#TRADESTATION

Explore tagged Tumblr posts

Text

Which Platform is Good for Commodity Trading?

Commodity trading has grown in popularity as investors seek to diversify their portfolios beyond traditional stocks and bonds. With the rise of online trading platforms, choosing the right platform for commodity trading can make a significant difference in your trading experience and profitability.

Top 10 Platforms for Commodity Trading:

Finding the best commodity trading platform is crucial for beginners looking to trade commodities such as gold, silver, and crude oil. Whether you need a mini futures broker or a comprehensive trading app, the right platform can enhance your trading experience. Here’s a quick overview of the top platforms to help you get started:

1. AvaTrade

Pros: User-friendly, offers both CFDs and futures, extensive educational resources, regulated globally.

Cons: Higher spreads, limited advanced features.

2. Eightcap

Pros: Low fees, ideal for beginners, mobile app available, offers a 20% deposit bonus.

Cons: Limited contract trading tools, fewer educational resources.

3. IG

Pros: Wide market selection, in-depth research reports, user-friendly.

Cons: Higher commissions, complex for beginners.

4. Interactive Brokers

Pros: Access to global exchanges, competitive fees, strong market insights.

Cons: High minimum deposit, steep learning curve.

5. Exness

Pros: Low fees, good educational content, mobile trading available.

Cons: Limited niche market access, complex platform for new traders.

6. CMC Markets

Pros: Low spreads, advanced charting tools, extensive educational content.

Cons: Complex for beginners, limited support for mini futures.

7. E*TRADE Futures

Pros: Low commissions, fast execution, strong research tools.

Cons: Limited educational content, restricted customer support hours.

8. NinjaTrader

Pros: Low-cost futures trading, real-time data, advanced tools for professionals.

Cons: Steep learning curve, limited customer support.

9. TradeStation Futures

Pros: Comprehensive tools for experienced traders, wide market access, strong risk management features.

Cons: High commissions for small traders, not beginner-friendly.

10. Webull Futures

Pros: Commission-free trading, mobile-friendly, real-time data access.

Cons: Limited selection of commodities, minimal educational content.

Each platform offers unique advantages tailored to different trading styles. Beginners should consider factors such as fees, ease of use, available educational resources, and market access before making a choice.

3 notes

·

View notes

Text

trader joes implies the existence of a superior Tradest Joe's as well as a subpar, mediocre trade joe

2 notes

·

View notes

Text

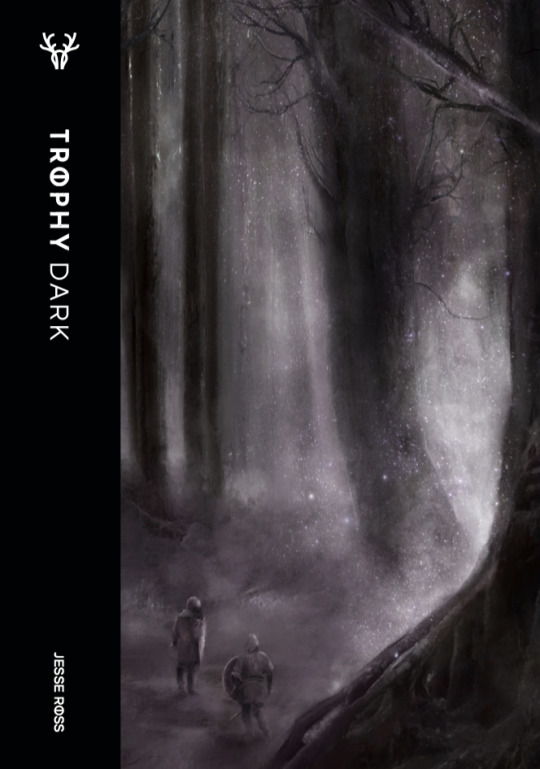

The Worst Thing: Great RPG Mechanics #RPGMechanics Week One

“Imagine the worst thing possible, assume it's true, and go from there.”

— Theodora Crain, The Haunting of Hill House, Season 1: Open Casket

Strong collaboration in play has changed my gaming in the last two decades. I come from the tradest of traddy backgrounds, learning D&D at a wee babe in the late 1970s. I grew up in a gaming community split between roleplayers, miniatures grognards, and classical wargamers. Given how young I was, I almost always played with GMs older than me, in a position of narrative and rule authority. You might get to define your character’s backstory a little, but you had little wiggle room before they’d say, “that’s not how X is.” That became my model and I kept hold of that for years.

The cracks came when, while complaining about prep and the need to revise the campaign gazetteer, my wife pointed out I didn’t need to do that work. She asked me how much of that material meaningfully impacted the table vs. how much I made up on the fly. That was the first break in the dam. The second was Dogs in the Vineyard. That swept everything away with the idea that you could just not prep at all beyond a basic framing concept.

And once you’ve allowed yourself to improv– and trust your own instincts– you can begin to trust others. You can start to respect and even seek out their input. For me it starts with a basic writer’s characterization technique: having the players describe where their characters live. Then once they’ve painted that kind of scene, giving them the space to develop other meaningful features of characters and play.

Like the horrors which await them.

There’s a great admonition in horror that the thing you imagine behind the door is much scarier than what lies behind the door. We have to embrace that moment between the introduction of the horrific and the revelation of the truth. That’s where you get dread, the real horror feeling you can create via games, books, and movies.

Bluebeard’s Bride does this with a simple collaborative concept. The Shiver from Fear move sets this: name the thing you are most afraid will happen, the groundskeeper will tell you how it’s worse than you feared. It engages you, and everyone else, with this imaginative process. You get to set some of the stakes for the moment. And you begin a light, meta-competition with others. How bad can I make it? What can I handle? What would really spook me out?

Jesse Ross’ Trophy Dark takes and builds on this concept, making the whole table complicit in the building of the horror. Rather than a single move, the whole thing game stands atop this: When you attempt a risky task, say what you hope will happen, and ask the GM and the other players what could possibly go wrong. Then gather dice.

There’s a phase of the whole table digging into this question: what’s the worst thing which could happen? Now when you roll, you have a panoply of possible fates to dread. You know what fates could be in store for you. Now we have that dread. You will get to pick your fate, but that’s even worse, because of course you want to make it interesting– and you know what scares you.

19 notes

·

View notes

Text

IBM Retraction

I need to retract the IBM chart and discussion from June 10th. Though I always set my charts to log scale, I toggled it slightly just before capturing the screen the shot, and caused it to revert arithmetic scale. I didn't notice the error. I owe many thanks to Peter Goodburn from WaveTrack International for kindly confirming it.

If you're a retail trader and want institutional-quality Elliott wave analysis, WaveTrack is a must. As much as insist on doing my own analysis, there is only one place I check my work against, and that's with Peter and his team at WaveTrack. None better.

The upshot is that I discovered that my usual data feed, Tradestation, will indeed provide data much farther back than I previously thought, and I was able to build a chart back to 1974. Needless to say, it's much different from my previous analysis, hence the retraction.

Tumblr loves to cut off images. If you can't see IBM's late-1974 low, click on the chart to make it full size.

Scenario #1:

Scenario #2:

Before posting these, my preferred count was #2. However, IBM is acting well, regardless of its lack of volume since the 2020 pandemic low, and is fast approaching a 161.8% Fib extension target at 312.76 which would be an ideal target for the proposed (iii) -- again, not real Elliott nomenclature here.

Currently flirting with the 132.8% Fib extension at 279.76, IBM certainly has enough momentum to blow it away. If it suddenly fails, well, that's an instant red flag. But for now, the facts have changed because my charts have changed, and I apologize for the error.

0 notes

Text

Wie man wirklich tradet: Mehr als nur Kaufen und Verkaufen

Trading klingt verlockend – Gewinne erzielen, während die Märkte schwanken. Doch echtes Trading ist mehr als nur blindes Kaufen und Verkaufen. Es ist eine Kunst, die Wissen, Strategie und Disziplin erfordert.

⸻

1. Lerne die Grundlagen

Bevor du mit dem Trading beginnst, solltest du die Märkte verstehen. Informiere dich über:

• Marktanalyse: Technische (Charts, Indikatoren) und fundamentale (Nachrichten, Ereignisse) Analyse.

• Instrumente: Verstehe, was du tradest – Aktien, Kryptowährungen, Forex oder Rohstoffe.

• Risikomanagement: Bestimme, wie viel Kapital du bereit bist, pro Trade zu riskieren.

⸻

2. Entwickle eine Strategie

Ohne Plan ist Trading Glücksspiel. Eine gute Strategie umfasst:

• Einstiegspunkte: Wann kaufst oder verkaufst du?

• Stop-Loss: Wo ziehst du die Grenze, um Verluste zu begrenzen?

• Gewinnziele: Wann realisierst du Gewinne?

Teste deine Strategie zuerst in einem Demo-Konto, bevor du echtes Geld einsetzt.

⸻

3. Emotionen im Griff behalten

Die größten Fehler beim Trading passieren durch Emotionen:

• Gier: Gewinne maximieren wollen und dabei den perfekten Ausstieg verpassen.

• Angst: Panikverkäufe bei kleinen Rückgängen.

• Geduld: Nicht jedem Trade hinterherrennen – manchmal ist Abwarten die beste Entscheidung.

⸻

4. Disziplin und Weiterbildung

Echter Erfolg im Trading kommt durch konstante Weiterbildung und Disziplin. Analysiere deine Trades, lerne aus Fehlern und bleibe up-to-date mit Markttrends.

⸻

Fazit: Trading ist ein Marathon, kein Sprint

Wirkliches Trading erfordert Zeit, Hingabe und Geduld. Es ist keine Garantie für schnelles Geld, sondern eine Fähigkeit, die über Jahre aufgebaut wird.

Wie siehst du Trading – als Beruf, Hobby oder Risiko? Teile deine Gedanken in den Kommentaren! 📈

0 notes

Text

📊 MACD feuert – doch der Markt zögert!

Bitcoin steht vor dem nächsten Move. Technisch bullisch, aber keiner drückt den Zünder. Was macht das Smart Money?

👀 Beobachtest du oder tradest du schon? 👇 Schreib in die Kommentare: Breakout oder Fakeout?

#Bitcoin#BTC#CryptoNews#MACD#TradingView#CryptoTikTok#FinanzTok#Chartanalyse#KryptoUpdate#Distributionsphase#ChartWise

0 notes

Text

What is Stock Options Trading? Unlocking a Flexible Investment Strategy

Investing doesn’t have to be one-dimensional. With stock options trading, you gain access to a powerful financial instrument that offers flexibility far beyond traditional buying and selling. But what exactly is it?

Defining Stock Options Trading

At its core, stock options trading involves contracts — not shares. These contracts give you the right (but not the obligation) to either:

Buy a stock (via call options), or

Sell a stock (via put options),

at a predetermined price before a specified expiration date. This makes it possible to profit from stock movements without actually owning the underlying asset.

The Flexibility Factor

What makes stock options unique is their versatility. You can use them to:

Speculate on stock price movements.

Hedge your existing stock positions to limit losses.

Generate consistent income through selling options (like covered calls).

Create complex strategies like spreads and straddles that profit in multiple market conditions.

This means you don’t have to rely on stocks going up to make money. You can profit from downward moves, market stagnation, or simply from the passage of time.

Choosing the Best Platform

To take advantage of these strategies, selecting the Best Stock Trading Platform is crucial. You’ll need a broker that offers:

Advanced trading tools for multi-leg strategies.

Access to options chains with customizable filters.

Detailed analytics and risk graphs.

Educational webinars and courses on options.

Some excellent platforms for intermediate to advanced traders include:

Tastytrade: Built specifically for options strategies and active traders.

Interactive Brokers: Known for its low fees and global market access.

TradeStation: Offers both beginner-friendly and advanced trading tools.

Final Thoughts

Stock options trading opens the door to strategies that fit your unique risk tolerance and market view. Whether you’re hedging your investments or aiming to profit from volatility, it’s a tool worth exploring. Just remember, always use the Best Stock Trading Platform for a smarter, safer trading experience.

1 note

·

View note

Text

Online Trading Platform Market Report 2032: Key Drivers, Challenges & Growth Analysis

Online Trading Platform Market size was valued at USD 9.58 Billion in 2023 and is expected to grow to USD 18.8 Billion by 2032 and grow at a CAGR of 8.18% over the forecast period of 2024-2032

The online trading platform market is witnessing remarkable growth, fueled by technological advancements and increasing investor participation. The rise of digital trading solutions has revolutionized the way individuals and institutions trade across global financial markets.

The online trading platform market continues to expand as more investors seek convenient and secure ways to trade stocks, forex, cryptocurrencies, and other financial instruments. Enhanced accessibility, algorithmic trading, and AI-driven analytics are further transforming the landscape, making online trading more efficient and user-friendly than ever before.

Get Sample Copy of This Report: https://www.snsinsider.com/sample-request/3347

Market Keyplayers:

MetaQuotes Software Corp. (MetaTrader 4, MetaTrader 5)

TD Ameritrade (thinkorswim, Mobile Trader)

Interactive Brokers (Trader Workstation, IBKR Mobile)

Charles Schwab Corporation (Schwab Mobile, StreetSmart Edge)

E*TRADE (Power ETRADE, ETRADE Pro)

Saxo Bank (SaxoTraderGO, SaxoInvestor)

Robinhood Markets Inc. (Robinhood Web, Robinhood App)

Fidelity Investments (Active Trader Pro, Fidelity Mobile)

IG Group (IG Trading Platform, ProRealTime)

Plus500 (Plus500 WebTrader, Plus500 App)

CMC Markets (Next Generation Platform, CMC Mobile Trading App)

eToro (eToro CopyTrader, eToro WebTrader)

Binance (Binance Exchange, Binance DEX)

Coinbase Global, Inc. (Coinbase Pro, Coinbase Wallet)

TradingView (TradingView Web Platform, TradingView Mobile App)

Zerodha (Kite, Coin by Zerodha)

Ally Invest (Ally Invest LIVE, Ally Invest Mobile)

TradeStation (TradeStation Platform, TradeStation Mobile)

OANDA Corporation (OANDA fxTrade, OANDA Mobile)

IQ Option (IQ Option Platform, IQ Option Mobile) and others

Key Market Trends Driving Growth

1. Surge in Retail Trading and Investment

The rise of commission-free trading platforms and easy access to financial markets have led to a surge in retail trading, attracting a new generation of investors.

2. Integration of Artificial Intelligence and Automation

AI-powered trading bots, predictive analytics, and automated investment strategies are enhancing decision-making and efficiency in online trading.

3. Growth of Cryptocurrency and Blockchain-Based Trading

The increasing adoption of cryptocurrencies has led to the development of specialized trading platforms, offering decentralized and secure trading experiences.

4. Expansion of Mobile and App-Based Trading

The shift towards mobile trading applications allows users to execute trades, monitor portfolios, and access real-time market data on the go.

5. Regulatory Compliance and Security Enhancements

With the rise of online trading, regulatory bodies are implementing stricter compliance measures to ensure transparency and security in digital trading platforms.

Enquiry of This Report: https://www.snsinsider.com/enquiry/3347

Market Segmentation:

By Component

Solution

Services

Consulting

Design & Implementation

Training & Support

By Technology

Machine Learning

Natural Language Processing

Robotic Process Automation (RPA)

Virtual Agents

Computer vision

Others

By Deployment

Cloud-based

On-premise

By Organization Size

Large Enterprise

SME

By Application

IT Operations

Business Process Automation

Application Management

Content Management

Security Management

Others

By Vertical

BFSI

Healthcare

Retail

IT & Telecom

Communication and Media & Education

Manufacturing

Logistics, and Energy & Utilities

Others

Market Analysis and Growth Potential

Key Drivers and Challenges

Drivers:

Growing financial literacy and awareness

Demand for diversified investment opportunities

Advancements in trading technologies

Challenges:

Cybersecurity threats and fraud risks

Regulatory complexities across different regions

Market volatility and risk management concerns

Future Prospects and Opportunities

1. Rise of Decentralized Finance (DeFi) and Smart Contracts

DeFi platforms and smart contracts are enabling trustless, transparent, and automated trading experiences.

2. Enhanced AI-Powered Trading Strategies

AI and machine learning algorithms will continue to optimize trading performance, mitigate risks, and provide personalized investment insights.

3. Expansion into Emerging Markets

The online trading market is expected to see increased penetration in emerging economies, where digital finance adoption is accelerating.

4. Introduction of More ESG-Focused Investment Platforms

Sustainable and ethical investment platforms will cater to the growing demand for environmental, social, and governance (ESG)-focused trading opportunities.

Access Complete Report: https://www.snsinsider.com/reports/intelligent-process-automation-market-3347

Conclusion

The online trading platform market is set to witness sustained growth, driven by technological advancements, evolving regulatory landscapes, and increasing retail investor participation. By integrating AI, blockchain, and mobile-first solutions, trading platforms will continue to enhance accessibility, efficiency, and security, shaping the future of digital investing.

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Contact Us:

Jagney Dave - Vice President of Client Engagement

Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK)

#Online Trading Platform Market#Online Trading Platform Market Scope#Online Trading Platform Market Size#Online Trading Platform Market Growth#Online Trading Platform Market Trends

0 notes

Text

NVSTly Brokerage Integration: The Future of Social Trading

Automated Trade Tracking & Sharing, Verify Accuracy, and Elevate Your Social Investing Experience with NVSTly’s Brokerage Integration.

In the fast-evolving world of investing, traders are constantly looking for ways to streamline their trading experience, share insights, and build transparency in the community. NVSTly, the social investing platform, has taken a significant step forward with its brokerage integration feature. This game-changing addition allows traders to automatically track and share their trades with 100% accuracy, creating an ecosystem of trust and transparency for both casual investors and top traders.

What is NVSTly's Brokerage Integration?

NVSTly's brokerage integration enables users to securely connect their brokerage accounts to the platform, allowing trades to be automatically recorded, tracked, and shared in real time. This means no more manual trade entries or missing crucial details—every trade is verified directly from the broker, ensuring authenticity.

Currently, NVSTly supports Webull, but we're actively working on adding support for Charles Schwab (ThinkorSwim), Robinhood, Moomoo, TradeStation, and more. As we expand, traders from multiple brokerages will be able to seamlessly integrate their accounts, making NVSTly the go-to platform for automated trade tracking and social investing.

How Does It Work?

Securely Link Your Broker – Users can connect their brokerage account to NVSTly through a secure authentication process.

Automatic Trade Tracking – Every trade executed in the linked brokerage account is automatically recorded on NVSTly, including trade details such as asset type, entry/exit price, time, and trade status.

Real-Time Trade Sharing – Users can choose to share trades instantly with their followers, to social media, or Discord.

100% Accuracy & Verification – Since all trades are pulled directly from the brokerage account, the data is fully verified and cannot be altered, ensuring complete transparency.

Why Are Traders Linking Their Broker Accounts?

NVSTly’s brokerage integration provides immense value for traders of all levels. Here’s why thousands are choosing to connect their broker:

1. No More Manual Entry

Keeping track of trades manually is time-consuming and prone to errors. With NVSTly, all trades are logged automatically, eliminating mistakes and saving traders valuable time.

2. 100% Trade Accuracy & Transparency

Top traders and signal providers on NVSTly can showcase their trades with full credibility, as every trade is verified directly from the broker. This builds trust within the community and ensures followers are seeing real, authentic trades, not fabricated ones.

3. Ideal for Signal Providers & Analysts

Signal providers and market analysts can effortlessly share their trades in real-time, giving their subscribers confidence in their strategies. The auto-sharing feature means followers get instant updates, allowing them to act quickly on trading opportunities.

4. Social Traders Can Learn From Verified Trades

Unlike traditional investing platforms where traders post trade ideas or screenshots, NVSTly ensures that every trade shown is real and executed. Social traders can analyze the moves of top investors and gain insights from actual, successful trading strategies.

What’s Next? 1-Click Copy Trading is Coming Soon

One of the most exciting upcoming features of NVSTly is 1-Click Copy Trading. Once we complete support for more brokerages, users will be able to automatically copy the trades of top-performing traders in real time. This will allow newer traders to follow experienced professionals and benefit from their strategies effortlessly.

The Future of Social Investing Starts Here

NVSTly's brokerage integration is revolutionizing the way traders track, share, and analyze trades. By providing automated tracking, trade verification, and real-time sharing, we are creating a transparent and trustworthy environment for traders, signal providers, and social investors.

If you're ready to take your trading experience to the next level, link your Webull account today and stay tuned as we expand our brokerage integrations to Charles Schwab (ThinkorSwim), Robinhood, Moomoo, TradeStation, and more!

NVSTly is available for free on web, mobile devices (iOS & Google Play), and is fully integrated with Discord via a unique bot- the only of it's kind and available to any server or trading community on Discord. Or feel free to join a community of over 50,000 investors & traders on our Discod server.

1 note

·

View note

Text

Maximize Your Trading Performance with QuantVPS ⚡

In the world of trading, speed and reliability are everything. Whether you're a professional trader or just starting out, ensuring that your trades are executed quickly and reliably is essential to staying ahead in the competitive financial markets. At QuantVPS, we offer VPS hosting for trading that is designed to meet the needs of both novice and experienced traders alike. Our solution provides ultra-low latency, optimized performance, and 24/7 uptime, so you can trade with confidence, knowing that your trades are executed as fast as possible.

About QuantVPS 🌟

At QuantVPS, we are passionate about empowering traders with the best tools to succeed. We specialize in providing high-performance VPS hosting for trading, with a focus on ultra-low latency, reliability, and seamless integration with top trading platforms. Our goal is to offer traders the infrastructure they need to execute trades quickly and efficiently, no matter the time of day.

Hosted on premium servers located in financial hubs like Chicago and New York, our VPS solutions are designed for traders who demand speed and precision. Whether you're into Futures, Forex, or automated trading, our VPS servers provide the perfect environment to run your strategies with minimal delay.

Our Mission: Speed, Reliability, and Performance ⚡

QuantVPS was built with one mission in mind: to help traders optimize their performance by providing VPS hosting that is both fast and reliable. Our infrastructure is designed to offer ultra-low latency (as low as 1ms), ensuring that your trades are executed in real-time, without delays.

We understand that the financial markets operate 24/5, and as a trader, you can't afford to miss a trade due to connection issues or downtime. That's why our VPS servers are equipped with robust features that keep your trading platform up and running at all times. Our commitment to providing high-quality service means that we’re here to support your trading journey every step of the way.

Why Choose Trading VPS? 🖥️

If you’re wondering why trading professionals choose VPS hosting for trading, the answer lies in the speed, stability, and reliability that a VPS offers. Here’s why you should consider using a VPS server for trading:

1. Ultra-Low Latency for Faster Execution ⏱️

The most critical aspect of trading is speed. A second's delay in the market can make all the difference between profit and loss. With our Trading VPS, you get ultra-low latency (as low as 1ms), ensuring that your trades are executed without lag. This lightning-fast speed is crucial for high-frequency traders, automated systems, and anyone relying on quick order execution to capture market opportunities.

2. 24/7 Uptime for Uninterrupted Trading 🔒

The financial markets never sleep, and neither do we. Our VPS hosting for trading ensures that your trading system is always online and ready to execute your trades. Hosted on high-performance servers, we offer 24/7 uptime and robust infrastructure to ensure that your trades are processed without interruption, even during peak market hours.

3. Secure and Reliable Hosting 🔐

Security is a top priority when trading online. QuantVPS offers a secure and stable environment for your trading system. With regular backups, encryption, and the latest security protocols in place, your data and strategies remain safe from cyber threats, allowing you to focus on what matters most: trading.

4. Optimized for Leading Trading Platforms 📊

QuantVPS is fully compatible with popular trading platforms like NinjaTrader, MT4, MT5, TradeStation, and QuantTower. Whether you’re trading Forex, Futures, or using automated strategies, our VPS hosting for trading is optimized for these platforms, making it easier to set up and execute your trades without hassle.

Why QuantVPS Is the Right Choice for Traders 🌍

With so many VPS providers available, why should you choose QuantVPS? Here’s why we stand out:

Low Latency for Quick Execution: Our VPS servers offer one of the lowest latencies in the industry, giving you the speed needed for real-time trading.

Reliability & Stability: Our VPS hosting for trading ensures your platform is always up and running, with 99.99% uptime reliability.

Security & Data Protection: We take security seriously, offering secure VPS hosting with regular updates and backups to protect your valuable data.

Scalable Plans: Whether you're just starting or need high-powered resources, our VPS plans are customizable to meet your needs.

Conclusion: Elevate Your Trading Experience with QuantVPS 🚀

In the fast-moving world of financial markets, using a VPS server for trading is no longer just an option; it's a necessity. By choosing QuantVPS, you get access to the speed, security, and reliability that professional traders demand. Our ultra-low latency, top-tier hosting, and seamless integration with trading platforms ensure that your trades are executed quickly and without interruption.

Take your trading to the next level with QuantVPS. Whether you're trading Forex, Futures, or using automated strategies, our VPS hosting for trading will provide the performance and reliability you need to succeed. Don’t let slow execution or downtime hold you back—choose QuantVPS and experience the difference in your trading performance today! 🌟

1 note

·

View note

Text

Top 10 Commodity Trading Platforms and Brokers in 2025: A Comprehensive Guide

As we move into 2025, commodity trading continues to rise in popularity, offering investors the chance to diversify their portfolios and protect against market volatility. Whether you’re trading metals like gold and silver, energy resources like crude oil, or agricultural products such as wheat and coffee, selecting the right trading platform is essential.

The digital transformation of the commodities market has made it easier than ever to trade online, with platforms offering a variety of tools and features for traders of all skill levels. In this guide, we break down the best commodity trading websites and brokers for 2025, highlighting what to look for when choosing the right platform.

What is Commodities Trading?

Commodities trading is the process of buying and selling raw materials or primary agricultural products such as oil, gold, and corn. Traders predict the future price movements of these commodities and make profits based on their predictions. This form of trading offers diversification and hedging opportunities, making it a popular choice for many investors.

Understanding Commodity Brokers:

Commodity brokers are firms that facilitate the buying and selling of commodities, acting as intermediaries between traders and the markets. They provide the necessary tools, research, and risk management services to help traders make informed decisions. Whether you’re a novice or an experienced trader, commodity brokers help streamline the trading process, offering access to vital information and tools.

How to Choose the Best Commodity Broker:

Selecting the right broker for commodity trading depends on several factors:

Regulation & Trust: Opt for brokers regulated by respected authorities like the CFTC or FCA for security and transparency.

Experience Level: Choose brokers that match your level of expertise, offering educational resources for beginners or advanced tools for experienced traders.

Range of Commodities: Ensure the broker offers the commodities you wish to trade, such as metals, energy, or agriculture.

Fees & Commissions: Review the broker’s fee structure, including spreads, commissions, and platform fees.

Platform Features: Look for a platform that’s easy to use, offers real-time data, and provides trading tools like charting and order execution.

The 10 Best Commodity Trading Platforms for 2025

AvaTrade – Great for beginners, with educational resources and a user-friendly platform.

Eightcap – Known for competitive fees and mobile trading options, perfect for traders on the move.

IG – Offers a wide range of markets and strong research tools, ideal for both novice and experienced traders.

Interactive Brokers – Best for active traders, offering access to global markets and advanced tools.

Exness – Offers low fees on commodities and educational content for beginners.

CMC Markets – Offers advanced charting and analysis tools for active traders.

E*TRADE Futures – Best for futures traders, with low commissions and in-depth research tools.

NinjaTrader – Specializes in futures trading with powerful charting tools and real-time data.

TradeStation Futures – Excellent for experienced traders looking for robust tools and risk management strategies.

Webull Futures – Known for commission-free trading and a mobile-friendly platform ideal for beginners.

Conclusion

The right commodity trading platform can make all the difference in achieving your financial goals. Whether you’re a beginner or a seasoned trader, platforms like AvaTrade, Eightcap, and IG offer the tools and features needed to succeed in 2025. Dive into the world of commodities trading and start building a diversified portfolio today.

1 note

·

View note

Text

Build Real Trading Strategies Using AI, Without Knowing How to Code (EARLY RELEASE) How many times have you told yourself that if you could just code, then that would solve all your trading problems. Remove all decision. Remove emotions. Never miss a trade because you were sick, traveling, or just not paying attention. How many times have you tried to learn to code, but never made it far enough to build live trading systems? How many ideas do you see everyday that you'd like to code up and see if it works? Well now's the time my friend! What you'll get: Proven System Building with AI framework The full code and walk through of how to implement every strategy we build (again you don't need to know how to code) AI Moves lightning fast, as new platforms and technology is released we'll update to the latest This is the same framework that we use to build live production trading systems for Hedge Funds and Family Offices. The same framework that we've built 15 live trading strategies with new ones coming on line regularly. Learn how to build custom AI's not just for trading but to help you everywhere in your life. Learn how to become highly competent with AI taking your trading, investing and business to the next level. Learn to build systems to algorithmically trade for you on any platform. Tradingview, Tradestation, Interactive Brokers, Think or Swim, Quantconnect, Python, Multicharts and any other platforms that allow API access or external trading. We'll use numerous coding languages, but unless you want to, there's no reason to get caught up in needing to know how to code. C#, Python, Pinescript, Easylanguage, Thinkscript, C++, Java any programming language. About Course: How many times have you told yourself that if you could just code, then that would solve all your trading problems? Remove all decision. Remove emotions. Never miss a trade because you were sick, traveling, or just not paying attention. How many times have you tried to learn to code, but never made it far enough to build live trading systems? How many ideas do you see every day that you’d like to code up and see if it works? What you’ll get: Proven System Building with AI framework The same framework that we’ve built 15 live trading strategies with new ones coming on line regularly. Learn how to build custom AI’s not just for trading but to help you everywhere in your life. Learn how to become highly competent with AI taking your trading, investing and business to the next level. Learn to build systems to algorithmically trade for you on any platform.

0 notes

Text

Thị trường chứng khoán Mỹ giảm mạnh sau quyết định hạ lãi suất của Fed

Fed hạ lãi suất nhưng không làm thị trường hài lòng

Cục Dự trữ Liên bang Mỹ (Fed) đã đáp ứng kỳ vọng của thị trường khi giảm lãi suất 25 điểm cơ bản (bps), đưa phạm vi mục tiêu xuống 4,25% - 4,5%. Tuy nhiên, dự báo của Fed về tương lai khiến các nhà đầu tư thất vọng, với chỉ hai lần giảm lãi suất trong năm 2025, thấp hơn so với kỳ vọng trước đó.

Tâm lý nhà đầu tư bị thử thách bởi triển vọng “diều hâu”

Theo biểu đồ "dot plot" mới nhất, Fed cho thấy thái độ thận trọng trước tình hình lạm phát dai dẳng và nền kinh tế vững mạnh. Điều này khiến các nhà đầu tư lo ngại về khả năng Fed có thể thắt chặt chính sách trở lại nếu các yếu tố vĩ mô không thuận lợi.

Thị trường chứng khoán Mỹ lao dốc

Ngay sau thông báo của Fed, các chỉ số chính trên thị trường chứng khoán Mỹ giảm sâu. Chỉ số Dow Jones mất hơn 1.100 điểm, nối dài chuỗi ngày giảm kỷ lục kể từ năm 1974. S&P 500 và Nasdaq Composite cũng giảm mạnh lần lượt 3% và 3,6%.

Bình luận từ các chuyên gia

David Russell, Giám đốc chiến lược tại TradeStation, nhận định: “Fed đã quyết định không chiều lòng thị trường. Với áp lực lạm phát cao hơn và tỷ lệ thất nghiệp giảm, họ không có lý do để tiếp tục lập trường mềm mỏng vào năm sau.”

Byron Anderson, từ Laffer Tengler Investments, nhấn mạnh: “Fed đã bảo vệ nền kinh tế quá mức trong thời gian qua. Giờ đây, sự chú ý chuyển sang chính sách tài khóa và tác động từ chính quyền mới.”

Việc Fed giảm lãi suất nhưng giữ lập trường thận trọng đã làm gia tăng tâm lý bất an trên thị trường. Trong bối cảnh lạm phát vẫn cao và những bất ổn vĩ mô tiềm tàng, nhà đầu tư cần tiếp tục quan sát chính sách tài khóa để đánh giá triển vọng kinh tế Mỹ.

0 notes

Text

Mastering Day Trading: Tips and Techniques for Success

Introduction to Day Trading: Understanding the Basics

Day trading, a popular method among active traders, involves buying and selling financial instruments within a single trading day. The aim is to capitalize on small price movements. This approach requires grasping key principles and possessing essential tools for success. Understanding the basics of day trading is crucial for anyone looking to explore this world.

Key Concepts in Day Trading

Volatility and Liquidity: Day traders thrive on volatility, as it provides opportunities for profit through price swings. Liquidity allows traders to enter and exit positions with ease, minimizing market impact.

Risk and Reward: The primary goal is to maximize profits while minimizing risks. Traders often use a risk-reward ratio to evaluate potential trades and manage their investment funds efficiently.

Leverage: To increase potential returns, many traders use leverage, which involves borrowing capital to gain greater market exposure. It is vital to understand the risks involved, as leverage can amplify both gains and losses.

Tools and Resources

Trading Platforms: An intuitive platform with real-time data, charting tools, and customizable features is essential for executing trades effectively.

Technical Analysis: Using charts and patterns, traders predict future price movements. Techniques such as trend analysis and momentum indicators assist in making informed decisions.

News and Market Sentiment: Staying updated on economic events and market sentiment helps traders anticipate potential market shifts. Reliable news sources and trading forums provide valuable insights.

Developing a Strategy

Day trading demands a well-defined strategy. Key elements include:

Entry and Exit Points: Establish criteria for entering and exiting trades, such as specific price levels or technical indicators.

Risk Management: Implement stop-loss orders to limit potential losses and secure profits when predefined levels are met.

Practice and Discipline: Consistent practice through simulated trading or paper trading builds confidence. Discipline is crucial in adhering to strategies and avoiding impulsive decisions.

By understanding these foundational aspects, a trader can better navigate the complexities of day trading, setting a foundation for potential success.

Setting Up Your Trading Environment: Tools and Platforms

Trading success begins with an organized and well-equipped environment. Selecting the appropriate tools and platforms is crucial for day traders looking to thrive in this fast-paced arena. Here are several critical components to establish a superior trading setup:

Key Tools for Day Trading

High-Performance Computer:

A swift computer with sufficient RAM and a high-speed processor is essential. Slow devices can result in latency issues and missed opportunities.

Reliable Internet Connection:

A stable and fast internet connection is paramount. Any interruptions could delay crucial trades, impacting profitability.

Multiple Monitors:

Utilizing multiple screens aids in monitoring various data streams simultaneously. This setup aids in managing several trading platforms and analyzing charts more effectively.

Essential Software and Platforms

Trading Platforms:

Selecting the right trading platform tailored to individual needs is crucial. Platforms like MetaTrader, TradeStation, and Thinkorswim offer a range of features catering to diverse trading strategies.

Charting Software:

Comprehensive charting tools such as TradingView enable traders to conduct technical analyses accurately. Better visualization aids in identifying patterns and making informed predictions.

Brokerage Services:

Opting for a reputable and reliable broker ensures seamless execution of trades. Evaluating commission fees and customer support is vital when making this choice.

Managing the Trading Ecosystem

"A well-structured environment enhances focus and efficiency during trading sessions."

Organized Trading Desk:

Arranging a clutter-free workspace promotes concentration and proficiency. All necessary equipment should be easily accessible to minimize distractions.

News and Data Feeds:

Keeping informed with real-time news feeds and data provides a competitive edge. Market data subscriptions can offer heightened insights into market movements.

By strategically equipping the trading environment with the right technology and tools and ensuring seamless connectivity and access to data, traders can enhance their performance and position themselves for success in the competitive world of day trading.

Developing a Winning Day Trading Strategy

To achieve success in day trading, traders must develop a robust strategy that aligns with their financial goals and risk tolerance. This involves understanding market dynamics and implementing specific tools and techniques.

Define Clear Objectives Successful traders begin with a clear statement of what they aim to achieve. Whether it's steady income, capital growth, or diversification, having well-defined objectives allows them to measure success and adapt strategies as needed.

Conduct Thorough Market Research Rigorous research forms the backbone of any fruitful trading strategy. Traders should acquaint themselves with diverse asset classes and understand how global events affect price movements. Staying informed about financial news, major economic indicators, and announcement dates can provide valuable insights.

Leverage Technical Analysis Tools To maintain a competitive edge, day traders utilize technical analysis tools. Chart patterns, Fibonacci retracement, moving averages, and other technical indicators help in identifying entry and exit points, trend direction, and potential reversals. Continual learning and adaptation to new tools are crucial.

Implement Risk Management Techniques Managing risk effectively can mean the difference between profit and loss. Setting stop-loss orders, determining position sizes carefully, and using a risk-reward ratio help traders mitigate potential losses. Adopting a disciplined approach helps maintain stability in volatile markets.

Evaluate Performance Consistently Successful traders regularly assess their strategies and trading performance. They maintain a trading journal to record trades, monitor decision-making processes, and analyze outcomes. This evaluation ensures that traders learn from past mistakes and refine strategies over time.

Stay Emotionally Detached Emotional control is essential in executing a strategic plan without deviation. Fear and greed can lead to irrational decisions; therefore, traders should stick to their plan and remain objective, even in the face of loss or unexpected market movements.

Following these structured steps allows day traders to develop a comprehensive strategy designed for long-term success.## Key Technical Analysis Techniques for Day Traders Day traders employ a variety of technical analysis techniques to make quick, informed decisions. Understanding these key techniques can enhance success in the fast-paced trading environment. ### 1. **Chart Patterns** Day traders analyze chart patterns to forecast future price movements. These patterns, such as head and shoulders, triangles, and flags, provide insights into potential trend reversals or continuations. By recognizing these formations, traders can anticipate market behavior and adjust their strategies accordingly. ### 2. **Candlestick Analysis** Candlestick charts are vital tools for day traders, depicting price action over specific time periods. Candlestick patterns, such as doji, hammer, and engulfing patterns, offer clues about market sentiment. This analysis aids traders in predicting short-term price reversals or trend continuations, enhancing timing and entry points. ### 3. **Moving Averages** Moving averages smooth price data to identify trends over time. Day traders often use simple moving averages (SMA) and exponential moving averages (EMA) to detect trend directions and potential reversal points. Crossovers of short-term and long-term moving averages are common signals for trade entries or exits. ### 4. **Relative Strength Index (RSI)** The RSI is a momentum oscillator that measures the speed and change of price movements. It helps day traders determine overbought or oversold conditions. An RSI above 70 often indicates a market is overbought, while below 30 suggests oversold conditions, signaling potential reversal opportunities. ### 5. **Bollinger Bands** Bollinger Bands consist of a moving average and standard deviation lines that form a channel around price action. Day traders use these bands to identify volatility and potential breakout points. When prices touch the upper or lower bands, it often signals high volatility and potential trend reversals. ### 6. **Volume Analysis** Volume analysis examines trading volume alongside price movements. High volume typically confirms trends, indicating strong market interest. Day traders use volume analysis to validate breakouts or reversals, ensuring they align trades with the market's underlying strength. > **Note:** Mastery of these techniques requires continuous practice and adaptation. Day traders should adopt a disciplined approach, tailoring strategies to specific markets or instruments.

Risk Management: Protecting Your Investments

Risk management in day trading is pivotal to safeguarding investments. Traders must adopt a robust risk management strategy that minimizes potential losses and maximizes gains, ensuring longevity in the trading landscape. The foundation of risk management rests on several key principles:

Diversification: Spread investments across various assets to mitigate the impact of a downturn in any single security. Diversification reduces the potential of significant losses from a single trade.

Position Sizing: Calculate the appropriate amount to invest per trade relative to the total capital. Typically, a trader should risk no more than 1-2% of their capital on any single trade to protect against substantial losses.

Stop-Loss Orders: Implement stop-loss orders to automatically sell a security when it reaches a predetermined price. This tool helps limit losses by controlling the downside risk in volatile markets.

Risk/Reward Ratio: Adhere to a favorable risk/reward ratio in trades. A common strategy is maintaining a ratio of at least 1:2, which ensures potential rewards outweigh the risks undertaken.

Emotional Discipline: Maintain emotional detachment from trading decisions. Emotional or impulsive trading can lead to decisions that overlook sound risk management practices.

"Managing risks means managing emotions," emphasizes the importance of a level-headed approach to trading.

Regular Review and Adaptation: Continuously review and adjust strategies in response to market conditions and personal performance analysis. Keeping a trading journal can be instrumental in tracking performance and spotting patterns or mistakes over time.

Stay Informed: Regularly update knowledge on market trends and news. Awareness of market shifts and economic indicators allows traders to make informed decisions that align with their risk management plan.

Professionals utilize these strategies to fortify their portfolios against market unpredictabilities, ensuring consistency and protection.

Psychological Aspects of Day Trading: Staying Disciplined

Day trading demands a high level of discipline and mental fortitude. Traders must cultivate the ability to manage their emotions and maintain focus amidst fluctuating markets.

Key Psychological Aspects

Emotional Control: A successful trader must learn to control emotions such as fear and greed. Emotional decisions can lead to impulsive trades that deviate from a well-crafted strategy.

Developing Patience: Patience is necessary for waiting for the right trading opportunities. Traders must resist the urge to jump into trades that do not align with their strategy.

Handling Stress: The fast-paced and high-stakes environment of day trading can be stress-inducing. It is crucial that traders implement stress-reduction techniques, such as regular breaks or mindfulness exercises, to maintain clarity of thought.

Avoiding Overconfidence: Success can lead to overconfidence, which may result in risky behavior and deviation from trading plans. Continuous self-assessment helps in staying grounded.

Techniques for Staying Disciplined

Set Clear Goals: Clearly defined financial goals and risk management strategies anchor decision-making processes in logic over emotion.

Utilize a Trading Plan: Adhering to a structured trading plan helps in making objective decisions. It serves as a roadmap to follow in different market scenarios.

Maintain a Trading Journal: Keeping a record of trades, including successes and mistakes, offers insights into patterns and helps improve future performance.

Implementing Stop-Loss Orders: Stop-loss orders guard against significant losses, allowing traders to stick to predetermined exit strategies without emotion.

Continuous Learning: Commitment to learning keeps traders informed and confident, reducing susceptibility to emotional trades.

“Discipline is the bridge between goals and accomplishment.” This quote highlights the integral role of discipline in achieving trading success.

Monitoring Psychological Well-being

Regular self-evaluation of emotions and mental state can help traders remain disciplined. Seeking peer support or professional guidance may also help in managing psychological challenges effectively, thereby enhancing overall performance in day trading.

Identifying Trends and Patterns in Market Data

Identifying trends and patterns in market data is pivotal for any day trader seeking success. The ability to discern these patterns aids in making informed decisions, reducing risks, and optimizing profits. Load up real-time market data since it is the cornerstone of analyzing trends accurately.

Understanding Market Structure

Price Movements: Price movements often indicate the prevailing sentiment in the market. Analyzing high and low points over different time frames helps in recognizing whether a market is trending upward, downward, or sideways.

Volume Analysis: Volume, or the number of shares/units traded, reflects the strength of a price trend. Higher volume during price spikes signals strong trends, while declining volume suggests a weakening trend.

Tools for Trend Identification

Moving Averages: Commonly used moving averages include simple (SMA) and exponential (EMA). These averages help smooth out price data, making it easier to spot trends by highlighting reversals and continuations.

Trend Lines and Channels: Trend lines are straight lines drawn up or down to connect significant prices, demonstrating a trend's direction. Channels, on the other hand, are two parallel trend lines providing clearer areas of potential support and resistance.

Pattern Recognition

Chart Patterns: Traders often recognize patterns such as head and shoulders, flags, and cup and handle, which can predict future price movements. Patterns often signify the culmination of previous movements and the commencement of new trends.

Candlestick Patterns: Candlestick charts offer detailed visual insights. Patterns like Doji, Hammer, and Engulfing can provide early warning signals for reversals or continuations.

"Successful traders always stay ahead by spotting trends and patterns early, adapting to changes swiftly, and maintaining a structured approach in their analysis."

Analyzing Indicators

MACD (Moving Average Convergence Divergence): This momentum indicator helps in spotting changes in the strength, direction, momentum, and duration of a trend, distinguishing the potential buy and sell signals.

Relative Strength Index (RSI): RSI measures recent price changes to evaluate overbought or oversold conditions, aiding traders in identifying possible reversal points.

Regularly updating skills and knowledge in identifying trends and patterns allows traders to maximize possibilities effectively.

Leveraging Technology: Using Trading Software Effectively

In the fast-paced world of day trading, leveraging the right technology is paramount for achieving success. Trading software offers sophisticated tools and platforms that can enhance decision-making, optimize efficiency, and manage risk. Traders must understand and utilize these technologies to gain a competitive edge in the market.

Key Features of Trading Software

Real-time Market Data: Access to live quotes, charts, and market news is essential. Trading software that provides real-time data helps traders react promptly to market movements.

Technical Analysis Tools: Software equipped with technical indicators, charting capabilities, and drawing tools aids in conducting detailed technical analyses. These features enable traders to evaluate market trends and patterns.

Automated Trading Systems: Many platforms offer automation, allowing traders to set predefined rules for entering and exiting trades. Automated systems can execute trades without human intervention, reducing emotional decision-making.

Risk Management Features: Leading trading platforms incorporate risk management tools such as stop-loss orders and profit-taking options. These functions help manage potential losses and protect gains.

Customizable Alerts and Notifications: Tailored alerts notify traders of specific market conditions or when certain thresholds are met. This feature ensures traders remain updated even when they are not actively monitoring screens.

Maximizing Trading Software Efficiency

Platform Familiarity: Traders should take time to learn and explore all features of the software they intend to use. Understanding the full capabilities enables better utilization.

Regular Software Updates: Frequent updates by software providers often include enhanced features and improved performance. Staying current ensures traders benefit from the latest advancements.

Enhanced Security Protocols: Security is crucial for safeguarding sensitive data. Traders should ensure their software includes robust security measures such as encryption and two-factor authentication.

“The ability to leverage technology and trading software effectively distinguishes successful traders from the rest. Mastery of these tools is vital for optimizing performance and sustaining competitiveness in the marketplace.” — Industry Expert

Ultimately, the efficacy of trading software lies in its ability to offer traders comprehensive tools with user-friendly interfaces. As technology evolves, staying informed and adapting to new tools is a necessary strategy for success in day trading.

Common Mistakes to Avoid in Day Trading

In the high-stakes world of day trading, novice and experienced traders alike may encounter numerous pitfalls that can hinder their success. Recognizing these common mistakes is crucial to minimizing risks and improving outcomes.

1. Lack of a Trading Plan

Traders frequently enter the market without a well-defined strategy:

Ignoring Entry and Exit Points: Failure to determine precise moments for buying and selling can lead to impulsive decisions.

Unrealistic Profit Targets: Setting unattainable goals often results in unwarranted risk-taking.

2. Overleveraging

Excessive use of leverage can quickly magnify losses:

Underestimating Market Volatility: Leverage can enhance gains, but it also amplifies losses during volatile market conditions.

Inadequate Risk Management: Overleveraged positions can lead to margin calls and significant capital depletion.

3. Neglecting Research and Analysis

Insufficient preparation leads to suboptimal trading decisions:

Ignoring Fundamental News: Market-moving events often impact security prices, and failure to monitor these can lead to unexpected losses.

Relying Solely on Technical Indicators: Overdependence on patterns and signals without comprehensive analysis limits understanding.

4. Emotional Trading

Trading decisions based on emotions rather than logic can be detrimental:

Fear and Greed: Emotional extremes cause traders to exit too early or enter too late, missing out on potential gains.

Failure to Stick to a Plan: Deviating from a predetermined strategy often results in poor performance and increased losses.

5. Overtrading

Engaging in too many trades often reduces profitability:

Chasing the Market: Impulsive trades to capitalize on every minor price movement increases exposure to unnecessary risk.

Neglecting Costs and Fees: Frequent trading incurs high costs, which erode profits over time.

Understanding these common mistakes is imperative for day traders aiming to increase their profitability and achieve long-term success in a competitive environment.

Continuing Education: Staying Updated with Market Changes

To excel in the ever-evolving world of day trading, ongoing education is indispensable, as market dynamics are subject to continuous shifts influenced by economic, political, and technological developments. Day traders must remain vigilant and informed to make profitable decisions.

Enroll in Specialized Courses Engaging in professional courses or webinars tailored to day trading can provide new insights and strategies. These programs, often offered by experienced traders and financial experts, cover topics such as technical analysis, chart patterns, and risk management. Institutions and online platforms provide an array of options tailored to diverse skill levels.

Subscribe to Financial Journals and Newsletters Access to current market analysis and forecasts is essential for staying informed. Subscribing to reputable financial journals or newsletters delivers timely updates directly to traders' inboxes. Publications such as The Wall Street Journal, Financial Times, and Bloomberg are esteemed sources of comprehensive market information.

Leverage Online Forums and Communities Participating in online trading communities can offer valuable peer insights and discussions about market trends. Platforms such as Reddit's r/Daytrading, Trade2Win, and Elite Trader foster an environment for knowledge exchange and provide guidance from seasoned traders.

Utilize Economic Calendars and Trading Tools Economic calendars alert traders to upcoming events that could impact markets, including earnings reports and economic indicators. Investing in advanced trading tools and software, such as algorithmic trading systems, helps in adapting to real-time changes and refining strategies with data-driven decision-making.

Attend Conferences and Networking Events Conferences present opportunities to learn from industry leaders and connect with other traders. Attending events like the International Traders Expo or similar gatherings fosters networking, while workshops and panel discussions offer an interactive learning experience.

Staying abreast of market changes is a continuous process—one that requires dedication and proactive effort. By investing in education and utilizing diverse resources, traders can ensure they are well-prepared to navigate the ever-shifting landscape of day trading.

Conclusion: Putting It All Together for Day Trading Success

Day trading success hinges on a structured approach, diligent practice, and adaptive strategies. By synthesizing the knowledge acquired, traders can craft a comprehensive plan to navigate dynamic markets effectively. Essential components that contribute to day trading mastery are outlined below.

Developing a Robust Strategy:

Traders must create a clear plan detailing entry and exit points, risk management tactics, and capital allocation. Tailoring strategies to align with financial goals and risk tolerance is crucial. Leveraging technical indicators, such as moving averages and relative strength index, can enhance decision-making precision.

Managing Risk and Emotions:

Implementing strict risk management rules is paramount. This includes setting stop-loss and take-profit levels to limit potential losses and lock in gains. Traders must also master emotional discipline to avoid impulsive decisions driven by fear or greed. Ensuring a consistent mindset helps in maintaining focus during market fluctuations.

Continuous Education and Practice:

Markets evolve, requiring traders to stay informed about global economic events, news, and emerging trends. Continuous learning through webinars, courses, and financial literature strengthens trading acumen. Practicing strategies in a simulated environment aids in honing skills without financial exposure.

Utilizing Technology and Tools:

Harnessing technology to streamline trading efficiency provides a competitive edge. Advanced trading platforms offer real-time data analysis, automated trading options, and charting capabilities. Selecting tools that enhance analytical capabilities and monitor market movements is imperative for informed decision-making.

Analyzing Performance:

Regularly reviewing trades to identify strengths and areas for improvement fosters growth. Tracking performance metrics, such as win-loss ratio and average gain per trade, allows traders to refine strategies. Documenting insights gained from each trade builds a rich database for future reference and continuous optimization.

By integrating these elements into their daily routine, traders can establish a solid foundation for achieving sustained success in the fast-paced world of day trading.

1 note

·

View note

Text

crypto

Gemini: New users can earn a flat $15 bonus in BTC after completing $100 of trading activity within their first 30 days. Alternatively, they can opt for up to 25% trading fee revenue share for higher trading volumes1.

Coinbase: Win a bonus ranging from $3 to $200 after making a cryptocurrency purchase on Coinbase.

Okcoin: Get $50 in BTC after making a trade of $100 or more.

Crypto.com: Lock up CRO tokens on the exchange to receive up to $50 in CRO.

TradeStation: Earn $50 in BTC by funding an account with $500.

M2: Receive up to 260 USDT in trading fee coupons.

Strike: Open an account and make a $1 deposit to get $5 in USD.

eToro: Purchase $100 worth of crypto to receive $10 in cash.

Lolli: Make a qualifying purchase to earn $5 in BTC.

iTrustCapital: Open a new IRA account and deposit at least $1,000 to receive $100.

Choice IRA: Open an IRA (minimum funding of $1) to get $50 in BTC.

Remember that some of these offers are based on referral codes, where both parties earn the bonus. Others are affiliate links, where the platform may earn a commission if you sign up1. Happy crypto exploring! 🚀🌟

signup

signup

signup

signup

1 note

·

View note