#Low-Power Microcontroller Unit Market

Explore tagged Tumblr posts

Text

Low-Power Microcontroller Unit Market

0 notes

Text

IoT Microcontroller Market Poised to Witness High Growth Due to Massive Adoption

The IoT microcontroller market is expected to enable connectivity of various devices used in applications ranging from industrial automation to consumer electronics. IoT microcontrollers help in building small intelligent devices that collect and transmit data over the internet. They offer benefits such as compact design, low-power operation and integrated wireless communication capabilities. With increasing connectivity of devices and growing demand for remote monitoring in industries, the adoption of IoT microcontrollers is growing significantly. Global IoT microcontroller market is estimated to be valued at US$ 6.04 Bn in 2024 and is expected to reach US$ 14.85 Bn by 2031, exhibiting a compound annual growth rate (CAGR) of 13.7% from 2024 to 2031.

The burgeoning need for connected devices across industries is one of the key factors driving the demand for IoT microcontrollers. Various industries are rapidly adopting IoT solutions to improve operational efficiency and offer enhanced customer experience through remote monitoring and management. Additionally, technology advancements in wireless communication standards such as Bluetooth 5, WiFi 6, and LPWAN are allowing development of low-cost IoT devices with extended range, which is further fuelling market growth. Key Takeaways Key players operating in the IoT microcontroller are Analog Devices Inc., Broadcom Inc., Espressif Systems (Shanghai) Co., Ltd., Holtek Semiconductor Inc., Infineon Technologies AG, Integrated Device Technology, Inc.,and Microchip Technology Inc. Key opportunities in the market include scope for integrating advanced features in microcontrollers to support new wireless technologies and opportunity to develop application-specific microcontrollers for niche IoT markets and applications. There is significant potential for IoT Microcontroller Market Growth providers to expand globally particularly in Asia Pacific and Europe owing to industrial digitalization efforts and increasing penetration of smart homes and cities concept in the regions. Market drivers Growing adoption of connected devices: Rapid proliferation of IoT across various industries such as industrial automation, automotive, healthcare is fueling demand for microcontroller-based solutions. IoT devices require microcontrollers to perform essential tasks like data processing and wireless communication. Enabling technologies advancements: Improvements in low-power wireless technologies, Embedded Systems, and sensors are allowing development of advanced yet affordable IoT solutions leading to new applications for microcontrollers. Market restraints Data privacy and security concerns: Use of IoT microcontrollers makes devices vulnerable to cyber-attacks and privacy breaches raising concerns among users. Addressing security issues remain a challenge restricting broader adoption. Interoperability issues: Lack of common communication protocols results in devices inability to communicate with each other smoothly restricting large-scale IoT deployments.

Segment Analysis The IoT Microcontroller Market Regional Analysis is segmented based on product type, end-use industry, and geography. Within product type, 8-bit microcontrollers dominate the segment as they are cheaper and suit basic IoT applications requiring low power consumption. Based on their wide usage in wearable devices, home automation systems, and smart appliances, 8-bit microcontrollers capture over 50% market share. 32-bit microcontrollers are gaining popularity for complex industrial, automotive and networking applications. The end-use industry segments of IoT microcontroller market include consumer electronics, automotive, industrial automation, healthcare, and others. Consumer electronics captures a major share owing to exponential increase in number of smart devices. Wearable fitness bands and smartwatches incorporate IoT microcontrollers to track vitals and connect to networks. Furthermore, incorporation of microcontrollers in smart home appliances like refrigerators, air conditioners, and washing machines are supporting the consumer electronics segment growth. Global Analysis In terms of regions, Asia Pacific dominates the IoT microcontroller market led by rising electronics production in India and China. counties like China, Japan and South Korea are major manufacturing hubs for smart appliances and wearable devices, driving the regional market. North America follows Asia Pacific in terms of market share led by growing industrial automation and presence of automotive giants in the US and Canada adopting connected car technologies. Europe captures a significant market share with growing penetration of IoT across industry verticals in major countries like Germany, UK and France. Middle East and Africa offer lucrative opportunities for embedded software development and IoT services companies eying untapped markets.

Get more insights on Iot Microcontroller Market

About Author:

Ravina Pandya, Content Writer, has a strong foothold in the market research industry. She specializes in writing well-researched articles from different industries, including food and beverages, information and technology, healthcare, chemical and materials, etc. (https://www.linkedin.com/in/ravina-pandya-1a3984191)

#Coherent Market Insights#Iot Microcontroller Market#Iot Microcontroller#Internet Of Things#Iot Devices#Embedded Systems#Smart Devices#Iot Development#Microcontroller Unit#MCU#Low-Power Microcontroller

0 notes

Text

Introduction PIC24FJ256GA106-I/PT for Microchip MCU IC Distributor The PIC24FJ256GA106-I/PT microcontroller is engineered to deliver outstanding performance for your embedded applications. With its 16-bit architecture and a clock speed of up to 32 MHz, this microcontroller offers a perfect blend of power and efficiency. Designed by Microchip Technology, the PIC24F series provides an extensive range of features, making it adaptable to various applications including automotive, industrial, and consumer electronics. MOQ of the PIC24FJ256GA106-I/PT for Microchip MCU IC Distributor MOQ is 100 units as seen online,more quantity more discount.Chat with us to negotiable to wholesale price.PIC24FJ256GA106 datasheet is here. Key Features The PIC24FJ256GA106-I/PT is loaded with essential features that enhance its versatility. It boasts 256 KB of Flash memory and 16 KB of RAM, allowing for the development of complex applications without limitations on memory. Additionally, the device incorporates multiple peripherals such as PWM outputs, ADC, UART, and I2C which cater to diverse project requirements. Moreover, its low power consumption helps in extending battery life, making it an ideal choice for portable devices. The integrated hardware support for USB connectivity integrates smoothly into designs necessitating user interfaces or data transfer capabilities. Applications and Use Cases This microcontroller is suitable for a variety of applications ranging from simple data logging devices to sophisticated control systems. Its capability to interface with sensors and actuators makes it indispensable in robotic systems, automotive applications, and smart home devices. Furthermore, the easy-to-use development tools provided by Microchip assist engineers in accelerating their design processes, resulting in reduced time to market. In summary, whether you are developing a new product or upgrading an existing one, the PIC24FJ256GA106-I/PT microcontroller is designed to meet the rigorous demands of modern electronics. Its blend of performance, versatility, and power efficiency makes it an excellent choice for anyone looking to leverage the latest in microcontroller technology. If you interested with more other parts number,view here.Know more about our company business. Read the full article

0 notes

Text

Global Mobile Digital ICs Market is expected to grow from US$ 23.67 billion in 2024 to US$ 36.84 Bn by 2032

Mobile Digital ICs Market Analysis:

The global Mobile Digital ICs Market size was valued at US$ 23.67 billion in 2024 and is projected to reach US$ 36.84 billion by 2032, at a CAGR of 6.5% during the forecast period 2025-2032

Mobile Digital ICs Market Overview

The global semiconductor market was valued at US$ 579 billion in 2022 and is projected to reach US$ 790 billion by 2029, growing at a CAGR of 6% during the forecast period.

In 2022, some major semiconductor categories showed strong double-digit year-over-year growth:

Analog: 20.76% growth

Sensor: 16.31% growth

Logic: 14.46% growth

However, the Memory segment experienced a decline of 12.64% year-over-year.

The Microprocessor (MPU) and Microcontroller (MCU) segments are expected to see stagnant growth, primarily due to weak shipments and reduced investment in notebooks, computers, and standard desktops.

We have surveyed the Mobile Digital ICs manufacturers, suppliers, distributors, and industry experts on this industry, involving the sales, revenue, demand, price change, product type, recent development and plan, industry trends, drivers, challenges, obstacles, and potential risks This report aims to provide a comprehensive presentation of the global market for Mobile Digital ICs, with both quantitative and qualitative analysis, to help readers develop business/growth strategies, assess the market competitive situation, analyze their position in the current marketplace, and make informed business decisions regarding Mobile Digital ICs. This report contains market size and forecasts of Mobile Digital ICs in global, including the following market information:

Global Mobile Digital ICs market revenue, 2020-2025, 2026-2032, ($ millions)

Global Mobile Digital ICs market sales, 2020-2025, 2026-2032, (K Units)

Global top five Mobile Digital ICs companies in 2024 (%)

Mobile Digital ICs Key Market Trends :

Rising Demand for IoT-Based Devices: The growing adoption of Internet of Things (IoT) electronics is boosting the need for advanced digital ICs with enhanced processing and control capabilities.

Shift Towards Hybrid MPUs and MCUs: Hybrid microprocessors and microcontrollers are gaining popularity due to their real-time embedded processing power suited for mobile and IoT applications.

Growth in Analog IC Integration: Analog integrated circuits for power management and signal conversion are increasingly integrated with digital ICs to improve device efficiency and performance.

Focus on Power Efficiency: Mobile devices require digital ICs that consume less power, driving innovation in low-power and high-efficiency IC designs.

Expansion in Automotive and Consumer Electronics: Mobile digital ICs are seeing increased use in vehicle electronics and consumer gadgets, expanding the application base beyond traditional mobile phones.

Mobile Digital ICs Market Regional Analysis :

https://semiconductorinsight.com/wp-content/uploads/2025/01/download-34_11zon-1.png

North America:Strong demand driven by EVs, 5G infrastructure, and renewable energy, with the U.S. leading the market.

Europe:Growth fueled by automotive electrification, renewable energy, and strong regulatory support, with Germany as a key player.

Asia-Pacific:Dominates the market due to large-scale manufacturing in China and Japan, with growing demand from EVs, 5G, and semiconductors.

South America:Emerging market, driven by renewable energy and EV adoption, with Brazil leading growth.

Middle East & Africa:Gradual growth, mainly due to investments in renewable energy and EV infrastructure, with Saudi Arabia and UAE as key contributors.

Mobile Digital ICs Market Segmentation :

Global Mobile Digital ICs market, by Type, 2020-2025, 2026-2032 ($ millions) & (K Units) Global Mobile Digital ICs market segment percentages, by Type, 2024 (%)

Small and Medium Power

High Power

Global Mobile Digital ICs market, by Application, 2020-2025, 2026-2032 ($ Millions) & (K Units) Global Mobile Digital ICs market segment percentages, by Application, 2024 (%)

Adapter and Charger

Consumer Electronics

LED Lighting

Vehicle Electronics

Others

Competitor Analysis The report also provides analysis of leading market participants including:

Key companies Mobile Digital ICs revenues in global market, 2020-2025 (estimated), ($ millions)

Key companies Mobile Digital ICs revenues share in global market, 2024 (%)

Key companies Mobile Digital ICs sales in global market, 2020-2025 (estimated), (K Units)

Key companies Mobile Digital ICs sales share in global market, 2024 (%)

Further, the report presents profiles of competitors in the market, key players include:

Texas Instruments

Qualcomm

Analog Devices

STMicroelectronics

ON Semi

Infineon

NXP

Toshiba

Maxim Integrated

Dialog Semiconductor

Renesas

Skyworks

MediaTek Inc.

Microchip

ROHM

Cypress Semiconductor

Power Integrations

Silergy

On-Bright Electronics

Alpha and Omega Semiconductor

Drivers

Growing Popularity of IoT Electronics: The surge in IoT devices increases the demand for mobile digital ICs that can support smart, connected applications efficiently.

Technological Advancements in Processors: Continuous improvements in hybrid MPUs and MCUs boost the performance and capabilities of mobile devices, driving market growth.

Expansion of Consumer Electronics Market: The rising sales of smartphones, wearable devices, and smart home products propel the need for advanced digital ICs.

Restraints

High Manufacturing Costs: Complex fabrication processes for advanced digital ICs increase production costs, impacting overall market growth.

Supply Chain Disruptions: Global semiconductor supply chain issues can delay production and affect the availability of mobile digital ICs.

Market Saturation in Developed Regions: Mature markets with slower smartphone adoption rates may limit growth opportunities for mobile digital ICs.

Opportunities

Emerging Markets Growth:��Rapid smartphone penetration and electronics adoption in regions like Southeast Asia and India offer significant expansion potential.

Automotive Electronics Development: Increasing integration of digital ICs in electric and autonomous vehicles opens new avenues for market growth.

Advancements in 5G Technology: The rollout of 5G networks boosts demand for mobile digital ICs that support faster communication and enhanced mobile experiences.

Challenges

Intense Market Competition: The presence of numerous global players intensifies competition, pressuring prices and margins.

Rapid Technology Changes: Constant innovation requires heavy investment in R&D, posing challenges for smaller players to keep pace.

Regulatory and Environmental Concerns: Compliance with international standards and eco-friendly manufacturing processes adds complexity to market operations.

0 notes

Text

AULTEN Mainline Voltage Stabilizer for Home 10 KVA Heavy duty

When it comes to protecting your valuable electrical appliances and machinery, a 10kVA stabilizer is a powerful and reliable choice. Whether you're running a small business, a commercial setup, or a large household with heavy-load appliances, a 10kVA voltage stabilizer ensures consistent voltage output and prevents damage due to power fluctuations.

What Is a 10kVA Stabilizer?

A 10 kVA stabilizer is designed to handle a load of up to 8000 watts (approx.), making it suitable for industrial machines, commercial air conditioners, medical equipment, and high-capacity home appliances like central AC units, refrigerators, and deep freezers. It regulates the incoming voltage and ensures that your equipment receives a safe and stable voltage level.

Aulten 10kVA Stabilizer Capacity

Aulten stabilizers are known for their robust build quality, high-performance circuits, and safety-first features. The Aulten 10kVA stabilizer is engineered to work efficiently even under extreme voltage fluctuations. It offers a wide input voltage range, overload protection, and advanced microcontroller-based design.

With a capacity of 10kVA, the Aulten stabilizer can comfortably manage heavy-duty electrical loads, making it a great investment for businesses, clinics, and large homes. The copper-wound transformer inside ensures long-lasting durability and low heat generation.

10kVA Stabilizer Price

The price of a 10kVA stabilizer varies depending on features like copper vs. aluminum winding, input voltage range, and brand quality. Typically, you can expect a 10kVA stabilizer price to range from ₹18,000 to ₹25,000 in the Indian market. Aulten offers competitive pricing while maintaining premium quality, which makes it a preferred choice among customers.

Why Choose Aulten Stabilizer?

Heavy-duty performance

Advanced protection features

Trusted by thousands of businesses

Competitive pricing

If you're looking for a reliable and efficient solution to protect your equipment, the Aulten 10kVA stabilizer is a solid choice. It combines performance, safety, and value for money – exactly what you need for peace of mind.

0 notes

Text

IoT Microcontroller Market Insights: Key Players & Innovations

The global IoT microcontroller market size is anticipated to reach USD 12.94 billion by 2030, according to a new report by Grand View Research, Inc. The market is projected to grow at a CAGR of 16.3% from 2025 to 2030. Increase in adoption of smart home devices integrated with mobile applications and advancements in low power Microcontroller (MCU) are expected to drive the market growth. The surge in the number of enterprise IoT connections across industries such as manufacturing, healthcare, and energy and power is also expected to drive the growth of the market over the forecast period.

Advancements in short-range wireless connectivity such as Zigbee, Bluetooth, and KNX technologies, notably in Europe and North America also expected to drive IoT adoption over the next few years. Advancements in disruptive technologies such as big data analytics, Artificial Intelligence (AI), and industrial IoT are further expected to propel the adoption of IoT-connected devices. Increasing investments through funding in start-ups such as Hypervolt, HIXAA, SmartRent, and other SMEs that help to gain new IoT-based projects in industries likely to create the need for a high-performance, low-power IoT MCUs market over the forecast period.

Key IoT MCU manufacturers such as RENESAS Electric Corporation, NXP Semiconductors, and STMicroelectronics are innovating high-performance MCUs to meet the demand. For instance, in 2022, Renesas Electric Corporation launched the 32-bit RA Family of microcontrollers (MCUs). The launched product is based on the Arm Cortex-M23 core, which offers shallow power consumer MCUs developed explicitly for IoT endpoint applications, including industrial automation, medical devices, intelligent home appliances, and wearables.

The COVID-19 outbreak positively impacted the IoT MCU market in 2020. Government-imposed restrictions and stay-at-home mandates increased the demand for smart wearables, including fitness trackers, health-based wearables, and other consumer IoT devices. Due to a sudden increase in demand for consumer IoT devices and a temporary halt of production units, the market experienced a shortage of MCUs in 2021, creating an imbalance in supply and demand. In light of these factors, device manufacturers are expected to hike the connected product prices in 2022, which is likely to continue until 2023.

IoT Microcontroller Market Report Highlights

32-bit captured more than 47% market share of the overall IoT MCU market in 2024, with the market size expected to register a healthy CAGR over the forecast period. An increase in the adoption of smart utilities and industrial robotics is expected to drive market growth over the forecast period

The industrial automation segment dominated the market with a revenue share of 33.1% in 2024. Industrial automation aims to streamline processes, increase operational efficiency, and improve productivity

Asia Pacific led the market in 2024, a trend expected to continue over the mid-term. Adding to this, increasing government initiatives to develop innovative and connected infrastructure signifies market growth

IoT Microcontroller Market Segmentation

Grand View Research has segmented the global IoT microcontroller market report based on product, application, and region:

IoT Microcontroller Product Outlook (Revenue; USD Billion, 2018 - 2030)

8 Bit

16 Bit

32 Bit

IoT Microcontroller Application Outlook (Revenue; USD Billion, 2018 - 2030)

Industrial Automation

Smart Home

Consumer Electronics

Smartphones

Wearables

Others

Others

IoT Microcontroller Regional Outlook (Revenue: USD Billion, 2018 - 2030)

North America

US

Canada

Mexico

Europe

UK

Germany

France

Asia Pacific

China

India

Japan

Australia

South Korea

Latin America

Brazil

Middle East & Africa (MEA)

UAE

Saudi Arabia

South Africa

Key Players in the IoT Microcontroller Market

Broadcom

Espressif Systems (Shanghai) Co., Ltd

Holtek Semiconductor Inc.

Infineon Technologies

Microchip Technology Inc.

Nuvoton Technology Corporation

NXP Semiconductors

Silicon Laboratories

STMicroelectronics

Texas Instruments Incorporated

Renesas Electronics Corporation

Order a free sample PDF of the IoT Microcontroller Market Intelligence Study, published by Grand View Research.

0 notes

Text

Automotive Microcontrollers Market: Trends, Forecasts, and Industry Outlook 2025–2030

Introduction

The automotive industry is undergoing a technological transformation, fueled by electrification, automation, and connectivity. At the core of this shift lies the growing adoption of automotive microcontrollers (MCUs)—compact computing units that power everything from infotainment and safety systems to engine control and electric vehicle (EV) functionalities. As vehicles become smarter and more software-defined, the automotive microcontrollers market is poised for significant growth between 2025 and 2030.

Market Overview

Automotive microcontrollers are integrated circuits designed to manage specific functions within vehicles. They play a critical role in:

Powertrain and transmission control

Advanced driver-assistance systems (ADAS)

Battery management systems (BMS)

Telematics and infotainment

In-vehicle networking and security

The market is currently valued at around USD 11–13 billion (2024) and is expected to surpass USD 20 billion by 2030, driven by increasing electronic content in vehicles and the global push toward vehicle electrification.

Key Market Drivers

⚡ EV and Hybrid Vehicle Growth

The surge in electric and hybrid vehicle production is significantly boosting demand for microcontrollers, especially for battery monitoring, power conversion, and motor control. EVs typically require more MCUs per vehicle than traditional internal combustion engine (ICE) vehicles.

🧠 Rise of ADAS and Autonomous Driving

As vehicles integrate more advanced driver-assistance systems, the need for real-time computing power grows. Microcontrollers enable critical functions like adaptive cruise control, lane-keeping assistance, collision avoidance, and automated parking.

🔄 Connectivity and Infotainment

With rising consumer expectations for connected car features, microcontrollers are being increasingly deployed in infotainment units, heads-up displays (HUDs), and over-the-air (OTA) update systems.

🛡️ Focus on Functional Safety and Cybersecurity

Compliance with standards like ISO 26262 and the implementation of vehicle cybersecurity protocols are boosting the demand for robust, safety-critical microcontroller architectures.

Emerging Trends

🚗 Shift Toward Centralized Vehicle Architectures

Automakers are transitioning from distributed ECUs (Electronic Control Units) to centralized computing platforms. This shift demands more powerful and integrated microcontrollers capable of handling multiple vehicle domains.

🧩 Integration of AI and ML Capabilities

Next-generation MCUs are being designed with support for machine learning and edge AI processing, enabling smarter features such as driver behavior analysis, voice recognition, and predictive maintenance.

🌱 Energy Efficiency and Compact Designs

There is increasing emphasis on low-power, high-performance microcontrollers, especially in EVs where energy efficiency directly affects vehicle range.

Regional Insights

RegionKey HighlightsNorth AmericaStrong R&D presence, autonomous vehicle testing, and Tier 1 supplier activityEuropeEV production hub with high demand for safety-compliant MCUsAsia-PacificLargest market share due to high vehicle production in China, Japan, and IndiaLatin America & MEAEmerging opportunities driven by automotive electronics localization

Competitive Landscape

The market is highly consolidated, with major players focusing on innovation, automotive-grade reliability, and strategic partnerships.

Key Players Include:

NXP Semiconductors

Renesas Electronics Corporation

Infineon Technologies AG

STMicroelectronics

Texas Instruments

Microchip Technology Inc.

Analog Devices (via Maxim Integrated)

Companies are also investing in automotive-specific MCU platforms, such as NXP’s S32 platform or Infineon’s AURIX series, tailored for high-performance vehicle applications.

Market Challenges

ChallengeImpactSemiconductor supply chain issuesMay cause production delays and increase costsRising software complexityDemands more processing power and advanced MCU architecturesCybersecurity threatsRequires constant innovation in secure MCU designIntegration and standardizationVarying OEM requirements make universal design challenging

Forecast (2025–2030)

Projected CAGR: 7–9%

By 2030, over 90% of new vehicles will contain advanced microcontroller systems.

ADAS and EV applications will be the fastest-growing MCU segments.

Emerging markets will witness increased demand due to local EV manufacturing and connected car adoption.

Conclusion

The automotive microcontrollers market is at the heart of the automotive industry's digital evolution. With vehicles becoming more autonomous, connected, and electrified, MCUs are playing a pivotal role in enabling these advancements. From managing real-time safety systems to enhancing driver experience, the strategic importance of microcontrollers will only intensify through 2030.

Automotive players that invest in high-performance, secure, and power-efficient MCU solutions will be better positioned to lead in the new era of mobility.

0 notes

Text

3D Sensor Companies - Infineon Technologies AG (Germany) and Microchip Technology Inc. (US) are the Key Players

The global 3D sensor market is expected to be valued at USD 6.1 billion in 2024 and is projected to reach USD 12.8 billion by 2029 and grow at a CAGR of 16.3% from 2024 to 2029. Market players ' major growth strategies are product launches, acquisitions, collaborations, partnerships, agreements, and expansions. These strategies have enabled them to fulfill the growing demand for 3D sensor from different verticals and expand their global footprint by offering products in all the major regions.

Key players operating in the 3D sensor market are Infineon Technologies AG (Germany), Microchip Technology Inc. (US), Sony Group Corporation (Japan), KEYENCE CORPORATION (US), STMicroelectronics (Switzerland), LMI TECHNOLOGIES INC. (US), ifm electronic gmbh (Germany), Qualcomm Technologies, Inc (US), NXP Semiconductors (Netherlands), OMNIVISION (US), SICK AG (Sweden), Velodyne Lidar, Inc. (US), Leuze electronic GmbH + Co. KG (US), ams-OSRAM AG (Austria), Melexis (Belgium), Pepperl+Fuchs (Germany), Teledyne Technologies Incorporated (US), Orbbec Inc. (China), Micro-Epsilon (Germany), Banner Engineering Corp. (US), wenglor (Germany), OMRON Corporation (Japan), Asahi Kasei Microdevices Corporation (Japan), Semiconductor Components Industries, LLC (US), SmartRay GmbH (Germany).

Major 3D Sensor companies include:

Infineon Technologies AG (Germany)

Infineon Technologies AG provides semiconductor and system solutions. It operates through the following segments: Automotive, Green Industrial Power, Power and Sensor systems, Connected Secure Systems, and Other Operating Segments. The Automotive segment designs, develops, manufactures, and markets semiconductors for automotive applications. The Green Industrial Power segment involves the design, development, manufacture, and marketing of semiconductors for electrical energy generation, transmission, and economy. The Power and Sensor systems segment includes the design, development, manufacture, and marketing of semiconductors for energy-efficient power supplies, mobile devices, and mobile phone network infrastructures. Connected Secure Systems designs, develops, manufactures, and markets semiconductor-based security products for card applications and network systems.

The company markets its products to the automotive, industrial, communications, and consumer and security electronics sectors worldwide, including the Americas, Europe, the Middle East, and Asia Pacific. It has 21 manufacturing units and 54 R&D centers in these regions.

Microchip Technology Inc. (US)

Microchip technology develops, manufactures, and sells intelligent, connected, and secure embedded control solutions used by customers for various applications. It sells its products globally through its sales and distribution network. The company’s product portfolio includes microcontrollers, amplifiers, memories, motor drivers, sensor, wireless connectivity products, safety & security products, power management, thermal management, and high-speed communication devices. The company’s synergistic product portfolio empowers disruptive growth trends, including 5G, artificial intelligence and machine learning, Internet of Things (IoT), advanced driver assist systems (ADAS) and autonomous driving, and electric vehicles, in key end markets such as automotive, aerospace and defense, communications, consumer, data centers and computing, and industrial.

The company has a patented 3D sensor technology called GestIC. This technology uses an electric field for proximity sensing and developing 3D gesture controllers. It enables users to interact with the device using hand or finger movement. These sensor have a detection range of 0–20 cm and operate at low power, which makes them energy-efficient. GestIC technology-based 3D sensor are not affected by surrounding light and sound; they use thin, low-cost sensing electrodes. These gesture controllers are used in smartphones, computer peripherals, electronic readers, game controllers, and consumer electronics products.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=248537071

Sony Group Corporation (Japan)

Sony is engaged in the development, design, production, manufacture, and sale of various kinds of electronic equipment, instruments, and devices for consumer, professional, and industrial markets, such as network services, game hardware and software, televisions, audio and video recorders and players, still and video cameras, mobile phones, and image sensor. It operates through the following segments: The G&NS segment includes the network services businesses, the manufacture and sales of home gaming products, and the production and sales of digital software and add-on content. The Music segment includes Recorded Music, Music Publishing, and Visual Media and Platform businesses. The Pictures segment comprises the businesses of Motion Pictures, Television Productions, and Media Networks. The ET&S segment consists of the Television business, the Audio and Video business, the Still and Video Cameras business, the smartphone business, and the internet-related service business. The I&SS segment includes the image sensor business. The financial services segment primarily represents individual life insurance and non-life insurance businesses in Japan and the banking business in Japan. All Other comprises various operating activities, including the disc manufacturing and recording media businesses.

STMicoelectronics (Switzerland)

STMicroelectronics (ST) is a leading global semiconductor company that plays a pivotal role in the 3D sensor market. The company offers a comprehensive portfolio of 3D sensing solutions, including time-of-flight (ToF) and structured light technologies, designed to deliver high precision, low power consumption, and compact form factors. These sensors are integrated into a wide range of applications, such as smartphones, industrial automation, automotive safety systems, and consumer electronics, enabling functionalities like facial recognition, augmented reality, and obstacle detection. ST's ToF sensors, such as the VL53L series, are renowned for their high performance, low power consumption, and compact size, making them ideal for integration into various devices.

Keyence Corporation (China)

Keyence Corporation, headquartered in Osaka, Japan, is a leading automation and inspection equipment provider. Established in 1974, the company has built a strong reputation for its high-quality products and innovative solutions across various industries. Keyence specializes in manufacturing sensor, vision systems, measurement systems, and laser markers, which are critical for automation, quality control, and process optimization. With a focus on research and development, Keyence continually introduces cutting-edge technologies that enhance productivity and efficiency in manufacturing and industrial applications.

In the 3D sensor market, Keyence offers a comprehensive range of products designed for precision measurement, inspection, and quality control. Their 3D laser scanners and profilers are widely used in automotive, electronics, and semiconductor manufacturing applications, where accurate and reliable measurements are essential. Keyence’s 3D sensor are known for their high resolution, speed, and ease of integration, making them suitable for various complex industrial environments. The company has a robust regional presence, with subsidiaries and offices in key markets across North America, Europe, and Asia-Pacific.

0 notes

Text

Methods of Implementing DC PLC Protocols

DC PLC communication mainly controls and monitors the condition of solar panels and energy storage systems. Additionally, DC PLC technologies are applied in industrial settings to supply power to electric motors and control them using a single pair of wires. All these applications suggest that the units responsible for communication over the power line are typically integrated into the corresponding devices (solar panel controllers, machines, and robots). Therefore, many automation system developers must understand how PLC protocols over DC power lines are implemented.

G3-PLC

The G3-PLC protocol is maintained by the international organization G3-Alliance.

Chipsets for this protocol generally comprise two microchips: an analog device for interfacing with the transmission line and a specialized microcontroller (SoC). In addition to signal processing, the microcontroller also handles encryption of the data transmitted over the line. The chipset may include a third chip responsible for converting the G3-PLC signal to one of the wireless protocols and back. Typically, this is the G3-Hybrid protocol designed for wireless networks to work alongside PLC. This protocol uses the 868 and 915 MHz frequency bands (which are not allowed for use in all countries).

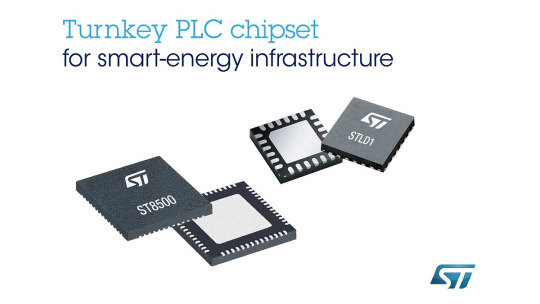

This is an example of a G3-PLC chipset from STMicroelectronics: on the left is the microcontroller, and on the right is the analog interface chip.

The chipsets and their firmware must be certified by the G3-Alliance to bear the G3-PLC label. However, such certification does not negate the need to certify G3-PLC solutions with national communications authorities if required by local regulations.

At least three manufacturers of G3-PLC chipsets are known: Maxim Integrated (a division of the US-based Analog Devices), STMicroelectronics (a European company headquartered in the Netherlands), and Vertexcom Technologies (China).

PLC-Lite

The implementation of this protocol is governed by TI's internal documents. The TMS320F28035 universal signal processor is used for signal processing. In addition, the receiver and transmitter must include the AFE031 line interface chip. The chipset also includes execution devices LM34910 and TPS62170.

IEEE 2847-2021

At the time of writing, a South Korean startup was producing devices supporting IEEE 2847-2021 (HPDS-PLC); the protocol is used in an LED lighting controller and a servo drive. Information about the components used for their development is not publicly available.

Data Transmission from Vehicle Batteries Sensors

A new technology that optimizes electric vehicle charging based on the battery's parameters and its wear level. Wireless sensors are installed on the battery. The wires inside the vehicle through which the charging current flows act as antennas. The signal passes through the electric vehicle charging connector. It continues to propagate along the charging cable as a guided medium. This solves the problem caused by the inability of radio waves to pass through the vehicle's metal body. A transceiver is connected to the cable at the charging station.

This solution uses one of the wireless protocols from the IEEE 802.15.4 family. The most widespread and cost-effective in this family is the Zigbee protocol. Therefore, it makes sense to use a chipset specifically for this protocol. Zigbee uses the 2.4 GHz band, and the frequency data transmission occurs along the charging station's cable. It should be noted that this solution is only possible for DC charging because, in this mode, the wires from the charging connector go directly to the battery.

Is software implementation of PLC algorithms possible?

For G3-PLC, using a general-purpose processor instead of a specialized microcontroller would require more chips than just two. Large production volumes and significant market competition produce relatively low prices for G3-PLC chipsets. These chips are manufactured across different regions—America, Europe, and Asia—ensuring a diversified supply. Therefore, developing a custom G3-PLC solution using general-purpose chips is not economically viable.

In PLC-Lite, a different company's signal processor can be used instead of TI's. However, new firmware would need to be written for it, which is quite costly. The TMS320F28035 is well protected from reverse engineering, so third parties cannot read the firmware stored in its memory.

No specialized chips are being produced yet for the IEEE 2847-2021 protocol, so its signal-processing algorithms must be implemented through the software on general-purpose microcontrollers.

It is more cost-effective to use specialized chips for creating PLC solutions.

The Zigbee protocol is implemented with a single chip that includes a microcontroller and a transceiver operating in the 2.4 GHz band. Using a general-purpose microcontroller would require a separate radio module, and interfacing these two units would be a highly complex task.

In conclusion, specialized chipsets are more cost-effective for PLC systems (except those using the IEEE 2847-2021 protocol).

0 notes

Text

#Global Low-Power Microcontroller Unit Market Size#Share#Trends#Growth#Industry Analysis#Key Players#Revenue#Future Development & Forecast

0 notes

Text

The Benefits of Using Microtek Inverter with Battery for Home and Office Power Solutions

In today’s speedy-paced world, uninterrupted power supply is critical for each houses and workplaces. Power outages can disrupt daily sports, damage productivity, and cause facts loss. One of the most reliable answers to fight those demanding situations is investing in a great inverter with a reliable battery. Among the marketplace’s pinnacle selections, the Microtek inverter with battery stands proud for its overall performance, durability, and fee-efficiency. In this blog, we’ll explore the benefits of using a Microtek inverter with battery for your private home and workplace, supporting you are making an knowledgeable selection.

Reliable Power Backup for Critical Needs Microtek inverters are designed to provide seamless strength backup, ensuring that your important gadgets keep walking even during electricity outages. Whether it is lighting fixtures, fanatics, computers, or home equipment, a Microtek inverter can electricity your own home or workplace without interruptions. This function is especially beneficial for enterprise environments where even a brief energy outage can bring about statistics loss or downtime.

Affordable and Cost-Effective Solution Compared to different inverters on the market, Microtek inverter with battery costs are relatively aggressive, making them an less costly option for each residential and business use. With strength-efficient era, these inverters eat much less energy and help lower your power bills. If you’re searching to buy an inverter with a battery that balances fee and excellent, Microtek gives outstanding fee in your cash.

Advanced Technology for Optimal Performance Microtek inverters come ready with advanced generation, consisting of PWM (Pulse Width Modulation) and microcontroller-based totally structures, which make certain longer battery lifestyles and higher electricity efficiency. These structures shield the inverter from overload, overheating, and deep discharge, extending the lifespan of both the inverter and the battery.

Versatility and Scalability Whether you need a power answer for a small home or a huge workplace, Microtek offers various inverters with varying capacities. From managing fundamental appliances to jogging vital office gadget, you could locate an inverter perfect in your unique wishes. Additionally, Microtek inverters can without problems integrate with different battery capacities, making them scalable as your power requirements develop.

User-Friendly and Low Maintenance Microtek inverters are regarded for his or her person-pleasant layout and coffee protection. Most models come with an smooth-to-study display that indicates the electricity status, battery stage, and other essential information. With proper installation and minimal protection, those inverters provide lengthy-term reliability, making them a trouble-loose answer for busy families and places of work.

Available at Competitive Prices in Bhopal If you’re primarily based in Bhopal and seeking to spend money on an inverter, Lotus Battery Wala offers competitive pricing at the complete variety of Microtek inverters. We provide professional steering and dependable support to help you pick the right inverter on your precise necessities. Whether you want a small unit for domestic use or a better-ability inverter in your office, we permit you to find the precise strength solution. For the latest inverter with battery expenses in Bhopal, go to Lotus Battery Wala for the quality offers.

Energy-Efficient and Environmentally Friendly Microtek inverters are designed to be power-green, helping you lessen your overall carbon footprint. By offering a easy and constant strength supply, they reduce energy wastage, making them an green alternative for environmentally aware users. This not simplest allows you shop on strength costs however additionally contributes to sustainability efforts.

Why Choose Lotus Battery Wala for Your Power Solution Needs?

At Lotus Battery Wala, we pleasure ourselves on being Bhopal’s main dealer of extraordinary inverters and batteries. When you purchase a Microtek inverter with a battery from us, you advantage from:

Expert Recommendations: Our crew of specialists will let you pick out the proper inverter for your property or workplace wishes.

Genuine Products: We provide 100% real products with producer warranties, making sure which you get the excellent pleasant to be had.

Affordable Prices: With our competitive pricing, you could be sure you’re getting the great deal on the town.

Post-Sales Support: We offer ongoing aid to make sure your inverter system is established and functioning optimally.

Final Thoughts Investing in a Microtek inverter with battery is a smart move for ensuring uninterrupted power supply in your home or office. With its superior features, affordability, and ease of use, it’s no surprise why Microtek is a desired preference for many. If you’re ready to enjoy the blessings of a dependable power backup answer, visit Lotus Battery Wala these days to discover the today's fashions and Microtek inverter with battery charges. Let us help you power your life, uninterrupted.

0 notes

Text

Semiconductor Timing IC Market Global Opportunity Analysis and Industry Forecast, 2024-2032

Semiconductor timing integrated circuits (ICs) are fundamental components in electronic systems, providing precise timing signals that synchronize operations across various devices. These ICs play a crucial role in applications ranging from telecommunications and computing to automotive and consumer electronics. Timing ICs ensure that digital circuits operate efficiently and reliably, facilitating data transfer, processing, and communication between components.

The demand for high-performance timing ICs is driven by the increasing complexity of electronic systems and the need for enhanced speed and accuracy. As technology advances, semiconductor timing ICs have evolved to offer lower power consumption, smaller form factors, and improved accuracy. These advancements are essential for meeting the growing requirements of modern applications, including 5G communication, Internet of Things (IoT) devices, and high-speed data processing systems.

The Semiconductor Timing IC Market is expanding, driven by the increasing demand for precision timing solutions in a variety of electronic devices. Advancements in timing technology are enabling higher accuracy, lower power consumption, and miniaturization, supporting applications in telecommunications, consumer electronics, and industrial automation.

Future Scope

The future of semiconductor timing ICs is poised for significant growth, propelled by the ongoing expansion of the electronics market. As industries continue to embrace digital transformation, the demand for reliable timing solutions will rise. The increasing adoption of advanced technologies, such as 5G and autonomous systems, will further amplify the need for high-precision timing ICs capable of supporting complex applications.

Moreover, advancements in semiconductor manufacturing processes are expected to yield more efficient and compact timing ICs. As manufacturers optimize production techniques, the cost of these components is likely to decrease, making them more accessible for a broader range of applications. The integration of timing ICs with other semiconductor components, such as microcontrollers and system-on-chips (SoCs), will also contribute to their widespread adoption.

Trends

Key trends shaping the semiconductor timing IC market include the rising demand for low-power solutions and the shift toward miniaturization. As battery-powered devices become more prevalent, manufacturers are focusing on developing timing ICs that consume less power while maintaining performance. Additionally, the trend toward smaller, more integrated components is driving innovation in timing IC design, resulting in more compact solutions that fit seamlessly into various electronic systems.

The growing importance of synchronization in communication networks is another trend influencing the timing IC market. As 5G technology rolls out and the number of connected devices continues to increase, precise timing becomes critical for ensuring reliable data transfer and communication. Timing ICs that support high-frequency operations and low jitter performance are essential for meeting these requirements.

Application

Semiconductor timing ICs find applications across numerous sectors, including telecommunications, computing, automotive, and consumer electronics. In telecommunications, timing ICs are vital for synchronizing signals in communication networks, ensuring reliable data transmission. In computing, they facilitate data processing by providing accurate clock signals to microprocessors and other digital components.

In automotive applications, timing ICs are used in various systems, including advanced driver-assistance systems (ADAS), infotainment units, and engine control units. Their ability to provide precise timing and synchronization enhances the performance and safety of these systems. Furthermore, in consumer electronics, timing ICs are integral to devices like smartphones, tablets, and wearables, where they ensure the proper functioning of features such as displays, audio processing, and connectivity.

As the demand for faster, more efficient, and reliable electronic devices continues to rise, semiconductor timing ICs will play a crucial role in enabling the next generation of technological advancements. Their versatility and essential functionality across various applications make them a foundational component in the modern electronics landscape.

Key Points

Fundamental components providing precise timing signals for synchronization.

Driven by the increasing complexity and performance requirements of electronic systems.

Promising future with growth in digital transformation and advanced technologies.

Trends include low-power solutions and miniaturization of components.

Applied in telecommunications, computing, automotive, and consumer electronics.

Read More Details: https://www.snsinsider.com/reports/semiconductor-timing-ic-market-4545

Contact Us:

Akash Anand — Head of Business Development & Strategy

Email: [email protected]

Phone: +1–415–230–0044 (US) | +91–7798602273 (IND)

0 notes

Text

Semiconductorinsight reports

Ultrasonic Sensor Market - https://semiconductorinsight.com/report/ultrasonic-sensor-market/

Vertical Cavity Surface Emitting Laser (VCSEL) Market - https://semiconductorinsight.com/report/vertical-cavity-surface-emitting-laser-vcsel-market/

Voltage Regulator Market - https://semiconductorinsight.com/report/voltage-regulator-market/

Wearable Sensors Market - https://semiconductorinsight.com/report/wearable-sensors-market/

Wireless Connectivity Market - https://semiconductorinsight.com/report/wireless-connectivity-market/

Zigbee Market - https://semiconductorinsight.com/report/zigbee-market/

3D NAND Flash Market - https://semiconductorinsight.com/report/3d-nand-flash-market/

Advanced Driver Assistance Systems (ADAS) Market - https://semiconductorinsight.com/report/advanced-driver-assistance-systems-adas-market/

Automotive Radar Market - https://semiconductorinsight.com/report/automotive-radar-market/

Bluetooth Low Energy (BLE) Market - https://semiconductorinsight.com/report/bluetooth-low-energy-ble-market/

CMOS Power Amplifier Market - https://semiconductorinsight.com/report/cmos-power-amplifier-market/

Compound Semiconductor Materials Market - https://semiconductorinsight.com/report/compound-semiconductor-materials-market/

Embedded FPGA Market - https://semiconductorinsight.com/report/embedded-fpga-market/

Flexible Electronics Market - https://semiconductorinsight.com/report/flexible-electronics-market/

Gallium Arsenide (GaAs) Market - https://semiconductorinsight.com/report/gallium-arsenide-gaas-market/

High Electron Mobility Transistor (HEMT) Market - https://semiconductorinsight.com/report/high-electron-mobility-transistor-hemt-market/

Indium Phosphide (InP) Market - https://semiconductorinsight.com/report/indium-phosphide-inp-market/

Low Dropout Regulator (LDO) Market - https://semiconductorinsight.com/report/low-dropout-regulator-ldo-market/

Microcontroller Unit (MCU) Market - https://semiconductorinsight.com/report/microcontroller-unit-mcu-market/

Optical Transceiver Market - https://semiconductorinsight.com/report/optical-transceiver-market/

Optoelectronic Components Market - https://semiconductorinsight.com/report/optoelectronic-components-market/

Power Amplifier Market - https://semiconductorinsight.com/report/power-amplifier-market/

Radio Frequency (RF) IC Market - https://semiconductorinsight.com/report/radio-frequency-rf-ic-market/

Semiconductor Manufacturing Equipment Market - https://semiconductorinsight.com/report/semiconductor-manufacturing-equipment-market/

Silicon-on-Insulator (SOI) Market - https://semiconductorinsight.com/report/silicon-on-insulator-soi-market/

Smart Grid Market - https://semiconductorinsight.com/report/smart-grid-market/

System-on-Module (SoM) Market - https://semiconductorinsight.com/report/system-on-module-som-market/

Thin Film Electronics Market - https://semiconductorinsight.com/report/thin-film-electronics-market/

Ultrathin and Flexible Electronics Market - https://semiconductorinsight.com/report/ultrathin-and-flexible-electronics-market/

Vertical Integration in Semiconductor Market - https://semiconductorinsight.com/report/vertical-integration-in-semiconductor-market/

Wearable Devices Market - https://semiconductorinsight.com/report/wearable-devices-market/

Wide Bandgap Power Devices Market - https://semiconductorinsight.com/report/wide-bandgap-power-devices-market/

Wireless Sensor Network (WSN) Market - https://semiconductorinsight.com/report/wireless-sensor-network-wsn-market/

Zigbee Wireless Technology Market - https://semiconductorinsight.com/report/zigbee-wireless-technology-market/

3D Printing Electronics Market - https://semiconductorinsight.com/report/3d-printing-electronics-market/

Advanced Semiconductor Packaging Market - https://semiconductorinsight.com/report/advanced-semiconductor-packaging-market/

Analog Mixed Signal Devices Market - https://semiconductorinsight.com/report/analog-mixed-signal-devices-market/

Automotive Power Electronics Market - https://semiconductorinsight.com/report/automotive-power-electronics-market/

Compound Semiconductor Devices Market - https://semiconductorinsight.com/report/compound-semiconductor-devices-market/

Embedded Memory Market - https://semiconductorinsight.com/report/embedded-memory-market/

0 notes

Text

The Arm Cortex M4 CPU in Motor Control Applications

Arm Cortex M4 CPU A 32-bit processing core intended for use in microcontrollers is the Arm Cortex M4 CPU. Because of its reputation for being strong and effective, it is a well-liked option for many different kinds of embedded systems.

Silent attributes Performance: Considering its size and power consumption, it offers excellent performance. Provides a three-step pipeline for effective execution of instructions. Possible to get a Dhrystone Million Instructions Per Second per Megahertz of 1.25 DMIPS/MHz. Power Efficiency: Optimal for battery-operated devices, it is designed for low-power applications. Provides options to cut down on power use while not in use, such as power gating and sleep modes. Dedicated DSP instructions are included in digital signal processing (DSP) to execute mathematical calculations utilised in signal processing activities efficiently. For applications like industrial automation, audio processing, and motor control, this makes it a good fit. Optional Floating-Point Unit (FPU): For applications needing computations with a greater level of accuracy, a single-precision FPU is available as an alternative.

Scalability and Usability: Facilitates the easy porting of code across various Cortex-M based microcontrollers by supporting the Cortex Microcontroller Software Interface Standard (CMSIS). This expedites the time to market for new goods and streamlines development. Uses: The Cortex-M4 is used in many embedded systems due to its versatility. Some common examples:

Automation controls motors, sensors, and other equipment in factories and other industrial environments. Motor control runs electric motors in power equipment, robots, and drones. Power management controls solar inverters and battery chargers’ power supplies. Processed audio signals in speakers, headphones, and musical instruments are embedded audio. The Internet of Things (IoT) powers connected devices with processing, data collecting, and transfer. Wearable electronics power fitness trackers, smartwatches, etc. Toshiba Electronic Devices & Storage Corporation (“Toshiba”) has added eight new products with 512KB/1MB flash memory capacity and four types of packages to the M4K Group of the TXZ Family Advanced Class 32-micro controllers equipped with CortexM4 core with FPU.

Management and Efficiency for Mixed-Signal Equipment The Arm Cortex M4 CPU family is intended to let developers construct power- and cost-efficient solutions for a wide variety of devices. The high-performance embedded Cortex-M4 processor was created to meet the needs of the digital signal control industries, which need a user-friendly, effective combination of control and signal processing capabilities.

Characteristics and Advantages of Arm Cortex M4 CPU Floating Point Processing: Achieve More With the integrated floating-point unit (FPU), you may reduce power consumption and increase battery life by 10 times for single precision floating-point computations. When paired with the Arm CMSIS-NN machine learning libraries, Cortex-M4 provide battery-operated embedded and Internet of Things devices cutting-edge intelligence.

Include DSP Features By combining control and signal processing into a single processor, chip system costs may be decreased. MAC, SIMD, and integrated digital signal processing (DSP) instructions streamline software development, debugging, and overall system architecture. With a large library of DSP operations and C programming support, it streamlines signal processing, lowers development effort, and makes DSP more accessible to a wider audience.

Reduce Design Risk and Get to Market Quicker One of the most popular Arm Cortex M4 CPU may help lower risk and provide first-time success. It is simple to build on existing software to produce powerful embedded devices with less work and a quicker time to market because to its wide ecosystem of tools, codecs, and other DSP code.

The Cortex-M4 processor Details The Arm Cortex M4 CPU is designed to meet the needs of digital signal control industries that need a user-friendly, effective combination of signal processing and control functionality. Numerous markets are satisfied by the Cortex-M series of processors’ low power, cheap cost, and simplicity of use combined with their high efficiency signal processing capabilities. These sectors include embedded audio, power management, motor control, automotive, and industrial automation.

Essentials of Arm Cortex-M Microcontroller System-on-Chip Design Get access to a thorough manual on embedded systems based on Arm Cortex-M processor cores, covering everything from the basics of microcontroller architectures and SoC-based designs to high-level hardware and software perspectives.

Arm cortex m4 microcontroller Continuing advances in the functionality of motor applications supporting IoT is increasing demand for large program capacity and firmware over-the-air support.

The new products expand code flash memory capacity from the 256KB maximum of Toshiba’s current product to 512KB[1]/1MB[2], depending on the product, and RAM capacity from 24KB to 64KB. Other features, such as an Arm Cortex-M4 core running up to 160MHz, integrated code flash and 32KB data flash memory with 100K program/erase cycle endurance, have been maintained.

The microcontrollers also offer various interfaces and motor control options, such as advance-programmable motor driver (A-PMD), advanced encoder 32-bit (A-ENC32), advanced vector engine plus (A-VE+) and three units of high-speed, high-resolution 12-bit analog/digital converters. As a result, the M4K Group products contribute to wider application of IoT, and bring advanced functionality to AC motors, brushless DC motors and inverter controls.

The new products implement the 1MB code flash in two separate 512KB areas. This realizes firmware rotation with the memory swap method[3], allowing instructions to be read from one area while updated code is programmed into the other area in parallel.

Devices in the M4K Group have UART, TSPI and I2C integrated as general communications interfaces. Self-diagnosis functions incorporated in the devices for flash memory, RAM, ADC and Clock help customers to achieve IEC 60730 Class B functional safety certification.

Documentation, sample software with actual use examples, and driver software that controls the interfaces for each peripheral are available. Evaluation boards and development environments are provided in cooperation with Armglobal ecosystem partners.

Toshiba is planning to increase capacity of flash memory also for M4M Group with CAN interface.

Applications Motors and inverter control of consumer products, industrial equipment IoT of consumer products, industrial equipment, etc. Features High-performance Cortex-M4 core with FPU, max 160MHz Increased capacity of internal memory Code flash memory: 512KB/1MB RAM: 64KB Memory swap method firmware rotation function, supporting firmware updates while the microcontroller continues to operate Self-diagnosis functions for IEC 60730 class B functional safety Four types of packages

Read more on Govindhtech.com

0 notes

Text

Microchip launches industry's first low-pin-count MCU family to support I3C

【Lansheng Technology News】As data collected and transmitted from cloud-connected edge nodes gradually increases, improved integrated circuits are quickly becoming a more sustainable solution for connecting high data rate sensors and will help expand the next Generation device capabilities. Microchip Technology Inc. pioneered the PIC18-Q20 family of microcontrollers, the industry's first low-pin-count MCUs with up to two I3C peripherals and multi-voltage I/O. Available in 14-pin and 20-pin packages with dimensions as small as 3 x 3 mm, PIC18-Q20 MCUs are compact solutions for real-time control, touch sensing and connectivity applications. The MCU provides configurable peripherals, advanced communication interfaces and easy connectivity across multiple voltage domains without the need for external components.

The PIC18-Q20 MCU's I3C functionality, flexible peripherals and ability to operate on three independent voltage domains make it ideal for use with a host MCU in larger overall systems. This family of MCUs can perform tasks that the main MCU cannot perform efficiently, such as processing sensor data, handling low-latency interrupts and system status reporting. Central processing units (CPUs) operate in different voltage domains, while I3C peripherals operate from 1.0 to 3.6V. The MCU features low power consumption and small size and can be used in a wide range of space-sensitive applications and markets, including automotive, industrial control, computing, consumer, IoT and medical.

Greg Robinson, corporate vice president of Microchip’s MCU Division, said: “One of the major barriers to large-scale IoT adoption is the cost of implementing edge nodes. Microchip is helping to break down this barrier with the launch of the PIC18-Q20 family of MCUs. This is an industry first. This low-pin-count MCU uses I3C and uses a new standard communication interface to enable flexible and cost-effective expansion of IoT applications."

As the market shifts to the need for higher performance, lower power and smaller size solutions, I3C can help designers and software developers meet these potentially challenging requirements. Compared with I2C, I3C has higher communication speed and lower power consumption, while maintaining backward compatibility with legacy systems. I3C and MVIO functionality combined with Microchip's Configurable Core-Independent Peripherals (CIP) reduces system cost, reduces design complexity, and shrinks the board by replacing external level translators with on-chip multiple voltage domains space.

Lansheng Technology Limited, which is a spot stock distributor of many well-known brands, we have price advantage of the first-hand spot channel, and have technical supports.

Our main brands: STMicroelectronics, Toshiba, Microchip, Vishay, Marvell, ON Semiconductor, AOS, DIODES, Murata, Samsung, Hyundai/Hynix, Xilinx, Micron, Infinone, Texas Instruments, ADI, Maxim Integrated, NXP, etc

To learn more about our products, services, and capabilities, please visit our website at http://www.lanshengic.com

0 notes

Text

Air Conditioning Repairs Denham Court

Whether you're a business owner or home-owner, the chances are you use your air conditioner to keep your space comfortable and cool. However, if you find that your air conditioning unit is faulty or requires a repair, then you're in luck. There are a variety of air conditioning services to choose from in Sydney. For example, if you're looking for an air conditioning repair service in Denham Court, you should consider Air conditioning Repairs Denham Court. This small family business provides services for both commercial and domestic air conditioning units.

Duct air conditioning repair

When it comes to air conditioning in Denham Court, it pays to entrust your system to a professional. The experts are well-versed in all things HVAC. They will be able to offer you advice on the best equipment for your needs. If you are in the market for a new air conditioner, or just need to replace an old one, call the pros today.

Using a good quality HVAC system is a great way to save on energy costs. But you'll need to know if you're doing it right. A technician can help you pick the best unit for your needs and install it correctly.

Inverter air conditioning

When you are looking for the most efficient way to cool your home, you may want to invest in inverter air conditioning repairs in Denham Court. This type of system has a number of advantages, including energy efficiency, low cost of operation, and less noise. However, it can be expensive to buy and maintain.

Inverter AC systems are regulated by an embedded microcontroller, which samples the ambient temperature and adjusts the speed of the compressor. In turn, this results in more energy-efficient operations.

One of the most notable features of inverter air conditioning is the ability to reach the desired temperature quickly. It starts off powerfully and slowly eases down as the room reaches the desired temperature.

Multi-split systems

If you want to cool and warm your home, you can install a multi-split system. This type of air conditioning provides quality climate control while lowering energy costs.

There are a few things to keep in mind when installing a multi-split system. The first is ensuring that you have the right equipment capacity for the building. You also need to consider the best installation locations.

One of the main factors that influence the air flow of an air con is the air ducts. If your ducts are not cleaned properly, it can affect your system's performance. Having your ducts professionally cleaned can reduce your energy costs.

Reverse cycle air conditioners

A reverse cycle air conditioner is a device that is able to provide both heating and cooling. It is ideal for homes that are located in regions with varying climates. Using the system can save you hundreds of dollars each year on your power bills.

Compared to other types of air conditioning, a reverse cycle air conditioner is the most energy efficient. It can transfer three units of heat for every one unit of electricity. These systems are also available in various models. You can choose from split or ducted systems. The size of the unit depends on the number of rooms you need to cool or heat.

0 notes