#U.S. 2 Year Treasury

Text

Stock futures fall to start week with key inflation data, earnings ahead

Stock futures fall to start week with key inflation data, earnings ahead

Stock futures were lower Monday morning as the markets come out of a tumultuous week and traders look ahead to key reports coming in the next week that can offer insights into the health of the economy.

Futures connected to the Dow Jones Industrial Average slid 28 points. S&P 500 futures were lower by 0.18%, while Nasdaq 100 futures fell 0.30%.

Market observers generally consider the week ahead…

View On WordPress

#Breaking News: Markets#business news#Citigroup Inc#Delta Air Lines Inc#Domino&x27;s Pizza Inc#Dow Jones Industrial Average#Economic events#JPMorgan Chase & Co#Levi Strauss & Co#Markets#Morgan Stanley#Nasdaq Inc#PepsiCo Inc.#S&P 500 Index#S&P Global Inc#Stock markets#U.S. 2 Year Treasury#United States#Wells Fargo & Co

2 notes

·

View notes

Text

LETTERS FROM AN AMERICAN

February 1, 2024

HEATHER COX RICHARDSON

FEB 2, 2024

One of the biggest stories of 2023 is that the U.S. economy grew faster than any other economy in the Group of 7 nations, made up of democratic countries with the world’s largest advanced economies. By a lot. The International Monetary Fund yesterday reported that the U.S. gross domestic product—the way countries estimate their productivity—grew by 2.5%, significantly higher than the GDP of the next country on the list: Japan, at 1.9%.

IMF economists predict U.S. growth next year of 2.1%, again, higher than all the other G7 countries. The Federal Reserve Bank of Atlanta projects growth of 4.2% in the first quarter of 2024.

Every time I write about the booming economy, people accurately point out that these numbers don’t necessarily reflect the experiences of everyone. But they have enormous political implications.

President Joe Biden, Vice President Kamala Harris, Secretary of the Treasury Janet Yellen, and the Democrats embraced the idea that using the government to support ordinary Americans—those on the “demand” side of the economy—would nurture strong economic growth. Republicans have insisted since the 1980s that the way to expand the economy is the opposite: to invest in the “supply side,” investors who use their capital to build businesses.

In the first two years of the Biden-Harris administration, while the Democrats had control of the House and Senate, they passed a range of laws to boost American manufacturing, rebuild infrastructure, protect consumers, and so on. They did so almost entirely with Democratic votes, as Republicans insisted that such investments would destroy growth, in part through inflation.

Now that the laws are beginning to take effect, their results have proved that demand-side economic policies like those in place between 1933 and 1981, when President Ronald Reagan ushered in supply-side economics, work. Even inflation, which ran high, appears to have been driven by supply chain issues, as the administration said, and by “greedflation,” in which corporations raised prices far beyond cost increases, padding payouts for their shareholders.

The demonstration that the Democrats’ policies work has put Republicans in an awkward spot. Projects funded by the Infrastructure Investment and Jobs Act, also known as the Bipartisan Infrastructure Law, are so popular that Republicans are claiming credit for new projects or, as Representative Maria Elvira Salazar (R-FL) did on Sunday, claiming they don’t remember how they voted on the infrastructure measure and other popular bills like the CHIPS and Science Act (she voted no). When the infrastructure measure passed in 2021, just 13 House Republicans supported it.

Today, Medicare sent its initial offers to the drug companies that manufacture the first ten drugs for which the government will negotiate prices under the Inflation Reduction Act, another hugely popular measure that passed without Republican votes. The Republicans have called for repealing this act, but their stance against what they have insisted is “socialized medicine” is showing signs of softening. In Politico yesterday, Megan Messerly noted that in three Republican-dominated states—Alabama, Georgia, and Mississippi—House speakers are saying they are now open to the idea of expanding healthcare through Medicaid expansion.

In another sign that some Republicans recognize that the Democrats’ economic policies are popular, the House last night passed bipartisan tax legislation that expanded the Child Tax Credit, which had expired last year after Senate Republicans refused to extend it. Democrats still provided most of the yea votes—188 to 169—and Republicans most of the nays—47 to 23—but, together with a tax cut for businesses in the bill, the measure was a rare bipartisan victory. If it passes the Senate, it is expected to lift at least half a million children out of poverty and help about 5 million more.

But Republicans have a personnel problem as well as a policy problem. Since the 1980s, party leaders have maintained that the federal government needs to be slashed, and their determination to just say no has elevated lawmakers whose skill set features obstruction rather than the negotiation required to pass bills. Their goal is to stay in power to stop legislation from passing.

Yesterday, for example, Senator Chuck Grassley (R-IA), who sits on the Senate Finance Committee and used to chair it, told a reporter not to have too much faith that the child tax credit measure would pass the Senate, where Republicans can kill it with the filibuster. “Passing a tax bill that makes the president look good…means he could be reelected, and then we won’t extend the 2017 tax cuts,” Grassley said.

At the same time, the rise of right-wing media, which rewards extremism, has upended the relationship between lawmakers and voters. In CNN yesterday, Oliver Darcy explained that “the incentive structure in conservative politics has gone awry. The irresponsible and dishonest stars of the right-wing media kingdom are motivated by vastly different goals than those who are actually trying to advance conservative causes, get Republicans elected, and then ultimately govern in office.”

Right-wing influencers want views and shares, which translate to more money and power, Darcy wrote. So they spread “increasingly outlandish, attention-grabbing junk,” and more established outlets tag along out of fear they will lose their audience. But those influencers and media hosts don’t have to govern, and the anger they generate in the base makes it hard for anyone else to, either.

This dynamic has shown up dramatically in the House Republicans’ refusal to consider a proposed border measure on which a bipartisan group of senators had worked for four months because Trump and his extremist base turned against the idea—one that Republicans initially demanded.

Since they took control of the House in 2023, House Republicans have been able to conduct almost no business as the extremists are essentially refusing to govern unless all their demands are met. Rather than lawmaking, they are passing extremist bills to signal to their base, holding hearings to push their talking points, and trying to find excuses to impeach the president and Secretary of Homeland Security Alejandro Mayorkas.

Yesterday the editorial board of the Wall Street Journal, which is firmly on the right, warned House Republicans that “Impeaching Mayorkas Achieves Nothing” other than “political symbolism,” and urged them to work to get a border bill passed. “Grandstanding is easier than governing, and Republicans have to decide whether to accomplish anything other than impeaching Democrats,” it said.

Today in the Washington Post, Jennifer Rubin called the Republicans’ behavior “nihilism and performative politics.”

On CNN this morning, Representative Dan Goldman (D-NY) identified the increasing isolation of the MAGA Republicans from a democratic government. “Here we are both on immigration and now on this tax bill where President Biden and a bipartisan group of Congress are trying to actually solve problems for the American people,” Goldman said, “and Chuck Grassley, Donald Trump, Mike Johnson—they are trying to kill solutions just for political gain."

LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

#economic news#economic policy#Letters From An American#Heather Cox Richardson#history#WAPO#Wall Street Journal#supply side economics#the demand side#greedflation#extremist Republicans

5 notes

·

View notes

Text

I’m going to summarize my thoughts on a government shutdown.

Shutdown bad!!! Working together without a political agenda and bias to make make sure government doesn’t get shutdown, good!!!

For anyone that wants to read more, please feel free.

FOUR REASONS WHY A GOVERNMENT SHUTDOWN IS HARMFUL

Government shutdowns occur when policymakers fail to enact legislation to fund the federal government by the end of the fiscal year on September 30. Each year, Congress must pass, and the president must sign, legislation to provide funding for most government agencies. That legislation comes in the form of 12 appropriation bills, one for each appropriations committee. Lawmakers may also choose to pass a temporary funding bill, known as a continuing resolution, to provide funding for a limited time. If lawmakers fail to pass some or all of the appropriations bills on time, and a continuing resolution is not in place, the government would experience a partial or full “shutdown.”

There are many reasons government shutdowns are harmful, and here are a few.

1. Government shutdowns are costly.

It may be counterintuitive, but government shutdowns are expensive. A government shutdown pauses programs and government operations, only for them to eventually start up again, and that has costs. For example, the Office of Management and Budget (OMB) estimated that the lost productivity of government workers during the shutdown in 2013, which lasted 16 days, cost the government $2 billion.

More recently, a report issued in September 2019 by the Senate Permanent Subcommittee on Investigations found that the “last three government shutdowns cost taxpayers nearly $4 billion — at least $3.7 billion in back pay to furloughed federal workers, and at least $338 million in other costs associated with the shutdowns, including extra administrative work, lost revenue, and late fees on interest payments.” That assessment is an underestimate because it excluded substantial costs associated with several government agencies (including the Department of Defense), which were unable to provide complete estimates to the Subcommittee.

2. Government shutdowns are bad for the economy.

Government shutdowns can harm economic growth and certainty. A 2013 Macroeconomic Advisors paper found that government shutdowns can impose costs on the economy such as increasing the unemployment rate, lowering the growth in gross domestic product (GDP), and raising the cost of borrowing. The Bureau of Economic Analysis estimated that the government shutdown in October 2013 reduced fourth-quarter GDP that year by 0.3 percentage points. An S&P Global analysis found that a government shutdown in 2017 could have reduced real fourth-quarter GDP growth by $6.5 billion per week. The Congressional Budget Office estimated that the partial government shutdown that lasted from December 22, 2018 until January 25, 2019 reduced real GDP by $11 billion over the fourth quarter of 2018 and the first quarter of 2019 (although they assumed that much of that reduction would have been made up later in the year).

Additionally, a shutdown can cause disruptions in sectors of the economy. For instance, a Partnership for Public Service report noted that the last government shutdown (which lasted from December 2018 to January 2019) halted two major Small Business Administration loan programs. Those programs typically dispense nearly $200 million a day to small and midsize U.S. businesses; lack of access to such loans hindered business plans and caused economic hardship for thousands of entrepreneurs and their employees. Shutdowns also impact regulatory offices like the Alcohol and Tobacco Tax and Trade Bureau within the Department of the Treasury. An example— without the necessary certifications and approvals to operate, production for craft breweries throughout the country stalled, thereby reducing revenue for over 7,300 producers who provide more than 135,000 jobs.

3. Government shutdowns interrupt federal programs and services.

While programs such as Social Security and Medicare would remain largely unaffected by a government shutdown, other programs and services could be interrupted by the temporary furlough of “nonessential” government staff. In 2013, OMB showed that the shutdown that year disrupted scientific research, services for veterans and seniors, and health and safety inspections by the Food and Drug Administration, the Federal Aviation Administration, and the National Transportation Safety Board, among other programs.

4. Government shutdowns may harm the federal workforce.

Shutdowns contribute to economic insecurity among federal workers. During the last shutdown, about 800,000 federal employees were either furloughed or went without pay. This included workers at national parks and museums, corrections officers at federal prisons, and officials from the Transportation Security Administration. The gap in pay creates an adverse situation for federal workers as about 20 percent of Americans are unable to pay their monthly bills in full and about 40 percent are unable to pay an emergency expense of $400 or more with cash, according to the Federal Reserve.

Also, shutdowns may harm recruitment and retention of quality staff. Experts interviewed by the Government Accountability Office noted that prolonged shutdowns may alter the perception of federal jobs and reduce the attractiveness of such jobs for younger workers. Such perceptions are already apparent in the federal government where, currently, just 7 percent of all permanent, full-time federal employees are under the age of 30; that age group makes up 20 percent of the broader labor market.

Conclusion

Engaging in fiscal brinksmanship is not an effective way of addressing our nation’s fiscal challenges. It delays the tough decisions and has real costs for the budget, the economy, and everyday Americans. Instead of governing by crisis, lawmakers should work together to create a long-term plan that addresses the growing mismatch between spending and revenue and puts us on a sustainable fiscal path.

5 notes

·

View notes

Text

Monetary aggregates are not important in themselves. What matters is macroeconomic performance as indicated by GNP, employment, and prices. Monetarist policies are premised on a tight linkage between the stock of money in dollars, say M1, and the flow of spending, GNP in dollars per year. The connection between them is the velocity of money, the number of times per year an average dollar travels around the circuit and is spent on GNP. By definition of velocity, GNP equals the stock of money times its velocity. The velocity of M1 was 6.6 in 1990. If it were predictable, control of M1 would control dollar GNP too. But M1 velocity is quite volatile. For the 1961-90 period its average annual growth was 2.1 percent. Its standard deviation was 3.0 percent. That is, the chance is about one in three in any year that velocity will either rise by more than 5.1 percent or decline by more than 0.9 percent. For the 1981-90 period the mean was -0.15, with a standard deviation of 4.0. (M2 velocity is less volatile, but M2 itself is less controllable.)

read this in an old article, so i decided to check, and

!!!!! ???? thats crazy

so i checked the GNP, and it's fully recovered, growing faster than before 2020 actually, so i checked the M1, and

Before May 2020, M1 consists of (1) currency outside the U.S. Treasury, Federal Reserve Banks, and the vaults of depository institutions; (2) demand deposits at commercial banks (excluding those amounts held by depository institutions, the U.S. government, and foreign banks and official institutions) less cash items in the process of collection and Federal Reserve float; and (3) other checkable deposits (OCDs), consisting of negotiable order of withdrawal, or NOW, and automatic transfer service, or ATS, accounts at depository institutions, share draft accounts at credit unions, and demand deposits at thrift institutions.

Beginning May 2020, M1 consists of (1) currency outside the U.S. Treasury, Federal Reserve Banks, and the vaults of depository institutions; (2) demand deposits at commercial banks (excluding those amounts held by depository institutions, the U.S. government, and foreign banks and official institutions) less cash items in the process of collection and Federal Reserve float; and (3) other liquid deposits, consisting of OCDs and savings deposits (including money market deposit accounts). Seasonally adjusted M1 is constructed by summing currency, demand deposits, and OCDs (before May 2020) or other liquid deposits (beginning May 2020), each seasonally adjusted separately.

so now it includes all liquid deposits, instead of all checkable deposits

As announced on March 15, 2020, the Board of Governors reduced reserve requirement ratios on net transaction accounts to 0 percent, effective March 26, 2020. This action eliminated reserve requirements for all depository institutions and rendered the regulatory distinction between reservable "transaction accounts" and nonreservable "savings deposits" unnecessary. On April 24, 2020, the Board removed this regulatory distinction by deleting the six-per-month transfer limit on savings deposits in Regulation D. This action resulted in savings deposits having the same liquidity characteristics as the transaction accounts currently reported as "Other checkable deposits" on Statistical Release H.6, "Money Stock Measures."

Because of the change in their liquidity characteristics, savings deposits will be recognized as a type of transaction account on the H.6 statistical release. The Board will combine H.6 statistical release items "Savings deposits" and "Other checkable deposits" and report the resulting sum as "Other liquid deposits." Like other transaction accounts, other liquid deposits will be included in the M1 monetary aggregate. This action will increase the M1 monetary aggregate significantly while leaving the M2 monetary aggregate unchanged.

the fed removed the reserve requirement on banks! weird!

also, M2 should be unchanged but it wasnt, it also shot up, and accordingly velocity shot down. seems...weird? bad?

16 notes

·

View notes

Text

Movies Set During Depression Era U.S.

Below is list of movies set during the Great Depression here in the U.S. The list is in chronological order and . . . you might find them interesting:

MOVIES SET DURING DEPRESSION ERA U.S.

1. “The Group” (1933) - This movie is an adaptation of Mary McCarthy’s novel about a group of friends and Vassar College graduates between 1933 and 1940. Sidney Lumet directed.

2. “Bonnie and Clyde” (1967) - Warren Beatty and Faye Dunaway starred in this biopic about the infamous Depression-era bank robbers, Bonnie Parker and Clyde Barrow. Arthur Penn directed.

3. “Sounder” (1972) - Martin Ritt directed this adaptation of William H. Armstrong’s 1969 novel about the struggles of an African American sharecropper family in the Deep South, during the Depression. Paul Winfield, Cicely Tyson and Kevin Hooks starred.

4. “Paper Moon” (1973) - Ryan and Tatum O’Neal starred in this comedy-drama about a pair of grifters on a road trip in the Midwest, during the Depression. Peter Bogdanovich directed.

5. “The Sting” (1973) - Paul Newman and Robert Redford starred in this Best Picture winner about a group of grifters who set up a major con against a crime lord responsible for the death of a friend. George Roy Hill directed.

6. “The Untouchables” (1987) - Brian De Palma directed this account of U.S. Treasury Agent Elliot Ness’ investigation into crime lord Al Capone’s bootlegging operation in Chicago, during the last years of Prohibition. Kevin Costner, Sean Connery, Charles Martin Smith, Andy Garcia and Robert De Niro starred.

7. “O Brother, Where Art Thou?” (2000) - Joel and Ethan Coen wrote and directed this satire set prison escapees in 1937 Mississippi, which was loosely based on Homer’s poem, “The Odyssey”. George Clooney, John Tuturro and Tim Blake Nelson starred.

8. “Road to Perdition” (2002) - Sam Mendes directed this adaptation of Max Allen Collins’ 1998 graphic novel about a mob enforcer, who seeks vengeance for the deaths of his wife and younger son, while protecting his older son, a murder witness. Set in 1931 Illinois, the movie starred Tom Hanks, Tyler Hoechlin, Jude Law and Paul Newman.

9. “Seabiscuit” (2003) - Gary Ross starred in this adaptation of Laura Hillenbrand’s 1999 book about the famous California racehorse from the late 1930s. Tobey Maguire, Jeff Bridges, Chris Cooper and Elizabeth Banks starred.

10. “Cinderella Man” (2005) - Russell Crowe starred in this biopic about boxer James J. Braddock and his struggles to survive the Depression via the sport. Directed by Ron Howard, the movie co-starred Renee Zellweger and Paul Giamatti.

11. “Public Enemies” (2009) - Johnny Depp and Christian Bale starred in this biopic about the exploits of Depression-era gangster John Dillinger and the efforts of F.B.I. Special Agent Melvin Purvis to capture him. Michael Mann directed.

#the group#the group 1966#sidney lumet#bonnie and clyde#bonnie and clyde 1967#arthur penn#Great Depression#prohibition#1930s#sounder#sounder 1972#martin ritt#paper moon#peter bogdanovich#the sting#the sting 1973#george roy hill#the untouchables#the untouchables 1987#brian de palma#o brother where art thou#coen brothers#joel coen#ethan coen#road to perdition#road to perdition 2002#sam mendes#seabiscuit#seabiscuit 2003#gary ross

33 notes

·

View notes

Text

After Hamas’s brutal surprise attack and massacre of Israeli civilians, policymakers are searching for the most effective ways to fight terrorist organizations. They can take an important lesson from something that recently happened to Hamas when it tried to use bitcoin to finance its operations.

Hamas thought it could flout Western surveillance and international sanctions by embracing the world’s leading digital asset. It thought wrong, and the story is illuminating for those who mistakenly believe that bitcoin provides a safe space for criminals, money launderers and the financiers of terror.

Just last week, Israeli law enforcement successfully located and froze multiple cryptocurrency accounts that Hamas had used to solicit donations. Israel then funneled the assets into its own treasury — the same treasury that is funding the war to wipe Hamas “off the face of the earth.”

The terrorist organization’s crypto scheme backfired badly, and this wasn’t even the first time it had backfired this year. In April, Hamas begged supporters to stop sending donations via bitcoin, specifically. In a surprise press statement, it announced it was suspending bitcoin donations “to ensure the safety of donors and protect them from any harm.” The terrorist network cited “the intensification of prosecution and the redoubling of hostile efforts against anyone who tries to support the resistance through this currency” as the logic behind this decision.

So what happened? Isn’t bitcoin ideal for money laundering? Isn’t it the preferred currency of terrorists and criminals the world over?

Quite the opposite. Hamas discovered all too late that making illegal transactions in bitcoin is a financial suicide mission. That’s because the open, transparent nature of the blockchain is a panopticon for intelligence agencies, allowing them to track transactions in real time with a speed and precision that would be unthinkable in the world of fiat currency.

Unlike paper money or computer files, the bitcoin blockchain is permanent, transparent and immutable. This means that each network transaction, whether it’s worth a few cents or millions of dollars, becomes fossilized on the blockchain like a prehistoric bug in digital amber.

These fossilized transactions include every donation to Hamas ever made through this medium. All law enforcement has to do is connect a transaction with a wallet and a wallet with an identity —a task which, in practice, it has had little difficulty doing.

It is for that reason that illicit activity makes up such a small fraction of transactions in the cryptocurrency space — about one quarter of one percent, according to a study by analytics firm Chainalysis. That is an especially small amount when compared to the 2 to 5 percent of fiat currency transactions attributed to money laundering and the like, according to United Nations data.

In other words, if you don’t like what certain people do with bitcoin, you are going to hate the U.S. dollar.

It’s an important lesson that certain lawmakers in Washington have yet to learn. And unfortunately, some of them are not open to learning facts that contradict their preconceived ideas.

Sen. Elizabeth Warren (D-Mass.), who openly boasts of raising an “anti-crypto army,” talks about cryptocurrency as if it were terrorist blood money. She remains heedless of countless examples where Western intelligence has leveraged the public nature of the blockchain to choke off illicit financing. This includes not only the most recent example with Hamas, but also 300 crypto accounts the Department of Justice seized to throttle funding for terrorist groups like al-Qaeda and ISIS. She might also find illuminating the recent high-profile criminal prosecution of a Manhattan rapper and her husband, who were easily caught when they tried to launder billions in stolen bitcoin. Again, it was the transparency of the blockchain that exposed them.

Warren’s bill solves a problem that no one has. It that would classify nearly all crypto industry participants — from wallet providers to miners to validators — as financial institutions, subjecting them to the onerous compliance regime of the Bank Secrecy Act. Under this bill, a teenager running a bitcoin mining rig in his basement could be subject to the same compliance burdens as JP Morgan Chase and Goldman Sachs.

But wallet providers, miners, and validators are not banks. They do not hold custody of assets. They certainly should not be collecting or storing the sensitive personal financial information of individual users of an asset. They merely provide infrastructure — the open-source software and computing power to help secure the network. Much like Microsoft, which also supplies a lot of software and cybersecurity products to financial institutions, they are not financial institutions.

It would be impossible for the industry to comply with Warren’s requirements, and she knows this. The point of her bill is not to improve national security or stop money laundering, but to kill digital asset innovation.

Instead of participating in Warren’s farce, Congress should seriously explore how to help federal law enforcement crack down on actual illicit finance. The Financial Technology Protection Act — a bipartisan bill introduced by Senators Ted Budd (R-N.C.) and Kirsten Gillibrand (D-N.Y.) — is a critical first step in that direction. It creates a working group to study and report on how terrorists actually use new financial technologies to advance their missions and ways Congress and regulatory agencies can combat them. Congress could take its findings and construct a regulatory regime that addresses actual risks, not imaginary ones.

This would help deter criminal activity such as money laundering while still preserving the ethos of personal freedom that has long defined the digital asset industry.

Terrorists and criminals — from Hamas and Al-Qaeda to the early drug runners of Silk Road — learned the hard way that bitcoin is not ideal for illicit finance. Lawmakers across the country have yet to receive the memo. So we’re circulating it today and asking that they adjust their policymaking accordingly.

2 notes

·

View notes

Text

The S&P rebounded, Salesforce backed the Dow, Tesla fell nearly 6% and Treasury yields retreated higher

U.S. unemployment and labor cost data underscored the resilience of the labor market, fueling inflationary pressures and prompting the Federal Reserve to keep raising interest rates. Of the three major U.S. stock indexes, only the Dow Jones Industrial Average rose in early trading. After Fed official Raphael Bostic said he still supported a quarter-point rate hike and could pause it this summer, the S&P index turned higher from its lowest level in more than a month and 2-year Treasury yields, which hit their highest since 2007 for five consecutive days, gave up most of their gains. The dollar index, which nears a seven-week high, trimmed gains. The Dow Jones Industrial Average rose to its highest level in a week for the second time in a row, while Salesforce, a component that beat estimates, rose more than 11%. Tesla fell more than 8% at one point, its biggest intraday drop this year. Overall, China Concept outperformed the market for several days, with station B up nearly 10% and XPeng Motor up more than 7%. Crude oil rose to a two-week high for the third time in a row, while U.S. natural gas snapped a six-game winning streak and fell to a four-week high. Gold stopped three straight gains, bid farewell to more than a week high. Lentin fell 3 percent and Lennickel hit a more than three-month low.

7 notes

·

View notes

Text

Two-Year U.S. Treasury Yields Hit 16 Year High, as Investors Are Spooked by Latest Jobs Report

Two-Year U.S. Treasury Yields Hit 16 Year High, as Investors Are Spooked by Latest Jobs Report https://link.theepochtimes.com/mkt_app/two-year-u-s-treasury-yields-hit-16-year-high-as-investors-are-spooked-by-latest-jobs-report_5381771.html?utm_source=andshare

But hey!!! No mean tweets, right?

5 notes

·

View notes

Text

The recent increase in mortgage rates, which has made buying a house or borrowing against home equity more expensive, in part reflects a broad increase in rates on long-term U.S. Treasury securities. But the increase in 30-year fixed mortgage rates over the past year has been unusually large relative to rates on long-term Treasury securities, which may suggest that mortgage rates are being pushed up by temporary factors. In particular, as the path of future interest rates becomes more certain, mortgage rates could fall by roughly half a percentage point.

Why have mortgage rates risen by so much more than yields on 10-year Treasury bonds? We find that much of the increase in this spread can be attributed to two factors: interest rates on Treasury bonds with maturities less than 10 years are higher than rates on 10-year Treasury bonds and mortgage prepayment risk has increased. Higher interest rates on shorter term bonds matter because mortgages are generally held for fewer than 10 years. Prepayment risk is higher than in recent decades largely because of uncertainty around future interest rates. Both these factors are likely to continue to push up mortgage rates over the next few quarters.

Factors Contributing to the Spread between Mortgage and 10-Year Treasury Bond Rates

Mortgage rates reflect the cost of using a mortgage to buy a home or tap home equity and thus affect the price of real estate and housing wealth. To the degree that the Federal Reserve’s tightening of monetary policy pushes up mortgage rates, this channel is an important way in which tighter monetary policy slows the economy and dampens inflation. As shown in figure 1, there has been a long downward trend in mortgage rates (dark green) over the past forty years in line with the rate of 10-year Treasury bonds (light green). However, the spread between mortgage rates and Treasury bond rates fluctuates for various reasons, including changes in credit conditions and interest rate uncertainty.

Mortgage rates generally track the rate on 10-year Treasury bonds because both instruments are long term and because mortgages have relatively stable risk. Nonetheless, to compensate investors for the higher risk of mortgages, rates for fixed mortgages have historically been, on average, one to two percentage points higher than Treasury yields. As rates on 10-year Treasury bonds have risen since mid-2020, mortgage rates have risen as well. But, over the past year, mortgage rates have risen by a surprisingly large amount relative to the 10-year Treasury rates, putting more restraint on borrowing conditions and the housing market.

Figure 2 shows the spread between 30-year fixed mortgage rates and 10-year Treasury rates from 1997 through May 2023. The peak spread during the housing crisis was 2.9 percentage points, reflecting a sharp tightening of credit conditions and significant disruptions in the financial markets that fund mortgages. The spread rose again during the COVID-19 pandemic, peaking in 2020 at 2.7 percentage points, reflecting shorter-lived disruptions in financial markets and concerns among lenders and investors in mortgage assets. Recently, the difference between 30-year fixed mortgage rates and 10-year Treasury rates has widened to an unusual degree. Since October 2022, the spread has hovered near the levels last seen during the housing crisis.

To explain why the spread between 30-year fixed mortgage rates and 10-year Treasury rates is so large, figure 3 parses it into three components:

The spread between the rate charged to borrowers and the yield on mortgage-backed securities (MBS), referred to as the primary-secondary spread, which is generally stable when the costs of mortgage issuance are stable (blue).

A combination of an adjustment for mortgage duration and prepayment risk (light green). The duration adjustment reflects that mortgages are generally held for fewer than 10 years and are more closely related to rates on a 7-year rather than a 10-year Treasury security. Prepayment risk reflects the probability that a future drop in rates induces borrowers to exercise their option to refinance.

The remaining spread, which reflects changes in demand for mortgage-related assets after adjusting for prepayment risk (purple).

Given estimates of 1 and 3, we are able to estimate 2 by subtraction.

Factors Driving Higher Mortgages Rates

Using this framework, we find that the biggest reason that the mortgage spread to the 10-year Treasury rate is higher relative to other periods is due to the duration adjustment and prepayment risk. Since mortgages are typically held for fewer than 10 years, they have a shorter duration than 10-year Treasuries. Since early 2022, and for the first time since 2000, the rate on 7-year Treasury securities is higher than the rate on 10-year Treasury securities. In particular, from 2015 through 2019, the 10-year rate exceeded the 7-year rate by about 0.15 percentage point on average. Instead, year-to-date, the 7-year rate has exceeded the 10-year rate by about 0.10 percentage point, on average. As a result, the duration adjustment explains roughly a quarter of a percentage point of the unusually large spread shown in figure 3.

In addition, prepayment risk is higher now than in previous years. Borrowers with mortgages are affected differently if interest rates rise or fall. If rates rise, mortgage holders can simply choose to keep their mortgages at the previously issued rate. Instead, if rates fall, mortgage holders can prepay and refinance their mortgages at lower rates. That means that if there is a wider range of uncertainty around the future of interest rates—even if that range is symmetrical—there is a higher probability that current mortgage holders will find it advantageous to refinance in the future. As it happens, measures of interest rate uncertainty (such as the MOVE index, or Merrill Lynch Option Volatility Estimate Index) are currently higher than before the pandemic. Moreover, when rates are very low as they were in early 2020, there is only so much lower they can go, and thus borrowers and lenders alike see a smaller likelihood of a new mortgage being refinanced to a lower rate in the future. Instead, when mortgage rates are higher, as they are now, there are more possible future outcomes where rates fall and mortgages are refinanced. In other words, mortgage lenders want to protect against the possibility that mortgages issued recently will be refinanced to lower rates. As a result, lenders charge a premium.

To get a sense of how much this factor is pushing up mortgage rates to an unusual degree, it is useful to compare the estimated contributions of the duration adjustment and prepayment risk now versus the late 1990s, which was before the housing bubble, the housing crisis, the slow recovery from the 2008 recession, and the COVID-19 pandemic. In the late 1990s, 10-year Treasury rates were moderately higher than today but, like today, the 7-year rate was higher than the 10-year rate. At that time, the estimated contribution of the duration adjustment and prepayment risk to the mortgage rates spread was roughly a half percentage point lower than today.

While the largest factors driving high mortgage rates are the duration adjustment and prepayment risk, another reason mortgage rates have been unusually high is because of a slightly elevated primary-secondary spread. Lenders often finance mortgages by selling claims to MBS, which are pools of mortgage loans that are guaranteed by government-sponsored enterprises. The spread between the primary mortgage rate to borrowers and the secondary rate on MBS reflects the costs of issuing mortgages. For example, originators have to bear interest rate risk between the time an interest rate on a mortgage is set and when it is closed. The primary-secondary spread jumped by 0.3 percentage points toward the end of 2022, but has retraced most of the runup since then.

Finally, the component after accounting for those factors is also somewhat elevated relative to before the pandemic. This component, referred to as the option-adjusted spread (and “other” in figure 3) is likely elevated due to reduced demand in the MBS market. In recent years, the Fed has reduced its holdings of MBS. In addition, private investors in MBS have readjusted portfolios in response to an increase in interest rates. This was particularly true when long-term Treasury rates jumped in the fourth quarter of 2022; demand for MBS has remained cool since then. In addition, holders of MBS may be more pessimistic about prepayment risk than empirical models reflect, which could be the case if investors think that future mortgage rates are more likely to be a little lower relative to current rates rather than a little higher.

Conclusions

Higher mortgage rates are probably here to stay for a while, but a reduction in uncertainty could meaningfully bring down mortgage rates. If interest rate uncertainty returns to more normal levels and prepayment risk fell back to levels seen in the late 1990s, rates could fall – perhaps by half a percentage point. Nonetheless, one factor keeping rates higher that is likely to persist for the next several quarters is dampened demand for MBS as the market for mortgage financing continues to recalibrate to restrictive monetary policy and higher interest rates.

Until the economy slows to a more sustainable pace, uncertainty will remain. How will a slowdown affect house prices? How much will it reduce the income of borrowers? Will financial markets remain stable? Until such questions are resolved, unusually high mortgage rates will probably continue to cool the housing market and dampen borrowing against housing equity.

2 notes

·

View notes

Text

The State of Mexico v. HSBC Bank

“It wasn’t just HSBC’s money laundering crimes over many years for the most notorious drug cartels. It was their admission of it and then their audacity to continue to commit those crimes.”

The United States Financial System is easily the largest in the world and in many aspects, the most advanced. It is also one of the most idiosyncratic systems, characterized by an unusually parochial set of laws and regulations that both constrain competition and shield inefficiencies. Banks doing business in the US routinely submit confidential reports to an intelligence office within the U.S Treasury Department known as the Financial Crimes Enforcement Network (FinCEN). HSBC (Hong Kong and Shanghai Banking Corporation), is a banking and financial services organization, with multiple branches in several countries including the USA.

HSBC in the U.S took on clients whose massive wealth translated into huge profits, but who turned out to be criminals. Its compliance staff negligently monitored customer activity, filed reports lacking crucial customer information on 16 shell companies that processed nearly $1.5 billion in more than 6,800 transactions through the bank’s Hong Kong operations alone. More than $900 million of that was linked to criminal networks. Leaked records show HSBC processed at least $31 million for companies that were later revealed to have moved stolen government funds from Brazil. And more than $292 million for an organization, Vida Panama, branded by U.S authorities as a major money launderer for drug cartels. As the Mexican drug war spread in the mid-2000s, HSBC provided essential U.S. dollar-denominated accounts to narco-gangs needing to clear hundreds of millions of dollars in drug earnings (200,000+ people who died in Mexico because of the funds that passed through HSBC).

The cartels designed carefully shaped boxes that fit HSBC’s teller windows to deliver the massive amounts of illegal cash pouring in. HSBC didn’t report any unusual activity after Drug Enforcement Administration agents posing as drug dealers deposited millions of dollars in Paraguayan banks and then transferred the money to accounts in the U.S. through HSBC. All this information is based on dozens of leaked interviews and Suspicious Activity Reports (SARs) with more than12 past HSBC anti-money-laundering employees.

Former HSBC compliance officers said that the bank did not give them adequate time to meaningfully investigate suspicious transactions and that branches outside the U.S often ignored requests for crucial customer information. They stated that they were treated as a second-class workforce within the bank, with little to no authority to shut down problematic accounts. Instances where Bank employees misrepresented data sent to senior managers, and where management altered risk ratings on certain clients so that suspect transactions didn’t set off alarms were plenty. The bank understaffed its anti-money laundering compliance division and hired naive, incompetent, and poorly trained personnel.

Task at Hand:

As the legal representatives of HSBC Bank or The State of Mexico (as allotted), you are required to defend the stance and further the interests of your client in the court of law. You shall deliberate the case on the following grounds, and suggest strategies to overcome the same:

a) The Issue of Money Laundering and furthering the Activities of the Mexican Drug Cartel

b) The Question of Negligence and Non-Compliance to International Banking Laws

c) The Necessity for Increased Monitoring to ensure Banking Efficiency and a New Standard Operating Procedure for Cross-Border Transactions

This round shall be conducted as a moot court, and shall include the following components, in a to-and-fro format:

1) Opening Statements: Introduction to the Stance and Establishing Legal Precedence

2) Legal Argumentation: Providing an Interpretation of the Law to Support your Case by using the Existing Legislations, Previous Verdicts and Legal Principles, as well as Suggesting Remedies and Solutions

3) Closing Remarks: Concluding your Arguments and Suggesting Final Proposals.

6 notes

·

View notes

Text

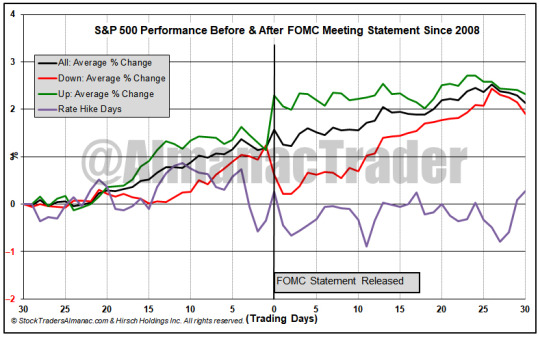

Another Fed Rate Hike – S&P Has Been Up on Announcement Day Four in a Row

Persistent inflation remains a thorn in the market and for the Fed. According to the CME Group’s FedWatch Tool there is a 84.0% probability of a 0.75% increase and a 16.0% chance of a 1% hike tomorrow (as of approximately 4:45 pm est). Treasury bond yields, the U.S. dollar and mortgage rates have all risen briskly in anticipation of the Fed’s next rate increase while the stock market has languished.

In the chart above the 30 trading days before and after the last 115 Fed meetings (back to March 2008) are graphed. There are four lines, “All,” “Up,” “Down,” and “Rate Hike Days.” Up means the S&P 500 finished announcement day with a gain, down it finished with a loss or unchanged. In 115 Fed meetings, there have been just 13 rate increases. Four have occurred this year. These 13 increases are represented by Rate Hike Days. Of the 13 hike days, S&P 500 was down 7 times and up 6 times with an average gain of 0.63% on all 13. This year’s rate hikes were well received by S&P 500 with gains over 2% in March, May and July and a near 1.5% gain in June. On the day after the last 13 rate hike announcements, S&P 500 has declined 0.74% on average.

2 notes

·

View notes

Photo

LETTERS FROM AN AMERICAN

April 17, 2023 (Monday)

HEATHER COX RICHARDSON

APR 18, 2023

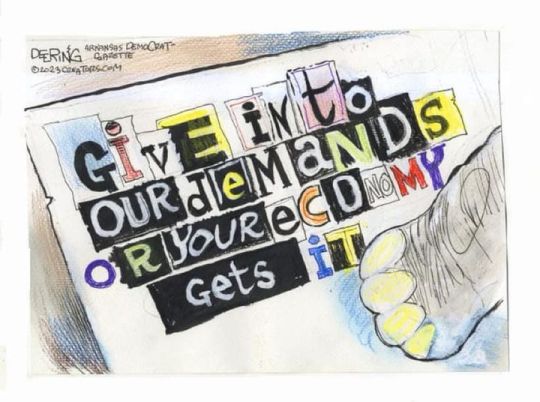

House speaker Kevin McCarthy (R-CA) was in New York City today, trying to calm jitters among investors by explaining to members of the New York Stock Exchange that the Republicans will not allow the government to default on its debts even as he insisted that the Republican Party must use the debt ceiling to enact legislative policies it can’t win through normal political negotiations.

The debt ceiling is an artificial limit to how much the Treasury can borrow to pay existing obligations to which Congress has already committed. It has nothing to do with future spending, which is hammered out in budget negotiations.

But McCarthy has not offered a budget proposal because the Republican conference cannot agree on one. Yesterday, for example, McCarthy floated the idea of cuts to food assistance for millions of low-income Americans, which Senate Republicans want no part of. Unlike House members, many of whom represent such gerrymandered districts they feel insulated from any backlash to extreme proposals, Senators run at-large. For them, cutting food support while backing tax cuts for the wealthy and corporations would be politically dangerous.

Instead, McCarthy is trying to use the threat of national default to extract the cuts extremist members of his conference want. The Biden administration has made it clear that it will not negotiate over paying the nation’s bills, especially since about a quarter of the debt was accumulated under former president Trump, $2 trillion of it thanks to tax cuts for the wealthy and corporations. In those years, Congress raised the debt ceiling three times. Biden presented his own long, detailed budget, full of his own priorities, as a start to negotiations in March, and he says he is eager to sit down and hammer out the budget once McCarthy produces his own plan. McCarthy is trying to deflect from his inability to do that but is confusing the issue, suggesting that he has the right to negotiate instead over whether or not to pay our bills.

Since defaulting, or even approaching default, would devastate both the U.S. and the global economy, not even all Republicans back McCarthy’s threats. When Sara Eisen of CNBC asked McCarthy if he had the support of his party for what he is proposing, McCarthy answered, “I think I have the support of America,” and that he would “get the party behind it.”

Meanwhile, when asked about a potential default, Mark Zandi, the chief economist at Moody’s Analytics, told Tony Romm of the Washington Post, “It will be financial chaos…. Our fiscal problems will be meaningfully worse.… Our geopolitical standing in the world will be undermined.”

Today, McCarthy offered to kick the can down the road by a year, raising the debt ceiling so long as the Democrats agree to cuts that he described only vaguely. Senate majority leader Chuck Schumer (D-NY) rejected this idea out of hand, saying: “If Speaker McCarthy continues in this direction, we are headed to default.” Schumer reiterated that the Democrats will be happy to negotiate with McCarthy over the budget when he can produce a detailed plan that can get the 218 votes it needs to pass the House. He noted that McCarthy’s vague proposals are “a recycled pile of the same things he’s been saying for months, none of which has moved the ball forward an inch.”

In part, McCarthy’s problem is that many of the members of his conference are in the majority for the first time. They are discovering that it is much easier to say no when opponents are in charge than it is to hammer coalitions together to advance realistic legislation. In the New York Times today, editorial board member Michelle Cottle called many of the current House Republicans “chaos monkeys” but noted that it is McCarthy’s fault that he gave them so much power by promising things he can’t deliver—like refusing to hike the debt ceiling without cuts—and by putting them at the head of important committees.

Ohio representative Jim Jordan, for example, sits at the head of the Judiciary Committee, as well as the Select Subcommittee on the Weaponization of the Federal Government, and his investigations so far have not produced the results he promised the Republican base. As Jesse Watters of the Fox News Channel put it last month: “Make me feel better, guys. Tell me this is going somewhere. Can I throw someone in prison? Can someone go to jail? Can someone get fined?”

Instead, Democrats on the committees have met Jordan’s wild rapid-fire accusations with facts that show the difference between unchallenged myth-making on right-wing media and actual governance. Today, at Jordan’s insistence, the Judiciary Committee held a hearing in New York City, a venue Jordan suggested was chosen to highlight how the policies of Manhattan district attorney Alvin Bragg had exacerbated violent crime, although in reality, Jordan’s attacks on Bragg for investigating former president Trump started even before Trump’s indictment in that jurisdiction.

Jordan set out to argue that Bragg was neglecting violent crime in New York City only to have Democrats point out that New York City is “not only safer than most large cities in America, it is safer than most cities of any size, and on a per capita basis, New York City is safer than most of the states of the members sitting...on the majority side,” as Jim Kessler, the co-founder and senior vice president for policy for Third Way, explained. Indeed, in 2020, Ohio’s murder rate was higher than the rate in New York City. Representative David Cicilline (D-RI) asked Jordan if the hearing could be moved to Ohio.

If one part of McCarthy’s problem is his extremist colleagues, another is that his argument is out of date. In what Catie Edmondson and Jim Tankersley of the New York Times called “a speech that was sprinkled with misleading statements and erroneous assertions,” McCarthy told the Wall Street executives, “We’re seeing in real time the effects of reckless government spending: record inflation and the hardship it causes….”

In reality, the inflation that plagued the U.S. as it reopened from the worst days of the Covid-19 pandemic has slowed dramatically, making it clear that the policies of the Biden administration are working. As Jennifer Rubin noted yesterday in the Washington Post, the annual inflation rate for producers is 2.7%—the lowest rate in more than two years—while consumer price increases are at their lowest point since May 2021: 5%. Gasoline prices have dropped 17.4% since the high prices that followed Russia’s invasion of Ukraine. The overall declines mark nine months of slowing inflation.

At the same time, labor force participation is at record high levels and unemployment is at a 50-year low of 3.5%. Black unemployment, which stands at 5%, has never been lower. Real incomes—that is, incomes after inflation is factored in—have risen 7% for those making $35,000 a year or less and 1.3% across the whole economy. Meanwhile, the deficit has dropped more than $1.7 trillion in two years.

The successes of Biden’s policies would seem worth considering in negotiations, but as Sarah Longwell noted in Bulwark+ today, the Republican Party has abandoned normal democratic politics. She notes that it is a mistake to look at the Trump years as a wild period from which the party will return to normality. Instead, she notes, “You have to think of Trump’s election as year zero” because “Republican voters say they don’t want any part of a Republican party that looks anything like it did before 2016.”

Trump’s administration was a culmination of forty years of Republican attempts to get rid of taxes and regulations by insisting that anyone calling for business regulation and a basic social safety net was a socialist who wanted to redistribute tax dollars from hardworking white men to minorities and women. But the racism, sexism, and religion in that formula used to be the quieter undertones of the call for small government. Now, though, the party is openly embracing the replacement of democracy with a strong government that would make white Christian nationalism the law of the land.

In illustration of that position, Florida governor Ron DeSantis, who has used the government to impose a Christian agenda on his state, today continued his crusade against the Walt Disney Company. A year ago, angry that then–chief executive officer Bob Chapek opposed his measure limiting discussion of gender identity in public school classrooms, DeSantis tried to take control of the company’s special self-governing district through a new board. Shortly before the takeover, Disney CEO Bob Iger outfoxed DeSantis by legally changing the terms of the agreement under which it has operated for decades, limiting the power of the board in perpetuity.

After Trump officials mocked him for being beaten by Mickey Mouse, DeSantis today suggested he is determined to use the power of the government to force Disney, a private company, to bend to his authority. He threatened to build a rival amusement park or a state prison on land next to Disney’s Florida park.

Disney promptly responded by advertising a “first-ever Disneyland After Dark” LGBTQIA+ themed event night at its California Disneyland resort, and former Republican National Committee chair Michael Steele tweeted: “When families stop visiting & Disney’s $75.2B economic impact & $5.8B tax revenues drop; its 75K employees face layoffs & 463K jobs are also imperiled what would your analytics say caused that to happen? WTF, Dumbo.”

—

LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

#Letters From An American#Heather Cox Richardson#Debt Ceiling#Disney#DeSantis#Christian Nationalism#white Supremacy#white supremacist#McCarthy#clown car#NYSE#Horsey#House GOP clown show

7 notes

·

View notes

Text

By Jessica Corbett

Common Dreams

June 11, 2024

"This is a historic opportunity for the United States to provide global leadership on tax fairness and also strengthen the administration's vital domestic efforts to achieve a fairer tax system."

U.S. Sen. Bernie Sanders and Rep. Ilhan Omar on Tuesday led a letter calling on President Joe Biden and Treasury Secretary Janet Yellen "to support an important initiative at the G20 to foster international cooperation on taxation of ultrawealthy individuals."

"This is a historic opportunity for the United States to provide global leadership on tax fairness and also strengthen the administration's vital domestic efforts to achieve a fairer tax system," wrote Sanders (I-Vt.) and Omar (D-Minn.), who were joined by 16 Democrats in Congress.

When Biden released his 2025 budget blueprint in March, the White House called for tackling "unfair aspects of our tax system," including by "reforming the international tax system to reduce the incentives to book profits in low-tax jurisdictions" and imposing at 25% minimum tax on Americans with wealth of more than $100 million.

The lawmakers wrote on Tuesday that "we agree with you that it is time for the very wealthiest to pay their fair share," noting research that shows the richest billionaires pay an effective income tax rate of 8.2% in the United States and as little as 2% in other countries.

"Every tax dollar not paid by a billionaire could have been used to invest in our communities, address climate change, and support public goods—from education to healthcare to infrastructure—that are critical to prosperity and a strong economy," they stressed, endorsing proposals from Biden and U.S. lawmakers "to build a more just tax system."

As the letter to Biden and Yellen details:

This year Brazil, which holds the G20 presidency, is calling for action on the taxation of wealthy individuals. They aim for increased cooperation between G20 countries to support tax progressivity and ensure the world's richest people pay their fair share. This could involve coordinated standards, information sharing, or a global minimum floor for taxation of the wealthy that could in theory be satisfied by many of the leading proposals to raise taxes on the ultrarich, including the billionaire minimum income tax. We have seen how international cooperation on taxation can deliver meaningful advances, as demonstrated by the landmark 2021 agreement by more than 130 countries to create a global tax framework on corporate taxation. This is a chance to build on what was learned and deliver better results by working together, but with a focus on individuals instead of corporations.

In April, as Common Dreamsreported at the time, Fernando Haddad, Brazil's finance minister, joined with government leaders from Germany, South Africa, and Spain to advocate for a 2% wealth tax targeting the world's billionaires to "invest in public goods such as health, education, the environment, and infrastructure."

"The argument behind such tax is straightforward: We need to enhance the ability of our tax systems to fulfill the principle of fairness, such that contributions are in line with the capacity to pay," the ministers explained. "Persisting loopholes in the system imply that high-net-worth individuals can minimize their income taxes."

Sanders, Omar, and their congressional colleagues argued to Biden and Yellen that "Brazil's G20 initiative is in the strategic interest of the United States."

International cooperation will strengthen domestic efforts to tax the wealthiest, including those that you and many of us in Congress have championed," the letter states. "We encourage your administration to join others in pledging support for this effort, and to help lead the G20 to a historic agreement that will secure a more equitable U.S. and global economy."

#wealth tax#wealth inequality#progressive taxation#janet yellen#biden administration#u.s. tax policy#g20#november 2024#ilhan omar#bernie sanders

1 note

·

View note

Text

U.S. Treasury to sell $22 billion of 30 year bonds at the top of the hour

June 13, 2024 at 05:47PM

The US treasury will auction off $22 billion of 30 year bonds at the top of the hour. On Monday the coupon auctions for the week was started with the sale of three year note. That auction did not go well with a positive tail (rate above the WI level at the time of the auction) and light bid-to-cover support.

On Tuesday, the 10 year auction was the complete opposite with a negative tail and stronger than the average bid to cover data.

With the FOMC rate decision yesterday, the treasury of the day off. The 30-year auction will cast the deciding vote for the coupon auctions this week.

What are the 6-month averages for the major components going into the auction (a proxy for the success or failure of the auction)

Bid to cover: 2.41X

Tail: -0.7 basis point

DIrects (a measure of domestic demand): 19.8%

Indirects (a measure of international demand): 64.9%

Dealers (they take the balance): 15.4%

Yields across the curve are lower today. The 2-year yield is down 6.0 basis points while the 10 year is down -4.0 basis points and the 30 year is down -2.8 basis points.

US stocks are now in negative territory with the NASDAQ now trading down minus 11.42 points or -0.07%. The S&P index is down -0.17%. Both those indices closed at re record levels yesterday. The Dow is down -0.59% while the small-cap growth in 2000 is down -1.35%.

This article was written by Greg Michalowski at www.forexlive.com.

0 notes

Text

McLaren Formula 1 Team VIP Experience Sweepstakes – Official Rules

NO PURCHASE OR PAYMENT NECESSARY TO ENTER OR WIN. A PURCHASE WILL NOT IMPROVE ONE’S CHANCES OF WINNING. THIS IS A SINGLE SWEEPSTAKES WITH OFFICIAL RULES BASED ON RESIDENCY OF THE ENTRANT. THE SELECTION OF THE WINNERS WILL BE MADE AMONG ALL ELIGIBLE ENTRANTS WORLDWIDE. THE PRIZES ARE ALLOCATED TO THE WINNERS WHO HAVE BEEN SELECTED ON A WORLDWIDE BASIS.

The Sweepstakes is in no way sponsored, endorsed or administered by, or associated with, Instagram, Facebook or any other social media site.

By participating in this sweepstakes (“Sweepstakes”), you unconditionally accept and agree to comply with and to be bound and abide by these Official Rules (“Official Rules”) and the decisions of the Sponsor, which shall be final and binding in all respects. All applicable federal, state, and local laws and regulations apply.

1. Sponsor: GetYourGuide Deutschland GmbH, Sonnenburger Str. 73, 10437 Berlin, Germany (“Sponsor”).

2. Eligibility: Except where prohibited by law, the Sweepstakes covered by these Official Rules is open to legal residents of the United Kingdom (England, Scotland, Wales and Northern Ireland) who possess a valid form of identification, are the age of majority or older (18 years of age in most jurisdictions). Persons identified as “Blocked Persons” or persons subject to applicable sanctions prohibitions, including, without limitation, those persons listed on the U.S. Department of Treasury Office of Foreign Assets Control’s Specially Designated Nationals and Blocked Persons List, are not eligible to participate in the Sweepstakes. Sponsor, its employees, officers, and directors, parent entities, subsidiaries and affiliated companies (collectively, “Sweepstakes Entities”), as well as advertising, or production agencies or partners (and their respective dependents, immediate family members, including children, spouse, parents, siblings and their respective spouses, regardless of where they reside, and individuals residing in their same household, whether or not related) are not eligible to participate or win. Entry into the Sweepstakes does not constitute entry into any other contest or sweepstakes. The Sweepstakes shall be subject to all applicable federal, state, municipal, local laws and regulations and these Official Rules and by entering, the entrant (“Entrant”) agrees that he, she or they have read these Official Rules, and the decisions of Sponsor, which shall be final and binding in all respects. False and/or deceptive entries or acts shall render Entrant ineligible.

3. Entry period: The Sweepstakes begins on Tuesday, June 11th, 2024 with a Sweepstakes feed post on @GetYourGuide s Instagram account and ends at 11.59 PM GMT on Monday , June 17th, (the “Sweepstakes Period”).

4. How to enter:

To enter the Sweepstakes, Entrant must follow the @getyourguide Instagram handle, comment on the competition post in feed, and tag a friend they’d like to bring along and follow the instructions provided to submit a completed online entry form to receive one (1) entry (“Entry” or “Entries”).

Limit one (1) Entry per person during the Sweepstakes Period. Any attempt by any Entrant to enter by using multiple/different email addresses, identities, registrations and logins, or any other methods will void that Entrant's Entries and that Entrant may be disqualified, at the sole discretion of Sponsor. Use of any automated system to participate is prohibited and may result in disqualification. Sponsor and Sweepstakes Entities are not responsible for lost, late, incomplete, invalid, unintelligible, or misdirected Entries, which may be disqualified. In the event of a dispute regarding who submitted an Entry, the Entry will be deemed submitted by the authorized account holder of the email address from which the Entry was submitted. "Authorized account holder" is defined as the natural person who is assigned the e‐mail address used to enter the Sweepstakes, by an Internet access provider, online service provider, or other organization (e.g., business, educational institution, etc.) that is responsible for assigning email addresses for the domain associated with relevant e‐mail address. No automatically generated Entries will be accepted.

5. Random drawing and winner notification: There will be 2 winners (the “Winner(s)”). One random drawing will be conducted after the Sweepstakes period ends in calendar week 25 by Sponsor to select the Winner(s) from among all eligible Entries received during the Sweepstakes period. Odds of winning depend on the total number of eligible Entries received during the Sweepstakes Period. The drawing will be conducted by Sponsor or its representatives, whose decisions are final and binding in all matters relating to this Sweepstakes. Sponsor’s determination of the Winners is binding and not subject to review or appeal.

6. Winner verification and notification: An Entrant is not deemed a Winner of any prize, even if the winning notification should so indicate, unless and until (i) the Entrant’s eligibility has been verified, (ii) all requirements to claim the Winner’s prize have been fulfilled, and (iii) the Entrant has been notified that the acceptance and verification process is complete.

In order to be declared Winners and be able to claim the Prize, the potential winners are subject to verification and must meet all eligibility requirements and may be required to provide an ID, their tax identification number, proof of residency, sign an Affidavit of Eligibility/ Liability Release with (where lawful) a publicity release, and work with any travel companion(s) to sign their guest release(s), or such other documents as Sponsor deems necessary, in its sole discretion (collectively, the “Prize Claim Documents”) each of which must be completed, signed and returned within 48 hours from date of issuance, or the Prize may be forfeited and may be awarded to an alternate winner. Winning is contingent upon fulfilling all requirements. Except as determined by Sponsor in its sole discretion, no substitution of any Prize is offered, no transfer of Prize to a third party is permitted, and non-cash Prize(s) may not be redeemed for cash value.

Verified Winner(s) will be solely responsible for all applicable federal, state and local taxes on Prize.

Sponsor is not responsible for any delay or cancellation of the Prize delivery due to unforeseen circumstances, or those outside of Sponsor’s control. If the fulfilling merchant cancels the order for reasons out of Sponsor’s control, the Prize will not be delivered, and no additional compensation will be provided. If any required documents are not timely received by Sponsor, or if any message or mail intended for a Winner is returned as undeliverable, then the Prize may be forfeited.

7. Prize: Winners will receive a McLaren Formula 1 Team VIP Experience from 5. to 7. 2024 for two (2) people in Northamptonshire, UK. The Main Prize is an event access only prize and excludes all travel related and other expenses incurred by the winner and / or their guest. ] (the “Prize”). Prize consists of only those items specifically listed as part of the prize. All other expenses not expressly listed in these Official Rules (including but not limited to travel and accommodation expenses) are the sole responsibility of the Winner(s).

8. Participation and Prize conditions: The Winner must complete and return any Prize Claim Documents required by Sponsor.

Winner hereby acknowledges that Sponsor has not and will not obtain or provide travel insurance or any other form of insurance for any part of the Prize. The Prize will not include any additional items, cash awards, or paid expenses, which will be Winners’ sole responsibility.

Released Parties (defined below) bear no responsibility if any event, element or detail of the Prize is canceled, postponed or becomes unavailable for any reason. Should any event, element or detail of the Prize become unavailable, Released Parties shall have no obligation to the Winner aside from providing the Prize, minus any unavailable event, element or detail. The Winner shall be subject to all terms and conditions printed on any ticket and gift card issued in conjunction with the Prize. In the event the Winner is denied entry into any ticketed location or is removed or barred from any ticketed location for any other reason, Released Parties are not responsible, and no further compensation or award will be provided.

In the event the Prize cannot be awarded as stated, that Prize will go unawarded. Costs and expenses associated with Prize acceptance and use not specifically stated herein as being provided are the sole responsibility of the Winner. The Prize is not redeemable for cash and is subject to availability, nontransferable, non-negotiable, nonrefundable and no substitution will be made except as provided herein at the Sponsor's sole discretion. Sponsor reserves the right to substitute the Prize (or any element thereof) for one of equal or greater value for any reason.

By participating, Entrant agrees their Entry may be shared on social media sites or other websites by the Sponsor. Acceptance of a Prize also constitutes permission to the Sweepstakes Parties to use Winners’ name, likeness and biographical information for marketing purposes without further compensation or right of approval, unless prohibited by law. All federal and state laws apply.

The Released Parties make no warranties concerning the Prize. WITHOUT LIMITING THE GENERALITY OF THE FOREGOING, THE PRIZE IS PROVIDED “AS IS” WITHOUT WARRANTY OF ANY KIND, EITHER EXPRESS OR IMPLIED, AND THE RELEASED PARTIES HEREBY DISCLAIM ALL SUCH WARRANTIES, INCLUDING BUT NOT LIMITED TO, THE IMPLIED WARRANTIES OF MERCHANTABILITY, FITNESS FOR A PARTICULAR PURPOSE AND/OR NON‐INFRINGEMENT.

9. Privacy policies and data collections: By entering this Sweepstakes, each Entrant agrees that the Sponsor has the right to contact the Entrant via email or social media account used to post the Entry and agrees to Sponsor's privacy policy and use of information it collects. Sponsor will collect some information about Entrant. Check out Sponsor’s privacy policy at https://www.getyourguide.com/privacy_policy.

10. Limitations on liability: By entering this Sweepstakes and/or accepting any Prize Entrants waive all right to, and hold the Sweepstakes Entities and any other organization responsible for sponsoring, fulfilling, administering, advertising or promoting this Sweepstakes, and their respective parent, subsidiaries, and affiliates and each of their respective officers, directors, members, employees, agents and subcontractors (collectively, the “Released Parties”) harmless from, any claim, liability, loss, injury, including without limitation, death and bodily injury and damage, or expense (including attorneys' fees) arising out of or in connection with participation in this sweepstakes or the acceptance, use, or misuse of any prize. SOME JURISDICTIONS DO NOT ALLOW THE LIMITATIONS OR EXCLUSION OF LIABILITY FOR INCIDENTAL OR CONSEQUENTIAL DAMAGES, SO THE ABOVE MAY NOT APPLY TO YOU. Sweepstakes Parties will not be responsible for: late, incomplete, or incorrect Entries; an Entrant's failure to receive prize notices due to Entrant's spam, junk e-mail, or other security settings or for Entrants' provision of incorrect or otherwise non-functioning contact information; technical, hardware, or software malfunctions, lost or unavailable network connections, or failed, incorrect, inaccurate, incomplete, garbled, or delayed electronic communications whether caused by the sender or by any of the equipment or programming associated with or used in this sweepstakes; by any human error which may occur in the processing of the Entries in this Sweepstakes; or any typographical, technological, or other error in the publishing of the offer, administration of the sweepstakes, or announcement of the Prize. If, in the Sponsor's opinion, there is such an error, or there is any suspected evidence of tampering with any portion of the sweepstakes, or if technical difficulties (including viruses and bugs) compromise the integrity of the sweepstakes, Sponsor reserves the right, in its sole discretion, to cancel or modify this Sweepstakes in a manner deemed appropriate by the Sponsor. In the event of termination, winners will be selected from among all eligible Entries received as of date of termination. In the event a dispute arises as to the identity of a potential winner, Entries will be declared made by the name on the online entry form.

TO THE FULLEST EXTENT ALLOWED BY APPLICABLE LAW, SPONSOR WILL NOT BE LIABLE TO ENTRANT FOR ANY INDIRECT, SPECIAL, INCIDENTAL, CONSEQUENTIAL, EXEMPLARY OR PUNITIVE DAMAGES, HOWEVER CAUSED AND UNDER ANY THEORY OF LIABILITY, INCLUDING CONTRACT OR TORT (INCLUDING PRODUCTS LIABILITY, STRICT LIABILITY AND NEGLIGENCE), AND WHETHER OR NOT SPONSOR WAS OR SHOULD HAVE BEEN AWARE OR ADVISED OF THE POSSIBILITY OF SUCH DAMAGE AND NOTWITHSTANDING THE FAILURE OF ESSENTIAL PURPOSE OF ANY REMEDY STATED HEREIN. TO THE FULLEST EXTENT ALLOWED BY APPLICABLE LAW, IN NO EVENT SHALL SPONSOR’S LIABILITY FOR ANY CLAIM ARISING OUT OF OR IN CONNECTION WITH THIS SWEEPSTAKES (WHEN AGGREGATED WITH SPONSOR’S LIABILITY FOR ALL OTHER CLAIMS ARISING OUT OF THIS SWEEPSTAKES) EXCEED ONE THOUSAND U.S. DOLLARS (US$1,000). THE PARTIES ACKNOWLEDGE AND AGREE THAT THE FOREGOING PROVISIONS REPRESENT A REASONABLE ALLOCATION OF RISK AND THAT THE PARTIES WOULD NOT ENTER INTO THIS AGREEMENT ABSENT SUCH PROVISIONS.

11. Disputes and Governing Law: Unless the laws relevant for the domicile of the Entrant provide otherwise, all issues and questions concerning the construction, validity, interpretation and enforceability of these Official Rules or the rights and obligations of Entrants or Sponsor in connection with the Sweepstakes shall be governed by and construed in accordance with the provisions of German law under exclusion of its conflict of law rules. The place of performance and exclusive legal venue for any disputes arising from or in connection with the performed services shall be Berlin provided.

Country Specific Notices: If any provision of these rules is invalid under the law, rules or regulations of a particular country, it will only apply to the extent permitted.

If the Entrant is a California resident, the Entrant hereby knowingly and voluntarily waives any and all rights or benefits that he/she/they may now have, or in the future may have, under the terms of section 1542 of the California Civil Code, which provides as follows: “A general release does not extend to claims which the creditor does not know or suspect to exist in his or her favor at the time of executing the release, which if known by him or her must have materially affected his or her settlement with the debtor.”

CAUTION: ANY ATTEMPT BY A PERSON TO DELIBERATELY DAMAGE OR UNDERMINE THE LEGITIMATE OPERATION OF THE SWEEPSTAKES MAY BE IN VIOLATION OF CRIMINAL AND CIVIL LAWS AND, SHOULD SUCH AN ATTEMPT BE MADE, SPONSOR RESERVES THE RIGHT TO SEEK REMEDIES AND DAMAGES (INCLUDING ATTORNEY’S FEES) FROM ANY SUCH PERSON TO THE FULLEST EXTENT OF THE LAW, INCLUDING CRIMINAL PROSECUTION. SPONSOR'S FAILURE TO ENFORCE ANY TERM OF THESE OFFICIAL RULES SHALL NOT CONSTITUTE A WAIVER OF THESE PROVISIONS.

12. Official rules/winners list:

For the first name, last initial, city and state of the Prize Winners of the McLaren VIP Race Experience Sweepstakes, please email [email protected]. Requests must be sent within four (4) weeks of the end of the Sweepstakes Period.

1 note

·

View note

Text

Wally Adeyemo is no stranger to economic crises. The 41-year-old policymaker first served in the U.S. Treasury Department amid the Great Recession that began in 2007 as deputy chief of staff to then-Treasury Secretary Timothy Geithner and, later, to Jack Lew. Adeyemo went on to serve as then-U.S. President Barack Obama’s representative to the G-7 and G-20. Each of those roles have served as crucial preparation for his current job as deputy secretary of the treasury under Janet Yellen.

But while some of the economic woes confronting the Biden administration are familiar to a policymaker like Adeyemo—such as high energy prices and a global food crunch—others feel more historic, if not unprecedented. Inflation is at its highest since the 1970s, and Russia’s war in Ukraine continues to dominate diplomatic attention.

FP interviewed Adeyemo as part of FP Live, the magazine’s forum for live journalism. We discussed how Washington has and hasn’t been able to corral global support for its sanctions on Moscow, the future of the U.S. dollar, competition with China, inflation, and much more. Subscribers can watch the full video here. What follows is a greatly condensed but lightly edited transcript.

Foreign Policy: Let’s start with the news this week. The oil cartel OPEC agreed this week to slash oil production—on paper, at least—by some 2 million barrels a day. I want to point you to a comment from Democratic Sen. Chris Murphy, who tweeted on the news: “I thought the whole point of selling arms to the Gulf states despite their human rights abuses, nonsensical Yemen War, working against U.S. interests in Libya, Sudan, etc. was that when an international crisis came, the Gulf could choose America over Russia/China.”

But it didn’t. How much has OPEC’s decision this week hurt American interests?