#Quantitative Analyst

Explore tagged Tumblr posts

Text

I love how impossible it is how to find shared profit companies and now. Google is changing. It sucks. I'm not the only one to know this.

0 notes

Text

Top-Paying Jobs in Finance

#finance jobs#top-paying jobs#financial advisors#Private Equity#Investment Banking#Chief Financial Officer#Hedge Fund Manager#Quantitative Analyst#High-Paying Finance Jobs#Finance Careers

1 note

·

View note

Text

Navigating the World of Quantitative Analyst Recruitment Agencies

In today's fast-paced financial landscape, quantitative analysts (QAs) play a pivotal role in making data-driven decisions that can impact the success of investment firms, hedge funds, and banks. However, finding the right talent to fill these roles can be a challenging task. This is where quantitative analyst recruitment agencies come into play. In this blog post, we'll delve into the world of quantitative analyst recruitment agencies, exploring their role, services, benefits, and how they can help both job seekers and employers.

Understanding the Role of Quantitative Analyst Recruitment Agencies

Quantitative analyst recruitment agencies are specialized firms that focus on connecting highly skilled quantitative professionals with job opportunities in the financial industry. Their primary role is to bridge the gap between employers seeking talented quantitative analysts and individuals looking for challenging career opportunities in quantitative finance.

Services Offered by Quantitative Analyst Recruitment Agencies

1. Talent Sourcing and Acquisition

One of the core services provided by quantitative analyst recruitment agencies is talent sourcing and acquisition. They have access to a vast network of experienced quantitative professionals and can identify candidates with the right skill set, background, and experience to meet their clients' specific needs.

2. Skill Assessment

Quantitative analyst recruitment agencies go beyond just matching resumes with job descriptions. They conduct rigorous skill assessments and interviews to evaluate candidates' quantitative abilities, coding proficiency, and problem-solving skills. This ensures that only the most qualified individuals are presented to employers.

3. Industry Knowledge

These agencies often have deep industry knowledge and are well-versed in the intricacies of quantitative finance. This expertise allows them to provide valuable insights to both candidates and employers, ensuring that job placements align with the evolving demands of the financial sector.

Benefits of Using Quantitative Analyst Recruitment Agencies

1. Time Efficiency

Recruiting quantitative analysts can be a time-consuming process, involving the screening of numerous resumes and conducting extensive interviews. By outsourcing this process to a recruitment agency, employers can save time and focus on their core business activities.

2. Access to a Diverse Talent Pool

Quantitative analyst recruitment agencies have access to a diverse pool of talent, including candidates with varied backgrounds, experiences, and skill sets. This diversity allows employers to find candidates who can bring fresh perspectives and innovative solutions to their organizations.

3. Customized Solutions

Each financial institution has its unique requirements when it comes to quantitative analysts. Recruitment agencies tailor their services to match these specific needs, ensuring that candidates presented are a perfect fit for the organization's culture and objectives.

4. Confidentiality

Maintaining confidentiality during the recruitment process is crucial, especially when dealing with sensitive financial information. Recruitment agencies can help ensure that both candidates and employers maintain discretion throughout the hiring process.

How Quantitative Analyst Recruitment Agencies Benefit Job Seekers

1. Career Guidance

Job seekers in the field of quantitative analysis can benefit from the guidance provided by recruitment agencies. These agencies can help individuals navigate the complex job market, offering insights into the latest trends and job opportunities.

2. Access to Exclusive Opportunities

Quantitative analyst recruitment agencies often have access to job openings that are not publicly advertised. This means job seekers can tap into a broader range of opportunities by partnering with these agencies.

3. Skill Enhancement

Recruitment agencies may recommend skill development or additional training to job seekers to make them more competitive in the job market. This can be invaluable in helping candidates secure their desired roles.

4. Negotiation Support

When it comes to salary negotiations and job offers, recruitment agencies can provide guidance to ensure that job seekers receive fair compensation and benefits.

Choosing the Right Quantitative Analyst Recruitment Agency

When selecting a quantitative analyst recruitment agency, it's essential to consider a few key factors:

1. Reputation: Look for agencies with a proven track record of successful placements and satisfied clients.

2. Industry Expertise: Opt for agencies that specialize in quantitative finance and have a deep understanding of the field.

3. Candidate-Centric Approach: Choose agencies that prioritize the needs and goals of job seekers, not just those of employers.

4. Transparency: Ensure that the agency's fee structure and processes are transparent and fair.

Conclusion

Quantitative analyst recruitment agencies play a vital role in the world of finance by connecting top-notch talent with organizations seeking quantitative analysts. They offer a range of services that benefit both employers and job seekers, from talent acquisition and skill assessment to career guidance and negotiation support. When choosing a recruitment agency, it's crucial to consider factors like reputation, industry expertise, and transparency to ensure a successful partnership. Ultimately, these agencies are instrumental in building the quantitative workforce that drives innovation and success in the financial sector.

#it recruitment agency#Quantitative Analyst#quantitative analyst recruitment agencies#Quantitative Analyst Recruitment#job opportunities

0 notes

Text

The Challenge of Recruiting a Quantitative Analyst

Many challenges are faced by IT recruitment agencies, as they search for dynamic candidates for specialist job-roles. However, new recruits wanting to further their career and maybe make it to the dizzy heights of a quantitative analyst position may face many challenges. The IT and finance sectors, are among the most competitive and dynamic industries in the world that require high calibre staff. The focus is very much on creating quality equal opportunities for career growth and development

Some Recruitment Advice for Quantitative Analyst Positions

High Expectations

New recruits in finance and IT are often expected to perform a high level of complex tasks from day one. Delivery high quality work and solving complex issues are part of the working day of a quantitative analyst. It is important that the IT recruitment process acknowledges this demand.

Candidates should have the best technical skills including programming know-how, modelling and data analysis. An excellent standard of communication and teamwork is also important. The ideal candidate should also adapt quickly to trends and innovations in this fast-moving sector of the IT industry.

Competition Is Intense

In IT recruitment, it is well recognised that candidates for the most senior positions have to compete for the best jobs and projects. As far as recruitment goes and attaining an interview, it is important to stand out from others. You can say that you need to showcase your talent to land the best jobs available in this particular sector.

Many of the best candidates have spent years building working relationships in the industry and have made good contacts within the IT recruitment field, that daily have to deal with both employers, colleagues and clients to focus on getting quality results for everyone.

Faster Than the Speed of Light

Working in the finance industry in London means you work in a very fast-paced and dynamic environment. The rate of change is fast. It is important to know how to prioritise tasks and multi-task. This is often something you have to do at the same time. If you can handle dealing with both employers and stakeholders, it could be worth considering becoming a quantitative analyst and you must enjoy working under a certain amount of pressure.

Work-Life Balance

Most IT recruitment specialists will point out that if you want to reach the top, your work-life balance may suffer.

You need to be aware that this is very much a job that you commit too. Some who work within this particular part of the IT sector, even see this job as more of a vocation. That is why it is important that you make sure it is for you.

Bear in mind you need to deliver results and meet tight deadlines. This is not always easy to do when you have a family and other commitments as well. Often it means making a lifestyle career choice.

Finally…

Guidance and support are an important factor. Both candidates and employers should make sure their partner with any IT recruitment agency that specialises in the IT and finance sectors. A specialist recruitment agency can help new candidates to find and secure the best jobs that match their skills and future prospects as a quantitative analyst.

Read More:

Working From Home The Importance of Diversity in Recruitment

0 notes

Text

The Role of a Quantitative Data Analyst in Driving Business Success

In today’s data-driven world, businesses thrive on making informed decisions. This is where the expertise of a Quantitative Data Analyst becomes invaluable. These professionals specialize in interpreting vast datasets to uncover trends, patterns, and actionable insights that drive growth and efficiency.

A Quantitative Data Analyst combines statistical analysis, mathematical modeling, and technical tools to solve complex business problems. Their work involves collecting data, cleaning it, and applying advanced techniques to generate insights that can optimize operations, predict market shifts, or enhance customer experiences.

For businesses aiming to stay competitive, hiring skilled analysts is essential. At Q-Dits, we pride ourselves on providing top-tier data analytics services. Our team employs state-of-the-art technologies and methodologies to ensure accurate and timely insights tailored to your specific needs. From financial forecasting to operational improvements, Q-Dits empowers organizations to leverage data effectively.

Whether you're looking to enhance efficiency or gain a competitive edge, partnering with experienced analysts can transform how you approach decision-making. Discover how Q-Dits can help your business harness the true power of data.

0 notes

Text

Quantitative Analyst vs Data Analyst: Decoding the Data-Driven Duo

The world of data analysis offers exciting careers. Unsure if Quantitative Analyst or Data Analyst is your fit? Dive into this breakdown. We explore their areas of focus, required skills, and potential career paths to help you make an informed decision.

0 notes

Text

we are hiring

home base jobs

remote work

This job is male and female

kindly interested person apply this opportunity

apply this link https://addresx.com/jobs/quantitative-analyst-datasys-consulting-software-inc-remote-or-usa/

0 notes

Text

Did you know that India's dairy market is projected to reach $124.93bn in 2023? That's a growth of over 8% from 2022!

The Indian #dairy market is one of the most dynamic and fastest-growing in the world. Learn more about this exciting market in our latest article.

Click the link to read the full article and learn more about the future of the dairy business in India. - https://www.instagram.com/p/CvZLae8v80L/?img_index=1

#research gates#researchers#market researchers#qualitative research#action research#operations research#quantitative and qualitative research#consumer research#audit company#experimental research#market research analyst#business research#Research Consultants#Researchers#market research consultants#Market Researchers#Audit Company#Auditing Company#Company Audit#mystery shopping#secret shopper

0 notes

Text

all the other characters are probably art/theater kids—both of which got nothing to do with time travel.

Yet Xia Fei, portrayed as the poor little exploited college student, is the one who might have actual technical knowledge on time travel… Suspicious

I don’t trust him. Never had

Xia Fei being an applied physics major is giving me whiplash because ever since his PV came out, I’ve been imagining him as a broke art student persisting in his art dreams in a foreign country even though it’s hard to find a good job with an art degree unless one’s really really good at it

no wait…that’s also the case for physics majors. never mind

(my brother was also a physics major, but in theoretical physics. he ended up having a career in finance and crypto instead of well, actual physics…so yeah.)

#and yeah prev my brother’s specific field is data science#quantitative analyst something#i don’t know much about it#xia fei#felix#link click felix#shiguang dailiren#link click#link click yingdu#时光代理人#miyamiwu.src

34 notes

·

View notes

Text

nerdjo (nerd gojo) hcs

reposting stuff from twt + google docs, i'm still here w/ this nerdy lovable fella

nerdjo studies in either physics, something science related along w/ combining math as his major (or maybe both physics and math, pretty much as a quantitative analyst in a way)

he'd be the one w/ both the brains and the looks (he may not know this), he'd be smug over what he knows and the more knowledge he has despite being a huge flustered mess over his crush (aka you, y/n.)

his room would be filled w/ his digimon collection, figurines, posters plastered up on the walls that contain his interests, whatever he's studying in, motivation type stuff, pretty much anything to make it cool and cozy for him.

nerdjo helps you out w/ studying that he becomes your tutor on the subject you desperately need help in (+ failing at the same time)

nerdjo would also be the type to give you a mini test on your knowledge, juuuuust to make sure you were paying attention to what he was saying (mind you, he knows a lot more about) so it'd be his own version of trivia night but it's the subject at hand, if you get it correct, he rewards you w/ something of his choosing. if you get it wrong, he'd get all cocky while poking fun at you in the most playful way imaginable.

he'd get flustered when he gets the chance to see you (almost all the time for the study sessions) that his glasses practically almost fall off however does manage to put them back on in the right place

!! especially when you try pretty much anything and i mean ANYTHING to get him to react like this such as giving him sweet kisses, wrapping your arms around him while he's trying to explain how to solve the problem at hand, cupping his face gently, etc., he tries to contain himself during these sessions to the point of becoming nervous/embarrassed from it that you find it adorable that you'd want to do that more often.

also on the topic of him trying to remain calm in front of you, he'd do the same thing over the possibility of doing something way more intimate w/ you than just holding hands, hugging, kissing, that sort of stuff. he'd also jolt from the touch of your fingers on his neck to the point of his whole body shivering.

he'd focus so much on what's he’s reading about, studying or rather what's in front of him while he's sitting (especially w/ having his legs crossed over or stretching out), having the pencil tucked between his ear or placing it in his mouth, even readjusting his glasses from time to time as well, however forgets and almost lets them fall off before picking them up.

nerdjo also gets eyebags due to the amount of studying, assignments, homework and projects and lack of sleep he has to the point that he ends up falling asleep at his desk w/ the book replacing a pillow instead.

he definitely has a sleeper build, he reveals it to you after walking through the rain w/ him to where you'd end up in his room filled w/ merchandise of his interests, it'd feel like you witnessed a sculpture come to life.

MORE NERDJO STUFF HOORAY!!

nerdjo as your boyfriend would be super sweet + caring towards you, still helping you w/ assignments and study for exams. he'd take you on dates to the aquarium, the arcade, any sweets shop for that matter, just to make the two of you happy and to have some relief from all the schoolwork.

(i'll include this last one unless if i edit it out but i'd like to introduce you to dark academia!gojo from june of 2024)

dark!academia gojo would have an entire library that have shelves filled w/ so much classic literature along w/ poetry and writing, for instance, if you asked him if he had this or that, he'd immediately have it while casually holding it in his hands while you're describing it to him like he knows, he sees and reads all...

#angela's writing hcs#gojo satoru#gojo x reader#gojo satoru x reader#gojo headcanons#nerdjo#jujutsu kaisen#jjk x reader#jujutsu kaisen x reader#jjk headcanons#jjk drabbles

304 notes

·

View notes

Text

In January 2025, Newton’s City Council passed an ordinance so absurd, it could only have been conceived by people who think authority equals wisdom. By a vote of 19 to 4, the Council approved a “generational ban” on tobacco products. Anyone born after March 1, 2004, will never—ever—be allowed to purchase tobacco in the city. Not at 21, not at 35, not at 55. It’s a lifetime prohibition based solely on your birth year.

Let that sink in: a 25-year-old veteran returning to Newton in 2030 could be carded and denied a cigarette because he was born three months too late. Meanwhile, his 31-year-old neighbor lights up with impunity. What starts as a health measure ends in age-based discrimination enshrined in law.

My recent interview with Navy veteran, quantitative analyst, and Newton resident Steve Snider laid bare the lunacy of this legislation. “This struck me as a huge infringement on personal freedom and liberty,” Snider said. “Once the precedent is set, they can apply this logic to anything.”

7 notes

·

View notes

Text

I'm an addict so naturally I chose a form of gambling as a profession.

0 notes

Text

How many missiles would the United States need in a conflict in the Indo-Pacific? How much ammunition? Perhaps most important, by how much do current stockpiles fall short of what would be needed in a war?

The first-ever US National Defense Industrial Strategy, published in 2022, sparked important discussions on these and other questions about the US defense industrial base. These questions in turn resulted in improvements across the strategy’s four strategic priorities: resilient supply chains, workforce readiness, flexible acquisition, and economic deterrence. Despite these improvements, however, a significant gap remains in producing the quantitative difference between peacetime stockpile requirements and the acute, continuous, and probable long-term demand needs during wartime.

Consider a hypothetical conflict with China in the Pacific. War games estimate that the United States could expend more than five thousand long-range missiles within the first few weeks of engagement. At the same time, several analysts and government agencies have highlighted the difficulty of replenishing weapons currently used in Ukraine—a much smaller-scale conflict compared to what should be anticipated in a war with China.

There are two ways to deal with this challenge: (1) enabling production in advance to stockpile and preposition equipment; and (2) replenishing materiel and stockpiles after hostilities have begun. However, the latter strategy often overlooks the complex challenge of rapidly increasing production to meet wartime demands, which could leave the United States vulnerable in the early stages of conflict.

Although the US government has begun investing in bolstering the defense industrial base, the current contracting system lacks the flexibility needed to transition from low demand to a rapid ramp-up of production to replenish depleted stockpiles. To address this issue, the United States should adopt an option contract model for armament procurement. This model involves the government paying a premium on current orders bought at the peacetime stockpile level with the option—but not the obligation—to purchase a significantly larger amount within a fixed timeframe, providing the defense industrial base with the necessary funds to develop and maintain rapid replenishment capabilities in the event of a conflict.

What are option contracts?

Like options in the stock market, an option contract grants the buyer—in this case, the US government—the right to purchase arms and ammunition at a preset price at a later date. If the government opts not to exercise this option, typically because peace prevails, the contractor retains the premium. This premium serves as a financial investment in future rapid replenishment capability and a continued steady demand signal for the industry, encouraging readiness and innovation without requiring the government to maintain unnecessary and wasteful stockpiles.

How this would work in practice

To illustrate why option contracts would be an improvement over the current model of US armament procurement, take the case of Tomahawk missiles. A February 2023 Center for Strategic and International Studies report estimated that the United States would expend four hundred Tomahawk missiles in the first three weeks of a full-scale conflict with China. In 2022, the US Navy procured 154 Tomahawks to be bought over a three-year period, translating to an annual production rate of about fifty missiles. This rate is orders of magnitude lower than what would be required to replenish expenditures during a full-scale conflict.

Applying the proposed option contract model to this scenario, the Navy would pay a premium on its annual order of fifty missiles, with the option to purchase an additional four hundred missiles within a single year if needed. The contractor would use the premium to invest in the capacity to scale up production, ensuring that the company can meet the full contract requirements on short notice if the need arose. This approach not only provides the contractor with the capital to enhance its production infrastructure and an incentive to maintain overcapacity, but also ensures that the United States has a ready supply of crucial munitions in times of need.

There are four main benefits of the option contract model:

Enhanced production readiness: By providing a financial incentive upfront, the option contract model enables defense contractors to invest in infrastructure and workforce improvements as a reserve that can be rapidly scaled up in response to a crisis.

Improved flexibility: This model allows the US government to lock in production capacity without committing to immediate full-scale procurement, balancing budget constraints with strategic readiness. This also helps meet small increases in demand in the event of smaller-scale conflicts.

Stimulated industry investment: The premium paid on option contracts signals sustained demand, encouraging defense contractors to prioritize and invest in production capabilities and innovation, rather than stock buybacks or similar programs that benefit shareholders at the expense of the government.

Mitigated risk: This approach hedges geopolitical risk, ensuring necessary arms and ammunition are available in short order during critical, unforeseen contingencies.

At the same time, several challenges must be addressed:

Potential for rising costs: The premium paid for option contracts will increase procurement costs. Military programs are generally under-resourced in the constrained budget environment, so the rising procurement costs could lead to lower peacetime stockpile levels. If the increased capacity is never utilized, the premium paid may be viewed as government waste. However, the money spent on training the workforce and expanding capacity may be partially recouped by savings in follow-on contracts. A detailed cost-benefit analysis is essential to ensure that the increased expenditure aligns with strategic needs and budgetary constraints.

Difficulties negotiating contracts: Establishing effective option contracts requires careful negotiation to define terms, production capabilities, and performance metrics, ensuring that both the government and contractors meet their obligations. The military-industrial base has not utilized these types of contracts in the past. This unfamiliarity could add time to complete what are currently straightforward contracts.

Limits to industry capacity: Not all defense contractors have the capacity to scale up production rapidly, especially with “exquisite” weapon systems, which often involve high-end technology, are difficult and expensive to produce at scale, and require numerous subcontractors to complete. It is crucial, therefore, to assess the capability of industry partners and ensure that they can meet the demands of an option contract. There would need to be a requirement for the contractor to demonstrate the ability to surge its production to ensure good-faith use of the premium.

The option contract model represents a viable solution to address the current shortcomings in the US defense industrial base for some munitions. By incentivizing contractors with upfront premiums, this approach can enhance production readiness, flexibility, and industry investment, ultimately ensuring that the United States is better prepared to meet the demands of future conflicts.

10 notes

·

View notes

Text

Demand for Data Scientists is Steadily Rising

Since the onset of the Covid-19 pandemic, the world has witnessed an unprecedented transformation in the way businesses operate and tackle complex challenges. Amid supply chain disruptions, rising inflation, energy price fluctuations, geopolitical tensions, and economic policy shifts, the demand for data scientists and quantitative analysts, commonly known as "quants," has surged across various industries.

Industries that have experienced significant demand for data scientists and quants include:

Healthcare: The medical sector has sought data scientists to analyze infection rates, predict virus spread, optimize vaccination distribution, and develop epidemiological models.

Finance: Financial institutions have hired quants and data scientists to manage risks, build predictive models, develop algorithmic trading strategies, and enhance fraud detection systems.

E-commerce and Retail: Companies in these sectors have been employing data scientists to improve supply chain management, optimize pricing strategies, and enhance customer experience.

Supply Chain and Logistics: Businesses grappling with supply chain issues have utilized data scientists to optimize inventory management, forecast demand, and identify alternate sourcing opportunities.

Energy and Utilities: Rising energy prices have motivated companies in this industry to employ quants to optimize energy consumption and develop sustainable energy solutions.

Government and Policy: Governments worldwide have sought data scientists and statisticians to analyze public health data, design economic recovery plans, and optimize resource allocation.

Concrete Examples of Problem-Solving by Quantitative Professionals:

Vaccine Distribution Optimization: Data scientists have leveraged mathematical models and simulations to optimize Covid-19 vaccine distribution, considering factors like population demographics, infection rates, and healthcare infrastructure.

Supply Chain Resilience: Quants have utilized advanced analytics and machine learning to identify vulnerabilities in supply chains, helping companies diversify suppliers and mitigate disruptions.

Predictive Pricing Strategies: Retailers and e-commerce platforms have employed data scientists to analyze historical data and predict pricing trends, enabling dynamic pricing strategies to respond to fluctuations in demand and inflation.

Sentiment Analysis in Finance: Quants have used natural language processing techniques to analyze market sentiment from news and social media data, aiding in more informed investment decisions.

Impact of Economic Forces on Quantitative Skills Demand:

The ongoing supply chain challenges, inflationary pressures, energy price fluctuations, geopolitical tensions like the war in Ukraine, and President Biden's economic policies have further intensified the demand for quantitative professionals in specific areas. For instance:

Inflation Forecasting: The current economic climate has led to a surge in demand for economists and data scientists capable of building accurate inflation forecasting models to guide business strategies.

Risk Management in Finance: The uncertain geopolitical landscape and market volatility have necessitated strong risk management expertise, leading to a higher demand for financial quants.

Renewable Energy Investment: With a growing focus on sustainable energy solutions, companies are seeking data scientists to analyze and optimize renewable energy projects' feasibility and potential returns.

Remote Work's Impact on Opportunities for Data Scientists and Quants:

The shift to remote work during the pandemic expanded opportunities for data scientists and quants globally. Companies were no longer limited by geographical constraints and could access talent from various locations. This remote work culture enabled professionals to collaborate on international projects and facilitated the sharing of diverse perspectives and methodologies.

Forecast for Future Demand: The demand for data scientists and quants is projected to remain robust. The increasing digitization of industries, the advent of big data and AI technologies, and a growing awareness of the significance of data-driven decision-making will sustain this trend. Moreover, the evolving economic landscape, such as addressing climate change challenges and optimizing resource allocation, will create new avenues for quantitative professionals in areas like climate modeling, sustainability, and circular economy initiatives. As data becomes increasingly valuable, data scientists and quants will remain essential contributors to driving innovation and informed decision-making across industries.

#quantitative analysts#data scientists#AI technologies#IT Recruitment Agency#Analytics & IT Recruitment#Analytic Recruiting

1 note

·

View note

Text

Very dispassionate and clinical poli sci/conflict theory thoughts on a dark and emotionally charged topic here, regarding the tragic death of Aaron Bushnell: Others have pointed out the self-immolation, regardless of our feelings regarding the act, have on a quantitative level been not very successful at actually bringing about the political aims of those who carry out such acts. I agree with the evidence, it speaks for itself; however, I also think Aaron Bushnell's death appears somewhat distinct from previous case studies. The aspect of Aaron Bushnell's self-immolation that I do think is worth pointing out as somewhat unique to other self-immolation cases, is that he was a member of the organization (i.e. the US Armed Forces/U.S Government) whose behavior he was seeking to change, whereas most previous cases were appealing to either indifferent but powerful third parties, or their opponents themselves. The US climate scientist who immolated himself on the SCOTUS building plaza back in April 2022 wasn't a judge or a worker in the fossil fuel industry, for example. If your political opponents literally set themselves on fire, one would predict just carrying on carrying on, as has been the case in other self-immolation cases. That has not yet been demonstrated as the case when its 'your own' performing public and ghastly suicides - least of which because it evokes all the actions they could have taken as alternatives that most people would not.

In Bushnell's case, his self-immolation invokes the specter of a great many alternative actions he could have performed. Dying as painfully and as publicly as he did, by his own hand, suggests he did not fear punishment or sanction - how much damage could a cyber-defense analyst like Bushnell do if his principles convinced him he needed to undermine US support of the occupation in Gaza via sabotage, espionage, etc., indifferent to the personal peril involved? It arguably adds an entirely new dimension to the political calculus surrounding Gaza: how long can we support the siege if it creates the risk of another Aaron Bushnell? Especially if the next Bushnell is not content with only harming themself, and wishes to strike out against Americans or Israelis as well.

#aaron bushnell#i/p conflict#hopefully this strikes the right balance of discussing bushnell's death charitably without delving into valorization or hero worship#I think the latter subsets are questionable at the best of times#and so best refrained from in discussing the martyrdom of a real breathing person#might delete later idk

9 notes

·

View notes

Note

https://twitter.com/CineGeekNews/status/1735028345794855200

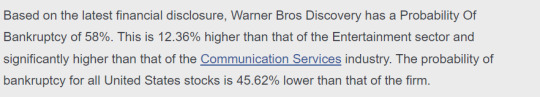

Warner Bros Discovery currently has an over 60% Probability of Bankruptcy.

I honestly am not sure if this is good or bad for the SPN revival. On the one hand, WB is NOT going to want to spend money on such a niche IP that will really mostly only draw ppl who were already fans if they are in such dire straits financially. On the other hand, they could bring in money by selling the IP to another studio who would obviously then want to actually do something with it since they spent money on it. But that also depends on another studio or streaming service wanting to do something with it which will be tougher. Netflix would make sense since they currently have SPN for streaming, except they will be losing their streaming rights at the end of 2025. A revival wouldn't even be released until then so why would Netflix want to put money into a revival of show that will, at that time, be streaming on a competitor (most likely Max since it will revert back to WB). Amazon is a possibility since both Jensen and Kripke are there (if they want to bring Kripke on for it) and Kripke seems to have some sway over there. But again, unless they buy the rights to SPN to stream on their platform, why would they want to make a show that will inadvertently benefit their competitor?

https://www.macroaxis.com/invest/ratio/WBD/Probability-Of-Bankruptcy#google_vignette

Oof... there's a boatload of information in that report that I just don't understand. (My year in finance did not make me an analyst, lol!)

I can see how the headline could be alarming, but I did see a couple of paragraphs that I believe are relevant to the discussion:

Basically, this all boils down to probability and analysis based on both quantitative and qualitative factors. You'll see in that first paragraph that they also take into consideration public headlines and social sentiment. Obviously, the WB's public presence is not good right now, but it doesn't necessarily mean they will be holding a fire sale of IP's anytime soon.

Now, to your question of how it might affect any reboot. Personally, I don't think the Supernatural IP is big enough for the WB to sell and have it make a difference on their books. If they were that strapped for cash, they'd sell the rights to a much bigger IP, like Loony Tunes (as we've already seen them try to scrap the new Wil. E. movie), or the Lego film franchise.

In the case that the WB keeps SPN, the question is, will they want to put money behind a short series reboot. In my opinion, no. Even though SPN does fairly well on Netflix, the first season viewing numbers don't even crack the top 1000 on Netflix. Plus, the WB has the most recent numbers of the miserably failed The Winchesters, which is still a part of the SPN IP (even though it had nothing to do with SPN as we know it.)

So, unless J2 can rally outside investors (and themselves) to pay for the majority of a reboot, (including convincing a different network to pay a licensing fee), I don't see the WB shelling out the money studios usually pay to produce a series.

But again, with the caveat that this is mostly guesswork on my part based on very little data (at least, data that I don't fully understand.)

#ask box#spn reboot speculation#warner bros bankruptcy speculation#it's all speculation#lol!#long post

13 notes

·

View notes