#Uniswap price history

Text

Ethereum vs Ethereum Classic: a comprehensive comparison

What Distinguishes Ethereum from Ethereum Classic?

Overview of Ethereum and Ethereum Classic

Ethereum uses proof of stake, supporting numerous decentralized applications, while Ethereum Classic uses proof of work, emphasizing immutability. Both networks originated from a common blockchain. The DAO incident led to a split, with Ethereum focusing on innovation and Ethereum Classic emphasizing stability. These points illustrate the different trajectories and attributes of Ethereum and Ethereum Classic, reflecting their status and technological focus as of July 2024.

History

Timeline of Events, Recent Data and Details (July 2024)

These events and data illustrate the major developments and changes in both Ethereum and Ethereum Classic, highlighting their evolution and status as of July 2024.

Technical Distinctions

Consensus Protocols

Ethereum has been using proof of stake (PoS) since the Ethereum 2.0 upgrade. Ethereum Classic continues to use proof of work (PoW), similar to Bitcoin.

Network Enhancements

Ethereum’s transition to PoS and Ethereum 2.0 increased efficiency and scalability. The London hard fork introduced EIP-1559, which restructured transaction fees. Ethereum Classic’s major upgrade, Thanos, reduced DAG size and improved security.

Philosophical Differences

Ethereum’s Vision

Ethereum wants to be a global computer. Vitalik Buterin envisions a decentralized platform for smart contracts and decentralized applications. Innovation and scalability are key goals. Vitalik Buterin emphases Ethereum’s role in creating a decentralized future and believes in its potential to revolutionize industries. Smart contracts can automate processes and reduce intermediaries.

Ethereum Classic’s Principles

Ethereum Classic prioritizes immutability and decentralization. It adheres to the concept of “code is law” and resists changes that alter transaction history. The Ethereum Classic community views the blockchain as an immutable ledger and argues that altering the blockchain’s history, as is done with Ethereum’s hard fork, undermines decentralization and trustworthiness.

Applications and Uses

Smart Contracts and Decentralized Apps

Ethereum has a larger ecosystem with popular apps such as Uniswap, Aave and OpenSea. Ethereum Classic also supports apps, but has a smaller user base.

DeFi and NFTs

Ethereum’s DeFi ecosystem has a total value locked (TVL) of over $559 billion, including various financial services. Ethereum’s NFT market is also thriving, with platforms such as OpenSea facilitating the trade of digital art and collectibles.

Market Performance and Adoption

Ethereum is the second-largest cryptocurrency by market capitalization. It enjoys wide adoption and a strong developer community. As of July 2024, Ethereum’s market cap is around $420 billion, making it a leading force in the crypto space. In contrast, Ethereum Classic, while smaller with a much lower market cap, has a loyal following and maintains a market presence.

In Q1 2024, Ethereum’s earnings tripled, reaching $370 million, and its revenue from transaction fees hit $12 billion, a 155% increase from the previous year. The total value locked in Ethereum’s DeFi ecosystem rose by 86% to $559 billion. Ethereum ETFs started trading on major US exchanges in July 2024, potentially driving further adoption and price increases.

Here is a bar chart illustrating Ethereum’s performance in Q1 2024:

Earnings: $370 million

Transaction Fees Revenue: $12 billion

Total Value Locked in DeFi: $559 billion

Security and Network Stability

Ethereum has improved security with its transition to proof of stake. However, Ethereum Classic has faced several 51% attacks, notably affecting its network stability and security. Despite these challenges, Ethereum Classic continues to enhance its security measures. The introduction of the Thanos upgrade aimed to strengthen its resilience against such attacks.

In July 2024, Ethereum’s network stability remains strong with a significant reduction in energy consumption due to the PoS consensus mechanism. This transition has also boosted the network’s security, as PoS is less vulnerable to 51% attacks compared to PoW. Ethereum Classic, despite past security breaches, has implemented measures to bolster its network. The community remains dedicated to maintaining the original blockchain’s integrity and security.

Future Outlook

Ethereum’s Future

Ethereum continues to innovate, with future upgrades focusing on scalability and performance. The transition to Ethereum 2.0 aims to improve scalability, security and energy efficiency. This upgrade includes the move to proof of stake (PoS), which significantly reduces energy consumption compared to proof of work (PoW).

Key Future Developments for Ethereum

Scalability Improvements: Ethereum 2.0 introduces sharding, splitting the network into smaller segments to process many transactions simultaneously. This should significantly increase the transaction throughput.

Enhanced Security: PoS makes it harder for malicious actors to control the network. Validators who wish to participate must stake ETH, providing an economic disincentive against attacks.

Energy Efficiency: PoS reduces energy consumption by about 99.95% compared to PoW, making Ethereum more environmentally friendly.

Community and Developer Support: Ethereum’s robust developer community continues to build innovative decentralized apps, DeFi protocols, and NFT platforms, maintaining its leading position in the blockchain ecosystem.

Institutional Adoption: Ethereum ETFs started trading on major US exchanges in July 2024, potentially boosting market adoption and visibility. This can attract institutional investors looking for regulated crypto investment options.

Predictions for Ethereum

2024: Ethereum’s price is expected to range between $2,334 and $2,447.

2025: Predictions suggest Ethereum could reach up to $3,179.

2030: Long-term forecasts estimate Ethereum’s price could be as high as $9,689.

These predictions are based on current market trends, technological advancements and increasing adoption rates. Growing interest from institutional investors and wider adoption of blockchain technology across different industries also contribute to these optimistic forecasts.

Ethereum Classic’s Future

Ethereum Classic, on the other hand, aims to maintain stability and security while exploring selective upgrades. Its community values the principles of immutability and decentralization, ensuring the network remains true to its original vision.

Key Future Developments for Ethereum Classic

Network Stability: Ethereum Classic focuses on maintaining a stable and secure network. The community prioritizes robustness over frequent updates, ensuring long-term reliability.

Selective Upgrades: While not as aggressive in upgrades as Ethereum, Ethereum Classic implements necessary improvements to maintain compatibility and enhance security. The Thanos upgrade, for example, was crucial for reducing DAG size and improving mining efficiency.

Community Support: Ethereum Classic’s dedicated community values the principles of immutability and decentralization. This core philosophy attracts users who prioritize an unaltered blockchain history.

Security Enhancements: Ongoing efforts to bolster security and prevent 51% attacks are critical. Implementing measures like the Mess (Modified Exponential Subjective Scoring) protocol can enhance network resilience.

Market Position: While Ethereum Classic’s market cap and trading volume are lower compared to Ethereum, it remains a significant player due to its steadfast adherence to original blockchain principles.

Predictions for Ethereum Classic

2024: Detailed predictions for Ethereum Classic are less common, but its price is influenced by its community’s commitment to the original blockchain principles and broader market adoption.

2025: If market conditions remain favorable, Ethereum Classic could see steady growth.

2030: Long-term success depends on continuous community support and effective security enhancements.

Conclusion

The choice between Ethereum and Ethereum Classic depends on your priorities. Each has different features, philosophies and technical implementations that appeal to different types of users and investors. Here are some key factors to consider:

Ethereum

Innovation and Scalability: Ethereum is continually evolving. The transition to Ethereum 2.0, including proof of stake (PoS), enhances scalability and significantly cuts energy usage, making Ethereum more sustainable.

Robust Ecosystem: Ethereum supports a vast network of decentralized applications, DeFi platforms, and NFTs with over 3,000 active apps. It offers a wide range of functionalities, from trading to gaming.

Institutional Adoption: The launch of Ethereum ETFs on major US exchanges has boosted institutional adoption, increasing Ethereum’s visibility and accessibility.

Developer Support: Ethereum benefits from a strong developer community that continuously works on new innovations and improvements, driving the creation of new applications.

Ethereum Classic

Immutability and Decentralization: Ethereum Classic maintains the “code is law” principle, ensuring the blockchain remains unchanged. This philosophy appeals to those who prioritize the original vision of a tamper-proof ledger.

Traditional Mining: Unlike Ethereum, which has shifted to PoS, Ethereum Classic continues to use proof of work (PoW). This method is preferred by those who value traditional mining and its associated security model.

Stability and Security: Despite facing security challenges, Ethereum Classic remains committed to enhancing network security through upgrades like Thanos, which aim to improve stability and mining efficiency.

Purists: If you value the original blockchain principles and prefer a network that does not alter transaction history, Ethereum Classic is a suitable choice.

In summary, Ethereum is ideal for those looking for a dynamic, scalable platform with extensive support for decentralized applications, DeFi and NFTs. It is well suited for developers and users who want to engage with the most innovative aspects of blockchain technology. Conversely, Ethereum Classic is perfect for those who value immutability and traditional mining, offering a stable and unchanging blockchain history. By understanding these key differences and future prospects, you can make an informed decision that aligns with your priorities and goals in the cryptocurrency space.

1 note

·

View note

Text

How to Choose a Cryptocurrency Exchange: A Comprehensive Guide

In the fast-evolving world of digital finance, choosing the right cryptocurrency exchange is a critical decision for any investor or trader. With countless exchanges available, each offering a variety of features, security measures, and fee structures, the task can seem daunting. This comprehensive guide aims to demystify the process, providing you with the essential information needed to make an informed choice. Whether you’re a novice investor or a seasoned trader, understanding how to choose a cryptocurrency exchange will help you navigate the complexities of the crypto market effectively.

Understanding Cryptocurrency Exchanges

Before diving into the specifics of choosing a, it’s important to understand what these platforms are and how they function. It is an online platform that allows users to buy, sell, and trade cryptocurrencies. These exchanges operate similarly to traditional stock exchanges but are tailored to the unique requirements of digital assets.

There are two main types of cryptocurrency exchanges:

Centralized Exchanges (CEXs): These are managed by a central authority or company. They typically offer high liquidity, advanced trading features, and a user-friendly experience. Examples include Binance, Coinbase, and Kraken.

Decentralized Exchanges (DEXs): These operate without a central authority, using smart contracts to facilitate trades directly between users. They offer greater privacy and control over funds but may have lower liquidity and fewer features. Examples include Uniswap, SushiSwap, and PancakeSwap.

Key Factors to Consider When Choosing a Cryptocurrency Exchange

When selecting it, several factors should be taken into account to ensure you choose a platform that aligns with your trading goals, security requirements, and overall experience. Here are the key factors to consider:

1. Security Measures

Security should be your top priority when choosing it. The digital nature of cryptocurrencies makes them a target for hackers and cybercriminals. To protect your funds, look for exchanges that offer robust security features, such as:

Two-Factor Authentication (2FA): This adds an extra layer of security by requiring two forms of verification before you can access your account.

Cold Storage: Ensure the exchange stores a significant portion of users’ funds in offline wallets, which are less susceptible to hacking.

Encryption and Security Audits: Check if the exchange uses advanced encryption protocols and undergoes regular security audits.

Insurance Fund: Some exchanges offer insurance to cover losses in case of a security breach.

For example, Coinbase is renowned for its strong security measures, including insurance coverage for digital assets held on the platform.

2. Reputation and Reviews

Research its reputation by reading reviews and user feedback. Platforms with a history of security breaches, poor customer service, or regulatory issues should be approached with caution. Trusted sources like forums, social media, and review sites can provide valuable insights into the reliability and credibility of an exchange.

Exchanges like Binance and Kraken have built strong reputations over the years through consistent performance, transparency, and responsiveness to user concerns.

3. Trading Volume and Liquidity

High trading volume and liquidity are essential for ensuring smooth and efficient transactions. Exchanges with higher trading volumes typically offer tighter spreads, better prices, and faster order execution. Liquidity is especially important for large trades, as it minimizes the impact on market prices.

Websites like CoinMarketCap and CoinGecko provide information on trading volumes across various exchanges, helping you identify platforms with robust liquidity.

4. Supported Cryptocurrencies

Different offers varying selections of cryptocurrencies for trading. While major exchanges typically support popular coins like Bitcoin (BTC), Ethereum (ETH), and Litecoin (LTC), the availability of lesser-known or newly launched tokens can vary. Ensure the exchange you choose supports the specific cryptocurrencies you wish to trade or invest in.

For example, Binance is known for its extensive list of supported cryptocurrencies, making it a popular choice for altcoin traders.

5. User Interface and Experience

A user-friendly interface is crucial for both novice and experienced traders. The exchange should offer a seamless experience with intuitive navigation, clear charts, and easy-to-understand trading options. Advanced traders may also look for features like customizable dashboards, advanced charting tools, and multiple order types.

Platforms like Coinbase and Gemini are praised for their clean and straightforward user interfaces, making them ideal for beginners.

6. Fees and Costs

It generates revenue through various fees, including trading fees, withdrawal fees, and deposit fees. These fees can vary significantly between exchanges, so it’s important to understand the fee structure before committing to a platform. Look for exchanges that offer competitive fees without compromising on security or user experience.

For instance, Binance offers some of the lowest trading fees in the industry, with further discounts available for users who pay fees using Binance Coin (BNB).

7. Regulatory Compliance

Regulatory compliance is an important consideration, as it reflects the exchange’s commitment to operating within legal frameworks and protecting users. Check if the exchange is registered with relevant regulatory bodies and adheres to Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements.

Exchanges like Coinbase and Gemini are known for their strong regulatory compliance, providing users with added peace of mind.

8. Customer Support

Reliable customer support is essential for addressing any issues or concerns that may arise during your trading experience. Look for exchanges that offer multiple support channels, such as live chat, email, and phone support, and ensure they have a reputation for timely and helpful responses.

For example, Kraken is often praised for its responsive and knowledgeable customer support team.

9. Mobile Compatibility

In today’s fast-paced world, the ability to trade on the go is a valuable feature. Ensure the cryptocurrency exchange offers a mobile app that is compatible with your device and provides a seamless trading experience. The app should offer the same security features and functionality as the desktop version.

Exchanges like Binance, Coinbase, and Kraken offer robust mobile apps that cater to traders who prefer managing their portfolios on their smartphones.

Step-by-Step Guide to Choosing a Cryptocurrency Exchange

To help you navigate the process of choosing one, here is a step-by-step guide:

1. Define Your Trading Goals

Before selecting an exchange, determine your trading goals and preferences. Are you looking to invest in major cryptocurrencies or explore lesser-known altcoins? Do you prioritize low fees, high security, or advanced trading features? Clarifying your objectives will help you narrow down your options.

2. Research and Compare Exchanges

Conduct thorough research on multiple cryptocurrency exchanges, comparing their features, security measures, fee structures, and user reviews. Utilize comparison websites and forums to gather insights from other traders.

3. Check Security Measures

Ensure the exchange employs robust security measures, such as two-factor authentication, cold storage, and encryption. Check for any history of security breaches and how the exchange handled them.

4. Evaluate Reputation and Reviews

Read reviews and testimonials from other users to gauge the exchange’s reputation. Pay attention to any recurring issues or red flags, such as poor customer service or regulatory problems.

5. Assess Trading Volume and Liquidity

Verify the exchange’s trading volume and liquidity to ensure efficient and smooth transactions. High liquidity is especially important for large trades and minimizing price slippage.

6. Verify Supported Cryptocurrencies

Ensure the exchange supports the cryptocurrencies you wish to trade. If you plan to trade a wide range of coins, choose an exchange with a diverse selection of supported assets.

7. Test the User Interface

Explore the exchange’s user interface to ensure it is intuitive and easy to navigate. Advanced traders should check for features like advanced charting tools and customizable dashboards.

8. Review Fees and Costs

Compare the fee structures of different exchanges, considering trading fees, withdrawal fees, and deposit fees. Choose an exchange with competitive fees that align with your trading frequency and volume.

9. Check Regulatory Compliance

Ensure the exchange complies with relevant regulations and adheres to KYC and AML requirements. Regulatory compliance adds a layer of protection and legitimacy to the platform.

10. Evaluate Customer Support

Test the exchange’s customer support by reaching out with questions or concerns. Assess their response time and the helpfulness of their answers. Reliable customer support is crucial for resolving any issues that may arise.

11. Consider Mobile Compatibility

If you prefer trading on the go, check if the exchange offers a mobile app that provides a seamless experience. Ensure the app has the same security features and functionality as the desktop version.

Detailed Analysis of Popular Cryptocurrency Exchanges

To further assist you in choosing a cryptocurrency exchange, here is a detailed analysis of some of the most popular exchanges in 2024:

Binance is one of the largest and most popular cryptocurrency exchanges in the world, known for its extensive selection of cryptocurrencies, low fees, and advanced trading features.

Key Features:

Supports over 500 cryptocurrencies and tokens.

Offers a variety of trading pairs, including fiat-to-crypto and crypto-to-crypto.

Provides advanced trading features like futures and margin trading.

Binance Smart Chain (BSC) supports DeFi applications and dApps.

Security Measures:

Two-factor authentication (2FA)

Cold storage for the majority of user funds

Regular security audits and bug bounty programs

Binance SAFU (Secure Asset Fund for Users) as an emergency insurance fund

Fees:

Competitive trading fees starting at 0.1%

Discounts are available for using Binance Coin (BNB) to pay fees

No deposit fees for most cryptocurrencies

User Experience:

User-friendly interface suitable for beginners and advanced traders

Comprehensive mobile app with full trading functionality

Responsive customer support via live chat and email

Pros:

Wide selection of supported cryptocurrencies

Low fees and additional discounts for using BNB

Strong security measures and insurance fund

Cons:

Complex interface for beginners

Regulatory scrutiny in some jurisdictions

Coinbase is a well-established cryptocurrency exchange known for its

Conclusion: Choosing the Right Cryptocurrency Exchange

In conclusion, selecting the right cryptocurrency exchange is a pivotal decision that can significantly impact your trading experience and financial security. With a plethora of options available in the market, each offering unique features and benefits, it’s crucial to conduct thorough research and consider various factors before making your choice. A cryptocurrency exchange serves as your gateway to the digital asset market, facilitating the buying, selling, and trading of cryptocurrencies

Also Read: Unveiling Lucrative Investment Opportunities: A Comprehensive Guide

0 notes

Text

Less Than Three Months Left for STC Wallet Users to Redeem Their Tokens!

Student Coin (STC), a well-known crypto project, is closing.

Thus, it requires all token holders within the STC Wallet to redeem their tokens before October 9, 2024, by submitting a Redemption Request and requires direct contact with the Student Coin team.

How to Redeem Your STC Tokens

The Student Coin team has implemented a multi-stage redemption process that has been in place for over five years to ensure transparency and user support.

The first and second deadlines for redeeming tokens within the STC wallet (automatically) and through centralized exchanges have already passed in June.

The third stage, set to end on October 9, 2024, involves submitting a Redemption Request and requires direct contact with the Student Coin team.

The final phase, which will continue until April 9, 2029, allows users to sell their tokens on-chain.

Moreover, according to recent announcements, 82,86% of the total supply of STC and 100% of the tokens held by the team have already been burned. Additionally, between May 30 and June 15, the tokens were delisted from KuCoin, ProBit Global, HitBTC, and all remaining centralized exchanges.

Manual Redemption via OTC Redemption Request: This method requires KYC/KYB procedures, AML checks, and submitting documents until October 9, 2024.

On-chain Redemption: This option is available until April 9, 2029, and allows users to choose between converting tokens to USDC on Uniswap V3 (recommended for smaller volumes) or sending tokens directly to the burn address (recommended for larger volumes).

As an alternative, recommended for larger amounts, you can use an on-chain burn procedure by simply sending all your STC tokens to the burn address directly from your self-custody wallet. In return, the STC team will transfer you an adequate value in USDC.

The redemption prices range between $0.006 and $0.0137 per token and vary based on particular accounts’ purchase history and activity. This approach rewards loyal users, long-term holders, Premium Program members, and direct purchases via STC Wallet.

About Student Coin

Student Coin, a project launched in 2019 in a Polish business school aimed to explore blockchain technology, is now shutting down. The project led to further initiatives, including creating the STC Wallet, launching the STC Academy, and, finally, establishing Coinpaper, currently one of the leading crypto news portals.

However, economic turmoil, industry scandals, and regulations slowed their momentum.

Despite navigating these challenges and prioritizing user protection during major crypto crashes, the Student Coin team made the difficult decision to sunset the STC token and related projects.

Learn More

Visit Student Coins‘ official website and follow them on social media platforms like X (Twitter) and Telegram to stay updated with the redemption process.

0 notes

Text

Less Than Three Months Left for STC Wallet Users to Redeem Their Tokens!

Student Coin (STC), a well-known crypto project, is closing.

Thus, it requires all token holders within the STC Wallet to redeem their tokens before October 9, 2024, by submitting a Redemption Request and requires direct contact with the Student Coin team.

How to Redeem Your STC Tokens

The Student Coin team has implemented a multi-stage redemption process that has been in place for over five years to ensure transparency and user support.

The first and second deadlines for redeeming tokens within the STC wallet (automatically) and through centralized exchanges have already passed in June.

The third stage, set to end on October 9, 2024, involves submitting a Redemption Request and requires direct contact with the Student Coin team.

The final phase, which will continue until April 9, 2029, allows users to sell their tokens on-chain.

Moreover, according to recent announcements, 82,86% of the total supply of STC and 100% of the tokens held by the team have already been burned. Additionally, between May 30 and June 15, the tokens were delisted from KuCoin, ProBit Global, HitBTC, and all remaining centralized exchanges.

Manual Redemption via OTC Redemption Request: This method requires KYC/KYB procedures, AML checks, and submitting documents until October 9, 2024.

On-chain Redemption: This option is available until April 9, 2029, and allows users to choose between converting tokens to USDC on Uniswap V3 (recommended for smaller volumes) or sending tokens directly to the burn address (recommended for larger volumes).

As an alternative, recommended for larger amounts, you can use an on-chain burn procedure by simply sending all your STC tokens to the burn address directly from your self-custody wallet. In return, the STC team will transfer you an adequate value in USDC.

The redemption prices range between $0.006 and $0.0137 per token and vary based on particular accounts’ purchase history and activity. This approach rewards loyal users, long-term holders, Premium Program members, and direct purchases via STC Wallet.

About Student Coin

Student Coin, a project launched in 2019 in a Polish business school aimed to explore blockchain technology, is now shutting down. The project led to further initiatives, including creating the STC Wallet, launching the STC Academy, and, finally, establishing Coinpaper, currently one of the leading crypto news portals.

However, economic turmoil, industry scandals, and regulations slowed their momentum.

Despite navigating these challenges and prioritizing user protection during major crypto crashes, the Student Coin team made the difficult decision to sunset the STC token and related projects.

Learn More

Visit Student Coins‘ official website and follow them on social media platforms like X (Twitter) and Telegram to stay updated with the redemption process.

0 notes

Text

Orca: Can Solana's DEX Become the Uniswap of the Next Crypto Cycle?

New Post has been published on https://www.ultragamerz.com/orca-can-solanas-dex-become-the-uniswap-of-the-next-crypto-cycle/

Orca: Can Solana's DEX Become the Uniswap of the Next Crypto Cycle?

Orca: Can Solana’s DEX Become the Uniswap of the Next Crypto Cycle?

The decentralized exchange (DEX) landscape continues to evolve, with established players like Uniswap on Ethereum facing competition from innovative challengers on emerging blockchains. Orca, a leading DEX built on Solana, presents a compelling case for becoming the “Uniswap” of the next crypto cycle, capitalizing on several key factors.

Uniswap’s Reign and Potential Challenges:

Uniswap revolutionized DeFi by pioneering the automated market maker (AMM) model, fostering a user-friendly platform for token swaps. However, Ethereum’s scalability issues have led to high gas fees, hindering user experience and potentially limiting its future growth.

Solana’s Rise as a Contender:

Solana, known for its blazing-fast transaction speeds and low fees, has emerged as a viable alternative to Ethereum. This has attracted developers and users seeking a smoother and more affordable DeFi experience.

Orca: Inheriting the DEX Crown?

Orca, built on Solana, positions itself to capitalize on these trends. Here’s why Orca could be the next Uniswap:

Low Fees & High Throughput: Leveraging Solana’s infrastructure, Orca offers near-instantaneous transactions with minimal fees, attracting users frustrated with Ethereum’s limitations.

Uniswap-inspired Interface: Orca’s user interface is familiar and user-friendly for those already accustomed to Uniswap, facilitating a smooth transition.

Concentrated Liquidity: Similar to Uniswap V3, Orca’s “Whirlpool” feature allows liquidity providers to deposit tokens within specific price ranges, potentially earning higher returns.

Growing Solana Ecosystem: As the Solana ecosystem thrives, Orca stands to benefit from increased adoption of DeFi applications built on Solana.

Low Market Cap: Compared to Uniswap’s massive market cap, Orca’s remains significantly lower. This presents a potential for substantial growth if the project gains wider adoption.

Potential Price Explosion:

Uniswap’s phenomenal rise, reaching a peak price over 300 times its initial value, serves as a potential benchmark for Orca’s future. If Orca captures a dominant share of the Solana DeFi market, its token price could conceivably reach similar heights. With Orca’s current market cap significantly lower than Uniswap’s at its peak, a 300x increase could propel Orca’s price to well over $120 per token during the next crypto bull run.

Is Orca a Guaranteed Success?

While Orca holds immense potential, the crypto space is inherently unpredictable. Competition from other DEXes on Solana and potential roadblocks for the Solana blockchain itself could pose challenges.

Looking Ahead:

The next crypto cycle remains shrouded in uncertainty. However, Orca’s strategic positioning on Solana, combined with its user-friendly interface and low-fee environment, presents a compelling chance to become the leading DEX on a burgeoning blockchain. As the DeFi landscape evolves, Orca’s performance bears close watching to see if it can indeed become the “Uniswap” of the next era.

Disclaimer: This information is for educational purposes only and should not be considered financial advice. Please consult with a qualified financial advisor before making any investment decisions.

Keywords:

Orca, DEX, Uniswap, Solana, Ethereum, DeFi, decentralized exchange, automated market maker (AMM), transaction fees, user-friendly interface, concentrated liquidity, scalability, blockchain, DeFi application, market cap, price prediction, Uniswap price history, crypto bull run, investment opportunity, Solana ecosystem, future of DeFi, competition, crypto market, potential, uncertainty, financial advice, disclaimer

#automated market maker (AMM)#blockchain#competition#concentrated liquidity#Crypto Bull Run#crypto market#decentralized exchange#DeFi#DeFi application#DEX#disclaimer#ethereum#financial advice#future of DeFi#investment opportunity#market cap#Orca#potential#price prediction#scalability#solana#Solana ecosystem#transaction fees#uncertainty#Uniswap#Uniswap price history#user-friendly interface#cryptocurrency#Gaming News#Technology

0 notes

Text

Ethereum vs Ethereum Classic

In the world of cryptocurrencies, Ethereum and Ethereum Classic stand as two distinct entities with intertwined histories and philosophical disparities. Born out of a contentious hard fork in 2016, these platforms have since followed divergent paths, each with its own community, development trajectory, and vision. As we delve into the comparison between Ethereum (ETH) and Ethereum Classic (ETC), it becomes evident that while they share similarities in terms of technology and functionality, their ideologies and approaches to governance set them apart.

1. Origins and Split:

Ethereum, conceived by Vitalik Buterin, went live in 2015 as a decentralized platform enabling smart contracts and decentralized applications (DApps) to be built and operated without any downtime, fraud, control, or interference. However, in 2016, following the infamous DAO (Decentralized Autonomous Organization) hack, the Ethereum community was divided on how to handle the situation. The majority opted for a hard fork to reverse the unauthorized transactions, resulting in the birth of Ethereum (ETH), while a minority believed in maintaining the original blockchain, giving rise to Ethereum Classic (ETC).

2. Ideological Differences:

The split between Ethereum and Ethereum Classic is primarily rooted in ideological disparities regarding immutability and decentralization. Ethereum proponents argued that the hard fork was necessary to rectify the exploit and protect investors, emphasizing pragmatism over absolute adherence to code. Conversely, Ethereum Classic adherents advocate for the immutability of blockchain, contending that tampering with the ledger undermines the core principles of decentralization and censorship resistance.

3. Development and Ecosystem:

Since the split, Ethereum (ETH) has witnessed exponential growth, becoming the leading blockchain platform for decentralized applications, initial coin offerings (ICOs), decentralized finance (DeFi), and non-fungible tokens (NFTs). Major companies and projects, including ConsenSys, MakerDAO, Aave, and Uniswap, have built their infrastructure and protocols on Ethereum, contributing to its vibrant ecosystem and network effects.

On the other hand, Ethereum Classic (ETC) has faced challenges in gaining widespread adoption and developer interest. While it maintains a loyal community and hosts projects like ETC Labs and Emerald Platform, its ecosystem remains relatively smaller compared to Ethereum. Nonetheless, Ethereum Classic proponents advocate for its resilience and commitment to principles, positioning it as a purist alternative to Ethereum.

4. Market Position and Performance:

In terms of market capitalization and price performance, Ethereum (ETH) has consistently outperformed Ethereum Classic (ETC). As of [current date], Ethereum commands a significantly higher market cap and price per token compared to Ethereum Classic. This divergence reflects the confidence of investors and the broader cryptocurrency community in Ethereum's vision, ecosystem, and development trajectory.

5. Security and Network Stability:

One of the contentious aspects surrounding Ethereum Classic is its susceptibility to 51% attacks due to its relatively lower hash rate compared to Ethereum. In recent years, Ethereum Classic has experienced multiple incidents of 51% attacks, leading to concerns regarding its security and network stability. These attacks have underscored the importance of robust security measures and community consensus in safeguarding blockchain networks.

6. Governance and Roadmap:

Governance mechanisms differ between Ethereum and Ethereum Classic, reflecting their respective approaches to decision-making and protocol upgrades. Ethereum operates under a more centralized governance model, with key decisions made by the Ethereum Foundation, core developers, and community stakeholders. In contrast, Ethereum Classic adheres to a more decentralized governance structure, emphasizing community governance and broader participation in decision-making processes.

Looking ahead, both Ethereum and Ethereum Classic have ambitious roadmaps aimed at enhancing scalability, interoperability, and sustainability. Ethereum is actively pursuing Ethereum 2.0, a major upgrade transitioning from proof-of-work (PoW) to proof-of-stake (PoS) consensus mechanism, while Ethereum Classic is focusing on improving its network security and developer tools.

Conclusion:

In conclusion, Ethereum and Ethereum Classic represent two divergent paths stemming from a shared history. While Ethereum (ETH) has emerged as the dominant force in blockchain technology, Ethereum Classic (ETC) maintains its niche as a steadfast proponent of decentralization and immutability. As the cryptocurrency landscape continues to evolve, the rivalry between Ethereum and Ethereum Classic serves as a reminder of the ideological tensions inherent in decentralized systems, shaping the future trajectory of blockchain technology.

In the end, the choice between Ethereum and Ethereum Classic boils down to individual preferences, values, and priorities, highlighting the diverse and dynamic nature of the blockchain ecosystem.

0 notes

Text

Bright Forecast: Analyst Sheds Light on UNI's Future with Bullish Prediction in Latest Report

Crypto Capo, a renowned crypto analyst with a history of accurate market predictions, has strategically thrown his weight behind Uniswap (UNI), unleashing a wave of interest and discussion within the crypto community. In a recent Telegram post, the analyst hinted at a bullish sentiment surrounding UNI, providing valuable insights that have captured the attention of traders and investors.

The analyst's endorsement of acquiring UNI at its current spot price adds a layer of significance to the ongoing market dynamics. Crypto Capo goes a step further by outlining a clear target known as the "upper dark zone." This target serves as a roadmap for potential gains, offering enthusiasts a strategic perspective on UNI's trajectory.

UNI is currently trading at $6.66, experiencing a 1.06% surge in the last 24 hours and an impressive 12.24% rise over the past week. With a 24-hour trading volume of $116,339,670, UNI's recent performance aligns with Crypto Capo's bullish sentiment.

Traders and investors, familiar with Crypto Capo's accurate analyses in the volatile crypto space, are actively engaging with his UNI predictions. As the crypto landscape evolves, these insights serve as a guiding light for making informed decisions in a dynamic and competitive market.

#Cryptocurrency#Cryptomarket#Crypto Capo#Uniswap#UNI#accurate market predictions#acquiring UNI#spot price#bullish sentiment#cryptocurrency community#Cryptotale

0 notes

Text

Crypto ecosystem trends in 2024, according to Binance Research

Binance's research department published a detailed report on the most recent events in the crypto ecosystem and Bitcoin, DeFi (Decentralized Finance), stablecoins and NFTs (Non-Fungible Tokens), where it projects an optimistic scenario for the crypto ecosystem in the year 2024.

Rebirth of Crypto Enthusiasm in 2023

Although it could still be anticipated to officially declare the resurgence of a bull market, the current year has witnessed renewed enthusiasm in the cryptocurrency sphere. The Binance team bases its observations and comments on the events and trends that have been evident in the market in recent months.

And to provide more depth of what this journey has been, the Binance research group was in charge of preparing a detailed summary of key topics and metrics that must be followed closely in the coming months and where, in addition, the main ones are broken down. crypto trends anticipated for next year.

Bitcoin in the Spotlight: Decisive Developments for 2024

The year 2023 has been a rollercoaster of events for Bitcoin, with significant developments spanning various areas. The introduction of Ordinals paved the way for innovations such as “ Inscriptions ,” which brought the commonly known NFTs to Bitcoin, thus gaining prominence in the ecosystem. Additionally, optimism surrounding potential approvals of Bitcoin exchange-traded funds (ETFs) in the United States has drawn the gaze of traditional institutional investors to the fascinating world of cryptocurrencies.

From a performance standpoint, Bitcoin (BTC) has outperformed many other key assets and indices, both traditional and crypto. As of December 5, 2023, BTC market capitalization has seen an impressive 162% year-on-year increase. Some of the crucial BTC developments that deserve special attention in 2024 include:

US BTC Spot ETF Approval: After notable progress in 2023, with the ruling in favor of Grayscale in August, the SEC is expected to review 13 BTC Spot ETF applications, with deadlines to be They extend from January to August 2024.

Bitcoin Halving: Expected in April 2024, this measure, designed to increase scarcity and strengthen the narrative of BTC as " digital gold ", could have a significant impact on the price of the cryptocurrency.

Ordinals and Inscriptions: The introduction of this system has allowed the creation of " Bitcoin NFTs " and has catalyzed the emergence of the so-called BRC-20 tokens, marking a milestone in the history of Bitcoin.

The positive quarterly net change in supply of the top five stablecoins by market capitalization during the last quarter of 2023 suggests possible buying pressure, marking a significant change from the beginning of 2022. As for NFTs, after experiencing monthly declines From February to September, a considerable increase in trading volumes was observed in November, highlighting the growth of Bitcoin NFTs.

Protocol commissions and competition in Layer 1 networks

Commissions generated across various protocols increased more than 88% when comparing November to January, with Ethereum leading as the largest generator, followed by DeFi projects such as Lido and Uniswap. On the other hand, non-fungible tokens or NFTs were also an important generator of commissions in 2023, with the OpenSea marketplace being the one with the greatest impact within the ecosystem.

Likewise, competition between Ethereum and other Layer 1 alternatives, such as Solana and Toncoin, will be essential in 2024. While technological developments could also set the agenda, as was also marked by the Shanghai update of Ethereum or the launch of opBNB within the Binance ecosystem, according to what Binance Research itself includes in its report.

SocialFi and the path to the future

The SocialFi concept, which merges DeFi and social media, has gained momentum with projects like friend.tech generating over $25 million in protocol fees since its launch. Other notable projects in this space are Farcaster, Lens Protocol and Binance Square, anticipating significant changes in social interactions on Web3 in the coming years.

Bitcoin: The possible great protagonist of 2024

In addition to the points raised above, there is a latent potential regarding the approval of regulated spot Bitcoin ETFs in the United States which, during this year 2023, has marked significant progress in this area. In August, US courts ruled in favor of Grayscale in its dispute with the Securities and Exchange Commission (SEC) over the transformation of its Grayscale Bitcoin Trust (GBTC) into a BTC spot ETF.

This positive ruling has motivated other prominent players, such as BlackRock, Fidelity, and Invesco, to file their own BTC spot ETF applications in the subsequent months. The SEC is currently evaluating a total of 13 BTC spot ETF applications. Among these, the closest deadline is scheduled for January 2024, while the most distant extends until August.

It was recently learned that Barry Silbert resigned as president of Grayscale Investments, and this may bring more uncertainty within the market, because the situation occurs at a crucial time, just when the SEC is evaluating the applications of various companies to transform their Bitcoin Trust (GBTC) in a Bitcoin ETF. Expectations remain latent regarding what could happen in the first weeks of January 2024 due to the possible approval of an ETF.

A highly anticipated event also for next year is the imminent Bitcoin Halving, where the miners of the mother cryptocurrency find their incentive in the validation of transactions and the security of the Blockchain through two mechanisms: block rewards and commissions. per transaction. Traditionally, block rewards account for the majority of miners' income. These rewards are awarded for each new block mined, with an average frequency of 10 minutes, and are halved every 210,000 blocks, approximately every four years.

Given BTC's fixed maximum supply of 21,000,000 units, the halving of the reward to miners introduces increasing scarcity designed to raise its value over time, cementing the narrative of BTC as a " digital gold " or safe haven asset. At the beginning of the Bitcoin Blockchain development company in 2009, block rewards started at 50 BTC. After subsequent halvings in 2012, 2016 and 2020, the current reward is 6.25 BTC per block. The next reward halving for miners is scheduled for April 2024, anticipating a block reward of 3,125 BTC.

Conclusions: A promising future

In the report presented by Binance, it is concluded that the last months of 2023 have marked a change of sentiment in the cryptocurrency industry. With new expectations, the entry of new participants and the resurgence of frenzy within the crypto ecosystem, it becomes crucial to closely monitor key indicators as we head towards 2024. The combination of technological developments, regulatory events and market dynamics promises a exciting year full of opportunities for cryptocurrency enthusiasts.

Clarification: The information and/or opinions expressed in this article do not necessarily represent the views or editorial line of Cointelegraph. The information presented here should not be taken as financial advice or investment recommendation. All investments and commercial movements involve risks and it is the responsibility of each person to do their due research before making an investment decision.

#blockchain#blockchain development company#criptocurrency#blockchain technology#blockchain development#cryptocurency news#cryptocurreny trading#crypto

1 note

·

View note

Text

The team of DeXFi, a novel on-chain trading and lending ecosystem on XRP Ledger, has shared a demo of its operations. With its instruments, holders of assets on XRPL are able to benefit from non-custodial trading and on-click cross-asset swaps.DeXFi introduces DEX trading to XRPL communityDeXFi, a platform for non-custodial DeFi products based on XRP Ledger, has released a demo video to display its existing and upcoming functionalities. Through DeXFi, users can exchange various XRPL-based assets like XRP, Sologenic (SOLO), CasinoCoin (CSC) and various synthetic coins, in a non-custodial way.With its trading module, XRPL enthusiasts can enjoy a CEX-level UX/UI and experiment with various types of limit and market orders. DeXFi's interface looks like that of major centralized exchanges with an order book, price charts, trading history and so on.Through the "Swap" module, visitors can convert XRPL-based assets in a single click. Not unlike Uniswap (UNI) and PancakeSwap (CAKE), DeXFi allows users to set estimated price slippage before initiating a trade.In the "Strategy" module, traders can try automated order placement instruments. With a back-tested strategy, users can automate their trading processes.As covered by U.Today previously, another DEX on XRP Ledger, Magnetic (MAG), faces backlash over an alleged memo spam attack that slowed down XRP transfers.Liquidity pools, P2P loans and more to come soonBesides existing trading and swap functions, DeXFi is going to release a peer-to-peer lending protocol, liquidity pools for various XRPL-based assets and fiat-pegged synthetics and a futures trading mechanism.XRPL enthusiasts asked the team about the possibility of adding advanced trading features like sophisticated order types.2023 might be a pivotal year for XRPL-based smart contracts and decentralized applications. Its Hooks amendment has passed a third-party security audit, while the Evernode L2 platform has accomplished major milestones with the new XRP+ asset.

Source

0 notes

Text

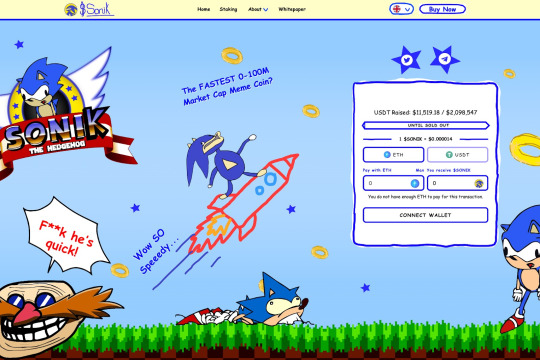

Can New Crypto Presale Sonik Coin 50x? This Stake to Earn Meme Coin Expects a Race to $100M MCAP

Can New Crypto Presale Sonik Coin 50x? This Stake to Earn Meme Coin Expects a Race to $100M MCAP

Source / Sonik

Tuesday, August 15, 2023 – Sonik Coin is the newest meme coin cryptocurrency, and it aims to be the fastest crypto to reach a $100 million market cap.

Inspired by the Sonic the Hedgehog character, Sonik is a riotously funny meme coin with a difference – it is a stake-to-earn coin where depositors into its staking smart contract receive rewards for sticking with the project.

The Sonik coin project offers a juicy annual percentage yield (APY) for its stakers to help boost $SONIK’s quest to reach the moon. Sonik is the world’s first stake-to-speed crypto!

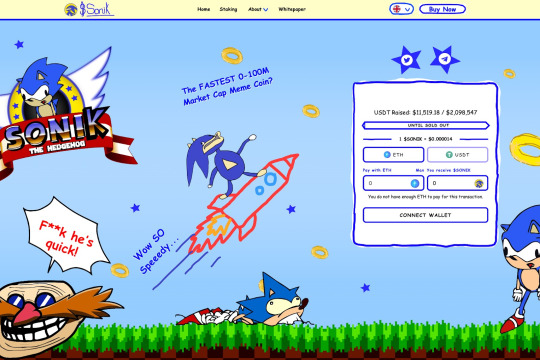

Buyers can start staking and earning right now. Of the total token supply, 40% has been allocated to community staking rewards, to be paid out over four years.

At the time of writing 90 million $SONIK tokens have already been staked at an APY of 26,648%, although that rate will reduce as more stakers deposit into the smart contract.

The team has set a modest low-cap target of only $2 million ($2,098,547), so expect this coin to sell out sooner rather than later.

Source / Sonik

$SONIK Staking Dampens Listing Sell Pressure and Incentivizes Long-Term Holding

The staking concept is burrowing its way deep into the meme coin and ‘version 2’ themed coin space.

A new coin called BTC20, which has recreated the block production history of bitcoin on Ethereum by going back in time to 2011 when BTC was valued at $1, has seen a massive take up of its staking service.

Approximately two-thirds of BTC20 token holders are staking their bags. Minutes into its listing, BTC20 went up in price 6x.

There’s no reason why Sonik could not repeat that staking achievement, providing prospective buyers with another selling point to consider when making their purchase decision.

Also, the staking utility means there will be far less selling pressure on the coin when it launches on the Uniswap decentralized exchange (DEX), providing an added source of comfort for buyers.

But it is advised not to hang around for too long when deciding whether to invest because the presale will likely sell out in two weeks or less.

Stay up-to-date with Sonik news and be the first to know when it lists by following the X (formerly Twitter) account and joining the Telegram group.

X / SONIKcoin

‘Gotta Go Fast’ – SONIK Could Be Another Pepe Coin

Setting it apart, Sonik has the viral potential of one of the most likable and well-known characters in gaming, helped by the unique meme art creations it is sure to encourage.

The highly meme-friendly characters shown on the website provide a feel for the endless fun artists will have with Sonik and friends.

There is no limit to how high Sonik coin could go, but you’ve ‘gotta go fast’ to be sure to be among the price-pump winners.

It could be another Pepe coin, but with the accent on fun and earning while you laugh.

$SONIK is priced at just $0.000014, so a $1,000 investment could quickly turn into $50,000 or even $100,000 if Sonik kills some zeros and returns 50x or 100x to its early buyers.

The token supply is a little shy of 300 billion, at 299,792,458,000. But why that random-looking supply amount?

Well, 299,792,458,000 meters per second is, of course, the speed of light, so catch Sonik if you can.

YouTube crypto analyst Jacob Crypto Bury is first out of the gate with an initial 10x price prediction for $SONIK.

Japan and Asia Love ‘Sonic’ and Will Jump at the Chance to be Part of the SONIK Coin Community

Sonik is expected to secure considerable traction in Asian markets because of the Japanese provenance of the Sonic the Hedgehog character created by the Sega team of Yuji Naka, Naoto Ohshima, and Hirokazu Yasuhara.

Although Sonik has no affiliation with Sega’s Sonic, it will probably find an enthusiastic audience of followers in the crypto market of Japan and other Asian countries.

According to sources, the website will be rolling out translations into Japanese, Simplified Chinese, and Korean, alongside other languages.

Asia remains one of the hottest and most engaged regional markets for crypto.

Sonik Smart Contract is Being audited, So No Security Worries

Security should be a significant consideration when deciding whether to invest in a presale project.

On that score, the team is listening to the broader crypto community, where many new meme coins that appear on Uniswap and elsewhere don’t bother to get their smart contract audited.

Again, Sonik is different in that respect by submitting its contract for audit. The audit report will be published soon and available for all to read on the website.

Sonik is a fair presale, where 50% of the total token supply is allocated for sale to the public. Forty percent is set aside for staking rewards and 10% for exchange liquidity.

The coin will list on the Uniswap DEX directly after the presale. Buyers will need ETH or USDT to buy the tokens.

Connect your wallet at the Sonik website to make your purchase, but hurry to make sure you don’t miss out.

Buy Sonik Here

.Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.

The Information contained in or provided from or through this website is not intended to be and does not constitute financial advice, investment advice, trading advice, or any other advice.

New Post has been published on https://crynotifier.com/can-new-crypto-presale-sonik-coin-50x-stake-earn-meme-coin-expects-race-100m-mcap-htm/

0 notes

Text

UniswapX creates a new paradigm for AMM protocols

UniswapX, a new trading protocol based on unmanaged Dutch auctions, is introducing significant advancements in the decentralized trading industry. This protocol aims to enhance the DEX ecosystem by addressing various challenges faced by decentralized exchanges.

One of the main highlights of UniswapX is its innovative approach to providing the best market price for traders. It achieves this by aggregating liquidity from both on-chain and off-chain sources through third-party fillers. These fillers, whether from platforms like Uniswap or off-chain traders, help ensure better prices for users. UniswapX searches for the optimal trading route, maximizing liquidity to find the most favorable prices for traders. This process ensures transparency and fairness as all transactions are recorded on the blockchain.

Another significant advantage of UniswapX is its gas-free trading. By utilizing the Permit 2 executable offline signature order structure, traders can execute transactions without paying high gas fees. Instead, third-party fillers cover the gas fees on behalf of traders. This feature reduces transaction costs and eliminates fees for failed transactions.

Furthermore, UniswapX has implemented multiple mechanisms to prevent MEV (Miner Extractable Value) attacks, ensuring a more secure and fair trading experience for users. By regulating the order of transactions and implementing other safeguards, UniswapX mitigates the impact of MEV on traders.

Additionally, UniswapX supports cross-chain exchange, allowing traders to seamlessly trade assets between different chains without compatibility issues or high transaction difficulties.

With UniswapX and the upcoming Uniswap V4 version, Uniswap is positioning itself as a strong competitor to centralized exchanges, aiming to improve user experience, transaction speed, and liquidity. This comes at a time when the decentralized finance (DeFi) market is gaining traction and DEX trading volume relative to CEX has been on the rise.

While UniswapX's launch has sparked some controversy in the industry, with some seeing it as a latecomer benefiting from brand advantage, it's important to acknowledge Uniswap's history as an industry innovator. Uniswap has played a significant role in pushing the boundaries of technology and setting the direction for the DEX industry.

In conclusion, UniswapX introduces several groundbreaking features that are reshaping the decentralized trading landscape, potentially leading to further growth and innovation in the DeFi market.

1 note

·

View note

Text

Uniswap v3 Introduces Oku: A Game-Changing User Interface for DeFi Trading

Uniswap v3 introduces Oku, a groundbreaking user interface designed to revolutionize DeFi trading. Developed by GFX Labs, Oku seamlessly combines the user experience of centralized exchanges with the complexities of decentralized finance. With advanced features like order books, price charts, and limit orders, Oku offers enhanced control and flexibility to traders. Backed by the Uniswap Foundation, Oku is deployed on prominent layer-1 networks and aims to bridge the gap between centralized exchanges and DeFi, driving the growth of decentralized finance.In this article, we delve into the game-changing capabilities of Oku, its potential to bridge the gap between centralized exchanges and DeFi, and its role in driving the growth and adoption of decentralized finance.

Enhancing User Experience: Oku's Vision for DeFi

Oku sets out to deliver a user experience (UX) that DeFi users are already accustomed to in popular centralized exchanges like Binance. The founder of GFX Labs, Getty Hill, highlights Oku's mission to provide a seamless transition for users by incorporating features such as order books, price charts, live trading history, and limit orders.

By offering a comprehensive view of all existing and new pools available on Uniswap v3, Oku eliminates the need for token listing requests. This intuitive interface streamlines the process of accessing different pools and empowers users to make informed trading decisions effortlessly.

Unlocking New Possibilities: Limit Orders and Enhanced Control

One of Oku's standout features is its support for limit orders. With this functionality, users gain the ability to apply specific conditions to their trading pools, granting them greater control over their trading strategies. This newfound flexibility helps users optimize their trades based on personalized parameters, ultimately leading to more efficient and effective transactions.

Hill emphasizes the limitations of existing DeFi trading interfaces offered by platforms like Uniswap, 1inch, and Matcha, stating that they fall short of meeting the expectations set by the wider crypto community. To foster the growth of DeFi, it is essential to entice users to transition from traditional exchanges to DeFi solutions. Oku's user-friendly interface bridges this gap, offering an exceptional user experience that is on par with centralized exchanges.

Supported by the Uniswap Foundation: Expanding Onto Prominent Blockchain Networks

Oku is backed by the Uniswap Foundation, a non-profit organization dedicated to supporting decentralized growth. As a testament to its commitment, Oku has already been deployed on several layer-1 networks, including Ethereum, Polygon, Arbitrum, and Optimism. Additionally, the platform has ambitious plans to expand its presence to other prominent blockchains in the near future.

Devin Walsh, the executive director at the Uniswap Foundation, highlights the significance of Oku's latest release. By combining the trust and security of the Uniswap Protocol with the speed and trading experience offered by centralized exchanges, Oku strikes a perfect balance. The Uniswap Foundation's mission is to foster innovation by funding diverse projects built on top of the Protocol, and Oku perfectly represents this vision. With an API-driven and professional interface, Oku fills a crucial gap in the DeFi space and is developed by a highly experienced team deeply integrated within the Uniswap ecosystem.

Conclusion

Uniswap v3's launch of Oku marks a significant milestone in the evolution of DeFi trading interfaces. With its focus on user experience and seamless integration with the Uniswap Protocol, Oku offers a game-changing solution that aims to attract and retain a broader user base within the decentralized finance ecosystem. By combining the best elements of centralized exchanges with the power of DeFi, Oku empowers users to trade with confidence and efficiency. As Oku continues to expand its presence across various blockchain networks, it is poised to revolutionize the way users engage with decentralized trading and shape the future of finance.

For more articles visit: Cryptotechnews24

Source: blockworks.co

Related Posts

Read the full article

#API#centralizedexchanges#CryptoNews#decentralizedexchanges#Defi#DeFitradinginterface#limitorders#livetradinghistory#Oku#orderbooks#pricecharts#Security#trust#UniswapFoundation#UniswapProtocol#UniswapV3#userexperience

0 notes

Text

Chancer presale accelerates as Binance CEO CZ makes a huge prediction on crypto

Chancer seeks to introduce a P2P betting model.

Chancer’s presale has accelerated, with over half of the tokens sold in the first stage.

The token could hit three-digit or four-digit percentage price increases in 2023.

When will cryptocurrencies resume a bullish trend after a down-beaten 2022 and 2023? Binance CEO Changpeng Zhao (CZ) thinks 2025 could be the likely year. And while investors may feel this might be a little bit far after expecting the bull market later in 2023 and 2024, the interest in crypto keeps growing. Investors are banking on newly launched tokens that can defy the bear market. Chancer, a blockchain-based predictive markets application, has been attracting investors. Investors have bought at least $615,560 worth of tokens in less than a month since the presale launched.

CZ predicts a bull market in 2025

In a recent AMA Twitter session, CZ told his followers that 2025 could be the probable year for a sustained Bitcoin bull market. According to CZ, the Bitcoin halving event in 2024 will likely catalyse the bullishness.

The Binance CEO pointed out that historical bull price movements in Bitcoin have followed the halving cycles. If history is to repeat itself, Bitcoin is set for a bullish surge in 2025, with the cryptocurrency’s price seen as a barometer for the rest of the sector. Notable halving events propelling Bitcoin’s price were in 2012 and 2016, and CZ projects a repeat after the halving event in 2024.

CZ’s insights underline growing sentiments that Bitcoin is set for a bullish market after the price recently attempted to break above the $30,000 barrier. Investors have been hopeful of a likely bull run over the next couple of months.

Nonetheless, macroeconomic concerns are yet to clear, meaning that a potential bull market could occur in or over a year. With this, investors could be looking for opportunities in newly launched projects to capture initial momentums before the bullish market. Chancer could be benefiting from this sentiment, given the fast-selling presale.

What is Chancer, and how does it work?

Chancer is a blockchain-enabled peer-to-peer (P2P) betting platform. As the name suggests, the platform lets users bet with friends, colleagues, and other participants via custom markets. Chancer works quite simply.

Users create P2P markets to predict the outcome of key events, processes, episodes, and many more. Unlike traditional betting, whose betting markets and odds are fixed by the bookmakers, Chancer allows users to determine what they want to bet on.

Users also place odds and rules which guide the betting and claiming of winnings. All these are enabled via a secure decentralised platform powered by Binance Smart Chain.

CHANCER will be the token to run the Chancer project. Users earn CHANCER by winning on successful predictions, creating Chancer markets, or sharing the platform with others. The token will also be available for staking, allowing investors to earn passive income by committing their holdings to the growth of the platform.

CHANCER prediction in 2023

Chancer is only starting, and a huge prediction for 2023 could be overambitious. However, the project is attracting global interest, which could propel it to higher value.

With the price of CHANCER at 0.01 BUSD in the first stage of the presale, the value could rise by triple digits before the end of 2023. The prediction is based on the fact that CHANCER will start listing in the third quarter of 2023, starting on Uniswap, giving it a chance to rise in value.

Although tokens have risen by 10x after listing, which would also be realistic for CHANCER, such increases could be limited for 2023. That’s because product development is still ongoing, with huge value increases possible in 2024.

Is it the right time to buy CHANCER?

There is no right time to buy Chancer. Nonetheless, investors are better off buying now when the price is low for a higher return-to-risk ratio. The token’s price will rise in the next presales, meaning buying now could be the right idea for investors.

Share this articleCategoriesTags

Source link

Read the full article

0 notes

Text

Decentralized Finance (DeFi) has emerged as a prominent trend in the world of cryptocurrency. DeFi applications are designed to offer financial services and products without relying on traditional financial institutions. In this article, we will explore the rise of DeFi, its potential benefits and risks, and how it is changing the cryptocurrency landscape.

What is Decentralized Finance (DeFi)?

DeFi refers to a financial system built on blockchain technology that operates without the need for traditional financial intermediaries such as banks. DeFi applications leverage smart contracts to create decentralized protocols that enable financial services to be built and delivered in a trustless and transparent manner. This can include everything from lending and borrowing platforms to decentralized exchanges and stablecoins.

DeFi offers a number of advantages over traditional finance, including increased transparency, accessibility, and security. By leveraging blockchain technology, DeFi protocols can provide greater transparency and visibility into financial transactions, which can help to reduce the potential for fraud and corruption. Additionally, DeFi applications can be accessed by anyone with an internet connection, regardless of their geographic location, income, or credit history.

Advantages of DeFi

One of the primary advantages of DeFi is the potential to democratize finance. By leveraging blockchain technology, DeFi protocols can provide financial services to a much broader audience than traditional financial institutions. This can include individuals who are underbanked or unbanked, as well as those who may not have access to traditional financial products.

In addition, DeFi can offer greater transparency and security. By using smart contracts and blockchain technology, DeFi applications can ensure that financial transactions are executed in a trustless and transparent manner, reducing the potential for fraud and corruption.

Another advantage of DeFi is its potential to reduce the costs associated with traditional financial intermediaries. By eliminating the need for intermediaries, DeFi applications can reduce transaction costs, making financial services more affordable and accessible.

Drawbacks of DeFi

While DeFi offers a number of potential advantages, there are also several risks and drawbacks associated with this emerging trend. One of the primary risks associated with DeFi is the potential for smart contract vulnerabilities. Since DeFi applications are built on smart contracts, they are only as secure as the underlying code. If there are vulnerabilities in the code, these can be exploited by malicious actors, potentially resulting in significant financial losses.

Another potential drawback of DeFi is liquidity risk. Since DeFi applications are decentralized, they rely on a network of users to provide liquidity for transactions. If there is not enough liquidity available, this can result in significant price volatility and other risks.

Finally, there are concerns about the regulatory landscape for DeFi. Since DeFi applications are not controlled by traditional financial institutions, they are not subject to the same regulatory oversight. This can create challenges for regulators and policymakers who are trying to ensure that DeFi applications are safe and secure for users.

Overview of Popular DeFi Projects

There are a number of popular DeFi projects that are currently in use. Some of the most prominent include:

Uniswap: a decentralized exchange that allows users to trade cryptocurrencies without the need for an intermediary

Aave: a lending and borrowing platform that uses smart contracts to enable peer-to-peer lending and borrowing

Compound: a lending platform that allows users to earn interest on their cryptocurrencies by lending them out to other users

Each of these projects offers unique features and characteristics that are designed to meet the needs of specific users.

Security Concerns in DeFi

One of the primary risks associated with DeFi is the potential for smart contract vulnerabilities. Smart contracts are self-executing contracts with the terms of the agreement between buyer and seller being directly written into lines of code. If there are vulnerabilities in the code, these can be exploited by malicious actors, potentially resulting in significant financial losses.

One example of this occurred in 2020, when a hacker exploited a vulnerability in the smart contract of the DeFi platform bZx, resulting in a loss of over $350,000. This incident highlighted the need for greater security in DeFi applications and the importance of conducting rigorous security audits before launching new projects.

To address these security concerns, the DeFi industry is working to develop new security standards and best practices. For example, the OpenZeppelin project has developed a library of secure smart contract components that can be used to build more secure DeFi applications. Additionally, many DeFi projects are now conducting regular security audits to identify and address vulnerabilities before they can be exploited.

Liquidity Risks in DeFi

Another potential risk associated with DeFi is liquidity risk. Since DeFi applications are decentralized, they rely on a network of users to provide liquidity for transactions. If there is not enough liquidity available, this can result in significant price volatility and other risks.

One way that DeFi applications are addressing liquidity risks is through the use of liquidity pools. Liquidity pools are pools of funds that are contributed by users and used to facilitate transactions on the platform. By pooling resources, DeFi applications can ensure that there is always enough liquidity available to meet the needs of users.

Additionally, many DeFi applications are now using automated market makers (AMMs) to help manage liquidity. AMMs use algorithms to determine the price of a cryptocurrency based on the amount of liquidity available in the pool. This can help to reduce price volatility and other risks associated with liquidity.

Regulatory Challenges for DeFi

One of the challenges facing DeFi is the lack of regulatory oversight. Since DeFi applications are not controlled by traditional financial institutions, they are not subject to the same regulatory oversight. This can create challenges for regulators and policymakers who are trying to ensure that DeFi applications are safe and secure for users.

While some jurisdictions have taken a more proactive approach to regulating DeFi, others have taken a wait-and-see approach. In the United States, for example, the Securities and Exchange Commission (SEC) has taken action against several DeFi projects that it deemed to be offering unregistered securities.

Moving forward, it will be essential for regulators and policymakers to strike a balance between protecting users and fostering innovation in the DeFi industry. This may require the development of new regulatory frameworks that are specifically designed to address the unique challenges of DeFi.

Future Potential of DeFi

Despite the risks and challenges associated with DeFi, many believe that this emerging trend has the potential to revolutionize the financial industry. By leveraging blockchain technology, DeFi applications can provide greater transparency, accessibility, and security than traditional financial institutions.

In the future, we may see the emergence of new DeFi applications that are designed to address specific needs and use cases. For example, DeFi applications may be used to provide financial services to underserved populations, such as those in developing countries. Additionally, DeFi may be used to create new financial instruments and products that are not currently available through traditional financial institutions.

Conclusion

Decentralized Finance (DeFi) is a rapidly evolving trend in the cryptocurrency landscape that offers the potential to democratize finance and transform the financial industry.

While DeFi offers a number of potential benefits, there are also risks and challenges associated with this emerging trend.

To ensure the safety and security of DeFi applications, it will be essential for the industry to develop new security standards and best practices. Additionally, regulators and policymakers will need to work together to strike a balance between protecting users and fostering innovation in the DeFi industry.

Despite these challenges, the future potential of DeFi is significant. By leveraging blockchain technology, DeFi applications can provide greater transparency, accessibility, and security than traditional financial institutions. As the DeFi industry continues to evolve, we can expect to see the emergence of new applications and use cases that will further transform the financial industry.

In conclusion, DeFi represents a significant shift in the way we think about finance. By enabling financial services to be delivered in a decentralized, trustless, and transparent manner, DeFi has the potential to create a more equitable and accessible financial system for all. As we move forward, it will be essential to continue exploring the potential benefits and risks of DeFi and to work towards developing a regulatory framework that can support this emerging trend.

0 notes

Text

Airdrops: Opportunities and Risks

There is a long history of airdrops being very profitable for participants. For example, the Uniswap airdrop of 2020 proved extremely rewarding for participants who held onto the airdropped UNI tokens until prices went parabolic the following year. However, given the volatility of the crypto markets, timing the market is challenging, and the value of these airdropped tokens fluctuates significantly over time.

0 notes

Text

DEX token GMX rallies 35% after beating Uniswap on trading fees for the first time

DEX token GMX rallies 35% after beating Uniswap on trading fees for the first time

The price of GMX rallied to its second-highest level in history on Dec. 1 as traders assessed the decentralized exchange’s ability to evolve as a serious competitor to its top rival Uniswap.

GMX established an intraday high of $54.50 in a recovery that started on Nov. 29 from $40.50. Its rally’s beginning coincided with crypto research firm Delphi Digital’s tweet on the GMX decentralized…

View On WordPress

0 notes