#M2M ecosystem

Explore tagged Tumblr posts

Video

youtube

M2M Services | Who Needs M2M Services Registration?

#youtube#M2MSPs#M2Mcommunication#IoT#M2M Services Registration#IoT SIM Cards Registration#M2M ecosystem#telecom#telecommunications#License

1 note

·

View note

Text

From Data to Strategy: Mapping the 5G Technology Market Potential

Introduction

The 5G revolution is no longer on the horizon — it’s here, and it’s reshaping industries, economies, and daily life across the globe. As the successor to 4G LTE, 5G (Fifth-Generation) wireless technology promises dramatically improved data speeds, ultra-low latency, massive device connectivity, and unparalleled network reliability. Beyond faster smartphones, 5G is the cornerstone for enabling advanced technologies like autonomous vehicles, smart factories, telemedicine, augmented reality (AR), and the broader Internet of Things (IoT) ecosystem.

The global 5G technology market has entered an accelerated growth phase, driven by soaring demand for high-speed data connectivity and the growing adoption of cloud-based applications and AI-powered services. From telecom providers and network hardware manufacturers to cloud service vendors and chipmakers, the 5G era is shaping new business models and competitive landscapes.

Market Overview

The 5G market encompasses a broad range of products and services — including network infrastructure (base stations, small cells, antennas), mobile devices (smartphones, tablets, routers), software (network slicing, SDN), and service providers offering 5G network access.

As of 2024, commercial 5G networks have been deployed across 80+ countries, with billions of connected devices expected to rely on 5G by 2032. The technology is being integrated into industries beyond telecom, including healthcare, automotive, smart cities, manufacturing, and media.

Download a Free Sample Report:-https://tinyurl.com/y6vrtts4

Key Market Drivers

Exploding Data Consumption

The proliferation of video streaming, cloud gaming, real-time collaboration tools, and immersive media has overwhelmed 4G LTE networks. 5G’s ability to deliver multi-gigabit per second speeds addresses this gap, making it indispensable for modern digital consumption.

Growth in IoT Devices

From smart homes and wearable health monitors to industrial automation, the number of IoT devices worldwide is projected to surpass 30 billion by 2032. 5G networks are uniquely designed to handle this surge, enabling seamless connectivity across millions of devices per square kilometer.

Industry 4.0 and Automation

In manufacturing and logistics, 5G enables real-time machine-to-machine (M2M) communication, predictive maintenance, remote operations, and digital twins — cornerstones of Industry 4.0. Private 5G networks are increasingly being adopted for operational control in factories, warehouses, and even oil rigs.

Support for Emerging Technologies

Augmented Reality (AR), Virtual Reality (VR), autonomous vehicles, and advanced telemedicine require low latency (often below 1 millisecond) and high bandwidth, both of which 5G provides. The growth of these cutting-edge technologies is tightly linked to the global rollout of 5G.

Market Challenges

While 5G adoption is accelerating, the market faces several challenges:

High Infrastructure Costs

Deploying 5G requires a dense network of small cells, fiber optic backhaul, and advanced antennas, representing substantial capital expenditure for telecom providers. The business case for 5G is still under pressure in low-ARPU (Average Revenue Per User) regions.

Spectrum Availability and Regulation

5G performance depends heavily on spectrum allocation — particularly in the millimeter-wave (mmWave) and mid-band frequencies. Regulatory delays in spectrum auctions and inconsistent allocation policies across countries can slow down market growth.

Security Concerns

The complex, software-defined nature of 5G networks introduces new vulnerabilities. Network slicing, virtualization, and multi-vendor environments create a broader attack surface, making cybersecurity a critical priority.

Industry Trends

Rise of Private 5G Networks

Large enterprises, particularly in the manufacturing, logistics, and healthcare sectors, are deploying private 5G networks to ensure high security, dedicated performance, and total control over network architecture. This trend is expected to become mainstream by 2027.

Network Slicing

5G enables network slicing — the ability to partition a single physical network into multiple virtual networks optimized for different use cases (e.g., autonomous vehicles, telehealth, streaming). This dynamic allocation of network resources will play a significant role in service delivery over the next decade.

Open RAN (Radio Access Network)

Traditional telecom networks have long been locked into proprietary hardware ecosystems. Open RAN is reshaping the 5G landscape by promoting hardware-agnostic, interoperable solutions that reduce costs and foster vendor diversity.

Edge Computing Integration

As 5G’s low-latency potential becomes fully realized, edge computing is evolving in parallel. By moving data processing closer to the user or device, edge computing enhances response times and reduces data load on core networks — a critical enabler for autonomous systems and immersive applications.

Regional Insights

North America

The U.S. and Canada are global leaders in 5G commercialization, backed by heavy investments from operators like Verizon, AT&T, T-Mobile, and Rogers. 5G is driving adoption in connected cars, remote surgeries, smart cities, and military communications.

Europe

European Union countries are focusing on pan-European 5G corridors for cross-border autonomous vehicle operations and industrial IoT applications. Operators like Vodafone, Deutsche Telekom, and Orange are at the forefront of 5G rollout, supported by government-backed initiatives.

Asia-Pacific

China, South Korea, and Japan are trailblazers in the 5G race. China, with over 3 million base stations as of 2024, leads in scale, while South Korea boasts some of the world’s fastest average 5G speeds. The Asia-Pacific region is also witnessing strong 5G growth in India, Singapore, and Australia.

Competitive Landscape

The 5G market is intensely competitive, involving global telecom giants, semiconductor companies, network equipment vendors, and cloud providers.

Key players include:

Telecom Operators: Verizon, AT&T, China Mobile, Vodafone, SK Telecom

Equipment Providers: Huawei, Ericsson, Nokia, Samsung Networks

Chip Manufacturers: Qualcomm, Intel, MediaTek

Cloud Providers: Amazon Web Services (AWS), Microsoft Azure, Google Cloud

Strategic partnerships, spectrum acquisitions, and R&D investments are driving differentiation in an increasingly commoditized market.

Market Forecast to 2032

According to industry forecasts, the global 5G technology market is expected to grow at a compound annual growth rate (CAGR) of approximately 28% from 2024 to 2032, reaching a market valuation of over USD 1.8 trillion by the end of the forecast period.

Key growth segments include:

Consumer Applications: Smartphones, smart homes, immersive media

Enterprise Applications: Private 5G networks, industrial IoT, remote collaboration

Public Infrastructure: Smart cities, autonomous transportation, telehealth

With each successive year, network capabilities, device compatibility, and use-case diversity will expand, unlocking new economic opportunities and technological breakthroughs.

Conclusion

5G technology represents a seismic shift in how the world connects, communicates, and computes. Far more than a simple speed upgrade, 5G enables a new digital ecosystem — one that fuels real-time, intelligent, and immersive experiences across every sector.

As the global rollout continues, industries will need to address challenges related to infrastructure, regulation, and security. However, the long-term impact of 5G is clear: it will be a foundation for future innovations ranging from self-driving cars and AI-powered robotics to remote surgery and fully connected smart cities.

Stakeholders that invest early in 5G ecosystem development — from chip design and network planning to application-layer solutions — will be best positioned to lead in the data-driven economy of 2032 and beyond.

Read Full Report:-https://www.uniprismmarketresearch.com/verticals/information-communication-technology/5g-technology

0 notes

Text

Europe Wearable Sensor Market Size, Share, Comprehensive Analysis, Opportunity Assessment by

The Europe Wearable Sensor Market is poised for significant growth, with projections indicating it will reach US1,109.30millionby2028, upfromUS1,109.30millionby2028, up from US 411.09 million in 2021, reflecting a robust CAGR of 15.2% during the forecast period. This growth is driven by several key factors, including advancements in hands-free wearable technology, the integration of IoT, AR, and M2M technologies, and increasing demand from sectors like healthcare and consumer electronics. 𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐏𝐃𝐅 𝐁����𝐨𝐜𝐡𝐮𝐫𝐞 - https://www.businessmarketinsights.com/sample/BMIRE00025224

Key Drivers of Market Growth:

Hands-Free Wearable Technology: The ability to deliver real-time information to users has made wearable devices increasingly popular. Mobile device OEMs are investing heavily in wearables to counter declining margins in traditional markets like smartphones and tablets.

Integration of IoT, AR, and M2M Technologies: These technologies enhance the flexibility, scalability, and functionality of wearable devices, particularly in the healthcare sector. Wearable medical devices equipped with M2M capabilities can collect, send, and process data efficiently, driving demand.

Diverse Product Offerings: The market is flooded with innovative products such as smart bands, smartwatches, and AR smart glasses (e.g., Xiaomi AR smart glasses), catering to various consumer needs and applications.

Healthcare and Consumer Electronics Demand: The increasing adoption of wearable devices in healthcare for remote patient monitoring, fitness tracking, and other applications is a significant growth driver. Similarly, consumer electronics are leveraging wearables for enhanced user experiences.

Strategic Insights for Stakeholders:

Market Differentiation: Companies should focus on identifying untapped market segments or developing unique value propositions to stand out in a competitive landscape. For example, targeting niche healthcare applications or integrating advanced AR features could provide a competitive edge.

Investment in Innovation: Continued investment in R&D for IoT, AR, and M2M technologies will be crucial. Developing next-generation wearables with enhanced capabilities, such as improved battery life, better data accuracy, and seamless integration with other devices, will attract more consumers.

Regional Nuances: Understanding regional differences in consumer preferences and regulatory environments across Europe will be essential. Tailoring products and marketing strategies to meet these specific needs can drive higher adoption rates.

Data-Driven Decision Making: Leveraging data analytics to anticipate market trends and shifts will enable stakeholders to make informed decisions. This includes monitoring consumer behavior, technological advancements, and competitive activities.

Long-Term Positioning: Adopting a future-oriented perspective is critical. Stakeholders should focus on long-term strategies that align with emerging trends, such as the increasing use of wearables in telemedicine, personalized healthcare, and smart home ecosystems.

Future Trends:

Expansion of AR and IoT Applications: The integration of AR and IoT in wearables is expected to create new opportunities, particularly in areas like augmented reality glasses and smart clothing.

Healthcare Wearables: The healthcare sector will continue to be a major growth area, with wearables playing a crucial role in remote patient monitoring, chronic disease management, and preventive healthcare.

Sustainability and Ethical Considerations: As the market grows, there will be increasing focus on sustainable manufacturing practices and ethical considerations, such as data privacy and security.

Conclusion:

The Europe wearable sensor market is on a strong growth trajectory, driven by technological advancements and increasing demand across various sectors. Stakeholders who leverage strategic insights, invest in innovation, and adopt a data-driven approach will be well-positioned to capitalize on this dynamic market. By anticipating future trends and addressing regional nuances, companies can differentiate themselves and achieve long-term success in the evolving wearable sensor landscape.

About Us:

Business Market Insights is a market research platform that provides subscription service for industry and company reports. Our research team has extensive professional expertise in domains such as Electronics & Semiconductor; Aerospace & Défense; Automotive & Transportation; Energy & Power; Healthcare; Manufacturing & Construction; Food & Beverages; Chemicals & Materials; and Technology, Media, & Telecommunications

Author’s Bio: Snehal Senior Market Research Expert at Business Market InsightsBrowse more Reports Europe Frozen Fruits Size -https://businessmarketins02.blogspot.com/2025/02/europe-frozen-fruits-size-share.html Europe Power over Ethernet Market - https://businessmarketins02.blogspot.com/2025/02/europe-power-over-ethernet-market-size.html US Sleepwear Market - https://businessmarketins02.blogspot.com/2025/02/us-sleepwear-market-size-share-trends.html

0 notes

Text

Recent Developments in the Global Machine-to-Machine (M2M) Connections Market Ecosystem: Trends and Analysis

The Machine-to-Machine (M2M) connections market is evolving rapidly, driven by advancements in connectivity technologies, increasing adoption of IoT, and the expansion of 5G networks. M2M communication facilitates seamless data exchange between devices, enabling industries to enhance automation, improve efficiency, and optimize decision-making processes. This article explores recent developments…

0 notes

Text

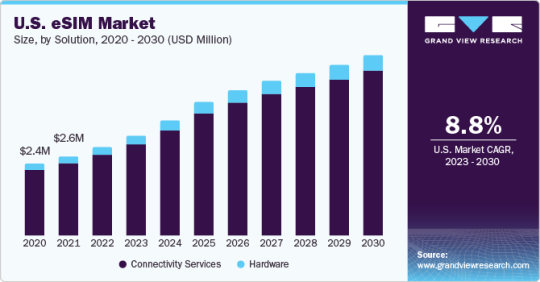

Future of the eSIM Market: How It’s Revolutionizing the Telecom Industry

The global eSIM market was valued at USD 8.07 billion in 2022 and is anticipated to expand at a compound annual growth rate (CAGR) of 7.9% from 2023 to 2030. This market growth is primarily driven by the increasing adoption of Internet of Things (IoT)-connected devices, particularly in machine-to-machine (M2M) applications and consumer electronics. One of the key trends contributing to this growth is the rising frequency of eSIM profile downloads across consumer devices. As more and more devices become eSIM-enabled, the market continues to accelerate.

According to Mobilise, the number of eSIM-enabled devices reached 1.2 billion in 2021, and this number is expected to increase significantly to 3.4 billion by 2025, reflecting the growing integration of eSIM technology across a wide range of devices.

A significant factor in the expansion of the eSIM market is its adoption within the automobile industry. The integration of eSIM technology into vehicles has introduced remarkable flexibility in offering cellular connectivity to cars and trucks. This shift is unlocking new capabilities and features for connected vehicles. In the coming years, it is expected that all cars will be equipped with cellular connectivity, improving the driving experience through innovative linked services. Recently, the automotive industry has made a significant advancement by implementing the GSMA-embedded SIM specification. This development is set to enhance vehicle connectivity and improve the security of various connected services, further enabling the next generation of connected and smarter automobiles.

Gather more insights about the market drivers, restrains and growth of the eSIM Market

Regional Insights

North America

North America led the eSIM market in 2022, accounting for the largest revenue share of 39.1%. The region is also expected to grow at the fastest compound annual growth rate (CAGR) of 8.7% during the forecast period. This growth is primarily driven by the strong presence of network providers and the rapid pace of technological advancements within the region. North America benefits from its advanced infrastructure, robust digital ecosystem, and the increasing adoption of IoT devices, all of which support the continued growth of eSIM technology.

Europe

Europe is also projected to experience significant growth over the forecast period. European companies have historically been early adopters of new technologies, and the region is home to many key market players, including Giesecke+Devrient Mobile Security GmbH, NXP Semiconductors N.V., and STMicroelectronics, among others. Additionally, Europe is witnessing a rising demand for smart connected devices and connected vehicles, particularly with the growing adoption of eSIM-enabled smartphones, smart cars, and other IoT devices. These factors position Europe to maintain a strong market presence alongside North America during the forecast period.

Asia Pacific

Asia Pacific is expected to see substantial growth as well, fueled by the increasing number of eSIM-enabled devices, particularly in the smartphone market. Major smartphone manufacturers such as Huawei and Samsung Electronics have already introduced eSIM-enabled devices, which are driving the momentum for eSIM adoption across the region. This shift is positioning eSIM as the future mainstream SIM technology for connected devices. Additionally, several original equipment manufacturers (OEMs) in countries like China and India are developing eSIM solutions, collaborating across the ecosystem to create innovative development paths. For example, in June 2021, IDEMIA, a leading eSIM manufacturer, expanded its production capacity in India, aiming to boost global eSIM production. According to Giesecke+Devrient (G&D), a German digital solutions provider, it is projected that 25-30% of smartphones will have eSIM capabilities by 2024.

Browse through Grand View Research's Communication Services Industry Research Reports.

• The global web real-time communication market size was valued at USD 8.71 billion in 2024 and is projected to grow at a CAGR of 45.7% from 2025 to 2030.

• The global near field communication market size was valued at USD 30.85 billion in 2024 and is projected to grow at a CAGR of 12.3% from 2025 to 2030.

Key Companies & Market Share Insights

Industry players in the eSIM market are actively pursuing strategies like product launches, acquisitions, and collaborations to expand their global presence and enhance market competitiveness. For example, in September 2022, BICS, a digital communications services and IoT company, partnered with Thales, a global technology provider, to streamline the integration of eSIM for the Internet of Things (IoT). This strategic collaboration aims to build an open ecosystem for eSIM technology within the IoT sector, allowing for easier integration and more efficient deployment of eSIM solutions across various industries. The collaboration is designed to enhance connectivity and operational efficiency, which could lead to more widespread adoption of eSIM technology.

As the eSIM market grows, competition is expected to intensify, with companies focused on developing advanced, cost-effective solutions. The ability of eSIM technology to simplify the process of switching between mobile network operators is expected to drive heightened competition among service providers. The growing ease with which consumers can change operators is likely to encourage more switching, leading to a more competitive landscape in the telecommunications sector.

For instance, in September 2021, Deutsche Telekom AG announced the launch of an in-car 5G and personal eSIM networking service in partnership with Bayerische Motoren Werke AG (BMW). The collaboration utilized personal eSIM technology and MobilityConnect to link the vehicle's connectivity with the customer’s mobile network on a 5G basis, enabling a more integrated and seamless experience for connected car users. This innovative solution highlights how companies are leveraging eSIM technology to enhance connectivity and create new value-added services in the automotive sector.

The following are some of the major participants in the global eSIM market

• Arm Limited

• Deutsche Telekom AG

• Giesecke+Devrient GmbH

• Thales

• Infineon Technologies AG

• KORE Wireless

• NXP Semiconductors

• Sierra Wireless

• STMicroelectronics

• Workz

Order a free sample PDF of the eSIM Market Intelligence Study, published by Grand View Research.

0 notes

Text

Connect the Dots: Telecom IoT Platform for Smarter Operations

As businesses become more reliant on connected devices, managing networks effectively has never been more important. With the growing Internet of Things (IoT) ecosystem, companies need a reliable and efficient way to handle the increasing number of devices. An advanced telecom IoT platform provides a comprehensive solution that enables businesses to improve operations, enhance control, and make better data-driven decisions.

By leveraging the best IoT connectivity management software, businesses can oversee every device on their network, monitor data flows, and ensure uninterrupted communication. A powerful M2M device management platformin IoT device systems further supports smooth, scalable management, allowing companies to achieve a higher level of operational control. Let’s look at how this technology can drive more efficient operations.

Telecom IoT Platform: Driving Smarter Operations

A reliable telecom IoT platform provides businesses with the ability to monitor and manage connected devices from a single point. With thousands of devices operating simultaneously, maintaining control over each one can be challenging. This is where a centralized platform comes into play. It offers a complete view of the entire IoT network, allowing administrators to monitor device health, track data usage, and manage connectivity effortlessly.

The addition of the best IoT connectivity management software ensures seamless communication between devices. It enables real-time data monitoring, quickly identifying and resolving any connectivity issues. This results in fewer disruptions and more efficient data transfers, helping businesses make timely decisions.

Furthermore, a well-integrated M2M device management platform in IoT device networks helps businesses ensure that all devices work together harmoniously. Machine-to-machine (M2M) communication is vital for industries that rely on multiple interconnected devices, such as smart meters, industrial sensors, and connected vehicles. The platform ensures that these devices function properly, continuously gather data, and stay up-to-date with necessary software upgrades.

Benefits of a Comprehensive IoT Platform

Centralized Device Control A powerful telecom IoT platform provides a unified dashboard for managing all connected devices. With the best IoT connectivity management software, businesses can track device performance, manage configurations, and control data flow with ease. This comprehensive control reduces the risk of system errors and improves overall operational efficiency.

Seamless Connectivity Across Devices Managing connectivity for a growing number of IoT devices requires the right tools. A M2M device management platform in IoT device ecosystems helps keep everything in sync. It ensures reliable, real-time communication between devices, regardless of location or network conditions. This leads to better performance and uninterrupted service, allowing businesses to maintain smooth operations without costly downtime.

Enhanced Security Measures Security is a major concern when dealing with multiple connected devices. A reliable telecom IoT platform includes robust security protocols to protect data and device communication. The best IoT connectivity management software ensures encrypted data transfers and real-time threat detection. Businesses can safeguard their IoT networks from potential cyber risks and comply with industry regulations, reducing the chance of breaches.

Scalable and Flexible Growth As your IoT ecosystem expands, your platform should be able to scale accordingly. A flexible M2M device management platform in IoT device networks makes it easy to add new devices and adjust to changing operational needs. Whether you’re managing a handful of devices or scaling to thousands, a scalable platform ensures that growth is smooth and efficient.

Cost-Effective Operations Implementing the best IoT connectivity management software helps reduce the need for manual monitoring and intervention. By automating many routine tasks and allowing administrators to manage devices remotely, businesses can cut operational costs. The result is a more streamlined process that minimizes the need for on-site visits and troubleshooting, ultimately lowering costs while improving performance.

How to Get the Most from Your IoT Platform

To fully benefit from an IoT platform, businesses must ensure that it integrates smoothly with their existing systems. A telecom IoT platform should support a variety of devices and provide reliable communication between them. The right platform ensures that companies can scale their operations without interruptions, while also optimizing data flow for better decision-making.

A well-implemented M2M device management platform in IoT device networks allows businesses to monitor performance, ensure timely maintenance, and prevent disruptions. With the best IoT connectivity management software, businesses can optimize network usage, reduce latency, and improve data transmission speeds.

By choosing a flexible platform that adapts to future needs, companies can maximize their return on investment. Whether adding new devices or expanding to new regions, the right IoT solution should enable seamless growth and ensure continued operational efficiency.

Conclusion

A well-chosen telecom IoT platform provides businesses with an effective way to manage connected devices, enhance security, and streamline operations. By integrating the best IoT connectivity management software and a reliable M2M device management platform in IoT device systems, businesses can boost performance, reduce costs, and ensure smooth scalability. Investing in the right IoT platform means gaining full control over your device network and ensuring continuous, efficient operations for years to come.Infinity, telecom IoT platform of 6D Technologies has enhanced operational efficiency and improved device management for several telecom companies. Additionally, this solution is built with powerful tools and solutions like connectivity management platform, M2M device management solution, IoT middleware platform, and more. To learn more about this powerful tool, please visit https://www.6dtechnologies.com/products-solutions/internet-of-things/

0 notes

Text

ESIM Imaging Market Size, Status and Forecast 2030

eSIM Industry Overview

The global eSIM market size was valued at USD 8.07 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 7.9% from 2023 to 2030. The market growth is driven by the rising adoption of IoT-connected devices in M2M applications and consumer electronics. There is an upsurge in the number of times eSIM profiles were downloaded across consumer devices. The eSIM market is propelling due to the rise in the adoption of eSIM-connected devices. According to Mobilise, in 2021, there were 1.2 billion eSIM-enabled devices, with the number expected to climb to 3.4 billion by 2025.

Gather more insights about the market drivers, restrains and growth of the eSIM Market

The introduction of eSIM in the automobile industry has provided tremendous flexibility in providing cellular connectivity to trucks and cars while unlocking new capabilities and features. It is expected that within the next several years, all cars will be cellular enabled, resulting in a better driving experience facilitated by novel linked services. Recently, the automotive industry took a giant step toward enabling the next generation of connected automobiles by implementing the GSMA-embedded SIM specification to strengthen vehicle connectivity. It is intended to improve security for various connected services.

The eSIM-enabled solutions offer automatic interoperability across numerous SIM operators, connection platforms, and remote SIM profile provisioning. With multiple network service providers involved in the operating chain, maintaining the security of these systems has grown complicated. Mobile Network Operators' (MNOs') credentials are collected and kept by the eSIM in the device's inbuilt software, making them vulnerable to security breaches. Furthermore, the operation of eSIM across numerous physical platforms and MNOs exposes it to several virtual environment concerns. As a result, the operational flexibility provided by eSIM may be rendered ineffective if security is breached, impeding market expansion.

Industry 4.0 is a technological breakthrough that has introduced smart machinery with automatic communication and control. Industry 4.0 refers to a networked environment in which actionable data and information are transferred between Machine to Machine (M2M) and Machine to Other (M2O) devices via the Internet of Things (IoT). Wi-Fi, sensors, RFID (radio frequency administrations), and autonomous computing software are all used in M2M systems to analyze data and send it over a network for further processing. M2M systems frequently rely on public and cellular networks for internet access. These factors enabled the integration of electronic manufacturers with eSIM (embedded SIM cards) into M2M systems, thereby contributing to market expansion. By enabling M2M communication, eSIM technology has enabled advancements in the connected ecosystem.

The increasing penetration of smartphones across countries such as China, India, Japan, and the U.S. is further anticipated to fuel market growth. Smartphone manufacturers such as Google, Samsung Electronics Co., Apple, Inc., and Motorola Mobility LLC, Ltd. have started implementing eSIM technology into their smartphones in alliance with several network service providers. For instance, Apple, Inc. has partnered with six service providers, Ubigi, MTX Connect, Soracom Mobile, GigSky, Redtea Mobile, and Truphone, to offer eSIM service. Smartphone and consumer electronics manufacturers' increasing adoption of eSIM to provide an enhanced and secure user experience is expected to bolster market growth.

Browse through Grand View Research's Communication Services Industry Research Reports.

• The global speech analytics market was valued at USD 2.82 billion in 2023 and is projected to grow at a CAGR of 15.7% from 2024 to 2030. Advancements in omnichannel integration capabilities fuel the market's growth.

• The global commerce cloud market size was estimated at USD 17.78 billion in 2023 and is expected to grow at a CAGR of 22.8% from 2024 to 2030. The market is experiencing robust growth driven by several key factors.

eSIM Market Segmentation

Grand View Research has segmented the global eSIM market based on solution, application, and region:

eSIM Solution Outlook (Revenue in USD Million, 2017 - 2030) • Hardware • Connectivity services

eSIMc Application Outlook (Revenue in USD Million, 2017 - 2030) • Consumer Electronics o Smartphones o Tablets o Smartwatches o Laptop o Others • M2M o Automotive o Smart Meter o Logistics o Others

eSIM Regional Outlook (Revenue in USD Million, 2017 - 2030) • North America o U.S. o Canada • Europe o UK o Germany o France • Asia Pacific o China o Japan o India o Australia o South Korea • Latin America o Brazil o Mexico • Middle East and Africa o Saudi Arabia o South Africa o UAE

Order a free sample PDF of the eSIM Market Intelligence Study, published by Grand View Research.

Key Companies profiled: • Arm Limited • Deutsche Telekom AG • Giesecke+Devrient GmbH • Thales • Infineon Technologies AG • KORE Wireless • NXP Semiconductors • Sierra Wireless • STMicroelectronics • Workz

Recent Developments

• In May 2023, Lonestar Cell MTN, a South African conglomerate, introduced eSIM technology in Liberia. This advancement allows subscribers to switch to eSIM-compatible devices without the hassle of removing physical SIM cards. Customers can scan a QR code provided at any Lonestar Cell MTN service center.

• In March 2023, Gcore, a public cloud and content delivery network company, launched its Zero-Trust 5G eSIM Cloud platform. This platform offers organizations across the globe a secure and dependable high-speed networking solution. By utilizing Gcore's software-defined eSIM, companies can establish secure connections to remote devices, corporate resources, or Gcore's cloud platform through regional 5G carriers.

• In February 2023, Amdocs, a software company, collaborated with Drei Austria to introduce a groundbreaking eSIM solution. This collaboration enables Drei Austria's customers to access the advantages of digital eSIM technology through a fully app-based experience. The innovative "up" app offers a seamless and entirely digital SIM journey powered by Amdocs' eSIM technology at Drei Austria.

• In December 2022, Grover, a subscription-based electronics rental platform, joined forces with Gigs, a telecom-as-a-service platform, to introduce Grover Connect, its very own mobile virtual network operator (MVNO), in the U.S. Through Grover Connect, customers in the U.S. can effortlessly activate any eSIM-enabled technology device, eliminating the complexities associated with carrier offers and contracts that may not align with their device rental duration.

• In October 2022, Bharti Airtel, a telecommunications service provider based in India, unveiled its "Always On" IoT connectivity solutions. This offering enables seamless connectivity for IoT devices across multiple Mobile Network Operators (MNOs) through an embedded SIM (eSIM) technology. Particularly beneficial for vehicle tracking providers, auto manufacturers, and scenarios where equipment operates in remote areas, requiring uninterrupted and widespread connectivity.

0 notes

Text

eSIM Market Size To Reach USD 15,464.0 Million By 2030

eSIM Market Growth & Trends

The global eSIM market is expected to reach USD 15,464.0 million by 2030 at a CAGR of 7.9% from 2023 to 2030, according to a study conducted by Grand View Research, Inc. Technological developments in consumer electronic devices such as smartphones, laptops, tablets, wearables fueling the eSIM market growth. Furthermore, due to the small size of the chipset, eSIMs are likely to be widely used in smartphones. For example, in 2018, Apple, Inc. released an iPhone featuring dual SIM capabilities, including a Nano-SIM and an eSIM. Furthermore, Apple, Inc. has included eSIM in their tablet and watch series.

SIM cards with eSIMs are considerably smaller than those with physical SIMs. Chipsets are therefore smaller when integrated into devices. Device manufacturers benefit from eSIM technology since they can save space by eliminating the physical SIM card tray and SIM card slot. Thus, factors such as compact design specification and multiple carrier support of the eSIM are propelling the market growth.

The 5G technology is intended to deliver faster internet speeds and more network capacity. 5G is expected to provide download speeds of 1 gigabit per second while lowering latency to less than a millisecond. This is expected to have a beneficial impact on the eSIM market, expanding its acceptance across a range of cellular-enabled devices. As a result, network service providers and OEMs are overhauling their infrastructure in order to efficiently manage the connectivity and speed provided by 5G. eSIM technology, which can be easily integrated into smaller devices like fitness bands, wearables, and smartwatches, is the future of 5G.

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/esim-market

Industry 4.0 is a technological breakthrough that has introduced smart machinery with automatic communication and control. Industry 4.0 refers to a networked environment in which actionable data and information are transferred between Machine to Machine (M2M) and Machine to Other (M2O) devices via the Internet of Things (IoT). Wi-Fi, sensors, RFID (radio frequency administrations), and autonomous computing software are all used in M2M systems to analyze data and send it over a network for further processing. M2M systems frequently rely on public and cellular networks for internet access. These factors enabled the integration of electronic manufacturers with eSIM (embedded SIM cards) into M2M systems, thereby contributing to market expansion. By enabling M2M communication, eSIM technology has enabled advancements in the connected ecosystem.

eSIM Market Report Highlights

Due to connectivity subscriptions from M2M devices, the connectivity services segment held the greatest market share in 2022

The hardware segment is expected to attain a substantial CAGR throughout the forecasted period due to smartphone manufacturers' use of eSIM technology

Due to technological improvements and IoT connectivity among devices, the consumer electronics segment is expected to expand at a considerable CAGR of more than 9.2% throughout the forecast period

Regional Insights

North America dominated the market and accounted for the largest revenue share of 39.1% in 2022. and is expected to grow at the fastest CAGR of 8.7% over the forecast period. The growth is due to the network providers' high presence and the region's fastest technological advancements. The growth is due to the network providers' high presence and the region's fastest technological advancements.

Europe is expected to grow significantly during the forecast period. European companies are the early adopters of the latest technologies. At the same time, the regions are headquarters to several prominent market players, such as Giesecke+Devrient Mobile Security GmbH, NXP Semiconductors N.V., STMicroelectronics, and others. These areas also witness the rising adoption of smart connected devices and cars. Due to all these factors, these two regions are expected to maintain their lead during the forecast period.

eSIM Market Segmentation

Grand View Research has segmented the global eSIM market based on solution, application, and region:

eSIM Solution Outlook (Revenue in USD Million, 2017 - 2030)

Hardware

Connectivity services

eSIMc Application Outlook (Revenue in USD Million, 2017 - 2030)

Consumer Electronics

M2M

eSIM Regional Outlook (Revenue in USD Million, 2017 - 2030)

North America

Europe

Asia Pacific

Latin America

Middle East and Africa

List of Key Players in eSIM Market

Arm Limited

Deutsche Telekom AG

Giesecke+Devrient GmbH

Thales

Infineon Technologies AG

KORE Wireless

NXP Semiconductors

Sierra Wireless

STMicroelectronics

Workz

Browse Full Report: https://www.grandviewresearch.com/industry-analysis/esim-market

0 notes

Text

The telecom sector is going through an exciting phase. With the upcoming 5G auction (26th July), a lot is at stake for the industry. So far, the fortunes of the sector have been decided by the consumer business as it generates more than 80% of the overall revenues ( maybe even more). But that trend is changing with the b2b or the enterprise business picking up steam.

Think about it, when we speak or hear about 5g, how many times do we discuss consumer use cases? Compare that with the b2b sector. The opportunity clearly lies in this segment. And that might be the big difference as we go forward with established players having a much stronger footing amongst enterprises as compared to newer entrants.

From a service breakout perspective, mobile services are the most significant revenue contributor (upwards of 60%), but the growth levers in this segment are SMS services and M2M connectivity.

The future of enterprise mobile services will pivot around IoT, and we will tell you how. Most of the use cases that we come across 5g are around IoT. The growth of SMS also stems from a significant push of M2M connectivity or A2P (application to person) messaging.

The timing is right for the telecom sector as we step into the future. Advancements in AI, 5G and IoT, in conjunction with their brand and high customer trust, can help telecom companies emerge as Large System Integrators (LSI). They are equipped to provide consulting, advisory, and systems integration (SI) services. Telcos will have a significant coordination role in the value chain. Pivoting the legacy business will require capitalizing on dedicated core networks, developing the right set of ecosystem partners, and fostering IoT agility to build customer trust. know more...

0 notes

Text

Table of ContentsExploring the Integration of Blockchain Technology in IoT for Enhanced Machine-to-Machine CommunicationThe Future of IoT Security: Implementing Blockchain for Trustworthy Machine-to-Machine TransactionsAdvancements in Decentralized Networks: The Role of Blockchain in Facilitating Autonomous Machine-to-Machine Interactions in IoT SystemsConclusion"Empowering Autonomous Interactions: Seamless Blockchain-Driven IoT Connectivity"Blockchain-based machine-to-machine (M2M) communication represents a paradigm shift in how devices interact in the Internet of Things (IoT) ecosystems. By leveraging blockchain technology, M2M communication can occur in a decentralized, secure, and trustless environment, which is a significant departure from traditional centralized systems. The integration of blockchain into IoT facilitates direct interactions between devices without the need for intermediaries. This is achieved through the use of distributed ledgers that record transactions in a tamper-resistant way. Each transaction or communication is verified by the network and then added to the blockchain, ensuring data integrity and traceability. Smart contracts, which are self-executing contracts with the terms of the agreement directly written into code, further enhance M2M communications. They enable devices to perform transactions and make decisions autonomously when certain conditions are met, thus creating a highly automated and efficient IoT ecosystem. Blockchain-based M2M communication offers several advantages, including improved security through encryption and consensus algorithms, increased transparency with an immutable record of interactions, and reduced operational costs by eliminating the need for central authorities. These features make blockchain an attractive technology for various IoT applications, such as supply chain management, smart grids, and autonomous vehicles, where secure and reliable M2M communication is crucial.Exploring the Integration of Blockchain Technology in IoT for Enhanced Machine-to-Machine CommunicationBlockchain-based machine to machine communications and IoT The integration of blockchain technology into the Internet of Things (IoT) is revolutionizing the way machines communicate with each other. By leveraging the inherent security and transparency features of blockchain, IoT networks are becoming more robust, autonomous, and efficient, paving the way for a new era of machine-to-machine (M2M) communication. At the heart of this transformation is the need for a secure and reliable method to facilitate transactions and data exchanges between devices without the need for a central authority. Traditional centralized systems are often vulnerable to attacks and outages, which can compromise the integrity of M2M communications. Blockchain technology, with its decentralized nature, offers a compelling solution to these challenges. Blockchain operates as a distributed ledger that records transactions across many computers so that the record cannot be altered retroactively without the alteration of all subsequent blocks and the consensus of the network. This level of security is particularly beneficial for IoT devices, which are frequently targeted by cyberattacks due to their often weak security protocols. Moreover, blockchain enables smart contracts, which are self-executing contracts with the terms of the agreement directly written into code. These contracts automatically enforce and execute the agreed-upon terms when certain conditions are met, without the need for intermediaries. In the context of IoT, smart contracts can be used to create agreements between devices, allowing for automated, trustless M2M interactions. For instance, consider a supply chain scenario where IoT sensors monitor the temperature of a perishable product during transit. If the temperature deviates from the agreed range, a smart contract could automatically trigger a response, such as notifying the supplier or adjusting the temperature control system.

This level of automation not only enhances efficiency but also reduces the potential for human error. Furthermore, blockchain can facilitate micropayments between devices, enabling new business models for IoT services. Devices can autonomously conduct transactions, paying for services or resources on a per-use basis. This could lead to a more granular and flexible pricing model for IoT services, where users only pay for what they consume. The integration of blockchain into IoT also addresses concerns regarding data privacy and ownership. With blockchain, data generated by IoT devices can be securely recorded and managed, giving users greater control over their data. Users can decide who has access to their data and under what conditions, ensuring that their privacy is maintained. However, the adoption of blockchain in IoT is not without its challenges. The scalability of blockchain networks is a significant concern, as the current technology may struggle to handle the vast amount of data generated by billions of IoT devices. Additionally, the energy consumption associated with blockchain's consensus mechanisms, such as proof of work, is at odds with the energy-efficient ethos of many IoT applications. Despite these challenges, the potential benefits of blockchain-based M2M communication in IoT are too significant to ignore. As blockchain technology continues to mature, we can expect to see more innovative solutions that address these issues, further enhancing the capabilities of IoT networks. In conclusion, the integration of blockchain technology into IoT is set to transform M2M communication, offering unprecedented levels of security, efficiency, and autonomy. As we move towards an increasingly connected world, the synergy between blockchain and IoT holds the promise of creating more intelligent, responsive, and self-sustaining systems that will underpin the next wave of technological advancement.The Future of IoT Security: Implementing Blockchain for Trustworthy Machine-to-Machine TransactionsThe Future of IoT Security: Implementing Blockchain for Trustworthy Machine-to-Machine Transactions In the rapidly evolving landscape of the Internet of Things (IoT), the security of machine-to-machine (M2M) communications stands as a critical concern. With billions of devices interconnected and exchanging data, the potential for vulnerabilities is vast. However, the integration of blockchain technology into M2M interactions promises a paradigm shift in how we approach IoT security, offering a robust solution to the trust challenges that have long plagued these networks. Blockchain, at its core, is a distributed ledger technology that maintains a secure and immutable record of transactions across a network of computers. This characteristic of decentralization inherently reduces the single points of failure, making it significantly more difficult for malicious actors to compromise the integrity of the data. In the context of IoT, blockchain can be leveraged to create a transparent and verifiable system for devices to communicate, authenticate, and transact with one another without the need for a central authority. The application of blockchain in IoT security is multifaceted. Firstly, it enables the creation of a tamper-proof log of all M2M interactions. This immutable record ensures that any attempt at data manipulation can be easily detected, thereby deterring potential attacks. Moreover, blockchain's cryptographic algorithms facilitate secure identity verification for devices, ensuring that only authorized machines can join and operate within the network. This level of security is paramount in scenarios where critical infrastructure, such as power grids or transportation systems, relies on the seamless and secure exchange of information between devices. Furthermore, blockchain technology can streamline the process of managing and updating IoT devices. By utilizing smart contracts – self-executing contracts with the terms of

the agreement directly written into code – updates and patches can be automatically distributed and applied across the network, ensuring that all devices are operating with the latest security measures. This not only enhances the overall security posture but also reduces the administrative burden and potential for human error. Another significant advantage of implementing blockchain in IoT is the facilitation of microtransactions. As IoT ecosystems become more complex, devices may need to conduct transactions with one another, such as purchasing energy or bandwidth. Blockchain enables these transactions to occur seamlessly and with minimal transaction fees, fostering new economic models for IoT services and applications. Despite these advantages, the integration of blockchain into IoT is not without its challenges. The scalability of blockchain networks, for instance, must be addressed to handle the vast number of transactions that large-scale IoT systems generate. Additionally, the energy consumption associated with blockchain's consensus mechanisms, such as proof of work, is a concern that needs to be mitigated to ensure the sustainability of these solutions. In conclusion, the implementation of blockchain technology in machine-to-machine communications heralds a new era for IoT security. By providing a secure, decentralized platform for devices to interact, blockchain not only enhances the trustworthiness of these transactions but also opens up a realm of possibilities for autonomous and economic interactions between machines. As the technology continues to mature, it is poised to become an integral component of the IoT infrastructure, ensuring that the networks of tomorrow are not only smarter but also significantly more secure. The journey towards a blockchain-enabled IoT ecosystem is complex, yet the potential rewards for security, efficiency, and innovation are too compelling to ignore.Advancements in Decentralized Networks: The Role of Blockchain in Facilitating Autonomous Machine-to-Machine Interactions in IoT SystemsIn the rapidly evolving landscape of the Internet of Things (IoT), the seamless interaction between devices is paramount to the realization of a fully autonomous and interconnected digital ecosystem. The integration of blockchain technology into this domain is revolutionizing the way machines communicate, transact, and collaborate with one another, heralding a new era of decentralized networks that promise enhanced security, trust, and efficiency. Blockchain, at its core, is a distributed ledger technology that enables secure, transparent, and tamper-proof record-keeping. By leveraging blockchain in IoT systems, machine-to-machine (M2M) communications are elevated to a level where devices can autonomously verify and trust the data exchanged without the need for centralized intermediaries. This paradigm shift not only reduces the potential for single points of failure but also mitigates the risks associated with data breaches and cyber-attacks. One of the most significant advantages of blockchain-based M2M communication is the facilitation of secure and automated transactions. Smart contracts, which are self-executing contracts with the terms of the agreement directly written into code, play a pivotal role in this process. They enable devices to conduct transactions and agreements among themselves as soon as certain predefined conditions are met, without human intervention. This automation of contractual processes not only streamlines operations but also ensures that the terms of the contract are unalterable once deployed, thereby fostering trust among participating entities. Furthermore, blockchain's inherent characteristics of decentralization and transparency are instrumental in creating a reliable audit trail of device interactions. Each transaction between IoT devices is recorded on the blockchain, providing an immutable history that can be verified by any participant in the network. This level

of traceability is crucial for applications where provenance and authenticity are of utmost importance, such as in supply chain management or quality assurance in manufacturing. The integration of blockchain into IoT also addresses the challenge of scalability. Traditional centralized systems often struggle to cope with the vast amount of data generated by the multitude of IoT devices. Blockchain networks, on the other hand, can distribute the workload across multiple nodes, ensuring that the system can scale effectively as the number of devices grows. This distributed approach not only enhances the capacity of IoT networks but also ensures that they remain resilient in the face of growing demands. Moreover, the use of blockchain in M2M communications opens up new avenues for innovative business models and revenue streams. For instance, IoT devices can engage in microtransactions, autonomously buying and selling data or services on a per-use basis. This could lead to the development of decentralized marketplaces for data, where devices can monetize the information they generate, fostering a more efficient and dynamic IoT ecosystem. In conclusion, the role of blockchain in facilitating autonomous M2M interactions in IoT systems is a testament to the transformative potential of decentralized networks. By providing a secure, transparent, and scalable framework for device communication, blockchain technology is not only enhancing the operational capabilities of IoT but also paving the way for a future where machines can interact with each other with unprecedented levels of autonomy and trust. As we continue to witness the convergence of these cutting-edge technologies, it is clear that the implications for businesses, consumers, and society at large are profound, setting the stage for a more interconnected and intelligent world.ConclusionBlockchain technology has the potential to significantly enhance machine-to-machine (M2M) communication within the Internet of Things (IoT) ecosystem. By providing a decentralized and secure ledger, blockchain can facilitate trustless interactions between devices, automate processes through smart contracts, and ensure data integrity and provenance. This can lead to increased efficiency, reduced costs, and improved security in IoT networks. However, challenges such as scalability, energy consumption, and integration with existing systems must be addressed to fully realize the benefits of blockchain in M2M communications.

0 notes

Text

5G NTN Market Intelligence Report: Key Drivers, Restraints & Opportunities

Introduction

As the global digital ecosystem evolves, connectivity is becoming as essential as electricity. While terrestrial 5G networks have already begun transforming industries through ultra-low latency and blazing-fast speeds, there are still major gaps in coverage — especially in remote, rural, or maritime areas and across air and space. To close this connectivity gap, the industry is turning to 5G Non-Terrestrial Networks (NTN).

5G NTN integrates satellite and airborne communication systems with terrestrial cellular networks, offering seamless global coverage and creating a new frontier for communication infrastructure. With its potential to redefine global connectivity, the 5G NTN market is expected to experience explosive growth through 2032, fueled by technological advances, increased adoption of autonomous systems, and the booming satellite communication sector.

What Are Non-Terrestrial Networks (NTNs)?

Non-Terrestrial Networks refer to communication systems that rely on space-based and airborne platforms rather than conventional ground-based cellular towers. These can include:

Low Earth Orbit (LEO) satellites

Medium Earth Orbit (MEO) satellites

Geostationary Earth Orbit (GEO) satellites

High-Altitude Platform Stations (HAPS) such as balloons and unmanned aerial vehicles (UAVs)

When integrated with 5G, NTNs promise uninterrupted global coverage, including in areas where terrestrial infrastructure is impossible, costly, or impractical.

Download a Free Sample Report:-https://tinyurl.com/423kdpjr

Market Drivers

1. Expanding Need for Global Connectivity

One of the core drivers behind 5G NTN is the demand for reliable communication in remote and underserved regions. From rural communities and oceans to deserts and polar zones, NTNs bridge the digital divide by extending coverage to locations that were previously beyond reach.

2. Surge in Satellite Deployment

The rapid increase in commercial and government satellite launches, driven by private firms like SpaceX (Starlink), Amazon (Project Kuiper), and OneWeb, is creating a robust backbone for the 5G NTN ecosystem. These constellations are enabling high-bandwidth, low-latency communication, unlocking the full potential of NTN-based 5G services.

3. Defense and Disaster Recovery Applications

Military operations, search and rescue missions, and disaster recovery efforts require secure and resilient communication systems that work even in the most adverse conditions. NTNs offer uninterrupted service, even in the event of natural disasters or conflict-induced infrastructure damage.

4. Growth in Autonomous Systems

The expansion of autonomous vehicles, drones, and IoT devices in sectors like logistics, agriculture, mining, and transportation creates a growing need for consistent, wide-area, high-reliability networks. NTNs support machine-to-machine (M2M) and IoT communication even in areas far removed from urban infrastructure.

5. Integration with 3GPP Standards

The inclusion of NTN capabilities in 3GPP’s Release 17 has solidified NTN's role in future 5G ecosystems. This standardization ensures interoperability between satellite networks and traditional 5G terrestrial systems, speeding up deployment and adoption.

Market Segmentation

By Component:

Hardware (Satellites, Ground Stations, Antennas)

Software (Network Management, Orchestration)

Services (Consulting, Implementation, Managed Services)

Hardware remains the largest segment, but software and service layers are becoming crucial for network optimization, security, and predictive maintenance.

By Platform:

Low Earth Orbit (LEO)

Medium Earth Orbit (MEO)

Geostationary Earth Orbit (GEO)

High-Altitude Platform Stations (HAPS)

LEO satellites currently dominate the 5G NTN landscape due to their low latency and high throughput, making them ideal for real-time applications like video streaming, remote diagnostics, and autonomous vehicle coordination.

By Application:

Maritime & Offshore Communication

Remote Sensing

Emergency & Disaster Recovery

Defense & Military

Telemedicine

Aviation

Rural Broadband Expansion

Industrial IoT

The defense sector is an early adopter, while commercial growth is being driven by rural broadband, maritime, aviation, and autonomous transport use cases.

By End User:

Government and Public Sector

Commercial Enterprises

Aerospace & Defense

Telecommunication Providers

Telecom providers are increasingly collaborating with satellite operators to offer hybrid terrestrial-satellite solutions, especially in emerging economies.

Regional Insights

North America

North America, led by the U.S., is a leader in the 5G NTN space due to its advanced aerospace sector, extensive government funding for space programs, and private sector giants like SpaceX. The region is also witnessing robust demand in defense, autonomous vehicles, and rural broadband initiatives.

Europe

Europe is making significant strides with the European Space Agency's initiatives and the EU's ambitions for digital sovereignty, driving investments in both GEO and LEO constellations.

Asia-Pacific

APAC is forecast to be one of the fastest-growing regions, driven by rural connectivity programs in India, China’s space race, and Japan's heavy investment in satellite IoT networks.

Industry Trends

LEO Satellite Mega-Constellations

The deployment of thousands of LEO satellites is reshaping the telecom landscape. These mega-constellations offer near-global, low-latency coverage, directly addressing the gaps left by traditional terrestrial networks.

Direct-to-Device Communication

One of the most disruptive trends is the ability of NTN networks to offer direct-to-device (D2D) connectivity, eliminating the need for ground-based relays or additional hardware for smartphones and IoT devices.

AI-Driven Network Management

Artificial intelligence and machine learning are increasingly used to manage 5G NTN networks, optimize bandwidth, predict congestion, and ensure fault tolerance in real time.

Convergence with IoT

5G NTN is seen as a key enabler of massive Machine-Type Communication (mMTC) for IoT devices, particularly in industries like shipping, agriculture, oil & gas, and wildlife monitoring, where cellular connectivity is limited.

Challenges

While the market outlook is highly promising, several challenges could slow adoption:

High Initial Costs: Satellite development, launch, and maintenance require significant capital investment.

Latency Issues (for GEO satellites): Although LEO addresses latency for real-time use cases, GEO satellites still face delays that may not be suitable for all applications.

Spectrum Regulation: Allocating spectrum for NTNs on a global scale involves complex international agreements.

Security Concerns: The potential for cyberattacks on satellite communication links remains a key concern for both commercial and government users.

Future Outlook: Forecast to 2032

According to industry analysts, the 5G NTN market is poised for double-digit compound annual growth (CAGR) through 2032. Key factors contributing to this trajectory include:

The convergence of AI, IoT, and 5G with satellite and HAPS systems.

Private-public collaborations that accelerate satellite launches and network rollouts.

The rising role of NTNs in national defense and security strategies.

Ongoing efforts by global telecom providers to expand their coverage footprint, particularly in emerging economies.

By 2032, the market is expected to evolve from early adopter niche applications to mainstream commercial and consumer deployments, potentially enabling new services such as space-based cloud computing, truly global emergency communications, and fully autonomous transportation networks.

Conclusion

The 5G NTN market represents a paradigm shift in the future of global connectivity, offering seamless coverage to every corner of the planet. As terrestrial and non-terrestrial networks converge, industries from healthcare to defense and logistics to entertainment will benefit from enhanced reach, reliability, and resilience.

With standardized frameworks, ambitious satellite constellations, and expanding demand for universal connectivity, 5G NTN is not just the next step for telecom — it is the future of how the world will stay connected.

Read Full Report:-https://www.uniprismmarketresearch.com/verticals/information-communication-technology/5g-ntn

0 notes

Text

What is Internet of Things: The Evolution

What is Internet of Things: The Evolution

The Internet of Things (IoT) has emerged as a transformative force, connecting billions of devices and enabling seamless communication and data exchange across various domains, including smart homes, healthcare, transportation, and industrial automation. But what exactly is the Internet of Things, and how has it evolved over the years?

At its core, the Internet of Things refers to the network of physical objects embedded with sensors, actuators, and other connected technologies that collect and exchange data over the internet. These "smart" devices can range from everyday objects like thermostats and light bulbs to complex industrial machinery and vehicles, each contributing to a vast ecosystem of interconnected devices and systems.

The evolution of the Internet of Things can be traced back to the early days of machine-to-machine (M2M) communication and industrial automation, where sensors and actuators were used to monitor and control physical processes in manufacturing plants and utility grids. However, with advancements in wireless networking, sensor technology, and cloud computing, the scope and scale of IoT deployments have expanded dramatically.

Today, IoT devices are ubiquitous, permeating every aspect of our lives, from smart homes and wearable devices to connected cars and smart cities. These devices collect a wealth of data about our environment, behaviors, and interactions, which can be analyzed and used to drive insights, automate processes, and improve decision-making in various industries and sectors.

In the consumer space, IoT devices like smart thermostats, fitness trackers, and voice-activated assistants have become mainstream, offering convenience, efficiency, and personalized experiences to users. In healthcare, IoT-enabled medical devices and remote monitoring systems are revolutionizing patient care, enabling real-time monitoring, diagnosis, and treatment outside traditional healthcare settings.

In industrial settings, IoT technologies are driving digital transformation initiatives, optimizing operations, increasing efficiency, and enabling predictive maintenance and asset management strategies. From smart factories and connected supply chains to agricultural IoT solutions and energy management systems, the potential applications of IoT are virtually limitless.

Looking ahead, the Internet of Things is poised to continue its rapid evolution, fueled by advancements in artificial intelligence, edge computing, and 5G connectivity. As more devices become connected and intelligent, the IoT will play an increasingly central role in shaping the future of technology and society, driving innovation, efficiency, and sustainability across the globe.

0 notes

Text

Title: Building the Future: A Comprehensive Guide to Smart Factory in Construction Industry 4.0 Today's digital age is catapulting the construction industry into a realm of possibilities and advancements that are as exhilarating as they are essential; a realm termed as Construction Industry 4.0. This transformative era is being shaped by the creation and evolution of smart factories, becoming the harbinger of efficient, innovative, and radically enhanced production processes. The core of Construction Industry 4.0 lies in the integration and optimization of automated construction, additive manufacturing, cloud computing, data analytics, and other IoT-based breakthroughs. This accelerates the transition towards Industry 4.0, where the term 'Smart Factory' is not merely an industry buzzword, but the fulcrum of productive evolution. A smart factory, often synonymous with digital manufacturing, is the quintessence of automation and data exchanges in-built into manufacturing technologies. This choreographed interplay shapeshifts traditional production lines into an interconnected, automated and optimized production environment. Seamless data integration across every aspect of the production chain yields several benefits in a smart construction setup, including reduced costs, waste minimization, accelerated output, enhanced accuracy, and boosted overall efficiency. It sets a platform that merges digital twins with real machines and creates value-adding networks to facilitate human-machine collaboration. As we delve deeper into Construction Industry 4.0, we find the Autonomous Robotic Construction System (ARCS) at its forefront. These sophisticated machines, paired with artificial intelligence and machine learning, streamline the construction process, enabling tasks to be executed much quicker and more precisely than ever. Machine-to-Machine (M2M) communication, a critical feature of smart factories, utilizes real-time data to support decision-making processes and operational efficiency. Internet of Things (IoT) enabled devices, predictive maintenance, augmented reality (AR), compound with M2M communication, forge a robust, responsive, and agile production ecosystem. The advent of the smart factory system holds more than just the promise of techno-driven efficiency. It acts as an imperative tool for sustainability. Aided by green manufacturing and augmented reality, smart factories contribute significantly to the reduction of environmental footprint. Alternatively, the blockchain technology ingrained within such factories contributes to maintaining traceability and accountability, further enhancing transparency within the industry. Beware, though, this digital transformation isn't without challenges. Cybersecurity threats loom larger than ever, with an increasing reliance on connected devices. Workforce adaptation to this rapid digitalization remains an uphill battle too. However, it is encouraging that stakeholders recognize these challenges, ensuring strong countermeasures and risk management strategies are in place. As we move beyond the present to step into the future, the construction sector needs to not just adopt, but adapt to this profound transformation. It is clear that the Smart Factory model, the beacon of Construction Industry 4.0, is here to stay, promising a future of sustainability, efficiency, and technological advancement. In this transformative era, successful enterprises will be those that harness the power of digital evolution, utilizing it to drive growth, innovation and competitiveness in an increasingly global market. All in all, with progressive sophisticated technologies at hand, we can look forward to building the future, today. Title: "Navigating the Construction Industry of Tomorrow: The Rise of the Autonomous Smart Factory" As we march steadfastly into the brave new world of Construction Industry 4.0, we are on the threshold of a revolution that's poised to entirely reshape our built environment.

Inspired by "Building the Future: A Comprehensive Guide to Smart Factory in Construction Industry 4.0," here's a glimpse into a future where the smart factories aren't just an addition to the construction scene, but the heart and soul of this transformative era. The construction industries of the future will be configured around fully automated, intelligent factories. Artificial Intelligence and Machine Learning algorithms will underpin the operations; these digital powerhouses will meticulously ensure enhanced efficiency, extreme precision, and significantly minimized waste. Deeper integration of technologies like 3D printing, robotics, and autonomous vehicles will further refine the construction processes. Tomorrow's smart factories will push the envelope, extending far beyond the manufacturing of materials and components. They will be digital-physical systems capable of self-diagnosis and self-optimization. Pioneering the concept of 'the Internet of Things' (IoT) in construction, these factories will communicate in real-time with every single component involved in construction processes, enabling seamless operations and just-in-time logistics. But it's not just about high-tech equipment and advanced software; the smart factory revolution will also change patterns of employed labor. As automation takes center stage, there will be a palpable shift towards tech-savvy professionals adept at managing and maintaining these advanced systems. The construction site of the future will be a spectacle of synchronized coordination. Autonomous drones and robots will work round the clock, performing tasks ranging from surveying to bricklaying, from transporting materials to performing maintenance checks. This prediction isn't mere speculation anymore; it's a reality taking shape, gradually altering the traditional contours of the construction industry. By adopting smart factories, the construction industry can ensure sustainable growth, with a major emphasis on 'green' practices. The meticulous precision of smart factories guarantees minimal wastage, reducing the industry's environmental footprint. So, what does this mean for you and your venture in the construction industry? Staying ahead of the curve requires embracing this digital transformation. Investing in this golden trove of digitalization means not only surviving but thriving in a future where smart factories are the new norm. The road to the future of the construction industry may seem daunting, but with the integration of smart factories, it promises a journey filled with innovation, efficiency, and sustainability. This is not just the rise of the smart factory; it's the dawn of Construction Industry 4.0 - a new epoch that embodies our collective aspiration for a smarter, greener, and a more efficient tomorrow. "Ready to step into the future of construction? Elevate your business to the next level with a smart factory. Don't get left behind - Start leveraging Industry 4.0 today! Click here to learn how. Your future self will thank you." Start Your Digital Transformation Now! As we continue to unlock the vast potentials of the combination of smart factory and Industry 4.0, the construction industry will inevitably revolutionize in ways we have not imagined. The advent of smart factories will undoubtedly lead to unparalleled efficiency, productivity, and safety levels. Machines will no longer just be tools; they will communicate, analyze, and make decisions. Automation will no longer only be for repetitive tasks, but for complex problem-solving and creative pursuits as well. As a consequence, we may foresee a future where construction sites are largely automated, with data being harnessed for precise planning and execution of projects at an unprecedented scale and pace. This can lead to significant reductions in project timelines and costs, simultaneously increasing the scalability of projects. However, there will also be drastic shifts required in skillsets. Workers

will need to become familiar with AI-driven technologies, robots, and other automation tools. Cybersecurity will become an essential aspect of the construction industry. In this context, perhaps architect and futurist Buckminster Fuller said it best: "We are in an era of comprehensive evolution. The success of the next phase of human development is no longer about the survival of the fittest, but the survival of the most cooperative. This is the future of the construction industry in the age of smart factories and Industry 4.0."

0 notes

Text

5G Fixed Wireless Access Industry anticipated to grow by 2028 with CAGR of 39.0%

The global 5G FWA market is expected to be valued at USD 29.4 billion in 2023 and is projected to reach USD 153.0 billion by 2028 growing at a CAGR of 39.0% during the forecast period. The increasing adoption of advanced technologies such as machine-to-machine (M2M) & IoT and the rising use of millimeter-wave technology for 5G FWA is expected to drive the growth of the 5G fixed wireless access market. However, the high costs of infrastructures and the adverse impact of millimeter wave technology on the environment are restraints for market growth.

Browse 135 market data Tables and 52 Figures spread through 217 Pages and in-depth TOC on "5G Fixed Wireless Access Market - Global Forecast to 2028"

Download PDF:

The 5G FWA market includes major Tier I and II players like Nokia (Finland), Samsung Electronics (South Korea), Huawei Technologies (China), Ericsson (Sweden), Inseego (US), and others. These players have a strong market presence for 5G FWA across various countries in North America, Europe, APAC, and RoW.

Growing use of millimeter-wave technology in 5G FWA

The growth of the 5G fixed wireless access market is expected to be driven by the increased wireless network capacity and high speed offered by high-frequency millimeter waves. Millimeter waves occupy a relatively unused portion of the electromagnetic spectrum between 30 GHz and 300 GHz, which offers excellent throughput and increased capacity. The 5G fixed wireless access technology provides large bandwidth, high resolution, low interference, cost-efficiency, and high security. It enables the development of miniaturized components for use in several commercial applications. 5G fixed wireless access is expanding to fixed communication, medicine, remote sensing, and consumer electronics applications. This includes using millimeter waves for IPTV, a prospective replacement of the Wi-Fi Alliance standards (802.11n), and wireless video transmission.

Customer premise equipment (CPE) is expected to hold the highest market share during the forecast period.