#comment backtester

Explore tagged Tumblr posts

Text

youtube

🔧 Comment utiliser vos indicateurs perso en backtest ProRealTime

Vous avez développé vos propres indicateurs sur ProRealTime ? Parfait. Mais les avez-vous testés dans de vraies conditions historiques avant de les utiliser en live ? Dans cette vidéo, découvrez comment intégrer et tester vos indicateurs personnalisés dans le moteur de backtest de ProRealTime, pour valider vos stratégies avant de les mettre en pratique.

📌 Dans cette vidéo, vous apprendrez : ✅ Comment insérer vos indicateurs perso dans une stratégie Prorealtime ✅ Comment écrire un code simple pour déclencher un backtest ✅ Comment utiliser des indicateurs importés dans une backtest

#stock market#ProRealTime#backtest ProRealTime#indicateur personnel ProRealTime#stratégie ProRealTime#indicateur trading#tester ses indicateurs#ProRealTime tutoriel#backtest trading#indicateur personnalisé#trading algorithmique#ProRealCode#coder stratégie trading#valider stratégie trading#stratégie automatique#comment backtester#tutoriel PRT#optimiser stratégie trading#créer indicateur trading#ProRealTime code#apprendre ProRealTime#Youtube

0 notes

Text

Legendary stock traders: How to Master Consistency in Market Chaos

Legendary stock traders: How to Master Consistency in Market Chaos

Frustrated by endless volatility? Discover how legendary stock traders have mastered simple, proven methods to achieve reliable results—even when markets feel impossible to predict.

The Secret Behind Legendary Stock Traders’ Success

Legendary stock traders aren’t born different—they follow data-driven systems. A 2023 analysis revealed that 80% of profitable traders rely on repeatable strategies, not gut instinct. These traders cut through noise with clear, actionable rules. If you’re tired of overcomplicating things, their disciplined approach is your blueprint for consistency.

Why Simplicity Beats Complexity in Trading

Complex strategies often fail under pressure. Legendary stock traders like Paul Tudor Jones credit their long-term consistency to simple systems. One study showed traders using straightforward entry/exit criteria outperformed “advanced” algorithmic traders by 16%. Focusing on clarity gives you an edge—especially in chaotic markets.

Proven Historical Performance Matters Most

Legendary stock traders always track results. For example, Richard Dennis’s Turtle Traders achieved a 100%+ annual return by sticking to tested rules. Real historical performance beats hype every time. Look for backtested strategies that show steady gains across multiple market cycles for genuine reliability.

Turn Chaos Into Clarity With a Reliable System

Market chaos is inevitable, but legendary stock traders thrive by using systems with clear risk controls. Simple rules—like 2% max loss per trade—help limit mistakes and boost confidence. The right system transforms confusion into clarity, so you act decisively, not emotionally, regardless of volatility.

Take Action: Start Your Consistent Trading Journey

Most traders struggle because they lack a clear, proven system. Legendary stock traders succeed by following simple, data-backed rules. Ready to trade with confidence? Embrace a systematic approach and leave frustration behind as you build consistency, one trade at a time.

Simplicity outperforms complexity in the stock market

Legendary stock traders rely on proven, data-driven systems

Clear rules and risk controls turn chaos into opportunity

Consistency is possible. Legendary stock traders have shown the way—now it’s your turn. Ready to master the markets? Start with a reliable, rules-based system today.

What traits set legendary stock traders apart?

Legendary stock traders excel through discipline, using simple, historically proven systems. They avoid emotional decisions and always track performance, focusing on consistent execution over flashy, high-risk moves.

How can I build my own data-driven trading strategy?

Begin by backtesting simple strategies and setting clear entry/exit rules. Monitor performance over time. Refine your approach based on real results, and never risk more than you can afford per trade.

Have you tried a rules-based system? Share your biggest trading challenge or breakthrough in the comments, and reblog if you found these legendary stock traders’ tips helpful!

0 notes

Text

Hedging with Puts: Do Volatility and Skew Signals Work?

Hedging with Puts: Do Volatility and Skew Signals Work? Portfolio hedging remains a complex and challenging task. A straightforward method to hedge an equity portfolio is to buy put options. However, this approach comes at a cost—the option premiums—leading to performance drag. As a result, many research studies are focused on designing effective hedging strategies that offer protection while minimizing costs. Reference [1] presents the latest research in this area. It examines hedging schemes for equity portfolios using several signals, including MOM (momentum), TREND, HVOL (historical volatility), IVOL (implied volatility), and SKEW. The study also introduces a more refined rehedging strategy for put options: If, during the investment period, a put option’s delta falls to −0.9 or lower, the option is sold to lock in profits and avoid losing them in case of a sudden price reversal. Put options are bought when implied volatility is below 10%, as they are considered cheap. No position is taken if implied volatility is above 30%, to avoid overpaying for expensive options. The authors pointed out, The results from the backtests of the long-put strategy, presented in Table 5, also indicate that the TREND signal is the most effective among those tested for selecting the underlyings on which to take option positions. Specifically, the TREND signal substantially reduces the portfolio’s risk without sacrificing annual return when compared with the BASE signal, the equity-only portfolio, with no option positions. This suggests that the TREND signal offers a compelling balance between downside protection and performance preservation. The SKEW signal contributes positively to the GMV allocation, although it fails to show the same effectiveness under the EW allocation scheme. Consistent with the findings from the covered call strategy, the introduction of additional trading rules, TR1 and TR2, does not consistently improve the performance of the portfolios. Their impact appears to be in the best-case marginal and in most cases negative … The bootstrapped results from Table 6 diverge from the ones of the backtests. The TREND signal no longer outperforms the BASE portfolio. Instead, the HVOL and IVOL signals emerge as the most effective, outperforming the BASE portfolio in risk-adjusted terms, with and without trading rules. The different findings from bootstraps vs. historical backtests indicate that the added value of these signals is dependent on the market regime. In short, buying put options using the TREND signal appears to improve portfolio risk-adjusted returns. While SKEW and IVOL add little in backtests, they perform better in bootstrapped results, suggesting that the effectiveness of put protection strategies is regime-dependent. This study offers a comprehensive evaluation of various hedging rules. There is no conclusive answer yet, implying that designing an efficient hedging strategy is complex and requires ongoing effort. Still, the article is a strong step in the right direction. Let us know what you think in the comments below or in the discussion forum. References [1] Sylvestre Blanc, Emmanuel Fragnière, Francesc Naya, and Nils S. Tuchschmid, Option Strategies and Market Signals: Do They Add Value to Equity Portfolios?, FinTech 2025, 4(2), 25 Article Source Here: Hedging with Puts: Do Volatility and Skew Signals Work? via Harbourfront Technologies - Feed https://ift.tt/QwiBabl June 20, 2025 at 11:50AM

0 notes

Text

Global investors craze! How XBIT innovative tools reshape the currency circle software ecology

Today, the cryptocurrency industry is experiencing a technological innovation storm. According to the international authoritative media CoinDesk, XBIT (dex Exchange) officially launched its self-developed "intelligent on-chain analysis module", which is called "a milestone breakthrough in the cryptocurrency market viewing software" by the industry. This news quickly topped the global crypto community hot search list, with more than 500,000 discussions within 24 hours.

The tool released by XBIT (dex Exchange) integrates multi-chain data sources and AI prediction models to achieve real-time cross-platform tracking of decentralized markets (DeFi) and centralized exchanges (CEX) for the first time. Users can monitor the on-chain capital flows, large-scale position changes and market sentiment fluctuations of more than 200 mainstream currencies through a single interface. "Traditional currency circle viewing software relies on CEX data, and XBIT's solution fills the analysis gap in the DeFi field, which may redefine industry standards." Data shows that on the first day of the tool's launch, the number of registered users on the platform surged by 37%, of which more than 60% were institutional investors.

According to the technical team, the core advantages of the new tool are "zero-delay data synchronization" and "trustless verification mechanism". By accessing the node network of 8 mainstream public chains such as Ethereum and Solana, XBIT (dex Exchange) can bypass third-party APIs and directly capture transaction data from the chain to ensure information transparency. "In the past, the most troublesome thing when using the currency circle viewing software was the asynchrony between CEX and DEX data," said Li Wei, head of the Singapore Quantitative Fund, in an interview. "The platform's cross-chain aggregation engine allows us to capture abnormal trading fluctuations on Uniswap 10 minutes in advance, which is crucial in arbitrage strategies." It is worth noting that the platform has also embedded an "AI early warning system" to identify potential risks based on historical patterns. For example, when the on-chain transfer volume of a token suddenly reaches 5 times the 30-day average, the system will automatically trigger a red alert.

Antonio Sanchez, research director of ARK36, a London-based digital asset hedge fund, revealed that his team has reached a strategic cooperation with XBIT: "We are testing the integration of the platform's analysis module into the self-developed trading system. Preliminary backtesting shows that the strategy winning rate of the ETH/USDT pair has increased by 12%. "The background of this cooperation is closely related to the macro trend. The latest report of the Bank for International Settlements (BIS) shows that in the third quarter of 2025, institutional investors' holdings in the cryptocurrency market accounted for 43%, an increase of 18% over the same period last year. The platform has become the preferred partner of many custodian banks due to its compliance architecture and institutional-level risk control system.

Faced with XBIT's strong attack, competitors are stepping up their layout. "Decrypt" quoted internal sources as saying that Binance plans to release the "On-chain Signal Dashboard" next week, while Coinbase was exposed to have acquired a startup company focusing on DeFi data visualization. "The essence of the war of currency circle viewing software is a battle for data sovereignty," commented Dr. Eleanor Grey, director of the Cambridge University Crypto Finance Laboratory. "XBIT (dex Exchange) has achieved control over the original on-chain data through technical means, which is more strategic than simply optimizing the UI interface." As of press time, XBIT's native token rose by 15.2% in 24 hours, setting a new high in nearly three months. A spokesperson for the platform confirmed to Bloomberg that it will launch the "Global Node Program" on October 10 to further strengthen its decentralized infrastructure.

0 notes

Text

Djellal Djouad Explique Comment Construire un Système de Trading pour les Dérivés

Le marché des dérivés est en pleine expansion, offrant aux traders des opportunités intéressantes pour se protéger contre les risques ou pour spéculer sur des mouvements de prix. Cependant, construire un système de trading efficace pour les dérivés nécessite des compétences avancées, une analyse rigoureuse et une stratégie bien pensée. Dans cet article, Djellal Djouad, un expert en finance et en trading algorithmique, nous guide sur la manière de créer un système de trading performant pour les dérivés.

Pourquoi Construire un Système de Trading pour les Dérivés ?

Les dérivés, comme les options, les contrats à terme et les swaps, sont des instruments financiers complexes utilisés par les investisseurs pour gérer les risques ou maximiser les rendements. Un système de trading bien conçu permet de prendre des décisions informées en temps réel, d'optimiser les stratégies de couverture et de capitaliser sur les fluctuations du marché. Selon Djellal Djouad, un tel système doit être basé sur des analyses de données robustes et un contrôle rigoureux des risques.

Les Étapes pour Construire un Système de Trading pour les Dérivés

1. Comprendre les Types de Dérivés

Avant de commencer à créer un système de trading, il est crucial de bien comprendre les différents types de dérivés. Djellal Djouad recommande de se concentrer sur les instruments les plus couramment utilisés, comme les futures, les options et les swaps. Chaque type de dérivé présente des caractéristiques uniques qui influencent leur stratégie de trading.

2. Identifier les Objectifs du Trading

La première étape dans la construction d’un système de trading est de définir des objectifs clairs. Selon Djellal Djouad, il est important de savoir si vous souhaitez utiliser les dérivés principalement pour la couverture des risques ou pour la spéculation. Ces objectifs détermineront la conception de votre système et les paramètres que vous devrez suivre.

3. Choisir une Stratégie de Trading

Une fois vos objectifs définis, l'étape suivante consiste à choisir une stratégie de trading. Cela pourrait inclure l'arbitrage, la couverture ou la spéculation. Djellal Djouad souligne que chaque stratégie nécessite un modèle algorithmique différent pour l’analyse des données et la gestion des risques.

4. Utiliser des Outils d’Analyse Quantitative

Le trading algorithmique repose largement sur des analyses quantitatives et des modèles mathématiques. Djellal Djouad recommande d’utiliser des outils comme Python, R, ou MATLAB pour créer des modèles prédictifs. Ces outils aident à analyser les tendances du marché, à détecter les anomalies et à prendre des décisions basées sur des données en temps réel.

5. Tester et Optimiser le Système

Avant de déployer un système de trading sur les marchés réels, il est essentiel de le tester. Djellal Djouad conseille d’utiliser des tests de rétroaction (backtesting) pour évaluer la performance de votre stratégie à travers des données historiques. Cela permet de repérer les faiblesses du système et d’ajuster les paramètres avant de commencer à trader en direct.

6. Gérer le Risque

La gestion du risque est un élément clé d’un système de trading efficace. Djellal Djouad insiste sur l'importance de définir des limites de perte (stop-loss) et des seuils de profit (take-profit) pour protéger votre capital. De plus, un suivi constant de l’exposition au risque est indispensable pour garantir la rentabilité à long terme du système.

Conclusion

Construire un système de trading pour les dérivés peut sembler complexe, mais avec la bonne approche et les bons outils, il est possible de maximiser les profits tout en minimisant les risques. Djellal Djouad, avec son expertise approfondie dans le domaine, souligne l'importance de comprendre les instruments financiers, de définir des objectifs clairs et de choisir les bonnes stratégies. En suivant ses conseils, vous serez mieux préparé à naviguer dans le monde des dérivés et à créer un système de trading performant.

N'oubliez pas que le succès dans le trading algorithmique dépend de la discipline, de l’adaptabilité et de l’utilisation judicieuse des outils d’analyse. Djellal Djouad encourage les traders à rester informés et à affiner constamment leurs stratégies pour réussir sur le marché des dérivés.

0 notes

Text

5 Proven Trading Strategies to Maximize Your Profits in 2025

Trading success hinges on staying ahead of market trends and having a solid strategy. Whether you’re a beginner or a professional, Miyagi Trading has identified five proven strategies to help you achieve maximum profits in 2025:

Trend Following: Identify strong trends using tools like Moving Averages (MA) and ride them until they reverse.

Scalping: Make quick, small profits by focusing on highly liquid assets and short-term price movements.

Swing Trading: Hold positions for days or weeks to capitalize on market swings ��� ideal for part-time traders.

Position Trading: A long-term approach focusing on macroeconomic trends and asset potential.

Algorithmic Trading: Use automated systems to execute trades based on predefined criteria, eliminating emotional decision-making.

Why Miyagi Trading? At Miyagi Trading, we provide the tools you need to succeed, including premium indicators, backtested strategies, and real-time buy/sell signals. Our platform is designed to support traders at every stage of their journey.

Final Thoughts Success in trading requires discipline, consistency, and a strategy that aligns with your goals. These five strategies can set you up for success in 2025 and beyond. Ready to take your trading to the next level? Join Miyagi Trading today and start your journey toward financial freedom!

What’s your favorite trading strategy? Share your thoughts in the comments below!

Originally Published At: https://miyagitrading.com/proven-trading-strategies-to-maximize-your-profits/

0 notes

Text

The Dark Side Of Trading No One Talks About Until It’s Too Late

When I initially started trading, I was delighted and perhaps a touch overconfident. The thought of working on my own terms and earning money from anyplace looked appealing. But, honestly, reality struck me hard. Trading isn't as straightforward as it's frequently made out to be, and there are so many things I wish I had known before starting. If you're new to this world, allow me to share some painful facts that I had to learn the hard way.

The Illusion of Quick Success

Trading is frequently marketed as a simple way to financial independence, but in reality, it is the opposite.

It takes real time and effort:

Successful trading needs attention, education, and practice. Nobody becomes a successful trader overnight, regardless of what social media portrays them.

Losses are unavoidable: Even the most successful traders lose money. The difference is that they understand how to handle them and learn from their mistakes. If you're in business for the long run, prioritize constructing a solid foundation above chasing immediate gains.

Emotions can be a hindrance to successful trading.

Fear and greed rule: fear may prevent you from seizing lucrative possibilities, but greed might lead to rash judgments.

Discipline is needed: Staying calm and disciplined, especially during market turbulence, is what distinguishes great traders from the competition. Take breaks when you're feeling overwhelmed. An uncluttered mind can make wiser decisions.

Hidden Costs You Don't Expect:

Trading is more than simply investing money in the market. There are other charges that may catch you off guard.

Fees and commissions: Every deal incurs fees, which mount up over time. Make sure to factor in this when calculating your profits.

Education and tools: Whether it's classes, software, or dependable data platforms, these are important but often expensive prerequisites for professional traders.

Being aware of these fees can help you avoid unreasonable expectations.

The Mental Pressure is Real: Trading is not just financially tough; it can also have a negative impact on your emotional health. Volatile markets can cause stress, making you worried and on edge. Having a plan in place can help alleviate the tension.

Loneliness of the journey: Unlike other vocations, trade is generally done alone. Creating a community of like minded individuals may truly help you stay motivated and supported.

Remember that taking care of your emotional health is equally vital as learning technical analysis.

Importance of a Clear Strategy:

Trading without a plan feels like driving without a map; you'll get lost quickly. Backtest your strategy: Before putting your hard earned money at jeopardy, be sure your methods work by testing them against previous data.

Focus on consistency: Small and regular gains are considerably preferable to chasing risky, huge wins. Your strategy should be your guide, and following it is critical for long term success.

Final Thoughts

Trading is a journey, and like any journey, it presents hurdles. The dark side exists, and if you are not prepared, it can have serious consequences. However, if you are disciplined, patient, and eager to learn, the rewards are well worth it.

Tell me honestly, have you ever faced any of these challenges in your trading journey? Share your thoughts & experiences in the comments I’m really waiting to know your stories.

"We're Building This Together"

Success is more meaningful when we achieve it together, with each shared story and learned lesson. This is more than just trading knowledge it’s about building a supportive community where we can openly share advice, experiences, and encouragement.

Your story could truly encourage someone else who is struggling on their journey!

Remember, each of you brings unique value and respect to this community, and I’m really grateful to have you here. Let's keep learning, growing, and achieving success together.

Your shared experiences, with all their ups and downs, encourage us all.

Together We're not just a community; we're a family, always standing by each other, no matter what comes our way.

Stay blessed 👍

#stock market#cryptocurrency#financialfreedom#trading success#learntotrade#trading tips#stock trading#tradingskills#forex traders#trading strategies#day trading#hardworkpaysoff#cryptocurreny trading#trading psychology#tradingprofit#tradesmart#longtermsuccess#tradingmindset#tradingjourney#investmentstrategies

1 note

·

View note

Text

Comment by Meymo on Reddit

It's a long grind. The only way to expedite the process is to continue to advance in your career so that you can contribute more.

Usually you wont "feel" the impacts of investing until your account growth starts to exceed your salary. The sequence of returns will make the biggest difference in how you feel about your account. I suspect that if you had your $150,000 (from your picture) fully invested in 2020, you'd be feeling a bit better right now ([you'd have $263,000](https://www.portfoliovisualizer.com/backtest-portfolio?s=y&timePeriod=4&startYear=2020&firstMonth=1&endYear=2022&lastMonth=12&calendarAligned=true&includeYTD=false&initialAmount=150000&annualOperation=1&annualAdjustment=2000&inflationAdjusted=true&annualPercentage=0.0&frequency=2&rebalanceType=1&absoluteDeviation=5.0&relativeDeviation=25.0&leverageType=0&leverageRatio=0.0&debtAmount=0&debtInterest=0.0&maintenanceMargin=25.0&leveragedBenchmark=false&reinvestDividends=true&showYield=false&showFactors=false&factorModel=3&portfolioNames=false&portfolioName1=Portfolio+1&portfolioName2=Portfolio+2&portfolioName3=Portfolio+3&symbol1=SPY&allocation1_1=100))

We've been in a drawdown period all year, so the vast majority of long positions are down at this point.

0 notes

Text

This conversation appears to be between two individuals discussing the application of reinforcement learning (RL) in financial markets, particularly regarding live or online data. Here's an analysis of the interaction:

Key Points:

Reinforcement Learning (RL) in Finance:

mymultiplatform seems to be suggesting the use of RL models in trading or financial markets, implying that RL could be integrated with other algorithms and used for decision-making (mentioning a "20% democracy vote").

Soupkiller, however, is skeptical about the real-time application of RL, stating that it's rare to find live RL being used in markets. He implies that while RL could be useful in theory, backtesting (historical data validation) is crucial before making any assumptions about its effectiveness.

Tone and Misunderstandings:

Soupkiller maintains a skeptical and somewhat dismissive stance throughout the conversation, emphasizing that experience in markets is critical and suggesting mymultiplatform should test ideas independently rather than rely on internet knowledge.

mymultiplatform seems to feel dismissed or misunderstood, reacting emotionally to Soupkiller's responses, especially after feeling that his ideas were not taken seriously. The statement "im having a mental breakdance" suggests frustration or confusion over the dismissive attitude.

Diverging Viewpoints:

mymultiplatform is interested in automation and sees RL as a viable tool for real-time decision-making.

Soupkiller seems to suggest that RL isn't commonly used for live trading and may be overhyped without solid backtesting. He questions the practicality of mymultiplatform's view and ends the conversation abruptly, likely due to frustration.

Emotional Dynamics:

There is a noticeable shift from discussing the technical aspects of RL to a more personal and confrontational tone. Soupkiller's comment "this career isn't for you" escalates the tension, leading to a strained conclusion where both participants feel misunderstood or frustrated.

Underlying Themes:

RL Skepticism: Soupkiller reflects a more cautious, skeptical approach to RL in financial markets, likely due to the complexity and risks associated with live trading.

Emphasis on Backtesting: He stresses that backtesting (i.e., testing on historical data) is essential before applying any model, especially RL, in real-time trading.

Automation and Innovation Enthusiasm: mymultiplatform seems open to exploring innovative tools like RL for automation in finance but might be more optimistic about the practical applicability of such tools without deeper technical validation.

Conclusion:

The conversation illustrates a clash between someone with a more pragmatic, cautious approach to RL in financial markets (Soupkiller) and someone more enthusiastic about automation and new technologies (mymultiplatform). The tension escalates due to a perceived lack of respect and misunderstanding, causing the dialogue to shift from constructive debate to a more personal confrontation. The interaction reflects broader discussions in tech and finance, where new tools (like RL) are met with both excitement and skepticism depending on experience, risk tolerance, and understanding.

0 notes

Text

Why TradingView is a Trader’s Best Friend

If you’re into trading—whether it’s stocks, crypto, forex, or even tracking the price of that obscure commodity your neighbor swears will “go to the moon”—then you’ve probably heard of TradingView. But if you haven’t, let me introduce you to your new best friend. And if you have heard of it, let’s be honest, you’re already hooked. Here’s why TradingView is every trader’s dream platform and why you’ll never look back.

1. It’s Ridiculously Easy to Use

Trading platforms can be intimidating—like they were designed by a supercomputer that assumes you understand quantum physics. Not TradingView! It’s user-friendly, intuitive, and sleek. It feels like it was made for humans. From day one, you can get up and running without needing a PhD in financial jargon.

2. It’s Social. Yes, Really.

Trading can be lonely, but not on TradingView. They’ve turned it into a social experience. You can share ideas, comment on charts, follow your favorite traders, and even get feedback. It’s like the Facebook of trading, but instead of cat videos, you’re checking out smart trades and charting tips. Plus, those who like to show off their chart masterpieces can publish them for others to marvel at (or critique).

3. Multi-Device? Check.

Stuck in traffic? Waiting in line for coffee? Or just lounging in bed? No worries, TradingView is available on your phone, tablet, and desktop. It’s like having your trading desk in your pocket, but way cooler.

4. The Charts are a Thing of Beauty

Let’s face it, traders are obsessed with charts. We stare at them for hours, so they better look good. TradingView delivers. Their charts are not only stunning but also ridiculously customizable. You can tweak colors, add drawings, compare multiple assets—you name it. It’s like the Photoshop of charts. Who said financial data can’t be eye candy?

5. Alerts That Actually Keep You in the Loop

Life happens. You can’t always be glued to your screen. TradingView’s alerts feature is the ultimate life-saver. Set up price alerts, indicator alerts, or custom alerts for just about anything. You’ll get notified instantly via email, SMS, or app push notifications—so you don’t miss out when the market moves, whether you’re on a date or watching the latest episode of that guilty pleasure TV show.

6. It’s Got the Community Vibe

Who says trading has to be a solo sport? TradingView’s community is full of traders, from seasoned veterans to newbies just learning the ropes. They share strategies, charts, and ideas. It’s a great place to not only learn but also to find inspiration. If you’ve ever wanted to connect with other traders without the whole Wall Street intimidation vibe, TradingView is where it’s at.

7. Tools Galore (But Not Overwhelming)

Sure, there are a million and one indicators out there, but TradingView gives you access to more tools than you could dream of, without making it overwhelming. From technical indicators to drawing tools, you have everything you need to craft the perfect strategy. Whether you’re a seasoned pro or just starting out, you’ll find what you’re looking for—without getting lost in a sea of options.

8. Backtesting Like a Pro

Ever had a trading idea but weren’t sure if it would actually work in real life? TradingView lets you backtest strategies so you can see how they would have performed in the past before putting your money on the line. It’s like having a time machine for your trading ideas—minus the awkward ’80s hair.

9. Affordable (and Free Options)

Let’s talk about everyone’s favorite topic: money. TradingView’s free version is loaded with features, so you can get a taste of all the magic before deciding if you want to upgrade. And even the paid plans are super affordable, especially compared to some other pricey platforms that leave you wondering if they come with free stock tips on the side.

10. Data From Everywhere

Whether you’re a fan of stocks, crypto, commodities, or anything in between, TradingView has you covered. They pull in data from multiple exchanges and markets globally, so you’re not limited to a single data source. And that means you can get a more complete view of the market, without jumping between 10 different websites.

Bottom Line: You Need TradingView in Your Life

In short, TradingView is like a Swiss Army knife for traders. It’s packed with features, yet simple to use. Whether you’re a pro looking to fine-tune your strategy or a beginner getting your feet wet, it has something for everyone. So, what are you waiting for? Dive in, and let TradingView become your new trading sidekick. Because honestly, why trade anywhere else when you could be doing it in style?

#forexsignals#forex indicators#forex education#forex broker#forextrading#forex market#forex#investing#stock market#business#finance#economy

0 notes

Text

Rotation Strategy In S&P 500 And Gold (SPY & GLD)

When the S&P 500 and gold ratio is above its moving average, ie. when stocks are performing better than gold, we are long S&P 500 the coming month. When the ratio falls below the moving average we switch to gold. Pretty simple, but as it turns out, it works pretty well.

We backtested the following the following trading rules:

* If the SP 500 and gold ratio (SP 500 divided by the gold price) is above its 20-month simple moving average, we are long the SP 500 from the close of the month until next month's close.

* If at next month's close the SP 500 and gold ratio is below its moving average, we sell the SP 500 and buy gold for the next month. Rinse and repeat at the close of every month. We tested from 1985 until July 2020.

Below is the equity chart showing the strategy compared to buy and hold for both the S&P 500 and the gold price.

Can the strategy be improved or made different? If you have any suggestions, please comment 👇

0 notes

Text

Crypto Trading for Serious Investors: AI-Powered and Proven Success

Rimc Group has announced the launch of a groundbreaking AI-powered crypto trading platform designed specifically for serious investors seeking consistent, data-driven success in the cryptocurrency market. As digital assets continue to gain traction globally, the platform offers investors a reliable and proven method to navigate the often volatile world of crypto trading with confidence.

The Rimc Group AI-driven system stands out by harnessing advanced algorithms, machine learning, and historical data analysis to execute trades that maximize profit while minimizing risk. This platform is perfect for investors who aim to stay ahead of market trends while managing their portfolios with precision. Given the unpredictability of the cryptocurrency market, this new tool provides a level of sophistication previously unavailable to mainstream traders.

The Future of Crypto Trading

AI technology has been revolutionizing various industries, and cryptocurrency is no exception. Investors have often been wary of the crypto market due to its notorious volatility. However, the new Rimc Group platform changes the game by integrating artificial intelligence to analyze patterns and predict market movements more accurately. The result is a system that offers consistent returns and smarter trading strategies.

A spokesperson from Rimc Group commented on the platform's development: "Our mission is to offer serious investors a smarter, more calculated approach to crypto trading. By using AI, we're helping investors optimize their portfolios, even in a fluctuating market. The era of relying solely on gut feelings or traditional methods is over—our platform is built for those who demand accuracy and efficiency."

This AI-powered platform is not just about making trades; it is about making the right trades. The system continuously learns from market fluctuations and user interactions, providing real-time, actionable insights for traders to make informed decisions.

How AI is Reshaping Crypto Investment

The integration of AI into crypto trading represents a significant shift in how serious investors approach the market. Traditional trading methods often involve guesswork, manual chart analysis, or advice from unreliable sources. With the Rimc Group AI platform, these methods are being replaced with data-backed decisions that reduce risk exposure and increase potential gains.

"Investors today need more than just tools; they need intelligent systems that adapt and learn in real-time," said a senior executive at Rimc Group. "Our AI platform is continually refining its algorithms, enabling it to predict market trends more accurately and make optimal trading decisions on behalf of our users. Whether you’re a seasoned investor or new to the crypto scene, our technology can provide a competitive edge."

This platform also levels the playing field for smaller investors who may not have access to professional-grade financial tools. Now, with just a few clicks, users can leverage AI’s power to make trades that are typically reserved for institutional investors and high-net-worth individuals.

A Proven Success Formula

One of the most notable aspects of this platform is its proven success rate. The team at Rimc Group has spent years perfecting their algorithms, testing them across multiple market scenarios to ensure the platform delivers consistent results.

"This isn’t just a software product," added the CEO of Rimc Group. "We’ve spent countless hours testing, refining, and optimizing our system. Our goal was simple: to create an AI-driven platform that not only delivers consistent returns but does so in a way that minimizes risk. After rigorous backtesting and live trading sessions, we are confident that our platform is the perfect tool for serious investors."

Investors using this platform have reported significant improvements in their trading performance, with many noting that they have achieved better portfolio outcomes compared to manual trading methods. By integrating AI’s capabilities, users benefit from enhanced decision-making processes, reduced emotional trading, and better timing for buy or sell orders.

Seizing the Opportunity in Crypto Markets

As cryptocurrency becomes more mainstream, the window of opportunity for serious investors continues to expand. With the rise of decentralized finance (DeFi), NFTs, and new blockchain technologies, navigating this space can be overwhelming for many. This is where the Rimc Group AI platform becomes invaluable.

It’s designed to help investors identify lucrative opportunities before they become apparent to the broader market, all while managing risk in real-time. With its intuitive interface, even those who are relatively new to cryptocurrency can start benefiting from AI-powered trading strategies.

"For investors who are serious about growing their wealth in the cryptocurrency space, this is the perfect time to act," said another representative from the company. "We’ve already seen great results, and as the market evolves, our platform will continue to adapt and improve."

Unlock Your Crypto Potential

The launch of Rimc Group's AI-powered crypto trading platform marks a new chapter for those looking to take their crypto investments to the next level. With AI optimizing trades and minimizing risks, investors are given the tools they need to succeed in this ever-changing market.

For those ready to move beyond manual trading and into the realm of data-driven, automated strategies, Rimc Group's platform offers a proven solution.

Take Control of Your Financial Future

Investors looking to enhance their portfolio performance, while keeping risks in check, are invited to explore this innovative new platform. With AI doing the heavy lifting, traders can focus on what matters most—growing their wealth.Unlock your crypto potential today by visiting Rimc Group and learning how AI can transform your trading strategy.

0 notes

Text

Best trader on Wall Street: How Frustrated Traders Find Consistency

Best trader on Wall Street: How Frustrated Traders Find Consistency

Are you tired of market chaos and elusive profits? Discover how the best trader on Wall Street uses proven systems to deliver clarity, confidence, and consistent results—no more guesswork.

The Power of Proven Trading Systems

The best trader on Wall Street doesn’t rely on gut feelings. Instead, they use a data-driven trading system with a 75% historical win rate. Backtested strategies cut through market noise, leaving no room for luck. This approach provides reliability, especially for traders who’ve faced repeated setbacks. Ready to ditch uncertainty? Let’s see how structure beats speculation.

Simplicity Over Complexity Wins Every Time

Complex indicators can cloud your judgment. The best trader on Wall Street seeks simplicity—focusing on 2–3 key signals and clear risk management rules. In 2023, traders who simplified their approach outperformed those using five or more indicators by 18%. Streamlining your process leads to less stress and more consistent wins.

Adapting to Market Chaos Without Emotion

Markets can be wild, but the best trader on Wall Street adapts calmly. By following a predefined plan, emotional decisions are minimized. According to a recent survey, 60% of consistent traders attribute their success to disciplined execution, not chasing trends. This discipline turns volatility into opportunity, not anxiety.

Historical Performance: Numbers Don’t Lie

Top traders demand proof. The best trader on Wall Street audits every system with years of backtesting. For example, a strategy with a 10-year record and 3:1 reward-risk ratio inspires trust and attracts serious capital. Historical results offer the clarity that frustrated traders crave—no more empty promises.

Actionable Steps You Can Use Today

Want results? Start by tracking your trades, defining your edge, and using strict risk limits. The best trader on Wall Street reviews performance weekly and adjusts only when data demands. This habit turns knowledge into profit and frustration into focus. Are you ready to make the shift?

Use simple, proven trading systems

Rely on backtested results, not opinions

Let discipline—not emotion—guide your trades

Consistency is possible. Follow the best trader on Wall Street and transform frustration into steady gains. Ready to take control? Start now for clarity and confidence.

What makes the best trader on Wall Street stand out?

They combine simple, proven strategies with strict discipline and historical performance data. This approach minimizes emotion, maximizes clarity, and delivers steady results in any market condition.

Can I apply these principles even if I’ve failed before?

Absolutely. Many top traders were once frustrated too. Adopting a data-driven system, tracking results, and focusing on simplicity enables anyone to turn past failures into future consistency.

Have you tried a systematic approach, or do you still rely on intuition? Comment or reblog—what’s your biggest trading frustration right now?

0 notes

Text

Stock and Volatility Simulation: A Comparative Study of Stochastic Models

Stock and Volatility Simulation: A Comparative Study of Stochastic Models Stress testing and scenario analysis are essential tools in portfolio management, helping portfolio and risk managers assess potential vulnerabilities under extreme market conditions. By simulating adverse scenarios such as financial crises, interest rate shocks, or geopolitical events, these techniques provide insights into how a portfolio might behave under stress and identify potential weaknesses. Reference [1] investigates several stochastic models for simulating stock and volatility paths that can be used in stress testing and scenario analysis. It also proposes a method for evaluating these stochastic models. The models studied include Geometric Brownian Motion (GBM), Generalized Autoregressive Conditional Heteroskedasticity (GARCH), Heston stochastic volatility, Stochastic Volatility with Jumps (SVJD), and a novel Multi-Scale Volatility with Jumps (MSVJ). The authors pointed out, When the objective is to evaluate and simulate scenarios that reflect market crashes, both short-term events and long-term crises, models such as GBM and the Heston model have been shown to be more effective. These models are better equipped to capture the sudden and severe price movements associated with market crashes, as demonstrated by their performance in reproducing historical drawdowns and their ability to capture tail risk… If the objective is to generate future scenario simulations for option pricing, the MSVJ model has proven to be the most suitable choice. The MSVJ model’s superior performance in capturing the range of the actual TQQQ price, as evidenced by its highest WMCR for both price and volatility, makes it particularly valuable for option pricing… When the primary goal is to simulate the most realistic price path and volatility paths for TQQQ, the SVJD model has demonstrated superior performance. By capturing both stochastic volatility and jump processes, the SVJD model can generate price and volatility trajectories that closely resemble the observed dynamics of TQQQ. Portfolio managers can utilize this model for more accurate backtesting of trading strategies and better assessment of portfolio risk under various market conditions. In short, each model has its strengths and weaknesses and serves a particular purpose. This study is an important contribution to the advancement of portfolio risk management. Let us know what you think in the comments below or in the discussion forum. References [1] Kartikay Goyle, Comparative analysis of stochastic models for simulating leveraged ETF price paths, Journal of Mathematics and Modeling in Finance (JMMF) Vol. 5, No. 1, Winter & Spring 2025 Post Source Here: Stock and Volatility Simulation: A Comparative Study of Stochastic Models via Harbourfront Technologies - Feed https://ift.tt/eDUBKMk March 12, 2025 at 09:11AM

0 notes

Text

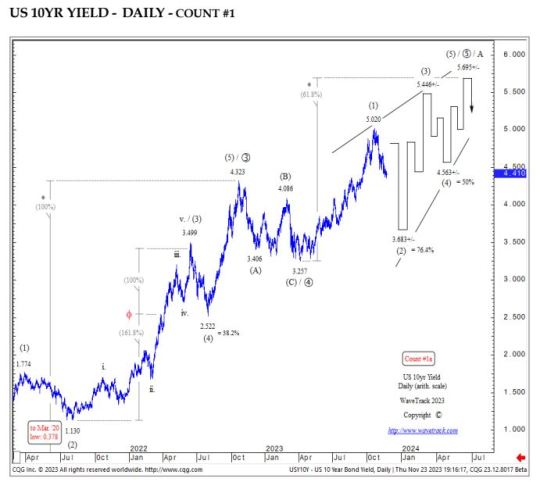

Market Comment

A long while back, I overheard a trader say that markets have become nothing more than liquidity gauges.

That's what inspires me about this provocative chart of US 10-year yields courtesy of Peter Goodburn, Managing Director of WaveTrack International GmbH.

It brings into context some aberrant market action over the last several days that may presage something lurking below the surface of the pool.

WTI tracks thousands of instruments across the global financial markets -- that's thousands of snapshots of liquidity, where it's flowing and how.

With equity traders intoxicated with visions of rate cuts dancing in their heads, WTI's chart of US 10-yr yields suggests the current decline in yields could be misinterpreted, as in as c'mon in boys, the water's fine.

What is dancing in my head is the effect a rate surprise might have on equities and crypto, two darlings of late. Neither one feels right.

Bitcoin, while benefitting from a possibly too-much-anticipated ETF and institutional boom, has morphed from having a 90% correlation to tech stocks during the 2020-2021 rally to currently having an 88% correlation to bonds and the US dollar.

It must be noted that correlations can swing wildly and quit suddenly. Yet if yields head to new highs, bitcoin's all-clear-for-risk-on rally may be in jeopardy. (Note its recent 4-day 10% correction coinciding with US Senator Warren's Crypto "crackdown" bill gaining momentum.)

Perhaps that's why yesterday saw the "Magnificent 7" tech stocks suddenly drop $200 billion in market cap. Yes, it could have been due to the NDX special rebalancing announcement, or even better, a broadening of the tech rally into more value names.

But regardless, where there's smoke there is usually fire.

Interestingly, the US dollar is higher since late November and bond yields rose for a third consecutive day yesterday.

Are some market participants slowly sniffing out the implications of the chart above?

Simply put, I feel that bitcoin and "Mag 7" are about to get sucker punched...by Elliott "B-waves."

Mood Report has shown the SPX B-wave count since April of 2023, also flagging both the 4662.85 gap and 4685.92 90% level (allowing for a possible Elliott "flat" retracement).

My thesis here is if yields rally per WTI's chart, both bitcoin and equities could top together in twin B-waves.

Both could still head higher. SPX could even head higher to a 127% Fib extension target at 5179.57. Bitcoin's 61.8% retracement level is 48,547 per the above chart. (Note the Elliott labels are for simplicity only and do not conform to proper Elliott nomenclature.)

Perhaps yesterday's action was nothing more than a foreshadowing of what could happen if rates do surprise.

With both spigots of liquidity -- fiscal & monetary -- having flooded the economy, it seems sophomoric to expect the Fed to lower rates for any reason other than a calamity.

Perhaps a calamity would be the "Mag 7" stocks losing a few trillion in market cap.

Finally, today being a New Moon (6:32pm NY time), I will be on the lookout for the possibility of a new market direction.

Lest I be perceived as nuts for mentioning the moon, please note the RBS moon trading study which was backtested to 1928 and showed an astonishing edge.

Many thanks to WaveTrack International (WTI) for permission to publish their 10-yr yield chart.

###

For big picture, institutional-quality work at a retail price, I swear by WTI's bi-yearly three-part report spanning stocks, commodities, and interest rates & currencies with about 300 charts, in-depth written commentary, and an hour+ video for each edition.

Part 1 should be ready in a few weeks. Highly recommended.

I have received no compensation for my comments.

0 notes

Text

Avis de non-responsabilité : ce post est un contenu sponsorisé et ne doit pas être consid��ré comme un conseil financier ou d'investissement. Faites toujours vos propres recherches avant de prendre des décisions financières. Les opinions exprimées dans ce post sont celles de l'auteur et ne reflètent pas nécessairement les vues de CryptoGlobe. Le marché de la cryptographie présente de nombreuses opportunités, mais sa nature imprévisible pose souvent des défis aux commerçants. Alors que les bots de trading automatisés soient apparus en tant qu'une solution, leurs modèles de stratégie simples et répétitifs et leur dépendance au paramétrage manuel par les traders comportent des risques inhérents. Comme alternative, certains traders se tournent vers les gestionnaires d'actifs traditionnels, pour ne trouver que des options de customisation limitées à cause de portefeuilles standardisés. Désormais, avec son approche globale et ses nombreux avantages, les stratégies de trading d'ATPBot s'attaquent à ces problèmes de front, ce qui en fait le choix préféré des traders. Diverses stratégies de qualité extraordinaire ATBot combine l'expertise de son équipe de modélisation de stratégie avec la puissance de l'intelligence artificielle pour créer des modèles de stratégie de niveau professionnel. Grâce à des calculs approfondis de divers paramètres, seules les meilleures stratégies sont filtrées. Chaque stratégie est soumise à une vérification rigoureuse de 1 à 3 ans de backtesting, minimisant les risques pour les traders. Adaptation de stratégie personnalisée ATPBot peut fournir des options de portefeuille d'investissement diversifiées. Ils utilisent les dernières technologies en matière d'intelligence artificielle, d'automatisation et d'analyse pour développer une stratégie d'investissement unique adaptée aux besoins spécifiques de l'utilisateur, en fonction de ses objectifs financiers, de sa tolérance au risque et de ses préférences de marché. Cette customisation permet aux investisseurs de prendre des décisions éclairées et d'atteindre correctement leurs objectifs financiers, tout en évitant d'être ciblés par la profondeur du marché et les teneurs de marché, augmentant ainsi leur potentiel de réussite. Opération de stratégie simplifiée Avec ATBot, les utilisateurs sont libérés de la charge et des risques associés liés à la notion de paramètres pour la génération de stratégies. Toutes les stratégies sont prêtes à l'emploi et accompagnées de descriptions de informations complètes, y compris les résultats de backtesting. Les utilisateurs doivent simplement activer en un seul clic la stratégie et se lancer dans leur voyage, sans aucune étape de configuration supplémentaire. Comment les stratégies d'ATPBot sont-elles générées ? 1. Tirer parti de la sagesse et de l'expérience : employer le support de modélisation de stratégie de fonds de Wiskeep et tirer parti de la vaste expérience de trading de l'équipe pour établir une logique de trading automatique. 2. Propulsé par des algorithmes de pointe : tire parti de la suite d'algorithmes avancés Sunspear 2.0 pour calculer des paramètres de très haut niveau essentiels pour des performances stratégiques optimales. 3. Sélection rigoureuse par backtesting : Pour être sûr que seules les stratégies les plus prometteuses réussissent, ATPBot effectue des backtests de informations historiques de grande ampleur. Parmi des dizaines de millions de groupes de paramètres, des stratégies avec des baisses minimales et des rendements impressionnants sont méticuleusement sélectionnées. 4. Optimisation adaptative avec l'IA : ATPBot ne s'arrête pas à la création initiale de la stratégie. Au fil du temps, la plate-forme utilise des capacités d'IA pour surveiller en permanence les informations du marché et émettre des instructions d'ajustement. Cette approche adaptative garantit que les stratégies restent alignées sur les conditions du marché en constante évolution.

Qu'est-ce qu'ATPBot ? ATBot est une plate-forme de premier plan spécialisée dans le développement et les services de stratégies de trading quantitatif. Il tire parti de la technologie de l'intelligence artificielle pour développer et mettre en œuvre des stratégies de trading quantitatives pour les utilisateurs. Engagé à fournir des solutions de gestion d'actifs professionnelles, à risque contrôlé et rentables, ATPBot permet à ses consommateurs de naviguer et de prospérer sur les marchés financiers dynamiques. Il se vante aussi des fonctionnalités suivantes : Retours stables : Sans émotion et objectif, ATPBot adhère strictement aux règles de trading, évitant systématiquement les décisions incorrectes. Gestion des risques robuste : ATBot utilise des mesures de gestion des risques à plusieurs niveaux, minimisant l'impact des risques incontrôlables. Réponse à grande vitesse : ATPBot capture rapidement les informations du marché en temps réel et répond en quelques millisecondes, permettant des opérations rapides pour capitaliser sur les opportunités du marché. Sécurité et transparence : les fonds des consommateurs ne sont pas accessibles par ATPBot. Toutes les opérations de trading sont transparentes et visibles. Polyvalence et diversité : ATPBot prend en charge le trading simultané de plusieurs paires et propose diverses stratégies de trading pour maximiser les opportunités de marché. Trading ininterrompu : fonctionnant 24h/24 et 7j/7, ATBot permet aux investisseurs de saisir les opportunités 24h/24. Assistance dédiée : l'équipe de service client d'ATPBot fournit une résolution personnalisée et rapide à tous les problèmes, garantissant un service de haute qualité. Sur le marché dynamique et lucratif de la cryptographie, ATPBot se consacre au développement de stratégies de trading de premier ordre qui génèrent constamment des revenus stables et durables pour les commerçants. Ne manquez pas cette opportunité - inscrivez-vous à ATPBot dès aujourd'hui pour surpasser le marché et vous engager sur la voie du réussite. De plus, si vous souhaitez voir plus de stratégies de trading ou de résultats en cours d'exécution, vous pouvez rejoindre la communauté de discorde ATPBot.

0 notes