#Remit Software

Explore tagged Tumblr posts

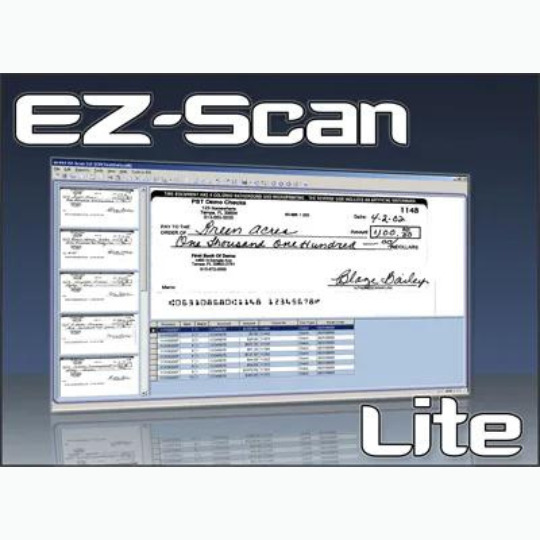

Photo

Efficient Check Scanner TS240 for Quick and Accurate Check Processing

Are you sick and tired of the hassles and holdups caused by manual check processing? Look no farther than the Check Scanner TS240, a state-of-the-art tool created to optimize and speed your check handling processes. With its cutting-edge technology and unparalleled performance, the Check Scanner TS240 assures quick and precise processing while saving you time and effort.

0 notes

Text

Choose the Best Money Remittance Software?

Are you planning to start your own online money transfer business and looking for the best money remittance software then this is for you? Ezulix Software is a leading money transfers software provider company in India since 2018. We are offering the best quality money remittance platform for a b2b business. By using our money transfer online software you can create unlimited members all over India and can make money by offering them money transfer service at the lowest surcharge. For more details visit my blog now.

#money remittance software#money remit software#money transfer software#money transfer software provider#money transfer online software

1 note

·

View note

Text

Bookkeeping Mistakes Made By Small Businesses: How To Avoid Them

Small and Medium-sized businesses are eager to grow, but they often miss the fundamentals like understanding the value of Bookkeeping which may undermine business procedures.

Accounting is often overlooked by business owners who consider it easy. Incorrect accounting and bookkeeping processes may adversely impact any company’s finances. Recurring bookkeeping errors can actually bankrupt your business.

Bookkeeping Mistakes

Keeping financial records is a very important part of running a business, big or small. Bookkeeping that is accurate and well-organized makes sure that your financial records are up-to-date and precise, which helps you make good decisions and compliance with legal policies.

There are however some mistakes that small businesses often make with their books. Here are some of these mistakes.

Failure To Keep Records

Some small businesses fail to keep accurate financial records, which can lead to confusion and errors. Record-keeping is an essential process in organizing your financial records. Adopt best practices and create a system for organizing and storing your financial documents. These relevant documents may include invoices, receipts, and bank statements. It is helpful to consider using accounting software to automate the process and centralize everything.

Irregular Reconciling of Accounts

Failure to reconcile your bank and credit card accounts on a regular basis can lead to inconsistencies and inaccuracies. Reconciliation entails matching your financial records with your bank and credit card statements. Reconcile your accounts on a regular basis and resolve any discrepancies quickly to avoid problems.

Combining Personal and Business-Related Finances

It is critical to separate your personal and business finances by avoiding using personal accounts for business transactions. This can complicate bookkeeping and make it difficult to accurately track expenses and income. You must establish a separate business bank account and use it solely for business transactions.

Inconsistent Categorization

It is critical to properly categorize your income and expenses for accurate financial reporting. Refrain from inconsistent or ambiguous categorization, as it can make evaluating of your company’s financial health a lot more difficult. It will be helpful to create a chart of accounts with distinct categories that correspond to your field of business and use it regularly.

Neglecting Cash Transactions

Small businesses often transact in cash, which can be overlooked easily and not properly recorded. To ensure that cash transactions are accurately accounted for, use cash registers, petty cash logs, or digital tools. Better yet, set up a system for keeping track of and documenting all cash transactions, including sales and expenses.

Failure To Keep Track of Receivables and Payables

Failure to maintain track of unpaid invoices (accounts receivable) and bills to be paid (accounts payable) might jeopardize your cash flow and client-vendor relationships. Use accounting software with invoicing and payment tracking features to implement a structured strategy for monitoring and following up on both receivables and payables.

Mishandling Payroll

Payroll can be complicated, and mistakes can have legal and financial ramifications. Keep up with advances in payroll requirements, calculate wages and taxes accurately, and make timely payments to employees and tax authorities. To ensure accuracy and compliance, consider adopting efficient payroll software or you can also outsource payroll duties.

Failure To Keep Backup of Records

Financial records might be lost because of corrupted data, hardware failure, or other unanticipated factors. Back up your financial data on a regular basis and keep it secure. Cloud accounting software can back up your data automatically to add an extra degree of security.

Neglect To Track and Remit Sales Taxes

If your company is obligated to collect sales taxes, it is critical that you track and remit them appropriately. Understand your sales tax duties, register with the proper tax authorities, and maintain accurate sales and tax collection records. To simplify the process, consider employing seamless sales tax automation software.

Doing-It-Yourself

This is a critical error that can have serious consequences for your company. Because bookkeeping is a complex process, it is best to seek professional help from a bookkeeper or accountant to set up and review your bookkeeping system on a regular basis. They can assist you in avoiding mistakes, providing financial insights, and ensuring tax compliance.

You can reduce the likelihood of these frequent errors and retain accurate financial records for your small business by being proactive and following appropriate bookkeeping practices with the help of expert bookkeepers and record-keepers.

How to Avoid Bookkeeping Errors

To avoid bookkeeping errors some proactive steps must be taken by small business owners. This may include familiarizing yourself with basic bookkeeping principles and practices to help you navigate your financial records effectively and make informed decisions.

This can be further established by using a good bookkeeping system coupled with reliable accounting software. As a business owner, it is important to invest in a reputable accounting software solution that suits the needs of your business and reduces errors.

In addition, it is important to reconcile accounts regularly to ensure your financial records match financial statements to help identify discrepancies and errors promptly.

Keep meticulous records by maintaining detailed records of all financial transactions and accept that it is always best to seek professional assistance from reliable bookkeepers and record-keepers who specializes in small business finances.

By implementing these practices, small business owners can reduce the likelihood of committing bookkeeping errors while maintaining accurate financial records.

The Bottomline

When you own a company, you put yourself in a position to take advantage of many different possibilities, including the chance to learn from your errors. When it comes to making mistakes, the key to success is to steer clear of those that are readily apparent and cut down on others as much as you possibly can. Remember that good bookkeeping and record-keeping practices contribute to informed decision-making and long-term business success.

Consider this list seriously and implement its suggestion so you will be well on your way to running your business in profitable ways and expanding it in all ways possible.

There is more that you can achieve with the most reliable team of professional bookkeepers and record-keepers. Visit us now and get started!

#bookkeepingservicesca#recordkeepingcalifornia#smallbusinesssolutionsca#healthcaresupport#healthcare bookkeeping#cpa firm

7 notes

·

View notes

Text

Bookkeeping Solutions for E-commerce Businesses

The rapid growth of online commerce has transformed how businesses operate, but it has also introduced new financial challenges. From managing multiple sales channels to tracking inventory and processing digital payments, bookkeeping in e-commerce is far more complex than traditional retail. Without the right solutions, small online businesses risk financial disorganization, inaccurate reporting, and costly compliance issues. To stay competitive and profitable, e-commerce entrepreneurs must adopt bookkeeping practices tailored specifically to their needs.

Managing Multi-Channel Sales and Payment Processors

E-commerce businesses often sell products on several platforms such as Shopify, Amazon, Etsy, and eBay. Each of these platforms has its own reporting systems, fees, and payout schedules. Proper bookkeeping involves reconciling sales across all channels and integrating them into a central accounting system. This requires linking payment processors like PayPal, Stripe, or Square and accounting for transaction fees, chargebacks, and refunds. Without proper reconciliation, it’s easy to overestimate revenue or underreport expenses, which can distort the true financial health of the business.

Real-Time Inventory and Cost of Goods Sold Tracking

Unlike traditional stores, e-commerce businesses typically manage inventory across warehouses or third-party logistics providers. Effective bookkeeping must include real-time inventory tracking and accurate recording of the cost of goods sold (COGS). This allows business owners to evaluate profit margins and make smarter decisions about purchasing and pricing. Automated tools that sync inventory with accounting platforms like QuickBooks or Xero help maintain up-to-date records and reduce human error.

Sales Tax Compliance Across States

Sales tax compliance is one of the biggest challenges for e-commerce businesses. Since online sales often cross state lines, business owners must stay compliant with a patchwork of state and local tax laws. This means identifying nexus in various states, registering for sales tax permits, and filing returns regularly. A solid bookkeeping solution will automate the tracking of tax obligations based on where products are sold and shipped. Using tools like TaxJar or Avalara in combination with your bookkeeping system ensures that taxes are collected and remitted accurately.

Handling Returns and Refunds

Returns and refunds are a common part of the e-commerce world, and they must be handled properly in your bookkeeping system. Each return affects inventory, revenue, and sometimes sales tax liability. Properly recording these transactions ensures that your financial statements remain accurate and up-to-date. Good bookkeeping software allows you to create reverse entries for returns and maintain consistent inventory counts.

Cash Flow Monitoring and Financial Reporting

E-commerce businesses often deal with high volume but low margin sales, making cash flow management critical. Bookkeeping systems should generate reports that reflect real-time financial performance, including profit and loss, balance sheets, and cash flow statements. This enables business owners to make data-driven decisions, plan for growth, and avoid unnecessary debt.

Conclusion

E-commerce bookkeeping demands precision, integration, and real-time data management. With sales happening around the clock and across various platforms, having a customized system is essential. Fortunately, there are experts offering bookkeeping services for small businesses who specialize in the e-commerce space. Their guidance can streamline operations, ensure tax compliance, and provide valuable insights that empower your business to grow with confidence.

0 notes

Text

2025 Payroll Tax Compliance: Overcoming Multi-State Payroll Challenges

As companies expand their remote and hybrid workforces, payroll compliance has become a maze of state-by-state regulations. In 2025, multi-state payroll challenges are at the forefront of employer concerns, with tax jurisdictions evolving faster than ever.

Businesses must now navigate a wide range of state and local tax laws, manage location-based employee data, and stay compliant with income tax and unemployment insurance requirements across the U.S. This article breaks down the key issues and how to stay compliant in today’s dynamic work environment.

Why Multi-State Payroll Is a 2025 Priority

With employees working remotely from different locations, businesses can no longer afford to treat payroll as a one-size-fits-all process. In fact, even having a single employee in another state can create significant tax and reporting obligations.

What’s driving the complexity?

Hybrid work models: Employees are no longer confined to a single office.

State audits are increasing: States are cracking down on businesses that fail to properly register and remit taxes.

Changing legislation: State and local governments continue to adjust payroll-related laws to adapt to post-pandemic employment trends.

Key Payroll Tax Compliance Challenges in 2025

Let’s explore the most common pain points companies are facing this year when managing multi-state payroll:

1. Determining Where Payroll Taxes Are Owed

Payroll taxes are generally owed in the state where the employee physically performs their work. This creates challenges when:

Employees move between states

Teams are distributed nationwide

Temporary work assignments are common

Example: A software developer based in California temporarily relocates to Colorado for three months. The company must evaluate whether that triggers a payroll tax obligation in Colorado.

2. Tracking Employee Locations Accurately

To comply with state income tax and unemployment insurance rules, employers need to know where employees are working day-to-day.

Common issues:

Inaccurate employee address records

Lack of real-time location tracking

Employees failing to report changes

Solution: Implement tools that track and verify employee locations through GPS or self-reporting portals.

3. Managing State Income Tax Withholding

Each state has its own rules on how and when employers should withhold income taxes. Some states have no income tax, while others require withholding even if the employee works there only temporarily.

Residency matters: Some states tax based on residency, others on work location.

No reciprocity: Many states do not have reciprocal tax agreements with others.

Employers must understand the specifics of each state their employees work in—there’s no universal standard.

4. Understanding Unemployment Insurance Rules

Determining the correct state to pay State Unemployment Tax (SUTA) can be challenging, especially for remote workers.

Key considerations:

Primary work location

Where the employee receives supervision

Where business operations are managed

The U.S. Department of Labor provides a four-factor test to help determine the appropriate SUTA state—but interpretation can still vary by state.

5. Navigating Local and City-Level Payroll Taxes

In addition to state requirements, certain cities and municipalities levy local income or payroll taxes. Employers must track, calculate, and remit these taxes based on where employees live or work.

Cities with notable local tax laws:

New York City (NY)

Philadelphia (PA)

Denver (CO)

San Francisco (CA)

Pro tip: Don’t assume your payroll software automatically handles all local tax obligations—manual setup may be required.

How to Stay Compliant with Multi-State Payroll in 2025

Multi-state payroll compliance isn’t just about avoiding penalties—it’s about building a scalable, employee-friendly HR system. Here’s how to do it:

1. Audit Employee Locations Regularly

Create a process to verify employee addresses and work locations on a quarterly basis. Even temporary moves can affect payroll obligations.

2. Register with Tax Authorities in Every State

If you have a tax nexus in a state—meaning a business or employment presence—you’ll need to register for state income tax withholding and unemployment insurance there.

Tip: Keep copies of registration confirmations and filing credentials for each state.

3. Use Payroll Software Designed for Multi-State Compliance

Modern payroll platforms can manage multiple state tax rates, forms, and filing schedules. Choose a provider with:

Auto-updated tax tables

State-specific compliance tools

Built-in audit logs

4. Train Payroll and HR Teams on State Rules

Make sure your staff understands key concepts like:

Tax nexus

Reciprocity agreements

State-specific filing frequencies

SUTA guidelines

Knowledge is your first line of defense against non-compliance.

5. Partner with Legal and Tax Experts

Complex scenarios—such as employees working in multiple states simultaneously or working abroad—require expert guidance. Outsourcing tax research or consulting with multi-state tax professionals can save time and money.

Consequences of Non-Compliance

Failing to comply with multi-state payroll regulations can lead to serious consequences:

Fines and penalties for incorrect filings

Interest on unpaid taxes

State audits and back tax liabilities

Loss of employee trust due to payroll errors

In 2025, states are collaborating more than ever, sharing payroll data across jurisdictions to identify companies that haven’t registered or are under-reporting.

Looking Ahead: Payroll Trends Beyond 2025

As we look to the future, multi-state payroll compliance will likely become even more automated—but also more regulated. Employers should prepare for:

Real-time tax updates through integrated payroll APIs

Tighter audit controls using AI and cross-state data sharing

Greater employee control over tax withholding and location reporting

Companies that invest in compliance today will be better positioned to grow across borders tomorrow.

For more information about Payroll Tax 2025 visit here- Mastering 2025 Payroll Taxes: Key Changes & Best Practices

Conclusion

Managing multi-state payroll in 2025 isn’t just a tax issue—it’s a strategic challenge that affects HR, finance, operations, and employee satisfaction. By staying informed, adopting the right technologies, and seeking expert advice, businesses can not only avoid costly penalties but also build a more agile, compliant workforce.

0 notes

Text

Complete Guide to Business and Legal Registrations in Coimbatore

Coimbatore, often referred to as the "Manchester of South India," is a prominent industrial hub and an emerging entrepreneurial hotspot in Tamil Nadu. Whether you're looking to start a small business or a large enterprise, it's crucial to understand the various business and legal registrations that ensure your business operates within the bounds of the law. The registration processes not only provide legal protection but also offer credibility and trust, which are vital for both customers and investors.

In this guide, we will walk you through the essential business and legal registrations you may need when starting or expanding a business in Coimbatore.

1. Trademark Registration in Coimbatore

The first and one of the most important steps for any new business is protecting your intellectual property. Trademark registration protects your unique business name, logo, and tagline. By registering your trademark, you can ensure that no one else can legally use your brand name or logo. It also increases your brand value and offers a competitive edge in the market. To learn more about the trademark registration process, check out Trademark Registration in Coimbatore.

2. Copyright Registration in Coimbatore

For businesses in creative industries, copyright registration is vital. This legal process protects original works such as books, music, films, and software from unauthorized use. By registering your creative works, you prevent others from reproducing, distributing, or performing your work without your permission. For more information, visit Copyright Registration in Coimbatore.

3. Patent Registration in Coimbatore

If you have developed a new invention or technology, patent registration is essential to safeguard your innovation. A patent gives you exclusive rights over the invention, allowing you to prevent others from making, using, or selling your patented invention. This is crucial for businesses in sectors such as technology and manufacturing. To know more about patent registration in Coimbatore, visit Patent Registration in Coimbatore.

4. Design Registration in Coimbatore

Design registration is important for businesses that produce unique visual designs for their products. Whether it's a fashion brand, automobile company, or electronics manufacturer, protecting your designs ensures that your intellectual property remains exclusive to you. Learn more about the benefits of Design Registration in Coimbatore.

5. GST Registration in Coimbatore

Goods and Services Tax (GST) registration is mandatory for any business that exceeds the prescribed turnover limit. GST registration enables businesses to collect tax from customers and remit it to the government. It also allows businesses to claim input tax credit on their purchases. To understand the registration process and its benefits, visit GST Registration in Coimbatore.

6. Private Limited Company Registration in Coimbatore

A Private Limited Company is the most popular form of business registration in India. It provides limited liability protection to shareholders, which means their personal assets are protected from business debts. Registering a Private Limited Company also increases the credibility of your business. To know more about the process, visit Private Limited Company Registration in Coimbatore.

7. Partnership Firm Registration in Coimbatore

A partnership firm allows two or more individuals to run a business together, sharing profits and losses. Registering your partnership firm is an essential step in making the business legally recognized. Learn more about Partnership Firm Registration in Coimbatore.

8. LLP Registration in Coimbatore

A Limited Liability Partnership (LLP) is a hybrid form of business that combines the flexibility of a partnership with the limited liability protection of a company. It’s an excellent choice for small to medium-sized enterprises. For more information on how to register an LLP in Coimbatore, visit LLP Registration in Coimbatore.

9. OPC Registration in Coimbatore

One Person Company (OPC) registration is ideal for single entrepreneurs who want to limit their liability while running their business independently. It’s an emerging model for solo entrepreneurs. Learn more about registering your OPC by visiting OPC Registration in Coimbatore.

10. Section 8 Company Registration in Coimbatore

If you're planning to establish a non-profit organization, Section 8 Company Registration is an excellent option. It allows you to run a charitable, social, or educational organization with the privileges of a company. For detailed guidance, visit Section 8 Company Registration in Coimbatore.

11. Trust Registration in Coimbatore

Establishing a Trust is an essential step if you want to run charitable activities in a structured and legal way. Trusts can manage assets for educational or religious purposes. To register your Trust in Coimbatore, check out Trust Registration in Coimbatore.

12. Society Registration in Coimbatore

A Society is another form of non-profit organization typically formed for cultural, educational, or charitable purposes. Registering a society provides legal recognition and structure for your operations. For more information, visit Society Registration in Coimbatore.

13. Nidhi Company Registration in Coimbatore

A Nidhi Company is a type of non-banking financial company that primarily focuses on lending and borrowing money among its members. To establish a Nidhi Company in Coimbatore, visit Nidhi Company Registration in Coimbatore.

14. ISO Certification in Coimbatore

ISO Certification is a testament to the quality standards followed by your business. It is widely recognized internationally and can enhance your business’s reputation and competitiveness. Learn about obtaining ISO Certification in Coimbatore.

15. Digital Signature Certificate in Coimbatore

A Digital Signature Certificate (DSC) is a key requirement for e-filing government documents and signing contracts digitally. For a secure and legally accepted way of doing business, Digital Signature Certificate in Coimbatore is essential.

16. Barcode Registration in Coimbatore

Barcode registration is critical for businesses that deal with retail products. It allows your products to be easily scanned and tracked, which is essential for inventory and sales management. Find out more about Barcode Registration in Coimbatore.

17. Udyam Registration in Coimbatore

For businesses classified as Micro, Small, or Medium Enterprises (MSMEs), Udyam Registration is mandatory. It provides access to government schemes and subsidies. Learn more about the registration process by visiting Udyam Registration in Coimbatore.

18. IEC Code Registration in Coimbatore

If you plan to engage in import and export, obtaining an Import Export Code (IEC) is a must. It’s required to clear customs for your goods. Find out how to register for IEC Code in Coimbatore.

19. APEDA Registration in Coimbatore

APEDA (Agricultural and Processed Food Products Export Development Authority) registration is necessary for businesses dealing with agricultural products. This certification enables you to export food products legally. For more information, visit APEDA Registration in Coimbatore.

20. AEPC Registration in Coimbatore

For businesses in the apparel industry, AEPC registration is required to ensure legal compliance when exporting garments. To learn more, visit AEPC Registration in Coimbatore.

21. FSSAI Registration in Coimbatore

For food businesses, FSSAI registration ensures that your products meet food safety standards. It’s crucial for the credibility and safety of your food-related business. Learn about FSSAI Registration in Coimbatore.

22. Legal Metrology Certification in Coimbatore

If your business involves measuring instruments (such as weights and measures), Legal Metrology Certification is mandatory. It ensures that your instruments comply with legal standards. Find out more about Legal Metrology Certification in Coimbatore.

23. ESI and PF Registration in Coimbatore

For businesses with employees, registering for ESI (Employee State Insurance) and PF (Provident Fund) ensures that your employees receive benefits like healthcare and retirement savings. Learn more about ESI and PF Registration in Coimbatore

0 notes

Text

Understanding Reverse Charge Mechanism in GST: 2025 Updates

The Goods and Services Tax (GST) includes the Reverse Charge Mechanism (RCM) as a fundamental component of indirect taxation that continues to be essential for India. Businesses operating in 2025 need to monitor the most recent GST reverse charge compliance requirements along with its application scope and implications toward financial operations. This platform presents contemporary information about the GST reverse charge mechanism which features new guidelines for compliance processes alongside specific updates for different businesses sectors.

What is Reverse Charge Mechanism in GST?

Under GST, the reverse charge mechanism allows purchasers to directly bear the tax responsibility for their transactions. The recipient becomes responsible for GST tax obligations under the RCM system because they determine the payable taxes before remitting them at face value while also claiming ITC benefits. The method exists to confirm tax adherence when suppliers carry exemptions or non-registration or belong to declared government categories.

How Does Reverse Charge Work in GST?

All businesses need to perform the following three actions under GST reverse-charge rules:

Determine all business scenarios requiring Reverse Charge Mechanism under GST.

Firms should compute and send GST payments to the governmental system directly.

All businesses should retain compliance records to apply for input tax credit benefits.

All transactions subject to the GST reverse charge requirement need reporting in monthly return documents.

Tax revenues are collected under RCM under GST from businesses making transactions with unregistered suppliers while raising their compliance requirements.

Reverse Charge Mechanism Applicability in India (2025 Updates)

The applicability of the reverse charge mechanism in India continues to evolve with changing tax regulations. As of 2025, the following categories remain subject to the GST reverse charge on services and goods:

1. Government-Notified Goods and Services

The government now includes more services under the scope of reverse charge tax application. Some notable categories include:

The provision of legal services through an advocate comes under the reverse charge tax requirements.

Transportation of goods by GTA (Goods Transport Agency). A company could previously deduct services received from its director before the implementation of the GST Act.

Digital service providers operating from outside India serving Indian consumers.

E-commerce operators for certain transactions (as per 2025 amendments).

2. Transactions from Unregistered to Registered Dealers

If a registered dealer purchases from an unregistered supplier, the registered recipient must pay GST liability under RCM applicability. This rule has been extended in 2025 to include:

Certain imports where tax is now collected under RCM.

Services provided by freelancers and gig workers above a specific turnover threshold.

Who is Liable to Pay Tax Under Reverse Charge?

Under RCM under GST, the recipient of goods or services must pay the tax directly to the government. This ensures tax compliance even when suppliers are not registered or fall within specific exemption categories.

GST Reverse Charge on Services and Goods: 2025 Examples

Services Covered Under RCM

Legal & professional services provided by advocates, chartered accountants, and consultants.

E-commerce services, where platforms facilitate transactions for unregistered suppliers.

Import of services, including software subscriptions and cloud services from international providers.

Goods Covered Under RCM

Raw materials purchased from unregistered suppliers.

Scrap & waste materials, where collection agencies operate outside the GST registration framework.

Agricultural products, where tax liabilities are assigned to large buyers.

RCM vs Forward Charge in GST (2025 Updates)

Aspect

Reverse Charge Mechanism (RCM)

Forward Charge Mechanism

Tax Liability

Paid by the recipient

Paid by the supplier

Invoice Issuance

Recipient generates self-invoice

Supplier issues invoice

ITC Claim

Allowed after tax payment

Allowed immediately

Compliance Requirement

More stringent

Less complex

GST Reverse Charge Compliance Requirements in 2025

Businesses liable for GST reverse charge compliance requirements must:

Pay GST on applicable transactions as per the updated rates.

Issue self-invoices for RCM transactions.

Report RCM under GST in monthly GST returns (GSTR-1 & GSTR-3B).

Maintain digital records as per the new compliance standards.

Ensure the automated reconciliation of RCM payments within GST filings.

Non-compliance with RCM applicability can lead to higher penalties and stricter audits, as per the revised GST laws in 2025.

How to Claim ITC on Reverse Charge in GST?

A major advantage of GST reverse charge is the ability to claim ITC on reverse charge in GST. The steps to claim ITC remain:

Pay GST liability under RCM.

Record the transaction in GSTR-3B.

Claim input tax credit in the next eligible return.

Ensure invoice matching for faster claim approval.

In 2025, the government has introduced automated verification for input tax credit claims, thus reducing processing delays and minimizing errors.

Latest Updates on Reverse Charge Mechanism in GST (2025)

The RCM system includes new services which now includes some digital services and select operations from the gig economy.

A system exists for automated verification of RCM payments within GST filing applications.

Even greater financial consequences are imposed on those who fail to adhere to RCM self-invoicing requirements; however, it's important to note that not all RCM transactions require self-invoicing—this typically applies only to transactions with unregistered suppliers.

E-commerce operators are liable for RCM payments only when facilitating specific services, such as transportation; it's important to note that this liability does not apply to all services.

The ITC claim process under RCM remains complex, especially with increased scrutiny, contrary to the misleading impression of it being simplified.

Impact of RCM on Businesses

Advantages:

Ensures tax compliance for transactions involving unregistered suppliers.

Allows businesses to claim input tax credit effectively.

Reduces tax evasion and increases government revenue.

Improved automation in compliance, reducing manual errors.

Challenges:

Increased GST compliance burden, requiring digital record-keeping.

Need for accurate reporting to avoid penalties.

Cash flow constraints due to upfront tax payments under RCM.

Conclusion

Businesses need to stay aware of the recent developments regarding the GST reverse charge mechanism in 2025. The understanding of how reverse charge works under GST leads businesses to establish effective tax planning systems through accurate reporting and maximize their potential for input tax deductions. Businesses that follow GST reverse charge compliance rules can both handle their tax responsibilities effectively and prevent tax penalties.

Businesses that maintain knowledge about GST reverse charge mechanism differences with forward charge methods alongside best practices for GST application will achieve better indirect tax management in the Indian market of 2025.

Recent 2025 updates under GST include a reduced e-invoicing threshold of ₹1 crore and mandatory e-invoicing for credit notes. RCM changes include a refund mechanism for excess payments, adjusted liability options, and updated rules for services like commercial rent and scrap dealing.

0 notes

Text

Real Estate Agent Tax Tips and Financial Planning

Success in real estate hinges on closing deals and how well agents manage their finances. Whether you're an industry veteran or just earning your first commission, a sound financial strategy can distinguish a thriving career from one burdened by tax stress.

1. Understand Your Tax Classification Real estate agents typically operate as independent contractors. This classification means you're responsible for your own taxes, including both income and self-employment tax. It’s crucial to understand what this means for quarterly payments, deductions, and financial liability.

2. Separate Business and Personal Finances Commingling funds is a cardinal sin in the eyes of the IRS. Open a dedicated business bank account and use separate credit cards for work-related expenses. It simplifies bookkeeping and protects you during audits.

3. Track Every Expense Meticulously Mileage, client lunches, MLS fees, staging costs—these all count. Keep digital receipts and consider using tools like QuickBooks or Expensify to automate the process. Proper tracking maximizes your deductions.

4. Leverage the Power of Deductions Deductions can substantially reduce your taxable income. Common deductible expenses include:

Advertising and marketing costs

Home office setup and utilities

Continuing education and license renewal fees

Phone and internet bills proportioned for business use

5. Maximize Vehicle Write-Offs You likely rack up miles showing homes and attending appointments. Use IRS standard mileage rates or actual expense methods to write off vehicle costs. Log every trip—yes, even that quick detour to the home improvement store.

6. Plan for Quarterly Estimated Taxes Avoid sticker shock in April by setting aside tax payments each quarter. Use IRS Form 1040-ES to estimate and remit your payments. Falling behind here can lead to penalties and an overwhelming tax bill.

7. Save for Retirement Early and Often Tax-advantaged retirement accounts like a SEP IRA or Solo 401(k) not only build your future nest egg but also lower taxable income. Make regular contributions and take advantage of compound interest.

8. Invest in a Professional Accountant A CPA familiar with real estate can uncover overlooked deductions, ensure compliance, and provide strategic tax planning. Consider it an investment in peace of mind.

9. Embrace Real Estate-Specific Software Tools like Realtyzam and BrokerMint simplify accounting, commissions, and even transaction coordination. Automation isn’t just trendy—it’s financially prudent.

10. Consider Incorporating Your Business Once your income stabilizes, forming an S-Corp or LLC might yield tax advantages. S-Corps can reduce self-employment taxes through a reasonable salary and dividend structure.

11. Pay Yourself a Salary Treating your income like a business, rather than a piggy bank, fosters discipline. Paying yourself a monthly salary helps with budgeting and predictable tax withholding.

12. Prepare for Income Fluctuations Real estate income is notoriously variable. Build a financial buffer of 3-6 months' expenses. In lean seasons, you’ll thank yourself.

13. Budget for Business Growth Marketing campaigns, better CRM tools, a part-time assistant—allocate funds to grow your brand and scale operations. Every dollar spent should have a projected ROI.

14. Know What You Owe Local and Provincial Authorities Real estate agents often forget about state or provincial taxes. Stay ahead by researching or consulting an expert familiar with your locale’s obligations. For example, if you're based in Alberta, here’s a helpful guide to get started: how to become a real estate agent in Alberta.

15. Document Your Income Rigorously Commissions, referral fees, bonuses—document all incoming funds. This ensures accurate reporting and builds trust with lenders should you seek financing.

16. Evaluate Health Insurance Options Self-employed professionals need private insurance or marketplace plans. Premiums may be deductible, and some HSAs offer additional tax benefits.

17. Create an Emergency Tax Fund Even with quarterly payments, tax discrepancies can happen. A small reserve can save you from panic and penalties.

18. Understand Capital Gains Implications If you invest in property personally, be aware of short- and long-term capital gains rules. Holding periods and renovation costs can drastically affect your tax liability.

19. Watch Out for Audit Triggers Huge mileage deductions, inconsistent income reports, or unverified expenses can raise red flags. Keep documentation clean and consistent.

20. Review and Adjust Annually Each year brings changes in income, deductions, and tax law. Make a habit of reviewing your financial plan and adjusting strategies with your accountant’s help.

Tax planning and financial strategy are not just for accountants. They’re vital tools for any real estate agent aiming for sustainable success. With the right systems and habits in place, you can spend less time worrying about taxes and more time doing what you love—closing deals and building dreams.

0 notes

Text

GST In Australia - Accomate Australia

Understanding GST and Its Impact on Accomate Australia

Introduction to GST Goods and Services Tax (GST) is a broad-based consumption tax levied on most goods and services in Australia. At a standard rate of 10%, GST applies to businesses that meet the turnover threshold of AUD 75,000 or more annually. Businesses are required to register for GST, charge it on taxable supplies, and remit it to the Australian Taxation Office (ATO). Understanding how GST applies is essential for businesses, including those in the accommodation sector, such as Accomate Australia.

How GST Affects the Accommodation Industry The accommodation industry is significantly impacted by GST regulations, as most services provided—such as short-term stays, hotel bookings, and serviced apartments—fall under taxable supplies. Businesses like Accomate Australia, which facilitates accommodation solutions, must consider GST compliance in pricing, invoicing, and tax reporting.

GST Compliance for Accomate Australia

GST Registration: Accomate Australia must ensure it is registered for GST if its turnover exceeds the threshold. Registration allows the business to claim input tax credits for GST paid on business expenses.

Charging GST: The company must include a 10% GST in the prices of accommodation services and clearly display it in invoices and receipts issued to customers.

Claiming Input Tax Credits: Accomate Australia can claim GST credits on business-related expenses such as property maintenance, utilities, and booking platform fees, reducing overall tax liability.

BAS Lodgment: The company must lodge a Business Activity Statement (BAS) regularly, reporting collected GST and claimed input tax credits to the ATO.

GST Exemptions and Special Cases While short-term accommodations are subject to GST, certain long-term rentals (over 27 days) may be GST-exempt or taxed differently. Accomate Australia must carefully assess lease durations to determine the correct tax treatment. Additionally, if international guests are involved, tax considerations may vary depending on residency status and service nature.

Managing GST Efficiently To streamline GST compliance, Accomate Australia can:

Use accounting software like Xero or MYOB to track GST transactions accurately.

Seek professional tax advisory to ensure adherence to GST rules and claim eligible deductions.

Maintain clear and organized financial records to simplify tax reporting.

Conclusion:-

GST plays a crucial role in Australia’s tax system and directly impacts businesses in the accommodation sector, including Accomate Australia. By staying compliant with GST regulations, registering properly, and optimizing tax credits, the company can efficiently manage its tax obligations while continuing to offer quality accommodation services. Understanding GST ensures financial transparency, minimizes risks, and fosters sustainable business growth in the hospitality industry.

𝐀𝐜𝐜𝐨𝐦𝐚𝐭𝐞 𝐀𝐮𝐬𝐭𝐫𝐚𝐥𝐢𝐚 :- https://accomate.au

Accomate Global — https://accomateglobal.com

Instagram — https://instagram.com/accomateglobal_pty_ltd/

Facebook — https://facebook.com/accomateglobalptyltd/

0 notes

Text

Effortless Scanning Made Easy with EZ-Scan

An innovative scanning method for quick document digitalization is called EZ-Scan. To increase productivity and expedite your scanning duties, learn about the simplicity of EZ-Scan and book mark it for quick access.

0 notes

Text

How ERP Software Helps Dubai Businesses Stay VAT-Compliant

Value-Added Tax (VAT) compliance is a crucial aspect of business operations in Dubai. Since the introduction of VAT in the UAE in 2018, businesses have been required to maintain accurate financial records, generate tax invoices, and file VAT returns in accordance with Federal Tax Authority (FTA) regulations. Enterprise Resource Planning (ERP) software plays a vital role in ensuring businesses remain compliant while streamlining financial management processes.

1. Automated VAT Calculation and Compliance

One of the key features of ERP software is its ability to automatically calculate VAT on transactions. The system applies the correct VAT rates based on the nature of the goods or services, ensuring that businesses charge and remit VAT accurately. This reduces human errors and ensures compliance with FTA regulations.

2. Real-Time Financial Reporting

ERP software provides real-time financial reporting capabilities, which help businesses monitor their VAT liabilities effectively. With automated reporting features, companies can generate VAT-compliant reports, track input and output tax, and prepare for VAT returns without manual intervention.

3. VAT-Compliant Invoicing

Dubai businesses are required to issue VAT-compliant tax invoices containing essential details such as the TRN (Tax Registration Number), VAT amount, and applicable rates. ERP software ensures that all invoices generated comply with FTA guidelines, reducing the risk of penalties due to non-compliance.

4. Accurate Record-Keeping for Audits

The FTA mandates that businesses maintain VAT-related records for at least five years. ERP software helps businesses store and organize all financial documents, including invoices, credit notes, and VAT reports, in a structured and easily retrievable manner. This simplifies the audit process and ensures businesses are prepared for any regulatory inspections.

5. Simplified VAT Return Filing

ERP solutions integrate VAT return filing features, enabling businesses to generate VAT reports in the required format. These reports can be directly submitted to the FTA portal, reducing manual work and ensuring timely submissions to avoid penalties.

6. Multi-Currency and Multi-Tax Support

For businesses that operate internationally or deal with multiple currencies, ERP software offers multi-currency and multi-tax support. This ensures that VAT is correctly applied based on the country’s tax regulations while maintaining compliance with UAE VAT laws.

7. Reducing Manual Errors and Enhancing Efficiency

Manual VAT calculations and reporting can lead to errors, miscalculations, and compliance risks. ERP software automates these processes, ensuring that VAT calculations, invoices, and reports are accurate. This saves time, reduces administrative burdens, and enhances overall business efficiency.

Conclusion

Staying VAT-compliant is essential for businesses operating in Dubai. ERP Software Dubai simplifies VAT management by automating calculations, ensuring accurate record-keeping, and streamlining VAT return filing. By investing in a robust ERP system, businesses can focus on growth while maintaining compliance with UAE tax regulations.

If your business is looking for a reliable ERP solution to manage VAT compliance efficiently, consider choosing an ERP software tailored for Dubai's regulatory requirements.

0 notes

Text

Dubai Manpower Agency: Your Guide to Hiring & Recruitment

Introduction

Dubai is one of the world trade capitals, in which employers and individuals can equally find themselves with unlimited opportunities. Despite this, exploiting the right persons from this market with so many contestants can be intimidating. This is where a manpower agency in Dubai can guide you. Whether you are an employer who is demanding appointment of qualified employees or candidates seeking employment, provide manpower services recruitment in Dubai, making the process easier, faster and more convenient. But what are they? Okay, let us find out the domain to recruit and hire in Dubai!

What is a Dubai Manpower Agency?

A Dubai manpower agency is an organization that takes on hiring the ideal candidate to companies. They provide an intermediary service from employers to employees, bringing both together in the best way they are able.

Why Think About a Manpower Agency in Dubai?

Time-Saving: The hiring process takes time, while agencies make things easier.

Access to Talent: They possess a ginormous talent pool of workers.

Legal Compliance: They arrange all hiring processes to comply with UAE labor law.

Expertise: Agencies have industry knowledge to find the best fit for your company.

Types of Recruitment Services Offered

Temporary Staffing: Short-term employees for projects or peak seasons.

Permanent Placement: Finding long-term employees for businesses.

Executive Search: Recruiting high-level executives.

Blue-Collar Recruitment: Hiring skilled laborers for construction, logistics, and manufacturing.

How Dubai’s Job Market Works

Dubai's employment market is vibrant with strong demand for employment in industries such as construction, healthcare, hospitality, IT, and finance. Expat workers are drawn to Dubai from all over the globe, resulting in competitive and rapid recruitment.

Dubai Legal Requirements for Employment

Employers have to abide by UAE labor law, which entails:

Work Permits & Visas: Necessary for expat hiring.

Employment Contracts: Need to be registered by the Ministry of Human Resources.

End-of-Service Benefits: The employer should remit gratuity compensation to employees.

Steps to Selecting the Appropriate Manpower Agency

Check Licensing: Verify that the agency is properly licensed in Dubai.

Industry Experience: Engage only agencies with experience in your industry.

Reputation: Review feedback and request references from clients.

Transparency: Verify that no additional fees are charged.

Steps to Recruitment by a Manpower Agency

Determine Your Needs: Specify the job function and requirements.

Select a Trustworthy Agency: Research and select an authentic agency.

Provide Job Description: Advertise information regarding the job.

Screening & Shortlisting: The agency shortlists and screens applicants on your behalf.

Interview & Final Appointment: Conduct the interview and complete the final hiring formalities.

Visa & Work Permit Processing: The agency does the paperwork on the legal side.

Industries Which Stand to Gain by Using Manpower Agencies

Construction (engineers, laborers, project managers)

Healthcare (doctors, nurses, hospital staff)

Hospitality (hotel staff, cleaners, chefs)

IT & Technology (cyber security professionals, software developers)

Retail & Customer Service (customer care executives, sales managers)

Fee for Engaging a Manpower Agency

Decided by:

The job position complexity

The recruitment process complexity

Level of experience needed

Other services such as visa facilitation

Common Problems and How to Overcome Them

High Turnover Levels: Provide competitive pay and benefits.

Skill Shortfalls: Offer training schemes.

Legal Problems: Employ an educated agency.

Dubai Recruitment Market Trends

Growing Remote Work: Organizations employ worldwide talent.

Emphasis on Digital Skills: The demand for tech talent increases.

Diversity & Inclusion: Organizations practice inclusive recruitment.

How Job Seekers Can Gain Advantage through Manpower Agencies

Single Window Access to Job Openings

Speed Recruitment Process

Resume & Interview Counselling

Visa & Work Permit Support

The Major Differences between Temporary and Permanent Staffing

Temporary employment: Work related to a project, short-term contracts.

Permanent employment: Permanently staffed career jobs with benefits.

Recruitment Future in Dubai

As digital recruiting sites and technology improve, hiring becomes even more effective. More companies are now relying on technology to increase candidate match and accelerate the hiring process.

Conclusion

Your Dubai manpower agency can be your best friend when you are looking for the ideal candidate or when you want to get a job in this competitive world. As a job seeker or employer, your knowledge regarding how recruitment agencies work can be a good thing on your side. Alliance Recruitment Agency is here to help you navigate this journey. Contact us today to find the best staffing solutions for your needs.

View source: https://recruitmentagencyfranchise.hashnode.dev/dubai-manpower-agency-your-guide-to-hiring-and-recruitment

0 notes

Text

The Role of Trucking Accounting Advisors in Streamlining Payroll Systems

Managing payroll in the trucking industry presents unique challenges, from handling multi-state tax withholdings to tracking driver payments based on mileage, hours, or loads delivered. Ensuring compliance with labor laws, tax regulations, and benefits administration can be complex and time-consuming. Trucking accounting advisors play a crucial role in streamlining payroll systems, ensuring accuracy, efficiency, and compliance while reducing administrative burdens for trucking companies.

Ensuring Accurate Driver Compensation

Trucking companies must manage different pay structures, including hourly wages, per-mile rates, percentage-based pay, and bonuses. Each driver’s compensation varies based on factors such as experience, location, and contract terms. Accounting advisors help trucking businesses establish efficient payroll systems that accurately track and calculate driver earnings, ensuring fair and timely payments. They also assist in setting up automated payroll software that reduces errors and minimizes discrepancies.

Managing Multi-State Payroll Tax Compliance

Trucking companies operating across multiple states must comply with various payroll tax laws, including state income tax withholding, unemployment insurance, and workers' compensation. Each state has different tax rates and reporting requirements, creating significant compliance challenges. Trucking accounting advisors ensure businesses correctly withhold and remit payroll taxes to the appropriate state agencies. They also help companies navigate reciprocal tax agreements between states, preventing double taxation and unnecessary tax liabilities.

Automating Payroll Processes

Manual payroll processing is time-consuming and prone to errors, which can lead to compliance issues and dissatisfied employees. Trucking accounting advisors help implement automated payroll systems that integrate with time tracking, fuel logs, and dispatch records. These systems streamline payroll calculations, ensure accurate deductions, and generate payroll reports efficiently. Automation not only reduces administrative workload but also minimizes payroll processing costs.

Managing Employee Benefits and Deductions

Payroll involves more than just paying wages—it also includes managing employee benefits such as health insurance, retirement plans, and per diem allowances. Trucking accounting advisors assist businesses in structuring employee benefits packages while ensuring proper deductions and contributions. They also help companies stay compliant with the Affordable Care Act (ACA) and other labor laws governing employee benefits.

Ensuring Compliance with Labor Laws

The trucking industry is regulated by various labor laws, including the Fair Labor Standards Act (FLSA) and the Department of Transportation (DOT) regulations on driver work hours. Misclassification of employees as independent contractors or failing to track overtime correctly can result in penalties and lawsuits. Accounting advisors provide guidance on labor law compliance, helping businesses properly classify workers, track hours accurately, and ensure that drivers receive legally required overtime pay.

Reducing Payroll Tax Liabilities and Maximizing Deductions

Trucking companies may qualify for payroll tax credits, such as Work Opportunity Tax Credits (WOTC) and deductions for per diem expenses. Accounting advisors identify tax-saving opportunities that help businesses lower payroll tax liabilities. They also ensure that trucking companies properly document and report deductions to avoid potential audits or penalties from the IRS.

Conclusion

Experts offering trucking accounting advisory services play a critical role in optimizing payroll systems by ensuring accurate driver compensation, tax compliance, and automation of payroll processes. Their expertise helps trucking companies reduce administrative burdens, improve efficiency, and stay compliant with complex payroll regulations. By leveraging the support of experienced accounting professionals, trucking businesses can focus on growth and profitability while maintaining a streamlined payroll system.

0 notes

Text

How to Handle Payments from Third-Party Marketplaces in eCommerce Accounting?

As eCommerce businesses expand their reach, many choose to sell products through third-party marketplaces. These platforms provide access to millions of potential customers but also add layers of complexity to accounting—especially when it comes to tracking payments, fees, and reconciliations. Properly handling payments from third-party marketplaces is essential for maintaining accurate books, understanding profitability, and ensuring tax compliance.

Understanding Marketplace Payment Structures

Third-party marketplaces typically collect payments on behalf of the seller and then remit those funds—often on a weekly or biweekly basis—after deducting their fees. These fees may include commissions, advertising charges, storage costs, fulfillment services, and transaction processing fees. Because the deposited amount doesn’t match the original sales price, it’s important to break down each payment into its components before recording it in your accounting system.

For instance, if you sell a product for $100 on Amazon and receive $85 in your bank account, the remaining $15 could include a referral fee, shipping charges, and fulfillment costs. Recording the full $100 as revenue and categorizing the $15 correctly as expenses ensures your income statement reflects the actual profitability of the sale.

Using Integrated Accounting Software

Manually entering transactions from third-party marketplaces is time-consuming and error-prone, especially as sales volumes increase. To streamline this process, use accounting software that integrates with your sales channels. Platforms like QuickBooks, Xero, and NetSuite offer add-ons or connectors that automatically import sales, fees, and deposits from marketplaces and assign them to the appropriate accounts.

These integrations ensure that gross sales, marketplace fees, refunds, and chargebacks are accurately recorded. This level of detail allows business owners and accountants to generate precise profit-and-loss statements and evaluate the financial performance of each sales channel individually.

Reconciling Bank Deposits with Sales Activity

Reconciliation is a critical part of eCommerce accounting. Even with automated imports, businesses should regularly reconcile bank deposits with marketplace reports to confirm accuracy. This involves matching the amount received in your bank account with the payout statement from the marketplace and verifying that all associated fees, taxes, and returns have been accounted for.

Discrepancies can occur due to timing differences, withheld funds, or chargebacks. Identifying and resolving these quickly ensures the integrity of your financial records and keeps your cash flow forecasts reliable.

Tracking Sales Tax and Fees Separately

Many third-party marketplaces now collect and remit sales tax on behalf of sellers in compliance with state laws. However, it’s important to track these amounts separately in your accounting records to avoid overstating your revenue. Likewise, fees and deductions from marketplaces should be categorized correctly so you can claim them as business expenses during tax season.

Accurate tax reporting is especially important for eCommerce businesses that operate across multiple states or countries, where tax obligations vary significantly.

Conclusion

Handling payments from third-party marketplaces requires a detailed and disciplined approach to accounting. By understanding how these platforms structure payments, using integrated accounting tools, and maintaining regular reconciliations, eCommerce businesses can ensure accuracy, improve financial insights, and stay compliant with tax regulations. A strong eCommerce accounting foundation enables sellers to confidently scale their operations and maximize marketplace opportunities.

0 notes

Text

Taxation Compliance for Businesses: Avoid Risks, Optimize Savings

Introduction:

Taxation Compliance is an essential component of operating a successful enterprise. Regardless of whether you manage a small startup or a large multinational organization, adherence to tax regulations provides legal protection, reduces risks, and enhances financial efficiency. Noncompliance with tax laws can result in significant penalties, legal repercussions, and damage to one’s reputation. Conversely, effective tax planning can enable businesses to maximize their savings and allocate resources more efficiently. This article delves into the significance of tax compliance, the primary challenges faced by businesses, and strategies to mitigate risks while enhancing savings.

Comprehending Tax Compliance

Tax compliance encompasses the adherence to tax legislation, the accurate filing of tax returns, timely payment of obligations, and the maintenance of appropriate financial documentation. Every business must comply with local, state, and federal tax laws, which vary based on its jurisdiction. Compliance includes several key elements, such as:

Income Tax: Businesses are required to report their earnings and pay taxes at the applicable rates.

Sales Tax: Companies engaged in the sale of goods or services must collect and remit sales taxes.

Payroll Tax: Employers are responsible for withholding and remitting employee taxes, including contributions to Social Security and Medicare.

Corporate Tax: Depending on the business structure, corporations may be liable for taxes on their profits.

Value-Added Tax (VAT) and Goods & Services Tax (GST): Numerous international businesses must comply with VAT and GST regulations.

Key Challenges in Tax Compliance

Complex Tax Regulations: The diversity of tax laws across different countries and states presents significant compliance difficulties for businesses that operate in multiple jurisdictions.

Frequent Regulatory Changes: The continual updates to tax codes necessitate that businesses remain vigilant and adapt their practices accordingly.

Errors in Tax Filings: Inaccuracies in the reporting of income, expenses, or deductions can result in audits and subsequent penalties.

Record-Keeping Issues: The necessity of maintaining precise records is paramount, yet it often proves challenging due to the high volume of transactions.

Lack of Expertise: Small enterprises may find tax compliance particularly daunting due to constrained resources and insufficient knowledge.

Risks of Non-Compliance

Neglecting tax compliance can result in severe repercussions, including:

Financial Penalties: Delayed filings, underpayments, or inaccuracies can incur substantial fines.

Legal Action: Persistent non-compliance may lead to lawsuits or even criminal charges.

Loss of Business Reputation: Public awareness of tax infractions can damage brand credibility.

Increased Scrutiny: Tax authorities may subject businesses to more rigorous audits and investigations.

Strategies for Mitigating Risks and Enhancing Savings

1.Stay Updated on Tax Regulations

Tax regulations are subject to frequent changes, and it is crucial for businesses to remain informed about developments that affect their sector. Engaging a tax advisor or subscribing to official tax notifications can assist businesses in maintaining compliance.

2. Keep Precise Financial Records

Accurate documentation of revenues, expenditures, and deductions is vital. Businesses should utilize accounting software to monitor financial transactions and retain records for a minimum of 5 to 7 years.

3. Utilize Tax Deductions and Credits

Numerous businesses fail to recognize deductions that could substantially lower their taxable income. Common tax-saving avenues include:

Business Expenses: Costs related to office rent, utilities, travel, and equipment.

Depreciation Advantages: Spreading the cost of long-term assets over their useful life.

R&D Tax Credits: Available for businesses that invest in research and development.

Employee Benefits Deductions: Health insurance, retirement plans, and other employee benefits.

4. Automate Tax Calculations and Submissions

Employing tax software or cloud-based solutions can enhance tax compliance, minimize errors, and ensure timely submissions. Many platforms provide automated tax calculations, electronic filing options, and compliance monitoring features.

5. Seek Guidance from a Tax Professional

Engaging a tax specialist or collaborating with an accounting firm guarantees compliance and aids in uncovering additional savings opportunities. Experts can offer customized advice, manage audits, and legally reduce tax liabilities.

6. Prepare for Tax Payments

Instead of scrambling for funds during tax season, businesses should regularly allocate a portion of their earnings to cover tax obligations. This approach mitigates last-minute financial pressure and potential penalties.

7. Capitalize on Tax Incentives

Governments frequently provide incentives for particular industries or business activities, such as:

Green Energy Credits for companies investing in environmentally sustainable practices.

Small Business Tax Benefits for startups and emerging enterprises.

Export Incentives for Enterprises Involved in Global Trade

Conclusion

Tax compliance transcends mere avoidance of penalties; it serves as a strategic instrument for fostering business expansion. By remaining well-informed, keeping precise records, utilizing available deductions, and seeking expert advice, enterprises can achieve compliance while maximizing their savings. Actively managing tax obligations enables companies to reinvest their resources, bolster financial stability, and uphold a robust market reputation.

In the end, organizations that emphasize tax compliance are more likely to achieve enduring success and sustainability. Whether you are a small business proprietor or a corporate executive, adopting a proactive stance on taxation will lead to cost savings, reduced anxiety, and the safeguarding of your company's future.

Taxation compliance is a crucial aspect of running a successful business, ensuring legal adherence while optimizing financial efficiency. By staying compliant with tax regulations, businesses can avoid hefty penalties, reduce legal risks, and maintain a positive reputation. At GTS Consultant India , we specialize in simplifying tax compliance, helping businesses navigate complex tax laws with expert guidance. Our tailored solutions not only ensure compliance but also identify strategic tax-saving opportunities, enhancing overall profitability.

0 notes

Text

Essential Accounting Practices for New Businesses

Starting a new business requires strong financial management. Here are the essential accounting practices every new business should follow:

1. Set Up a Proper Accounting System

Choose the right accounting method:

Cash Basis: Recognizes income and expenses when money changes hands.

Accrual Basis: Records income and expenses when they occur, regardless of cash flow.

Use reliable accounting software like QuickBooks, Xero, or FreshBooks to track finances efficiently.

2. Separate Business & Personal Finances

Open a dedicated business bank account and credit card.

Avoid mixing personal and business transactions to simplify tax filing and financial tracking.

3. Track Income & Expenses

Keep records of all revenue and expenses.

Categorize expenses properly (e.g., rent, utilities, salaries, marketing).

Store digital receipts and invoices for easy access during tax season.

4. Manage Cash Flow Effectively

Regularly monitor cash inflows and outflows to ensure liquidity.

Forecast cash flow to anticipate potential shortfalls.

Set payment terms with customers to maintain steady cash flow.

5. Stay on Top of Taxes

Determine your tax obligations (e.g., income tax, sales tax, payroll tax).

Keep track of tax deadlines to avoid penalties.

Consider working with a tax professional to optimize deductions and credits.

6. Create Financial Statements

Balance Sheet: Shows assets, liabilities, and equity.

Profit & Loss Statement: Tracks income and expenses over a period.

Cash Flow Statement: Helps you understand where money is going.

7. Implement an Invoicing System

Send invoices promptly and follow up on unpaid ones.

Offer multiple payment options to speed up collections.

Automate invoicing with accounting software to reduce manual work.

8. Budget & Plan for Growth

Set financial goals and allocate budgets accordingly.

Review financial performance regularly and adjust spending as needed.

Plan for future investments, expansion, or emergency funds.

9. Maintain Accurate Payroll Records

Ensure employees and contractors are paid correctly and on time.

Withhold and remit taxes appropriately.

Use payroll software to automate calculations and compliance.

10. Work with an Accountant or Bookkeeper

A professional can help with complex financial matters and compliance.

Regular financial reviews can identify risks and opportunities.

0 notes