#Season 132.0

Link

0 notes

Text

Annual Change in HC&SA Subsector Employment (Not Seasonally Adjusted, Full-Year Change for 2017-2021, Year-to-Date Change for 2022)

HWDC Releases November 2022 Health Workforce Brief Series 2: Regional and Sectoral Employment

The Department of Health Professions' Healthcare Workforce Data Center has released the November 2022 issue of its Virginia Health Care Workforce Brief Series 2: Regional and Sectoral Employment. Data in this Brief is not seasonally adjusted.

According to preliminary estimates, three of Virginia’s four regions increased Health Care & Social Assistance (HC&SA) employment in October. Northern Virginia’s HC&SA sector enjoyed particularly impressive employment growth during the month. In October, Northern Virginia created 3,500 new HC&SA jobs, a gain that represents a one-month annualized employment growth rate of 33.9%. In addition, this increase also represents the largest monthly employment gain in Northern Virginia’s HC&SA sector in more than two years. Hampton Roads also experienced strong HC&SA employment growth in October thanks to the creation of 1,300 new jobs during the month. This increase in Hampton Roads’ HC&SA employment translates into a 17.1% annualized growth rate. Hampton Roads is currently enjoying the fastest long-term HC&SA employment growth in the state thanks to its 12-month employment growth rate of 7.6%. Meanwhile, the Rest of Virginia increased HC&SA employment by 900 in October. However, Richmond’s HC&SA sector saw employment fall by 100 during the month.

Regional HC&SA employment highlights are included in the table below (in thousands of employees):

Region Oct. 2021 Oct. 2022 YOY Growth Virginia 445.2 471.5 5.9% Hampton Roads 92.5 99.5 7.6% Northern Virginia 137.1 145.6 6.2% Richmond 83.6 86.7 3.7% Rest of Virginia 132.0 139.7 5.8%

All four of Virginia’s HC&SA subsectors experienced positive employment growth during the month. This growth was strongest in Social Assistance, which increased employment by 2,400 in October. This increase in Social Assistance employment represents a remarkable one-month annualized growth rate of 43.1%. Over the past 12 months, Social Assistance has increased employment by 7.9%. This represents the fastest 12-month employment growth rate among Virginia’s four HC&SA subsectors. Meanwhile, Ambulatory Health Care Services created 1,500 new jobs in October, which translates into a 9.0% annualized employment growth rate. With this gain, Ambulatory Health Care Services has produced 13,800 jobs so far in 2022. This year-to-date employment gain represents more than half of all HC&SA jobs created in the state so far this year. With respect to Virginia’s two other HC&SA subsectors, Hospitals created 1,200 new jobs in October, while Nursing & Residential Care Facilities increased employment by 500 during the month.

Additional employment highlights by HC&SA subsector are included in the table below (in thousands of employees):

Subsector Oct. 2021 Oct. 2022 YOY Growth Total HC&SA 445.2 471.5 5.9% Ambulatory Health Care 197.0 210.4 6.8% Hospitals 104.6 107.7 3.0% Nursing & Residential Care 68.0 71.8 5.6% Social Assistance 75.6 81.6 7.9%

To access the full brief, click the image above. To see all Virginia Health Care Workforce Briefs and to access archival briefs, visit our website.

#data#employment#growth#health#Richmond#Hampton Roads#Northern Virginia#Social Assistance#Ambulatory Health Care Services#Nursing & Residential Care Facilities#health care economics#health care workforce#health care briefs#Healthcare Workforce Data Center#jobs#statistics#Virginia health care employment#October health care employment

0 notes

Text

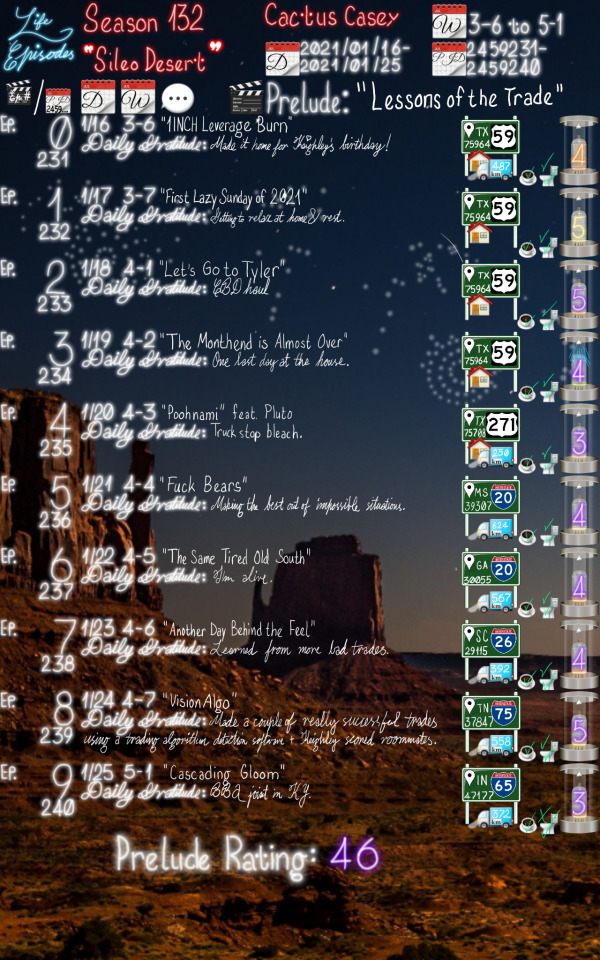

#Life Episodes#Season 132.0#20210116#20210117#20210118#20210119#20210120#20210121#20210122#20210123#20210124#20210125#3/10#4/10#5/10#I-20#I-26#I-65#I-75#US-59#US-271#TX#MS#GA#SC#IN#TN

0 notes

Text

U.S. consumer confidence hits 18-year high; house prices slowing

WASHINGTON (Reuters) – U.S. consumer confidence surged to an 18-year high in September as households grew more upbeat about the labor market, pointing to sustained strength in the economy despite an increasingly bitter trade dispute between the United States and China.

FILE PHOTO – A family shops at the Wal-Mart Supercenter in Springdale, Arkansas June 4, 2015. REUTERS/Rick Wilking/File Photo

While other data on Tuesday showed a moderation in house price increases in July, the gains probably remain sufficient to boost household wealth and continue to support consumer spending, as well as making home purchasing a bit more affordable for first-time buyers.

“The consumer is always in the driver’s seat when it comes to stoking the fires that run the engines of economic growth, but the million dollar question is what is going to happen down the road when the trade tariffs start to bite?” said Chris Rupkey, chief economist at MUFG in New York.

The Conference Board said its consumer confidence index increased to a reading of 138.4 this month from an upwardly revised 134.7 in August. That was the best reading since September 2000 and the index is not too far from an all-time high of 144.7 reached that year.

Economists polled by Reuters had forecast the consumer index slipping to a reading of 132.0 this month from the previously reported 133.4 in August.

Consumers’ assessment of labor market conditions improved sharply even as the trade war between the United States and China escalated, which economists warned would lead to job losses and higher prices for consumers.

Washington on Monday slapped tariffs on $200 billion worth of Chinese goods, with Beijing retaliating with duties on $60 billion worth of U.S. products. The United States and China had already imposed tariffs on $50 billion worth of each other’s goods.

For now, consumers appear to be shrugging off the trade tensions. Households were this month upbeat about business conditions over the next six months, with many planning purchases of household appliances, motor vehicles and houses.

Some economists believe a tightening labor market, which is starting to boost wage growth, and higher savings could provide a cushion for households against more expensive consumer goods imports from China.

“Moreover, consumers may choose to substitute purchases of goods affected by tariffs with other goods and firms may choose to absorb the higher costs,” said Roiana Reid, an economist at Berenberg Capital Markets in New York.

STRONG LABOR MARKET

The Conference Board consumer survey’s so-called labor market differential, derived from data about respondents who think jobs are hard to get and those who think jobs are plentiful, rose to 32.5 in September, the highest level since January 2001, from 30.2 in August.

This measure, which closely correlates to the unemployment rate in the Labor Department’ employment report, is pointing to further declines in the jobless rate and labor market slack. The labor market is viewed as either at or near full employment, with the jobless rate at 3.9 percent.

The robust labor market, together with the strong economy and steadily rising inflation, have left economists confident that the Federal Reserve will raise interest rates on Wednesday for the third time this year.

The dollar was trading slightly weaker against a basket of currencies, while U.S. government bond yields rose. Stocks on Wall Street were little changed.

The consumer confidence report added to fairly upbeat data on consumer spending and manufacturing that have suggested solid economic growth in the third quarter. Gross domestic product increased at a 4.2 percent annualized rate in the second quarter. Growth estimates for the July-September quarter are above a 3.0 percent pace.

While the broader economy is powering ahead, the housing market is continuing to lag behind amid signs that higher mortgage rates and house prices are starting to hurt demand.

Separately, the S&P CoreLogic Case-Shiller composite home price index of 20 U.S. metropolitan areas rose 5.9 percent in July from a year ago after increasing 6.4 percent in June.

Prices in the 20 cities edged up 0.1 percent in July from June on a seasonally adjusted basis, the survey showed.

The moderation in house price inflation was also underscored by another report from the Federal Housing Finance Agency, which showed its home price index rising 0.2 percent in July after gaining 0.3 percent in June.

The FHFA’s index is calculated by using purchase prices of houses financed with mortgages sold to or guaranteed by mortgage finance companies Fannie Mae and Freddie Mac.

“Consumers are delirious but not bidding up prices of homes as much as they had been,” said Joel Naroff, chief economist at Naroff Economic Advisors in Holland, Pennsylvania. “Increasing prices and mortgage rates are reducing affordability and sales and that is translating into slower price gains.”

Reporting By Lucia Mutikani; Editing by Chizu Nomiyama and Andrea Ricci

Our Standards:The Thomson Reuters Trust Principles.

Source link

The post U.S. consumer confidence hits 18-year high; house prices slowing appeared first on Today News Stories.

from WordPress https://ift.tt/2QZSULs

via IFTTT

0 notes

Text

Bears keep Connor Shaw despite announcing they would cut him earlier in the day

After announcing earlier in the day they were releasing Shaw, the Bears were forced to keep him on the roster.

Quarterback Connor Shaw is still with the Chicago Bears, and that’s — seemingly — exactly how the universe wants things.

Despite announcing earlier in the day that the team was releasing the former Gamecock, they were forced to make room for him on their 90-man roster. Shaw was saved from the waiver wire after Mark Sanchez suffered a knee injury during practice. While Sanchez’s injury isn’t expected to be serious, the team will keep Shaw around for a little while longer.

This is the second time in a year that Shaw has had odd experiences that suited him up for the Bears. The first being in July 2016, when the New Orleans Saints tipped their hand by accidentally emailing the 31 other NFL teams their interest in claiming the quarterback from the Browns. Chicago was able to snag Shaw before risking him going elsewhere.

Shaw ended up playing in the Bears’ first three preseason games, recording 127 yards on 11-of-16 passes for two touchdowns and a 132.0 passer rating — with zero interceptions. His future looked promising until he broke his leg against the Kansas City Chiefs, and ended up missing the entire 2016 regular season.

The Bears now have Mike Glennon, Mark Sanchez and No. 2 overall draft pick Mitch Trubisky in their quarterback room, but for now, Shaw’s still got a spot.

If the universe eventually does let Shaw take roots in a city other than Chicago, he might have a tough time finding a home thanks to his injury history. In addition to his leg last season, he spent the 2015 season sidelined by a thumb injury — also, sustained during preseason.

Shaw’s future with the team now depends on how long Sanchez is expected to be out and how quickly Trubisky picks up the playbook. Even if he stays on through training camp, eventually the 90-man roster will be hacked down to 53, and at that point, he might have to brush up on his interview skills.

But for the time being, it appears Shaw is destined to be a Bear.

0 notes