#Technical Analysis Patterns

Explore tagged Tumblr posts

Text

How to Trade the Bullish Engulfing Pattern: Complete Guide with Strategies

In the world of candlestick trading, price action patterns offer invaluable insights into market sentiment and potential reversals. One of the most powerful and frequently observed reversal patterns is the Bullish Engulfing Pattern. This pattern signals a shift from bearish to bullish sentiment, often preceding a strong upward move. In this blog post, we’ll explore: What the Bullish Engulfing…

#Best candlestick patterns for trading#Bullish Candlestick Patterns#Bullish Engulfing confirmation#Bullish Engulfing in downtrend#Bullish Engulfing in intraday trading#Bullish Engulfing Pattern#Bullish Engulfing pattern explained with examples#Bullish Engulfing setup#Bullish Engulfing trading strategy#Bullish Engulfing vs Bearish Engulfing#candlestick chart patterns#Candlestick reversal patterns#EMA bounce with candlestick patterns#engulfing candle setup#Engulfing candle trading strategy#Entry and exit strategy for Bullish Engulfing#High volume Bullish Engulfing#How to identify a Bullish Engulfing pattern#How to Trade Bullish Engulfing#intraday trading strategy#learn technical analysis#Price Action Strategy#Profitable Bullish Engulfing strategy for beginners#reversal trading signals#RSI and Bullish Engulfing#Stock trading patterns#Support and resistance trading#Swing trading with Bullish Engulfing#technical analysis#Technical Analysis Patterns

0 notes

Text

Importance of chart analysis for equity investments

Image by freepik Chart analysis, or technical analysis, can be quite helpful for equity investment in the Indian stock market. Here are several reasons why it is beneficial: Benefits of Chart Analysis in the Indian Stock Market 1.Trend Identification The Indian stock market, like any other, exhibits trends over time. Chart analysis helps in identifying these trends, allowing investors to ride…

#chart analysis#equity investment#Financial Markets#Indian stock market#investment strategies#market analysis#Market Sentiment#Stock Charts#Stock Market#Stock Trading#Support and Resistance#Technical Analysis#Technical Indicators#Trading Patterns#Trend Identification#Volume Analysis

3 notes

·

View notes

Text

Technical Analysis in a Nutshell

Technical analysis is a method used to evaluate and forecast the price movements of financial instruments, such as stocks, commodities, and currencies, by analyzing historical price data and trading volumes. Unlike fundamental analysis, which focuses on a company’s financial health, technical analysis relies on patterns, trends, and statistical indicators to make trading decisions. This article…

#Bollinger Bands#Chart Patterns#Divergence#Entry and Exit Points#Exponential Moving Average#Financial Markets#Fundamental Analysis#MACD#Market Movements#Moving Average#Moving Average Convergence Divergence#Oversold Conditions#Position Sizing#Price Charts#Price Movement#Price Movements#Relative Strength#Risk Management#RSI#Security#Stop-Loss#Support And Resistance#Technical Analysis#Trading Decisions#Trading Strategies#Trading Volume#Trend Lines#Volatility

2 notes

·

View notes

Note

hey sara when you read rwrb did you also assume alex knew he was bi up until his sexuality crisis revealed the truth to you or was it just me who labored under delusions for the first 25 percent of the book, a whole quarter of the way through, before getting the shocking surprise that alex claremont-diaz, main character of nyt bestselling debut novel red white and royal blue, by author casey mcquiston, was NOT an out and proud bisexual man?

no actually, because im not delulu like u are . anyway .

#LMAO theres a pattern to how these books work and only occasionally are Both ppl comfortable in their identity before getting together.#bc queer panic is fun to write and also a convenient plot point to maybe add Angst or just further the Getting Together process.#besides‚ the whole point was to have a Major Big Realization that his obsession w henry wasnt purely antagonistic.#and it made for some good dramatic irony and unreliable narrator shenanigans. so im saying that it was the only way to fill up space.#and also it caused introspection‚ which leads to us learning more backstory and empathising with him more in general.#also it was hilarious that alex was high key obsessed with him for years and also had Gay Experiences in hs but still didn't realize.#and that makes alex a relatable character overall and makes the pacing of the story better‚ which is why Most queer authors tend to do this#so basically for technical reasons that i Knew bc i do literary analysis‚ also in the specific case of rivals to lovers it just made Sense.#sara's asks#rori <33#rwrb

7 notes

·

View notes

Text

I found something weird again!

So I have two sets of compiled images of fairy wings for my research.

One was taken from the episodes where Harlequin fights the albion, The other comes from the later in the series, where Harlequin and Diane have their time travel adventure/test thing from Gloxinia and Drole.

Now the weird bit. There seems to be a shift in wing patters over time.

During the trial we see the old Fairy King's Forest and the population of Fairies that was present during the first Holy War. In the new Fairy King's forest we obviously see the population of Fairies that's currently present.

In my references from the first Holy War there are a lot of Fairies with spots on their wings. The wings are a solid color with large/small cell vein configurations and spots, typically of a darker version of the primary color.

During present day I have a lot of images of Fairies with "tipped" wings. Again there's a solid color, though there's more variation in vein configuration. But the tips of the wings have a darker color.

3000 years ago there were NO Fairies with this type of wing marking. Though currently there are still Fairies with the spotted pattern, but A LOT fewer.

I don't have any theory as to why or how this shift occurred. Cuz...it's not like there's a genetic element... but it is interesting.

Another thing I... don't have an "in-universe" explanation for is Ende.

they're not tipped, they're edged. And this is not super common currently but it's not the most rare pattern either. And it used to be VERY common 3000 years ago.

#seven deadly sins#nanatsu no taizai#7ds#nnt#7ds fairy#nnt fairy#7ds analysis#nnt analysis#the irl explanation for Ende's wings being common during the 1st holy war is that they did a lot more reusing assets later in the series#so they just recolored her model and pasted it everywhere#there are...i think 6 fairies that this is true about and they make up the majority of the crowds during the trial#one of the other ones is that first picture with the spotted wings#that's technically why that pattern is so common back then

8 notes

·

View notes

Text

Candlestick Charting: A Tale of Tradition and Innovation from Japan

Candlestick charting's rich origins in Japan reveal timeless insights into market sentiment. Embrace the past's wisdom as we navigate today's markets, confident that understanding emotions will illuminate brighter trading paths! 🚀📈 #FinancialWisdom

Candlestick charting, a vital tool for traders globally, originated in 18th-century Japan amid a feudal society and a thriving rice market. Developed by legendary trader Munehisa Homma, it visualised price movements using candlesticks, revealing market psychology and predicting trends. Steve Nison’s introduction of candlestick charting to the West in the 1980s revolutionised technical analysis.…

View On WordPress

#Bullish and Bearish Patterns#Candlestick Patterns#Feudal Japan#Financial Education#Japan#Market Psychology#Modern Trading#Price Action#Risk management#Technical Analysis

4 notes

·

View notes

Text

Technical Analysis & Trend Patterns: Learn Share Market Trading the Right Way

At Chart Monks, we believe that trading is a skill — not a gamble. If you’re tired of confusion, indicator overload, or following calls blindly, it’s time to change the way you trade. With our practical approach to technical analysis and real-time understanding of trend continuation patterns, we help you learn online trading the right way — with clarity, confidence, and control.

Whether you're a complete beginner or someone looking to refine your strategies, we offer some of the best trading courses in India tailored to every stage of your journey.

Why Choose Chart Monks to Learn Online Trading?

Unlike traditional platforms that focus heavily on theory or flashy strategies, we simplify the process. At Chart Monks, we teach you to read the price action, understand market psychology, and make independent decisions based on structure and logic — not noise.

Our mission is to provide online trading courses for beginners and intermediate traders that are grounded, actionable, and free from unnecessary complexity.

Trading Classes for Beginners – Build a Strong Foundation

If you're just getting started, you don’t need complicated strategies. You need a strong foundation. That’s why our trading classes for beginners focus on what truly matters:

Understanding how price moves

Identifying market phases

Recognizing demand and supply zones

Reading structure and trend continuation patterns

Managing risk and maintaining discipline

We break down each concept in a simple, visual way that anyone can understand — no financial background needed. You’ll gain the skills to trade independently, without relying on tips or signals.

Share Market Technical Analysis Course – Learn What Really Moves the Market

Our share market technical analysis course is one of the most practical and insightful programs available online in India. We go beyond just candlesticks and indicators. We train you to see the bigger picture — how institutions move the market, how retail traders react, and how you can stay ahead by reading pure price action.

Inside this course, you’ll learn:

How to recognize and trade trend continuation patterns with confidence

How to build high-probability setups using price structure

The psychology behind big moves

How to avoid common traps and false breakouts

Real chart examples from the Indian stock market

This isn’t about memorizing patterns — it’s about understanding why the market moves and where it’s likely to go next.

Avoid Trading Burnout – Train with Clarity and Focus

Many traders face trading burnout not because they lack motivation, but because they’re overwhelmed with too much conflicting information. At Chart Monks, we remove that stress by offering a structured, step-by-step learning journey.

Our approach helps you:

Focus on one system and master it

Avoid information overload from too many sources

Gain mental clarity with simple, repeatable strategies

Build the right mindset to handle wins and losses calmly

At Chart Monks, we believe trading success is 20% strategy and 80% psychology. That’s why we also help you develop the mental discipline to stay consistent.

Online Trading Courses in India – Learn Anytime, Anywhere

We understand that flexibility is important. That’s why we offer all our online courses —so you can learn whenever and wherever it suits you. Whether you're working full-time, in college, or trading part-time, our online trading courses for beginners are designed to fit your schedule.

With our platform, you get:

Lifetime access to course material

Mobile and desktop-friendly video content

Downloadable resources and charts

Live sessions and mentor support

Community access for feedback and progress tracking

No need to travel or attend costly seminars — with Chart Monks, everything is available from the comfort of your home.

What Makes Our Trading Courses Online the Best?

There are many platforms offering trading courses online, but few truly focus on what matters. We stand out by:

Teaching real price action, not just theory

Breaking down live chart examples from the Indian stock market

Focusing on trend continuation patterns and practical setups

Helping you develop a consistent mindset

Offering support through mentorship, not just videos

Keeping things affordable and transparent

We don’t promise overnight success. We promise real skills and lifelong learning.

Free Online Courses for Trading – Start With Zero Risk

Still unsure if our courses are the right fit? Try our free online courses for trading. These mini-courses give you an introduction to how we teach and what we cover. You’ll learn key trading concepts, market structures, and entry-level technical analysis — all at zero cost.

They’re a great way to test the waters and see if our approach aligns with your goals.

Prepared to Begin Your Trading Journey with the Right Approach?

If you’re serious about trading and want to learn in a clear, practical, and mentally sustainable way, Chart Monks is here to guide you. Whether you're looking for trading classes for beginners, a share market technical analysis course, or a full online trading course in India, we’ve got the roadmap you need.Start with our free courses, or dive into our full programs to transform your approach to the market. Call us now at +91-9220943789, Visit: www.chartmonks.com.

#Learn Online Trading#Trading Classes For Beginners#Share Market Technical Analysis Course#Trend Continuation Patterns#Trading Courses Online#Best Trading Courses#Trading Burnout#Free Online courses For Trading#Online Trading Courses For Beginners#Online Trading Course in India#Price Action#Technical Analysis Course#Chart Monks

0 notes

Text

youtube

Looking to spot trend reversals before the rest of the market catches on? This video breaks down powerful reversal signals every smart trader should know to maximize profits and minimize losses. In this detailed guide, we uncover the top reversal patterns, indicators, and techniques used by successful traders across the stock, forex, and crypto markets. Learn how to identify momentum shifts, trap zones, and entry/exit points that could change the game for your trading strategy. Whether you're day trading, swing trading, or investing long-term, understanding reversal signals is key to protecting your capital and boosting returns. Websites: https://tradegenie.com/ https://nosheekhan.com/ Twitter - https://twitter.com/marketswizard Facebook - https://www.facebook.com/financialmar Head Office: Trade Genie Inc. 315 South Coast Hwy 101, Encinitas, CA 92024 Phone Number: 212-408-3000 #ReversalSignals #TradingProfits #TechnicalAnalysis #PriceAction #ChartPatterns #StockMarketTips #ForexTrading #CryptoSignals #SwingTrading #DayTrading #TrendReversal #SmartTrading #UnlockProfits #TradingEducation #MarketMoves

#Reversal-Signals#Trading-Profits#Technical-Analysis#Price-Action#Chart-Patterns#Stock-Market-Tips#Forex-Trading#Crypto-Signals#Swing-Trading#Day-Trading#Trend-Reversal#Smart-Trading#Trading-Education#Youtube

0 notes

Text

Nifty Forecast Tomorrow: Expert Predictions and Market Trends You Should Know

If you're looking for the most accurate Nifty forecast for tomorrow, you're not alone. Every day, thousands of traders and investors closely follow the Nifty 50 index, aiming to anticipate the next market move and get a step ahead of the volatility. In this post, we break down key technical levels, current sentiment, and expert-backed strategies to help you prepare for the trading session ahead.

📊 What Is the Nifty 50 and Why Its Forecast Matters

The Nifty 50 is India’s flagship stock market index, representing 50 of the largest and most liquid companies listed on the National Stock Exchange (NSE). It's a key barometer for market trends and investor confidence.

A well-researched forecast for Nifty 50 movement tomorrow can be highly valuable for:

Intraday traders planning entry and exit points.

Swing traders timing short-term opportunities.

Investors staying aligned with macroeconomic trends.

🔍 Nifty 50 Technical Analysis for Tomorrow

1. Key Support and Resistance Levels

Based on today’s market close and recent trading patterns:

Support zones: 22,300 and 22,180

Resistance zones: 22,500 and 22,640

If the index breaks above 22,500 with momentum, it may push higher. A drop below 22,180 could shift sentiment toward bearish.

2. Moving Averages

Nifty is trading above both 20-day and 50-day EMAs, suggesting the trend remains positive.

The Relative Strength Index (RSI) is around 58–60, reflecting healthy momentum without overbought conditions.

3. Candlestick Pattern

Today’s session showed indecision, forming a neutral candle. A breakout candle or a bullish engulfing pattern tomorrow would be a strong confirmation of upward momentum.

🗣️ Market Sentiment & Global Cues

Sentiment in the market remains cautiously optimistic. Some of the key global and domestic factors influencing the Nifty forecast tomorrow include:

U.S. Federal Reserve commentary on interest rates

Movement in crude oil prices

INR/USD exchange rate fluctuations

Institutional investor activity (FII/DII inflow/outflow)

FIIs were net buyers today, a signal that global appetite for Indian equities remains intact — at least for now.

📈 Expert Outlook: Nifty Forecast for Tomorrow

Analysts are leaning towards a mild bullish trend continuing into tomorrow’s session, assuming no sudden negative cues overnight. That said, volatility is likely to spike during the first hour of trade.

Here are some smart trading reminders:

Don’t chase early price gaps.

Stick to well-defined stop losses.

Wait for volume confirmation, especially near breakout zones.

💡 Tip: A breakout above 22,500 on strong volume could provide a high-probability setup for short-term trades.

🛠️ Action Plan for Traders

Intraday Traders

Observe the first 15–30 minute range for market direction.

Indicators like MACD, RSI, and volume spikes are crucial for timing entries.

Use a trailing stop-loss strategy once in profit.

Positional Traders

Consider adding long positions above 22,500 with upside targets around 22,800.

If Nifty dips below 22,180, reassess and wait for a base to form before entering.

🔗 Live Updates and Tools

Want more granular data? For real-time charts, key levels, and analyst videos, check out the full Nifty 50 forecast and live analysis page.

📬 Final Thoughts

A well-informed Nifty prediction for tomorrow helps traders cut through the noise and take calculated risks. No forecast is 100% guaranteed, but combining technical signals, market sentiment, and global cues can give you an edge.

Trade smart. Stay disciplined. And always have a plan.

#nifty forecast tomorrow#nifty 50 prediction#nifty 50 forecast#nifty technical analysis#nifty trend tomorrow#share market forecast#stock market prediction#nifty outlook#nifty analysis#nifty trading strategy#nifty support and resistance#nifty levels tomorrow#intraday trading tips#stock market india#nifty market trend#nifty tomorrow analysis#nifty movement prediction#NSE forecast#indian stock market forecast#market trend analysis#technical analysis nifty 50#nifty 50 chart#fii dii data analysis#stock market update today#trading view nifty#nifty live updates#nifty chart pattern#nifty stock tips#nifty breakout strategy#nifty candlestick analysis

0 notes

Text

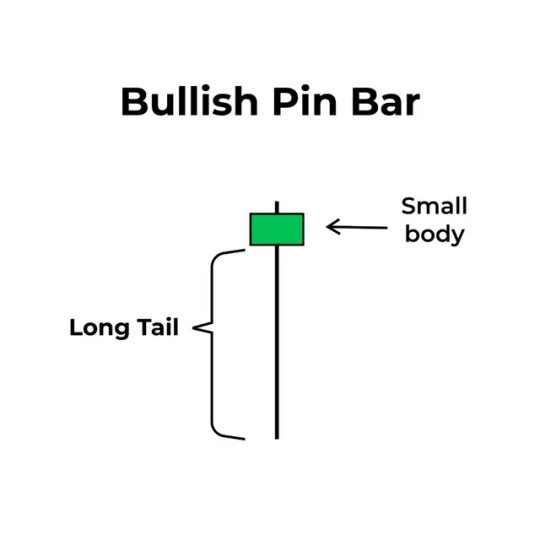

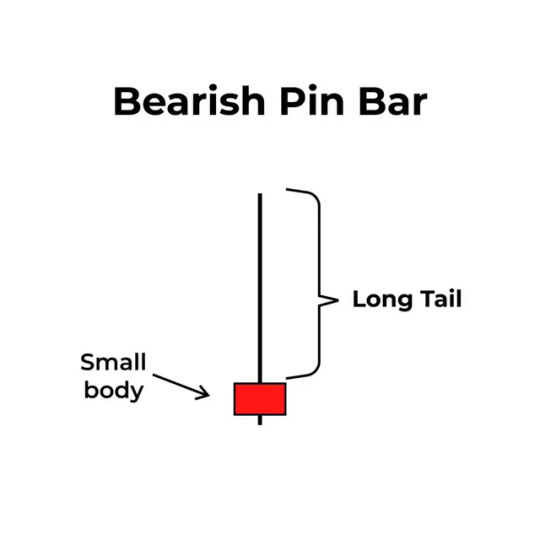

Pin Bar Candlestick Pattern: A Trader’s Guide to Smart Entries and Exits

Have you ever noticed a candle on a chart that looks like a pin or a needle? That structure is known as a pin bar, and it can give traders powerful insights into future price movement. Whether you're entering or exiting a trade, the pin bar can help you make smarter, more strategic decisions.

If you've found it challenging to recognize or understand this pattern, you're not alone. In this Market Investopedia guide, we’ll walk you through everything you need to know about pin bars—how they work, their pros and cons, and how to trade them effectively.

What Is a Pin Bar?

A pin bar is a candlestick formation that signals a potential price reversal or continuation. It’s made up of:

A small body (green or red),

A long wick on one end,

And a short wick on the opposite end.

This structure reveals price rejection—meaning the market attempted to move in one direction but was strongly pushed back, hinting at an upcoming shift.

Key Features of a Pin Bar

To identify a pin bar, look for the following elements on your chart:

Small Candle Body

The body should be short, showing little difference between the opening and closing prices. This indicates a balance—or struggle—between buyers and sellers.

Wicks (Shadows)

There are two wicks on a pin bar. One is very long, and the other is short. The long wick reveals where the price was rejected, and it's the most important part of the pin bar.

Closed Candle

Never trade a pin bar that hasn’t closed yet. Wait for the candle to close before making a decision based on its signal.

Types of Pin Bars

Bullish Pin Bar

Appears during a downtrend

Has a small green body

Features a long lower wick

Signals a potential upward reversal

The long lower wick suggests sellers pushed the price down, but buyers fought back, rejecting the lower levels. This often indicates a buying opportunity.

Bearish Pin Bar

Appears during an uptrend

Has a small red body

Features a long upper wick

Signals a potential downward reversal

Here, buyers tried to push the price higher, but sellers stepped in and rejected the highs. This often signals a selling opportunity.

How to Trade Using Pin Bars

1. Identify a Pin Bar

Scan your chart (preferably 4-hour, daily, or weekly) for a small-bodied candle with a long wick on one end and a short wick on the other.

2. Use Confirmation Tools

Combine pin bars with tools like:

RSI (Relative Strength Index)

Fibonacci Retracement

Bollinger Bands These indicators can help confirm whether the signal is strong enough to act on.

3. Trade Reversals

When a pin bar forms at a key support or resistance level, it often signals a reversal. Trade in the direction opposite the long wick.

4. Trade Trend Continuations

Not every pin bar signals a reversal. In some cases, especially during a trend pause, a pin bar can indicate that the current trend is about to continue. For example, a bullish pin bar during an uptrend suggests that buyers are still in control.

How to Spot High-Quality Pin Bars

Not all pin bars are equal. Here's what to look for in a strong setup:

Key Levels: Look for pin bars forming at significant support or resistance zones.

Longer Time Frames: Pin bars on 4H, daily, or weekly charts tend to be more reliable than those on 5-minute or 15-minute charts.

Wick Length: The longer the wick (at least two-thirds of the candle's length), the stronger the signal.

Smaller Body: A smaller body means less indecision and more rejection.

Volume Confirmation: Higher trading volume strengthens the validity of the pattern.

Pros of Trading Pin Bars

Easy to recognize, even for beginners

Work well with various assets—Forex, stocks, crypto, commodities Clearly define potential entry and exit levels

Combine well with trendlines, moving averages, and other tools Suitable for multiple timeframes

Cons of Trading Pin Bars

Less effective in choppy or sideways markets

Relies on probabilities—there’s no guarantee the signal will play out

Can produce false signals without proper confirmation

Final Thoughts

The pin bar candlestick is a powerful yet simple tool that traders can use to spot trend reversals or continuations. It's easy to learn, and when combined with other forms of analysis, it can provide high-probability trade setups.

However, like any trading method, pin bars are not foolproof. It's important to assess each one carefully, confirm the signal, and avoid trading them in low-quality setups or during erratic market conditions.

Ready to dive deeper into price action and trading strategies? Explore more articles on Market Investopedia or join our free webinar for hands-on learning with real chart examples.

0 notes

Text

Top 8 Must-Know Chart Patterns in Technical Analysis | NTA®

Discover the 8 essential chart patterns every trader should master. Enhance your trading strategy with insights into market trends and price action analysis.

0 notes

Text

Unlocking the Power of TradingView: The Best Charting Platform for Traders

A sleek and modern TradingView dashboard displaying real-time charts, candlestick patterns, and powerful technical indicators like RSI and MACD. Are you looking for a powerful, easy-to-use charting tool to enhance your trading? Whether you’re a beginner or an experienced trader, TradingView is one of the best platforms for technical analysis, market insights, and strategy building. And here’s…

#Affiliate Marketing#Automated trading#Candlestick patterns#Crypto trading#Day trading#Forex trading#Investing#MACD#Market analysis#Online trading#passive income#RSI#Stock market#Swing trading#Technical analysis#Trading alerts#Trading bots#Trading platform#Trading signals#Trading strategies#Trading tools#TradingView#TradingView charts#TradingView indicators#TradingView plans#TradingView pricing#TradingView review

0 notes

Text

Binge-Worthy Trading: When Technical Analysis Meets Your Watch List

Hey streaming fanatics turned traders! Ever notice how your chart analysis skills improved after watching 47 episodes of your favorite show in one sitting? No? Let me explain this hilarious connection between your Netflix addiction and trading success!

Remember how you predicted that plot twist in your favorite series because you noticed all the subtle hints? That's exactly what technical analysis is - except instead of predicting who ends up with who, you're predicting where prices might go. And trust me, both can be equally dramatic!

Think about your favorite crime series. You know how detectives look for patterns to solve cases? Well, traders are basically market detectives! Instead of looking for clues at a crime scene, we're searching for clues in our charts. Though sometimes the market commits crimes against our portfolio, but that's another story...

The best part is how similar chart patterns are to TV show formulas. You've got your reversal patterns (like season finales), continuation patterns (like mid-season episodes), and those false breakouts (like clickbait episode titles that promise more than they deliver).

And don't even get me started on double tops and bottoms - they're like those classic "evil twin" episodes. Just when you think you know what's happening, the market pulls a soap opera move on you!

Concluding paragraph: So next time someone tells you you're watching too much TV, just tell them you're actually studying advanced pattern recognition for your trading career! And remember, just like you wouldn't skip to the last episode of a series, don't rush your trading journey. Enjoy the show, learn the patterns, and maybe keep some popcorn handy for those volatile market days!

#trading entertainment#Netflix analysis#market patterns#trading humor#technical analysis basics#chart patterns#trading psychology#market trends#trading education#beginner trading

1 note

·

View note

Text

Head and Shoulders Chart Pattern in Stock Trading

The Head and Shoulders pattern is a chart formation that often signals a reversal in the trend of a financial asset like stocks, commodities, or currencies. Traders use this pattern to spot when a market is about to shift from an upward trend to a downward trend (or vice versa), making it an essential tool for both beginners and experienced investors. This pattern has three peaks with the centre peak shaped like a ‘head’ supported by the two ‘shoulders’ or smaller peaks on either side which gives the pattern its name.

Read Full Blog Post: Head and Shoulders Pattern in Technical Analysis

#Head and Shoulders Chart Pattern in Technical Analysis#How to Trade using Head and Shoulders Pattern#Different Types of Head and Shoulders Pattern#Head And Shoulders Pattern In Stock Trading#Inverse head and shoulders pattern

0 notes

Text

youtube

Mastering Forex Charts: A Beginner's Guide to Candlesticks, Lines, and Bar Patterns

#Forex trading#Forex charts#candlestick charts#line charts#bar charts#trading tutorial#chart analysis#technical analysis#Forex market#bullish patterns#bearish patterns#price movements#market trends#OHLC#trading strategies#chart reading#price action#trading tips#beginner trading#advanced trading#Forex education#PipInfuse#trading insights#market sentiment#trend analysis#trading confidence#Youtube

1 note

·

View note

Text

Unlock your full potential by delving into the world of trading without any cost. Our app is tailored to equip you with the knowledge and skills needed to navigate the complexities of the market, fostering financial independence through informed trading decisions.

Our aim is to make high-quality financial education accessible to everyone for free while ensuring both absolute beginners and trading beasts both have new knowledge to unlock.

With this candlestick patterns app you will go from a stock market noob to an expert day trader at the speed of sound using 5 powerful tools to help you learn Candlestick Patterns, Technical Analysis & Fundamental Analysis with ease.

• Expertly Written Lessons, To Help You Learn With Ease

• A Candlestick Simulator To Help You Practice

• A Profile Page To Make It Easier To Track Your Progress

• Quizzes & Tests To Help You Test Your Knowledge

• A Settings Page To Help You Customize Your Full App Experience

With these 5 POWERFUL features you could quickly and easily become a stock market expert and start making money on the stock market.

Candlestick patterns are used by professionals all the time to help them predict the markets and help them make money, So why shouldn't you use those tools as well?

Just a friendly heads-up: Trading can be a rollercoaster ride, with its ups and downs, and there's a chance you could lose some, or even all, of your capital invested. Everything you learn in the candlestick patterns app is here to enlighten and educate, not to serve as financial advice or an investment recommendation. So, enjoy the journey, but remember to buckle up!

Download ‘Learn Candlestick Patterns’ To Start Learning Now!

0 notes