#RangeTrading

Explore tagged Tumblr posts

Text

In-Depth Exploration of Trading Strategies: Trend Following, Range Trading, Scalping, Mean Reversion, and Momentum Trading

The world of trading is vast and dynamic, with numerous strategies available for traders to exploit the financial markets. Among these strategies, five stand out due to their popularity and effectiveness: Trend Following, Range Trading, Scalping, Mean Reversion, and Momentum Trading. Each strategy involves a unique approach to market behavior, risk management, and decision-making. In this essay, we will explore these trading strategies in detail, providing real-life examples and evidence of their applications in various markets.

1. Trend Following

Trend following is one of the most widely used trading strategies, based on the simple premise that markets move in identifiable trends over time. Traders using this strategy seek to capitalize on sustained price movements in a particular direction, whether upward (bullish) or downward (bearish). The basic principle behind trend following is that "the trend is your friend" until it shows signs of reversing.

How It Works:

A trader identifies a prevailing trend using technical indicators such as moving averages, Relative Strength Index (RSI), or trendlines. Once the trend is confirmed, the trader enters a position in the direction of the trend, holding it as long as the price continues to move favorably.

Real-World Example:

During the COVID-19 pandemic, tech stocks like Amazon and Apple experienced a clear bullish trend as the world became more reliant on technology for remote work and e-commerce. Trend-following traders who identified this upward momentum early and entered positions enjoyed significant profits as these stocks rallied throughout 2020 and into 2021. Similarly, Bitcoin's historic rally from $10,000 to over $60,000 between 2020 and early 2021 offered substantial opportunities for trend followers in the cryptocurrency market.

Evidence:

The Turtle Traders Experiment in the 1980s, initiated by legendary traders Richard Dennis and William Eckhardt, demonstrated the effectiveness of trend following. Dennis trained a group of novices, and by applying simple trend-following rules, many of them became highly successful traders, turning significant profits from the futures market.

2. Range Trading

Range trading is a strategy focused on identifying assets that move within a well-defined price range over a certain period. In this strategy, traders aim to buy at the support level (the lower boundary of the range) and sell at the resistance level (the upper boundary), capturing profits from the asset's oscillation within that range.

How It Works:

Range traders use tools such as Bollinger Bands or horizontal support and resistance levels to identify the boundaries of a range. They then execute trades by buying when the price approaches support and selling when it nears resistance. This strategy assumes that price will revert to the mean when reaching these extremes.

Real-World Example:

Gold often trades in a range when there is no significant geopolitical or economic news driving its price. For instance, between mid-2018 and mid-2019, gold prices fluctuated between $1,200 and $1,350 per ounce. Traders using range trading strategies during this period could have profited from buying at the lower bound and selling at the upper bound of the range.

Evidence:

According to research by Ince and Porter (2006) on range-bound trading in the foreign exchange market, currency pairs like the EUR/USD often exhibit range-bound behavior during periods of market uncertainty. Range trading is especially effective in sideways markets where trends are not dominant.

3. Scalping

Scalping is a high-frequency trading strategy that aims to capture small price movements within a very short time frame. Scalpers enter and exit trades rapidly, often holding positions for only seconds to minutes. This strategy requires precision, quick decision-making, and the ability to manage risks effectively.

How It Works:

Scalpers typically rely on advanced technical analysis tools such as level 2 order book data, volume indicators, and short-term moving averages. They often use leverage to amplify returns, but due to the high frequency of trades, they must also be vigilant about transaction costs and slippage.

Real-World Example:

In the forex market, scalping is particularly popular due to its high liquidity and low spreads. Traders might take advantage of micro-movements in the EUR/USD pair during volatile news releases. For instance, during a significant U.S. economic data release (such as Non-Farm Payroll), scalpers may make multiple trades within a few minutes, capitalizing on short bursts of volatility.

Evidence:

Scalping is most commonly associated with high-frequency traders (HFT), who use algorithms to execute trades in milliseconds. Firms like Citadel Securities and Virtu Financial, some of the largest market makers, employ similar strategies to scalp profits in a range of markets, from equities to foreign exchange.

4. Mean Reversion

Mean reversion is a trading strategy that assumes asset prices tend to revert to their historical average or mean over time. Traders using this strategy seek to profit by buying assets that are undervalued or oversold and selling assets that are overvalued or overbought, expecting the price to return to its historical mean.

How It Works:

Traders use technical indicators such as Bollinger Bands, RSI, or moving averages to identify when an asset has strayed too far from its historical mean. When the price is considered oversold (below the mean), traders buy, and when it is overbought (above the mean), they sell.

Real-World Example:

A classic example of mean reversion can be observed in the S&P 500 index. After significant declines during market corrections or crashes (e.g., the 2008 financial crisis or the March 2020 COVID-19 crash), the index historically reverts to its upward trend, offering opportunities for mean reversion traders to buy during dips and profit from the recovery.

Evidence:

Academic research supports the concept of mean reversion, particularly in the bond and stock markets. In his study, Narayan et al. (2013) found that bond yields tend to revert to their historical means after deviating significantly, especially during periods of economic stress.

5. Momentum Trading

Momentum trading is based on the idea that assets that have shown strong price momentum in the past will continue to perform well in the future. Momentum traders capitalize on assets that exhibit significant upward or downward momentum, assuming that these price trends will persist for some time.

How It Works:

Momentum traders use technical indicators like the Moving Average Convergence Divergence (MACD), RSI, and rate of change (ROC) to identify assets with strong price momentum. The strategy is particularly effective in trending markets, as it seeks to ride the wave of strong price movements.

Real-World Example:

During the GameStop short squeeze in January 2021, momentum traders flocked to the stock after it showed explosive upward momentum driven by a short squeeze initiated by retail traders on platforms like Reddit. Traders who entered positions during the initial momentum phase reaped massive gains as the stock surged from under $20 to over $300 in a matter of days.

Evidence:

Research by Jegadeesh and Titman (1993) demonstrated that stocks exhibiting high returns over the past three to 12 months tend to outperform in the future, providing empirical support for momentum strategies. Their findings have been widely cited in the literature on behavioral finance and technical trading.

Conclusion

Each of these trading strategies—Trend Following, Range Trading, Scalping, Mean Reversion, and Momentum Trading—offers unique ways to exploit market behavior. Trend following is ideal for traders seeking to profit from long-term price movements, while range trading is suitable for markets that fluctuate within predictable boundaries. Scalping requires quick execution and low latency, making it suitable for fast-paced markets, while mean reversion caters to those looking to capitalize on price corrections. Momentum trading thrives in environments where price movements are sharp and sustained.

The key to success in any of these strategies lies in understanding the underlying market conditions and using appropriate risk management techniques. Traders should also be aware of transaction costs, market liquidity, and the emotional discipline required to execute these strategies effectively. With careful planning and execution, these strategies can provide consistent returns across various asset classes.

#TradingStrategies#TrendFollowing#RangeTrading#Scalping#MeanReversion#MomentumTrading#RiskManagement#DecisionMaking#FinancialMarkets#TradingApproaches#MarketAnalysis#Investing#FinancialLiteracy#TradingPsychology#MarketWizards#LegendaryTraders#RealLifeApplications#MarketInsights#FinancialMarketsEducation

0 notes

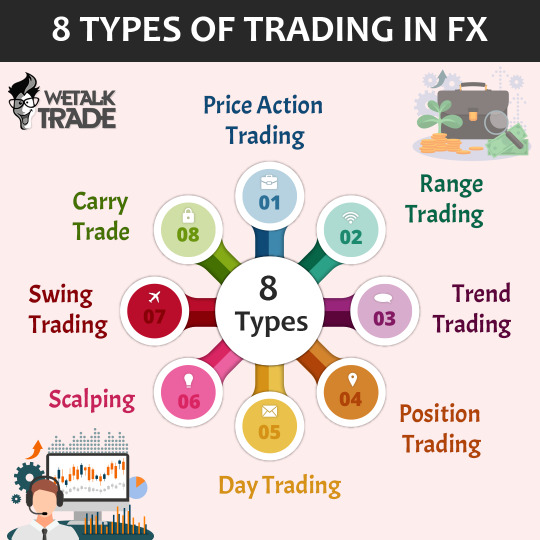

Photo

Pick the style that suits you

1 note

·

View note

Link

Each individual follows a certain trading style which suits him well and he adopts some trading strategies that work for his trading style.

Read the article to know more. https://tradersir.com/forex-trading-strategies-for-beginners/

#forex#tradingstrategies#rangetrading#trendtrading#support#resistance#riskrewardratio#tradingstyle#tradingeducation#tradersir

0 notes

Photo

Learn to adapt and survive! 3 Forex tips for you to adjust to the low volatility.

0 notes

Text

The Beginners Guide To Best Trading Strategy

Forex is a combination of foreign currency and exchange. exchange is that the method of fixing one currency into another currency for a huge sort of reasons, including:

• Commerce • Trading • Tourism

Forex, or exchange, is explained as a network of patrons and sellers, WHO transfers currency between associateother} at an united value. By doing these people, corporations and central banks convert one currency into another. whereas plenty of exchange is finished for sensible functions, the overwhelming majority of currency conversion is undertaken with the aim of earning a profit.

Learning the way to trade Forex are often an advanced method for beginners. the general public have a dream of obtaining wealthy long, which can prove precisely as false because it sounds. the globe of Forex commerce are often overwhelming, particularly after you area unit new the sport, and don’t grasp or perceive the principles yet. There area unit plenty of figures concerning several|what percentage|what number} traders with success build cash and the way many traders occur a loss of cash. the foremost common figure appears to be that ninetieth of traders occur a loss of cash, and solely 100 percent of traders area unit systematically profitable. what's it that this 100 percent do that place them during this league? initial, you'll need:

• A fast wit • The ability to figure and keep calm below stress • The courageousness to require risks • Persistence a • The ability to create fast selections

Decoding the foremost common terms employed in forex can speed up traders understanding of the globe of currencies: Currency Nicknames:

• Single Currency – EUR (Euro) • Loonie – CAD (Canadian dollar) • Swissie– CHF (Swiss franc) • Aussie – AUD (Australian dollar) • Kiwi – NZD (New Seeland dollar) • Greenback, Buck – USD (U.S. dollar) • Sterling, quid – GBP (British pound)

-Popular phrases

• Going Long – gap a optimistic (buying) trade • Going Short – gap a pessimistic (selling) trade • Cutting Short – to shut a losing position early • Plunging – A value that’s sinking or falling from its previous worth • Currency rallying – A value that recovers when a amount of its decline • Position Trading–Trading with Brobdingnagian stop-losses for many months to years, while not being too involved with short term movements in quality costs

Technical Indicators in Forex commerce methods Technical indicators area unit the calculations supported the worth and volume of security and area unit used each to substantiate the trend and therefore the quality of chart patterns, and to assist traders verify the obtain and sell signals.

• Moving Average • Bollinger Bands • Relative Strength Index (RSI) • Stochastic generator • Moving Average Convergence/Divergence (MACD) • RSI-Bars • ADX • Momentum

In Forex technical analysis a chart may be a graphical depiction of value movements over an explicit time-frame. It will show security’s value movement over a month or a year amount.

The Best Forex commerce methods are:

Perhaps the most important a part of forex commerce methods relies on the most sorts of Forex marketing research wont to perceive the market movement.

1. Forex Technical Analysis methods

What is Forex technical analysis? Forex technical analysis is that the study of market action by the first use of charts for the aim of prediction future value trends. Forex traders can develop best strategies and tips of trading based on various technical analysis tools together with –

• Market trends • Volume • Range • Support • Resistance levels • Chart patterns • Indicators

Forex traders will conduct a Multiple time-frame Analysis by the utilization of various timeframe charts. Technical analysis methods area unit an important methodology of evaluating assets supported the analysis and statistics of past market action, past costs and past volume.

2. Forex trend commerce Strategy

Trends represents one in every of the foremost essential ideas in technical analysis.All the technical analysis tools that area unit used have one purpose which is to assist determine the market trends. what's Forex Trend? very like the other trend as an example in fashion- it's the direction within which the market moves. a lot of exactly sensible to grasp, the exchange market doesn't move in an exceedingly line, however a lot of in sequent waves with clear peaks or highs and lows. looking on the movement of those ‘highs and lows’ one will then perceive the trend’s sort. There area unit 3 sorts of trends that the market will move in:

• Uptrend • Downtrend • Sideways Traders and investors confront 3 sorts of decisions: • To buy • To sell • Do nothing

Learn how to trade Forex. transfer our free e-book

During any kind of trend, traders ought to develop a particular strategy. The shopping for strategy is desirable once the market goes up and equally the commercialism strategy may be profitable once the market goes down. however once the market moves sideways the third possibility – to remain aside– are the cleverest call.

3. Support and Resistance commerce Strategy

In order to completely perceive the core of the support and resistance commerce strategy, traders ought to perceive what a horizontal level is. A horizontal level is:

A price index indicating either a support or resistance within the market. In technical terms – value lows and highs severally.

The term support indicates:

The space on the chart wherever the shopping for interest ispointedlystrong and exceeds the commercialism pressure.

The Resistance level indicates:

An space on the chart wherever commercialism interest overpowers shopping for pressure. It isusually markedby previous peaks.

In order to develop a support andresistance strategy traders ought to be conscious of however the trend is known through these horizontal levels.

4. Forex RangeTrading Strategy

What is vary trading?

• A vary commerce strategy (Channel trading) is generally related to the shortage of market direction and it's used throughout the absence of a trend.

Range trading identifies currency price movement in channels to find the range. This process is carried out by connecting a series of highs and lows with a horizontal trendline.

5. Forex Volume trading strategy

The volume shows the number of securities that are traded over a particular time.

• Higher volume = higher degree of intensity or pressure.

In order to determine the upward or downward movement of the volume, traders should look at the trading volume bars usually presented at the bottom of the chart.Any price movement is more significant if accompanied by a relatively high volume + a weak volume. Take note:Not all volume types may influence the trade, it’s the volume of large amounts of money that is traded within the same day and greatly affects the market.

6. Multiple Time Frame Analysis Strategy

Using Multiple Time Frame Analysis suggests following a certain security price over different time frames. Itisa very useful strategy for traders to analyse various time frames while determining the “trading circle” of the security. Through the Multiple Time Frame Analysis (MTFA) traders can regulate the trend both on smaller and bigger scales and recognize the overall market trend. The whole process of MTFA starts with the exact identification of the market direction on higher time frames (long, short or intermediary) and analysing it through lower time frames starting from a 5-minute chart.

7. Forex Trading Strategy Based on Fundamental Analysis

While technical analysis is focused on the study and past performance of market action, Forex fundamental analysis focusses on the fundamental reasons that make an influence on the market direction.

8. Forex Trading Strategy Based on Market Sentiment

Market sentiment is defined by investors’ attitude towards the financial market or particular security. What and how people feel and how it behaves in Forex market is the notion behind the market sentiment strategy. Forex trading strategies can also be developed by following popular trading styles including day trading, carry trade, buy and hold strategy, hedging, portfolio trading, spread trading, swing trading, order trading and algorithmic trading.

Selecting A Trading Strategy

Selecting a trading strategy doesn’t have to be complicated and you don’t have to stick with just one. A key thing to remember is that the best traders are adaptable and can change their trading strategy based on opportunities. Therefore, it’s a good idea to learn about each individual trading strategy and by combining different approaches to trading, you will become adaptive to each situation. Nevertheless, remember not to become disheartened if you encounter initial losses on your capital. Patience is key when learning to become a successful trader, and mistakes and losses are inevitable in order to grow and develop your trading skills. Successful traders often track their profits and losses, which helps to maintain their consistency and discipline across all trades. Read full review and article- Tips and Strategies for trading on Xlntrade that could help to improve your trade performance.

#xlntrade#xlntrade maxico#trading strategy#best trading platform#best trading system#best trading strategy#best trading tips#forex trading#forex broker

0 notes

Text

USDJPY stays in n/t range-trading, with the upside being in focus

New Post has been published on http://u.to/5_nkDA

USDJPY stays in n/t range-trading, with the upside being in focus

EURUSD

Near-term consolidation above 1.0895 low, remains capped by falling trendline that connects 1.1712 and 1.1458 peaks, which currently lies at 1.1042. Barrier is reinforced by falling daily 10SMA and together with 200SMA at 1.1106, marks strong resistance zone, which is seen capping upside attempts, ahead of fresh push lower. Near-term studies are in neutral/negative mode, while bears prevail on daily technicals and favor bearish resumption of larger bear-leg from 1.1494, peak of 15 Oct, after completion of corrective phase from 1.0895, 28 Oct low. Alternatively, sustained break above 200SMA and 1.1124, Fibonacci 38.2% of 1.1494/1.0895 downleg, would sideline bears, in favor of extended correction.

Res:1.1029; 1.1042; 1.1071; 1.1094 Sup: 1.0983; 1.0964; 1.0937; 1.0895

GBPUSD

Cable entered near-term consolidative phase, after yesterday’s attack at key 1.5506, stalled ticks below the barrier, after unsuccessful attempt above daily Ichimoku cloud top at 1.5475. Subsequent easing returned below daily cloud base at 1.5435, however, dips found temporary support at 1.5400, Fibonacci 38.2% of 1.5240/1.5495 upleg. This marks consolidation range floor and is expected to hold and keep immediate focus at the upside. Bullishly aligned near-term studies, support the notion. On the other side, yesterday’s daily candle with long upper shadow, signals rising pressure, along with bearish momentum building up, seeing potential for stronger pullback on loss of 1.54 handle. Extension below 1.54 and violation of daily 20SMA at 1.5371 is needed to confirm scenario.

Res: 1.5435; 1.5475; 1.5495; 1.5506 Sup: 1.5400; 1.5371; 1.5338; 1.5300

USDJPY

The pair probes again above daily Ichimoku cloud top at 120.70, following yesterday’s positive close that occurred ticks above cloud’s top. However, the price action remains entrenched within near-term range established between120.00/121.46 and sustained break of either range boundary will signal fresh direction. Near-term studies hold bullish/neutral tone, while daily indicators are bullishly aligned, but setup of MA’s is still mixed. Lift above daily Ichimoku cloud top, to expose 121.03, 200SMA, which guards key barriers at 121.46, consolidation top and 121.64, 31 Aug high and top of multi-month congestion. Daily Tenkan-sen marks initial support at 120.53, ahead of psychological 120 handle, also range floor and widened daily cloud base at 119.76.

Res: 120.83; 121.03; 121.46; 121.64 Sup: 120.53; 120.16; 120.00; 119.76

USDTRY

The pair breaks above 2.8107/2.8347, near-term consolidation range, in attempts to resume recovery, following yesterday’s over 5% fall on strong gap-lower opening, after which the price posted fresh 3-month low at 2.7575. Indecision was seen after yesterday’s wide-range trade between 2.7575 and 2.8577, as trading ended in a shape of long-legged Doji candle. Extended consolidation between fresh low at 2.7575 and strong barrier at 2.8590, former low of 23 Oct / daily Ichimoku cloud base, which capped yesterday’s upside attempts is seen as favored near-term scenario. Overall structure is firmly bearish and favors fresh downside attempts, after completion of consolidative phase. Initial resistance lies at 2.8500, Daily Tenkan-sen line, which guards pivotal 2.8590 barrier, penetration of which would sideline bearish scenarios and signal further correction. Next pivot lies at 2.8719, Fibonacci 61.8% of 2.9426/2.7575 fall, while regain of descending daily 20SMA, currently at 2.8997, will neutralize bears and open way filling Monday’s gap

Res: 2.8500; 2.8590; 2.8719; 2.8997 Sup: 2.8105; 2.7989; 2.7781; 2.7575

Read More http://u.to/5_nkDA

1 note

·

View note

Text

USDJPY stays in n/t range-trading, with the upside being in focus

New Post has been published on http://u.to/5_nkDA

USDJPY stays in n/t range-trading, with the upside being in focus

EURUSD

Near-term consolidation above 1.0895 low, remains capped by falling trendline that connects 1.1712 and 1.1458 peaks, which currently lies at 1.1042. Barrier is reinforced by falling daily 10SMA and together with 200SMA at 1.1106, marks strong resistance zone, which is seen capping upside attempts, ahead of fresh push lower. Near-term studies are in neutral/negative mode, while bears prevail on daily technicals and favor bearish resumption of larger bear-leg from 1.1494, peak of 15 Oct, after completion of corrective phase from 1.0895, 28 Oct low. Alternatively, sustained break above 200SMA and 1.1124, Fibonacci 38.2% of 1.1494/1.0895 downleg, would sideline bears, in favor of extended correction.

Res:1.1029; 1.1042; 1.1071; 1.1094 Sup: 1.0983; 1.0964; 1.0937; 1.0895

GBPUSD

Cable entered near-term consolidative phase, after yesterday’s attack at key 1.5506, stalled ticks below the barrier, after unsuccessful attempt above daily Ichimoku cloud top at 1.5475. Subsequent easing returned below daily cloud base at 1.5435, however, dips found temporary support at 1.5400, Fibonacci 38.2% of 1.5240/1.5495 upleg. This marks consolidation range floor and is expected to hold and keep immediate focus at the upside. Bullishly aligned near-term studies, support the notion. On the other side, yesterday’s daily candle with long upper shadow, signals rising pressure, along with bearish momentum building up, seeing potential for stronger pullback on loss of 1.54 handle. Extension below 1.54 and violation of daily 20SMA at 1.5371 is needed to confirm scenario.

Res: 1.5435; 1.5475; 1.5495; 1.5506 Sup: 1.5400; 1.5371; 1.5338; 1.5300

USDJPY

The pair probes again above daily Ichimoku cloud top at 120.70, following yesterday’s positive close that occurred ticks above cloud’s top. However, the price action remains entrenched within near-term range established between120.00/121.46 and sustained break of either range boundary will signal fresh direction. Near-term studies hold bullish/neutral tone, while daily indicators are bullishly aligned, but setup of MA’s is still mixed. Lift above daily Ichimoku cloud top, to expose 121.03, 200SMA, which guards key barriers at 121.46, consolidation top and 121.64, 31 Aug high and top of multi-month congestion. Daily Tenkan-sen marks initial support at 120.53, ahead of psychological 120 handle, also range floor and widened daily cloud base at 119.76.

Res: 120.83; 121.03; 121.46; 121.64 Sup: 120.53; 120.16; 120.00; 119.76

USDTRY

The pair breaks above 2.8107/2.8347, near-term consolidation range, in attempts to resume recovery, following yesterday’s over 5% fall on strong gap-lower opening, after which the price posted fresh 3-month low at 2.7575. Indecision was seen after yesterday’s wide-range trade between 2.7575 and 2.8577, as trading ended in a shape of long-legged Doji candle. Extended consolidation between fresh low at 2.7575 and strong barrier at 2.8590, former low of 23 Oct / daily Ichimoku cloud base, which capped yesterday’s upside attempts is seen as favored near-term scenario. Overall structure is firmly bearish and favors fresh downside attempts, after completion of consolidative phase. Initial resistance lies at 2.8500, Daily Tenkan-sen line, which guards pivotal 2.8590 barrier, penetration of which would sideline bearish scenarios and signal further correction. Next pivot lies at 2.8719, Fibonacci 61.8% of 2.9426/2.7575 fall, while regain of descending daily 20SMA, currently at 2.8997, will neutralize bears and open way filling Monday’s gap

Res: 2.8500; 2.8590; 2.8719; 2.8997 Sup: 2.8105; 2.7989; 2.7781; 2.7575

Read More http://u.to/5_nkDA

0 notes

Text

USDJPY stays in n/t range-trading, with the upside being in focus

New Post has been published on http://u.to/5_nkDA

USDJPY stays in n/t range-trading, with the upside being in focus

EURUSD

Near-term consolidation above 1.0895 low, remains capped by falling trendline that connects 1.1712 and 1.1458 peaks, which currently lies at 1.1042. Barrier is reinforced by falling daily 10SMA and together with 200SMA at 1.1106, marks strong resistance zone, which is seen capping upside attempts, ahead of fresh push lower. Near-term studies are in neutral/negative mode, while bears prevail on daily technicals and favor bearish resumption of larger bear-leg from 1.1494, peak of 15 Oct, after completion of corrective phase from 1.0895, 28 Oct low. Alternatively, sustained break above 200SMA and 1.1124, Fibonacci 38.2% of 1.1494/1.0895 downleg, would sideline bears, in favor of extended correction.

Res:1.1029; 1.1042; 1.1071; 1.1094 Sup: 1.0983; 1.0964; 1.0937; 1.0895

GBPUSD

Cable entered near-term consolidative phase, after yesterday’s attack at key 1.5506, stalled ticks below the barrier, after unsuccessful attempt above daily Ichimoku cloud top at 1.5475. Subsequent easing returned below daily cloud base at 1.5435, however, dips found temporary support at 1.5400, Fibonacci 38.2% of 1.5240/1.5495 upleg. This marks consolidation range floor and is expected to hold and keep immediate focus at the upside. Bullishly aligned near-term studies, support the notion. On the other side, yesterday’s daily candle with long upper shadow, signals rising pressure, along with bearish momentum building up, seeing potential for stronger pullback on loss of 1.54 handle. Extension below 1.54 and violation of daily 20SMA at 1.5371 is needed to confirm scenario.

Res: 1.5435; 1.5475; 1.5495; 1.5506 Sup: 1.5400; 1.5371; 1.5338; 1.5300

USDJPY

The pair probes again above daily Ichimoku cloud top at 120.70, following yesterday’s positive close that occurred ticks above cloud’s top. However, the price action remains entrenched within near-term range established between120.00/121.46 and sustained break of either range boundary will signal fresh direction. Near-term studies hold bullish/neutral tone, while daily indicators are bullishly aligned, but setup of MA’s is still mixed. Lift above daily Ichimoku cloud top, to expose 121.03, 200SMA, which guards key barriers at 121.46, consolidation top and 121.64, 31 Aug high and top of multi-month congestion. Daily Tenkan-sen marks initial support at 120.53, ahead of psychological 120 handle, also range floor and widened daily cloud base at 119.76.

Res: 120.83; 121.03; 121.46; 121.64 Sup: 120.53; 120.16; 120.00; 119.76

USDTRY

The pair breaks above 2.8107/2.8347, near-term consolidation range, in attempts to resume recovery, following yesterday’s over 5% fall on strong gap-lower opening, after which the price posted fresh 3-month low at 2.7575. Indecision was seen after yesterday’s wide-range trade between 2.7575 and 2.8577, as trading ended in a shape of long-legged Doji candle. Extended consolidation between fresh low at 2.7575 and strong barrier at 2.8590, former low of 23 Oct / daily Ichimoku cloud base, which capped yesterday’s upside attempts is seen as favored near-term scenario. Overall structure is firmly bearish and favors fresh downside attempts, after completion of consolidative phase. Initial resistance lies at 2.8500, Daily Tenkan-sen line, which guards pivotal 2.8590 barrier, penetration of which would sideline bearish scenarios and signal further correction. Next pivot lies at 2.8719, Fibonacci 61.8% of 2.9426/2.7575 fall, while regain of descending daily 20SMA, currently at 2.8997, will neutralize bears and open way filling Monday’s gap

Res: 2.8500; 2.8590; 2.8719; 2.8997 Sup: 2.8105; 2.7989; 2.7781; 2.7575

Read More http://u.to/5_nkDA

0 notes

Text

USDJPY stays in n/t range-trading, with the upside being in focus

New Post has been published on http://u.to/5_nkDA

USDJPY stays in n/t range-trading, with the upside being in focus

EURUSD

Near-term consolidation above 1.0895 low, remains capped by falling trendline that connects 1.1712 and 1.1458 peaks, which currently lies at 1.1042. Barrier is reinforced by falling daily 10SMA and together with 200SMA at 1.1106, marks strong resistance zone, which is seen capping upside attempts, ahead of fresh push lower. Near-term studies are in neutral/negative mode, while bears prevail on daily technicals and favor bearish resumption of larger bear-leg from 1.1494, peak of 15 Oct, after completion of corrective phase from 1.0895, 28 Oct low. Alternatively, sustained break above 200SMA and 1.1124, Fibonacci 38.2% of 1.1494/1.0895 downleg, would sideline bears, in favor of extended correction.

Res:1.1029; 1.1042; 1.1071; 1.1094 Sup: 1.0983; 1.0964; 1.0937; 1.0895

GBPUSD

Cable entered near-term consolidative phase, after yesterday’s attack at key 1.5506, stalled ticks below the barrier, after unsuccessful attempt above daily Ichimoku cloud top at 1.5475. Subsequent easing returned below daily cloud base at 1.5435, however, dips found temporary support at 1.5400, Fibonacci 38.2% of 1.5240/1.5495 upleg. This marks consolidation range floor and is expected to hold and keep immediate focus at the upside. Bullishly aligned near-term studies, support the notion. On the other side, yesterday’s daily candle with long upper shadow, signals rising pressure, along with bearish momentum building up, seeing potential for stronger pullback on loss of 1.54 handle. Extension below 1.54 and violation of daily 20SMA at 1.5371 is needed to confirm scenario.

Res: 1.5435; 1.5475; 1.5495; 1.5506 Sup: 1.5400; 1.5371; 1.5338; 1.5300

USDJPY

The pair probes again above daily Ichimoku cloud top at 120.70, following yesterday’s positive close that occurred ticks above cloud’s top. However, the price action remains entrenched within near-term range established between120.00/121.46 and sustained break of either range boundary will signal fresh direction. Near-term studies hold bullish/neutral tone, while daily indicators are bullishly aligned, but setup of MA’s is still mixed. Lift above daily Ichimoku cloud top, to expose 121.03, 200SMA, which guards key barriers at 121.46, consolidation top and 121.64, 31 Aug high and top of multi-month congestion. Daily Tenkan-sen marks initial support at 120.53, ahead of psychological 120 handle, also range floor and widened daily cloud base at 119.76.

Res: 120.83; 121.03; 121.46; 121.64 Sup: 120.53; 120.16; 120.00; 119.76

USDTRY

The pair breaks above 2.8107/2.8347, near-term consolidation range, in attempts to resume recovery, following yesterday’s over 5% fall on strong gap-lower opening, after which the price posted fresh 3-month low at 2.7575. Indecision was seen after yesterday’s wide-range trade between 2.7575 and 2.8577, as trading ended in a shape of long-legged Doji candle. Extended consolidation between fresh low at 2.7575 and strong barrier at 2.8590, former low of 23 Oct / daily Ichimoku cloud base, which capped yesterday’s upside attempts is seen as favored near-term scenario. Overall structure is firmly bearish and favors fresh downside attempts, after completion of consolidative phase. Initial resistance lies at 2.8500, Daily Tenkan-sen line, which guards pivotal 2.8590 barrier, penetration of which would sideline bearish scenarios and signal further correction. Next pivot lies at 2.8719, Fibonacci 61.8% of 2.9426/2.7575 fall, while regain of descending daily 20SMA, currently at 2.8997, will neutralize bears and open way filling Monday’s gap

Res: 2.8500; 2.8590; 2.8719; 2.8997 Sup: 2.8105; 2.7989; 2.7781; 2.7575

Read More http://u.to/5_nkDA

0 notes

Text

USDJPY stays in n/t range-trading, with the upside being in focus

New Post has been published on http://u.to/5_nkDA

USDJPY stays in n/t range-trading, with the upside being in focus

EURUSD

Near-term consolidation above 1.0895 low, remains capped by falling trendline that connects 1.1712 and 1.1458 peaks, which currently lies at 1.1042. Barrier is reinforced by falling daily 10SMA and together with 200SMA at 1.1106, marks strong resistance zone, which is seen capping upside attempts, ahead of fresh push lower. Near-term studies are in neutral/negative mode, while bears prevail on daily technicals and favor bearish resumption of larger bear-leg from 1.1494, peak of 15 Oct, after completion of corrective phase from 1.0895, 28 Oct low. Alternatively, sustained break above 200SMA and 1.1124, Fibonacci 38.2% of 1.1494/1.0895 downleg, would sideline bears, in favor of extended correction.

Res:1.1029; 1.1042; 1.1071; 1.1094 Sup: 1.0983; 1.0964; 1.0937; 1.0895

GBPUSD

Cable entered near-term consolidative phase, after yesterday’s attack at key 1.5506, stalled ticks below the barrier, after unsuccessful attempt above daily Ichimoku cloud top at 1.5475. Subsequent easing returned below daily cloud base at 1.5435, however, dips found temporary support at 1.5400, Fibonacci 38.2% of 1.5240/1.5495 upleg. This marks consolidation range floor and is expected to hold and keep immediate focus at the upside. Bullishly aligned near-term studies, support the notion. On the other side, yesterday’s daily candle with long upper shadow, signals rising pressure, along with bearish momentum building up, seeing potential for stronger pullback on loss of 1.54 handle. Extension below 1.54 and violation of daily 20SMA at 1.5371 is needed to confirm scenario.

Res: 1.5435; 1.5475; 1.5495; 1.5506 Sup: 1.5400; 1.5371; 1.5338; 1.5300

USDJPY

The pair probes again above daily Ichimoku cloud top at 120.70, following yesterday’s positive close that occurred ticks above cloud’s top. However, the price action remains entrenched within near-term range established between120.00/121.46 and sustained break of either range boundary will signal fresh direction. Near-term studies hold bullish/neutral tone, while daily indicators are bullishly aligned, but setup of MA’s is still mixed. Lift above daily Ichimoku cloud top, to expose 121.03, 200SMA, which guards key barriers at 121.46, consolidation top and 121.64, 31 Aug high and top of multi-month congestion. Daily Tenkan-sen marks initial support at 120.53, ahead of psychological 120 handle, also range floor and widened daily cloud base at 119.76.

Res: 120.83; 121.03; 121.46; 121.64 Sup: 120.53; 120.16; 120.00; 119.76

USDTRY

The pair breaks above 2.8107/2.8347, near-term consolidation range, in attempts to resume recovery, following yesterday’s over 5% fall on strong gap-lower opening, after which the price posted fresh 3-month low at 2.7575. Indecision was seen after yesterday’s wide-range trade between 2.7575 and 2.8577, as trading ended in a shape of long-legged Doji candle. Extended consolidation between fresh low at 2.7575 and strong barrier at 2.8590, former low of 23 Oct / daily Ichimoku cloud base, which capped yesterday’s upside attempts is seen as favored near-term scenario. Overall structure is firmly bearish and favors fresh downside attempts, after completion of consolidative phase. Initial resistance lies at 2.8500, Daily Tenkan-sen line, which guards pivotal 2.8590 barrier, penetration of which would sideline bearish scenarios and signal further correction. Next pivot lies at 2.8719, Fibonacci 61.8% of 2.9426/2.7575 fall, while regain of descending daily 20SMA, currently at 2.8997, will neutralize bears and open way filling Monday’s gap

Res: 2.8500; 2.8590; 2.8719; 2.8997 Sup: 2.8105; 2.7989; 2.7781; 2.7575

Read More http://u.to/5_nkDA

0 notes

Photo

Pick the style that suits you

3 notes

·

View notes

Link

Each individual follows a certain trading style which suits him well and he adopts some trading strategies that work for his trading style.

Read the article to know more. https://tradersir.com/forex-trading-strategies-for-beginners/

#forex#tradingstrategies#rangetrading#trendtrading#support#resistance#riskrewardratio#tradingstyle#tradingeducation#tradersir

0 notes

Text

USDJPY stays in n/t range-trading, with the upside being in focus

New Post has been published on http://u.to/5_nkDA

USDJPY stays in n/t range-trading, with the upside being in focus

EURUSD

Near-term consolidation above 1.0895 low, remains capped by falling trendline that connects 1.1712 and 1.1458 peaks, which currently lies at 1.1042. Barrier is reinforced by falling daily 10SMA and together with 200SMA at 1.1106, marks strong resistance zone, which is seen capping upside attempts, ahead of fresh push lower. Near-term studies are in neutral/negative mode, while bears prevail on daily technicals and favor bearish resumption of larger bear-leg from 1.1494, peak of 15 Oct, after completion of corrective phase from 1.0895, 28 Oct low. Alternatively, sustained break above 200SMA and 1.1124, Fibonacci 38.2% of 1.1494/1.0895 downleg, would sideline bears, in favor of extended correction.

Res:1.1029; 1.1042; 1.1071; 1.1094 Sup: 1.0983; 1.0964; 1.0937; 1.0895

GBPUSD

Cable entered near-term consolidative phase, after yesterday’s attack at key 1.5506, stalled ticks below the barrier, after unsuccessful attempt above daily Ichimoku cloud top at 1.5475. Subsequent easing returned below daily cloud base at 1.5435, however, dips found temporary support at 1.5400, Fibonacci 38.2% of 1.5240/1.5495 upleg. This marks consolidation range floor and is expected to hold and keep immediate focus at the upside. Bullishly aligned near-term studies, support the notion. On the other side, yesterday’s daily candle with long upper shadow, signals rising pressure, along with bearish momentum building up, seeing potential for stronger pullback on loss of 1.54 handle. Extension below 1.54 and violation of daily 20SMA at 1.5371 is needed to confirm scenario.

Res: 1.5435; 1.5475; 1.5495; 1.5506 Sup: 1.5400; 1.5371; 1.5338; 1.5300

USDJPY

The pair probes again above daily Ichimoku cloud top at 120.70, following yesterday’s positive close that occurred ticks above cloud’s top. However, the price action remains entrenched within near-term range established between120.00/121.46 and sustained break of either range boundary will signal fresh direction. Near-term studies hold bullish/neutral tone, while daily indicators are bullishly aligned, but setup of MA’s is still mixed. Lift above daily Ichimoku cloud top, to expose 121.03, 200SMA, which guards key barriers at 121.46, consolidation top and 121.64, 31 Aug high and top of multi-month congestion. Daily Tenkan-sen marks initial support at 120.53, ahead of psychological 120 handle, also range floor and widened daily cloud base at 119.76.

Res: 120.83; 121.03; 121.46; 121.64 Sup: 120.53; 120.16; 120.00; 119.76

USDTRY

The pair breaks above 2.8107/2.8347, near-term consolidation range, in attempts to resume recovery, following yesterday’s over 5% fall on strong gap-lower opening, after which the price posted fresh 3-month low at 2.7575. Indecision was seen after yesterday’s wide-range trade between 2.7575 and 2.8577, as trading ended in a shape of long-legged Doji candle. Extended consolidation between fresh low at 2.7575 and strong barrier at 2.8590, former low of 23 Oct / daily Ichimoku cloud base, which capped yesterday’s upside attempts is seen as favored near-term scenario. Overall structure is firmly bearish and favors fresh downside attempts, after completion of consolidative phase. Initial resistance lies at 2.8500, Daily Tenkan-sen line, which guards pivotal 2.8590 barrier, penetration of which would sideline bearish scenarios and signal further correction. Next pivot lies at 2.8719, Fibonacci 61.8% of 2.9426/2.7575 fall, while regain of descending daily 20SMA, currently at 2.8997, will neutralize bears and open way filling Monday’s gap

Res: 2.8500; 2.8590; 2.8719; 2.8997 Sup: 2.8105; 2.7989; 2.7781; 2.7575

Read More http://u.to/5_nkDA

0 notes

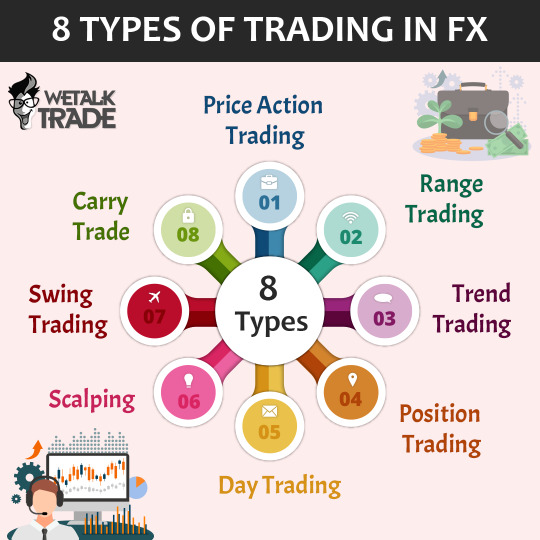

Photo

All roads lead to same destination. But what is your way of doing it? Choose the one which suits to your personality.

2 notes

·

View notes

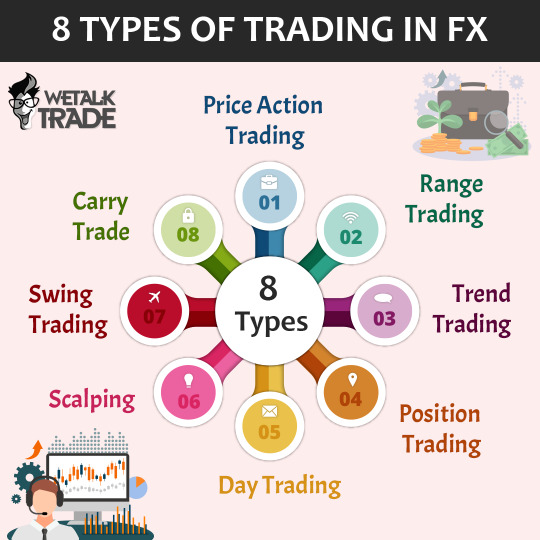

Photo

8 Types of Trading in FX.

#fxtrading#priceaction#rangetrading#trendtrading#positiontrading#daytrading#scalping#swingtrading#carrytrade#tradingtips#wetalktrade

0 notes

Photo

All roads lead to same destination. But what is your way of doing it? Choose the one which suits to your personality.

0 notes