#Silicon Carbide MOSFETs (SiC MOSFETs)

Text

https://www.futureelectronics.com/p/semiconductors--discretes--transistors--silicon-carbide-mosfets-sic-mosfets/sct2750nytb-rohm-1080295

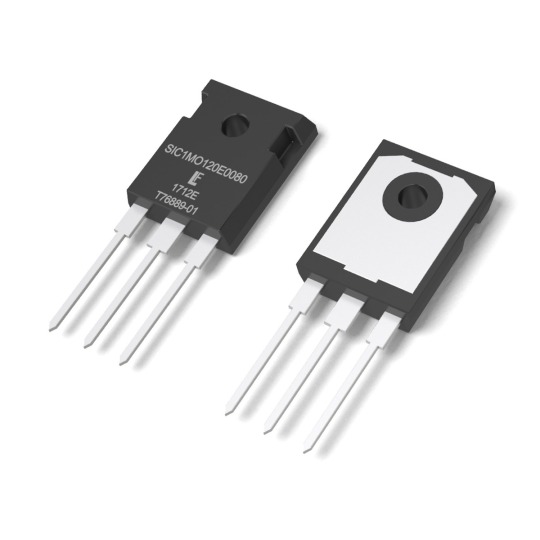

ROHM, SCT2750NYTB, Transistors, Silicon Carbide MOSFETs (SiC MOSFETs)

N-Channel 1700 V 0.75 Ohm Surface Mount SiC Power Mosfet - TO-268-2

#ROHM#SCT2750NYTB#Transistors#Silicon Carbide MOSFETs (SiC MOSFETs)#sic mosfet module#high voltage sic module#igbt#Power MOSFET#mosfet Transistors#Surface Mount SiC Power Mosfet#Transistors mosfet

1 note

·

View note

Text

youtube

Conquer High Switching Losses with Microchip Silicon Carbide MOSFETs Trounce IGBTs

https://www.futureelectronics.com/resources/featured-products/microchip-silicon-carbide-power-solutions. When compared to silicon IGBTs, SiC MOSFETs can reduce switching losses by over 70 percent. Learn more about Microchip’s broad portfolio of SiCdevices, including MOSFETs, diodes, gate drivers and our new, industry-leading, 3.3 kV SiC MOSFET. https://youtu.be/h_TVG3sNe4k

#Microchip#silicon IGBTs#SiC MOSFETs#switching losses#Microchip SiC devices#MOSFETs#diodes#gate drivers#3.3 kV SiC MOSFET#Silicon Carbide MOSFETs#Trounce IGBTs#SiC MOSFET#Microchip MOSFETs#Microchip diodes#Youtube

1 note

·

View note

Text

Can Silicon Carbide Conduct Electricity?

In its pure state, silicon carbide acts as an electrical insulator. SiC, on the other hand, can express semi-conduction properties, which means that as a semiconductor, it neither allows a free-flowing current nor entirely repels it, with the controlled addition of impurities or doping agents, and because it has the appropriate resistivity.

Doping SiC with aluminum, boron, or gallium results in a p-type semiconducting SiC, whereas nitrogen and phosphorus impurities produce an N-type semiconductor. Furthermore, regulated doping could potentially lead to superconductivity.

However, electrical aging, or the rise in electrical resistivity, may have an impact on the electrical conductivity characteristics of silicon carbide. The oxidation of the substance is thought to be connected to aging. Depending on variables like voltage or the intensity of infrared, visible, and ultraviolet photons, SiC can conduct electricity in some situations but not in others.

Want to know more about Silicon Carbide and SiC MOSFET??

Visit our official website - millenniumsemi.com for complete information!

1 note

·

View note

Text

Infineon expands CoolSiC™ MOSFET family for better thermal performance, power density and easier assembly

July 21, 2023 /SemiMedia/ — Infineon Technologies AG expands its CoolSiC portfolio with the Silicon Carbide (SiC) CoolSiC™ MOSFET 650 V in TO Leadless (TOLL) packaging, optimized for lowest losses, highest reliability and ease of use in applications such as server SMPS, telecom infrastructure, and energy storage systems and battery formation solutions.

The CoolSiC 650 V high-performance…

View On WordPress

#CoolSiC MOSFET 650 V#electronic components news#Electronic components supplier#Electronic parts supplier#Infineon

2 notes

·

View notes

Text

SiC Power Device Market Trends Outlook and Growth Analysis 2023-2030

Powering the Future: Navigating the SiC Power Device Market's Electrifying Potential

Introduction: In the realm of power electronics, Silicon Carbide (SiC) power devices are heralding a new era of efficiency, performance, and sustainability. With superior electrical properties compared to traditional silicon-based devices, SiC power devices are revolutionizing industries ranging from automotive and renewable energy to industrial automation and telecommunications. Join us as we explore the dynamic landscape of the SiC Power Device market, uncovering its significance, innovations, and the transformative impact it's poised to have on our energy future.

The Significance of SiC Power Devices: Silicon Carbide (SiC) power devices represent a paradigm shift in power electronics, offering higher efficiency, faster switching speeds, and increased power density compared to conventional silicon-based devices. By enabling more efficient power conversion and reduced energy losses, SiC power devices play a crucial role in addressing global challenges such as climate change, energy security, and the electrification of transportation.

Request Sample Report: https://www.snsinsider.com/sample-request/3340

Market Dynamics: The SiC Power Device market is experiencing exponential growth, driven by factors such as increasing demand for electric vehicles, renewable energy integration, and the need for higher power density and efficiency in industrial applications. According to industry forecasts, the global SiC Power Device market is expected to reach significant valuations by 2025, propelled by investments in infrastructure, research and development, and manufacturing capacity expansion.

Key Players and Innovations: A multitude of companies, ranging from semiconductor manufacturers to power electronics integrators, are driving innovation and competitiveness in the SiC Power Device market. These players are continuously developing advanced SiC materials, device architectures, and packaging technologies to meet the evolving demands of diverse applications. Innovations such as SiC MOSFETs, Schottky diodes, and integrated power modules are enhancing performance, reliability, and cost-effectiveness in power electronics systems.

Applications Across Industries: The applications of SiC Power Devices span across a wide range of industries, each benefiting from the superior electrical properties and performance advantages offered by SiC technology. In the automotive sector, SiC power devices enable the electrification of vehicles by increasing powertrain efficiency, extending range, and reducing charging times. Similarly, in renewable energy systems, SiC devices enhance the efficiency and reliability of solar inverters, wind turbines, and energy storage systems, enabling the transition towards a more sustainable energy future.

Challenges and Opportunities: Despite the promising prospects, the adoption of SiC Power Devices faces challenges such as manufacturing complexity, cost competitiveness, and reliability concerns. Moreover, the integration of SiC devices into existing power electronics systems and supply chains poses technical and logistical challenges for industry stakeholders. However, these challenges also present opportunities for collaboration, innovation, and investment in research and development to address emerging needs and drive market growth.

Future Outlook: As we look ahead, the future of the SiC Power Device market appears promising. With advancements in manufacturing processes, economies of scale, and technology maturity, SiC devices will become increasingly cost-competitive and accessible across a broader range of applications. Moreover, as industries strive towards electrification, decarbonization, and energy efficiency, SiC Power Devices will play a pivotal role in enabling the transition towards a more sustainable and resilient energy ecosystem.

Access Full Report Details: https://www.snsinsider.com/reports/sic-power-device-market-3340

0 notes

Text

Electric Vehicle Power Inverter Market: Strategic Developments

Automotive manufacturers are progressively transitioning their production from conventional engine vehicles to hybrid and electric vehicles. This is attributed to increasingly stringent global emission standards. Concurrently, governments worldwide are implementing incentives to encourage the adoption of electric vehicles and stimulate sales in this sector. Subsequently, the electric vehicle demands are poised to surge the sales of critical components integral to electric vehicles. For instance, electric vehicle power inverters. As per Inkwood Research, the global electric vehicle power inverter market is expected to project a CAGR of 14.36% during 2024-2032 and is set to reach a revenue of $34868.78 million by 2032.

Furthermore, several manufacturers have committed to developments associated with electric vehicles and their components. This blog focuses on strategic product developments by key players regarding electric vehicle power inverters.

Request a FREE sample of the Electric Vehicle Power Inverter Market-

Global Electric Vehicle Power Inverter Market: Strategic Product Developments Prominent Players

· Tesla’s Offbeat Silicon Carbide Inverter

In 2018, with the introduction of the Model 3, Tesla pioneered the incorporation of SiC metal-oxide-semiconductor field-effect transistors (MOSFETs) from STMicroelectronics into an internally designed inverter. While the overall design boasts numerous innovations, the integration of SiC packages stands out as a primary advancement.

The utilization of SiC MOSFETs presents a breakthrough in inverter design and opens avenues for novel materials. Coping with increased areal power densities involves the use of a Cu lead frame, replacing conventional Al wire bonds. Moreover, the die-attach material has transitioned from conventional solders to Ag-sintered die-attach.

As with any nascent technology, cost has traditionally impeded the widespread adoption of SiC MOSFETs and related materials in power module packages. However, Tesla has effectively addressed this challenge, achieving a noteworthy cost reduction in its inverter within a mere three years.

The outcome is a Tesla inverter and permanent magnet motor combination that stands among, if not at the pinnacle of the market. With an impressive 97% efficiency, it delivers extended range without necessitating a costly increase in battery capacity. All this, while maintaining a comparable cost to the older technologies it is displacing.

· Diamond Foundry strikes Gold with its Latest Innovation

Diamond Foundry Inc has launched an electric car inverter utilizing diamond wafers. With this, the entity has reached a significant milestone in electric vehicle technology. This advanced inverter is six times smaller than the one in Tesla Model 3. Even outperforming in both efficiency and power delivery. The incorporation of diamond wafers is credited for this groundbreaking feat. This further significantly enhances thermal conductivity and electrical insulation – two crucial factors in semiconductor design. The progress in miniaturization represents a notable advancement in electric car efficiency, potentially reshaping power electronics in the industry.

Diamond Foundry’s innovation utilizes the unique properties of diamond wafers to address longstanding thermal challenges in power semiconductors. The company’s inventive approach enables robust voltage isolation while maintaining optimal thermal performance. Additionally, this creative use of diamond wafers overcomes past limitations in a cost-effective manner, paving the way for new designs in power electronics.

Get CUSTOMIZED market insights delivered right to your inbox!

· Hillcrest’s Pioneering Promise

The US and Canadian governments aim for net-zero emissions by 2050, necessitating substantial electrification. However, auto manufacturers face mineral shortages, especially lithium, crucial for EV batteries. With the surge in electric vehicle (EV) sales, battery demand may double by 2050.

Hillcrest Energy Technologies Ltd addresses this by introducing a groundbreaking ‘soft switching‘ inverter. Unlike conventional ‘hard switching’ inverters in EVs, Hillcrest’s inverter utilizes Zero Voltage Switching (ZVS) technology, eliminating trade-offs. This results in enhanced efficiency, performance, and reliability, allowing manufacturers to produce batteries up to 15% smaller while maintaining performance and reducing the need for lithium and other metals.

Hillcrest’s ZVS inverter marks a significant breakthrough, addressing challenges present in the industry since the 1990s.

Stay up-to-date with the Latest Global Electric Vehicle Power Inverter Market Trends- https://inkwoodresearch.com/global-electric-vehicle-power-inverter-market/

Electric Vehicle Power Inverter Market: Reassuring Inputs

The electric vehicle market’s rapid growth is driven by the imperative for decarbonization, aligning with sustainability goals. The electric vehicle power inverter, crucial in the drive system, converts DC battery voltage to AC, propelling the traction motor for vehicle torque.

Notably, the on-board charging system, serving as a rectifier for AC-to-DC conversion, significantly influences charging times. This system interfaces with Level 1 or Level 2 chargers, enhancing the AC-to-DC charging service when plugged into the vehicle.

Furthermore, combining the on-board charger and inverter in some instances leverages high-voltage architecture efficiencies. This integrated approach, coupled with effective thermal management, enhances power output, expediting the charging process. As a result, strategic product developments and integrations are expected to bode well for the global electric vehicle power inverter market.

FAQ

What role does the power inverter play in an electric vehicle?

The electric vehicle power inverter is a crucial component responsible for converting direct current (DC) from the vehicle’s battery into alternating current (AC) for the electric motor. This conversion is vital for powering the motor and ensuring the efficient operation of the electric vehicle.

How do advancements in electric vehicle power inverters contribute to overall vehicle performance?

Advancements in electric vehicle power inverters often result in improved energy efficiency, faster response times, and better thermal management. The evolution of power inverter technology contributes to extended battery life, increased driving range, and optimized electric drivetrain performance, thereby influencing the overall efficiency and capabilities of electric vehicles.

0 notes

Text

0 notes

Text

STMicroelectronics’ Silicon-Carbide helps Li Auto Accelerates Towards High-Voltage EV Market

STMicroelectronics a global semiconductor leader serving customers across the spectrum of electronics applications, has signed a long-term silicon carbide (SiC) supply agreement with Li Auto, a leader in China’s new energy vehicle market that designs, develops, manufactures, and sells smart premium electric vehicles. Under this agreement, STMicroelectronics (”ST”) will provide Li Auto with SiC MOSFET devices to support Li Auto’s strategy around high-voltage battery electric vehicles (BEVs) in various market segments. Read more...

0 notes

Text

Strong Partnership: ROHM & Toshiba Unite for Power Devices

ROHM & Toshiba Collaboration

The Ministry of Economy, Trade and Industry has acknowledged and will support ROHM and Toshiba Electronic Devices & Storage Corporation’s plan to work together in the manufacture and increased volume production of power devices as a step toward assisting the Japanese government in achieving its goal of a secure and stable semiconductor supply. Silicon carbide (SiC) and silicon (Si) power devices will be heavily invested in by ROHM and Toshiba Electronic Devices & Storage, respectively. They will also effectively improve their supply capabilities and leverage the production capacity of other parties in a complementary manner.

Power devices are necessary parts for creating a carbon-free, carbon-neutral society as well as for supplying and controlling power in all types of electronic equipment. It is anticipated that current demand will continue to rise. Alongside the explosive rise in vehicle electrification, advances have been made in the creation of smaller, lighter, and more efficient electric powertrains for automotive applications. Stable power supply and enhanced features are essential in industrial applications to accommodate growing automation and more stringent efficiency standards.

In light of this, ROHM has expedited its attempts to become carbon-free and developed a management strategy that reads, “They focus on power and analog solutions and solve social problems by contributing to they customers’ needs for energy savings and miniaturization of their products.” Energy savings are mostly dependent on SiC power devices.

Ever since SiC MOSFETs were produced in large quantities for the first time, ROHM has been at the forefront of technological advancement. These include the most recent 4th Generation SiC MOSFETs from ROHM, which are slated to be used in a variety of industrial and electric car applications. Working on the SiC business, which involves aggressive and ongoing investment to improve the production capacity of SiC and meet rapid demand growth, is one of ROHM’s top priorities.

With its enduring Basic Commitment of “Committed to People, Committed to the Future,” Toshiba Group seeks to promote the development of a circular economy and carbon neutrality. Si power devices, mostly for the automotive and industrial applications, have been supplied by Toshiba Electronic Devices & Storage for many years, aiding in the development of energy-saving technologies and the downsizing of equipment.

In order to boost production capacity and keep up with the rapid growth in demand, the company is increasing investment. Production on a 300mm wafer line was launched last year. By fully utilizing the knowledge it has developed in railway vehicle applications, it is also furthering the development of a wider range of SiC power devices, particularly for automotive and power transmission and distribution applications.

Although ROHM had previously declared its involvement in Toshiba’s privatization, the two firms’ production cooperation did not begin with this investment. For a while now, ROHM and Toshiba Electronic Devices & Storage have been thinking about working together in the power device market due to the escalating global competitiveness in the semiconductor industry. This has led to the joint application.

In order to increase both businesses’ global competitiveness, ROHM and Toshiba Electronic Devices & Storage will work together to manufacture power devices through significant investments in SiC and Si power devices, respectively. Additionally, the corporations aim to bolster the robustness of Japan’s semiconductor supply chains.

Read more on Govindhtech.com

0 notes

Text

Infineon launches new 62 mm package CoolSiC product portfolio to help achieve higher efficiency and power density

【Lansheng Technology News】Infineon Technologies AG recently announced the addition of new industry-standard packaging products to its CoolSiC 1200 V and 2000 V MOSFET module series. It uses a mature 62 mm device half-bridge topology design and is based on the newly launched enhancement-mode M1H silicon carbide (SiC) MOSFET technology. This package enables SiC to be used in mid-power applications above 250 kW, where the power density of traditional IGBT silicon technology has reached its limit. Compared with traditional 62mm IGBT modules, its application scope has now expanded to solar energy, servers, energy storage, electric vehicle charging piles, traction, commercial induction cookers and power conversion systems.

Enhanced M1H technology can significantly widen the gate voltage window, even at high switching frequencies, without any restrictions, ensuring high gate reliability against induced voltage spikes caused by drivers and layout. Additionally, extremely low switching and transmission losses minimize cooling requirements. Combined with high reverse voltage, these semiconductor devices also meet another requirement of modern system design. With Infineon's CoolSiCTM chip technology, the converter design can become more efficient and the power rating of a single inverter can be further increased, thereby reducing the overall system cost.

Featuring a copper base plate and threaded interface, the package features a highly robust mechanical design that increases system availability, lowers service costs and reduces downtime costs. Excellent reliability is achieved through strong thermal cycling capabilities and a continuous operating junction temperature (Tvjop) of 150°C. Its symmetrical internal package design enables the upper and lower switches to have the same switching conditions. Optional pre-applied thermal interface material (TIM) is available to further enhance the module’s thermal performance.

Lansheng Technology Limited, which is a spot stock distributor of many well-known brands, we have price advantage of the first-hand spot channel, and have technical supports.

Our main brands: STMicroelectronics, Toshiba, Microchip, Vishay, Marvell, ON Semiconductor, AOS, DIODES, Murata, Samsung, Hyundai/Hynix, Xilinx, Micron, Infinone, Texas Instruments, ADI, Maxim Integrated, NXP, etc

To learn more about our products, services, and capabilities, please visit our website at http://www.lanshengic.com

0 notes

Text

0 notes

Text

Nexperia’s premier SiC MOSFETs now come in the increasingly popular D2PAK-7

May 24, 2024 /SemiMedia/ — Nexperia recently announced that it now offers industry-leading 1200 V silicon carbide (SiC) MOSFETs in D2PAK-7 surface mount device (SMD) packages, available in 30, 40, 60 and 80 mΩ RDSon values. This announcement follows on from Nexperia’s late-2023 release of two discrete SiC MOSFETs in 3 and 4-pin TO-247 packaging and is the latest offering in a series which will…

View On WordPress

#D2PAK-7 package#electronic components news#Electronic components supplier#Electronic parts supplier#Nexperia

0 notes

Text

SiC MOSFET Chips (Devices) and Module Market Size, Outlook and Forecast 2023 to 2029

The global SiC MOSFET Chips (Devices) and Module market was valued at US$ 540.9 million in 2022 and is projected to reach US$ 2731.9 million by 2029, at a CAGR of 26.0% during the forecast period. The influence of COVID-19 and the Russia-Ukraine War were considered while estimating market sizes.

Get Full Report : https://semiconductorinsight.com/report/sic-mosfet-chips-devices-and-module-market/

SiC MOSFET chips (devices) and modules are types of semiconductor components made from silicon carbide (SiC) material. They are used in power electronics applications due to their superior characteristics compared to traditional silicon-based MOSFETs. SiC MOSFETs offer faster switching speeds, higher efficiency, and greater temperature tolerance, making them suitable for high-power applications. SiC MOSFET chips are standalone devices that are integrated into electronic circuits, while SiC MOSFET modules combine multiple chips to form a single module for high-power applications. These chips and modules are used in various industries such as automotive, industrial, photovoltaic, and others.

Silicon carbide MOSFET has the characteristics of low on-off resistance and small switch loss, which can reduce device loss and improve system efficiency. It is more suitable for high frequency circuit.

It is widely used in new energy vehicle motor controller, on-board power supply, solar inverter, charging pile, UPS, PFC power supply and other fields.

This report investigates the market for SiC MOSFET chips and devices and SiC MOSFET modules.

This report aims to provide a comprehensive presentation of the global market for SiC MOSFET Chips (Devices) and Module, with both quantitative and qualitative analysis, to help readers develop business/growth strategies, assess the market competitive situation, analyze their position in the current marketplace, and make informed business decisions regarding SiC MOSFET Chips (Devices) and Module.

This report contains market size and forecasts of SiC MOSFET Chips (Devices) and Module in global, including the following market information:

Global SiC MOSFET Chips (Devices) and Module Market Revenue, 2018-2023, 2024-2029, ($ millions)

Global SiC MOSFET Chips (Devices) and Module Market Sales, 2018-2023, 2024-2029, (K Units)

Global top five SiC MOSFET Chips (Devices) and Module companies in 2022 (%)

The global SiC MOSFET Chips (Devices) and Module market was valued at US$ 540.9 million in 2022 and is projected to reach US$ 2731.9 million by 2029, at a CAGR of 26.0% during the forecast period. The influence of COVID-19 and the Russia-Ukraine War were considered while estimating market sizes.

The top 5 players hold a total market share of approximately 80% in the SiC MOSFET market.

The automotive industry is expected to hold the largest share of the SiC MOSFET market in terms of revenue. This can be attributed to the increasing demand for electric and hybrid vehicles and the growing focus on reducing carbon emissions.

From a global perspective, China is the largest production region, and the main production enterprises are also concentrated in this region, such as Infineon Technologies, ON Semiconductor, STMicroelectronics etc. The total output value of China in 2019 is 222.31 million USD, accounting for 62.14% of the world, followed by Japan. The main manufacturers in this area include ROHM and Mitsubishi Electric, etc.

In Asia-Pacific, China is the largest market for SiC MOSFET devices and modules, driven by the country’s growing power electronics industry and the government’s focus on energy conservation and emissions reduction. Japan and South Korea are also significant markets for SiC MOSFETs, with a focus on automotive and renewable energy applications.

In North America, the United States is the largest market for SiC MOSFETs, driven by the growing demand for electric vehicles and renewable energy. The region also has a strong semiconductor industry, which supports the development and production of SiC MOSFET devices and modules.

In Europe, Germany is the largest market for SiC MOSFETs, with a focus on automotive and renewable energy applications. The region also has a strong semiconductor industry, which supports the development and production of SiC MOSFET devices and modules.

Market Drivers:

Higher Efficiency: SiC MOSFETs have a higher efficiency compared to traditional silicon-based devices, resulting in reduced power loss and improved performance.

Faster Switching Speed: SiC MOSFETs have a faster switching speed, which enables them to switch on and off more quickly, reducing power loss and improving system efficiency.

Higher Temperature Tolerance: SiC MOSFETs can operate at higher temperatures than traditional silicon-based devices, making them suitable for high-temperature applications such as electric vehicles and industrial automation.

Increasing Adoption of Electric Vehicles: The demand for SiC MOSFETs is increasing due to the growing adoption of electric vehicles. SiC MOSFETs offer higher efficiency and faster switching speeds compared to traditional silicon-based devices, making them ideal for electric vehicle applications.

Growing Renewable Energy Market: The increasing demand for renewable energy is also driving the demand for SiC MOSFETs. SiC MOSFETs are used in renewable energy systems such as solar inverters and wind turbines due to their higher efficiency and faster switching speeds.

Industrial Automation: The growing trend towards Industry 4.0 and industrial automation is driving the demand for SiC MOSFETs. These devices are used in high-power applications such as motor drives and power supplies, where high efficiency and fast switching speeds are critical.

In the report, there are two mainly types of SiC MOSFET Chips/Devices and Module, including SiC MOSFET Chips/Devices and SiC MOSFET Module. And SiC MOSFET Chips/Devices is the main type for SiC MOSFET Chips/Devices and Module

We surveyed the SiC MOSFET Chips (Devices) and Module manufacturers, suppliers, distributors and industry experts on this industry, involving the sales, revenue, demand, price change, product type, recent development and plan, industry trends, drivers, challenges, obstacles, and potential risks.

Total Market by Segment:

Global SiC MOSFET Chips (Devices) and Module Market, by Type, 2018-2023, 2024-2029 ($ Millions) & (K Units)

Global SiC MOSFET Chips (Devices) and Module Market Segment Percentages, by Type, 2022 (%)

Sic MOSFET Chip and Device

Sic MOSFET Module

Global SiC MOSFET Chips (Devices) and Module Market, by Application, 2018-2023, 2024-2029 ($ Millions) & (K Units)

Global SiC MOSFET Chips (Devices) and Module Market Segment Percentages, by Application, 2022 (%)

Motor Drives

Industrial Power Supplies

Electric Vehicle (EV) Charging Stations

Traction Inverters

UPS and SMPS

Industrial Photovoltaic (pv)

Other

Global SiC MOSFET Chips (Devices) and Module Market, by Industry, 2018-2023, 2024-2029 ($ Millions) & (K Units)

Global SiC MOSFET Chips (Devices) and Module Market Segment Percentages, by Industry, 2022 (%)

Automotive

Aerospace and Defense

Power Generation and Distribution

Electronics and Telecommunications

Other

Global SiC MOSFET Chips (Devices) and Module Market, By Region and Country, 2018-2023, 2024-2029 ($ Millions) & (K Units)

Global SiC MOSFET Chips (Devices) and Module Market Segment Percentages, By Region and Country, 2022 (%)

North America

US

Canada

Mexico

Europe

Germany

France

U.K.

Italy

Russia

Nordic Countries

Benelux

Rest of Europe

Asia

China

Japan

South Korea

Southeast Asia

India

Rest of Asia

South America

Brazil

Argentina

Rest of South America

Middle East & Africa

Turkey

Israel

Saudi Arabia

UAE

Rest of Middle East & Africa

Competitor Analysis

The report also provides analysis of leading market participants including:

Key companies SiC MOSFET Chips (Devices) and Module revenues in global market, 2018-2023 (Estimated), ($ millions)

Key companies SiC MOSFET Chips (Devices) and Module revenues share in global market, 2022 (%)

Key companies SiC MOSFET Chips (Devices) and Module sales in global market, 2018-2023 (Estimated), (K Units)

Key companies SiC MOSFET Chips (Devices) and Module sales share in global market, 2022 (%)

Further, the report presents profiles of competitors in the market. Key players include:

Wolfspeed

Infineon Technologies

STMicroelectronics

ROHM

Semiconductor Components Industries, LLC

Littelfuse

Microchip

Mitsubishi Electric

GeneSiC Semiconductor Inc.

Shenzhen BASiC Semiconductor LTD

ON Semiconductor

Toshiba

Fuji Electric

Key Industry Developments:

In June 2021, Infineon Technologies announced the acquisition of Cypress Semiconductor Corporation, which will further strengthen Infineon’s position in the automotive and Internet of Things (IoT) markets.

In May 2021, Cree/Wolfspeed announced the expansion of its manufacturing capacity for SiC MOSFETs and other power electronics products, in response to the growing demand for these products in electric vehicles, renewable energy, and industrial automation applications.

In February 2021, ON Semiconductor introduced a new range of SiC MOSFETs with higher voltage ratings, designed for use in electric vehicle and renewable energy applications.

In January 2021, STMicroelectronics unveiled a new SiC MOSFET power module for electric vehicle applications, which features high efficiency and compact design.

In October 2021, ROHM Semiconductor announced the development of a new SiC MOSFET chip that achieves the industry’s lowest on-resistance, enabling higher efficiency and lower power loss in power electronics applications.

Get Full Report : https://semiconductorinsight.com/report/sic-mosfet-chips-devices-and-module-market/

0 notes

Text

What is a Power Semiconductors

Power semiconductors are electronic devices that are specifically designed to handle high levels of power and voltage. These components play a crucial role in power conversion, control, and regulation in various electrical and electronic systems. Power semiconductors are essential in applications that require efficient energy conversion, such as power supplies, motor drives, renewable energy systems, electric vehicles, and industrial automation.

Unlike regular semiconductors, power semiconductors are built to withstand higher power levels and voltage stresses. They are designed to handle large current flows and dissipate heat generated during operation effectively. Power semiconductors are characterized by their ability to control and switch electrical power with minimal losses, enabling efficient energy utilization and minimizing heat dissipation.

There are several types of power semiconductor devices commonly used in various applications:

Power MOSFETs (Metal-Oxide-Semiconductor Field-Effect Transistors): These devices are widely used for their high switching speeds, low on-state resistance, and excellent efficiency. Power MOSFETs are commonly employed in power supplies, motor control, and other applications that require high-frequency switching.

IGBTs (Insulated Gate Bipolar Transistors): IGBTs combine the fast switching capability of MOSFETs with the low conduction losses of bipolar transistors. They are commonly used in applications that require high voltage and high current switching, such as motor drives, inverters, and welding equipment.

Thyristors: Thyristors are semiconductor devices that can handle high voltages and currents. They are widely used in applications that require controlled power switching, such as AC motor control, lighting dimming, and power factor correction.

Silicon Carbide (SiC) and Gallium Nitride (GaN) devices: SiC and GaN are wide-bandgap semiconductors that offer superior performance compared to traditional silicon-based devices. They have higher breakdown voltages, faster switching speeds, and lower losses, making them ideal for high-power and high-frequency applications.

Power semiconductors play a critical role in enabling efficient power conversion and control in various industries. The ongoing advancements in power semiconductor technology, such as the development of new materials, device structures, and packaging techniques, continue to enhance their performance and broaden their application scope. With the increasing demand for energy efficiency and the growing adoption of renewable energy sources, the power semiconductor industry holds great potential for future development and innovation.

1 note

·

View note

Text

Revolutionizing Circuit Protection: How New Solutions, Investments, and M&A are Driving Industry Growth" - KaleidoScot

Revolutionizing Circuit Protection: How New Solutions, Investments, and M&A are Driving Industry Growth" - KaleidoScot

# Revolutionizing Circuit Protection: How New Solutions, Investments, and M&A are Driving Industry Growth - KaleidoScot #

## Introduction ##

In today's fast-paced digital age, electronic devices are increasingly becoming an essential part of our lives. From smartphones to laptops, we rely heavily on these gadgets for communication, entertainment, and work. However, this increase in demand for electronic devices also comes with a rise in the need for circuit protection. The circuit protection industry is experiencing an unprecedented boom, thanks to new solutions, investments, and mergers and acquisitions (M&A). In this article, we will discuss how these factors are driving industry growth and revolutionizing circuit protection.

## The Importance of Circuit Protection ##

Circuit protection is the process of safeguarding electronic devices from possible electrical faults that could cause damage or fire. This process ensures that devices operate safely and efficiently. It is a crucial aspect of electronic design and manufacturing. The demand for circuit protection has grown exponentially as devices become more powerful, complex, and smaller.

According to a report by MarketsandMarkets, the global circuit protection market is projected to grow from $35.85 billion in 2017 to $53.56 billion by 2023, at a CAGR of 6.13%.

## New Solutions Driving Revolution ##

New solutions are driving a revolution in circuit protection. The industry is witnessing innovative technologies such as polymeric positive temperature coefficient (PPTC) resettable fuses and thermally protected varistor (TPV) surge protection devices.

- Polymeric Positive Temperature Coefficient (PPTC) Resettable Fuses

PPTC resettable fuses provide an alternative to traditional fuses and breakers. They offer faster protection time, resettable operation, and overcurrent protection. These fuses are ideal for applications such as consumer electronics, LED lighting, and automotive systems.

- Thermally Protected Varistor (TPV) Surge Protection Devices

TPV surge protection devices are devices that protect against voltage spikes and surges. They operate by using a thermally protected varistor instead of traditional MOV-based devices. This technology delivers better reliability, safety, and performance compared to traditional varistors.

## Investments Driving Industry Growth ##

Investments in the circuit protection industry are on the rise, fueling industry growth. The industry is attracting venture capitalists and private investors who see the potential for profits in the growing market.

In October 2020, Kalen Energy, a UK-based developer of energy storage solutions, secured €3.6 million in funding from multiple investors. The funds will be used to develop new energy storage systems that utilize advanced circuit protection technologies.

Likewise, in May 2021, Littelfuse, a leading provider of circuit protection solutions, announced an investment of $15 million in Monolith Semiconductor, a manufacturer of silicon carbide (SiC) technology. This investment is aimed at developing innovative SiC-based MOSFETs for circuit protection applications.

## M&A Driving Industry Growth ##

Mergers and acquisitions (M&A) are driving industry growth by enabling companies to expand their product offerings, enter new markets, and enhance their capabilities.

- Eaton Acquires Cooper Industries

In 2012, Eaton, a leader in power management solutions, acquired Cooper Industries, a provider of circuit protection solutions. This acquisition enabled Eaton to expand its portfolio of solutions in the circuit protection market and establish a stronger presence in the North American market.

- Littelfuse Acquires TE Connectivity's Circuit Protection Business

In 2016, Littelfuse acquired TE Connectivity's circuit protection business for $350 million. This acquisition enabled Littelfuse to expand its product offerings and address the growing demand for circuit protection solutions in the automotive, industrial, and telecommunications markets.

## FAQS ##

Q. What is the circuit protection market?

A. The circuit protection market is a growing industry that provides solutions to safeguard electronic devices from possible electrical faults that could cause damage or fire.

Q. What are PPTC resettable fuses?

A. PPTC resettable fuses are innovative fuses that offer faster protection time, resettable operation, and overcurrent protection.

Q. What is a TPV surge protection device?

A. A TPV surge protection device is a device that protects against voltage spikes and surges. It operates by using a thermally protected varistor instead of traditional MOV-based devices.

Q. Who invests in the circuit protection industry?

A. Venture capitalists and private investors are investing in the circuit protection industry to take advantage of the growing market.

Q. What are the advantages of M&A in the circuit protection industry?

A. M&A enables companies to expand their product offerings, enter new markets, and enhance their capabilities.

Q. How is the circuit protection industry projected to grow?

A. According to a report by MarketsandMarkets, the global circuit protection market is projected to grow from $35.85 billion in 2017 to $53.56 billion by 2023, at a CAGR of 6.13%.

## Conclusion ##

The circuit protection industry is evolving rapidly, thanks to new solutions, investments, and M&A. Polymeric positive temperature coefficient (PPTC) resettable fuses and thermally protected varistor (TPV) surge protection devices are leading the way in innovation. Investments from venture capitalists and private investors are driving industry growth, while M&A is enabling companies to expand their product offerings and capabilities. The future looks bright for the circuit protection industry, with projections of continued growth in the coming years. #BUSINESS

Read the full article

0 notes

Text

NEW YORK, Jan. 26, 2023 (GLOBE NEWSWIRE) --

These are some of the most exciting findings from a recent IndexBox report on the global transistor market.

The global transistor market is forecast to grow from $31B in 2022 to $39B by 2030, at a CAGR of 3.0% during the forecast period. This growth is driven by increasing demand for transistors in end-use industries such as automotive, consumer electronics, and telecommunications; the declining prices of transistors due to advancements in manufacturing technology; the growing demand for miniaturized transistors in portable electronic devices such as smartphones and tablets.

View a sample report and free data online

The transistor was invented in 1947 by physicists John Bardeen, Walter Brattain, and William Shockley at Bell Labs. It is a semiconductor device used to amplify or switch electronic signals and electrical power, and are the fundamental building blocks of modern electronic devices, including computers, mobile phones, and other digital technologies.

Market Segmentation

On the basis of type, the transistor market is classified into MOSFET, IGBT, and BJT. Currently, MOSFETs are widely used in various applications such as power management in computers, portable electronic devices, and electric vehicles thanks to their low ON resistance.

IGBTs are applied in UPS systems, solar inverters, welding equipment, and traction systems due to their fast-switching speed as compared to MOSFETs.

BJTs are commonly used amplifiers & switches in various electronic circuits owing to their easy manufacturing process compared to MOSFETs & IGBTs.

On the basis of material, the transistor market is classified into silicon and compound semiconductor. For traditional silicon-based transistors, competition from alternative technologies such as silicon carbide (SiC) and gallium nitride (GaN) increases.

With the ever-increasing demand for data storage and processing, DRAM is expected to be the major application for transistors. The high data storage capacity and fast data processing speed of DRAM make it ideal for use in a wide range of applications including artificial intelligence (AI), big data, and cloud computing.

Geographically, Asia-Pacific is set to dominate the transistor market owing to increasing investments in the semiconductor sector and rising demand for consumer electronics and automotive. China, Japan, and India are the major countries of focus in the region. Moreover, favorable government initiatives such as the “Make in India” scheme and National Integrated Circuit (IC) Promotion Plan are expected to further enhance the growth of the Asia Pacific transistor market during the forecast period.

Market Challenges

One of the major challenges faced by the transistor market is declining average selling prices. With the commoditization of transistors, manufacturers are facing stiff competition from low-cost Asian players. This has led to a decline in the selling prices of transistors, resulting in fierce price wars among vendors, which is negatively impacting their margins.

Moreover, with the ever-changing consumer electronics landscape, it has become difficult for vendors to keep up with the latest trends and developments. This has led to an increase in product development costs and time-to-market for new products, thereby affecting vendors’ profitability levels. Logistics tensions lead to disruptions in the supply of raw materials, creating additional challenges for stable transistor production.

About IndexBox

IndexBox is a market research firm developing an AI-driven market intelligence platform that helps business analysts find actionable insights and make data-driven decisions. The platform provides data on consumption, production, trade, and prices for more than 10K+ different products across 200 countries.

Companies Mentioned in the Report

Intel Corporation, Samsung Electronics Co., Ltd., Renesas Electronics Corporation, Toshiba Corporation, STMicroelectronics N.V., Texas In

struments, Renesas Electronics, Hitachi, Infineon Technologies AG, Taiwan Semiconductor Manufacturing Co.

Sources

World – Transistors, Other Than Photosensitive Transistors - Market Analysis, Forecast, Size, Trends and Insights

EU - Transistors, Other Than Photosensitive Transistors - Market Analysis, Forecast, Size, Trends and Insights

Asia - Transistors, Other Than Photosensitive Transistors - Market Analysis, Forecast, Size, Trends and Insights

U.S. - Transistors, Other Than Photosensitive Transistors - Market Analysis, Forecast, Size, Trends and Insights

Americans are crazy for tech, and they're spending a fortune on it. According to the Consumer Technology Association, U.S. tech retail revenue will top $485 billion in 2023. Discover: 11 Grocery Items...

The price per million British Thermal Units is now less than $3, compared with more than $9 as recently as August.

The crypto exchange wants to question its founder’s family as it seeks to locate allegedly misappropriated funds

Integrated energy company Phillips 66 is scheduled to report latest quarterly numbers on Tuesday. In this daily bar chart of PSX, below, I can see a strong rally from late September. PSX corrected into December and has resumed the advance.

Yahoo Finance Live looks at BuzzFeed shares as the media company plans to craft "personalized" content using ChatGPT.

Companies pay severance to shield themselves from liability and help workers. Here's what a package could look like.

Is America's biggest telecom getting clotheslined by the kitchen phone chord? AT&T has seen healthy gains in its cellular and broadband arms,...

The surprise leadership shuffle on Thursday at Toyota Motor Corp, renewed urgency at Renault and Nissan Motor Co to restructure their alliance and Elon Musk's declaration that Tesla Inc will be the world's No. 1 automaker by a wide margin have one thing in common: What once defined the global auto industry's center is no longer holding. The announcement that Akio Toyoda will step down as chief executive of the world's top-selling automaker on April 1 came just hours after Musk used a quarterly earnings call to declare that Tesla was now the auto industry's leader in profitability and manufacturing efficiency - the crown Toyota held for three decades. Toyota's incoming CEO, Koji Sato, faces a daunting task.

Laid-off tech employees on work visas describe the urgency to find new jobs.

These companies are well positioned to earn the title "tech giant" a decade or two down the road.

MIT David Austin Professor of Management, Marketing, IT and Data Science and 'The Hype Machine' Author Sinan Aral discusses how big of an advantage Microsoft has regarding its recent investment in ChatGPT. You can see the entire interview here. Key Video Takeaways 00:11 On Google being "shook" 00:23 On the "existential threat" of ChatGPT to Google

Yahoo Finance Live anchors discuss the latest companies to announce job cuts as SAP and IBM join tech giants in laying off workers.

Worker disconnectedness is on the rise in the U.S., and some employees are feeling more disengaged than others.

American refiners had an exceptional 2022. Low natural gas prices and a Russian product ban show conditions still look favorable.

Tractor Supply's 2,333 stores, found in every state but Alaska, provide the company an expansive look at the national economy. CEO Hal Lawton discusses his outlook on wages, inflation, and hiring — plus the evidence he sees that counters the national narrative of rural America being in decline.

Nokia Corp (NYSE: NOK) reported a fourth-quarter FY22 net sales growth of 16% year-on-year (11% in constant currency) to €7.45 billion. Network Infrastructure sales grew 14% Y/Y in CC. Cloud and Network Services sales increased by 5% Y/Y in CC, while Nokia Tech rose 82% Y/Y as a long-term licensee exercised an option. Mobile Networks sales grew by 3% Y/Y in CC with a meaningful shift in regional mix. Also Read: Samsung, Nokia Ink New Multi-Year 5G Patent Deal Margins: Gross margin expa

nded by 33

PARIS (Reuters) -Luxury goods group LVMH's sales rose 9% in the fourth quarter as shoppers in Europe and the United States splurged over the crucial holiday season, helping partly to offset COVID disruptions in China. Sales at the world's biggest luxury group reached 22.7 billion euros ($24.65 billion) in the final three months of the year, with the 9% increase on an organic basis a touch above analyst expectations for 7% growth, based on a consensus cited by UBS. That marked a deceleration from the 20% growth recorded in the first nine months of the year, due to the hit in China from lockdowns and its subsequent exit from a zero-COVID policy, which has spurred a surge of infections in the world's second-largest economy.

CEO Jonah Peretti said the publisher would use the technology to make more comprehensive quizzes and interactive content.

If someone receiving Social Security benefits earns money by working, the Social Security Administration may reduce the amount of that person's benefits. This only affects people who start taking benefits before reaching full retirement age. And only income earned from … Continue reading → The post What Income Reduces Social Security Benefits? appeared first on SmartAsset Blog.

Industry experts predict the real estate sector will register slowed economic growth in 2023 amid higher-than-average inflation levels and growing recession fears. And real estate investment trusts (REITs) have historically remained well-positioned to weather economic uncertainties. Even though rental rates have been cooling over the past couple of months, they are significantly higher than in 2021. Strong rental pricing should allow properties to improve their balance sheets and liquidity to cu

source

0 notes