#Mints App Review

Explore tagged Tumblr posts

Text

instant connection .ᐟ.ᐟ

di!leon x reader - long-distance relationship - part 1

next part

leon's a liar.

he doesn't mean to be. he tells you he works in security because it's easier than explaining the shitshow that is the DSO. you'll ghost him in a few messages anyway - and if you don't, he'll do the honors.

leon. 6'0''. works in security at no. undecided on kids. doesn't drink, doesn't smoke, long-term relationship, open to short. his first picture is of him throwing a peace sign to the camera, hair immaculate. (he'd had to crop out the hideous monster, a writhing mass of flesh and teeth, and now bullets. leon had realized very quickly that most of his selfies were ones he sent to hunnigan and ranged from drowned cat couture, 'forgot my umbrella today' to 'i'll help you train if you want to be a field agent, you're missing out', encouragement in the same frame as his latest monstrosity.)

the only thing completely true on his profile is his name and his status as a non-smoker and newly minted teetotaler. (according to his sobriety chip, he hasn't touched a drink in eight months. he keeps it in the same pocket he used to stash his flask in.) he's probably six foot in his shoes, he figures. that's only a half lie. 'undecided' should be 'unlikely', but that hadn't been an option in the drop down menu. his therapist says he needs to keep himself open to happiness, not to hold his dreams under water and drown them the moment he dares to have hope. it sounds kind of like bullshit, but undecided is the closest he's letting himself get to optimism for the time being. it's the same deal with long-term, open to short - blind optimism undercut by what he knows life has in store for him.

companionship isn't in the cards for him, not in any meaningful way, and that's fine. you get used to it after a while. it dulls out, gets hazy, only really creeps in on lazy weekends when he leaves the window cracked, swept in on sweet-smelling spring breezes.

it's one of those days when he opens his dating app to review his scant few likes. he clears the cobwebs from his profile only often enough to keep it active (there's that hope again). activity was few and far between, usually saved up to have claire or hunnigan go through his options and point out red flags that he would gladly sail right past - but that day, a cavern had opened in his chest. he only knew how to fill it with validation.

you were half-way across the goddamn country. you'd probably liked him weeks ago when you were passing through. seemed like a safe enough bet. more than likely, you'd never respond. even if you did, this would never work out. the distance was crazy.

so of course he messages you.

all right, what's wrong with you?

kind of a weird thing to say to a stranger, but you take it in stride and turn the question back on him when you respond an hour and a half later, the notification so surprising to him that he has to reel back through your profile to see what he's actually dealing with.

the distance makes it safe. there's a buffer between you. unspoken, mutual understanding that this is impractical and a waste of time.

the messages get more frequent. the stilted conversation melted to daily updates, and he'd exchanged phone numbers with you out of convenience. the app was a pain in the ass. he didn't want to get guff for being on a dating app during work hours, but texts were easily hand-waved. daily pictures escalated to weekly calls, which mutated into scheduled movie nights. there were a host of classics he needed to show you. his contribution to society was making one more person culturally conscious of leon s. kennedy's greatest hits.

leon remembers exactly where he was when you'd sleepily confessed that you weren't talking to anyone else. posted up in a hotel in belgium, getting ready for his operation. it was the middle of the night for you. the day loomed ahead of him, loaded with hostility and viscera. you were half asleep. he could have told you anything and you would have hummed and forgot it, nestled into your pillow. he tells you the truth instead, that he'd deleted the app you'd met on, that you're the only one he's talking to as well. it's the closest to commitment he can do and you take that promise to your dreams.

since then, he warns you when he'll be away for a 'business conference', unlikely to respond.

(conference sucked, he messages you from his hospital bed. he's fresh off assignment chest wrapped tight in bandages. he'll be out in a few hours. nothing serious. part of him aches to reassure you about something you didn't even know you had to worry about. execs tried to eat me alive out there.)

leon realizes he's fucked when he pays more attention to you, pinned to the top right corner of his laptop, than the cheesy horror-comedy you'd picked out for movie night. one hand itches for the bottle and the other itches for you, imagining what it would feel like with your weight dipping the mattress next to him, how his hand might fit against the arc of your hip - the movie on the big screen, not his laptop, still ignored in favor of watching you.

"are you even paying attention?" your voice crackles over the speaker, competing with the honking of a clown nose. he's lost the plot of the movie, doesn't quite understand where all the clowns came from (outer space, he thinks, but that would be ridiculous). he's too busy replaying your voice in his head, imagining it slower, sleepier, pressed into his shoulder.

"yeah, of course."

"uh-huh," you hum doubtfully.

you encourage him to pay attention to the next scene, pointing as if that will do anything when there's so many miles between you. something about the practical effects. he tries, honest to god, but his eyes keep drifting up to you.

he's not a monster. he waits til the movie is over to spring his stupid idea on you. leon respects the sanctity of film, the intimacy of showing your favorites with another person and the anxious hope that they'll understand the piece of you you're trying to share with them.

but he can't get the idea out of his head, and he'll make it up to you with a thorough analysis of the movie next time you have a movie date because if he doesn't say this now he's going to pussy out.

"listen, i was thinking," he ruminates, taking his time to chew his words. plenty of time to back out. leon's grown good at identifying what sort of anxiety is brewing in his gut - perks of the job - and he knows he'll kick himself if he back out now.

"that's rare."

"hilarious. i'm serious, i've been thinking. i've got some time off built up. if i don't use it by the end of the year, they don't pay it out. company's a bunch of cheap asses."

he's talking in circles and you've already reached the ending. he leans a little closer to the screen, hopes the look in your eye is glee and not fear.

"so..." leon trails off. plenty of room to back out. if you don't grasp this he'll just ask for travel tips and lick his wounds somewhere warm and tropical.

but you don't offer that. you sit up a little straighter. he swears that's a smile that you're fighting to keep down. "so...how soon are you thinking?"

casual. nice.

"as soon as possible." less casual. shit. "i was thinking a week. is that--?"

"that's great. can you let me know the dates?"

"yeah. yeah, of course."

this is going too well. too smoothly.

leon takes a breath, combs his fingers through his hair.

"we are talking about me coming to visit, right?"

you laugh at him. he's never been so happy to be laughed at.

"yeah, leon. you're coming to visit."

"just making sure."

it's impractical. it's unlikely. his therapist is going to have a field day next session. he still hasn't figured out what to do when you find out that 'security' had been a very misleading description of his work, or when you figure out that he's only 5'10'' on a good day. none of it is fair to you, he realizes, but booking his flight is his first step in trying to do right by you.

"i'll pick you up from the airport," you insist.

"i want a sign with my name on it."

"i'll put 'kennedy' on it and wear a suit and sunglasses so people think you're a big deal."

"i kind of am a big deal."

you roll your eyes. "oh, my mistake."

if only you knew that was the truth.

dividers from @/adornedwithlight

#leon kennedy x reader#leon s kennedy x reader#leon kennedy x you#leon kennedy fluff#resident evil fluff#resident evil fanfic#resident evil x reader#hiding my brave yet controversial headcanon in the tags: leon is a virgo#leon kennedy fanfic

824 notes

·

View notes

Text

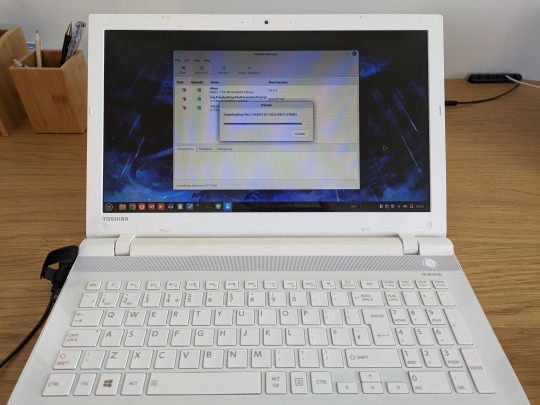

15.03.25

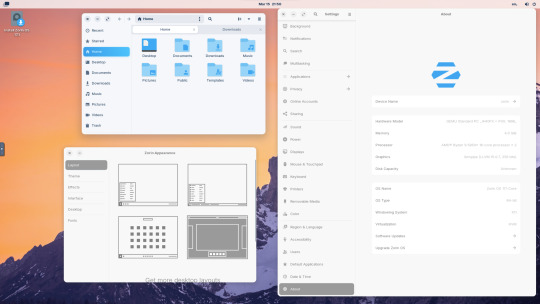

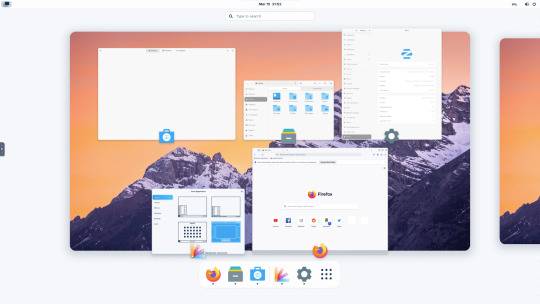

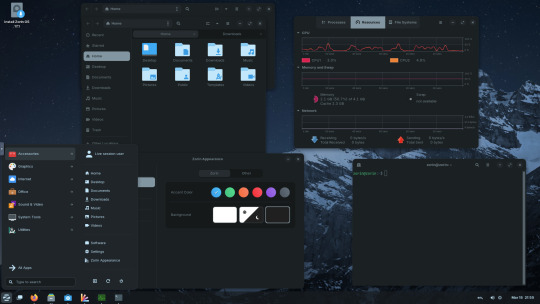

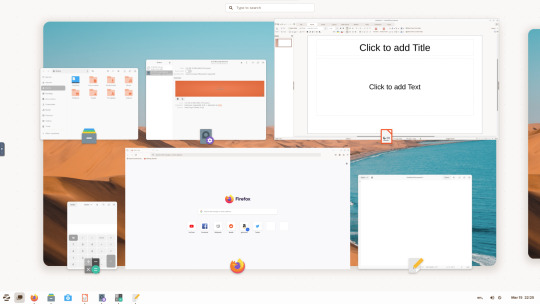

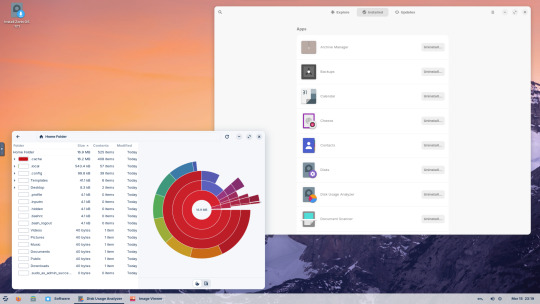

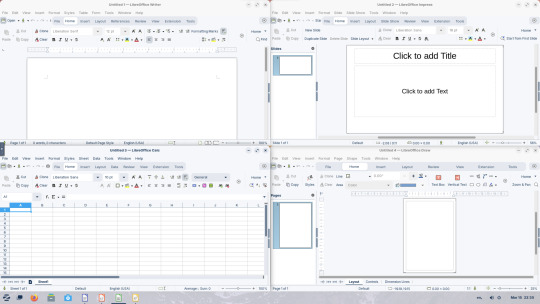

I tried out Zorin OS Linux on Distrosea.

https://distrosea.com/

Zorin OS started its development in 2008 by co-founders Artyom and Kyrill Zorin. The company is based in Dublin, Ireland.

Main site:

https://zorin.com/os/

Wiki link:

https://en.wikipedia.org/wiki/Zorin_OS

Like Linux Mint, it is based on Ubuntu, which in turn is based on Debian and uses the current Ubuntu 24.04.2 LTS base release.

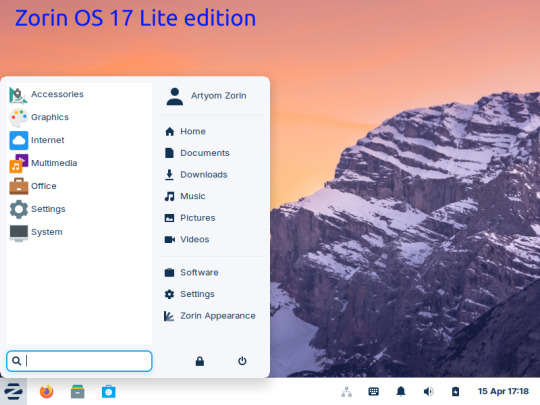

It features the GNOME 3 and XFCE desktop environments and is available in Lite, Education and Core editions.

Due to enhanced performance optimizations in the Core, Pro, and Education editions of Zorin OS, the Lite version is being discontinued.

However the XFCE desktop packages will still be available through the official software repositories:

https://help.zorin.com/docs/getting-started/getting-zorin-os-lite/

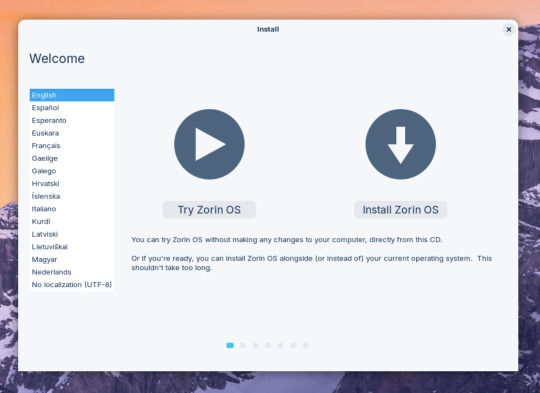

I chose version 17 and selected the 'Core' edition.

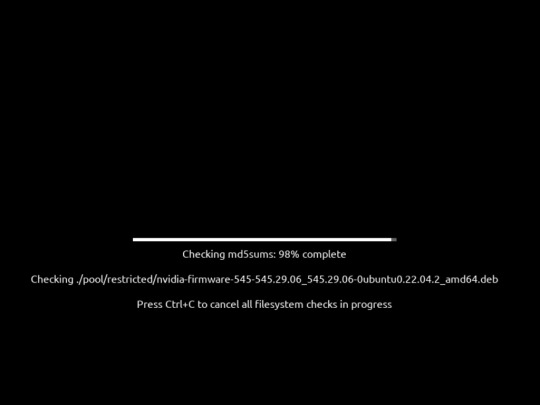

This version (Core64) features the GNOME desktop and a few more apps. I clicked 'Try' when the Linux distro booted up to the install wizard. The distro performs a md5 sum check before boot-up to check the security of the .iso file.

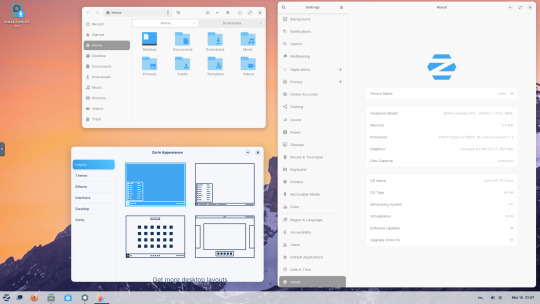

The distro can be easily customised to echo Windows or MAC-OS, as well as being tweaked to the users preferred layout.

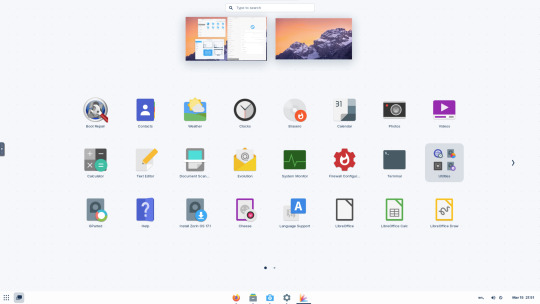

Software can be installed through Zorin's Software Store. applications are available to install in APT, dpkg, Snap and flatpak.

Windows software can be ran using Wine, a compatibly layer for running Windows only programs on Linux, MAC OS and BSD systems.

Zorin OS 17 also comes with various menu layouts from a Windows Classic/7 layout, Windows 11 style layout, GNOME menu and full screen menus. Some of the menu layouts are only available in the paid for Pro edition.

For more about the various layouts and a review see:

https://www.zdnet.com/article/zorin-os-demonstrates-exactly-what-a-desktop-operating-system-should-be/

The panel (referred to as a taskbar) is also highly configurable in size and appearance and can be changed to match the desktop layouts.

Various window management set-ups are featured for tiling windows to the sides of the screen.

I like the operating system as it is both familiar to me as a Windows user, but also is very configurable, features a polished user interface and is easy to navigate. Also Zorin comes with some very striking desktop backgrounds and colours!

However, I couldn't get the VM to connect to the internet, so I couldn't browse Firefox or try out any additional software.

This is just the way that it has been set-up on Distrosea. For test purposes though, it works very well.

It also feels very speedy, even in a virtual machine over the host internet!

4 notes

·

View notes

Note

HARRYS HOME WAS EVERYTHING. CAN U POST UR FAV SMUTTY SERIES??

Omg thank you so much🥰❤️I’d been working on it for months, I really wanted it to be perfect. I feel like it’s exactly the way I want it and I’m really happy that it’s getting love.

My fav smutty series on Tumblr? Hmm…I haven’t read tumblr smut in a hot minute, but I remember being obsessed with @gurugirl’s Mint Chocolate Chip series—absolutely loved it, along with a few other series on her page. I really love a lot of @watchmegetobsessed’s work as well.

But if you’re curious to read smut outside of the fandom, I’d seriously recommend you look through my GoodReads Profile and see the books I’ve read and reviewed on there. So much smut. I read on my Kindle app for hours upon hours. My personal favorite authors have been Jessa Kane, Sierra Simone, Skye Warren, Lena Little, and Carleigh Ray. In my opinion, they have the best smut—all in their own ways.❤️💋 xoxo ~R

#harry styles fanfic#harry styles smut#harry styles fic#harry styles fanfiction#asks are always appreciated#asks open#answered asks#send asks#anon ask#ask me anything#ask#send me asks#ask away!#ask me stuff#ask me questions#send me anons#send anons#send dirty asks#send me dirty asks#send me anything

10 notes

·

View notes

Text

Why do Indians prefer RideBoom more than Ola and Uber?

Indians prefer RideBoom over Ola and Uber for several reasons. Let's explore some of these reasons based on the search results:

Competitive Pricing: RideBoom offers competitive pricing compared to Ola and Uber [1]. This can be appealing to Indian customers who are looking for affordable transportation options.

Better Customer Service: RideBoom is known for providing excellent customer service [1]. This can be a significant factor for Indians who value good customer support and assistance.

Safety and Security: RideBoom prioritizes the safety and security of its passengers [1]. This can be particularly important for Indian customers who are concerned about their well-being during their rides.

Availability in Smaller Cities: RideBoom has a presence in smaller cities, providing transportation options to customers in areas where Ola and Uber may have limited coverage [1]. This can make RideBoom a preferred choice for individuals residing in these locations.

User-Friendly App: RideBoom offers a user-friendly mobile app [1]. This can attract Indian customers who appreciate a seamless and convenient booking experience.

Promotions and Discounts: RideBoom frequently offers promotions and discounts to its customers [1]. This can be enticing for Indians who are looking to save money on their rides.

Support for Local Economy: RideBoom is an Indian company, and supporting it can be seen as contributing to the local economy [1]. This may resonate with Indian customers who prioritize supporting homegrown businesses.

Positive Word-of-Mouth: Positive reviews and recommendations from friends and family can influence Indians to choose RideBoom over Ola and Uber [1]. Personal experiences and word-of-mouth can play a significant role in shaping consumer preferences.

Learn more:

10 Reasons why Uber is better than Ola

Uber vs Ola: The battle for dominance in India’s taxi market | Mint

Ola vs Uber: The latest score in the great Indian taxi-app game

#rideboom#rideboom app#delhi rideboom#ola cabs#biketaxi#uber#rideboom taxi app#ola#uber driver#uber taxi

12 notes

·

View notes

Text

That Sinking Feeling

Did you ever have that sinking feeling that things weren’t going to turn out as planned? The proof of the pudding is under the crust, and retirement 2024 was a bit crusty.

The only goal I nearly achieved was clearing the cattails from my shoreline. After many hours over the summer – I’m estimating somewhere between 60 and 100 – of wading into the muck and pulling the little bastards one-by-one, I managed to clear about 90%. I would need a drone to get a picture with a good perspective (perhaps a 2025 hobby?) but this is the best picture I currently have.

As usual, I digress. Today in the Total Wine and More app I stumbled across Wrexham Lager. The Wrexham brewery in Wales was built by German immigrants in 1882. Fortunately, they were not deported with the rest of the German criminals, rapists and I assume other fine Germans before they began to brew a lager that is described as subtly hopped with a clean aroma - light, refreshing and easy to drink.

Before purchasing said beer I decided to check out the reviews. A couple stood out:

A 5-star review submitted by Wrexham Lager said “Amazing beer. I bought it today and it’s great.” Biased? Perhaps. Four people found this helpful.

Another 5-star review, this time by Jason Wrexham:

Obviously totally unbiased.

Eight people, including me, found this helpful.

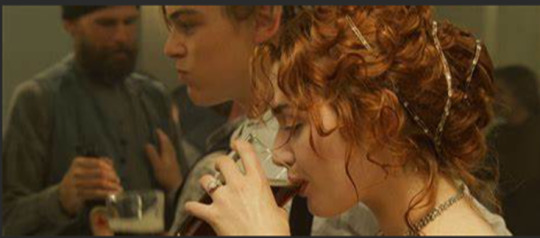

The beer served aboard the Titanic! OMG!!!!!!!!

The can says, “Store in a cool dry place, away from icebergs” Maybe. I might need new bifocals.

I recall that the beer being consumed in the steerage scene in the movie Titanic looked more like a stout than a beer with “a light amber color”. Maybe it was brought aboard by the Irish rogues in steerage, or maybe James Cameron just thought it worked better. Chalk it up to Hollywood magic.

Speaking of Hollywood magic, current co-owners of Wrexham Brewing are Rob McElhenney and Ryan Reynolds. Yes, the same Ryan Reynolds who does the Mint Mobile commercials, and I guess a movie called Deadpool (haven’t seen it).

As with all things JiBBM, this just keeps getting weirder and weirder. These guys bought into the Welsh brewery to help promote the local football team that they purchased, Wrexham AFC. Apparently there is even a docuseries about it on FX called Welcome to Wrexham. I guess I’ll have to check it out.

Okay, I’m back. I just dropped $2.99 on episode 1 of season 1 (on Hulu) and I must say that I was entertained. The town and the football club are down in the dumps. The team has already been demoted to the lowest level league and COVID has emptied the stands, but there is optimism because of the new ownership. I just might watch episode 2 or jump ahead to “free to me” season 3.

The brewery has a similar rocky past. Although the website bills it as the UK’s oldest lager brewery, it omits the phrase “in continuous operation”.

According to their website:

“Wrexham Lager became overshadowed by other brands. Sadly, commercial production at its Wrexham birthplace stopped in 2000 and total production in the UK ceased in 2002.

The brewery was demolished and a retail park was built in its place, the only vestige of Wrexham Lager being the original Brewhouse, now a Grade II listed building. All documents and brewery artefacts were razed to the ground save but a few treasured items from fans and collectors alike.”

Does this mean that the recipe was lost? It doesn’t really matter because it’s a decent beer with a timeless taste. The brewery reboot by Martin Jones and the Roberts family revived the brand in 2011 and subsequent investment by the Hollywood boys is keeping a good thing going.

Will McElhenny and Reynolds do more than just rearrange the deck chairs in their ownership of the football club and the brewery? Previewing season 3 of the series and the fact that I can now buy this beer in Minnesota hint that the answer is probably yes.

Perhaps the team should consider getting a sponsorship from Adidas. Afterall, a logo that resembles a ship’s smokestacks slipping beneath the waves would be fitting for this Titanic team.

#Red Dragon Ventures#Wrexham#Ryan Reynolds#Rob McElhenny#RMS Titanic#Wrexham Lager#Wrexham AFC#Titanic

2 notes

·

View notes

Text

How to Take Control of Your Finances: A Beginner’s Guide

Taking control of your finances is one of the most empowering steps you can take in your journey toward financial freedom. Whether you're just starting out, feeling overwhelmed by your money situation, or simply looking to improve your financial habits, it's never too late to get on track. This step-by-step guide will show you how to budget, save, and manage your finances effectively.

1. Assess Your Current Financial Situation

The first step to taking control of your finances is understanding where you currently stand. Take a good look at your income, expenses, debts, and savings.

Track Your Income: List all sources of income you have, whether from a job, side hustle, or investments. Knowing exactly how much money you have coming in each month is the foundation of any financial plan.

List Your Expenses: Track all your monthly expenses—both fixed (rent, utilities, subscriptions) and variable (groceries, entertainment). Use apps like Mint or YNAB (You Need a Budget) to get an accurate picture of where your money is going.

Review Your Debts: Make a list of any debts you owe, including credit card balances, student loans, and personal loans. Understanding how much debt you have will help you plan your repayments.

By getting clear on your current financial picture, you'll have a solid foundation to make better decisions moving forward.

2. Set Clear Financial Goals

Once you know where you stand, it’s time to set financial goals that will guide your actions. Your goals should be specific, measurable, and realistic.

Short-Term Goals: These might include paying off credit card debt, saving for an emergency fund, or setting aside money for a vacation.

Long-Term Goals: Long-term goals can be things like saving for retirement, purchasing a home, or starting a business.

Write your goals down and break them into smaller, actionable steps. By setting clear goals, you’ll be able to prioritize your finances and stay motivated.

3. Create a Budget

A budget is a powerful tool that will help you manage your money and make intentional choices about how you spend and save. The goal of budgeting is not to restrict yourself, but to align your spending with your values and priorities.

Use the 50/30/20 Rule: This popular budgeting method divides your income into three categories:

50% for needs (housing, utilities, groceries)

30% for wants (entertainment, dining out, hobbies)

20% for savings and debt repayment

Track Your Spending: Use budgeting apps or spreadsheets to track your spending and ensure you’re sticking to your budget each month. Adjust categories as needed to make sure you’re meeting your goals.

Sticking to a budget will help you control unnecessary spending and direct more money toward your financial goals.

4. Start Saving for the Future

Saving is key to achieving financial independence, but it can be tough to start. Here’s how to make saving a priority:

Build an Emergency Fund: Aim to save at least 3 to 6 months’ worth of living expenses. This will give you peace of mind and protect you in case of unexpected events like job loss or medical emergencies.

Automate Your Savings: Set up automatic transfers to a savings account, so you’re consistently putting money away. Even small amounts add up over time, and automating the process makes saving easy and effortless.

Set Up Retirement Accounts: Start contributing to retirement accounts, like a 401(k) or IRA, as soon as possible. The earlier you begin saving for retirement, the more time your money has to grow through compound interest.

Remember, it’s not about how much you save at first—it’s about building the habit of saving regularly.

5. Pay Off Debt

If you have debt, it’s important to have a plan to pay it off. Paying off high-interest debt, like credit cards, should be a priority.

Start with High-Interest Debt: Focus on paying off high-interest debt first (such as credit cards) to save money on interest over time.

Consider the Snowball Method: Another strategy is the debt snowball method, where you pay off your smallest debts first to build momentum. Once a debt is paid off, move on to the next smallest.

Negotiate Your Debt: If you’re struggling to make payments, reach out to creditors and see if they’ll offer lower interest rates or a more manageable payment plan.

Reducing your debt load will increase your financial freedom and allow you to focus on building wealth.

6. Track Your Progress

To stay motivated and on track, regularly review your finances. Track your spending, savings, and progress toward your goals each month. Adjust your budget and goals as needed to stay aligned with your changing financial situation.

Set Monthly Check-ins: Each month, review your budget, check your bank accounts, and assess your progress toward your savings and debt goals.

Celebrate Milestones: Celebrate when you pay off a debt, hit a savings target, or reach a major financial goal. These wins keep you motivated to continue on your path.

7. Seek Professional Advice if Needed

If you feel uncertain about budgeting, saving, or investing, consider seeking advice from a financial advisor. A professional can help you create a personalized financial plan, guide you on investments, and help you optimize your tax strategy.

Final Thoughts

Taking control of your finances is a process that requires discipline, patience, and consistency. By assessing your situation, setting clear goals, budgeting effectively, saving regularly, and paying off debt, you’ll be well on your way to financial freedom. Remember, it’s not about perfection—it’s about progress. Every step you take brings you closer to a future where you’re in charge of your money and your life.

Start today, and take control of your financial destiny!

2 notes

·

View notes

Text

Just looked at my February monthly in review in budgeting app (monarch, rip mint) and my net worth went down over 12% 😭😭😭 damn foundation and house falling apart 😭😭

#I knew it was a big hit#but did not like seeing the number#I don’t have my house or retirement accounts in monarch so it’s not quite that bad#but I have everything else so it’s still pretty bad!#love having a house#so fun#sigh#I want to fix and re do the landscaping#but no more money for it so will have to wait

7 notes

·

View notes

Text

Top 5 Things to Consider for NFT Marketplace App Development

As an NFT Marketplace development company, we know that turning a great idea into a live platform takes more than code; it requires clear goals, smart choices, and the right expertise. Let’s dive into the five areas you absolutely can’t overlook.

What Is an NFT Marketplace?

An NFT marketplace is a digital venue where creators issue, showcase, and trade distinct blockchain‑backed assets—think art, music tracks, or in‑game collectibles. It’s the bridge connecting artists with collectors, giving every sale a transparent record of ownership.

How Does This Marketplace Work?

Wallet Connection: Visitors link their crypto wallets (MetaMask, WalletConnect) to your site.

Explore & Engage: They browse items listed at a set price, bid in auctions, or submit offers.

Smart Contract Activation: When a sale happens, a smart contract handles the transfer and records it on‑chain.

Settlement: Funds move to the seller’s account, and the NFT arrives in the buyer’s wallet immediately.

Behind the scenes, you’ll handle gas‑fee forecasts, transaction staging, and solid contract safeguards so every step feels smooth and trustworthy.

Types of NFT Marketplaces

Open Platforms: Anyone can mint or trade, ideal for maximum reach.

Curated Galleries: Invite‑only or application‑based, perfect for premium art.

Niche Hubs: Focus on specific genres like gaming assets or music rights.

White‑Label Solutions: A customizable, off‑the‑shelf framework lets you launch faster without building every feature from scratch.

Your choice here shapes who comes on board, how you price transactions, and the story you’ll tell in your marketing.

Must‑have Features in the NFT Marketplace

A great marketplace rests on a few non‑negotiable pillars. Nail these, and you’ll offer a user experience that feels polished and professional:

Wallet Integration & User Authentication Integrate multiple crypto wallets plus social logins for the simplest entry point.

Minting & Listing Dashboard Guide creators through uploading their files, setting a price or auction details, and defining royalties.

Search, Filters & Categories Let visitors refine their search by selecting specific collections, price ranges, blockchain networks, or creators.

Payment Gateway & Gas Management Offer options like layer‑2 networks or automated fee estimators to keep transaction costs predictable.

Ratings & Reviews Encourage feedback so buyers feel confident and creators build a reputation.

Secondary Sales Tracking Automate royalty payments every time an NFT changes hands, rewarding artists for ongoing success.

Key Considerations When Developing the Marketplace

Creating a strong NFT marketplace requires careful planning and attention to everything, from performance to overall costs. Address these areas head‑on to avoid headaches later:

Scalability: Use cloud services and modular code so you can handle traffic surges and an expanding catalog without hiccups.

Security & Audits: Frequent smart contract checks, SSL encryption, and protected key storage are essential for safeguarding the platform.

User Experience: Prioritize fast load times, intuitive navigation, and mobile‑friendly design to keep people coming back.

Blockchain Selection: While Ethereum is secure, its gas fees can bite. Explore alternatives like Polygon or Solana for lower costs and faster transactions.

Budget & Support: Factor in ongoing maintenance, server costs, and future upgrades. Many businesses opt for an nft marketplace development service that bundles launch, monitoring, and updates.

The Benefits of NFT Marketplace App Development

Building your own marketplace opens new income channels through listing fees, transaction commissions, and premium features. You’ll cultivate a loyal community around your brand and gain insights into buying habits and trending categories. Plus, owning the platform roadmap means you can quickly adapt to new token standards or cross‑chain opportunities, keeping your marketplace future‑ready.

Hiring a Developer for NFT Marketplace App Development

When you’re ready to hand your vision off to pros, look for teams well‑versed in Solidity, Web3.js/Ethers.js, and front‑end stacks like React or Vue. At Justtry Technologies, we deliver both bespoke platforms and white label NFT marketplace development, tailored to your brand and timeline. Be sure to ask:

For examples of past smart‑contract audits

About their deployment and rollback strategy

How they handle post‑launch updates and support

Selecting the right team transforms a challenging project into a simple and successful experience.

Conclusion

Focus on these five pillars—defining your platform, mapping the user flow, choosing the right marketplace model, integrating must‑have features, and securing expert development support—and you’ll be set for a standout launch. Whether you select a full‑service nft marketplace development service or a custom build, careful preparation and the right partner are your keys to success. As a dedicated NFT Marketplace development company, we’re excited to bring your vision to life.

#nft marketplace development company#nft marketplace development service#white label nft marketplace development

0 notes

Text

Your First Taste of Guatemalan Food: What to Expect

When you think of vibrant flavors, heartwarming meals, and festive atmospheres, Guatemalan cuisine checks all the boxes. Whether you’re walking into a local eatery for the first time or seeking the best "Guatemalan food near me," your first taste of Guatemalan food is bound to leave a lasting impression.

Exploring the Essentials of Guatemalan Cuisine

The Cultural Roots of Guatemalan Food

Guatemalan food is a flavorful mosaic of Mayan heritage, Spanish influences, and local traditions. These culinary elements have come together to create a cuisine that is both distinctive and deeply rooted in the country's history. From the highlands to the coastlines, each bite reflects a celebration of culture and community.

Key Ingredients That Define the Flavor

The heart of Guatemalan cuisine lies in its staple ingredients: corn, beans, rice, and chilies. Corn, in particular, is revered—not just in tortillas but in the famed Guatemalan food tamales, which are wrapped in banana leaves and filled with savory or sweet goodness. Fresh herbs like cilantro and mint, spices such as annatto, and hearty vegetables like potatoes and squash also play starring roles.

Understanding Regional Variations in Guatemalan Cuisine

While you’ll find core ingredients across the board, regional specialties are where the cuisine shines. Coastal areas may offer seafood-rich dishes, while the highlands specialize in earthy stews and thicker sauces. Each region contributes to the rich tapestry that defines Guatemalan food, ensuring that every experience is unique and worth savoring.

Signature Dishes You Can’t Miss

Guatemalan Food Tamales: A Staple of Celebration

Unlike Mexican tamales, Guatemalan food tamales are typically larger and made with a softer masa. Wrapped in plantain or banana leaves instead of corn husks, these tamales are often filled with pork, chicken, or even sweet fillings like raisins and chocolate. They are a beloved dish during holidays, birthdays, and religious festivals.

Pepian and Kak’ik: Traditional Rich Stews

Pepian, a hearty stew made with roasted seeds, vegetables, and chicken or beef, is one of Guatemala’s national dishes. Its smoky and earthy flavors are unforgettable. Kak’ik, a bright red turkey stew infused with native spices like achiote, is another must-try, especially for those craving something both rich and exotic.

Street Food Delights and Snacks to Try

When exploring Guatemalan food, don’t overlook street offerings. From rellenitos (mashed plantains stuffed with sweet black beans) to garnachas (mini corn tortillas with meat and veggies), the streets offer quick bites full of flavor. These treats are perfect for anyone seeking authentic flavors on the go.

Where to Find Guatemalan Food Near You

Spotting an Authentic Guatemalan Restaurant

Finding a true Guatemalan restaurant near you may require a bit of research, but the effort is well worth it. Look for places that serve traditional dishes like tamales, pepian, and pupusas, and that embrace Guatemalan décor and culture.

Online reviews and local Latin communities can be great resources for identifying these hidden gems.

What to Expect on the Menu

Once inside, prepare to be wowed by a diverse and colorful menu. In addition to tamales and stews, you’ll likely find items like churrasco (grilled meats), enchiladas (Guatemalan-style tostadas), and caldos (brothy soups). Desserts like mole de plátano and arroz con leche often round out the meal, offering a sweet finish.

Finding “Guatemalan Food Near You” with Confidence

Searching for “Guatemalan restaurant near me” or “Guatemala restaurant near me” on platforms like Google Maps, Yelp, or even food apps can yield excellent results. Be sure to read customer reviews and check for menu photos. Many of these restaurants are small, family-owned establishments, adding to the authenticity of your experience.

The Dining Experience: More Than Just the Food

Atmosphere and Hospitality in Guatemalan Restaurants

A key part of enjoying Guatemalan cuisine is immersing yourself in the warm, inviting ambiance of the restaurant. Expect colorful decorations, friendly smiles, and a feeling of being welcomed into someone’s home. Guatemalan hospitality is genuine, making your dining experience even more enjoyable.

Enjoying Beverages with Your Meal

Traditional beverages are an essential part of Guatemalan dining. Try atol de elote, a sweet corn-based drink, or fresco de rosa de jamaica, a hibiscus tea served chilled. For those looking for something stronger, local beers or a glass of Zacapa rum might be on offer. Beverages not only complement the food but add another layer to the cultural experience.

Live Latin Music and Cultural Vibes

Many Guatemalan restaurants, especially those in urban centers, enhance the atmosphere with live Latin music. From marimba performances to salsa nights, these venues offer more than just food—they provide a festive environment where culture and cuisine come alive. It's an excellent opportunity to connect with Guatemalan heritage in a vibrant and engaging way.

FAQs

What makes Guatemalan food different from Mexican food?

While both cuisines use corn, beans, and chilies, Guatemalan food leans more toward earthy, stew-based dishes and often uses banana leaves for cooking. It also incorporates more native herbs and spices.

Are Guatemalan tamales spicy?

Not typically. Guatemalan tamales are rich in flavor but not overly spicy. Spice can be added with optional sauces or sides if desired.

Can I find vegetarian options in Guatemalan cuisine?

Yes, vegetarian options are available, including bean-based dishes, vegetable stews, and fresh salads. Be sure to ask your server for recommendations.

How do I locate a good Guatemalan restaurant near me?

Use search terms like “Guatemalan food near me” or “Guatemalan restaurant near me” on review platforms. Check ratings, photos, and menu options to ensure authenticity.

What are typical beverages served with Guatemalan food?

Popular beverages include atol de elote, horchata, hibiscus tea, and Guatemalan coffee. Alcoholic options like beer and rum are also available in some restaurants.

Conclusion

Your first taste of Guatemalan food is more than just a meal—it’s a journey through a rich cultural heritage full of vibrant flavors and welcoming traditions. From the savory tamales and hearty stews to the lively atmosphere filled with music and color, every detail is thoughtfully woven into the dining experience. With so many great resources available today, finding an authentic “Guatemalan restaurant near me” is easier than ever. So go ahead—explore, savor, and enjoy the rich tapestry of Guatemalan cuisine.

#food & beverages#restaurant#countries#california#usa#north hills#guatemalan_food_tamales#guatemalan_cuisine#guatemalan_food_near_me#guatemalan_food

0 notes

Text

Building a Pump.fun Clone App: Your Step-by-Step Development Guide

Introduction

Pump.fun has quickly become a viral sensation in the web 3 space, allowing users to launch meme coins with only a few clicks and immediately thank for the underlying liquidity mechanisms. Its success lies in its simplicity, speed and entertainment value of rapid token construction. A clone app repeats the main features of an existing platform, making developers and entrepreneurs a chance to learn, adapt and even innovate at the top of a proven concept. Construction of a pump. Fun Clone not only helps you understand blockchain mechanics such as token mining and liquidity pool, but also opens the doors to launch your own crypto experiments. This guide is ideal for developers, crypto enthusiasts, and hobbies who want to detect solana development, want to create a web 3 application, or simply tap in the growing meme coin culture.

What is Pump.fun?

Pump.fun is a decentralized application built on the Solana blockchain that allows users to make and trade meme coins immediately, in which no coding experience is necessary. At its core, the platform automatically organizes the entire life cycle and streamlines tokens - from a new token, to inject it with liquidity and list it for public trade. Users can launch a meme coin in seconds, name it, and can see it live with a real -time price chart and trading interfaces. Major features include one-click token manufacturing, auto-liquidity provision, a simple trading UI and viral social sharing tools that help tokens to spread rapidly in platforms such as Twitter and Telegram. On the technical side, pump.fun took advantage of Smart contracts to manage token logic and liquidity to Solana's high-speed, low-blockchain, smart contracts, and to provide a spontaneous user experience using a modern front, react, typescript, and website. The result is a platform that feels like a game, but the real decentralized is operated on the infrastructure.

Planning the App Architecture

To make a successful pump. Careful planning of clone, app architectures is important. On the front, the pump is to be repeated. Users must be able to create a token, look at its live chart and trade it - everything in spontaneous clicks. For the backend, instead of traditional server logic, you will rely on a smart contract engine posted on Solana. This contract will handle core logic such as token minting, auto-bookidity provisioning and market interactions. Blockchain integration is required: you will need to connect with Phantoms such as Solna wallets, allow for SPPL token to build, and interact with token metadata and liquidity pool. Finally, security should not be ignored. The input verification on the frontend (eg, token name restriction) should complement the smart contract-level check. Basic auditing practice-like code reviews, limiting the permission of the authority, and the age case test-will help ensure that your clone is safe, stable and user friendly.

Building the Smart Contract

The heart of a pump.fun clone Built on Solana blockchain, the contract should follow the spl -token standard, equal to the ERC -20 of Solan, ensures complete compatibility with the wallet and DEFI tools. To simplify growth and reduce boilerplates, many developers use anchor framework, a rust-based toolset that provides macros, error handling and account verification to style smart contract creations. Your contract will require to create a new token, it must assign a supply, produce a liquidity pool (often pairing it with the sole), and storing a token name, symbol and image like metadata. Integration with the Solan token program and token metadata program is important for appropriate on-chain management and visibility. Handling these interactions properly ensures that the tokens made through your app appear correctly in the wallet and can be traded in the solana-based platforms.

Setting Up the Frontend

The front of your pump. To achieve this, you can use modern UI libraries such as usefulness to accessible, polished components and tailwind CSS for Shadc/UI. Start by creating the required UI elements, including a token manufacturing form, where users input a name, symbol and alternative image for their new meme coins. Next, apply a live token feed to show new launched tokens and their activity in real time - this can be operated by the website for immediate updates or polling solana index on time. Integrate wallet connection tools such as phantom or solfleer, users to certify, sign transactions and interact directly with your browsers with smart contracts. Finally, ensure that your app clearly handles the transaction, loading indicators, success messages, and token makes the error handling to guide users through each stage of construction and trading process.

Real-Time Data and Analytics

To make an attractive pump.fun clone It is important to display clone, real -time trading data. This includes token prices, trading volumes and live updates on recent transactions, informing users and encouraging active participation. You can obtain it by integrating it with APIs provided by popular Solana Explorers such as Solcan or Solana Beach, which provides graph close or restful endpoints to query blockchain data. For more serial requirements or fast access, running your own Solana Indexer is an option - these tools listen directly to blockchain phenomena and provide customized data streams. Adding these data sources with a websocket connection or efficient voting ensures that your app creates a dynamic and reliable experience for users interacting with new tokens and markets, which distributes up-to-second insights.

Testing and Deployment

Completely testing and smooth priests are important for launching a reliable pump. For smart contracts, use anchor test framework that provides a powerful war-based environment to simulate blockchain interactions and write units and integration tests to verify your token mint and liquidity logic. On the front, equipment such as playwrights or gestures help automated UI and functionality tests, form, wallet integration, and real -time updates ensure that the browsers work defectively in the browsers. When it comes to deployment, start by releasing your smart contracts on Solana Dawnet to safely test in a real blockchain environment before going to the mainnet. For the frontend, popular hosting services such as Vercel, Netlify, or Cloudflare page offer their web apps with sharp, scalable and easy-to-easy-to-easy-to-easy-to-easy-to-easy-to-easier platforms. The combination of rigorous tests with a strong signing pipeline guarantees a spontaneous user experience from the first day.

Monetization and Launch Strategy

Monetizing your pump. Fun Clone can take several forms, with the most direct platform fees - a small percentage charged on each token manufacture or business, which generates stable revenue as your user base grows. Additionally, you can offer premium features such as advanced analytics, exclusive token launch tools, or priority list spots for power users and communities wishing for priority services. When it comes to launching your app, effective marketing is important: taking advantage of viral content, impressive partnership and meme campaigns on social platforms such as Twitter can promote rapid visibility. The construction of an engaged community on channels such as discord, telegram and Twitter not only supports user retention, but also encourages organic development through user-generated propagation and response. The combination of these strategies helps you create a permanent, rich platform beyond cloning the main functionality.

Construction

A pump. Fun clones are a great way to dive into the development and catch tokens, liquidity pools and the main mechanics of decentralized business. While cloning helps you to launch a proven concept quickly, the actual capacity lies in innovating beyond the clone - adding unique features, improving the purpose, or starting the new tokenomics that distinguish your app in the web 3 space that develops rapidly. Remember, a successful project combines solid technology with a vibrant community and effective marketing strategies. If you find this guide helpful, do not hesitate to share it, star any open-source repository you use, and join the developer communities to cooperate and learn with others. The future of decentralized finance is created by creators like you - so start, use boldly, and help shape the next wave of blockchain innovation!

0 notes

Text

DIY Budgeting vs. Working With a Financial Advisor

When it comes to managing money, there’s no one-size-fits-all solution. Some people swear by spreadsheets and budgeting apps, while others prefer sitting down with a professional who knows the ins and outs of personal finance. If you’re weighing the benefits of DIY budgeting versus working with a financial advisor, the right choice depends on your goals, financial knowledge, and how much time and effort you want to invest.

Let’s break down both approaches so you can make a confident decision about what works best for you and your financial future.

Is DIY Budgeting or a Financial Advisor Right for You?

The short answer is, it depends on your situation. DIY budgeting is often ideal for people who have a relatively simple financial picture and the motivation to stick to a plan on their own. It gives you full control, saves you money in advisory fees, and works well if your main focus is on tracking spending, saving for short-term goals, or getting out of debt.

On the other hand, a financial advisor can be worth every penny if your finances are more complex or you need guidance beyond basic budgeting. Advisors can help with long-term planning, investing, retirement savings, taxes, and even estate planning. They’re particularly helpful if you’re making big life changes, like buying a home, starting a family, or preparing for retirement.

So, how do you know which one is right for you? Start by looking at your needs. If you're mostly trying to get a handle on monthly expenses and set up a budget that works, you can likely do that on your own with free tools. But if you're dealing with multiple income streams, investments, tax concerns, or future planning, a professional might offer the clarity and structure you need.

What’s Involved in DIY Budgeting?

Doing your own budgeting is more than just tracking expenses. It’s about building awareness, creating a plan, and adjusting your habits as needed. People who budget on their own typically use a combination of tools, maybe a spreadsheet, a mobile app like YNAB or Mint, or just good old pen and paper.

The process usually starts with listing all your income sources and tracking your fixed and variable expenses. From there, you create categories for your spending and set limits based on what you can realistically afford. Over time, you check in regularly to see if you’re sticking to your plan, tweak where needed, and celebrate small wins like paying off a credit card or reaching a savings goal.

DIY budgeting works especially well when your finances aren’t too complicated. If you’re single or a couple without kids, have one or two income sources, and aren’t juggling multiple debts or investment accounts, you’ll probably find it manageable to budget without outside help.

But it does require discipline. You need to be consistent about tracking your spending, reviewing your progress, and adjusting your budget as life changes. And while there are a lot of great resources out there, it can be overwhelming to figure it all out alone, especially if money stresses you out to begin with.

How Does Working With a Financial Advisor Compare?

Financial advisors offer more than just budgeting advice. They’re trained to take a full-picture view of your finances and help you set both short-term and long-term goals. That includes things like investing wisely, saving for retirement, minimizing taxes, planning for college, or making sure you have the right insurance coverage.

When you meet with an advisor, they typically start with a comprehensive assessment. They'll look at your income, expenses, debts, assets, and goals, then build a plan tailored to your situation. Some advisors work on a one-time consultation basis, while others offer ongoing support and review your finances annually or even quarterly.

One of the biggest advantages of working with an advisor is the peace of mind. Instead of second-guessing every financial decision or wondering if you're doing the right thing, you’ve got an expert guiding you through it. That can be especially comforting when markets fluctuate, laws change, or you go through major life events.

Advisors can also save you from making costly mistakes. Whether it’s avoiding tax penalties, helping you invest smarter, or recommending financial tools you didn’t know existed, their advice can more than pay for itself over time. That said, not all advisors are created equal. It’s important to find someone who is transparent about their fees, has experience in areas relevant to you, and acts as a fiduciary, meaning they’re legally required to act in your best interest.

What About the Cost?

One of the main reasons people stick with DIY budgeting is cost. Most budgeting apps are free or low-cost, and even if you go the spreadsheet route, the only investment is your time. If your financial needs are basic, paying hundreds or thousands for financial advice might not seem worth it.

Financial advisors usually charge in one of three ways, flat fees, hourly rates, or a percentage of assets under management (commonly 1% annually). Some may offer packages that include a financial plan and a few follow-ups. Others work on commission and make money from selling you insurance or investment products, which can lead to conflicts of interest if not managed carefully.

If you're not ready to hire a full-time advisor, you can still pay for a one-time session. Many people find it helpful to do this after a big life change, like marriage, a new baby, or receiving an inheritance, just to make sure they’re headed in the right direction. It's a good middle ground if you're mainly self-managing but want a professional opinion once in a while.

Which One Helps You Stay on Track?

Accountability plays a big role in whether a budgeting method works long-term. With DIY budgeting, it’s easy to set ambitious goals, and just as easy to forget about them a few weeks later. Unless you’re naturally motivated or really into financial planning, your budget might fall apart the first time something unexpected comes up.

That’s where a financial advisor can offer real value. Having someone check in with you, review your progress, and keep you focused can make a big difference. It’s not just about giving you advice, it’s about helping you follow through. Think of them as a coach for your financial life.

But that doesn’t mean DIYers can’t stay accountable. Many people create systems to track their progress, whether it’s through weekly check-ins, financial journaling, or syncing their budget with a partner. Some even join online communities or accountability groups to share goals and get motivation from others.

Ultimately, the key to staying on track is having a system that fits your personality. If you thrive with structure and support, an advisor might be best. If you’re more independent and detail-oriented, DIY might suit you just fine.

Conclusion

DIY budgeting and working with a financial advisor each have their place, and they don’t have to be mutually exclusive. You might start with a DIY approach to build confidence and then bring in an advisor when you’re ready for the next level. Or you might do most of the work yourself and check in with a professional once a year to make sure everything still makes sense.

The important thing is to find an approach that helps you move forward. Whether you’re tracking every dollar with an app or mapping out a five-year plan with an advisor, the goal is the same, to take control of your money and build a life that aligns with your values.

#DIYBudgetingvsWorkingWithaFinancialAdvisor#WhenShouldYouHireaFinancialAdvisortoHelpWithDebt?#AreDebtSettlementCompaniesaScam?WhatYouShouldKnow#DebtSettlementvsDebtConsolidation:What’sBestforYou?#CreditCounselingBeforeBankruptcy:ScamorSmartStep?#HowtoHandleDebtCollectorsWithoutLosingYourRights#SignsYouMayNeedtoFileforBankruptcy#HowBankruptcyAffectsYourCredit:MythsvsReality

1 note

·

View note

Text

How Do I Change My Flight on JetBlue?

When travel plans shift unexpectedly, knowing how to manage your JetBlue flight becomes essential. Whether due to emergencies, work obligations, or personal reasons, flight changes are a common part of modern travel. JetBlue, one of the leading low-cost airlines in the United States, offers flexible options to help passengers modify their bookings.

Understanding how to change your flight on JetBlue can save you time, money, and stress. This guide explores the key steps, options, tradeoffs, and common challenges involved in managing your JetBlue flight.

Step-by-Step: How to Change Your Flight on JetBlue

Changing your flight with JetBlue is straightforward, especially if you follow the steps below:

1. Visit the Official JetBlue Website

Start by going to the JetBlue homepage. Click on "Manage Trips", which is located at the top of the homepage. This is the gateway to manage your JetBlue flight.

2. Enter Your Booking Information

You’ll need your confirmation code and last name. Once entered, you’ll see your flight itinerary.

3. Choose the Flight to Change

Click on the specific flight you want to adjust. You’ll be presented with options such as changing the date, time, or destination.

4. Review and Confirm Fees or Fare Differences

JetBlue may charge a fare difference if the new flight is more expensive. However, change fees have been eliminated for most fares, including Blue, Blue Extra, and Mint fares (except Blue Basic).

5. Finalize Your Flight Change

After selecting your new flight, confirm the changes. You will receive an updated confirmation email.

JetBlue Fare Types and Change Policies

Understanding JetBlue’s fare structure is critical when trying to manage your JetBlue flight.

Blue Basic

Lowest fare, but most restricted.

Flight changes are not permitted (except for same-day changes for a fee).

Not ideal if your plans might change.

Blue, Blue Plus, Blue Extra, and Mint

Offer more flexibility.

Free changes with fare differences applicable.

Mint provides added luxury with similar flexibility.

Same-Day Flight Changes

For certain fares, you can make same-day confirmed changes for a fee (usually around $75), waived for Mosaic members.

Tradeoffs Involved in Changing a JetBlue Flight

There are always tradeoffs to consider when changing a flight:

Flexibility vs. Cost: More flexible fares cost more but provide peace of mind if plans change.

Timing vs. Availability: Changing closer to your departure may limit flight availability.

Convenience vs. Policy Restrictions: Blue Basic fares are cheaper but offer minimal change options.

Balancing these tradeoffs depends on your travel priorities and budget.

Challenges of Managing a JetBlue Flight Change

While JetBlue has simplified the process, some challenges remain:

Limited Change Options for Blue Basic

Many travelers book Blue Basic to save money but overlook its rigid rules. This becomes problematic when plans change.

Fare Differences

Even though change fees are waived, a more expensive new flight can significantly increase your total cost.

Website or App Errors

Although rare, technical glitches can occur when managing your JetBlue flight online. In such cases, calling JetBlue’s customer support is recommended.

Tips to Smooth the Process of Changing Your JetBlue Flight

Book Flexible Fares: If there’s any chance your plans might change, avoid Blue Basic.

Use the JetBlue App: The mobile app offers an easy way to manage your JetBlue flight.

Monitor Flight Prices: Before making changes, compare other available flights to reduce fare difference costs.

Sign Up for Travel Insurance: This can cover unexpected cancellations or changes not covered by JetBlue policies.

JetBlue’s Customer Support: When to Call

If you encounter issues online or need special accommodations, JetBlue’s customer service can help. You can call (888) 919-5016 or use the live chat on their website.

Considering the Broader Impact of Flight Changes

When managing your JetBlue flight, it’s important to consider the ripple effects:

Accommodation Adjustments: Changing a flight might require hotel cancellations or rescheduling.

Ground Transportation: Rebooking airport shuttles or rental cars can add complexity.

Group Travel Impact: Changing your flight might affect your companions' itineraries.

Thinking ahead helps reduce unexpected costs and complications.

Conclusion: Managing Your JetBlue Flight Doesn’t Have to Be Stressful

Knowing how to change your JetBlue flight allows for more flexible and confident travel planning. By understanding fare rules, the change process, and potential tradeoffs, you can make informed decisions that align with your needs.

Whether you're flying for business or leisure, the ability to manage your JetBlue flight efficiently ensures a smoother experience. Plan ahead, know your fare type, and don’t hesitate to seek help if needed.

1 note

·

View note

Text

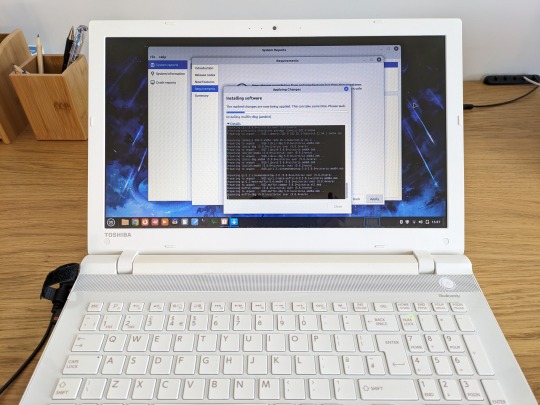

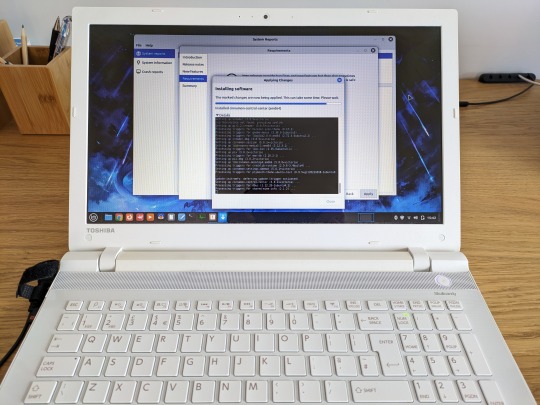

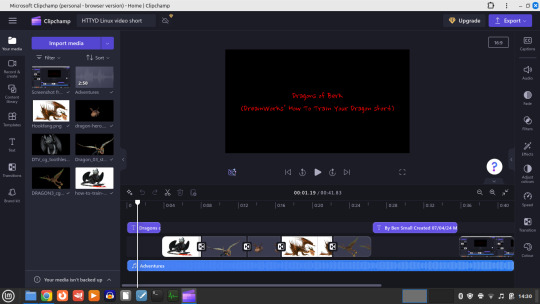

07.04.24

I turned on and upgraded my Linux Mint Cinnamon laptop to 21.3, the latest release version for Mint. Last year I upgraded this Toshiba laptop from Windows 10 to Linux Mint 21.1.

The updates and upgrade went smoothly and I also uninstalled the video editors 'Shotcut' and 'Pitivi' from the system.

I chose to use Microsoft's Clipchamp video editor web app instead.

See link from previous install or search Tumblr:

https://www.tumblr.com/bjsmall/721772986670219264/070623-linux-laptop-install-6-after-trying?source=share

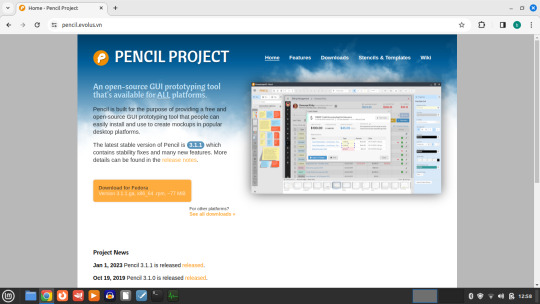

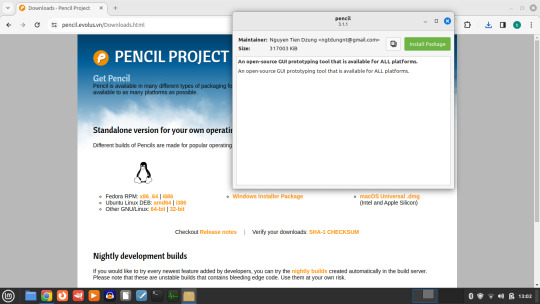

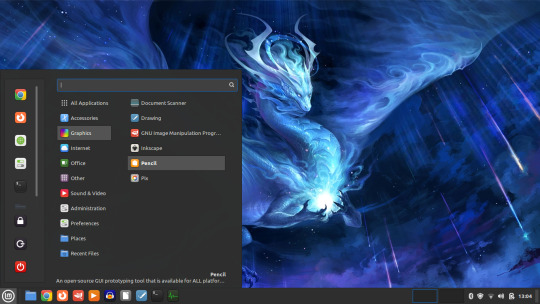

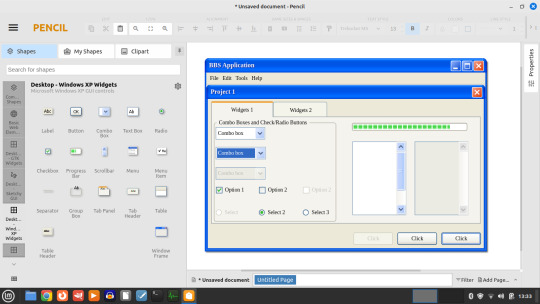

On the 7th of April 2024, I installed Evolus Pencil Project, a muti-platform open source user interface prototyping tool.

Original 2020 blog review:

https://www.tumblr.com/bjsmall/663247392149323776/back-in-2020-i-installed-evolus-pencil-project?source=share

Watch a sample video featuring the main dragon characters from How To Train Your Dragon below!

3 notes

·

View notes

Text

Smart Budgeting Tips for Millennials

In today’s fast-paced world, budgeting is more than just tracking expenses—it’s a vital skill that helps young adults secure financial independence and peace of mind. For millennials navigating student loans, rising living costs, and economic uncertainty, smart budgeting is essential. With the right tools and mindset, it’s possible to take control of your money and build a path toward long-term financial health.

A strong budget begins with awareness. Knowing where your money is going each month is the first step in gaining control over your finances. Start by reviewing your bank statements, credit card bills, and any recurring payments. Categorize your spending into needs, wants, and savings or debt repayment. Needs typically include rent, groceries, utilities, and transportation. Wants are things like entertainment, dining out, and subscriptions. Once you see the big picture, it becomes easier to identify areas for improvement.

Millennials are digital natives, and luckily, there are plenty of apps designed to make budgeting easier. Tools like Mint, YNAB (You Need A Budget), and EveryDollar can link directly to your bank accounts, categorize spending, and provide visual dashboards. These apps allow users to set limits for different spending categories and send alerts when limits are near or exceeded. Leveraging technology reduces the stress of manual tracking and helps build better financial habits.

Another key to smart budgeting is the “50/30/20 rule,” a simple guideline for distributing your income. Allocate 50% to necessities, 30% to discretionary spending, and 20% to savings or debt repayment. This flexible rule works well for most income levels and encourages a healthy balance between enjoying life now and planning for the future. If you’re paying off student loans or building an emergency fund, you may consider adjusting the ratios temporarily.

Cutting costs doesn’t have to feel restrictive. It’s about being intentional with your money. Simple swaps—like cooking at home more often, canceling unused subscriptions, or choosing generic brands—can free up significant cash. Use cashback apps or loyalty programs to earn rewards on everyday purchases. Set spending limits before you shop and avoid impulse purchases by following a 24-hour rule: if you want something that’s not essential, wait a day before buying it.

Automating your finances is a smart move that makes saving feel effortless. Set up automatic transfers from checking to savings accounts on payday. If your employer offers direct deposit, split your paycheck between different accounts. Consider using separate accounts for bills, spending, and savings to avoid mixing funds. This method reduces the temptation to dip into money that should be reserved for essentials or future goals.

An emergency fund is a cornerstone of any budget. Life is unpredictable, and having three to six months’ worth of expenses saved up can make a world of difference during tough times like job loss or medical emergencies. Start small if necessary—even $500 in savings is better than nothing. Prioritize this fund over extra discretionary spending until it’s fully funded.

Debt can be a major burden, especially for millennials juggling student loans, credit cards, and car payments. A good budget prioritizes debt repayment alongside saving. The snowball method focuses on paying off the smallest debts first for quick wins, while the avalanche method targets the highest interest rates for long-term savings. Choose the method that keeps you motivated and on track.

Long-term goals should also be part of your budget. Whether you’re saving for a vacation, a home, or early retirement, assign those goals a dollar amount and deadline. Break the amount down into monthly contributions and treat them like recurring bills. Keeping your goals in sight gives purpose to your budget and reinforces positive habits.

Lastly, review and adjust your budget regularly. Life changes—so should your budget. Revisit your plan every few months or whenever there’s a major shift in income or expenses. Reflecting on your progress helps you stay accountable and make informed decisions moving forward.

Budgeting doesn’t mean you can’t enjoy life—it means you’re making sure you can enjoy it without unnecessary financial stress. With discipline, the right tools, and clear goals, millennials can take charge of their financial future and build lasting wealth.

1 note

·

View note

Text

Buy Vapes Online in Nairobi: Get Your Vape Delivered to Your Doorstep In 15 Minutes!

Why do we love online shopping? Its convenience daah! With doorstep vape delivery you can now enjoy your favorite vapes from premium vape brands like Hart Vapes in under 15 minutes. Still need more convincing? Alright spare 2 minutes of your time and explore how to buy vapes online in Kenya, why rechargeable vapes are a game-changer, and where to find the best vapes deals including discounted Hart vapes in just a few clicks.

Why Buy Vapes Online in Nairobi?

Doorstep Vape Delivery

Say goodbye to driving or walking across town to find a reliable vape shop. Today, with just your phone or desktop, you can order rechargeable vapes, e-liquids, and accessories at online vape shops and vape them delivered to your doorstep. Vape retailers like Foxtrot Vape Shop specialize in instant delivery with your order arriving in 10 to 25 minutes within Nairobi. Simply search “vape shop near me” or visit their website, and your order will be on its way.

Variety Vape Brands at Your Fingertips

Shopping online on apps like Glovo gives you access to top-tier brands like Hart Vapes known for their rich flavor profiles, long-lasting batteries, and sleek designs. Hart vapes flavor catalogue can be categorized in three sectors. Fruity flavors include Hart Grape Ice, Hart Strawberry Cosmo, Hart Pineapple Ice, Hart Blueberry Razz Ice, Hart Spritz, and Hart Peach Ice. Minty flavors include Hart Manhattan Mint. Energy flavors include Hart Polar Energy.

Exclusive Vape Discounts and Promotions

Online vape retailers such as Foxtrot Vape Shop offer unbeatable discounts and seasonal sales. You can save us on some coins with some of the exclusive vape discounts Hart Vapes offer.

How to Order Vapes Online in Kenya

Search “Vape Shop Near Me”

Start by searching “vape shop near me” to find retailers with instant vape delivery options. Foxtrot Vape Shop stands out for its speed, reliability, and curated selection of rechargeable Hart vapes bringing you premium flavors’ such as Grape Ice.

Browse and Customize Your Order

Explore a wide range of products, from 3500 puffs rechargeable vapes, 1500 puffs non-rechargeable, and energy/caffeine pouches. Hart Vapes’ rechargeable e-cigarettes are ideal for vapers who value sustainability and convenience.

Checkout and Enjoy Fast Delivery

Once you’ve selected your items, checkout securely and track your order in real time. Foxtrot Vape Shop’s 10–25-minute delivery window ensures you’ll never wait long to enjoy your purchase.

Why Hart Rechargeable Vapes are a Game-changer

Unmatched Quality and Innovation

Hart Vapes combines cutting-edge technology with sleek, portable designs. Their rechargeable vapes are perfect for on-the-go lifestyles, offering long battery life and consistent performance.

Hart Refund Policy: Shop with Confidence

Hart Vapes backs its products with a customer-friendly refund policy. If you’re unsatisfied with your purchase, their team ensures a hassle-free resolution, making it a risk-free choice for new vapers.

Rave Hart Vapes Reviews

Kenyan vapers consistently praise Hart Vapes for their flavor variety, durability, and ease of use. One reviewer noted, “I very rarely leave reviews; however, this is one vape shop that deserves one. The vape quality is consistently outstanding, exceeding my expectations every time. I highly recommend!”

Final Thoughts: Elevate Your Vaping Experience

Buying vapes online in Kenya is the ultimate blend of convenience, quality, and affordability. With retailers like Foxtrot Vape Shop offering instant delivery and brands like Hart Vapes delivering premium performance, there’s never been a better time to explore the world of vaping.

Pro Tip: Keep an eye out for discounted Hart vapes and subscribe to newsletters for exclusive deals. Whether you’re searching “vape shop near me” or ordering online, Kenya’s vaping scene is ready to impress.

0 notes

Text

Your Complete Checklist for Smart Financial Planning in 2025

In today’s fast-paced world, managing your finances wisely has never been more important. As we enter 2025, financial planning isn't just about saving a portion of your income—it’s about creating a roadmap for long-term stability and wealth. Whether you're an individual, a growing entrepreneur, or a small business owner, the right strategy can help you meet your financial goals, reduce risk, and prepare for the unexpected.

At Robert Ricco, Inc, An Accountancy Corp, we offer comprehensive accounting services in Santa Monica to help you make informed financial decisions every step of the way. In this guide, you'll find everything you need to build your financial checklist for 2025—from budgeting and debt reduction to investment planning and tax optimization.

Define Your Financial Goals for 2025

Setting clear goals is the foundation of smart financial planning. Begin by categorizing your objectives into three types:

Short-term goals: Emergency fund, debt repayment, vacation

Mid-term goals: Saving for a home, expanding a business

Long-term goals: Retirement planning, college funds for children

Build a Practical Budget

A budget is a financial blueprint that ensures you're spending within your means and allocating money wisely. In 2025, inflation, interest rates, and economic uncertainty may impact everyday expenses—making budgeting even more crucial.

Popular budgeting strategies:

50/30/20 Rule: 50% on needs, 30% on wants, 20% on savings/debt

Zero-based budgeting: Every dollar is assigned a purpose

Use apps like YNAB, Mint, or QuickBooks to track spending

If you own a business or work as a freelancer, our Bookkeeping Services in Santa Monica ensure your financial records are always up-to-date and accurate.

Create a Reliable Emergency Fund

An emergency fund acts as a safety net for unexpected events such as job loss, medical expenses, or urgent repairs. In 2025, aim to save 3–6 months’ worth of essential expenses. Store this fund in a high-yield savings account to earn interest while keeping it accessible.

At Robert Ricco, Inc, our Santa Monica accounting experts can help you automate your savings and develop cash flow strategies to build your emergency reserves.

Strategically Manage Debt

Debt management is essential to maintaining financial freedom. High-interest debt like credit cards or unsecured loans can hinder your progress.

Popular repayment strategies:

Avalanche method: Pay off the highest-interest debt first

Snowball method: Pay off the smallest debts first to build momentum

Our CPA in Santa Monica works closely with clients to review liabilities, assess credit impact, and develop debt payoff plans that align with their income.

Maximize Your Income and Career Potential

Whether you're seeking a promotion, changing careers, or launching a new business, maximizing income in 2025 is vital.

Here’s how to grow your earnings:

Upskill with certifications or online courses

Explore side hustles or part-time consulting

Network and negotiate effectively

Develop a Smart Investment Strategy

Smart investing helps grow your wealth over time. In 2025, trends such as automation, green tech, and global diversification are shaping new opportunities.

Investment areas to consider:

ETFs and mutual funds

Stocks and dividend portfolios

Real estate and REITs

Roth IRAs and 401(k) plans

Our CPA firm Santa Monica CA provides personalized investment planning services to help clients diversify their portfolios based on goals and risk tolerance.

Prepare for Tax Season All Year Long

Proactive tax planning can save you thousands over the long term. With constant changes in tax codes, it's critical to stay up-to-date.

Tax planning tips for 2025:

Maximize deductions and credits (home office, business expenses)

Contribute to tax-advantaged accounts (401(k), HSA, SEP IRA)

Keep detailed records year-round

Let our CPA in Santa Monica manage your filings, minimize liabilities, and ensure full IRS compliance.

Review Insurance Coverage

Protecting your assets and income through insurance is an essential part of financial planning.

Types of insurance to consider:

Health and disability insurance

Life insurance (term or whole)

Home, auto, and renters insurance

We'll help assess your current policies and ensure you're adequately covered for life's unpredictable moments.

Set Up Estate Planning Documents

Estate planning ensures your assets are distributed according to your wishes. It's not just for the wealthy—it's smart financial planning for everyone.

Key documents to have in place:

A legally binding will

Power of attorney

Healthcare proxy

Living trust (if applicable)

Our firm connects you with trusted estate planning professionals to protect your legacy.

Use Technology and Financial Tools

In 2025, digital tools make financial planning more accessible than ever. Whether you're managing a business or household, automation and software streamline decision-making.

Recommended tools:

QuickBooks or Xero for small business finances

Robo-advisors like Betterment for hands-off investing

Personal finance dashboards for budget tracking

At Robert Ricco, Inc, we integrate these tools into our Bookkeeping Services in Santa Monica to give you real-time financial clarity.

Review and Adjust Your Plan Regularly

A successful financial plan is dynamic—not static. We recommend scheduling quarterly or biannual reviews to adjust your budget, savings goals, and investment strategies.

Our clients benefit from regular strategy sessions with a dedicated CPA in Santa Monica, ensuring that their plans evolve with their lives and business goals.

Why Choose Robert Ricco, Inc for Your Financial Planning?

At Robert Ricco, Inc, An Accountancy Corp, we’re more than just number crunchers. We’re a strategic partner in your financial success. With deep expertise in Santa Monica accounting, tax compliance, and investment planning, we help clients build wealth, reduce risk, and meet their financial goals with confidence.

📞 Call Now for Smart Financial Planning (310) 729-3705

👉 Related Blog

Source Page

0 notes