#Support Help For Quickbooks

Explore tagged Tumblr posts

Text

Unleashing the Power of QuickBooks Tool Hub: Your Ultimate Solution

Welcome to the dynamic realm of QuickBooks, where financial management meets user-friendly tools. If you've ever found yourself caught in the web of accounting challenges, QuickBooks Tool Hub is here to untangle the knots. Imagine it as your digital Swiss Army knife, ready to troubleshoot and optimize your QuickBooks experience seamlessly. In this article, we'll embark on a journey through the multifaceted world of QuickBooks Tool Hub, uncovering its features, benefits, and how it can transform your financial management game.

QuickBooks Tool Hub: A Panacea for Accounting Woes

What is QuickBooks Tool Hub?

Before we dive into the labyrinth of functionalities, let's unravel the mystery of QuickBooks Support. In essence, it's a toolbox, a virtual haven for QuickBooks users facing technical glitches and quandaries. This hub consolidates various diagnostic tools and utilities under one digital roof, making it your go-to troubleshooter when things go awry.

Navigating Through the Features

Imagine you're a ship captain navigating treacherous waters. The QuickBooks Tool Hub serves as your compass, guiding you through stormy technical seas. Here's a breakdown of its key features:

Installation Diagnostic Tool: This tool acts like a diagnostic stethoscope, pinpointing installation errors and ensuring your QuickBooks is set up for smooth sailing.

Connection Diagnostic Tool: Just like a skilled navigator ensures the ship's connection to the stars for direction, this tool troubleshoots network issues, ensuring seamless communication between your QuickBooks and the server.

PDF Repair Tool: Ever felt like your financial documents are trapped in a digital Bermuda Triangle? The PDF Repair Tool is your rescue ship, retrieving and restoring lost or damaged PDFs.

File Doctor Tool: Think of this tool as your ship's mechanic. It repairs damaged company files, resolving errors that could potentially sink your financial ship.

The Seamless Integration Dance

Picture a symphony orchestra where each instrument plays a crucial role. QuickBooks Tool Hub orchestrates a harmonious integration of its tools, ensuring they work together seamlessly. It's not just a collection of utilities; it's a synchronized dance of problem-solving prowess.

The QuickBooks Tool Hub Advantage: Why Bother?

Saves Time and Frustration

In the high-speed world of finance, time is money, and frustration is the iceberg waiting to sink your productivity ship. QuickBooks Tool Hub is your lifeboat, rescuing you from the time-consuming abyss of technical issues. It streamlines troubleshooting, ensuring that you spend more time steering your financial ship than fixing its sails.

Cost-Efficient Troubleshooting

In the vast sea of financial software solutions, many come with a hefty price tag. QuickBooks Tool Hub stands as a beacon of cost-efficiency. Why invest in expensive technical support when you have a virtual toolbox at your disposal? It's like having a skilled sailor on board without the added expense.

User-Friendly Interface: Navigating the Seas with Ease

Smooth navigation is the hallmark of any reliable ship, and QuickBooks Tool Hub takes this principle to heart. Its user-friendly interface is designed for both seasoned captains and those setting sail on the financial seas for the first time. No need for a degree in information technology – the hub speaks the language of simplicity.

Unwrapping the Toolbox: How to Access QuickBooks Tool Hub

Step 1: Download the Tool Hub

Getting your hands on this digital lifesaver is a breeze. Head to the official Intuit website and download QuickBooks Tool Hub. It's like receiving a treasure map that leads you straight to the chest of solutions.

Step 2: Installation Jamboree

Installation is as easy as raising the anchor. Follow the prompts, and soon you'll see the QuickBooks Tool Hub icon on your desktop – your ticket to a world of troubleshooting magic.

Step 3: Navigating the Seas of Solutions

Click on the icon, and the hub unfolds like a treasure trove. The various tools at your disposal are neatly organized, ready to be summoned at a moment's notice. It's like having a trustworthy crew awaiting your command.

Frequently Asked Questions: Unraveling the Mysteries

1. Is QuickBooks Tool Hub compatible with all QuickBooks versions?

Absolutely! QuickBooks Tool Hub is the Swiss Army knife compatible with various QuickBooks versions. Whether you're sailing with QuickBooks Pro, Premier, or Enterprise, the hub adapts to the wind of your financial voyage.

2. Can I trust the PDF Repair Tool with sensitive documents?

Indeed, you can. The PDF Repair Tool is like a vault specialist, ensuring the security and integrity of your financial documents. It's not just about fixing; it's about safeguarding your treasure trove of information.

3. How often should I use the Connection Diagnostic Tool?

Think of it as routine maintenance for your ship. While it's not necessary daily, a periodic check ensures a smooth sailing experience. Don't wait for stormy seas – preventive measures keep your financial ship resilient.

Conclusion: Setting Sail into a Seamless Financial Odyssey

In the vast ocean of financial management, QuickBooks Tool Hub stands as your trusty navigator, your compass through choppy waters. Its seamless integration, user-friendly interface, and cost-efficiency make it the ultimate solution for QuickBooks users navigating the complexities of accounting.

So, fellow financial sailors, don't let technical glitches and installation storms deter you. Equip yourself with the QuickBooks Tool Hub, and let your financial ship sail smoothly through the digital tides. It's not just a toolbox; it's your co-captain in the journey of financial success. Bon voyage!

youtube

1 note

·

View note

Text

QuickBooks Enterprise Support https://smbdaily.com/quickbooks-enterprise-support/

1 note

·

View note

Text

Intuit TurboTax 2021 R12 – 2021 Free Full Activated

TurboTax is a popular tax preparation software developed by Intuit, the same company behind QuickBooks and Mint. It helps users file federal and state income tax returns online.The software is designed for people with little or no tax knowledge. You answer simple questions, and TurboTax does the calculations for you.

Submit your tax return online to receive the fastest possible tax refunds. Connect with an expert in one click and get answers when you need them with SmartLook. Every personal return from TurboTax is backed by our audit support guarantee for free individual audit instructions from a trained tax professional.

3 notes

·

View notes

Text

How to Start a Business from Scratch in 2025 – A Step-by-Step Guide for New Founders

Thinking about launching your own business but don’t know where to begin? You’re not alone. In 2025, starting a business from scratch is more accessible—and more competitive—than ever before. Here’s how to do it right.

🚀 Introduction: Why 2025 Is the Perfect Year to Start a Business

The rules of entrepreneurship are changing fast. Thanks to AI tools, digital platforms, and remote work, building a business from scratch has never been more possible—or more exciting.

But with opportunity comes complexity. The startup world in 2025 is competitive, fast-paced, and constantly evolving. If you’ve got an idea and the ambition to bring it to life, this guide will walk you through how to start a business from scratch—step by step.

Whether you’re launching a tech startup, a local service, or a creative venture, this practical roadmap will help you move from dream to launch with clarity and confidence. Importance of Startups for India’s Economy

Startups play a pivotal role in shaping India’s economy by creating jobs, fostering innovation, and contributing significantly to GDP growth. As of 2022, startups accounted for about 2.64% of employment in the Indian market, highlighting their importance. The government of India has recognized this potential and launched various initiatives, such as the Startup India scheme, to support startup growth through funding, mentorship, and favorable policies. This ecosystem has propelled India into the ranks of top global leaders in innovation and entrepreneurship.

Step 1: Validate Your Business Idea

Don’t build before you validate.

Many new entrepreneurs fall in love with their idea before checking if people actually need it. In 2025, with customer attention at a premium, market validation is non-negotiable.

Here’s how to validate:

Talk to potential customers (online or offline).

Use tools like Google Trends, Reddit, and Quora to check demand.

Launch a quick landing page with tools like Carrd or Webflow and collect signups.

Offer a pre-sale or pilot to gauge interest.

If no one bites, pivot or refine.

Step 2: Do Market Research

Understand your customers, competitors, and trends.

Before spending time or money, study the landscape. What’s trending in your industry? Who else is offering similar products or services?

Use:

Google & YouTube for trend spotting.

SEMrush or Ubersuggest for keyword and competitor analysis.

Statista, CB Insights, or even Instagram/TikTok for emerging consumer behavior.

Find your edge. Your unique value proposition (UVP) is what will separate you from the noise in 2025.

Step 3: Write a Simple Business Plan

This isn’t corporate homework—it’s your action blueprint.

In 2025, your business plan doesn’t have to be 40 pages long. Keep it lean, focused, and useful. Include:

What you’re selling

Who it’s for

How you’ll reach customers

Cost to build/operate

Revenue model (how you’ll make money)

Short-term and long-term goals

Tools like Notion, LivePlan, or Canva Business Plan templates can help make it painless.

Step 4: Choose a Business Name & Register It

Your brand starts with a name.

Make it:

Easy to remember

Easy to spell

Relevant to your offering

Available online (domain + social handles)

Use tools like Namechk, GoDaddy, or NameMesh to check availability. Once chosen, register it in your country or state. In India, use the MCA (Ministry of Corporate Affairs) portal. In the US, check with your Secretary of State’s website.

Don’t forget to buy the domain and secure the social media handles.

Step 5: Handle Legal & Financial Basics

Yes, it’s boring—but skipping it can cost you.

Choose a business structure (sole proprietorship, LLP, private limited, etc.)

Apply for licenses or permits based on your industry.

Open a business bank account.

Set up accounting tools like Zoho Books, QuickBooks, or even Excel if you're bootstrapping.

Separate personal and business finances from day one.

If unsure, talk to a startup consultant or accountant. Step 6 : Choose the Right Business Structure

In 2025, many new founders prefer flexible setups that protect their personal assets and allow easy growth. You can choose from:

Sole Proprietorship (easy, but less protection)

LLP/LLC (more legal protection, preferred for small businesses)

Private Limited Company (ideal for startups looking to raise funds)

Each country has its own rules, so check your local regulations or consult a business advisor.

Step 7 : Build Your Online Presence

If you’re not online, you’re invisible.

In 2025, your digital presence is as important as your product. Get started with:

A clean, responsive website (WordPress, Wix, or Webflow)

Active social media profiles (LinkedIn, Instagram, YouTube, depending on your audience)

A basic Google Business Profile if you’re local

Email marketing tools like Mailchimp or Beehiiv

Build credibility through consistency, not perfection.

Step 8: Create a Minimum Viable Product (MVP)

Start simple, launch fast.

Whether it’s a physical product, digital service, or mobile app, launch with the minimum set of features needed to test real demand.

Your MVP might be:

A no-code app built with Glide or Bubble

A service offered through DMs and GPay

A prototype product made by hand

Speed is your friend. Launch. Learn. Improve.

Step 9: Start Marketing Early

If you build it, they won’t come—unless you market it.

Use cost-effective methods to start:

Organic social media content

Blogging and SEO (try ChatGPT to draft posts!)

Influencer partnerships or product seeding

Referral programs or giveaways

Cold outreach (emails, DMs, calls)

In 2025, community is currency—build yours early and nurture it.

Step 10: Explore Funding Options (If Needed)

If your startup requires capital, explore:

Bootstrapping (your own savings)

Friends & family

Crowdfunding (Kickstarter, Ketto, etc.)

Angel investors or venture capital

Startup accelerators or incubators

Pro tip: Even if you’re not raising money yet, create a pitch deck. It clarifies your vision and makes you look investor-ready.

Benefits of Government Schemes for Startups1. Financial Support: 2. Tax Exemption 3. Simplified Compliance 4. Easier Public Procurement 5. IPR Support 6. Access to Funding 7. Incubation and Mentorship 8. Mentorship and Skill Development 9. Networking Opportunities 10.Promotion of Innovation

Conclusion: 2025 Is the Best Time to Build. So Start.

Starting a business from scratch isn’t about waiting for the “perfect” moment. It’s about taking the first small step, validating, building smart, and learning fast.

In 2025, you don’t need a million-dollar idea. You need clarity, a problem to solve, and the grit to keep going.

✅ Ready to launch your startup?

At Innomax Startup Advisory, we help first-time founders go from idea to impact with mentorship, incubation, funding support, and everything in between. Don’t do it alone—get expert help that actually moves you forward.

👉 Visit https://innomaxstartup.com/ to get started. Your business starts now Let’s build it—step by step.

2 notes

·

View notes

Text

Accounting Firms in India: Enabling Financial Growth for Modern Businesses

The Essential Role of Accounting Firms in India

In today’s competitive business environment, accounting firms in India have become indispensable to companies aiming for financial transparency, legal compliance, and sustained growth. These firms are not only handling traditional tasks like bookkeeping and tax filing but are also offering strategic support in areas such as auditing, payroll management, and financial consulting. As India’s economy continues to evolve, the role of accounting professionals is becoming more crucial than ever.

With the increasing complexity of tax laws and financial regulations, businesses are turning to professional accounting firms to manage their financial responsibilities accurately and efficiently. The right firm can help reduce financial risks, ensure compliance with Indian accounting standards, and support the overall decision-making process.

Why Businesses Choose Professional Accounting Firms

Managing finances internally can be overwhelming, especially for small and mid-sized businesses. That’s why many organizations choose to outsource accounting functions to expert firms. Here’s why this trend is growing:

Regulatory Compliance: Accounting firms keep up with evolving tax laws, ensuring that businesses remain compliant with GST, income tax, and MCA regulations.

Cost Savings: Outsourcing is often more affordable than hiring an in-house accounting team, reducing operational costs.

Efficiency and Accuracy: Professional firms use advanced software and tools to ensure accurate record-keeping and timely financial reporting.

Scalable Solutions: Services can be adjusted to meet the needs of growing businesses, from startups to established enterprises.

Services Offered by Accounting Firms in India

Accounting firms in India offer a wide range of services tailored to different types of businesses. These include:

1. Bookkeeping and Financial Reporting

Maintaining organized financial records is the foundation of sound business practices. Firms handle daily transaction tracking, journal entries, ledger management, and monthly financial statement preparation.

2. Tax Planning and Filing

Navigating India’s tax system can be challenging. Accounting firms assist with GST returns, income tax filings, TDS calculations, and tax audits, while also advising on effective tax-saving strategies.

3. Audit and Assurance Services

Internal audits, statutory audits, and compliance audits help identify risks and inefficiencies. These services enhance transparency and build trust with stakeholders and investors.

4. Payroll and Compliance Management

From salary processing to PF, ESI, and professional tax deductions, accounting firms handle every aspect of payroll while ensuring compliance with labor laws and statutory requirements.

5. Business Advisory and Financial Consulting

Many firms also provide financial planning, budgeting, and forecasting services. This helps business owners make informed decisions based on data-driven insights.

Qualities to Look for in an Accounting Firm

Choosing the right accounting partner is a strategic business decision. When evaluating potential firms, consider the following:

Certification and Experience: Ensure the firm is registered with the Institute of Chartered Accountants of India (ICAI) and has experience in your industry.

Technological Capability: Look for firms that use modern accounting tools such as Tally, Zoho Books, QuickBooks, or Xero.

Transparent Communication: A reliable firm provides regular updates, clear reports, and prompt support.

Customizable Services: Every business has unique needs. Choose a firm that offers tailored solutions instead of one-size-fits-all packages.

The Advantages of Hiring Indian Accounting Firms

India’s accounting sector is recognized for its high standards of professionalism and affordability. Some of the key benefits include:

Skilled Workforce: India produces thousands of qualified CAs and finance professionals each year.

Language Proficiency: English-speaking professionals make communication seamless for both domestic and international clients.

Competitive Pricing: Indian firms offer world-class services at cost-effective rates, making them attractive for global outsourcing.

The Evolving Future of Accounting in India

The accounting industry in India is rapidly adapting to technological innovation. Automation, artificial intelligence (AI), and cloud computing are transforming how firms deliver services. Clients now benefit from real-time financial data, predictive analytics, and paperless operations.

Additionally, government initiatives such as faceless assessments, e-invoicing, and digital compliance are pushing accounting firms to adopt smarter workflows and enhance client service quality.

As businesses continue to embrace digital transformation, accounting firms are expected to play an even bigger role—not just as compliance experts, but as strategic financial advisors.

Conclusion

In a fast-changing economic landscape, accounting firms in India have emerged as trusted partners for businesses that want to operate with confidence and clarity. Their expertise, combined with advanced technology and deep regulatory knowledge, allows companies to focus on their core activities while leaving the complexities of finance and compliance to the professionals.

Whether you're launching a startup, managing a growing enterprise, or expanding internationally, working with a reliable accounting firm can drive efficiency, reduce risk, and support long-term success.

2 notes

·

View notes

Text

Online Bookkeeping Services by Mercurius & Associates LLP

In today’s fast-paced digital economy, accurate and efficient financial management is crucial for every business. Whether you're a startup, small enterprise, or a growing company, keeping track of your finances is vital for sustainability and success. That’s where Mercurius & Associates LLP steps in with its online bookkeeping services — blending technology, expertise, and reliability to manage your books with precision.

Why Bookkeeping Matters

Bookkeeping is the foundation of any business’s financial health. It involves recording, classifying, and organizing all financial transactions so that businesses can:

Monitor their financial position

Ensure regulatory compliance

Make informed decisions

File accurate tax returns

Plan for growth and investment

Yet, many businesses struggle to keep up with bookkeeping due to time constraints, lack of in-house expertise, or outdated processes.

Benefits of Online Bookkeeping Services

Online bookkeeping is a game-changer for modern businesses. It offers:

Real-time access to financial data

Cloud-based solutions for anytime, anywhere access

Cost-effective services compared to in-house staff

Scalability as your business grows

Increased accuracy through automated tools

Secure data storage with regular backups

By outsourcing bookkeeping to professionals, businesses can focus more on core operations while ensuring their books are in order.

Why Choose Mercurius & Associates LLP?

At Mercurius & Associates LLP, we specialize in providing online bookkeeping services tailored to your business needs. Here’s what sets us apart:

1. Experienced Professionals

Our team comprises skilled accountants and finance experts who understand the nuances of bookkeeping across industries. We ensure compliance with Indian and international accounting standards.

2. Customized Solutions

We understand that no two businesses are the same. Our bookkeeping services are tailored to suit your industry, size, and specific requirements.

3. Technology-Driven Approach

We leverage cloud-based platforms like QuickBooks, Zoho Books, Xero, and Tally for seamless and accurate bookkeeping. Integration with your existing systems is quick and hassle-free.

4. Transparent Reporting

You receive regular financial reports that help you track performance, manage cash flow, and plan strategically. Our detailed reports include profit and loss statements, balance sheets, and cash flow summaries.

5. Data Security

We implement best-in-class data protection protocols to ensure your financial information is secure and confidential.

Services We Offer

Daily, weekly, or monthly transaction recording

Bank and credit card reconciliation

Accounts payable and receivable management

General ledger maintenance

Payroll processing support

GST return preparation and filing

Financial reporting and analysis

Industries We Serve

Our online bookkeeping services are ideal for:

Startups & Entrepreneurs

E-commerce Businesses

Healthcare Professionals

Legal Firms

Retail & Wholesale Businesses

IT & Software Companies

NGOs and Trusts

Get Started with Mercurius & Associates LLP

Outsourcing your bookkeeping doesn’t mean losing control. With Mercurius & Associates LLP, you gain a partner who brings clarity, accuracy, and efficiency to your financial operations.

Let us handle your books while you focus on growing your business.

📞 Contact us today to learn more about our online bookkeeping services or to request a free consultation.

#accounting & bookkeeping services in india#audit#businessregistration#chartered accountant#income tax#taxation#foreign companies registration in india#auditor#ap management services

2 notes

·

View notes

Text

Nonprofit Software: A Key to Efficient Mission Management

Nonprofit organizations operate in a challenging environment where maximizing impact is essential while keeping administrative costs low. Managing donations, volunteers, events, and operational workflows can be overwhelming without the right tools. Nonprofit software has emerged as a vital solution, tailored to address the specific needs of mission-driven organizations. These tools streamline operations, enhance donor engagement, and ultimately help nonprofits achieve their goals more effectively.

In this article, we’ll explore the types, benefits, and future of nonprofit software, shedding light on how it empowers organizations to thrive in today’s competitive landscape.

What is Nonprofit Software?

Nonprofit software refers to digital tools and platforms specifically designed to help nonprofits manage their operations efficiently. Unlike generic software, nonprofit-specific tools address core needs such as donor relationship management, fundraising, volunteer coordination, grant tracking, and financial reporting. With features tailored to their unique challenges, nonprofits can save time, optimize resources, and focus on their missions.

Types of Nonprofit Software

Donor Management Software Also known as nonprofit CRM (Customer Relationship Management), donor management software helps organizations track donor interactions, manage contributions, and personalize engagement. Tools like Bloomerang, DonorPerfect, and Little Green Light simplify donor retention and make campaigns more effective.

Fundraising Software Platforms like Classy, Givebutter, and Fundly empower nonprofits to create online fundraising campaigns, process donations, and analyze results. Peer-to-peer fundraising, recurring donations, and mobile giving features enhance the donor experience.

Volunteer Management Tools Managing volunteers is essential for many nonprofits. Tools like VolunteerHub and SignUpGenius streamline recruitment, scheduling, and communication, ensuring an organized and engaged volunteer base.

Grant Management Software Grant tracking tools such as Foundant or Submittable help nonprofits identify funding opportunities, submit applications, and manage deadlines and compliance, improving the chances of securing vital grants.

Accounting and Financial Management Software Nonprofits need tools to maintain transparency and manage budgets. Accounting software like QuickBooks for Nonprofits or Aplos ensures accurate reporting, proper fund allocation, and regulatory compliance.

Event Management Software Nonprofits often rely on events to engage supporters and raise funds. Tools like Eventbrite or Cvent simplify event planning, ticketing, and attendee management, creating seamless experiences for donors and participants.

Benefits of Nonprofit Software

Operational Efficiency Nonprofit software automates routine tasks such as data entry, reporting, and communication, allowing staff to focus on mission-critical activities.

Improved Donor Relationships With donor management tools, nonprofits can personalize outreach, track giving history, and maintain strong relationships that increase donor retention.

Transparency and Accountability Financial and grant management tools ensure that nonprofits comply with regulations and demonstrate transparency to stakeholders, boosting credibility.

Better Decision-Making Analytics and reporting features provide valuable insights into campaign performance, donor behavior, and operational efficiency, enabling data-driven decisions.

Scalability As nonprofits grow, software solutions can scale to accommodate larger donor bases, expanded programs, and increasing complexity.

Challenges of Implementing Nonprofit Software

While nonprofit software offers significant benefits, organizations may face challenges, including:

Budget Constraints: Even with nonprofit discounts, advanced tools can strain limited budgets.

Learning Curve: Staff and volunteers may require training to use the software effectively.

Integration Issues: Ensuring new tools work seamlessly with existing systems can be complex.

Data Security: Protecting sensitive donor and organizational data is crucial and requires robust security measures.

Organizations should evaluate their specific needs, select user-friendly tools, and partner with providers offering support and training to overcome these challenges.

Future of Nonprofit Software

The future of nonprofit software lies in innovation and technology integration. Artificial intelligence (AI) is already being used to predict donor behavior, optimize outreach, and analyze trends. Blockchain technology is enhancing transparency in donation tracking, while virtual reality (VR) is creating immersive experiences to engage donors. These advancements will further empower nonprofits to achieve their missions efficiently and effectively.

Conclusion

Nonprofit software is transforming the way mission-driven organizations operate. From donor management and fundraising to financial tracking and volunteer coordination, these tools address the unique challenges nonprofits face. By adopting the right software solutions, organizations can save time, optimize resources, and focus on what truly matters—making a difference in the world.

As technology continues to evolve, nonprofit software will remain a cornerstone of effective mission management, helping organizations thrive in a rapidly changing environment. For nonprofits seeking to maximize their impact, investing in the right software is not just an option—it’s a necessity.

3 notes

·

View notes

Text

Your Guide to Choosing the Right AI Tools for Small Business Growth

In state-of-the-art speedy-paced international, synthetic intelligence (AI) has come to be a game-changer for businesses of all sizes, mainly small corporations that need to stay aggressive. AI tools are now not constrained to big establishments; less costly and available answers now empower small groups to improve efficiency, decorate patron experience, and boost revenue.

Best AI tools for improving small business customer experience

Here’s a detailed review of the top 10 AI tools that are ideal for small organizations:

1. ChatGPT by using OpenAI

Category: Customer Support & Content Creation

Why It’s Useful:

ChatGPT is an AI-powered conversational assistant designed to help with customer service, content creation, and more. Small companies can use it to generate product descriptions, blog posts, or respond to purchaser inquiries correctly.

Key Features:

24/7 customer service via AI chatbots.

Easy integration into web sites and apps.

Cost-powerful answers for growing enticing content material.

Use Case: A small e-trade commercial enterprise makes use of ChatGPT to handle FAQs and automate patron queries, decreasing the workload on human personnel.

2. Jasper AI

Category: Content Marketing

Why It’s Useful:

Jasper AI specializes in generating first rate marketing content. It’s ideal for creating blogs, social media posts, advert reproduction, and extra, tailored to your emblem’s voice.

Key Features:

AI-powered writing assistance with customizable tones.

Templates for emails, advertisements, and blogs.

Plagiarism detection and search engine optimization optimization.

Use Case: A small enterprise owner uses Jasper AI to create search engine optimization-pleasant blog content material, enhancing their website's visibility and traffic.

Three. HubSpot CRM

Category: Customer Relationship Management

Why It’s Useful:

HubSpot CRM makes use of AI to streamline purchaser relationship control, making it less difficult to music leads, control income pipelines, and improve consumer retention.

Key Features:

Automated lead scoring and observe-ups.

AI insights for customized purchaser interactions.

Seamless integration with advertising gear.

Use Case: A startup leverages HubSpot CRM to automate email follow-ups, increasing conversion costs without hiring extra staff.

Four. Hootsuite Insights Powered by means of Brandwatch

Category: Social Media Management

Why It’s Useful:

Hootsuite integrates AI-powered social media insights to help small businesses tune tendencies, manipulate engagement, and optimize their social media method.

Key Features:

Real-time social listening and analytics.

AI suggestions for content timing and hashtags.

Competitor evaluation for a competitive aspect.

Use Case: A nearby café uses Hootsuite to agenda posts, tune customer feedback on social media, and analyze trending content material ideas.

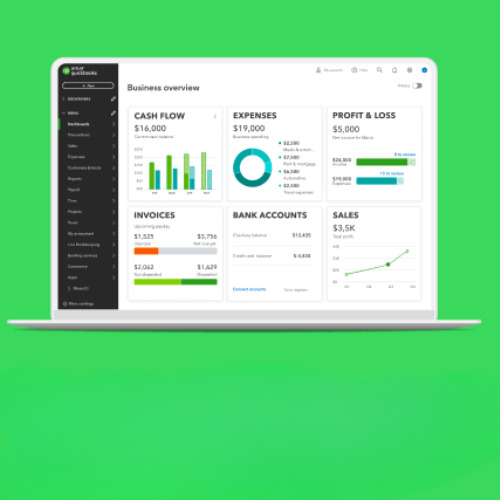

Five. QuickBooks Online with AI Integration

Category: Accounting & Finance

Why It’s Useful:

QuickBooks Online automates bookkeeping responsibilities, rate monitoring, and economic reporting using AI, saving small agencies time and reducing mistakes.

Key Features:

Automated categorization of costs.

AI-driven economic insights and forecasting.

Invoice generation and price reminders.

Use Case: A freelance photo designer uses QuickBooks to simplify tax practise and hold tune of assignment-primarily based earnings.

6. Canva Magic Studio

Category: Graphic Design

Why It’s Useful:

Canva Magic Studio is an AI-more advantageous design tool that empowers non-designers to create stunning visuals for marketing, social media, and presentations.

Key Features:

AI-assisted layout guidelines.

One-click background elimination and resizing.

Access to templates, inventory pictures, and videos.

Use Case: A small bakery makes use of Canva Magic Studio to create pleasing Instagram posts and promotional flyers.

7. Grammarly Business

Category: Writing Assistance

Why It’s Useful:

Grammarly Business guarantees that each one written communications, from emails to reviews, are expert and blunders-unfastened. Its AI improves clarity, tone, and engagement.

Key Features:

AI-powered grammar, spelling, and style corrections.

Customizable tone adjustments for branding.

Team collaboration gear.

Use Case: A advertising company makes use of Grammarly Business to make sure consumer proposals and content material are polished and compelling.

Eight. Zapier with AI Automation

Category: Workflow Automation

Why It’s Useful:

Zapier connects apps and automates workflows without coding. It makes use of AI to signify smart integrations, saving time on repetitive tasks.

Key Features:

Automates responsibilities throughout 5,000+ apps.

AI-pushed recommendations for green workflows.

No coding required for setup.

Use Case: A small IT consulting corporation makes use of Zapier to routinely create tasks in their assignment management device every time a brand new lead is captured.

9. Surfer SEO

Category: Search Engine Optimization

Why It’s Useful:

Surfer SEO uses AI to assist small businesses improve their internet site’s seek engine scores thru content material optimization and keyword strategies.

Key Features:

AI-pushed content audit and optimization.

Keyword studies and clustering.

Competitive evaluation equipment.

Use Case: An on-line store uses Surfer search engine marketing to optimize product descriptions and blog posts, increasing organic site visitors.

10. Loom

Category: Video Communication

Why It’s Useful:

Loom lets in small groups to create video messages quick, which are beneficial for group collaboration, client updates, and customer service.

Key Features:

Screen recording with AI-powered editing.

Analytics for viewer engagement.

Cloud garage and smooth sharing hyperlinks.

Use Case: A digital advertising consultant makes use of Loom to offer video tutorials for customers, improving expertise and lowering in-man or woman conferences.

Why Small Businesses Should Embrace AI Tools

Cost Savings: AI automates repetitive duties, reducing the need for extra group of workers.

Efficiency: These equipment streamline operations, saving time and increasing productiveness.

Scalability: AI permits small organizations to manipulate boom with out full-size infrastructure changes.

Improved Customer Experience: From personalized tips to 24/7 help, AI gear help small groups deliver superior customer service.

3 notes

·

View notes

Text

Revolutionizing Transactions with PayWint Digital Wallet

In a world where convenience and efficiency dominate, the demand for reliable and feature-rich digital wallets has skyrocketed. Enter PayWint, the ultimate digital wallet solution designed to streamline your financial transactions while ensuring security and ease of use. Whether you're a student, traveler, freelancer, or small business owner, PayWint is here to revolutionize how you manage, send, and receive money.

Why Choose PayWint?

PayWint stands out in the crowded digital wallet space with its seamless features tailored to meet diverse user needs. From real-time alerts to AI-powered fraud detection, PayWint ensures your transactions are not just swift but also highly secure.

Key Features at a Glance:

Instant Money Transfers: Request, send, and receive money in real-time, making it the perfect companion for personal and professional needs.

Multi-Currency & Multi-Language Support: Operate effortlessly across borders, thanks to PayWint's global usability.

Shared Wallets: Split bills or manage group expenses with family, friends, or business partners through shared wallets.

Virtual & Physical Cards: Open a digital bank account and enjoy the convenience of virtual or physical cards.

Perfect for Everyone

PayWint caters to a diverse audience, ensuring inclusivity and functionality for all.

Students and Freelancers can use PayWint to manage international payments, ensuring they can receive funds from clients or family abroad without delays.

Small Business Owners can streamline payroll, vendor payments, and even customer transactions, all from one centralized platform.

Travel Enthusiasts can enjoy hassle-free currency conversions and transactions no matter where they are.

Unparalleled Integrations

One of PayWint's standout features is its ability to integrate with leading financial and payment platforms such as Apple Pay, Google Pay, PayPal, CashApp, and Venmo. Users can also link multiple bank accounts or credit and debit cards for effortless transactions. Moreover, businesses can integrate accounting platforms like QuickBooks, Zoho, or FreshBooks to simplify bookkeeping.

Enhanced Security & Real-Time Updates

Security is at the heart of PayWint. With encryption and AI-powered fraud detection, users can trust their financial data is always safe. Real-time alerts via text, email, or push notifications ensure you stay informed about every transaction.

Beyond Payments

PayWint isn't just a digital wallet; it's a comprehensive financial management tool. The AI-powered budget planner helps users track expenses and set financial goals. For businesses, the ability to schedule recurring payments and integrate payment widgets into websites adds unparalleled convenience.

Always There for You

With 24/7 customer support available via phone, email, text, and chat, help is always just a call or message away. You can reach us at (408) 516-1413 for any assistance. Whether it's a quick query or a technical issue, PayWint ensures you're never left in the dark.

Get Started with PayWint

Ready to transform how you handle money? Download the PayWint Digital Wallet Mobile App today from the Apple Store or Google Play Store. Alternatively, visit PayWint.com to access your financial world instantly.

2 notes

·

View notes

Text

Asha Kanta Sharma - Finance & Accounts

Asha Kanta Sharma is a competent professional with 14+ Years of Post Qualification (Bachelor's of Commerce with Accountancy Major) experience with rich exposure in Finance, Accounting Systems & Operations, IFRS, GAAP, Auditing, Direct & Indirect Taxation, Company Law Rules/Regulations, Financial and Statutory Statements, Compliances, Reports, and industry trends. He is conversant in Online/Offline ERP Packages i.e. SAP ERP (IB, FICO, SD & MM Module), Tally ERP9, QuickBooks, Zoho, and having Sound knowledge of Microsoft Excel & Microsoft Word.

Asha Kanta Sharma is willing to engage in a career that will allow for progress in terms of expertise, socio-economic development, and innovation through exposure to new ideas for professional growth, as well as the growth of the company.

The prime reason for hiring him will be his passion for what he does. He is trustworthy, truthful, Open Minded, Lifelong Learner, Helps others rise and give support, Responsible, and I love working in his areas of expertise and it is not a job for him. He can be trusted and reliable and he has in the past helped a lot of businesses to further improve their processes and systems and automate a lot of things saving time and energy.

https://www.linkedin.com/in/ashakantasharma

Email - [email protected]

Mobile +91.975.993.1111

Mobile +91.911.997.1155

#jobs#jobsearch#online jobs#jobseekers#job hunting#career#opportunities#employment#working#employees

2 notes

·

View notes

Text

Melio is a financial technology platform designed to streamline accounts payable and receivable processes for small and medium-sized businesses. It aims to simplify bill payments, improve cash flow management, and enhance overall financial operations. Here is a detailed review of its features and functionalities:

Key Features

Bill Payments:

Multiple Payment Methods: Melio allows businesses to pay vendors using ACH bank transfers, credit cards, or checks. This flexibility helps businesses manage cash flow and earn credit card rewards, even if the vendor only accepts checks. Schedule Payments: Users can schedule payments in advance, ensuring timely bill payments and avoiding late fees. Batch Payments: The platform supports batch payments, allowing users to pay multiple bills at once, saving time and reducing administrative burden.

Accounts Receivable:

Payment Requests: Businesses can send payment requests to customers via email, including a link for customers to pay directly through the platform.

Customer Management: Track customer payments, manage outstanding invoices, and automate reminders to improve collection rates.

Integration and Syncing:

Accounting Software Integration: Melio integrates with popular accounting software like QuickBooks, Xero, and FreshBooks, ensuring seamless data synchronization and reducing manual data entry.

Bank Integration: Direct integration with banks facilitates easy payment processing and reconciliation. User-Friendly Interface:

Dashboard: A clean and intuitive dashboard provides an overview of pending and completed payments, cash flow status, and upcoming bills.

Mobile Access: The platform is accessible via mobile devices, allowing users to manage payments and view financial data on the go.

Security and Compliance:

Secure Transactions: Melio employs robust security measures, including encryption and secure data storage, to protect user information and financial transactions.

Compliance: The platform adheres to financial regulations and industry standards, ensuring compliance with relevant laws.

Cash Flow Management:

Flexible Payment Options: By allowing credit card payments for bills, Melio helps businesses manage cash flow more effectively, providing the flexibility to defer payments while still meeting obligations.

Payment Scheduling: Advanced scheduling options enable better planning and control over outgoing cash flow.

Collaboration Tools:

Team Access: Multiple users can be granted access to the platform, allowing for collaborative financial management. Permission settings ensure that sensitive information is accessible only to authorized personnel.

Audit Trail: Detailed records of all transactions and activities help maintain transparency and accountability.

Pros Flexibility in Payments: The ability to pay bills via credit card, even when vendors don’t accept them, provides a unique advantage in managing cash flow and earning rewards. Ease of Use: The platform’s user-friendly interface and straightforward setup make it accessible for businesses of all sizes.

Integration with Accounting Software: Seamless integration with major accounting tools ensures accurate financial tracking and reduces manual workload.

Security: Strong security measures and compliance with industry standards provide peace of mind for users.

Batch Payments: Support for batch payments simplifies the process of paying multiple bills, saving time and reducing errors.

Cons Cost: While Melio offers a free version, certain advanced features and payment methods (like credit card payments) incur fees, which might be a consideration for cost-sensitive businesses. Limited Global Reach: Melio primarily serves businesses in the United States, which may limit its usefulness for companies with significant international operations or those based outside the U.S. Learning Curve for Advanced Features: Some users might find the advanced features complex initially, requiring time to fully utilize all functionalities.

Melio is a powerful and flexible tool for small and medium-sized businesses looking to streamline their accounts payable and receivable processes. Its ability to manage payments through various methods, integration with popular accounting software, and user-friendly design make it an attractive option for businesses aiming to enhance their financial operations. While there are costs associated with some features and a learning curve for advanced functionalities, the overall benefits, including improved cash flow management and operational efficiency, make Melio a valuable tool for modern businesses.

4 notes

·

View notes

Text

In today’s fast-paced business environment, enhancing productivity is more crucial than ever to successfully accomplish this, one can rely on the power of automation. By automating routine tasks, businesses can save time, reduce errors, and focus on more strategic activities. In this blog post, we will explore essential automation strategies that can help boost productivity in your organization.

Boost productivity with these essential automation strategies. Automation is transforming the way businesses operate, making processes more efficient and streamlined. Implementing the right automation strategies can lead to significant improvements in productivity and overall business performance. In this article, we will discuss several key automation strategies that can help you achieve these goals.

1. Automate Repetitive Tasks

One of the most effective ways to boost productivity is by automating repetitive tasks. These tasks often consume a significant amount of time and can be easily automated using the right tools. For example, you can automate data entry, email responses, and appointment scheduling. By doing so, you free up valuable time for more critical activities.

2. Utilize Workflow Automation

Workflow automation involves creating a series of automated actions that complete a process. This strategy is particularly useful for complex processes that involve multiple steps and departments. Tools like Zapier and Microsoft Power Automate can help you set up automated workflows, ensuring that tasks are completed efficiently and accurately.

3. Implement Marketing Automation

Marketing automation can significantly enhance your marketing efforts by automating tasks such as email marketing, social media posting, and lead nurturing. Platforms like HubSpot and Mail chimp offer comprehensive automation features that can help you reach your target audience more effectively and improve your marketing ROI.

4. Enhance Customer Service with Chatbots

Integrating chatbots into your customer service strategy can greatly improve efficiency and customer satisfaction. Chabot’s can handle a wide range of customer queries, provide instant responses, and escalate issues to human agents when necessary. This not only saves time but also ensures that customers receive timely and accurate support.

5. Streamline Financial Processes

Automation can also be applied to financial processes such as invoicing, expense tracking, and payroll management. Tools like QuickBooks and Xero offer robust automation features that can help you manage your finances more efficiently and reduce the risk of errors.

Boost Productivity with These Essential Automation Strategies. Automation is a powerful tool that can help businesses enhance productivity and efficiency. By implementing the strategies discussed in this article, you can streamline your processes, reduce manual workload, and focus on more strategic activities. Have you tried any of these automation strategies?

#Automation#Productivity#BusinessEfficiency#TechTrends#WorkflowAutomation#DigitalTransformation#AutomationTools#SmartBusiness#Innovation#Accomation#BusinessAutomation#InvoiceManagement#EfficiencyTools#AutomationSolutions#SmallBusinessTools#StreamlineOperations#BusinessGrowth#FinancialAutomation

2 notes

·

View notes

Text

The Small Business Owner's Guide to Software: Demystifying Tech for Growth in Patna, Bihar

In the heart of Bihar, Patna is witnessing a digital shift in how small businesses function. With growing competition and increasing customer expectations, embracing the right software solutions is no longer a luxury—it's a necessity. At Sanity Softwares, we are committed to helping small businesses in Patna bridge the gap between traditional business models and modern technological solutions.

Why Small Businesses in Patna Must Embrace Software Solutions

Small businesses often face challenges such as manual errors, inefficient workflows, inventory mismanagement, and delayed customer service. The right software tools can automate tasks, streamline operations, and boost overall productivity, enabling businesses to compete effectively and grow sustainably.

Top Business Areas Where Software Can Make a Big Difference

Accounting and Finance Management

Managing accounts manually can be time-consuming and prone to human error. Accounting software like Tally, Zoho Books, and QuickBooks can:

Automate invoice generation

Track expenses and payments

Generate financial reports in real-time

Ensure GST compliance

We, at Sanity Softwares, provide customized accounting solutions tailored for local businesses, helping them stay compliant and organized.

Customer Relationship Management (CRM)

Maintaining customer relationships is vital for repeat business. CRM software helps:

Track interactions

Manage leads and follow-ups

Send automated reminders and emails

Understand customer buying behavior

Local retailers, real estate firms, and service providers in Patna are increasingly adopting CRM tools to strengthen their customer engagement strategies.

Inventory and Billing Software

Running a Kirana shop, pharmacy, or wholesale business? Inventory mismanagement can lead to overstocking or stockouts. Our inventory solutions:

Track stock in real-time

Generate auto-alerts on low inventory

Simplify billing with barcode integration

Offer mobile-based sales reporting

Sanity Softwares specializes in deploying GST-ready inventory and billing software designed specifically for small-scale businesses in Bihar.

HR and Payroll Management Software

Even small businesses with 5–50 employees need an efficient way to manage attendance, salaries, and statutory deductions.

Benefits include:

Automated salary calculation

PF, ESI, and TDS compliance

Biometric attendance tracking

Leave and holiday management

We offer cloud-based payroll solutions with easy-to-use dashboards and local language support for Patna-based companies.

POS Systems for Retailers

Retailers in Patna's Boring Road, Kankarbagh, or even rural outskirts can benefit from Point-of-Sale (POS) systems that:

Process transactions quickly

Accept multiple payment modes

Maintain real-time sales records

Integrate with inventory systems

Our POS solutions are scalable and affordable for startups and growing shops alike.

Why Sanity Softwares is the Go-To Partner for Small Businesses in Patna

Founded with a vision to digitize Bihar's business ecosystem, Sanity Softwares brings:

Local expertise with a deep understanding of regional market needs

Customized software solutions for retail, distribution, education, and service sectors

Dedicated support team to assist with installation, training, and after-sales

Affordable pricing models to ensure even micro-enterprises can digitize affordably

Whether you're an electronics wholesaler in Ashok Rajpath or a boutique in Patliputra Colony, we ensure your transition to software is smooth, supported, and successful.

How to Choose the Right Software for Your Business in Patna

1. Identify Your Business Needs

Start by listing down the processes that consume the most time or are error-prone.

2. Evaluate Features and Scalability

Choose software that grows with your business and includes features you'll need tomorrow, not just today.

3. Ask for a Demo

Before buying, request a live demo. At Sanity Softwares, we offer free trials and demos to help you make an informed decision.

4. Check for Support and Updates

Choose software that offers regular updates, data security, and a responsive customer support team.

Real-Life Success Stories from Patna

Retail Chain in Bazar Samiti

Implemented billing and CRM software from Sanity Softwares. Saw a 40% increase in repeat customers and reduced billing time by 60%.

Tutoring Institute in Rajendra Nagar

Adopted a student management system. Now manages fees, attendance, and exam results digitally with zero paperwork.

Benefits of Going Digital with Sanity Softwares

Boost operational efficiency

Reduce manpower cost

Enhance customer satisfaction

Improve business insights through reports and analytics

We don’t just sell software—we partner with businesses to help them thrive in the digital age.

Frequently Asked Questions

1. I have a very small team. Do I still need business software?

Yes! Even solo entrepreneurs can benefit from automation tools that save time and eliminate manual errors.

2. Do I need to be tech-savvy to use your software?

No. Our solutions are designed for simplicity, and we provide hands-on training and local language support.

3. What kind of support do you offer?

From installation to troubleshooting, our Patna-based support team is always a call away.

4. Can your software handle Bihar’s GST rules?

Absolutely. All our software is 100% GST-compliant and regularly updated as per government mandates.

5. How do I get started?

Just visit sanitysoftwares.com or call us for a free consultation and demo.

Patna’s small businesses are entering a new era. Don’t let outdated methods hold you back. Let Sanity Softwares help you transform, grow, and succeed.

0 notes

Text

Your Career Guide to Choosing International Accounting Courses at Perfect Computer Education

If you want to grow professionally, particularly in finance, it is helpful to think long term. The globe is more integrated than ever before, and companies tend to work in different countries. That is why knowing accounting in your home country is no longer sufficient. Global skills are necessary.

That is where International Accounting Courses come into play. These courses familiarise you with accounting in other areas of the world. The concept is to make you prepared for jobs not only in India, but also in the USA, UK, Dubai, Australia and more.

Why are International Accounting Skills important?

Companies now employ professionals who are familiar with various accounting systems. If you are familiar with software such as QuickBooks, XERO, or SAGE, and you are familiar with IFRS and international tax principles, you are more employable.

With the help of International Accounting Courses, you can manage international accounts with confidence and use the same accounting vocabulary as your foreign clients or business partners.

What Your Learners Will Gain from These Courses?

● Improved career prospects: These certificates are well regarded everywhere in the world. Whether you want to work in India or internationally, this provides you with more opportunities.

● Real-world skills: You are taught software and systems that are currently used in businesses, not theory.

● Job confidence: Once you know international best practices, you are able to handle international clients and reports with confidence.

● Flexibility in the future: If you begin your own business or work in an international firm, you will already possess the skills.

What to Check Before You Enroll?

Begin by considering your career ambitions. Next, verify that the course covers contemporary accounting software. Opt for institutes offering practical training and flexible learning. Check their past achievements and testimonials from students.

Learn From The Best At Perfect Computer Education

Ever since 1994, Perfect Computer Education in Ahmedabad has educated more than 3,000 finance graduates, MBAs and CAs. Their aim is obvious. They are eager to teach practical skills that lead to practical jobs. There's the option of taking classes either in person or online. There is one-to-one guidance, mentoring and support until you are successful.

You can also gain knowledge of auditing and compliance. This subject educates you on how to review if the financials of a company are correct and comply with all regulations. Companies actually hire people who are good in these skills.

The solution is with Perfect Computer Education.

Learn More about this to visit our Website - https://perfecteducation.net/international-accounting-courses-career-guide.php

0 notes

Text

Budget Smarter: 15 Expert-Approved Ways to Lower Business Expenses

In today's competitive business environment, managing costs is more crucial than ever. Whether you're a startup navigating growth or an established company looking to maximize profits, cost optimization can significantly impact your bottom line. The good news? Lowering your business expenses doesn’t mean compromising on quality or efficiency. With a few smart strategies—many used by successful corporate travel companies and financial experts—you can maintain excellence while saving more.

Here are 15 expert-approved ways to cut costs and budget smarter for long-term business success.

1. Embrace Digital Transformation

Automating repetitive tasks like invoicing, payroll, and customer service reduces labor costs and human error. Tools like QuickBooks, Zoho, and FreshBooks streamline operations efficiently.

2. Outsource Non-Core Activities

Delegate tasks like IT support, HR functions, and content creation to specialized freelancers or agencies. Outsourcing often proves more cost-effective than maintaining in-house teams.

3. Optimize Corporate Travel Management

Partner with corporate travel companies that offer all-in-one platforms, negotiated discounts, and real-time tracking. Smart corporate travel management minimizes overspending and improves employee safety and efficiency during travel.

4. Go Remote (or Hybrid)

Reducing office space saves on rent, utilities, and office supplies. Hybrid work models also improve employee satisfaction and productivity.

5. Use Cloud-Based Software

Cloud computing reduces the need for expensive infrastructure and software licenses. Platforms like Google Workspace, Microsoft 365, and Dropbox offer scalable solutions for growing businesses.

6. Monitor Subscriptions & Licenses

Audit your recurring software and service subscriptions regularly. Eliminate underused or duplicate tools to avoid unnecessary expenses.

7. Review Supplier Contracts

Negotiate with vendors annually. Loyalty discounts, bulk order rates, or switching to a more affordable supplier can lead to substantial savings.

8. Implement Energy-Efficient Practices

LED lighting, smart thermostats, and energy-efficient appliances help cut utility costs while promoting sustainability.

9. Adopt Virtual Meetings

Reduce business travel by embracing virtual platforms like Zoom and Microsoft Teams. This also aligns with your broader corporate travel management strategy to cut travel-related costs.

10. Train Employees on Cost-Conscious Behavior

Empower your team to make budget-friendly choices—whether it’s printing fewer documents or choosing economy class for flights.

11. Consolidate Business Tools

Using all-in-one platforms for marketing, customer management, and analytics reduces tool redundancy and subscription costs.

12. Leverage Tax Deductions

Work with a financial advisor to identify eligible business expenses for tax deductions, from office supplies to travel.

13. Implement a Budgeting System

Use real-time budget tracking tools like YNAB (You Need A Budget) or Mint to control overspending and make informed decisions.

14. Collaborate with Corporate Travel Companies

Instead of managing employee travel piecemeal, corporate travel companies streamline the entire process, from booking to expense reporting—saving both time and money.

15. Regularly Review Financial Reports

Analyze your monthly P&L statements to identify trends, spot leaks, and optimize spending in real time.

Final Thoughts

Smart budgeting isn’t about cutting corners—it’s about making strategic, data-driven decisions. Whether it’s choosing reliable corporate travel management partners or moving your operations to the cloud, every cost-saving measure contributes to your business’s long-term sustainability and growth.

Adopt these expert-approved strategies today and take control.

0 notes

Text

QuickBooks Has Big Savings for Small Businesses This Summer

Ad content in partnership with QuickBooks. Small business owners already know that every little bit of support means the world and can make all the difference. We’re cheering you on at RetailMeNot and QuickBooks is a big fan too and wants to help make your life a little easier. How do we know? The brand has an amazing offer that will help small business owners score some savings this summer.…

View On WordPress

0 notes