#Please file if you are a creditor

Text

Sherry Tenney has filed for Chapter 13 bankruptcy!

If you are unfamiliar with scam artist Sherry Tenney, I have pinned a post here.

A former bankruptcy paralegal has provided some helpful advice:

If you are a creditor (i.e., if Sherry owes you money), do not count on your claim with the AG’s office if you filed one. You need to file a proof of claim in the bankruptcy case to have any chance at recovery. They will likely ask for supporting documentation, which would be whatever documentation you have that she owes you money.

Also - please note the deadline for filing is February 12th. That’s a little less than 2 weeks away. If you are mailing in the claim form, stay aware of the mailing times - it has to arrive at the Clerk’s office by the 12th, not be postmarked by the 12th. If you wait until next week to file, you may be better off doing that electronically to be 100% sure your claim gets in by the deadline.

You can electronically file using PACER. You will need to make an account as a creditor first. The form is relatively easy to fill out online. As with the paper filing, you will be asked to upload supporting documentation of your claim. If you get stuck or have questions, the clerk’s office is your best bet for help.

In a Chapter 13, unsecured creditors usually are paid pennies on the dollar, although I have seen payments of up to 25%-50% in a few cases. Unsecured creditors are also paid last, so it may be up to four or five years before payment, depending on her plan and whether she is able to stick to it.

Please help signal boost the message as the filing deadline for creditors is in two weeks! Sherry owes more than $100k USD to people.

And, honestly, if this makes her need to sell her animals to get them away from her abuse, all the better.

3 notes

·

View notes

Text

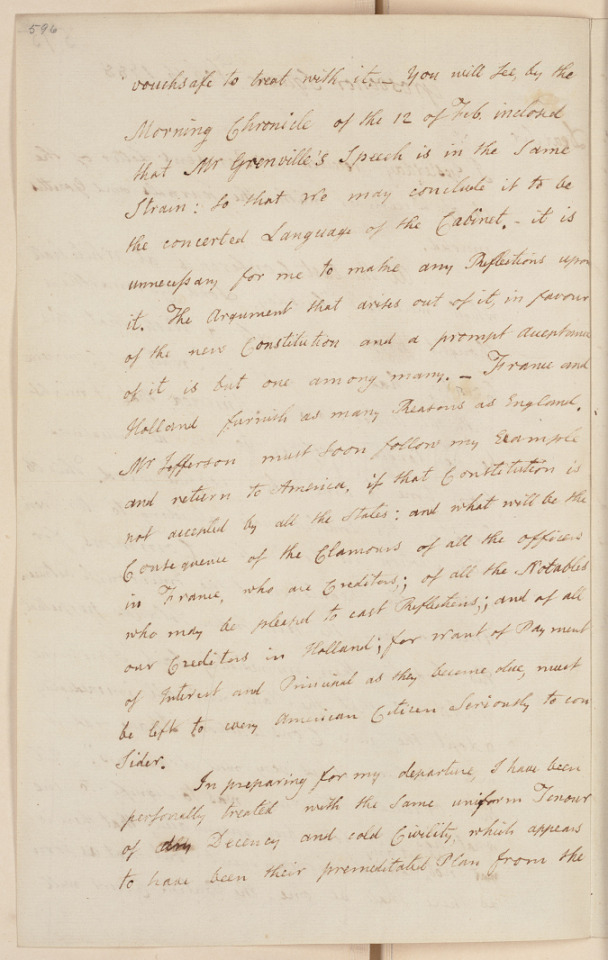

“ . . . there is not as yet any national Government; but that as soon as there shall be one, the British Court will vouchsafe to treat with it.”

John Adams reports good news on the British Government’s view of the not-yet-ratified Constitution of the U.S., February 15, 1788.

Record Group 360: Records of the Continental and Confederation Congresses and the Constitutional Convention

Series: Papers of the Continental Congress

File Unit: Letters from John Adams

Transcription:

595

Grosvenor Square Feb 15 1788

Dear Sir,

I yesterday received Mr. Romsens Letter of the 15 of December, with the Journals and Gazettes inclosed(sic).

At the last Conferences at Whitehall which were last Thursday, Lord Carmarthen thought proper to express a wish that this Country had some sort of Treaty of Commerce with the United States of America, that it might be no longer necessary to take new measures from time to time, which looked hard. This observation his Lordship made alluding to Mr Grenvilles Motion in the House of Commons for making the Regulation of the Intercourse between America and the West Indian Islands perpetual. His Lordship then, immediately said "I presume Mr Adams that the states will all immediately adopt the new Constitution. I have read it with pleasure. it is very well drawn up." All this oracular utterance, was to signify to me what has all along been intimated, that there is not as yet any national Government; but that as soon as there shall be one, the British Court will

[page 2]

vouchsafe to treat with it._ You will See, by the Morning Chronicle of the 12 of Feb inclosed(sic) that Mr Grenville's Speech is in the same strain: So that we may conclude it to be the concerted Language of the Cabinet. it is unnecessary for me to make any reflections upon it. The argument that arises out of it, in favor of the new Constitution and a prompt acceptance of it is but one among many._ France and Holland furnish as many Reasons as England. Mr Jefferson must soon follow my example and return to America, if that Constitution is not accepted by all the states: and what will be the Consequence of the Clamours(sic) of all the officers in France, who are creditors; of all the Notable who may be pleased to cast reflections, ; and of all our Creditors in Holland; for want of payment of interest and principal as they become due, must be left to every American Citizent Seriously to consider.

In preparing for my departure I have been personally treated with the same uniform Tenour(sic) of dry Decency and cold Civility which appears to have been their premeditated plan from the

[page 3]

597

beginning: and Opposition as well as Administration appear to have adopted the same spirit. Mr Fox and Mr Burke, Lord Gambelin and the Duke of Richmond, Lord Hawksbury and Lord North and Lord Hortmont, have all behaved alike. If this country can make such arrangements that the King of Prussia may make a Diversion of the French Forces by Land, and the native Indians or discontented subjects, another of those of Spain in South America, you may easily believe that England will be eager for War. Let not our Countrymen flatter themselves that they shall be able to maintain Peace. Lord Carmarthen indeed said to me that he did not see a possibility of a misunderstanding in Europe, and that he even hoped that peace would be made between Russia and the Porte. His Lordship is in profound ignorance of it, I presume, if there is really any Probability of an alliance of France with the Emperor or Empress. Mr Jefferson has informed you of his conjectures, as well as his intelligence on that Point.

[page 4]

The Marquis de la Luzerne is now Ambassador at this Court from France, and has already met with with humiliations not easily borne by Ambassadors. Monsieur De Calonne appears at the levee and drawing room, and even at the Table of the Marquis of Carmarthen, on the Queens Birth Day with the French Ambassador. The Chevalier De Ternant was presented by the French Ambassador to the King and Queen, and treated with the most marked Disgust by both. These things are hard to bear. I have had some conversations with th[word runs off page] Minister, with whom I made a voyage in 1779 from L'Orient to Boston in the Sensible, and could wish to have resided longer with him, for he will certainly be attentive and able; But my embarkation is fixed to the month of March, and I hope to be in Boston in May. With great esteem and regard I have the Honour to be, dear Sir your most obedient and most humble Servant

John Adams

His Excellence John Jay

Secretary of State Etc Etc

24 notes

·

View notes

Link

#buyingahome#ClientSatisfaction#comprehensivemarketanalysis#ContinuousSupport#expertnegotiationskills#expertrealestateadvice#extensiverealestatenetwork#innovativemarketingstrategies#irinashoket#jeffshoket#localmarketknowledge#personalizedrealestateservice#PropertyValues#RealEstateGuidance#realestatemarkettrends#RealEstateSuccess#sellingahome#ThousandOaksRealEstate#ThousandOaksRealtors#toprealtors

0 notes

Text

Navigating the Storm: Surviving a Second Bankruptcy

Introduction

"Bankruptcy is not the end; for many, it's a challenging beginning. Facing it twice? That's a testament to resilience and the start of a profound transformation." This bold statement invites us to rethink our perception of financial setbacks, especially when they strike more than once.

Personal Experience: A Journey Through Double Bankruptcy

How does the saying go? Full me once shame on you, full me twice shame on me. You would think that going through bankruptcy would be a hard enough experience that I won't do it again. You would also think that I should have learned my lesson and avoided what led me to that first bankruptcy in the first place. Not me; I am a slow learner because, within 5 years of filing my first bankruptcy, I am filing for my second one. And let me tell you is not fun at all.

Putting aside the humiliation factor, the process of a second bankruptcy is awful. Especially when is so soon and so close to the first one. The skepticism and the judgment from the court and your creditors are on a completely different level. The scrutiny and the invasion of personal life are on a whole different spectrum. And to be fair, I don't blame them. I am a repeat offender so I deserve it. But still is not a good position to be in. Not to mention and perhaps the important thing, you fail your loved ones one more time.

In my case, I have a wonderful wife whom I call my Super Womam. And I also have 6 amazing children. And when you set seal in the journey of entrepreneurship, even though you are the captain and perhaps you are doing all the work sometimes we forget that there are a lot of other people in the boat with us. And that is that ship sinks, they will drown with you. And that is what happened to me way too many times. Even though I have 2 bankruptcies, I have had a lot of businesses in the past that failed too. Every time that I failed and lost a business, not only me but my entire family had to pay the price and the consequences of my failures.

Some of those consequences have been so damaging that I still trying to repair them. It is easy to justify our behavior and our actions by saying that everything that we are doing is for our families and to better them and their future. When in reality we are doing it for us. Because we are prideful and because we want to prove something and in many cases to people that can care less about us. But that is a topic for another blog.

The great thing about it is that our governmental laws created these bankruptcy laws so we have an option in case we fail. Trust me, if you can avoid going into bankruptcy please do so. But the fear of failing shouldn't t be a reason why you don't try to pursue your business dreams. Having these laws in place should be an indicator that there is a chance that you will fail. That is why they exist. A lot of other people have failed in the past. But this should not discourage you. Use this as a motivation to pursue your dreams.

In the same way that so many fail, so many others succeed. It is up to us which statistics are we going to be part of. The only way that you can actually fail is when you stop trying. To me, my past failures I don't see them as failures. I see them as lessons that need to be learned in order to move to the next level. Painful, and humiliating, of course, but those lessons have made me stronger and wiser, or at least I like to believe that 😅. I am already on the books of those who failed too many times. Now I am the books of those who never give up. And soon, God willing, I will be in the books of those who succeeded.

Data: Insights Into Bankruptcy Trends and Impacts

Statistics show that a significant percentage of businesses that file for bankruptcy once are likely to do so again. Research from the Administrative Office of the U.S. Courts indicates that about 16% of businesses that file for Chapter 11 bankruptcy are repeat filers. This suggests that the challenges leading to the first bankruptcy may not have been fully addressed or new challenges have arisen that were not anticipated (Administrative Office of the U.S. Courts, 2020).

The Problem: Recurring Financial Crisis

The core issue in recurring bankruptcies often lies in inadequate risk management, insufficient financial buffers, and an underestimation of market volatility. For many, the root causes of the first bankruptcy, such as high operational costs or poor strategic planning, remain unaddressed, leading to subsequent financial failures.

The Solution: Building a Stronger Financial Foundation

To avoid the cycle of financial distress, consider these practical steps:

- Thorough Post-Bankruptcy Analysis: Conduct a comprehensive review of what led to each bankruptcy to identify and address underlying issues.

- Enhanced Financial Education: Regularly update your financial knowledge and skills, focusing on cash flow management, budgeting, and forecasting.

- Strategic Planning and Diversification: Diversify income streams and continuously update business plans to adapt to market changes.

Implementing these strategies can help individuals and businesses not only recover from bankruptcy but also build a resilient financial future.

Conclusion: Turning Adversity Into Opportunity

In conclusion, experiencing bankruptcy twice can be both daunting and enlightening. It presents an opportunity to reassess, learn, and rebuild with a stronger, more informed approach. The key to turning these difficult experiences into success stories lies in proactive management and continuous learning.

Read the full article

0 notes

Text

Digifinex Labs: Celsius Creditors Facing Clawbacks Withdrawals Over $100,000 in 90 Days Preceding Bankruptcy Prompt Legal Action

According to the notice published on Tuesday, account holders who withdrew more than $100,000 in the 90 days prior to July 13, 2022 (the day Celsius declared bankruptcy), are subject to clawbacks. Letters will be sent to the affected accounts, directing them to repay 27.5% of the amount withdrawn during the specified period. Compliance with this directive would make them eligible for future distributions under the company’s reorganization plan.

Alan R. Rosenberg, a partner at the Markowitz Ringel Trusty & Hartog law firm, explained, “This notice is giving folks who have preference exposure above $100k — meaning that they withdrew $100k or more within 90 days of the filing date — to preemptively settle with the Estate for 27.5% of the amount they withdrew, without getting sued. They still have to vote to accept the plan and not opt-out of the releases.

Get your $550

Registering DigiFinex now grants you a newcomer’s package worth $550: Click to register

If you want to receive all the rewards, please contact me: Telegram

0 notes

Text

DataNet Systems reports data breach - Voter roll may have been compromised

DataNet Systems, Washington D.C. company, announced that it experienced a data incident in which an unauthorized person obtained some information of District of Columbia voters. DataNet Systems helps the District of Columbia Board of Elections provide information to voters. The company takes the privacy and security of personal information very seriously and is providing notice of the incident to potentially affected individuals.

On October 5th 2023, the company discovered unusual activity within its network. This activity was discovered to be unauthorized access to the system through a software program used to advise voters. The company immediately took steps to secure the network and minimize the impact of the incident. The company also engaged a leading independent cybersecurity firm to investigate what happened and determine whether any sensitive information may have been impacted. While that investigation has not determined definitively whose information may have been involved in the incident, out of an abundance of caution we are notifying individuals whose information may have been involved in the relevant data set.

The information may have involved the names, physical and email addresses, dates of birth, phone numbers and voter registration information, partial Social Security numbers, and driver's license numbers of involved individuals. On November 20 the company determined who may have been involved in the incident and is sending individual messages to people with known contact information. If you do not receive one of these communications but want to know if your information was involved, or if you would like further information, please call (888) 817-5125 Monday through Friday from 8AM to 8 PM Central Time.

You also have the right to place a security freeze on your credit report free of charge pursuant to 15 U.S.C. § 1681c-1 and set out below is information on how a resident may request a security freeze. This will prevent new credit from being opened in your name without the use of a PIN number that is issued to you when you initiate the freeze. A security freeze is designed to prevent potential creditors from accessing your credit report without your consent. As a result, using a security freeze may interfere with or delay your ability to obtain credit. You must separately place a security freeze on your credit file with each credit reporting agency. A security freeze may be placed or lifted free of charge.

You may make that request by certified mail, overnight mail, or regular stamped mail, or by following the instructions found at the websites listed below. The following information must be included when requesting a security freeze (note that if you are making a request for your spouse, this information must be provided for him/her as well): (1) full name, with middle initial and any suffixes; (2) Social Security number; (3) date of birth; (4) current address and any previous addresses for the past five years; and (5) any applicable incident report or complaint with a law enforcement agency or the Registry of Motor Vehicles. The request must also include a copy of a government-issued identification card and a copy of a recent utility bill or bank or insurance statement. It is essential that each copy be legible, display your name and current mailing address, and the date of issue. You may obtain a security freeze by contacting any one or more of the following national consumer reporting agencies:

Equifax Security FreezePO Box 105788Atlanta, GA 303481-800-685-1111www.equifax.com

Experian Security FreezePO Box 9554Allen, TX 750131-888-397-3742www.experian.com

TransUnion (FVAD)PO Box 2000Chester, PA 190221-800-888-4213www.transunion.com

Additional Free Resources:

You can obtain information from the consumer reporting agencies, the FTC or from your Attorney General about steps you can take toward preventing identity theft. You may report suspected identity theft to local law enforcement, including to the FTC or to the Attorney General in your state.

Federal Trade Commission600 Pennsylvania Ave, NWWashington, DC 20580consumer.ftc.gov, andwww.ftc.gov/idtheft1-877-438-4338

Washington D.C. Attorney General441 4th Street, NWWashington, DC 20001www.oag.dc.gov/consumer-protection/consumer-alert-identity-theft1-202-727-3400

The company regrets any worry or inconvenience that this incident causes.

Read the full article

0 notes

Link

#debt_free_planner#debt_log#Debt_Pay_off_Log#Debt_payment_tracker#Debt_Snowball#Debt_Tracker#easy_savings_tracker#Money_Planner#personal_finance_log#repayment_planner#savings_log_tracker#savings_printable#savings_tracker

0 notes

Link

#debt_free_planner#debt_log#Debt_Pay_off_Log#Debt_payment_tracker#Debt_Snowball#Debt_Tracker#easy_savings_tracker#Money_Planner#personal_finance_log#repayment_planner#savings_log_tracker#savings_printable#savings_tracker

0 notes

Link

0 notes

Text

We are looking to hire a Senior Accountant for their company. The ideal candidate should have 5 to 8 years of experience in accounting and finance, possess strong analytical skills, and be able to work independently as well as in a team.

Job Duties:

Responsible for validation and verification of invoices before processing

Responsible for vendor invoice processing with TDS, GST & Prepaid Compliances

Ensure all the invoice proceed with proper supporting

Responsible for vendor Master Data Creation in System with proper Approval

Responsible for vendor modification as & when required

Responsible for parking of vendor invoices if Invoice value is more than threshold limit

Billing of Purchase and Sales (Tax Invoice).

General Accounting.

Journal, Ledger, Voucher, Challan.

Debit note, Sundry Debtors and Sundry Creditors Outstanding Reports.

Trading P & L, Balance sheet.

Bank Reconciliation, Party Ledger Reconciliation, Cash Management, Asset Management, Taxations & Statutory, Regular Outstanding Follow –Up, Internal and External Audit, On line Return File,

Filling of GST Return like GSTR-1, GSTR-3B

Filling of GSTR 9A and GSTR 9C

• Reversal & re-class of entry as & when required

• Prepare monthly vendor reconciliation

• Handle all the vendor queries on daily basis.

If you are interested in applying for the Senior Accountant position at Pranjal Projects Pvt. Ltd., please submit your resume and cover letter to the company's HR department.

Interested candidates may share CV at……………[email protected] , [email protected]

0 notes

Text

Update in the Sherry Tenney case!

If you don't know who the scam artist Sherry Tenney is, here is my pinned post about her.

[The Bureau of Consumer Protection is writing to update you concerning the consumer complaint you filed against Tenney’s Fiber Farm, LLC (the “Company”) and the above-referenced litigation.

As you may know, Sherry Tenney has filed for Chapter 13 bankruptcy in the United States Bankruptcy Court in the Middle District of Pennsylvania under Case Number 1:23-bk-02752-HWV.

If you have not done so already, you may wish to file a proof of claim form in the bankruptcy. A proof of claim form may be filed either electronically or as a paper document. The Bankruptcy Court has set a deadline of February 12, 2024 for creditors to file proofs of claim. To assist you in that matter, we have enclosed a blank proof of claim form for you to complete and submit to the bankruptcy court.

Please send the completed proof of claim form to:

Sylvia H. Rambo US Courthouse U.S. Bankruptcy Court 1501 N. 6th St. Harrisburg, PA 17102

Please be advised, our office cannot offer you legal advice. You should consult with a private attorney to ensure that your rights are preserved in the bankruptcy proceedings.

Very truly yours,

Mia Paone Consumer Protection Agent]

If Sherry Tenney owes you money, please file immediately!

Sherry Tenney's next court date is February 1st, 2024. So she could be trying to get ahead of a verdict. I have a feeling, given everything that's come out in discovery, that the judge is going to throw the book at her. She also owes nearly $80k in legal fees at this point, and with no income and no job, she's probably stiffing her lawyer too.

And, as always, a trapped wolf can still bite, so please avoid her at all costs. She is still bragging about being armed and dangerous.

#warning to all fiber artists#sherry tenney#scam artist sherry tenney#it's probably not over yet#but she's finally seeing consequences for her actions

8 notes

·

View notes

Text

Cortes Law Firm Expands to Offer Lawton Oklahoma Probate Attorney Services

Cortes Law Firm, an estate planning law firm based in Oklahoma City, OK, is pleased to announce that they have expanded their legal services to include probate matters in Lawton, OK, and the neighboring areas. The firm’s attorneys have an in-depth understanding of probate law and are dedicated to helping clients navigate the legal procedures with professionalism and compassion. Probate is the legal process of distributing and settling the assets of a person who has passed away. It can be an emotional and complicated process for those who are involved, which is why the attorneys are ready to guide their clients at every step of the process. They can help with the distribution of assets, the payment of debts and taxes, and the resolution of any disputes that may arise.

Steve Cortes of the Cortes Law Firm says, “Probate law is the process of administering a deceased person's estate, and it involves the distribution of assets to the rightful heirs or beneficiaries. This process is necessary to ensure that the deceased's wishes are carried out and that their assets are distributed according to their wishes. When it comes to probating a loved one's estate, it is important to find the right Lawton probate attorney to ensure that the administration is carried out in the most efficient and effective manner. If you are an heir, you most likely have not had to experience the pain of probate settlement.”

There are two general types of probate in Oklahoma. One is the regular probate and the other one is the summary probate process. The summary probate may be used when the total assets are less than $200,000 and it will take at least 45 days, according to the law. Depending on the schedule of the court, a summary probate is typically completed within two to three months. It can be a great option when the estate is small, there is not real estate property that has to be sold, and all of the family members are in agreement throughout whole probate process. All of the heirs have to agree in writing to proceed with the summary probate to be able to file the initial petition for probate. Even if just one person disagrees, the probate cannot push through as a summary administration.

The regular probate process will usually require several months or even years if the parties fail to agree. The lawyers will first determine if there is a last will, a pour-over will, or there is no will at all. The lawyer will draft an initial petition for probate and if the client agrees with the wording, the firm will file the petition with the Comanche County Court Clerk. The court will order the hearing of the petition at a future date and the probate lawyers will publish a notice of the hearing in the local newspaper and will mail a copy of the Notice of Hearing to all involved parties.

The Court will make four determinations at the initial hearing and once these have been accomplished, it will appoint the petitioner as the personal representative, who will be in charge of administering the estate of the deceased. Creditors typically have 60 days after the filing of a Notice to Creditors to file a claim against the estate. The Court will have to approve the claim before any payment can be made. A general inventory of the estate’s assets will usually be needed, with the list including personal property, real estate, financial accounts, and mineral interests. If everything proceeds perfectly, a probate will usually take four to five months but they generally take five to seven months because the proceedings never go perfect.

Started in 2013 by Attorney Steve Cortes, Cortes Law Firm offers estate planning and probate services for individuals, enterprises, and business people in Oklahoma City and surrounding areas. Steve Cortes has been providing legal services for estate planning for a wide range of clients for more than 24 years.

Those who are interested in getting the services of a Lawton Oklahoma probate attorney can visit the Cortes Law Firm website or contact them on the telephone or through email. They are open from 9:00 am to 5:00 pm, from Monday to Friday.

Source: Cortes Law Firm Expands to Offer Lawton Oklahoma Probate Attorney Services

0 notes

Text

Understanding An A-B Trust

Understanding An A-B Trust

An A-B trust is an estate planning device that can be confusing to a first timer. It’s a two-part trust that divides your assets in a way that will minimize the amount of estate tax paid upon your passing.

There are several reasons why a couple will choose to create an A-B trust. For example, it may provide protection for the children of the deceased. Additionally, it can also be used to shelter the assets from creditors and divorces.

However, before you decide to set up an A-B trust, you need to understand the most important details. First, you should know that the A-B trust was once a popular estate planning tool, especially when the estate tax exemption was low. Currently, married couples are able to pass up to $22 million tax-free. If you are considering using an AB trust, you should consult a competent estate planning attorney to determine the best course of action.

The B part of an A-B trust is a bypass trust, which can be a tax savings for the surviving spouse. This type of trust shelters the assets of the surviving spouse from creditors during their lifetime. After the surviving spouse dies, the assets are dispersed among the remaining beneficiaries. Some of these assets may even be distributed to children of the deceased.

Protecting the surviving spouse from creditors

A bypass trust can also help offset the hefty tax burden. For instance, you may decide to leave your home to your children. Depending on how much you own, you may be able to exclude the sale of the home from your taxable income. Another benefit of the AB trust is that your loved ones will be able to use generation-skipping exemptions to avoid triggering estate taxes.

While the AB trust is a useful tool for the surviving spouse, there are many negatives associated with the trust. For one, if you live in a state that taxes estates, you will still have to file a separate income tax return for the trust every year. You will also have to continue to accurately track and record all of the assets within the trust. Finally, there is a chance that the assets in the trust will be taxed again when the surviving spouse dies.

An AB trust is not a replacement for a will, but it can be a helpful tool in the process of transferring assets. When done properly, an AB trust can protect your estate from probate. But if you have a complicated estate, you may find that an A-B trust is not the best choice. As with all estate planning strategies, consult an estate planning attorney for advice. Creating an AB trust can be very complicated, so you should hire a professional.

Although an AB trust was once the prevailing tax advantage, the benefits have diminished in recent years. Couples now have higher estate-tax exemptions, so you may want to consider other options.

Disclaimer: This is not legal advice and is simply an answer to a question and that if legal advice is sought to contact a licensed attorney in the appropriate jurisdiction.

Estate Planning Attorney Free Consultation

If you have any questions or in need a Estate Planning Attorney, we have the Best Attorneys in Utah. Please call this law firm for free consultation.

We help you with Estate Planning, Wills, Trusts, Power of Attorney, Health Care Directive, Estate Administration, Probate and More

When you need a Lawyer, contact this law firm:

Parklin Law

5772 W 8030 S, # N206

West Jordan UT 84081

(801) 618–0699

https://www.parklinlaw.com/

0 notes

Text

Liens- What Are They and How They Work?

In our day to day life when we have everything going well, we hardly think that somebody has a lien registered on our property. However, we are never worried about lien since it helps to purchase things like Home, Vehicle and other things. Nonetheless, there are situations when lien on the property can create some problems for us, which is why knowledge about lien is essential. Read on to find out important things about the lien.

What is A Lien?

A lien is a legal claim given to another party (the creditor) on a property for which you (owner) took a loan from him. In this, a creditor has the right to reclaim the property or bring legal action to satisfy his debt or obligations.

These liens are part of public records so that potential creditors have a chance to check whether there is any debt on the property before giving a loan for that property.

Here’s an example to make it simple for you- When someone buys a car, they are required to pay a certain amount for it. Many people can pay this particular amount, but some people do not have enough funds and they may borrow some amount from another party (Individual, Bank etc.). These other parties are called creditors, the amount they lend is known as (debt) and a party who borrows the amount are called debtors. You have promised to repay this debt to a creditor, but they don't have any security if you don't pay the debt. This is why they file certain documents with the Government and become lienholder on debtor property (car). This whole process makes creditor's debt secured and now he is in a better position to take his debt back.

Benefits of lien to creditors

Liens create a claim on the debtor’s property. They have the right to take debtor's property and sell it, in case their debt is not paid.

As they are part of public records, a debtor will not be able to again take a debt on the property which has a lien on it.

How to check if there is a lien on the vehicle/property you are planning to buy?

Before you buy any vehicle/property, you should check if there is any lien against that property, this can be done online by going to a website that provides services of a lien checking. Speedy search helps you check lien on a vehicle by VIN search is ON. They charge you a nominal amount to provide information which can be done through ON VIN check. As the name of the company suggests, you get speedy results when you check by VIN search is ON. The results of ON VIN check is emailed to you within 45 minutes.

Olivier Thomas is the author of this article. To know more about ON Vin Check. Please visit our website: speedysearch.ca

0 notes

Text

Alternatives For Bankruptcy When In Debt

Are there any alternatives to bankruptcy?

There are alternatives to bankruptcy. Some people may not need to file for bankruptcy. Suppose you've made many poor financial decisions in the past but have been managing your finances responsibly lately. In that case, there may be ways to revitalize your credit without dealing with the considerable downsides of filing for bankruptcy.

If you are struggling to pay your mounting debt and feel like you're going to lose everything, it's a scary thought that there might not be any other way out aside from declaring bankruptcy. But fortunately, there are some alternatives.

Debt Consolidation

Debt consolidation is an option in which you team up with a loan company to pay off your debts with a single monthly payment from the lender, who then works directly with your creditors to make sure they get paid. The most important thing to remember about debt consolidation is that you will still have debt; you'll have one large loan instead of several smaller ones—so it's important to ask the lender about interest rates and fees before signing on for the loan.

You may even have the option of paying off the loan early if you can afford to, which will save you money in interest payments and help you avoid having another big payment hanging over your head after paying off all your credit cards and loans.

Chapter 7 and Chapter 13

If you've racked up such a high balance on your credit cards or loans that even a debt consolidation company won't help, consider filing for bankruptcy to eliminate most of your debts. If this is the best option for you, there are two types of bankruptcies: Chapter 7 and Chapter 13.

Bankruptcy Attorney Free Consultation

If you have any questions or in need a Bankruptcy Attorney, we have the Best Attorneys in Utah. Please call this law firm for free consultation.

Ascent Law LLC

8833 S Redwood Road Suite C

West Jordan UT 84088

(801) 676-5506

https://www.ascentlawfirm.com

https://docs.google.com/spreadsheets/d/1QZQk-B_3p8eXcE3Y-5cEPdB6z0ZbIqOW1FoLRSNOKhE

http://dailyutahbankruptcies.com/alternatives-for-bankruptcy-when-in-debt/

Disclaimer: This is not legal advice and is simply an answer to a question and that if legal advice is sought to contact a licensed attorney in the appropriate jurisdiction.

0 notes

Text

Ikigai Exec Says ‘Large Majority’ of Crypto Asset Management Firm’s Funds Stuck on FTX

“a large majority of the hedge fund’s total assets” were stored on FTX. Ikigai chief investment officer, Travis Kling, told the public on Twitter and he said there’s “a lot of uncertainty about what’s going to happen next.”

Ikigai Chief Investment Officer Shares ‘Some Pretty Bad News’

Another hedge fund has detailed it has lost money from the FTX scandal, according to a Twitter thread published by Ikigai’s chief investment officer Travis Kling. “Unfortunately,” Kling said. “I have some pretty bad news to share. Last week Ikigai was caught up in the FTX collapse. We had a large majority of the hedge fund’s total assets on FTX. By the time we went to withdraw Monday , we got very little out. We’re now stuck alongside everyone else.”

A similar situation happened to the hedge fund Galois Capital, according to the company’s co-founder Kevin Zhou. The Galois co-founder noted that his firm had “roughly half” of the firm’s capital “stuck on FTX.” Kling’s thread published on Nov. 14, 2022, details that Ikigai has been “in constant communication” with the hedge fund’s investors since Monday.

“The amount of support we’ve received has been astonishing given the circumstances, and deeply heartwarming,” Kling remarked. However, Kling further stressed that he wasn’t too pleased with the decisions he made. Kling said:

It was entirely my fault and not anyone else’s. I lost my investors’ money after they put faith in me to manage risk and I am truly sorry for that. I have publicly endorsed FTX many times and I am truly sorry for that. I was wrong.

Galois and Ikigai are not the only companies that have shared exposure to the FTX fallout. Reports show that the crypto venture capital firm Multicoin Capital had $25 million stuck on FTX. Furthermore, Galaxy Digital published its third-quarter earnings report and explained it has an “exposure of approximately $76.8 million of cash and digital assets to FTX.”

The crypto exchange FTX filed for bankruptcy protection in the U.S. on Nov. 11, 2022. The company’s creditors will now have to deal with bankruptcy court proceedings going forward. Galois’s Zhou told his investors that the bankruptcy process may take years.

“Over the coming weeks and months, the timeline and potential recovery for FTX customers will become clearer,” Ikigai’s CIO Kling said. “Right now, it’s really hard to say. At some point, we’ll be able to make a better call on whether Ikigai is going to keep going or just move into winddown mode,” the executive added.

What do you think about the hedge fund Ikigai having funds stuck on FTX? Let us know your thoughts about this subject in the comments section below.

Read the full article

#bank#bankruptcy#chrase#cio#company#crashed#crisis#Crypto#cryptocrisis#customers#fbs#financialcrisis#ftt#FTX#Ikigai#investment#Investors#Multicoin#Rohingyacrisis#same#shares#USA

0 notes