's how accounting experts can support you with the average costing method:

Evaluate if the method suits your inventory and industry

Configure accounting software to automate calculations

Provide training to internal staff on using the method effectively

Ensure compliance with GAAP or IFRS reporting standards

Perform audits and reconciliations to validate accuracy

Working with reputable accounting services in California ensures your inventory valuation process is not only streamlined but also scalable as your business grows.

Conclusion

The average costing method is a practical, efficient, and widely accepted inventory valuation technique that helps businesses maintain consistency and simplicity in their accounting practices. It’s particularly beneficial in environments where inventory is purchased frequently, and items are interchangeable.

By choosing the average costing method, businesses can:

Reduce administrative effort

Avoid drastic COGS fluctuations

Maintain compliance with accounting standards

However, like any accounting practice, successful implementation requires proper planning, tools, and expertise. That’s why partnering with professional accounting services in California can make a significant difference in how well this method serves your business.

If you're considering adopting the average costing method, don’t hesitate to consult with trusted accounting services in California to ensure you're on the right track.

0 notes

Text

How LIFO Inventory Accounting Saves Businesses Money During Inflation

Imagine you’re the owner of a bustling electronics store, and every week, the price of the latest smartphones jumps by 10%. Your inventory is a collection of gadgets bought at varying prices, and when you sell one, which cost do you use? This is where Last In, First Out (LIFO) enters the scene—a method that might feel counterintuitive at first but can be a game-changer for businesses navigating…

0 notes

Text

What is the Average Costing Method?

When it comes to managing inventory and determining profitability, the average costing method stands out as one of the most practical and widely used strategies, especially among small and medium-sized businesses. This method simplifies complex inventory processes and ensures consistency in financial reporting. But what exactly is the average costing method, and why is it beneficial for growing companies?

At Accounting Profitspear, we understand how vital it is for small businesses to adopt accurate and efficient accounting practices. Our team offers specialized accounting services for small business in California, helping clients apply the best inventory methods to match their operational needs.

Understanding the Average Costing Method

The average costing method—also known as the weighted average cost method—is an inventory valuation technique where the cost of goods sold (COGS) and ending inventory is determined using the average cost of all similar items in stock, regardless of when they were purchased.

Here’s how it works:

You calculate the total cost of inventory on hand.

Divide it by the total number of units available.

The resulting figure is the average cost per unit, applied to both sold and remaining inventory.

This simple yet effective approach is a cornerstone of the accounting services for small business in California offered by Accounting Profitspear, especially for businesses dealing with high-volume or fast-moving inventory.

Why Choose the Average Costing Method?

1. Simplicity in Record-Keeping

Compared to FIFO (First-In, First-Out) or LIFO (Last-In, First-Out), the average costing method eliminates the need to track individual batches of inventory. For small business owners, this can mean less administrative work and fewer errors.

2. Stability in Pricing

This method smooths out price fluctuations over time, giving a more consistent cost basis. That’s why many clients using our accounting services for small business in California opt for this method—especially those in retail, food services, or manufacturing.

3. Easy Integration with Accounting Systems

Most accounting software platforms support the average costing method, making it easy to automate calculations and generate accurate reports without manual input.

When to Use the Average Costing Method

The average costing method is particularly effective when:

Your inventory items are indistinguishable (like screws, grains, or liquids).

Purchase prices fluctuate frequently.

You prefer consistency in financial statements over matching current costs.

At Accounting Profitspear, our experts help determine whether this approach aligns with your business model. As a provider of premium accounting services for small business in California, we analyze your inventory flow, cash position, and tax implications to guide you toward the best choice.

Example of Average Costing in Action

Let’s break down a real-world scenario:

You purchase:

100 units at $10 = $1,000

200 units at $12 = $2,400

Total cost: $3,400 Total units: 300

Average cost per unit: $3,400 / 300 = $11.33

If you sell 150 units, the cost of goods sold is: 150 x $11.33 = $1,699.50

The remaining inventory is: 150 x $11.33 = $1,699.50

As simple as it seems, the correct implementation of this method can be critical—especially when preparing for tax filings or investor reports. That’s why our accounting services for small business in California include dedicated inventory management support tailored to your niche.

Tax and Reporting Implications

Using the average costing method has implications for your tax strategy and financial reporting:

More Predictable Profits: Smoothing price variations can lead to steadier gross margins.

Compliance-Friendly: It aligns well with GAAP (Generally Accepted Accounting Principles), making audits and due diligence easier.

Inventory Valuation Accuracy: Your books reflect a fair approximation of your true costs.

At Accounting Profitspear, we ensure that all tax filings reflect accurate inventory values—making us a trusted name in accounting services for small business in California.

Why Accounting Profitspear?

Whether you’re a startup or an established player, choosing the right accounting method can impact your cash flow, compliance, and business decisions. That’s where Accounting Profitspear brings unmatched value:

We personalize strategies, including the average costing method, to align with your financial goals.

We automate processes for better accuracy and time savings.

We provide full-service accounting services for small business in California, including inventory valuation, tax planning, and bookkeeping.

By leveraging our services, small businesses not only stay compliant but also unlock opportunities for smarter growth and financial forecasting.

Final Thoughts

Understanding the average costing method is more than just a technical necessity—it’s a smart move toward better decision-making and financial clarity. It’s ideal for businesses looking for simplicity, consistency, and compliance.

If you’re looking for expert guidance to manage your inventory and accounting more effectively, look no further than Accounting Profitspear. Our specialized accounting services for small business in California ensure your operations are streamlined and your books are accurate.

0 notes

Text

How ERP Software Helps in Inventory and Material Management?

Efficient inventory and material management is the backbone of any successful business — especially in manufacturing, distribution, and retail sectors. Without proper oversight, companies risk stockouts, overstocking, production delays, and ultimately, lost revenue. That’s where ERP (Enterprise Resource Planning) software steps in as a transformative solution.

Whether you’re running a large-scale manufacturing operation or a growing retail chain, ERP software can help you take control of your inventory and streamline material management from procurement to production. In this blog, we’ll explore how the Best ERP Solutions in India empower businesses to optimize stock levels, reduce costs, and enhance decision-making.

Why Inventory and Material Management Matters

Inventory management is more than just tracking products in a warehouse. It includes:

Monitoring stock levels

Managing raw materials and finished goods

Replenishing stock based on real-time needs

Avoiding overstock or understock scenarios

Ensuring smooth production cycles

Poor inventory control can lead to missed sales, higher carrying costs, and operational inefficiencies.

How ERP Software Improves Inventory and Material Management

1. Centralized Inventory Control

ERP software consolidates inventory data from various locations — multiple warehouses, stores, and suppliers — into a single dashboard. This unified view eliminates blind spots and helps managers make informed decisions quickly.

2. Real-Time Stock Visibility

With ERP, businesses gain real-time insights into current stock levels, item movements, and availability across the supply chain. This enables faster response to demand changes and reduces the chances of stockouts or overstocking.

3. Automated Reorder Management

ERP systems automate stock replenishment using Minimum and Maximum stock levels or Reorder Points (ROP). The software generates automatic Purchase Orders (POs) or Material Requests when inventory falls below threshold levels — ensuring smooth supply continuity.

4. Material Requirements Planning (MRP)

One of the key features in manufacturing ERP systems is MRP (Material Requirements Planning). It calculates what raw materials are needed, when they’re needed, and in what quantity — helping avoid production halts due to shortages.

If you’re searching for the Best ERP Software for Manufacturing Industry, make sure it includes robust MRP capabilities to streamline your entire production process.

5. Barcode and RFID Integration

Modern ERP systems integrate with barcode scanners and RFID technology, enabling fast and accurate inventory tracking during goods receipt, movement, and dispatch. This minimizes manual errors and enhances stock accuracy.

6. Batch, Lot, and Serial Number Tracking

For industries like pharmaceuticals, electronics, and food processing, ERP allows tracking of inventory using batch numbers, lot numbers, or serial numbers. This ensures compliance, traceability, and quality control.

7. Inventory Cost Optimization

ERP tracks inventory carrying costs, storage costs, and procurement costs, helping you identify excess inventory and optimize working capital. It also provides valuation methods like FIFO, LIFO, and weighted average.

Key Benefits of ERP in Inventory Management

Implementing ERP software for inventory and materials management offers:

Improved Stock Accuracy

Reduced Holding Costs

Faster Order Fulfillment

Lower Risk of Stockouts

Enhanced Production Planning

Data-Driven Forecasting

Choosing the Right ERP for Inventory and Material Control

To get the most out of ERP for inventory management, businesses should partner with the best ERP software company India has to offer — one that understands local business needs and compliance standards.

Look for ERP software that includes:

Real-time inventory tracking

Smart analytics and dashboards

Vendor and supplier integration

Mobile access for warehouse teams

Customizable workflows and alerts

Final Thoughts

Inventory and material management can make or break your business operations. With ERP software, businesses can gain complete control over their inventory — ensuring the right product is in the right place, at the right time, and in the right quantity.

Whether you’re a manufacturer, distributor, or retailer, implementing the Best ERP Solutions in India will not only improve operational efficiency but also boost profitability and customer satisfaction.

0 notes

Text

Understanding the Average Costing Method: A Guide for Small Business Owners

Managing inventory and calculating the cost of goods sold (COGS) can be complex, especially for small businesses that need to track their expenses closely. One approach to streamline inventory costing is the average costing method. This method offers simplicity and consistency, which makes it particularly beneficial for small business owners who want a clear overview of their financial health.

In this blog post, we'll break down what the average costing method is, how it works, its advantages and disadvantages, and why it might be the right choice for your business. We'll also explore how leveraging accounting services for small business in California can simplify the process—and how Accounting.Profitspear can help you implement the best practices in inventory accounting.

What is the Average Costing Method?

The average costing method, also known as the weighted average cost method, is an inventory valuation approach where the cost of inventory is averaged over time. Instead of tracking the exact cost of each item sold, this method calculates the average cost of all inventory items available during a period and applies that cost to each unit sold.

Formula:

Average Cost per Unit=Total Cost of Goods Available for SaleTotal Units Available for Sale\text{Average Cost per Unit} = \frac{\text{Total Cost of Goods Available for Sale}}{\text{Total Units Available for Sale}}Average Cost per Unit=Total Units Available for SaleTotal Cost of Goods Available for Sale

This cost is then used to calculate the cost of goods sold and the ending inventory value.

Example:

Suppose your business purchases 100 units at $10 each and later buys 100 more units at $14 each. The average cost per unit becomes:

(100×10)+(100×14)200=1000+1400200=2400200=12\frac{(100 \times 10) + (100 \times 14)}{200} = \frac{1000 + 1400}{200} = \frac{2400}{200} = 12200(100×10)+(100×14)=2001000+1400=2002400=12

So, each item is considered to cost $12, regardless of which batch it came from.

Why Use the Average Costing Method?

There are multiple reasons why small businesses opt for the average costing method:

1. Simplicity and Efficiency

This method removes the need to track specific purchase prices for each item, reducing administrative work. It’s ideal for businesses with high inventory turnover or when identical items are purchased at varying prices.

2. Consistency

By smoothing out price fluctuations, the average costing method ensures consistent valuation, avoiding the sharp swings in COGS seen in methods like FIFO (First-In-First-Out) or LIFO (Last-In-First-Out).

3. Fair Reflection of Inventory Value

Especially in times of moderate inflation, the average costing method provides a balanced view of your costs and inventory value.

Benefits of Average Costing for Small Businesses

For small businesses, particularly in dynamic markets like California, choosing the right inventory accounting method can significantly impact profitability and decision-making.

Here’s why the average costing method is often a smart choice:

- Reduces Complexity in Bookkeeping

Tracking costs using FIFO or LIFO can be challenging without specialized software. With the average costing method, calculations are easier, and record-keeping is streamlined. If you're working with accounting services for small business in California, professionals can automate this for you efficiently.

- Improves Forecasting and Budgeting

The consistency provided by the average costing method helps small business owners create more accurate forecasts and budgets.

- Ideal for Digital Platforms and E-commerce

If your business involves selling identical products online, the average costing method avoids the complexities of matching sales to specific inventory purchases.

Drawbacks to Consider

While the average costing method has many advantages, it's essential to be aware of its limitations:

1. Not Always Tax-Optimized

In times of rising prices, FIFO may result in lower taxes due to lower COGS, whereas average costing could result in higher taxable income.

2. May Not Reflect Real-Time Costs

If prices vary significantly, average costing might not accurately reflect the actual cost of the inventory sold or in stock.

The average costing method offers the best balance for small businesses prioritizing simplicity and consistency, especially when prices are relatively stable.

Choosing the Right Accounting Partner

Whether you're just starting or already managing a growing inventory, having expert support can make all the difference. This is where Accounting.Profitspear steps in.

We specialize in accounting services for small business in California, and we understand the unique challenges faced by local entrepreneurs. Our professionals can help you:

Select the best inventory costing method for your business.

Automate your bookkeeping using cutting-edge accounting software.

Remain compliant with California tax laws and federal regulations.

Focus on growth while we handle your financials.

Our tailored solutions ensure that you make informed decisions backed by accurate financial data.

Real-Life Use Case: Small Business in California

Let’s look at a hypothetical example:

Business Type: A boutique coffee shop in Los Angeles Inventory: Coffee beans, cups, napkins, baked goods Problem: Prices of supplies fluctuate weekly due to local supplier costs and market demand. Solution: By implementing the average costing method, the business was able to streamline monthly reporting, reduce discrepancies in inventory valuation, and improve profit forecasting.

Result: With the help of Accounting.Profitspear's accounting services for small business in California, the coffee shop saved over 15% in bookkeeping costs within the first three months and improved cash flow visibility.

Key Takeaways

The average costing method simplifies inventory valuation by averaging out the cost of goods available for sale.

It is particularly beneficial for small businesses with consistent or identical inventory items.

While it may not always reflect real-time price changes, it promotes consistency and simplifies bookkeeping.

Partnering with an expert like Accounting.Profitspear can enhance the efficiency of your accounting processes and ensure compliance and clarity.

Final Thoughts

Inventory costing is a critical part of financial management. The average costing method offers a reliable and straightforward solution for many small businesses. When paired with professional guidance, this method can become a powerful tool in your business’s financial toolkit.

If you're searching for expert accounting services for small business in California, look no further than Accounting.Profitspear. Let us help you make smarter financial decisions, streamline operations, and pave the way for long-term growth.

0 notes