#Payment Processing

Explore tagged Tumblr posts

Text

Fintech bullies stole your kid’s lunch money

I'm coming to DEFCON! On Aug 9, I'm emceeing the EFF POKER TOURNAMENT (noon at the Horseshoe Poker Room), and appearing on the BRICKED AND ABANDONED panel (5PM, LVCC - L1 - HW1–11–01). On Aug 10, I'm giving a keynote called "DISENSHITTIFY OR DIE! How hackers can seize the means of computation and build a new, good internet that is hardened against our asshole bosses' insatiable horniness for enshittification" (noon, LVCC - L1 - HW1–11–01).

Three companies control the market for school lunch payments. They take as much as 60 cents out of every dollar poor kids' parents put into the system to the tune of $100m/year. They're literally stealing poor kids' lunch money.

In its latest report, the Consumer Finance Protection Bureau describes this scam in eye-watering, blood-boiling detail:

https://files.consumerfinance.gov/f/documents/cfpb_costs-of-electronic-payment-in-k-12-schools-issue-spotlight_2024-07.pdf

The report samples 16.7m K-12 students in 25k schools. It finds that schools are racing to go cashless, with 87% contracting with payment processors to handle cafeteria transactions. Three processors dominate the sector: Myschoolbucks, Schoolcafé, and Linq Connect.

These aren't credit card processors (most students don't have credit cards). Instead, they let kids set up an account, like a prison commissary account, that their families load up with cash. And, as with prison commissary accounts, every time a loved one adds cash to the account, the processor takes a giant whack out of them with junk fees:

https://pluralistic.net/2024/02/14/minnesota-nice/#shitty-technology-adoption-curve

If you're the parent of a kid who is eligible for a reduced-price lunch (that is, if you are poor), then about 60% of the money you put into your kid's account is gobbled up by these payment processors in service charges.

It's expensive to be poor, and this is no exception. If your kid doesn't qualify for the lunch subsidy, you're only paying about 8% in service charges (which is still triple the rate charged by credit card companies for payment processing).

The disparity is down to how these charges are calculated. The payment processors charge a flat fee for every top-up, and poor families can't afford to minimize these fees by making a single payment at the start of the year or semester. Instead, they pay small sums every payday, meaning they pay the fee twice per month (or even more frequently).

Not only is the sector concentrated into three companies, neither school districts nor parents have any meaningful way to shop around. For school districts, payment processing is usually bundled in with other school services, like student data management and HR data handling. For parents, there's no way to choose a different payment processor – you have to go with the one the school district has chosen.

This is all illegal. The USDA – which provides and regulates – the reduced cost lunch program, bans schools from charging fees to receive its meals. Under USDA regs, schools must allow kids to pay cash, or to top up their accounts with cash at the school, without any fees. The USDA has repeatedly (2014, 2017) published these rules.

Despite this, many schools refuse to handle cash, citing safety and security, and even when schools do accept cash or checks, they often fail to advertise this fact.

The USDA also requires schools to publish the fees charged by processors, but most of the districts in the study violate this requirement. Where schools do publish fees, we see a per-transaction charge of up to $3.25 for an ACH transfer that costs $0.26-0.50, or 4.58% for a debit/credit-card transaction that costs 1.5%. On top of this, many payment processors charge a one-time fee to enroll a student in the program and "convenience fees" to transfer funds between siblings' accounts. They also set maximum fees that make it hard to avoid paying multiple charges through the year.

These are classic junk fees. As Matt Stoller puts it: "'Convenience fees' that aren't convenient and 'service fees' without any service." Another way in which these fit the definition of junk fees: they are calculated at the end of the transaction, and not advertised up front.

Like all junk fee companies, school payment processors make it extremely hard to cancel an automatic recurring payment, and have innumerable hurdles to getting a refund, which takes an age to arrive.

Now, there are many agencies that could have compiled this report (the USDA, for one), and it could just as easily have come from an academic or a journalist. But it didn't – it came from the CFPB, and that matters, because the CFPB has the means, motive and opportunity to do something about this.

The CFPB has emerged as a powerhouse of a regulator, doing things that materially and profoundly benefit average Americans. During the lockdowns, they were the ones who took on scumbag landlords who violated the ban on evictions:

https://pluralistic.net/2021/04/20/euthanize-rentier-enablers/#cfpb

They went after "Earned Wage Access" programs where your boss colludes with payday lenders to trap you in debt at 300% APR:

https://pluralistic.net/2023/05/01/usury/#tech-exceptionalism

They are forcing the banks to let you move your account (along with all your payment history, stored payees, automatic payments, etc) with one click – and they're standing up a site that will analyze your account data and tell you which bank will give you the best deal:

https://pluralistic.net/2023/10/21/let-my-dollars-go/#personal-financial-data-rights

They're going after "buy now, pay later" companies that flout borrower protection rules, making a rogues' gallery of repeat corporate criminals, banning fine-print gotcha clauses, and they're doing it all in the wake of a 7-2 Supreme Court decision that affirmed their power to do so:

https://pluralistic.net/2024/06/10/getting-things-done/#deliverism

The CFPB can – and will – do something to protect America's poorest parents from having $100m of their kids' lunch money stolen by three giant fintech companies. But whether they'll continue to do so under a Kamala Harris administration is an open question. While Harris has repeatedly talked up the ways that Biden's CFPB, the DOJ Antitrust Division, and FTC have gone after corporate abuses, some of her largest donors are demanding that her administration fire the heads of these agencies and crush their agenda:

https://prospect.org/power/2024-07-26-corporate-wishcasting-attack-lina-khan/

Tens of millions of dollars have been donated to Harris' campaign and PACs that support her by billionaires like Reid Hoffman, who says that FTC Chair Lina Khan is "waging war on American business":

https://prospect.org/power/2024-07-26-corporate-wishcasting-attack-lina-khan/

Some of the richest Democrat donors told the Financial Times that their donations were contingent on Harris firing Khan and that they'd been assured this would happen:

https://archive.is/k7tUY

This would be a disaster – for America, and for Harris's election prospects – and one hopes that Harris and her advisors know it. Writing in his "How Things Work" newsletter today, Hamilton Nolan makes the case that labor unions should publicly declare that they support the FTC, the CFPB and the DOJ's antitrust efforts:

https://www.hamiltonnolan.com/p/unions-and-antitrust-are-peanut-butter

Don’t want huge companies and their idiot billionaire bosses to run the world? Break them up, and unionize them. It’s the best program we have.

Perhaps you've heard that antitrust is anti-worker. It's true that antitrust law has been used to attack labor organizing, but that has always been in spite of the letter of the law. Indeed, the legislative history of US antitrust law is Congress repeatedly passing law after law explaining that antitrust "aims at dollars, not men":

https://pluralistic.net/2023/04/14/aiming-at-dollars/#not-men

The Democrats need to be more than The Party of Not Trump. To succeed – as a party and as a force for a future for Americans – they have to be the party that defends us – workers, parents, kids and retirees alike – from corporate predation.

Support me this summer on the Clarion Write-A-Thon and help raise money for the Clarion Science Fiction and Fantasy Writers' Workshop!

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/07/26/taanstafl/#stay-hungry

Image: Cryteria (modified) https://commons.wikimedia.org/wiki/File:HAL9000.svg

CC BY 3.0 https://creativecommons.org/licenses/by/3.0/deed.en

#pluralistic#fintech#ed-tech#finance#usury#payment processing#chokepoints#corruption#monopoly#cfpb#consumer finance protection bureau

215 notes

·

View notes

Video

youtube

Visa Mastercard Censorship Comes for Denpasoft! How Can It Be Stopped?

a bit late for finding this type of stuff~~ I think I also saw a video from Rev Says Desu about this kind of thing too~~

why’re card companies trying to decide for us what types of art we can or cannot enjoy?

I think the Rev Says Desu video I saw on this was about mastercard and visa pulling funding for pixiv or melonbooks or some other anime/manga sites? idr so the only way to pay on whatever site that was is by japanese card companies or whatever funding platforms are on the site...

just let us buy the thing as long as it doesn’t hurt anyone~~ only thing that’s wrong with fictional art is papercuts and hand cramps from writing/drawing for a long time....

or censoring japanese games but allowing similar or worse stuff in western games, like a “it’s ok if we do it” ..... T_T;; the main thing I’m thinking of in that regard is all the customization and nsfw in “baulder’s gate 3″ yet the anime/manga/visual novels get censored??

not angry but why does this double standard for east/west media exist? censorship is a slippery slope~~~ didn’t like it when 4kids westernized the japanese culture out of childhood anime that I watched, and it seems to be getting worse~~

#youtube#youtube video#otaku spirit youtube#not mine#just wanted to share#card companies#bank cards#censorship#anti censorship#bank#banks#payment#payment processing#payment processors#discussion#anti censorship discussion#art#artist#artists#denpa#denpasoft

3 notes

·

View notes

Text

Join Wise and get £50. It's simple, quick, and rewarding!

Wise Money, Wise choices!

Looking for a smarter way to handle your money across borders? Wise is the answer. And here’s an even better reason to join—sign up with my invite, and you’ll get £50!

Smart Transfers, Happy Wallets!

Wise.com makes sending, receiving, and converting money internationally fast, easy, and affordable. With real exchange rates and low fees, you’ll save more on every transaction. Plus, their platform is user-friendly, so you can manage your money with confidence.

Save More, Send Smarter!

Signing up is simple. Just use my invite link, create your account, and you’ll get £50 to kickstart your journey with Wise. It’s a win-win—secure your bonus and start saving today! Your Money, Your Way—Easily!!!

#payments#payment gateway#payment solutions#payment processing#payment fraud protection#payment plan#partnership#credit#network#paypal#wise words#wise quotes#wise zzz#payment transfer easily#spilled ink#artists on tumblr#deadpool and wolverine#hermitcraft#photography#grunge#dc comics#splatoon#splatoon 3

7 notes

·

View notes

Text

Future-Proof Payment Solutions: A Guide to Merchant Account Innovations

Article by Jonathan Bomser | CEO | Accept-Credit-Cards-Now.com

In the fast-paced world of online commerce, payment solutions have evolved into the linchpin for the success of businesses spanning diverse industries. Whether steering an e-commerce venture, specializing in credit repair, or navigating the CBD retail landscape, procuring an apt merchant account and avant-garde payment processing system is paramount. This guide delves into the domain of payment innovation, spotlighting future-proof solutions crafted to meet the exigencies of contemporary high-risk businesses.

DOWNLOAD THE FUTURE-PROOF PAYMENT SOLUTIONS INFOGRAPHIC HERE

The Core of Merchant Accounts

Merchant accounts, serving as the bedrock of secure payment processing, play an instrumental role in facilitating various transactions, including credit and debit card payments. The significance of reliable and efficient merchant processing services cannot be overstated. Whether operating in the high-risk echelons or mainstream e-commerce, securing the right merchant account is a prerequisite for ensuring the fluidity of transactions.

Navigating the Landscape of High-Risk Payment Processing

Industries perched in the high-risk echelons, such as credit repair and CBD, grapple with distinctive challenges in the realm of payment processing. Traditional payment processors often shy away from these ventures due to perceived risks. However, this guide unravels the nuances of high-risk payment processing, spotlighting innovations designed to fortify and safeguard businesses operating in these precarious niches.

E-Commerce Payment Prowess

In this digital epoch, the ascent of e-commerce is meteoric. To flourish in this fiercely competitive landscape, online enterprises must proffer payment options that seamlessly meld convenience with security. This section delves into e-commerce payment processing solutions, underscoring the perks of embracing a dedicated e-commerce merchant account. Whether dealing in products or services, the payment gateway emerges as the conduit to triumph.

Bespoke Services for Credit Repair

Credit repair entities assume a pivotal role in aiding individuals to reconstruct their financial landscapes. Yet, the distinctive nature of this terrain necessitates specialized merchant processing services. This guide unravels the intricacies of payment processing and payment gateways uniquely tailored for credit repair merchants, ensuring compliance with industry regulations.

youtube

Mastery of Payment Processing in the CBD Realm

While the CBD industry witnesses unprecedented growth, it concurrently stands as one of the most high-risk sectors for payment processing. Securing a dependable CBD merchant account and payment gateway is imperative for enterprises navigating this domain. This section dissects the challenges confronting CBD retailers and unveils innovative solutions engineered to usher in secure and efficient credit card processing for CBD products.

In the ever-evolving realm of payment processing, proactive adaptation is the linchpin for businesses of every stature and kind. From high-risk payment processing to e-commerce sagas and specialized solutions for credit repair and CBD landscapes, the payment tableau is undergoing a metamorphosis. Armed with the right merchant account and payment gateway, businesses can fortify their standing in the digital arena, future-proofing their enterprise while presenting customers with a payment experience that seamlessly amalgamates security and convenience.

#high risk merchant account#credit card processing#payment processing#high risk payment gateway#high risk payment processing#accept credit cards#credit card payment#merchant processing#payment#youtube#Youtube

23 notes

·

View notes

Text

Abbreviation for Payment: Definition & Meaning

3 notes

·

View notes

Text

All-in-One Payment Solutions for Any Business

What Are Payment Solutions?

Imagine a world where transactions were clunky, slow, and insecure. Not only would businesses struggle, but customers would also be frustrated. That’s where payment solutions come in.

They are the backbone of the modern commerce experience, facilitating smooth, secure, and efficient money exchanges in a world that demands speed and reliability.

From in-store purchases to digital subscriptions, payment solutions enable every kind of business transaction.

At Valor, we understand that payments are not just about exchanging money – they’re about ensuring a seamless, secure, and smart transaction every time. This is why we’re constantly evolving to offer payment solutions that help businesses thrive.

#payment solutions#payment gateway#payment processor#payment processing#payments#credit card#POS#pos software#pos system#pos machine#pos solutions

3 notes

·

View notes

Text

How Does Payment Gateway Integration Simplify Online Transactions?

In the digital age, where e-commerce and online services dominate the market, payment gateway integration has emerged as a cornerstone of seamless online transactions. A payment gateway acts as a bridge between customers and merchants, enabling secure and efficient payment processing. This article delves into how payment gateway integration simplifies online transactions while highlighting the role of payment solution providers and innovations like those from Xettle Technologies in enhancing the experience.

What Is Payment Gateway Integration?

Payment gateway integration refers to the process of embedding a payment gateway into a website, application, or e-commerce platform to facilitate the secure transfer of payment information between the customer, the merchant, and the financial institutions involved. This integration ensures that transactions are processed smoothly, enhancing the user experience and building trust among customers.

Payment gateways handle critical tasks such as encrypting sensitive data, verifying card details, and authorizing payments, making them an indispensable part of any online business.

Benefits of Payment Gateway Integration

1. Enhanced Security

One of the primary advantages of payment gateway integration is the high level of security it offers. Payment gateways use advanced encryption technologies to protect sensitive customer data, such as credit card details and personal information. By complying with industry standards like PCI DSS (Payment Card Industry Data Security Standard), they ensure that transactions remain secure from cyber threats and fraud.

Many payment solution providers also incorporate features such as tokenization, two-factor authentication, and fraud detection systems, further safeguarding the transaction process.

2. Seamless User Experience

Payment gateway integration ensures that customers can complete their transactions without any interruptions or complications. A smooth checkout process is essential for reducing cart abandonment rates and enhancing customer satisfaction. Features like multiple payment options, one-click payments, and mobile compatibility contribute to a user-friendly experience.

For example, integrated payment gateways often support a wide range of payment methods, including credit and debit cards, digital wallets, net banking, and even cryptocurrencies. This flexibility ensures that businesses can cater to diverse customer preferences.

3. Global Reach

With payment gateway integration, businesses can easily expand their reach to international markets. Most payment gateways support multiple currencies and languages, enabling businesses to offer localized payment experiences to their global customers. This capability is particularly beneficial for e-commerce platforms seeking to scale their operations.

4. Real-Time Payment Processing

Payment gateway integration ensures that transactions are processed in real-time, reducing delays and providing instant confirmation to customers and merchants. This immediacy not only enhances the customer experience but also helps businesses maintain accurate records of their transactions.

5. Simplified Reconciliation and Reporting

Integrated payment gateways often come with dashboards and reporting tools that provide businesses with detailed insights into their transactions. These tools simplify the process of tracking payments, managing refunds, and generating financial reports, enabling better decision-making and financial planning.

The Role of Payment Solution Providers

Payment solution providers play a crucial role in making payment gateway integration accessible and efficient. These providers offer a range of services, from payment gateway setup and customization to ongoing support and updates. By partnering with reliable payment solution providers, businesses can ensure a hassle-free integration process and stay ahead in the competitive digital landscape.

Xettle Technologies, for instance, is a leading payment solution provider known for its innovative approach to payment gateway integration. Their solutions are designed to cater to businesses of all sizes, offering flexibility, security, and scalability. By leveraging the expertise of providers like Xettle Technologies, businesses can focus on their core operations while leaving the technical aspects of payment processing in capable hands.

Key Considerations for Payment Gateway Integration

When integrating a payment gateway, businesses must consider several factors to ensure optimal performance and customer satisfaction:

Security: Ensure that the payment gateway complies with industry security standards and offers advanced fraud prevention features.

Compatibility: Choose a payment gateway that integrates seamlessly with your existing website or application.

User Experience: Opt for a gateway that offers a smooth and intuitive checkout process.

Cost: Evaluate the pricing structure, including setup fees, transaction fees, and monthly charges.

Support: Partner with a payment solution provider that offers reliable customer support and technical assistance.

Conclusion

Payment gateway integration is a vital component of modern online transactions, providing businesses with the tools they need to deliver secure, efficient, and user-friendly payment experiences. By partnering with trusted payment solution providers and leveraging innovative technologies, businesses can streamline their payment processes and build lasting relationships with their customers.

The expertise of companies like Xettle Technologies demonstrates how payment gateway integration can be tailored to meet the unique needs of businesses, ensuring scalability and adaptability in a fast-evolving market. As the demand for seamless online transactions continues to grow, investing in robust payment gateway integration is not just an option but a necessity for businesses aiming to thrive in the digital era.

2 notes

·

View notes

Text

Nurit Credit Card Processing Terminals: A Comprehensive Overview

#Nurit Credit Card Processing Terminals: A Comprehensive Overview#credit card processing#credit card terminal#credit#processing#nurit#credit card machine#credit card payments#card processing#emv credit card processing#exs credit card processing#accept credit cards#terminals#payment processing#credit card#best way to accept credit cards#credit card (industry)#free emv credit card terminal#process credit card payments#emv credit card terminal#cardpointe credit card terminal#credit card services

2 notes

·

View notes

Text

#eCheck#Electronic checks#ACH (Automated Clearing House)#Digital payments#Payment processing#Merchant services#Payment solutions#Secure transactions#Business payments#Online payments#Payment gateway#Payment technology#Financial services#E-commerce#Retail business#Small business#USA businesses#American merchants#Payment methods#Payment processing company#Payment processing solutions#Electronic payment options#Payment security#Card processing#Payment terminals#Mobile payments#Payment software#Point of sale (POS)#Payment integration#Business growth

7 notes

·

View notes

Text

Plinkpump linkdump

I'm on a 20+ city book tour for my new novel PICKS AND SHOVELS. Catch me in PDX on Jun 20 at BARNES AND NOBLE with BUNNIE HUANG. After that, it's LONDON (Jul 1) and MANCHESTER (Jul 2).

Every now and again, I reach the end of the week with more stray links that I've been able to squeeze into the newsletter, and when that happens it's time for a linkdump. This is linkdump number 31; here's 1-30:

https://pluralistic.net/tag/linkdump/

It's been five years (to the day!) since Wired killed off "Beyond the Beyond," Bruce Sterling's excellent blog, a wanton act of online vandalism that, among other things, made it much harder to figure out what was on Bruce's mind, a subject I find endlessly fascinating:

https://pluralistic.net/2020/05/17/cheap-truthers/#cheap-truth

Sterling's got a Medium that he almost never updates. I follow it through RSS, the best way to keep up with both things that update frequently and also hardly ever:

https://pluralistic.net/2024/10/16/keep-it-really-simple-stupid/#read-receipts-are-you-kidding-me-seriously-fuck-that-noise

This week, he posted a long, thoughtful, and seriously intriguing review of Cafe Europa Revisited, Slavenka Drakulic's followup to her 1996 international blockbuster Cafe Europa:

https://bruces.medium.com/cafe-europa-revisited-2025-be8875c06c4c

I confess that I had never heard of Drakulic, though, as I read Sterling's review, it became clear why he dotes on the acerbic Croatian essayist, a keen observer of the material world and theorizer of political upheaval:

https://www.penguinrandomhouse.com/books/602764/cafe-europa-revisited-by-slavenka-drakulic/

Drakulic is well-known for an essay collection called "How We Survived Communism and Even Laughed," and the subtitle of this volume is "How to Survive Post-Communism," which just about says it all. Sterling characterizes it as the start of a new hot genre, "Old books directly written for old people by old people."

"The West" (whatever that is) is getting old. For more than a decade, Bruce Sterling's been predicting a future of "old people, in big cities, afraid of the sky." Original Sin, a new heavily reported book on the 2024 election makes a good case that Biden was indeed in a state of advanced senescence through much of his presidency and the entire election campaign, and had no business occupying the White House, much less running for another four years:

https://www.nytimes.com/2025/05/13/books/review/originial-sin-jake-tapper-alex-thompson.html

Biden's unwillingness to confront his age and frailty, along with Trump's obvious mental and physical decline, has many terrified American political thinkers talking about the gerontocracy that's running the country:

https://pluralistic.net/2023/07/01/designated-survivors/

Corey Robin got in some good licks on this one, in a piece called "We really are the oldest democracy in the world":

https://coreyrobin.com/2025/05/15/we-really-are-the-oldest-democracy-in-the-world/

"Oldest democracy" as in, "the democracy with the oldest leaders." The Democrats are gearing up for the midterms with such repeat offenders as Maxine Waters (86), Rosa DeLauro (82), John Garamendi (80), Doris Matsui (80) and Bonnie Watson Coleman (80). Also running: David Scott (79) who had to step down as ranking House Ag Committee member over health concerns. And: Dwight Evans (70), who missed most of last year's votes after suffering a stroke.

Meanwhile, Nancy Pelosi (85), Steny Hoyer (85), Danny Davis (83), Frederica Wilson (82), Emanuel Cleaver (80) and Alma Adams (78) won't say whether they're running in 2026:

https://www.axios.com/2025/05/15/house-democrats-age-members-reelection-biden

At 53, I can tell that I've lost a step. Sure, I have the benefits of wisdom, but man, I am so tired. Maybe the reason our Democratic leaders have sat idly by and watched as Trump dismantled democracy and installed fascism is that they're too tired to scale the fences like their South Korean counterparts did?

https://www.theverge.com/24312920/martial-law-south-korea-yoon-suk-yeol-protest-dispatch

I'm not saying everyone over 65 in Congress should retire. I'm saying that a caucus that skewed younger might be more, you know, vigorous. I'm minded of my favorite John Ciardi poem, "About Crows":

The young crow flies above, below, and rings around the slow old crow. What does the fast young crow not know? WHERE TO GO.

https://spirituallythinking.blogspot.com/2011/10/about-crows-by-john-ciardi.html

Meanwhile, young people might just be getting something out of the regulatory apparatus. Thanks to a smashing court loss in the USA and regulation in the EU, Apple is now required to allow app makers to use their own payment processors, skipping the 30% App Tax Apple levies on every in-app purchase, to the tune of $100b/year.

Among other things, this means that every Fortnite skin and upgrade could suddenly get 25% cheaper without costing Epic Games a dime. The only problem is that Apple refuses to obey the regulation or the court order:

https://pluralistic.net/2025/05/01/its-not-the-crime/#its-the-coverup

This week, Apple blocked Fortnite's app from the App Store:

https://www.macrumors.com/2025/05/16/apple-blocks-fortnite-return-to-ios-app-store/

And defied EU regulators by slapping deceptive warning labels all over any EU app that accepts payments without kicking 30% up to Apple:

https://www.theverge.com/news/667484/apple-eu-ios-app-store-warning-payment-system

Apple's in a lot of trouble in the USA (Apple execs who lied to a federal judge about this stuff now face criminal sanctions), and it looks like they're spoiling for a fight with the EU. After all Trump flew to Davos and threatened to destroy any country that tried to regulate US Big Tech. The rest of the world doesn't seem scared – or at least, they're more scared of the risk of trusting US cloud technology that can be cut off to kneecap a rival economy, or used to spy on government and industry, or both. In the EU, Cryptpad – a free, open cloud based document collaboration platform – is luring away Google Docs and Office 365 users at speed:

https://cryptpad.org/

Meanwhile, back in the USA, things are looking grim for Meta, as the FTC's case against the company moves into the end-game. The stakes are high: Meta could be forced to sell off Whatsapp and Instagram:

https://www.bigtechontrial.com/p/from-roadshow-to-expert-witness-courtroom

That is, if Mad King Trump doesn't step in. Seems like nothing is too petty for the Trump admin. How petty are they? This week, Trump's CBP seized a load of t-shirts from the subversive design studio Cola Corporation:

https://www.404media.co/cbp-seizes-shipment-of-t-shirts-featuring-swarm-of-bees-attacking-cops/

Why did CBP seize Cola's tees? Apparently, it was design that featured a cop being attacked by a swarm of bees. Cola knows good publicity when he sees it: he's printing up more of the tees and selling them in a new line he calls "the confiscated collection":

https://www.thecolacorporation.com/collections/confiscated

Get yours while supplies last!

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2025/05/17/odds-and-sods/#cafe-europa

#pluralistic#linkdump#linkdumps#gerontocracy#corey rubin#democrats#dinos#FTC#meta#antitrust#trustbusting#scare screens#apple#eu#payment processing#app tax#Slavenka Drakulic#books#reviews#bruce sterling

40 notes

·

View notes

Text

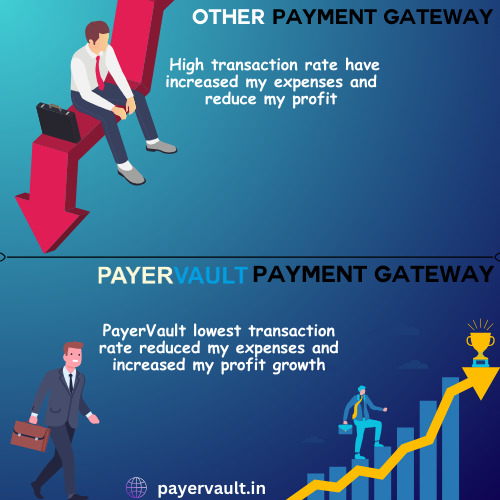

Ready to revolutionize your business's online transactions? Payervault offers seamless payment solutions at the lowest charges. Get started today! 💻💳 #Payervault #PaymentGateway #OnlineBusiness" Visit the website to learn more- https://payervault.in/

#finance#payments#payment solutions#business consulting#payment gateway#payment collection#paying#payouts#payment processing#payment services#payment systems#ecommerce#online#online shops offer#online store#online shopping#small business

3 notes

·

View notes

Text

Join Wise and get £50. It's simple, quick, and rewarding!

#money#make money online#earn money online#entrepreneurship#entrepreneurs#make money home#old money#wealth#finances#income#payment processing#payments#bank#operations#report#market

3 notes

·

View notes

Text

Innovations in Credit Repair Payment Gateway Integration

Article by Jonathan Bomser | CEO | Accept-Credit-Cards-Now.com

In the swiftly changing world of e-commerce and high-risk merchant processing, the demand for secure and efficient payment gateways is crucial. As we explore the innovations in Credit Repair Payment Gateway integration, this journey empowers businesses to thrive in the digital age. This article delves into cutting-edge solutions and strategies while keeping your business's financial security at the forefront.

DOWNLOAD THE INNOVATIONS IN CREDIT REPAIR INFOGRAPHIC HERE

Embracing High-Risk Payment Processing

Payment processing for high-risk industries has been historically challenging. However, the contemporary technology-driven world provides notable solutions. Pioneering companies specializing in Merchant Processing Services lead the way in high-risk merchant processing. They grasp the unique challenges faced by businesses in this sector and have developed tailored solutions. In a landscape where trust and security are paramount, a credit repair payment gateway plays a pivotal role, offering a lifeline to broader customer outreach for businesses navigating high-risk waters.

The Role of Credit Repair Payment Gateway

The term "Credit repair payment gateway" essentially refers to the backbone of your e-commerce payment processing system. It not only facilitates the acceptance of credit and debit card payments but also plays a crucial role in building trust with your customers. A robust credit repair payment gateway acts as your bridge to accepting payments online. It serves as a secure intermediary between your website and financial institutions, ensuring each transaction is encrypted and protected. This level of security fosters trust among your customers, especially vital in high-risk industries.

Expanding Horizons with CBD Merchant Accounts

CBD businesses, on the rise, often encounter difficulties in securing a payment processing partner. High-risk payment gateways bridge the gap by offering specialized solutions for CBD merchants. By choosing to accept credit cards for CBD, businesses in this industry can unlock tremendous growth potential. CBD merchant accounts are a game-changer, designed to cater to the unique needs of CBD sellers often in the high-risk category due to the evolving legal landscape. With the right payment gateway, seamlessly processing payments for CBD products expands your customer base and revenue streams.

The Evolving Landscape of Online Payment Gateways

As e-commerce continues to flourish, the demand for reliable and secure online payment gateways grows. Your credit repair business can thrive by integrating the right e-commerce credit card processing solution. This technology empowers you to accept credit cards for credit repair with ease, catering to the evolving needs of your customers. Online payment gateways have evolved significantly, facilitating transactions and offering enhanced security features. This is particularly important for businesses in high-risk industries where trust is paramount.

The Power of Innovation: Credit Card Processing

The cutting-edge credit card payment processing system ensures your business stays ahead. This high-risk merchant account provider offers the flexibility and security to navigate the complex terrain of payment processing for credit repair. In credit card processing, reliability and security are non-negotiable. Specialized companies understand the unique needs of businesses in high-risk industries and tailor solutions accordingly. Partnering with a trusted provider streamlines your payment processes, allowing a focus on growing your credit repair business.

Merchant Processing for High-Risk Industries

High-risk merchant processing demands a unique set of tools and expertise. It's essential to partner with a provider understanding the intricacies of your industry. By integrating a high-risk payment gateway, you're not only safeguarding transactions but also opening doors to a broader customer base. In high-risk industries, trust and security are paramount. Your choice of merchant processing services can make or break your business. It's crucial to work with a provider specializing in high-risk transactions, offering robust security measures to protect your business and customers.

youtube

The Future of Accepting Credit Cards

Looking ahead, accepting credit cards for e-commerce remains a cornerstone. Innovations in payment gateway integration ensure your customers can transact seamlessly, fostering trust and loyalty. The future of accepting credit cards is bright, with continuous advancements in technology. Payment gateways will continue to evolve, offering enhanced features and security measures. Staying up-to-date with these innovations positions your business to thrive in the ever-changing landscape of e-commerce.

In the realm of high-risk e-commerce payment processing, embracing innovation becomes the linchpin of success. Forward-thinking providers comprehend the distinctive requirements of businesses, spearheading pioneering solutions meticulously designed for specific industries. Wholeheartedly embracing groundbreaking advancements in the integration of payment gateways for credit repair fuels business growth, nurturing the potential for a prosperous future in your financial ventures. This unwavering commitment to innovation promises to illuminate the path forward, ensuring promising prospects and boundless growth for enterprises.

#high risk merchant account#merchant processing#payment processing#credit card processing#high risk payment processing#high risk payment gateway#credit card payment#accept credit cards#payment#youtube#credit repair#Youtube

23 notes

·

View notes

Text

Empower Your Business with a Custom Merchant Account for Payment Ease

Looking to secure a merchant account for your business? Our team of payment processing professionals provides a complete range of merchant account services tailored to match your distinct business requirements. Covering everything from processing credit and debit cards to offering virtual terminals and mobile payment options, we're here to accelerate your transactions and enhance your financial results. Connect with us now to gain insights into our merchant account solutions and initiate the process of embracing payments to drive your business's expansion.

5 notes

·

View notes

Text

At Valor PayTech, we’re shaping the future of payments. Our secure & reliable solutions - powered by the Valor Payment Gateway and cloud-based CRM - help ISOs & merchants streamline transactions, boost customer experience to thrive in a digital world.

#payment solutions#payment gateway#payment processor#payment processing#payments#credit card#pos#payment device

2 notes

·

View notes