#Personal loan calculator

Text

Discover how our intuitive loan calculator can simplify your financial planning. Easily estimate your monthly loan payments, compare various loan options, and make informed decisions with confidence. Our tool helps you understand your budget, plan effectively, and find the best loan tailored to your needs. Perfect for anyone looking to make smarter financial choices and stay on top of their loan management.

#personal loan calculator#loan payment estimator#auto loan monthly payment calculator#mortgage payment estimator#easy loan calculator online#best loan calculators#loan payment calculator#monthly loan payment estimator#personal loan repayment calculator

0 notes

Text

Navigating Personal Loans in Australia: A Comprehensive Guide

In Australia, personal loans serve as versatile financial tools that cater to a wide range of needs, from financing home renovations to consolidating debt or covering unexpected expenses. Understanding the landscape of personal loans, including their types, eligibility criteria, application process, and considerations, is crucial for making informed financial decisions. In this blog post, we explore everything you need to know about personal loans in Australia to help you navigate this aspect of personal finance effectively.

Types of Personal Loans in Australia

1. Unsecured Personal Loans:

Description: These loans do not require collateral and are typically based on the borrower's creditworthiness, income, and financial history.

Benefits: Provide flexibility for various purposes, such as travel, medical expenses, or purchasing goods and services.

2. Secured Personal Loans:

Description: Secured against an asset, such as a vehicle or property, which serves as collateral to secure the loan.

Benefits: Generally offer lower interest rates compared to unsecured loans due to reduced risk for the lender.

3. Fixed-Rate vs. Variable-Rate Loans:

Fixed-Rate Loans: Maintain a consistent interest rate throughout the loan term, providing predictability in monthly repayments.

Variable-Rate Loans: Interest rates may fluctuate based on market conditions, potentially offering initial lower rates but subject to change.

Eligibility Criteria for Personal Loans

1. Age Requirement:

Typically, applicants must be at least 18 years old to apply for a personal loan in Australia.

2. Income and Employment:

Lenders often require proof of stable income and employment to ensure the borrower's ability to repay the loan.

3. Credit History:

A good credit history demonstrates responsible financial behavior and may affect loan approval and interest rates offered.

Applying for a Personal Loan in Australia

1. Research Lenders:

Explore banks, credit unions, online lenders, and financial institutions to compare interest rates, fees, and loan terms.

2. Gather Documentation:

Prepare documents such as proof of identity (e.g., passport or driver's license), income statements (e.g., pay slips or tax returns), and details of assets and liabilities.

3. Submit Application:

Complete the lender's online application or visit a branch to submit your application along with the required documentation.

Considerations When Choosing a Personal Loan

1. Interest Rates and Fees:

Compare interest rates, including any establishment fees, monthly fees, or early repayment penalties, to assess the total cost of borrowing.

2. Repayment Terms:

Evaluate the loan's repayment schedule, including the loan term and frequency of repayments, to ensure they fit within your budget and financial goals.

3. Flexibility and Features:

Consider additional features such as redraw facilities, repayment holidays, or flexible repayment options that align with your financial needs.

Benefits of Personal Loans in Australia

1. Access to Funds:

Personal loans provide quick access to funds for various purposes without needing to dip into savings or investments.

2. Consolidation of Debt:

Consolidating high-interest debts into a single personal loan with a lower interest rate can simplify finances and potentially reduce overall interest costs.

3. Financial Planning:

Personal loans can be used strategically to fund major expenses or investments, supporting long-term financial goals.

Conclusion

Personal loans in Australia offer a valuable financial solution for individuals seeking flexibility, convenience, and access to funds for a variety of purposes. By understanding the types of loans available, eligibility requirements, application process, and factors to consider when choosing a loan, borrowers can make informed decisions that align with their financial needs and goals.

Explore the diverse options of personal loans in Australia today to find the right solution for your financial aspirations. Empower your financial journey with clarity, confidence, and the right financial tools.

At Triple M Finance, our experience and a wealth of industry connections allow us to assist you with your application from start to finish and make the process simple. We take the time to get to know each and every client’s indvidual needs and circumstances to ensure we provide you with your ideal financial solution.

#personal loans services#personal loan calculator#personal loans in australia#personal loans comparison

0 notes

Text

Which Loan is Best, FD, Gold Loan, Mutual Fund, Personal Loan

What is Loan

Some Types of Loans

FD (Fixed Deposit) Loan

You can take a loan against bank FD without breaking it. In this way, along with the benefit of maintaining the savings deposited in the bank, one also gets the necessary cash.

The interest rates (12–15%) applicable on FD loans are also lower than personal loans. This loan is also easily available immediately. Also, there is no need to submit many documents to the bank for this. Savings also remain intact along with debt.

Gold Loan

Gold loans have become attractive these days as gold prices have reached Rs 75,000 per 10 grams. Now you will get more loan than before on mortgaging jewellery.

READ MORE>>>>

#which loan is best#Which loan is best in india#Which Bank is best for personal loan with low interest#Which loan is best for bad credit#FD LOAN#Personal Loan#Gold Loan#Mutual Fund#HDFC Personal Loan#Personal loan rate of interest#Personal loan calculator#interest rate#Fd loan sbi#Gold Loan interest rates#Gold loan Calculator#Gold Loan SBI#Mutual fund calculator#Mutual funds India#SBI Mutual Fund#Mutual fund investment#4 types of mutual funds#Mutual Fund Sahi Hai#HDFC Mutual Fund#Mutual Fund investment Plan#SBI Gold Loan interest rate#Gold loan per gram#Gold loan EMI calculator#Gold loan near me#IIFL gold loan#Fd loan calculator

0 notes

Text

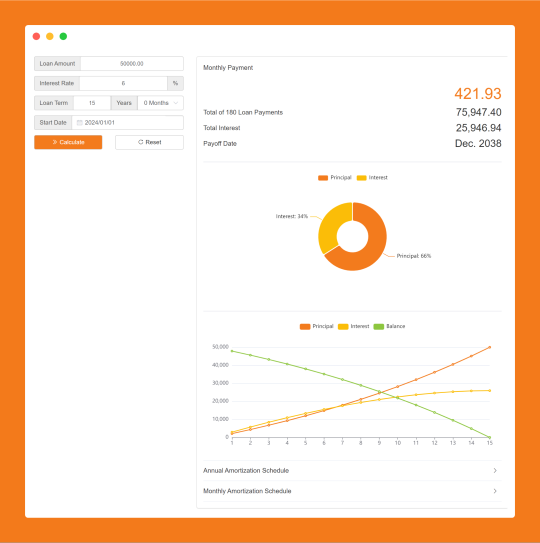

Personal Loan Calculator is an online finance calculate tool that can help you to estimate your monthly payments, total interest, true loan cost, and annual percentage rate (APR) after factoring the fees, insurance to plan your finances wisely.

#Online Web Tools#Web Tools#Free Web Tools#Online Tools#Free Online Tools#A.Tools#Web Apps#Online Calculator#Personal Loan Calculator#Loan Calculator

0 notes

Text

Streamline Business Banking with SBM Bank Kenya Online

Elevate your business banking experience with SBM Bank Kenya Online, offering comprehensive solutions tailored to your business needs. Manage your accounts, initiate transactions, and access a suite of financial tools seamlessly through our secure online platform. From convenient fund transfers to efficient payment processing, empower your business with the flexibility and efficiency of SBM Bank Kenya Online banking services.

#banking from home in kenya#personal loan calculator#personal loan calculator kenya#online business bank account

0 notes

Text

Personal Loans offer a unique financial solution by providing unsecured access to funds without the need to pledge any collateral, such as property, vehicles, or insurance policies. Operating a Personal Loan EMI calculator involves entering critical details like your desired loan amount, the prevailing interest rate, and preferred loan tenure.

#Personal Loan EMI Calculator Online#Personal Loan Calculator#Calculate Personal Loan EMI#EMI Calculator Online

0 notes

Text

EMI calculator | Stashfin

The Stashfin EMI Calculator is a valuable resource for planning your personal finances. It helps you estimate your Equated Monthly Installments (EMIs) based on your loan amount, tenure, and interest rate. By using this tool, you can make informed decisions about your loan, ensuring that it aligns with your budget and financial goals.

#emi calculator#loan calculator#personal loan calculator#emi instant loan#personal loan with EMI#stashfin

1 note

·

View note

Text

Personal Loan Calculator: Estimate Your Loan Repayments

Calculate your personal loan options with precision using SBM Bank's Personal Loan Calculator. Make informed financial decisions by entering your desired loan amount, interest rate, and tenure to estimate your monthly repayments. Access this user-friendly tool at SBM Bank to plan your loan and manage your finances responsibly. Whether you're considering a new purchase, investment, or debt consolidation, our loan calculator empowers you to tailor your borrowing to your specific needs. Stay in control of your financial future with SBM Bank's Personal Loan Calculator – your trusted financial companion.

#banking from home in kenya#business bank account kenya#loan calculator kenya#personal loan calculator

0 notes

Text

Maximizing Financial and Health Well-being with Modern Calculators

In today's fast-paced world, modern calculators have become indispensable tools for individuals seeking to achieve financial stability and maintain optimal health. Whether you're planning your finances or managing your fitness goals, the suite of calculators available on ModernCalculators.com offers a range of solutions to help you make informed decisions.

1. Online Loan Calculators

Understanding the financial implications of loans is the first step to making sound borrowing decisions. Online loan calculators provide valuable insights into monthly payments, interest rates, and the overall cost of borrowing, ensuring that you can navigate the lending landscape with confidence.

2. Weight Gain Goal Calculator

For individuals looking to embark on a weight gain journey, this calculator is an invaluable ally. It helps you determine the precise calorie intake needed to reach your desired weight, ensuring that you achieve your goals in a healthy and sustainable manner.

3. Rectangle Body Shape Calculator

Understanding your body shape is key to making informed fashion choices. The rectangle body shape calculator offers personalized style tips and advice, empowering you to accentuate your unique figure.

4. Pear Body Shape Calculator

Just like the rectangle body shape calculator, this tool caters specifically to individuals with a pear-shaped figure, providing fashion recommendations to enhance their appearance.

5. Triangle Body Shape Calculator

For those with a triangular body shape, this calculator offers tailored fashion advice to help you look and feel your best.

6. Car Payment Calculator GA

If you're considering buying a car in Georgia, this calculator assists in estimating your monthly car payments, allowing you to budget effectively for your new vehicle.

7. Mobile Home Mortgage Calculator

Financing a mobile home involves specific considerations, and this calculator helps you understand the financial aspects of mobile home ownership, including mortgage payments.

8. Car Payment Calculator Illinois, Colorado, Virginia

Residents of Illinois, Colorado, and Virginia can benefit from this calculator, which offers region-specific insights into car payments, taxes, and fees.

9. Car Payment Calculator AZ

Planning to purchase a car in Arizona? This calculator helps you estimate your monthly car payments, ensuring you stay within your budget.

10. FintechZoom Mortgage Calculator

Mortgages can be complex, but this calculator simplifies the process by providing estimates for monthly mortgage payments, interest rates, and more.

11. Construction Loan Calculator

For those embarking on construction projects, this calculator assists in managing finances by estimating construction loan payments.

12. Aerobic Capacity Calculator

Fitness enthusiasts can gauge their aerobic capacity with this calculator, gaining insights into cardiovascular health and overall fitness levels.

13. Aircraft Loan Calculator - Airplane Loan Calculator

Aviation enthusiasts can use this tool to calculate loan payments when purchasing aircraft or airplanes.

14. Manufactured Home Loan Calculator

If you're considering financing a manufactured home, this calculator helps you understand the financial aspects of this significant investment.

15. Classic Car Loan Calculator

For vintage car enthusiasts, this calculator aids in estimating loan payments when purchasing classic cars.

16. FintechZoom Loan Calculator

FintechZoom offers a versatile loan calculator for various financial needs, providing insights into repayment schedules and interest rates.

17. ATV Loan Calculator

Planning to buy an ATV? This calculator helps you budget for your new adventure vehicle.

18. Farm Loan Calculator

Farmers and agricultural entrepreneurs can use this calculator to understand the financial implications of farm loans.

19. Pool Loan Calculator

Building a pool? This calculator assists in estimating loan payments for your dream backyard oasis.

20. Solar Loan Calculator

As solar energy becomes more accessible, this calculator helps you determine the financial aspects of financing solar panel installations.

21. Mobile Home Loan Calculator

For individuals considering mobile home ownership, this calculator provides insights into mobile home loan payments.

22. Bridge Loan Calculator - Bridging Loan Calculator

Bridge loans can be complex, but this calculator simplifies the process by estimating bridge loan payments, facilitating informed borrowing decisions.

23. Hard Money Loan Calculator

Investors and real estate professionals can use this calculator to understand the financial aspects of hard money loans.

24. HDFC SIP Calculator

For Indian investors, HDFC offers a systematic investment plan (SIP) calculator to estimate returns on mutual fund investments.

25. Step Up SIP Calculator

This calculator assists Indian investors in planning systematic investment plans with increasing contributions over time.

26. What Calculators Are Allowed on The ACT

Students taking the ACT can use this resource to understand which calculators are permitted during the exam, ensuring they are well-prepared.

27. ALC Calculator

In the realm of beverages, this calculator helps producers determine alcohol content (ALC) in various drinks, ensuring regulatory compliance and quality control.

28. Amortization Loan Calculator

Managing loan repayments is simplified with this calculator, offering a comprehensive schedule of payments over the loan term.

29. ANC Calculator

Healthcare professionals rely on the Absolute Neutrophil Count (ANC) calculator to assess immune system health and make informed treatment decisions.

30. Annual Interest Rate Calculator

This calculator aids in computing the annual interest rate on loans and investments, facilitating financial planning and decision-making.

31. Annualized Percentage Rate Calculator

Understanding the Annualized Percentage Rate (APR) is vital when borrowing money. This calculator simplifies APR calculations for loans and credit cards.

32. Auto Loan Calculator

Whether you're purchasing a new or used car, this calculator helps you estimate monthly auto loan payments, including taxes and fees.

33. Bench Press One Rep Max Calculator

For weightlifters, this calculator determines your one-repetition maximum (1RM) for the bench press, aiding in strength training programs.

34. Refinance Calculator

Refinancing loans can lead to significant savings. This calculator helps you evaluate potential savings when refinancing various types of loans.

35. TDEE Calculator

Your Total Daily Energy Expenditure (TDEE) is crucial for managing your diet and fitness goals. This calculator estimates your daily caloric needs, ensuring you maintain a balanced diet.

36. Body Shape Calculator

Understanding your body shape is the first step in choosing clothing that enhances your appearance. This calculator offers personalized fashion advice based on your body shape.

37. BSA Calculator or Body Surface Area Calculator

Healthcare professionals rely on this calculator to estimate body surface area, a critical factor in medication dosages and treatment planning.

Now that you're acquainted with the diverse range of calculators available on ModernCalculators.com, you can harness their power to make informed decisions in various aspects of your life. Whether you're planning a major purchase, pursuing fitness goals, or seeking to enhance your overall well-being, these calculators are your trusted companions on the journey to success.

#one rep max calculator or 1rm max calculator#online loan calculators#ovulation calculator#savings calculator#sip calculator or sip return calculator#period due date calculator#personal loan calculator#pregnancy conception date calculator#pregnancy timeline calculator#present value calculator#real estate calculators#rent calculator#rent vs buy calculator#rental property calculator#retirement plan calculator#rmr calculator or resting metabolism calculator#return on investment calculator or ROI Calculator#simple interest Rate calculator#squat one rep max calculator#steps to miles calculator#student loan calculator#vo2 max calculator#waist to hip calculator#weight gain pregnancy calculator#weight gain goal calculator

0 notes

Text

Personal loans are a popular type of loan that can be used for a variety of purposes, such as consolidating debt, paying for home improvements, or starting a new business. So when applying for a personal loan, it is important you do your research, and by this we mean, comparing interest rates and loan terms from different lenders. And in this search of yours a personal loan interest calculator can be a helpful tool for comparing different loan options. See how?

0 notes

Text

LoanMoney

Welcome to LoanMoney, your trusted and reliable partner for all your financial needs. As a registered and authorized Direct Selling Agent (DSA) of various National, Multinational, and Non-Banking Financial Companies (NBFCs), we take great pride in offering a wide range of financial solutions to individuals and businesses alike.

At LoanMoney, we understand that life is full of unexpected challenges and opportunities. Whether you dream of owning your own home, starting a new business venture, expanding an existing one, or need funds for personal emergencies, we are here to support you every step of the way. Our comprehensive suite of financial products includes Personal Loans, Business Loans, Home Loans, Loan Against Property, and Working Capital Loans, each tailored to cater to your unique requirements.

#loan#personal loans#loanmoney#personal loan emi#personal loan online#personal loan eligibility#personal loan calculator#personal loan interest rates

1 note

·

View note

Text

Use Personal Loan EMI Calculator Before Applying for a Loan

Are you considering applying for a Personal Loan but worried about managing the monthly repayments? Before applying, it’s crucial to understand the financial implications and plan your finances wisely. A Personal Loan EMI Calculator is an essential tool that can help you make an informed decision. Using this user-friendly tool, you can estimate your monthly loan instalments and assess your repayment capacity.

Just enter your loan amount, preferred loan tenure and applicable interest rate in the Personal Loan EMI Calculator, available on the websites of top lending institutions, and get the payable EMI instantly with a break to principal and interest amount.

Meanwhile, those with poor credit scores keep seeking answers to the question, “How to get a Personal Loan with a low CIBIL score?” on search engines may not get an appropriate reply. With the right knowledge and strategy, getting a Personal Loan with a low credit score is possible. This guide will walk you through obtaining a Personal Loan with a low CIBIL score, providing valuable tips and insights.

Evaluate your current income, expenses, and debts to determine repayment capacity. Consider your monthly budget and ensure the loan EMIs fit comfortably within it. Learn about the significance of a credit score in loan approval and interest rates. And explore ways to improve your credit score, such as clearing outstanding debts and making timely payments.

Research lenders who offer Personal Loans specifically designed for individuals with low credit scores. Compare their interest rates, processing fees, and terms and conditions to find the most suitable loan option.

0 notes

Text

What happens to the Personal Loan when the borrower dies?

A financial requirement can arise anytime. Naturally, you would turn to your savings and investments to fulfil your requirement. However, it may not be the recommended option. This is because it disturbs your long-term financial plans. You could be building a corpus to finance your Home Loan down payment. Do not let a sudden financial requirement hinder achieving your goals. Apply for a Loan instead.

Personal Loan is an excellent financing option to meet significant and sudden financial requirements. You can get the required Loan amount at a competitive interest rate for a flexible tenure. You can repay the obtained Loan amount in Equated Monthly Instalments. You should use a Personal Loan calculator to determine your EMI payable.

You would be aware of how Personal Loan repayment works. But what happens to the Personal Loan when the borrower dies?

The scenario

Once the borrower dies, a lot depends on the Loan type you have applied for. There are two types of Loans: Secured and Unsecured Loans. A Secured Loan is backed by collateral. In case of non-payment, the bank seizes the collateral. An Unsecured Loan is solely offered considering the borrower’s creditworthiness, income, and other factors. Hence, the bank cannot seize collateral for non-payment.

Secured Loans

If a Secured Loan borrower dies, the bank asks the legal heir of the collateral to repay the outstanding Loan amount. A legal heir inherits both the borrower’s assets and liabilities. If the legal heir cannot repay the Loan amount, the bank holds the authority to sell the collateral to recover the Loan amount.

Unsecured Loans

Generally, a Personal Loan is an Unsecured Loan. This means a collateral does not back it. Hence, it ensures that your assets are not at risk. If an Unsecured Loan borrower dies following two things can happen:

Co-applicant repays the Loan

The borrower can apply for a Personal Loan with a co-applicant. It often proves Personal Loan eligibility, and you can apply for a higher Loan amount. If the borrower had applied for a Loan with a co-applicant on the primary borrower’s demise, the co-applicant is liable to pay it. As a borrower, you should be mindful of this when applying for a Personal Loan with a co-applicant.

Declared as a Non-Performing Asset

If there is no co-applicant to the Personal Loan, seeing no legal way to recover it, the bank may declare it as a Non-Performing Asset. If you are a family member of the deceased borrower, you should reach out to the bank and inform them about the borrower’s demise. Upon verification, the bank writes off the outstanding Personal Loan. You can find these details highlighted in the Personal Loan documents, so read them thoroughly.

0 notes

Text

Taking a personal loan is a significant financial decision. It is, therefore, advisable to use a personal loan EMI calculator to get a clear idea of the required EMI payout, which, in turn, allows one to plan their finances accordingly.

0 notes

Text

Securely Open a Bank Account from Home with SBM Bank: Hassle-Free Convenience

Explore the ease of opening a bank account from the comfort of your home with SBM Bank. Enjoy seamless digital onboarding, robust security, and a user-friendly interface. Additionally, utilize the SBM Bank loan calculator to plan your finances effectively, ensuring smart financial decisions tailored to your needs. Experience banking simplicity and innovation with SBM Bank's digital solutions.

#sbm credit card#banking from home in kenya#personal loan calculator#personal loan calculator kenya#online business bank account#loan calculator kenya

0 notes

Text

Personal Loan Calculator

Fast & efficient Online Loan Calculator that will help to easily work out the car, personal or business loan you need & repayment cost that suits you. Try now. Visit: https://www.yesloans.com.au/loan-calculator/

0 notes