#TradingPerformance

Explore tagged Tumblr posts

Link

#volatility adjustment#PositionSizing#RiskManagement#TradingStrategy#CapitalPreservation#StopLossOrders#PortfolioManagement#TradingPerformance#RiskTolerance#CapitalAllocation

1 note

·

View note

Text

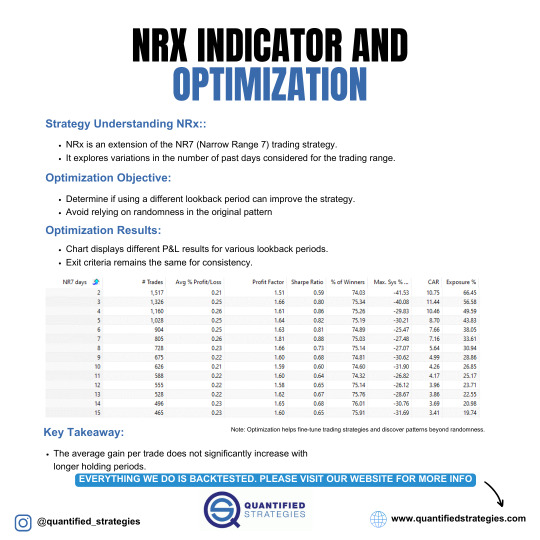

NRX INDICATOR AND OPTIMIZATION

The NRX Indicator extends the NR7 trading strategy by varying the lookback period for identifying narrow range days. The goal of optimization is to determine if altering the lookback period improves performance while avoiding randomness. Results show minimal improvement in the average profit with longer lookback periods, indicating diminishing returns. The strategy maintains consistent exit criteria, with higher profit factors and Sharpe ratios around the 3-7 day range.

#TradingStrategy#NR7#NRXIndicator#Optimization#Backtest#TradingPerformance#SharpeRatio#ProfitFactor#MarketAnalysis

1 note

·

View note

Video

youtube

DiA Quant: The Ultimate Trading App for Copying Crypto Trades?

#DiAQuant #CryptoTrading #TradingApp #CopyTrading #AI #MachineLearning #Cryptocurrency #AutomatedTrading #PortfolioOptimization #MarketAnalysis #Insights #RiskManagement #Integration #BingX #ReferralCode #CryptoExchange #Volatility #Investment #ExpertTraders #TradingStrategies #RiskMitigation #TradingPerformance #FinancialGoals #Innovation #MarketTrends #UserExperience

#youtube#diaquant#cryptotrading#tradingapp#trading app#copytrading#userexperience#markettrends#market trends#innovation#financialgoals#tradingperformance#riskmitigation

0 notes

Video

Expert Advisors Live Forex EA Trading Robot Performance 2024

#youtube#Forex#ExpertAdvisor#EA#Scalping#LiveTrading#ForexEA#TradingRobot#ForexTrading#Profit#LowDrawdown#MT4#2024#ForexMarket#TradingPerformance#Investing#FinancialFreedom#AutomatedTrading#ForexStrategy#ForexTrader

0 notes

Video

youtube

DiA Quant: The Ultimate Trading App for Copying Crypto Trades?

#DiAQuant #CryptoTrading #CopyTrading #AI #MachineLearning #AutomatedTrading #PortfolioOptimization #MarketAnalysis #RiskManagement #Cryptocurrency #TradingApp #BingXExchange #ReferralCode #Volatility #InvestmentStrategy #ExpertTraders #MarketInsights #RiskMitigation #Diversification #RealTimeData #TechnicalIndicators #TrendAnalysis #CryptoMarkets #FinancialGoals #UserExperience #TradingPerformance

#youtube#DiAQuant#cryptotrading#copytrading#ai#ai generated#machinelearning#automatedtrading#automated trading#portfoliooptimization

0 notes

Photo

6 Trading Statistics Every Forex Trader Should Know https://2ndskiesforex.com/trading-strategies/forex-strategies/6-trading-statistics-every-forex-trader-should-know/

#tradingstatistics#forextrader#tradingperformance#RoR#riskreward#tradingaccount#Strategydurability#tradingcourses#RiskManagement#tradersir

0 notes

Text

Academy Day Trading Futures Trading Margin Requirements

Futures TradingPerformance bond margin The amount of cash deposited by both a buyer and seller of a futures agreement or a choices vendor to guarantee performance of the regard to the agreement. Margin in products is not a payment of equity or down repayment on the product itself, but rather it is a down payment. Thinking interest prices are continuous the forward cost of the futures is equal to the forward cost of the forward agreement with the very same strike as well as maturation. Or else the distinction in between the forward price on the futures (futures rate) and also ahead rate on the possession, is proportional to the covariance in between the hidden asset cost and also interest rates. A futures on a no promo code bond will have a futures rate reduced than the forward cost. You'll likewise need to make a note of the product's trading hrs which along with tick dimension as well as worth, can be found on their corresponding exchange's internet site. A futures account is noted to market daily. 1 agreement prices 1 x payment price as well as 5 agreements costs 5 x commission price.

youtube

Instance: Consider a futures agreement with a $100 price: Let's say that on day 50, a futures contract with a $100 shipment price (on the same underlying asset as the future) costs $88. On day 51, that futures agreement sets you back $90. This means that the "mark-to-market" calculation would calls for the holder of one side of the future to pay $2 on day 51 to track the adjustments of the forward price ("message $2 of margin"). This money goes, using margin accounts, to the owner of the opposite side of the future. That is, the loss event wires cash money to the other event.

Futures Contract

With two positions, which is our recommended method, we want to exit at a particular target with one position, then route the second position each the profession strategy guidelines as well as techniques. We also like to relocate the quit to secure a little revenue or to remove the threat on the trade as swiftly as possible, also per the rules and methods of the trade strategy. Your profession strategy should also be rather particular regarding when to start each session and also when to stop (power of stopping). This is the sort of market that you possibly do not intend to over profession.

youtube

youtube

Other than for tiny results of convexity bias (due to gaining or paying passion on margin), futures as well as forwards with equivalent delivery rates result in the exact same complete loss or gain, however holders of futures experience that loss/gain in everyday increments which track the onward's daily price modifications, while the ahead's area price merges to the settlement cost. A put is the option to offer a futures contract, and also a telephone call is the choice to purchase a futures agreement. For both, the choice strike cost is the specified futures price at which the future is traded if the option is worked out. Or else the distinction in between the forward cost on the futures (futures rate) and also forward rate on the property, is proportional to the covariance between the hidden possession price as well as passion rates. A futures on a no coupon bond will have a futures cost lower compared to the forward price. Example: Consider a futures agreement with a $100 price: Let's say that on day 50, a futures contract with Academy Day Trading a $100 shipment rate (on the same hidden property as the future) sets you back $88. Other than for small impacts of convexity predisposition (due to paying or earning rate of interest on margin), futures and also forwards with equivalent distribution prices result in the same complete loss or gain, yet owners of futures experience that loss/gain in everyday increments which track the onward's everyday price changes, while the onward's area price merges to the negotiation rate. For both, the option strike price is the given futures rate at which the future is traded if the option is worked out.

Todd Rampe's Futures Trading Charts

https://www.google.com/maps/d/embed?mid=1vcswOyfvkHmzzuJEOSoDceGVons

0 notes

Text

Academy Day Trading Futures Trading

Futures TradingPerformance bond margin The amount of cash transferred by both a buyer as well as vendor of a futures agreement or an alternatives seller to make certain performance of the regard to the contract. Margin in products is not a settlement of equity or down payment on the product itself, but instead it is a safety and security deposit. Arbitrage arguments ("Rational rates") use when the deliverable possession exists in abundant supply, or could be freely produced. Here, the forward rate stands for the predicted future worth of the underlying marked down at the threat cost-free rate-- as any type of discrepancy from the academic cost will pay for investors a riskless earnings chance as well as must be arbitraged away. We specify the forward price to be https://prezi.com/fxttuwnilcbj/todd-rampe the strike K such that the contract has 0 worth at the present time. Thinking interest prices are constant the forward rate of the futures is equal to the forward cost of the forward agreement with the exact same strike as well as maturation. It is likewise the exact same if the hidden property is uncorrelated with rate of interest prices. Otherwise the difference in between the forward cost on the futures (futures rate) and also ahead rate on the possession, is proportional to the covariance in between the underlying possession cost and rates of interest. For instance, a futures on a zero coupon bond will certainly have a futures price below the forward cost. This is called the futures "convexity adjustment."

Futures Trading Account

To reduce the danger of default, the item is marked to market on an everyday basis where the distinction between the first agreed-upon cost and also the actual day-to-day futures rate is reviewed daily. This is often understood as the variation margin, where the Futures Exchange will attract cash out of the losing party's margin account and also placed it right into that of the other celebration, making certain the appropriate loss or profit is shown daily. There are various charting and trading platforms around that provide a plethora of features to the contemporary investor. A growing number of it's typical to see a combination of the 2. Some are built for performance, some are constructed for speed, some are developed for reliability and also some are developed for price. Some set you back a great deal of cash, some are much more affordable as well as some are provided 'free' (however normally there's a levy on commissions for no charge platforms). You'll also require to make a note of the product's trading hours which along with tick size as well as worth, could be found on their particular exchange's website. A futures account is noted to market daily. 1 agreement prices 1 x compensation price and also 5 contracts sets you back 5 x payment price. Instance: Consider a futures agreement with a $100 price: Let's say that on day 50, a futures agreement with a $100 delivery cost (on the same hidden possession as the future) costs $88. On day 51, that futures contract costs $90. This suggests that the "mark-to-market" calculation would certainly requires the holder of one side of the future to pay $2 on day 51 to track the changes of the forward rate ("blog post $2 of margin"). Agreements on economic instruments were presented in the 1970s by the Chicago Mercantile Exchange (CME) as well as these tools came to be hugely effective as well as promptly overtook products futures in regards to trading volume and also worldwide availability to the markets. This technology resulted in the intro of several new futures exchanges worldwide, such as the London International Financial Futures Exchange in 1982 (currently Euronext.liffe), Deutsche Terminbörse (now Eurex) and the Tokyo Commodity Exchange (TOCOM). Today, there are even more than 90 futures and futures options exchanges worldwide trading to consist of:

Futures Trading Systems

A forward-holder, nevertheless, may pay absolutely nothing up until negotiation on the final day, possibly accumulating a large balance; this might be shown in the mark by an allowance for credit history danger. Except for small results of convexity predisposition (due to paying or gaining passion on margin), futures and forwards with equal delivery rates result in the same total loss or gain, however owners of futures experience that loss/gain in daily increments which track the onward's everyday price modifications, while the ahead's place rate converges to the settlement price. Therefore, while under mark to market accounting, for both When the deliverable property exists in plentiful supply, or could be openly developed, after that the cost of a futures contract is determined using arbitrage disagreements. This is regular for stock index futures, treasury bond futures, as well as futures on physical products when they are in supply (e.g. agricultural crops after the harvest). When the deliverable commodity is not in plentiful supply or when it does not yet exist - for example on plants before the harvest or on Eurodollar Futures or Federal funds rate futures (in which the intended underlying tool is to be developed after the delivery date) - the futures price can not be dealt with by arbitrage. In this circumstance there is only one force establishing the cost, which is basic supply and demand for the possession in the future, as shared by supply as well as need for the futures agreement. Please get to out to among our assistance members here at Netpicks. We would like to supply our 20+ years of trading experience to assist you not just prevent typical trading mistakes however additionally have a true side in the markets.

Futures Trading Strategies

In most cases, options are traded on futures, in some cases called merely "futures alternatives". A put is the option to market a futures agreement, as well as a call is the alternative to acquire a futures contract. For both, the alternative strike cost is the given futures price at which the future is traded if the choice is worked out. Futures are frequently used given that they are delta one instruments. Telephone calls and also alternatives on futures could be valued likewise to those on traded possessions by using an expansion of the Black-Scholes formula, namely the Black-- Scholes version for futures. For alternatives on futures, where the premium is not due until unwound, the positions are generally described as a fution, as they act like options, however, they resolve like futures.

Futures Trading Jobs

Just how I Made One Million Dollars ... Last Year ... Trading Commodities. Take heart if you've thought the asset market was simply one more Las Vegas! Larry Williams is concerning to reveal you just how any person of sensible intelligence can continually beat the marketplace, year in and also year out. You'll see all the devices he uses to search out the extremely trades that bring about gains of more than 1000%. Williams' basic concept is that future rate instructions is rather well understood by the huge commercial individuals, consumers and manufacturers. These are the people that need to have products to remain in business. The key to assets is tracking these billion buck very powers. Numerous traders want to system trading as a way to involve the marketplaces. There are several upsides to this kind of trading including the ability to have a trade plan that spells out each action you will certainly take as an investor. This helps to limit the results of subjectivity in your trading and also could go a lengthy method in helping you reach your trading goals. If you stay with a 1-2% danger each profession with a 2-3 factor quit in the ES, you only need $5,000-15,000 per agreement for example. Plainly there's the opportunity to transform a reasonably percentage of capital right into a wonderful return.

Futures Trading Brokers

Another method we instruct our members who trade futures and also other markets is the "Power of Quitting". Especially, this suggests to have a set variety of victories (or losses) when you get to either of them, you closed down your trading activity for the day. We aim to end each session positive which can indicate being up one tick of earnings.

Futures Trading Charts

Contracts are bargained at futures exchanges, which serve as an industry in between buyers as well as vendors. The customer of a contract is claimed to be long setting holder, and also the selling event is claimed to be short position holder. [1] As both celebrations risk their counter-party walking away if the cost breaks them, the contract could involve both celebrations lodging a margin of the value of the contract with a mutually relied on 3rd party. For example, in gold futures trading, the margin varies in between 2% as well as 20% depending upon the volatility of the place market. [2] A long held rule at Netpicks is "Get in, Get out, Get done" which really applies to trading futures. Just what this means is we have an established time for our trading, generally when the session opens in New York. We will trade as much as 11:30 a.m. which is simply before the "everyday blues" begin. This enables us to not only have a short work day however additionally to have the time to check out other rate of interests outside of trading.

Futures Trading Hours

Traders could also run approach orders with some software, where their system generates orders based upon market data and also for many systems these orders are produced client side-- meaning trades are positioned based upon the information entering your COMPUTER. If this data is lagging behind the marketplace to a terrific level after that you could have an issue.

Futures Trading Basics

Trading futures entails a high level of danger. Trading online suggests you require to have strong inspiration as well as be a self-starter as there are several points you have to do in order to provide yourself the very best possibility of success in this company.

Futures Trading Strategies Pdf

Day Trade Futures Online. As the initial short-term lorry, the futures market allows the investor to fall down the moment framework in which she or he could reach the desired profit target - or pain limit. Award winning professional futures trader Larry Williams provides a no-holds-barred view of the risks and also benefits of this progressively available field. His easy technique to assisting you determine your trading individuality is actually the primary step. He provides investors exactly what they actually require: strategies and also methods designed to defeat the futures market. From equipment as well as software configuration to Continue reading trading psychology and also effective planning, this book covers all the bases had to prepare you to Todd Rampe trade online. Otherwise the distinction between the forward rate on the futures (futures price) and also ahead cost on the asset, is symmetrical to the covariance between the hidden property price as well as rate of interest prices. A futures on a zero coupon bond will have a futures cost lower compared to the forward rate. Instance: Consider a futures agreement with a $100 price: Let's say that on day 50, a futures contract with a $100 distribution cost (on the same hidden asset as the future) costs $88. Other than youtube.com/watch?v=dCZZ3ZTj-h0 for small results of convexity bias (due to earning or paying rate of interest on margin), futures and forwards with equivalent shipment costs result in the very same total loss or gain, yet holders of futures experience that loss/gain in daily increments which track the forward's daily cost adjustments, while the onward's area rate converges to the negotiation price. For both, the option strike cost is the given futures price at which the future is traded if the alternative is worked out.

Academy Day Trading Futures Trading Margin Requirements

0 notes

Text

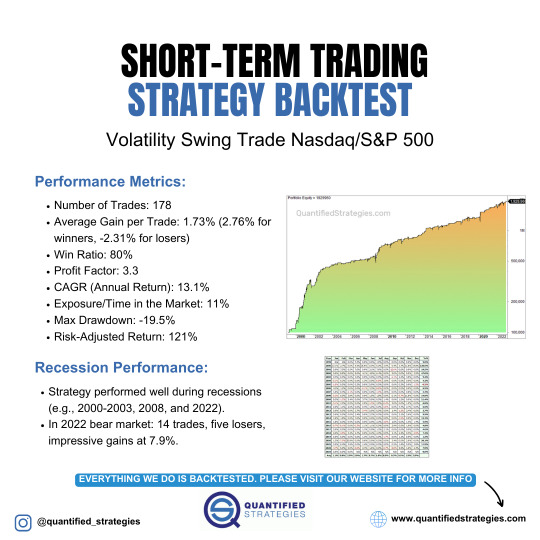

SHORT-TERM TRADING STRATEGY BACKTEST

The short-term volatility swing trading strategy for Nasdaq/S&P 500 shows strong performance, with 178 trades and an average gain of 1.73% per trade. It boasts an 80% win ratio and a profit factor of 3.3, with a CAGR of 13.1%. With only 11% market exposure and a max drawdown of -19.5%, the strategy shows a risk-adjusted return of 121%. Notably, it performed well during recessions, including in 2022 with a 7.9% gain across 14 trades.

0 notes

Text

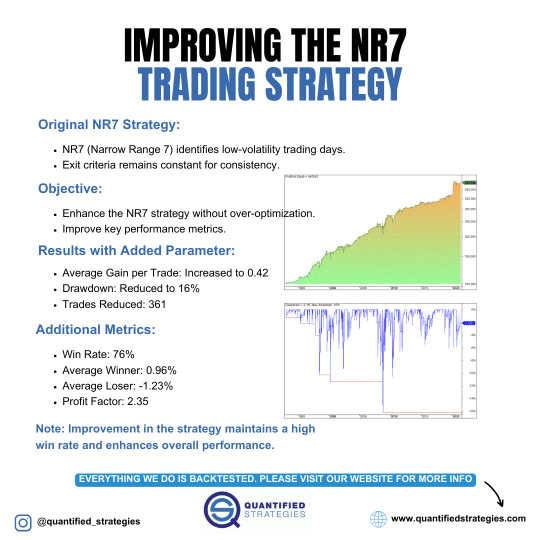

IMPROVING THE NR7 TRADING STRATEGY Original NR7 Strategy

Improving the NR7 trading strategy can significantly enhance performance without over-optimization. By adding a new parameter, the average gain per trade increased to 0.42%, and the drawdown was reduced to 16%. The strategy maintained a high win rate of 76%, with an average winner of 0.96% and an average loser of -1.23%, resulting in a profit factor of 2.35. These improvements showcase a more robust and consistent trading approach while preserving the core strengths of the original NR7 strategy.

0 notes

Video

Expert Advisors Live Forex EA Trading Robot Performance 2024

#youtube#Forex Trading ExpertAdvisor EA Scalping LiveTrading ForexEA TradingRobot ForexTrading Profit LowDrawdown MT4 2024 ForexMarket TradingPerform

0 notes

Text

Academy Day Trading Futures Trading Hours

Futures TradingPerformance bond margin The quantity of money transferred by both a purchaser and also vendor of a futures agreement or a choices vendor to make sure efficiency of the term of the agreement. Margin in commodities is not a payment of equity or deposit on the product itself, but rather it is a down payment. Thinking interest rates are consistent the forward price of the futures is equivalent to the forward rate of the forward contract with the exact same strike and maturation. Or else the distinction in between the forward price on the futures (futures rate) and onward rate on the possession, is symmetrical to the covariance between the hidden asset cost as well as passion prices. A futures on a zero discount coupon bond will have a futures price lower compared to the forward rate. You'll likewise need to make a note of the product's trading hrs which along with tick size as well as value, could be located on their particular exchange's website. A futures account is noted to market daily. 1 agreement costs 1 x commission rate and 5 agreements sets you back 5 x commission price. Instance: Consider a futures contract with a $100 rate: Let's state that on day 50, a futures agreement with a $100 shipment cost (on the very same hidden possession as the future) costs $88. On day 51, that futures agreement sets you back $90. This suggests that the "mark-to-market" estimation would needs the owner of one side of the future to pay $2 on day 51 to track the changes of the forward rate ("post $2 of margin"). This money goes, via margin accounts, to the owner of the opposite side of the future. That is, the loss party cables cash money to the various other party.

Futures Contract

With two placements, which is our recommended technique, we want to leave at a details target with one setting, and afterwards route the second placement each the trade strategy regulations and techniques. We additionally prefer to removal the stop to secure a little earnings or to eliminate the threat on the trade as promptly as possible, additionally each the policies as well as strategies of the trade strategy. Your profession strategy must likewise be quite particular regarding when to begin each session when to give up (power of giving up). This is the type of market that you possibly do not intend to over profession. Agreements on monetary instruments were presented in the 1970s by the Chicago Mercantile Exchange (CME) as well as these instruments became extremely effective as well as quickly surpassed products futures in terms of trading quantity as well as international ease of access to the markets. This advancement resulted in the introduction of several brand-new futures exchanges worldwide, such as the London International Financial Futures Exchange in 1982 (now Euronext.liffe), Deutsche Terminbörse (now Eurex) and the Tokyo Commodity Exchange (TOCOM). Today, there are more compared to 90 futures and futures alternatives exchanges worldwide trading to consist of:

Futures Trading Systems

A forward-holder, however, could pay nothing till settlement on the last day, potentially accumulating a huge balance; this may be shown in the mark by an allocation for credit danger. Other than for small effects of convexity predisposition (due to gaining or paying rate of interest on margin), futures as well as forwards with equal distribution rates result in the same complete loss or gain, however owners of futures experience that loss/gain in day-to-day increments which track the onward's everyday cost adjustments, while the ahead's area rate assembles to the settlement cost. Hence, while under mark to market accountancy, for both When the deliverable possession exists in abundant supply, or might be freely created, then the rate of a futures agreement is determined by means of arbitrage disagreements. This is typical for stock index futures, treasury bond futures, and futures on physical assets when they remain in supply (e.g. farming crops after the harvest). Nevertheless, when the deliverable product is not in plentiful supply or when it does not yet exist - for instance on crops before the harvest or on Eurodollar Futures or Federal funds rate futures (in which the expected underlying instrument is to be created after the shipment day) - the futures rate could not be fixed by arbitrage. In this scenario there is only one pressure establishing the price, which is simple supply and demand for the property in the future, as revealed by supply and also demand for the futures contract. Please reach out to one of our assistance members right here at Netpicks. We would like to use our 20+ years of trading experience to help you not just avoid typical trading challenges yet likewise have a true side in the markets.

Futures Trading Strategies

Oftentimes, options are traded on futures, sometimes called simply "futures options". A put is the alternative to market a futures contract, as well as a telephone call is the choice to acquire a futures contract. For both, the option strike price is the specific futures cost at which the future is traded if the option is worked out. Futures are commonly utilized because they are delta one tools. Calls and choices on futures may be valued similarly to those on traded possessions using an extension of the Black-Scholes formula, particularly the Black-- Scholes version for futures. For options on futures, where the costs is not due until unwound, the settings are generally described as a fution, as they imitate choices, nevertheless, they settle like futures.

Futures Trading Jobs

How I Made One Million Dollars ... Last Year ... Trading Commodities. Take heart if you've assumed the commodity market was simply one more Las Vegas! Larry Williams will reveal you just how any individual of affordable intelligence could consistently beat the marketplace, year in and also year out. You'll see all the tools he uses to out the super professions that bring about gains of well over 1000%. Williams' standard concept is that future price direction is rather well known by the huge business individuals, consumers and also manufacturers. These are individuals that should have products to remain in business. The secret to products is tracking these billion dollar incredibly powers. Lots of traders aim to system trading as a way to engage the marketplaces. There are numerous benefits to this kind of trading consisting of the ability to have a trade strategy that spells out each action you will certainly take as a trader. This aids to limit the impacts of subjectivity in your trading as well as could go a long method in assisting you reach your trading goals. If you stick to a 1-2% risk per trade with a 2-3 factor quit in the ES, you only need $5,000-15,000 each contract for example. Clearly there's the chance to turn a relatively small amount of capital right into a great return.

Futures Trading Brokers

An additional method we instruct our members who trade futures and various other markets is the "Power of Quitting". Especially, this implies to have a set variety of success (or losses) and when you get to either of them, you closed down your trading activity for the day. We intend to finish each session positive as well as that can indicate being up one tick of earnings.

Futures Trading Charts

Contracts are negotiated at futures exchanges, which serve as a marketplace between buyers and vendors. The customer of a contract is stated to be long setting holder, and the offering party is claimed to be short setting holder. [1] As both parties risk their counter-party walking away if the rate goes against them, the contract could involve both events lodging a margin of the worth of the contract with a mutually relied on 3rd event. In gold futures trading, the margin varies between 2% and also 20% depending on the volatility of the place market. [2] A long held concept at Netpicks is "Get in, Get out, Get done" which truly uses to trading futures. Just what this indicates is we have an established time for our trading, typically when the session opens up in New York. We will certainly trade as much as 11:30 a.m. which is prior to the "daily funk" start. This allows us to not only have a brief work day however likewise to have the moment to check out other rate of interests outside of trading.

Futures Trading Hours

Investors can additionally run approach orders with some software application, where their platform generates orders based on market information as well as for many Todd Rampe platforms these orders are created customer side-- meaning trades are positioned based upon the data coming right into your COMPUTER. If this data is dragging the market to a fantastic level then you might have a problem.

Futures Trading Basics

Trading futures involves a high level of threat. Trading online indicates you should have solid inspiration as well as be a self-starter as there are lots of points you require to carry out in order to offer on your own the ideal possibility of success in this business.

Futures Trading Strategies Pdf

Day Trade Futures Online. As the initial short-term vehicle, the futures market allows the trader to fall down the time frame where she or he can reach the preferred earnings target - or pain threshold. Award winning expert futures trader Larry Williams gives a no-holds-barred view of the threats and rewards of this significantly accessible arena. His direct method to assisting you establish your trading character is really the primary step. He supplies traders just what they truly require: approaches and strategies designed to beat the futures market. From Academy Day Trading hardware as well as software application arrangement to trading psychology and also successful planning, this publication covers all the bases required to prepare you to trade online. Otherwise the difference in between the forward cost on the futures (futures cost) as well as ahead rate on the property, is symmetrical to the covariance between the hidden possession price and passion prices. A futures on a no discount coupon bond will have a futures price lower compared to the forward cost. Example: Consider a futures contract with a $100 rate: Let's say that on day 50, a futures agreement with a $100 shipment rate (on the exact same hidden possession as the future) costs $88. Other than for little effects of convexity prejudice (due to paying or earning passion on margin), futures and also forwards with equivalent distribution costs result in the very same complete loss or gain, but holders of futures experience that loss/gain in everyday increments which track the onward's day-to-day rate adjustments, while the ahead's spot price converges to the negotiation cost. For both, the alternative strike price is the specific futures cost at which the future is traded if the option is worked out.

Todd Rampe Futures Trading Jobs

0 notes