#Revaluation of Assets and Liabilities

Explore tagged Tumblr posts

Text

How Rising Markets Boost the Loan Against Securities Value Proposition

Rising stock markets often bring optimism and financial opportunities, particularly for investors seeking to leverage their portfolio without liquidation. One strategy gaining traction is availing a loan against securities, a flexible financial tool enabling investors to secure loans by pledging their financial assets.

When markets are high, the value of pledged securities rises, amplifying the advantages of this loan type. But how exactly does a bullish market influence the loan against security interest rate and other key factors? Let’s explore the dynamics of loans against securities during rising markets and why it’s a compelling choice for savvy investors.

What is a Loan Against Securities?

A loan against securities (LAS) allows borrowers to use their financial assets, such as stocks, bonds, mutual funds, or insurance policies, as collateral. This provides immediate liquidity without requiring the sale of these investments.

Lenders assess a borrower’s eligibility by evaluating the type and market value of securities pledged, along with the borrower’s creditworthiness and market conditions. Typically, lenders offer a percentage of the market value of securities as a loan, ensuring borrowers retain ownership while unlocking liquidity.

Key features of LAS include:

Immediate liquidity: Gain access to funds while continuing to earn returns on your investments.

Flexible end usage: Use the funds for any purpose—personal expenses, business needs, or investments.

Lower interest rates: The collateralised nature of LAS ensures competitive interest rates, often lower than unsecured loans.

Borrowers can pre-emptively seek pre-approved loans from financial institutions, allowing them to respond quickly to unforeseen financial needs or opportunities without selling their securities.

Why Rising Markets Make Loans Against Securities Thrive?

A thriving stock market amplifies the benefits of taking loans against securities. Here’s why:

Increased Loan Amounts

During bullish phases, securities’ values rise, leading to higher loan eligibility. Lenders typically approve a percentage of the pledged assets’ market value, so a higher valuation means larger loan amounts. This makes it easier to meet substantial financial requirements like funding a business expansion or a major purchase.

Favourable Interest Rates

A robust market reduces the perceived risk for lenders. As a result, borrowers often enjoy more attractive loan against security interest rates. Lower interest rates can make LAS a cost-effective borrowing option compared to personal loans or credit cards.

Retain Portfolio Upside Potential

Availing a LAS allows investors to preserve their portfolio during market uptrends. Instead of liquidating securities and missing out on potential gains, borrowers can leverage their assets while still benefiting from their appreciation.

Tax Advantages

Selling securities often triggers capital gains tax. LAS helps avoid this, enabling investors to borrow without incurring tax liabilities tied to asset liquidation.

Flexibility in Fund Utilisation

With no restrictions on end usage, borrowers can allocate funds to meet diverse financial needs, such as business investments, medical emergencies, or lifestyle upgrades.

Key Considerations Before Opting for a Loan Against Securities in Rising Market

While rising markets offer numerous advantages for LAS borrowers, careful planning is crucial. Here are some critical factors to evaluate:

Market Volatility and Collateral Revaluation

Stock markets can be unpredictable. Lenders periodically reassess the value of pledged securities. If their value drops, borrowers may need to provide additional collateral or repay a portion of the loan to maintain the loan-to-value (LTV) ratio.

Loan-to-Value (LTV) Ratio Variations

LTV ratios vary depending on the type of securities pledged. For instance, blue-chip stocks might offer higher ratios compared to mutual funds. Understanding these ratios and regulatory caps is essential to maximise your borrowing potential.

Interest Rate Sensitivity

Though LAS typically features lower interest rates, these can fluctuate based on market conditions. Borrowers should monitor interest trends and lock in favourable rates whenever possible.

Repayment Terms and Flexibility

LAS often operates like an overdraft facility, where interest is charged only on the utilised amount. Borrowers should carefully evaluate repayment terms to align with their cash flow and financial goals.

Lender Credibility

Choosing a reliable lender ensures smooth loan management and protects pledged assets. Conducting thorough research into lender terms and conditions is vital for a hassle-free experience.

Benefits of LAS in Rising Markets

While rising markets enhance LAS value, bear markets present unique opportunities. Here’s how LAS remains relevant during market downturns:

Immediate Liquidity: Access funds without selling your investments.

Lower Interest Rates: Enjoy competitive rates compared to unsecured loans.

Flexible Repayment Options: Pay interest only on the amount used or close the loan early without penalties.

No Impact on Ownership: Retain your portfolio and benefit from market gains.

End-Usage Freedom: Use funds for diverse financial needs without restrictions.

Future Trends in Loan Against Securities

Here are emerging trends that could shape the future of LAS:

Digital Lending Platforms: With the rise of fintech, LAS processes are becoming more seamless and accessible, enabling faster approvals and fund disbursement.

Expanded Collateral Options: Beyond traditional securities, some lenders are exploring new asset classes, such as ETFs and cryptocurrency, as collateral for loans.

Dynamic Interest Rate Models: Lenders are adopting more responsive interest rate mechanisms tied to market conditions, benefiting borrowers with timely adjustments.

These trends point to a promising future for LAS, particularly in economies with thriving financial markets.

Conclusion

A loan against securities during a rising stock market offers a strategic way to unlock liquidity while retaining the potential for portfolio growth. With favourable loans against security interest rates, higher borrowing limits, and flexible repayment options, LAS provides an efficient and cost-effective alternative to traditional loans.

However, prudent borrowing requires careful assessment of market conditions, lender terms, and personal financial goals. Whether you’re planning to fund a business, manage emergency expenses, or capitalise on a lucrative opportunity, LAS can serve as a versatile financial tool tailored to your needs.

Investors and borrowers alike can benefit from understanding the nuances of LAS and leveraging its advantages, ensuring they remain financially resilient and strategically positioned for market fluctuations.

Frequently Asked Questions

Are Loan Against Security interest rates lower than personal loans?

Yes, Loan Against Security interest rates are typically lower due to the collateralised nature of the loan, providing a cost-effective borrowing option.

Can I use LAS funds for business purposes?

Absolutely. Loan Against Securities funds have no end-use restrictions, making them suitable for personal, business, or investment needs.

What happens if my securities’ value drops?

Lenders may require additional collateral or partial loan repayment to maintain the loan-to-value ratio during market downturns.

Is LAS a good option for long-term borrowing?

LAS is ideal for short-to-medium-term liquidity needs. For long-term goals, it’s essential to evaluate repayment capacity and interest implications.

0 notes

Text

Understanding the US GAAP with Indian GAAP

Introduction

Navigating banking rules is an important step for Indian enterprises entering the US market and USA Taxes. Understanding the difference between Generally Accepted Accounting Principles (GAAP) in the United States and Indian Accounting Standards (Ind AS) in India is an important part of this. While both strive to present a fair and realistic picture of a company's financial health, there are some important differences to be aware of.

Conceptual Framework:

US GAAP: Focuses on the "true and fair view" principle, with the goal of presenting financial information that is relevant and dependable for users' decision-making.

Ind AS: follows the "fair presentation" approach, which ensures that the financial statements accurately reflect the company's underlying economic reality.

Key Differences:

Here's a breakdown of some key areas where US GAAP and Ind AS diverge:

Inventory valuation: US GAAP permits several methodologies (FIFO, LIFO, and weighted average), while Ind AS generally utilizes FIFO.

Property, Plant, and Equipment (PPE) Valuation: While US GAAP prohibits the revaluation of PPE, Ind AS allows it under specific conditions.

Intangible Assets: US GAAP normally demands the amortization of intangible assets, however, Indian AS may permit capitalization for a longer duration.

R&D Costs: US GAAP normally mandates expensing R&D costs, whereas Indian AS enables capitalization under certain conditions.

Leases: US GAAP has a more complex classification system for leases, which affects how they are shown on the balance sheet.

Consolidation: US GAAP normally demands the consolidation of subsidiaries with controlling interests, although Ind AS permits for exceptions in specific circumstances.

These changes might cause discrepancies in reported profits, asset values, and liabilities between US GAAP and Ind AS financial accounts. This could be important for:

US Investors: Financial statements prepared in accordance with US GAAP are required to attract US investors who are familiar with the standard.

Public Listings: Indian companies wishing to list on the US stock exchange must provide financial accounts in accordance with US GAAP.

Reconciliation and Reports:

To close the gap, businesses might create a reconciliation document that explains the differences between their Ind AS and US GAAP financial accounts. This helps users comprehend the implications of using different accounting standards.

Seeking Professional Help:

Understanding and navigating US GAAP can be complicated. It is suggested that Indian enterprises entering the US market get advice from individuals who are familiar with both US GAAP and Ind AS. These specialists can walk you through the process of creating US GAAP-compliant financial statements, guaranteeing smooth operations, and recruiting investors in the US market.

Conclusion

Understanding the distinctions between US GAAP and Ind AS is critical for Indian businesses migrating into the US. By becoming acquainted with these variations and receiving professional assistance as needed, you can ensure accurate financial reporting, foster trust with US stakeholders, and pave the way for success in the US market. Remember that this blog provides a basic overview; for individual problems, you should seek a certified professional.

0 notes

Text

What are the additional risks involved in the software industry?

This excerpt provides an overview of various business risks and internal audit procedures within the software industry, as well as specific checklists for asset verification, loans and borrowings, and foreign currency transactions.

Here's a breakdown:

Business Risks:

Strategic Risk: Related to industry operations and board decisions.

Economic/ Financial Risk: Includes financial risks such as shareholder losses and insufficient cash flow.

Operational Risk: Involves risks like misappropriation of assets and financial errors.

Compliance/ Legal Risk: Arises from non-compliance with government regulations.

Brand Reputation Risk: Risk of reputational damage to the company.

Technology Risk: Risk associated with outdated technology.

Human Capital Risk: Concerns shortage of skilled resources in the IT sector.

Risk Mitigation:

Internal audits involve assessing vulnerabilities in software development processes, addressing security gaps, ensuring data privacy compliance, and validating adherence to coding standards.

Asset Verification:

Internal auditors verify proper use and periodic verification of assets, including physical verification, insurance coverage, revaluation, and accurate accounting records.

Loans and Borrowings:

Special audit procedures are necessary for representing liabilities, including verifying credit/borrowing limits, statutory compliances, terms of borrowing, and closing balances.

Foreign Currency Transactions:

Checklists ensure compliance with regulations and protection of financial interests, including compliance with RBI/FEMA, FCNR accounts, tax regulations, and DTAA/foreign tax reliefs.

This information is useful for stakeholders in the software industry to understand and mitigate various risks through effective internal audit processes and adherence to compliance measures.

0 notes

Text

What is Property tax outsourcing?

The decision to outsource is a strategic cost-saving opportunity for non-core activities such as property taxes that require impeccable execution. PPTOG's property tax consulting practice brings extensive experience in this field, allowing you and your property manager to focus on your core business activities. Managing property tax appeals requires expertise in this compliant activity, along with a thorough understanding of critical deadlines, revaluation cycles, and the balance between corporate objectives and the permissibility of tax authorities.

Our group's mission is to be the client's property tax department, with all property tax functions working to meet the needs and best interests of the client. These services include strategic assistance in addition to the preparation of all property tax related documents. It also ensures thorough and timely communication.

Outsourcing ultimately relieves the workload of corporate asset managers and real estate managers who lack the time and expertise to focus on these unique. Outsourcing also provides a tremendous level of value in exchange for a dedicated in-house real estate expert.

PPTOG removes the burden of complex processes including tracking multiple deadlines, coordinating multiple consultants, handling appeals and tracking refunds after successful appeals.

Accuracy is key when it comes to property tax management. You can invest the time and energy to do it yourself or contact Best Indian Tax Advisors & Accountants in Delaware experienced professionals. We are your property tax outsourcing solution. With nearly 30 years of experience, we offer a range of comprehensive services to help you efficiently manage your property taxes. There are wealth management software programs out there, but most of us still prefer to talk to real people. It is clear that there are responsibilities related to property tax administration.

With all the complexities of property tax management, our services are the most comprehensive on the market. Here's what we offer.

Complete property tax outsourcing services for your collateral or property.

Returns are received, evaluations are tracked, and appeals are made and resolved.

Tax liability is assessed and tax invoices are processed, paid and verified.

Tax sales are suspended, redemptions are made, and property and collateral are protected.

Taxes are investigated and arrears are identified.

Custom tax summaries are delivered through a secure web portal, giving clients 24/7 access to a full tax summary.

Crisis management:

The pitfalls of not paying taxes vary from state to state. Consequences range from extra cost and time to catastrophic damage to collateral and property. Property titles and debt collateral must be monitored for tax liabilities, and there must be a systematic process for paying them off.

Document management:

Juggling all the various compliance dates and certifications along with the filing of returns, evaluations, appeals and billing processes can make maintaining tax records and corporate property taxes cumbersome. Tax records are usually stored alongside mortgage or property records and are difficult to manage.

Resource Management:

Companies that specialize in Bank reconciliation & Cash management in Chicago, investments, or other professions with a concentration of real estate as assets or collateral know that taxes are important, but they usually have little time for the arduous tax management tasks. This distracts skilled and underutilized personnel from administrative functions such as taxes, rather than core functions. Tax issues usually hinder and disrupt the continuity of major Business Accountants in Chicago. They are in the hands of administrative resources who manage property taxes full-time.

Cash management:

Taxes must be paid, but evaluated, analyzed, reduced and paid without fire drills. A system must be in place to ensure timely review of all tax assessments in order to make an informed decision on appeals and to accurately assess tax obligations and their impact on cash flow. The outsourcing process must also have predictable costs.

Crisis management:

Taxes are sold, property is lost, investors buy deeds and liens, and claim repayments. Overdue tax sales typically occur monthly in all states, and for lenders, notice is a good idea, but often untimely. In these cases, you need a practitioner who knows the property tax business well and can handle the crisis.

Distressed Asset Purchase/Loss Sharing Arrangements:

These actions are usually accompanied by property tax issues that require immediate attention and decisive action. Cold River specializes in the treatment and repair of tax portfolios acquired through debt/asset purchases or loss-sharing acquisitions. Documentation is critical in a loss sharing agreement and reporting means reimbursement.

Loan Service Provider:

Lending service providers can build the tax management portion of any portfolio and place Cold River in the back office for tax management.

#financial services#tax advisory#transaction services#accounting services#payroll services#auditing#corporate tax#accounting#accounting firm#bookkeeping

0 notes

Text

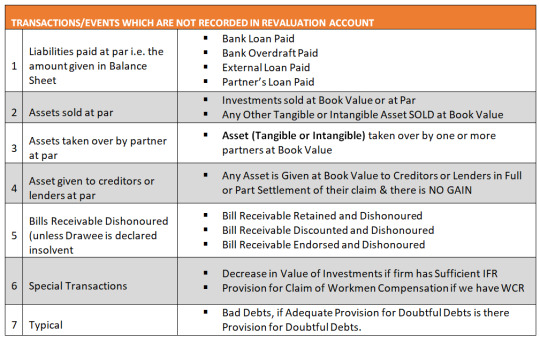

Exception to Revaluation Account : Partnership Account

Exception to Revaluation Account TRANSACTIONS/EVENTS WHICH ARE NOT RECORDED IN REVALUATION ACCOUNT Back to Index

View On WordPress

#CBSE XII Accountancy Notes#Change in PSR#Change in the Profit Sharing Ratio#Different Terms Used in Revaluation Assets#Exception to Revaluation Account#Fact about Revaluation Account#Format of Revaluation Account#Pratap Naik Resources#Revaluation of Assets and Liabilities

0 notes

Text

Brazil: News and deadlines for submitting Individual Income Tax Return and Foreign Assets statement for Brazilian Central Bank – 2021

[Image description: picture of a city are with tall buildings]

Brazilian taxpayers can already submit their Declaration of Foreign Assets, which is due on 5 April 2021, to the Brazilian Central Bank (DCBE). The declaration must be filed by individuals or legal entities resident, domiciled or headquartered in Brazil, with foreign assets in the amount equal to or greater than: (i) USD 1 million on 31 December 2020; and (ii) USD 100 million on 31 March, 30 June and 30 September of each year base. Please note that until last year, this threshold amount was USD 100,000 for the annual statement.

Besides the information already required by the Brazilian Central Bank, there are new fields included this year for individuals who own 10% or more interest in foreign companies. In particular, information about the decomposition of the company’s results will be requested, more specifically information about: (i) the results of non-recurring items; (ii) the results of revaluation of assets or liabilities (e.g., impairment); and (iii) the results from exchange variation.

Continue reading.

1 note

·

View note

Text

Hardwyn India Limited: Standalone Financial Results for the Year Ended March 31, 2023

In accordance with Regulations 30 and 33 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015, as amended, it is as a result of this informed that the Board of Directors of “Hardwyn India Limited” held a meeting on Monday, May 29th, 2023, at the registered office of the company in New Delhi, India. During the meeting, the Board of Directors considered and approved the audited financial results (Standalone and Consolidated) of the company for the quarter and fiscal year ended on March 31, 2023.

The company is enclosing a copy of the said financial results (Standalone and Consolidated) along with the Auditor’s Report (Standalone and Consolidated) by the Statutory Auditors. The meeting of the Board of Directors commenced at 06:15 P.M. and concluded at 07:45 P.M.

Furthermore, an independent auditor’s report on the quarterly and year-to-date audited standalone financial results of Hardwyn India Limited, as required by Regulation 33 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015, has been provided.

The independent auditor’s report states that, in their opinion, the standalone financial results for the quarter ended March 31, 2023, and the year-to-date results for the period from April 1, 2022, to March 31, 2023, presented in accordance with Regulation 33 of the Listing Regulations, give a true and fair view in conformity with the recognition and measurement principles laid down in the applicable Indian Accounting Standards and other accounting principles generally accepted in India.

The auditor conducted the audit in accordance with the Standards on Auditing specified under section 143(10) of the Companies Act, 2013, and expressed their opinion based on the audit evidence obtained. The management of the company is responsible for the preparation of the standalone financial results and maintaining adequate accounting records in accordance with the provisions of the Act.

The auditor’s report also outlines their responsibilities, including assessing the risks of material misstatement, obtaining sufficient and appropriate audit evidence, and evaluating the overall presentation and content of the standalone financial results.

The standalone audited financial results for the quarter and year ended March 31, 2023, including income, expenses, profit/loss, assets, and liabilities, have been provided in the statement accompanying the report.

The financial data for the periods ending on 31.03.2023, 31.12.2022, and 31.03.2022 are as follows: In the current year ended on 31.03.2023, the revenue from operations was 16,465.77, while there was no other income recorded. The total income for the period amounted to 16,536.72. On the expense side, there were no costs of material consumed or purchases of stock in trade. The change in inventories of finished goods, work-in-progress, and stock-in-trade resulted in a decrease of 1,827.56. Employee benefits expenses, finance costs, depreciation and amortization expense, and other expenses were also not incurred. The total expenses amounted to 15,225.61. As a result, the profit before exceptional items and tax for the period was -1,311.11. There were no exceptional items recorded. The profit before tax was also -1,311.11. No tax expenses were incurred in the current period. The net profit (loss) for the period from continuing operations was -928.06. Other comprehensive income and total comprehensive income for the period were not reported. The paid-up equity share capital remained unchanged at 2,616.64. The other equity (excluding revaluation reserve) was 34,639.70. The earnings per share for continuing operations were not available.

The financial data presented for the period ending 31.03.2023 highlights the performance of Hardwyn India Limited. The company reported revenue from operations and a decrease in inventories but also incurred various expenses resulting in a profit before tax. However, after considering exceptional items and tax expenses, the company recorded a net loss from continuing operations. The specific details of the previous year’s financial performance were not provided. These financial figures provide insights into the company’s financial health and performance, which can be further analyzed and compared to previous periods for a comprehensive evaluation.

0 notes

Text

Rental Property Depreciation in Sydney: What You Need to Know

Leverage depreciation to increase your ROI on investment properties

Depreciation is a very important aspect of owning an investment property. In simple terms, it is the decrease in value of an asset over time due to wear and tear. For rental properties, this means that owners are able to claim a tax deduction on the structural components of their investment, such as the building itself, the fitted kitchen, and even the carpets.

In order for an owner to claim depreciation, they must first have their property professionally valued by a qualified Quantity Surveyor. A Quantity Surveyor will compile a report which details the current value of all the eligible depreciating assets within the property. This report is then used by the owner's accountant to calculate the depreciation deductions that can be claimed each financial year.

The Benefits of Depreciation

There are many benefits of depreciation, the main one being that it can generate significant tax savings for investors. When an investor claims on their rental property depreciation Sydney, they are effectively reducing their taxable income, which can result in a lower tax bill at the end of the financial year.

Another benefit of depreciation is that it can help to increase your return on investment (ROI). For example, if you purchase a property for $500,000 and claim depreciation deductions of $10,000 per year, your effective ROI would be 2% higher than if you didn't claim any deductions.

Finally, claiming depreciation can also help to reduce your capital gains tax (CGT) liability when you eventually sell your investment property. This is because the CGT is calculated on the profit you make from the sale, and depreciation deductions can reduce your overall profit.

Things to Keep in Mind

There are a few things that you need to keep in mind when it comes to depreciation, such as:

You can only claim depreciation on investment properties, so if you own your home then you won't be able to get any deductions. Depreciation is only available on newly built or renovate homes - if you purchase an older property then you won't be able to claim any deductions.

The eligible depreciating assets within a property can change over time, so it's important to have your property revalued every few years to make sure you're still claiming all the deductions you're entitled to.

How to Claim Depreciation

To claim depreciation, you will need to get a depreciation schedule prepared by a qualified Quantity Surveyor. This schedule will detail all of the eligible depreciating assets within your property and their respective values. Once you have this schedule, you can then provide it to your accountant who will use it to calculate your annual deductions.

If you're thinking of purchasing an investment property in Sydney, or if you already own one, then make sure you talk to your accountant about depreciation and how it could benefit you. It could save you thousands of dollars in tax each year, and help to increase your overall return on investment.

Increasing Your ROI with Depreciation

If you’re thinking about purchasing a rental property, it’s important to factor in the potential for increased return on investment (ROI) that can come from rental property depreciation in Sydney. Depreciation is the decrease in value of an asset over time due to wear and tear, and for rental properties, this means owners can claim a tax deduction on the structural components of their investment – including the building itself, any fitted kitchens or carpets.

Conclusion:

Depreciation is a powerful tool that can be used by investors to increase their return on investment. It is important to remember that claims must be calculated correctly and maintained over time in order to maximize benefits. If you have any questions about claiming on your rental property depreciation in Sydney, be sure to speak to your accountant or financial advisor.

0 notes

Text

Adjusted Trial Balance: Definition, Example, Purposes, How to Prepare, Importance

What is a Trial Balance?

The trial balance is a part of a company’s internal records used to prepare the financial statements. It gets its information from the balances reported in the general ledger accounts. Usually, the trial balance includes both income statement and balance sheet items. However, some versions of this report may also consist of only balance sheet balances.

A trial balance enlists all balances from general ledger accounts at a particular time. It includes at least three columns, including the account name, debit, and credit side. Each item in the trial balance also consists of its balance on its relative debit or credit column. Usually, it enlists balances related to assets, liabilities, equity, income, and expenses.

What is an Adjusted Trial Balance?

Usually, companies prepare the trial balance at the end of each fiscal period. At that point, it only includes balances from the general ledgers, as stated above. However, companies must also make year-end adjustments, known as adjusting entries. Once companies pass these entries, they prepare the trial balance again. It is called the adjusted trial balance.

The adjusted trial balance is the final document to prepare the financial statements. Without adjusting entries in this record, companies cannot document their finances. However, it does not differ from the unadjusted version in its format. It uses the same three-column approach to reporting closing balances. However, companies may include other information in this format, like account numbers, etc.

The essence of the adjusted trial balance is the year-end adjusting entries. These entries convert the unadjusted trial to the adjusted version. Usually, year-end adjusting entries include the following items.

Depreciation of tangible fixed assets.

Amortization of intangible assets.

Inventory adjusting entries.

Accrued expenses.

Prepayments or prepaid expenses.

Unearned or deferred income.

Bank reconciliation adjusting entries.

Impairment of assets.

Revaluation adjusting entries.

What is the importance of the Adjusted Trial Balance?

The adjusted trial balance is crucial in allowing companies to prepare financial statements. It also helps accommodate adjusting entries at the end of a fiscal period. Consequently, it allows for a more accurate presentation of finances in the financial statements. The adjusting trial balance is also a critical part of the accounting process, getting its data from the general ledger and unadjusted trial balance.

The adjusted trial balance also helps verify the total of the debit and credit balances in the general ledger. By balancing these items, companies can ensure that the accounting entries within the accounting system are complete. Similarly, the adjusting trial balance also helps provide a summary of all general ledger accounts before reporting them in the financial statements.

How to prepare the Adjusted Trial Balance?

Companies prepare the adjusted trial balance through a process. This process includes the following steps.

Record all transactions in the accounting system.

Prepare the general ledger and calculate the closing balances on each account.

Prepare the unadjusted trial balance.

Record the year-end adjusting entries.

Prepare the adjusted trial balance.

Conclusion

The trial balance is a crucial document used in preparing financial statements. It includes all balances in the general ledger. Usually, companies prepare this record at the end of each fiscal period. Once they do so, they pass adjusting entries which help create the adjusted trial balance. It is the final document used to prepare financial statements.

Post Source Here: Adjusted Trial Balance: Definition, Example, Purposes, How to Prepare, Importance

from Harbourfront Technologies - Feed https://harbourfronts.com/adjusted-trial-balance/

0 notes

Text

Essentials Of Financial Accounting NMIMS MCQ Set 4

Essentials Of Financial Accounting NMIMS MCQ Set 4

QN1. Unrecorded assets will be _ to the Revaluation account. QN2. Unrecorded liabilities will be _ to Revaluation account. QN3. Revaluation account is debited for an increase in the value of _. QN4. Profit on revaluation is transferred to the _ of the partners’ capital account. QN5. Reserve should be distributed amongst the existing partners in _. QN6. Accumulated Losses are _ in the…

View On WordPress

0 notes

Text

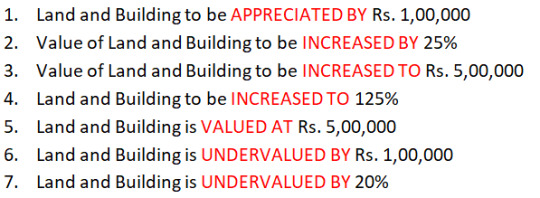

Different Terms Used in Revaluation Assets : Partnership Accounts

Different Terms Used in Revaluation Assets Example 1 Book Value of Land and Buildings is Rs. 4,00,000 Additional Information Despite of different language in the above statements, account treatment is same for all. Example 2 Book Value of Plant & Machinery is Rs. 1,00,000 Additional Information Despite of different language in the above statements, account treatment is same for all. Back…

View On WordPress

#CBSE XII Accountancy Notes#Change in PSR#Change in the Profit Sharing Ratio#Different Terms Used in Revaluation Assets#Fact about Revaluation Account#Format of Revaluation Account#Pratap Naik Resources#Revaluation of Assets and Liabilities

0 notes

Text

Chapter 3 : Admission of a Partner - NCERT Question Class 12 Accountancy

Chapter 3 : Admission of a Partner – NCERT Question Class 12 Accountancy

Question 1 A and B were partners in a firm sharing profits and losses in the ratio of 3:2. They admit C into the partnership with 1/6 share in the profits. Calculate the new profit sharing ratio? (Ans : 3:2:1) Question 2 A,B,C were partners in a firm sharing profits in 3:2:1 ratio. They admitted D for 10% profits. Calculate the new profit sharing ratio? (Ans : 9:6:3:2) Question 3 X and Y…

View On WordPress

#Adjustment of Accumulated Loss#Adjustment of Accumulated Profit#Adjustment of Capital#Adjustment of Deferred Revenue Expenditure#Adjustment of Reserves#Admission of a Partner#CBSE Class 12 Accountancy#Change in the Profit-sharing Ratio#NCERT Accountancy Solution Class 12#Profit & Loss Appropriation Account#Revaluation of Assets and Liabilities#Valuation of Goodwill

0 notes

Text

Accountant in Narren Warren

Professional Accountants have been compelled to make up their mind that building trust requires more than just honesty. It requires the power to practice sound moral values. Accountant in Narren Warren Specialised Trust Accounting Services and assistance is just one of the valuable services we offer our clients. We pride ourselves on reliable and up-to-date trust accounting and personalised service to meet our client’s unique needs. If you are thinking about setting up a Trust, it would be beneficial to consider setting up an inter vivos trust. This Trust is set up for the benefit of the trust’s beneficiaries and can achieve specific estate planning, asset protection, and limit estate duty liability. The Trust assets and administration duties are managed by the appointed trustees as per the deed. Our Trust Accounting service options include transferring your daily disbursements to your bank for Positive Pay verification, daily account balancing by retrieving your bank's list of cleared checks and deposits, and receiving electronic bank statements to reconcile your trust accounts. Supernova Trust manages the complexities surrounding the calculation and compliance of trust distributions. The feature automatically recognises capital losses and unrealised gains, transfers them to the capital loss or asset revaluation reserve, and then adjusts the amount available for distribution.

0 notes

Text

Market Dip Offers Chance to Buy Green Tech Stocks on the Cheap (FCEL, ECOX, ENB, BEP, FSLR, SONY, NIO, SEDG)

Rising commodity prices and skyrocketing inflation have imposed on global policy makers the burden of an economic context not seen since the 1970’s. That backdrop is also now paired with increasing angst over the pace and status of the climate change agenda, creating a rock-and-hard-place conundrum where no one wins… except perhaps private sector investments in companies sitting at the leading-edge of the sustainable energy tech revolution. For most of us, this is an all-or-nothing scenario of accelerating urgency. Energy prices (think of how the price at the pump has changed this year) are helping to crystallize this emergency. But it has been building for years. One of the biggest hurdles in solving the problem is complacency. But the current context may finally be enough to spur action on a grassroots level, driven by basic economics. While our old-fashioned reliance on fossil fuels has been understood as a catastrophe in the making for at least a decade, the economics involved in radically shifting that paradigm have been a barrier to action. But the recent jump in oil and gas pricing could spur the collective will to make lasting radical changes. All of that adds up to an investment thesis supporting a potential mass reallocation of capital into green energy solutions. It’s a perfect storm favoring upside revaluation of assets tethered to that paradigm shift. Investors may benefit from an increased focus on stocks positioned to offer a new path. With that in mind, we take a close look below at a few of the more interesting stories in the stock market that stand to benefit from this shift. FuelCell Energy Inc. (Nasdaq:FCEL) engages in the development, design, production, construction and servicing of high temperature fuel cells for clean electric power generation. It develops turn-key distributed power generation solutions and provides comprehensive services for the life of the power plant. The firm's fuel cell solution is an alternative to traditional combustion-based power generation and is complementary to an energy mix consisting of intermittent sources of energy, such as solar and wind turbines. It provides solutions for various applications, including utility-scale distributed generation, on-site power generation, combined heat and power, distributed hydrogen, carbon capture and hydrogen-based long duration storage. The Company's platform has the differentiating ability to do all these applications utilizing multiple sources of fuel including natural gas, renewable biogas, and propane, among other sources. FuelCell Energy Inc. (Nasdaq:FCEL) recently announced that a carbon capture demonstration project using the Company’s proprietary carbonate fuel cell technology has been awarded $6.8M in funding as part of Canada’s Clean Resource Innovation Network (CRIN) low emission fuels and products technology competition. “To demonstrate the power of our carbonate fuel cell technology, and for the project to receive this funding from CRIN, is an honor,” said FuelCell Energy CEO and President, Jason Few. “We are confident that the pilot will deliver the significant environmental benefits that the Canadian government is looking for, while helping to decarbonize its oil and gas industry and increase its competitiveness in the global market.” Even in light of this news, FCEL hasn't really done much of anything over the past week, with shares logging no net movement over that period. FuelCell Energy Inc. (Nasdaq:FCEL) managed to rope in revenues totaling $31.8M in overall sales during the company's most recently reported quarterly financial data -- a figure that represents a rate of top line growth of 113.7%, as compared to year-ago data in comparable terms. In addition, the company has a strong balance sheet, with cash levels exceeding current liabilities ($389.6M against $75.3M). Eco Innovation Group (OTC US:ECOX) looks like a deep value play in the space. The stock trades on the OTC and is clearly the most speculative name on out list. But the company recently transitioned from development stage to commercial stage and is already seeing strong revenue growth through its ECOX Spruce Construction subsidiary, which is in the business of refitting existing facilities to optimize around ecological footprint. The company’s model is driven by nurturing the work of top inventors in the US and Canada, helping to bring their best green-tech ideas to life and then signing exclusive licensing deals to commercialize the results. Company communications suggest it will be launching some of its pipeline projects this year. However, in the meantime, its green construction segment is already nailing lucrative deals into place. Eco Innovation Group (OTC US:ECOX) recently earned projects with a major US military base and a Fortune 500 retailer. Its latest deal is to provide all services to renovate a retail location of a major U.S. merchandiser in Hyannis, Massachusetts. The contract was awarded by a large project management firm engaged in the development, transformation, and maintenance of real estate in both the public and private sectors, to Edgar E. Aguilar of Blueprint Construction, the managing officer of ECOX Spruce Construction. Through a construction services contract with Aguilar and Blueprint Construction, ECOX fulfills all aspects of Blueprint's active contractor and subcontractor agreements. The Company began work in Hyannis on February 21st. ECOX's management believes that ECOX Spruce Construction may be in a position to renovate additional retail locations for this merchandiser, with over 1,000 stores in North America, as well as other opportunities. The Company has set a goal of achieving $6 million in revenues from related projects in the 2022 fiscal year. Eco Innovation Group (OTC US:ECOX) CEO Julia Otey-Raudes recently stated, "ECOX Spruce Construction has the capacity to reach our financial target with our current pace of project acquisition. In January, we signed a commercial renovation contract with Davaco for a U.S. military base in California, this month we break ground on a commercial retail renovation, and we intend to continue acquiring and completing green construction projects. The end client here is an iconic Fortune 500 brand in the domestic U.S. retail market, and we are very excited to have broken ground on this project in February 2022." Brookfield Renewable Partners L.P. (NYSE:BEP) engages in owning a portfolio of renewable power generating facilities primarily in North America, Colombia, Brazil, Europe, India, and China. The company operates through its Hydroelectric, Wind, Solar, Energy Transition, and Corporate segments. The Energy Transition segment distributes generation, pumped storage, cogeneration, and biomass. Brookfield Renewable Partners L.P. (NYSE:BEP) recently announced its participation in a privatization proposal in respect of AGL Energy Limited, the largest integrated power generation and energy retailer in Australia. The Consortium’s proposal which is subject to due diligence as well as other conditions, is at a price of A$7.50/share which values AGL at an equity value of A$5 billion. “By combining our access to capital and clean energy expertise, we are capable of helping carbon-intensive businesses transition to more competitive and sustainable futures while making a meaningful contribution to the transition to net zero,” said Connor Teskey, CEO of Brookfield Renewable. “By helping businesses such as AGL achieve their net-zero ambitions through the significant build out of clean energy capacity, we can contribute tangible benefits to stakeholders including net-zero GHG emissions, clean power delivered at competitive prices and new jobs in the green economy, all while generating strong returns for our unitholders.” The chart shows 17% tacked on to share pricing for the listing in the past month. Market participants may want to pay attention to this stock. BEP has evidenced sudden upward volatility on many prior occasions. What's more, the stock has registered increased average transaction volume recently, with the past month seeing 28% above its longer-run average levels. Brookfield Renewable Partners L.P. (NYSE:BEP) has a significant war chest ($1.4B) of cash on the books, which is balanced by about $4.1B in total current liabilities. BEP is pulling in trailing 12-month revenues of $5.1B. In addition, the company is seeing major top-line growth, with y/y quarterly revenues growing at 16.2%. Other core players in the eco-innovation space include Enbridge Inc. (NYSE:ENB), First Solar Inc. (Nasdaq:FSLR), Sony Group Corp. ADR (NYSE:SONY), NIO Inc. ADR (NYSE:NIO), and SolarEdge Technologies Inc. (Nasdaq:SEDG). Read the full article

0 notes

Text

Business Valuation Firms: The Best Backdoor into Investment Banking and Private Equity

Appraisal firms, as the name suggests, offer paid valuation services for all kinds of scenarios: M&A transactions, estate planning, employee stock ownership plans (ESOPs), litigation, unbiased opinions, and more Top property valuation firms .

The scope of services is much broader than what a typical investment bank offers.

But the work itself tends to be an inch wide and a mile deep.

In other words, you can spend weeks valuing just one asset for a single company, all to support one small aspect of a deal, lawsuit, or inheritance.

By contrast, the job in investment banking is a mile wide but an inch deep: You're running multiple trading processes, responding to client requests, and dealing with random tasks at the same time, but you don't go incredibly deep into any task.

Some examples of common assignments at appraisal firms include:

Private Company / ESOP Valuation: All private companies own shares, but their share prices are not easy to determine because they are not listed on public markets.

So when private companies grant stock options to employees and determine the appropriate exercise price, they hire appraisal firms to perform 409A valuations.

These valuations also arise when there is a lawsuit pending or an existing shareholder wants to sell shares.

Purchase Price Allocation: When an M&A deal closes, the buyer must "purchase price allocate" to different items and adjust the seller's assets and liabilities to fair market value.

You can also create new items, such as goodwill and other intangibles, to "bridge the gap" between the stock purchase price and the seller's common equity, which is noted in the agreement (see: How to Calculate Goodwill). trade).

Bankers treat this as a mere afterthought in models, but appraisal firms spend a lot of time valuing and revaluing these assets because companies must record accurate figures in their filings:

Purchase price allocation

Goodwill Impairment Test: For example, if Company A acquired Company B for $1 billion, created $200 million of goodwill in the process, and then Company B becomes less valuable, Company A you need to "reduce" or "impair" that goodwill to reflect this change.

Companies hire appraisal companies to carry out these periodic checks and determine the correct deterioration.

Private Equity Portfolio Company Valuation: Private equity clients may hire valuation firms to verify their portfolio company valuations and ensure accurate reporting.

If they disagree with a PE company's assumptions for discount rate, valuation multiples, growth rates or liquidity discount, the value of the entire portfolio could change.

Inheritance and gift tax: If a wealthy person dies, his or her attorney may hire an appraisal firm to determine the value of the wealthy person's net assets.

The government will then collect estate taxes based on this estimate.

So… How does the “Company Valuation” work? “Wow, this job sounds pretty complex,” you might say, “So how does valuation work? Are there new methodologies? Hidden tricks? New and complex math?

No!

Valuation is valuation: it still uses DCF models based on unlevered free cash flow, valuation multiples based on comparable companies or transactions, and asset-based approaches such as liquidation valuation.

The difference lies in the level of detail: programs and assumptions that span many spreadsheets rather than much simpler approaches in IB.

"Mathematics" still does not go beyond basic arithmetic and statistics.

(An exception is if your group values complex financial derivatives, in which case the level of mathematics required increases.)

In addition to the level of detail, another difference is that the purpose of the work varies depending on the type and size of the company.

For example, in the Big 4 companies, the valuation teams exist primarily to support their audit teams.

Therefore, he spends a lot of time reviewing other companies' valuations so the audit team can agree on specific line items on the financial statements, such as stock-based compensation expense recorded on the income statement.

Instead, you'll often do more "interesting" work at boutiques and smaller independent firms - anything from valuing Anthony Bourdain's estate to

0 notes

Text

How to Prepare Revaluation Account?

How to Prepare Revaluation Account?

Sometimes the value of the assets and liabilities of a firm does not appear at its current value in the books of account. With the passage of time, their values in the books may differ from their current values. It means there could be an increase or decrease in the values. Therefore, at the time of admission of a new partner, it is desirable to ascertain the true current value of all the assets…

View On WordPress

0 notes