#Stock Broker Frauds United States

Photo

LETTERS FROM AN AMERICAN

March 15, 2023

Heather Cox Richardson

The Justice Department today announced the arrest of Chinese billionaire Guo Wengui, also known as Ho Wan Kwok and Miles Guo, charged with defrauding followers of more than $1 billion. The 12-count indictment for wire fraud, securities fraud, bank fraud, and money laundering says Guo and a co-conspirator, Kin Ming Je, raised money by promising stock in Guo’s GTV Media Group, a high-end club, or cryptocurrency but then used the money themselves for items that included a $53,000 fireplace log holder, a watch storage box that cost almost $60,000, and two $36,000 mattresses, as well as more typical luxury items: a 50,000-square-foot mansion, a Lamborghini, and designer furniture.

The U.S. government seized more than $630 million from multiple bank accounts as well as other assets purchased with illicit money. If convicted, Guo faces up to 20 years in prison. Guo has attracted donors by developing the idea that he is a principled opponent of the Chinese Communist Party, but Dan Friedman, who writes on lobbying and corruption for Mother Jones, points out that this persona appears to be a grift.

Guo is close to sometime Trump ally Steve Bannon, who was reading a book on Guo’s yacht, Lady May, when federal officers arrested him in 2020 for defrauding donors of $25 million in his “We Build the Wall” fundraising campaign. Rather than constructing a wall, Bannon and three associates funneled that money to themselves. Trump pardoned Bannon for that scheme hours before he left office.

Friedman points out that prosecutors say Guo’s criminal conspiracy began in 2018, which is the year that Guo and Bannon launched The Rule of Law Foundation and the Rule of Law Society. They claimed the organizations would defend human rights in China and then, according to prosecutors, lured donors to other products.

In April 2020, Guo and Bannon formed the GTV Media Group, which flooded the news with disinformation before the 2020 election, especially related to Hunter Biden and the novel coronavirus. Sued by the U.S. Securities and Exchange Commission in September 2021 for the illegal sale of cryptocurrency, GTV paid more than $539 million to settle the case. Bannon’s War Room webcast features Guo performing its theme song.

One of the entities Guo and Bannon created together is the “New Federal State of China,” which sponsored the Conservative Political Action Conference in Washington, D.C., earlier this month.

In other money news, Hugo Lowell of The Guardian reported today that $8 million of the loans that bankrolled Trump’s social media platform Truth Social came from two entities that are associated with Anton Postolnikov, a relation of an ally of Russian president Vladimir Putin named Aleksandr Smirnov.

Banks continue to writhe, in Europe this time, as Credit Suisse disclosed problems in its reporting and its largest investor, Saudi National Bank, said it would not inject more cash into the institution. The government of Switzerland says it will backstop the bank.

In the U.S., Michael Brown, a venture partner at Shield Capital and former head of the Defense Department’s Defense Innovation Unit, told Marcus Weisgerber and Patrick Tucker of Defense One that the collapse of Silicon Valley Bank had the potential to be a big problem for national security, since a number of the affected start-ups were working on projects for the defense sector. “If you want to kind of knock out the seed corn for the next decade or two of innovative tech, much of which we need for the competition with China, [collapsing SVB] would have been a very effective blow. [Chinese President Xi Jinping and Russian President Vladimir Putin] would have been cheering to see so many companies fail.”

Federal and state investigators are looking into the role of Representative George Santos (R-NY) in the sale of a $19 million yacht from one of his wealthy donors to another, for which he collected a broker’s fee. In an interview with Semafor last December, Santos explained that his income had jumped from $55,000 in 2020 to enough money to loan his 2022 campaign $705,000 because he had begun to act as a broker for boat or plane sales. He told Semafor: “If you’re looking at a $20 million yacht, my referral fee there can be anywhere between $200,000 and $400,000.”

Today’s emphasis on money and politics brings to mind the speech then–FBI director Robert Mueller gave in New York in 2011, warning about a new kind of national security threat: “so-called ‘iron triangles’ of organized criminals, corrupt government officials, and business leaders” allied not by religion or political inclinations, but by greed.

It also brings to mind the adamant opposition of then–National Republican Senatorial Committee chair Mitch McConnell (R-KY) to campaign finance reform in 1997 after he raised a record-breaking amount of money for Republican candidates, saying that political donations are simply a form of free speech. The Supreme Court read that interpretation into law in the 2010 Citizens United decision, but the increasingly obvious links between money, politics, and national security suggest it might be worth revisiting.

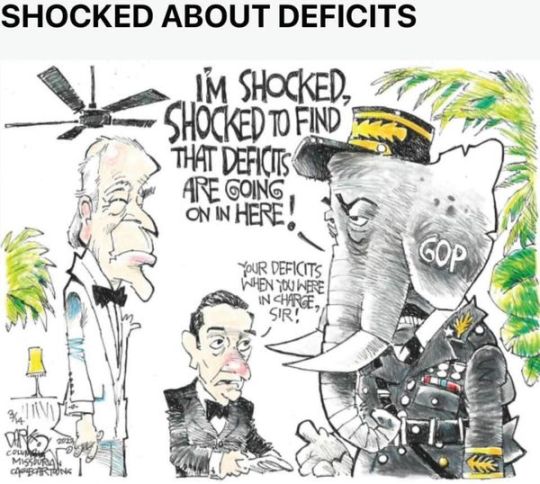

Money and politics are in the news in another way today, too, as part of the ongoing budget debates. A letter yesterday from the Congressional Budget Office to Senators Sheldon Whitehouse (D-RI) and Ron Wyden (D-OR), answering their questions about how to eliminate the deficit by 2033, says that it is impossible to balance the budget by that year without either raising revenue or cutting either Social Security, Medicare, or defense spending. Even zeroing out all discretionary spending is not sufficient. Led by House speaker Kevin McCarthy (R-CA), Republicans have promised they can do so, but they have not yet produced a budget. This CBO information makes their job harder.

And finally, today, in Amarillo, Texas, U.S. District Judge Matthew Kacsmaryk held a hearing on the drug mifepristone, used in about half of medically induced abortions. The right-wing “Alliance Defending Freedom,” acting on behalf of antiabortion medical organizations and four doctors, is challenging the approval process the Food and Drug Administration used 22 years ago to argue that the drug should be prohibited. While the approval process took more than four years, it was conducted under an expedited process that speeds consideration of drugs that address life-threatening illnesses. “Pregnancy is not an illness,” senior counsel for Alliance Defending Freedom Julie Marie Blake said.

And yet mifepristone is commonly used in case of miscarriage and for a number of other medical conditions. And Texas’s Maternal Mortality and Morbidity Review, released in December 2022, concluded that from March 2021 to December 2022, at least 118 deaths in Texas were related to pregnancy. In 2020, 861 deaths in the U.S. were related to pregnancy, up from 754 in 2019.

Public health officials note that extensive research both in the U.S. and in Europe has proven the medication is safe and effective. They warn that a judge’s overturning a drug’s FDA approval 20 years after the fact could upend the country’s entire drug-approval system, as approvals for coronavirus treatments, for example, become plagued by political challenges.

Kacsmaryk was appointed by Trump and is well known for his right-wing views on abortion and same-sex marriage. Initially, he kept the hearing over a nationwide ban on the key drug used for medicated abortion off the docket, and in a phone call last Friday he asked lawyers not to publicize today’s hearing, saying he was concerned about safety. Legal observers were outraged at the attack on judicial transparency—a key part of our justice system—and Chris Geidner of LawDork outlined the many times Kacsmaryk had taken a stand in favor of the “public’s right to know.”

According to Ian Millhiser of Vox, Kacsmaryk let 19 members of the press and 19 members of the public into today’s hearing.

—

LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

#heather cox richardson#Letters From An American#Corrupt GOP#Criminal GOP#Kacsmaryk#Corrupt SCOTUS#money in politics#Citizens United

6 notes

·

View notes

Text

15 Best Stock Market Movies To Watch: A Blend of Entertainment and Education

Introduction:

Stock market movies offer a captivating blend of drama, suspense, and insight into the world of finance. Whether you're a seasoned investor or just curious about the intricacies of Wall Street, these films provide entertainment while shedding light on the complexities of the stock market. From tales of greed and ambition to stories of triumph and resilience, here are 15 must-watch stock market movies that will both entertain and educate.

The Wolf of Wall Street (2013):

Directed by Martin Scorsese and starring Leonardo DiCaprio, this film is based on the true story of Jordan Belfort, a wealthy stockbroker who engages in corruption and securities fraud. It's a wild ride through the excesses of Wall Street in the 1990s, offering a darkly humorous look at greed and moral bankruptcy.

Wall Street (1987):

Directed by Oliver Stone, "Wall Street" stars Michael Douglas as the infamous Gordon Gekko, a ruthless corporate raider who epitomizes the greed of the 1980s. The film explores themes of ambition, ethics, and the moral dilemmas faced by those in the financial industry.

Boiler Room (2000):

Inspired by real events, "Boiler Room" follows a young stockbroker who gets caught up in a high-pressure brokerage firm engaged in unethical practices. The film delves into the world of pump-and-dump schemes and the allure of quick riches, highlighting the consequences of unchecked ambition.

Margin Call (2011):

Set during the early stages of the 2008 financial crisis, "Margin Call" offers a fictionalized account of a prestigious investment bank grappling with the impending collapse of the housing market. The film provides a tense and thought-provoking look at the ethical dilemmas faced by those in the financial industry.

The Big Short (2015):

Based on Michael Lewis's book of the same name, "The Big Short" chronicles the events leading up to the 2008 financial crisis through the eyes of a group of investors who predicted the collapse of the housing market. With its star-studded cast and witty script, the film sheds light on the complexities of the financial system and the flaws that led to the crisis.

Trading Places (1983):

This classic comedy stars Eddie Murphy and Dan Aykroyd as a streetwise hustler and a wealthy commodities broker who unwittingly switch lives as part of a social experiment. "Trading Places" offers a humorous take on the world of commodities trading while addressing themes of class and privilege.

Rogue Trader (1999):

Based on the true story of Nick Leeson, "Rogue Trader" follows the rise and fall of a young trader who single-handedly brings down Britain's oldest merchant bank, Barings Bank, through unauthorized speculative trading. The film offers a cautionary tale about the dangers of unchecked ambition and the consequences of financial fraud.

Inside Job (2010):

This documentary provides a comprehensive analysis of the 2008 financial crisis, examining the systemic corruption and regulatory failures that led to the collapse of the global economy. Through interviews with economists, politicians, and industry insiders, "Inside Job" offers a damning indictment of Wall Street's role in the crisis.

Too Big to Fail (2011):

Based on Andrew Ross Sorkin's book, "Too Big to Fail" offers a behind-the-scenes look at the events surrounding the 2008 financial crisis, focusing on the efforts of government officials and Wall Street executives to prevent a complete meltdown of the financial system. The film provides a gripping account of the high-stakes negotiations and power struggles that defined the crisis.

Enron: The Smartest Guys in the Room (2005):

This documentary explores the rise and fall of Enron, once one of the largest and most respected companies in the United States. Through interviews with former employees and archival footage, "Enron: The Smartest Guys in the Room" exposes the corporate greed and accounting fraud that led to the company's spectacular collapse.

Barbarians at the Gate (1993):

Based on the book by Bryan Burrough and John Helyar, "Barbarians at the Gate" tells the story of the leveraged buyout of RJR Nabisco in the late 1980s. The film offers a gripping portrayal of corporate intrigue and boardroom battles as rival executives vie for control of the company.

Wall Street: Money Never Sleeps (2010):

Directed by Oliver Stone, this sequel to the original "Wall Street" follows Gordon Gekko as he emerges from prison and attempts to rebuild his life and reputation in the aftermath of the financial crisis. The film explores themes of redemption and the changing landscape of Wall Street in the wake of the crisis.

The Pursuit of Happyness (2006):

While not strictly a stock market movie, "The Pursuit of Happyness" offers a powerful portrayal of the struggles faced by a single father trying to make ends meet while pursuing a career in finance. Starring Will Smith, the film is based on the true story of Chris Gardner, who overcame homelessness and adversity to become a successful stockbroker.

Boiler Room (2000):

Directed by Ben Younger, this film follows a young college dropout who lands a job at a shady brokerage firm that specializes in cold-calling unsuspecting investors. As he gets drawn deeper into the world of high-pressure sales tactics and dubious financial schemes, he must confront his own moral compass.

Moneyball (2011):

Based on Michael Lewis's book, "Moneyball" tells the true story of Oakland Athletics general manager Billy Beane, who revolutionized the game of baseball by using statistical analysis to assemble a competitive team on a limited budget. While not directly about the stock market, the film offers valuable lessons about the power of data-driven decision-making and unconventional thinking.

Conclusion:

Stock market movies offer more than just entertainment; they provide valuable insights into the workings of the financial world and the human psyche. Whether you're interested in high-stakes trading, corporate scandals, or the psychology of investing, these 15 films offer something for everyone. So grab some popcorn, settle in, and prepare to be entertained and enlightened by the best that Hollywood has to offer in the realm of finance.

0 notes

Text

What is a stock exchange?

A stock exchange is a centralized marketplace or platform where financial instruments, primarily stocks and other securities, are bought and sold. These exchanges provide a regulated and organized environment for the trading of financial instruments, facilitating the efficient functioning of financial markets. Investors, both individual and institutional, use stock exchanges to buy and sell securities.

Here are some key features and functions of a stock exchange:

Listing of Securities: Companies that want to sell their shares to the public typically go through an initial public offering (IPO) and then list their shares on a stock exchange. This process allows the company's shares to be traded among investors on the exchange.

Trading Platform: Stock exchanges provide a platform where buyers and sellers can come together to execute trades. This is typically done through a combination of electronic trading systems and traditional floor trading, where human traders facilitate transactions.

Regulation: Stock exchanges are regulated by financial authorities to ensure fair and transparent trading practices. Regulatory bodies establish rules and standards that companies must adhere to for listing on the exchange. They also monitor trading activities to prevent fraud and market manipulation.

Price Discovery: Stock exchanges play a crucial role in the price discovery process. Prices of securities are determined by the forces of supply and demand in the marketplace. The constant buying and selling of stocks on the exchange contribute to the establishment of market prices.

Best tool for stock market and option chain

Indices: Stock exchanges often have benchmark indices that track the performance of a specific group of stocks. These indices, such as the S&P 500 or the FTSE 100, provide a snapshot of the overall market conditions and are used as indicators of economic health.

Brokerage Firms: Investors typically access stock exchanges through brokerage firms. These firms act as intermediaries, executing trades on behalf of their clients. Investors place orders through their brokers, who then execute the trades on the exchange.

Examples of well-known stock exchanges include:

New York Stock Exchange (NYSE): Located in New York City, NYSE is one of the largest and most influential stock exchanges globally.

Nasdaq: Known for its electronic trading platform, Nasdaq is another major stock exchange in the United States, with a focus on technology and internet-based companies.

London Stock Exchange (LSE): Based in the United Kingdom, LSE is one of the oldest and largest stock exchanges in the world.

Stock exchanges play a critical role in the functioning of financial markets by providing liquidity, transparency, and a regulated environment for the buying and selling of securities.

Best way to learn stock market with investing daddy

As a financial expert, Dr. Vinay Prakash Tiwari has made substantial contributions in understanding and predicting movements in stock market. His proprietary tool, LTP CALCULATOR, is recognized for its innovation and utility.

0 notes

Link

0 notes

Text

ERISA Bonds

What is ERISA?

The Employment Retirement Income Security Act of 1974 (ERISA) is a congressional law in the United States that protects individuals in most private retirement and health plans by setting minimum standards that must be followed. According to the Department of Labor (DOL), the Act:

“requires plans to provide participants with plan information including important information about plan features and funding; sets minimum standards for participation, vesting, benefit accrual and funding; provides fiduciary responsibilities for those who manage and control plan assets; requires plans to establish a grievance and appeals process for participants to get benefits from their plans; gives participants the right to sue for benefits and breaches of fiduciary duty; and, if a defined benefit plan is terminated, guarantees payment of certain benefits through a federally chartered corporation, known as the Pension Benefit Guaranty Corporation (PBGC).”

What is an ERISA Bond?

An ERISA Bond is an insurance policy that protects the plan assets against theft, fraud or dishonesty by Fiduciaries and other persons who handle plan funds or property. Acts covered by an ERISA Bond include but are not limited to embezzlement, larceny, theft, forgery, willful misapplication, willful conversion, willful abstraction and other acts of dishonesty. An ERISA Bond is considered a Fidelity Bond.

ERISA Bond Exclusions

ERISA Bonds DO NOT cover Fiduciaries for acts that breach their fiduciary duties. It is NOT a Fiduciary Liability Insurance Policy. Although it is usually recommended for Fiduciaries to be covered by such a policy, it is not required under ERISA.

ERISA Bonds also do not cover investment losses caused by regular market conditions. An example would be an investment declining in market value.

Who is Required to Be Covered by an ERISA Bond?

Under ERISA, every Fiduciary on the plan and every person who handles funds or property must be covered by an ERISA Bond. Funds and Property include contributions from employees and employers, property, mortgages, investments, private company stock, along with cash, checks or investment used for making distributions. It is an unlawful act for anyone to receive, handle, disperse or exercise control over any covered ERISA plan assets without being covered by an ERISA Bond.

According to the Department of Labor, a person is deemed to be handling funds or property whenever their duties or activities could cause loss to the plan by fraud or dishonesty. This applies whether they are operating alone or in concert with others. The DOL further determines a general criteria for handling to include:

Physical contact with cash, checks or similar property

Power to transfer funds from the plan to oneself or to a third party

Power to negotiate plan property (e.g., mortgages, title to land and buildings or securities)

Disbursement authority or authority to direct disbursement

Authority to sign checks or other negotiable instruments

Supervisory or decision-making responsibility over activities that require bonding

Anyone performing these roles must be covered by an ERISA Bond.

ERISA Service Providers

There is a strong industry trend to outsource many services covered by ERISA. Third Party Administrators, investment advisors and other parties must be covered by an ERISA Bond if they meet the criteria of handling funds and property for the covered plan.

Exclusions for Who Needs an ERISA Bond

Some parties are exempt from providing ERISA Bonds. These parties include:

Certain Banking Institutions and Trusts

Retirement Plans Completely Unfunded (Most Union Plans)

Government and Church Retirement Plans under Title 1.

Certain Insurance Carriers

Certain Broker Dealers

What is the Required Amount of an ERISA Bond?

ERISA Bonds are required to cover at least 10% of the amount of assets that each covered person handled for the plan in the previous year. For example, a plan holds $1,000,000 assets in the company 401k. Trustees, administrators and other parties will need to have an ERISA Bond in the amount of at least $100,000. Generally these bonds are written to cover all the parties involved for at least 10% of the plan assets. If there is no previous plan year, the DOL allows the company to make estimates for the plan amount.

The law does set both a minimum and maximum amount required for each individual under an ERISA Bond. An ERISA Bond must be at least $1,000. However, the required amount does not have to exceed $500,000 for most plans. This maximum increases to $1,000,000 if the plan holds company securities in the plan.

ERISA Bond Amount Covering Multiple Plans

An ERISA Bond may cover multiple plans. However, the $500,000 bond maximum does not apply when more than one plan is covered. The bond amount in such cases must still meet the 10% requirement for BOTH plans. For example, an employer is covering two plans with an ERISA Bond. One plan has $1,000,000 in assets while the other plan has $5,000,000 in assets. The minimum amount of the ERISA Bond must be $600,000. This is calculated by taking Plan 1’s minimum amount ($1,000,000 x 10% = $100,000) and adding it to Plan 2’s minimum amount ($5,000,000 x 10% = $500,000). A claim by one plan can not reduce the minimum amount available for the second plan.

Although the DOL sets a maximum required ERISA Bond amount, Employers should consider higher or full limits. A loss to employee retirement assets by dishonesty or fraud could destroy a company’s reputation, cause devastating litigation and potentially a loss of its workforce.

Failure to report the correct bond amount on the company’s 5500 could trigger an Audit of the plan. It can also lead to plan termination and penalties.

ERISA Bond Inflation Guard

Some ERISA Bonds contain an “Inflation Clause”. These clauses generally raise the bond amount by a specified amount each year to accommodate an increase in assets. These clauses do provide great protection to covered parties. However, ERISA Bond limits should still be reviewed regularly. Increased contributions, market performance and other factors can often lead to bond limit increases that may exceed the inflation amount.

No Dollar ERISA Bonds

For larger plans, a “no dollar” ERISA Bond may be purchased. These bonds say that the ERISA Bond covers 10% of plan assets, at a minimum of $1,000 and a maximum of $500,000. These bonds are allowed by ERISA and protect the company from increases to the plan assets automatically.

ERISA Bond Deductible

An ERISA Bond cannot have a deductible or any mechanism to reduce the bond’s ability to pay first dollar of the minimum required amounts. However, an ERISA Bond may have a deductible above the minimum amount.

Who Are the Parties to an ERISA Bond?

Although “Bond” is in the name, an ERISA Bond is an insurance party. It is a two party agreement. The Plan is the beneficiary of the bond. The surety or insurance carrier is the party writing the coverage. Unlike a surety bond, indemnity is not required for an ERISA Bond. Should a covered individual cause a loss, the plan can make a claim against the ERISA Bond. You can read about differences between surety bonds and insurance here.

How to Obtain an ERISA Bond

ERISA Bonds are very easy to obtain. Many companies can simply add the coverage through their commercial insurance policy. Others can purchase ERISA Bonds online in just a few minutes by clicking the button below. ERISA Bonds are considered low risk and easy to obtain for almost any business.

Exclusions on ERISA Bonds

Many ERISA Bonds do contain exclusions for any individuals known by the plan to have committed acts of dishonesty. These individuals will need to be prevented from handling plan funds and property or an ERISA Bond without this language will need to be secured.

What do ERISA Bonds Cost?

ERISA Bonds Costs depend on the insurance carrier writing the bond. However, these bonds are very inexpensive. The cost of an ERISA Bond is usually about 0.1%. For example, a $500,000 ERISA Bond can be obtained for about $500.

What Companies Can Write ERISA Bonds?

Because it is a U.S. Government requirement, all ERISA Bonds must be written by a surety bond company or insurance company that is approved in the U.S. Treasury’s 570 Circular. Certain Lloyds of London Insurers are also allowed to write ERISA Bonds.

ERISA Bonds are an important instrument to protect employees from dishonesty and fraud. These bonds are required by law and should be in place for any company utilizing a covered plan. These bonds are very easy to obtain and inexpensive so all companies can easily meet the requirements.

1 note

·

View note

Text

Securities Fraud Law

Forensic investigators, nonetheless, have a slim scope of apply, charged with amassing factual and documented evidence of fraud, assessing the harm from that fraud, and making suggestions on how to deter such fraud sooner or later. Fraud is usually seen as extra of a authorized issue than an accounting issue, and as a result many accountants have chosen to treat fraud as one thing outdoors securities fraud lawyer their principle jurisdiction. But forensic accountants and forensic financial investigators discover exactly the intersection between fraud and accounting. First, this Article will give a brief overview of the historic problems that European corporations have had with an over-reliance on debt financing. It will then discuss how reforms like higher redress for fraud can change that by giving equity buyers a stronger belief that they will get a good shake.

Securities fraud is becoming more advanced because the business develops more complicated investment autos. In addition, white collar criminals are expanding the scope of their fraud and are looking outside the United States for brand spanking new markets, new traders, and banking secrecy havens to hide unjust enrichment. Securities fraud, additionally referred to as stock or funding fraud, is a type of seriouswhite-collar crimethat may be dedicated in a wide range of varieties but securities class action claim primarily involves misrepresenting information investors use to make selections. The defendant is charged in the indictment with securities fraud in violation of federal securities law. Fines.Securities fraud can involve very high fines, although the amount of fantastic will rely upon the circumstances of the case. In some conditions, similar to in cases of insider trading, fines of up to $5 million are attainable, whereas fines for different kinds of securities fraud may be $10,000 or extra.

To reach this conclusion we would wish some extra substantive filters to eliminate inconsequential misreporting. Nevertheless, this estimate does not bode nicely for the US auditing system. In spite of all of the regulation, roughly half of the US financial statements suffer from misreporting extra severe than pure clerical errors. By contrast, Assumption 2 is more likely to maintain for misconducts that auditors are extra securities fraud lawyers likely to catch, similar to accounting restatements and auditor-detected fraud. Thus, in column 2 of Table 3, Panel B, we report the detection chance estimate obtained by pooling together only the 2 fraud measures for which Assumption 2 is more more likely to hold. The estimated detection chances are zero.33, with a 95% confidence interval of zero.24–0.forty five.

Then, solely when the federal government has gathered a substantial amount of proof will someone discover out that they're concerned in a federal investigation. Subject – There is proof that this person may need been involved in committing a federal crime, so they're included in the scope of investigation. Usually, the government doesn't consider this person was concerned securities fraud in committing the crime beneath investigation. After this part is full, if the brokers still imagine that a felony offense was committed, they might execute a search of an office or someone’s house, or they may begin interviewing folks. This is often when most people find out that they are concerned in a federal investigation.

The two commonest types of securities fraud in penny stocks are “pump and dump” and “bogus offerings”. A latest appeals court decision invalidating securities fraud convictions could undercut Justice Department enforcement of insider buying and selling, public corruption, crypto fraud, and other white-collar crimes. In U.S. v. O’Hagan, a lawyer started buying call choices and shares of stock for Pillsbury after the firm the lawyer labored for received employed by a company getting ready to make a tender securities fraud class action supply for Pillsbury inventory. After the company introduced its intention to buy the Pillsbury inventory, the price rose dramatically and the lawyer offered his stock and choices for a profit of $4.three million. The SEC indicted the lawyer for insider trading on nonpublic info in violation of Rule 10-5. Every funding carries a point of danger, which is mirrored in the fee of return you probably can count on to obtain.

Charles Ponzi made $20 million by way of his pyramid scheme, equal to $222 million in 2011. This kind of deceptive conduct is towards the law and a violation of Section 10 of the Securities Exchange Act of 1934. Victims in these cases have the right to recuperate their investment losses they suffered because of the fraud. To use the No Knowledge protection strategy in a securities fraud case, the defendant should securities fraud attorneys prove they had no prior knowledge of SEC regulations or guidelines pertaining to their crime. With respect to the fifth factor, financial loss, it is in all probability the easiest to show. If the transaction is the purchase of a stock, a subsequent sale at a lower price would show loss.

When monetary publications began questioning HUSA’s disclosures beginning in April 2010, the corporate denied these accusations and continued to issue false statements throughout the category interval. From October 2010 Houston American was investigated for potential violations of federal securities laws in regards to the company’s purported reserves. Houston American acquired three SEC subpoenas in reference securities fraud attorney to the investigation, which had been hid till April 2012. The deceptive statements inflated the worth of Houston American stock from its closing price of $4 in November 2009 to a document worth of $20.forty four on July 6, 2011. The securities attorneys at Gana Weinstein LLP have a wide-ranging securities fraud practice.

0 notes

Text

Insider Trading and Securities Fraud

Insider trading refers to the unauthorized trading of the stock or securities of a publicly traded company, usually based on inside information. It is considered as an illegal act, though the practice is not well known. In different countries, some types of trading also based on inside information is prohibited. Thus, a trader must know the law and must be able to distinguish between the different types of insider trading, especially when they are trading in stocks of publicly traded companies.

Insider trading may be done through three types of mediums: banks, exchanges, and brokerage firms. The most common type of this kind of trading is done on the over-the-counter bulletin board market, or OTC. This market is not supervised by the Securities and Exchange Commission, which makes it very risky for the investors. In the United States, the law prohibited the banks from trading the securities on their own behalf and from offering them to the public.

The regulation of insider trading was established by the SEC. The SEC creates the National Security Exchange Act (NSAEA) that regulates the trading on securities. Most derivatives markets are not supervised by the SEC, which is why there is a high risk for investors. For these reasons, the practice of insider trading is strictly prohibited by the law.

According to the securities exchange act trading, anyone who knowingly and intentionally assists in the fraudulent activities of another person is guilty of securities fraud. These include all transactions, both retail and online, that involve the purchase or sale of securities for someone else. The person who commits securities fraud is called an "insider". On Wall Street, however, there are a few that are referred to as Wall Street sharks.

There have been many instances throughout history where individuals have been charged with securities fraud and insider trading. Some of these include Bernard Madoff and his Ponzi scheme. Another case that involves an alleged insider-trading ring is that of Jonna's Upload. The U.S. Supreme Court ruled that the trades made by Upload were unlawful because the broker did not disclose material information to the client before making the trade. Consequently, the broker contributed to the damage caused to the investor.

Recently, there was a case in which the SEC charged a former employee of Morgan Stanley with insider trading. The former employee was accused of trading shares within the confines of an agreement between Morgan Stanley and a certain Canadian company in an attempt to receive a tip about the status of that firm's stock. The SEC ruled that the charges against the man were unfounded and that he was, in fact, being paid to obtain inside information about the trades.

1 note

·

View note

Text

Donald J. Trump: On the Threshold of Greatness

By Daniel Davies

Despite the many ways in which he’s reviled today, I believe that history will record Trump as one of America’s greatest presidents. Looking at America’s most admired presidents, I was able to identify the four criteria needed to earn that accolade:

• First and foremost, the president led the country through a life and death struggle.

• Second, the president suffered intense defamation, attack, pernicious plots, and even demonization both domestic and foreign but prevailed.

• Third, the president defended and supported our Republic’s foundational documents and institutions: the Declaration of Independence and the Constitution, including all Amendments, especially the Bill of Rights.

• Fourth, he supported American liberty, prosperity, and social welfare. All the greats promoted the actualization of the Declaration of Independence, Constitution, and Bill of Rights during their presidencies.

Four presidents have met all those criteria: George Washington, Abraham Lincoln, Franklin Roosevelt, and Ronald Reagan. One president, Donald Trump, is on the threshold of meeting those criteria. His place is reserved at Mt. Rushmore and history will tell if he is successful. If he is not successful, our nation may perish in the face of the life and death struggle we are now in.

Donald Trump entered the office of the president in 2016 facing a life and death struggle. The previous administration had eviscerated the US military, created an unhealthy alliance with Iran, taken a stand against Israel, failed to take the ISIS caliphate seriously, and presided over a weakening NATO alliance in which member states failed to contribute to the mutual defense. In addition, both Iran and North Korea openly developed nuclear weapons and North Korea threatened an attack on the USA. The United States economy, still not recovered from the recession triggered by the 9/11/2001 attacks, suffered from unequal trade agreements and suffocating government regulations. Race war threatened to break out in a hyper divided nation. The USA also maintained a co-dependent relationship with China, enabling its campaign of total war against the USA in their quest to become the world’s only superpower.

As serious as all those challenges were, the most serious challenge came from within the USA (the second criterion). The previous administration colluded with the DOJ, CIA, FBI, and the federal court system. In addition, corporate media colluded with the administration. The previous administration’s executives entered into corrupt relationships with China, Russia, and Ukraine in return for money.

Despite the constant attack from domestic forces, especially the deep state media, deep state politicians, deep state executive branch departments which falsely accused Trump of racist policies, immorality, graft, collusion with Russia, fascist policies, poor health, and insanity, President Trump presided over the most successful presidency in history, thereby meeting the third and fourth criteria. He

• defused the North Korean and Iranian nuclear threats,

• completely defeated the ISIS caliphate,

• concluded the wars in the Middle East and Afghanistan,

• renegotiated trade agreements,

• strengthened NATO,

• brought energy independence to the USA,

• presided over the strongest economic recovery in history, especially for minorities,

• husbanded historic stock market highs,

• freed businesses from strangling regulations,

• advanced religious liberty,

• protected freedom of speech,

• thwarted illegal immigration,

• rebuilt the military,

• kept the promise to acknowledge Jerusalem as the capital of Israel,

• brokered peace treaties between Israel and former enemies,

• protected the rights of the unborn,

• protected Second Amendment rights,

• advanced health insurance reforms, and

• reformed the VA hospital system.

President Trump nearly single-handedly brought the USA back as the world leader. We were prosperous, at peace, and growing in national unity. All in the face of the most vicious and hostile attacks domestic and foreign.

Donald Trump’s election caught the ruling party by surprise. They had counted on manipulating the 2016 election to maintain control of the government. When that failed, the Deep State launched an all-out effort to remove Donald Trump from office by any means possible. The Deep State (including the CIA, DOJ, FBI, Congress, media including social media, and state governments loyal to the administration) colluded to remove Donald Trump from office through impeachment. When those efforts failed, the Deep State, led by the previous administration behind the scenes, ramped up its program to steal the election of 2020.

In January 2020, both the first and second metrics reappeared (great national crisis; extreme attacks against the president). China unleashed a weapons-grade, biologically engineered virus on the world, the so-called COVID-19 virus. President Trump took quick action to thwart the attack by banning Chinese from traveling to the USA, providing care for the sick, and developing preventatives as well as vaccines. The Deep State immediately seized the opportunity to use the pandemic to consolidate control of the government (federal and state) and to damage President Trump politically.

The pandemic worked perfectly into their plan to steal the election from President Trump. They learned from the campaign of 2016 that they could not defeat President Trump in a fair election because most Americans rejected the Deep State’s anti-American values.

The Deep State’s plans to rig the election got aid from billions of dollars from social media giants and anti-American agents. They manipulated state governments through courts to permit unmonitored mail-in ballots, bypassing the state legislatures in key swing states. Through that and other types of fraud, the Deep State engineered a stolen election.

On January 6, 2021, when Congress convened to accept the electors’ votes for president and vice president, between 500,000 to 1 million Americans assembled in Washington D.C. to protest the stolen election and oppose Congress’s acceptance of electors. Despite overwhelming proof of election fraud, the swing states ramrodded through electors supporting the Deep State’s candidates. State and federal courts refused to review the evidence to delegitimize the election. Members of both political parties voted to accept the sham electors. The people who gave President Trump a landslide victory felt betrayed.

The Deep State, working hand in glove with domestic terrorists, co-opted a huge, peaceful protest into a small assault on the Capitol buildings. The Deep State media (included social media), through prearranged statements, immediately characterized the protest as an “insurrection” that President Trump engineered. The media censored any view to the opposite and sought to shut down all free speech.

This is a life and death threat to the Republic unlike the life and death threats faced by other great presidents. This is an attack on American institutions and values from within and without. If President Trump can save the country from this attack, he will take his place in Mr. Rushmore. I believe that he will.

5 notes

·

View notes

Photo

“Racket Promotion On Extensive Scale Laid to Suspect,” The Globe and Mail. March 20, 1937. Page 04.

----

John Nelles Neville, Alias Hurd, Alias de Morney, Arrested in New York on Charges of Theft Arising Out of Deals in Northern Ontario

---

IS WANTED IN BOSTON

---

Described by the police in Canada and the United States as a ‘get-rich-quick promoter,’ John Nelles Neville, alias Hurd, alias Jean De Morney, was arrested in New York City yesterday. He is wanted by the Toronto police.

Neville is also wanted in Boston, Mass., on a charge of fraud involving $27,000. This money, the Boston police claim, was used for the publication in that city of a financial tipster’s sheet.

Had Luxurious Home

Neville’s financial activity in Toronto, Timmins, Kirkland Lake and other towns in Northern Ontario resulted in three charges against him. The charges are theft of sums of $500, $250, and $700 from stock selling.

The accused is 35 years of age. He was born in Roblin, Ont., and always gave the police his occupation as a broker.

He engaged in financial operations in London, England, and later came to the United States. he had a lavish home in Rosedale and later purchased an estate in Bobcaygeon. Here he had yachts, fast motorboats, and according to the police was living the life of a wealthy man.

One of the enterprises he promoted was the D’Arnac et Cle., women’s wear. Large blocks of stock were sold in this concern in the year 1925. He was adjudged bankrupt. Two years later, the residence was auctioned and the money divided amongst creditors of the defunct company.

Deported in 1935

The criminal activities in Toronto police records of Neville date back to August 1922, Two years ago he was deported to Canada from the United States. On March 11, of 1935, he was charged with stealing Victory Bonds valued at $4,000 from a University of Toronto professor. He was remanded for sentence on probation for two years. The period of remand has expired, but the police prior to that had issued warrants for his arrest.

A charge of violating the United States immigration laws by returning to that counrty after having been deported from Detroit, will also be made against the young financier by the Boston Police.

The Toronto police announced last night that they would not likely have Neville returned to Toronto for trial until the charges against him in Boston have been disposed of.

#new york#swindler#investment swindle#get rich quick scheme#confidence man#stock broker#financial speculation#defrauding investors#bobcaygeon#timmins#kirkland lake#toronto#deportation to canada#professional criminal#great depression in canada#crime and punishment in canada#history of crime and punishment in canada#boston#crime and punishment#history of crime and punishment

1 note

·

View note

Link

Robert S. Mueller III, of course, is a prosecutor. His job as special counsel, now complete, was to decide whether to indict. But what if some of the most egregious and corrupt offenses are not illegal? Russian President Vladimir Putin has long insisted that American democracy itself is corrupt. Under his aegis, the Russians have methodically studied various components of the American body politic — campaign finance, our legal system, social media and perhaps especially the real estate industry — and exploited every loophole they could find.

As Oleg Kalugin, a former head of counterintelligence for the KGB, told me in an interview for my book “House of Trump, House of Putin: The Untold Story of Donald Trump and the Russian Mafia,” the Mafia amounts to “one of the branches of the Russian government today.” Where Americans cracked down on the Italian American Mafia, Putin dealt with the Russian mob very differently. He co-opted it. He made it an integral part of his Mafia state. Russian gangsters became, in effect, Putin’s enforcers. They had long and deep relationships. According to a tape recording made by former Russian agent Alexander Litvinenko a year before he was fatally poisoned in London, Putin had close ties to Semion Mogilevich, a top mobster, that dated to the early 1990s.

That criminals with ties to Russia bought Trump condos, partnered with Trump and were based at Trump Tower — his home, his place of work, the crown jewel of his empire — should be deeply concerning. It’s not hard to conclude that, as a result, the president, wittingly or not, has long been compromised by a hostile foreign power, even if Mueller did not conclude that Trump colluded or conspired with the Russians.

Let’s go back to 1984, when David Bogatin, an alleged Russian gangster who arrived in the United States a few years earlier with $3 in his pocket, sat down with Trump and bought not one but five condos, for a total of $6 million — about $15 million in today’s dollars. What was most striking about the transaction was that at the time, according to David Cay Johnston’s “The Making of Donald Trump,” Trump Tower was one of only two major buildings in New York City that sold condos to buyers who used shell companies that allowed them to purchase real estate while concealing their identities. Thus, according to the New York state attorney general’s office, when Trump closed the deal with Bogatin, whether he knew it or not, he had just helped launder money for the Russian Mafia.

And so began a 35-year relationship between Trump and Russian organized crime. Mind you, this was a period during which the disintegration of the Soviet Union had opened a fire-hose-like torrent of hundreds of billions of dollars in flight capital from oligarchs, wealthy apparatchiks and mobsters in Russia and its satellites. And who better to launder so much money for the Russians than Trump — selling them multimillion-dollar condos at top dollar, with little or no apparent scrutiny of who was buying them.

Over the next three decades, dozens of lawyers, accountants, real estate agents, mortgage brokers and other white-collar professionals came together to facilitate such transactions on a massive scale. According to a BuzzFeed investigation, more than 1,300 condos, one-fifth of all Trump-branded condos sold in the United States since the 1980s, were shifted “in secretive, all-cash transactions that enable buyers to avoid legal scrutiny by shielding their finances and identities.”

The Trump Organization has dismissed money laundering charges as unsubstantiated, and because it is so difficult to penetrate the shell companies that purchased these condos, it is almost impossible for reporters — or, for that matter, anyone without subpoena power — to determine how much money laundering by Russians went through Trump-branded properties. But Anders Aslund, a Swedish economist, put it this way to me: “Early on, Trump came to the conclusion that it is better to do business with crooks than with honest people. Crooks have two big advantages. First, they’re prepared to pay more money than honest people. And second, they will always lose if you sue them because they are known to be crooks.”

After Trump World Tower opened in 2001, Trump began looking for buyers in Russia through Sotheby’s International Realty, which teamed up with a Russian real estate outfit. “I had contacts in Moscow looking to invest in the United States,” real estate broker Dolly Lenz told USA Today. “They all wanted to meet Donald.” In the end, she said, she sold 65 units to Russians in Trump World Tower alone.

The condo sales were just a part of it. In 2002, after Trump had racked up $4 billion in debt from his disastrous ventures in Atlantic City, the Russians again came to his rescue, by way of the Bayrock Group. At a time when Trump found it almost impossible to get loans from Western banks, Bayrock offered him enormous fees — 18 to 25 percent of the profits — simply to use his name on its developments.

So how did all this go unchallenged? According to Jonathan Winer, who served as deputy assistant secretary of state for international law enforcement in the Clinton administration, one answer may be lax regulations. “If you are doing a transaction with no mortgage, there is no financial institution that needs to know where the money came from, particularly if it’s a wire transfer from overseas,” Winer told me in an interview for my book. “The customer obligations that are imposed on all kinds of financial institutions are not imposed on people selling real estate. They should have been, but they weren’t.”

And without such regulations, prosecutors’ hands are tied.

All of which made it easier for the Russian Mafia to expand throughout the United States. As it did so, it grew closer to Trump. Even though Mogilevich had no known direct contacts with Trump, several of his associates did. Among them was Bogatin, who took part in a massive gasoline tax scam, and whose brother, Jacob (Yacov) Bogatin, was indicted with Mogilevich in 2003 on 45 felony counts of stock fraud. (Because there is no extradition treaty between the United States and Russia, they were never brought to trial in the United States.)

Another Mogilevich associate in Trump’s orbit was the late Vyacheslav Ivankov, a ruthless extortionist who became renowned as one of the most brutal killers in the annals of Russian crime. Mogilevich had sent him to New York in 1992 with a mandate to consolidate the Russian Mafia in the United States and to form alliances with the Cosa Nostra and other Mafias. Once he arrived, Ivankov became a regular at the Trump Taj Mahal in Atlantic City, and was widely thought to be based in the Brighton Beach area of Brooklyn, where many Russian mobsters lived. But when the FBI came looking for him, it discovered that the head of the Russian Mafia in New York owned a luxury condo in the glitziest part of Manhattan — at 721 Fifth Avenue, in fact — Trump Tower. There is no evidence of personal interaction between Trump and Ivankov.

Yet another Mogilevich associate with ties to Trump was Alimzhan Tokhtakhounov, better known as Taiwanchik, whose relationship with Mogilevich dates back more than three decades. Indicted in 2002 for bribing Olympic figure skating judges, Tokhtakhounov was awarded the No. 5 position on the FBI’s Most Wanted List, two slots behind Mogilevich. In April 2013, two gambling rings that he allegedly ran were busted by the FBI on the 63rd floor of Trump Tower, resulting in the indictments of 34 members and associates of Russian organized crime. Among them was Tokhtakhounov, who fled the country to avoid prosecution, and appeared later that year at Trump’s 2013 Miss Universe pageant in Moscow.

These were just some of the Russian mobsters who gravitated toward Trump as they laundered money and cultivated politicians. Over time, they learned how to work the system. They paid large sums for the most powerful legal talent in the land — enough, at times, to woo the very men who had once been charged with pursuing them. In 1997, former FBI director William Sessions traveled to Moscow and alerted the world to the horrifying dangers of the brutal Russian Mafia. But 10 years later, he took on as a client the Ukrainian-born Mogilevich. At the time, the U.S. Department of Justice was investigating racketeering charges against Mogilevich over questionable energy deals between Russia and Ukraine. Sessions’s successor as FBI director, Louis Freeh, also later represented Russian clients. All perfectly legal. In Freeh’s case, the client was Denis Katsyv’s Cyprus-based Prevezon Holdings. Freeh helped Prevezon settle a money laundering probe by the U.S. government after the company was accused of laundering more than $200 million in a Russian tax fraud scheme in which an American hedge fund manager and his firm, Hermitage Capital, were said to have been framed by the Russians. The ensuing scandal culminated in the death of Sergei Magnitsky, Hermitage’s accountant, and led to the passage of the Magnitsky Act, which sanctioned high-level Russian officials. Natalia Veselnitskaya, Prevezon’s defense lawyer, attended the much-discussed June 2016 meeting at Trump Tower with Trump’s eldest son, Donald Trump Jr.; Trump’s son-in-law, Jared Kushner; and Trump campaign chairman Paul Manafort.

Manafort has been convicted of bank fraud, tax fraud and failure to comply with the Foreign Agents Registration Act by not reporting foreign income.

The special counsel’s report has not yet been released, only Attorney General William P. Barr’s summary with its finding of no collusion. But it’s clear that it was profoundly naive to think that a prosecutor would save the day and cure our diseased democracy of all that ails it. That’s because the problem behind this assault on the nation’s sovereignty far transcends the criminal arena. I’m no fan of Putin’s, but he was right about one thing: Swaths of American society are corrupt. If we want to protect our most precious institutions, we should examine new regulations in a wide range of sectors. The House Intelligence Committee, the House Oversight Committee and the House Judiciary Committee have geared up for hearings and investigations. They had better move fast. We have a president who has a long, tangled history with figures connected to Russian organized crime — all of it, apparently, perfectly legal.

5 notes

·

View notes

Link

Securities fraud litigation is used when a business or individual commits fraud related to securities investing. This type of fraud can cost investors billions of dollars, especially when it’s linked to a corporation.

Unfortunately, incidents of securities fraud seem to be on the rise, which is why it’s so important to understand your risk as an investor and find an experienced securities fraud legal expert to help you if you are a victim.

What is Securities Fraud?

Securities fraud can come in a variety of forms but is a white collar crime that most often involves the misrepresentation of information to investors in order to affect their decisions. Some acts of fraud are committed in an effort to manipulate the financial markets.

Securities fraud can be committed by a stockbroker, a broker firm, or an investment bank.

Examples of securities fraud might include:

Breach of fiduciary duty

Failure to supervise

Misrepresentation of investment

Omissions of material facts

Unauthorized trading

Ponzi schemes

Churning

Pyramid schemes

Advanced fee schemes

Foreign currency fraud

Broker embezzlement

Hedge fund-related fraud

High yield investment fraud

Manipulating stock prices

Lying on SEC filing forms

Committing accounting fraud

Late day trading

According to the FBI, securities fraud might be linked to high-pressure investment tactics or unsolicited offers and investors should beware if they believe either of these is occurring.

Scholars have counted 148 financial meltdowns since 1870 where a country’s economy has shrunk by ten percent or more. This confirms that booms and busts can be a feature of our economic system, but this recent meltdown went beyond disrupting the way Wall Street made money. Recent investors securities fraud robbed millions of everyday people of their livelihood, their homes, and their retirements.

Check Out Our Securities Fraud Pages:

Auction Rate Securities

Auction Rate Securities Collapse Litigation

Goldman Sachs Securities Litigation

Insider Trading

IPO Litigation

Madoff Securities Investment Fraud

Sarbanes-Oxley Act

Securities Fraud Attorneys

Securities Fraud Lawyers

Waldman-v-Wachovia Auction Rate Securities Case

The Birth of Securitization

Financial Terms Glossary

Investors Securities Fraud

What Kind of Help Might a Securities Fraud Lawyer Provide?

If you’ve been a victim of an investment fraud scheme, a securities fraud lawyer might be able to help.

When you work with a securities fraud lawyer, he or she might:

Review and assess financial statements and determine if securities fraud occurred

Determine the value of the damages that occurred

Gather testimony from financial experts regarding securities fraud and your case

File a Statement of Claim with FINRA describing the inappropriate behavior or violation of fiduciary duty and the loss it caused you

Gather documents relevant to your claim

Submit evidence to FINRA in support of the allegations of securities fraud

Represent you at the final FINRA hearing

Financial advisors are required by law to understand their client’s risk tolerance and investment objectives before providing any advice. They must also disclose all information related to an investment and explain all risk associated with that investment.

If your financial advisor failed to do any of these things, you might have a case. A securities fraud lawyer can discuss your situation with you and help you determine your next best step.

Questions to Ask a Securities Fraud Attorney

If you believe you have been a victim of an investment scheme, it’s important to contact a securities fraud attorney. The experience of meeting with an attorney can be intimidating, especially if you aren’t sure a crime was committed or you don’t know how to describe your situation.

An experienced securities fraud attorney can ask you questions about your case and help you determine where you stand and what you should do. During the consultation, it’s important to assess the attorney’s experience and skills, and to determine how comfortable you feel working with the attorney.

Some of the questions you should ask a securities fraud attorney include:

Is the primary focus of your practice on investment and securities fraud?

Are you a FINRA attorney?

How familiar are you with the latest fraud schemes?

Does your experience include securities fraud cases similar to mine?

What is your experience with and success rate in FINRA arbitration cases?

Do you believe I have a strong case?

As a victim of securities fraud, you’re likely feeling a variety of emotions and you are concerned about your financial well-being. A securities fraud attorney might be able to help you sort through the detail of your case and determine whether or not a crime was committed. If you’d like to learn more or discuss a potential case, contact us to schedule a consultation.

Regulatory Changes Afoot

The SEC plans to enhance its disclosure review and investors securities policy operations through the development of three new offices. This broader oversight will focus on large financial institutions, asset-backed securities and other structured products, and securities offering trends.

Despite tighter oversight promised by the SEC, investors securities fraud remains a problem. Read how to protect yourself. If you have been a victim, please fill out this form and let us help.

We Support Victims of Investors Securities Fraud

Investors securities fraud takes on many forms: It involves deceptive practices used to artificially inflate (or depress) the price of a security, entice investors to make decisions to purchase or sell investments, or manipulate the market for a given security. Read Birth of Securitization.

Originally, investors securities fraud protection came from the states in blue sky laws (starting in 1911) enacted to regulate the offering and sale of securities. However, the blue sky laws were often ignored or by-passed without a consistent federal standard. Because more protection was needed, Congress then passed the following acts:

Congress passed the Securities Act of 1933 to increase public trust in capital markets. Also known as the “Truth in Securities Act” or “Federal Securities Act.”

A year later, Congress passed the Securities Exchange Act regulating secondary trading of securities; that is, trading between individuals and companies not involving the original security issuers. This Act spawned the Securities and Exchange Commission (SEC) to enforce the federal securities laws and regulate the securities industry.

The SEC’s authority and oversight were expanded by later acts, including the Trust Indenture Act of 1939, the Investment Act of 1940, the Investment Advisers Act of 1940, the Sarbanes-Oxley Act of 2002, and the Credit Rating Agency Reform Act of 2006.

The SEC includes five commissioners with terms staggered so that one commissioner’s term ends on June 5 each year. While the commissioners are politically appointed by the President of the United States, no more than three may be from the same political party. One of the five commissioners is appointed Chairman. In 1934, President Franklin Delano Roosevelt appointed Joseph P. Kennedy, Sr. as the SEC’s initial Chairman.

Some common forms of investors securities fraud where business fraud attorneys, like Seeger Weiss, are most beneficial are described below:

Accountant fraud occurs when public accounting firms falsify or recklessly disregard false financial reports on behalf of their corporate clients leading to a false impression of the company’s financial status. The price of the company’s securities is affected by the false financial reports and represents a form of securities fraud.

Insider trading is the exchange of stocks or other securities by those with non-public information about a company. Originally the definition referred to trading done by company officers, directors, and owners of more than 10 percent of a class of securities. The definition has become more expansive in application and may refer to any individual who knowingly trades securities based on non-public information violating the corporation’s trust to shareholders. The violation of trust to corporate shareholders—someone with non-public information breaches a fiduciary responsibility to company shareholders—is the key issue in affecting whether illegal insider trading has occurred.

Internet securities fraud, a form of market manipulation, is usually found in “pump-and-dump” schemes. Pump-and-dump schemes involve placing false and/or fraudulent information on the Internet with the purpose of influencing the price of securities. For example, information is disseminated positively influencing the prices of a stock that is then dumped by investors responsible for the false and/or fraudulent information before the price falls to lower levels. The investors’ profit is derived by manipulating the price of stocks with fraudulent information.

Microcap securities fraud involves stocks with a market capitalization under $250 million that are generally traded on the OTC Bulletin Board and Pink Sheets Electronic Quotation Service. Many microcap stocks trade below $5 a share as penny stocks. Many forms of microcap stock fraud exist, but the more common techniques are pump and dump schemes and selling of “chop stocks.” Chop stocks are purchased for pennies and then sold to unwary investors at dollars a share. “Boiler rooms” pursue microcap stock fraud techniques using telesales to pressure clients into fraudulent trades.

Disclosure claims are actions by investors against publicly traded corporations where corporate officials have failed to disclose the true state of the company’s financial and business affairs to its investors. In today’s exchange-based securities trading environment, information disseminated to the market by companies and their officials often has a dramatic impact on the price of that company’s stock. Where that information is complete, accurate, and timely revealed, the impact of the disclosure of that information on the price of a security, or the value of a person’s investment, is part and parcel of the investment process. Where information has been only selectively or falsely disclosed such that a misleading picture has been painted, investors may have been wronged.

Investors in securities need to be on the guard against victimization from securities fraud. Accordingly, the securities fraud lawyers at Hamilton Lindley might be able to assist victims of securities investors fraud if there are improper and illegal securities practices occurring. If you have been a victim of securities fraud, please contact the securities fraud attorneys at Hamilton Lindley.

43 notes

·

View notes

Text

Guilty Moon. Law firm was paid $100,000 up front and $50,000 a month to obtain a presidential pardon for Moon. It failed.

▲ Sun Myung Moon and Takeru Kamiyama in Danbury prison.

Moon used money in his attempt to fight the facts that resulted in the two men being jailed. Details here:

Sun Myung Moon was found guilty of US tax fraud and sent to Danbury prison in 1984

Moon, 62, was convicted of failing to report as personal income $112,000 of interest on $1.6 million in his Chase accounts, as well as $50,000 worth of stock in Tong Il Enterprises, a profit-making import company that Moon controlled. Convicted with him was his top financial aide, Takeru Kamiyama, 40, who was charged with helping the evangelist prepare false tax returns to conceal the income, attempting to block the subsequent Government investigation by submitting phony backdated documents, and lying to a grand jury.

___________________________________________

Here is what Sun Myung Moon did:

Extract from transcript of PBS

Frontline: The Resurrection of Reverend Moon

Broadcast January 21, 1992

Eric Nadler, reporter. Written and produced by Rory O'Connor.

Narrator: Moon ultimately went to the top in his effort to clear his name seeking a presidential pardon for his crimes.

Narrator: The point man was Max Hugel, a former Reagan campaign official and one-time deputy director of the Central Intelligence Agency in charge of covert operations.

Hugel: “It is so important to have a superb intelligence agency.”

Narrator: Hugel was forced to leave the agency in the wake of a stock scandal.

(Soundtrack) PRESS CONFERENCE: Reporter off camera: “Can you tell us why you’re not choosing to stay on and fight?”

Narrator: Hugel later went into business with Jonathan Park, the son of Bo Hi Pak.

ATLANTIC VIDEO DEMO REEL: Announcer: “Through two huge sound locks are the best outfitted tele-production studios in the region.”

Narrator: Hugel worked with Park to expand Moon’s electronic media empire, while also brokering contacts between Bo Hi Pak and Vice President George Bush.

Narrator: In this April, 1988 memo to Unification Church member Marc Lee, Hugel offers to arrange for Pak to have his picture taken with the Vice President at a cost of $50,000. Hugel also promises to try to get Bush to write to Pak. Two months later, Bush did write to Pak, and told him, “I hope we can meet again soon.” Did they discuss a pardon during their meeting? Neither President Bush nor Bo Hi Pak would comment to FRONTLINE.

Narrator: Later in 1988, Hugel also recruited the law firm of one of Ronald Reagan’s best friends to assist in Moon’s pardon effort, former Senator Paul Laxalt.

(Soundtrack) Ronald Reagan: “The friend who understands you creates you, a wise man once said. Paul created because he always understood and for that I am and shall always be grateful.”

Narrator: Laxalt’s law firm was paid $100,000 up front and $50,000 a month to obtain a presidential pardon for Moon. According to billings submitted by the lawyers, Laxalt was directly involved in the pardon effort. This petition for executive clemency was delivered to the Justice Department, accompanied by letters from Senator Orrin Hatch, publisher William Rusher, and civil rights leader Ralph Abernathy endorsing the pardon.

Narrator: The Washington Times also became involved in the pardon campaign. First, Editor Arnaud de Borchgrave wrote a “letter from the editor.”

Cheshire: “It was not really a letter to the editor, it was a letter to President Reagan urging President Reagan to grant Reverend Moon a presidential pardon.”

Narrator: Later, The Times ran this article examining Reagan’s record on pardons. After it appeared, Laxalt’s partner, Paul Perito, became alarmed. Perito warned Bo Hi Pak that “if a case can be made…that the Church allegedly controls and dictates the activities of organizations such as The Washington Times…this will affect our credibility and could materially damage our prodigious efforts.”

(Soundtrack) Off-Camera Female Reporter: “Any last thoughts for us, President and Mrs. Reagan, on your way out?”

Narrator: Ronald Reagan never pardoned Sun Myung Moon. Moon’s pardon application is still pending before the Bush Administration. Max Hugel, Paul Laxalt, and Paul Perito all refused to comment. Ronald Reagan also declined to comment.

VIDEO: The Resurrection of Reverend Moon

___________________________________________

From Ronald Reagan's Diary:

Monday December 24, 1984

“Senator Orrin Hatch is after me to grant clemency to the Rev. Moon. I've explored this & find I just can't. I have, however, taken action to see if I can grant him a furlough over New Years. It seems that day is the holiest in that religion.”

Orrin Hatch was a well-known Mormon.

Ronald Reagan Diaries: http://wonkette.com/263737/reagan-diary-lets-bust-rev-moon-out-of-prison-for-new-years

___________________________________________

Moon did get a furlough from prison in March of 1985, before his final release – and what did he do with that time? He crowned himself “Emperor of the Universe!”

Sun Myung Moon: The Emperor of the Universe

Nansook Hong interviewed for the documentary: “Moon crowned himself as the Emperor of the Universe. It was quite odd. Pictures were forbidden. Nobody could take pictures, because it had to be an absolute secret. At that point he became God, in his eyes.”

___________________________________________

June 6, 2010

UTS Professor Oh Yong-taek spoke about the time of Danbury.

Tim Elder translated:

“Particularly when Father was in Danbury in 1985, on March 16th by the lunar calendar, Father was given a temporary furlough out of Danbury. And he came out of Danbury briefly, it was a very brief time. Father and Mother met, they then put on robes at that point and they put on crowns and they held a coronation ceremony at that point.”

___________________________________________

Moon admitted his guilt in court in 1955; started two year jail sentence

Moon asked his disciples to raise money to get him out of jail and to purchase a FAKE “certificate of innocence.” He was unable to use the same tactics in the United States in the 1980s.

___________________________________________

‘Emperor of the Universe’ information in Japanese:

これが『統一教会』の秘部だ – 世界日報事件で『追放』された側の告発

副島嘉和

そえじまよしかず

(「インフォメ一ション」編集発行人)

井上博明

いのうえひろあき

(「インフォメ一ション」営業担当)

___________________________________________

Where did Moon get all that money from?

Moon extracted $500 million from Japanese female members

A huge FFWPU scam in Japan is revealed

FFWPU / UC of Japan used members for profit, not religious purposes

$80 million: 4,200 female Japanese followers allegedly deposited as much as $25,000 each in the Moon-controlled Banco de Credito in Uruguay.

400 Japanese men and women were flown to the US. “Each person took, I think, about $2,000,” Soejima said.

I was given $20,000 in two packs of crisp new bills to smuggle into the US

#Sun Myung Moon#tax cheat#guilty#jail#messiah#Unification Church#Family Federation for World Peace and Unification#Orrin Hatch#Ronald Reagan#Arnaud de Borchgrave

4 notes

·

View notes

Text

An objective phenomenon exists independently of human consciousness and human beliefs. Radioactivity, for example, is not a myth. Radioactive emissions occurred long before people discovered them, and they are dangerous even when people do not believe in them. Marie Curie, one of the discoverers of radioactivity, did not know, during her long years of studying radioactive materials, that they could harm her body. While she did not believe that radioactivity could kill her, she nevertheless died of aplastic anaemia, a disease caused by overexposure to radioactive materials.

The subjective is something that exists depending on the consciousness and beliefs of a single individual. It disappears or changes if that particular individual changes his or her beliefs. Many a child believes in the existence of an imaginary friend who is invisible and inaudible to the rest of the world. The imaginary friend exists solely in the child’s subjective consciousness, and when the child grows up and ceases to believe in it, the imaginary friend fades away.

The inter-subjective is something that exists within the communication network linking the subjective consciousness of many individuals. If a single individual changes his or her beliefs, or even dies, it is of little importance. However, if most individuals in the network die or change their beliefs, the inter-subjective phenomenon will mutate or disappear. Inter-subjective phenomena are neither malevolent frauds nor insignificant charades. They exist in a different way from physical phenomena such as radioactivity, but their impact on the world may still be enormous. Many of history’s most important drivers are inter-subjective: law, money, gods, nations.

Peugeot, for example, is not the imaginary friend of Peugeot’s CEO. The company exists in the shared imagination of millions of people. The CEO believes in the company’s existence because the board of directors also believes in it, as do the company’s lawyers, the secretaries in the nearby office, the tellers in the bank, the brokers on the stock exchange, and car dealers from France to Australia. If the CEO alone were suddenly to stop believing in Peugeot’s existence, he’d quickly land in the nearest mental hospital and someone else would occupy his office.

Similarly, the dollar, human rights and the United States of America exist in the shared imagination of billions, and no single individual can threaten their existence. If I alone were to stop believing in the dollar, in human rights, or in the United States, it wouldn’t much matter. These imagined orders are inter-subjective, so in order to change them we must simultaneously change the consciousness of billions of people, which is not easy. A change of such magnitude can be accomplished only with the help of a complex organisation, such as a political party, an ideological movement, or a religious cult. However, in order to establish such complex organisations, it’s necessary to convince many strangers to cooperate with one another. And this will happen only if these strangers believe in some shared myths. It follows that in order to change an existing imagined order, we must first believe in an alternative imagined order.

In order to dismantle Peugeot, for example, we need to imagine something more powerful, such as the French legal system. In order to dismantle the French legal system we need to imagine something even more powerful, such as the French state. And if we would like to dismantle that too, we will have to imagine something yet more powerful.

There is no way out of the imagined order. When we break down our prison walls and run towards freedom, we are in fact running into the more spacious exercise yard of a bigger prison.

- Yuval Noah Harari, Building pyramids in Sapiens: A Brief History of Humankind

1 note

·

View note

Text

Experts Suggest That Regulating Binary Options Trading Has Become Inevitable!