#Online Payroll Software

Explore tagged Tumblr posts

Text

#payroll software#payroll software in india#hrandpayrollsoftware#human resource management system#erecruitmentmanagement#online payroll software#ess management software#leave and attendance software in delhi#employee self service#grievance management system

0 notes

Text

Payroll Software Features That Improve Compliance

In this constantly evolving world of speed and hustle, pay roll compliance is something which creates a lot of headache for companies. With constant changes in tax laws and labor regulations, it becomes very important for a company to always follow the very updated legal requirement in order to stay clear from penalties. Manual Payroll Management increases the risk of human errors and takes a toll on time. Here, Payroll Software becomes the most important tool in automating the compliance process and ensuring error-free payroll processing. When we have the Best Payroll Software in India, businesses can maintain proper taxation, employee class types, and reporting while complying with labor laws.

How Payroll Software Can Be Helpful in Maintaining Business Compliance

Payroll compliance means complying with tax regulations, wage laws, or other statutory requirements. A robust Payroll Software in India brings automation and accuracy so that businesses can pay more attention to these matters of compliance. Here are the main features that keep the payroll complaints for organizations:

Automatically Calculate and File Taxes

Accurate and timely tax computing and filing turns out as one of the busiest and most challenging affairs for businesses. Payroll Software calculates federal, state, and local taxes automatically under the updated tax laws. This feature helps businesses:

Deduct correct amounts of tax from employee salaries.

File the tax forms and payments in front of prescribed deadlines.

Keep updated with the changes in tax rules that arise.

Wage and Hour Tracking

Wage and hours regulations are important with respect to compliance with labor regulations for businesses. Payroll Software in India helps in tracking working hours, overtime, and break time of employees. It may fulfill the minimum wage and overtime laws. It also:

Provides accurate timesheets and attendance reports for employees.

Alerts businesses regarding wage discrepancies.

Helps in avoiding any labor law violations.

Employee Classification

Wrong employee classifications may lead to legal penalties and back payment claims. The Best Payroll Software in India helps to classify employees accurately by:

Differentiating between full time, part time and employees on contract basis.

Applying the correct tax rates and wage policies Authorizing, and detailing, any possible risk for misclassification during payroll.

Compliance with Leave Management

Leave management is yet another very important aspect that has been considered in payroll compliance. Payroll Software has all the features required for automating leave tracking and aids companies in meeting their obligations regarding sick leave, maternity, and paid time off policies. It:

Government policies consider how to accrue leave based on the given policies of the particular company.

Tracking leave balances without any possible manual errors.

It helps confirm that the organizations are compliant with the laws of the federal and state governments regarding leave.

Reporting New Employees

Businesses are required to report new hires to state agencies. Indian Payroll Software does this with minimal manual intervention by:

Submitting employee data to the government.

Maintaining I-9 and W-4 forms, and so on.

Integrating new-hire-reporting functions into employee onboarding workflows.

Audit Trails and Compliance Reporting

Maintaining payroll records in detail is of utmost importance to get compliance. Free Payroll Software maintains all Payroll Records and audit trails on any payroll action. This will enable companies to:

Incorporate factual compliance reports while audits.

Keep track of changes that were done in payroll data.

Ensure transparency and accountability in the payroll process. Why Choosing the Right Payroll Software is Important

Choosing the Best Payroll Software in India is imperative for businesses to ward off legal pitfalls and ensure compliance. The right payroll software solution should provide for automated compliance, continuously updated with the latest labor laws, and integrates seamlessly with HR systems. Kredily provides a full Payroll Software solution for efficient payroll while enabling businesses to be compliant.

Conclusion

Payroll compliance is not merely paying employees; however, it is actually about compliance with tax laws, wage laws, and reporting requirements. Right Payroll Software gives the extra power of automating compliance and eliminating legal penalties which arise on manual errors. Kredily Payroll Software in India provides an integrated solution for smooth payroll processing and puts businesses on the right side of the law.

Step into a seamless journey of payroll compliance - Schedule for a free demo on Kredily's Payroll Software right away!

#Payroll Software#Employee Payroll Software#Best Payroll Software in India#Payroll Software in India#HR and Payroll Software#Online Payroll Software

0 notes

Text

Workforce Management

Workforce management refers to the optimal use of people and resources in an organization. In this section, you'll see information related to a wide range of topics under resource planning, discipline, and manpower cost management.

#hr#payroll#hr management#payroll management#hr and payroll#hr and payroll software#online hr software#online payroll software#greythr

0 notes

Text

Making the Most of Payroll Software for Small Businesses

Payroll can be overwhelming for small businesses, but there are a few things you can do with Payroll software for small businesses to make your payroll processes more efficient. One tip is to automate the process as much as possible. This can be achieved by investing in software that can automate tax calculations, employee data updating, and direct deposit. Let's learn more tips in this blog!

#hrms payroll software small businesses#online payroll software#best payroll software#payroll software in gurgaon#payroll software in india

0 notes

Text

Top 10 Payroll Management Service Providers in USA for 2025-26

Finding the right payroll management services is important for streamlining employee compensation, ensuring tax compliance and improving financial accuracy. In 2025–26, many top-respected providers in the USA will be offering strong payroll management systems to suit small businesses, startups, and enterprises. From automated processing to real-time reporting and direct deposit facilities, these companies are redefining parole efficiency. Whether you are scaling or simplifying, this list helps you make informed decisions. To find out the Top 10 Payroll Management Service Providers in the USA for 2025-26, our full blog must be read here.

Read More : https://www.linkedin.com/pulse/top-10-payroll-management-service-providers-usa-2025-26-wadhwani-4zutf/

0 notes

Text

Your Trusted Partner for Taxation & Compliance Solutions Since 1962

Tax Print (Since 1962) For over 60 years, Tax Print has been a trusted partner for businesses across Mumbai, India. We specialize in the manufacturing and distribution of essential taxation and compliance products, serving companies with a wide range of software and physical solutions.

Our Offerings Include:

Taxation & Compliance Software: TDS Software, Payroll Software, HRM Software, Fixed Assets Software, PDF Signer, 26AS Reconciler, XBRL Software

Companies Act, 2013 Solutions: Compliance stationery, specialized products for newly incorporated Pvt. Ltd. and Ltd. companies

Corporate Essentials: Company seals, share certificate printing, statutory registers, minutes binders, and minutes paper

Whether you need robust digital tools or high-quality printed materials, Tax Print is your reliable source for all tax and compliance-related needs.

Let me know if you’d like a shorter version or one tailored for a specific platform like your website or brochure.

#payroll management software#hr software in mumbai#online payroll software in mumbai#26as reconciler software in mumbai#pdf signer software in mumbai#fixed asset management#best tds software in mumbai

0 notes

Text

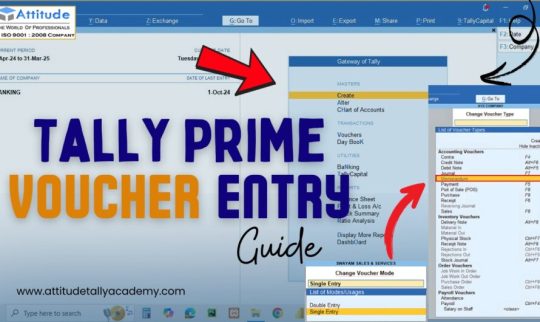

Master e-Accounting with TallyPrime: Learn Smart Financial Management

Level up your accounting skills with an in-depth e-Accounting course using TallyPrime. Designed for beginners and professionals, this course covers everything from manual accounting to GST, TDS, payroll, bank reconciliation, inventory management, and financial reporting. Learn how to create accurate books of accounts and manage real-time transactions using one of the most trusted accounting software solutions in the industry.

Whether you're looking to boost your resume or manage business finances efficiently, mastering TallyPrime is a smart investment in your career.

Start today and build a strong foundation in digital accounting!

Visit Attitude Academy📚

📍 Visit Us: Yamuna Vihar | Uttam Nagar

📞 Call: +91 9654382235

🌐 Website: www.attitudetallyacademy.com

📩 Email: [email protected]

📸 Follow us on: attitudeacademy4u

#TallyPrime Course#e-Accounting Course#Tally with GST Training#Learn TallyPrime#TallyPrime Online Course#Tally Accounting Software#GST with Tally Course#Tally Course for Beginners#Financial Accounting with Tally#Payroll in TallyPrime#TDS and TCS in Tally#Advanced Tally Course#TallyPrime with e-Invoicing#Business Accounting Course#Tally Certification Course

0 notes

Text

Best Payroll Software in India | Employee Payroll Management System

EzyPayroll is India’s leading Payroll Management System, offering a seamless HR and Payroll Software solution. Automate salary calculations, tax deductions, and online leave management with ease.

0 notes

Text

How to Apply for a Thailand Business Visa: Step-by-Step Process (2025)

Thinking of working or starting a business in Thailand? You’ll need a Thailand Business Visa!

✅ Step-by-step application guide ✅ Visa requirements & document checklist ✅ Expert tips for smooth approval

📩 Let AMI Advisor handle your Visa & Work Permits Services in Thailand so you can focus on your business!

📞 Call us now: +66 (0)93 580 4536 🔗 Read more: https://ami-advisor.com

#ThailandBusinessVisa #VisaAssistanceThailand #ThailandVisa #BusinessVisaThailand #WorkInThailand #AMIAdvisor #ThaiVisaExperts

#bookkeeping services thailand#corporate services thailand#tax consultant thailand#thai business visa#thailand visa#study visa#bookkeeping#accounting software thailand#company incorporation#thailand visa online#Visa Assistance Thailand#Bookkeeping Services Thailand#Thai Business Visa#Tax Consultant Thailand#Payroll Services Thailand#Accounting Software Thailand#Expat Tax Services Thailand#Corporate Services Thailand#Financial Planning Services Thailand

0 notes

Text

How to Choose the Best Payroll Software in India?

Introduction

Managing payroll efficiently is one of the biggest challenges for businesses in India. From calculating salaries to ensuring tax compliance, HR teams often struggle with manual errors and administrative burdens. Choosing the best Payroll Software in India can help automate payroll processing, ensure compliance with labor laws, and save valuable time. But with so many options available, how do you select the right solution? This guide will help you understand key factors to consider when choosing payroll software for your business.

Identify Your Payroll Needs

1. Understand Your Company’s Structure and Requirements

Before selecting a payroll solution, evaluate your company's size, industry, and payroll complexities:

Number of employees and office locations

Different pay scales, allowances, and deductions

Industry-specific compliance needs

For growing businesses, Payroll Software for Small Business can offer cost-effective and scalable payroll management solutions.

2. Key Payroll Functionalities to Look For

A good Online Payroll Software should include:

Automated salary calculations and direct bank transfers

Tax deductions, including TDS, PF, and ESI compliance

Integration with attendance and leave management

Employee self-service portals for payslips and tax documents

If your business is just starting, you might consider a Free Payroll Software to handle basic payroll tasks before upgrading to a premium solution.

3. Future Growth and Scalability

As your business expands, so will your payroll needs. The software should be scalable, allowing you to add more employees and customize payroll workflows without disruptions.

Evaluate Payroll Software Options

1. Research the Best Payroll Software in India

With multiple options available, conducting thorough research is crucial. Some important aspects to evaluate include:

User reviews and ratings

Feature comparison with competitors

Suitability for your business size and industry

2. Compare Software Features and Capabilities

A reliable Payroll Software in India should provide:

End-to-end payroll processing with automation

Accurate compliance with Indian tax laws

Real-time payroll reporting and analytics

If you have a distributed workforce, cloud-based Online Payroll Software can help you access payroll data anytime, from anywhere.

3. Vendor Reputation and Customer Support

When choosing payroll software, consider:

The vendor’s experience and credibility

Availability of customer support and training

Feedback from existing users in your industry

Determine the Right Pricing Model

1. Understand Different Pricing Structures

Payroll software providers offer various pricing models:

Free Payroll Software with limited features for startups

Subscription-based plans with fixed monthly costs

Per-employee pricing for scalable solutions

2. Assess the Total Cost of Ownership

Choosing the Best Payroll Software in India involves not only upfront costs but also long-term benefits, such as:

Reduction in payroll errors, saving money on compliance fines

Improved efficiency, freeing up HR resources for strategic tasks

Implement and Optimize the Payroll Software

1. Ensure a Smooth Implementation

A well-planned implementation can prevent payroll disruptions. Steps to follow include:

Data migration from existing payroll systems

Training HR teams on new software features

2. Monitor and Continuously Improve

To ensure maximum efficiency, regularly:

Review payroll reports to identify discrepancies

Update software settings based on changing compliance laws

Conclusion

Selecting the best Payroll Software in India requires thorough research and a clear understanding of your business needs. Whether you opt for a Free Payroll Software or a full-featured Online Payroll Software, the right choice will help you manage payroll efficiently while ensuring compliance with Indian labor laws.

Looking for a powerful Payroll Software in India to simplify payroll processing? Kredily offers a comprehensive and cost-effective payroll solution tailored for Indian businesses. Contact us today to explore our features!

#Payroll Software in India#Best Payroll Software in India#HR and Payroll Software#Free Payroll Software#Online Payroll Software#Employee Payroll Software

0 notes

Text

The Importance of Outsourcing Payroll Work in the UK

Managing payroll is a critical aspect of running any business, but it can also be one of the most challenging and time-consuming tasks. For businesses in the UK, particularly small to medium-sized enterprises (SMEs), outsourcing payroll has become a popular and effective solution. By partnering with a professional payroll service provider, businesses can ensure compliance, accuracy, and…

View On WordPress

#Buy Payslips#Online Payslips#Order Payslips#outsource payroll#Payroll Software#Replacement Payslips

0 notes

Text

Best Attendance Management Software

Managing employee attendance effectively is crucial for any organization aiming to improve productivity and streamline payroll processes. This is where attendance management software comes into play as a powerful tool for tracking and managing employee work hours, leaves, and attendance records with precision.

What is Attendance Management Software?

Why Your Business Needs Attendance Management Software

In today’s dynamic workplace environment, businesses need reliable tools to ensure workforce efficiency and accurate record-keeping. Here’s why attendance management software is essential:

Real-Time Attendance Tracking:- Capture employee attendance in real-time using biometric systems, mobile apps, or cloud-based platforms.

Improved Accuracy:- Minimize human errors by automating attendance records and calculations, ensuring precision in payroll processing.

Seamless Leave Management:- Allow employees to apply for leaves, view balances, and track approvals through an integrated platform.

Compliance and Reporting:- Ensure adherence to labor laws and generate comprehensive reports for audits and analytics.

Enhanced Employee Engagement:- Foster transparency by allowing employees to access their attendance data and stay informed about policies.

Key Features of the Best Attendance Management Software

When evaluating attendance management software, look for these critical features:

1. Customizable Attendance Policies

Align the software with your company’s attendance and leave policies, including flexible work hours and shifts.

2. Integration with Payroll Systems

Ensure accurate salary calculations by integrating attendance data directly into the payroll system.

3. Cloud Accessibility

Opt for a cloud-based system to enable remote access and real-time updates from anywhere.

4. Biometric and Geolocation Support

Implement biometric systems or geolocation tracking to prevent buddy punching and ensure attendance authenticity.

5.Detailed Analytics and Reports

Use dashboards and analytics tools to gain insights into attendance patterns, overtime, and absenteeism.

How to Select the Best Attendance Management Software

Choosing the right attendance management software requires careful consideration of your business needs. Here are some factors to keep in mind:

Scalability: Ensure the software can accommodate your growing workforce.

Ease of Use: Choose a system that is user-friendly and intuitive for both employees and administrators.

Data Security: Prioritize solutions that provide robust security features to protect sensitive employee data.

Cost-Effectiveness: Look for a solution that offers the best value without compromising essential features.

Customer Support: Select a provider that offers reliable customer support and regular software updates.

#Top attendance management software#staff attendance software#online attendance management system#Top Attendance Management Systems in Indian#attendance and payroll software

0 notes

Text

Smart Online Attendance Management for Your Team Transform how you track attendance with our comprehensive online system. Experience easy integration, detailed analytics, and enhanced compliance. Sign up for a demo today!

#online attendance management system#staff attendance software#employee attendance management system#attendance and payroll software#attendance management software

0 notes

Text

Best Payroll Management System

Liberate your payroll processes with the most effective payroll management system designed for accuracy, compliance, and efficiency. Pacexgrowth offers online payroll services and short business payroll services that promise timely salary disbursement, tax calculation, and statutory compliance—all on a skilled platform. Whether you are running a startup or growing business, our payroll management system provides intelligent automation to reduce manual workload and increase productivity.

Website : https://pacexgrowth.com/payroll-system-management-software/

#payroll services for small business#online payroll services#payroll management services#payroll management software

0 notes

Text

Manage HR Payroll Software to Meet Your Right Strategy

When you create engaging HR management software to meet the core operational techniques and needs of your business processes, the organization receives support for growth and essential success. Strategy is important in an HR operations setting that determines the various features to meet the different demands under payroll management. This post is a take on the essential functions of HR payroll software to manage and maintain the core functionalities to boost your business strategy and setup.

HR Payroll Software Features that Aid in Business Strategy

The primary features and functions that add support and value to your business operations can be summarized in this section. It is relevant from an engaging HR payroll perspective and scenario. Maximum effects of payroll for business strategies are covered in this particular format. The top-notch and popular features that create value for your business strategy using HR payroll management are listed below:

Feasible deduction patternIf you can use the services of online HR management software, it is easy to build a strategic and feasible payroll deduction pattern for all your employees and the corresponding operational functions that they play a part effortlessly.

Easier integration functionsYou have the quality to build and develop streamlined and seamless integration management techniques to add special quality to your payroll functions. These factors contribute to the effective integration of core business strategies into the specific model.

Payroll processing and reportingThe generation and activation of payroll processing support and reporting functions can be technically covered under the categorical management of genuine payroll operations. It aids you in delivering an empowering processing and reporting function that caters to your business strategy.

Compliance and auditYou can utilize the solution services under the best cloud HR software to boost your business strategy with efficient payroll management. The adoption of compliance measures, audit steps, and regulatory norms comes under the evolution of this particular payroll management step.

Automated payroll managementIf you can deliver payroll processing and management in an automated workflow model, it facilitates the route for creating an effective system that enhances the various measures in the business strategy provisions and policies.

The primary quality of business strategy management can be actively supported and delivered using the essential functions of an empowering HR software platform. Any HRMS model with optimum customization tricks and personal upgrades can work effectively to create an empowering operations management system. You can also tune the HR payroll software to meet your specific business strategy needs according to your industry-specific and niche-related requirements.

0 notes