#Nft Platform Like Art Blocks Development

Explore tagged Tumblr posts

Text

Masterpieces in Pixels: The Best of Digital Photo Artwork

When Technology Meets Imagination

Once, the masterpiece was born of brush and canvas. Today, some of the world's most breathtaking compositions begin with a stylus and screen. Welcome to the world of digital art painting, where creativity knows that there is no limit and pixels do not become poetry.

This article is a celebration of the digital renaissance - showing iconic digital photo artifacts, spotting impressive artists, and revealing how the technique is changing the visual stories.

The Rise of Digital Art: A New Chapter in Art History

The development of art has always been powered by equipment—stone, charcoal, oil, and acrylic. The digital era brought a new set of devices: graphic tablets, photo-editing software, and 3D rendering engines.

Why Digital Art Painting Deserves the Spotlight

Critics once rejected digital art as "less real," but the world of art has moved. Today, digital photo artwork is displayed in major galleries, collected as NFTs, and used in gaming, film, fashion, and advertising.

Here’s what makes it stand out:

Versatility: From photorealism to essence, digital equipment suits every style.

Efficiency: Premous, again, and layers use the experiment risk-free.

Exception: Artists worldwide can cooperate, share, and sell their work.

Digital Masterpieces That Inspire

Let's dive into some standout examples that show the emotional and technical depth of digital art painting.

1. “Portrait of the Future” by Artgerm

A hyper-detailed science-fiction portrait that mixes Eastern aesthetics with the Western comic book effect. The signature of the artgerm is possible with the work of the complex layer in Photoshop.

2. “City of Light” by Beeple

One of the most famous digital artists of our time creates a dystopian world with quality like Bipal cinema. Their daily rendering leads the boundaries of digital storytelling.

3. “Dreams in Bloom” by Ross Tran

This colorful, chaotic, and joyful piece shows how digital equipment can reflect an artist's personality. Ross's bold brushstrokes and unique character design make their work immediately recognizable.

Behind the Scenes: How Digital Art Paintings Are Created

Creating a digital work includes more than just software. It is a process filled with vision, technology, and story.

Step-by-step Process:

Sketching the concept —just like traditional art.

Blocking in shapes and color —using layers for flexibility.

Adding depth and lighting—digital brushes simulate texture and light.

Refining details—highlights, shadows, effects, and final polish.

Meet the Masters: Influential Digital Artists

Loish (Lois van Baarle)

Known for its dreamy characters and expressive brushwork, depiction and animation of bridges in a vibrant digital style.

Feng Zhu

Concept artist for games like Star Wars and Transformers, Feng brings cinematic flair to every digital stroke.

Magdalena Pagowska

Their fantasy-themed digital photo artifacts featured a mixture of realism and imagination, often accompanied by ethereal light and flowing texture.

How to Appreciate Digital Art

It is not certain how to read digital paintings. Here are things to see:

Brush technique: Is it painterly, smooth, or textured?

Lighting: Does it evoke a mood?

Composition: How are the elements balanced?

Emotion: What story is it telling?

Digital does not mean. In fact, with repetition and the ability to use it, digital art often captures deep emotional nuances.

Getting Started: Become a Digital Creator Yourself

Inspired? You can try your hand at digital art painting even as a beginner. Here’s how:

Beginner Tools: Try free apps like Krita or use an iPad with Procreate.

Learn the Basics: Study traditional drawing—digital is just a new medium.

Take Courses: Platforms like Skillshare, Udemy, and YouTube are goldmines.

Join the Community: Reddit, ArtStation, and Discord groups provide support and feedback.

The best way to improve? Just keep creating. Even the best artists started with stick figures.

The Digital Canvas: What's Next?

Technology leads the limits of creativity.

AI-assisted painting tools are helping artists generate ideas faster.

Augmented and virtual reality art is becoming more interactive.

NFTs and blockchain have created new art markets and collector experiences.

Celebrating Creativity in the Digital Age

Digital art painting is proof that artistry is not limited by medium. Whether it is painted on a canvas or prepared on a tablet, what matters is the story that tells it, and it is a feeling.

In Pixel, these works reflect the same passion, technology, and surprise that are hanging any oil painting in a museum. So next time you see a digital artwork, look closely - you can gaze into the future of art.

4 notes

·

View notes

Text

Blockchain Investment: A New Frontier for Investors

The rise of blockchain technology over the last decade has sparked interest across various industries, from finance and supply chain management to healthcare and entertainment. As blockchain matures, investors are starting to recognize its potential not only for transforming traditional sectors but also for offering new investment opportunities. In this article, we explore the significance of blockchain investment, the types of investments available, the associated risks, and the future outlook for this promising technology.

What is Blockchain?

Blockchain is a decentralized digital ledger technology that securely records transactions across multiple computers. It allows information to be stored transparently, immutably, and without the need for intermediaries such as banks or government bodies. The most famous application of blockchain technology is Bitcoin, the first cryptocurrency, but its potential extends far beyond digital currencies.

Blockchain’s unique features—decentralization, transparency, and security—make it an appealing foundation for various applications, ranging from finance to supply chain management to voting systems. With an increasing number of industries exploring blockchain’s use cases, it has garnered significant attention from investors.

youtube

Why Invest in Blockchain?

Disruption of Traditional Systems: Blockchain has the potential to disrupt a wide range of industries by providing more efficient, transparent, and secure alternatives to legacy systems. For example, blockchain-based financial services can lower transaction costs, reduce fraud, and offer access to previously unbanked populations. The transformation of industries such as healthcare, logistics, and government services is just beginning.

The Growth of Cryptocurrencies: Blockchain is the backbone of cryptocurrencies, which have seen exponential growth in recent years. Bitcoin, Ethereum, and other altcoins have become established assets, and decentralized finance (DeFi) platforms built on blockchain promise further innovation in financial markets. Investors can benefit from both the appreciation of these digital assets and the broader adoption of cryptocurrency ecosystems.

Tokenization of Assets: Blockchain enables the tokenization of real-world assets, including real estate, art, and commodities. This allows investors to gain fractional ownership in previously illiquid assets, opening up new avenues for diversification and investment. Tokenization can also improve liquidity and streamline processes such as cross-border payments and property transfers.

Venture Capital and Startups: Many blockchain-based startups are developing innovative applications, from decentralized applications (dApps) to non-fungible tokens (NFTs) to blockchain-based identity verification systems. Venture capitalists and angel investors can tap into the high growth potential of these companies, as blockchain adoption continues to rise globally.

Types of Blockchain Investments

Blockchain investments can be approached in several ways. Some of the most common types include:

Cryptocurrencies: Direct investment in digital currencies like Bitcoin, Ethereum, and other altcoins is the most straightforward form of blockchain investment. These cryptocurrencies can be purchased through exchanges and stored in digital wallets. While Bitcoin and Ethereum are the most well-known, there are thousands of altcoins that investors can explore.

Blockchain-related Stocks and ETFs: Rather than investing directly in cryptocurrencies, investors can gain exposure to blockchain technology by purchasing stocks in companies that are integrating blockchain into their operations. Public companies such as Nvidia (which provides hardware for mining), Coinbase (a cryptocurrency exchange), and Block (formerly Square) are examples of firms investing heavily in blockchain. Additionally, blockchain-focused exchange-traded funds (ETFs) allow investors to diversify their exposure to the sector.

Initial Coin Offerings (ICOs) and Token Sales: ICOs and token sales are fundraising mechanisms where startups issue their own cryptocurrency tokens in exchange for investments. While ICOs were initially seen as high-risk, high-reward ventures, they have become more regulated over time. This form of investment allows early-stage investors to gain a stake in blockchain projects before they are widely adopted.

Blockchain Real Estate: The tokenization of real estate allows fractional ownership of property via blockchain-based tokens. Platforms like RealT and Propy have been pioneers in this space, enabling investors to buy shares in real estate and receive dividends from rental income. Blockchain’s transparency and immutability make it ideal for managing property transactions.

Decentralized Finance (DeFi): DeFi is a rapidly growing sector that leverages blockchain to provide financial services such as lending, borrowing, and trading without intermediaries. By investing in DeFi projects or liquidity pools, investors can earn returns in the form of interest or tokens.

Risks of Blockchain Investment

While blockchain presents exciting investment opportunities, there are several risks to consider:

Volatility: Cryptocurrencies, in particular, are known for their extreme price volatility. Dramatic price swings can occur in a short time, making blockchain investments high-risk, especially for short-term traders. Long-term investors should be prepared for fluctuations in value.

Regulatory Uncertainty: Blockchain and cryptocurrencies are still in the early stages of regulatory development. Governments around the world are working on creating frameworks to govern blockchain and digital currencies, but until clear regulations are established, there could be sudden changes in legal and tax requirements that impact investment returns.

Security and Fraud Risks: While blockchain technology itself is secure, the platforms and exchanges built on top of it may not always be. Hacks, scams, and fraud have occurred in the blockchain space, with investors losing substantial amounts of money. Conducting thorough research and choosing reputable platforms is crucial.

Technological Risks: Blockchain is still an emerging technology, and its long-term scalability, interoperability, and environmental impact remain open questions. For instance, Ethereum, one of the leading blockchains, is transitioning from a proof-of-work to a more energy-efficient proof-of-stake consensus mechanism, highlighting the potential for technical challenges.

The Future of Blockchain Investment

As blockchain technology evolves, it’s expected that adoption across industries will only increase. Many experts believe that blockchain will play a central role in reshaping the global economy, particularly in areas like supply chain transparency, decentralized finance, and digital identity verification.

The rise of central bank digital currencies (CBDCs), which are government-backed digital currencies that leverage blockchain technology, will likely spur further mainstream adoption. Additionally, innovations in smart contracts, which automate transactions based on predefined conditions, will expand the use of blockchain beyond simple transactions into complex business processes.

For investors, this presents an exciting opportunity to position themselves at the forefront of a technological revolution. However, as with any emerging technology, it is important to approach blockchain investment with caution, conducting thorough due diligence and maintaining a diversified portfolio to manage risk effectively.

Conclusion

Blockchain investment offers promising opportunities for those willing to navigate its complexities. From cryptocurrencies to tokenized assets to decentralized finance, the potential for growth in this sector is vast. However, investors should carefully consider the risks associated with volatility, regulation, and security before diving in. As blockchain technology matures and becomes more widely adopted, it will likely be a key driver of innovation, providing unique opportunities for savvy investors to capitalize on the next generation of digital transformation.

2 notes

·

View notes

Text

What Exactly is Cryptocurrency? A Comprehensive Guide to Get You Started!

The term cryptocurrency has been gaining increasing attention over the past few years, capturing the interest of both investors and the general public. But what exactly is this emerging digital asset? How does it work, and what does it mean for someone new to the world of crypto? In this guide, we’ll walk you through the basics, from the core concepts to real-world applications, offering a complete insight into the rapidly evolving world of cryptocurrency.

What is Cryptocurrency?

Cryptocurrency is a digital asset built on blockchain technology. Unlike traditional currencies, it is not issued by central banks but is created and managed through decentralized technology. The key characteristics of blockchain are its openness, transparency, and immutability, which allow for secure transactions without the need for intermediaries like banks or other financial institutions.

Bitcoin (BTC), created in 2009, is the first and most well-known cryptocurrency. Its creator, Satoshi Nakamoto, aimed to leverage blockchain technology to build a new financial system that operates independently of traditional banking institutions. Since then, countless other cryptocurrencies have emerged, including Ethereum (ETH), Ripple (XRP), and many more.

Different cryptocurrencies have different design goals. Some are used for payments, others for executing smart contracts, while others are primarily investment or store-of-value tools. In essence, cryptocurrencies emerged to address issues in the traditional financial system, such as high transaction fees, long settlement times, and lack of transparency.

Cryptocurrency and Blockchain: The Relationship

To understand cryptocurrency, it’s essential to grasp the underlying technology — blockchain. Simply put, blockchain is a distributed ledger where all participants can view transaction records, but no one can arbitrarily alter them. Each time a transaction is completed, it’s added to a "block," and these blocks are linked in chronological order to form a chain — hence the name "blockchain." This setup ensures that every step of the transaction is traceable and nearly impossible to manipulate.

Another critical feature of blockchain is decentralization, meaning that no single entity controls the system, which, in theory, enhances its security and transparency. The reason cryptocurrencies are so popular is largely due to the independence that blockchain technology provides from traditional financial systems.

Beyond Payments: Cryptocurrency’s Other Use Cases

Although cryptocurrencies were initially designed as digital payment systems, their applications have grown exponentially over time. Here are a few common use cases:

Payment Systems: Cryptocurrencies like Bitcoin are widely used as global payment tools, especially in regions where traditional payment systems are inaccessible, such as countries with unstable political or economic conditions.

Smart Contracts and Decentralized Applications (DApps): Ethereum, beyond being a cryptocurrency, is also a platform for developing smart contracts — self-executing contracts that automatically enforce terms without human intervention. These contracts have broad applications across industries like law, finance, and logistics.

Decentralized Finance (DeFi): DeFi is one of the hottest trends in the crypto world. It aims to create a decentralized financial system where users can lend, borrow, trade, and earn interest on crypto assets without intermediaries like banks. DeFi is seen as more transparent and efficient compared to traditional banking systems.

NFTs and Digital Art: NFTs (Non-Fungible Tokens) are unique digital assets stored on the blockchain. Each NFT has a unique identifier, making it impossible to copy or divide, which has led to their popularity in digital art and collectibles markets.

How to Buy Cryptocurrency?

For beginners, the most common way to buy cryptocurrency is through a crypto exchange. These platforms provide a convenient interface for users to convert fiat money (like USD, EUR, or TWD) into cryptocurrency. Popular exchanges include Binance, Bitget,OKX,Gate·io, Kraken and Bybit. These platforms typically support various payment methods, including bank transfers, credit cards, and third-party payment systems.

Here’s a basic guide to purchasing cryptocurrency:

Create an Account: Choose an exchange and create an account. Most exchanges require identity verification to comply with KYC (Know Your Customer) regulations.

Deposit Funds: Once registered, you can deposit funds via bank transfer or another payment method.

Choose a Cryptocurrency and Place an Order: After depositing, you can select the cryptocurrency you want to purchase, set the quantity, and place an order. Most exchanges offer market orders (buying at the current price) or limit orders (setting a target price).

Transfer to a Wallet: Once your purchase is complete, it’s recommended to transfer your cryptocurrency to a private wallet for safekeeping. Wallets can be online, hardware, or paper-based.

Security Concerns Around Cryptocurrency

While blockchain technology itself is highly secure, cryptocurrency transactions still come with significant risks. Some of the most common include:

Market Volatility: The price of cryptocurrencies can fluctuate wildly in short periods, offering high returns but also posing substantial risks, especially for newcomers.

Scams and Hacking: Fraudulent schemes, like "rug pulls" (where project creators disappear with investors’ money), are common. Exchanges are also frequent targets for hackers, making it crucial to choose a reputable platform and store assets in a secure personal wallet.

Regulatory Risk: Cryptocurrency regulations vary widely across different countries. Some nations ban crypto trading, like China, while others, like the U.S., Singapore, and Hong Kong, are more open. Investors need to be aware of local regulations, especially regarding tax reporting and asset management.

The Future of Cryptocurrency: Opportunities and Challenges

While cryptocurrency has seen significant growth, it still faces several challenges, including market volatility, regulatory uncertainty, and the need for improved user experiences. Stablecoins, like USDT and USDC, have emerged to address price volatility, offering a more stable investment option. However, as governments increasingly seek to regulate the sector, the industry’s transparency and legitimacy are likely to improve over time.

On the technological front, high-energy consumption is a critical issue for some cryptocurrencies, especially Bitcoin. However, projects like Ethereum's switch to a Proof-of-Stake (PoS) model, which is more energy-efficient than traditional Proof-of-Work (PoW), signal an environmentally friendly future for blockchain. With continuous advancements in technology and growing mainstream adoption, cryptocurrency is poised to become a significant part of our daily lives.

Conclusion

Cryptocurrency represents a transformative financial tool, offering new possibilities through decentralization, transparency, and efficiency. From Bitcoin to Ethereum, and from DeFi to NFTs, the scope of cryptocurrency’s application continues to expand, offering unprecedented opportunities for investors, developers, and everyday users.

Despite its potential, investing in cryptocurrency carries risks, particularly in terms of volatility, security, and regulatory uncertainty. However, for those willing to invest time in understanding the landscape and remaining patient as the technology matures, cryptocurrency presents an exciting frontier to explore.

Whether you’re a beginner or a seasoned crypto enthusiast, understanding the fundamental concepts and future prospects of this rapidly evolving field is key to thriving in the industry. As technology continues to develop and mainstream applications grow, cryptocurrency could become an integral part of our financial system, reshaping our understanding of money, transactions, and assets.

2 notes

·

View notes

Text

January 7 - What art form would you like to try that you haven't—or, alternately, what art form have you tried that you most want to work on? -killabeez

KILLA!! What a great prompt, thank you for asking me an art question!

I spent the previous few years working on acrylic pours which has been amazing and fun and messy and a joy. but I could sense that I needed to shift gears eventually…

I’m getting back into intuitive/expressionistic painting again and some mixed media. I’m also looking forward to trying to develop some figurative drawing skills. I have not had the patience or inclination to work on my drawing skills before but I think I’ve reached the point where I really want to focus on drawing so I can do figurative abstract. Currently not very good at drawing shapes and people with any kind of intent or control. I’ve got a number of tutorials queued up for the new year. Did some practice in October and November sporadically. Have plenty of sketchbooks and even tracing paper to practice with.

I just need to put it all together and begin this new art practice and stick with it for awhile. I want to draw people, trees, plants. And cats. Been working on my doodle skills. Daily practice. Slow and purposeful.

Tools-wise I also was really fond of spray painting techniques that I tried. But I never have a good place to do that outdoors and I can't do that indoors. However I do have an air compressor and have practiced with that a little bit but I want to do more with that.

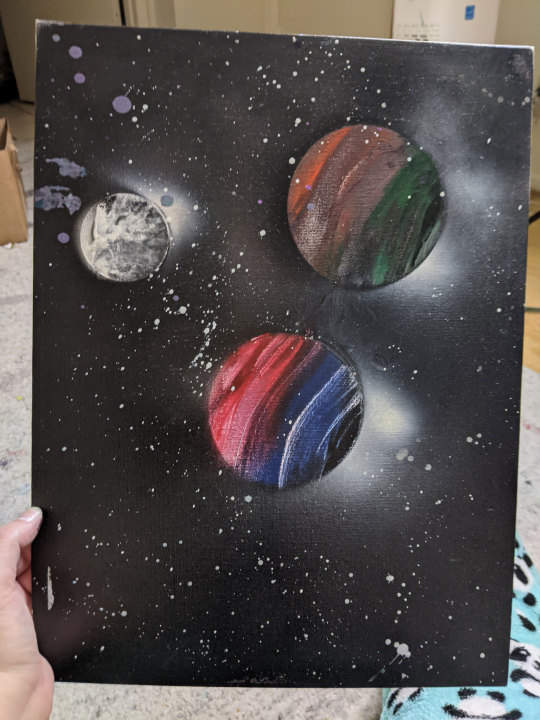

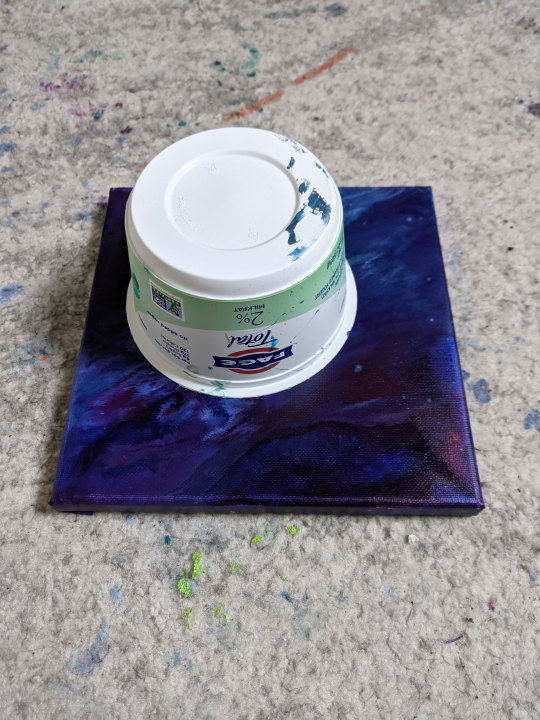

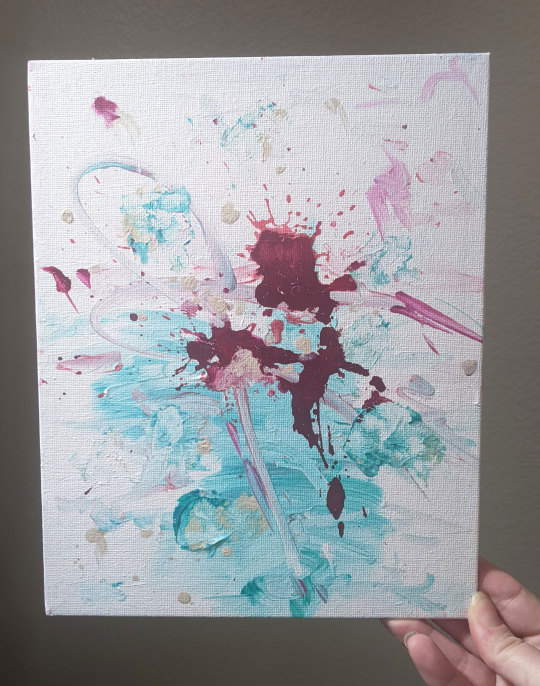

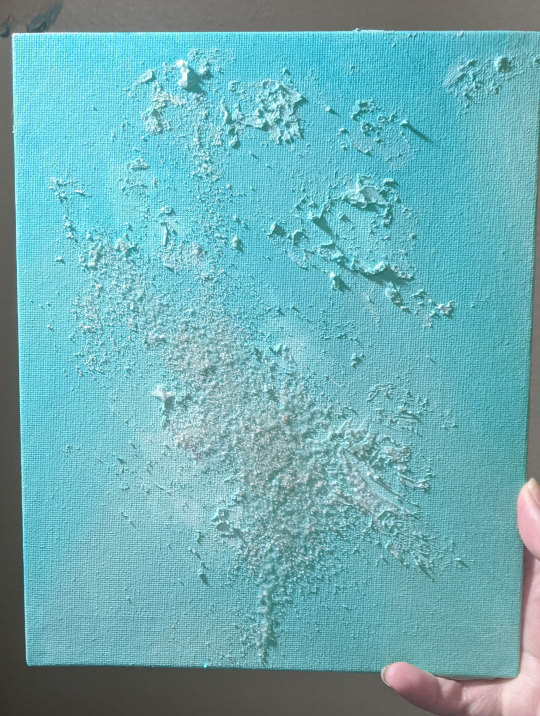

I would love do various kinds of acrylic pour galaxies with airbrush planets and nebulas, using some sponging and blending techniques too for starscapes. I had this vague idea to recreate the color palette of Star Wars planets that I kind of tried to some degree a few years ago but didn’t get too far with. It’s very cool. I just need way more practice! Here's some early practice with spray paint and later a masking attempt with a purple-y acrylic pour. The tall piece was an acrylic pour and later splattered with paint in my bath tub. Finished with a circle stencil and airbrushing for the spheres. It turns out I have to focus really hard to understand light/shadow.

I cleaned my room and hauled out a bunch of old paintings to stare at while I do some fresh warm-ups this month. I feel like I had stalled out with this kind of thing, but I think there's more I can do to express myself. Most of these I don't think have enough structure to ground the eye and whatnot, but that's why I've been staring at them off and on for a week while reviewing some inspiration videos and books. Been thinking more about color blocking and linework to help create structure.

I'm feeling adrift when it comes to sharing/posting art on various social media platforms because of the spam on Insta/Twitter (I was getting dozens of spam replies/DMs and requests for NFTs/probable theft). Not sure if to create a new sideblog or new tumblr for my art. Or if I want to rename my studio name that doesn't feel quite right anymore but I'm not ready to give up yet. Thinking about crossposting on dreamwidth/bluesky and image hosting. But really I need to keep warming my brain and brushes back up.

Anyway! Have some fresh art that I've practiced this week!

Acrylic on canvas board. Love me some quinacridone magenta on the left. The right piece has modeling paste and sand for texture. Gonna do some more layering on that.

January posting meme + claim a date - prompt me. Still writing about pretty much anything.

#January posting meme#january posting meme 2024#artdora#kuwdora's art#my painting wips#my art#textpost

5 notes

·

View notes

Text

Sure, here's a piece of content based on your requirements:

Crypto Art +blockchaincloudmining.com

Crypto art has become a significant part of the blockchain ecosystem, offering artists and collectors a new way to create, sell, and own unique digital artworks. This innovative form of art is often referred to as NFTs (Non-Fungible Tokens), which are stored on a blockchain, ensuring their authenticity and ownership.

For those interested in exploring the world of crypto art, understanding how it integrates with blockchain technology is crucial. Blockchain platforms like Ethereum provide the infrastructure for these digital assets, allowing for secure transactions and verification. Websites such as https://blockchaincloudmining.com offer valuable insights into the broader cryptocurrency landscape, including the latest trends in crypto art.

Investing in crypto art can be both a financial opportunity and a way to support digital artists. As the market continues to grow, it’s important to stay informed about the latest developments. Whether you’re an artist looking to showcase your work or an investor interested in this emerging asset class, resources like https://blockchaincloudmining.com can be incredibly helpful.

This piece incorporates the keyword "crypto art" in the title and includes the specified URL within the text.

blockchaincloudmining.com

Block Chain Cloud Mining

BlockChain Cloud Mining

0 notes

Text

Smart Contracts: The Self-Executing Code Behind Blockchain Magic

Imagine a contract that doesn't need lawyers, middlemen, or paper trails. A contract that executes itself automatically when predefined conditions are met — no questions, no delays. That’s exactly what smart contracts do on the blockchain.

In Episode 6 of Unpacking Blockchain Technology with Thabiso Njoko, we dive deep into one of the most powerful innovations in the blockchain ecosystem: Smart Contracts.

What Is a Smart Contract?

A smart contract is a self-executing program stored on the blockchain. It runs automatically when specific rules or conditions — written in code — are fulfilled.

In short: “If X happens, then do Y.”

They eliminate the need for intermediaries by ensuring that agreements are carried out exactly as programmed.

Key Features of Smart Contracts

Here’s what makes them revolutionary:

Autonomous – Executes automatically without human intervention Immutable – Once deployed, they can’t be altered Trustless – Parties don't need to trust each other, only the code Transparent – The contract code is visible and verifiable by anyone Secure – Stored across decentralized networks, making them resistant to tampering

Real-World Use Cases

Smart contracts are the building blocks of Web3, powering decentralized applications across industries:

1. Finance (DeFi)

Lending & Borrowing Platforms like Aave and Compound use smart contracts to automate collateralized loans.

Yield farming and staking protocols distribute rewards via code.

2. NFTs

When you mint or sell an NFT, smart contracts ensure:

Ownership is transferred

Royalties are sent to the creator

The transaction is recorded immutably

3. DAOs (Decentralized Autonomous Organizations)

Governance rules and treasury management are coded into smart contracts.

Members vote and make proposals through transparent on-chain mechanisms.

4. Supply Chain

Contracts trigger actions like payments or shipment releases when sensors confirm product delivery or conditions are met.

5. Gaming

In blockchain games, smart contracts manage in-game assets, rewards, and upgrades.

“Smart contracts are not just digital agreements — they’re trustless executors. Whether it’s splitting revenue among collaborators or automating donations, these lines of code are changing how we do business online.”

He further explains how Ethereum popularized smart contracts, and why other chains like Solana, BNB Chain, and Avalanche are optimizing them for scale and performance.

How Do Smart Contracts Work?

Written in code (often Solidity for Ethereum)

Deployed on the blockchain with a unique address

Triggered by users or other smart contracts when specific inputs or events occur

Execute predefined actions and update the state on-chain

Think of them as digital vending machines — you insert the input (e.g. crypto), the machine checks conditions (e.g. amount received), and then it delivers the output (e.g. an NFT or a token).

Limitations & Risks

While powerful, smart contracts are not foolproof:

Bugs in code can lead to costly exploits (e.g., The DAO Hack in 2016)

No flexibility once deployed unless designed with upgrade paths

Scalability issues on some blockchains

Legal grey areas in traditional regulatory systems

“Code is law — but that comes with responsibility,”

“Audit your contracts. Test everything.”

Why Smart Contracts Matter

Smart contracts are key to decentralization. They remove gatekeepers, increase transparency, and allow anyone, anywhere, to build trustless systems.

From splitting royalties for a music collaboration to powering decentralized insurance — smart contracts put control in the hands of creators, developers, and communities.

Tune In Now

Listen to Episode 6 of Unpacking Blockchain Technology with Thabiso Njoko on your favorite podcast platform to explore the world of smart contracts — and discover how they’re quietly transforming everything from banking to digital art.

#SmartContracts#BlockchainTechnology#Web3Education#Ethereum#DeFi#DAOs#NFTs#BlockchainAfrica#UnpackingBlockchain#ThabisoNjoko#CryptoDevelopment#Web3Tools#blockchaineducation#blockchain#blockchainforgood#bitcoin#blockchaininnovation#eswatini#EswatiniTech#AfricanInnovation#TechInAfrica#Web3Africa#DigitalAfrica#EswatiniBlockchain#BlockchainPodcast#Web3Podcast#PodcastSeries#LearnBlockchain#EducationalContent#BlockchainForBeginners

0 notes

Text

how does blockchain technology contribute to the concept of web3

1. Introduction

Welcome to the next era of the internet—Web3. It’s more than just a buzzword. It’s a whole new world where users gain control, data is decentralized, and privacy is prioritized. But what’s fueling this revolutionary change? You guessed it—blockchain technology. Let’s take a deep dive into how blockchain is reshaping the internet as we know it.

2. What Is Web3?

Web3 is the third generation of the internet. Unlike Web1 (read-only) and Web2 (interactive but centralized), Web3 is decentralized. It empowers users instead of corporations, thanks to technologies like blockchain that remove the need for intermediaries.

3. A Quick Look at Blockchain Technology

Blockchain is a distributed ledger system. It keeps data secure, transparent, and immutable across a network of nodes. Each transaction is recorded in blocks, and once confirmed, it can’t be changed—making it ideal for the trustless environment of Web3.

4. Understanding the Backbone — Blockchain Explained

The Core Principles of Blockchain

Decentralization

No central authority controls the system. Users interact peer-to-peer, which boosts transparency and removes single points of failure.

Transparency and Immutability

Every transaction is publicly verifiable and cannot be altered once validated. That’s trust without needing to trust anyone!

How Blockchain Networks Operate

Every node in a blockchain network stores a copy of the ledger. When a new block is created, it’s verified by consensus mechanisms like Proof of Work or Proof of Stake before being added.

5. Web3 and Blockchain — A Powerful Partnership

Why Blockchain Is Essential for Web3

Without blockchain, Web3 would still rely on centralized servers. Blockchain allows for true ownership of data, secure identity management, and self-executing smart contracts.

The Transition from Web2 to Web3

Web2 is dominated by tech giants like Google and Meta. Web3 shifts power back to the users, with decentralized apps (dApps) and platforms that run on transparent protocols.

6. Key Benefits of Blockchain Technology in Web3

User Empowerment and Data Ownership

Blockchain gives users control over their own data. Imagine owning your digital identity like you own your house.

Decentralized Identity

Say goodbye to logging into sites using your email. Your wallet becomes your identity, making for safer, seamless logins.

Enhanced Security and Trust

Thanks to blockchain’s immutable nature, data breaches are drastically reduced. Users no longer need to trust corporations to keep their info safe.

7. Use Cases of Blockchain in Web3

Decentralized Finance (DeFi)

DeFi allows people to borrow, lend, and trade assets without banks.

Real-World Example: Uniswap

Uniswap is a decentralized exchange where users can swap crypto tokens without middlemen, using automated smart contracts.

Decentralized Autonomous Organizations (DAOs)

DAOs are internet-native organizations governed by code, not CEOs. Decisions are made through token-holder voting.

NFTs and Digital Ownership

Non-fungible tokens prove ownership of unique digital items—from art to music to virtual real estate.

Web3 Social Platforms

Platforms like Lens Protocol let users own their content and move it across apps without losing followers.

8. The Role of Blockchain in Web3 App Development

Smart Contracts as the Backbone

Smart contracts are self-executing programs that run on the blockchain. They eliminate the need for third-party enforcement.

Real-Time Data Integrity

Because data is recorded on the blockchain, it's tamper-proof and trustworthy—great for apps that need transparency.

Developer Opportunities and Challenges

Web3 app development opens new doors but comes with learning curves—especially around blockchain infrastructure and gas fees.

9. Use of Blockchain Technology in Financial Services

Transparent Transactions

Every transaction on a blockchain is traceable, making auditing and compliance easier than ever.

Elimination of Intermediaries

No need for middlemen like brokers or banks. This reduces costs and speeds up transactions.

Cross-Border Payments

Sending money across borders is faster and cheaper with blockchain-based stablecoins and crypto networks.

10. Real World Examples of Web3 and Blockchain Synergy

Ethereum Ecosystem

Ethereum is the go-to platform for Web3 development. It supports smart contracts and hosts countless dApps.

Polkadot and Interoperability

Polkadot connects different blockchains, allowing them to share data and assets seamlessly.

Filecoin for Decentralized Storage

Filecoin stores data across a decentralized network instead of centralized servers, giving users full control.

11. Security Aspects of Blockchain in Web3

Can Blockchain Be Hacked?

It's extremely difficult, but not impossible. A hacker would need to control over 51% of the network, which is highly improbable for well-established blockchains.

Measures That Protect Blockchain Systems

Cryptographic hashing, consensus mechanisms, and decentralization make blockchain one of the most secure digital infrastructures.

12. The Future of Web3 Development

Scalability Solutions

Tech like Layer 2 rollups and sharding are making blockchain faster and cheaper to use.

Interoperability Between Networks

Projects like Cosmos and Polkadot are building bridges between blockchains for a more connected ecosystem.

13. Challenges and Solutions

Scalability and Speed

Solution: Implementing Layer 2 and optimizing consensus algorithms.

Regulatory Issues

Solution: Creating hybrid solutions that balance decentralization with compliance.

Adoption Barriers

Solution: Better UX and education to help users and developers transition smoothly.

14. Final Thoughts

Blockchain isn’t just a piece of tech—it’s the foundation of Web3. From secure identities and transparent financial systems to decentralized apps and user empowerment, the use of blockchain technology is redefining our digital future. So, as the world shifts toward decentralization, are you ready to embrace the Web3 revolution?

#technology#blockchain development#web3 development#web3#blockchain business#blockchain technology in healthcare#blockchain technology#blockchain#blockchain basics

0 notes

Text

Integrating NFTs into Web3 dApps Using Ethers.js & Web3.js

In the rapidly evolving Web3 landscape, Non-Fungible Tokens (NFTs) have transformed from a niche crypto curiosity into a fundamental building block for the next generation of decentralized applications. Whether you're building a marketplace, a game, or a social platform, integrating NFT functionality can add unique value to your dApp. This comprehensive guide will walk you through the process of implementing NFT features using two of the most popular JavaScript libraries in the Ethereum ecosystem: Ethers.js and Web3.js, focusing on concepts and strategies rather than specific code implementations.

Understanding the NFT Integration Landscape

Before diving into implementation details, it's important to understand what we're trying to achieve with NFT development. NFT integration typically involves several key functionalities:

Minting: Creating new NFTs on the blockchain

Transferring: Enabling users to send NFTs to other wallets

Displaying: Fetching and rendering NFT metadata and images

Trading: Facilitating the buying and selling of NFTs

Interacting: Allowing special actions with NFTs based on your dApp's features

Each of these functions requires different approaches, and your choice between Ethers.js and Web3.js may depend on your specific requirements and preferences.

Setting Up Your Development Environment

The first step in NFT development is preparing your development environment. You'll need to install the appropriate libraries and set up your project structure.

Essential Dependencies

For an effective NFT integration, you'll typically need:

A JavaScript library for Ethereum interaction (Ethers.js or Web3.js)

Smart contract interfaces for popular NFT standards

Tools for handling metadata and media files

Front-end frameworks for building the user interface

Project Structure Considerations

A well-organized project structure makes NFT development more manageable. Consider separating your codebase into:

Contract interfaces and abstractions

Service layers for blockchain interactions

UI components for NFT display and interaction

Utility functions for metadata handling

Storage solutions for off-chain assets

This separation of concerns will make your codebase more maintainable as your NFT features evolve.

Understanding NFT Standards

Most NFTs on Ethereum follow the ERC-721 or ERC-1155 standards. Understanding these standards is crucial for NFT DEVELOPMENT.

ERC-721

The ERC-721 standard is the original NFT standard on Ethereum. Each token is completely unique and has its own specific token ID. This is perfect for one-of-a-kind digital assets like art pieces or unique collectibles.

Key functions in the ERC-721 standard include:

Transferring tokens between addresses

Approving specific addresses to transfer tokens

Checking ownership of specific tokens

Getting metadata for tokens

ERC-1155

The ERC-1155 standard allows for both fungible and non-fungible tokens within the same contract. This makes it more gas-efficient and ideal for applications with multiple types of tokens, such as games with both unique items and currency tokens.

Key benefits of ERC-1155 include:

Batch transfers for multiple token types

Reduced gas costs for similar operations

Support for both fungible and non-fungible tokens

More flexible metadata handling

Using Ethers.js for NFT Integration

Ethers.js provides a clean, minimal interface for interacting with Ethereum and has become increasingly popular among developers engaged in NFT development.

Key Ethers.js Features for NFT Integration

When working with NFTs, Ethers.js offers several advantages:

Provider Management: Easily connect to various Ethereum networks and providers

Contract Interaction: Streamlined interface for calling NFT contract functions

Event Handling: Subscribe to events like transfers and minting

Wallet Integration: Connect with browser wallets like MetaMask seamlessly

Transaction Management: Better handling of transaction status and errors

Implementation Strategy with Ethers.js

To integrate NFTs using Ethers.js, you would typically:

Create a provider connection to the Ethereum network

Connect to user wallets for transaction signing

Create contract instances for NFT contracts

Implement functions for key NFT operations

Set up event listeners for NFT transfers and other events

Ethers.js for NFT Metadata Handling

Ethers.js provides efficient tools for retrieving and processing NFT metadata:

Fetch token URIs from contracts

Resolve IPFS and other decentralized storage links

Parse JSON metadata and handle various formats

Efficiently batch metadata requests for collections

Working with NFTs Using Web3.js

Web3.js is the original Ethereum JavaScript API and still has a large user base in the NFT DEVELOPMENT community.

Key Web3.js Features for NFT Integration

Web3.js offers its own advantages for NFT integration:

Broader Ecosystem Support: Works with more Ethereum node types

Comprehensive Utilities: More built-in tools for common operations

Batch Requests: Native support for batching multiple contract calls

Subscription API: Real-time updates for blockchain events

Extensive Community Resources: More examples and tutorials available

Implementation Strategy with Web3.js

To integrate NFTs using Web3.js, your approach would typically include:

Set up a Web3 instance connected to an Ethereum provider

Request account access from the user's wallet

Initialize contract objects for NFT interactions

Implement functions for key NFT operations

Set up subscriptions for relevant blockchain events

Web3.js for NFT Ownership and Transfers

Web3.js provides robust tools for managing NFT ownership:

Checking token ownership across collections

Handling transfer approval workflows

Managing gas estimation for transfers

Processing transfer events for UI updates

Building an NFT Gallery Experience

A key part of NFT DEVELOPMENT is creating an engaging way to display NFTs to users.

Core Components of an NFT Gallery

An effective NFT gallery typically includes:

Grid or list views for displaying multiple NFTs

Detailed view for individual NFT information

Filtering and sorting options based on metadata

Loading states and placeholders for better UX

Interactive elements for NFT actions

Metadata Handling Strategies

NFT metadata can vary widely, so your application should be able to:

Handle different metadata schemas and formats

Deal with missing or malformed metadata gracefully

Support various media types (images, videos, 3D models)

Provide fallback displays when media can't be loaded

Cache metadata to improve loading performance

Performance Optimization

When displaying many NFTs, performance becomes crucial:

Implement virtualized lists for large collections

Lazy load images and media as they enter the viewport

Use caching for frequently accessed metadata

Implement pagination or infinite scrolling

Optimize media for fast loading

Comparing Ethers.js and Web3.js for NFT DEVELOPMENT

Both libraries have their strengths for NFT integration:

Ethers.js Advantages

More modern API design with cleaner abstractions

Better TypeScript support for safer development

Lower bundle size, which is better for frontend applications

More consistent error handling for better user experience

Simpler interfaces for common NFT tasks

Web3.js Advantages

Larger community and more examples to reference

More comprehensive documentation for various use cases

Broader ecosystem integration with existing tools

More established tooling and plugins

Support for more Ethereum node types and providers

For NFT DEVELOPMENT specifically, Ethers.js often provides a cleaner developer experience, but Web3.js may offer more pre-built tools and examples.

Advanced NFT Integration Features

Lazy Minting Concepts

Lazy minting is a cost-saving technique where NFTs aren't actually minted until someone buys them:

Creator generates metadata and signs it off-chain

Marketplace lists the "unminted" NFT with the signature

When a buyer purchases, they pay the gas fees for minting

The NFT is minted directly to the buyer's wallet

This approach significantly reduces costs for creators and marketplaces.

NFT Metadata Rendering Strategies

Advanced rendering of NFT metadata can improve user experience:

Display attributes and traits in visually appealing ways

Show rarity scores and collection statistics

Implement 3D viewers for compatible NFTs

Support audio NFTs with appropriate players

Enable animations for dynamic NFTs

Batch Operations for Collections

For applications dealing with multiple NFTs, batch operations can improve efficiency:

Group similar transactions to reduce gas costs

Implement parallel processing for metadata fetching

Use collection-wide operations when supported by contracts

Provide bulk action interfaces for users managing many NFTs

Best Practices for NFT Integration

As you develop your NFT features, keep these best practices in mind for successful NFT development:

Cache metadata when possible to reduce API calls and improve loading times

Implement fallback image handling for when IPFS or other storage is slow

Use event listeners to update UI when NFT ownership changes

Consider gasless transactions for a better user experience

Test thoroughly on testnets before deploying to mainnet

Implement proper error handling to guide users when transactions fail

Support multiple wallet providers for broader accessibility

Provide clear transaction feedback so users understand what's happening

Consider mobile experiences as many NFT users browse on mobile devices

Stay updated on new standards as the NFT ecosystem evolves rapidly

Security Considerations in NFT DEVELOPMENT

Security is paramount when dealing with valuable digital assets:

Contract Interaction Security

Always verify contract addresses before interaction

Implement spending limits and confirmation steps

Use established libraries for signature verification

Test extensively on testnets before mainnet deployment

Metadata Security

Validate metadata before displaying to prevent injection attacks

Implement secure handling of external URLs

Use content security policies for media display

Consider decentralized storage for metadata persistence

User Experience Security

Provide clear confirmation steps for all transactions

Show estimated gas costs before transaction submission

Implement timeout and retry mechanisms for failed transactions

Educate users about common NFT scams and security practices

Conclusion

Integrating NFTs into your Web3 dApp opens up exciting possibilities for digital ownership, creative expression, and new business models. Whether you choose Ethers.js or Web3.js depends on your specific requirements and preferences, but both libraries provide the tools needed for comprehensive NFT development.

Remember that the NFT landscape continues to evolve rapidly. New standards, marketplaces, and use cases emerge regularly. The best integrations will be those that combine technical excellence with a deep understanding of your users' needs and the unique value proposition of your dApp.

By following the approaches outlined in this guide, you'll be well on your way to creating compelling NFT experiences that engage users and showcase the true potential of Web3 technologies.

#game#mobile game development#multiplayer games#metaverse#gaming#vr games#blockchain#unity game development#NFT

1 note

·

View note

Text

NFT Top News: Latest Market Trends and Innovations with Coin Pulse HQ

Non-Fungible Tokens (NFTs) have persisted to revolutionize the virtual world, increasing beyond just artwork into gaming, real estate, music, or even social media. As new NFT traits emerge, investors, creators, and creditors want dependable resources for the ultra-modern insights. Coin Pulse HQ is at the forefront of handing over top NFT news, protecting market trends, upcoming tasks, regulatory updates, and essential sales.

In this article, we dive into the pinnacle NFT news, exploring the trendy traits shaping the enterprise and what the destiny holds for digital property.

NFT Market Trends: What’s Happening Now? The NFT marketplace has visible primary shifts over the last year, with new collections, technological improvements, and institutional adoption playing a vital function in its boom.

Blue-Chip NFT Top News Holding Strong Despite fluctuations within the broader crypto marketplace, blue-chip NFT top news like Bored Ape Yacht Club (BAYC), CryptoPunks, and Azuki maintain to dominate. According to Coin Pulse HQ, these collections preserve strong community assist and investor hobby, keeping their floor charges fantastically stable.

Gaming NFTs at the Rise The integration of NFTs into gaming has received big traction, with projects like Axie Infinity, The Sandbox, and Gods Unchained main the way. Play-to-Earn (P2E) models are evolving, providing gamers real monetary incentives. Coin Pulse HQ highlights that principal gaming corporations are actually investing in NFT-based economies, signaling lengthy-term growth in this sector.

AI-Generated NFTs Gaining Popularity Artificial intelligence (AI) has made its manner into the NFT area, enabling creators to generate unique, algorithmically crafted artistic endeavors. AI-powered NFT initiatives are pushing the limits of digital art, attracting both collectors and tech enthusiasts. Coin Pulse HQ reports that AI-generated NFTs have become a new trend, with platforms like Art Blocks leveraging generative generation to supply excessive-price portions.

NFT Sales and Celebrity Endorsements High-Value NFT Sales Making Headlines NFTs maintain to sell for extraordinary quantities, with creditors and buyers eager to personal uncommon virtual property. Coin Pulse HQ lately reported on a file-breaking NFT sale wherein a piece from Beeple’s latest series offered for thousands and thousands, reinforcing the strong call for for exceptional virtual artwork.

Celebrities and Brands Entering the NFT Space More celebrities and worldwide manufacturers are launching NFT collections, using mainstream adoption. Coin Pulse HQ covers most important figures like Snoop Dogg, Justin Bieber, and Paris Hilton, who have actively promoted NFT projects. Additionally, luxury brands which include Gucci and Nike are freeing unique NFT-based virtual belongings, providing specific reports for their audiences.

Regulatory Developments Impacting NFTs SEC Scrutiny and Legal Challenges As NFTs develop in reputation, regulatory bodies like the U.S. Securities and Exchange Commission (SEC) are analyzing their category. Coin Pulse HQ reviews that a few NFT initiatives are facing criminal challenges concerning their token systems, raising issues about whether or not positive NFTs should be categorized as securities.

Europe’s Approach to NFT Regulation The European Union’s Markets in Crypto-Assets (MiCA) law pursuits to create a framework for virtual belongings, such as NFTs. While nevertheless in development, Coin Pulse HQ notes that regulatory clarity in Europe may also help increase institutional self assurance in the NFT marketplace.

Asia’s Growing Influence in NFT Adoption Countries like Japan and South Korea are embracing NFTs with government-sponsored tasks. South Korea’s metaverse and NFT techniques suggest a long-time period imaginative and prescient for blockchain integration, as said through Coin Pulse HQ. Meanwhile, China is launching nation-sponsored digital collectibles, showcasing a different approach to NFT regulation.

Metaverse and Web3: The Future of NFTs Metaverse Projects Expanding NFT Use Cases The metaverse is a prime driving force of NFT adoption, with structures like Decentraland, The Sandbox, and Otherside permitting users to buy, promote, and trade digital land and belongings. Coin Pulse HQ reports that organizations are investing heavily in metaverse improvement, indicating a strong future for NFT application in digital worlds.

Web3 and Decentralized Ownership Web3 is remodeling how people engage with digital assets, giving customers more manipulate over their content and identity. NFT-based totally digital identities, memberships, and ticketing structures are gaining traction. Coin Pulse HQ highlights that decentralized platforms are integrating NFTs for one of a kind content material access and network engagement.

NFT Security and Challenges While the NFT space is booming, challenges such as safety risks and scams stay. Coin Pulse HQ emphasizes the significance of secure trading practices and secure wallets to protect virtual belongings.

Phishing Attacks and Fake Marketplaces Cybercriminals are concentrated on NFT holders through phishing scams and fraudulent marketplaces. Coin Pulse HQ warns users to confirm structures and use hardware wallets for brought security.

Intellectual Property Disputes The upward thrust of NFTs has led to disputes over ownership rights and copyright claims. Coin Pulse HQ reports that criminal frameworks are being developed to address those issues, ensuring honest safety for creators.

Conclusion NFTs preserve to form the digital financial system, expanding into new industries and attracting global attention. With pinnacle NFT information and expert insights from Coin Pulse HQ, investors and fanatics can live beforehand of marketplace traits and make knowledgeable choices.

From excessive-profile income and gaming NFTs to regulatory updates and metaverse integrations, the NFT area is evolving swiftly. Stay tuned to Coin Pulse HQ for the modern updates on NFT improvements and the way they're remodeling the future of digital ownership.

0 notes

Text

```markdown

Cryptocurrency Keyword Coverage: Understanding the Buzzwords in the Digital Currency World

In the rapidly evolving landscape of digital currencies, staying informed about the latest trends and terminologies is crucial. This article delves into some of the most commonly used keywords in the cryptocurrency space, providing you with a comprehensive guide to navigate this complex world.

Bitcoin (BTC)

Bitcoin, often referred to as the "king of cryptocurrencies," was the first decentralized digital currency. It operates on a peer-to-peer network that allows users to conduct transactions without the need for intermediaries like banks. Bitcoin's value has fluctuated significantly over the years, making it a popular investment choice for many.

Blockchain Technology

Blockchain technology is the backbone of cryptocurrencies. It is a distributed ledger that records all transactions across a network of computers. Each block in the chain contains a number of transactions, and every time a new transaction occurs on the blockchain, a record of that transaction is added to every participant’s ledger. This technology ensures transparency, security, and immutability.

Altcoins

Altcoins are alternative cryptocurrencies that have emerged after Bitcoin. These coins aim to improve upon Bitcoin's technology or serve different purposes. Some popular altcoins include Ethereum (ETH), Litecoin (LTC), and Ripple (XRP). Each has its unique features and use cases, contributing to the diversity of the cryptocurrency ecosystem.

Decentralized Finance (DeFi)

Decentralized finance, or DeFi, refers to financial services built on blockchain technology. Unlike traditional finance, which relies on centralized institutions, DeFi platforms allow users to lend, borrow, trade, and earn interest without intermediaries. This shift towards decentralization offers greater accessibility and potentially lower fees.

NFTs (Non-Fungible Tokens)

NFTs are unique digital assets that represent ownership of a piece of art, music, or other forms of media. Each NFT is stored on a blockchain, ensuring its authenticity and scarcity. The NFT market has exploded in recent years, with artists, musicians, and creators using this technology to monetize their work in innovative ways.

Mining

Mining is the process of verifying transactions on a blockchain and adding them to the public ledger. Miners use powerful computers to solve complex mathematical problems, and in return, they receive newly created cryptocurrencies as a reward. This process is essential for maintaining the integrity and security of the blockchain.

Wallets

A cryptocurrency wallet is a software program that stores your private and public keys, allowing you to send and receive cryptocurrencies. There are two main types of wallets: hot wallets, which are connected to the internet and offer easy access to funds, and cold wallets, which are offline and provide enhanced security.

Understanding these keywords is just the beginning of your journey into the world of cryptocurrencies. As the industry continues to evolve, keeping up with the latest developments will be key to making informed decisions.

What do you think?

Which cryptocurrency keyword do you find most intriguing? Share your thoughts and experiences in the comments below!

```

加飞机@yuantou2048

SEO优化

谷歌霸屏

0 notes

Text

Shaping Tomorrow: Top Crypto and AI Trends Today

The intersection of cryptocurrency, NFTs, and artificial intelligence (AI) is shaping the future of technology, finance, and culture. These transformative sectors are unlocking new possibilities, creating innovative solutions, and pushing boundaries across industries. From Bitcoin price fluctuations to the rise of generative AI and the explosion of digital collectibles, these trends are not just fleeting moments—they are the building blocks of tomorrow.

In this blog, we explore the latest developments in cryptocurrency, NFTs, and AI, and how they are converging to create new opportunities for investors, creators, and businesses alike.

1. Cryptocurrency: Revolutionizing the Financial Landscape

Cryptocurrency has moved beyond the early days of experimentation into becoming a mainstream financial tool. It is no longer just about Bitcoin; the entire ecosystem of crypto coins is evolving at an unprecedented rate, and its impact is being felt across industries.

A. Institutional Adoption of Crypto

From hedge funds to publicly traded companies, the interest in cryptocurrency among institutional investors continues to grow. Bitcoin remains the most popular asset, with large-scale players such as MicroStrategy and Tesla diversifying their portfolios with digital assets. The growing confidence in cryptocurrency is also reflected in its wider acceptance as a legitimate financial asset, attracting investors from around the world.

Stay up to date with the Bitcoin price today and explore crypto coin news today for the latest market shifts and trends.

B. The Rise of Central Bank Digital Currencies (CBDCs)

Central banks are launching their own digital currencies (CBDCs) as they seek to bring the benefits of cryptocurrency into the regulatory fold. These state-backed digital assets aim to provide greater security, reduced transaction costs, and more accessible financial systems. Leading economies, including China, Europe, and the United States, are now actively experimenting with or developing their own CBDCs, setting the stage for the future of digital currency.

C. Decentralized Finance (DeFi) – The Future of Banking

DeFi continues to grow as a driving force in the cryptocurrency space. By using blockchain technology, DeFi enables users to access financial services—such as lending, borrowing, and yield farming—without the need for traditional financial intermediaries like banks. This financial freedom, combined with enhanced transparency and reduced fees, is creating new opportunities for anyone with access to the internet.

For the latest in coins news crypto and Bitcoin news, visit CryptoVenture for real-time updates.

2. NFTs: Changing the Landscape of Digital Ownership

Non-Fungible Tokens (NFTs) are rapidly revolutionizing digital ownership. Initially, NFTs found fame through digital art, but now their applications are expanding into gaming, virtual real estate, and more. The unique ability of NFTs to verify ownership and authenticity has opened up entirely new markets and opportunities.

A. NFTs in Gaming and Virtual Real Estate

Games like Axie Infinity and platforms like Decentraland are at the forefront of the NFT revolution, where players buy, sell, and trade in-game assets and virtual land as NFTs. This shift towards virtual economies has created a new form of wealth creation in the digital world, with NFT-based assets becoming valuable commodities for gamers and investors alike.

B. Eco-Friendly NFTs: Sustainability Takes the Lead

As NFTs grow in popularity, concerns regarding their environmental impact have emerged. With Ethereum’s energy-intensive proof-of-work model, many NFT creators and collectors are seeking more sustainable solutions. Blockchain platforms like Tezos and Flow are offering environmentally friendly alternatives, ensuring that NFTs can thrive without compromising the planet.

3. Artificial Intelligence: Pushing the Boundaries of Innovation

AI is increasingly transforming how we approach technology, business, and creativity. Its applications span numerous industries, from healthcare and finance to entertainment and marketing. As AI continues to evolve, it is reshaping everything it touches, including cryptocurrency and NFTs.

A. Generative AI: Redefining Creative Possibilities

Generative AI is one of the most exciting developments in recent years, allowing machines to create art, music, text, and more. Tools like ChatGPT and DALL·E are enabling creators to produce high-quality content more efficiently and creatively. This technology has the potential to redefine what is possible in the creative industry, offering fresh opportunities for NFT creators and digital artists to explore new frontiers.

B. AI-Powered Trading and Crypto Investment

In the world of cryptocurrency, AI is playing an increasingly crucial role in trading. AI-powered platforms use machine learning algorithms to analyze massive amounts of market data, helping investors make more informed, data-driven decisions. This is especially beneficial in the fast-paced and volatile world of cryptocurrency, where Bitcoin and other coins can fluctuate dramatically within short periods.

For the latest Shiba Inu coin news and Bitcoin news, stay connected with CryptoVenture for up-to-date market trends and insights.

4. The Convergence: What Happens When Crypto, NFTs, and AI Meet?

As the worlds of cryptocurrency, NFTs, and AI continue to evolve, they are beginning to merge in unexpected and exciting ways. The intersection of these technologies promises to bring even greater innovation and opportunities.

A. AI-Driven NFTs and Digital Art

AI is playing an increasing role in the creation of NFTs, with algorithms now able to generate unique, high-quality digital artworks. This allows artists and creators to produce an endless variety of NFT assets that were previously unimaginable, broadening the horizons of digital art and ownership.

B. Smarter Crypto Trading with AI

In the fast-paced world of cryptocurrency, traders are now turning to AI for better analysis and prediction of market trends. By integrating AI with crypto trading strategies, users can automate their trading processes, make more accurate predictions, and ultimately maximize returns while minimizing risks.

C. Blockchain for AI Data Security and Privacy

The integration of AI with blockchain technology is enhancing privacy and data security. Blockchain ensures that user data remains encrypted, transparent, and tamper-proof, while AI enables the efficient processing of this data. This combination holds great potential for creating more secure digital platforms, where users can interact, transact, and share data without the risk of compromising privacy.

Conclusion: The Future Is Here

The rapid advancements in cryptocurrency, NFTs, and AI are not only changing the way we interact with technology, but they are also creating new opportunities for businesses, creators, and investors. By embracing these trends, individuals and companies can stay ahead of the curve in an increasingly digital and decentralized world.

For the latest updates on Bitcoin price today, coins news crypto, and Shiba Inu coin news, visit CryptoVenture for the most up-to-date insights. Whether you're a crypto enthusiast, an NFT creator, or an AI advocate, staying informed about these emerging trends will help you navigate the ever-changing landscape of digital innovation.

0 notes

Text

Innovative Token Solutions: How a Token Development Company Powers Digital Economies

In the ever-evolving landscape of digital economies, tokens have emerged as fundamental building blocks, driving innovation and transformation across various sectors. Token development companies play a pivotal role in shaping these digital ecosystems, offering innovative solutions that empower businesses and revolutionize how value is exchanged and managed. Here's a closer look at how these companies power digital economies with cutting-edge token solutions.

1. Revolutionizing Traditional Finance

Token development companies are at the forefront of transforming traditional finance through the introduction of digital tokens. These tokens represent various forms of value, including:

Stablecoins: Pegged to stable assets like fiat currencies, stablecoins offer a reliable medium of exchange and store of value within digital economies.

Security Tokens: Represent ownership in traditional assets like stocks and bonds, providing a bridge between traditional finance and blockchain technology.

Utility Tokens: Used within specific ecosystems to access services or products, driving engagement and adoption within digital platforms.

By developing these innovative tokens, companies enable new financial models and streamline transactions, making traditional financial systems more accessible and efficient.

2. Empowering Decentralized Finance (DeFi)

Decentralized Finance (DeFi) is a rapidly growing sector that leverages blockchain technology to recreate and enhance traditional financial services. Token development companies are instrumental in building and expanding the DeFi ecosystem by:

Creating DeFi Tokens: These include governance tokens that allow holders to participate in decision-making processes and liquidity tokens that facilitate decentralized exchanges (DEXs).

Developing Yield Farming Solutions: Tokens enable users to earn rewards by providing liquidity to decentralized protocols, driving liquidity and participation in the DeFi space.

Innovating Lending and Borrowing Platforms: Tokens power decentralized lending platforms, allowing users to lend or borrow assets without intermediaries.

By providing the infrastructure for DeFi, token development companies help democratize access to financial services and create new opportunities for users globally.

3. Facilitating Tokenized Assets

Tokenization is the process of converting physical or digital assets into blockchain-based tokens. This innovation is transforming asset management and investment by:

Fractional Ownership: Tokens enable fractional ownership of high-value assets like real estate, art, and collectibles, making them accessible to a broader audience.

Increased Liquidity: Tokenized assets can be traded on blockchain platforms, enhancing liquidity and allowing for faster and more efficient transactions.

Enhanced Transparency: Blockchain technology provides a transparent and immutable record of ownership, reducing fraud and increasing trust in asset transactions.

Token development companies are leading the way in asset tokenization, unlocking new investment possibilities and creating more inclusive financial markets.

4. Driving Innovation in Gaming and NFTs

The gaming industry and Non-Fungible Tokens (NFTs) are areas where token development companies are making significant strides:

Gaming Tokens: Tokens power in-game economies, enabling players to earn, spend, and trade digital assets within gaming ecosystems. This creates new revenue streams and enhances player engagement.

NFTs: Unique digital assets representing ownership of digital or physical items, NFTs are transforming how creators monetize their work and how collectors acquire and trade digital art, collectibles, and virtual goods.

By developing innovative token solutions for gaming and NFTs, companies are reshaping digital entertainment and providing new ways for creators and players to interact and transact.

5. Enhancing Supply Chain and Logistics

Token development companies are also applying blockchain technology to optimize supply chain and logistics management:

Tracking and Transparency: Tokens can represent goods and track their movement through the supply chain, providing real-time visibility and reducing the risk of fraud.

Smart Contracts: Automated agreements triggered by token transactions streamline processes such as payments, inventory management, and compliance checks.

These innovations improve efficiency, reduce costs, and enhance transparency in supply chain operations.

6. Enabling Community and Social Tokens

Community and social tokens are gaining popularity as tools for building and engaging communities:

Community Tokens: These tokens enable users to participate in and support community-driven projects, giving them a stake in the success and governance of the community.

Social Tokens: Issued by individuals or organizations, social tokens provide exclusive access to content, experiences, or benefits, fostering deeper connections between creators and their audiences.

Token development companies help create and manage these tokens, empowering communities and individuals to leverage blockchain technology for social impact and engagement.

7. Supporting Regulatory Compliance

Navigating the complex regulatory landscape is a crucial aspect of token development. Professional token development companies ensure that:

Compliance with Laws: Tokens are designed to meet legal requirements and adhere to relevant regulations, including securities laws and anti-money laundering (AML) standards.

Implementation of KYC/AML Measures: Necessary measures are integrated to verify the identity of users and prevent illicit activities.

By addressing regulatory challenges, token development companies help projects operate within legal frameworks and mitigate potential risks.

Conclusion

Token development companies are driving the evolution of digital economies through innovative solutions that enhance financial systems, empower new technologies, and create opportunities for diverse sectors. From transforming traditional finance and enabling DeFi to revolutionizing gaming, NFTs, and supply chain management, these companies play a crucial role in shaping the future of digital value and transactions. By leveraging their expertise and cutting-edge technology, token development companies are not only powering digital economies but also paving the way for a more inclusive and dynamic financial landscape.

0 notes

Text

Blockchain Market Share, Sales Channels and Overview Till 2030

The Blockchain Market once a niche segment reserved for tech enthusiasts and early adopters, has grown into a thriving global industry. From its humble beginnings as the underlying technology for Bitcoin, blockchain has expanded its reach across various sectors, transforming how we think about data, security, and transactions. As we navigate through 2024, the blockchain market continues to evolve, presenting new opportunities and challenges for businesses, investors, and developers alike.

The Growth of Blockchain Beyond Cryptocurrency

Initially, blockchain technology was synonymous with cryptocurrency, particularly Bitcoin. However, as the technology matured, its potential applications broadened significantly. Today, blockchain is being utilized in a wide range of industries, including finance, supply chain management, healthcare, real estate, and even entertainment.

Get a Sample Report: https://intentmarketresearch.com/request-sample/blockchain-market-3475.html

These platforms are democratizing access to financial services, particularly in regions where banking infrastructure is lacking. Additionally, central banks in various countries are exploring Central Bank Digital Currencies (CBDCs), which could revolutionize how governments issue and manage currency. Beyond finance, blockchain’s ability to provide transparent, immutable records has made it an invaluable tool in supply chain management. Companies are leveraging blockchain to track goods from origin to consumer, ensuring authenticity and reducing the risk of fraud. In healthcare, blockchain is being used to secure patient data and streamline the sharing of medical records, while in real estate, it is facilitating faster, more secure property transactions.

The Rise of NFTs and the Metaverse

Another significant development in the blockchain market is the rise of non-fungible tokens (NFTs) and their role in the burgeoning metaverse. NFTs are unique digital assets that represent ownership of a specific item or piece of content, often related to art, music, or virtual real estate. The explosion of interest in NFTs has not only provided artists and creators with new revenue streams but has also sparked a broader conversation about digital ownership and value.

The metaverse, a virtual world where users can interact, work, and play, is increasingly being built on blockchain technology. In this space, NFTs serve as the building blocks, allowing users to own and trade virtual assets. As companies like Meta (formerly Facebook) and other tech giants invest heavily in the metaverse, the integration of blockchain will likely become even more pronounced, opening up new markets and business models.

Challenges and Regulatory Landscape

Despite its rapid growth, the blockchain market faces several challenges, with regulatory uncertainty being one of the most significant. Governments around the world are grappling with how to regulate cryptocurrencies, DeFi platforms, and other blockchain-based services. The lack of clear regulatory frameworks can create uncertainty for businesses and investors, potentially slowing down adoption.

Moreover, blockchain technology is still relatively new, and scalability remains an issue. As blockchain networks grow, they often face challenges related to transaction speed and energy consumption. Solutions such as layer 2 protocols and more energy-efficient consensus mechanisms are being developed, but widespread implementation is still a work in progress.

Another challenge is the complexity of blockchain technology. For widespread adoption to occur, user-friendly interfaces and greater education about blockchain’s benefits and risks are needed. This includes not only understanding the technology itself but also the implications of decentralization, digital ownership, and the potential for disruptive innovation across industries.

Get an insights of Customization: https://intentmarketresearch.com/ask-for-customization/blockchain-market-3475.html

The Future of the Blockchain Market

Looking ahead, the future of the blockchain market is filled with potential. As technology continues to evolve and mature, we can expect to see even more innovative applications emerge. The integration of blockchain with other emerging technologies, such as artificial intelligence (AI) and the Internet of Things (IoT), could lead to new use cases and efficiencies across various sectors.