#StocksInFocus

Text

11 Stocks to Watch for Next 5 year With 25% returns from Jefferies

Jefferies has identified 11 stocks that are expected to deliver 12-25% compound annual growth rate (CAGR) returns over the next five years, driven by themes like the capex cycle, government manufacturing push, state-owned enterprise (SOE) reforms, and financialization of savings. Here are the stocks and their growth outlooks:

Amber Enterprises: A leader in AC outsourcing, benefiting from low AC penetration in India compared to global averages.

Ambuja Cement: India’s second-largest cement producer, focusing on expansion and efficiency improvements.

Axis Bank: Expected to grow earnings at a CAGR of 18% due to its strong deposit franchise and digital platforms.

Bharti Airtel: Positioned well due to market share gains and potential ARPU growth in the telecom sector.

JSW Energy: Focused on renewable energy, with plans to increase its capacity significantly by FY30.

Larsen & Toubro (L&T): A major player in India’s infrastructure and capex upcycle.

Macrotech (Lodha): A key beneficiary of the ongoing housing upcycle, with strong growth in pre-sales.

Max Healthcare: Expected to deliver robust revenue and EBITDA growth due to expansion in healthcare services.

State Bank of India (SBI): Leveraging its large customer base and digital expansion to drive loan and earnings growth.

TVS Motor Company: Set to benefit from a revival in two-wheeler demand and growth in the electric vehicle segment.

Zomato: India’s leading food delivery platform, benefiting from growth in food delivery and quick commerce segments(mint)(FortuneIndia).

These stocks are favored due to their strong growth potential, leadership positions, and alignment with key economic themes expected to drive market performance over the next five years.

0 notes

Text

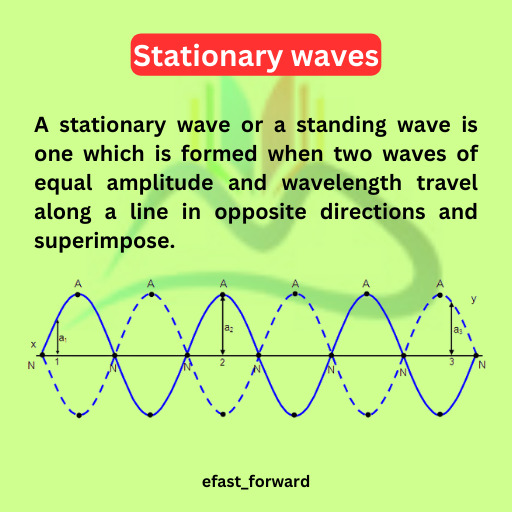

Stationary waves

.

INDIA's FIRST E- MAGAZINE WITH LIVE TESTING

.

LINK IN BIO... .

'

#jeemain2024#NEETUG2024#Pithapuram#RajasthanRoyals#ॐ_हं_हनुमंते_नमः#SanjuSamson#StocksInFocus#bajrangbali

0 notes

Text

Introduction to Stock Market: A Beginner's Guide

The stock market is a crucial component of the global financial system and offers individuals the opportunity to invest in companies and potentially earn returns on their investments. Here's a beginner's guide to help you understand the basics:

What is the Stock Market?

The stock market is a marketplace where investors can buy and sell ownership shares (also known as stocks or equities) of publicly-traded companies. Publicly-traded companies are those that have decided to "go public" by offering shares of their ownership to the general public through various exchanges.

Key Concepts:

Stocks: Stocks represent ownership in a company. When you buy a stock, you become a shareholder and own a portion of that company.

Shares: A company's ownership is divided into shares. When you buy shares, you're buying a fraction of the company.

Stock Price: The price of a stock is determined by various factors, including the company's performance, earnings, market sentiment, and economic conditions.

Stock Exchange: A stock exchange is a platform where stocks are bought and sold. Examples include the New York Stock Exchange (NYSE) and the Nasdaq.

Ticker Symbol: A unique combination of letters representing a particular company's stock. For example, "AAPL" is the ticker symbol for Apple Inc.

Bull and Bear Markets: A bull market refers to a period of rising stock prices, while a bear market is characterized by falling stock prices.

Market Capitalization: This is the total value of a company's outstanding shares, calculated by multiplying the stock price by the number of shares.

Why Do People Invest in Stocks?

Capital Appreciation: Investors buy stocks with the hope that the stock's value will increase over time. If the stock price goes up, they can sell it at a profit.

Dividend Income: Some companies pay a portion of their profits back to shareholders in the form of dividends, providing a steady income stream.

Diversification: Investing in stocks can be a way to diversify your investment portfolio, reducing overall risk.

Long-Term Growth: Historically, the stock market has shown long-term growth trends, although it's important to note that past performance is not indicative of future results.

Risks and Considerations:

Volatility: Stock prices can be highly volatile, meaning they can change rapidly and unpredictably.

Market Risk: There's always a risk of losing money in the stock market, especially in the short term.

Research: It's essential to research companies before investing. Consider their financial health, business model, and industry trends.

Diversification: Spreading investments across different stocks can help manage risk.

Investment Horizon: Consider your investment goals and how long you're willing to hold onto your investments.

How to Get Started:

Educate Yourself: Learn about different investment strategies, stock analysis techniques, and market trends.

Open an Account: Choose a brokerage firm to open a trading account. Online brokerages have made it easy for individuals to start investing.

Research and Select Stocks: Research companies you're interested in and consider factors like their financials, industry, and growth potential.

Make Your First Investment: Once you've done your research, you can buy your first stocks through your brokerage account.

Monitor and Learn: Keep an eye on your investments and continue learning about the stock market.

Remember, investing in the stock market carries risks, and it's important to do your due diligence and potentially consult with financial professionals before making investment decisions.

Open a FREE Demat & Trading account with Zerodha & Start Trading in Stock Market!

#Stocks#StocksToBuy#StocksToSell#stockstowatch#StocksInFocus#StocksToTrade#StocksInNews#StocksoftheDay#StockMarket#StockMarketindia#StockMarketcrash#StockUpdate#marketupdate

0 notes

Video

youtube

The Shocking Truth Behind the Stock Market Crash: Decoding The Great Bub...

0 notes

Text

TGGI Stock News: A Surprising Price Revolution Ahead

TGGI (Trans Global Group Inc.) has acquired ZuiXianGui, a wine producer located in Shenzhen, but the transaction details have not been publicly disclosed. Zui Xian Gui is a wine brand distributed and retailed in the People’s Republic of China by Trans Global Group, Inc. The company’s online self-operated retail and e-commerce platform is used to sell its products, and its headquarters can be found in Shenzhen, China.

Read More:- https://lnkd.in/dEp5N4k9

#tggistock#tggi#transglobal#usstockmarket#StockMarket

#DowJones#StockToWatch#StocksInFocus#StocksToBuy

#trading

0 notes

Text

Why Penny Stocks Are So Dangerous: Unveiling the Dark Side of High-Risk Investments

In the financial world, there’s a term that often comes with a mix of allure and caution: penny stocks.

#Pennystocks #pennystock #StocksInFocus

Read more :https://earlypost.news/why-penny-stocks-are-so-dangerous/

0 notes

Text

Stock Market Highlights: Nifty chart hints at consolidation ahead ... - Economic Times

Stock Market Highlights: Nifty chart hints at consolidation ahead … – Economic Times

Economic Times | 17 Nov, 2022 | 11:02PM IST– Kunal Shah, Senior Technical Analyst at LKP Securities– Vinod Nair, Head of Research at Geojit Financial Services– Rupak De, Senior Technical Analyst at LKP Securities#NewsAlert | @SEBI_India is working on guidelines to regulate financial influencers; guidelines to govern growing… https://t.co/qvLDPXPtDe#StocksInFocus | Aditya Birla Fashion announces…

View On WordPress

0 notes

Link

3 notes

·

View notes

Text

9 Maharatna Stocks to hold Forever

Here are nine Maharatna companies in India that are considered strong, well-established, and could be worth holding for the long term:

Oil and Natural Gas Corporation (ONGC)

A leader in oil and gas exploration and production in India, ONGC is crucial for India's energy security.

Coal India Limited (CIL)

The largest coal-producing company in the world, Coal India plays a key role in India's energy sector.

Indian Oil Corporation (IOC)

A major player in refining, marketing, and distributing petroleum products across India.

Bharat Petroleum Corporation Limited (BPCL)

Engaged in refining, marketing, and distributing petroleum products. BPCL is a key player in India's oil and gas sector.

Steel Authority of India Limited (SAIL)

One of the largest steel-making companies in India, SAIL is vital for the infrastructure sector.

Bharat Heavy Electricals Limited (BHEL)

A leader in engineering and manufacturing, BHEL is involved in the energy and infrastructure sectors.

GAIL (India) Limited

The largest state-owned natural gas processing and distribution company in India, GAIL is pivotal for the country's gas infrastructure.

NTPC Limited

The largest power generation company in India, NTPC is crucial for meeting India's growing energy demands.

Power Grid Corporation of India Limited (PGCIL)

The central transmission utility of India, Power Grid is key to the country’s electricity distribution infrastructure.

These companies have strong fundamentals and a significant impact on India's economy, making them potential long-term holds for investors.

0 notes

Text

#TataSteel#StockMarket#MarketsWithBS#StocksInFocus#stockstowatch#nifty50#investing#StockMarketindia#sensex#BSE#nse#trade#stockmarket#stock#livetrading#stocks#stockmarketnews#Markets#tata#news#swastika#investmart#swastikainvestmart#investment#investor#investnews#tatasteelstocks#steel#steelstocks

0 notes

Text

#trendingnews#trending#viralpost#viral#entertainment#trendingtales#fedral#stocksinfocus#unitedstatesofamerica#internet

1 note

·

View note

Video

youtube

Weekly Stock Market and Zodiac Predictions| Jan 18 -24, 2021

#चंद्रगोचर #Aries #Taurus #Gemini #Cancer #Leo #Virgo #Libra #Scorpio #Sagittarius #Capricorn #Aquarius #Pisces #Astrology #Zodiacsigns #Horoscopes #Horoscope #मेषराशि #बृषभराशि #बृश्चिकराशि #धनुराशि #सिहराशि #मेषराशि #मिथुनराशि #कर्कराशि #तुलाराशि #कन्याराशि #मकरराशि #कुम्भराशि #मीनराशि

0 notes

Video

youtube

Best Stocks to buy tomorrow for Intraday Trading 29th December | Intrad...

0 notes

Text

sensex today: Stock Market Highlight: Nifty forms a small positive candle. What traders should do on Friday - Economic Times

sensex today: Stock Market Highlight: Nifty forms a small positive candle. What traders should do on Friday – Economic Times

Economic Times | 09 Dec, 2022 | 12:53PM IST– Rupak De, Senior Technical Analyst at LKP Securities– S Ranganathan, Head of Research at LKP securities– Vinod Nair, Head of Research at Geojit Financial#MarketsWithETNOW | Nifty Bank hits fresh record high #NiftyBank #StockMarket #StocksToWatch https://t.co/jRsAt1EWAE#StocksInFocus | Venky's (India): Biggest single day gain since June 22, 2021…

View On WordPress

0 notes

Link

4 notes

·

View notes

Link

Stocks In focus - Blog By SEBI Registered Investment Advisor Investelite Research. Board Meetings and Results Today On India Share Market

0 notes