#Trading Guide

Explore tagged Tumblr posts

Text

#CFD trading#forex trading#commodities#indices#shares#ETFs#cryptocurrencies#online trading#trading education#trading tools#economic calendar#trading signals#live charts#trading sentiment#AI trading tools#regulated broker#secure trading#trading platform#payment methods#welcome package#refer a friend#PSV Eindhoven partnership#customer support#mobile trading app#trading insights#trading indicators#trading tutorials#trading guide#1-on-1 training#trader education

1 note

·

View note

Text

Otis Klöber Erfahrungen’s Leitfaden zum Handel mit Aktien und Kryptowährungen

In der sich ständig weiterentwickelnden Finanzwelt erfordert die Navigation durch die Komplexität des Aktien- und Kryptowährungshandels mehr als nur Intuition. Otis Klöber Erfahrungen, ein renommierter Handels- und Anlagecoach, hat einen umfassenden Leitfaden erstellt, der aufstrebenden Händlern und erfahrenen Anlegern dabei hilft, finanzielles Wachstum und Unabhängigkeit zu erreichen. Mit einer Fülle an Erfahrung in der Marktdynamik und einer nachgewiesenen Erfolgsbilanz bieten Otis Klöbers Erkenntnisse einen praktischen Fahrplan zum Erfolg.

Marktdynamik verstehen

Der Eckpfeiler der Philosophie von Otis Klöber Erfahrungen ist ein tiefes Verständnis des Marktverhaltens. Er legt Wert darauf, Muster zu erkennen, Trends zu analysieren und über globale Wirtschaftsereignisse auf dem Laufenden zu bleiben. „Wissen ist Macht im Handel“, sagt Otis Klöber. „Ein gut informierter Händler ist besser gerüstet, um fundierte Entscheidungen zu treffen.“ Sein Leitfaden ermutigt Händler, Tools wie technische Analyse, grundlegende Forschung und Stimmungsindikatoren zu nutzen, um eine ganzheitliche Marktansicht zu erhalten.

Risikomanagement: Der Schlüssel zur Langlebigkeit

Einer der wichtigsten Aspekte des Leitfadens von Otis Klöber Erfahrungen ist sein Fokus auf das Risikomanagement. Er rät Händlern, ihre Risikotoleranz zu definieren und sich daran zu halten. „Kapitalerhalt ist genauso wichtig wie Gewinne zu machen“, erklärt er. Zu diesem Zweck stellt Klöber Strategien vor, wie das Setzen von Stop-Loss-Orders, die Diversifizierung von Portfolios und die Vermeidung einer Überschuldung. Diese Praktiken helfen Händlern, die Marktvolatilität zu überstehen und eine nachhaltige Handelsstrategie beizubehalten.

Kryptowährungshandel meistern

Kryptowährungen haben die Finanzlandschaft revolutioniert und bieten beispiellose Wachstumschancen. Sie bringen jedoch auch erhebliche Risiken mit sich. Der Leitfaden von Otis Klöber Erfahrungen befasst sich mit den Feinheiten des Handels mit digitalen Vermögenswerten und betont, wie wichtig es ist, die Blockchain-Technologie zu verstehen, Projektgrundlagen zu bewerten und die Marktstimmung zu erkennen. Er warnt auch davor, auf Hype hereinzufallen, und fordert Händler auf, eine gründliche Due Diligence durchzuführen, bevor sie in eine Kryptowährung investieren.

Entwicklung einer disziplinierten Handelsmentalität

Emotionen können der schlimmste Feind eines Händlers sein. Otis Klöbers Leitfaden unterstreicht die Bedeutung der Entwicklung einer disziplinierten Denkweise, um impulsive Entscheidungen aus Angst oder Gier zu vermeiden. „Erfolgreicher Handel erfordert Geduld, Belastbarkeit und eine klare Strategie“, erklärt er. Zu seinen praktischen Tipps gehören das Führen eines Handelstagebuchs, das Setzen realistischer Ziele und das Lernen aus Erfolgen und Misserfolgen.

Nutzung von Technologie und Ressourcen

Im heutigen digitalen Zeitalter haben Händler Zugriff auf eine Fülle von Tools und Plattformen, die ihren Entscheidungsprozess verbessern können. Otis Klöber empfiehlt die Verwendung zuverlässiger Handelsplattformen, algorithmischer Tools und Bildungsressourcen, um immer einen Schritt voraus zu sein. Er betont auch den Wert des Beitritts zu Handelsgemeinschaften, um Erkenntnisse auszutauschen und von Kollegen zu lernen.

Kontinuierliches Lernen: Eine lebenslange Reise

Otis Klöber Erfahrungen glaubt, dass die Finanzmärkte ein dynamisches Umfeld sind, das ständiger Anpassung bedarf. „Sobald Sie aufhören zu lernen, geraten Sie ins Hintertreffen“, warnt er. Sein Ratgeber empfiehlt kontinuierliche Weiterbildung durch Bücher, Webinare und Mentorenprogramme, um die Handelsfähigkeiten zu verfeinern und über Markttrends auf dem Laufenden zu bleiben.

Abschließende Gedanken

Otis Klöbers Ratgeber zum Handel mit Aktien und Kryptowährungen ist ein Beweis für sein Engagement, Einzelpersonen dabei zu unterstützen, die Kontrolle über ihre finanzielle Zukunft zu übernehmen. Durch die Kombination praktischer Strategien mit einem disziplinierten Ansatz bieten seine Erkenntnisse eine solide Grundlage für Händler, die in der wettbewerbsorientierten Finanzwelt erfolgreich sein wollen. Egal, ob Sie ein Neuling oder ein erfahrener Investor sind, Otis Klöbers Anleitung kann Ihnen helfen, die Komplexität des Marktes zu meistern und Ihre finanziellen Ziele zu erreichen.

#Otis Klöber Erfahrungen#Trading Guide#Investment Tips#Financial Freedom#Crypto Trading#Stock Market Tips

0 notes

Text

UK Inflation Rises for the Second Consecutive Month in November

Inflation in the UK has increased for the second consecutive month, reflecting ongoing challenges for households and businesses. According to official figures from the Office for National Statistics (ONS), the inflation rate rose from 2.3% in October to 2.6% in November, driven primarily by increases in fuel and clothing prices.

Read More...

1 note

·

View note

Text

0 notes

Text

Mastering the Art of Short-Term Crypto Trading

Short-Term Crypto Trading has rapidly gained popularity in recent years, with an increasing number of individuals seeking to capitalize on the volatility of digital assets. Short-term crypto trading, in particular, has emerged as a lucrative opportunity for traders looking to profit from price fluctuations over brief periods. However, navigating the fast-paced world of short-term trading requires a solid understanding of market dynamics, technical analysis, and risk management. In this beginner’s guide, we’ll delve into the essentials of mastering the art of short-term crypto trading.

Introduction to Short-Term Crypto Trading

Short-term trading involves buying and selling assets within a relatively short time frame, typically ranging from minutes to days. Unlike long-term investing, which focuses on the fundamental value of an asset over time, short-term trading relies on exploiting short-term price movements for profit. While short-term trading can offer quick returns, it also comes with higher levels of risk due to increased volatility.

Setting Up Your Trading Environment

Before diving into short-term crypto trading, it’s crucial to establish a conducive trading environment. Start by choosing a reputable cryptocurrency exchange that offers a wide range of trading pairs and robust security features. Once you’ve selected an exchange, create a trading account and complete the necessary verification procedures. Additionally, familiarize yourself with the various trading tools and resources available, such as charting platforms, order types, and market analysis tools.

Understanding Market Analysis

Successful short-term trading requires a deep understanding of market analysis techniques. Technical analysis involves studying price charts and identifying patterns and indicators to predict future price movements. Fundamental analysis, on the other hand, focuses on evaluating the intrinsic value of an asset based on factors such as market demand, technology, and team expertise. Additionally, sentiment analysis involves gauging market sentiment through social media, news sentiment, and other indicators.

Developing a Trading Strategy

Having a well-defined trading strategy is essential for navigating the volatile crypto markets. Start by setting clear goals and objectives, such as profit targets and risk tolerance levels. Next, choose a trading style that aligns with your personality and risk appetite, whether it’s scalping, day trading, or swing trading. Implement robust risk management techniques, such as position sizing and diversification, to minimize potential losses.

Join our exclusive Four Candles Formula Master Class and unlock the secrets to profitable trading! Learn from industry experts and discover the strategies behind successful candlestick analysis. Don’t miss this opportunity to elevate your trading skills and achieve consistent results in the market. Enroll now to secure your spot and take the first step towards mastering the art of trading with confidence. ->See the course

Effective Entry and Exit Strategies

One of the keys to successful short-term trading is mastering entry and exit strategies. Identify optimal entry points based on your analysis of price patterns, support and resistance levels, and momentum indicators. Set stop-loss and take-profit levels to manage risk and lock in profits. Additionally, develop a clear plan for exiting trades, whether it’s based on predetermined targets or changing market conditions.

Managing Emotions and Psychology

Emotions play a significant role in short-term trading, often leading to impulsive decisions and irrational behavior. To succeed as a short-term trader, it’s essential to master your emotions and maintain a disciplined approach to trading. Avoid succumbing to fear and greed by sticking to your trading plan and avoiding emotional attachments to trades. Learn to accept both wins and losses as part of the trading process and focus on continuous improvement.

Continuous Learning and Adaptation

The cryptocurrency market is constantly evolving, with new trends, technologies, and regulations shaping its landscape. As a short-term trader, it’s crucial to stay informed and adapt to changing market conditions. Keep abreast of market trends and news that may impact your trading decisions. Moreover, leverage educational resources, such as online courses, webinars, and trading communities, to enhance your knowledge and skills.

Conclusion

Short-term crypto trading offers exciting opportunities for traders to capitalize on market volatility and generate profits within a short time frame. By mastering the art of short-term trading and developing a solid trading strategy, beginners can navigate the complexities of the crypto market with confidence. Remember to focus on continuous learning, risk management, and emotional discipline to succeed in the dynamic world of short-term crypto trading.

Join our exclusive Four Candles Formula Master Class and unlock the secrets to profitable trading! Learn from industry experts and discover the strategies behind successful candlestick analysis. Don’t miss this opportunity to elevate your trading skills and achieve consistent results in the market. Enroll now to secure your spot and take the first step towards mastering the art of trading with confidence. ->See the course

FAQs

Is short-term crypto trading suitable for beginners?

Short-term crypto trading can be challenging for beginners due to its fast-paced nature and higher risk levels. It’s essential to start with small investments and gradually build your skills and experience.

How much time do I need to dedicate to short-term trading?

The amount of time required for short-term trading depends on your trading style and strategy. Some traders may spend several hours a day analyzing markets and executing trades, while others may take a more passive approach.

What are some common mistakes to avoid in short-term crypto trading?

Common mistakes in short-term trading include overtrading, ignoring risk management principles, and letting emotions dictate trading decisions. It’s crucial to remain disciplined and stick to your trading plan.

Can I use automated trading bots for short-term crypto trading?

Automated trading bots can be useful tools for short-term trading, but they also come with risks. It’s essential to thoroughly research and test any trading bot before using it with real funds.

How can I stay updated on market trends and news relevant to short-term trading?

Stay informed by following reputable cryptocurrency news outlets, joining trading communities, and utilizing social media platforms to stay updated on market developments.

#Short Term Trading#Trading Guide#Bitcoin Trading Guide#Bitcoin Money#Trading Formula#binance#coinbase#earn money online#passive income#crypto news#crypto trading tools#ethereum

0 notes

Text

Trading gold and silver online has long been an attractive prospect for investors seeking to diversify their portfolios and capitalize on the enduring value of precious metals. In this comprehensive guide, we will explore the intricate world of online trading, providing insights into the fundamentals, strategies for success, and practical tips to navigate the dynamic landscape of gold and silver markets.

0 notes

Text

Learn how to trade like the pros! Get access to secret tools, tips & tricks only Wall Street Wolves know.

0 notes

Text

0 notes

Text

How do I avoid scams in the crypto and forex trading industry?

The crypto and forex trading industry has become increasingly popular in recent years. With the rise of cryptocurrencies and the ease of online trading, more and more people are investing in these markets. However, as it becomes more popular, scams also become more prevalent.

It's important to avoid scams in the crypto and forex trading industry because they can have serious consequences. Scams can result in the loss of your investment and can damage your financial future. In addition, scams can erode trust in the industry and make it more difficult for legitimate traders to succeed.

To avoid scams, it's important to choose a reputable broker. You can also look for reviews from trusted sources to help you choose a broker.

In addition, it's important to learn about foreign currency trading and crypto trading strategies. By understanding the basics of trading and learning about different trading strategies, you can make informed decisions about your investments.

If you're looking for a list of top forex brokers or top cryptocurrency exchanges, there are many resources available online. You can also find information about trading signals and other trading strategies to help you succeed in the industry.

Scams in the crypto and forex trading industry

In the crypto and forex trading industry, scams can take many forms. In the forex industry, scams can be perpetrated by unscrupulous brokers, fraudulent investment schemes, or other malicious means. Some common forex trading scams include Ponzi schemes, pyramid schemes, and fake investment opportunities.

In the cryptocurrency industry, scams can take many forms as well. Some common cryptocurrency scams include giveaways, blackmail, rug pulls, romance scams, phishing, extortion emails, fake company alerts, initial coin offerings (ICOs), non-fungible tokens (NFTs), and fake mining apps or networks.

How to identify scams in the crypto and forex trading industry

To identify scams in the crypto and forex trading industry, you should be aware of some common warning signs. For example, if a broker promises guaranteed returns or claims that you can make a lot of money quickly, it's likely a scam. In addition, if a broker is unregulated or registered in offshore jurisdictions with little to no oversight, it's also a red flag.

Another way to identify scams is to look for poorly written white papers or excessive marketing. You should also be wary of anyone asking you to send them cryptocurrency or asking for your private information such as security codes.

It's important to do your research before investing in any crypto or forex trading opportunity. You should learn the basics of trading and understand the risks involved. You should also check the background of the broker and look for reviews from trusted sources.

How to avoid scams in the crypto and forex trading industry

To avoid scams in the crypto and forex trading industry, you should follow some best practices. To begin with, only invest funds that you can afford to lose. You should also do your research and learn the basics of trading before investing.

Another way to avoid scams is to choose a reputable broker. Look for brokers who have a solid reputation in the sector and are governed by trustworthy authorities. You can also look for reviews from trusted sources to help you choose a broker.

It's also important to be aware of common scams and warning signs. It is probably genuine if it looks too good to be true. You should also be wary of anyone asking you to send them cryptocurrency or asking for your private information such as security codes.

Finally, you should always keep your private information secure. Protect your accounts by using two-factor authentication and secure passwords.

Conclusion

In conclusion, scams in the crypto and forex trading industry can take many forms and can be perpetrated by unscrupulous brokers, fraudulent investment schemes, or other malicious means. To avoid scams, you should only invest money that you can afford to lose and do your research before investing. You should also choose a reputable broker that is regulated by reputable authorities and has a good reputation in the industry.

It's also important to be aware of common scams and warning signs such as promises of guaranteed returns or excessive marketing. Finally, you should always keep your private information secure.

If you're looking for a list of top forex and cryptocurrency trading platforms, Trading Critique is a great resource. Trading Critique provides unbiased reviews of the top cryptocurrency exchanges and forex brokers in the industry.

0 notes

Text

Was anyone going to tell me the new Sultai are incredibly based?

#planeswalker’s guide to tarkir dragonstorm#Sultai#tarkir dragonstorm#mtg#magic the gathering#honestly I love what they’ve done with every clan though#the mardu clash of sky and ember is epic and makes total sense in an environment full of storms and wimd#also it’s nice to see their technological abilities emphasized and how they can actually contribute to global trade#instead of just raiding everyone all the time#the abzan seem pretty similar to their pre-dtk incarnation which makes sense for a clan so focused on tradition#I’m glad they stopped kidnapping orphans though#the jeskai also seem pretty similar in terms of overall societal structure and ideals#I can’t say much about the temur. this planeswalker’s guide certainly goes into a lot more detail on their actual traditions#and survival strategies than the old ktk planeswalker’s guide which is nice#the sultai change is probably the most dramatic and the most deserved though.#I mean there’s definitely a place for ruthlessly exploitative civilizations but against the backdrop of liberation from the dragonlords#it’s nice to see the sultai becoming a much fairer and more prosperous society

55 notes

·

View notes

Text

Michael Hingson was in Tower One of the World Trade Center on the morning of 11 September 2001.

What sets his story apart is that Hingson is blind and was guided to safety by his guide dog, Roselle.

They were on the 78th floor when the plane hit.

Despite the chaos, Roselle remained calm, leading Hingson and several others down 1,463 steps to safety. The descent took about an hour.

Remarkably, just moments after they exited the building, Tower Two collapsed, covering them in debris. Both survived.

Hingson later said:

"While everyone ran in panic, Roselle remained totally focused on her job, while debris fell around us, and even hit us, Roselle stayed calm."

Once clear, Roselle led her owner to the safety of a subway station, where they helped a woman who had been blinded by falling debris.

Once they arrived home, Roselle immediately began playing with her retired guide dog predecessor, Linnie, as if nothing important had happened.

Hingson's story became widely known as an extraordinary tale of trust, teamwork, and the human-animal bond.

He later wrote a memoir, "Thunder Dog," detailing his experience.

In 2004, Roselle was diagnosed with immune-mediated thrombocytopenia, but medications were able to control the condition.

In March 2007, she retired from guiding after it was discovered that the medication was beginning to damage her kidneys.

Roselle passed away on 26 June 2011 at age 13.

Roselle (March 12, 1998 - June 26, 2011)

#Roselle#Labrador Retriever#guide dog#Guide Dogs for the Blind#PDSA Dickin Medal#Dickin Medal#Worl#Michael Hingson#World Trade Center#Twin Towers#11 September 2001#hero dogs#Thunder Dog#9/11

452 notes

·

View notes

Text

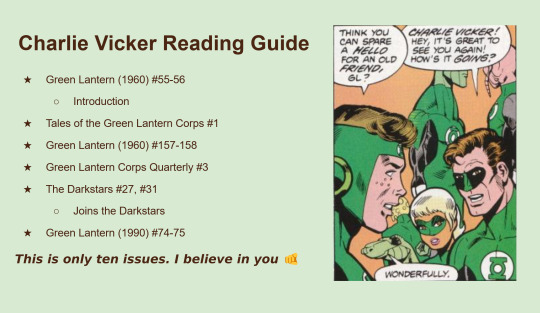

charles "charlie" vicker reading guide. please im begging you. hello can anyone hear me its so cold out here. hello

#charlie vicker#reading guide#trade offer. you read charlies comics. you receive a better understanding and appreciation of my charlieposts

311 notes

·

View notes

Text

I have recently found myself speaking again to once-nobles and remembering interesting differences between us and our Karrakin neighbors, so in the interest of cultural exchange let me tell you this: On Sanjak we tell the story of Passacaglia differently.

To those who grew up on the story as told by the ones who would make a great hero of the man, you'll recognize most of it, but I'd ask you to pay attention to the details of the story, and consider what we Sanjak see in it.

Once there was a man who lived in the shadow of a ruler. Like us, he was born ignoble, and like we once were, he was pledged to labor in that ruler's fields. He and his family would toil, day in and out, and produce great quantities of food that would be tithed to the man that owned his land and his pledge. One day he would unify the people and rule under the name Passacaglia, but before he was just a man who turned soil to wheat in the shadow of the great city Reis.

But Reis was troubled: there were raiders at the borders, both the desperate and the spiteful, those left hungry by the tyrants in power and those sent by those same tyrants to bite at the heels of the one Passacaglia was pledged to.

In those times, as now, it was common for those in power to look upon those below them and see them as things to be used. So too did Pasha Reis, the ruler of Reis, who looked upon Passacaglia's family and saw naught but serfs who could be traded for continued safety from the raiders who plagued his borders. A deal was struck: Passacaglia's family may be made fallow so that the peace can remain.

The peace brought the deaths of twelve of his brothers over twelve years of fighting, as the tithe Passacaglia's family paid the nearby Pasha was repaid in silence. Bearing the grief of his brothers and the rage of his mothers, Passacaglia begged Pasha Reis for aid. He was refused. Another brother died. Passacaglia begged again, on both knees. He was refused. Another brother died. A third time, he groveled and cried for aid. He was refused. Another brother died.

Left then with nothing else to do, Passacaglia and his last remaining brother, Anaxandron, looked to the people of their commune and the great city they bordered, and then back to the lord who had left them for dead, and came up with a plan: Passacaglia would deny the tithe and take to the city to seek their aid, and Anaxandron would spread word of the dereliction of the Pasha from his duty. And so Passacaglia left for ancient Karrakis.

He returned with a great many soldiers and a great many weapons to find the people of Reis turn coat to join under his banner. Anaxandron, who spoke of the cruelty and betrayal of the Pasha, had swayed the people of Reis, who had come to find that the true enemy is not the one outside their gates but the one above them.

Stood by the throne of Reis, Passacaglia looked out. He saw the nature of the world around him as the Pasha once did. Reis is but a fragment of the whole world, its injustices a mirror to the injustices made manifest in Laurent, and Cosimo, and Dellamar. Across the surface of Karrakis, other families were made fallow, other brothers killed. His anger, once abated after the death of Pasha Reis, was ignited by the firebrand once again, and he pointed the people of Reis at the thrones of Laurent and Reis and Cosimo. Ahead of them, the words of Anaxandron, that those in power stayed in that place only for betrayal and violence, spread. The other great city-states of the melee fell as Reis did.

At the end of it all, Passacaglia stood in the ancient city Karrakis and looked upon the known world. He saw the people liberated, and saw the banner that they waved. He had been the tip of that spear, and he knew himself to be just, felt the Firebrand at one hand and the Titan at the other. Passacaglia looked up once again, to a higher throne even than Pasha Reis ever held, empty. The old rulers failed, he thought, but they did so because they had to compromise to the powers around them. Reis was threatened by Cosimo and so had to cede lives to maintain the peace. But Passacaglia thought that would have to bow to no one: he thought could bring justice and prosperity by his hand alone. So the wheel turned: a tyrant replaced with a kinder tyrant. A revolution betrayed by the allure of power. One kind of oppression replaced by another.

We tell this story to our children as a lesson on the nature of change. It is not enough to rid the world of a tyrant only to replace them with a better one. The reign of Passacaglia and his progeny produced the reign of Tyrannus, which produced the system we fought so hard to overthrow. Only when the revolution seeks liberation for the people and not the elevation of a better tyrant can it end the cycle of violence that we live within.

My mentor Ozia used to call him the Fool's revolutionary, but I think that pays too much disrespect to the Fool. Of all the Passions, the Fool teaches us humility, that we may look upon ourselves and see ourselves as fallible and capable of erring. Passacaglia learned no such lesson. In this way, he lives in the hearts of the nobility now: they do not see the error of putting power in the hands of a virtuous few.

Consider this lesson carefully. When he stepped on the road to war, Passacaglia was told that the empire he would build would make monuments to his mothers and brothers from the ashes of other mothers and other brothers, and he would trade the families of others for the comfortable peace of empire. He chose to ascend to the throne regardless. Here I warn you now: this is the nature of all empire, and all revolutions like Passacaglia's.

-Mistral

#mistral reporting#ooc this takes place after the off the air posting if you care abt the timeline here#also yeah this is mostly covered in the ktb field guide but the latter half is a lot of recontextualization#and the front half is needed for that#wanted to explore some facets of how i think the sanjak ungratefuls reconcile their cultural history#and i think that reframing the passacaglia story is an interesting way of doing it#i think the bit abt passacaglia being an ignoble revolutionary who was marked for death#would resonate a lot#lancer rpg#lancer ttrpg#karrakin trade baronies#ktb#lancer ktb#free sanjak

22 notes

·

View notes

Text

1 note

·

View note