#HDFC Mutual Fund

Text

Which Loan is Best, FD, Gold Loan, Mutual Fund, Personal Loan

What is Loan

Some Types of Loans

FD (Fixed Deposit) Loan

You can take a loan against bank FD without breaking it. In this way, along with the benefit of maintaining the savings deposited in the bank, one also gets the necessary cash.

The interest rates (12–15%) applicable on FD loans are also lower than personal loans. This loan is also easily available immediately. Also, there is no need to submit many documents to the bank for this. Savings also remain intact along with debt.

Gold Loan

Gold loans have become attractive these days as gold prices have reached Rs 75,000 per 10 grams. Now you will get more loan than before on mortgaging jewellery.

READ MORE>>>>

#which loan is best#Which loan is best in india#Which Bank is best for personal loan with low interest#Which loan is best for bad credit#FD LOAN#Personal Loan#Gold Loan#Mutual Fund#HDFC Personal Loan#Personal loan rate of interest#Personal loan calculator#interest rate#Fd loan sbi#Gold Loan interest rates#Gold loan Calculator#Gold Loan SBI#Mutual fund calculator#Mutual funds India#SBI Mutual Fund#Mutual fund investment#4 types of mutual funds#Mutual Fund Sahi Hai#HDFC Mutual Fund#Mutual Fund investment Plan#SBI Gold Loan interest rate#Gold loan per gram#Gold loan EMI calculator#Gold loan near me#IIFL gold loan#Fd loan calculator

0 notes

Text

#share market#demat account#mutual fund#mutual funds#hdfc#hdfc share price#hdfc amc#hdfc mutual fund#best mutual fund#best demat account lowest brokerage

0 notes

Text

Best Mutual Funds, Online Investment Platform, Certified Financial Advisor | Sigfyn

https://www.sigfyn.com/

Get Best Mutual Fund Advisory at Sigfyn, we are best AI-powered platforms that provides personalized and holistic financial advisory to grow wealth by SIP. Invest in best mutual funds portfolios such SBI, HDFC, ICICI Prudential, Nippon India curated by expert-built algorithms.

#Best Mutual Funds#Online Investment Platform#Certified Financial Advisor#Financial Advisors#Mutual Funds#SBI Mutual Funds#HDFC Mutual Funds#ICICI Prudential Mutual Funds#Nippon India Mutual Funds#Sigfyn

4 notes

·

View notes

Text

#best online coaching for ras#best test series for ras#Daily Current Affairs Capsules 28th December 2023#Daily Current Affairs Capsules 28th December#RBI permits ICICI Pru Mutual Fund to acquire 10% stake in Federal#RBL Bank#SBI#HDFC Bank will need to maintain higher capital from FY25#says RBI#RBI flags concentration risk among govt-NBFCs#RBI approves IDFC-IDFC First Bank merger#Actor-Politician Vijayakanth Dies At 71#Japan lifts operational ban on world's biggest nuclear plant#India Makes Its 1st-Ever Rupee Payment For Crude Oil Purchase From UAE#RBI Unveils Forex Correspondent Scheme to Enhance Foreign Exchange Services#Incident Of Ammonia Gas Leakage Reported#Reliance Jio working on 'Bharat GPT' with IIT-Bombay#The Hindu Newspaper Analysis#Current affairs 2024#Current affairs 2023#Daily Current Affairs Capsules#Weekly Current Affairs 2023#Daily Current Affairs Class 24#Daily Current Affairs#Current affairs#Current Affairs#Today Current Affairs#Latest Current Affairs 2023#Daily Current Affairs Capsule#Current Affairs Capsule

0 notes

Video

youtube

HDFC Mutual Fund launches HDFC Technology Fund Minimum Investment 100Rs ...

0 notes

Text

इन 5 लार्जकैप फंड में जिसने लगाया पैसा, उसकी हुई पौ बारह पच्चीस, रिटर्न जानकर आप कहेंगे- मैं पीछे रह गया

भारत 22 ईटीएफ का नाम छप्परफाड़ रिटर्न देने के मामले में पहले नंबर पर है. एक साल में इस फंड ने 36 फीसदी रिटर्न निवेशकों को दिया है. इस फंड ने आईटीसी, लार्सन एंड टुब्रो, एक्सिस बैंक, एनटीपीसी, एसबीआई और एक्सिस बैंक जैसी बड़ी कंपनियों में निवेश किया है. आप इस फंड में पांच हजार रुपये से निवेश शुरू कर सकते हैं

#2023 investment strategy#Best 5 large cap funds#Best Large Cap Mutual Funds in India To Invest in 2023#Bharat 22 ETF#business news in Hindi#Edelweiss Large Cap Fund#HDFC Top 100 fund#Investment tips#LargeCap Fund#Largecap Shares#mutual fund#Nippon India fund#stock market#Top 5 Large Cap Mutual Funds

0 notes

Link

You may ensure that your hard-earned money is used to its full potential by investing with HDFC mutual funds. To build a portfolio that can expand your wealth, you must be well-informed about the many funds that are available and choose the ones that best meet your needs.

0 notes

Text

youtube

HDFC Large and Mid Cap Funds | Mutual Funds Review

#HDFC Large and Mid Cap Funds#Mutual Funds Review#Mutual Funds#stock market#Directusinvestments#Mohit Munjal youtube#investor#service#Youtube

0 notes

Text

List of Best Trading Apps in India 2023

The world of trading has become more accessible than ever before, thanks to the rise of trading apps. With just a few clicks on your smartphone, you can now buy and sell shares in real-time from anywhere in India. But with so many options available, which trading app should you choose? In this article, we've compiled a list of the top 10 best trading apps in India for 2023. Whether you're a seasoned trader or just starting out, this comprehensive review will help you find the perfect app for your needs. So let's dive right into it!

List of the Top 10 Trading Apps in India

Zerodha: With over 3 million users, Zerodha is one of the most popular trading apps in India. It offers a user-friendly interface and low brokerage fees, making it an excellent choice for both beginners and experienced traders.

Upstox: Another top-rated app is Upstox, which boasts a simple yet effective platform for buying and selling stocks. It has competitive pricing and advanced charting tools to help you make informed decisions.

Angel Broking: Known for its extensive research capabilities, Angel Broking provides valuable insights into market trends that can help investors maximize their profits. The app also features a range of financial products like mutual funds and insurance.

Groww: A relatively new player in the market, Groww has quickly gained popularity thanks to its zero-commission policy on stock trades and easy-to-use interface.

Kotak Securities: This app by Kotak Mahindra Bank offers seamless integration with your bank account, allowing you to transfer funds seamlessly between them while trading shares or investing in mutual funds.

Sharekhan: With more than 20 years of experience in the market, Sharekhan is known for its robust research reports that provide detailed analysis of stocks from various sectors.

Edelweiss: Offering customizable watchlists and charts along with real-time news updates, Edelweiss makes it easier for investors to stay up-to-date with current events affecting their investments.

HDFC Securities: This app by HDFC Bank provides access to global markets along with local ones at affordable prices while providing comprehensive research reports covering several industries

ICICI Direct: ICICI direct allows you not only trade through mobile but also via call-n-trade. Their simplified version makes it perfect even if you are a beginner

Axis Direct: Last but not least AxisDirect comes equipped with all essential features including personalized alerts, easy order placement and comprehensive market analysis tools.

Complete Review of All Best Trading Apps in India

When it comes to choosing the best trading app in India, there are plenty of options available. But which one is right for you? In this complete review of all the best trading apps in India, we will take a closer look at each one and help you make an informed decision.

First up is Angel Broking. With its user-friendly interface and advanced charting tools, Angel Broking makes it easy for beginners to get started with trading. It also offers low brokerage fees and instant fund transfer options.

Next on our list is Zerodha. Known for its no-brokerage policy, Zerodha has quickly become a popular choice among traders in India. The app offers various features such as market depth analysis, advance charts and technical indicators.

Groww is another great option for those looking for a seamless trading experience. Its simple design allows users to navigate through the app with ease while offering commission-free investments in mutual funds.

Kotak Securities’ mobile application provides real-time updates on the stock market along with research reports from their team of experts giving you valuable insights about specific companies' performances based on their financial history.

Edelweiss Trading App combines investment opportunities with insightful advice from analysts making sure that traders make informed decisions before investing money into stocks or mutual funds

These are just some of the top contenders when it comes to finding the best trading app in India - but ultimately, your choice will depend on what suits your needs as an investor or trader.

To sum up, in this article we have discussed the top 10 trading apps in India for the year 2023. We have reviewed each app based on its features, user interface and overall performance.

Whether you are a beginner or an experienced trader, these apps offer you a seamless experience with no brokerage charges and easy access to market data.

Angel Broking, Zerodha and Kotak Securities are some of the popular names that provide unique features to make your trading journey smooth. Edelweiss also offers reliable services with advanced charts and tools.

Groww is another great option for beginners as it has a simple user interface along with low brokerage fees. nifty bees share price can be easily tracked through Angel One while Old Mumbai Chart provides historical data essential for analysis.

Each app excels in different areas making them suitable for different types of traders. So choose the one that best fits your requirements and start trading today!

After analyzing and reviewing the top 10 trading apps in India, it is evident that each app has its unique features and benefits. Whether you are a beginner or an experienced trader, there is an app on this list that will suit your needs.

From Angel Broking's seamless user interface to Zerodha's low brokerage fees, each app offers something special. Other notable mentions include Kotak Securities' advanced charting tools, Edelweiss' research reports, and Groww's zero brokerage platform for mutual funds.

Choosing the best trading app in India can be challenging. However, by assessing your needs as a trader and comparing them with the offerings of these top 10 trading apps, you can find one that perfectly suits you. So go ahead and download your favorite trading app today

Related - https://hmatrading.in/best-trading-app-in-india/

Source - https://sites.google.com/view/list-of-best-trading-apps

#best trading app in india#best trading app in india 2022#angel broking login#zerodha brokerage calculator#nifty bees share price#angel one share price#kotak securities login#edelweiss share price#old mumbai chart#angel broking share price#no brokerage#groww brokerage calculator#angelone share price#HMA Trading

2 notes

·

View notes

Text

Small-Cap vs Large-Cap Mutual Funds: A Comprehensive Guide

When it comes to building a diversified investment portfolio in India, one of the key decisions you’ll need to make is whether to invest in small-cap or large-cap mutual funds. Both offer unique advantages, but the right choice depends on your financial goals, risk tolerance, and investment horizon..

What are Mutual Funds?

The Basics of Mutual Funds

Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. Professional fund managers handle the investments, aiming to generate returns in line with the fund’s objective. In India, mutual funds are a popular way for investors to participate in the stock market without directly buying stocks.

Different Types of Mutual Funds

Mutual funds come in different varieties, such as equity funds, debt funds, and hybrid funds. This article will focus on equity mutual funds, specifically small-cap and large-cap funds, which invest primarily in shares of companies listed on Indian stock exchanges.

Understanding Market Capitalization

What is Market Capitalization?

Market capitalization, or market cap, is the total value of a company’s outstanding shares in the stock market. It is calculated by multiplying the share price by the number of outstanding shares. In India, companies are classified into different categories based on their market capitalization: small-cap, mid-cap, and large-cap.

Categories of Market Capitalization

Small-Cap

Small-cap companies have a market capitalization of up to ₹5,000 crore. These companies are typically in the early stages of growth and have significant potential for expansion, but they are also more volatile and risky.

Large-Cap

Large-cap companies have a market capitalization of more than ₹20,000 crore. These are well-established companies with a long history of stable performance. In India, companies like Reliance Industries, HDFC Bank, and TCS are examples of large-cap companies.

What are Small-Cap Mutual Funds?

Characteristics of Small-Cap Mutual Funds

Small-cap mutual funds invest primarily in companies with smaller market capitalizations. These funds target companies that are still in the growth phase and may have higher potential for long-term gains. However, since these companies are less established, small-cap funds tend to be more volatile and can fluctuate widely based on market conditions.

Risk and Rewards of Small-Cap Funds

The biggest attraction of small-cap mutual funds is their potential for higher returns. Since small-cap companies are in their growth stage, they have the potential to grow quickly, offering significant returns to investors. However, these funds come with higher risk, as smaller companies are more likely to be affected by market downturns or economic challenges.

For example, a small-cap company with a market capitalization of ₹3,000 crore could double in value over a few years, giving substantial returns. On the flip side, such companies can also lose value rapidly if the market conditions turn unfavorable.

What are Large-Cap Mutual Funds?

Characteristics of Large-Cap Mutual Funds

Large-cap mutual funds invest in well-established companies with a large market capitalization. These companies are industry leaders and have a long track record of performance, making large-cap mutual funds more stable and less risky compared to small-cap funds.

Risk and Rewards of Large-Cap Funds

Large-cap funds are generally less volatile and more predictable than small-cap funds. While they may not offer the same explosive growth potential, they provide steady returns over time. For instance, investing in a large-cap mutual fund focused on companies like Infosys or ITC would generally offer stable returns even during periods of market uncertainty.

Investors can expect consistent, though moderate, returns from large-cap funds, making them suitable for those seeking long-term wealth creation without too much risk.

Comparing Small-Cap and Large-Cap Mutual Funds

Growth Potential

Small-cap mutual funds generally offer higher growth potential than large-cap funds, as they invest in companies that are still expanding. If you're willing to take on more risk, small-cap funds could yield higher returns.

Risk Factor

Small-cap funds are inherently riskier, as these smaller companies are more sensitive to economic fluctuations. Large-cap funds, on the other hand, tend to be more stable, with lower risks due to the maturity and market position of the companies they invest in.

Volatility

Small-cap funds are far more volatile compared to large-cap funds. A market correction can drastically impact small-cap stocks, whereas large-cap stocks are usually more resilient and less affected by short-term fluctuations.

Liquidity

Large-cap mutual funds are generally more liquid, meaning that it's easier to buy and sell shares without significantly affecting the stock price. Small-cap stocks, on the other hand, can be less liquid, which means they may experience larger price fluctuations when traded.

Investment Horizon

Small-cap mutual funds are typically recommended for investors with a long-term horizon of 7 to 10 years, as they need time to realize their growth potential. Large-cap funds, on the other hand, can be a good fit for both short-term and long-term investors due to their stability.

Which Should You Choose?

For Aggressive Investors

If you are an aggressive investor with a high risk appetite and a long-term investment horizon, small-cap mutual funds may be a better choice. They offer higher returns but come with increased volatility.

For Conservative Investors

If you're a conservative investor who prefers stability and lower risk, large-cap mutual funds are a better option. They offer steady growth and are less susceptible to market volatility, making them a safer investment choice.

Performance Over Time: Historical Trends

Historical Performance of Small-Cap Funds

Historically, small-cap funds have delivered higher returns during bullish markets in India. For example, in a growing market, a small-cap mutual fund could deliver annual returns of 15%–20% or more. However, during a market downturn, these funds may suffer significant losses.

Historical Performance of Large-Cap Funds

Large-cap funds have consistently delivered stable returns, generally in the range of 8%–12% annually. During periods of market volatility, large-cap funds tend to perform better than small-cap funds due to the stability of the companies they invest in.

Tax Implications of Small-Cap and Large-Cap Funds

In India, capital gains from mutual funds are taxed based on the duration of the investment. For both small-cap and large-cap mutual funds:

Short-term capital gains (STCG): If units are sold within one year, the gains are taxed at 15%.

Long-term capital gains (LTCG): If units are sold after one year, gains over ₹1 lakh are taxed at 10% without indexation benefits.

Key Points to Consider Before Investing

Risk Appetite: Consider how much risk you're comfortable taking.

Investment Horizon: Small-cap funds suit long-term investors, while large-cap funds can work for both short- and long-term goals.

Market Trends: Keep an eye on market conditions before investing.

Diversification: A mix of both small-cap and large-cap funds can offer a balanced portfolio.

Conclusion: Finding the Right Balance for Your Portfolio

In the end, the choice between small-cap and large-cap mutual funds depends on your individual financial goals and risk tolerance. A well-balanced portfolio could include both types of funds, allowing you to benefit from the growth potential of small-cap companies while enjoying the stability of large-cap firms. Consulting a financial advisor can also help you make the best choice tailored to your needs.

FAQs

Are small-cap funds riskier than large-cap funds?

Yes, small-cap funds are riskier due to the volatile nature of small companies. Large-cap funds are generally more stable.

Can I invest in both small-cap and large-cap mutual funds?

Yes, many investors choose to invest in both to balance high growth potential with stability.

Which type of fund performs better during economic downturns?

Large-cap funds tend to perform better during economic downturns because of the stability and financial strength of the companies they invest in.

How do I know which mutual fund is right for me?

Consider your risk tolerance, investment goals, and time horizon when choosing between small-cap and large-cap funds. Consulting a financial advisor can also provide personalized guidance.

What is the role of a financial advisor when choosing between small-cap and large-cap funds?

A financial advisor can help assess your risk tolerance, time horizon, and financial goals to recommend the best mix of small-cap and large-cap funds for your portfolio.

0 notes

Text

🔍 Discover HDFC Sky in 2024!

Our latest review delves into brokerage charges, margin requirements, trading features, and the Demat account setup. Equip yourself with the knowledge to make informed trading decisions! Read more:

1 note

·

View note

Text

Best SIP Plans for ₹1000 Per Month: Start Small, Grow Big

Starting a SIP for ₹1000 per month may seem like a small step, but it’s a powerful way to build long-term wealth. Funds like Axis Bluechip, Mirae Asset Emerging Bluechip, and SBI Small Cap offer different risk-return profiles to suit every type of investor. By staying committed and investing regularly, you can achieve your financial goals with ease, no matter how small your initial contribution.

1. Axis Bluechip Fund

Category: Large Cap

Axis Bluechip Fund is one of the top-performing large-cap mutual funds, focusing on investing in well-established companies with strong financial health. It offers relatively lower risk and steady returns, making it ideal for conservative investors. The fund’s consistent performance and sound management make it a reliable option for long-term wealth creation.

Key Benefits:

Strong portfolio of large-cap companies

Lower risk compared to mid or small-cap funds

Suitable for long-term wealth building

2. Mirae Asset Emerging Bluechip Fund

Category: Large & Mid-Cap

Mirae Asset Emerging Bluechip Fund is an excellent choice for investors looking for a mix of stability and growth. It invests in both large and mid-cap stocks, giving you the potential for higher returns while balancing the risk. Though it’s slightly more aggressive, the fund has a solid track record of delivering superior returns over the long term.

Key Benefits:

Balanced risk with exposure to large and mid-cap stocks

High potential for returns

Suitable for long-term investors with moderate risk tolerance

3. SBI Small Cap Fund

Category: Small Cap

If you have a higher risk appetite and want to invest in companies with high growth potential, the SBI Small Cap Fund could be the right fit. This fund focuses on small-cap stocks, which can offer significant upside in the long run. However, small-cap funds are volatile and better suited for those willing to ride out market fluctuations.

Key Benefits:

Potential for high returns in the long term

Exposure to small-cap companies with growth opportunities

Ideal for aggressive investors

4. ICICI Prudential Equity & Debt Fund

Category: Hybrid (Equity-Oriented)

For investors seeking a balanced approach, the ICICI Prudential Equity & Debt Fund offers the best of both worlds. This hybrid fund invests in both equities and debt, reducing the overall risk while still providing the potential for growth. It’s ideal for investors who prefer stability but also want equity exposure for higher returns.

Key Benefits:

Balanced risk with equity and debt exposure

Stability combined with growth potential

Suitable for conservative to moderate investors

5. HDFC Mid-Cap Opportunities Fund

Category: Mid-Cap

HDFC Mid-Cap Opportunities Fund is a popular choice among investors looking for exposure to mid-sized companies with strong growth potential. It is a moderately risky option, offering higher returns than large-cap funds but with less volatility than small-cap funds.

Key Benefits:

High growth potential with mid-cap stocks

Moderate risk level

Suitable for long-term investors with a moderate risk appetite

Why Invest in SIPs?

Disciplined Investing: SIP plan help in building a disciplined approach to investing by making small, regular contributions.

Power of Compounding: Even small investments can grow significantly over time due to the power of compounding.

Rupee-Cost Averaging: Investing regularly helps average out the purchase cost, reducing the impact of market volatility.

Flexibility: SIPs are flexible, allowing you to increase or decrease your investment amount as per your financial situation.

0 notes

Text

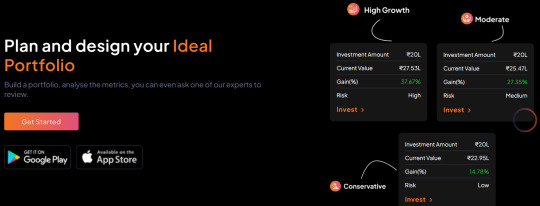

Portfolio Designer – A Unique Strategy to Build & Customise Your Portfolio | Sigfyn

An exclusive approach for an ideal mutual fund portfolio that suits your financial needs powered by algorithms. Enhance returns and manage risk by diversifying investments across different asset classes.

#portfolio designer#portfolio management#Certified Investment Planner#Asset Allocation#Risk Management#Investment Planning#Portfolio Insights#Mutual Fund Portfolio#Mutual Funds Schemes#Investment Advisors#Best HDFC Mutual Funds#HDFC Mutual Funds Online#SIP Investment Services#HDFC MF#Financial Advisory Services#Financial Planning Company#Sigfyn

0 notes

Text

Mutual Funds vs. Stocks: Which Investment Option is Best for You?

Investing is all about putting your money to work for you, but choosing between mutual funds and stocks can feel like deciding between coffee and tea. Both options can be profitable, but each has its unique risks and rewards.

Did you know that in FY 2023, more than 14 million new demat accounts were opened in India, with retail investors pouring ₹7.5 lakh crore into mutual funds? That’s how much the investment game has heated up!

So, if you’re wondering which investment option mutual funds or stocks is right for you, then Hurry Up! Contact Mutual Fund advisor Now.

Understanding the Basics: Mutual Funds vs. Stocks

Let's start with the basics.

Stocks represent ownership in a company. When you buy shares of a stock, you essentially own a piece of that company. If the company does well, your investment grows; if it doesn’t, your investment can shrink or vanish. Stocks can offer high returns, but they also come with high risk.

Mutual Funds, on the other hand, pool money from many investors to invest in a diversified portfolio of stocks, bonds, or other securities. A fund manager handles this for you, taking care of the stock picking and balancing. Mutual funds generally offer lower risk because of this diversification, but they also tend to deliver lower returns compared to individual stocks in the short term.

Risk Factor: How Much Can You Handle?

Let’s be honest: when it comes to investing, risk is always on the table.

Stocks: Buying individual stocks is like riding a rollercoaster. Sometimes you’re flying high, and sometimes you’re plummeting. Stocks are volatile, and you need to keep an eye on the market. For example, if you had invested in Reliance Industries in the early 2000s, you'd have seen your money multiply several times over. But stocks like Yes Bank have shown us that things can go south quickly if the company takes a hit.

Mutual Funds: If you're not into the adrenaline rush of constant market checks, mutual funds might be more your style. Since mutual funds spread your investment across various stocks, the overall risk is reduced. Even if one stock in the fund performs poorly, the others may balance it out. In 2023, the average equity mutual fund in India offered returns of about 12-15%, which is decent without putting your heart at risk!

Control: Do You Like Being Hands-On?

If you're someone who loves keeping control and doesn’t mind doing the research, then stocks might be your go-to option.

Stocks: You can pick and choose your companies, buy and sell whenever you want, and stay in total control. This is great if you enjoy learning about companies, industries, and market trends. However, the downside is that you need to stay constantly updated. Think of this as managing your own sports team—you're the coach and manager all rolled into one.

Mutual Funds: Here, a fund manager takes the wheel. They make the buying and selling decisions, freeing you from day-to-day management. So, if you’re someone who’d rather sit back and let an expert handle things, mutual funds are a good fit. It’s like hiring a coach for your sports team—you’re still in the game, but someone else is making the tactical calls.

Returns: What Are You Looking to Gain?

When it comes to returns, stocks generally have the potential to outperform mutual funds, but this comes with higher risk.

Stocks: Over the long term, stocks have historically delivered better returns than most other investments. For instance, stocks in companies like Infosys, TCS, and HDFC have consistently shown growth over the years. But, they come with wild swings. Your investment could double, or you could lose half of it within a few months.

Mutual Funds: While mutual funds may not offer the same high returns as individual stocks, they do provide more stable returns over time. Equity mutual funds can give you 12-15% annual returns, while debt mutual funds typically offer around 7-9%. The growth may be slower, but it’s more consistent, making mutual funds a great option for long-term wealth building.

Time Commitment: Do You Have the Patience?

The time and effort you’re willing to commit to your investments also play a big role in deciding whether stocks or mutual funds are right for you.

Stocks: You need to actively monitor your portfolio. If you have the time and interest to stay updated with the market trends, quarterly earnings, and corporate news, stocks can be rewarding. It’s like maintaining a garden—constant care and attention are needed.

Mutual Funds: If you don’t have time to monitor the market, mutual funds are more like a set-it-and-forget-it option. The fund manager does the heavy lifting, so you can relax while your money grows slowly but steadily.

Liquidity: How Quickly Can You Get Your Money?

Liquidity, or how easily you can turn your investment back into cash, is another crucial factor.

Stocks: Stocks are highly liquid. You can sell your shares anytime the stock market is open, and the money is usually credited to your account in a couple of days. This flexibility can be great, especially if you foresee needing cash on short notice.

Mutual Funds: Mutual funds are generally liquid, but they’re not as instantaneous as stocks. You can redeem your units, but it usually takes a day or two for the funds to appear in your account. Some funds, like ELSS (Equity Linked Saving Schemes), come with lock-in periods, so be mindful of the type of fund you choose.

Conclusion: Which Investment Option is Best for You?

It all boils down to your personal preferences, financial goals, and risk tolerance.

If you’re okay with higher risk and enjoy staying involved in your investments, stocks might be the better choice for you.

If you prefer a safer, hands-off approach, mutual funds could be your best bet.

For example, a young investor in their 20s with time on their side might lean towards stocks for high growth, while someone nearing retirement may prefer the steady returns and lower risk of mutual funds.

In the end, there’s no one-size-fits-all answer. Many investors choose to balance both, creating a diversified portfolio that includes mutual funds for stability and stocks for growth. So, which will it be for you?

0 notes

Video

youtube

HDFC Mutual Fund launches HDFC Technology Fund Minimum Investment 100Rs ...

0 notes

Text

Bajaj Housing Finance IPO: Check Price, GMP, Guidelines, Quota, Issue Size

Bajaj Housing Finance IPO much-anticipated is set to open for public subscription on Monday, September 9. On the previous Friday, the company raised Rs 1,758 crore from anchor investors. The IPO, which totals Rs 6,560 crore, has a price band set between Rs 66 to Rs 70 per share.

Important IPO Dates

The IPO will open on September 9 and close on Wednesday, September 11. The allotment of shares is expected to be finalized by September 12, with the listing scheduled on both BSE and NSE on September 16.

IPO Quota Allocation

The IPO quota is divided into different investor categories:

- 50% is reserved for qualified institutional buyers (QIBs)

- 35% for retail investors

- 15% for high-net-worth individuals (HNIs)

Additionally, Rs 500 crore worth of shares are reserved for the shareholder quota, available to eligible shareholders of Bajaj Finance Limited and Bajaj Finserv Limited as of the Red Herring Prospectus date (August 30, 2024). Only bids at or above the issue price will be considered.

Price Band and Issue Size

The price band for the Rs 6,560 crore IPO has been fixed between Rs 66 and Rs 70 per share. This includes a fresh issue of equity shares worth Rs 3,560 crore and an offer for sale (OFS) of Rs 3,000 crore by the parent company, Bajaj Finance.

Gray Market Premium (GMP) for Bajaj Housing Finance IPO

Market watchers report that the unlisted shares of Bajaj Housing Finance Ltd are trading at a Rs 50 premium in the gray market, indicating a 71.43% expected public benefit over the issue price. The gray market premium is driven by market sentiment and may fluctuate.

Analysts' Recommendations

Analysts are generally optimistic about the IPO. Anand Rathi has given a 'buy' recommendation, citing the Rs 7,000 crore fundraising as a catalyst for Bajaj Finance's (BAF) stock performance. The brokerage notes Bajaj Housing Finance’s higher return on equity (RoE) and return on assets (RoA), which justify premium valuations.

On the other hand, InCred Equities has issued a 'hold' recommendation, acknowledging that while Bajaj Housing Finance trades at a higher multiple compared to peers like LIC Housing Finance (1.2x) and PNB Housing (1.7x), it still finds the stock attractive due to 30% CAGR AUM growth, solid asset quality, and a strong tech platform.

More on Anchor Investors

Prominent anchor investors include the Government of Singapore, Abu Dhabi Investment Authority, Fidelity, Morgan Stanley, and other major institutions like HDFC Mutual Fund, SBI Life Insurance, ICICI Prudential Life Insurance, and Goldman Sachs. A total of 25.11 crore equity shares have been allocated to 104 companies at Rs 70 per share, bringing the anchor investment total to Rs 1,758 crore.

IPO Objectives and Regulatory Compliance

The IPO has been launched in compliance with Reserve Bank of India (RBI) regulations, requiring top-tier non-banking financial companies (NBFCs) to be listed by September 2025. Proceeds from the fresh issue will be used to expand the capital base to meet future business needs.

Company Background

Bajaj Housing Finance has been registered with the National Housing Bank since September 2015, offering a range of financial solutions, including home loans, property loans, and developer financing. For the fiscal year 2023-2024, the company reported a net profit of Rs 1,731 crore, marking a 38% increase over the previous year.

Lead Managers and Recent Listings

Lead book managers for the IPO include Kotak Mahindra Capital, BofA Securities India, SBI Capital Markets, Goldman Sachs (India) Securities, and JM Financial. Recently, other housing finance companies like Aadhar Housing Finance and India Shelter Finance have also listed on the stock market.

Read the full article

0 notes