#Megaphone Chart Pattern

Explore tagged Tumblr posts

Text

Trading Strategies for the Broadening Top Pattern

Understanding the Broadening Top Pattern The Broadening Top Pattern, also referred to as the megaphone pattern, is a classic chart formation that signifies increasing volatility and indecision in the market. This pattern is characterized by a series of higher highs and lower lows, creating a structure that resembles an expanding triangle or a megaphone. Traders often observe this formation…

#Bearish Broadening Top#Breakout Trading Strategy#Broadening Top Examples#Broadening Top Pattern#Broadening Top Reversal#Bullish Broadening Top#Chart Patterns for Trading#How to Trade Broadening Top#learn technical analysis#Megaphone Chart Pattern#Stock Market Chart Analysis#Stock market trading strategies#stock markets#stock trading#successful trading#technical analysis#Technical Analysis Patterns#Trading Risk Management#Trendline Retest Strategy#Volume confirmation in trading

0 notes

Text

The Sounds of Success: Decoding the Money Anthem Trend in Music

Lately, I've noticed my playlist is echoing a certain vibe! There's a wave of tracks where female artists aren't just hitting the high notes—they're also celebrating high earnings and the luxe life. But why is the love of lucre such a hit theme, especially among women in my playlist? That is really the million dollar question.

Market Trends

If it's streaming, it's steaming hot! Music moguls know what we like and they're serving up a decadent diet of dollar-sign ditties. It's simple: we stream, they supply.m, and apparently I’m all stocked up with it too.

Algorithmic Echoes

Our digital DJs (a.k.a. algorithms) love a good repeat. Liked one money mantra? Get ready for a playlist packed with prosperity, and the luxurious life feels fancy! Yass! Basically, algorithmic echoes resonate powerfully, emitting a frequency of vibes that reverberate within individuals.

Pattern Play

Our brains love to connect the dots. Notice a few cash-centric choruses and suddenly it's like every track is all about that bank. This s Pattern Play. And oh, honey, our brains are basically dot-connecting wizards in a world of cash-themed spells. Spot a couple of those dollar-dropping lyrics and bam! It's like every tune on the charts is competing to be the soundtrack of Wall Street. We're not just hearing the music; we're swimming in a sea of bling-bling beats? Love it though!

Cultural Mirror

Songs reflect our world and right now, that world is pretty cash-obsessed. Female artists are flipping the script on wealth, wielding their wealth anthems as tools of empowerment. Our brains are rockstar conjurers in the glitzy realm of moolah-magic. We catch one or two of those cha-ching choruses, and whoosh – it's as if every hit out there is hustling to be the anthem of the almighty dollar. And let's be real, it's not just floating through the airwaves; it's pulsating through us! We're not merely listeners; we're the living, breathing VIPs of this cash-crazy club, drowning in waves of those bling-bling rhythms!

Artist Autonomy

Musicians are the maestros of their own message. Singing about success and stacks might be personal, political, or just plain fun. Let's spill the real tea here – musicians are the ultimate bosses of their beat-driven domains. When they're laying down tracks about climbing success or stacking that paper, it could be a deep dive into their diary, a battle cry for social change, or just their way of keeping it 100 with some playful swagger. They're not just making tunes; they're crafting their own megaphone to holler at the world, on their own terms. So, whether they're serenading us with their personal anthems of affluence or just having a blast, these artists are serving us their stories straight up, no chaser.

Commercial Hits

Controversy clicks. Music execs know that a song about swiping cards can also swipe up streaming stats, and you better believe it! Controversy is like that secret sauce – it’s the clickbait of the music industry. Those bigwig music execs? They've got the 411 on what sizzles. They know when an artist drops a track that's all about living large and swiping plastic, it doesn't just turn heads – it racks up those streaming numbers faster than you can say 'cha-ching'. It's all about that buzz, baby. A song that serves up a slice of the luxe life can light up the charts and have everyone from influencers to the Insta-famous sliding it into their latest story. It's not just a hit; it's a strategy.

We are all Gold Diggers?

Don’t fret! If this question made any nervous. Just because you've got an ear for hits that happen to flaunt a little (or a lot of) bling doesn't mean you're on a treasure hunt. We all love a good bop that makes us feel like we're dripping in finesse—even if our wallets tell a more humble tale. So, keep jamming to those beats that make you feel like a million bucks. It's all about the vibe, not the bankroll!

So, why does my playlist seem to have a common theme with these "females that love to sing about loving money"? Maybe it's a sign that women are owning their success and telling their stories on their terms—unapologetically. Maybe that’s partly my anthema and maybe equally or more, that controversy sells, and in the music industry, this is a well-known fact. Music executives keenly understand that a track with controversial or provocative themes related to materialism and luxury can significantly boost streaming numbers. These songs act as clickbait, attracting listeners with the allure of the high life and the glamour associated with it. When artists drop music that flaunts wealth and excess, it doesn't just catch the public's attention; it explodes in popularity, often dominating charts and becoming the backdrop to countless social media stories.

Yet, enjoying these tracks doesn't necessarily reflect the listener's personal values or lifestyle. If we find ourselves drawn to songs that celebrate opulence and indulgence, it doesn't imply we’are, I am, a "gold digger”?

“Gold Digger”, that would be a rhetorical self accusation, and one that seems to comment on the wider appeal of these controversial themes. Music that glorifies wealth and an extravagant lifestyle often has broad appeal, not necessarily because listeners are themselves "gold diggers," but because such music can be catchy, provide a form of escapism, or offer a fantasy that listeners can momentarily indulge in. It's the allure of a lifestyle that many find attractive, even if it's not one they live or aspire to realistically.

Listening to and enjoying these songs doesn't define one's character—it's often more about the beat, the melody, and the way the music makes one feel. It's a strategy by artists and music executives to create a buzz, ensure the music is talked about, and get it shared across various platforms, from streaming services to social media. The phenomenon reflects the complex relationship between art, commerce commerce, and the psychology of listeners.

Many people appreciate these anthems for their catchy beats and the escapism they offer, allowing them to experience, if only vicariously, a more luxurious life. It's the feeling they evoke that counts, allowing listeners to revel in a sense of elegance and sophistication, regardless of their actual financial status. So go ahead and enjoy the music that makes you feel extravagant— because it’s also about the sensation, not just the cost.

In fact it’s a sensation we are uniting too t be exact, if one choses for reduce the rhetoric down to that. Our personal gold digging "anthem" represents more than just an aggregation of data points that can be analyzed and predicted by algorithms, though. We are more than sensations, and rhetoric together too. It's a reflection of our individuality, our experiences, and the complexities of our personality, which go beyond what any algorithm can fully comprehend or anticipate. Like me being so high in open to experience that I’m imagining I’m a gold digging female on tha weekends! Obviously!

Just playing! But In the music industry, algorithms have become essential tools for predicting trends and understanding listener preferences. They help to shape the creation and promotion of music by providing insights into what is likely to be successful. However, these algorithms operate on historical data and observable patterns, and while they can be incredibly powerful in forecasting trends and tastes, they aren't infallible. They can't capture the spontaneous, emotional, and sometimes irrational reasons why a particular song might resonate with an individual.

Our connection to a song—that ineffable feeling that makes it your "anthem"—is deeply human and can't be wholly reduced to computational processes. It's where art meets the individual heart and mind, and it's a space that remains profoundly personal and uniquely human, despite the ever-growing capabilities of algorithms in our digital world.

Are we more than our Algorithms though?

This really depends if people believe that humans “are more than a sum of their parts”? According to Edelman (2012), the complexity of the human mind extends beyond the simple sum of our parts, suggesting a richness to consciousness that is deeply rooted in the dynamics of our brain's neural circuits.

These tracks could be the anthems of autonomy, the soundtracks of success, resonating with anyone who's chasing their own version of the dream.

Conclusion

The question of whether we are more than our algorithms touches upon the deep philosophical debate about the nature of human consciousness and identity. Edelman's (2012) perspective suggests that while our minds can be understood in terms of computations and algorithms, there is a qualitative aspect to our consciousness—our phenomenal awareness—that cannot be fully captured by computational theories alone. This awareness is an emergent property of the brain's complex neural dynamics and not merely a mechanical byproduct of it.

Edelman's view aligns with the idea that humans cannot be fully understood by breaking them down into simpler parts or processes. The richness of human experience and the intrinsic nature of our consciousness suggest that we might possess qualities that extend beyond the realm of algorithms and computations. These qualities could involve emergent phenomena that arise from the intricate interplay of our neural circuits but are not reducible to them.

In essence, if consciousness indeed has an emergent quality that is not solely the result of computational processes, then humans are more than the sum of their algorithms. The debate continues in the scientific and philosophical communities, with many nuances and varying opinions contributing to our evolving understanding of what it means to be human. What's your take on this trend? Drop a beat, I mean, your thoughts below! Let me see your algorithms within please!

#MusicTrends #WomenInMusic #PowerAnthems

References:

Edelman, S. (2012, September 18). We're more than the sum of our parts. *Psychology Today*. https://www.psychologytoday.com/us/blog/the-happiness-pursuit/201209/were-more-the-sum-our-parts

1 note

·

View note

Text

Solana network activity surge and ‘megaphone’ chart pattern set $210 SOL price target

Key Takeaways: Solana formed a megaphone chart pattern with a potential $210 price target. Solana’s ecosystem growth highlights renewed investor interest with a $4 billion realized cap increase and 731 million transactions. Solana (SOL) price tested its key resistance at $180 earlier this week, but the altcoin failed to establish a position above the level. Over the past few days, SOL has…

0 notes

Text

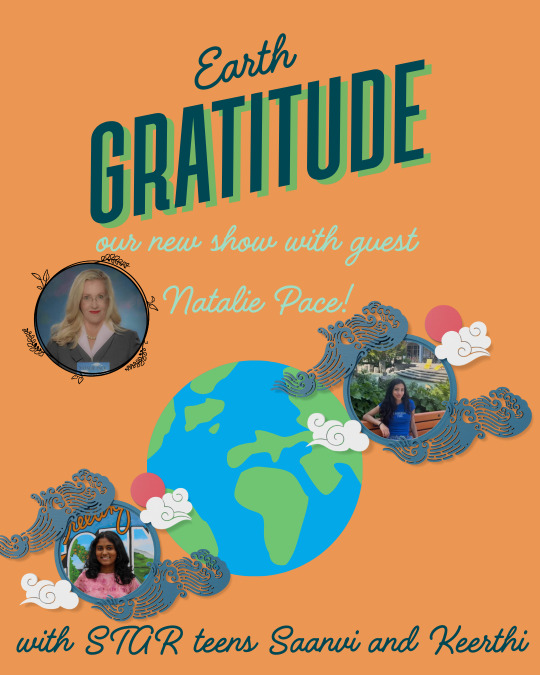

Earth Gratitude and Healing the Planet

Hosts Saanvi Phaneendra and Keerthi Eranivan weigh in on how teens can save the planet while being grateful for our glorious planet earth. Saanvi starts off the discussion with her Space Spotlight segment. While today’s conversation is rooted in healing our planet, we can’t ignore the skies above us-because what happens in space impacts Earth more than we realize. She shares that over 100 million pieces of debris orbit our planet-ranging from inactive satellites to tiny fragments from past collisions, all traveling at speeds over 17,000 miles per hour. This growing cloud of space junk poses serious risks to Earth-monitoring satellites, which are critical for tracking climate change, wildfires, sea level rise, and weather patterns.

Keerthi and Saanvi then interview Natalie Pace who founded the Earth Gratitude Project which features sustainability tips from the most respected experts and visionaries on the planet, including H.M. King Charles III (when he was H.R.H. The Prince of Wales), H.H. The 14th Dalai Lama of Tibet, Sia, Elon Musk, H.M. Queen Diambi, Deepak Chopra and more. She also talks about teens and financial freedom. College students can use Natalie Pace’s information to get a better degree for half the cost. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why she is enthusiastically recommended by Nobel Prize winning economist Gary S. Becker and Main Street families. Natalie recommends that students take a gap year between graduating from high school and going to college.

In the final segment, Keerthi shows how teens are the final defense to healing and saving the planet. She advises teens to:

1.Embrace Your Inner Eco-Warrior

2. Use Your Voice. And Maybe Your Megaphone.

3. Get a Squad: Saving the planet is way more fun with friends.

4.Make Sustainable Trendy

5. Think Bigger: Earth is our only home!

The choices we make now—what we eat, buy, share, and say—will shape the future we all live in.

Every choice we make ripples across its forests, oceans, skies… and even space.

May the forest be with you! Tune in and heal our planet!

Bio: Natalie Pace

Natalie Wynne Pace is the author of The Power of 8 Billion: It’s Up to Us and The ABCs of Money for College (and other bestsellers) and is the co-creator of the Earth Gratitude project. The Earth Gratitude Project features sustainability tips from the most respected experts and visionaries on the planet, including H.M. King Charles III (when he was H.R.H. The Prince of Wales), H.H. The 14th Dalai Lama of Tibet, Sia, Elon Musk, H.M. Queen Diambi, The Duchess of Northumberland, XPRIZE.org, Arianna Huffington, Deepak Chopra, EARTHDAY.ORG, the NRDC, Global Green, WildlifeDirect, Unify, Ron Finley, Lynne Twist, Green Our Planet, Living Homes, Master Sha and more. Watch the free 5-part docuseries on Food & Soil, Kids, Animals & Conservation, Everyday Sustainability and the Power of Gratitude at earthgratitude.org. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders).

Visit NataliePace.com

https://www.instagram.com/nataliewynnepace

https://instagram.com/earth_gratitude

Follow us: https://www.starstyleradio.com/expressyourselfteenradio

https://www.facebook.com/ExpressYourselfTeenRadio/

https://www.facebook.com/BTSYAcharity/

https://www.instagram.com/expressyourselfradio/

Sign up for FREE Newsletter: https://cynthiabrian.substack.com/

Buy shirts and hats with BTSYA logos: https://www.bonfire.com/store/be-the-star-you-are-merch/

Listen to StarStyle®-Be the STAR You Are!® shows: https://sites.libsyn.com/556617

Find out more about Express Yourself! at https://www.starstyleradio.com/expressyourselfteenradio

Listen to all Express Yourself!™ Teen shows at https://sites.libsyn.com/560220

Listen at Voice America Network, Empowerment Channel: https://sites.libsyn.com/560220/earth-gratitude-and-healing-the-planet

#earthgratitude#healingtheplanet#nataliepace#powerof$8billion#itsuptous#ABCSofmoneyforcollege#space#earthday#teenstalk#expressyourselfteenradio#starstyle#voiceamerica#bethestaryouare#cynthiabrian

0 notes

Text

Understanding Broadening Top and Bottom Patterns in Technical Analysis

In the vast realm of technical analysis, chart patterns are invaluable tools for traders and investors alike. These patterns, formed by price movements on charts, provide insights into potential future price directions. Among the myriad of patterns, the broadening top and bottom patterns stand out as intriguing formations that offer valuable signals to those who can decipher them.

What Are Broadening Top and Bottom Patterns?

Broadening top and bottom patterns, also known as megaphone patterns, are reversal patterns that occur in both uptrends and downtrends. They are characterized by their distinct shape, resembling a megaphone or a widening cone. These patterns consist of a series of higher highs and lower lows (for broadening top) or lower lows and higher highs (for broadening bottom), indicating increasing volatility and indecision in the market.

The Anatomy of Broadening Top and Bottom Patterns

Broadening Top Pattern:

The broadening top pattern typically forms after a sustained uptrend.

It consists of higher highs and lower lows, creating a widening range between successive peaks and troughs.

Volume tends to diminish as the pattern develops, indicating uncertainty and a lack of conviction among traders.

The pattern is confirmed when prices break below the lower trendline, signaling a potential trend reversal to the downside.

Broadening Bottom Pattern:

Conversely, the broadening bottom pattern emerges after a prolonged downtrend.

It comprises lower lows and higher highs, expanding the range between successive troughs and peaks.

Similar to the broadening top, volume diminishes as the pattern unfolds, reflecting market indecision.

Confirmation of the pattern occurs when prices breach the upper trendline, suggesting a potential reversal to the upside.

Interpreting Broadening Top and Bottom Patterns

Interpreting broadening top and bottom patterns requires careful analysis of price action, volume dynamics, and overall market sentiment. Here are some key points to consider:

Increasing Volatility: The widening price range indicates escalating volatility and uncertainty in the market. Traders should exercise caution as these conditions often precede significant price movements.

Volume Dynamics: Volume plays a crucial role in confirming the validity of broadening patterns. Decreasing volume as the pattern develops suggests waning momentum and weakening conviction among market participants.

Pattern Confirmation: Confirmation of a broadening pattern occurs when prices break through the pattern's boundary lines. For a broadening top, a downside break confirms the reversal, while an upside break confirms a broadening bottom.

Price Targets: Some traders use the height of the pattern to estimate potential price targets upon confirmation. For broadening tops, the distance between the highest high and the lowest low of the pattern is projected downwards from the breakout point. Conversely, for broadening bottoms, the distance is projected upwards.

Cautionary Note: While broadening patterns can provide valuable insights, they are not foolproof indicators. Traders should use them in conjunction with other technical tools and market analysis techniques to validate their trading decisions.

Trading Strategies Using Broadening Top and Bottom Patterns

Traders employ various strategies when trading broadening patterns, depending on their risk appetite, time horizon, and market conditions. Here are some common approaches:

Breakout Trading: Traders wait for confirmation of the pattern through a breakout and enter positions in the direction of the breakout. Stop-loss orders are typically placed to manage risk in case of false breakouts.

Reversal Trading: Some traders anticipate trend reversals based on the formation of broadening patterns. They may enter contrarian positions ahead of the breakout, relying on the pattern's historical accuracy in signaling trend changes.

Pattern Combos: Broadening patterns are often observed alongside other technical indicators or chart patterns. Traders look for confluence between different signals to increase the probability of successful trades.

Real-World Examples

To better understand broadening top and bottom patterns, let's examine a couple of real-world examples:

Broadening Top Pattern in Stock ABC: After a prolonged uptrend, Stock ABC forms a broadening top pattern characterized by higher highs and lower lows. As volume diminishes, prices eventually break below the lower trendline, confirming the pattern. Traders who entered short positions upon confirmation capitalize on the subsequent downtrend.

Broadening Bottom Pattern in Currency Pair XYZ: In a downtrending currency pair XYZ, a broadening bottom pattern emerges with lower lows and higher highs. A breakout above the upper trendline confirms the pattern, signaling a potential reversal to the upside. Traders who anticipated the reversal and entered long positions profit from the subsequent uptrend.

Conclusion

Broadening top and bottom patterns are valuable tools in the arsenal of technical analysts and traders. By understanding the anatomy of these patterns, interpreting their signals, and deploying appropriate trading strategies, market participants can gain an edge in navigating volatile market conditions. However, like any technical indicator, broadening patterns should be used judiciously in conjunction with other forms of analysis to make well-informed trading decisions.

0 notes

Text

Megaphone Pattern Analysis: Predicting Bitcoin's Future Price Movement

In a recent development stirring excitement within the cryptocurrency community, Titan of Crypto, a technical analyst, has ventured into X platform with a bold prediction, envisioning Bitcoin surpassing its 2021 all-time high. The foundation for this optimistic forecast rests on the identification of a "Megaphone Pattern" gracing Bitcoin's price chart – a renowned technical indicator signaling substantial price movements looming on the horizon.

The Megaphone Pattern, also known as a "Broadening Formation," intricately displays expanding higher highs and lower lows, crafting a pattern resembling the shape of a megaphone. Accentuated in the chart by dark red lines and complemented by dotted yellow trajectories, this pattern hints at an imminent shift from bearish to bullish momentum, potentially leading to a noteworthy upswing in Bitcoin's price.

Adding credibility to this bullish sentiment is the recurrence of the Megaphone Pattern not once, but twice on the chart. Traditionally heralding periods of heightened volatility, these formations suggest that although short-term market uncertainty may persist, a substantial price movement is on the horizon.

However, the Megaphone Pattern's characteristic volatility escalation prompts a note of caution among traders, emphasizing that the pattern does not decisively indicate the direction of the breakout.

A closer examination of current market indicators paints a mixed yet cautiously optimistic picture. Bitcoin's present price stands at $52,330.31, reflecting a marginal 0.05% decrease over the last 24 hours. Despite this minor dip, the robust trading volume and market cap indicate ongoing interest and investment in Bitcoin.

The 4-hour Relative Strength Index (RSI) reading of 60.03 positions Bitcoin in a neutral zone, suggesting the potential for consolidation or an imminent shift in momentum. Similarly, a 4-hour Moving Average Convergence Divergence (MACD) reading of 243 points towards underlying bullish momentum. However, the awaited confirmation from key support and resistance levels is crucial for a clearer understanding of the trend direction.

Consequently, the crypto market stands at a pivotal juncture with the Megaphone Pattern hinting at a plausible bullish reversal. Investors and traders diligently monitor these technical indicators, combined with market dynamics, to assess the potential for Bitcoin to establish new records.

The anticipation surrounding Bitcoin's next significant move is palpable, with technical patterns and market signals portraying a narrative of potential and volatility. While the path forward may witness fluctuations, the underlying sentiment remains optimistic for reaching new heights. Historical patterns and prevailing market indicators align to suggest a favorable outcome in the ongoing saga of Bitcoin's price trajectory.

#Market News#StarkNet#Market Makers#STRK Token#Blockchain Scalability#Cryptocurrency Ecosystem#Cryptotale

0 notes

Text

An In-Depth Look at the Market Podcasting Market : Navigating the Landscape of Opportunities

“According to the research report published by Polaris Market Research, the Global Podcasting Market Size Is Expected To Reach USD 149.34 Billion By 2030, at a CAGR of 31.5% during the forecast period.” Polaris Market Research has unveiled an updated report on Podcasting Market Share, Size, Trends, Industry Analysis Report, By Genre (News & Politics, Society & Culture, Comedy, Sports, Others); By Format (Interviews, Panels, Solo, Repurposed Content, Conversational); By Region; Segment Forecast, 2022 - 2030, that provides a thorough analysis of the market status with the best facts and figures, definitions, applications, and the latest developments across the globe. The report assesses the industry structure based on Podcasting Market size, segments, source, distribution channel, and major regions. It scrutinizes the latest trends in the industry and studies their impact on the overall market environment. The market has evolved swiftly in recent years and has made a remarkable contribution to global finances in terms of growth rate, Podcasting Market share, and revenue generation.

Get Sample PDF with Report Insight @ https://www.polarismarketresearch.com/industry-analysis/podcasting-market/request-for-sample

Key Market Dynamics This analytical study report provides information on significant aspects of the market, such as dynamics, key demand and price, technology trends, and detailed profiles of key players, industry revenue, and regional segments analyzing the Podcasting Market based on SWOT and Porter's Five Forces models. Details of segment markets by type, application, and region have been covered in this report, with historical data presented in metrics of sales volume, revenue, and growth rate.

Key Offerings:

Industry Dynamics

Podcasting Market Segmentation

Market Size in terms of Value and Volume: Current, Historical, and Projected Data

Industrial Trends and Developments

Competitive Landscape

Opportunities in the market

Strategies and Products offerings of Major Players

Strategic Recommendations for the new entrants

Production and Consumption Analysis by Regions

Growth Prospects with Revenue Estimations

Main Findings and Insights

The next section gives a detailed description of the key drivers, restraints, growth opportunities, challenges, and risks in the market. Further, the development status and future [KEYWORD] trends are tracked in the report. The supply chain and cost analysis in the report are both explained in-depth. Through technological innovation and advancement, the product's performance will be further optimized, expanding its use in downstream applications. Additionally, readers will find market dynamics and consumer behavior studies as essential data for understanding the market. Top Key Players:

Amazon.com Inc.

Apple Inc.

Audacy Inc.

iHeartMedia Inc.

Megaphone LLC

Pandora Media Inc.

Soundcloud Limited

Spotify AB

Stitcher

TuneIn Inc.

Podcasting Market key players are presented along with their expansion plans, share, strategies, and business overview. In addition to this, their company profiles, sales figures, profit margins, and product and service portfolios are evaluated in the report. The chapter sheds light on the business expansion strategies employed by these players, such as mergers and acquisitions, product launches, collaborations, M&A, contracts, partnerships, and joint ventures.

Inquire your Questions If any Before Purchasing this Report @ https://www.polarismarketresearch.com/industry-analysis/podcasting-market/inquire-before-buying

How Will This Report Help you?

The report delivers extensive analysis in the form of figures, tables, charts, and graphs combined with an in-depth study of current and future Podcasting Market prospects. It further allows readers to comprehend the competitive regional pattern by comparing the sales volume and revenue of the world's key regions. Import volume and export volume are evaluated on a regional level. Key statistical insights are presented in a straightforward manner that will users grasp the market's development patterns, crucial factors, and other loopholes which are expected to affect the market expansion.

Key Regions Covered By Report:

North America (United States, Canada, and Mexico)

Europe (Germany, France, United Kingdom, Russia, Italy, and the Rest of Europe)

Asia-Pacific (China, Japan, Korea, India, Southeast Asia, and Australia)

South America (Brazil, Argentina, Colombia, and the rest of South America)

The Middle East and Africa (Saudi Arabia, United Arab Emirates, Egypt, South Africa, and the Rest of the Middle East and Africa)

The entire market industrial chain is examined in the research, from the important upstream raw materials and their suppliers to the midstream distributors and downstream customers, while taking the effects of global inflation into account. Finally, it predicts the market's future trends from the perspectives of various types, uses, and significant geographical areas. This study is a trustworthy source for market research that will greatly accelerate the growth of your business and increase its presence in the Podcasting Market. Browse Additional Details on "Podcasting Market" @ https://www.polarismarketresearch.com/industry-analysis/podcasting-market

Reasons to Purchase This Report

This research includes a thorough worldwide and regional analysis of the market.

It gives thorough coverage of every sector of the market in order to assess prospective trends, growth plans, and industry size projections.

The firm profiles of each industry player examine the industry portfolio, sales income, SWOT analysis, and current advancements.

Comprehension of the market's drivers, restrictions, and key small markets.

Analysis of collaboration and authorizing transaction trends can be used to identify commercial prospects in the market sales scenario.

The research analyzes how specific industry structures, ideas, or technological advancements may help with player promotion.

About Us

Polaris Market Research is a worldwide market research and consulting organization. We give unmatched nature of offering to our customers present all around the globe across industry verticals. Polaris Market Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We at Polaris are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semiconductors, chemicals, automotive, and aerospace & defense, among different ventures, present globally.

Contact Us:

Polaris Market Research

Email: [email protected]

Ph: +1-929 297-9727

0 notes

Text

The price of Bitcoin (BTC) is holding above $26,000 on Sept. 25, continuing to show weakness after last week’s United States Federal Reserve interest rate decision. Will the Fed push Bitcoin price lower?On Sept. 21, Fed officials decided to keep interest rates unchanged. However, projections released after the Fed meeting showed that most officials favor increasing rates one more time in 2023. BTC price is down 4.25% since.BTC/USD daily price chart. Source: TradingViewHigher interest rates have proven to be bearish for non-yielding assets like Bitcoin recently. Instead, they have helped raise investors’ appetite for safer assets like the U.S. dollar. As a result, the 20-day average correlation coefficient between Bitcoin and the U.S. Dollar Index (DXY) has dropped to -0.73, the lowest since September 2022, suggesting an increasingly inverse relationship. BTC/USD vs. DXY weekly correlation coefficient. Source: TradingViewOn the other hand, the bulls are pinning their hopes on the U.S. Securities and Exchange Commission (SEC) possibly approving a spot Bitcoin exchange-traded fund (ETF) in October. The biggest argument is that the approval of the first gold ETF in 2003 saw gold prices skyrocket over 300% in the following years. These factors have offset each other, producing one of Bitcoin’s least volatile periods in history. Bitcoin’s historical volatility index — a metric that measures BTC price volatility at one-minute intervals for 30 minutes — has dropped to 13.39 this month.By comparison, the index’s peak was 190 in February 2018. Bitcoin historical volatility index monthly performance. Source: TradingView/MacnBTCLong-term Bitcoin sentiment stableNevertheless, the Fed’s hawkishness has done little to shake the sentiment of Bitcoin long-term holders (LTH) based on the net unrealized profit/loss (NUPL) reading (the blue area in the chart below).Any NUPL value above zero indicates that the network is enjoying an overall net profit, whereas values below zero imply that the network is facing net losses. Currently, BTC investors holding their tokens for over 155 days have remained profitable throughout 2023. In other words, most LTH entities have not sold their BTC holdings yet in 2023 and are likely expecting a higher Bitcoin price in the future.Bitcoin net unrealized profit/loss by cohort. Source: CryptoQuantConversely, the NUPL (the red area) of short-term holders (STH), which typically react swiftly to market volatility, has declined sharply in 2023. This suggests STHs or “speculators” have been securing their profits and accumulating BTC at higher prices.Bitcoin trading pundits: BTC bull run aheadMeanwhile, multiple Bitcoin chart analysts anticipate BTC to go on an extended bull run in late 2023 and throughout 2024.For instance, pseudonymous analyst Rekt Capital sees Bitcoin’s ongoing flat trend as a buying opportunity ahead of the Bitcoin halving by mid-2024. Previous halving events have all served as bullish catalysts, the analyst argues. BTC/USD weekly price chart. Source: TradingView/Rekt CapitalSimilarly, popular market analyst Moustache cites a classic Megaphone pattern to predict a bull run in the Bitcoin market, with upside projections above $100,000.BTC/USD weekly price chart. Source: TradingView/MoustacheShort-term bearish biasHowever, in the shorter term, Bitcoin price technicals are flashing a warning as a potential head-and-shoulders (H&S) pattern emerges.An H&S pattern forms when the price forms three peaks in a row atop a common support line (called neckline). The middle peak, called the head, is higher than the other two peaks: the left and the right shoulders. The H&S pattern resolves after the price breaks below the neckline and falls to the level at length equal to the maximum height between the head and the neckline. As shown below, Bitcoin has started breaking down below its neckline level of around $26,420.BTC/USD four-hour price chart. Source; TradingViewAs a result of this classic technical setup, the bearish target for BTC price sometime in October will be around $25,400.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. Source

0 notes

Link

Copper Commodity Market Outlook Analysis Reports

MCX Copper - Technical Outlook 11th NOV

Copper daily chart has formed “Megaphone chart” pattern. The last few sessions been in bearish in trend but also consolidated after retesting near a key support zone inside the channel. The market is expected to continue on bearish momentum based on the current price action, once the same breaks below the key support holding at 428. The downside rally could be testing all the way through 424-420 levels in the upcoming sessions. Alternatively, if the key support holds strong then the market might retest the same and turn bullish. The upside rally could test up to 435-440 levels. Key resistance holds at 440. For the complete report with technical chart visit https://enrichbroking.in/copper-commodity

#Enrich #Copper #Commodity #Market #Outlook #Analysis #Reports

1 note

·

View note

Text

Solana risks 35% price crash with SOL price chart 'megaphone' pattern

Solana risks 35% price crash with SOL price chart 'megaphone' pattern

Solana market grapples with multiple bearish setups if it breaks below its key 50-week moving average. Source link

View On WordPress

0 notes

Text

Solana market grapples with multiple bearish setups if it breaks below its key 50-week moving average. Solana (SOL) risks crashing 35% in the coming days as it comes closer to painting a so-called "megaphone" pattern.SOL price "megaphone" patternIn detail, megaphone setups consist of a minimum of lower lows and two higher highs and form during a period of high market volatility. But generally, these patterns consist of five consecutive swings, with the final one typically acting as a breakout signal.SOL has been sketching a similar pattern since the beginning of 2022, with the coin undergoing a pullback after testing the megaphone's upper trendline near $140 as resistance — the fourth wing.As a result of the pattern, the Solana token could extend its decline to test the megaphone's lower trendline as support near $65, about 35% below today's price. Could SOL crash further?If this scenario plays out, SOL could crash further after forming the fifth swing on its prevailing megaphone structure. While finding a perfect downside target in case of a breakout is tricky, traders typically select it by measuring the distance between the two trendlines from the point the lower one breaks and book profits when the price reaches 50-60% of that distance.SOL/USD weekly price chart featuring 'megaphone' breakout scenario. Source: TradingViewA bearish breakout risks putting SOL's price en route to nearly $40 in the coming weeks.A pullback scenarioOn the other hand, SOL's bearish megaphone setup could fall short of achieving its breakout target as its price holds above a flurry of concrete support levels.These levels include SOL's 50-week exponential moving average (50-week EMA; the red wave) and an upward sloping trendline (the black line) that have served as accumulation zones for traders, as shown in the chart below. As a result, an early pullback from 50-week EMA could invalidate the megaphone scenario.SOL/USD weekly price chart featuring 50-week EMA and rising trendline support. Source: TradingViewSuppose the price falls below the 50-week EMA, only to seek a bounce from rising trendline support. In that case, it could confirm the presence of a "rising wedge" or "bear flag" setup in conjugation with the megaphone pattern's upper trendline — again a bearish setup.SOL/USD weekly price chart featuring bear flag/rising wedge scenario. Source: TradingViewThe rising wedge's downside target appears to be near $60 after measuring the maximum distance between its upper and lower trendline (about $40) and subtracting it from the potential breakout point near $100.Related: Profit taking and Bitcoin consolidation give bears an opportunity to take controlMeanwhile, the bear flag's downside target is near $30 after calculating the height of its previous uptrend (about $60) and subtracting it from the potential breakout point near $90.The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision. Go to Source

0 notes

Text

Solana network activity surge and ‘megaphone’ chart pattern set $210 SOL price target

Key Takeaways: Solana formed a megaphone chart pattern with a potential $210 price target. Solana’s ecosystem growth highlights renewed investor interest with a $4 billion realized cap increase and 731 million transactions. Solana (SOL) price tested its key resistance at $180 earlier this week, but the altcoin failed to establish a position above the level. Over the past few days, SOL has…

0 notes

Text

💎 Complete Guide to Diamond Pattern in Trading: Spot It, Trade It, Master It

Ever stared at a chart wondering if the chaos is hiding something powerful? Enter the Diamond Pattern – a rare but potent formation that can signal big moves in either direction. If you’re trading stocks, especially in fast-moving markets like NSE or BSE, understanding this pattern could be your edge.

Whether you're a beginner or a technical analyst, this guide unpacks everything: how to identify, validate, and trade the Diamond Pattern with real-world insights, backtested results, and practical strategies. Let's dive in.

🔍 What Exactly Is a Diamond Pattern in Trading?

A Diamond Pattern is a technical reversal pattern that resembles – yes, you guessed it – a diamond shape on the price chart. It often forms at market tops or bottoms and signals a major trend reversal.

📉 Diamond Top: Appears at the end of an uptrend and signals a potential bearish reversal.

📈 Diamond Bottom: Forms after a downtrend and hints at a bullish reversal.

According to Thomas Bulkowski, the technical analyst and chart pattern researcher, Diamond Tops are more common than Diamond Bottoms and often precede a significant drop in price.

🔄 Top vs Bottom: What’s the Difference?

🔺 A Diamond Top consists of broadening price action followed by narrowing — think of a megaphone shape turning into a wedge. You'll often see this before breakdowns.

🔻 A Diamond Bottom, on the other hand, suggests seller exhaustion. Prices widen out then compress, and eventually break upward.

🎯 Strike Money, one of the few Indian charting platforms that allows dynamic pattern detection, has integrated real-time diamond pattern screeners across equities and derivatives. Patterns like these formed in Reliance Industries (NSE: RELIANCE) and Tata Steel (NSE: TATASTEEL) during transitional periods between 2020–2023.

👀 How to Spot the Diamond Pattern (Without Guessing)

Identifying a Diamond Pattern requires patience and visual clarity. Here's how traders do it using tools like Strike Money or TradingView:

🟠 Look for a broadening formation where highs and lows widen – this reflects market indecision.

🟢 Watch for symmetrical compression that follows – a narrowing range of candles forming a converging shape.

🔵 Volume typically increases during the widening phase and tapers as the pattern completes.

Using this method, traders identified a textbook Diamond Top in Infosys (NSE: INFY) in October 2022, which led to a sharp drop of over 12% within 3 weeks.

🧠 Why the Diamond Pattern Works: The Psychology Behind It

Every pattern tells a story, and this one narrates the battle between bulls and bears.

💥 The widening phase shows growing volatility – participants are unsure, pushing the price in both directions.

🧊 The contraction indicates consensus is forming, but no one knows which side will win – until the breakout.

⚠️ This shift in psychology is why the diamond pattern is viewed as a reliable reversal signal, especially when paired with volume confirmation and momentum indicators like RSI and MACD.

📈 How to Trade the Diamond Pattern Like a Pro

You’ve identified the diamond. Now what?

🚀 Wait for the breakout – This is the key. Enter only when the price decisively breaks above or below the diamond structure with rising volume.

🛑 Set a stop-loss just outside the opposite end of the diamond.

🎯 Target: Measure the widest part of the pattern and project it from the breakout point.

🛠️ In May 2023, HDFC Bank (NSE: HDFCBANK) broke out from a diamond bottom pattern and surged over 8% in the following weeks – with confirmation from RSI crossing 50 and bullish divergence on MACD.

📊 How Reliable Is the Diamond Pattern? Here’s the Data

According to a 10-year performance study by Thomas Bulkowski, diamond tops have a success rate of 65%, while bottoms are slightly more volatile but still reliable at 61%.

📉 Diamond Top: ✔️ Avg drop after breakout: 15% ⏱️ Avg time to reach target: 1–2 months

📈 Diamond Bottom: ✔️ Avg rise after breakout: 17% ⏱️ Avg time to reach target: 3–6 weeks

These numbers are even more meaningful when backtested on Indian equities. Strike Money's pattern scanner recorded over 70 instances of diamond setups between 2022–2024, with a hit rate close to 68% when volume and RSI conditions were met.

🚫 Don’t Get Trapped: Avoid These Common Mistakes

❌ Jumping in too early – Enter only after breakout confirmation with strong volume.

❌ Ignoring fake-outs – Use momentum indicators like RSI or Stochastic to validate the move.

❌ Misidentifying patterns – Don’t confuse it with a Head and Shoulders or Symmetrical Triangle. Use a charting tool like Strike Money for automated detection and overlays.

One notable example of a false breakout was seen in Zomato (NSE: ZOMATO) in early 2023, where a diamond top appeared to form, but lack of volume led to a failed breakdown and a short squeeze.

🧰 Best Tools to Detect Diamond Patterns Instantly

No trader has time to stare at charts all day.

🔎 Strike Money offers an intuitive visual pattern scanner for NSE & BSE stocks, where you can set alerts for real-time diamond formations.

🖥️ TradingView: Global favorite with customizable pattern recognition tools.

📱 MetaTrader & ThinkorSwim: For those who trade global markets, these platforms also allow pattern scanning and backtesting.

💡 Pro Tip: Set alerts not just for the pattern, but also for volume spikes and RSI confirmation, so you avoid fakeouts.

🌍 Does the Diamond Pattern Work in Stocks, Crypto, and Forex?

Yes – and each market behaves differently.

📈 In Indian stock markets, the pattern is most effective on mid- and large-cap stocks with high liquidity. Examples include HUL, Infosys, and Kotak Bank.

💰 In cryptocurrencies, volatility exaggerates both breakouts and false signals. Use tighter stops and higher confirmation.

💱 In Forex, patterns can form across time zones – diamond formations in USD/INR on the hourly chart often mirror market sentiment around RBI policy announcements.

Across all markets, context matters. Never trade a diamond pattern in isolation.

🤔 Should You Include the Diamond Pattern in Your Trading Strategy?

Absolutely – if you know when and how to use it.

💎 It’s not a pattern you’ll see every day. But when it shows up, especially on higher timeframes (4H, Daily, Weekly), it deserves your attention.

📚 Combine it with: 📊 Volume analysis 🔁 Fibonacci retracement levels 📉 Momentum indicators 🔐 Risk management strategy

Tools like Strike Money can give you alerts, overlays, and backtested confidence, making it easier to integrate into your existing strategy.

✅ Final Thoughts: The Diamond Pattern Is Rare, But Powerful

If you’re serious about trading the markets – be it stocks, crypto, or forex – the Diamond Pattern is a tool you’ll want in your arsenal. It requires discipline, confirmation, and proper execution, but the payoff can be impressive.

⚡ Want to level up your charting game? Use Strike Money to spot, validate, and trade diamond patterns across Indian markets – in real time.

💬 Got questions? Drop them below or explore our deep dives into Head and Shoulders, Cup and Handle, and Breakout Trading Strategies next.

🧠 FAQ: Quick Answers You’re Probably Searching For

Q: Is the Diamond Pattern bullish or bearish? A: Depends on its type. A diamond top is bearish; a diamond bottom is bullish.

Q: Does the pattern work in Indian markets? A: Yes. Proven examples include Reliance, Infosys, and HDFC Bank on NSE.

Q: What’s the best timeframe to use? A: 4H, Daily, and Weekly give the most reliable signals.

Q: Can I use this with options? A: Yes. Combine with option chain data for directional trades post-breakout.

Q: What’s the success rate? A: Historically between 60%–68%, higher with volume confirmation.

0 notes

Text

Solana risks 35% price crash with SOL price chart 'megaphone' pattern - ZellaNews

Solana risks 35% price crash with SOL price chart ‘megaphone’ pattern – ZellaNews

Solana (SOL) risks crashing 35% within the coming days because it comes nearer to portray a so-known as “megaphone” pattern. SOL price “megaphone” pattern In element, megaphone setups encompass a minimal of decrease lows and two increased highs and kind throughout a interval of excessive market volatility. But typically, these patterns consist of 5 consecutive swings, with the ultimate one…

View On WordPress

0 notes

Text

Solana risks 35% price crash with SOL price chart 'megaphone' pattern

Solana market grapples with multiple bearish setups if it breaks below its key 50-week moving average.

from Cointelegraph.com News https://ift.tt/X2NUAuO

0 notes

Link

Bank Nifty - Technical Outlook 11/26/2018 9:19:00 AM

Bank nifty daily chart has formed “Megaphone chart” pattern. The last few sessions ended up bearish in trend along with some corrections inside the channel. The market is expected to continue on bearish momentum, once the same breaks below a key support holding at 25900. The downside rally could be testing all the way up to 25700-25500 levels in upcoming sessions. Alternatively, if the key support holds strong then the market might retest the same and turn bullish. The upside rally could test up to 26100-26400 levels. Key support holds at 26400. For the complete reports visit https://enrichbroking.in/equity-report-bank-nifty

#Enrich #Equity #Research #Outlook #Analysis #Reports

1 note

·

View note