#Legality of Algorithmic Trading in India

Explore tagged Tumblr posts

Text

Exploring the Legality of Algorithmic Trading in India

Algorithmic trading (algo trading) has transformed the operation of financial markets all over the world and the impact of it is also evident in India. Read more at Bigul.

Read more..

#Algorithmic Trading#Algorithmic Trading in India#Legality of Algorithmic Trading#Legality of Algorithmic Trading in India#algo trading#financial markets#operation of financial markets#Stock Brokers#guidelines for algorithmic trading#SEBI#algo trading app#bigul#algo trading india#algo trading platform#algo trading strategies#bigul algo#free algo trading software#algorithm software for trading#finance#bigul algo ideas#bigul execution algos#bigul algos#execution algos#bigul algo trading review#bigul algo trading#bigul algo trading app#bigul trading#bigul trading app#bigul trading platform#trading strategies

0 notes

Text

The Fragmented Future of AI Regulation: A World Divided

The Battle for Global AI Governance

In November 2023, China, the United States, and the European Union surprised the world by signing a joint communiqué, pledging strong international cooperation in addressing the challenges posed by artificial intelligence (AI). The document highlighted the risks of "frontier" AI, exemplified by advanced generative models like ChatGPT, including the potential for disinformation and serious cybersecurity and biotechnology risks. This signaled a growing consensus among major powers on the need for regulation.

However, despite the rhetoric, the reality on the ground suggests a future of fragmentation and competition rather than cooperation.

As multinational communiqués and bilateral talks take place, an international framework for regulating AI seems to be taking shape. But a closer look at recent executive orders, legislation, and regulations in the United States, China, and the EU reveals divergent approaches and conflicting interests. This divergence in legal regimes will hinder cooperation on critical aspects such as access to semiconductors, technical standards, and the regulation of data and algorithms.

The result is a fragmented landscape of warring regulatory blocs, undermining the lofty goal of harnessing AI for the common good.

youtube

Cold Reality vs. Ambitious Plans

While optimists propose closer international management of AI through the creation of an international panel similar to the UN's Intergovernmental Panel on Climate Change, the reality is far from ideal. The great powers may publicly express their desire for cooperation, but their actions tell a different story. The emergence of divergent legal regimes and conflicting interests points to a future of fragmentation and competition rather than unified global governance.

The Chip War: A High-Stakes Battle

The ongoing duel between China and the United States over global semiconductor markets is a prime example of conflict in the AI landscape. Export controls on advanced chips and chip-making technology have become a battleground, with both countries imposing restrictions. This competition erodes free trade, sets destabilizing precedents in international trade law, and fuels geopolitical tensions.

The chip war is just one aspect of the broader contest over AI's necessary components, which extends to technical standards and data regulation.

Technical Standards: A Divided Landscape

Technical standards play a crucial role in enabling the use and interoperability of major technologies. The proliferation of AI has heightened the importance of standards to ensure compatibility and market access. Currently, bodies such as the International Telecommunication Union and the International Organization for Standardization negotiate these standards.

However, China's growing influence in these bodies, coupled with its efforts to promote its own standards through initiatives like the Belt and Road Initiative, is challenging the dominance of the United States and Europe. This divergence in standards will impede the diffusion of new AI tools and hinder global solutions to shared challenges.

Data: The Currency of AI

Data is the lifeblood of AI, and access to different types of data has become a competitive battleground. Conflict over data flows and data localization is shaping how data moves across national borders. The United States, once a proponent of free data flows, is now moving in the opposite direction, while China and India have enacted domestic legislation mandating data localization.

This divergence in data regulation will impede the development of global solutions and exacerbate geopolitical tensions.

Algorithmic Transparency: A Contested Terrain

The disclosure of algorithms that underlie AI systems is another area of contention. Different countries have varying approaches to regulating algorithmic transparency, with the EU's proposed AI Act requiring firms to provide government agencies access to certain models, while the United States has a more complex and inconsistent approach. As countries seek to regulate algorithms, they are likely to prohibit firms from sharing this information with other governments, further fragmenting the regulatory landscape.

The vision of a unified global governance regime for AI is being undermined by geopolitical realities. The emerging legal order is characterized by fragmentation, competition, and suspicion among major powers. This fragmentation poses risks, allowing dangerous AI models to be developed and disseminated as instruments of geopolitical conflict.

It also hampers the ability to gather information, assess risks, and develop global solutions. Without a collective effort to regulate AI, the world risks losing the potential benefits of this transformative technology and succumbing to the pitfalls of a divided landscape.

2 notes

·

View notes

Text

AI and Investment Banking: How Artificial Intelligence is Reshaping the Future of Finance

Investment banking is experiencing a tech-driven transformation, and Artificial Intelligence (AI) is leading the charge. From deal origination to automated trading and compliance, AI is optimizing nearly every facet of the industry. For finance aspirants, this isn't just a trend—it’s a roadmap to the future.

If you're serious about breaking into this evolving field, enrolling in an investment banking course in Mumbai that incorporates AI and analytics training can be your best career move.

How AI is Transforming Investment Banking

1. Smarter Deal Origination with Predictive Analytics

AI-powered platforms are changing how banks source potential mergers and acquisitions. These systems crunch massive data sets—financial statements, market trends, and even news headlines—to flag promising targets with surgical precision.

🔍 Example: Goldman Sachs uses predictive models to evaluate which companies are likely to be involved in M&A deals based on industry trends and financial patterns.

2. AI-Enhanced Valuation and Risk Modelling

Traditional valuation models are being revamped with machine learning algorithms. AI doesn’t just speed up the due diligence process—it makes it smarter by identifying anomalies, inconsistencies, and even hidden risks in real-time.

This means faster, more accurate decision-making—something top investment banks now rely on for IPOs and leveraged buyouts.

3. Algorithmic Trading and Robo-Advisors

AI is deeply entrenched in capital markets through algorithmic trading. These AI bots execute trades at lightning speed, maximizing returns by analyzing market signals across the globe in real time.

At the same time, robo-advisors are democratizing wealth management, using AI to build customized investment portfolios for clients of all sizes.

4. AI in Compliance and Regulatory Tech (RegTech)

Investment banks face complex regulatory environments—and AI is making compliance easier and cheaper. RegTech uses AI to scan documents, monitor transactions, and flag suspicious activities, reducing the risk of hefty fines.

🛡️ Case in Point: JP Morgan’s COiN platform analyzes thousands of legal contracts in seconds, saving over 360,000 hours of manual work annually.

5. AI-Powered Client Relationship Management

AI is not just about efficiency—it’s also about personalization. Investment banks use AI to track client behavior, predict their investment needs, and personalize interactions—making client engagement smarter and more data-driven.

Ethical Concerns and Limitations

Despite its many benefits, AI raises key questions:

Bias in models: AI algorithms can unintentionally reinforce existing biases.

Data privacy risks: Handling large volumes of sensitive financial data requires robust cybersecurity.

Job displacement: As AI automates routine tasks, traditional roles are being reshaped or replaced.

However, this also opens new doors for professionals who understand both finance and AI.

Why AI Literacy Is a Must for Aspiring Investment Bankers

The future of investment banking lies at the intersection of finance, data, and technology. Employers are looking for candidates who not only know valuation models but also:

Use Python or R for data analysis

Understand machine learning basics

Know how to visualize financial data

To gain this blended expertise, a specialized investment banking course in Mumbai can give you a strategic advantage. Courses that offer live projects, case studies, and exposure to tools like Excel, Tableau, and Bloomberg Terminal help bridge the gap between academics and the fast-evolving industry needs.

India’s AI-Driven Finance Boom: The Local Advantage

In India, the fusion of AI and finance is picking up speed. Leading firms like ICICI Securities and Axis Capital are already using AI to enhance decision-making. With Mumbai as the financial capital, the demand for AI-ready investment bankers is rising sharply.

So, if you’re based in or near Mumbai, you’re at the epicenter of India’s AI-finance revolution. And with the right training, you can capitalize on this momentum.

Conclusion

Artificial Intelligence is no longer a futuristic concept—it’s reshaping investment banking in real-time. From optimizing deal flows to transforming how trades are executed, AI is the force driving the next wave of financial innovation.

If you're aiming to break into this dynamic field, now is the perfect time to equip yourself with the right skills. Enrolling in a top-tier investment banking course in Mumbai will help you gain not only foundational finance knowledge but also the AI edge you’ll need to thrive in the future of banking.

0 notes

Text

Trying to Really Understand This Stock Market Thing, Okay?

The stock market can seem like a really big and complicated place, full of numbers and words that don't always make sense right away. But when you break it down, it's mostly about people trying to grow their money over time. Today, I wanted to think more deeply about how to find good people to ask for help, and explore some of the tools that are available to make sense of it all.

Finding Someone Good and Trustworthy to Ask for Stock Advice: The Importance of a SEBI Registered Investment Advisor

When you're thinking about where to put your hard-earned money, you naturally want to feel confident in the advice you're getting. In India, if you're looking for help with your investments in the stock market, it's crucial to understand the role of sebi registered investment advisors. What this registration signifies is that these professionals have gone through a vetting process with SEBI, the Securities and Exchange Board of India, which is the regulatory body for the stock market here. They are bound by certain codes of conduct and are meant to act in your best financial interest.

Seeking stock market advisory from a sebi registered investment advisor offers a layer of trust and accountability. Unlike individuals who may simply offer opinions, a sebi registered investment advisor has the credentials and the legal obligation to provide advice that is suitable for your specific financial situation and goals. Before making any investment decisions, consulting with a sebi registered investment advisor can provide clarity and help you navigate the complexities of the market with greater confidence. You can usually verify their registration details on the official SEBI website, which is a step I always recommend.

Using Technology to Navigate the Market: Exploring Trade Ideas

In today's fast-paced world, technology plays a significant role in stock trading and analysis. There are various platforms and tools designed to help investors make more informed decisions. One such tool that often comes up in discussions among traders is Trade Ideas.

Trade Ideas is essentially a sophisticated software platform that continuously scans the stock market in real-time. It uses a wide range of algorithms and pre-defined filters to identify potential trading opportunities based on various technical and fundamental criteria, as well as unusual trading activity. For someone trying to understand the market or even actively trade, Trade Ideas can be invaluable. It helps to sift through the vast amount of data available and highlight stocks that are exhibiting specific characteristics that might be of interest.

For instance, Trade Ideas can alert users to stocks that are breaking out of certain price patterns, experiencing a surge in volume, or showing other technical signals. While it doesn't provide direct financial advice, it acts as a powerful filtering tool, helping investors to narrow their focus and conduct further research on potentially interesting stocks. Understanding how to use a tool like Trade Ideas can be a significant advantage in keeping up with the market's constant movements.

My Thoughts on Getting Started

Trying to understand the stock market and make informed decisions about where to invest can feel like a big undertaking. However, by understanding the importance of seeking guidance from a sebi registered investment advisor and leveraging the power of tools like Trade Ideas, the journey can become a bit clearer. It's about combining expert knowledge with technological assistance to navigate the complexities and work towards your financial goals.

What are your initial thoughts on the potential benefits of using a tool like Trade Ideas in your own exploration of the stock market?

0 notes

Text

Netherex Pro Review – Scam or Legitimate Crypto Trading Platform

NetherexPro has become a prominent player in the ever-evolving realm of digital finance, where automated trading systems are becoming the standard. Particularly for individuals looking into choices in areas like Netherex Pro Kenya, this review of NetherexPro attempts to thoroughly examine the platform—how it functions, its salient features, and its legality. As interest in AI-powered trading grows, it's critical to determine if NetherexPro is a genuine product or merely another overhyped one.

👉 Open Your Netherex Pro Account Now

📌 What is Netherex Pro?

Netherex Pro is a modern, AI-powered auto-trading platform that allows users to invest in cryptocurrencies, forex, and CFDs with minimal effort. The platform combines machine learning and algorithmic trading to help users place smarter trades in real time.

It’s designed for users with no prior experience, offering automation, a clean dashboard, and multiple risk-adjustment tools. The question remains: Is NetherexPro the real deal or just another trading gimmick?

🧠 How Netherex Pro Works

Registration – Sign up with basic details in under 5 minutes.

Verification – Submit KYC documents for account approval.

Deposit Funds – Minimum initial deposit is $250.

Set Strategy – Choose from Conservative, Balanced, or Aggressive.

Activate AI Auto-Trade – Let the bot analyze and trade for you.

Withdraw Profits – Withdrawals are typically processed within 24–48 hours. Netherex Pro Review

🔑 Key Features of Netherex Pro

🤖 AI-Powered Trade Engine

Utilizes predictive modeling, historical trends, and real-time market signals to identify profitable trades automatically.

💱 Multi-Asset Trading

Trade assets across:

Cryptocurrencies (BTC, ETH, XRP, SOL)

Forex pairs (USD/EUR, GBP/JPY)

Commodities & Indices

🧪 Demo Account

Explore and test strategies with virtual funds in a risk-free environment.

🛡️ Regulated Broker Integration

Netherex Pro works with regulated third-party brokers, offering secure access to markets.

📲 Web-Based Interface Netherex Pro App

No downloads required. Access your account from any browser or mobile device.

👉 Open Your Netherex Pro Account Now

✅ Pros and ❌ Cons

✅ Pros

Beginner-friendly interface

High win-rate AI predictions (claimed up to 88%)

Demo mode for practice

24/7 automated trading

Fast and simple withdrawal process

❌ Cons

Not available in all regions (e.g., U.S., CA)

No mobile app (web-only as of 2025)

Profits not guaranteed — markets still carry risk

📈 Is Netherex Pro Profitable?

Many users report consistent returns, especially when using the balanced strategy. While not a guaranteed profit machine, Netherex Pro Platform AI engine provides a statistical edge in volatile markets.

Example Reported ROI:

Tip: Always start with demo mode to understand the system before going live. Netherex Pro Bitcoin Trading App

👥 User Testimonials

“I started with $250 and tested it for 2 weeks. The AI was shockingly accurate. Definitely not a scam.” – Ravi M., India

“Love the simplicity. I don’t need to analyze charts anymore — it’s handled automatically.” – Elena T., Spain

“Withdrawal was smooth. Took about 36 hours to reach my account.” – Carlos F., Mexico

⚠️ Is Netherex Pro a Scam?

✅ No, Netherex Pro is not a scam.

Registered partnerships with regulated brokers

Offers demo trading for testing without risk

Enforces KYC and AML compliance

Provides full transparency in trade reports

However, due diligence is always advised. Avoid platforms asking for additional off-site deposits or non-verifiable apps.

👉 Open Your Netherex Pro Account Now

🧾 How to Get Started with Netherex Pro

Sign Up on the official website

Verify Identity to comply with KYC

Deposit Funds ($250 minimum)

Choose Risk Mode

Activate Live Trading

Track Performance in real-time

💡 Pro Tip: Use the demo mode first to learn the platform risk-free.

💬 Frequently Asked Questions (FAQ)

❓ What is Netherex Pro?

Netherex Pro is an AI-based auto-trading software that trades on behalf of users using real-time data and predictive analytics.

❓ Is Netherex Pro Legit or a Scam?

Netherex Pro is legit. It partners with licensed brokers and uses encryption and compliance measures to protect users.

❓ How much money can I make? Netherex Pro Scam

Earnings vary. With a balanced risk setting, users report 5–10% weekly returns, though markets are never risk-free.

❓ Can I withdraw my funds anytime?

Yes. Withdrawals are typically processed within 24 to 48 hours, depending on your payment method.

❓ Is there a mobile app?

Currently, there is no official app, but the platform is fully mobile responsive.

❓ Do I need experience to use Netherex Pro?

Not at all. The system is designed for complete beginners, with automation handling trade execution.

👉 Open Your Netherex Pro Account Now

🧠 Final Verdict – Should You Use Netherex Pro in 2025?

✅ YES — if you’re looking for a beginner-friendly AI trading tool.

Netherex Pro brings powerful automation, reasonable success rates, Netherex Pro Crypto Platform and user-centered features that appeal to both beginners and passive investors. While it's not without flaws, its strengths make it a top contender in the 2025 automated trading space.

#Netherex Pro#NetherexPro#Netherex Pro Review#Netherex Pro App#Netherex Pro Bitcoin Trading App#Netherex Pro Platform#Netherex Pro Scam#Netherex Pro Crypto Platform

1 note

·

View note

Text

Quanttrix: Best Algo Trading Software in India

Quanttrix: The Best Algo Trading Software in India (2025)

Ever wished you could trade in the stock market without constantly watching charts or stressing over when to buy or sell? What if you had a smart assistant that could do all the work for you—flawlessly, quickly, and without emotions?

Welcome to the world of Quanttrix—widely recognized as the best algo trading software in India today. If you’re looking for automation that feels like magic but works with solid logic, this is where your journey begins.

Discover why Quanttrix is the best algorithmic trading software India offers. Simple, smart, and powerful—perfect for every trader.

What is Algo Trading?

Algo trading, or algorithmic trading, means using software to automate your trades based on pre-set rules. Instead of manually buying and selling stocks, you tell the system, “Hey, buy if this happens, and sell if that happens.” The software then watches the market and follows your instructions without a single yawn or coffee break.

Why Quanttrix is Making Headlines

Quanttrix has emerged as a game-changer. It’s not just another trading platform—it’s a fully equipped trading assistant that combines smart design with powerful automation. It’s no surprise many call it the best algorithmic trading software India has today.

What makes Quanttrix different? It speaks your language, adapts to your needs, and puts simplicity and control in your hands.

How Quanttrix Works (In Everyday Language)

Imagine you have a friend who never sleeps, watches the stock market 24/7, and makes decisions based purely on logic. You give them a clear plan: “If this stock goes below ₹100, buy. If it crosses ₹110, sell.” And they follow it exactly, without second-guessing.

That’s Quanttrix.

It lets you:

Create a trading strategy

Set your conditions (like price, volume, time)

Let the software run it for you automatically

You can relax, go for a walk, or even sleep—Quanttrix keeps working.

Top Features of Quanttrix

Here’s why so many traders are switching to Quanttrix:

No Coding Needed – Build strategies visually, like stacking blocks.

Real-Time Execution – Trades happen instantly when your conditions are met.

Backtesting – Test your idea using past data to see how it would have performed.

Smart Alerts – Get notified when something important happens.

Broker Integration – Connects easily with top Indian brokers.

Clean Interface – Easy to understand, even if you're not tech-savvy.

Why It’s the Best Algo Trading Software in India

Quanttrix ticks all the right boxes:

✅ Beginner-Friendly: You don’t need to be a programmer or finance expert.

✅ Reliable: Built with robust systems and great uptime.

✅ Fast Execution: Your trades won’t miss the moment.

✅ Customizable: From simple to complex strategies, it handles them all.

That’s why when people search for the best algo trading software in India, Quanttrix is at the top of the list.

Who Should Use Quanttrix?

Whether you're:

A first-time trader wanting to automate simple trades

A full-time investor looking for precision and speed

A strategy creator testing advanced models

Quanttrix is for you. It fits like a glove, no matter your experience level.

Getting Started with Quanttrix

Starting is easy:

Sign Up on the Quanttrix website.

Choose Your Plan based on your needs.

Connect Your Broker (like Zerodha, Upstox, etc.)

Build Your Strategy using their intuitive dashboard.

Go Live or Test First using their built-in backtesting tool.

No hidden steps. No confusing tech jargon.

Quanttrix vs. Traditional Trading Platforms

Feature

Quanttrix

Traditional Platform

Automation

✅ Yes

❌ Manual

Strategy Builder

✅ Visual & easy

❌ Not available

Backtesting

✅ Built-in

❌ Limited or none

Speed

✅ Instant

❌ Slower reactions

Accessibility

✅ User-friendly

❌ Often complex

Traditional platforms are like using an old calculator. Quanttrix? It’s like handing your trades to a smart AI assistant.

How Safe and Legal is Algo Trading in India?

Great news: Algo trading is legal and regulated in India.

Quanttrix operates within SEBI-approved frameworks and works only with registered brokers. Your data is secure, and your trades are fully compliant.

Just make sure you understand the basics and trade responsibly.

User Experience and Support

Users love Quanttrix for:

Friendly UI – No technical clutter

Responsive Support – Fast responses via chat and email

Tutorials & Help Center – Learn at your own pace

Need help? Their team’s got your back—whether you’re stuck setting up a strategy or connecting your broker.

Real-Life Example: A Day with Quanttrix

Ravi, a working professional, wanted to invest but didn’t have time to stare at charts. He set up a strategy on Quanttrix: Buy NIFTY when it dips 2%, sell when it rebounds 3%.

He went to work, had meetings, and came home to find his strategy had already executed, made a small profit, and sent him a neat summary via email.

All while he was offline. That’s Quanttrix in action.

How Much Does Quanttrix Cost?

Quanttrix offers flexible plans:

Free Tier: For beginners to test and learn

Premium Plans: For more trades, more features, and full automation

You pay for what you use—no tricks, no surprises.

And honestly, for the time and stress it saves, it pays for itself pretty quickly.

Tips Before You Start Trading with Quanttrix

Start Small: Don’t jump in with your full capital.

Backtest First: Always test strategies before going live.

Stay Informed: Watch webinars or read updates.

Use Stop Losses: Don’t skip risk protection settings.

Experiment: Try different ideas to see what works best.

The Future of Algo Trading in India

With tools like Quanttrix, algo trading is becoming more accessible. It's no longer just for big institutions or tech-savvy experts. Everyday people are now using it to grow their wealth, manage their trades, and reduce stress.

Quanttrix is leading this revolution—and it’s just getting started.

Conclusion – Let Quanttrix Work for You

If you’ve ever felt overwhelmed by trading, or just wished for more control and smarter decisions, Quanttrix is your answer.

It’s smart, user-friendly, and powerful enough to handle any trading strategy you throw at it. That’s why it’s not just any tool—it’s the best algorithmic trading software India has to offer in 2025.

Don’t just trade harder. Trade smarter—with Quanttrix.

FAQs

What makes Quanttrix the best algo trading software in India? It combines ease of use, advanced features, fast execution, and no-code strategy building—all in one place.

Do I need to know coding to use Quanttrix? Not at all! Quanttrix is designed for everyone—even if you've never written a single line of code.

Is Quanttrix suitable for beginners? Absolutely. It has a clean, simple interface and helpful tutorials for first-time users.

Can I test my trading strategy before going live? Yes! Quanttrix offers powerful backtesting tools to test your strategy using historical data.

Is algo trading with Quanttrix legal in India? Yes. Quanttrix operates within SEBI guidelines and works only with approved brokers.

0 notes

Text

Choosing the Top Law Firm in India: What Businesses and Startups Must Know

In today’s fast-paced and highly regulated business environment, having the right legal partner can make a significant difference in your company’s success. Whether you are a growing startup or an established enterprise, legal issues are inevitable, from contract negotiations and intellectual property (IP) protection to compliance and litigation. This is why choosing one of the top law firms in India is not just a good decision, it’s a critical one.

But how do you know which law firm is right for your business? Here’s a comprehensive guide on what businesses and startups must consider when selecting the best legal partner, especially if you're seeking an expert IP law firm in India or a full-service legal team.

Understanding Your Business Needs

Before choosing a law firm, it's essential to understand your specific legal requirements. Are you looking for help with business formation, intellectual property rights, contract drafting, or regulatory compliance? A startup might need guidance with fundraising and IP registration, whereas an established business may require assistance with mergers, acquisitions, or international trade laws.

Being clear about your legal priorities will help you identify firms that specialize in those areas and can deliver the most value.

Key Criteria for Choosing a Top Law Firm in India

Here are the main factors businesses should evaluate while looking for legal counsel:

1. Expertise and Specialization

Not all law firms offer the same services. Some may specialize in litigation, while others focus on corporate law or IP law. For example, if you’re a tech startup developing proprietary software or a product-based company launching a new brand, working with an experienced IP law firm in India becomes essential. They can help you protect your innovations through patents, trademarks, copyrights, and licensing agreements.

2. Reputation and Track Record

Always check the firm’s track record. The top law firms in India usually have a strong reputation for handling high-profile or complex cases successfully. Look for client testimonials, industry recognition, and a history of working with companies similar to yours.

3. Industry Knowledge

A law firm that understands the nuances of your industry can provide more targeted and effective legal advice. For instance, legal needs vary significantly between industries like fintech, healthcare, manufacturing, and e-commerce. Choose a firm that stays updated on regulatory trends and has worked with clients in your domain.

4. Scalability and Resources

As your business grows, your legal needs will expand. Whether you’re expanding into new markets, acquiring companies, or facing legal disputes, you need a firm that can scale its services with you. A top-tier firm with a well-rounded team can offer end-to-end support across various legal domains.

5. Communication and Accessibility

Startups and smaller businesses often overlook the importance of clear communication. Your legal partner should be responsive, easy to reach, and capable of explaining complex legal concepts in simple terms. A strong working relationship with your legal team fosters trust and efficiency.

Why IP Law Matters for Startups and Businesses

Intellectual property is often one of the most valuable assets a company owns. For startups especially, innovation is the backbone of their competitive edge. Whether it's a unique algorithm, branding, design, or product, protecting these assets through the right legal channels is crucial.

Choosing a top IP law firm in India ensures that your intellectual property is properly filed, monitored, and defended when needed. It also ensures that your business avoids common pitfalls like IP infringement, which can result in costly legal battles or business interruptions.

IP law firms not only help in securing trademarks and patents but also assist in licensing, technology transfers, and dispute resolution—all of which can have a lasting impact on your business success.

Legal Support Beyond Just Compliance

Apart from regulatory compliance, law firms can be strategic partners in decision-making. A reliable legal advisor can support business negotiations, advise on liability issues, help secure investor funding with the right legal framework, and ensure that your contracts protect your interests.

For startups, legal guidance from the early stages can prevent future complications. From founders’ agreements to investor term sheets and employee contracts, having the right legal structures in place from the start can save time, money, and reputation later.

Selecting the right legal partner isn’t just about ticking boxes. It’s about finding a team that understands your vision, aligns with your goals, and brings the expertise you need to grow confidently in a competitive marketplace. Whether you’re a startup protecting a groundbreaking idea or a business expanding across borders, the right legal advice is your foundation for sustainable success.

If you’re searching for trusted legal guidance across corporate and intellectual property law, Royzz & Co. stands as a reliable choice among the top law firms in India, especially renowned as a leading IP law firm in India offering strategic legal solutions tailored to modern business needs.

Disclaimer:

This site or article is for informational purposes only and does not constitute an advertisement or solicitation. It does not create an attorney-client relationship between you and Royzz & Co., nor is it intended to provide legal advice on the topics presented. We recommend that readers seek professional legal counsel for the same or for any such specific situations or on such related topics. Further, links to external websites do not imply endorsement or affiliation, and Royzz & Co. is not responsible for the content or information on these sites.

#law firm in mumbai#top law firms in India#ip law firms in india#law firm#law firms#top law firms#legal services#ip law firms

0 notes

Text

How CFA Professionals Are Shaping the Future of Fintech

The pace of evolution of finance is no longer limited to trading floors and investment banks. With digital transformation impacting every nook of the industry, the juncture of finance with technology—Fintech—has today become one of the dynamic and opportunity-rich sectors. For candidates pursuing a CFA course in Bengaluru or already having the CFA title, the fintech space opens up interesting vistas beyond the traditional domain.

From algorithmic trading to robo-advisors, blockchain platforms to digital payment ecosystems, fintech is not about the future; it is about now. Where does the CFA terrain fit into such a frenzied world?

Let's break it down.

Reasons for the Boom in Fintech

The boom in the fintech sector has been the buzzword for the last some years. In 2024, a report by Tracxn stated that the fintech ecosystem in India occupied the third position globally for funding. With innovations in digital lending, insure-tech, and blockchain infrastructure, there has probably never been a higher demand for professionals with a financial mindset and technological capabilities.

Recent developments in the industry also hint at significant collaboration between traditional banks and fintech companies. For instance, large institutions are partnering with startups to enhance customer experience using AI-driven credit scoring and risk analytics. The result? An increasing need for professionals who appreciate the granularity of finance and can grasp with pace and subtlety the nuances of technology integration.

The CFA Edge in a Fintech Role

The Chartered Financial Analyst (CFA) title is recognized worldwide for its rigor in investment analysis, portfolio management, and ethical conduct. Whilst fintech may sound very tech-oriented at first, most roles in the industry cannot do without an underlying good financial understanding, exactly what the CFA program provides.

Here is where CFA professionals can uniquely add value:

1. Strong Analytical Foundations

Fintech roles in product management, financial modeling, and algorithm development need strong analytical aptitude. CFA charterholders have the training to interpret financial data, assess for risks, and make informed decisions; these are critical traits for any fintech product team.

2. Market Insights

Market knowledge is crucial when building a trading bot or designing a robo-advisor. CFA candidates and charterholders arrive with such market insights coupled with structured knowledge about asset classes, which would render them fitting partners to data scientists and engineers.

3. Compliance and Ethics

Ethics is one of the pillars of CFA curriculum. In the fintech environment where innovation frequently glides a pace ahead of regulation, having professionals who understand the compliance framework and will enforce transparency can act as a focal safeguard against legal mishaps.

4. Client-Centric Financial Innovation

Many fintech products are B2C—apps or platforms or services designed for common person. A CFA background helps ensure that these products are not merely innovative but match real financial needs and risk profiles.

The Career Scope for CFA Professionals in the Fintech Industry

Fintech provides a variety of roles where CFA skills are not just relevant but are critical. Some of the career roles include:

Product Manager - WealthTech: Responsible for supervising the development of investment platforms or robo-advisors.

Financial Data Analyst: The focus is on working with big data teams in the build-and-improve process of financial models.

Compliance Analyst: Ensuring product and service regulatory requirements are delivered upon.

Investment Strategist - Fintech Startup: Setting algorithmic trading strategies or digital advisory tools.

Risk Manager - Digital Lending: To evaluate borrower risk with data collected from non-traditional sources while utilizing various AI models.

Up-Skilling for the Fintech Surge

While CFA programs do provide a strong financial background, supplementing the financing with some technology skills could further open doors. Most useful would be Python, SQL, data visualization, and blockchain. Many CFA candidates today are engaging in scripting basics and economic APIs as a part of their own learning.

Then comes networking. Attending fintech meetups, being active in LinkedIn communities, and looking for what is happening in the start-up world can expose candidates to live occurrences and job leads. Networking is life within the fintech space, and those who early engage build invaluable capital for their professional lives.

CFA in Fintech: Real Synergy

There is a shifting view about regions where traditional finance professionals made success in fintech. With the increasing rapidity of fintech hubs, the synergy between CFA training with modern financial innovation is now becoming crystal clear.

Major fintech players are no longer interested only in tech graduates: they are hiring individuals who can cross over from code to capital. This is where the CFA comes in: someone who can bring structure, strategy, and compliance to the creative tech-infused solutions.

Conclusion: The Future is Hybrid

Fintech disrupts the financial industry as it exists today, and the most wanted guys tomorrow will be the ones speaking both languages of finance and technology. Presidency in CFA is an excellent ground of credibility, analytical capacity, and ethics, which fintech start-ups and scale-ups need.

The change has been actuated, particularly in regions witnessing rapid emergence as talent hubs for fintech innovation. Take, for instance, the rising demand for professionals enrolling in a CFA Training Program in bengaluru, where the fintech job market is booming due to increased VC funding, tech infrastructure, and global connectivity.

In this space, CFA professionals are not merely filling places in fintech, they are actually the architects of its future. Whether you are a potential candidate or a charter holder, it is time for you to look into ways to adapt and upgrade your skills, thus maturing into this fast-paced frontier. Your next grand opportunity may not happen in a conventional firm; it might land in the next disruptive fintech idea.

0 notes

Text

Everything you need to know about online financial technology courses

The financial landscape is evolving rapidly, driven by digital innovation and disruptive technologies. Financial technology, or fintech, is reshaping the way businesses and consumers connect with financial services, from digital payments and blockchain to AI-driven investment strategies.

For professionals who want to stay ahead in this sector, financial technology online courses offer an invaluable opportunity to gain expertise in cutting-edge financial technologies and their applications.

Why learn fintech?

Fintech is no longer a niche industry. It is an important component of global finance, influencing banking, investment, Insurance, and even regulatory frameworks. Professionals in finance, technology, and business strategy can benefit from fintech education in the following ways:

Understanding disruptive technologies: Gain insights into blockchain, AI, machine learning, and digital banking systems.

Enhancing career opportunities: Acquire skills that are highly sought after in financial institutions, start-ups, and tech firms.

Driving innovations in businesses: Leverage fintech solutions to streamline financial operations and customer experience.

Navigating regulatory and compliance challenges: Learn about global fintech regulations, cybersecurity, and ethical considerations.

Adapting to the future of finance: Prepare for trends like decentralised finance, embedded finance, and smart contracts.

Advantage of learning fintech online

Traditional classroom-based education may not always keep pace with industry trends. Online courses offer flexibility, real-time industry insights, and hands-on learning through virtual simulations and case studies. Reasons to prefer learning fintech online:

Self-paced and interactive learning: Courses allow learners to progress at their own speed while engaging with expert-led sessions.

Industry-relevant curriculum: Updated course material ensures learners stay current with the latest financial innovations.

Networking opportunities: Interact with fintech professionals, investors, and technology leaders worldwide.

Practical application of concepts: These courses often include live projects, case studies, and practical exercises to apply knowledge in real-world scenarios.

Top online fintech courses

Various online learning programs cater to finance professionals, entrepreneurs, and technologists looking to build expertise in fintech. Some notable course categories include:

Blockchain and cryptocurrency fundamentals

Covers decentralised finance, smart contracts, and the impact of cryptocurrencies on global markets.

Ideal for professionals interested in digital assets and blockchain applications.

AI and machine learning in financial services

Focuses on algorithmic trading, risk modelling, and AI-driven financial decision-making.

Suitable for finance professionals and data analysts integrating AI into financial strategies.

Digital banking and payments innovation

Explores the rise of mobile banking, payment gateways, and financial inclusion through digital platforms.

Recommended for professionals in banking, financial services, and payment technologies.

Cybersecurity and regulatory compliance

Provides insights into financial regulations, fraud detection, and data security.

Essential for compliance officers, legal professionals, and cybersecurity specialists in finance.

WealthTech and robo-advisory solutions

Focuses on digital wealth management, automated financial planning, and customer-centric investment platforms.

Ideal for investment advisors and financial planners adapting to digital advisory trends.

Conclusion

Selecting a fintech course depends on career aspirations, prior experience, and industry demands. India offers fintech programs that include theoretical knowledge with hands-on exposure to real-world applications. These programs help you with skills needed to navigate the changing financial landscape and drive digital transformation in your organisations.

With fintech reshaping the future of finance, investing in specialised education is essential for professionals who want to stay ahead of industry trends.

1 note

·

View note

Text

Understanding the Legal Landscape of Algorithmic Trading in India

Understand the legal landscape of algorithmic trading in India, SEBI regulations, and key updates for retail and institutional investors.

Read more..

#Algorithmic Trading in India#Algorithmic Trading#algo trading#algo trading app#algo trading india#bigul#algo trading platform#algo trading strategies#bigul algo#free algo trading software#algorithm software for trading#finance#Algorithmic trading for beginners#Algorithmic trading strategy#Algorithmic trading India#Algorithmic trading software#Basics of Algorithmic Trading#Automated Trading#algorithmic trading software free#algorithmic trading platform#algorithmic software for trading#algorithmic trading software#algorithm#bigul algo trading review#bigul algo trading#bigul trading#bigul trading app#best algo trading software#best share trading app in india#best share trading app

0 notes

Text

SEBI's New Framework for AI Tools: A Step Towards Regulated Innovation

In a significant move towards regulating artificial intelligence in India's financial markets, the Securities and Exchange Board of India (SEBI) has proposed comprehensive amendments to assign responsibility for AI tools used by market infrastructure institutions and intermediaries. This development comes at a crucial time when, as noted by leading SEBI expert lawyer and Thinking Legal's founder, Vaneesa Agrawal, "AI is taking the world by storm and is widely expected to change every aspect of life over the medium (or maybe even short) term."

Understanding the New Framework

The proposed amendments span across three major regulations: the Securities Contracts Regulation (Stock Exchanges and Clearing Corporations) Regulations, 2018; the SEBI (Depositories and Participants) Regulations, 2018; and the SEBI (Intermediaries) Regulations, 2008. These changes aim to establish clear accountability for AI implementation in financial markets.SEBI expert lawyersemphasize that these changes aim to establish clear accountability for AI implementation in financial markets.

The fundamental principle underlying these amendments is accountability. As Vaneesa Agrawal points out in her analysis of AI regulation, "While AI offers immense potential benefits, its unregulated growth poses significant risks that could have far-reaching consequences." This aligns perfectly with SEBI lawyers' observation of this proactive approach to regulation.

Key Responsibilities Under the New Framework

The cornerstone of these amendments lies in their clear delineation of responsibilities. SEBI lawyershighlight that this clarity is crucial for ensuring accountability in the rapidly evolving AI landscape. As multiple SEBI expert lawyers point out, the framework establishes specific obligations that cannot be delegated or circumvented.

Privacy, security, and integrity of investors' and stakeholders' data

Outputs arising from the usage of such tools and techniques

Compliance with applicable laws in force

The Need for AI Regulation in Financial Markets

The timing of these amendments is particularly relevant. As Vaneesa Agrawal emphasizes in her recent article, "To mitigate these risks, it is essential to develop robust regulatory frameworks that govern the development and deployment of AI. These frameworks should address issues such as data privacy, algorithmic bias, and the ethical implications of AI technologies."

Note that this proposed framework appears to address these concerns directly. The SEBI expert lawyers also point out that these regulations cover both internally developed AI tools and those procured from third-party providers, ensuring comprehensive oversight regardless of the source.

Scope and Application

The regulatory landscape for AI in financial markets is evolving rapidly, and SEBI's proposed framework reflects this dynamic environment. Vaneesa Agrawal, an expert SEBI lawyer explains that the amendments' scope is intentionally broad to accommodate future technological developments while maintaining regulatory effectiveness.

The amendments define AI tools broadly to include:

Applications or software programs for market analysis and trading

Executable systems for risk management and compliance

Tools used for facilitating trading and settlement

Systems for automated compliance requirements

Public product offerings utilizing AI capabilities

Management or other business purposes

SEBI expert lawyers point out that this comprehensive definition ensures no critical AI applications in financial markets escape regulatory oversight. The scope also extends to AI tools used in customer interface, data analytics, and decision-making processes, as noted by experienced SEBI lawyers following these developments.

This comprehensive scope reflects what SEBI expert lawyer, Vaneesa Agrawal describes as the need for "striking the right balance between innovation and control," which she identifies as "crucial to harnessing the benefits of AI while mitigating its potential harms."

Impact on Market Participants

The implementation of these amendments will significantly affect various market participants, as SEBI lawyershighlight. Vaneesa Agrawal also states that understanding these impacts is crucial for ensuring compliance and maintaining market efficiency.

Stock Exchanges and Clearing Corporations

Expert SEBI lawyers advise regular audits of AI systems. Ensure that the tools meet regulatory standards.

Depositories

For this market, SEBI lawyers note the importance of maintaining transaction integrity. This means the industry must adapt to their AI-powered security measures.

Intermediaries registered with SEBI

SEBI expert lawyers emphasize the need for proper documentation.

Asset Management Companies

SEBI lawyers suggest evaluating AI tools used in portfolio management and implementing regular monitoring systems

Investment Managers of Alternative Investment Funds

SEBI lawyers recommend comprehensive documentation and to maintain clear audit trails of AI-driven decisions.

Infrastructure and Real Estate Investment Trust Managers

SEBI lawyers, for this market, advise implementing appropriate safeguards for sensitive data.

A Forward-Looking Approach

SEBI's approach aligns with global trends in AI regulation. Vaneesa Agrawal, an expert SEBI lawyer, notes in her article that "International cooperation would be key for ensuring that AI is developed and used in a responsible and beneficial manner." This perspective is particularly relevant as India's financial markets become increasingly integrated with global systems.SEBI expert lawyersobserve that this alignment with international standards will facilitate cross-border transactions and cooperation.

"By establishing clear guidelines and ethical frameworks, policymakers can ensure that AI is developed and deployed responsibly, benefiting society as a whole."

- Vaneesa Agrawal, SEBI lawyer and founder of Thinking Legal

Conclusion

SEBI's proposed amendments represent a significant step toward creating a structured framework for AI deployment in India's financial markets. AsVaneesa Agrawal concludes in her analysis, "The future of AI is uncertain, but the need for thoughtful regulation is undeniable." The regulations strike a balance between enabling innovation and ensuring responsibility, particularly in protecting investor interests and maintaining market integrity.

The proposed changes provide a foundation for responsible AI adoption while maintaining the flexibility needed for technological advancement. Expert SEBI lawyers continue to monitor these developments closely, providing valuable insights into their implementation and impact.

0 notes

Text

AI in Investment Banking: How Artificial Intelligence is Transforming Deal-Making and Risk Management

In the fast-paced world of investment banking, speed, precision, and insight are everything. Today, those advantages are increasingly driven by artificial intelligence (AI). From optimizing mergers and acquisitions to transforming how financial institutions manage risk, AI is becoming the silent partner behind every major financial decision.

For aspiring professionals, this evolution is more than just fascinating—it’s a call to action. Enrolling in a modern, industry-relevant investment banking course in Thane is the first step toward mastering the future of finance.

📈 How AI is Reshaping Investment Banking

AI isn’t just about robots and automation—it’s about smart systems that learn, adapt, and optimize complex processes. In investment banking, this means better predictions, faster deal execution, and more accurate risk assessments.

Here’s how:

1. Smarter Deal-Making with Predictive Analytics

AI algorithms are now being used to analyze vast amounts of structured and unstructured data to identify profitable M&A (Mergers and Acquisitions) opportunities. These systems:

Spot undervalued assets or companies

Predict the success of a deal using historical data

Analyze competitor strategies

This data-driven approach allows bankers to make smarter, faster, and more profitable decisions.

2. Automated Financial Modeling

Traditionally, financial modeling required hours of manual Excel work. Today, AI tools can automate much of this process:

Generate dynamic models

Integrate real-time market data

Identify anomalies or risks instantly

This not only saves time but also enhances accuracy—a must-have in high-stakes financial environments.

3. Enhanced Risk Management with Machine Learning

Risk management is central to investment banking, and AI has revolutionized it by:

Monitoring real-time market risks

Predicting credit defaults or financial distress

Assessing geopolitical risks through sentiment analysis

Machine learning models continuously learn and improve, offering banks an edge in proactively managing potential threats.

4. Faster Due Diligence and Compliance

AI-driven platforms can review thousands of legal documents, contracts, and financial records in minutes—something that would take humans days or weeks. Natural Language Processing (NLP) tools help banks:

Detect red flags

Ensure regulatory compliance

Avoid costly legal oversights

5. Algorithmic Trading & Robo-Advisors

Many investment banks and hedge funds now use AI for high-frequency trading, where decisions are made in milliseconds based on live data streams. Similarly, robo-advisors use AI to create and manage investment portfolios for clients automatically.

🏦 Real-World Examples

JP Morgan uses its COIN platform to automate legal document review.

Goldman Sachs has developed Marcus Insights, an AI tool for customer portfolio optimization.

ICICI Securities in India has integrated AI for equity research and customer service.

These examples show that AI in investment banking is not a future concept—it’s the present reality.

🎓 The Role of Education: Why You Should Consider an Investment Banking Course in Thane

With AI redefining finance, investment banking professionals must stay ahead of the curve. This is where a modern investment banking course in Thane can make a real difference.

At the Boston Institute of Analytics (BIA), students are trained not only in core banking functions like financial modeling, valuation, and equity research but also in AI-driven tools, fintech integration, and risk analytics.

What You’ll Learn:

Advanced Excel & Python for Finance

AI tools used in financial modeling

Data analytics in risk management

Case studies from global investment banks

Real-time trading simulations

Interview preparation for top investment banks

The course is led by industry experts and includes live projects and internship support to help you gain hands-on experience.

📍 Why Thane is Emerging as a Finance Education Hub

Located close to Mumbai—India’s financial capital—Thane is quickly becoming a preferred location for finance aspirants. With easy access to industry connections, networking events, and corporate hubs, studying in Thane gives students a unique advantage.

An investment banking course in Thane doesn’t just offer knowledge—it offers proximity to opportunity.

🔮 The Future of Investment Banking is AI-Powered

AI is no longer an optional add-on in the world of finance—it’s an essential skill. Whether you want to become a financial analyst, investment banker, or risk manager, understanding how AI integrates into finance will give you a competitive edge.

As global markets become more complex, professionals who can combine financial knowledge with AI literacy will be in highest demand.

✅ Final Thoughts

The investment banking industry is transforming—and AI is at the center of that transformation. If you’re looking to build a successful career in this evolving sector, now is the time to act.

Enroll in a cutting-edge investment banking course in Thane at the Boston Institute of Analytics, and gain the tools, knowledge, and confidence to thrive in the AI-driven world of finance.

0 notes

Text

Maximising Your Investment Potential with SEBI-Registered Investment Advisors and Trade Ideas

Investing in the stock market is both an art and a science. To navigate its complexities successfully, you need trusted expertise, innovative tools, and data-driven strategies. Keywords like SEBI registered investment advisor, Trade Ideas, and best stocks to swing trade highlight essential elements that can transform your trading journey.

Why SEBI-Registered Investment Advisors Are Crucial

The Securities and Exchange Board of India (SEBI) ensures that investment advisors adhere to strict ethical and professional standards. Engaging a SEBI-registered investment advisor provides the assurance of transparency, accountability, and personalized financial planning.

Key benefits include:

Tailored Advice: Advisors analyze your financial goals and risk appetite to offer customized solutions.

Market Expertise: They provide insights into market trends, helping you identify profitable opportunities.

Regulatory Compliance: SEBI registration ensures that advisors follow legal guidelines to protect your interests.

Leveraging Trade Ideas for Smarter Decisions

In the fast-paced world of trading, having access to advanced tools is vital. Trade Ideas, a leading AI-powered stock screening platform, empowers traders to identify opportunities with precision and efficiency.

Features of Trade Ideas include:

Stock Screening: Advanced filters to pinpoint the best stocks to swing trade.

Real-Time Alerts: Instant notifications for market movements and trends.

AI-Driven Insights: Algorithms analyze patterns to suggest profitable trades.

By combining Trade Ideas with expert advice from a SEBI-registered advisor, you can optimize your trading strategies and reduce risks.

The Best Stocks to Swing Trade: A Winning Approach

Swing trading focuses on capturing short- to medium-term gains over a few days or weeks. Identifying the best stocks to swing trade requires a combination of technical analysis, market research, and tools like Trade Ideas.

To excel in swing trading:

Use a reliable stock screener to identify high-performing stocks.

Analyze key indicators like moving averages and RSI.

Consult with a SEBI-registered advisor for expert guidance.

Combining Human Expertise with Technology

The synergy of human expertise and AI-driven tools is the ultimate recipe for success in stock trading. A SEBI-registered investment advisor brings in-depth market knowledge and personalized strategies, while Trade Ideas delivers actionable insights through advanced algorithms. Together, they enable you to make informed and confident decisions.

Conclusion

The stock market offers immense potential for wealth creation, but it requires the right resources to navigate effectively. With the support of SEBI-registered investment advisors, the power of Trade Ideas, and a focus on the best stocks to swing trade, you can achieve your financial goals.

Take the next step in your investment journey and make smarter trading decisions today. Combine professional advisory services with cutting-edge technology for a winning strategy that drives success.

0 notes

Text

How Spotify is Revolutionizing Music Consumption

The global music industry has undergone a seismic shift in the last two decades, thanks to advancements in technology and the rise of streaming services. Among these, Spotify has emerged as a revolutionary force, redefining how people discover, share, and consume music. This article delves into the evolution of Spotify, its impact on music consumption, and how its presence in diverse markets like India has contributed to its global success.

The Origins of Spotify

Launched in 2008 in Sweden, Spotify was created to combat the rampant piracy that plagued the music industry during the early 2000s. By offering a legal and affordable alternative to pirated music, Spotify provided users access to a vast library of tracks while ensuring that artists and rights holders received fair compensation. But who owns Spotify? The company is publicly traded, with its founders Daniel Ek and Martin Lorentzon playing pivotal roles in its establishment and growth.

Spotify’s business model introduced the concept of freemium services, where users could choose between free ad-supported streaming or a premium subscription for an ad-free experience. This model has since become the industry standard, with several other platforms adopting similar approaches.

Transforming Music Discovery

One of Spotify’s standout features is its ability to help users discover new music. Personalized playlists like “Discover Weekly” and “Release Radar” have made it easier than ever for listeners to find songs tailored to their tastes. These playlists are powered by advanced algorithms and machine learning, which analyze user behavior to provide recommendations.

Spotify’s focus on user experience and personalization has also led to the development of curated playlists for specific moods, activities, and genres. For instance, playlists like “Chill Hits” and “Workout Beats” cater to listeners' varying needs throughout the day, ensuring a more immersive and engaging experience.

Impact on Artists and the Industry

Spotify has significantly changed the dynamics of how artists distribute and monetize their music. By offering access to a global audience, the platform has enabled emerging musicians to gain visibility without relying on traditional record labels. Independent artists can now upload their music directly to Spotify, bypassing traditional gatekeepers.

While Spotify’s reach is undeniably impressive, its revenue model has sparked debates within the industry. Artists and rights holders have expressed concerns about the low per-stream payouts. Despite this, the platform continues to play a vital role in providing exposure to new talent. Many artists who began their journeys on Spotify have gone on to achieve mainstream success.

Additionally, Spotify's partnerships with major record labels have solidified its position as an industry leader, enabling it to offer exclusive content and special promotions that draw in more users.

The Spotify Launch Date in India

The Spotify launch date in India was February 26, 2019, marking a significant milestone in the platform's global expansion. India, with its rich and diverse music culture, represented a unique opportunity for Spotify. The platform’s entry into this market brought with it a curated collection of regional and international music, tailored to suit the preferences of Indian audiences.

Spotify introduced features like multilingual playlists, Bollywood hits, and regional tracks in languages like Tamil, Telugu, and Punjabi. This localization strategy helped Spotify quickly gain traction among Indian users, who appreciated the blend of global hits and regional favorites.

However, the competition in India’s streaming market was fierce, with players like JioSaavn, Gaana, and Wynk Music already well-established. Despite this, Spotify managed to carve out a niche by leveraging its global brand and unique offerings.

SoundCloud vs. Spotify

When discussing music streaming, comparisons between platforms are inevitable. Spotify’s focus has always been on providing a seamless listening experience for users, but platforms like SoundCloud offer distinct advantages for creators. The SoundCloud founders envisioned a platform where musicians could share their work without intermediaries, making it a favorite among independent artists.

While Spotify prioritizes user experience and personalization, SoundCloud emphasizes community building and artist discovery. This differentiation allows both platforms to coexist, catering to different segments of the music market.

Regional Players and Their Influence

Spotify’s success in India highlights the importance of understanding and catering to regional preferences. Platforms like Anand Audio have been instrumental in promoting regional music in India. The Anand Audio owner has played a pivotal role in preserving and popularizing Kannada music.

Such regional players serve as a reminder that the music industry is not just about global hits but also about nurturing local talent and culture. Spotify’s inclusion of regional content demonstrates its commitment to creating a platform that resonates with diverse audiences.

The Role of Technology in Spotify’s Success

At the heart of Spotify’s success is its use of cutting-edge technology. From its advanced recommendation algorithms to its seamless cross-device compatibility, Spotify continuously innovates to stay ahead of the curve.

Machine Learning and AI: Spotify uses artificial intelligence to analyze listening habits and provide personalized recommendations.

Cross-Platform Access: Whether on a smartphone, desktop, or smart speaker, Spotify ensures a consistent experience across devices.

Podcast Integration: Recognizing the growing popularity of podcasts, Spotify has invested heavily in exclusive podcast content, further diversifying its offerings.

These technological advancements have not only enhanced the user experience but also solidified Spotify’s position as a leader in the music streaming industry.

The Rise of Music Jobs

The digital revolution has created numerous opportunities in the music industry. From content creators to data analysts, the demand for specialized roles has skyrocketed. Platforms like Spotify and SoundCloud have played a significant role in generating music jobs for professionals with diverse skill sets.

For instance, Spotify employs data scientists, sound engineers, and marketing experts to ensure the platform runs smoothly. Meanwhile, independent creators can leverage Spotify’s tools to build careers as playlist curators or music marketers.

Challenges and Criticisms

Despite its many achievements, Spotify is not without its challenges. The platform faces criticism for its low payout rates to artists, which has led to calls for more equitable revenue sharing. Additionally, its reliance on algorithms has raised concerns about the homogenization of music discovery, as users are often directed toward mainstream tracks rather than niche or experimental genres.

The Future of Music Streaming

As Spotify continues to grow, its focus will likely remain on innovation and expansion. The platform is already experimenting with new features like live audio and enhanced social sharing tools. Moreover, its investment in podcasting suggests that it aims to be more than just a music streaming service.

The question remains: Can Spotify maintain its dominance in an increasingly competitive market? With competitors like Apple Music, Amazon Music, and SoundCloud offering unique features, the battle for user attention is far from over.

Conclusion

Spotify has undoubtedly transformed the way we consume music. From its personalized playlists to its global reach, the platform has set the standard for music streaming services. Whether exploring the story of who owns Spotify, learning about its Indian launch, or comparing it to platforms like SoundCloud, Spotify’s journey is a testament to the power of innovation in the music industry.

What do you think about Spotify’s impact on the music world? Share your thoughts in the comments below!

0 notes

Text

Complete Guide to Stock Broker: Types, How They Work & Choosing the Best One

Investing in the stock market requires a reliable stock broker who can execute trades efficiently. But with so many options—full-service brokers, discount brokers, online platforms, and robo-advisors—choosing the right one can be confusing.

This guide covers everything about stock brokers, including their role, types, fees, regulations, and how to select the best one based on your trading needs. We’ll also explore real-world examples from the Indian stock market, key statistics, and emerging trends in stock brokerage.

1. What is a Stock Broker & What Do They Do?

A stock broker is a licensed professional or firm that facilitates buying and selling of securities like stocks, bonds, and ETFs on behalf of investors. They act as intermediaries between traders and stock exchanges such as NSE (National Stock Exchange) and BSE (Bombay Stock Exchange).

Key Responsibilities of a Stock Broker:

✅ Execute buy/sell orders on behalf of clients. ✅ Provide market research, recommendations, and investment advisory (full-service brokers). ✅ Offer trading platforms and charting tools like Strike.money for market analysis. ✅ Maintain investor accounts and regulatory compliance.

Example from the Indian Market:

In India, Zerodha, Upstox, Angel One, and ICICI Direct are among the leading brokerage firms, with Zerodha being the largest in terms of active clients due to its discount brokerage model.

2. How Do Stock Brokers Work? (Mechanism & Trading Process)

Stock brokers connect retail and institutional investors to stock exchanges, ensuring smooth trade execution.

Trading Process via a Stock Broker:

1️⃣ Investor Places an Order: A trader places a buy/sell order using a broker's trading platform. 2️⃣ Broker Routes Order to the Exchange: The order is sent to NSE/BSE via their algorithmic trading systems. 3️⃣ Order Execution & Settlement: The trade is executed, and ownership of securities is transferred via SEBI-regulated clearing corporations.

Market Makers vs. Stock Brokers:

🔹 Stock Brokers act as intermediaries and execute orders for clients. 🔹 Market Makers provide liquidity by buying and selling stocks directly.

Real-World Example:

HDFC Securities and ICICI Direct offer both trading and market research, whereas Zerodha is a discount broker focused only on trade execution without advisory services.

3. Types of Stock Brokers: Which One is Right for You?

🔹 Full-Service Brokers (Best for long-term investors)

✅ Offer personalized investment advice, research reports, and portfolio management. ✅ Charge higher brokerage fees. Examples: ICICI Direct, HDFC Securities, Sharekhan.

🔹 Discount Brokers (Best for active traders)

✅ Low brokerage fees with self-service trading platforms. ✅ No advisory services. Examples: Zerodha, Upstox, Angel One.

🔹 Online Brokers (Best for mobile traders)

✅ Fully digital trading with user-friendly platforms. ✅ AI-driven investment insights. Examples: Groww, Paytm Money.

🔹 Robo-Advisors (Best for passive investors)

✅ AI-based automated investing. ✅ Ideal for beginners with small capital. Examples: ET Money, Kuvera.

Choosing the Right Broker Based on Your Needs:

💰 For Low-Cost Trading: Go with Zerodha, Upstox. 📊 For Research & Advisory: Choose ICICI Direct, Motilal Oswal. 📱 For Mobile Trading: Opt for Groww, Paytm Money.

4. Regulations & Legal Framework of Stock Brokers in India

Stock brokers operate under strict SEBI regulations to ensure investor protection.

Regulatory Bodies Governing Stock Brokers in India:

🔹 SEBI (Securities and Exchange Board of India): Licenses and monitors brokers. 🔹 NSE & BSE: Stock exchanges where brokers execute trades. 🔹 Depositories (NSDL, CDSL): Maintain investor holdings electronically.

Key SEBI Rules for Brokers:

✔️ Brokers must maintain transparency in fees and charges. ✔️ Must provide a risk disclosure document before account opening. ✔️ Cannot engage in unfair trade practices like unauthorized trading.

Case Study:

In 2020, SEBI fined Karvy Stock Broking for misusing client securities, highlighting the need for due diligence before selecting a broker.

5. How to Choose the Right Stock Broker?

✅ Factors to Consider:

🔹 Brokerage Charges: Look for zero or low-cost brokers like Zerodha & Upstox. 🔹 Trading Platform & Charting Tools: Check if the broker offers platforms like Strike.money for technical analysis. 🔹 Regulatory Compliance: Ensure SEBI registration. 🔹 Customer Support: Choose brokers with reliable support (e.g., ICICI Direct, HDFC Securities).

6. Best Stock Brokers in India (Comparison Table)

📊 Tip: Use a demo account before finalizing a broker!

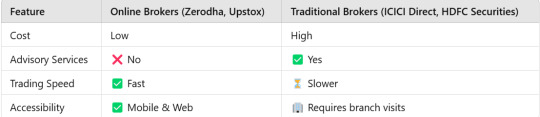

7. Online vs. Traditional Brokers: Pros & Cons

💡 Conclusion: If you're a DIY investor, go online. If you need expert guidance, opt for full-service brokers.

8. How Stock Brokers Make Money: Fees & Commissions Explained

Types of Brokerage Fees:

🔹 Flat-Fee Model: ₹20 per trade (Zerodha, Upstox). 🔹 Percentage-Based Model: 0.5% per trade (ICICI Direct, HDFC Securities). 🔹 Hidden Charges: Annual maintenance fees, fund transfer charges.

Example Calculation:

If you invest ₹1 lakh via ICICI Direct, you may pay ₹500 as brokerage, whereas in Zerodha, it’s just ₹20 per trade.

📌 Always check the broker’s fee structure before opening an account!

9. Step-by-Step Guide: How to Open a Brokerage Account

📌 Documents Required: PAN Card, Aadhaar, Bank Account Details.

Steps to Open an Account:

1️⃣ Choose a broker and visit their website. 2️⃣ Fill out the KYC form and upload documents. 3️⃣ Complete e-KYC verification using Aadhaar OTP. 4️⃣ Fund your trading account and start investing!

📝 Tip: Use Strike.money for charting and market analysis before placing your first trade.

10. Stock Broker Scams & Red Flags to Watch Out For

🚨 Common Brokerage Scams: 🔹 Unauthorized Trading: Broker executes trades without permission. 🔹 Hidden Fees: Extra charges not disclosed upfront. 🔹 Ponzi Schemes: Fake firms promising high returns.

How to Avoid Scams?

✅ Always choose SEBI-registered brokers. ✅ Read the brokerage agreement carefully. ✅ Use Strike.money to verify market trends before investing.

11. Future of Stock Brokering: Trends & Innovations

🔹 AI-Powered Trading Bots (used by Zerodha’s Streak). 🔹 Blockchain-Based Settlements to reduce fraud. 🔹 Fractional Investing to allow small investors access to high-value stocks.

🚀 The Future is Digital: Expect zero-commission investing and AI-driven market insights to dominate brokerage services.

Final Thoughts: Which Broker is Best for You?

✔ For Beginners: Groww, Paytm Money. ✔ For Active Traders: Zerodha, Upstox. ✔ For Research & Advisory: ICICI Direct, Motilal Oswal.

Use Strike.money for advanced charting and technical analysis before making investment decisions.

Which broker do you prefer? Let us know in the comments! 🚀📈

0 notes

Text

The Fragmented Future of AI Regulation: A World Divided

The Clash Between Global Cooperation and Geopolitical Realities

In November 2023, China, the United States, and the European Union surprised the world by signing a joint communiqué, expressing their commitment to international cooperation in regulating artificial intelligence (AI). The document highlighted the potential risks of advanced AI models, such as ChatGPT, including disinformation, cybersecurity threats, and the misuse of biotechnology. This signaled a growing consensus among major powers on the need for AI regulation.

However, despite the rhetoric of cooperation, the reality on the ground suggests a future of fragmentation and competition.

As countries like China, the United States, and the EU take individual actions to regulate AI, divergent legal regimes are emerging. These regimes, focused on access to semiconductors, technical standards, and data and algorithms, are creating a divided landscape of warring regulatory blocs. This article explores the challenges and obstacles that hinder the establishment of a coherent global framework for AI regulation.

youtube

The Battle Over Semiconductors

One of the most prominent areas of conflict in AI regulation is the ongoing duel between China and the United States over global semiconductor markets. The export controls imposed by the United States on advanced chips and chip-making technology have global implications, affecting any manufacturer that uses U.S. software or technology. In response, China implemented its own export controls on rare minerals necessary for chip manufacturing.

This tit-for-tat competition over semiconductors erodes free trade and sets destabilizing precedents in international trade law, leading to lower levels of trade and increased geopolitical tensions.

The Fracturing of Technical Standards