#TaxCode

Text

Cost Segregation Service Helps Commercial Property Owners Recoup Depreciation On A Faster Schedule With Reclassification.

Our Cost Segregation service if one of three flagship services making up our Specialized Incentives.

Cost Segregation is an engineering based study that permits commercial real estate owners to reclassify real property for depreciation purposes and reclassify it as more rapidly depreciating personal property. This reclassification results in significant cash flow benefits in both present and…

View On WordPress

#AcceleratedDepreciation#AssetAllocation#AssetOptimization#BuildingDepreciation#CommercialProperty#CommercialRealEstate#CostSegregation#CostSegServices#Depreciation#DepreciationStudy#IRSCompliance#PropertyTax#RealEstateInvesting#RealEstateTax#TaxBenefits#TaxCode#TaxDeductions#TaxPlanning#TaxSavings#TaxStrategy

0 notes

Text

Check out my latest article: Certified Public Accountant! Your Financial Expertise!

#FinanceExperts#CertifiedPublicAccountant#FinancialManagement#TaxPlanning#AccountingServices#FinancialConsulting#CPAQualifications#FinancialAdvisors#TaxEfficiency#FinancialPlanning#AuditingServices#BusinessConsulting#ForensicAccounting#EstatePlanning#FinancialRegulations#TaxCode

1 note

·

View note

Text

PROFESSIONAL TAX REGISTRATION

Professional tax is a mandatory tax imposed by some state governments in certain countries on individuals engaged in various professions, trades, or employments. This tax is distinct from the income tax and is levied to support the local government's funds and administrative expenses. The aim of professional tax is to ensure that professionals contribute to the state's revenue in proportion to their earnings. In this article, we will explore the fundamentals of professional tax, its significance, and its impact on professionals.

Applicability and Scope

Professional tax is applicable to individuals who earn an income through a profession, trade, calling, employment, or vocation. It includes salaried employees, self-employed professionals, freelancers, and business owners. The tax is typically administered by the respective state government, and the rates and rules may from state to state.

For More Information > Click Here https://ngandassociates.com/professional-tax-registration

0 notes

Text

THE WHOLE AMERICAN LAW SYSTEMJ IS A JOKE AND LIKE THE TAXCODE? LOPSIDED AND UNFAIR!

4 notes

·

View notes

Text

Great intro to why the rich don’t pay taxes.

@boston_grandpa #SenatorWhitehouse #TaxCodes #Taxpayers #TaxTheRich #NoMoreTrickleDownEconomics #TaxFairness #TaxEquity #TaxTheBillionaires #FYP ♬ original sound – Boston_Grandpa

View On WordPress

7 notes

·

View notes

Video

youtube

TDS ki कक्षा|Part 3|Interest, Fees, Penalty, Prosecution, Expense Disallowance under TDS|Income Tax

TDS ki कक्षा TDS Knowledge series Part 3 @cadeveshthakur #tds #incometax #cadeveshthakur #trending #viral TDS compliance and the consequences associated with it. In this video, we’ll explore various sections of the Income Tax Act related to TDS (Tax Deducted at Source) and discuss the implications for defaulting taxpayers. Here’s the content breakdown: 📌 Timestamps 📌 00:00 to 00:56 Introduction 00:57 to 02:46 Content Part3 02:47 to 03:54 Example 03:55 to 08:48 Assessee in default 08:49 to 11:00 example 11:01 to 17:07 late fees 17:08 to 23:40 interest 23:41 to 31:51 how to calculate interest & fees 31:52 to 37:00 penalties 37:01 to 38:30 prosecution 38:31 to 39:43 disallowance 1. Section 201: Assessee in Default o Explanation of what constitutes an “assessee in default.” o Consequences for failure to deduct or pay TDS. o Key points: Interest (Section 201(1A)): When a deductor fails to deduct tax at source or doesn’t deposit it to the Government’s account, they are deemed an assessee in default. They become liable to pay simple interest: 1% per month (or part of a month) on the amount of tax from the date it was deductible to the date of deduction. 5% per month (or part of a month) on the amount of tax from the date of deduction to the date of actual payment. Interest as Business Expenditure: Clarification that interest paid under Section 201(1A) cannot be claimed as a deductible business expenditure. Penalty (Section 221): If a person is deemed an assessee in default under Section 201(1), they are liable to pay penalty under Section 221 in addition to tax and interest under Section 201(1A). The penalty amount cannot exceed the tax in arrears. Reasonable Opportunity: The assessee has the right to be heard and prove that the default was for good and sufficient reason. 2. Section 234E: Late Fee for TDS/TCS Returns o Explanation of late fees for non-filing or late filing of TDS/TCS returns. o Due dates for filing TDS/TCS returns. o Late fee calculation: INR 200 per day until the default continues (not exceeding the TDS/TCS amount). o FAQs on Section 234E. 3. Section 276B: Prosecution for Failure to Deduct TDS o Overview of prosecution provisions for non-compliance with TDS obligations. 4. Disallowance of Expenses (Section 40(a)(i)/(ii)) o Explanation of disallowance of expenses if TDS is not deducted or paid. #youtubevideos #youtube #youtubeviralvideos #tdsfreecourse #freecourse #taxdeductedatsource #TDSCompliance #IncomeTax #TaxDeduction #TCSReturns #LateFiling #Penalty #BusinessExpenditure #TaxLiabilities #FinancialCompliance #TaxPenalties #TaxationLaws #AssesseeInDefault #InterestPayment #TaxProcedures #LegalObligations #TaxAwareness #TaxEducation #FinancialLiteracy #TaxPlanning #TaxConsultancy #TaxAdvisory #TaxProfessionals #TaxUpdates #TaxGuidance #TaxTips #TaxAccounting #TaxFiling #TaxReturns #TaxPolicies #TaxChallenges #TaxSolutions #TaxExperts #TaxCompliance #TaxAware #TaxMistakes #TaxConsequences #TaxPenalties #TaxKnowledge #TaxRules #TaxRegulations #TaxBestPractices #TaxManagement #TaxUpdates #TaxNews #TaxInsights #TaxGuidelines #TaxCode #TaxEnforcement #TaxEnforcementActions #TaxPenaltyProvisions #TaxPenaltyLaws #TaxPenaltyGuidance #TaxPenaltyExplained #TaxPenaltyFAQs #TaxPenaltyCompliance #TaxPenaltyAvoidance #TaxPenaltyMitigation #TaxPenaltyResolution #TaxPenaltyAdvice #TaxPenaltyConsulting #TaxPenaltyExperts #TaxPenaltyHelp #TaxPenaltyTips #TaxPenaltyEducation #TaxPenaltyAwareness #TaxPenaltyPrevention #TaxPenaltyManagement #TaxPenaltyStrategies #TaxPenaltyUpdates #TaxPenaltyNews For more detailed videos, below is the link for TDS ki कक्षा TDS Knowledge series https://www.youtube.com/playlist?list=PL1o9nc8dxF1RqxMactdpX3oUU2bSw8-_R

#youtube#what is tds#tax deducted at source#how to file tds return#how to issue tds certificate#tds due dates fy 2024-25#tds due dates fy 2023-24#tds free course#cadeveshthakur

0 notes

Photo

The more things change the more they stay the same. First America instituted an unjust #WarOnDrugs that funded the prison industrial complex to create social, psychological and economic chaos in targeted communities. Not only that...after years of state + federal coordination, the federal government allowed states to implement unjust legalization policy that denies access to the same targeted communities. Not only that...now the #federal #government plans to open up the #USTreasury and #US #TaxCode to further subsidize the capitalization & expansion of the #cannabis industry. We are coming to every #Statehouse and then the #WhiteHouse. It’s time to cut the check! #Repost @lamonbland (at New York, New York) https://www.instagram.com/p/CIVwvJ2hT9X/?igshid=s1mcm2838h2u

0 notes

Photo

В ГОСДУМУ ВНЕСЕН ЗАКОНОПРОЕКТ УВЕЛИЧЕНИЯ НАЛОГА НА БОГАТЫХ / GOSDUMA INTRODUCED A BILL TO INCREASE THE TAX ON THE RICH В Налоговый кодекс РФ предполагается внести законопроект об установлении НДФЛ 15% для тех, чей доход превышает 5 млн рублей в год. Документ подготовлен Правительством РФ, ранее с этой инициативой выступил Президент РФ Владимир Путин, сообщается на официальном сайте Госдумы РФ. Подробности на нашем сайте www.laikainfo.com. Перейти на сайт м��жно через ➡️ @laikainfo. The Tax code of the Russian Federation is expected to introduce a bill on the establishment of personal income tax of 15% for those whose income exceeds 5 million rubles a year. The Document was prepared by the government of the Russian Federation, earlier this initiative was made by Russian President Vladimir Putin, according to the official website of the state Duma of the Russian Federation. _______ #Налоговыйкодекс #законопроект #НДФЛ #15процентов #Правительство #Президент #Путин #налогнабогатство #прогрессивнаяшкала #налог #Taxcode #bill #personalincometax #15percent #Government #President #Putin #wealthtax #progressivescale #tax #прогрессивныйналог #progressivetax (at Moscow, Russia) https://www.instagram.com/p/CFzZrMygz7L/?igshid=mbbre87nq7ee

#налоговыйкодекс#законопроект#ндфл#15процентов#правительство#президент#путин#налогнабогатство#прогрессивнаяшкала#налог#taxcode#bill#personalincometax#15percent#government#president#putin#wealthtax#progressivescale#tax#прогрессивныйналог#progressivetax

0 notes

Text

Joe Biden is proposing changes to the corporate tax code Read More

Read the full article

0 notes

Photo

JJ is making his rounds with my crew. I’m now fielding weekly queries about the man himself . Who is he? Do I really know him? Is he like that in real life? He’s a really good speaker. Impressed. I really like him. What does he smell like? . Those are all things folks have said to me about #jjthecpa; well, except the last one. Apparently im the only one who was interested about that . . My CPA friends are in #CPE season, and JJ seems to be one of my the stars. Keep it up cap! . #accounting #taxes #goodman #money #Taxcode #199 #flowthrough #cpa #education #license (at Marlboro, Monmouth County, New Jersey) https://www.instagram.com/p/B5skw-1BQDV/?igshid=prsu2lo8q4u1

0 notes

Photo

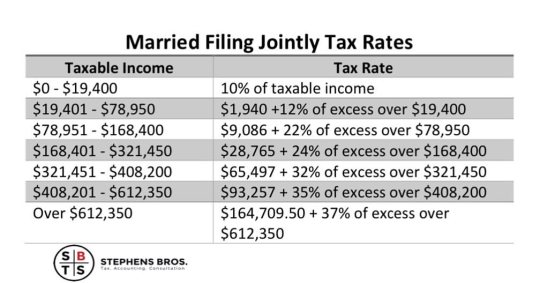

Individual Tax Rates – Married Filing Jointly For tax year 2019, the tax rates for married individuals filing joint returns are shown in the table above. This chart also applies to individuals filing as a “Surviving spouse.” #marry #married #marriedfilingjointly #survivingspouse #taxyear #taxseason2020 #chart #taxeducation #taxlaw #taxcode #taxupdate #motherhood #mother #father #fatherandson #stephensbros (at Grand Central Terminal) https://www.instagram.com/p/B5Teb-KFczY/?igshid=oxsabeqjqznz

#marry#married#marriedfilingjointly#survivingspouse#taxyear#taxseason2020#chart#taxeducation#taxlaw#taxcode#taxupdate#motherhood#mother#father#fatherandson#stephensbros

0 notes

Text

ASP.NET C# class to check for Italian Tax Code / Fiscal Code / VAT ID

There's no Italian programmer (or one who has worked in Italy) who has not had to deal at least once with Italian Tax Codes / Fiscal Codes: we literally run into them everytime we need to work on any context involving the management of someone's personal data: registries, flows, management, economic / financial calculation tools.

For this reason, many years ago, I developed a class in ASP.NET C # helper class that allows you to do most of these operations. Since after many years I continue to use it very much I think it may be useful to share it, in the hope that it will simplify the life of other fellow developers.

This post contains the ENGLISH version of the source code: the italian version is available here, together with a bunch of additional explanation regarding how the Italian Fiscal Codes actually work, including the algorythms that generates them and how to properly verify them: I won't be translating that part because I don't think it would be of any interest for non-italian readers. If you think you need these info, feel free to contact us using the Comments section below this post and we'll be pleased to fill that gap.

That said, here's the C# helper class. Enjoy!

///

/// A set of generic utils to retrieve, calculate and check the Fiscal Code for an italian citizen.

/// ref.: https://www.ryadel.com/en/italian-tax-code-fiscal-code-vat-id-c-sharp-class/

///

public static class FiscalCodeUtil

{

#region Private Members

private static readonly string Months = "ABCDEHLMPRST";

private static readonly string Vocals = "AEIOU";

private static readonly string Consonants = "BCDFGHJKLMNPQRSTVWXYZ";

private static readonly string OmocodeChars = "LMNPQRSTUV";

private static readonly int ControlCodeArray = new { 1, 0, 5, 7, 9, 13, 15, 17, 19, 21, 2, 4, 18, 20, 11, 3, 6, 8, 12, 14, 16, 10, 22, 25, 24, 23 };

private static readonly Regex CheckRegex = new Regex(@"^{6}{2}{2}{3}$");

#endregion Private Members

#region Public Methods

///

/// Retrieves a formally correct Fiscal Code given the required fields:

///

/// - FirstName

/// - LastName

/// - Date of Birth

/// - Gender

/// - ISTAT code

///

/// NOTES:

///

/// - The ISTAT code depends to the citizen's birth location and can be retrieved from the following lists:

/// http://www.agenziaentrate.gov.it/wps/content/Nsilib/Nsi/Strumenti/Codici+attivita+e+tributo/Codici+territorio/Comuni+italia+esteri/

///

/// - There are no guarrantees that the returned Fiscal Code is the correct one for that citizen,

/// as this function does not take edge case scenarios into account. For more info, look for "omocodia" here:

/// http://www.agenziaentrate.gov.it/wps/content/Nsilib/Nsi/Home/CosaDeviFare/Richiedere/Codice+fiscale+e+tessera+sanitaria/Richiesta+TS_CF/SchedaI/FAQ+sul+Codice+Fiscale/

///

/// First Name

/// Last Name

/// Date of Birth

/// Gender ('M' or 'F')

/// ISTAT code (1 letter, 3 numbers. Es.: H501 for Rome, Italy)

/// A valid Fiscal Code, compatible with all the given input fields

public static string GetFiscalCode(string firstName, string lastName, DateTime birthDate, char gender, string istatCode)

{

if (String.IsNullOrEmpty(firstName)) throw new NotSupportedException("ERROR: First Name is required.");

if (String.IsNullOrEmpty(lastName)) throw new NotSupportedException("ERROR: Last Name is required.");

if (gender != 'M' && gender != 'F') throw new NotSupportedException("ERROR: Gender must either be 'M' or 'F'.");

if (String.IsNullOrEmpty(istatCode)) throw new NotSupportedException("ERROR: ISTAT code is required.");

//string fc = GetLastNameCode(lastName) + GetNameCode(name) + GetBirthDateByGenderCode(birthDate, gender);

string fc = String.Format("{0}{1}{2}{3}",

GetLastNameCode(lastName),

GetFirstNameCode(firstName),

GetBirthDateByGenderCode(birthDate, gender),

istatCode

);

fc += GetControlChar(fc);

return fc;

}

///

/// Checks for a Fiscal Code formal integrity using the following criteria:

///

/// - check for null/empty value

/// - check for standard Regex {6}{2}{2}{3}

/// - check for a valid Control Character

///

/// NOTES:

/// - Even if this function validates a Fiscal Code as OK, there are no guarrantees that the Fiscal Code is valid and existing.

/// The only way to check this is to use the official tools provided by "Agenzia delle Entrate", such as:

/// https://telematici.agenziaentrate.gov.it/VerificaCF/Scegli.do?parameter=verificaCf

/// Or other services that are connected to the "Agenzia delle Entrate" database and thus able to perform lookups there.

///

/// The Fiscal Code to check

/// TRUE if the fiscal code is correct, FALSE otherwise

public static bool IsValid(string fc)

{

if (String.IsNullOrEmpty(fc) || fc.Length fc = Normalize(fc, false);

if (!CheckRegex.Match(fc).Success)

{

// Regex failed: it can be either an omocode or an invalid Fiscal Code

string nonOmocodeFC = ReplaceOmocodeChars(fc);

if (!CheckRegex.Match(nonOmocodeFC).Success) return false; // invalid Fiscal Code

}

return fc == GetControlChar(fc.Substring(0, 15));

}

/// Checks for a Fiscal Code formal integrity using the following criteria:

///

/// - check for null/empty value

/// - check for standard Regex {6}{2}{2}{3}

/// - check for a valid Control Character

/// - check it against given firstName, lastName, birthDate, gender and ISTATcode

///

/// NOTES:

/// - Even if this function validates a Fiscal Code as OK, there are no guarrantees that the Fiscal Code is valid and existing.

/// The only way to check this is to use the official tools provided by "Agenzia delle Entrate", such as:

/// https://telematici.agenziaentrate.gov.it/VerificaCF/Scegli.do?parameter=verificaCf

/// Or other services that are connected to the "Agenzia delle Entrate" database and thus able to perform lookups there.

/// The Fiscal Code to check

/// The First Name to check the Fiscal Code against

/// The Last Name to check the Fiscal Code against

/// The Birth Date to check the Fiscal Code against, together with gender.

/// The Gender to check the Fiscal Code against, together with birthDate.

/// The birthday city ISTAT code to check the Fiscal Code against

/// TRUE if the fiscal code is correct, FALSE otherwise

///

public static bool IsValid(string fc, string firstName, string lastName, DateTime birthDate, char gender, string istatCode)

{

if (String.IsNullOrEmpty(fc) || fc.Length fc = Normalize(fc, false);

string nonOmocodeFC = string.Empty;

if (!CheckRegex.Match(fc).Success)

{

// Regex failed: it can be either an omocode or an invalid Fiscal Code

nonOmocodeFC = ReplaceOmocodeChars(fc);

if (!CheckRegex.Match(nonOmocodeFC).Success) return false; // invalid Fiscal Code

}

else nonOmocodeFC = fc;

// NOTES:

// - 'fc' is the given Fiscal Code (it might be omocodic)

// - 'nonOmocodeFC' is the non-omocodic version of the given Fiscal Code (identical to 'fc' for non-omocodic Fiscal Codes)

if (String.IsNullOrEmpty(firstName) || nonOmocodeFC.Substring(3, 3) != GetFirstNameCode(firstName)) return false;

if (String.IsNullOrEmpty(lastName) || nonOmocodeFC.Substring(0, 3) != GetLastNameCode(lastName)) return false;

if (nonOmocodeFC.Substring(6, 5) != GetBirthDateByGenderCode(birthDate, gender)) return false;

if (String.IsNullOrEmpty(istatCode) || nonOmocodeFC.Substring(11, 4) != Normalize(istatCode, false)) return false;

// We need to use 'fc' here instead of 'nonOmocodeFC': that's because the ControlChar is calculated using the omocode chars (if any).

if (fc != GetControlChar(fc.Substring(0, 15))) return false;

// if we reach this, it means that the Fiscal Code is formally valid.

return true;

}

///

/// Replace OmocodeChars (if present) to their corresponding numeric values

///

/// Fiscal Code potentially containing omocode chars

///

public static string ReplaceOmocodeChars(string fc)

{

char fcChars = fc.ToCharArray();

int pos = new { 6, 7, 9, 10, 12, 13, 14 };

foreach (int i in pos) if (!Char.IsNumber(fcChars)) fcChars = OmocodeChars.IndexOf(fcChars).ToString();

return new string(fcChars);

}

#endregion Public Methods

#region Private Methods

///

/// Gets the first 3-letters of the name used to calculate the Fiscal Code.

///

/// the person's Last Name (es. De Angelis)

/// the 3 FC-relevant letters for the name (es. DNG)

private static string GetLastNameCode(string s)

{

s = Normalize(s, true);

string code = string.Empty;

int i = 0;

// pick Consonants

while ((code.Length {

for (int j = 0; j {

if (s == Consonants) code += s;

}

i++;

}

i = 0;

// pick Vocals (if needed)

while (code.Length {

for (int j = 0; j {

if (s == Vocals) code += s;

}

i++;

}

// add trailing X (if needed)

return (code.Length }

///

/// Gets the first 3-letters of the name used to calculate the Fiscal Code.

///

/// the person's name (es. Matteo)

/// the 3 FC-relevant letters for the name (es. MTT)

private static string GetFirstNameCode(string s)

{

s = Normalize(s, true);

string code = string.Empty;

string cons = string.Empty;

int i = 0;

while ((cons.Length {

for (int j = 0; j {

if (s == Consonants) cons = cons + s;

}

i++;

}

code = (cons.Length > 3)

// if we have 4 or more consonants we need to pick 1st, 3rd and 4th

? cons.ToString() + cons.ToString() + cons.ToString()

// otherwise we pick them all

: code = cons;

i = 0;

// add Vocals (if needed)

while ((code.Length {

for (int j = 0; j {

if (s == Vocals) code += s;

}

i++;

}

// add trailing X (if needed)

return (code.Length }

///

/// Retrieves the Birth Date Code (by Gender)

///

/// Birth Date

/// Gender (either 'M' or 'F')

/// the Birth Date Code (by Gender)

private static string GetBirthDateByGenderCode(DateTime d, char g)

{

string code = d.Year.ToString().Substring(2);

code += Months;

if (g == 'M' || g == 'm') code += (d.Day

Read the full article

0 notes

Text

LMAO! the rich, the politician, the corporation loves blaming the average american as they setup barriers and an unfair taxcode to keep poverty levels as high as possible while the deficit climbs in the name of the rich and corporations via Citizens United corruption! As they defund Education and roll back child labor laws and fight union creation!

3 notes

·

View notes

Photo

Tax Code czyli kod podatkowy w UK – co właściwie oznacza? Jak wpływa na wysokość płaconego podatku w Wielkiej Brytanii? Sprawdź na www.taniabrytania.uk! #taniabrytania #wielkabrytania #uk #Anglia #emigracja #emigracjaUK #Polonia #Polacy #tax #taxcode #podatek #podatki #kodpodatkowy #hmrc #ksiegowosc #ksiegowawuk #praca #rozliczenie prawo #gospodarka (w: United Kingdom) https://www.instagram.com/p/BzRIvc0IFxK/?igshid=120avz8dl8ky0

#taniabrytania#wielkabrytania#uk#anglia#emigracja#emigracjauk#polonia#polacy#tax#taxcode#podatek#podatki#kodpodatkowy#hmrc#ksiegowosc#ksiegowawuk#praca#rozliczenie#gospodarka

0 notes

Photo

#Repost @nastywomanagainstcorruption ・・・ Waiting for the #fools to do their #taxes. #incometax #taxeseason #taxcode #scam #trumptaxscam #middleclass #taxrefund #trumpsupporters #trumpscum #showusyourtaxestrump #economics #nomoneynohoney #magascam #maga https://www.instagram.com/p/Bug12UaHzAV/?utm_source=ig_tumblr_share&igshid=1rfhyirmfnz5z

#repost#fools#taxes#incometax#taxeseason#taxcode#scam#trumptaxscam#middleclass#taxrefund#trumpsupporters#trumpscum#showusyourtaxestrump#economics#nomoneynohoney#magascam#maga

0 notes

Text

Five Things to Consider When Researching Retirement Questions on the Internet

By Beverly DeVeny

Chief IRA Analyst at Ed Slott and Company

Follow Us on Twitter: @theslottreport

The internet can be a blessing and it can be a curse. It is a fantastic place to do research on almost anything, but is the information you find current and accurate? Here are five things to consider when doing internet research into retirement questions.

Check the Date

When was the article or blog written and/or posted? The tax code and rules change often. What was true three years or five years ago may not be true today. Many brackets or income limits are adjusted for inflation each year. Those numbers need to be checked to see if they are the most recent limits.

Check out the Website

What company controls the content on the website? Are they reputable and knowledgeable? Are they unbiased or are they selling a product or strategy? Do a search on the company to see if you come up with positive or negative information. Look for unbiased information.

Check out the Individuals

Similar to checking out the company, you need to check out the individuals running the company. Are they knowledgeable and unbiased or are they focused on selling a product or a strategy? Do a search on the individual to see if you come up with any regulatory complaints against the individual or court cases they were involved in.

Multiple Sources

Multiple sources can help you confirm that the information you’re reading is correct. If you come up with the same information on several websites, then you are probably on the right track. But keep an eye out for qualifiers such as many experts say or many experts think. Who are those experts? Also, beware of claims that the IRS has given a stamp of approval to an investment, product or strategy. The IRS interprets and enforces the tax code; they do not issue approvals of what promoters might be recommending.

The Golden Rule

If it sounds too good to be true, it probably is.

Any website promoting a product, investment or strategy will generally only give you information that bolsters their end goal – to get your money. This is true of all websites, those offering “good” information as well as those offering “bad” information. This difference is that those offering good information willingly give you full, complete answers to your questions; those offering dubious information evade your questions or give incomplete information and pressure you to complete a transaction.

This article was originally published by Ed Slott and Company, LLC in The Slott Report on IRAhelp.com on 7/19/17. Click here to view the original publication and read more articles: http://bit.ly/2tGiVTy

1 note

·

View note