#Termlifeinsurance

Text

#insurance#lifeinsurance#corporation#starhealthinsurance#healthinsurance#starhealthplans#policy#starhealthinsuranceplanslatest#starhealthinsurancebestplan#starhealthinsuranceclaimprocess#termlifeinsurance#lic#lifeinsurancepolicy#lifeinsuranceexplained#wholelifeinsurance

3 notes

·

View notes

Text

Proton Finserve For Life Insurance Is Like A Spare Tire |

Proton FinServe is a leading insurance agency in Utah, providing a wide range of insurance services to individuals and businesses in the area. We are committed to helping our clients protect their assets and plan for their future with our comprehensive insurance policies.

At Proton FinServe, we understand the importance of having the right insurance coverage in place. That's why we offer a wide range of insurance services, including #lifeinsurance, #termlifeinsurance, and #additionalinsuranceservices to meet the unique needs of our clients.

In addition to traditional insurance services, we also offer a variety of #financialservices, including #annuities, to help our clients plan for their retirement and achieve their financial goals. Our team of experienced #insuranceagents are dedicated to providing personalized service and expert advice to help our clients make informed decisions about their insurance needs.

At Proton FinServe, we are proud to be a locally-owned and operated #insuranceagencyinutah, serving the community for over a decade. We are committed to providing our clients with the highest level of service and support, and we are dedicated to building long-term relationships with our clients based on trust and mutual respect.

If you're in need of #insuranceservices in #Utah, USA, look no further than Proton FinServe. Contact us today to schedule a consultation with one of our experienced insurance agents and learn more about how we can help protect your assets and plan for your future. #proton #protonfinserve

#protonfinserve#proton#inusranceagent#insuranceservices#insuranceagencyinutah#insurancepolicy#lifeinsurance#termlifeinsurance#additionalinsuranceservices#fiancialservices#annuties#utah#usa

2 notes

·

View notes

Text

How to Read and Understand the Terms and Conditions of a Term Insurance Policy

Introduction

Term insurance is a crucial part of financial planning, providing a safety net for your loved ones in case of your untimely demise. However, the fine print in insurance policies can be complex and confusing. Understanding the terms and conditions is essential to ensure you know exactly what you're signing up for. In this article, we will guide you on how to read and comprehend the terms and conditions of a term insurance policy. Confused about insurance? Claim your free consultancy: familyraksha.com.

Understanding the Basics

1. Policy Document Overview

The policy document is the contract between you and the insurance company. It outlines the terms, conditions, benefits, exclusions, and obligations of both parties. Familiarize yourself with the layout of the document to make it easier to find the information you need.

2. Definitions Section

Most policy documents include a definitions section. This part clarifies the meanings of specific terms used throughout the document. Understanding these definitions is crucial for interpreting the rest of the policy correctly.

Key Sections to Focus On

1. Coverage Details

This section specifies the amount of coverage (sum assured) and the term of the policy. It’s important to verify that these details match what you discussed with your insurance agent or what you selected during the purchase.

2. Premium Payment Terms

Here, you will find information on the premium amount, payment frequency (monthly, quarterly, annually), and due dates. Ensure you understand the premium schedule to avoid lapses in coverage due to missed payments.

3. Death Benefit

The death benefit section outlines the amount that will be paid to your beneficiaries upon your death. It also describes any conditions or exclusions that might affect the payout.

4. Exclusions and Limitations

This is one of the most critical sections. It lists the circumstances under which the insurer will not pay the death benefit. Common exclusions include death due to suicide within the first policy year, participation in hazardous activities, or death due to pre-existing conditions.

5. Policy Riders

Riders are additional benefits that you can add to your base policy for extra coverage. Examples include critical illness rider, accidental death benefit rider, and waiver of premium rider. Review these carefully to understand the additional costs and benefits.

6. Grace Period

The grace period is the time allowed after the premium due date during which the policy remains in force. Knowing the grace period helps you avoid unintentional policy lapses. For more details, visit familyraksha.com.

7. Renewal Terms

This section explains whether the policy can be renewed at the end of the term, and under what conditions. Some policies are non-renewable, while others may offer renewal at a higher premium.

8. Claims Process

Understanding the claims process is vital. This section details the steps your beneficiaries need to take to file a claim, the documentation required, and the time frame for claim settlement.

9. Surrender Value

If you decide to terminate the policy before its maturity, the surrender value section explains whether you are entitled to any payout and how it is calculated.

10. Free Look Period

The free look period is a specified time frame (usually 15-30 days) during which you can review the policy and cancel it without any penalty if you are not satisfied. This is an important consumer protection feature.

Steps to Understand the Policy

1. Read Thoroughly

Take your time to read the policy document from start to finish. Highlight or make notes on sections that you find confusing or that you think are particularly important.

2. Seek Clarification

Don’t hesitate to ask your insurance agent or the company’s customer service for clarification on any points you don’t understand. It’s their job to ensure you fully understand the policy.

3. Compare with Other Policies

Comparing your policy with others can help you understand its strengths and weaknesses. Look for similar policies online or ask your agent for comparisons.

4. Use Online Resources

There are many online resources and forums where you can find explanations of common insurance terms and conditions. Websites like familyraksha.com offer valuable insights and free consultancy.

5. Consult a Financial Advisor

If you are still unsure about certain aspects of your policy, consider consulting a financial advisor. They can provide professional guidance tailored to your financial situation and goals.

Conclusion

Reading and understanding the terms and conditions of a term insurance policy is essential to ensure you and your beneficiaries are well-informed about the coverage and any potential limitations. By thoroughly reviewing the policy document, seeking clarifications, and using available resources, you can confidently make the best decisions for your financial security. For more personalized advice, check out familyraksha.com.

#TermLifeInsurance#LifeInsurance#Insurance#FinancialPlanning#Investment#WealthManagement#FinancialSecurity#ProtectYourFamily#AffordableInsurance#HealthInsurance#MedicalCoverage#HealthCoverage#InsurancePlans#InsuranceAdvice#InvestSmart#FuturePlanning#SecureYourFuture#MoneyManagement#FamilyProtection#CoverageMatters

0 notes

Text

Tips for Determining the Right Term Life Insurance Length

Selecting the optimal term requires weighing your debts, dependents, retirement timeline. Get multiple term quotes, then pick affordable length with enough coverage. Lock in low rates before annual premium increases. Consult an advisor when undecided. Thoughtful planning results in the ideal policy.

0 notes

Text

Criticare Insurance Policy Purposes

The purposes of criticare insurance policy is different than ordinary medical policies. Usually people take criticare insurance policy for the purposes of financial support while he or she suffering any major illnesses. Criticare insurance policy support families as a financial stability or we say the purposes of it are like a protection plan.Criticare policies, also known as critical illness insurance, are designed to provide financial protection in case you are diagnosed with a serious medical condition. They typically function in two ways:

Lump sum benefit payout: Upon diagnosis of a covered critical illness, the insurance company pays you a lump sum of money according to the terms of the policy. This money can be used for any purpose, such as covering medical bills, replacing lost income, or making other financial arrangements during a difficult time.

Specified disease coverage: Criticare policies cover a specific list of critical illnesses, which may include cancer, heart attack, stroke, kidney failure, or major organ transplants. Not all illnesses are covered, so it’s important to review the details of each policy carefully.

Overall, criticare policies are meant to offer financial peace of mind in the face of a critical illness. The payout can help manage the financial burden of treatment and recovery.

what are the main diseases cover in criticare policies

The exact diseases covered by critical illness policies can vary depending on the specific insurer and plan, but they generally focus on major medical conditions that are:

Life-threatening: These are illnesses with a high risk of mortality if left untreated.

Require extensive medical care: Critical illnesses often involve lengthy and expensive treatment processes.

Cause significant disability: The illness may leave the person with long-term limitations on their ability to work or perform daily activities.

Here are some of the common critical illnesses covered by criticare policies:

Cancer: Most policies cover various types of cancer diagnosed at a specified severity level.

Heart diseases: This can include heart attack, coronary artery bypass surgery (CABG), and valve replacement surgery.

Stroke: Coverage may extend to strokes resulting in permanent neurological impairments.

Kidney failure: This typically refers to chronic kidney disease requiring regular dialysis.

Organ transplants: Coverage may include major organ transplants like kidney, liver, or heart.

Neurological disorders: Some plans cover conditions like multiple sclerosis or Parkinson’s disease.

It’s important to remember that this is not an exhaustive list. It’s always best to carefully review the policy details to understand exactly which critical illnesses are covered and what the specific criteria are for receiving a payout.

Critical illness insurance (critical care or criticare policy) is separate from regular health insurance. They work together to provide a more comprehensive safety net for your health finances, but they address different needs:

Medical Insurance:

Covers the costs associated with medical treatment itself, including hospitalization, doctor visits, medications, and surgeries.

Typically pays the provider directly or reimburses you for covered expenses.

Designed to address a wide range of medical needs, both minor and major.

Critical Illness Insurance:

You can use the money for any purpose, including covering uncovered medical costs, lost income replacement, or other financial needs arising from the illness.

Focuses on specifically defined critical illnesses, not all health issues.

Here’s an analogy: Think of medical insurance as a safety net that catches you if you fall ill and need medical care. Critical illness insurance is more like a targeted financial cushion specifically for critical illnesses and their related expenses.

Provides More Comprehensive Coverage:

Mediclaim: Handles the bills for your actual medical treatment like hospitalization, surgery, medications etc.

Criticare Policy: Provides a lump sum payout upon diagnosis of a critical illness. This money can be used for various purposes, including:

Covering any out-of-pocket medical expenses not covered by mediclaim.

Replacing lost income if you’re unable to work due to the illness.

Managing other financial burdens arising from the illness, such as childcare or home modifications.

Reduces Financial Stress:

Critical illnesses can be financially devastating. The lump sum payout from criticare provides immediate financial relief, allowing you to focus on your health and recovery without worrying about mounting medical bills or lost income.

Peace of Mind:

Knowing you have both mediclaim and criticare offers a double layer of security. You’ll have peace of mind knowing you’re financially protected in case of any major medical event.

Here’s an example:

Imagine someone with both mediclaim and criticare gets diagnosed with cancer.

Mediclaim: Covers a significant portion of the hospitalization and treatment costs.

Criticare Policy: Pays out a lump sum amount. This money can be used for things like:

Covering any additional medical expenses not covered by mediclaim (e.g., advanced treatment options).

Replacing income lost due to missing work for treatment.

Supporting family needs during the recovery period.

However, it’s important to consider:

Cost: Having both policies increases your overall insurance premium.

Need: Evaluate your individual health needs and risk factors before deciding if criticare is necessary.

Overall, having both mediclaim and criticare can be a wise decision, especially for those with a higher risk of critical illnesses or who want the most comprehensive financial protection for their health.

0 notes

Text

Video: Podcast with Insurance Expert Part 2

Insurance expert Charee Villa and I discuss #termlifeinsurance, #mortgageinsurance, #mutualfunds, and #Segregatedfunds

The #CanadianMoneyTalk channel concentrates on #Canadianinvesting and #personalfinance in Canada.

Visit: http://www.canadianmoneytalk.caThe Investing & Personal Finance Basics course is at https://canadianmoneytalk.ca/investing-personal-finance-basics-course/The Advanced…

View On WordPress

0 notes

Text

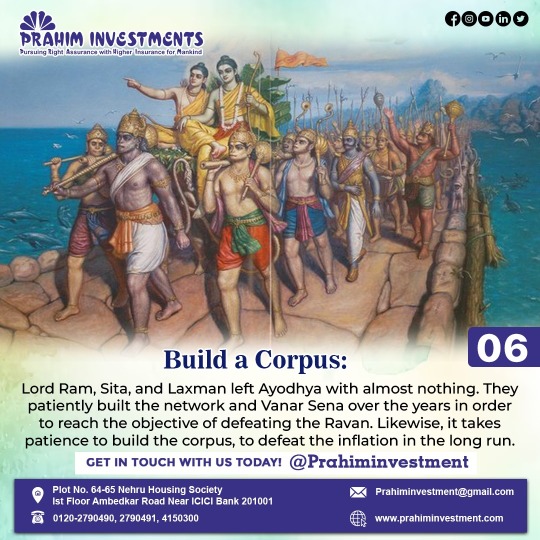

8 Financial Lesson from Ramayana to be learned.

Day 6. Build a Corpus: Lord Ram, Sita, and Laxman left Ayodhya with almost nothing. They patiently built the network and Vanar Sena over the years in order to reach the objective of defeating the Ravan. Likewise, it takes patience to build the corpus, to defeat the inflation in the long run.

#prahiminvestments#laxman#hanumanji#Sanjeevani#ramayana#ramayanadecoded#maasita#lordrama#lordram#14Years#vanvas#ayodhya#vanarsena#ravan#day6#buildacorpus#insurance#insuranceprovider#termlifeinsurance#longterm#longtermstay#paitence

0 notes

Link

One of the most popular insurance options that insurance seekers turn to for securing the futures of their loved ones or for financial planning is term life insurance. However, what is term insurance, how does it work, and what types of deaths are covered and not covered by it? All of these and more will be below.

What Is Term Life Insurance?

A term life insurance plan is also known as a pure life insurance plan because it guarantees a stated death benefit if the insured dies during the period specified in the policy. When a term insurance policy expires, it can either be renewed for another term, converted to permanent coverage, or terminated.

How Term Life Insurance Works

An insurer determines how much you’ll pay for a term life insurance policy by considering your age, gender, and health, as well as the value of the policy (the payout amount). Occasionally, a medical exam is required. In addition to your driving record, your insurance company may ask about your current medications, smoking status, occupation, hobbies, and family history. If you died during the policy’s term, the insurer would pay the policy’s face value to your beneficiaries. Benefit recipients may use the cash benefit to pay for things such as medical care and funeral expenses, consumer debt and mortgage debt. This cash benefit is generally not taxable. When a policy expires before you die, you will not receive any benefits. When a term policy expires, you may be able to renew it, but your premiums will be recalculated based on your age at renewal. There is no value to term life insurance policies other than the death benefit.

Types Of Death Covered By Term Life Insurance

Below is a quick summary of the coverage under term life insurance policies:

Natural causes

A term life insurance policy covers deaths caused by natural causes. Beneficiaries will receive insurance payouts if an insured dies of a heart attack, cancer, infection, kidney failure, stroke, or old age.

Accidents

If an automobile accident, drowning, poisoning, accidental drug overdose, or other tragic events, your term life insurance policy will pay out death benefits to your beneficiaries.

Murder

If murdered, your beneficiaries will receive your death benefit unless they were involved in the murder.

Suicide

Insurance covers suicide. The company will grant the beneficiaries unless the death occurs during the “contestability period” – usually the first two years – assuming there isn’t another exclusion.

Pandemic Illness

A COVID-19 death is a death by natural causes under your existing policy, which means your beneficiaries will receive the benefit. If, however, you apply for a new policy amid an ongoing pandemic and lie about your health or exposure, you will not qualify. If that happens, the insurer may refuse to pay.

Deaths Not Covered by Term Life Insurance?

These are the situations in which your beneficiaries may not be able to collect benefits:

Risky Activities

Risky activities may not be covered, depending on the situation. The following activities are dangerous because they have a high potential for injury or death:

Scuba diving

BASE jumping

Hang gliding

Auto racing

Aviation

Rock and mountain climbing

There are also dangerous jobs in this category, including logging, flying, working on offshore oil rigs, fishing offshore, and working underground as a miner.

Murder

Specifically, the “Slayer Rule” says that if your beneficiary commits murder—or is somehow involved in your murder—they won’t receive a death benefit. Instead, your insurer will distribute your death benefit to your estate or your contingent beneficiaries.

Suicide

Life insurances cover suicide. There is, however, a “suicide clause”-or contestability period-during the first two years of a policy. If someone commits suicide during this period, their life insurance policy won’t cover the cost. If the policyholder dies from a drug overdose during this period, the situation can get messy. In this case, the insurer must demonstrate that the benefit was due to intentional overdose.

0 notes

Text

#whole life insurance#insurance policy#insurers#term life insurance#health insurance#termlifeinsurance

0 notes

Text

Why should you buy term insurance early?

When you are young and healthy and at the start of earning phase of your life, buying a term insurance may not be your priority. But do you know that buying term insurance early in life comes with a few of benefits?

The biggest benefit is that you are most likely to get the adequate cover by insurance companies when you are healthy and young. This may not be the case as age progresses and some kind of lifestyle or critical illnesses set in.

So get the cover when you are still eligible for it. Or otherwise it might be just too late.

When you take a term policy early in life, the amount you need to pay every year for the cover is much lesser than what you pay when you take the same amount of cover later in life.

The premiums rise steeply as the age progresses. The amount a 25 year old pays for a term policy is significantly lower than the amount a 35 years old would pay for the same amount of cover. The overall cost of having a term insurance is lower when you buy it early.

When you have people in your family who are financially dependent on you, it become even more important that you get yourself adequate term cover early. Till the time you don’t get it, your family is at the risk of financial loss in case you are no more.

So protect your loved ones by purchasing a term insurance policy for yourself at the right time.

www.algates.in

0 notes

Text

What are the Key Features of a Term Insurance Policy?

Introduction

Understanding Term Insurance

Term insurance is a type of life insurance that provides coverage for a specific period, or "term." If the policyholder dies during the term, a death benefit is paid to the beneficiaries. It's a straightforward and affordable way to ensure financial security for your loved ones.

Importance of Knowing the Key Features

Knowing the key features of a term insurance policy can help you make an informed decision when choosing the right plan for your needs. It can also help you maximize the benefits of your policy and ensure that your loved ones are adequately protected.

Key Features of a Term Insurance Policy

1. Coverage Duration

Defined Term Lengths

Term insurance policies offer coverage for a specific period, typically ranging from 10 to 30 years. Some insurers also offer coverage up to certain ages, like 60 or 65.

Choosing the Right Term Length

Select a term that aligns with your financial goals and responsibilities. For instance, if you have young children, you might choose a term that lasts until they are financially independent.

2. Death Benefit

Lump-Sum Payout

The death benefit is the amount paid to your beneficiaries if you pass away during the term. This is typically a lump-sum payment that can be used for various purposes, such as paying off debts, covering living expenses, or funding education.

Customizable Amount

You can choose the death benefit amount based on your financial needs and goals. Higher coverage amounts usually result in higher premiums.

3. Premiums

Fixed Premiums

Most term insurance policies come with fixed premiums, meaning the amount you pay remains the same throughout the policy term. This makes it easier to budget for the premiums.

Affordable Rates

Term insurance is generally more affordable than other types of life insurance, such as whole life or universal life insurance, making it accessible for many individuals.

4. Policy Renewal

Renewable Policies

Some term insurance policies offer the option to renew the policy at the end of the term, without needing to undergo a medical exam. However, the premiums for the renewed term may be higher.

Conversion Options

Many term policies include a conversion feature, allowing you to convert your term policy into a permanent life insurance policy (like whole life or universal life) without a medical exam. This can be beneficial if your needs change over time.

Confused about insurance? Claim your free consultancy: familyraksha.com

5. Riders and Add-Ons

Customizable Coverage

You can enhance your term insurance policy with riders, which are additional features or benefits. Common riders include:

Accidental Death Benefit Rider: Provides an additional payout if death occurs due to an accident.

Waiver of Premium Rider: Waives future premiums if you become disabled and are unable to work.

Critical Illness Rider: Provides a lump-sum payment if you are diagnosed with a specified critical illness.

6. Simplicity and Transparency

Straightforward Policies

Term insurance policies are typically straightforward and easy to understand. There are no complicated investment components, cash values, or borrowing options, which can be found in other types of life insurance.

Clear Terms and Conditions

The terms and conditions of term insurance policies are usually clear, making it easier for policyholders to know what is covered and what is not.

7. No Cash Value

Pure Protection

Unlike whole life or universal life insurance, term insurance does not accumulate cash value. It is designed purely for protection, providing a death benefit if you pass away during the term.

Lower Premiums

Because there is no cash value component, the premiums for term insurance are generally lower compared to permanent life insurance policies.

8. Flexibility

Adaptable to Your Needs

Term insurance offers flexibility in terms of coverage amount, term length, and additional riders. This allows you to tailor the policy to fit your specific financial needs and goals.

Options for Different Life Stages

Whether you are just starting a family, buying a home, or planning for retirement, there is likely a term insurance policy that can meet your needs at different stages of life.

9. Financial Security

Peace of Mind

Having a term insurance policy in place can provide peace of mind, knowing that your loved ones will have financial support in the event of your untimely death.

Coverage for Major Financial Obligations

Term insurance can help cover major financial obligations such as mortgage payments, education expenses, and daily living costs, ensuring that your family is protected.

Visit us for more: familyraksha.com

Conclusion

Understanding the key features of a term insurance policy is crucial for making an informed decision. With its affordable premiums, straightforward terms, and flexibility, term insurance can be an excellent choice for those seeking financial protection for their loved ones. By carefully considering your needs and exploring the options available, you can find a term insurance policy that provides the peace of mind and security you desire.

FAQs

1. Can I change my term insurance policy later? Yes, many term insurance policies offer options to convert to permanent insurance or add riders for additional coverage.

2. How do I determine the right coverage amount? Consider factors like your income, debts, living expenses, and future financial goals to determine an adequate coverage amount.

3. What happens if I outlive my term insurance policy? If you outlive your policy term, the coverage ends, and there is no payout. You may have the option to renew or convert the policy.

4. Are medical exams always required for term insurance? Not always. Some insurers offer no-exam policies, though these may come with higher premiums.

5. Can I have multiple term insurance policies? Yes, you can have multiple term insurance policies to cover different financial needs or stages of life.

#TermLifeInsurance#LifeInsurance#Insurance#FinancialPlanning#Investment#WealthManagement#FinancialSecurity#ProtectYourFamily#AffordableInsurance#HealthInsurance#MedicalCoverage#HealthCoverage#InsurancePlans#InsuranceAdvice#InvestSmart#FuturePlanning#SecureYourFuture#MoneyManagement#FamilyProtection#CoverageMatters

0 notes

Text

Think Twice Before Buying Permanent Life Insurance

Permanent life insurance generally carries higher premiums and complexity compared to term life insurance. Term life typically meets Canadians' temporary coverage needs for less cost. Read on to learn why permanent life insurance likely doesn't make sense for most people.

0 notes

Text

Purpose of Term Insurance

The purpose of term insurance is very unique in life insurance category. Unfortunately many people dont know the important,details and purpose of term insurance in our nation. Term insurance serves several important purposes for a family, acting as a financial safety net during unforeseen circumstances. Here’s how it benefits a family:

Income Replacement: The primary purpose of term insurance is to replace the income of the breadwinner in case of their untimely demise. This ensures that the family’s standard of living is maintained and that they can continue to afford necessities such as housing, food, and healthcare without financial strain.

Debt Protection: It helps in covering outstanding debts such as a mortgage, personal loans, or car loans. This prevents the family from facing the burden of debts and possibly losing assets that were collateral for those debts.

Educational Expenses: Term insurance can also ensure that children’s educational expenses are taken care of, allowing them to pursue their studies without financial hurdles, even in the absence of the earning member.

Estate Planning: It can be used as a tool for estate planning, providing the necessary liquidity to heirs to settle estate taxes or equalize inheritances without having to sell off assets.

Wealth Transfer: Term insurance can be strategically used to leave a legacy for the next generation or to donate to a charity, ensuring that the policyholder’s wishes are fulfilled even after their demise.

Business Protection: For families involved in business, term insurance on a key person can help in the continuity of the business by providing the necessary funds to overcome the loss of the key individual and find a replacement.

Peace of Mind: Beyond financial aspects, having term insurance offers peace of mind, knowing that loved ones will be financially secure in case of any eventuality. This emotional reassurance is invaluable for both the policyholder and their family.

Affordability: Term insurance is relatively inexpensive compared to other life insurance products, which means families can secure a larger coverage amount at a lower premium, making it an efficient way to manage risk.

In essence, term insurance is a crucial component of a comprehensive financial plan, offering protection and security to a family during times of greatest need. It’s a straightforward way to ensure that your family’s future is safeguarded, even in your absence.

what are the types of term insurance policies

Term insurance policies come in various forms, each designed to meet different needs and preferences. Understanding the types helps in choosing a policy that best aligns with individual or family requirements. Here are the main types of term insurance policies:

Level Term Insurance:

The most straightforward type of term insurance, where the death benefit (the amount paid out upon the policyholder’s death) and the premium remain constant throughout the policy term.

The death benefit increases over the term at a predetermined rate or percentage, which can be a way to adjust for inflation or increasing financial responsibilities. However, premiums may also increase.

Decreasing Term Insurance:

Opposite to increasing term insurance, the death benefit decreases over time, typically aligned with the decreasing liability or loan amount, such as a mortgage. Premiums usually remain constant.

Convertible Term Insurance:

This policy allows policyholders to convert their term insurance into a permanent life insurance policy (such as whole life or universal life) without a medical exam, within a specific period. It’s suitable for those whose coverage needs may change over time.

Renewable Term Insurance:

Offers the option to renew the insurance policy without undergoing a medical examination at the end of the term, though premiums may increase based on the age of the insured at renewal.

Return of Premium Term Insurance:

If the policyholder survives the policy term, this policy returns the premiums paid for the coverage, either partially or fully. This type of policy is more expensive than a traditional term policy.

Group Term Insurance:

Often offered by employers or associations as part of a benefits package, this provides term coverage to a group of people under one policy. Individual proof of insurability is typically not required, making it an easy and cost-effective option for employees or members.

TROP (Term with Return of Premium):

Similar to return of premium term insurance, TROP policies refund the premium paid if the policyholder outlives the policy term. This type can be seen as a hybrid, offering both death benefit protection and a form of savings return.

Each type of term insurance has its benefits and limitations, and the choice among them should be based on individual financial goals, coverage needs, and other factors like affordability, age, and health status. It’s crucial to carefully assess these factors and possibly consult with a financial advisor to select the most suitable term insurance policy.

0 notes

Text

Term Life Insurance: 5 Common Mistakes to Avoid

Term life insurance is a crucial component of financial planning, offering valuable protection for your loved ones in case the unexpected happens.

However, to make the most of this coverage, it's essential to navigate the process wisely and avoid common pitfalls that can have significant long-term consequences.

In this short article, we'll delve into each aspect of term life insurance, providing in-depth information on the five common mistakes to avoid when obtaining this vital coverage.

Understanding Term Life Insurance

Lack of Understanding: Before you apply for any life insurance policy, it's crucial to comprehend the fundamentals of term life insurance. Unlike permanent life insurance, term life insurance provides coverage for a specific term, typically ranging from 10 to 30 years.

If the insured person passes away within the term, the policy pays out a lump sum death benefit to the beneficiaries. Due to the limited term, these policies are generally more affordable, making them an attractive choice for many individuals and families.

Determining the Right Coverage Amount

Insufficient Coverage: One of the most significant mistakes you can make when purchasing term life insurance is underestimating the amount of coverage needed.

When determining the appropriate coverage amount, consider your existing financial obligations, such as mortgages, outstanding debts, and future educational expenses for your children.

Additionally, think about the lifestyle you want your family to maintain if you're no longer there to provide for them. A thorough assessment of these factors will help you arrive at an appropriate death benefit that ensures your loved ones' financial security.

The Importance of Riders

Neglecting Riders: Term life insurance policies often come with riders, which are optional add-ons that provide extra protection and flexibility. For instance, a disability income rider can offer financial support if the insured becomes disabled and unable to work.

Another valuable rider is the accelerated death benefit, which allows policyholders to access a portion of the death benefit if they are diagnosed with a terminal illness. Additionally, a guaranteed insurability rider enables you to increase your coverage amount at specified intervals without undergoing medical underwriting.

Carefully assess your needs and consider incorporating relevant riders to enhance your policy's utility.

Finding the Best Rates

Failure to Compare Rates: Insurance companies offer different rates for term life insurance policies, depending on various factors, such as age, health, and lifestyle habits. It's crucial to shop around and compare prices from multiple insurers to find the most competitive and suitable policy for your needs.

Fortunately, many insurers provide online tools that can generate quick quotes based on the information you provide, making the comparison process easier.

Exploring Group Life Insurance

Missing Out on Group Rates: If you're employed, your employer may offer group life insurance plans as part of your benefits package. Group rates can be significantly lower than individual policies, and they may not require a medical exam for enrollment.

It's worth exploring this option and taking advantage of any group life insurance plans offered by your employer or union.

However, keep in mind that group policies may have limitations, such as being tied to your current job, and they might not offer the same level of customization as individual policies.

Conclusion

Term life insurance is a valuable tool for protecting your family's financial future in the event of your passing. By avoiding the five common mistakes outlined above, you can ensure that you make well-informed decisions about your coverage.

Remember to educate yourself about term life insurance, assess your coverage needs thoroughly, consider adding riders that align with your circumstances, and compare rates from multiple insurers.

Furthermore, if group life insurance plans are available through your employer, explore this option as it can potentially offer cost-effective coverage. A well-considered policy, when in place will give you peace of mind, as it safeguards your loved ones for years to come.

Regularly review your policy to ensure it continues to meet your family's evolving needs and consider consulting with a qualified insurance professional for personalized guidance.

Sources: THX News & American Family Life Assurance Company.

Read the full article

#Additionaloptions#Compareprices#Deathbenefit#Financialsecurity#Grouplifeinsurance#Insurancecoverage#Mistakestoavoid#Protectlovedones#Termlifeinsurance#Termlifepolicy

0 notes