#Mortgage rates

Text

29 notes

·

View notes

Text

#usa news#us politics#usa today#usa#usa politics#usa election#us news#us elections#politics#house prices#house for sale#building#home#mortgage loan#mortgage rates#mortgage broker#mortgage modification#realestate

3 notes

·

View notes

Text

Part Time Jobs for International Students in the USA

Join Link: https://part-time.makemoneycareer.com/?pub=14565

Part Time Jobs for International Students in the USA

#the owl house#united states#indian in united states#mortgage rates#interest rates#part time job in arizona state university#arizona state university#on campus job in arizona state university#united kingdom#grand valley state university#my part time job in usa | florida state university | ms in us#parttimedining#part time jobs in usa telugu#part time job#parttimejobs#part time jobs#part-time job#how to get a part time job#usa part time jobs telugu#part time telugu

2 notes

·

View notes

Text

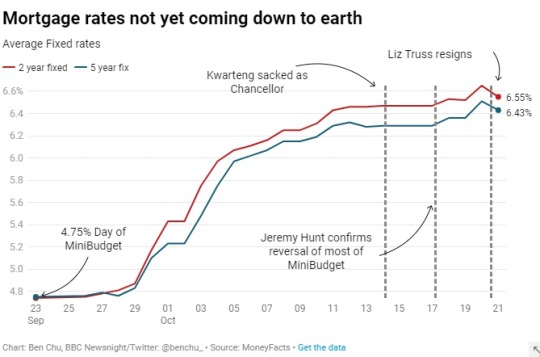

UK mortgage rates

12 notes

·

View notes

Text

The UK Labour Market looks pretty strong

The UK labour market has produced a set of figures this morning that are in line with the present weather which is rather sunny. We have even achieved something which it feels like we were on the cusp of almost forever!

In the latest quarter, total actual weekly hours worked increased by 15.8 million to a record high of 1.06 billion hours. This is 6.3 million hours above pre-coronavirus pandemic…

View On WordPress

#business#economy#Employment#employment rate#Finance#Hours worked#Inactivity#mortgage rates#Real Wages#UK Labour Market#Unemployment#Wages

3 notes

·

View notes

Text

Mortgage Rates Just Shot Up Again—but the News Gets Worse From There

Mortgage Rates Just Shot Up Again—but the News Gets Worse From There

View On WordPress

#allen#buyer agent#DFW real estate#Ebby Halliday#ebbyplano#first time buyers#frisco#home buying#home loans#house hunting#interest rates#mckinney#mortgage rates#north texas homes#plano#real estate agent#realtor#texas homes

2 notes

·

View notes

Link

8 notes

·

View notes

Text

“Mortgage Rates” Fall – After Banks Fail

Mortgage rates have fallen to historic lows as a result of the recent bank failures, which also had a significant effect on the housing market. The pandemic-related economic downturn has been devastating for many, but those looking to buy or refinance a home may discover that this is the ideal time to do so. This article will look into the reasons for the drop in mortgage rates as well as how homeowners can benefit from it. read more

2 notes

·

View notes

Text

Wisconsin realtors hopeful for further mortgage rate declines, but supply is bigger issue

Gladue and Bruno said prices have risen despite mortgage rate increases because there just isn’t enough supply of housing to keep up with demand.

By Joe Schulz | Wisconsin Public Radio

Some Wisconsin realtors are hopeful mortgage rates will decline slightly through 2025 after the Federal Reserve’s interest rate cut last week. But they say a lack of supply remains the biggest challenge for prospective homebuyers.

The Fed cut the Federal Funds rate by half a percentage point last Wednesday, but average 30-year fixed mortgage rates have…

0 notes

Text

China Unveils Measures to Revitalize Struggling Economy

China Unveils Measures to Revitalize Struggling Economy #Chinaeconomy #Mortgagerates #PanGongsheng

#China economy#Mortgage rates#Pan Gongsheng#People&039;s Bank of China#property market#reserve requirement ratios#stock markets

0 notes

Text

How Much Of A Down Payment Should I Make On My Home?

There are a lot of steps that people need to take when buying a home. One of the most common issues that people discuss is the down payment. Most banks will require a down payment so that they aren’t the only ones taking on the risk of buying a home. The common question people have is how much of a down payment they should apply.

The Rule Of Thumb

Most people have heard about placing 20 percent down on a house as a solid rule of thumb. This number has been passed down from prior generations who purchased houses with similar down payments.

On the other hand, the price of housing has risen over the past few decades and this down payment might not be possible for some people. While 20 percent down might work for some people, it might not be feasible for others.

Other Considerations

There are several additional factors that homebuyers need to think about. First, how big of a down payment is the bank requiring? Some banks might not lend to someone at all if they don’t reach a certain threshold. In other cases, the lender might ask someone to purchase something called private mortgage insurance, often abbreviated PMI.

This is an insurance policy that the borrower will have to purchase for the lender. If the borrower loses the home in foreclosure, the lender gets its money back through this insurance policy. Obviously, borrowers do not want to have this added expense. This is where the down payment is important.

In addition, banks might also be willing to lower the interest rate on the mortgage if the borrower increases the size of the down payment. With a lower interest rate, this can save someone a substantial amount of money down the road. Try to see if the lender will lower the interest rate in exchange for a larger down payment.

Deciding The Down Payment

These are a few of the many factors that homebuyers should think about when thinking about the down payment. While nobody wants to pay more than they should, the down payment is only one of the financial aspects people need to consider.

As always, call your trusted mortgage planning professional to help you decide on the best solution for your personal situation.

0 notes

Text

Fairfield and Westport Real Estate Market Report September 2024 🪻

Image: Twilight pool at 115 Lalley Blvd, Fairfield CT

September is in Full Swing! 🪻🏡

As we dive into ‘back to school’ mode, here’s a look at what happened at the end of summer in our local Fairfield and Westport single-family housing markets. If you’re curious which homes sold, take a look at the What Sold Reports.

Here’s what happened in August 2024.

Prices: Up in Both Towns Compared to…

View On WordPress

#are home prices falling?#are home values falling#Connecticut#CT Real Estate Data#fairfield county CT real estate#Fairfield CT real estate#fairfield-and-westport-housing-market-update-july-2024#fairfield-ct-realtor#home buyers#home sellers#housing#housing market#investing#july-2024-housing-market#Linda Raymond#May Real Estate Report 2024#mortgage rates#Property Sales Update#Real estate agent#Real estate investing#Real estate report for Fairfield CT: May 2024#Real Estate Report: Westport CT May 2024#Real estate trends#real-estate#Realtor#Spring housing market#spring-market#Summer Real Estate market Update#Westport CT real estate

0 notes

Text

Mortgage Rate Effects On Purchasing Power

0 notes

Text

China presses the economic panic button

Today is definitely a day to look East as something we have been waiting for has occurred. For several years now we have been observing the consequences of the way the Chinese property sector has turned from boom to bust. This morning one could say that the Chinese cavalry has arrived. Here is Mr. Pan Gongsheng, Governor of the People’s Bank of China.

In terms of the total amount of monetary…

#business#China#economy#Finance#house prices#Interest Rates#Investing#mortgage rates#PBOC#People&039;s Bank of China#QE#Reserve Rate Cut#Stock Market

0 notes

Text

Navigating the Complex Landscape of the 2024 Housing Market

Understanding Market Trends for 2024

As a homeowner or potential buyer, understanding the market trends in the 2024 housing landscape is crucial for making informed decisions. Currently, the market presents a multifaceted scenario featuring projected increases in home prices, fluctuating mortgage rates, and persistent inventory challenges. Let’s dive into these aspects to give you a comprehensive…

0 notes