#UKTax

Text

Navigating UK Tax: A Guide to VAT Returns

Tax season can be a daunting time for businesses, especially when it comes to understanding and managing Value Added Tax (VAT) returns in the UK. Whether you're a small business owner or a seasoned entrepreneur, staying on top of your tax obligations is crucial for financial health and compliance. In this guide, we'll delve into the intricacies of UK tax, focusing specifically on VAT returns and how you can navigate them with confidence.

Understanding VAT

VAT is a consumption tax levied on the value added to goods and services at each stage of production or distribution. In the UK, VAT applies to most goods and services provided by businesses, as well as some goods and services imported from outside the European Union.

There are different VAT rates applicable to various goods and services, including the standard rate of 20%, reduced rates of 5% and 0%, and exemptions for certain goods and services like food, children's clothing, and healthcare.

VAT Registration

Businesses with taxable turnover exceeding the VAT threshold must register for VAT with HM Revenue & Customs (HMRC). As of 2024, the VAT registration threshold is £85,000. However, businesses with turnover below this threshold can voluntarily register for VAT.

Once registered, businesses must charge VAT on their taxable sales (output tax) and can reclaim VAT on eligible purchases (input tax). VAT-registered businesses are required to submit VAT returns to HMRC, usually on a quarterly basis, detailing their VAT transactions.

VAT Returns

A VAT return is a document submitted to HMRC summarizing the VAT due on sales and VAT reclaimable on purchases during a specific accounting period. Businesses must accurately report their VAT transactions in their VAT returns to ensure compliance with tax regulations.

When completing a VAT return, businesses must include the total value of sales and purchases subject to VAT, as well as any VAT owed to or reclaimable from HMRC. VAT returns can be filed online using HMRC's Making Tax Digital (MTD) system, which aims to streamline the tax reporting process and improve accuracy.

Tips for VAT Compliance

To ensure compliance with VAT regulations and minimize the risk of errors or penalties, businesses should:

Keep detailed records of all VAT transactions, including sales invoices, purchase receipts, and VAT accounting records.

Reconcile VAT transactions regularly to identify any discrepancies or missing documentation.

Familiarize themselves with VAT rules and regulations, including VAT rates, exemptions, and thresholds.

Seek professional advice from accountants or tax advisors to navigate complex VAT issues and ensure compliance with tax laws.

Utilize accounting software or online VAT filing services to automate VAT calculations and streamline the VAT return process.

By following these tips and staying informed about VAT regulations, businesses can effectively manage their VAT obligations and avoid costly mistakes.

Conclusion

Navigating UK tax, particularly VAT returns, requires careful attention to detail and a good understanding of tax regulations. By registering for VAT, maintaining accurate records, and submitting timely VAT returns, businesses can ensure compliance with tax laws and minimize the risk of penalties.

While VAT compliance may seem daunting, especially for small businesses, there are resources and tools available to simplify the process. Whether it's leveraging digital accounting software or seeking professional advice, businesses can take proactive steps to navigate UK tax with confidence.

Remember, VAT compliance is not just about meeting legal requirements—it's also about ensuring financial stability and fostering trust with customers and stakeholders. By prioritizing VAT compliance, businesses can lay the foundation for long-term success in the ever-changing landscape of UK taxation.

1 note

·

View note

Text

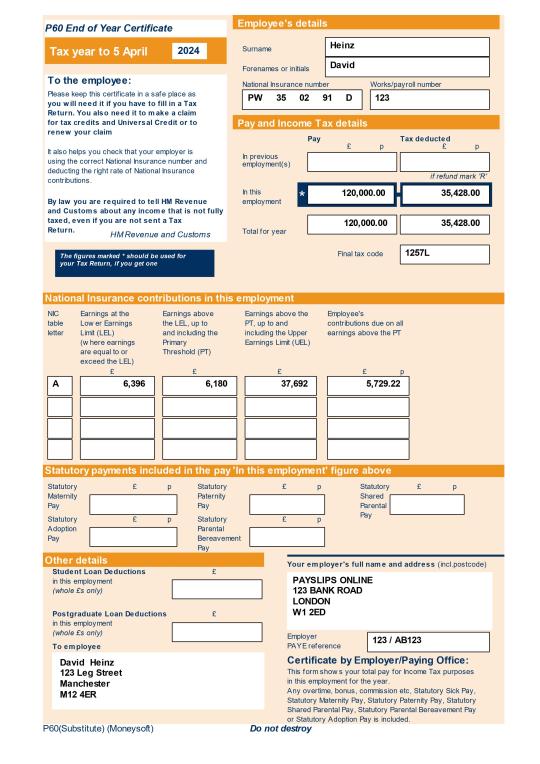

Attention UK Employees! 🇬🇧 Time to order your new P60 online! The financial year 2023-24 ends on April 5, 2024. Don't miss out! Follow these simple steps:

1️⃣ Visit Payslips Online official website. Order P60 Online UK

2️⃣ Create or Login your account

3️⃣ Navigate to the P60 section.

4️⃣ Follow the instructions to order your new P60.

5️⃣ Verify and submit your request.

Stay organized with your taxes!

1 note

·

View note

Text

Are you a parent? Or do you have a child living with you? We guess you get the Child Benefit payments then. Do you know that if your Adjusted net income over £50,000, you are liable to pay for some or all the Child Benefit payments? Yes, you have heard the right!

While living in the UK, and you or your partner has an annual net income individually more than £50,000, a High Income Child Benefit Charge (HICBC) occurs. Also, if you or your partner gets the child benefit, you are liable to make the payments, even if the child living with you is not your own kid.

Now, your question may be, who will pay the tax charge, right? For this answer, the best thing you can do is read this blog for a clear idea of the High Income Child Benefit Charge (HICBC), including the total taxable income and other facts. And finally, visit a professional tax consultant nearby to make sure of all the rules so you don’t have to face penalties later.

Everything You Need to Know about High Income Child Benefit Charges (HICBC)

As mentioned, you may have to pay for the High Income Child Benefit Charge (HICBC) if your partner or you have an individual Adjusted net income over £50,000 or any of you is a recipient of Child Benefit payments.

Now, with these conditions applied, you (when you are the recipient) and your partner need to decide jointly, whether you should stop getting Child Benefit payments to avoid paying the tax charge or continue receiving the amount and pay for it via Self-Assessment.

If you continue getting Child Benefit payments, learn who will pay their tax charge at the end of every tax year. If the conditions are that both you and your partner earn more than £50,000, the one having the higher Adjusted net income will pay.

Note: Here, partner means the person you are married to, living with or in a civil relationship, not separated permanently.

What Is Considered a Total Taxable Income?

Now, speaking of the net income, you should know what counts as an income in this case. In the matter of High Income Child Benefit Charge (HICBC), your adjusted net income will be the total taxable income, excluding Gift Aid and allowances, while including interest from dividends and savings.

Can the Tax Charge for High Income Child Benefit Increase?

Yes, it can. According to the UK Government, the High Income Child Benefit Charge (HICBC) will increase gradually with your increased annual income. For example, when you earn between £50,000 and £60,000, the charge drives up, which is equal to 1%of one family’s Child Benefit payments for every £100 of annual income over £50,000 every year. However, the tax charge will be less than the total ChB amount. That’s why many recipients or parents decide to continue getting the Child Benefit payments and pay the HICBC.

But, in case you earn more than £60,000 annually, the tax charge will be equal to the total Child Benefit amount. In this condition, you and your partner can decide to opt out of getting ChB payments to avoid paying the tax charges.

Note: Even after you stop getting the child Benefit payments, you have to pay the tax charge on the ChB amount you got. Moreover, when you decide to opt out of receiving ChB payments, your ChB claim will remain active unless the circumstances change. By claiming ChB, you can earn National Insurance credits counted as your State pension, while your child will get a National Insurance number before 16 years without making any application.

In Conclusion

We hope this guide will remain helpful for you to understand the High Income Child Benefit Charge (HICBC). Now, if you need expert help to learn all the rules related to tax charges or require tax services nearby, count on us. At Tax first consultants ltd, our experts help with not just self-assessment tax returns for individuals & self-employed people and HMRCs’ investigation but preparing year-end accounts, bookkeeping using software, payroll, tax planning and much more. Call us today for a consultation, or click here for a live chat now!

For more details, Visit our website : https://www.taxfirstconsultants.co.uk/blog/high-income-child-benefit-charge-hicbc-ins-and-outs-in-brief-explained/

1 note

·

View note

Text

I find it funny that I understand things like booking holiday at a job and severance pay because they were both featured within fanfics I read.

#fanfic#ao3fic#AO3#can someone explain taxes next?#you only get severance pay if you’re fired!#uktaxes#I wish just once I remember that one maths lesson when they showed us a tax form

0 notes

Text

Core value's of UKCA

Follow us on Insta- @cloudaccountantsuk

Email: [email protected]

Reach us: 02070788999

Visit us: https://cloudaccountants.co/

#ukca

#ukcloudaccountants

#lifeatukca

#Reliableaccountants

#creativeaccountants

#innovativeaccountants

#byaccountantsforaccountants

#acca

#fcca#ukcharteredaccountants

#ukaccountants

#ukaccounting

#ukbookkeeping

#ukpayroll

#uktaxation

#ukAccountingoutsourcing

#ukvatoutsourcing

#ukbookkeepingoutsourcing

#ukpayrolloutsourcing#uktaxoutsourcing

#brandpartnerships

#2023trends

#repost

2 notes

·

View notes

Photo

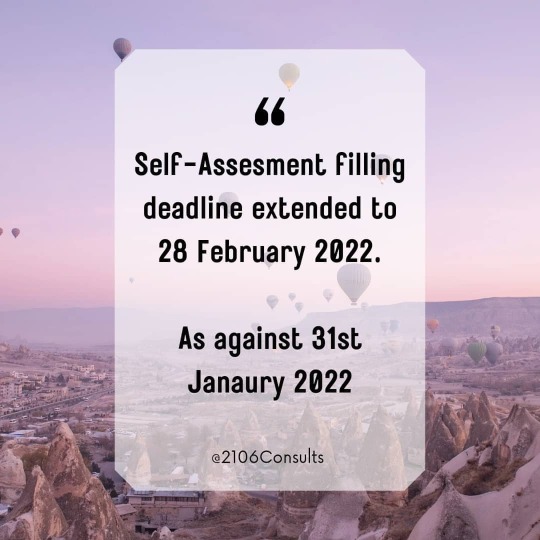

Today HMRC has announced that we will not charge: 1. Late filing penalties for those who file online by 28 February 2022. 2. Late payment penalties for those who pay the tax due in full or set up a payment plan by 1 April 2022. This will give customers and their representatives additional time if they need it and will operate in the same way as the equivalent waivers last year. However, HMRC is encouraging customers to file and pay on time if they can – almost 6.5 million have already done so. #uktax #selfassessment #taxreturns #selfemployedlife (at United Kingdom) https://www.instagram.com/2106consults/p/CYY1dImqNeS/?utm_medium=tumblr

0 notes

Photo

Great day full of meetings - New instructions received by TaxQube. We met yet another large construction company that has invested over 100M in the UK on behalf of an overseas billionaire and had never heard of tax credits. Instructions received. Book a consultation through our website- www.taxqube.co.uk #london #researchanddevelopment #funding #taxcredits #newcompany #nowinnofee #construction #ukconstruction #ukengineering #mayfair #uktax #ukstartup (at Hanover Square, Westminster) https://www.instagram.com/p/B9T6WPVnm6_/?igshid=e8lacu8zjabm

#london#researchanddevelopment#funding#taxcredits#newcompany#nowinnofee#construction#ukconstruction#ukengineering#mayfair#uktax#ukstartup

0 notes

Text

Allowable finance costs

Although the way in which landlords obtain relief for finance costs on residential properties is changing, there is no change to the type of finance costs that are eligible for relief.

What qualifies for relief

The basic rule is that relief is available for expenses that are incurred wholly or exclusively for the purposes of the property rental business, and this rule applies equally to finance costs. Relief is available for eligible finance costs where they meet this test.

The definition of finance costs includes mortgage interest and interest on loans to buy a furnishing and suchlike. Relief is also available for the incidental costs of obtaining finance, as long as the interest on the loan is allowable. Incidental costs of loan finance include items such as arrangement fees, and fees incurred when taking out or repaying loans or mortgages.

Limit on eligible borrowings

A landlord can obtain relief for the costs of borrowings on a loan or mortgage up to the value of the property when it was first to let. Buy-to-let mortgages are often more expensive than residential mortgages with interest charged at a higher rate. The loan does not have to be secured on the let property. Where a landlord wishes to buy a rental property and has sufficient equity in their own home, it may make commercial sense to release capital from the home by borrowing against it and using the money to purchase the rental property. Interest on the loan is eligible for relief, despite the fact the loan is not secured on the rental property.

No relief for capital repayments

Capital repayments, such as the capital element of a repayment mortgage or loan repayments, are not eligible for relief. Where the borrowings are in the form of a repayment mortgage, it will be necessary to split the payment between the interest and capital when working out the relief. The lender should provide this information on the statement.

Example

Mervyn wishes to invest in a buy to let property. As he only has a small mortgage on his home, he remortgages to release £150,000 of equity.

Following the remortgage, he has a mortgage of £200,000 in his own home. Using the released equity, he buys a property to let for £150,000. He spends some time renovating the property in his spare time before letting it out. When the property is first to let, it has a value of £160,000.

During the 2019/20 tax year, Mervyn pays mortgage interest of 10,000and makes capital repayments of £10,800. The property is let throughout.

Mervyn can claim relief for 80% of the interest costs – this is attributable to the borrowings of £160,000 (80% of the loan of £200,000), being the value of the let property when first let. The interest eligible for relief is, therefore, £8,000 (80% of £10,000). For 2019/20, 25% (£2,000) is relieved by deduction with the balance giving rise to a deduction from the tax due to £1,200 (75% x £8,000 x 20%).

No relief is available for the capital repayments.

0 notes

Text

VAT Guide for Small Business Owners

Are you an entrepreneur managing a small business and considering if you should register for VAT? This blog covers some essential information about UK VAT to get you started with your assessment to register or not.

What is VAT?

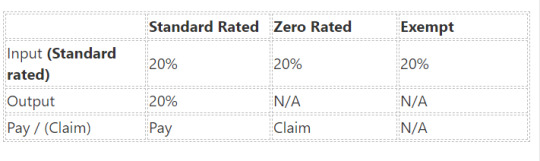

Value Added Tax or VAT is an indirect tax that is applied to on purchase value of goods and services. In some jurisdictions outside the UK, it is also referred to as Sales Tax of General Sales Tax (GST). In the VAT system, all VAT registered participants in the supply chain have to collect VAT on sales and deposit it to HMRC, after deducting the allowable VAT on their purchases. So effectively every seller collects tax from their customer on the value added to the goods and services, and that’s where the name Value Added Tax comes from.

Who needs to register for VAT?

VAT registration threshold in the UK is a turnover of £85,000 of taxable supplies for a period of consecutive twelve months. So, if your business turnover in the last twelve months exceeds the VAT threshold, then you must register for VAT.

There are two types of registration.

Compulsory Registration

You can determine if you are required to register for VAT by assessing your turnover against the following two tests. If you pass either of the tests, you will need to register for VAT.

Historic Test

If your value of cumulative taxable supplies exceeds £85,000 for twelve consecutive months, then you need to register for VAT. It is important to note that you need to apply this test at the end of every month by calculating the cumulative turnover of taxable supplies for the previous twelve months. It doesn’t have to coincide with the calendar year or your finance or tax year. So if you are a fast growing business, you must pay attention to this limit.

Future Test

You don’t only apply the historic test; you also need to apply a future test. You are required to register for VAT at any time if there are reasonable grounds for believing that your taxable turnover (excluding VAT) in the following 30 days will exceed £85,000 for the cumulative period of twelve months.

Voluntary Registration

You can voluntarily register for VAT even if your taxable turnover falls below the compulsory registration threshold. The definite benefit of registration is that you can claim back the VAT paid on purchases and expenses.

The VAT is charged on taxable supplies. A taxable supply is any supply made in the UK which is not exempt from VAT. Taxable supplies include those which are zero-rated for VAT.

VAT Schemes for SME’s:

For the ease and benefit of SME’s, HMRC has introduced different VAT Schemes for businesses to consider. You need to consider which scheme is suitable for you depending on your business circumstances.

Cash Accounting Scheme

You can only opt for this scheme if your taxable turnover (excluding VAT) for twelve months is not expected to exceed £1,350,000.

You are required to leave this scheme if the value of taxable supplies exceeds £1,600,000. It means, at the time of registering for VAT your expected revenue should not be more than £1,350,000 but once joined you can continue to pay taxes under this scheme unless your taxable revenue exceeds £1,600,000. As above, all calculations are for twelve consecutive months and will have to be assessed at the end of every calendar month for the past twelve months.

Under this scheme, you need to account for the VAT on the basis of cash received or paid. You will also get a benefit that you will not be required to claim back VAT previously paid on sales that eventually turned out bad debt as the VAT is paid when you receive cash from the customer.

Flat Rate Scheme

You can join this scheme if you have an annual taxable turnover (excluding VAT) of up to £150,000.

You need to leave the scheme if the total value of your VAT inclusive supplies in the year is more than £230,000.

Under this scheme, you are required to calculate VAT by applying a fixed percentage (usually depends on the trade sector in which business falls) on your tax inclusive turnover. A 1% reduction of the flat rate is applicable if it’s your first year of VAT registration.

Annual Accounting Scheme

Rather than making quarterly returns, this scheme gives you a chance to make advance installments towards your bill consistently. You then file one VAT return and pay the balance or claim back a refund for any overpayments. This option is available to organizations with a turnover below £1.35 million

Benefits of Registration for VAT:

VAT registration adds credibility to your business profile as most businesses prefer to deal with companies registered with VAT.

If you are an importer or exporter, it would be an added advantage for you as some countries give tax benefits for VAT Register Company.

You can reclaim input VAT on all goods or services your business purchases if you register for VAT, including asset purchases that can be a significant

You can also reclaim VAT from past, once you get registered for VAT you get eligible to claim input VAT on goods by going back four years from the date of registration, and you still have that goods available in your business premises.

VAT Accounting or Accounting for VAT:

VAT accounting means recording VAT on purchases and sales.

The VAT on purchases should be recorded from the purchase price. This input VAT is recoverable if the business is VAT registered.

The VAT on sales should be recorded separately from the sales price. This VAT is payable to HMRC along with the VAT return.

You can easily record your VAT using an Accounting software or on a simple excel sheet. Alternatively, you can automate the recording of expenses with an automated bookkeeping app like Receipt Bot. In this case, you just take pictures of your bills and receipts with a mobile camera or upload documents from scanners and email. If you are using a cloud accounting software like Xero and QuickBooks Online, you can integrate Receipt Bot to automatically record all expenses in this software and then submit your VAT return with ease.

Even if you are not VAT registered, proper accounting is still essential for your business management. Not only it will help you with income tax filing, but it will also enable you to analyze the potential savings that you can get by registering for VAT.

0 notes

Link

1 note

·

View note

Photo

Did you know over 60K individuals filed their returns on the 5th April 2021. Why wait till the last minute to prepare and file your clients' tax returns?Get ahead of the curve. Outsource your clients #selfassessmenttaxreturns to Fin-eX Outsourcing.Learn more > www.finexoutsourcing.com#accountants #outsourcing #selfassessment #tax #uktax #accounting #bookkeeping #acca #icaew #accountant

1 note

·

View note

Link

How will the new Landlord tax effect you?

#buytolet#landlords#property#renting#rental#investment#uktax#tax#goverment#taxes#incometaxes#realestate

0 notes

Text

Fuel the Growth of your Business with UKCA. As your Outsourcing Partner.

Follow us on Insta- @cloudaccountantsuk

Email: [email protected]

Reach us: 02070788999

Visit us: https://cloudaccountants.co/

#ukca

#ukcloudaccountants

#lifeatukca

#Reliableaccountants

#creativeaccountants

#innovativeaccountants

#byaccountantsforaccountants

#acca

#fcca

#ukcharteredaccountants

#ukaccountants

#ukaccounting

#ukbookkeeping

#ukpayroll

#uktaxation

#ukAccountingoutsourcing

#ukvatoutsourcing

#ukbookkeepingoutsourcing

#ukpayrolloutsourcing

#uktaxoutsourcing

#ukca#ukcloudaccountants#lifeatukca#Reliableaccountants#creativeaccountants#innovativeaccountants#byaccountantsforaccountants#accounting#business#branding#finance#economy

0 notes

Photo

Today HMRC has announced that we will not charge: 1. Late filing penalties for those who file online by 28 February 2022. 2. Late payment penalties for those who pay the tax due in full or set up a payment plan by 1 April 2022. This will give customers and their representatives additional time if they need it and will operate in the same way as the equivalent waivers last year. However, HMRC is encouraging customers to file and pay on time if they can – almost 6.5 million have already done so. #uktax #selfassessment #taxreturns #selfemployed (at United Kingdom) https://www.instagram.com/p/CYY1NWiKFMw/?utm_medium=tumblr

0 notes

Photo

Summertime In Mind .. 💋👌🏻 Beautiful @miss_candy_bell wears our NEW Jane blouse .. looking summertime ready 💞 Not long now ladies for this stunning mew print to arrive ! Pre Orders still available too .. pre order will give you priority dispatch ✨ 8-18 available.. £29.oo💖 (UKTAX REMOVED AT CHECKOUT AUTOMATICALLY) #summervibes #summercheck #summertime #summeriscoming #summeroutfits #summerstyle #classicblouse #classicfashion #classicstyle #rockabella #pinup #letsdance #tiesleeves #bow #1950s #1950sfashion #1950sstyle #1950slook #fiftiesstyle #vintagewoman #vintagelady #rollonsummer #vintagefashion #vintagestyle #vintageinspired #lookgoodfeelgood #summertime #timelessdesign #rocknromance #comingsoon https://www.instagram.com/p/COlBqN0AacU/?igshid=xzou7dzw0i8u

#summervibes#summercheck#summertime#summeriscoming#summeroutfits#summerstyle#classicblouse#classicfashion#classicstyle#rockabella#pinup#letsdance#tiesleeves#bow#1950s#1950sfashion#1950sstyle#1950slook#fiftiesstyle#vintagewoman#vintagelady#rollonsummer#vintagefashion#vintagestyle#vintageinspired#lookgoodfeelgood#timelessdesign#rocknromance#comingsoon

0 notes

Photo

Pra que@ trabalha por conta própria! Vale a pena dar uma olhadinha @perolasderikardo • @mmaccountancy 🇬🇧This scheme is being extended. You will be able to make a claim for a second and final grant which will be available in August 2020. At this time the government will be covering 70% of your Trading Profit. You must apply for this if your Income has been affected by the Covid-19. You can still work or intend to work. If you have any questions about this, please don’t hesitate to contact. - - - 🇧🇷Este esquema está sendo estendido. Você poderá solicitar uma segunda e última concessão, que estará disponível em agosto de 2020. Neste momento, o governo cobrirá 70% do seu lucro comercial. Você deve solicitar isso se sua renda foi afetada pelo Covid-19. Você ainda pode trabalhar ou retomar as suas atividades. Se você tiver alguma dúvida sobre isso, não hesite em entrar em contato. - - - Send me a message or schedule your appointment! ☎Telephone: 07341811003; 📧E-mail: [email protected] #noticias #accountantlife #fiqueligado #brasileirosemlondres #selfemployed #beneficios #hmrc #government #london #covid-19 #pguk20 #beaware #accountantlife #fiqueligado #brasileirosemlondres #juntossomosmaisfortes #hmrc #uk #reinounido #covid-19 #mmaccountancy #limitedcompany #taxseason #quickbooks #accountantlife #fiqueligado #counciltaxuk #government #beorganised #discount #benficios #epm #guerreirasempreendedorasuk #corporationtax #bookkeeper #uktaxes #hmrc #soletrader (at Bristol, United Kingdom) https://www.instagram.com/p/CA7Vc2OJwaj/?igshid=1ibr1f2e3vyy6

#noticias#accountantlife#fiqueligado#brasileirosemlondres#selfemployed#beneficios#hmrc#government#london#covid#pguk20#beaware#juntossomosmaisfortes#uk#reinounido#mmaccountancy#limitedcompany#taxseason#quickbooks#counciltaxuk#beorganised#discount#benficios#epm#guerreirasempreendedorasuk#corporationtax#bookkeeper#uktaxes#soletrader

0 notes