#Public Limited Company Registration in Chennai

Text

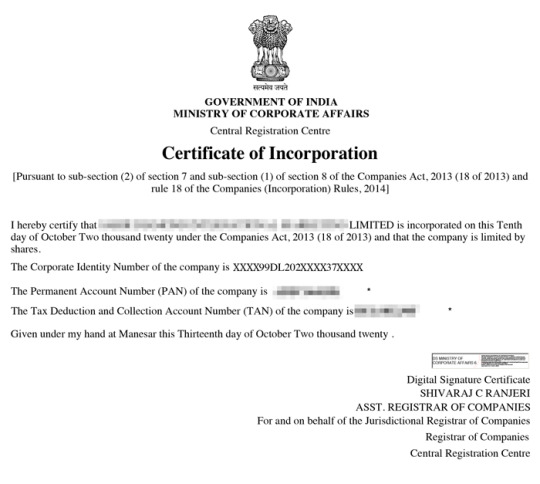

Public Ltd Company Registration in India - Online Process, Documents Required, Fees

A Public Limited Company is a type of business entity which has limited liability features and offers shares to the general public for raising equity capital. It is governed by the Companies Act, 2013 and registered under the Ministry of Corporate Affairs. It can be incorporated with a minimum number of seven members and at least three members must be the directors of the company.

A Public Limited Company has the benefits of limited liabilities and it can sell its shares to the general public for raising capital. It is suitable for large businesses that require huge capital and are registered under the Companies Act, 2013.

Advantages of Public Limited Company registration:

Limited Liability

Separate Legal Entity

Raise Capital

Credibility and Attention

Free Transferability of Shares

Minimum requirements for Public Limited Company registration:

Minimum of seven members is required

Minimum of 5 lakh rupees is required for share capital

At least three members must be the directors of the company

Public Limited Company Registration Fees:

The total cost of Public Limited Company registration in India, including government and professional fees, starts from ₹11,999 and takes around 14-21 working days.

To know more (click here)

#public limited company registration#business#india#startup#business growth#manage business#nidhi company registration#partnership firm registration#private limited company registration in bangalore#private limited company registration in chennai#private limited company registration online#indian business

0 notes

Link

Read more...

#llp registration in coimbatore#opc registration in chennai#public limited company registration in bangalore

0 notes

Link

#company name registration in chennai#company name#company registration#online company registration#private limited company registration#One Person Company Registration#Public limited company#Private Limited Company Registration in Chennai#Partnership Firm Registration in Coimbatore#Partnership Deed Registration in Chennai

0 notes

Text

CA in Chennai

CA in Chennai is a legal process that involves formalizing the existence of a business entity within the administrative and regulatory framework of the Indian capital city. This registration is essential for establishing the firm’s legal identity, facilitating business operations, and complying with various government regulations. Here is a description of the key steps and details involved in the ca of firm in Chennai.

Business Structure: Before registering your firm, you need to decide on its legal structure. Common options include a sole proprietorship, partnership, limited liability partnership (LLP), private limited company, or public limited company. Your choice will affect the registration process and the legal liabilities of the firm’s owners.

Choose a Business Name: Select a unique and suitable name for your firm. Ensure that it complies with the guidelines set by the Ministry of Corporate Affairs (MCA). You can check the availability of your chosen name on the MCA website.

Obtain Director’s Identification Number (DIN): If you plan to register a private limited company, you need to obtain a DIN for the proposed directors of the company. This can be done online through the MCA portal.

Digital Signature Certificate (DSC): To file online documents with the Registrar of Companies (RoC), you must obtain a digital signature certificate. This is necessary for digitally signing the required documents.

File for Incorporation: For different types of firms, you will need to file different incorporation documents. For example, for a private limited company, you will need to file the Memorandum of Association (MoA) and Articles of Association (AoA). For an LLP, you need to file the LLP Agreement. These documents outline the structure, objectives, and operational guidelines of your firm.

Registration Fees: Pay the necessary registration fees as prescribed by the MCA or relevant authority. The fee may vary depending on the type and capital of the firm.

Obtain Permanent Account Number (PAN): Apply for a PAN card for your firm through the Income Tax Department. A PAN card is essential for tax-related purposes.

Tax Registration: Depending on your business activities and turnover, you may need to register for Goods and Services Tax (GST) or other state-specific taxes. This registration ensures compliance with India’s tax laws.

Professional Tax Registration: If you have employees in Chennai, you may be required to register for Professional Tax with the local authorities.

Compliance with Labor Laws: Ensure compliance with labor laws, including obtaining necessary licenses or permits for employing workers, if applicable.

Business Bank Account: Open a bank account in the firm’s name. This account will be used for financial transactions related to the business.

Post-Incorporation Compliances: After registration, you must fulfill ongoing compliance requirements, such as filing annual financial statements, holding annual general meetings, and adhering to other regulatory obligations.

Other Licenses and Permits: Depending on your business activities, you may require additional licenses and permits from local, state, or central government authorities.

0 notes

Text

Trademark Registration in Ahmedabad: A Comprehensive Guide

Trademark Registration in Ahmedabad

Attention Ahmedabad Entrepreneurs! 📢 Are you ready to protect your brand and intellectual property? We've got you covered with seamless Trademark Registration services right here in Ahmedabad. 🌐✍️ Secure your business identity and gain legal protection today. Contact us to get started! 💼🔒

For new business registration and support, contact kanakkupillai.com today. 🌌🚀

Check out us - https://www.kanakkupillai.com/trademark-registration-in-ahmedabad

Contact us - 73053 45345 or Whatsapp us https://wa.me/917305048476

What is Trademark Registration in Ahmedabad?

Trademark registration is a crucial step for businesses in Ahmedabad, Andaman, Andhra Pradesh, Assam, Bangalore, Bihar, Bhopal, Bhubaneswar, Chhattisgarh, Chennai, Coimbatore, Dehradun, Gangtok, Gandhi Nagar, Gujarat, Gurgaon, Guwahati, Haryana, Himachal Pradesh, Hyderabad, Indore, Jharkhand, Kerala, Kolkata, Lucknow, Madhya Pradesh, Madurai, Maharashtra, Mangalore, Mumbai, Nagpur, New Delhi, Noida, Odisha, Patna, Pune, Punjab, Puducherry, Raipur, Rajasthan, Shimla, Sikkim, Surat, Srinagar, Telangana, Thiruvananthapuram, Tripura, Uttar Pradesh, Uttarakhand, Visakhapatnam, and West Bengal. Protecting your brand through trademark registration ensures legal rights and safeguards your intellectual property. Feel free to consult with professionals to navigate the trademark registration process smoothly.

Step-by-Step Procedure for Trademark Registration in Ahmedabad:

1. Trademark Search:

Conduct a comprehensive search to ensure your desired trademark is unique.

2. Trademark Application Filing:

Apply with the Trademark Registry.

3. Examination:

The Trademark Office examines your application for compliance.

4. Publication:

If the authorities approve it, they will publish your trademark in the Trademark Journal.

5. Opposition Period:

There's a 4-month window for others to oppose your trademark.

6. Registration Certificate:

If uncontested, you'll receive a Registration Certificate.

Choosing a unique and effective Trademark is crucial for Brand Recognition and Legal Protection. Here are some steps to help you make the right choice:

Research Your Industry: Begin by researching trademarks in your industry. Understand the common themes, words, and phrases used.

Be Distinctive: Make your trademark stand out and be distinctive. Avoid using generic terms or phrases commonly used in your industry.

Avoid Descriptive Terms: Trademarks that describe the product or service they represent are often less protectable. Try to create a name that is suggestive rather than merely descriptive.

Check Availability: Before finalizing a trademark, check if it's already registered or used by another company. You can do this through the trademark office's website or with the help of a trademark attorney.

Consider Your Target Audience: Consider your target audience and what kind of trademark would resonate with them.

Think Long-term: Choose a trademark that can grow with your business. Consider how it will fit if you expand into new products or services.

Avoid Geographic Terms: Using geographic terms in your trademark can limit your ability to expand your business.

Trademark Search: Conduct a comprehensive trademark search to ensure no one else has registered your desired trademark.

Legal Advice: Consult with a trademark attorney for professional guidance. They can help you navigate the legal aspects and provide valuable insights.

Test It: Before finalizing, test your trademark with a focus group or potential customers to see how it resonates.

Remember that a unique and effective trademark can be a valuable asset for your business, helping you stand out in the market and protecting your brand identity.

Documents Required for Trademark Registration in Ahmedabad:

Trademark details.

Applicant's identity and address proof.

Business registration certificate (if applicable).

Trademark representation (logo or wordmark).

Authorization of attorney (if hiring one).

Benefits of Trademark Registration in Ahmedabad:

Legal Protection: Exclusive rights to your brand.

Prevent Infringement: Stop others from using your mark.

Brand Recognition: Build trust and credibility.

Asset Creation: Trademarks are valuable business assets.

Latest 15 Questions and Answers for Trademark Registration in Ahmedabad:

How long does trademark registration take in Ahmedabad?

Typically, 1-2 years.

What classes can I register my trademark under?

Choose the relevant courses based on your goods/services.

Can a foreign national register a brand in Ahmedabad?

Yes, foreign nationals can register trademarks.

Do I need an attorney for trademark registration?

While it's not mandatory, we recommend seeking legal expertise.

What is the trademark renewal process?

Renew every ten years.

Can I trademark a sound or scent?

Yes, non-conventional trademarks are accepted.

What if someone opposes my trademark application?

Legal proceedings may follow.

Can I use the ® symbol without registration?

No, it's only for registered trademarks.

What is the difference between TM and ® symbols?

TM is for unregistered marks; ® is for registered ones.

Can I transfer my trademark ownership?

Yes, trademarks can be assigned or licensed.

What if my brand becomes generic?

It may lose protection.

Can I register a trademark for a business name?

Yes, if it distinguishes your products/services.

Can I trademark a colour or combination of colours?

Yes, if it's distinctive for your brand.

Is a trademark valid internationally?

No, it's territorial, but you can seek protection abroad.

What's the cost of trademark registration in Ahmedabad?

Prices vary based on class and filing mode; professional fees apply.

Related Articles:

Trademark Registration

Trademark Registration in Chennai

Trademark Registration in Bangalore

Trademark Registration in Coimbatore

Trademark Registration in Hyderabad

Trademark Registration in Pune

Trademark Registration in Mumbai

Related Keywords:

Trademark Registration,Trademark process,Trademark requirements,Trademark classes,Trademark benefits,Trademark guidelines,Trademark registration portal,Trademark application status,Trademark office locations,Trademark rules,Trademark registration steps,Trademark registration services,Trademark attorneys,Trademark cost,Trademark search,Trademark protection,Register a trademark,Trademark application fees,Trademark renewal,Trademark objection,Trademark filing process

#Trademark Registration#Trademark process#Trademark requirements#Trademark classes#Trademark benefits#Trademark guidelines#Trademark registration portal#Trademark application status#Trademark office locations#Trademark rules#Trademark registration steps#Trademark registration services#Trademark attorneys#Trademark cost#Trademark search#Trademark protection#Register a trademark#Trademark application fees#Trademark renewal#Trademark objection#Trademark filing process#trademark registration in ahmedabad

0 notes

Text

Can I Do Business Without Registering: Everything to Know

Everyone wants to run their own business, but it may be confusing, especially when there are so many alternatives available. This can lead to more uncertainty regarding the type of organization to pick, as well as registration and other issues. When it comes to registration, small companies can operate in India without registering, although doing so is advised to take advantage of certain benefits and to maintain legal compliance. Starting a business without registration involves operating it without receiving any official government approval. So registering your business is an important step.

If your business is not registered, it may not be given any legal recognition. This implies that it won’t be able to sign contracts with other businesses or bring legal action against someone or something. Your firm won’t be able to benefit from some tax reductions or other advantages provided to registered enterprises without legal recognition. Without legal recognition, the company will also have a hard time getting financing from banks or other financial organizations. Emblaze, the top Company Registration Consultants in Kochi, Kerala, will assist you in all aspects of business registration.

Benefits Of Registering Your Business

What comes next once you’ve successfully navigated the most challenging phase of starting a small business? As a brand-new business owner, you’ll have a lot of fresh decisions to make. Making the decision to register your business or not is a step in this decision-making process. While there are many advantages to establishing your business, there are a few factors you should look at as well.

> The first thing is you can limit your personal liability. You are legally accountable for every element of your firm, including debts and losses, as an independent owner or partner. Additionally, you will be held personally responsible if you sell a product that is faulty or make a mistake. This type of company operation might be hazardous since it puts your personal assets at risk as well. A corporation, on the other hand, is a distinct legal entity that makes it simple to shield your personal assets from business decisions. You won’t be personally liable for the company’s debts, allowing you to concentrate on growing your firm.

> You will need to provide evidence that you are a legal firm when you apply for small business loans. Before qualifying you for a loan, lenders and investors will request to examine your business registration as well as other application criteria. Lenders may also request to see your company registration documents if you apply for a credit card as a business.

> Registering your company contributes to business longevity, brand awareness, and longevity, all of which have a good effect on client loyalty and sales. A registered business can be passed on to an inheritor, ensuring that it will continue to operate even if the original proprietors are no longer actively involved. This is excellent for your company’s reputation and helps to attract loyal clients.

> Shares of an organization are only as many as were acquired Shareholders may transfer it to another person. Shares may be transferred at the shareholder’s option. A signed copy of the share transfer form and share certification would be sent to the share buyer. Technically, there are no restrictions on the transfer of shares of a public limited corporation.

One of the finest methods to grow your business and assure its success is by registering a corporation. In addition to being risk-free, reduced tax rates will allow you to concentrate on growing your company into the successful endeavour you want it to be. Emblaze offers Business Registration Services in Kochi, Kerala, Chennai from start to finish, ensuring that your objectives are met in a timely manner. As a result, we prepare the way for the most appropriate entry route while also supporting you with transaction structure.

0 notes

Text

Bank of Baroda Recruitment 2023: Acquisition Officer (500 Posts)

Bank of Baroda Recruitment 2023: Bank of Baroda has released an employment notification for the recruitment of the Acquisition Office. Eligible candidates may apply online. The last date for submission of the application is 14.03.2023.

Post Name:- Acquisition Officer

- No of posts:- 500

- Location-wise vacancy list:-

1. Ahmedabad: 25 Posts

2. Allahabad: 9 Posts

3. Anandaman: 8 Posts

4. Bareilly: 9 Posts

5. Bengaluru: 25 Posts

6. Bhopal: 15 Posts

7. Chandigarh: 8 Posts

8. Chennai: 25 Posts

9. Coimbatore: 15 Posts

10. Delhi: 25 Posts

11. Ernakulam: 16 Posts

12. Guwahati: 8 Posts

13. Hyderabad: 25 Posts

14. Indore: 15 Posts

15. Jaipur: 10 Posts

16. Jalandhar: 8 Posts

17. Jodhpur: 9 Posts

18. Kanpur: 16 Posts

19. Kolkata: 25 Posts

20. Lucknow: 19 Posts

21. Ludhiana: 9 Posts

22. Mangaluru: 8 Posts

23. Mumbai: 25 Posts

24. Nagpur: 15 Posts

25. Nashik: 13 Posts

26. Patna: 15 Posts

27. Pune: 17 Posts

28. Rajkot: 13 Posts

29. Surat: 25 Posts

30. Udaipur: 8 Posts

31. Vadodara: 15 Posts

32. Varanasi: 9 Posts

32. Visakhapatnam: 13 Posts

- Age limit:- 21 to 2 years. The Upper age relaxation is up to 3 years for OBC, 5 years for SC/ST, and 10 years for PWD candidates.

- Salary:- Metro cities: Rs. 5 Lakhs per annum and for Non-Metro cities: Rs. 4 lakhs per annum. Apart from the Fixed Salary, the selected candidate will be eligible for Performance Linked Variable Pay which will be over and above the Fixed Salary but linked to the achievement of specific targets.

- Essential Qualification:- A Degree (Graduation) in any discipline from a University recognized by the Govt. Of India./Govt. bodies/AICTE.

- Post Qualification Experience:- Candidates having preferably 1 year of experience with Public Banks/ Private Banks/ Foreign Banks/ Broking Firms/ Security Firms/ Asset Management Companies. Proficiency/knowledge in the local language/area/ market/ clients is desirable.

How to apply for Bank of Baroda Recruitment 2023: Acquisition Officer Vacancies?

Candidates are required to apply Online through the website www.bankofbaroda.co.in. No other means/mode of application will be accepted.

The last date for submission of the application is 14.03.2023.

Application Fee

- SC/ST/Persons with Disability (PWD)/ Women: Rs.100/- plus applicable taxes & payment gateway charges

- GEN/OBC/EWS: Rs.600/- plus applicable taxes & payment gateway charges

Candidates may follow the below-mentioned steps to apply online.

- Scroll down, and go to below Online Application Link.

- Click on "Apply Online" and complete the registration process by clicking "New Registration".

- In the next stage, click on the "Online Application" Link and log in.

- Fill out your all personal and educational details and upload the necessary documents.

- In the end, submit the form.

- Don't forget to take a print of a copy of the submitted application form.

Those who wish to apply are advised to go through the below official notification in detail before submitting applications.

Online Application Link

Click Here

Download Official Notification

Click Here

Job Updates on Facebook

Click Here

Read the full article

0 notes

Text

Section 8 Company registration in Chennai

A company licensed under section 8 of the Companies Act of 2013 is a section 8 company. It is a non-profit organization (NPO) with the mission of fostering commerce, the arts, science, sports, education, and other fields. These kinds of businesses don't pay dividends to their shareholders and instead use their profits to advance their cause.

These businesses have Section 8 company registration in Chennai for charitable purposes, social welfare, and achieving the organization's societal goals. The central government obtains these businesses' incorporation certificates, which guarantee compliance with central government regulations.

In accordance with the regulations, the Central Government may order the NPO to be wound up if it fails to fulfill its responsibilities. In addition, the company's members will all face severe legal action.

Features

Registration done through Section 8 company registration in Chennai has several features as below.

1.) An entity that is proposed to have Section 8 company registration in Chennai under section 8 of the Companies Act must satisfy the central government.

· Includes the context for promoting commerce, art, science, sports, education, research, social welfare, religion, philanthropy, and environmental protection.

· The newly formed entity's profits or income will be used to advance the charitable goals of the company.

· Licenses may be granted under any conditions the Central Government deems appropriate; permit its registration as a limited company.

2.) Companies that have Section 8 company registration in Chennai the same rights and responsibilities as limited companies.

· The new company cannot alter the memorandum or articles of association once it has been registered under this act without first obtaining permission from the central government.

· The fulfillment of any and all conditions imposed from time to time is necessary for conversion into another type of company incorporation.

3.) Revocation of License:

The central government may direct the newly registered company to convert its status and change its name if the company fails to comply with any of the requirements outlined in this section or acts in a manner that is contrary to the company's goals or detrimental to the public interest.

After that, if the license is revoked and the Central Government is satisfied that it is essential to the public interest that the newly registered company be combined with another company that was formed under this, then the Central Government may make arrangements for the merger to create a single company with the features that the government has specified in the order.

4) The Rehabilitation and Insolvency Fund established by section 269 can receive proceeds from the sale or winding up/dissolution of a company registered under section (8) of the Companies Act, subject to certain conditions imposed by the Tribunal.

5.) Companies can only be combined if they are both registered under the same section of the act and have similar goals.

Compliance for Section 8 company registration

Following are the compliance for Section 8 company registration in Chennai.

· A company secretary is not required for Section 8 company registration in Chennai, and incentives and commissions are not permitted in Section 8 companies.

· The company's business operations should only be used to achieve the company's objectives.

· An annual general meeting (AGM) can be held by a Section 8 company with very little notice.

· The company's goal cannot be altered without prior approval from the Indian Central Government.

· If a company has Section 8 company registration in Chennai under 80G and 12A, its income is exempt from all taxes. More than 20 businesses offer positions to the company's directors.

· Section 8 company incorporation does not have a minimum share capital requirement.

Rules & Regulations

To have Section 8 company registration in Chennai, following rules must be satisfied.

The MCA portal has a form that can be filled out online as the first step. Digital signature certificates, or DSCs, must be obtained.

· Additionally, the MCA website should be used to apply for the Director's identification number.

· Obtaining a section 8 company name from the Ministry of Corporate Affairs; applying for a section 8 company incense from the Director of the Ministry of Corporate Affairs; and submitting an online Spice+ form to the registrar of companies for final incorporation.

· The company must have PAN and TAN for Section 8 company registration in Chennai. The same information can be obtained online after incorporation.

· The applicant must open a bank account within 30 working days. Companies in Section 8 are exempt from income tax under sections 80G and 12A; however, the applicant must register the company.

Conclusion

A non-profit organization known as a Section 8 company was established for charitable and social welfare purposes. It was founded solely with the intention of helping the poorest members of society.

As a result, the directors of the section 8 company do not share in the profits generated by its business operations. It can only be used to achieve the section 8 company's goal. Section 8 company registration in Chennai can be done by professionals of Smartauditor.

0 notes

Link

#Public Limited company registration in Coimbatore#Public Limited Company Registration in Chennai#Business Registration in Chennai#Business Registration in Coimbatore#private limited company registration in chennai

0 notes

Link

#Business registration in chennai#private limited company registration in chennai#public limited company registration in chennai#llp registration in chennai#partnership registration in chennai

0 notes

Link

#Public limited company registration in Chennai#Public limited company registration in Trivandrum#public limited company registration in Cochin#public limited company registration in Hyderabad#public limited company registration in bangalore

0 notes

Text

Who offers the best company registration services in Chennai?

Solubilis offers the best company registration services in Chennai. They have done all types of company registration services like Private limited companies, One Person Companies, limited liability partnerships, Public limited companies, Partnership firms and so on. Solubilis serves with affordable cost, fast online processing with excellent team supports in Chennai.

#Company registration services in Coimbatore#Solubilis#private limited company#LLP#Public limited company

0 notes

Link

#company#company culture#company secretary#company secretarial services#company registration#Company Registration in Madurai#company registration in bangalore#Company Registration In Coimbatore#private limited company registration#one person company#One Person Company Registration#One Person Company Registration in Chennai#public limited company registration in madurai#llp registration in madurai#llp registration#private limited company in India#private limited company registration in madurai#private limited company

0 notes

Text

Private Limited Company in Chennai

A Private Limited Company in Chennai offers a range of advantages for entrepreneurs and business owners. With a minimum of two shareholders, it provides a flexible and manageable structure for small to medium-sized enterprises. Chennai's thriving business ecosystem makes it an ideal location for setting up such companies. These entities enjoy limited liability, safeguarding the personal assets of shareholders. Additionally, they can raise funds from Venture Capitalists or Angel investors, providing opportunities for growth and expansion. The registration process involves a few straightforward steps, including obtaining Digital Signature Certificates (DSC) and Director Identification Numbers (DIN) for directors to ensure compliance with regulatory requirements. A Private Limited Company in Chennai offers a conducive business growth and development environment.

📢 Ready to take your business to the next level in Chennai? 🚀 Don't miss out on the benefits of Private Limited Company Registration! 🏢💼

Gain limited liability protection, build investor confidence, and secure your brand's future. It's time to formalise your business and make a mark in the corporate world. 💪🌟

Features of a Private Limited Company in Chennai:

1. Members: According to the provisions of the Companies Act 2013, a company must have at least two members and can have a maximum of 200 members.

2. Prospectus: Private companies are not required to issue a prospectus or file a statement instead of a prospectus with the Registrar of Companies.

3. The company cannot accept deposits: Private companies cannot solicit funds from the public, and shareholders face restrictions on selling or transferring their shares.

4. Fund Raising Capacity: Private Limited Companies can secure funds from Venture Capitalists or Angel investors but are not permitted to go public as more giant corporations do.

5. Protection Against Liabilities: Shareholders of a Private Limited Company are generally not pursued for any shortfall to pay creditors unless proven to have acted recklessly. However, if the company becomes insolvent, Investors may lose their investment.

6. Limited Liability: The most essential feature of a Private Limited Company is limited liability. Shareholders' assets are protected if the company faces financial difficulties.

Benefits of Registering a Private Limited Company in Chennai:

1. Min 2 Shareholders: You can initiate a Private Limited Company in Chennai with just two members who will act as shareholders and directors.

2. Borrowing Capacity: Private Limited Companies have better-borrowing avenues than other business forms, such as sole proprietorships and partnerships.

3. Business Continuity: A Private Limited Company enjoys perpetual existence, meaning it continues to exist regardless of changes in ownership.

4. Minimum Capital Required: One lakh is required to incorporate a Private Limited Company.

5. Limited Liability: Shareholders' assets are not at risk if the company faces financial distress. They have limited liability, which means Their responsibility is confined to the unpaid amount on their shares.

6. Separate Legal Entity: Unlike partnership firms, a company possesses a distinct legal identity separate from its owners.

Documents for Private Limited Company Registration in Chennai:

PAN card and Residence Proof of company directors.

Copy of the rental agreement or EB Card for the Registered office

A copy of the most recent bank statement, telephone or mobile bill, or electricity or gas bill.

Passport-size photographs.

Specimen signature (a blank document with signatures of directors only)

Copy of the passport (in the case of a Foreign Director).

Services Included in this Package:

Verification of Documents

DSC and DIN for two directors

Name approval and ROC fees

Drafting MOA & AOA

We will follow up until we obtain the certificate.

Applying for PAN and TAN.

Process of Private Limited Company Registration Online in Chennai:

1. Applying DIN and DSC: All directors require Digital Signature Certificates (DSC) and Director Identification Numbers (DIN).

2. Name Approval: Provide 4-6 proposed names that should be unique and suggestive of the company's business.

3. MOA, AOA and Affidavit: Draft Memorandum and Articles of Association Prepare an affidavit and declaration by the first subscribers and directors.

4. Company Registered: Once the ROC accepts the filing, it issues a certificate of incorporation, allowing the company to commence its operations.

5. Apply for PAN, TAN, and Bank Accounts: Apply for PAN and TAN. Once received, submit the Incorporation certificate, MOA, AOA, and PAN to open a bank account.

Frequently Asked Questions (FAQs) about Private Limited Companies in Chennai:

What is a Private Limited Company in Chennai?

A Private Limited Company is a type of business structure where the liability of its members (shareholders) is limited to the amount unpaid on their shares. It's a popular choice for small to medium-sized businesses in Chennai.

How many members are required to start a Private Limited Company in Chennai?

A minimum of two members and a maximum of 200 members are required to establish a Private Limited Company in Chennai.

What is the minimum capital requirement for registering a Private Limited Company in Chennai?

The minimum capital required to incorporate a Private Limited Company in Chennai is one lakh rupees.

Can a Private Limited Company in Chennai raise investor or public funds?

Private Limited Companies can raise funds from Venture Capitalists or Angel investors but cannot issue shares to the public through a stock exchange like larger public companies.

What is the process for registering a Private Limited Company in Chennai?

The registration process involves obtaining Digital Signature Certificates (DSC) and Director Identification Numbers (DIN) for directors, reserving a unique name for the company, drafting the Memorandum and Articles of Association, and submitting the necessary documents to the Registrar of Companies.

Is the liability of shareholders in a Private Limited Company limited?

Yes, the liability of shareholders in a Private Limited Company is limited to the unpaid amount on their shares, protecting their assets in case of financial distress.

Is there an annual renewal requirement for Private Limited Companies in Chennai?

No, Private Limited Companies do not need to renew their registration annually. It is a one-time registration with a perpetual existence.

Can a Private Limited Company become another type of business structure in Chennai?

Yes, a Private Limited Company can convert into another business structure, but this process involves specific legal procedures and approvals.

What documents do you need for registering a Private Limited Company in Chennai?

Documents typically include PAN cards and residence proof of company directors, rental agreement or EB card for the registered office, bank statements or utility bills, passport-sized photographs, and specimen signatures of directors.

How long does it take to register a Private Limited Company in Chennai?

The registration process usually takes around 15 to 20 business days, depending on the timely submission of documents and approvals from regulatory authorities.

#ChennaiBusiness #PrivateLimitedCompany #BusinessGrowth #Entrepreneurship #LegalShield #CorporateSuccess #BusinessRegistration #BrandProtection #InvestorConfidence #ChennaiEntrepreneurs #SmallBusinessSuccess #CompanyRegistration #PrivateLimited #BusinessIncorporation #LegalEntity #LimitedLiability #Entrepreneurship #BusinessGrowth #StartupJourney #SmallBusiness #CorporateStructure #BusinessFormation #InvestorConfidence #BusinessOwnership #LegalFormality #FinancialSecurity #BusinessSuccess #NewVenture #CompanyFormation #EntrepreneurLife

For new business registration and support, contact kanakkupillai.com today. 🌌🚀

Check out us - https://www.kanakkupillai.com/private-limited-company-registration-chennai

Contact us - https://wa.me/917305048476

#PrivateLimitedCompany#BusinessGrowth#Entrepreneurship#LegalShield#CorporateSuccess#BusinessRegistration#BrandProtection#InvestorConfidence#ChennaiEntrepreneurs#SmallBusinessSuccess#CompanyRegistration#PrivateLimited#BusinessIncorporation#LegalEntity#LimitedLiability#StartupJourney#SmallBusiness#CorporateStructure#BusinessFormation#BusinessOwnership#LegalFormality#FinancialSecurity#BusinessSuccess#NewVenture#CompanyFormation#EntrepreneurLife

0 notes

Link

Having dream of opening own company and looking for Company Registration in chennai, Company registration online in india

#Company Registration#Company registration online in india#Private Limited Company Registration in Chennai#One Person Company Registration in Chennai#Proprietorship Registration in Chennai#Partnership company Registration in Chennai#Startup Registration in Chennai#LLP Registration in Chennai#Public Limited Company Registration in Chennai

0 notes

Link

Company Setup India is a single stop for off-shore company formation, buying an off-the-shelf (readymade) company, entire range of business and legal services, online accounting and all support services concerning foreign investment in India.

The main services we provide:-

· Formation of One Person Company (OPC) in India

· Formation of Private Limited Company in India

· Formation of Public Limited Company in India

· Formation of Limited Liability Partnership in India

· Creation of a NBFC Company in India

· Set up of a Government Company in India

· Set up of a Holding/ Subsidiary Company in India

· Set up of a Foreign Company in India

· Buy a Readymade Company in India in India

· Formation of Company Under Section 8 in India

· Formation of Producer Company in India

· Acquiring a Non-Banking Financial Company (NBFC) in India

· Statutory Records & Compliances

· Mergers, Acquisitions & Demergers

· Amalgamation, Acquisition & Reconstruction

· Open a Branch Office in India

· Open Liaison Office in India

· Foreign Direct Investment in India

· All Post Incorporation Services such as TDS/Withholding Tax Registration, VAT/Sales Tax Registration,

· Service Tax Registration, Import Export Code (IEC) Registration, ESI/PF Registration etc.

· Business and Legal services

· Accounting and Auditing Service

· Service for Filling of Various Statutory Returns

· The law relating to a partnership firm is contained in the Indian Partnership Act, 1932.

Company Setup India is based at New Delhi NCR, India to service clients anywhere in the world. We have our network on PAN India basis & across globe. We have our regional offices at Mumbai, Kolkata, Chennai, Bangalore, Chandigarh, Ranchi and Muzaffarpur.

#Company Incorporation in India#Limited Liability Partnership#FDI in India#Compare Different Business#Conversion of Business#Supp.Co.Incorporation Service#Small Business Registration#Value added services#Post Incorporation Reg.#Consulting Services

1 note

·

View note