#Private limited company registration Karnataka

Text

#Private limited company registration in Bangalore#Private limited company registration in Bangalore online#Private limited company registration in Karnataka#online Private limited company registration in Bangalore#PVT limited company registration in Bangalore#Private limited company registration online in Bangalore

0 notes

Text

Discover seamless private limited company registration services in Bangalore. Our expert team guides you through the process, ensuring compliance and efficiency. Start your business journey with ease. Contact us today.

#private limited company registration in Bangalore#private limited company registration online#private limited company registration#private limited company registration in india#private limited company registration in karnataka

0 notes

Text

PVT LTD Company Registration Services in Bangalore:9844713239.

Private Limited Company Registration Bangalore Bengaluru Karnataka: Call@ 9844713239. pvt ltd registration bangalore, pvt ltd company registration in bangalore, register a pvt ltd company in bangalore, pvt ltd company registration fees in bangalore, pvt ltd company registration in bangalore cost, private limited company registration bangalore bengaluru karnataka.

#pvt ltd registration bangalore#pvt ltd company registration in bangalore#register a pvt ltd company in bangalore#pvt ltd company registration fees in bangalore#pvt ltd company registration in bangalore cost#private limited company registration bangalore bengaluru karnataka

0 notes

Text

Top Benefits of Registering Your Company in Bangalore: Why It’s the Ideal Business Hub

A Comprehensive Guide to Company Registration in Bangalore

Bangalore, often referred to as the Silicon Valley of India, is a hub for startups and established companies alike. The city’s vibrant ecosystem makes it an ideal location for entrepreneurs to launch their ventures. If you’re considering Company Registration in Bangalore, this guide will walk you through the process, benefits, and important considerations.

Why Register a Company in Bangalore?

Bangalore is not just a tech hub; it's also a thriving business environment with numerous advantages:

Access to Talent: Bangalore is home to some of the best educational institutions in India, providing a steady supply of skilled professionals.

Robust Infrastructure: The city offers excellent infrastructure, including coworking spaces, incubators, and accelerators, making it easier to start and grow a business.

Supportive Ecosystem: With a high concentration of investors, mentors, and a strong network of professionals, Bangalore offers ample support for businesses at every stage.

Innovation and Technology: The city is a hotbed for innovation, especially in technology, biotech, and IT services.

Government Initiatives: The Karnataka government has introduced several initiatives to support startups and SMEs, making it easier to do business in the state.

Types of Companies You Can Register

Before registering your company, it’s essential to choose the right type of entity based on your business goals. The most common types of companies in Bangalore include:

Private Limited Company: This type of company is ideal for startups and businesses looking to raise capital. It requires at least two directors and two shareholders.

One-Person Company (OPC): Suitable for solo entrepreneurs who want to enjoy the benefits of a company structure without the need for multiple directors or shareholders.

Limited Liability Partnership (LLP): This type of partnership combines the benefits of a partnership and a company, offering limited liability to partners.

Public Limited Company: Suitable for large businesses looking to raise funds from the public. It requires at least three directors and seven shareholders.

Sole Proprietorship: A simple business structure where the owner and the business are the same entity. It is easy to set up but offers no limited liability protection.

Steps to Register a Company in Bangalore

Here’s a step-by-step guide to registering your company in Bangalore:

Obtain a Digital Signature Certificate (DSC): The first step in the registration process is to obtain a DSC for the proposed directors of the company. It is essential to file electronic documents with the Ministry of Corporate Affairs (MCA).

Obtain Director Identification Number (DIN): The next step is to apply for a DIN for all the company's directors by filing Form DIR-3.

Name Reservation: You need to choose a unique name for your company and get it approved by the MCA. You can do this by filing the SPICe+ form (Simplified Proforma for Incorporating Company Electronically Plus).

File Incorporation Documents: Once the name is approved, you must file the incorporation documents, including the Memorandum of Association (MOA) and Articles of Association (AOA), along with the SPICe+ form.

Obtain Certificate of Incorporation: After the MCA verifies your documents, they will issue the Certificate of Incorporation. This certificate serves as proof that your company is now legally registered.

Apply for PAN and TAN: You will also need to apply for a Permanent Account Number (PAN) and Tax Deduction and Collection Account Number (TAN) for your company.

Open a Bank Account: Once you have the Certificate of Incorporation, you can open a bank account in the company’s name.

Register for GST: If your company’s turnover exceeds the threshold limit, you need to register for the Goods and Services Tax (GST).

Documents Required for Company Registration

The following documents are typically required for registering a company in Bangalore:

Identity Proof: PAN card of all directors and shareholders.

Address Proof: Aadhaar card, voter ID, or passport of all directors and shareholders.

Registered Office Proof: Rental agreement or property ownership documents, along with a utility bill.

Photographs: Passport-sized photographs of all directors and shareholders.

NOC from Property Owner: If the registered office is a rented property, a No Objection Certificate (NOC) from the property owner is required.

Post-Registration Compliance

After registering your company, there are several post-registration compliances you need to adhere to:

Annual Filing: Companies are required to file annual returns with the Registrar of Companies (RoC).

Accounting Records: Maintain proper accounting records and get your financial statements audited.

Tax Filings: Ensure timely filing of Income Tax returns, GST returns, and other applicable taxes.

Compliance with Labour Laws: If you have employees, ensure compliance with labour laws, including PF and ESI registration.

Board Meetings: Conduct regular board meetings and maintain minutes of the meetings.

Conclusion

Registering a company in Bangalore is a straightforward process if you follow the necessary steps and comply with the legal requirements. The city offers a conducive environment for businesses to thrive, with access to talent, infrastructure, and a supportive ecosystem. By choosing the proper business structure and adhering to regulatory requirements, you can set the foundation for a successful business venture in Bangalore.

0 notes

Text

India's Thriving Cashew Export Industry: Opportunities and Top Exporters

India has emerged as one of the world’s leading producers and exporters of cashews and cashew-related products, thanks to its favorable climate and skilled workforce. With more than 15% of global cashew exports, India holds the top spot as the world's largest exporter. The cashew export industry in India is a lucrative business venture for entrepreneurs eager to enter the international trade market.

Is the Cashew Export Business Profitable?

Indeed, cashew export from India are highly profitable. However, the profit margin varies depending on several factors. On average, the revenue generated from 1 kg of value-added cashew goods is substantial, making it a promising venture for traders.

According to data, India, the US, and Germany are the top three cashew-importing countries. Cashew nuts are consumed globally, either as sweet or salty snacks or as ingredients in various culinary dishes. The global cashew market size is expected to reach USD 7.82 billion by 2024 and USD 9.20 billion by 2029, with a compound annual growth rate (CAGR) of 3.31% during the forecast period, driven by the rising popularity of healthy food options and increasing health consciousness.

Top 10 Cashew-Producing Countries

India is one of the top cashew producers globally. Here’s a breakdown of the leading cashew-producing countries:

Ivory Coast - 970,000 tonnes

India - 743,000 tonnes

Vietnam - 283,328 tonnes

Indonesia - 170,000 tonnes

Benin - 120,000 tonnes

Burkina Faso - 115,000 tonnes

Guinea-Bissau - 90,000 tonnes

Tanzania - 80,000 tonnes

Mozambique - 70,000 tonnes

Philippines - 65,000 tonnes

India produces over 0.8 million metric tons of cashew nuts annually, with Maharashtra, Kerala, Karnataka, Tamil Nadu, Andhra Pradesh, Goa, Orissa, West Bengal, and parts of the Northeast being the major cashew-growing states.

Cashew Export Data from India: 2023-24

India's dominance in the global cashew market is evident from its export statistics. According to cashew export data 2023, India exported 65,808.42 metric tons of cashews, valued at approximately USD 356 million. However, there was a slight decline in export value from USD 290.95 million in 2022 to USD 282.54 million in 2023.

The top export destinations for Indian cashews include the United Arab Emirates, Japan, and the Netherlands. The UAE was the largest buyer, accounting for USD 127 million in 2022-2023, representing 34.9% of total exports. The Netherlands and Japan also featured among the top three importers of Indian cashews, each accounting for 10% of exports.

Top Cashew Nut Exporting Countries

India remains the largest exporter of cashews, with an export value of USD 356.6 million. Other major cashew-exporting countries include:

Netherlands - USD 253.3 million

Germany - USD 213.3 million

Nigeria - USD 152.6 million

Brazil - USD 68.6 million

Ghana - USD 31.0 million

Turkey - USD 24.6 million

Benin - USD 21.8 million

Mozambique - USD 20.4 million

Tanzania - USD 18.6 million

Top Cashew Exporters in India

India boasts some of the largest cashew exporters in the world. Here are the top 10 cashew exporters in India:

Griva Enterprise - Gujarat

Yesraj Enterprises - Maharashtra

Sahyadri Cashew Processors - Karnataka

Virendra Haribhai Pansara - Gujarat

Puduvai Exports - Puducherry

Andalan Shakti Private Limited - Gujarat

Saa Vishnu Bakers Private Limited - Jharkhand

Amirtham Enterprises Private Limited - Tamil Nadu

Nayan Enterprises - Rajasthan

M. Madhavaraya Prabhu - Karnataka

These companies represent the best in India's cashew export industry, ensuring that the country maintains its strong position in the global market.

How to Start a Cashew Export Business from India

To establish a successful cashew export business in India, you need several documents, including export documentation, an export license, a certificate of origin, and an FSSAI food license. Here are the essential steps to get started:

Business Registration: Register your business with the appropriate legal structure and ensure compliance with India’s tax regulations.

Market Research: Conduct thorough market research to understand the nature and qualities of the product. Understanding the market is crucial for success in the cashew export business.

Find Buyers or Distributors: Identifying reliable buyers or distributors is critical. Platforms like Seair Exim Solutions offer valuable insights and data on cashew export trends, helping you connect with potential trading partners.

Conclusion

The cashew export industry in India offers numerous opportunities for traders, farmers, and entrepreneurs. The industry is well-positioned for continued growth with the right approach, focusing on quality, and leveraging government support. Platforms like Seair Exim Solutions provide up-to-date trade data, making it easier to navigate the market and succeed in the global cashew trade.

#Cashew export from India#cashew nut export#cashew export data#cashew exporters in India#cashew exporters

0 notes

Text

Maximizing Profit: A Guide to Exporting Dry Fruits from India

Dry fruits are an excellent source of potassium, calcium, protein, and essential oils. For fitness enthusiasts, dry fruits can boost metabolism and help achieve protein goals with fewer calories. Not only are they healthy, but they are also delicious, and there are many ways to incorporate them into snacks and cooking.

The Growing Market for Dry Fruits in India

Did you know the Indian dry fruits market was valued at US$ 370.29 million in 2022? This growing market offers significant opportunities for exporting dry fruits from India. In this article, we will explore the profitability of dry fruits export, production data, key exporters, and essential steps to start dry fruits export from India.

Is dry fruits export from India Profitable?

Yes, exporting dry fruits from India is highly profitable. Thousands of exporters earn millions of dollars by exporting to countries with high demand for dry fruits. To maximize profits, it is crucial to understand the dry fruit export data and identify top importing countries. Efficiently and effectively managing the export process is key to success.

Leading Dry Fruit Producing States in India

India is the 6th largest producer of dry fruits globally, with major production states including West Bengal, Tamil Nadu, Himachal Pradesh, Jammu and Kashmir, Haryana, and Karnataka. In the 2022-23 period, India produced 290k metric tonnes of dry fruits, contributing to the global production of 3.13 million tonnes. Major dry fruits produced in India include:

Almonds

Raisins

Cashews

Dates

Walnuts

Dry Fruits Export Data: 2022-23

In 2022-23, India's dry fruit exports were valued at approximately 33 million dollars, making India the 20th largest dry fruit exporter in the world. The fastest-growing markets for Indian dry fruits are Iraq, the United Arab Emirates, and Bangladesh. In 2022, there were 22.5k shipments of dry fruits exported by 1,788 Indian exporters to 3,146 buyers.

Top 10 Dry Fruits Exporting Countries

Turkey - US$ 457.32 million

Chile - US$ 294.56 million

Thailand - US$ 275.88 million

United States - US$ 269.13 million

China - US$ 248 million

Germany - US$ 221.6 million

Spain - US$ 115.32 million

France - US$ 96.28 million

Netherlands - US$ 84.84 million

Italy - US$ 60.5 million

These countries dominate the global dry fruits export market. Although India's export figures are currently lower, there is significant potential for growth.

Top Dry Fruit Exporters in India

Prominent dry fruit exporters in India include:

Nani Agro Foods

Pisum Food Services

Shree Shyam Impex

Grace Enterprises

Sankhla Mehandi Udhyog

SBH Foods Private Limited

Cilantro Food Products Private Limited

Anantagriexports

Kesco Organics Exports

Thiva Exim

These companies play a crucial role in meeting the global demand for Indian dry fruits.

Major Destinations for Indian Dry Fruits

The top destinations for Indian dry fruits exports are:

United Arab Emirates - $5.4 million

Bangladesh - $5.07 million

Vietnam - $3.29 million

United States - $2.78 million

Malaysia - $2.32 million

These countries offer substantial opportunities for Indian exporters due to their high import volumes.

Factors Driving the Increase in Dry Fruits Exports

The global dry fruits market was valued at US$ 9713 million in 2022 and is projected to reach US$ 11,487 million by 2028, growing at a CAGR of 4.6%. Factors contributing to this growth include:

Inadequate domestic production in many countries

Specific soil and climate requirements for dry fruit cultivation

Rising global demand for nutrient-rich foods

How to Export Dry Fruits from India

To successfully export dry fruits from India, follow these steps:

Market Research: Conduct thorough research to identify profitable markets. Utilize resources like India Dry fruits export data for insights.

Registration and Documentation: Register with a reliable export corporation and prepare necessary documents, including GST registration, APEDA Certificate, PAN card, Import Export Code (IEC), FSSAI Registration, commercial invoices, packaging lists, bills of lading, quality certifications, and certificates of origin.

Find Buyers: Identify potential buyers through government portals, trade fairs, and online platforms. Eximpedia.app is an excellent resource for finding genuine dry fruit buyers.

Finding Accurate Buyers for Dry Fruits

Exporters can easily find reliable buyers using the informative dashboard of Eximpedia.app. The platform provides real-time import-export data, helping exporters connect with buyers globally.

Conclusion

Exporting dry fruits from India is a lucrative business with the potential for significant profits. Success depends on careful planning, efficient management, and adherence to international trade regulations. Utilizing resources like Eximpedia.app can help exporters navigate the market and connect with trustworthy buyers. Start your journey in the dry fruits export market and tap into the growing global demand for these nutritious and delicious products.

#dry fruits export from India#dry fruits export data#how to export dry fruits from India#dry fruit exporters#dried fruit export#imported dry fruits#dry fruit exporters in India#Indian dry fruits

0 notes

Text

LLP Company Registration in Bangalore: Expertise You Can Trust

For businesses seeking LLP company registration in Bangalore, Kros-Chek offers unparalleled expertise and support throughout the registration process. With a thorough understanding of the regulatory requirements and procedural intricacies involved in LLP registration, Kros-Chek ensures that its clients' interests are protected and their compliance needs are met. By leveraging its industry knowledge and experience, Kros-Chek facilitates seamless LLP registration, enabling businesses to establish a legal entity quickly and efficiently.

Private Limited Company Registration in Bangalore: Setting the Foundation for Success

Private Limited Company Registration in Bangalore are the preferred choice for businesses looking to raise capital, attract investors, and enjoy limited liability protection. Kros-Chek specializes in private limited company registration in Bangalore, guiding entrepreneurs through the intricate process of company formation. From name reservation and drafting the Memorandum of Association (MoA) to obtaining the Certificate of Incorporation (CoI) and PAN/TAN registration, Kros-Chek handles every aspect of the registration process with precision and expertise.

Kros-Chek: Your Gateway to Business Compliance and Success

In conclusion, Kros-Chek is more than just a consultancy firm—it's a trusted partner in your journey towards business compliance and success. With its comprehensive range of services, including GST return filing, LLP and private limited company registration, Kros-Chek simplifies the complexities of business operations and ensures regulatory compliance at every step. Whether you're a startup looking to establish your presence or an established business seeking to streamline your operations, Kros-Chek is here to support you with expert guidance, personalized solutions, and unwavering commitment to your success.

More information:

Contact-us

365 Shared Space, 2nd Floor,#153, Sector 5,

1st Block Koramangala, HSR Layout,

Bengaluru, Karnataka 560102

#KrosChek#KrosChekBangalore#llpcompanyregistrationservicesnearbangalore#llpcompanyregistrationinbangalore#llpcompanyregistrationservicesinBangalore#PrivateLimitedCompanyRegistrationinBangalore

0 notes

Text

Streamlining Private Limited and LLP Company Registration Services in Bangalore with Kros Chek

Establishing a business in Bangalore, one of India's bustling metropolises, requires navigating through various legal and administrative procedures. Among the most crucial steps is company registration, whether it's a Private Limited Company or a Limited Liability Partnership (LLP). To ensure a smooth and compliant registration process, businesses in Bangalore often rely on expert guidance from firms like Kros Chek.

Private Limited Company Registration in Bangalore

Private Limited Company registration in Bangalore is a preferred choice for many entrepreneurs due to its distinct advantages, including limited liability, separate legal entity status, and ease of raising funds. Kros Chek, a prominent firm specializing in Pvt Ltd company registration in Bangalore, offers comprehensive services tailored to meet the specific needs of businesses.

Why Choose Kros Chek for Pvt Ltd Company Registration in Bangalore?

1. Expertise: With years of experience in the industry, Kros Chek boasts a team of skilled professionals well-versed in the nuances of Pvt Ltd company registration in Bangalore. They provide expert guidance at every step of the registration process.

2. Tailored Solutions: Understanding that every business is unique, Kros Chek offers personalized solutions to ensure that Pvt Ltd company registration in HSR Layout, Bangalore, and other areas meets the specific requirements of each client.

3. Compliance Assurance: Ensuring compliance with all legal and regulatory requirements is paramount during Pvt Ltd company registration. Kros Chek meticulously handles all documentation and formalities, guaranteeing adherence to the law.

LLP Company Registration Services in Bangalore

For businesses seeking a flexible and less cumbersome structure, LLP registration in Bangalore is an excellent option. An LLP combines the benefits of a partnership with the advantages of a limited liability entity, making it an attractive choice for many entrepreneurs. Kros Chek extends its expertise to LLP company registration services in Bangalore, assisting businesses in navigating through the process effortlessly.

Benefits of Choosing Kros Chek for LLP Company Registration in Bangalore

1. Seamless Process: LLP registration involves several steps, including drafting the LLP agreement, obtaining Digital Signatures, and filing necessary documents with the Registrar of Companies (ROC). Kros Chek simplifies the entire process, ensuring a hassle-free experience for clients.

2. Expert Guidance: From choosing a suitable name for the LLP to obtaining the Certificate of Incorporation, Kros Chek's team provides expert guidance and assistance, ensuring that clients are well-informed throughout the registration process.

3. Post-Registration Support: Kros Chek goes beyond LLP company registration services in Bangalore by offering comprehensive post-registration support. This includes assistance with obtaining PAN, TAN, and GST registrations, ensuring that clients are fully compliant with regulatory requirements.

In conclusion, whether you're looking to register a Private Limited Company or an LLP in Bangalore, Kros Chek is your trusted partner for seamless and compliant registration services. With their expertise in Pvt Ltd company registration in Bangalore and LLP company registration services in Bangalore, Kros Chek simplifies the process, allowing businesses to focus on their growth and success. Choose Kros Chek for reliable and efficient company registration services in Bangalore, and embark on your entrepreneurial journey with confidence.

More information:

365 Shared Space, 2nd Floor,#153, Sector 5,

1st Block Koramangala, HSR Layout,

Bengaluru, Karnataka 560102

Phone : +91-9880706841

Email : [email protected]

#privatelimitedcompanyregistrationinbangalore#llp company registration services in bangalore#llp company registration in bangalore#TaxConsultantsinBangalore

0 notes

Text

Company Registration in Karnataka: A Comprehensive Guide

Embark on your entrepreneurial journey in the vibrant city of Karnataka! Secure your business future with seamless company registration. Let's build success together!

For new business registration and support, contact kanakkupillai.com today.

Step-by-Step Procedure for Company Registration in Karnataka:

Name Reservation:

Choose a unique name for your company and check for availability.

Apply for name reservation with the Registrar of Companies (RoC).

Digital Signature Certificate (DSC): Secure a Digital Signature Certificate (DSC) for the nominated directors of the company.

Secure a Digital Signature Certificate (DSC) for the appointed directors of the company.

Director Identification Number (DIN): Apply for DIN for all the directors through Form DIR-3.

Incorporation Application: File the incorporation application (SPICe Form) with the necessary documents.

MOA and AOA: Draft your company's Memorandum of Association (MOA) and Articles of Association (AOA).

Registered Office: Provide the address of the registered office for the company.

PAN and TAN Application: Apply for PAN and TAN for your company.

Certificate of Incorporation: After verification, the RoC will issue a Certificate of Incorporation.

Bank Account: Open a company bank account using the Certificate of Incorporation.

Documents Required for Company Registration in Karnataka:

Identity and Address Proof of Directors

Address Proof of Registered Office

Memorandum of Association (MOA)

Articles of Association (AOA)

Declaration of Compliance

Affidavit from Directors and Shareholders

Director Identification Number (DIN) of Directors

Digital Signature Certificate (DSC)

Proof of Name Reservation

Benefits of Company Registration in Karnataka:

Legal Recognition: Gain legal recognition as a distinct business entity.

Limited Liability: Enjoy little liability protection for directors and shareholders.

Business Opportunities: Access a broader range of business opportunities.

Fundraising: Easier access to capital through shares and debentures.

Perpetual Existence: Continuity of existence even if directors change.

Latest 15 FAQs for Company Registration in Karnataka:

1. How long does the registration process take?

Typically, it takes around 15-20 days.

2. Is it possible for a foreign national to serve as a director?

Indeed, a foreign national can assume the role of a director.

3. What are the statutory compliances post-registration?

Compliance includes filing annual returns and audited financial statements.

4. Is a physical office necessary?

Yes, a registered office is mandatory.

5. What is the capital requirement?

There is no minimum capital requirement.

6. Can a single person form a company?

Yes, a single-person company (OPC) is allowed.

7. What is the Registrar of Companies (RoC) role?

RoC oversees company registrations and compliance.

8. Can a company own property?

Yes, a company can own property in its name.

9. Are there tax benefits for registered companies?

Companies enjoy certain tax benefits.

10. Can I change the company's registered office?

Yes, by following a prescribed process.

11. What is the minimum number of directors?

At least two directors are required.

12. How often should I file annual returns?

We should file annual returns every year.

13. Is it mandatory to have a company secretary?

It is not mandatory for private companies, but it is advisable.

14. Can a company be converted into another type?

Yes, conversion is possible, subject to certain conditions.

15. How is the company's name protected?

We protect the registered name from unauthorized use.

Related Articles:

Private Limited Company Registration

Private Limited Company Registration Chennai

Private Limited Company Formation

Private Limited Company Registration in Bangalore

Private Limited Company Registration in Coimbatore

Private Limited Company Registration in Hyderabad

Private Limited Company Registration in Pune

Private Limited Company Registration in India

Private Limited Company Registration in Ahmedabad

Private Limited Company Registration in Mumbai

Private Limited Company Registration in Lucknow

Private Limited Company Registration in Kerala

Related Keywords:

#KarnatakaBusiness #KarnatakaEntrepreneurs #CompanyRegistrationinKarnataka #PrivateLimitedCompany #CompanyFormation #BusinessFormation #BrandProtection #LegalCompliance #StartupSuccess #BusinessGrowth #LegalRecognition #Entrepreneurship #LegalShield #CorporateSuccess #BusinessRegistration #InvestorConfidence #SmallBusinessSuccess #BusinessIncorporation #LegalEntity #LimitedLiability #StartupJourney

#karnatakaBusiness#karnatakaEntrepreneurs#PrivateLimitedCompany#LegalCompliance#BusinessIncorporation#CompanyFormation#StartupSuccess#BusinessGrowth#LegalRecognition#Entrepreneurship#LegalShield#CorporateSuccess#BusinessRegistration#BrandProtection#InvestorConfidence#SmallBusinessSuccess#CompanyRegistration#LegalEntity#LimitedLiability#StartupJourney#CorporateStructure#BusinessFormation#BusinessOwnership#LegalFormality#FinancialSecurity#EntrepreneurLife

0 notes

Text

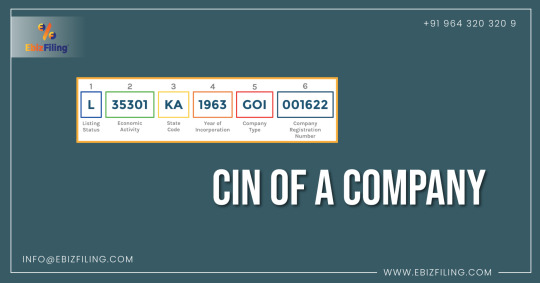

What is Corporate Identification Number (CIN)?

Introduction

This blog includes information on the corporate identification number (CIN), covering information on the CIN for companies, what it is, how to check it, and other related information. The Registrar of Companies (ROC) assigns each company incorporated in India with a unique identification number known as a Corporate Identification Number (CIN). After receiving their Registration Certificate, companies are granted their CIN by the ROC. The CIN is significant because every business is required to include this specific number on all documents submitted to the MCA, such as audits and other reports.

What is CIN Number?

The Ministry of Corporate Affairs issues the Corporate Identification Number (CIN), a 21-digit alpha-numeric identifier, to businesses that are formed in India after they have registered with the ROC in various states across the country.

All businesses that register in India are issued a CIN; examples are listed below.

One Person Company (OPC)

Nidhi Company

Limited Liability Company

State-owned enterprises

The company from Section 8 and others

On the other hand, Limited Liability Partnerships (LLP) registered in India do not acquire a CIN. LLPs are given a special 7-digit identifying number called the LLPIN (Limited Liability Partnership Identifying Number) by the ROC.

Description of the 21-digit of CIN

Section 1

The first character of a CIN shows whether a company is “Listed” or “Unlisted” on the Indian stock exchange. So, the first character indicates if the company is a stock market listed company. The CIN of a company will start with the letter “L” if it is listed, and with the letter “U” if it is not.

Section 2

The next five numeric digits classify a company’s economic activity or the industry to which it belongs. This categorization is based on the kind of economic activity that a facility like that would carry out. The MCA (Ministry of Corporate Affairs) has issued numbers to each category and industry.

Section 3

The next two letters represent the Indian state where the company is registered. As an illustration, GJ signifies Gujarat, MH signifies Maharashtra, KA signifies Karnataka, and so on. It works in the same way that a vehicle registration number does.

Section 4

The next four digits in a CIN number represent the year in which the company was created.

Section 5

The next three letters stand for the company class. These three letters indicate whether a company is a public limited or private limited company. If the CIN number is FTC, it means the business is a subsidiary of a foreign corporation, whereas the Government of India means the business is owned by the Indian government.

Section 6

The final six numerical digits represent the registration number provided by the concerned ROC (Registrar of Companies).

The importance of a company’s CIN number

The 21-digit CIN has a unique importance that is easy to understand and simplifies the identification of important corporate data.

It is used to obtain the fundamental data on businesses that are registered in the nation with the MCA (Ministry of Corporate Affairs).

A company’s CIN (Corporate Identification Number) must be submitted on all transactions with the relevant ROC (Registrar of Companies), and it is used to track all of its activities beginning with the time the ROC first established the company.

CIN numbers can be used to identify or track organizations for various levels of information maintained by MCA/ROC. The CIN provides details about the Registrar of Companies (ROC) as well as the identification of the company.

How to obtain a CIN number for your company?

Once you have chosen the type of business you want to establish, the steps to obtaining a CIN are as follows.

Get a DSC (Digital Signature Certificate).

Obtain a DIN (Director Identification Number).

The new user registration process must be finished.

After completing this, complete the company incorporation process.

Incorporate the Company

After receiving the company’s incorporation papers, the MCA (Ministry of Corporate Affairs) will evaluate and approve the application. After all of the application’s data has been verified, the CIN is assigned.

“Effortlessly meet compliance with our comprehensive LLP Annual Return Filing services. Expert assistance for seamless filings, ensuring your business stays on track. Stay focused on growth while we handle the paperwork.”

Summary

A business registration number, also referred as a CIN (Corporate Identification Number), a special identification number issued by the ROC (Registrar of Companies). In simple terms, a CIN is a special code that includes both the company’s identification number and extra details about how it operates.

0 notes

Text

#Private limited company registration in Bangalore#Private limited company registration in Bangalore online#Online Private limited company registration in Bangalore#Private limited company registration in karnataka#Private limited company registration online in Bangalore#Private limited company registration in india#PVT limited company registration

0 notes

Link

#Private limited company registration tlangana#Private limited company registration maharastra#Private limited company registration Karnataka#Private limited company registration Gujarat

0 notes

Text

Understanding Professional Tax Registration: A Comprehensive Guide for Businesses

Streamlining Finances: A Guide to Professional Tax Registration Online in India

The Professional Tax Registration Procedure involves the state governments in India charging individuals who earn income or practise professions such as chartered accountants, lawyers, and doctors. Different states have varying rates and collection procedures for this service, which are imposed at the state level. Not all states enforce this tax, with Karnataka, West Bengal, Andhra Pradesh, Telangana, Maharashtra, Tamil Nadu, Gujarat, Assam, Chhattisgarh, Kerala, Meghalaya, Odisha, Tripura, Madhya Pradesh, and Sikkim being exceptions. This tax applies to entrepreneurs, working individuals, traders, and various occupations.

Professional tax is collected by specific Municipal Corporations and most Indian states, serving as a revenue source for the government. The maximum annual amount payable is INR 2,500, with predetermined slabs based on the taxpayer's income. Employers deduct this tax from employees' salaries in private companies and remit it to the Municipal Corporation. Professional tax is mandatory, and individuals are eligible for income tax deductions for this payment.

To initiate Professional Tax Registration, individuals must register their mobile number and email ID. After registration, they receive a unique username and password through secure channels like mobile and email. Through the Citizen portal, applicants create a self-assessment application and submit it for professional tax assessment.

The procedure of conversion of LLP into a Private Limited Company

1. Determine Eligibility:

- Confirm whether you meet the criteria for professional tax filing based on your income from profession, trade, or employment.

2. Gather Necessary Documents:

- Collect essential documents, including proof of income, identification, and other relevant details.

3. Online Registration:

- Initiate the professional tax filing by registering online through the designated portal.

4. Provide Personal Information:

- Enter accurate personal information, including your name, address, contact details, and PAN.

5. Employment Details:

- Furnish details regarding your profession, trade, or employment, along with relevant employment records.

6. Income Declaration:

- Declare your income earned through profession, trade, or employment within the specified format.

7. Compute Tax Liability:

- Calculate your professional tax liability based on the applicable slab rates and income brackets.

8. Payment Submission:

- Pay professional tax through the online portal using the available payment options.

9. Generate Acknowledgment:

- Obtain an acknowledgement receipt or confirmation of your professional tax filing for future reference.

10. Compliance with Due Dates:

- Ensure timely filing and payment to adhere to the specified due dates and avoid penalties.

11. Periodic Review:

- Periodically review your professional tax filing status to stay compliant with any regulation changes.

12. Seek Professional Assistance:

- Consult with tax professionals or experts to ensure accurate and smooth professional tax filing.

Conclusion

Navigating the intricacies of Professional Tax Registration in India requires understanding the diverse rates and procedures across states. While not uniformly enforced, this tax is mandatory for entrepreneurs, working individuals, traders, and professionals in specific occupations. With a maximum annual payment cap and Eligibility for income tax deductions, it is a crucial revenue source for governments. The online registration process, facilitated through secure channels and the Citizen portal, streamlines the filing procedure. Additionally, the guide for converting LLPs into Private Limited Companies emphasises the importance of eligibility confirmation, document collection, accurate information entry, and timely compliance to ensure a seamless transition with the possibility of seeking professional assistance if required.

0 notes

Link

Read Legal Details About Sushant Gupta Defsys Solutions Here ⏫

#defsys#sushant gupta#defsys solutions#sushant gupta defsys#defsys solutions private limited#details

2 notes

·

View notes

Text

Kros-Chek: Your Gateway to Business Compliance and Success

Kros-Chek is more than just a consultancy firm—it's a trusted partner in your journey towards business compliance and success. With its comprehensive range of services, including GST return filing, LLP and private limited company registration, Kros-Chek simplifies the complexities of business operations and ensures regulatory compliance at every step. Whether you're a startup looking to establish your presence or an established business seeking to streamline your operations, Kros-Chek is here to support you with expert guidance, personalized solutions, and unwavering commitment to your success.

More information:

Contact-us

365 Shared Space, 2nd Floor,#153, Sector 5,

1st Block Koramangala, HSR Layout,

Bengaluru, Karnataka 560102

0 notes