#OmnichannelRetail

Text

#POSsoftware#smartcashiersystem#retailmanagement#inventorycontrol#salesanalytics#pointofsaletechnology#cashiertraining#efficientcheckout#businessautomation#paymentprocessing#customerloyaltyprogram#cloudbasedpos#mobilepos#ecommerceintegration#contactlesspayments#omnichannelretail

2 notes

·

View notes

Text

Conquer the World: Unveiling SCDL's Program for International Retail Success

The retail industry has shed its national borders. The rise of e-commerce and a globally interconnected society have opened doors for retailers to expand their reach far beyond their domestic markets. But venturing into the international arena requires a unique skillset that goes beyond understanding product trends and managing inventory. The Retail Management Program at Symbiosis University Distance Education or SCDL in short, recognizes this reality and equips aspiring retail professionals with the knowledge and tools necessary to flourish in the dynamic world of global retail markets.

Beyond Borders: Exploring Global Retail Strategies and Markets

SCDL's curriculum delves deep into the intricacies of global retail strategies, providing you with a comprehensive understanding of the complexities involved. Here are some key areas you'll explore:

Understanding the Nuances of International Markets: This goes beyond mere geography. You'll analyze factors like cultural nuances, economic conditions, legal regulations, and consumer behavior that significantly impact retail operations in different countries. Understanding these factors allows you to tailor your strategies to resonate with local markets.

Global Sourcing and Supply Chain Management: Navigating the intricacies of international sourcing is crucial for successful global retail operations. SCDL's program helps you understand the complexities involved, including managing logistics across borders, navigating customs regulations, and ensuring ethical sourcing practices throughout your supply chain.

Omnichannel Strategies for a Global Audience: A successful omnichannel strategy in your home market might not translate seamlessly to a new region. The program equips you to adapt your omnichannel marketing and sales strategies to cater to diverse customer preferences across different continents. You'll learn how to leverage social media platforms popular in specific regions, tailor online content to local languages, and integrate physical stores with e-commerce platforms in a way that resonates with the target audience.

Global E-commerce Landscape: E-commerce presents both unique challenges and exciting opportunities in the global marketplace. The program equips you with the knowledge to navigate this dynamic landscape. You'll explore topics like cross-border e-commerce regulations, adapting to different payment methods, and managing international fulfillment strategies.

Learning from the Best: Case Studies of Retail Giants

SCDL's program doesn't just focus on theoretical knowledge. It brings the global retail landscape to life through in-depth case studies of international retail giants. By analyzing the strategies employed by successful companies like Walmart's meticulous planning for global expansion or IKEA's success in adapting its product offerings and store layouts to different cultures, you gain invaluable insights into navigating the global retail landscape with confidence.

Building Your Global Retail Toolkit: Essential Skills for Success

SCDL's program goes beyond equipping you with knowledge; it prepares you for a successful career in international retail management. Here's how:

Developing Intercultural Competence: Building strong relationships with international business partners and customers is crucial for success. The program emphasizes developing intercultural competence, the ability to understand and effectively interact with people from different cultures. You'll learn about cultural etiquette, communication styles, and how to navigate potential cultural clashes.

Mastering Global Business Communication Skills: Effective communication across cultures is paramount. You'll hone your communication skills to ensure your message is clearly understood by international audiences. This includes understanding nonverbal communication cues, adapting your writing style to different regions, and mastering the art of active listening.

Building a Global Network: SCDL's program fosters connections with industry professionals and potential employers with a global reach. You'll have opportunities to network with classmates from diverse backgrounds, participate in guest lectures from international retail leaders, and potentially engage in international internship programs. This network can be a game-changer when seeking opportunities in the international retail market.

Embracing the Global Challenge

The global retail landscape presents a world of exciting challenges and opportunities for ambitious professionals. SCDL's Retail Management Program equips you with the knowledge, skills, and global perspective to navigate this dynamic environment with confidence. By understanding international markets, learning from industry leaders, and developing the necessary competencies, you'll be well-positioned to conquer the world of global retail and carve a thriving career path on the international stage.

#GlobalRetail#RetailCareers#SCDL#InternationalBusiness#RetailManagementProgram#CareerDevelopment#BusinessGrowth#OmnichannelRetail#GlobalMarketing

0 notes

Text

How to 5x Your Revenue Using Diginyze

Unlock the full potential of your eCommerce store with Diginyze!

Explore the power of AI personalization, real-time analytics, and dynamic pricing.

From enhanced security to advanced inventory management, and seamless omnichannel experiences, everything you need for exponential growth is right here.

Join the future of eCommerce with Diginyze and see your revenue soar.

Learn more: https://www.diginyze.com/blog/how-to-5x-your-revenue-using-diginyze/

#Infographic#Diginyze#GrowWithDiginyze#AIeCommerce#Sales#RetailTech#RevenueGrowth#eCommerceSuccess#DigitalTransformation#FutureOfRetail#CustomerExperience#OnlineBusiness#Personalization#MarketingAutomation#SecureShopping#BusinessIntelligence#InventoryManagement#OmnichannelRetail#EcommerceSecurity#DataDrivenDecisions#DynamicPricing

0 notes

Text

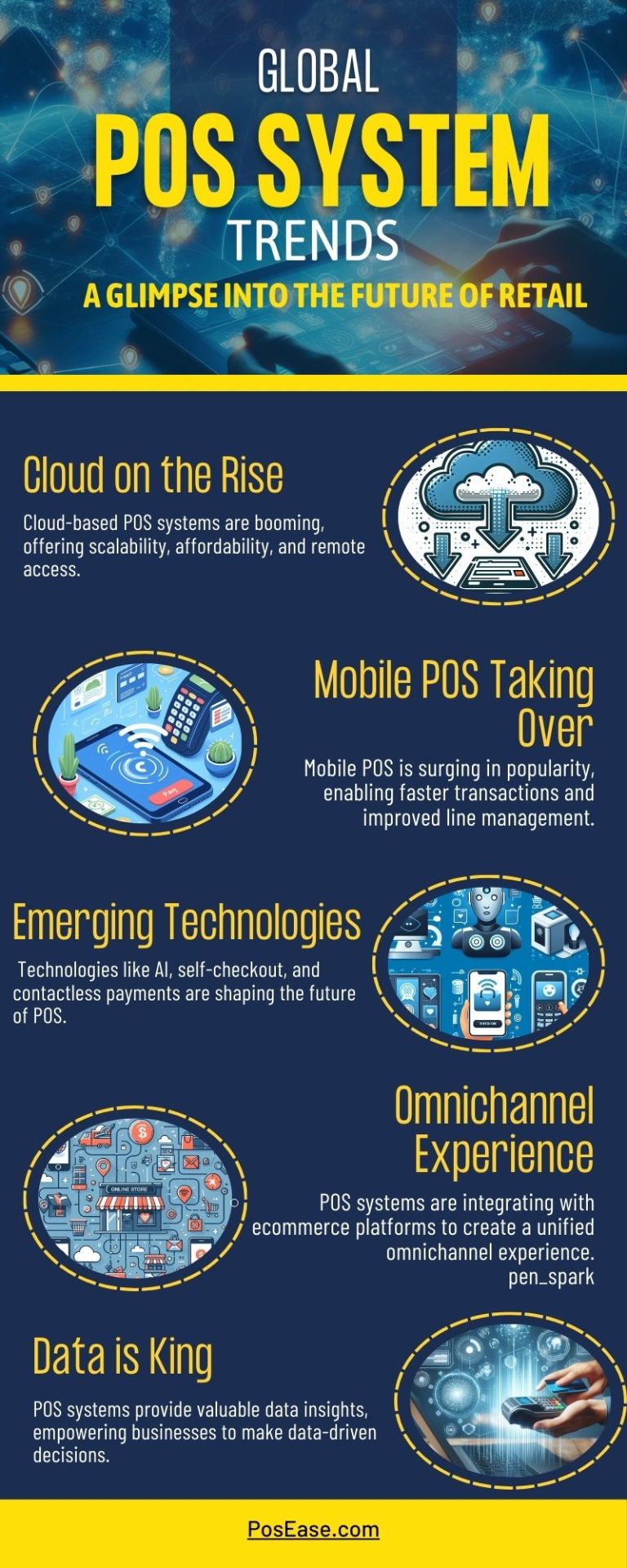

Global POS System Trends: A Glimpse into the Future of Retail

Global POS systems are on the rise! This infographic explores key trends shaping the future, like cloud-based solutions, mobile adoption, and cutting-edge tech. Discover how these trends impact omnichannel experiences, data insights, and global compliance.

#retailtech#pos#point-of-sale#globalbusiness#omnichannel#cloudpos#mobilepos#cuttingedgetech#omnichannelretail#datainsights#globalcompliance

0 notes

Text

youtube

All-In-One Retail Software Solutions - POS, CRM, ERP, Omnichannel | RETAIL IT SOLUTIONS

As a retail software development company, we offer IT and technology solutions for POS, ERP, CRM, E-commerce, inventory management, omnichannel strategy, supply chain, and online shops.

Retail Solutions

Retail Software Development Company

Retail Software Solutions

Retail POS Software

Retail ERP Software

Retail CRM Software

Retail Inventory Software

Software for Retail Shop

Retail Management System

Retail Inventory Management Software

Retail Technology Solution

#retailmanagement#ecommerce#POS#retail software#retailtechnology#omnichannelretail#retailinnovation#retailAI#retailERP#retailCRM#retailWMS#retailPOS#retailindustry#retailtrends#retailfuture#Youtube

0 notes

Text

From Brick-and-Mortar to Click-and-Order: Exploring E-commerce's Impact

youtube

Introduction

In the ever-evolving landscape of the retail industry, a significant transformation has taken place over the past couple of decades. The traditional brick-and-mortar stores that once dominated the marketplace have been increasingly challenged by the rapid growth of e-commerce. Today, we explore the profound impact of e-commerce on the retail world and how it has reshaped the way consumers shop.

The Rise of E-commerce

The rise of e-commerce can be attributed to the convergence of technological advancements, changing consumer behaviors, and the convenience it offers. With the advent of the internet, consumers gained access to an unlimited marketplace, allowing them to shop from the comfort of their homes, at any time of day or night. The online shopping experience has become synonymous with convenience and ease, which has been a driving force behind its meteoric rise.

Challenges for Brick-and-Mortar Retail

Traditional brick-and-mortar retailers have faced several challenges as a result of the e-commerce boom. The most significant of these is the competition for consumer attention and dollars. As e-commerce platforms continue to expand their offerings and improve user experiences, they attract a growing share of customers who might have otherwise shopped at physical stores.

Furthermore, e-commerce has expanded the geographical reach of retail, enabling consumers to buy products from around the world. This has prompted many brick-and-mortar stores to innovate and adapt their business models to remain competitive.

Consumer Benefits of E-commerce

E-commerce has brought numerous advantages to consumers. It offers a broader selection of products and brands, often at more competitive prices due to reduced overhead costs. Additionally, the convenience of browsing, comparing, and ordering products online has revolutionized the way we shop. This shift has made it easier for individuals with busy schedules or limited mobility to access a wide range of products and services.

The Omnichannel Approach

Many traditional retailers have recognized the importance of embracing an omnichannel approach. This strategy combines their physical stores with an online presence, allowing them to meet consumers wherever they prefer to shop. It enables customers to research products online and then make in-store purchases or vice versa. This blending of online and offline experiences has become vital for the survival and growth of brick-and-mortar retail.

Impact on Local Communities

While e-commerce has undoubtedly transformed the retail landscape, it has also had an impact on local communities. The decline of traditional stores in some areas has resulted in job losses and vacant storefronts. This has prompted discussions about the importance of supporting local businesses and finding ways to ensure their continued success in the digital age.

Conclusion

E-commerce's impact on traditional brick-and-mortar retail is undeniable. The convenience, accessibility, and vast product offerings of online shopping have reshaped consumer behavior and the retail industry as a whole. As the retail landscape continues to evolve, it's clear that both online and offline retailers will need to adapt and find ways to coexist in this new era of consumer choice.

In the end, it's not necessarily a competition between e-commerce and brick-and-mortar, but rather a call for innovation, adaptation, and providing consumers with the shopping experiences they desire. The future of retail is likely to be a dynamic fusion of both, where consumers can enjoy the best of both worlds.

#EcommerceImpact#RetailTransformation#BrickAndMortar#Ecommerce#RetailRevolution#OmnichannelRetail#LocalBusinessSupport#OnlineShopping#ConsumerBehavior#RetailInnovation#ShopLocal#EcommerceTrends#DigitalRetail#ShoppingHabits#RetailAdaptation#FutureOfRetail#ClickAndOrder#RetailTechnology#EcommerceGrowth#RetailSurvival#EcommercevsRetail#Youtube

1 note

·

View note

Text

𝗧𝗵𝗲 𝗣𝗼𝘄𝗲𝗿 𝗼𝗳 𝗢𝗺𝗻𝗶𝗰𝗵𝗮𝗻𝗻𝗲𝗹

Want to develop a strong omnichannel strategy? Take these 4 steps?

🆅🅸🆂🅸🆃:https://www.indglobaldigital.com/ecommerce-development/omni-channel-ecommerce-development-company/

#indglobaldigital#omnichannel#omnichannelmarketing#omnichannelretail#omnichannelstrategy#omnichannelexperience#omnichannelconcept#omnichannelselling#omnichannelsolutions#omnichannelservices#omnichannelcrm

0 notes

Text

Retail Sector's Rollercoaster Ride: How COVID-19 Changed Shopping and What it Means for Investors

#consumerspending #COVID19pandemic #discountstores #homeimprovementstores #longtermoutlook #mallbasedapparel #omnichannelretailing #retailindustryperformance #retailsector #retailstocks

#Business#consumerspending#COVID19pandemic#discountstores#homeimprovementstores#longtermoutlook#mallbasedapparel#omnichannelretailing#retailindustryperformance#retailsector#retailstocks

0 notes

Text

Evolution of Retail Consumers in Mexico

Written By: Gargi Sarma

Success in today's dynamic retail environment depends critically on recognizing and meeting customers' changing demands and preferences. This is particularly true in Mexico's dynamic market, where urbanization, shifting demographics, and changes in consumer behavior are transforming the retail industry.

The growing need for convenience is one of the major themes influencing consumer behavior in Mexico. Convenience is given top priority when making purchases by modern consumers due to their hectic schedules and high standards. Time is becoming more and more of a limited resource, which is driven by several causes such as urbanization, longer working hours, and the development of dual-income households.

Figure 1: Online Acceleration in Mexico, 2022 (Source: McKinsey & Company)

In contrast to pre-pandemic levels, online sales of books and consumer electronics rose significantly in Mexico, and despite flat global demand, a wide range of consumer products showed a shift in sales to e-commerce platforms as a result of the pandemic (Figure 1).

Market Dynamics:

The Mexican convenience store market is expected to grow at a CAGR of 5.4% from 2022 to 2027. This growth is being driven by several factors, including the increasing urbanization of the Mexican population, the rising disposable incomes of Mexican consumers, and the growing popularity of convenience shopping.

The new Mexican consumer is younger, more tech-savvy, and more demanding than previous generations. They are looking for convenient shopping experiences that are tailored to their needs and preferences.

Retailers need to adopt new business models to cater to the new Mexican consumer. This includes offering a wider variety of products and services, providing more convenient shopping options, and using technology to personalize the shopping experience.

Knowing Consumer Values: Two Mexicos, One Growing Middle Class

Mexico's Duality: A clear image of economic and social inequality is painted by the idea of two Mexicos: one established and formal, and the other less developed and informal. A growing middle class made up of customers from both sides, who individually cling to their values while looking for goods and services that speak to them, is the unifying factor within this complex terrain.

Recognizing the Principles: Although the story of "Two Mexicos" depicts general economic realities, it's important to keep in mind that customers within each category are not monolithic groups. The middle class has a wide range of complex and varied values and goals.

From Mexico's Developed States:

Aspiration for modernity: Customers look for cutting-edge technology and fashionable, well-known brands worldwide.

Appreciate quality and experience: They place a high priority on upscale goods, practicality, and individualized care.

Awareness of one's well-being and health: Eco-friendly, sustainable, and organic products are popular.

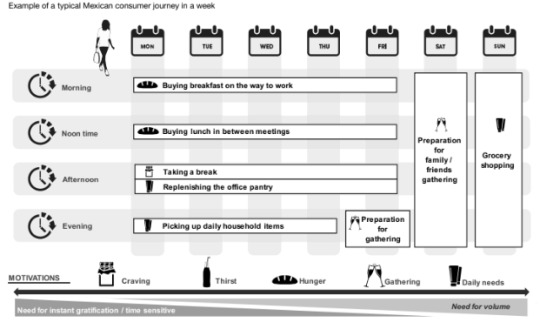

Figure 2: Example of A Typical Mexican Consumer Journey in a Week (Source: PwC)

From Mexico informally:

Value for money: Practicality and affordability should be prioritized, along with budget consciousness.;

Community and trust are important Strong relationships are formed between known stores and local brands.

Entrepreneurial spirit: Do-it-yourself projects and resourcefulness are highly valued.

Filling the Void: Comprehending these distinctions in values is imperative for companies targeting the expanding middle class. Effective tactics will not only copy models from "Mexico," but instead provide a range of goods and services: Appeal to premium and cost-conscious markets.

Adopt omnichannel tactics: For ease of use and accessibility, integrate physical and online experiences.

Bring new ideas to the local market: Adjust international patterns to suit local tastes and circumstances.

Establish community and trust: Join forces with nearby companies and participate in neighborhood projects.

The New Mexican Consumer:

Tech-savvy and mobile: This group is comfortable using online tools for shopping, research, and payments. They expect seamless omnichannel experiences.

Time-pressed: Juggling work, family, and social commitments, they value convenience and speed. They're more likely to make smaller, frequent purchases than large, infrequent ones.

Value-conscious: They seek quality products at affordable prices. Private-label brands and value packs can be appealing.

Digitally connected: They rely on social media and online reviews for information and recommendations. Building a strong online presence is crucial.

Mexican Consumers Look to E-commerce for Better Prices:

Mexican consumers, particularly younger generations, are increasingly turning to e-commerce for their shopping needs, driven by the allure of better prices. This trend is fueled by several factors, including rising inflation, growing internet access, and the convenience of mobile shopping. Platforms like Mercado Libre and Amazon are attracting new users seeking deals and wider product selection compared to traditional brick-and-mortar stores. While brand loyalty remains important, price sensitivity is driving the shift, with savvy shoppers comparing prices across platforms before making a purchase. This trend presents both challenges and opportunities for businesses, requiring them to adapt their online strategies to offer competitive pricing, seamless buying experiences, and robust logistics networks to meet the expectations of the evolving Mexican consumer.

Figure 3: Top Reasons For Buying Food and Household Supplies Online, Mexico (2023)

In Figure 3, according to the McKinsey Survey, the results between the pre-COVID-19 pandemic and early 2023, it was revealed that although it is no longer the primary means of purchase for Mexican consumers as it was during the pandemic, online shopping nevertheless accounts for a larger portion of purchases than it did before the outbreak: 17 percent of respondents say they shop online for most or all of their purchases, up from 15 percent of prepandemic respondents. Customers claim that the main reason they shop online is the price: they can locate more affordable goods, take advantage of larger discounts, and quickly compare costs across various merchants. Online purchasing is convenient for them as well. However, they do have some reservations about online shopping. These reservations stem from the potential for defective or damaged goods to arrive, mismatches between what is advertised online and what is received, and expensive delivery or shipping costs.

Figure 4: Share of Respondents Reporting That They Buy Products Online Most of the Time Or Always, By Category, Mexico (2023)

According to the McKinsey Survey (Figure 4), the results between the pre-COVID-19 pandemic and early 2023, it was revealed that the mentioned categories saw the largest movement away from traditional brick-and-mortar stores and toward online shopping: cosmetics, consumer electronics, and toys and infant supplies. These tendencies have a resemblance to e-commerce patterns observed in developed markets.

Going Beyond Division:

It's critical to keep in mind that distinctions between the "two Mexicos" are becoming more hazy. As consumers become more knowledgeable and connected, hybrid values—which combine old sensibilities with modern aspirations—become more prevalent.

Through identification of this dynamic and comprehension of the varied values held by the emerging middle class, companies can seize enormous prospects inside the Mexican market.

Prioritizing ease in their goods and strategies is crucial for merchants hoping to win over the attention and allegiance of the new Mexican consumer. The following are some crucial tactics that retailers should use:

Optimized Store Formats: To improve customer convenience, retailers can rethink their store layouts. To make shopping more efficient, this involves placing products in strategic locations, having clear signage, and having a simple navigation system. Convenience can be further improved by providing options like click-and-collect or in-store pickup for online orders.

E-commerce and Delivery Services: E-commerce is expanding quickly in Mexico as a result of the country's rising smartphone and internet connectivity rates. By making investments in reliable online platforms and effective delivery services, retailers may profit from this trend. Options for same-day or next-day delivery can greatly increase convenience for customers who would rather purchase from home.

Localized Assortments: By ensuring that customers can locate the items they need without having to search far, localized product assortments can increase convenience by taking into account regional preferences. In order to appeal to various customer segments, merchants provide a variety of payment choices as part of their specialized approach.

Technology Integration: You may improve convenience and expedite the shopping process by utilizing technology, such as digital loyalty programs, self-checkout kiosks, and mobile apps. Mobile apps, for example, can save users time and effort by offering tailored suggestions, instant inventory updates, and easy payment processes.

Convenient Payment Solutions: Offering digital wallets, installment plans, and contactless payment choices can streamline the payment process, reducing friction at the point of sale and improving customer convenience. Additionally, loyalty programs that offer discounts for regular purchases might encourage recurring business.

Emphasis on Accessibility: Providing a really easy shopping experience requires ensuring accessibility for all customers, especially those with special needs or disabilities. This entails taking into account things like wheelchair accessibility, unambiguous signage, and assistance services to let clients successfully explore the store.

Conclusion:

In summary, convenience is now a need for merchants hoping to succeed in Mexico's cutthroat market rather than merely a nice-to-have. Through the implementation of tactics that cater to the needs of the New Mexican Consumer and a focus on convenience, businesses may foster customer loyalty, increase customer happiness, and ultimately thrive in the dynamic retail industry.

About RapidPricer

RapidPricer helps automate pricing and promotions for retailers. The company has capabilities in retail pricing, artificial intelligence and deep learning to compute merchandising actions for real-time execution in a retail environment.

Contact info:

Website: https://www.rapidpricer.com/

LinkedIn: https://www.linkedin.com/company/rapidpricer/

Email: [email protected]

#retailevolution hashtag#mexicanconsumers hashtag#convenienceshopping hashtag#ecommercetrends hashtag#techsavvyconsumers hashtag#urbanizationimpact hashtag#middleclassgrowth hashtag#consumerbehavior hashtag#omnichannelretail hashtag#mexicanmarket hashtag#digitaltransformation hashtag#onlineshopping hashtag#customerexperience hashtag#retailindustry hashtag#pricesensitivity hashtag#brandloyalty hashtag#convenientpaymentoptions hashtag#localizedassortments hashtag#mobileshopping hashtag#retailinnovation hashtag#marketdynamics hashtag#mexicaneconomy hashtag#digitalloyaltyprograms#hashtag#ConvenientPaymentMethods#CustomerSatisfaction#RetailTechnology#EconomicTrends#CustomerConvenience#MexicanRetail

0 notes

Text

Evolution of Retail in India

Written by: Jagriti Shahi, Business Analyst at Global Launch Base

The retail industry in India has undergone significant evolution over the years, driven by factors such as economic growth, urbanization, changing consumer preferences, technological advancements, and government policies. The retail industry in India has evolved significantly over the years. The early days of retailing in India were dominated by small, independent mom-and-pop stores and Kirana stores. These stores catered to the needs of the local community and offered a limited range of products.

In the 1990s, the Indian economy liberalized, which led to the entry of foreign retailers into the Indian market. These retailers brought with them new concepts and practices, such as large format stores, supermarkets, and hypermarkets. This led to the growth of the organized retail sector in India.

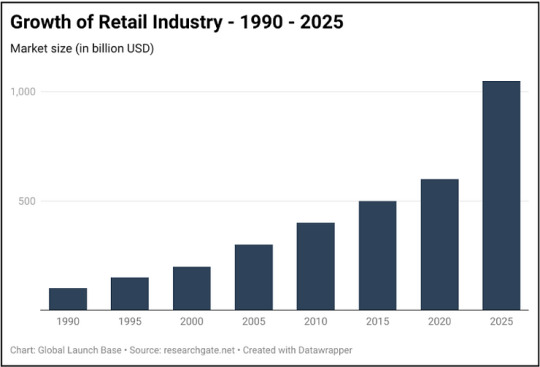

Figure 1: Expected Growth of Retail Industry till 2025

The market size of the Indian retail market is expected to grow at a compound annual growth rate (CAGR) of 10% from 2022 to 2025. This growth is being driven by a number of factors, including the growing population, rising incomes, and increasing urbanization.

The Indian retail industry is expected to continue to grow in the coming years. The factors driving this growth include increasing urbanization, rising disposable incomes, and growing consumer demand for convenience.

Here's an overview of the evolution of retail in India:

Traditional Retail (Pre-1990s)

Figure 2: Traditional Retail Store

Traditional retail in India refers to the practice of selling products or services through physical stores, such as mom-and-pop stores, Kirana stores, bazaars, and weekly markets. These stores are typically small and family-owned, and they offer a limited range of products. They are often located in residential areas and cater to the needs of the local community.

Figure 3: Kirana Stores

Kirana stores: Kirana stores are small, neighborhood grocery stores that sell a variety of food items, household goods, and other necessities. They are often family-owned and operated, and they play an important role in the daily lives of many Indians.

Figure 4: Weekly Markets

Weekly markets: Weekly markets are held in different parts of the city on a weekly basis. They sell a variety of goods, including fresh produce, meat, fish, and other food items. Weekly markets are a popular place for people to buy their groceries and other household items.

Figure 5: Street Shops

Street shops: Street shops are small, open-air shops that line the streets of many Indian cities. They sell a variety of goods, including clothing, jewellery, souvenirs, and other items. Street shops are a popular place for tourists to buy souvenirs and other items.

Figure 6: Hawkers

Hawkers: Hawkers are street vendors who sell a variety of goods, including food, drinks, and other items. They often move around from place to place, and they are a common sight in many Indian cities.

Figure 7: Public Distribution System

Public distribution system: The public distribution system (PDS) is a government-run program that provides essential food items to low-income households. The PDS operates through a network of ration shops, which are small, government-run stores that sell subsidized food items.

Economic Liberalization (1990s)

India's economic reforms in the 1990s opened the doors for foreign direct investment (FDI) and led to the emergence of modern retail formats. Brands like McDonald's and Pizza Hut entered the Indian market during this time. However, organized retail remained limited due to challenges such as infrastructure constraints, regulatory hurdles, and consumer preferences for familiar traditional shopping experiences.

Figure 8: Shopping Malls in India

The 2000s witnessed the growth of shopping malls in major cities. These malls housed a mix of international and domestic brands, along with entertainment and dining options. The mall culture changed the way Indians shopped, providing a one-stop destination for shopping and leisure.

The rise of shopping malls in the 2000s was driven by a number of factors, including:

The growth of the middle class in developing countries, such as India and China, led to an increase in demand for Western-style shopping experiences.

The rise of e-commerce had a limited impact on the mall industry in the early 2000s, as many consumers still preferred to shop in person.

Malls were seen as a safe and convenient place to shop, especially for families.

Malls offered a variety of entertainment options, such as movie theaters, food courts, and arcades, which made them a popular destination for people of all ages.

As a result of these factors, the number of shopping malls in the world grew rapidly in the 2000s. In India, for example, the number of malls increased from 3 in 2000 to over 650 in 2022.

However, the rise of e-commerce in the late 2000s and early 2010s began to have a negative impact on the mall industry. As more and more people started shopping online, mall traffic declined. This trend was exacerbated by the COVID-19 pandemic, which forced many malls to close temporarily.

As a result, the mall industry is facing a number of challenges in the 2020s. Malls are having to adapt to the changing retail landscape by offering more experiential and interactive experiences, such as food halls, art installations, and fitness centers. They are also trying to attract more foot traffic by partnering with non-retail businesses, such as healthcare providers and coworking spaces.

Only time will tell whether the mall industry will be able to survive the challenges of the 2020s. However, the rise of shopping malls in the 2000s is a testament to their ability to adapt to changing consumer trends.

Modern Retail Formats (2000s-2010s): Large-format retail stores like Big Bazaar, Reliance Retail, and others introduced modern retail concepts, offering a variety of products under one roof. These stores aimed to provide convenience, value, and a wide range of options to consumers.

Here are some of the modern retail formats that emerged in the 2000s and 2010s:

E-commerce: This is the sale of goods and services over the Internet. E-commerce has grown rapidly in recent years and is now a major force in the retail industry.

Omnichannel retailing: This refers to the integration of online and offline retail channels. Omnichannel retailers offer customers the ability to shop online, in-store, or through a combination of both channels.

Pop-up stores: These are temporary retail stores that are typically open for a short period of time, such as a few weeks or months. Pop-up stores are often used by brands to test new products or concepts or to reach a specific target audience.

Warehouse clubs: These are large-scale retailers that offer members discounted prices on a variety of goods. Warehouse clubs typically require an annual membership fee.

Factory outlets: These are stores that sell discounted merchandise, such as overstock, discontinued items, and seconds. Factory outlets are often located in outlet malls.

Membership-based retailers: These are retailers that require customers to pay a membership fee in order to shop. Membership-based retailers typically offer exclusive benefits to members, such as discounts, free shipping, and early access to new products.

Social commerce: This is the use of social media platforms to sell goods and services. Social commerce has grown in popularity in recent years, as more and more people use social media to shop.

Blurring of the lines between retail and entertainment: Retailers are increasingly incorporating entertainment elements into their stores, such as arcades, game rooms, and food courts. This is done in an effort to make shopping more fun and engaging for customers.

E-commerce Boom (2010s): The advent of the internet and the rise of e-commerce platforms like Flipkart, Amazon, and Snapdeal brought a transformative change to the retail landscape. E-commerce offers consumers the convenience of shopping from home, a vast array of products, and attractive discounts. The growth of smartphones and improved internet connectivity further accelerated the adoption of online shopping.

The e-commerce boom in India began in the early 2010s, driven by a number of factors, including:

The increasing availability of high-speed internet

The growth of the Indian middle class

The rise of smartphones

The government's pro-business policies

In 2010, the Indian e-commerce market was worth just $3.9 billion. By 2022, it had grown to $84.5 billion, making India the second-largest e-commerce market in the world after China.

The growth of e-commerce in India has had a major impact on the economy. It has created jobs, boosted exports, and helped to bring down prices for consumers. It has also helped to connect rural areas with the rest of the country.

Some of the major players in the Indian e-commerce market include:

Flipkart

Amazon

Paytm Mall

Snapdeal

Myntra

Nykaa

BigBasket

Grofers

Udaan

Zilingo

These companies offer a wide range of products and services, including electronics, fashion, groceries, home goods, and travel. They have also expanded into new areas, such as food delivery and online payments.

The e-commerce boom in India is still in its early stages. It is expected to continue to grow in the coming years, driven by the factors mentioned above. This growth will have a positive impact on the Indian economy and society.

Here are some of the key impacts of the e-commerce boom in India:

Increased access to goods and services: E-commerce has made it possible for people in rural areas and smaller towns to access a wider range of goods and services than ever before.

Increased competition: The entry of new players into the e-commerce market has led to increased competition, which has benefited consumers in the form of lower prices and better-quality products.

Job creation: The e-commerce sector has created millions of jobs in India, both directly and indirectly.

Increased tax revenue: The government has been able to collect more tax revenue from the e-commerce sector.

Improved logistics: The e-commerce boom has led to the development of better logistics infrastructure in India, which has benefited other sectors of the economy as well.

Overall, the e-commerce boom has been a positive force for the Indian economy and society. It has helped to improve the lives of millions of people and has boosted the country's economic growth.

Omni-Channel Retailing: Retailers started adopting omni-channel strategies, integrating physical stores with online platforms. This approach allowed consumers to research products online and make purchases either online or in-store. Retailers like Tata Group's Croma and fashion brands implemented these strategies to provide a seamless shopping experience.

Omni-channel retailing has gained significant traction in India as the country's retail landscape continues to evolve and adapt to changing consumer preferences and technological advancements. Indian retailers have embraced omni-channel strategies to provide customers with seamless and personalized shopping experiences across various channels. Here's how omni-channel retailing is shaping up in India:

E-commerce Pioneers: India's booming e-commerce sector has been at the forefront of omni-channel adoption. Leading e-commerce platforms like Flipkart, Amazon India, and Snapdeal have expanded their offerings to include not only online marketplaces but also BOPIS (Buy Online, Pick Up In-Store) options and partnerships with brick-and-mortar stores for faster deliveries.

Traditional Retailers Going Digital: Traditional retailers have recognized the importance of digital transformation. Many established brick-and-mortar brands have launched their own e-commerce websites and mobile apps to cater to the growing online shopper base. For instance, retail chains like Shoppers Stop, Reliance Retail, and Tata-owned Croma have developed omni-channel strategies to bridge the gap between offline and online shopping.

Click-and-Mortar Stores: Some Indian retailers have adopted the "click-and-mortar" approach, wherein they maintain both physical stores and robust online platforms. This approach allows customers to seamlessly move between online and offline channels. Brands like Nykaa, a cosmetics and beauty retailer, have successfully combined their e-commerce presence with offline stores to offer customers a comprehensive shopping experience.

Fashion and Lifestyle Industry: The fashion and lifestyle sector in India has been a key driver of omni-channel strategies. Leading fashion brands like Myntra, Lifestyle, and FabIndia have integrated their online and offline operations, offering customers options like trying on clothes in-store before ordering online or making online purchases and returning items to physical stores.

Mobile-First Approach: With the increasing penetration of smartphones in India, mobile apps have become a crucial aspect of omni-channel strategies. Retailers focus on creating user-friendly and responsive apps that allow customers to browse, shop, and track orders on their mobile devices.

Personalization and Loyalty Programs: Indian retailers are leveraging customer data to offer personalized recommendations, discounts, and promotions. Loyalty programs that span across online and offline channels encourage repeat business and brand loyalty.

Challenges: While omni-channel retailing is on the rise in India, challenges such as inadequate technology infrastructure, supply chain complexities, and varying levels of digital literacy in different regions still exist. Retailers need to tailor their omni-channel strategies to suit the diverse Indian market.

Government Regulations: Indian regulations around e-commerce and foreign direct investment (FDI) have influenced how some companies implement omni-channel strategies, particularly in the multi-brand retail segment. Regulations may impact how international brands and retailers establish their presence in India.

Future Outlook: As technology continues to advance and consumer expectations evolve, omni-channel retailing is expected to play an increasingly vital role in the Indian retail sector. Retailers will likely continue to invest in technology, data analytics, and personalized experiences to create a seamless and convenient shopping journey for customers across various channels.

Rural Retail Expansion

Figure 9: Rural Retail

Here are some key points to consider in the context of rural retail expansion:

Rationale for Rural Retail Expansion:

Untapped Market Potential: Rural areas often have a large population that can be a significant consumer base. As rural incomes rise and lifestyles change, there is a growing demand for a wide range of products.

Increased Purchasing Power: With the expansion of agriculture, government schemes, and remittances from urban areas, rural consumers have more disposable income to spend on goods and services.

Market Saturation in Urban Areas: In many cases, urban markets may have become saturated or highly competitive, prompting retailers to explore new growth opportunities in rural regions.

Government Initiatives: Various government initiatives aimed at rural development and financial inclusion can boost rural purchasing power and create an enabling environment for retail expansion.

Strategies for Successful Rural Retail Expansion:

Local Understanding: Successful expansion requires a deep understanding of the local culture, preferences, and consumer behavior in rural areas. What works in urban markets may not necessarily work in rural regions.

Product Localization: Tailoring product offerings to suit local tastes and needs is crucial. This may involve introducing smaller pack sizes, adapting to local preferences, and offering products that are relevant to rural lifestyles.

Distribution Networks: Establishing efficient and cost-effective distribution networks is essential. This might involve partnerships with local distributors, leveraging existing local retailers, or using innovative delivery methods.

Affordability: Rural consumers are often more price-sensitive than their urban counterparts. Offering affordable options and value for money is critical to gaining their trust and loyalty.

Education and Awareness: Rural consumers might not be familiar with certain products or brands. Providing information and education about the benefits and usage of products can drive adoption.

Localized Marketing: Customizing marketing campaigns to resonate with rural consumers' aspirations, values, and cultural nuances can help build a strong brand presence.

Technology Adoption: Leveraging technology, especially mobile phones, can be a powerful tool for reaching rural consumers. Mobile apps, SMS campaigns, and digital platforms can facilitate engagement.

Financial Inclusion: Introducing payment options that align with rural consumers' financial cycles and offering credit or installment payment plans can enhance affordability.

Challenges of Rural Retail Expansion:

Infrastructure: Poor roads, inadequate transportation, and lack of basic amenities can pose logistical challenges.

Lack of Awareness: Rural consumers might not be aware of new products or brands, necessitating efforts to build awareness and educate them.

Distribution Challenges: Reaching remote areas with limited connectivity can be challenging, impacting the efficiency of distribution networks.

Cultural Sensitivity: Diverse cultures and languages in different rural regions require a sensitive and localized approach to marketing and communication.

Grocery and Fresh Retail: The grocery segment saw significant transformation with players like BigBasket and Grofers offering online grocery delivery services. Additionally, numerous hypermarkets and supermarkets entered the scene, catering to consumers' demand for fresh produce and convenience.

Key Characteristics:

Essential Goods: Grocery and fresh retail primarily deals with essential food items and household consumables that people need on a regular basis.

Perishable Items: A significant portion of the products sold in this segment are perishable, which requires careful management of inventory, supply chain, and storage to maintain product quality and reduce wastage.

Wide Product Range: Grocery and fresh retail encompasses a wide range of products, from staples like rice, flour, and lentils to fresh produce, dairy products, bakery items, frozen foods, and packaged goods.

Frequent Purchases: Consumers tend to visit grocery stores regularly for their daily or weekly needs, making it an integral part of their routine.

Customer Loyalty: Successful grocery retailers often build strong customer loyalty due to their consistent and reliable supply of essentials.

Challenges:

Quality Maintenance: Maintaining the quality and freshness of perishable items is a significant challenge, requiring proper storage, transportation, and inventory management.

Wastage Management: Reducing food wastage due to spoilage or expiration is a top concern in this sector.

Price Sensitivity: Grocery shoppers are often price-sensitive and seek the best value for their money. Retailers need to strike a balance between quality and affordability.

Competition: The grocery sector is highly competitive, with multiple retailers vying for consumers' attention. This can lead to slim profit margins.

Supply Chain Complexity: Managing the supply chain for perishable products requires a robust distribution network and efficient transportation to ensure timely deliveries.

Modern Trends and Innovations:

Online Grocery Shopping: The rise of e-commerce has led to the growth of online grocery platforms that allow customers to order essentials and have them delivered to their doorstep.

Contactless Shopping: The COVID-19 pandemic has accelerated the adoption of contactless shopping methods, such as curbside pickup and home delivery.

Smart Inventory Management: Retailers are using technology and data analytics to optimize inventory, reduce wastage, and streamline the supply chain.

Private Labels: Many retailers are introducing their own private-label brands for grocery items, offering quality products at competitive prices.

Fresh Formats: Some retailers are focusing on "fresh" formats, offering a wide selection of high-quality produce and perishables.

Key Players:

In India, the grocery and fresh retail sector is served by various players:

Kirana Stores: Small neighborhood stores that play a crucial role in serving local communities with everyday essentials.

Supermarkets: Larger stores that offer a broader range of products and are known for organized displays and air-conditioned shopping environments.

Hypermarkets: Larger than supermarkets, hypermarkets provide an extensive range of products, including groceries, electronics, clothing, and more.

Online Grocers: E-commerce platforms like BigBasket, Grofers, and Amazon Pantry offer online grocery shopping and home delivery.

Specialty Stores: These focus on specific categories, such as organic foods, gourmet products, or health-conscious items.

The grocery and fresh retail segment is an essential and dynamic part of the retail industry, continually adapting to consumer preferences, technological advancements, and changing market dynamics.

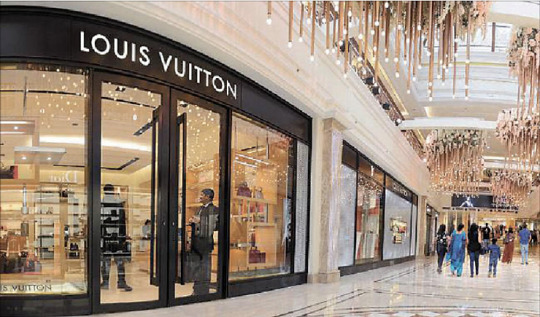

Figure 10: Luxury Retails Stores

The luxury retail sector also experienced growth, with international luxury brands setting up stores in premium malls and high-street locations in major cities. This shift reflected changing consumer aspirations and increased disposable incomes.

Key Characteristics:

Premium Products: Luxury goods are characterized by their exceptional quality, craftsmanship, and attention to detail. These products often use the finest materials and are crafted with precision.

Exclusivity: Luxury brands often limit the availability of their products to maintain a sense of exclusivity and rarity.

Brand Image and Status: Luxury brands are built around a strong brand identity and aspirational image. Owning luxury items can signal a certain social status and lifestyle.

Innovation and Design: Luxury brands focus on innovation in design, technology, and aesthetics to create unique and desirable products.

Retail Experience: Luxury retail emphasizes providing a superior shopping experience, with well-designed stores, personalized customer service, and immersive brand environments.

Factors Driving Luxury Retail Growth:

Rising Affluence: The growth of high-net-worth individuals and the middle class in various regions, including Asia, has expanded the customer base for luxury products.

Globalization: Luxury brands have expanded their presence beyond traditional markets, tapping into emerging economies and new consumer segments.

E-commerce: The growth of online luxury retail has allowed brands to reach a wider audience and provide a convenient shopping experience for consumers.

Millennial and Gen Z Influence: Younger consumers are showing an affinity for luxury brands and experiences, pushing the industry to evolve and adapt to changing tastes.

Experiential Retail: Luxury brands are focusing on creating memorable and immersive retail experiences, combining art, culture, and technology to engage customers.

Challenges and Trends:

Counterfeit Concerns: Luxury brands often face challenges related to counterfeit products and protecting their brand's authenticity.

Sustainability: Consumers are increasingly seeking sustainable and ethical luxury products, prompting brands to adopt more environmentally friendly practices.

Digital Transformation: Luxury brands are adopting digital strategies to engage consumers, whether through social media, e-commerce, or augmented reality experiences.

Inclusivity and Diversity: Brands are working towards greater inclusivity and diversity to cater to a wider range of consumers and reflect changing societal values.

Personalization: Customization and personalization are becoming more important in luxury retail, allowing customers to create unique products that resonate with their individual preferences.

Technology Integration

Retailers embraced technology with features like digital payment options, personalized recommendations, and augmented reality (AR) for virtual try-ons. Data analytics and AI-driven insights were also employed to understand consumer behavior and optimize inventory management.

Technology integration in the Indian retail industry has undergone a significant transformation, driven by the nation's expanding digital infrastructure and the changing behaviors of consumers. E-commerce platforms like Flipkart, Amazon India, and Snapdeal have established a dominant presence, offering a wide spectrum of products and streamlining order fulfillment and delivery processes. With the surge in smartphone usage, mobile commerce (m-commerce) has taken center stage, facilitated by mobile apps and optimized websites that provide convenient shopping experiences. The rise of digital payment methods such as mobile wallets (Paytm, Google Pay, PhonePe) and the Unified Payments Interface (UPI) has revolutionized the way Indians transact, fostering a cashless ecosystem both online and offline.

Moreover, data analytics and personalization have become integral to retail strategies, empowering businesses to tailor product recommendations and marketing efforts based on consumer insights. Additionally, the COVID-19 pandemic has expedited the adoption of contactless technologies, including digital payments, QR code menus, and touchless checkout solutions, ensuring the safety of customers. As part of omni-channel initiatives, retailers are endeavoring to create cohesive shopping experiences across physical and digital channels.

This technological transformation is not only visible in urban areas; it has also reached rural regions where retailers are introducing technology solutions to meet the growing demand for digital shopping experiences. Ultimately, the fusion of technology and retail in India is reshaping the consumer landscape, altering brand-customer interactions, and reshaping the dynamics of business operations. With technology continuing to evolve and consumer preferences shifting, the Indian retail sector is poised for further innovation and growth.

Emerging Technologies: Emerging technologies are shaping the future of the retail industry, transforming the way businesses operate and engage with customers. These technologies offer innovative solutions to enhance customer experiences, optimize operations, and drive business growth.

Here are some of the key emerging technologies in the retail sector:

Artificial Intelligence (AI) and Machine Learning:

Personalization: AI analyzes customer data to provide personalized product recommendations, offers, and marketing messages.

Inventory Optimization: Machine learning predicts demand, helping retailers optimize inventory levels and reduce stockouts.

Chatbots: AI-powered chatbots provide instant customer support and assist in product inquiries and purchases.

Augmented Reality (AR) and Virtual Reality (VR):

Virtual Try-Ons: AR allows customers to virtually try on clothing, accessories, and cosmetics before making a purchase.

Virtual Showrooms: VR creates immersive shopping environments where customers can explore products and make selections.

Internet of Things (IoT):

Smart Shelves: IoT-enabled shelves track inventory levels and trigger restocking orders when products are running low.

Beacon Technology: Beacons send location-based notifications to customers' smartphones, offering personalized promotions and recommendations.

Contactless and Cashless Solutions:

Contactless Payments: NFC-enabled payments, QR code scans, and mobile wallets provide convenient and hygienic payment options.

Touchless Checkout: Self-checkout kiosks and mobile apps enable customers to complete transactions without physical contact.

Robotics and Automation:

Inventory Management: Robots automate stock counting and shelf restocking, improving inventory accuracy and reducing manual labor.

Fulfillment Centers: Automated warehouses and fulfillment centers streamline order processing and reduce delivery times.

5G Technology:

Enhanced Connectivity: 5G offers faster and more reliable internet connectivity, enabling real-time interactions, immersive experiences, and IoT applications.

Voice Commerce:

Voice Assistants: Voice-activated devices like Amazon Echo and Google Home allow customers to shop and make purchases using voice commands.

Blockchain Technology:

Supply Chain Transparency: Blockchain enhances supply chain transparency by providing an immutable and verifiable record of product origins, transactions, and authenticity.

Biometric Technology:

Facial Recognition: Biometrics enable personalized experiences, including fast and secure payments through facial recognition.

Customer Identification: Biometric authentication helps retailers identify and serve customers more efficiently.

Sustainable Technologies:

Green Retail: Technologies that focus on reducing carbon footprints and minimizing waste are gaining traction as consumers prioritize sustainability.

Sustainable Packaging Solutions: Biodegradable and compostable packaging materials reduce the environmental impact of packaging waste. Retailers can explore alternatives to traditional single-use plastics.

Renewable Energy Certificates (RECs): Retailers can purchase RECs to offset their carbon footprint by supporting renewable energy projects elsewhere.

Digital Receipts and Paperless Transactions: By offering digital receipts and reducing paper usage, retailers can minimize their environmental impact.

Data Analytics and Predictive Insights:

Predictive Analytics: Advanced analytics tools use historical data to forecast consumer trends, allowing retailers to make informed decisions.

Demand Forecasting: Retailers use historical sales data, seasonal trends, and external factors like holidays to predict future demand for products. This helps in optimizing inventory levels, reducing stockouts, and minimizing overstock situations.

Price Optimization: Analytics help retailers determine the optimal pricing strategy by analyzing customer behavior, competitor pricing, and market dynamics. Dynamic pricing adjusts prices in real-time based on factors like demand and competition.

Customer Segmentation: Data analytics group customers based on purchasing behavior, demographics, and preferences. Retailers can then tailor marketing campaigns and product offerings to specific segments.

Personalized Recommendations: Retailers use customer data to provide personalized product recommendations, improving cross-selling and upselling opportunities.

Inventory Management: Advanced analytics help retailers optimize stock levels by analyzing sales patterns, product turnover rates, and seasonal trends.

Social Commerce:

Shopping on Social Media: Retailers are leveraging social media platforms to showcase products and enable shopping directly from posts.

These emerging technologies are driving innovation across the retail sector, enabling retailers to provide seamless, personalized, and convenient experiences for customers while optimizing business operations for improved efficiency and competitiveness.

Tier Cities in the Retail Industry

Tier cities, also known as tier 2, tier 3, or tier 4 cities, are a classification system used in India to categorize cities based on their population size, economic development, infrastructure, and overall urbanization. The concept of tier cities is significant in the context of the retail industry as it plays a crucial role in shaping retail strategies and market expansion.

Let's explore how tier cities work in the retail industry:

Classification of Tier Cities:

The classification of tier cities is not standardized, and the specific criteria used to determine which city falls into which tier can vary. However, the general classification is as follows:

Tier 1 Cities: These are the largest and most economically developed cities in India, including metropolitan areas like Mumbai, Delhi, Chennai, and Kolkata.

Tier 2 Cities: These are smaller cities with moderate economic development and infrastructure, such as Jaipur, Ahmedabad, and Pune.

Tier 3 Cities: These cities are smaller and less developed than tier 2 cities, often serving as district or regional centers.

Tier 4 Cities: These cities are typically smaller towns and municipalities with limited economic activity and infrastructure.

Role of Tier Cities in the Retail Industry:

Market Potential: Tier cities collectively represent a substantial portion of the Indian population. As urbanization and disposable incomes increase, these cities become important markets for retail expansion.

Untapped Consumer Base: Retailers recognize the growth potential in tier cities due to the rising purchasing power of residents who are looking for better quality products and improved shopping experiences.

Reduced Competition: Tier cities often have lower levels of retail saturation compared to tier 1 cities. This provides opportunities for retailers to establish a presence with potentially less competition.

Diverse Consumer Behavior: Consumer preferences and behaviors can vary significantly between tier cities and tier 1 cities. Retailers need to understand these nuances to tailor their offerings effectively.

Digital Adoption: As digital connectivity increases across India, including tier cities, e-commerce platforms and online shopping are becoming popular. Retailers can tap into this trend by offering online options.

Hyperlocal Strategies: Tier cities may require more localized strategies, considering regional tastes, preferences, and cultural factors that influence shopping decisions.

Offline and Online Mix: A hybrid approach that combines both physical stores and online platforms can be effective in tier cities. Consumers may prefer exploring products in-store before making purchases.

Logistics and Distribution: Efficient supply chain management becomes crucial in tier cities, ensuring timely deliveries of products to meet customer demands.

Challenges in Tier Cities:

Infrastructure: Some tier cities might have limited infrastructure, posing challenges for setting up modern retail outlets or ensuring seamless online deliveries.

Awareness and Education: Educating consumers about product offerings, quality, and benefits may be required, especially in markets where modern retail is still evolving.

Cost Structure: Operating costs, including real estate, may be lower in tier cities, but retailers need to strike a balance between affordability and maintaining quality services.

Future Outlook:

The growth of tier cities in terms of population, economic activity, and consumer aspirations presents a significant opportunity for the retail industry. Retailers that adapt to the unique characteristics of tier cities, adopt localized strategies, and offer a mix of offline and online options stand to tap into this vast and evolving consumer market.

Regulatory Changes and Challenges

The Indian retail sector witnessed regulatory changes such as the introduction of Goods and Services Tax (GST) and discussions around FDI regulations in multi-brand retail. These changes, while aimed at simplifying taxation and encouraging investment, also brought about challenges and debates.

Post-Pandemic and Future Trends

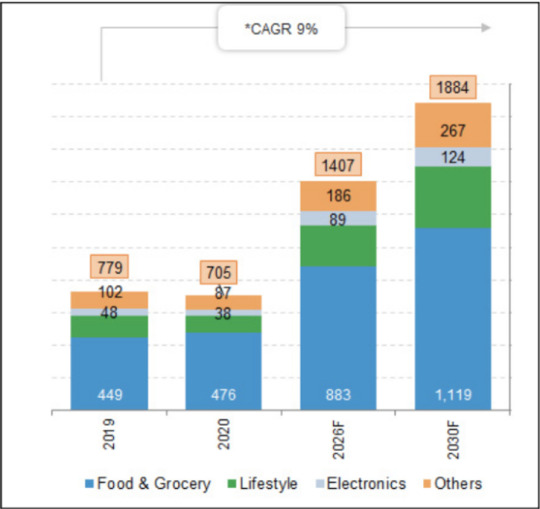

Figure 11: Retail Market Size (Image Source: IBEF)

According to Kearney Research, India's retail industry is projected to grow at a compound annual growth rate (CAGR) of 9% from 2019 to 2030. The market size is expected to reach $1.407 trillion by 2026 and $1.8 trillion by 2030.

The revenue of India's offline retailers, also known as brick-and-mortar (B&M) retailers, is expected to increase by $1.39-2.77 billion in fiscal year (FY) 2020.

India's direct selling industry is expected to be valued at $2.14 billion by the end of 2021. E-retail has been a boon during the pandemic. According to a report by Bain & Company in association with Flipkart, the e-retail market is expected to grow to $120-140 billion by FY26, increasing at a CAGR of approximately 25-30% over the next 5 years.

Despite unprecedented challenges, the Indian consumption story is still robust. Driven by affluence, accessibility, awareness, and attitude, household consumption stood at $1.63-1.75 trillion in 2021.

The COVID-19 pandemic further accelerated e-commerce adoption as consumers turned to online shopping for safety reasons. Retailers had to adopt contactless delivery methods and enhance their online presence to stay competitive.

Conclusion

The evolution of retail in India reflects a dynamic interplay of consumer preferences, technological advancements, policy changes, and economic growth. The future of retail in India is likely to continue embracing digital innovations, convenience-focused models, and strategies that cater to diverse consumer segments across both urban and rural areas.

Global Launch Base helps international startups expand in India. Our services include market research, validation through surveys, developing a network, building partnerships, fundraising, and strategy revenue growth. Get in touch to learn more about us.

Contact Info:

Website: www.globallaunchbase.com

LinkedIn: https://www.linkedin.com/company/globallaunchbase/

Email: [email protected]

#retailindustry#india#evolution#ecommerce#brickandmortar#onlineshopping#consumerbehavior#digitalization#technology#omnichannelretailing#mobileshopping#urbanization#supplychain#modernretail#traditionalmarkets#shoppingtrends#paymentsystems#customerexperience#marketplaces#fdiinretail#sustainability#ruralretail#hypermarkets#malls#shoppingapps#personalization#cashlesstransactions#retailstrategies#growthopportunities#competition

0 notes

Text

#RetailManagement #WholesaleOperations #InventoryControl #PointOfSale #SupplyChainOptimization #OmniChannelRetail #InventoryManagement #ERPImplementation #RetailTech #WholesaleSoftware #CRMIntegration #ECommerceIntegration #SupplyChainManagement #RetailAnalytics #CustomerExperience #OrderFulfillment #WarehouseManagement #BusinessIntelligence #RFIDTechnology #OmniChannelStrategy

1 note

·

View note

Text

RetailRevolution: Transforming Shopping Experiences with Retail Automation

In today's fast-paced retail landscape, Retail Automation is reshaping the way businesses operate and interact with customers, driving efficiency, and enhancing the overall shopping experience.

Download PDF Sample Report@https://www.globalinsightservices.com/request-sample/GIS23986/?utm_source=SnehaP-Article

From cashier-less checkout systems and inventory management solutions to personalized recommendation engines and AI-powered chatbots, automation technologies streamline operations, reduce costs, and increase revenue. By leveraging data analytics and machine learning algorithms, retailers can gain valuable insights into consumer behavior, preferences, and trends, allowing for targeted marketing campaigns and product assortments. Moreover, automation optimizes supply chain logistics, ensuring seamless inventory replenishment and timely deliveries. As retailers embrace digital transformation, RetailRevolution paves the way for enhanced customer satisfaction, increased loyalty, and sustained business growth. #RetailAutomation #DigitalTransformation #CustomerExperience #AI #MachineLearning #InventoryManagement #SupplyChain #RetailTech #Personalization #DataAnalytics #OmniChannelRetail #ECommerce #RetailInnovation #ConsumerInsights #BusinessEfficiency

0 notes

Text

Embracing the Future of Retail: The Rise of Digital Commerce

With the rise of #DigitalCommerce, the #RetailIndustry is undergoing a significant transformation. Consumers are increasingly turning to online shopping, and retailers must adapt to meet this demand.

EcommercePlatforms, mobile devices, and new technologies like AI and IoT are changing the way people shop and purchase goods. Retailers that embrace these changes and innovate will thrive, while those that resist risk becoming irrelevant.

#DigitalCommerce provides consumers with greater convenience, a wider selection of products, and the ability to shop anytime, anywhere. #RetailBusinesses can reach a global audience and gather valuable data on their customers through digital commerce. The growth of digital commerce shows no signs of slowing down, and retailers must adapt to succeed in the future.

Features

#DigitalCommerce offers convenient and accessible shopping for consumers with 24/7 availability and a wide selection of products. Personalized experiences and secure payment options are possible through the use of customer data. Businesses benefit from the increased reach and access to valuable customer data. Retailers that embrace digital commerce will provide better shopping experiences and increase competitiveness in the retail industry.

Trends

DigitalCommerce is rapidly evolving, with several trends shaping its future. #MobileCommerce is a significant trend as mobile devices are increasingly being used for shopping and purchasing goods. #ArtificialIntelligence technologies, #MachineLearning, and #NaturalLanguageProcessing are being used to enhance the customer experience. #VoiceCommerce is growing in popularity, with voice-enabled devices changing the way people shop. Social media platforms like Facebook and Instagram are also being used for shopping. Subscription services are becoming increasingly popular.

OmnichannelRetail is another trend, where retailers integrate their physical and digital presence to offer a seamless shopping experience. These trends provide opportunities for retailers to innovate and differentiate themselves in the market. By embracing these trends, retailers can provide a better shopping experience for their customers and increase their competitiveness in the digital commerce industry.

In conclusion, embracing the future of retail means recognizing the emergence of digital commerce and its potential to revolutionize how goods are bought and sold. By adopting new technologies such as e-commerce platforms, AI-driven analytics, mobile payments, and more, retailers can increase their reach while providing customers with a more personalized shopping experience. Ultimately, investing in digital commerce is not only beneficial for businesses but also for consumers who can now access products from around the globe at any time. To start engaging with digital commerce yourself today, consider researching some available tools that could help you get started on your journey toward becoming an online retailer!

To take the advantage and to know more about Digital Commerce, Contact us today at!

[email protected]

https://sekel.tech/

0 notes

Text

Tweeted

Participants needed for online survey! Topic: "Omnichannel shopping experience and omnichannel shopping intention" https://t.co/dyQI9g8LBg via @SurveyCircle #OmnichannelRetailing #ShoppingExperience #fastfashion #ShoppingIntention #survey #surveycircle https://t.co/hWnRxchBru

— Daily Research @SurveyCircle (@daily_research) Jan 26, 2023

0 notes

Photo

Omnichannel retailing describes a retailer’s efforts to provide a consistent, coordinated customer experience across all possible customer channels, using consistent, universal data.

.

.

For more information, Call us at 0172-5090668, Whatsapp No. 7527003884.

Visit or DM us at https://tdsgroup.in/

For Job Application, Apply here https://tdsgroup.in/career/

#tdsgroup#omnichannelretail#channels#network#omnichannel#ecommerce#marketing#retail#customerexperience#business#technology#digital#customerservice#digitaltransformation#onlineshopping#ecommercebusiness#innovation#businessstrategy#strategy#analytics#marketingdigital#cloud

2 notes

·

View notes

Link

The retail industry is one of the largest sectors in the world and is expected to grow as the middle classes are increasing substantially in size and in buying power. Retail purchases via ecommerce and m-commerce are growing at a high rate due to the advent of high-speed internet connections, advancements in Smartphone technology and online-related technology, improvements in the product lines of e-commerce firms, a selection of delivery options and better payment options.

The advent of big data in retail industry represents a cultural shift in the way retailers connect with consumers in a meaningful way. This bottom-line impact of big data is what makes it a business imperative and why retailers around the world are leveraging it to transform their processes, their organizations and, soon, the entire industry.

As consumer technology adoption and multi-channel shopping experiences become the norm, data becomes increasingly critical.

Retailers who use customer data to transform themselves are better positioned to thrive and create sustainable growth in the new digital retail landscape.

Below is a set of defined use cases designed to drive value through more effective application of customer data.

Use-Case 1: Personalizing the In-Store Experience with Big Data in Retail

By doubling down on the customer experience, retailers can thrive by leveraging your physical stores to deliver a powerful, personalized experience.

The key is to create a unique shopping experience where customers derive both value and pleasure from visiting physical storefronts.

It is important to collaborate with merchandising teams to understand the merchandising strategy and the key metrics for improvement. Review data, identify opportunities to drive improvement, and develop hypotheses for how to enhance the customer shopping experience.

Thanks to advances in IoT and edge-computing, we are seeing more devices being placed in stores to monitor traffic.

Companies like RetailNext are leading the charge on such solutions and helping retailers through a variety of use-cases. Operations teams can measure traffic accurately and optimize staffing to reduce costs or improve the shopper experience. Marketers can measure the impact of certain campaigns through trends in traffic and areas of the store that have been visited. Merchandising teams can understand the impact of their assortment choices and display products accordingly. Products can be placed optimally to drive conversion. Finally, retailers can change the entire store design to optimize traffic, assortment, and conversion.

Almax has created “smart mannequins” that consist of cameras for eyes and analyze shoppers’ faces to detect age, gender, ethnicity, and multiple other characteristics. A luxury goods retailer is currently piloting their technology to better assess their marketing messages, potentially discover new target groups, and tune their in-store displays.

NEC has built a similar system called NeoFace that can alert staff when a loyal customer or a big spender walks into a store.

Building an effective personalization program will help accelerate the retailer’s progress toward results: a more personalized experience, greater customer loyalty, increased wallet share, and substantially better top and bottom lines.

Use-Case 2: Customer Journey Analytics

Engaging a customer at the right place at the right time with the right offer is the holy grail for marketers.

Tracking the customer journey allows to serve the most relevant product and content recommendations based on a customer’s shopping, browsing and transaction history.

A global e-commerce platform, EMEA, wanted to expand its product recommendation capabilities across its many product verticals. The retailer spent 12‑18 months aggregating all customer data across verticals to create a single view of customers’ browsing and purchasing patterns. The retailer ran A/B tests on the customer data and developed an algorithm to drive continuous improvement in recommendation accuracy. This resulted in a 500% increase in sales conversion in some of the retailer’s product lines.

We’re primarily seeing this sort of omni-channel journey orchestration possible in customer data platforms (CDPs) and modern marketing automation tools.

Marketing automation tools like Braze and Salesforce Marketing Cloud allow marketers to create journeys based on a variety of events such as API triggers, time-based triggers, data changes and more. These journeys can then span multiple days and dynamically adapt messaging based on customer data being fed into the system during the journey lifespan. Imagine getting a thank you e-mail for a product you purchased and then getting recommendations for other similar products a few days later, only to receive a promotion after that for being a loyal customer and writing a product review on the site.

Supercharging these marketing automation tools, are CDPs which have the power to ingest unlimited amounts of data and produce personalized customer recommendations. CDPs can ingest numerous sources of customer data to create a consolidated Customer 360 view. They then enhance that view with machine learning models to figure out likelihood to churn, propensity to buy, recommended products and more. These insights can then be used in audience creation during the journey building process, and ultimately activated via marketing automation tools, advertising, Connected TV and website personalization.

Use-Case 3: Assortment Planning Analytics

Assortment planning is a lengthy and complex process that occurs before major seasons. The volume of information that needs to be collected, analyzed and acted upon becomes incredibly difficult to process manually. Legacy assortment management suites would just put a UI on top of this process, but that is no longer enough. Modern assortment management uses data to take the guesswork out of planning and drive higher sales with better product breadth and depth. They reduce excess inventory and can keep additional stock for high selling items.

Stores are no longer clustered and graded based on revenue, but on a variety of factors such as store size, location, revenue, and more. Modern systems can also help you forecast the success of new products that plan on being introduced.

Analyze customer purchasing behavior to help inform future product catalog and web placement decisions.

Below are the four steps to activate this use case after developing your data foundations.

1) Collect data:

Identify data elements created by customers on your owned and operated websites, stores. Browsing and purchasing data are two key data sets as they indicate what customers are looking at and what they respond to. Develop and document a data strategy that defines the first-party data you will collect and sets integration goals for data collection and management efforts.

2) Build Segments:

Analyze your data to reveal customer insights. Focus segmentation and targeting efforts on grouping customers based on common characteristics, such as the products they browse and buy, traffic source, or basket size. The critical element is to uncover the characteristics that will influence your product assortment, product hierarchy, and merchandising decisions.

3) Develop and run tests:

The data team and product assortment and merchandising team need to collaborate to perform A/B testing of the different levers (e.g., layouts, product categories) across the different segments. Tests should be conducted live and continuously to constantly refine your design decisions and drive incremental value.

4) Implement changes and iterate:

Use the insights gained from A/B testing to inform new decisions about product hierarchy, layout, and range, as well as how to most effectively tailor these elements for each customer. For some retailers, merchandising includes content planning to inspire customers who do not yet know what they are looking to purchase.

By improving their ability to deliver the right merchandise assortments to the right outlets

at the right price and manage their inventories to these data-driven consumer demand signals, retail organizations are better positioned to seize market opportunities by delivering new customer-centric products at more predictable costs.

Use-Case 4: Pricing, product recommendations and promotions

We live in an era in which smart pricing strategies can catapult new brands and retailers to quick success. At the same time, failure to project the right price image can seriously undermine the prospects of businesses

Think of Dollar Shave Club, an e-commerce subscription start-up that grew rapidly on the promise of providing “a great shave for a few bucks a month.” And then, of course, there are widely admired brands such as Apple, Patagonia, American Eagle and Lululemon that have largely avoided discounting based on the merits of their product quality. As these examples demonstrate, price plays an important role in establishing the brand image and what it stands for. A brand that dependably connects with shoppers through its price message is typically a brand that enjoys long-lasting customer loyalty.

How Analytics Can Help Manage Pricing Priorities

As complex as pricing analytics may seem, managing a brand’s price position is crucial to the way it is perceived by consumers.