#ProRealTime code

Explore tagged Tumblr posts

Text

youtube

🔧 Comment utiliser vos indicateurs perso en backtest ProRealTime

Vous avez développé vos propres indicateurs sur ProRealTime ? Parfait. Mais les avez-vous testés dans de vraies conditions historiques avant de les utiliser en live ? Dans cette vidéo, découvrez comment intégrer et tester vos indicateurs personnalisés dans le moteur de backtest de ProRealTime, pour valider vos stratégies avant de les mettre en pratique.

📌 Dans cette vidéo, vous apprendrez : ✅ Comment insérer vos indicateurs perso dans une stratégie Prorealtime ✅ Comment écrire un code simple pour déclencher un backtest ✅ Comment utiliser des indicateurs importés dans une backtest

#stock market#ProRealTime#backtest ProRealTime#indicateur personnel ProRealTime#stratégie ProRealTime#indicateur trading#tester ses indicateurs#ProRealTime tutoriel#backtest trading#indicateur personnalisé#trading algorithmique#ProRealCode#coder stratégie trading#valider stratégie trading#stratégie automatique#comment backtester#tutoriel PRT#optimiser stratégie trading#créer indicateur trading#ProRealTime code#apprendre ProRealTime#Youtube

0 notes

Text

Prorealtime Library

If you are looking for a place to find top information on Prorealtime Library check out the above site. Many other helpful details regarding Prorealtime Code Library are offered here. This site is admired by many people.

1 note

·

View note

Text

What Is Automated Trading And How Does It Help The Traders?

Automated Trading is a type of trading that is based on the method of taking part in the trading by using a program that is based on some pre-set rules for the traders in terms of exit and entry. In trading, the traders will combine technical analysis by setting limits such as the orders to open, guaranteed stops, and irregular stops. Automated trading helps one to carry out large volumes to trading in a limited amount of time by keeping all trading emotions at bay. In Automated Trading, it is possible because all parameters are pre-set in the system, but the traders may use their previous strategy to understand the market trend.

• How does automated trading work?

In automated trading, the trader will first choose the platform and set their limitations for their own trading strategy. The traders will use their own set rules and conditions based on their experiences and then the customized algorithm will apply the criteria to place the trades on the traders’ behalf. These factors largely depend on the time of trade and the price at which the trading is happening. Automated trading constantly takes care of and screens the trading market. The focus of this type of trading is to see that the trading happens efficiently, fast with no emotional hang-ups.

• What are the advantages of automated Trading?

. Traders must fit their strategy according to the schedule and execute trades in a much-automated manner all day.

. Auto trading helps the traders to reduce emotionally and gut reactions and focus more on trading strategies.

. Helps to identify new strategies, opportunities and analyze trends with a wide range of pointers.

. The one most important benefit o Auto trading is that it executes multiple traders in real-time and removes manual execution.

• Platforms that can be used in automated trading

There are several options that are available in automated trading options available for the clients involved in Automated trading.

• ProRealTime – Auto trading helps to create own tools that will help the traders to create simple and advanced automatic trading strategies with no help of coding. With this ProRealTime strategy, one will be able to get hold of an advanced, easy-to-use, and back-testing suite to test the system.

• MetaTrader4 – The trader must customize their trading experience by building their own trading algorithms, placing the range of orders, and by creating indicators and these will help to find opportunities based on the pre-defined limits.

• APIs - One must build their own platform and trading solutions from the beginning. These platforms enable the user to create their own algorithm. One can view real-time and historical market prices and trader sentiment information and then analyze the market instrument.

If anyone is looking to trade as per any predefined parameters then automated trading is the best mechanism one must follow. This trading mechanism is a low-maintenance trading strategy based on advanced technology.

Conclusion:

Auto trading is called Algorithm trading that used computers and requires no prior knowledge of technology or programming. It helps the traders to trade in a much systematic way with no emotions attached.

#algorithmic trading india#Algo trading in India#algorithmic trading strategies#Algo Trading#algorithmic trading#automatic trading#automated trading#auto trading

0 notes

Photo

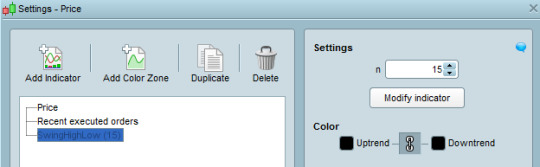

New Post has been published on http://patternsmart.com/wp/prorealtime-swing-high-low-indicator-and-screener/

ProRealTime Swing High Low indicator and screener

This is a custom ProRealTime indicator, it works the same way as my TOS version's Swing High Low extension indicator and proscreener.

The Swing high low extension indicator will plot lines that represent the swing high low points based on the swing length input(number of bars to the left and right of the swing point).

Swing highs and lows can be used by traders to identify possible areas of support and resistance , which can then be used to determine optimal positions for stop-loss or profit target orders. If an indicator fails to create a new swing high while the price of the security does reach a new high, there is a divergence between price and indicator, which could be a signal that the trend is reversing.

Swing highs and swing lows are earlier market turning points. Hence, they are natural choices for projecting support and resistance levels. Every swing point is a potential support or resistance level. However, for effective trading, focus on major swing highs and lows.

This package includes Swing high low extension indicator and proscreener for ProRealTime. It works on any time frame(Tick, Minutes, Daily, Weekly, Monthly) and all markets(Stocks, Futures, Forex, Options,ETF, etc.)

The default SCAN will search any symbol that the Close cross below the swing low or cross above the swing high.

Please follow the steps below to import the indicator and proscreener:

Import all files that I sent to you.

After import the indicator, you will be able to add it to chart.

The input n represents the number of bars to the left and right of the swing point.

Please note: only the file SwingHighLow is for indicator.

SwingHigh-SCAN and SwingLow-SCAN are for ProScreener only, please do not load them on chart.

Here is how to create the screener:

1. find Proscreener tab, and click the icon shown in below

2. click 'New' button then copy & paste the code(in .txt file) I sent to you.

3. change it to your preferred name.

4. select a list to scan and click 'Execute' button.

5. repeat the steps 1-4 for both swing high and low scans.

Once the New screener is created, you can change the input n by clicking on 'Modify' the screener file as shown below

The default setting of the ProScreener is to scan if the price close above or below the current swing high or low.

The picture below is an example of price close above the current swing high, you will get 'Criteria'=1 in ProScreener when you execute swing high scan.

The swing ProScreener can also be customized to meet your needs.

Please send me the details if you want a different screener.

-

0 notes

Text

All You Need To Know About Automated Trading

Exactly what is "automatic trading?"

It is possible to participate in the financial markets using computer software that automatically performs pre-determined trading rules. As a trader, it is up to you to conduct a thorough technical analysis before deciding on the parameters of the trades you will take.

By automating your trading, you can make more transactions in less time while also removing the influence of emotion from your trading decisions. This is because the criteria you choose already include all of the industry guidelines. Using some algorithms, you may even be able to use your pre-determined trading techniques to follow trends and make trades.

What is the process of automatic trading?

There are several options available to you when it comes to choosing a trading platform and setting the parameters of a strategy. Your custom algorithm will use a set of rules and circumstances based on your own trading expertise to place trades on your behalf. The price at which the deal should be opened and concluded and the amount all have a role in these variables.

When a specified set of parameters are met, transactions will be automatically performed based on the parameters of the automated trading strategy. The goal is to take advantage of specific, technical market developments while also executing trades more quickly and efficiently.

The benefits of automated trading can be summarized as follows:

Automated trading allows you to:

• According to your strategy, execute transactions automatically at any time of day or night.

• Planned techniques can lessen the influence of emotional and gut reactions.

• A wide range of indicators can be used to identify new possibilities and analyze trends.

• Remove the need to execute several real-time deals manually.

What platforms can you use for automated trading?

Your trading preferences will determine which platform you select for automatic trading. Customers of IG can choose from a variety of automated trading solutions.

ProRealTime

Using assisted design tools, you can create simple or complex auto trading strategies without knowing how to code. With ProRealTime, you have access to a backtesting suite that is both advanced and easy to use. More than 100 indicators are available for novice and professional traders alike on the site.

MetaTrader4

Create your own expert algorithms, indicators, and order types to tailor your trading experience. In addition, you may use Expert Advisors (EAs) to assist you in locating investment opportunities based on predefined criteria. When an opportunity arises, your EA can either alert you to it or open a position for you.

APIs

Start from the start and build your own platform for trade. You can build your algorithms from the ground up using this platform. With IG's leading technology, orders are filled quickly and accurately. In addition to seeing current and historical market prices, you can also analyze market instruments and trader moods.

Conclusion:

While the term "automation" may imply that a process is made easier, a few considerations must be made before using such systems. It's important to be aware of what you're entering into and to be well-versed in the system. Keep your aims and techniques simple before moving on to more complex trading strategies. Make sure to keep in mind that there isn't an all-inclusive solution.

#algo trading strategies#algorithmic trading strategies#algo trading#algorithmic trading#automated trading#automatic trading

0 notes