#Robotic Process Automation Market Forecast

Explore tagged Tumblr posts

Text

Robotic Process Automation Market - Forecast(2025 - 2031)

Robotic Process Automation Market Overview

The Robotic Process Automation Market is estimated to reach USD22.14 billion by 2030, growing at a CAGR of 35.9% during the forecast period 2024-2030. Robotic process automation (RPA) is an automation software technology that makes it simple to design, deploy and manage software robots that resemble how people interact with digital systems and software. . Hyperautomation refers to the integration of various automation technologies, including RPA, artificial intelligence (AI), machine learning (ML), and process mining, to automate and optimize end-to-end business processes comprehensively. This trend involves expanding the scope of automation beyond routine, repetitive tasks to encompass complex, rule-based processes that involve decision-making and analysis. By combining RPA with AI and other advanced technologies, organizations can achieve greater efficiency, agility, and scalability in their operations, leading to increased productivity and cost savings. Intelligent automation involves the use of cognitive technologies, such as natural language processing (NLP), computer vision, and predictive analytics, to enable RPA bots to perform tasks that require cognitive capabilities. Cognitive RPA goes beyond rule-based automation by allowing bots to understand unstructured data, make decisions, and adapt to dynamic environments. This trend enables organizations to automate more sophisticated processes, enhance customer experiences, and drive innovation. By leveraging cognitive RPA, businesses can unlock new opportunities for growth and competitive advantage in an increasingly digital and data-driven world.

Report Coverage

The “Robotic Process Automation Market Report – Forecast (2024-2030)” by IndustryARC, covers an in-depth analysis of the following segments in the Robotic Process Automation Market.

By Form: Attended Automation, Unattended Automation and Hybrid RPA.

By Solutions: Automated Software Solutions (Tools and Services, Software robot, Self-learning solutions, Rule-Based Operation, Knowledge-Based Operation, Cognitive automation, Enterprise software, Programmable RPA bots, Others), Decision Support Solutions and Interaction Solutions.

By Deployment: On-premises and Cloud.

By Organization Size: Small & Medium scale enterprises and Large scale enterprises.

By Application: Administration and reporting, Customer support, Data migration and capture, Data analysis, Compliance and Others.

By End-users: Aerospace and Defense, BFSI, Automobile, Food & Beverage, Retail, Governments, Education, Manufacturing, Transportation and Logistics, Telecommunication & IT, Energy and Utilities, Healthcare and Others.

By Geography: North America (the U.S., Canada, Mexico), Europe(Germany, UK, France, Italy, Spain, Others), APAC (China, Japan, South Korea, India, Australia, Others), South America (Brazil, Argentina, Others), RoW (Middle East, Africa).

Request Sample

Key Takeaways

The large-scale enterprise segment held the largest share with 70% in the RPA market by organization size, in 2021. The high adoption of RPA in large-scale enterprises is driven by the growing demand for automation processes in complex business processes to gain maximum productivity.

The Retail sector segment by end users in the Robotic Process Automation Market is expected to grow fastest at a CAGR of 38.2% during the forecast period 2022-2027. The high adoption of RPA in the retail sector is due to its rapid switch to digital modes for efficient management and tracking of business activities.

Asia-Pacific is expected to grow the fastest at a CAGR of 39.1% in the Robotic Process Automation Market during the forecast period 2022-2027. The widescale adoption of RPA in this region is driven by the increasing adoption of technologically advanced RPA systems for handling complex business processes.

The high adoption of RPAaaS to eliminate the licensing cost for RPA is driving the market growth.

Robotic Process Automation Market Segment Analysis - by Organization Size

The Robotic Process Automation Market by organization size has been segmented into small & medium scale enterprises and large-scale enterprises. The large-scale enterprise segment held the largest share with 70% in the RPA market by organization size, in 2022. The high adoption of RPA in large-scale enterprises is driven by the growing demand for automation processes in complex business processes to gain maximum productivity. The leading companies are adopting new strategies such as extended licensing terms and supplemental software items to improve the RPA already in use. In April 2022, FPT Software Company stated that it would be giving its current customers a free extension on the licensing of its product.

Inquiry Before Buying

Robotic Process Automation Market Segment Analysis - by End-users

The Robotic Process Automation Market by end users has been segmented into aerospace and defense, BFSI, automobile, food & beverage, retail, governments, education, manufacturing, transportation and logistics, telecommunication & IT, energy and utilities, healthcare and others. The retail sector segment by end users in the Robotic Process Automation Market is expected to grow fastest at a CAGR of 38.2% during the forecast period 2024-2030. The high adoption of RPA in the retail sector is due to its rapid switch to digital modes for efficient management and tracking of business activities such as accounting and finance, customer service management and customer behavior analysis. In July 2022, Comtec Information System in their report stated that the use of RPA in retail sectors can save more than $2 trillion in the global workforce.

Robotic Process Automation Market Segment Analysis - by Geography

The Robotic Process Automation Market by geography is segmented into North America, Europe, APAC, South America and RoW. Asia Pacific is expected to grow at the fastest CAGR with 39.1%, during the forecast period 2024-2030. The widescale adoption of RPA in this region is driven by the increasing adoption of technologically advanced RPA systems for handling complex business processes. In 2022, the Blue Prism report stated several organizations in this are adopting intelligent RPA technology that uses machine learning for more complex business processes. It also stated Australia topped the list of organizations using RPA in APAC followed by India with 78% and 49% respectively.

Schedule a Call

Robotic Process Automation Market Drivers

The high adoption of RPAaaS to eliminate the licensing cost for RPA is driving the market growth.

RPAaaS eliminate the licensing cost for RPA. The RPAaaS enables zero cost for bot licensing as it is hosted on a cloud. It offers 100% faster deployment as no installation is required. The software will be also automated through the cloud automatically. This is expected to fuel market growth as the above factors will encourage more companies to adopt the technology. In July 2022, AutomationEdge a leading AI-powered IT automation and robotic process automation company in their report mentioned how RPAaaS will power the mid-market growth over the next few years.

The advancement in the latest technology like optical character recognition (OCR), machine learning and robotics process automation analytics is fueling the market expansion.

The latest technology such as optical character recognition (OCR), machine learning and robotics process automation analytics are integrated into the RPA. This led to the development of an intelligent automation system having Tools and Services & Decision Support solutions. This is expected to eliminate desk interaction by 40%, by 2025. In Jan 2022, an article published by NICE stated that OCR in RPA-enabled organizations is quipped to automate a large volume of operational business processes, particularly tasks that still depend heavily on scanned paperwork such as customer-completed forms.

Buy Now

Robotic Process Automation Market Challenge

The lack of awareness among enterprises about the advantages of RPA can restrict the market growth.

Lack of knowledge among enterprises on the full potential of robotic process automation and reluctance to invest in the integration of the software are two major challenges to the Robotic Process Automation Market growth. Most organizations are unaware of the full potential of robotic process automation and how digital transformation can help reduce the overall cost for the company. In Jan 2022, Techwire Asia in their survey report stated that 47% of organizations have not implemented due to lack of awareness, budget constraints and privacy concerns

Robotic Process Automation Industry Outlook

Product launches, collaborations, and R&D activities are key strategies adopted by players in the Robotic Process Automation Market. The Robotic Process Automation Market's top 10 companies include:

IPsoft, Inc.

Verint Systems Inc.

Blue Prism Group plc

Xerox Corporation

Redwood Software

FPT Software Ltd.

Kofax Inc.

NICE Ltd Inc.

UiPath

OnviSource, Inc.

Recent Developments

In August 2022, macami.ai a robotic process automation company launched a new intelligent automation system which explores the integration of robotic process automation and artificial intelligence.

#Robotic Process Automation Market#Robotic Process Automation Market Share#Robotic Process Automation Market Size#Robotic Process Automation Market Forecast#Robotic Process Automation Market Report#Robotic Process Automation Market growth

0 notes

Text

UiPath Inc. Stock Price Forecast: Is It the Right Time to Invest?

Explore UiPath Inc.stock price forecasts, and investment insights. Discover why this leading RPA company could be a valuable #UiPathInc #PATH #investment #stockmarket #stockpriceforecast #stockgrowth #ArtifacialIntelligence #stocinsights #NyseUiPath

UiPath Inc. is a global software company specializing in robotic process automation (RPA) and AI-powered automation. Founded in 2005 by Daniel Dines and Marius Tîrcă in Bucharest, Romania, UiPath’s platform helps businesses automate repetitive tasks, streamline workflows, and boost productivity. The company’s headquarters are in New York City, and it operates in over 31 countries. Continue…

#Artificial intelligence#Automation technology#Financial performance#Innovation#Investment#Investment Insights#Market Analysis#PATH#Robotic process automation (RPA)#Stock Forecast#Stock Insights#Stock Price Forecast#Strategic growth#UiPath Inc

0 notes

Text

0 notes

Text

AI’s Role in Business Process Automation

Automation has come a long way from simply replacing manual tasks with machines. With AI stepping into the scene, business process automation is no longer just about cutting costs or speeding up workflows—it’s about making smarter, more adaptive decisions that continuously evolve. AI isn't just doing what we tell it; it’s learning, predicting, and innovating in ways that redefine how businesses operate.

From hyperautomation to AI-powered chatbots and intelligent document processing, the world of automation is rapidly expanding. But what does the future hold?

What is Business Process Automation?

Business Process Automation (BPA) refers to the use of technology to streamline and automate repetitive, rule-based tasks within an organization. The goal is to improve efficiency, reduce errors, cut costs, and free up human workers for higher-value activities. BPA covers a wide range of functions, from automating simple data entry tasks to orchestrating complex workflows across multiple departments.

Traditional BPA solutions rely on predefined rules and scripts to automate tasks such as invoicing, payroll processing, customer service inquiries, and supply chain management. However, as businesses deal with increasing amounts of data and more complex decision-making requirements, AI is playing an increasingly critical role in enhancing BPA capabilities.

AI’s Role in Business Process Automation

AI is revolutionizing business process automation by introducing cognitive capabilities that allow systems to learn, adapt, and make intelligent decisions. Unlike traditional automation, which follows a strict set of rules, AI-driven BPA leverages machine learning, natural language processing (NLP), and computer vision to understand patterns, process unstructured data, and provide predictive insights.

Here are some of the key ways AI is enhancing BPA:

Self-Learning Systems: AI-powered BPA can analyze past workflows and optimize them dynamically without human intervention.

Advanced Data Processing: AI-driven tools can extract information from documents, emails, and customer interactions, enabling businesses to process data faster and more accurately.

Predictive Analytics: AI helps businesses forecast trends, detect anomalies, and make proactive decisions based on real-time insights.

Enhanced Customer Interactions: AI-powered chatbots and virtual assistants provide 24/7 support, improving customer service efficiency and satisfaction.

Automation of Complex Workflows: AI enables the automation of multi-step, decision-heavy processes, such as fraud detection, regulatory compliance, and personalized marketing campaigns.

As organizations seek more efficient ways to handle increasing data volumes and complex processes, AI-driven BPA is becoming a strategic priority. The ability of AI to analyze patterns, predict outcomes, and make intelligent decisions is transforming industries such as finance, healthcare, retail, and manufacturing.

“At the leading edge of automation, AI transforms routine workflows into smart, adaptive systems that think ahead. It’s not about merely accelerating tasks—it’s about creating an evolving framework that continuously optimizes operations for future challenges.”

— Emma Reynolds, CTO of QuantumOps

Trends in AI-Driven Business Process Automation

1. Hyperautomation

Hyperautomation, a term coined by Gartner, refers to the combination of AI, robotic process automation (RPA), and other advanced technologies to automate as many business processes as possible. By leveraging AI-powered bots and predictive analytics, companies can automate end-to-end processes, reducing operational costs and improving decision-making.

Hyperautomation enables organizations to move beyond simple task automation to more complex workflows, incorporating AI-driven insights to optimize efficiency continuously. This trend is expected to accelerate as businesses adopt AI-first strategies to stay competitive.

2. AI-Powered Chatbots and Virtual Assistants

Chatbots and virtual assistants are becoming increasingly sophisticated, enabling seamless interactions with customers and employees. AI-driven conversational interfaces are revolutionizing customer service, HR operations, and IT support by providing real-time assistance, answering queries, and resolving issues without human intervention.

The integration of AI with natural language processing (NLP) and sentiment analysis allows chatbots to understand context, emotions, and intent, providing more personalized responses. Future advancements in AI will enhance their capabilities, making them more intuitive and capable of handling complex tasks.

3. Process Mining and AI-Driven Insights

Process mining leverages AI to analyze business workflows, identify bottlenecks, and suggest improvements. By collecting data from enterprise systems, AI can provide actionable insights into process inefficiencies, allowing companies to optimize operations dynamically.

AI-powered process mining tools help businesses understand workflow deviations, uncover hidden inefficiencies, and implement data-driven solutions. This trend is expected to grow as organizations seek more visibility and control over their automated processes.

4. AI and Predictive Analytics for Decision-Making

AI-driven predictive analytics plays a crucial role in business process automation by forecasting trends, detecting anomalies, and making data-backed decisions. Companies are increasingly using AI to analyze customer behaviour, market trends, and operational risks, enabling them to make proactive decisions.

For example, in supply chain management, AI can predict demand fluctuations, optimize inventory levels, and prevent disruptions. In finance, AI-powered fraud detection systems analyze transaction patterns in real-time to prevent fraudulent activities. The future of BPA will heavily rely on AI-driven predictive capabilities to drive smarter business decisions.

5. AI-Enabled Document Processing and Intelligent OCR

Document-heavy industries such as legal, healthcare, and banking are benefiting from AI-powered Optical Character Recognition (OCR) and document processing solutions. AI can extract, classify, and process unstructured data from invoices, contracts, and forms, reducing manual effort and improving accuracy.

Intelligent document processing (IDP) combines AI, machine learning, and NLP to understand the context of documents, automate data entry, and integrate with existing enterprise systems. As AI models continue to improve, document processing automation will become more accurate and efficient.

Going Beyond Automation

The future of AI-driven BPA will go beyond automation—it will redefine how businesses function at their core. Here are some key predictions for the next decade:

Autonomous Decision-Making: AI systems will move beyond assisting human decisions to making autonomous decisions in areas such as finance, supply chain logistics, and healthcare management.

AI-Driven Creativity: AI will not just automate processes but also assist in creative and strategic business decisions, helping companies design products, create marketing strategies, and personalize customer experiences.

Human-AI Collaboration: AI will become an integral part of the workforce, working alongside employees as an intelligent assistant, boosting productivity and innovation.

Decentralized AI Systems: AI will become more distributed, with businesses using edge AI and blockchain-based automation to improve security, efficiency, and transparency in operations.

Industry-Specific AI Solutions: We will see more tailored AI automation solutions designed for specific industries, such as AI-driven legal research tools, medical diagnostics automation, and AI-powered financial advisory services.

AI is no longer a futuristic concept—it’s here, and it’s already transforming the way businesses operate. What’s exciting is that we’re still just scratching the surface. As AI continues to evolve, businesses will find new ways to automate, innovate, and create efficiencies that we can’t yet fully imagine.

But while AI is streamlining processes and making work more efficient, it’s also reshaping what it means to be human in the workplace. As automation takes over repetitive tasks, employees will have more opportunities to focus on creativity, strategy, and problem-solving. The future of AI in business process automation isn’t just about doing things faster—it’s about rethinking how we work all together.

Learn more about DataPeak:

#datapeak#factr#technology#agentic ai#saas#artificial intelligence#machine learning#ai#ai-driven business solutions#machine learning for workflow#ai solutions for data driven decision making#ai business tools#aiinnovation#digitaltools#digital technology#digital trends#dataanalytics#data driven decision making#data analytics#cloudmigration#cloudcomputing#cybersecurity#cloud computing#smbs#chatbots

2 notes

·

View notes

Text

The Impact of AI Software on Business: Enhancing Efficiency with AI Business Tools

In today's fast-paced digital landscape, businesses are continuously seeking innovative solutions to enhance productivity and streamline operations. AI software for business and AI business tools have emerged as transformative technologies, enabling organizations to harness the power of artificial intelligence to improve efficiency, decision-making, and customer satisfaction. This article explores the benefits, applications, and best practices of integrating AI software into your business strategy.

Understanding AI Software for Business

AI software for business encompasses a wide range of applications and tools designed to perform tasks that typically require human intelligence. These can include natural language processing (NLP), machine learning (ML), computer vision, and robotic process automation (RPA). By leveraging these technologies, businesses can automate routine tasks, analyze large datasets, and gain insights that drive strategic decision-making.

Benefits of AI Software

Increased Efficiency: One of the primary advantages of AI software is its ability to automate repetitive tasks. For example, businesses can use AI-powered chatbots to handle customer inquiries, allowing human agents to focus on more complex issues.

Data Analysis and Insights: AI tools can analyze vast amounts of data quickly, providing valuable insights that help businesses make informed decisions. This capability is particularly beneficial in areas such as market research, customer behavior analysis, and financial forecasting.

Enhanced Customer Experience: AI software can personalize customer interactions by analyzing user behavior and preferences. For instance, AI can recommend products based on past purchases, improving customer satisfaction and loyalty.

Cost Savings: By automating tasks and improving operational efficiency, businesses can significantly reduce labor costs. AI tools can help identify inefficiencies and areas for improvement, leading to further cost reductions.

Scalability: AI business tools can easily scale with a company’s growth. As a business expands, AI solutions can adapt to increasing data volumes and more complex operational needs without requiring a complete overhaul.

Key Applications of AI Business Tools

AI business tools can be integrated into various business functions, enhancing productivity and effectiveness. Here are some key applications:

1. Marketing Automation

AI software can analyze customer data to optimize marketing campaigns. Tools like predictive analytics can forecast customer behavior, allowing businesses to tailor their marketing strategies for better engagement. Moreover, AI can automate social media posting and email marketing, ensuring timely communication with minimal effort.

2. Customer Service

AI-powered chatbots are revolutionizing customer service by providing instant responses to customer inquiries. These bots can handle multiple requests simultaneously, improving response times and reducing wait times for customers. Additionally, AI can analyze customer interactions to identify common issues and suggest improvements to service processes.

3. Sales Optimization

AI business tools can streamline the sales process by providing insights into customer behavior and preferences. Sales teams can utilize AI for lead scoring, identifying high-potential leads based on historical data. This targeted approach helps sales representatives prioritize their efforts, increasing conversion rates.

4. Human Resources Management

AI software can transform human resources processes by automating tasks such as resume screening and employee onboarding. AI tools can analyze candidate profiles, helping HR professionals identify the best-fit candidates quickly. Furthermore, AI can monitor employee performance and engagement, enabling proactive measures to enhance workplace satisfaction.

5. Supply Chain Management

In supply chain management, AI can optimize inventory management, demand forecasting, and logistics. AI algorithms analyze historical data and market trends to predict demand, helping businesses maintain optimal inventory levels. This reduces carrying costs and minimizes the risk of stockouts or overstocking.

Best Practices for Implementing AI Software

While integrating AI software into your business can yield significant benefits, it’s essential to approach implementation strategically. Here are some best practices:

1. Define Clear Objectives

Before adopting AI software, clearly define your business objectives. Identify the specific problems you aim to solve or the processes you wish to improve. This clarity will guide your selection of AI tools and help measure their impact.

2. Start Small

Begin with small-scale AI projects to test their effectiveness before rolling them out on a larger scale. This approach allows you to evaluate the software’s performance, identify potential challenges, and make necessary adjustments.

3. Invest in Training

Providing training for your team is crucial to ensure successful adoption. Employees should understand how to use AI tools effectively and be aware of the benefits they bring. Ongoing training will also help them adapt to new features and updates.

4. Monitor Performance

Continuously monitor the performance of AI software to assess its impact on your business. Collect data on key performance indicators (KPIs) related to the areas you aim to improve. Regular evaluations will help you refine your AI strategy and make informed decisions about future investments.

5. Prioritize Data Security

As AI software relies on data to function effectively, it’s essential to prioritize data security and privacy. Implement robust security measures to protect sensitive information and comply with relevant regulations. Ensure that your AI solutions follow best practices for data handling and storage.

Conclusion

Incorporating AI software for business and AI business tools can significantly enhance operational efficiency and drive growth. By automating tasks, providing valuable insights, and improving customer interactions, businesses can stay competitive in an ever-evolving market. As you explore the potential of AI, remember to approach implementation thoughtfully, keeping in mind the specific needs and objectives of your organization. With the right strategy, AI can be a game-changer for your business, paving the way for increased productivity and success.

3 notes

·

View notes

Text

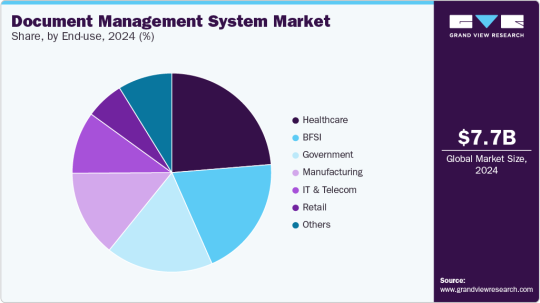

AI in Action: Intelligent Solutions for the Document Management System Market

The global document management system market was valued at USD 7.68 billion in 2024 and is projected to reach USD 18.17 billion by 2030, demonstrating a robust Compound Annual Growth Rate (CAGR) of 15.9% from 2025 to 2030. This expansion is primarily fueled by organizations' increasing need to securely manage and store vast volumes of digital information.

As businesses worldwide embrace digital transformation and move towards paperless operations, the demand for effective solutions for document storage, retrieval, and management has escalated. The accelerated adoption of cloud-based DMS solutions has further spurred this trend, offering businesses scalable, cost-effective, and readily accessible options. Moreover, the heightened focus on compliance and regulatory mandates is significantly contributing to the growth of the DMS industry. Enterprises operating in heavily regulated sectors like healthcare, finance, and legal are increasingly implementing DMS to ensure strict adherence to data security, privacy, and record-keeping regulations. These systems facilitate streamlined audits, maintain secure document trails, and mitigate the risk of non-compliance penalties.

Key Market Trends & Insights:

Regional Leadership: The North American document management system market commanded a substantial revenue share of almost 40.0% in 2024, driven by the escalating demand for digital transformation across various industries.

Component Dominance: The software segment held the largest market share, exceeding 67.0% of the revenue in 2024. This dominance is attributed to the growing demand for cloud-based, AI-driven, and compliance-ready solutions.

Deployment Preference: The cloud segment led the market with a revenue share of over 67.0% in 2024. This is propelled by the integration of advanced technologies such as Artificial Intelligence (AI), Machine Learning (ML), and Robotic Process Automation (RPA) into cloud DMS platforms.

Enterprise Size Leadership: Large enterprises accounted for nearly 67.0% of the market's revenue share in 2024. This is due to the immense volume of enterprise-grade documents they manage and their critical need for scalable, secure, and intelligent document workflows.

End-Use Sector Dominance: The healthcare segment generated over 23.0% of the market's revenue share in 2024. A significant driver here is the accelerating shift towards Electronic Health Records (EHRs) and paperless systems within the healthcare industry.

Order a free sample PDF of the Document Management System Market Intelligence Study, published by Grand View Research.

Market Size & Forecast

2024 Market Size: USD 7.68 billion

2030 Projected Market Size: USD 18.17 billion

CAGR (2025-2030): 15.9%

North America: Largest market in 2024

Asia Pacific: Fastest growing market

Key Companies & Market Share Insights

Leading companies in the document management system (DMS) industry, including Microsoft, IBM Corporation, Oracle Corporation, Open Text Corporation, and Hyland Software, Inc., are actively engaged in strategic initiatives to enhance their competitive edge. These strategies largely involve new product development, forging partnerships and collaborations, and entering into agreements.

Illustrative of these efforts, in April 2025, Hyland Software, Inc. significantly expanded its product offerings by integrating advanced AI capabilities. Through substantial updates to Hyland Automate, Hyland Knowledge Discovery, and key improvements to Hyland OnBase and Hyland Alfresco, the company aims to provide organizations with sophisticated tools for optimizing content, processes, and application intelligence. Their Hyland Content Intelligence product line is designed to empower businesses with actionable insights derived from simple natural language queries, thereby streamlining complex searches and delivering precise information from vast enterprise content.

Similarly, in March 2025, IBM Corporation launched IBM Storage Ceph as a Service, broadening its suite of flexible on-premises infrastructure solutions. This new service complements IBM Power delivered as a service, offering a distributed compute platform with diverse form factors and adaptable consumption models. The IBM Storage Ceph service facilitates the integration of cloud-based solutions with on-premises environments, providing a unified software-defined storage solution that encompasses block, file, and object data. Its goal is to help organizations eliminate data silos and modernize their data lakes and virtual machine storage, delivering a seamless cloud storage experience within their own data centers.

Further demonstrating industry innovation, in December 2024, OpenText introduced Core Digital Asset Management (Core DAM). This solution is engineered to optimize the digital content supply chain by incorporating powerful features that yield tangible results. Core DAM leverages practical AI to automate tasks such as image tagging, video transcript generation, and the creation of design inspiration images using OpenText Experience Aviator, significantly boosting the efficiency and accuracy of creative workflows. It also provides global content access, enabling users to generate instant links for high-performance display worldwide.

Key Players

Agiloft, Inc.

Alfresco Software Inc.

Cflowapps

DocLogix

Hyland Software, Inc.

IBM Corporation

Integrify

Browse Horizon Databook for Global Document Management System Market Size & Outlook

Conclusion

The document management system (DMS) market is rapidly growing, driven by the need for secure digital information management and paperless transitions. Cloud-based solutions and regulatory compliance are key growth factors. North America leads the market, with software and cloud deployments dominating. Large enterprises and the healthcare sector are major adopters. Leading companies are innovating with AI and strategic collaborations to enhance their offerings.

0 notes

Text

Industrial Efficiency Gains Spark Growth in Torque Limiter Market

The global Torque Limiter Market was valued at US$ 324.9 Mn in 2023 and is projected to grow at a CAGR of 5.8% from 2024 to 2034, reaching US$ 597.4 Mn by the end of the forecast period. Increasing demand for machine safety, process efficiency, and the integration of advanced technologies is fueling this robust expansion.

Market Overview: Torque limiters, essential components in mechanical systems, play a critical role in protecting machinery from damage due to overload conditions. They disengage the drive system when preset torque levels are exceeded, ensuring operational safety and minimizing downtime.

The ongoing transition to smart manufacturing, fueled by Industry 4.0, is significantly contributing to the adoption of torque limiters. Industries such as automotive, aerospace, and renewable energy are the largest consumers of these components due to their need for precision, reliability, and safety.

Market Drivers & Trends

Automation in Production Processes: The proliferation of automation, especially in developing economies, is a major growth driver. Smart factories demand precise safety mechanisms, prompting widespread integration of torque limiters.

Electric Vehicle Growth: Torque limiters are essential in protecting sensitive EV components from torque surges. The EV boom, especially in Asia and Europe, is translating to increased product demand.

Wind Energy Integration: As wind turbines face varying loads, torque limiters prevent mechanical failure, ensuring operational reliability. This is particularly significant as global wind capacity surpassed 900 GW in 2023.

Latest Market Trends

Smart Torque Limiters: IoT-enabled limiters with real-time monitoring capabilities are becoming mainstream. These systems offer predictive maintenance and better control, aligning with smart factory goals.

Customization and Miniaturization: With the rise of compact machinery and robotics, manufacturers are offering smaller and application-specific torque limiters.

Sustainability and Energy Efficiency: Modern torque limiters are being designed with a focus on energy savings, lighter materials, and recyclability to meet environmental standards.

Key Players and Industry Leaders

The market is moderately fragmented with the presence of prominent players including:

Chr. Mayr GmbH + Co. KG

R+W Antriebselemente GmbH

KTR Systems GmbH

Nexen Group, Inc.

Tsubakimoto Chain Co.

Altra Industrial Motion Corp.

RINGSPANN GmbH

Howdon Power Transmission Ltd.

These companies are investing heavily in R&D, digital capabilities, and strategic partnerships to enhance their offerings and global presence.

Explore the highlights and essential data from our Report in this sample - https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=32813

Recent Developments

Regal Rexnord Corporation (June 2023) launched the next-gen Autogard F400 Series torque limiter with enhanced performance and drop-in compatibility.

ENEMAC (May 2023) introduced the ECP torque limiter featuring an integrated ball bearing for superior concentricity and overload protection in indirect drives.

U.S. Tsubaki (2020) unveiled a torque limiter sprocket assembly combining torque control and drive in a single unit, offering ease of installation and reliability.

Market Opportunities

Emerging Economies: Expanding industrial bases in India, Southeast Asia, and Latin America present substantial growth avenues, especially with increasing government investments in automation.

Retrofit Solutions: As legacy equipment needs upgrades to comply with safety norms, torque limiter retrofits offer a lucrative opportunity.

Predictive Maintenance Services: There’s rising demand for service models that combine hardware with analytics-driven maintenance, particularly in high-risk environments.

Future Outlook

According to industry analysts, the torque limiter market is on a steady trajectory, driven by the convergence of smart manufacturing, safety standards, and sustainable industrial practices. The integration of torque limiters into predictive maintenance ecosystems and their indispensable role in electrification will sustain long-term market momentum.

While higher upfront costs of advanced models may pose a challenge in cost-sensitive regions, the return on investment in terms of reduced downtime and equipment longevity makes a compelling case for adoption.

Market Segmentation

By Type:

Friction Type

Ball & Roller Type (Dominated market with 65.6% share in 2023)

Others

By Torque Range:

< 150 Nm

151–500 Nm

501–3000 Nm (Held 35.9% market share in 2023)

3000 Nm

By End-user Industry:

Automotive

Aerospace

Energy & Power

Fabricated Metal Manufacturing

Food & Beverage

Packaging & Labelling

Plastic & Rubber

Others

Regional Insights

Europe leads the global torque limiter market, accounting for 32.6% of global revenue in 2023. Germany, France, and the U.K. are key contributors due to their strong automotive and manufacturing sectors. Europe’s focus on Industry 4.0, energy efficiency, and safety regulations underpins its market leadership.

North America follows closely with 29.3% share, driven by its robust industrial base and emphasis on advanced automation. The U.S. and Canada are adopting IoT-enabled torque limiters in line with smart factory initiatives.

Asia Pacific is witnessing rapid growth due to massive industrialization and the EV boom in China, India, and Japan. The region is also the fastest-growing market in terms of volume consumption.

Why Buy This Report?

Gain in-depth understanding of the torque limiter market dynamics, including macroeconomic trends and sector-specific drivers.

Access historical data (2020–2023) and forecasts (2024–2034) for strategic planning.

Evaluate key opportunities by segment, region, and application.

Review competitive benchmarking and company profiles of major and emerging players.

Identify investment and partnership opportunities in emerging regions and technologies.

Frequently Asked Questions (FAQs)

Q1: What is the projected size of the torque limiter market by 2034? A1: The market is expected to reach US$ 597.4 Mn by 2034, growing at a CAGR of 5.8%.

Q2: Which industry is the largest consumer of torque limiters? A2: The automotive industry is the largest, driven by rising EV adoption and drivetrain protection needs.

Q3: What is the fastest-growing torque range segment? A3: The 501–3000 Nm range is the fastest-growing due to demand in heavy machinery and manufacturing.

Q4: Which region dominates the global torque limiter market? A4: Europe, with 32.6% market share in 2023, leads due to its industrial modernization and safety regulations.

Q5: What are the latest innovations in the torque limiter market? A5: Innovations include IoT-enabled smart torque limiters, predictive maintenance integration, and lightweight materials.

Q6: Who are the key market players? A6: Major players include Chr. Mayr GmbH + Co. KG, KTR Systems GmbH, Tsubakimoto Chain Co., and Nexen Group, Inc.

Explore Latest Research Reports by Transparency Market Research:

GMC based Motion Controller Market: https://www.transparencymarketresearch.com/gmc-based-motion-controller-market.html

Metal Oxide Varistors Market: https://www.transparencymarketresearch.com/metal-oxide-varistors-market-2018-2026.html

GaN on Diamond Semiconductor Substrates Market: https://www.transparencymarketresearch.com/gan-diamond-semiconductor-substrates-market.html

Humidity Meter Market: https://www.transparencymarketresearch.com/humidity-meter-market.html

About Transparency Market Research Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information. Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports. Contact: Transparency Market Research Inc. CORPORATE HEADQUARTER DOWNTOWN, 1000 N. West Street, Suite 1200, Wilmington, Delaware 19801 USA Tel: +1-518-618-1030 USA - Canada Toll Free: 866-552-3453 Website: https://www.transparencymarketresearch.com Email: [email protected]

0 notes

Text

Edge AI Meets Smart Sensors: Real-Time Data Processing Takes the Lead

The global smart sensors market is experiencing unprecedented growth, fueled by rapid digital transformation across industries, rising adoption of IoT-enabled devices, and the integration of artificial intelligence in sensor technologies. As industries shift toward automation, real-time monitoring, and data-driven operations, smart sensors have become the backbone of modern electronic ecosystems.

Unlock exclusive insights with our detailed sample report :

According to recent industry insights, the smart sensors market was valued at USD 45.63 billion in 2023 and is projected to reach USD 145.23 billion by 2031, growing at a CAGR of 15.6% during the forecast period. Key industries including automotive, healthcare, consumer electronics, aerospace, and manufacturing are witnessing a surge in demand for intelligent sensors capable of capturing and processing environmental data with minimal latency.

Market Drivers and Growth Opportunities

1. Proliferation of IoT Devices and Smart Infrastructure The explosion of IoT applications in smart homes, smart cities, and industrial IoT (IIoT) has driven the need for sensors that are not only accurate but also intelligent. These sensors support seamless data transmission and decision-making capabilities in connected ecosystems.

2. Automation and Industry 4.0 Transformation Industries are investing heavily in predictive maintenance, process automation, and robotics. Smart sensors such as temperature, pressure, proximity, and image sensors are at the core of these applications, enabling real-time monitoring and adaptive control in automated systems.

3. Rising Demand in Healthcare Smart sensors are revolutionizing healthcare through wearable technology, patient monitoring devices, and remote diagnostics. With the growing geriatric population and demand for personalized healthcare, sensor integration in medical devices is a key market driver.

4. Growing Popularity of Smart Consumer Electronics From smartphones and smartwatches to AR/VR devices and home appliances, the integration of multi-functional smart sensors is enhancing user experience and device interactivity, contributing to soaring market demand.

5. Environmental Monitoring and Sustainability Climate change and environmental regulations are encouraging governments and industries to adopt smart sensors for air quality, water purity, and pollution monitoring. These solutions are essential for meeting global sustainability goals.

Speak to Our Senior Analyst and Get Customization in the report as per your requirements:

https://www.datamintelligence.com/customize/smart-sensors-market

Market Segmentation Overview

By Sensor Type: Includes pressure sensors, temperature sensors, image sensors, touch sensors, motion sensors, and gas sensors. Image and motion sensors are gaining traction in automotive and consumer electronics sectors.

By Technology: MEMS (Microelectromechanical Systems), CMOS (Complementary Metal-Oxide-Semiconductor), and optical sensing technologies dominate due to their efficiency, miniaturization, and compatibility with IoT platforms.

By End-Use Industry: Automotive, healthcare, industrial automation, consumer electronics, and aerospace & defense are key application areas. Among them, industrial and healthcare sectors are the fastest growing.

U.S. and Japan Market Insights

United States The U.S. remains a dominant force in smart sensor adoption, driven by strong demand across aerospace, automotive, defense, and healthcare industries. In early 2025, the U.S. Department of Energy announced a $1.2 billion fund for smart grid modernization, which includes significant investment in smart sensors for energy distribution and consumption tracking. Additionally, major tech firms such as Apple, Texas Instruments, and Honeywell are innovating sensor fusion technologies to enable smarter and more efficient devices.

Japan Japan, a global leader in robotics and automation, is rapidly advancing smart sensor deployment in its manufacturing and automotive sectors. With its focus on Smart Factories under “Society 5.0,” Japan is integrating AI-powered sensors into robotics, EVs, and public infrastructure. In March 2025, a leading Japanese electronics manufacturer launched a new line of miniaturized smart sensors for next-generation autonomous vehicles and wearable healthcare devices, underscoring Japan’s strong R&D capabilities.

Latest Trends and Innovations

AI-Embedded Smart Sensors: Integration of edge AI allows sensors to process data locally, improving response times and reducing the load on central systems. This is particularly useful in autonomous vehicles, predictive maintenance, and smart healthcare.

Sensor Fusion for Enhanced Accuracy: Combining multiple sensor inputs (e.g., gyroscope + accelerometer + magnetometer) provides more precise data. This trend is rising in consumer electronics and wearable fitness devices.

Advances in MEMS Technology: MEMS-based sensors are evolving rapidly, enabling lower power consumption and smaller form factors. These are ideal for implantable medical devices and compact electronics.

Energy Harvesting Sensors: To support sustainability, sensors that draw energy from ambient sources like light, heat, or motion are becoming more prominent, especially in remote monitoring and IoT applications.

Cybersecurity in Sensor Networks: As smart sensors become part of critical infrastructure, the importance of secure data transmission and sensor-level encryption is gaining attention, especially in military, healthcare, and smart grid applications.

Buy the exclusive full report here:

Competitive Landscape

The market is moderately consolidated with global players focusing on R&D, strategic collaborations, and geographic expansion to maintain competitiveness. Key players include:

Honeywell International Inc.

STMicroelectronics

Infineon Technologies AG

Robert Bosch GmbH

Texas Instruments Incorporated

TE Connectivity Ltd.

NXP Semiconductors

Analog Devices, Inc.

Siemens AG

Omron Corporation

These companies are pushing the boundaries in multi-sensor integration, AI-powered detection systems, and low-power sensor networks.

Future Outlook and Market Opportunities

1. Smart City Initiatives: Governments across the globe, particularly in the U.S. and Asia, are investing in smart infrastructure. Smart sensors will play a central role in traffic management, lighting, surveillance, and environmental monitoring.

2. Growth in Electric Vehicles (EVs): EVs require a wide array of sensors for battery management, motor control, and safety systems. As EV adoption surges globally, the demand for automotive-grade smart sensors will follow suit.

3. Space and Aerospace Applications: High-reliability smart sensors are being developed for satellites and space missions to monitor pressure, radiation, and temperature in extreme environments.

4. Expanding Use in Agriculture (AgriTech): Smart sensors are increasingly used in precision farming, monitoring soil moisture, crop health, and weather patterns to optimize resource use and productivity.

Stay informed with the latest industry insights-start your subscription now:

Conclusion

The global smart sensors market stands at the intersection of innovation, automation, and connectivity. With widespread applications across industries and increasing integration of AI and IoT, smart sensors are redefining how machines interact with their environments. The market’s rapid expansion—led by the U.S. and Japan—signals a transformative shift toward a more responsive, efficient, and intelligent future. As sensor technologies continue to evolve, businesses and governments alike must harness their full potential to stay ahead in the digital age.

About us:

At DataM Intelligence, we specialize in delivering end-to-end market research and consulting solutions designed to unlock your business potential. By harnessing proprietary insights, market trends, and breakthrough developments, we craft intelligent strategies that drive results.

With a repository of 6,300+ detailed reports across 40+ sectors, we’ve helped over 200 global businesses across 50+ nations achieve growth. From syndicated analysis to tailored research, our dynamic approach addresses the critical intelligence your business needs to thrive.

Contact US:

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: [email protected]

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

#Smart sensors market#Smart sensors market size#Smart sensors market growth#Smart sensors market share#Smart sensors market analysis

0 notes

Text

Factory Automation Market

Factory Automation Market size is forecast to reach $233.5 Billion by 2030, after growing at a CAGR of 3.3% during 2024–2030.

🔗 𝐆𝐞𝐭 𝐑𝐎𝐈-𝐟𝐨𝐜𝐮𝐬𝐞𝐝 𝐢𝐧𝐬𝐢𝐠𝐡𝐭𝐬 𝐟𝐨𝐫 𝟐𝟎𝟐𝟓-𝟐𝟎𝟑𝟏 → 𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐍𝐨𝐰

Factory Automation Market is a rapidly growing sector driven by the demand for increased productivity, precision, and cost efficiency in manufacturing. It encompasses technologies like robotics, sensors, control systems, AI, and IoT to streamline industrial processes. Automation reduces human intervention, minimizes errors, and enhances operational efficiency.

Key industries adopting automation include automotive, electronics, pharmaceuticals, and food processing. As smart factories and Industry 4.0 trends gain momentum, the market is witnessing significant investments and innovation.

🔑 𝐊𝐞𝐲 𝐌𝐚𝐫𝐤𝐞𝐭 𝐃𝐫𝐢𝐯𝐞𝐫𝐬:

🔸 𝐈𝐧𝐝𝐮𝐬𝐭𝐫𝐲 𝟒.𝟎 𝐀𝐝𝐨𝐩𝐭𝐢𝐨𝐧

Integration of smart technologies like AI, IoT, and big data is transforming factories into intelligent, connected systems.

🔸 𝐑𝐢𝐬𝐢𝐧𝐠 𝐃𝐞𝐦𝐚𝐧𝐝 𝐟𝐨𝐫 𝐄𝐟𝐟𝐢𝐜𝐢𝐞𝐧𝐜𝐲 & 𝐏𝐫𝐨𝐝𝐮𝐜𝐭𝐢𝐯𝐢𝐭𝐲

Manufacturers seek faster production cycles, reduced downtime, and higher output with fewer errors.

🔸 𝐋𝐚𝐛𝐨𝐫 𝐒𝐡𝐨𝐫𝐭𝐚𝐠𝐞𝐬 & 𝐑𝐢𝐬𝐢𝐧𝐠 𝐋𝐚𝐛𝐨𝐫 𝐂𝐨𝐬𝐭𝐬

Automation helps address skilled labor shortages and reduce long-term labor costs.

🔸 𝐄𝐦𝐩𝐡𝐚𝐬𝐢𝐬 𝐨𝐧 𝐐𝐮𝐚𝐥𝐢𝐭𝐲 & 𝐂𝐨𝐧𝐬𝐢𝐬𝐭𝐞𝐧𝐜𝐲

Automated systems ensure uniform product quality and reduce variability in production.

🔸 𝐆𝐫𝐨𝐰𝐢𝐧𝐠 𝐔𝐬𝐞 𝐨𝐟 𝐈𝐧𝐝𝐮𝐬𝐭𝐫𝐢𝐚𝐥 𝐑𝐨𝐛𝐨𝐭𝐬

Robotics adoption is surging in sectors like automotive, electronics, and logistics for precise and repetitive tasks.

𝐓𝐨𝐩 𝐊𝐞𝐲 𝐏𝐥𝐚𝐲𝐞𝐫𝐬:

BizLink Factory Automation & Machinery | Mitsubishi Electric Ireland Factory Automation | Mitsubishi Electric Factory Automation Benelux | Festo USA | ABB | Avago Technologies | Banner Engineering | FANUC America Corporation | Invio Automation | MISUMI USA | Hai Robotics | Afag | Discrete Automation | OTC Industrial Technologies

#FactoryAutomation #SmartManufacturing #IndustrialAutomation #ManufacturingInnovation #AutomationSolutions #AutomatedManufacturing #SmartFactory #DigitalManufacturing #Industry40 #IoTInManufacturing

0 notes

Text

5G IoT Chip Market: Technology Trends and Future Outlook 2025–2032

MARKET INSIGHTS

The global 5G IoT Chip market size was valued at US$ 4.87 billion in 2024 and is projected to reach US$ 12.43 billion by 2032, at a CAGR of 14.6% during the forecast period 2025-2032.

5G IoT chips are specialized semiconductor components that integrate 5G connectivity with IoT device functionalities. These system-on-chips (SoCs) combine radio frequency (RF) transceivers, baseband processors, and application processors in compact form factors, enabling high-speed, low-latency wireless communication for smart devices. Leading manufacturers are focusing on chips manufactured at 7nm, 10nm, and 12nm process nodes to balance performance and power efficiency.

The market expansion is driven by several factors, including the rollout of 5G infrastructure globally, increasing demand for industrial automation, and the proliferation of smart city applications. While the semiconductor industry overall grows at 6% CAGR, 5G IoT chips represent one of the fastest-growing segments due to their critical role in enabling next-generation applications. Key players like Qualcomm, MediaTek, and Intel are investing heavily in R&D to develop energy-efficient chips capable of supporting massive machine-type communications (mMTC) and ultra-reliable low-latency communications (URLLC) – two fundamental 5G IoT use cases.

MARKET DYNAMICS

MARKET DRIVERS

Proliferation of 5G Network Infrastructure Accelerating IoT Chip Adoption

The global rollout of 5G networks is creating unprecedented demand for compatible IoT chipsets. With over 290 commercial 5G networks deployed worldwide as of early 2024, telecom operators are investing heavily in infrastructure that requires low-latency, high-bandwidth connectivity solutions. The enhanced capabilities of 5G—including speeds up to 100 times faster than 4G and latency under 5 milliseconds—enable mission-critical IoT applications that were previously impractical. This technological leap is driving adoption across industries from manufacturing to healthcare, where real-time data processing is becoming essential for operational efficiency. Recent enhancements in network slicing capabilities further allow customized connectivity solutions for diverse IoT use cases.

Industrial Automation Revolution Driving Demand for Robust Connectivity Solutions

Industry 4.0 transformation across manufacturing sectors is creating substantial demand for 5G IoT chips capable of supporting advanced automation. Smart factories require thousands of connected sensors, actuators and control systems that demand reliable, low-latency communication. Predictive maintenance applications alone are projected to save manufacturers billions annually through reduced downtime. Autonomous mobile robots (AMRs) in warehouse operations increasingly rely on 5G’s ultra-reliable low-latency communication (URLLC) capabilities, creating new requirements for industrial-grade IoT chipsets. The growing integration of AI at the edge further intensifies processing demands, prompting chipmakers to develop solutions that combine 5G connectivity with neural processing capabilities.

Government Initiatives for Smart City Development Stimulating Market Growth

National smart city programs globally are accelerating deployment of 5G-powered IoT solutions for urban infrastructure management. Many governments have designated 5G as critical infrastructure, with billions allocated for digital transformation projects. Smart utilities, intelligent transportation systems, and public safety applications collectively require millions of connected devices. Smart meter deployments alone are projected to exceed 1.5 billion units globally by 2027, with advanced models incorporating 5G connectivity for real-time grid monitoring. These large-scale public sector IoT implementations create sustained demand for ruggedized, energy-efficient 5G chips designed for long-term outdoor deployment.

MARKET RESTRAINTS

High Power Consumption of 5G Modems Constraining Mass IoT Adoption

While 5G offers superior bandwidth and latency characteristics, the technology’s power requirements present significant challenges for battery-operated IoT devices. Current 5G modem implementations consume substantially more power than LTE-M or NB-IoT alternatives, limiting practicality for deployments requiring years of battery life. This power inefficiency affects adoption in asset tracking, agricultural monitoring, and other remote sensing applications where long intervals between maintenance are critical. Though chipmakers are developing low-power modes and advanced power management architectures, achieving parity with LTE power profiles while maintaining 5G performance remains an ongoing engineering challenge restricting certain market segments.

Complex Regulatory Compliance Increasing Time-to-Market for New Chip Designs

The global regulatory environment for 5G spectrum usage creates substantial barriers to IoT chipset development. Unlike previous cellular generations, 5G operates across numerous frequency bands (sub-6GHz and mmWave) with varying regional allocations and certification requirements. A single chipset intended for worldwide deployment must comply with dozens of different technical regulations regarding radio emissions, frequency use, and security protocols. This regulatory complexity extends development timelines and increases testing costs, particularly for smaller semiconductor firms without established compliance infrastructure. Recent geopolitical tensions have further fragmented the regulatory landscape, requiring manufacturers to develop region-specific variants of their products.

MARKET CHALLENGES

Semiconductor Supply Chain Vulnerabilities Disrupting Production Timelines

The 5G IoT chip market faces ongoing challenges from global semiconductor supply chain instability. Advanced nodes required for 5G modem integration (particularly 7nm and below) remain capacity-constrained at leading foundries, creating allocation challenges for fabless chip designers. The industry’s heavy reliance on a limited number of advanced packaging facilities further compounds supply risks. Recent geopolitical developments have introduced additional uncertainty regarding access to critical semiconductor manufacturing equipment and materials. These supply chain limitations create unpredictable lead times that complicate product roadmaps and constrain manufacturers’ ability to respond to sudden demand surges in key vertical markets.

Security Vulnerabilities in Heterogeneous IoT Ecosystems Creating Deployment Concerns

The distributed nature of 5G IoT implementations introduces significant cybersecurity challenges that chipmakers must address. Unlike traditional IT systems, IoT deployments incorporate numerous edge devices with varying security capabilities connected through potentially vulnerable networks. Recent analyses indicate that over 40% of IoT devices contain critical security flaws that could compromise entire networks. While 5G standards include enhanced security protocols compared to previous generations, their effective implementation relies on robust hardware-level security in endpoint chips. The semiconductor industry faces increasing pressure to incorporate hardware roots of trust, secure boot mechanisms, and hardware-based encryption accelerators—features that add complexity and cost to chip designs.

MARKET OPPORTUNITIES

Emergence of AI-Enabled Edge Computing Creating Demand for Intelligent 5G IoT Chips

The convergence of 5G connectivity with edge AI processing represents a transformative opportunity for the IoT chip market. Next-generation applications require localized decision-making capabilities to reduce latency and bandwidth requirements. Smart cameras for industrial quality control, autonomous vehicles, and augmented reality devices increasingly integrate AI acceleration alongside 5G modems. This trend is driving demand for heterogeneous chips that combine neural processing units (NPUs) with cellular connectivity in power-efficient packages. Leading chipmakers are responding with architectures that enable on-device machine learning while maintaining always-connected 5G capabilities, opening new markets at the intersection of connectivity and intelligence.

Enterprise Digital Transformation Initiatives Fueling Private 5G Network Deployments

The growing adoption of private 5G networks by industrial enterprises presents significant opportunities for specialized IoT chip solutions. Unlike public networks, private 5G implementations require tailored connectivity solutions that prioritize reliability, security, and deterministic performance. Manufacturing plants, ports, and mining operations are increasingly deploying private networks to support mission-critical IoT applications. This emerging market segment demands industrial-grade chipsets with support for network slicing, ultra-reliable low-latency communication (URLLC), and precise timing synchronization. Semiconductor vendors able to address these specialized requirements while meeting industrial certifications stand to gain substantial market share in this high-value segment.

5G IoT CHIP MARKET TRENDS

5G Network Expansion Fuels Demand for Advanced IoT Chips

The global expansion of 5G networks is revolutionizing the IoT chip market, with 5G IoT chip shipments expected to grow at a CAGR of over 35% between 2024 and 2030. The superior bandwidth, ultra-low latency, and massive device connectivity offered by 5G technology have created unprecedented opportunities for IoT applications across industries. Manufacturers are increasingly focusing on developing 7nm and 10nm process chips that offer optimal performance while maintaining energy efficiency for IoT edge devices. Recent innovations include integrated AI capabilities directly on IoT chips, enabling faster localized decision-making in smart applications from industrial automation to connected healthcare.

Other Trends

Industrial IoT Adoption Accelerates

Industries are rapidly deploying 5G-enabled IoT solutions for predictive maintenance, asset tracking, and process optimization. The industrial segment now accounts for nearly 30% of all 5G IoT chip demand. Factories implementing Industry 4.0 solutions particularly favor chips supporting URLLC (Ultra-Reliable Low-Latency Communications), which enables real-time control of machinery with latencies below 10ms. Meanwhile, the renewable energy sector is leveraging 5G IoT for smart grid management, with chipmakers developing specialized solutions that can withstand harsh environmental conditions.

Smart Cities Drive Heterogeneous Chip Demand

Urban digital transformation initiatives worldwide are creating diverse requirements for 5G IoT chips. While smart meters typically use economical 28nm chips, more advanced applications like autonomous traffic management systems require high-performance 7nm processors with integrated AI accelerators. The Asia-Pacific region leads in smart city deployments, accounting for nearly 50% of global smart city 5G IoT chip consumption. Chip manufacturers are responding with flexible system-on-chip (SoC) designs that can be customized for various municipal applications, from environmental monitoring to public safety systems.

COMPETITIVE LANDSCAPE

Key Industry Players

Semiconductor Giants Compete for Dominance in 5G IoT Chip Innovation

The global 5G IoT chip market exhibits a dynamic competitive landscape, dominated by established semiconductor manufacturers and emerging fabless players. This arena is characterized by rapid technological evolution, strategic partnerships, and intense R&D investments as companies vie for market share in this high-growth sector.

Qualcomm Technologies Inc. currently leads the market with approximately 35% revenue share in 2024, demonstrating technological prowess with its Snapdragon X series chipsets designed specifically for IoT applications. The company’s success stems from its early-mover advantage in 5G modems and strong relationships with smartphone manufacturers expanding into IoT solutions.

MediaTek and Hisilicon collectively hold about 28% market share, capitalizing on cost-competitive solutions for mid-range IoT devices. MediaTek’s recent Helio i series chips gained significant traction in smart home and industrial automation segments, while Hisilicon’s Balong chips power numerous connected devices in China’s expanding IoT ecosystem.

Smaller specialized players demonstrate remarkable agility in niche applications. Sequans Communications secured design wins with several European smart meter manufacturers, while Eigencomm made breakthroughs in antenna integration technologies for compact IoT devices. These innovators threaten incumbents by addressing specific pain points neglected by larger competitors.

The competitive intensity is escalating as traditional computing giants enter the fray. Intel leveraged its process technology advantage to launch 10nm IoT-focused SoCs, targeting industrial and automotive applications where its x86 architecture maintains influence. Meanwhile, UNISOC and ASR Microelectronics continue gaining ground in emerging markets through aggressive pricing strategies and customized solutions.

List of Key 5G IoT Chip Manufacturers Profiled

Qualcomm Incorporated (U.S.)

MediaTek Inc. (Taiwan)

Hisilicon (China)

Intel Corporation (U.S.)

UNISOC (China)

ASR Microelectronics Co., Ltd. (China)

Eigencomm (China)

Sequans Communications (France)

Segment Analysis:

By Type

7 nm Segment Dominates Due to High Performance and Energy Efficiency in 5G Connectivity

The market is segmented based on type into:

7 nm

10 nm

12 nm

Others

By Application

Industrial Applications Lead as 5G Chips Drive Smart Manufacturing and Automation

The market is segmented based on application into:

PC

Router/CPE

POS

Smart Meters

Industrial Application

Other

By End User

Telecom Sector Emerges as Key Adopter for 5G Network Infrastructure Deployment

The market is segmented based on end user into:

Telecommunication

Automotive

Healthcare

Consumer Electronics

Others

Regional Analysis: 5G IoT Chip Market

North America The North American 5G IoT chip market is driven by rapid advancements in connectivity infrastructure and strong investments from major tech firms. The U.S. remains a key player, accounting for over 60% of regional market share, primarily due to high 5G deployment rates and innovations from companies like Qualcomm and Intel. Industries such as smart manufacturing, automotive, and healthcare are accelerating demand for low-latency, high-speed IoT connectivity. However, regulatory complexities around spectrum allocation and security concerns pose challenges for large-scale IoT adoption. The rise of private 5G networks for industrial automation is expected to further fuel growth, supported by government initiatives like the National Spectrum Strategy.

Europe Europe’s 5G IoT chip market is characterized by strict data privacy regulations (e.g., GDPR) and a strong push for industrial digitization under initiatives like Industry 4.0. Germany and the U.K. lead in adoption, particularly in smart city and automotive applications. The EU’s focus on semiconductor sovereignty, including the Chips Act, is increasing local production capabilities to reduce dependency on imports. While sustainability and energy-efficient chips are prioritized, slower 5G rollouts in certain countries—due to bureaucratic hurdles—impede faster market expansion. Nonetheless, the demand for ultra-reliable IoT solutions in logistics and healthcare continues to grow, creating long-term opportunities.

Asia-Pacific Asia-Pacific dominates the global 5G IoT chip market, with China, Japan, and South Korea collectively contributing over 50% of worldwide shipments. China’s aggressive 5G rollout and government-backed IoT projects, such as smart city deployments, drive massive demand for cost-effective chips. Meanwhile, India’s expanding telecom infrastructure (e.g., BharatNet) and rising investments in edge computing present new growth avenues. While regional players like Huawei’s Hisilicon and MediaTek lead innovation, geopolitical tensions and supply chain dependencies on Western technology remain key challenges. The shift toward AI-enabled IoT chips for industrial automation and consumer electronics further strengthens the region’s market position.

South America South America’s 5G IoT chip market is nascent but growing, fueled by gradual 5G deployments in Brazil and Argentina. Limited telecom infrastructure and economic instability slow adoption compared to other regions, but sectors like agricultural IoT and smart energy management show promise. Local chip production is almost nonexistent, leaving the region reliant on imports, which inflates costs and delays implementation. However, partnerships with global semiconductor firms and pilot projects in urban centers indicate potential for mid-term growth, particularly as government policies begin prioritizing digital transformation.

Middle East & Africa The Middle East & Africa region is witnessing sporadic but strategic 5G IoT adoption, led by the UAE, Saudi Arabia, and South Africa. Telecom operators are investing heavily in smart city projects (e.g., NEOM in Saudi Arabia), creating demand for high-capacity IoT chips. Conversely, Africa’s market growth is constrained by underdeveloped 5G infrastructure and affordability barriers. Despite challenges, sectors like oil & gas digitization and remote monitoring in mining are driving niche demand. The lack of local semiconductor manufacturing increases reliance on imports, but regional collaborations and foreign investments signal gradual market maturation.

Report Scope

This market research report provides a comprehensive analysis of the global and regional 5G IoT Chip markets, covering the forecast period 2025–2032. It offers detailed insights into market dynamics, technological advancements, competitive landscape, and key trends shaping the industry.

Key focus areas of the report include:

Market Size & Forecast: Historical data and future projections for revenue, unit shipments, and market value across major regions and segments. The Global 5G IoT Chip market was valued at USD 1.2 billion in 2024 and is projected to reach USD 3.8 billion by 2032, growing at a CAGR of 15.6%.

Segmentation Analysis: Detailed breakdown by product type (7nm, 10nm, 12nm), application (PC, Router/CPE, Industrial IoT), and end-user industry to identify high-growth segments.

Regional Outlook: Insights into market performance across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. Asia-Pacific currently holds 48% market share.

Competitive Landscape: Profiles of leading market participants including Qualcomm, MediaTek, Intel, and Hisilicon, covering their product portfolios and strategic initiatives.

Technology Trends & Innovation: Assessment of emerging 5G NR standards, AI integration in chipsets, and advanced fabrication techniques below 10nm.

Market Drivers & Restraints: Evaluation of 5G infrastructure rollout, IoT adoption, and challenges like supply chain constraints and geopolitical factors.

Stakeholder Analysis: Strategic insights for semiconductor manufacturers, IoT device makers, telecom operators, and investors.

Related Reports:https://semiconductorblogs21.blogspot.com/2025/06/fieldbus-distributors-market-size-and.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/consumer-electronics-printed-circuit.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/metal-alloy-current-sensing-resistor.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/modular-hall-effect-sensors-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/integrated-optic-chip-for-gyroscope.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/industrial-pulsed-fiber-laser-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/unipolar-transistor-market-strategic.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/zener-barrier-market-industry-growth.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/led-shunt-surge-protection-device.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/type-tested-assembly-tta-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/traffic-automatic-identification.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/one-time-fuse-market-how-industry.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/pbga-substrate-market-size-share-and.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/nfc-tag-chip-market-growth-potential-of.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/silver-nanosheets-market-objectives-and.html

0 notes

Text

Why Global Enterprises Are Partnering with the Top AI Companies in India

Artificial Intelligence (AI) is revolutionizing the way businesses operate. From automating mundane tasks to predicting market trends, AI is becoming an integral part of modern digital transformation strategies. Today, global enterprises are not just experimenting with AI; they are investing heavily in scalable, intelligent solutions to gain a competitive edge. A key trend emerging in this landscape is the growing number of partnerships between international organizations and top AI companies in India.India has steadily positioned itself as a global technology leader, especially in the AI and data science space. Companies like WebSenor are helping bridge the innovation gap by offering high-quality, cost-effective, and scalable AI solutions to clients across the globe.

India’s Emergence as a Global AI Hub

A Convergence of Talent, Technology, and Investment

India’s rise in the global AI market is the result of a powerful mix: a large talent pool, rapid technological adoption, and strong institutional support. The country boasts thousands of skilled professionals including data scientists, AI engineers, and machine learning experts. Government initiatives such as the National AI Mission and support from private institutions have catalyzed growth, making India an ideal ground for AI development.

Furthermore, academic institutions and research bodies are actively contributing to the artificial intelligence industry in India, leading to innovations in machine learning, deep learning, and natural language processing.

Cost Efficiency with High-Quality Output

Compared to the U.S. or European markets, India offers significant cost advantages without sacrificing quality. Whether it's AI-powered software companies or data science companies in India, the value delivered per dollar spent is considerably higher. This makes India a lucrative outsourcing destination for AI projects.

Why Enterprises Prefer Indian AI Companies for Strategic Partnerships

Proven Track Record in Enterprise AI Solutions

Indian AI firms like WebSenor have developed solutions for industries such as healthcare, retail, logistics, education, and finance. Their ability to deliver enterprise-grade AI models, intelligent automation systems, and analytics platforms has made them preferred technology partners.

WebSenor, in particular, stands out with a robust portfolio showcasing successful deployments and measurable business results, including cost savings, process efficiencies, and improved customer engagement.

Access to End-to-End AI Development Capabilities

Global enterprises prefer working with AI service providers in India that offer end-to-end capabilities. WebSenor provides a comprehensive suite of services, from data preprocessing and model training to cloud deployment and monitoring. This full-stack approach ensures seamless integration and long-term reliability.

Focus on Responsible & Ethical AI

Today, responsible AI is more important than ever. WebSenor adheres to ethical guidelines by ensuring data privacy, model transparency, and compliance with global standards such as GDPR and HIPAA. Their use of explainable AI methods and secure infrastructure makes them a trusted AI partner.

Key Services Offered by Top AI Companies in India

AI-Powered Data Analytics and Business Intelligence

India's leading AI startups and technology firms are leveraging AI to build advanced analytics platforms. These tools help businesses perform customer segmentation, sales forecasting, and predictive maintenance. WebSenor has helped multiple global clients drive decisions using AI-powered dashboards and predictive insights.

Intelligent Automation and RPA

Robotic Process Automation (RPA) powered by AI is transforming back-office operations. WebSenor delivers solutions that automate repetitive tasks, reducing manual labor and operational costs.

NLP and Conversational AI Solutions

Virtual assistants, smart chatbots, and multilingual sentiment analysis engines are redefining customer service. WebSenor’s NLP models are particularly effective in regional and global markets, offering high precision in diverse languages.

Computer Vision and Image Recognition

From facial recognition systems to defect detection in manufacturing, computer vision is widely applied. WebSenor’s image recognition tools are used in security surveillance, retail analytics, and healthcare diagnostics.

Custom AI Model Development and Deployment

WebSenor offers bespoke AI development services, tailoring models to unique enterprise challenges. They work with proprietary datasets, enabling high-performance outcomes in real-time environments.

The WebSenor Advantage in the Global AI Landscape

Years of Cross-Industry Experience