#Sheldon Whitehouse

Text

By Jake Johnson

Common Dreams

Jan. 6, 2024

"Billionaires attempting to influence politics from the shadows should not be rewarded with taxpayer subsidies," said Sen. Sheldon Whitehouse.

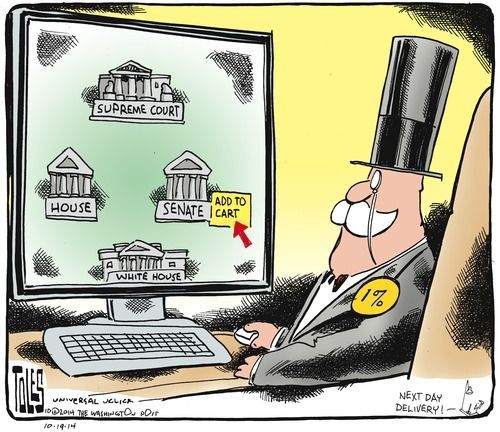

Legislation introduced Tuesday by a pair of Democratic lawmakers would close a loophole that lets billionaires donate assets to dark money organizations without paying any taxes.

The U.S. tax code allows write-offs when appreciated assets such as shares of stock are donated to a charity, but the tax break doesn't apply when the assets are given to political groups.

However, donations to 501(c)(4) organizations—which are allowed to engage in some political activity as long as it's not their primary purpose—are exempt from capital gains taxes, a loophole that Sen. Sheldon Whitehouse (D-R.I.) and Rep. Judy Chu (D-Calif.) are looking to shutter with their End Tax Breaks for Dark Money Act.

Whitehouse, a member of the Senate Judiciary Committee who has focused extensively on the corrupting effects of dark money, said the need for the bill was made clear by what ProPublica and The Lever described as "the largest known donation to a political advocacy group in U.S. history."

The investigative outlets reported in 2022 that billionaire manufacturing magnate Barre Seid donated his 100% ownership stake in Tripp Lite, a maker of electrical equipment, to Marble Freedom Trust, a group controlled by Federalist Society co-chairman Leonard Leo.

The donation, completed in 2021, was worth $1.6 billion. According to ProPublica and The Lever, the structure of the gift allowed Seid to avoid up to $400 million in taxes.

"It's a clear sign of a broken tax code when a single donor can transfer assets worth $1.6 billion to a dark money political group without paying a penny in taxes," Whitehouse said in a statement Tuesday. "Billionaires attempting to influence politics from the shadows should not be rewarded with taxpayer subsidies."

"We cannot allow millionaires and billionaires to run roughshod over our democracy and then reward them for it with a tax break."

If passed, the End Tax Breaks for Dark Money Act would ensure that donations of appreciated assets to 501(c)(4) organizations are subjected to the same rules as gifts to political action committees (PACs) and parties.

"Thanks to the far-right Supreme Court, billionaires already have outsized influence to decide our nation's politics; through a loophole in the tax code, they can even secure massive public subsidies for lobbying and campaigning when they secretly donate their wealth to certain nonprofits instead of traditional political organizations," said Chu. "We can decrease the impact the wealthy have on our politics by applying capital gains taxes to donations of appreciated property to nonprofits that engage in lobbying and political activity—the same way they are already treated when made to traditional political organizations like PACs."

The new bill comes amid an election season that is already flooded with outside spending.

The watchdog OpenSecrets reported last month that super PACs and other groups "have already poured nearly $318 million into spending on presidential and congressional races as of January 14—more than six times as much as had been spent at this point in 2020."

Thanks to the Supreme Court's 2010 Citizens United ruling, super PACs can raise and spend unlimited sums on federal elections—often without being fully transparent about their donors.

Morris Pearl, chairman of the Patriotic Millionaires, said Tuesday that "there is no justifiable reason why wealthy people like me should be allowed to dominate our political system by donating an entire $1.6 billion company to a dark money political group."

"But perhaps more egregious is the $400 million tax break that comes from doing so," said Pearl. "It's a perfect example of how this provision in the tax code is used by the ultrawealthy to manipulate the levers of government while simultaneously dodging their obligation to pay taxes. We cannot allow millionaires and billionaires to run roughshod over our democracy and then reward them for it with a tax break."

117 notes

·

View notes

Text

Sheldon Whitehouse (D-RI)

United States Senator

57 notes

·

View notes

Text

youtube

This is an amazing breakdown of the corruption affecting the U.S. Supreme Court. This court needs to either be expanded or abolished.

6 notes

·

View notes

Photo

Sheldon Whitehouse (D-RI)

United States Senator

I need to give Sheldon some love.

#Sheldon Whitehouse#american politician#handsome daddy#daddy#PILF#celebrities#politician#us senator#rhode island politican

23 notes

·

View notes

Text

Watch "The Scheme 22: Justice Alito and the Polluter Page" on YouTube

youtube

How Republicans subverted the Supreme Court.

2 notes

·

View notes

Text

Shining Light on Dark Money is Good for Democracy

By Senator Sheldon Whitehouse (D-R.I.)/ Public Citizen/ September 18, 2023

I have concluded, based on considerable observation and evaluation, that a band of right-wing billionaires has its hooks deep into our government. It uses these hooks to thwart climate action, putting American and global safety at risk. The good news? We can fix the climate threats if we can get their hooks out.

When…

View On WordPress

0 notes

Text

Bad Faith, Espionage & Propaganda, from COP28 host:

As Cop emails are read out by oil firm...

And a fake PR campaign props the worst choice for UN COP host, an oil exec... 🙄

#boycott cop28#cop28#united nations#sheldon whitehouse#congress#john kerry#climate conference#environment#adnoc#espionage#troll army

0 notes

Text

youtube

Time to Wake Up 289: Rising Tides, Rising Temps

Senator Sheldon Whitehouse

July 27, 2023 posting

July 26 | Senator Sheldon Whitehouse, Chairman of the Senate Budget Committee, delivered his 289th speech on the Senate floor urging his colleagues to wake up to the threat of climate change.

#sheldon whitehouse#ocean warming#zettajoules#fossil fuels#climate crisis#oceanic heatwave#extreme heat#el niño#coral bleaching#Youtube

5 notes

·

View notes

Photo

Sheldon Whitehouse (D-RI)

United States Senator

65 notes

·

View notes

Text

youtube

People need to listen. Senator Sheldon Whitehouse tells it true.

0 notes

Text

Watch "Chairman Whitehouse Opens Hearing on President Biden's FY2024 Budget Proposal" on YouTube

youtube

👏👏👏👏👏

0 notes

Text

Watch "Chairman Whitehouse: We Can Protect Social Security For All Without Cutting Benefits" on YouTube

youtube

0 notes

Link

1 note

·

View note

Text

Ultrawealthy Americans enjoy so many ways to avoid taxes that Gary Cohn, former President Donald Trump’s director of the National Economic Council, once wisecracked, “Only morons pay the estate tax.”

On Monday, a group of four Democratic senators urged Treasury Secretary Janet Yellen to crack down on a host of specially-designed trusts and financial vehicles that allow the wealthiest individuals to shield their personal fortunes and pass down massive inheritances tax-free.

The letter, from Sens. Elizabeth Warren, Bernie Sanders, Chris Van Hollen, and Sheldon Whitehouse, laid out a series of potential IRS regulations that would make trusts, particularly, less attractive as tax shelters for the 1%.

“Billionaires and multi-millionaires use trusts to shift wealth to their heirs tax-free, dodging federal estate and gift taxes,” the senators wrote. “And they are doing this in the open: Their wealth managers are bragging about how their tax dodging tricks will be more effective in the current economy.”

Only about 0.1% of Americans pay estate taxes, despite thousands of families having fortunes larger than the current $25.48 million exemption.

When President Joe Biden promised on the campaign trail to raise taxes on the richest Americans, it unleashed a race to set up the kinds of legal tax shelters that would protect their inheritable assets from the estate tax.

They feared Biden would lower the estate tax exemption — which Republicans under Trump had raised to its all-time high — and resuscitate proposed IRS rules that make it more difficult to use trusts to avoid taxes on substantial inheritances.

But Democrats dropped their plans to raise inheritance taxes early on in the Biden administration. And in their letter, the lawmakers argued there is far more the IRS can do to crack down on the “shell games” the ultrawealthy use to shield huge generational wealth transfers from taxation.

Popular schemes they highlighted include families using special vehicles, called family limited partnerships, to understate the values of their estates; placing assets that will rise in value, such as a stock portfolio, inside a tax-shielded trust before the price can rebound; and cycling stocks and other assets through a grantor trust to avoid inheritance taxes.

The current economy, where stocks have lost double digits in value, actually supercharges some of these tax shelters because they shield appreciation from taxation.

“As the richest Americans celebrate and take advantage of these favorable tax opportunities, middle-class families struggle with inflation and Republicans threaten austerity measures and the end of Social Security and Medicare,” the lawmakers wrote.

They argued that the Treasury Department could crack down on these tax-avoidance vehicles without action from Congress.

It can revoke a rule that currently exempts transfers between grantors and grantor trusts from taxes, and it can require grantor trusts to hold a minimum value so they would be less useful as a pass-through for avoiding taxes. And it can clarify and rein in the kinds of asset sales and valuation practices tax planners have abused to wedge their clients’ enormous estates into various tax-shielded trusts and partnerships.

“Although the details of various trusts may differ, the result of wealthy individuals transferring millions in assets to heirs tax-free does not,” they continued. “The ultra-wealthy at the top of the socioeconomic ladder live by different rules than the rest of America.”

#us politics#news#huffington post#2023#tax the rich#tax the 1%#tax the wealthy#janet yellen#department of treasury#sen. elizabeth warren#sen. bernie sanders#sen. Chris Van Hollen#sen. sheldon whitehouse#irs#internal revenue service#estate taxes#tax shelters#biden administration

71 notes

·

View notes