#Payment Processing Providers

Explore tagged Tumblr posts

Text

Xipster: Your trusted Canadian payment solutions company. Streamline transactions with our cutting-edge online payment systems, generate payment links, and elevate your business. Accept payments by link seamlessly with Xipster.

#Generate payment links#payment solutions company#payment processing providers#payment processing#payment solutions#accept payments by link

1 note

·

View note

Text

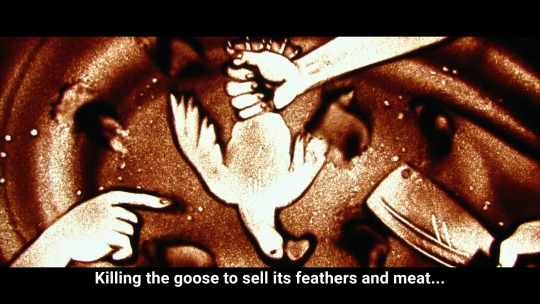

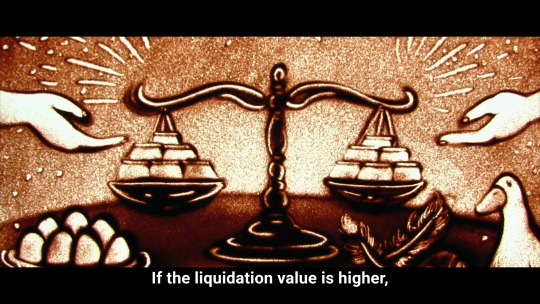

#this is a simplified narrative obviously#because before a company even goes to liquidation there are steps and due process#the auditor only gives an opinion or in certain cases refuses to give an opinion on the financial statements of a company#what happens next depends on the shareholders#if creditors demand immediate payment in full of the debt and the company somehow manages to strike a deal then the company survives#this is what you call voluntary administration#however if the insolvent company fails to meet its obligations then creditors may try seeking a court order for liquidation#and that is a separate exercise#the court would would then allow for the creditors to appoint a third party independent auditor to provide recommendations to the court#the court then may issue an order to liquidate the company based on recommendations from the third party independent auditor#so the narrative in this scene is the later stage obviously#mbc numbers#kdrama

8 notes

·

View notes

Text

#Echeck#Electronic Check#Merchant Services#Payment Processing#Merchant Account#Payment Processing Companies#Payment gateway providers#Best Merchant Services#High Risk Merchant Account#Echeck Account#Echeck Payment Processor#Echeck Payment#Echeck Payment Processing#Electronic Check Payment#what is an echeck#Check 21#echeck casino#e commerce payment processing

3 notes

·

View notes

Text

Vape Merchant Account & Payment Solution

Vape businesses often encounter challenges in payment processing, as many traditional banks classify them as high-risk. Our Vape Merchant Account is designed to overcome these challenges, ensuring smooth payment acceptance for your business. With our expertise, you can focus on growing your business while we handle your payment processing.

https://payfacsolutions.com/industries/vape-merchant-account-payment-solution.php

0 notes

Text

Gaming businesses in the UK face high chargebacks and strict regulations, making traditional payment processing challenging. A high-risk payment gateway ensures secure transactions, fraud protection, and seamless payments. It supports multiple currencies, fast payouts, and compliance with industry standards. Stay ahead in the gaming industry with a reliable, high-risk payment solution.

#high risk payment processing#radiant pay#merchant account providers#payment processing solutions in uk

0 notes

Text

Renting vs. Buying Credit Card Terminals: Which Is Right for You?

Credit card processing has become a fundamental aspect of any merchant's operations. Whether you are a small business or a high-risk merchant, accepting credit cards is essential for ensuring customer satisfaction and improving sales. One of the key decisions you’ll need to make is whether to rent or buy a credit card terminal. This decision can have a significant impact on your business's credit card processing fees, upfront costs, and long-term financial commitments.

#merchant services#merchant service provides#high-risk merchants#merchant services in USA#Credit Card Terminals#Credit card processing#high-risk merchant#rent or buy a credit card terminal#credit card processing fees#high-risk payment gateways

0 notes

Text

CareCredit: Your Health and Wellness Credit Card Marketplace

Managing out-of-pocket healthcare expenses can be overwhelming, especially when insurance doesn’t cover all costs. The CareCredit credit card offers a practical solution, enabling you to pay for a wide range of health and wellness services over time. From dental care to veterinary treatments, Care Credit simplifies healthcare financing and helps manage your health-related bills. Let’s explore how…

#accepted providers#CareCredit#CareCredit account management#CareCredit application process#CareCredit benefits#CareCredit credit card#CareCredit interest rates#CareCredit promotional plans#CareCredit tips#cosmetic procedure financing#credit card for medical bills#credit score impact#dental care financing#dental treatments financing#Flexible payment options#health and wellness costs#health credit card#health expenses card#health financing#healthcare costs#healthcare credit card#healthcare financing options.#healthcare financing tool#healthcare payment plans#healthcare providers#how to apply for CareCredit#manage healthcare costs#managing healthcare expenses#medical credit card#medical expenses

0 notes

Text

#Forex Trading Merchant Account Providers#forex merchant account#forex payment processing#forex business payment processing

0 notes

Text

iSmart Payments team member Greg teaching the staff at Davenport Foundation Repair about our PayAnywhere PAX A77 mobile payment terminals. Now they can take customer payment wherever the foundation repair job is.

#payments#smallbusiness#construction#business#mobilepayments#cardmachine#credit card processing#merchant services#accept credit card payments#payment solutions#payment service providers

1 note

·

View note

Text

Optimizing Financial Management with Chiropractic Billing Services

In the healthcare sector, chiropractic care plays a vital role in managing musculoskeletal conditions, improving mobility, and enhancing patients' overall quality of life. However, managing the financial aspects of a chiropractic practice can be challenging due to the unique nature of treatments, frequent patient visits, and varying insurance policies. This is where medical billing services come into play, ensuring that chiropractic practices can focus on providing care while their financial operations run smoothly. These services streamline the billing process, minimize errors, and enhance reimbursement rates, which ultimately leads to better revenue management for chiropractic practices.

What Are Chiropractic Billing Services?

Chiropractic billing services are specialized financial solutions designed to meet the unique needs of chiropractic practices. These services are a critical component of Revenue Cycle Management (RCM) services, which oversee the entire process of patient billing, from claim submission to final payment. Chiropractic billing services handle everything from insurance verification and coding of chiropractic adjustments to following up on claims and managing denials. Since chiropractic care often involves ongoing treatments and multiple patient visits, these billing services ensure that claims are submitted accurately and promptly, reducing delays and maximizing revenue.

The Importance of Medical Billing and Coding in Chiropractic Care

Accurate medical billing and coding is essential for chiropractic practices to ensure that they are compensated for the services they provide. Chiropractic care involves various treatments, such as spinal adjustments, physical therapy, and other therapeutic services, each of which requires precise coding to avoid errors. Incorrect or incomplete coding can lead to claim denials or underpayments, which can negatively affect a practice’s cash flow. By partnering with experienced billing professionals who specialize in medical billing and coding, chiropractic practices can ensure that their claims are submitted correctly and in compliance with industry standards, leading to improved financial outcomes.

Benefits of Healthcare IT in Chiropractic Billing

In the digital age, Healthcare IT has transformed the way billing services are managed, offering numerous benefits for chiropractic practices. Advanced billing software and electronic health record (EHR) systems streamline the billing process by automating tasks such as claim submission, coding, and patient record management. Healthcare IT reduces human error, speeds up payment cycles, and allows for better communication between chiropractic providers and insurance companies. Additionally, real-time tracking and reporting features enable chiropractic practices to monitor the status of claims and payments, ensuring that revenue is managed efficiently. Healthcare IT enhances both the accuracy and efficiency of chiropractic billing, leading to improved practice operations.

Chiropractic Billing Services at Mediclaim Management

Mediclaim Management offers specialized Chiropractic Billing Services designed to meet the needs of chiropractic practices. With a deep understanding of the unique challenges that chiropractors face, their team of billing experts ensures that all aspects of the billing process are handled with precision and care. Mediclaim Management’s Chiropractic Billing Services help providers reduce billing errors, increase claim approval rates, and expedite reimbursements. By partnering with Mediclaim Management, chiropractic practices can focus on delivering high-quality care to their patients while ensuring that their financial operations run smoothly in the background.

With Mediclaim Management’s Chiropractic Billing Services, chiropractic providers can optimize their revenue cycle, reduce financial stress, and ensure that their practice remains financially healthy. This allows chiropractors to focus on what truly matters—improving the health and well-being of their patients.

#medical billing#Optimizing Financial Management with Chiropractic Billing Services#In the healthcare sector#chiropractic care plays a vital role in managing musculoskeletal conditions#improving mobility#and enhancing patients' overall quality of life. However#managing the financial aspects of a chiropractic practice can be challenging due to the unique nature of treatments#frequent patient visits#and varying insurance policies. This is where medical billing services come into play#ensuring that chiropractic practices can focus on providing care while their financial operations run smoothly. These services streamline t#minimize errors#and enhance reimbursement rates#which ultimately leads to better revenue management for chiropractic practices.#What Are Chiropractic Billing Services?#Chiropractic billing services are specialized financial solutions designed to meet the unique needs of chiropractic practices. These servic#which oversee the entire process of patient billing#from claim submission to final payment. Chiropractic billing services handle everything from insurance verification and coding of chiroprac#these billing services ensure that claims are submitted accurately and promptly#reducing delays and maximizing revenue.#The Importance of Medical Billing and Coding in Chiropractic Care#Accurate medical billing and coding is essential for chiropractic practices to ensure that they are compensated for the services they provi#such as spinal adjustments#physical therapy#and other therapeutic services#each of which requires precise coding to avoid errors. Incorrect or incomplete coding can lead to claim denials or underpayments#which can negatively affect a practice’s cash flow. By partnering with experienced billing professionals who specialize in medical billing#chiropractic practices can ensure that their claims are submitted correctly and in compliance with industry standards#leading to improved financial outcomes.#Benefits of Healthcare IT in Chiropractic Billing#In the digital age

0 notes

Text

In the current rapidly evolving digital currency market, decentralized finance (DeFi) platforms are redefining the shape of financial services with their unique advantages. Bit Loop, as a leading decentralized lending platform, not only provides a safe and transparent lending environment, but also opens up new passive income channels for users through its innovative sharing reward system.

Personal links and permanent ties: Create a stable revenue stream One of the core parts of Bit Loop is its recommendation system, which allows any user to generate a unique sharing link when they join the platform. This link is not only a “key” for users to join the Bit Loop, but also a tool for them to establish an offline network. It is worth noting that offline partners who join through this link are permanently tied to the recommender, ensuring that the sharer can continue to receive rewards from the offline partner’s activities.

Unalterable referral relationships: Ensure fairness and transparency A significant advantage of blockchain technology is the immutability of its data. In Bit Loop, this means that once a referral link and live partnership is established, the relationship is fixed and cannot be changed. This design not only protects the interests of recommenders, but also brings a stable user base and activity to the platform, while ensuring the fairness and transparency of transactions.

Automatically distribute rewards: Simplify the revenue process Another highlight of the Bit Loop platform is the ability for smart contracts to automatically distribute rewards. When the partner completes the circulation cycle, such as investment returns or loan payments, the smart contract automatically calculates and sends the corresponding percentage of rewards directly to the recommender’s wallet. This automatic reward distribution mechanism not only simplifies the process of receiving benefits, but also greatly improves the efficiency of capital circulation.

Privacy protection and security: A security barrier for funds All transactions and money flows are carried out on the blockchain, guaranteeing transparency and traceability of every operation. In addition, the use of smart contracts significantly reduces the risk of fraud and misoperation, providing a solid security barrier for user funds. Users can confidently invest and promote boldly, and enjoy the various conveniences brought by decentralized finance.

conclusion As decentralized finance continues to evolve, Bit Loop offers a new economic model through its unique recommendation system that enables users to enjoy highly secure and transparent financial services while also earning passive income by building and maintaining a personal network. Whether for investors seeking stable passive income or innovators looking to explore new financial possibilities through blockchain technology, Bit Loop provides a platform not to be missed.

#In the current rapidly evolving digital currency market#decentralized finance (DeFi) platforms are redefining the shape of financial services with their unique advantages. Bit Loop#as a leading decentralized lending platform#not only provides a safe and transparent lending environment#but also opens up new passive income channels for users through its innovative sharing reward system.#Personal links and permanent ties: Create a stable revenue stream#One of the core parts of Bit Loop is its recommendation system#which allows any user to generate a unique sharing link when they join the platform. This link is not only a “key” for users to join the Bi#but also a tool for them to establish an offline network. It is worth noting that offline partners who join through this link are permanent#ensuring that the sharer can continue to receive rewards from the offline partner’s activities.#Unalterable referral relationships: Ensure fairness and transparency#A significant advantage of blockchain technology is the immutability of its data. In Bit Loop#this means that once a referral link and live partnership is established#the relationship is fixed and cannot be changed. This design not only protects the interests of recommenders#but also brings a stable user base and activity to the platform#while ensuring the fairness and transparency of transactions.#Automatically distribute rewards: Simplify the revenue process#Another highlight of the Bit Loop platform is the ability for smart contracts to automatically distribute rewards. When the partner complet#such as investment returns or loan payments#the smart contract automatically calculates and sends the corresponding percentage of rewards directly to the recommender’s wallet. This au#but also greatly improves the efficiency of capital circulation.#Privacy protection and security: A security barrier for funds#All transactions and money flows are carried out on the blockchain#guaranteeing transparency and traceability of every operation. In addition#the use of smart contracts significantly reduces the risk of fraud and misoperation#providing a solid security barrier for user funds. Users can confidently invest and promote boldly#and enjoy the various conveniences brought by decentralized finance.#conclusion#As decentralized finance continues to evolve#Bit Loop offers a new economic model through its unique recommendation system that enables users to enjoy highly secure and transparent fin

1 note

·

View note

Text

well i haven't spilled my guts on tumblr since i was in college but it's the platform that's felt The Most Mine thru the years, so

let's talk!

i've had a huge chip on my shoulder that i wanted off before the year ends. very bad professional experience to follow

so firstly to get ahead of the speculating, i'm not naming names or anything. some of you will puzzle out who i'm talking about, but please don't bother anyone especially not on my behalf. i've worked hard to distance myself from them the past few months. shit happens, especially when you're a dumb bitch (that's me!)

but also this person was someone i considered a close friend and it makes me uneasy to possibly direct backlash at them. "then why post about it" bc i did intermittent work for them for over a year. this is just about that. so hear me out

basically it started off fine. i initially did some commission work for good pay, then was invited to become more involved with their team. unfortunately as i became more involved with their operation it became more disorganized over time. projects started then forgotten, constantly shifting schedules, lapsing communication between roles, confusing financials, and often inconsistent if not late payments. during mid 2023 i was doing colorist work, sometimes on a one day turnaround (all while also preparing drawfee's summer merch launch). the payroll wasn't set up correctly so i wasn't paid for that work for over a year (more on that later), tho to be fair that was largely my own fault at first as i just didnt realize the payments didn't go thru lol

i always consider myself decently capable of separating friendship and coworker-ship; i run a company with 4 wonderful friends, going strong for almost 5 years. that didn't really work out in this case. by early this year our friendship was on the rocks; work issues fed into personal issues and vice versa. so as the rest of this shit plays out, we had just had our first "big fight" which i felt very bad about and added to all the upcoming tension

a huge point of friction was the fact that i really wanted to work with them to make a music video for one of their songs. i've always wanted a chance to make a music video, was confident in a concept i came up with, and even did some concept art for the idea. everyone insisted they loved the concept and that we should do it, but we kept pushing it back for various reasons. it ended up becoming a huge sticking point for my frustrations, which i tried to express productively. TLDR, we eventually got around to discussing it seriously around april.

i planned to ask for $4000 with negotiable add-on for the whole project, which was my Friend Discount price. i was offered a contract for $1000 flat rate, as they insisted that was the only budget they had for it.

don't ask me why i signed it lol. i didn't even counter offer

there was some girlmath to it: i wanted an extra 1k for a student scholarship i provide every spring and well, there it was. but if i had to guess, i saw it as something i just couldn't back down from any more. i caused these folks- my friends- a lot of problems bc i dug my heels in so deep to chase this project, so fuck it we ball

i had about 4 months to solo a 3 minute music video. they wanted it done in august so they could release it before summer ended, bc "it was a summer song". to be fair i was asked if i needed them to pay for anything extra like assistants (which i would have to find and manage) but i was so immediately overwhelmed that i didn't wanna slow down to wait on that process lol. there was very minimal communication other than brief progress check-ins every few weeks. i did everything for that project myself: the original concept, character designs, storyboards, layouts, backgrounds. i even did the editing/compositing for the final cut of the MV. the only favor i did myself was limiting the amount of it that was actually animated to simple loops and motions. hardly my best work but it was work still done

i did it all in between my full time job. i ended up having to take nearly a month away from most of my drawfee duties (with the support of the others) to make the august deadline. i only ever asked for a 3 day extension (notice given about a week in advance, around the same time i was given the final song file lol). i finished the music video at 6am on the final deadline and recorded drawfee the next day on 2 hours of sleep

but it was done, coolies. the team was very happy with the final product. honestly, without getting into it, those were a very emotionally taxing 4 months. on the professional side, i regretted agreeing to the project and especially for the dogshit rate they offered. i felt like a hypocrite- as someone who always wanted to advocate for younger artists demanding their worth in a world that's getting increasingly hostile toward creatives, i failed myself

so when i met with the manager to discuss the release plan, i told them to do whatever worked best for them as i only had one request: i wanted my credit removed from the project

tbh... like... lmao this dramatic bitch right!! but really, i decided that bad practices only breed worse business. friends or not, it was unprofessional of me to accept such a low paying job so i just didn't want my name used in association. everything felt so muddled to me and i was just really tired at this point

the manager was very understanding and then offered that i could be paid more. they said that their team "was surprised" i accepted their low rate and they would be happy to up the amount. this confused me as the initial budget seemed pretty set and at no point between april and august was i offered a better rate. i knew these guys weren't made of money. so, i declined. i didn't want to put anyone out of their means over work that was already done and agreed upon. but more importantly, i was over the whole thing and didn't want to prolong the project with a contract renegotiation. i just insisted my name be removed

they decided to use a pseudonym (which i was fine with) so they could create a story about a character who made the MV (this sounds really convoluted but i don't know how better to put it without getting specific, sorry). that way if people asked about the credit, they could speak comfortably about it without signaling that something went wrong behind the scenes. ok, kind of a silly narrative imo but whatevs. and maybe this is where i finally went truly wrong but. yolo i guess

i gave the name "D. Smithee", D as in dilfosaur and Smithee as in Alan Smithee. look it up for fun film trivia ig! was it passive aggressive of me to reference that in this context? yeah, honestly. but i thought it was kinda funny and really not that deep. if it was a problem, i have other real, non-cheeky pseudonyms i regularly use. the manager accepted it and all i had to do was wait for them to post the video and i could leave the whole experience behind me

a week later i received a message from the manager that my pseudonym had been denied by the rest of the team bc one of them got the reference. fair enough lol. however, they decided that rather than ask for a different name, the were going to make one up for me that they liked and would "fit the [story]", without asking me

and that! is when i finally snapped!

i was so tired of giving them concessions at this point and having a credit made up for me without any input from me felt genuinely violating and unethical. i started to Panic bc of how stressed i was, and asked for my overdue payments (aka the $500 still owed on the MV, and the colorist rate from a year prior that was never paid even tho i reported it in january) to be scheduled ASAP as i was leaving the work discord immediately

i finally told them off for exploiting me throughout the months while i kept trying to just be nice and finish my contact cleanly. in return i was told that it was unfair to say that as i agreed to everything- i accepted their cheap rate and denied further payment so that was all settled, and it was ok to change my credit without my consent bc i "said they could do whatever with the release". i called bullshit, ended the convo as kindly as i could, and cried lol. they agreed to ditch the pseudonym and just give no credit. that night was the last i heard from anyone on that team

and the real kicker?

august came and went. then september, october... and they never released the music video

and i don't know why, because i was never contacted about it. i've been removed from the picture entirely i guess. 4 months and boatloads of stress. just. up in smoke. i don't know what i expected honestly

it's hard to not take everything that happened personally and as done in bad faith. i really do, honestly. i've had plenty of shitty deals in my almost 10 year art career, but it hits different from people you saw as friends. but to the point of "why not keep it private", i have never felt so disrespected as a professional as i did this past year. i can toy with money and credits and other formalities all i want, but my work- my ideas, my labor, my effort- is still so important to me. i felt like the biggest idiot for doing so much work, pouring so much of myself into a piece for someone's use, for what has amounted to nothing

but more importantly i hated myself for undervaluing my work, even if initially i thought this person was a trusted friend. money is not really an issue for me- drawfee is my main job and i am fine and comfortable. it's so important to pay artists appropriately but i often undersell my own work bc i value the collaboration and passion between creatives more than the reward. i think a lot of artists tend to feel the same, and it often makes us easy to take advantage of. it's so difficult to find the balance between passion and making a fair living, and i think there's some shame within ourselves when artists choose to prioritize that passion

i wanted to finally get all this off my chest bc i was ashamed of every choice i made. things like this happen all the time i'm sure and hiding these mistakes only make it easier for it to happen to other people

tldr always value your work and protect your passion from people who just see it as a product. and don't give cheeky pseudonyms i guess lol

(and again pls don't bother anyone involved about this. a lot of chaos has left my life as i moved past all this, and this is me closing a door without opening new ones hopefully lol)

this shit was truly

so ass.

but i'm moving past it now

but on a nicer note. outside of all of this nonsense, i made lots of good memories this year. i'm truly so grateful to the many wonderful people in my life who keep me going even when i fuck up big time!

and thank you to all of you strangers who, despite everything, give me the time of day. especially if you read this whole thing. you're a real one :')

happy new year!

#getting personelle#reflecting about some shit#thank u for reading or not reading just thanks for sticking around ig

4K notes

·

View notes

Text

#Echeck#Electronic Check#Merchant Services#Payment Processing#Merchant Account#Payment Processing Companies#Payment gateway providers#Best Merchant Services#High Risk Merchant Account#Echeck Account#Echeck Payment Processor#Echeck Payment#Echeck Payment Processing#Electronic Check Payment#what is an echeck#Check 21#echeck casino#e commerce payment processing

4 notes

·

View notes

Text

Offshore Company Registrations with Bank Account?

In today's globalized economy, businesses are increasingly looking beyond domestic borders to "optimize their operations", reduce costs, and gain access to international markets. One strategy that has gained popularity among entrepreneurs and investors is the establishment of offshore companies. In this comprehensive guide, we'll explore the concept of "offshore company registrations", their benefits, considerations, and the process of setting up an offshore company with a bank account.

Understanding Offshore Companies

Definition and characteristics of offshore companies

"Offshore companies are entities registered" in a jurisdiction different from where they conduct their primary business activities or where their owners reside. These companies often enjoy favorable tax treatment, regulatory advantages, and enhanced privacy compared to domestic entities.

Reasons why businesses choose to register offshore Businesses may opt for "offshore company registrations" for various reasons, including tax optimization, asset protection, confidentiality, access to global markets, and simplified regulatory requirements.

Legal and financial implications of offshore company registration While offshore companies offer several benefits, they also come with legal and financial considerations. It's crucial to understand the regulatory environment, tax implications, and compliance requirements associated with offshore operations.

Benefits of Offshore Company Registrations

Tax advantages Offshore companies often benefit from low or zero corporate tax rates, allowing businesses to minimize their tax liabilities and retain more profits.

Asset protection By holding assets offshore, businesses can shield them from potential legal claims, creditors, or other financial risks.

Privacy and confidentiality Offshore jurisdictions typically offer strict confidentiality laws, ensuring the privacy of company ownership and financial information.

Access to global markets Offshore companies can facilitate international trade and investment by providing a platform to conduct business across borders more efficiently.

Simplified regulatory requirements Some offshore jurisdictions have lenient regulatory frameworks, reducing administrative burdens and compliance costs for businesses.

Considerations Before Registering an Offshore Company

Jurisdiction selection Choosing the right jurisdiction is critical, as it determines the regulatory environment, tax implications, and overall suitability for the business's objectives.

Legal requirements and regulations Businesses must comply with the legal and regulatory requirements of both the offshore jurisdiction and their home country to avoid legal issues and potential penalties.

Banking and financial considerations Access to banking services is essential for offshore companies. However, some jurisdictions may have restrictions or challenges in opening and maintaining bank accounts.

Costs involved in setting up and maintaining an offshore company While "offshore company registrations" offer potential cost savings, businesses should consider the upfront and ongoing expenses associated with incorporation, administration, and compliance.

Risks and challenges associated with offshore operations Offshore companies may face risks such as regulatory changes, political instability, reputational damage, and increased scrutiny from tax authorities.

Steps to Register an Offshore Company with Bank Account

Conducting thorough research Before proceeding with offshore company registration, businesses should conduct comprehensive research on potential jurisdictions, legal requirements, and service providers.

Choosing the right jurisdiction Selecting a jurisdiction that aligns with the business's objectives, preferences, and industry requirements is crucial for successful offshore operations.

Hiring professional services Engaging legal, financial, and other professional services is advisable to navigate the complexities of "offshore company registrations" and ensure compliance with relevant laws and regulations.

Preparing and submitting necessary documents Businesses must gather and submit the required documents, such as identification proofs, business plans, and incorporation forms, to the offshore jurisdiction's authorities.

Opening a bank account for the offshore company Securing banking services is an integral part of "offshore company registrations in UK". Businesses should approach reputable banks in the chosen jurisdiction and fulfill their account opening requirements.

Compliance with ongoing regulatory requirements Once the "offshore company" is registered and the bank account is opened, it's essential to maintain compliance with ongoing regulatory requirements, including filing annual reports, tax returns, and other obligations.

Common Challenges and Solutions

Regulatory compliance issues Navigating complex regulatory frameworks and staying compliant with evolving laws and "regulations can be challenging for offshore companies". Seeking professional advice and regular updates on regulatory changes is essential.

Banking restrictions and challenges Some offshore jurisdictions may "face banking restrictions" or challenges due to regulatory scrutiny or international sanctions. Exploring alternative banking options or engaging specialized banking services can help overcome these challenges.

Tax implications and controversies Offshore companies may face scrutiny and controversies related to tax avoidance or evasion. Maintaining accurate records, adhering to tax laws, and seeking tax advice from experts can mitigate tax-related risks.

Reputation risks associated with offshore entities Offshore companies often face stigma and negative perceptions due to associations with tax evasion, money laundering, or illicit activities. Maintaining transparency, ethical business practices, and good corporate governance can help mitigate reputational risks.

#Offshore Company Registration#Offshore payment processors#Offshore high risk payment gateway#Offshore payment gateway high risk#Offshore online payment processing#Offshore payment service provider#Offshore merchant payment services#Offshore bitcoin debit card#Offshore Company#Offshore companies#Offshore company in UK#Offshore company in USA#Offshore company Registration in UK#Offshore company Registration in USA#Offshore company formation#Offshore incorporation services

0 notes

Text

High-Risk Merchant Accounts for Casinos: What You Need to Know

Casinos are classified as high-risk businesses, making it challenging to secure merchant accounts. A high-risk casino merchant account ensures smooth payment processing while mitigating fraud and chargebacks. Learn the key factors, benefits, and how to get approved hassle-free.

0 notes