#Unsecured Business Loan

Text

Startup Funding

UNSECURED CREDIT PERSONAL and BUSINESS

0% INTEREST FOR 9-18 MTHS

TERM LOANS STARTING at 7%

650+ CREDIT SCORE

15k-150k REVOLVING

NO TERMS

Term Loans:3 yrs

bit.ly/ineedaloan

#lines of credit#bridge loan#arrest your debt#fix my credit#business loan#startup funding#credit repair#personal loan#sell house for cash#debt restructuring#term loans#unsecured business loan

8 notes

·

View notes

Link

Small Business Loan

We understand that each small business loan has unique financial requirements. We take pride and effort in ensuring that business owners and entrepreneurs meet their business goals by offering them the best possible credit solutions.

Moreover, our web portal named Financeseva have designed and end to end digital process so that you can apply for a business loan from the convenience of home anytime and anywhere.

Based on the information you give on your small business loan application; our team of experts will work on behalf of you to make sure that it best fits your needs.

Key features & benefits

Flexible Loan facilities: A flexible business loan facilities allow borrowers to repay your loan within 12-60 months as per your inconvenience. This makes you ensure that your repayment schedule matches your cash flow. In addition, you are also be allowed to prepay loan amount without any additional charges.

Fulfill Capital Requirements: Get easy and quick finance of up to Rs. 75 lakhs* for small and medium-sized enterprises. Our reasonable interest rate ensures that your cost of capital will remain low.

Collateral – free Loans: With no collateral facility, you can get collateral-free business loans and needn’t pledge your personal or business assets to secure a small business loan.

One-stop Solutions: Our small business loan products come with pre-approved offers for your capital needs. In which you can also get a maximum loan top-up amount and choose a repayment tenure of up to 60 as per your wish.

2 notes

·

View notes

Text

Definition and Meaning of Payroll Funding

Payroll financing, also referred to as payroll funding, is a lending service that enables companies to get funds for the processing of their payrolls. There can be times when businesses can face difficulties managing their cash flow and making payrolls on schedule.

Small to medium-sized businesses sometimes find themselves in a jam when it comes to funding in these unprecedented times. It is more difficult than ever for firms to stay afloat. A lot of business had to close down and most had to lay off their staff as cash flow was tight. Payroll financing is becoming a need for businesses that wish to retain their workforce and avoid having to let them go.

According to a report, roughly 40% of organizations experience cash flow problems. A business's need for extra funding is not an indication of poor management. Due to pending invoices, which typically have a cycle of one month to sixty days, cash flow can be tight. As a result, there may come a time when money is scarce and processing payrolls is difficult. Having to inform your employees that they will not be receiving their salary or that it will arrive late can put you in a difficult situation.

Businesses in need of funds can get payroll funding solutions from 1 Click Capital. We don't want your company to fail just because your financial reserves are momentarily low. We don't want you to deal with banks, take out traditional loans that require a high credit score or collateral, or wait weeks for your loan to be authorized.

Payroll funding is easy with 1 Click Capital's 1 Click Payroll. We take pride in collaborating with business owners like you so that you may pay employees on time and concentrate on growing your enterprise.

We like to keep things simple at 1 Click Capital, so you can receive a line of credit to assist you in making payroll on time in challenging situations such when cash flow is tight or invoices haven't cleared on time. Unlike other traditional loans, we don't require collateral, we don’t take weeks to process your funds, or have extremely high interest rates. In other words, there are no hoops to go through.

Payroll delays or entire payroll postponement can hurt your company. Employee morale may suffer as a result, and that could lead to employee turnover. Employee productivity and trust in you will suffer greatly if they are concerned about whether they will receive your next salary.

At 1 Click Capital, we take pride in being a payroll funding company whose mission is to help businesses that are struggling to manage their cash flow. We don't want to mess with your business, change it, or worse yet put it out of business. We are only here to help companies

that are currently short on funds but have payroll obligations to meet. Our payday loans help keep you afloat when your finances are out of balance.

2 notes

·

View notes

Text

#Unsecured Personal Loan#Unsecured Business Loan#Instant loan#Quick loan provider#Project finance for builders in India#Project Loan#project finance for redevelopment projects#Loan against property#cash credit facility#overdraft facility

1 note

·

View note

Text

Unsecured business loans, a beacon in the financial landscape, offer entrepreneurs a strategic and flexible solution to fund their ventures. Presented by various banks and non-banking financial companies (NBFCs), these loans stand out for being collateral-free, making them an appealing choice for unsecured business loan in India looking to run, expand, or initiate operations. Commonly referred to as signature loans, My Mudra's unsecured business loans come with minimal documentation, ensuring a seamless and straightforward application process.

Unlocking the Advantages of Unsecured Business Loans

Streamlined Application: Initiate the application process effortlessly by visiting www.mymudra.com and providing basic details.

Effortless Documentation: Expedite the approval process by submitting KYC documents, company financial details, and registration particulars.

Freedom from Collateral: Embrace the freedom of a collateral-free loan, eliminating the need for additional security.

Flexible Repayment Options: Enjoy a shorter tenure compared to traditional loans, coupled with flexible repayment options tailored to your business's needs.

Rapid Disbursal: Experience the swift disbursal of the approved loan amount within a single day, ensuring timely financial support.

Navigating the Application Process with My Mudra

Embarking on your journey to secure an unsecured business loan with My Mudra is as simple as 1-2-3:

Seamless Online Application: Visit www.mymudra.com, where a few clicks set the application process in motion.

Swift Document Verification: Complete the necessary documentation within a day, ensuring a speedy approval process.

Express Disbursal: Witness the approved loan amount swiftly deposited into your account within 24 hours.

Documents Needed for Unsecured Business Loans

My Mudra simplifies the approval process with minimal documentation requirements. Ensure you have the following readily available:

Proof of Identity:

PAN Card (for Company/Firm/Individual)

Aadhaar Card

Passport

Voter's ID Card

Driving Licence

Proof of Address:

Aadhaar Card

Passport

Voter's ID Card

Driving Licence

Additional Documents:

Bank statements from the previous 6 months

Latest ITR, Balance Sheet, and Profit & Loss account for the preceding 2 years (CA Certified/Audited)

Proof of continuation (ITR/Trade licence/Establishment/Sales Tax Certificate)

Other Mandatory Documents (Sole Prop. Declaration, Certified Copy of Partnership Deed, Certified true copy of Memorandum & Articles of Association, Board resolution)

Interest Rate and Transparent Charges

My Mudra upholds transparency, ensuring no hidden fees for unsecured loan for business The interest rate and charges are as follows:

Unsecured Business Loan Interest Rate: 15%

Business Loan Processing Fee: 1-2%

Other Charges: NIL

Conclusion:

In summary, My Mudra stands as a comprehensive solution for diverse financial needs. This article spotlights the advantages of unsecured business loans, emphasising the user-friendly application process and prompt disbursal provided by My Mudra. Transform your perception of business loans, overcome financial obstacles, and propel your business towards success. Apply for a My Mudra Business Loan today to experience swift approval and disbursal within a day.

#unsecured business loan#unsecured loan for business#unsecured business loan in india#unsecured business loan online#unsecured business loan india

0 notes

Text

Get Quick Unsecured Business Loans - No Collateral Needed

Secure the funds your business needs with hassle-free unsecured business loans. Fast approval, no collateral required. Apply now for financial flexibility!

0 notes

Text

Don't think anymore...Just click on the link and get a loan for your business needs

https://www.shopfins.com/personal-loan

#finance#investing#businessloans#business#loans#fast cash loans online#cash loans#unsecured business loan#onlineloans#business news#trending#entrepreneur

0 notes

Text

What is the importance of credit score?

Introduction:

Credit is a vital part of our financial lives, and maintaining a good credit score is crucial for financial well-being. A credit score is a numerical representation of an individual's creditworthiness, and it is used by lenders and other financial institutions to determine whether or not to extend credit to an individual. A high credit score indicates that an individual is responsible with their financial obligations and is more likely to pay back debts on time. In this article, we will delve deeper into the importance of credit scores and how they can impact various aspects of our financial lives.

What is a Credit Score?

A credit score is a number that reflects an individual's creditworthiness. It is calculated based on several factors, including payment history, credit utilization, length of credit history, and types of credit used. Credit scores range from 300 to 900, with higher scores indicating a lower risk of defaulting on debt. The most commonly used credit score model is the CIBIL score, which is used by the majority of lenders.

Importance of Credit Score:

Maintaining a good credit score is crucial because it can impact various aspects of our financial lives. Here are some reasons why a good credit score is important:

1. Access to Credit:

One of the primary reasons why a good credit score is essential is that it can impact an individual's access to credit. Lenders use credit scores to determine whether or not an individual qualifies for a loan or credit card. If an individual has a low credit score, they may be denied credit or may be required to pay higher interest rates and fees. On the other hand, individuals with high credit scores are more likely to qualify for credit with favorable terms and lower interest rates.

2. Lower Interest Rates:

Individuals with high credit scores are more likely to qualify for loans and credit cards with lower interest rates. This can save those thousands of dollars over the life of the loan or credit card. Lenders view individuals with high credit scores as less risky, and they are more likely to extend credit to them with favorable terms.

3. Higher Credit Limits:

Individuals with high credit scores are also more likely to qualify for higher credit limits on their credit cards. This can provide them with more flexibility in managing their finances and can help them build their credit history. However, it's essential to use credit responsibly and not take on more debt than can be repaid.

Conclusion:

In conclusion, maintaining a good credit score is essential for financial well-being. A good credit score can provide individuals with access to credit, lower interest rates, higher credit limits. It is important to regularly monitor credit scores and take steps to improve them if necessary. Individuals can improve their credit scores by paying bills on time, keeping credit utilization low, and avoiding opening too many new credit accounts at once. By maintaining a good credit score, individuals can improve their financial futures and achieve their financial goals.

Note if you want to apply for business loan and for personal loan you can apply from the website: www.nkbkredit.com/

0 notes

Text

Exploring Unsecured Business Loan Interest Rates and Fees

Unsecured Business Loans are a popular option for small business owners who need financing without putting up collateral. These loans typically have higher interest rates than secured loans, which require collateral such as property or equipment. In this article, we’ll explore unsecured Business Loan interest rates and fees, and what factors can affect them.

0 notes

Text

Empowering women entrepreneurs is crucial to achieving gender equality and creating a more inclusive society. Starting a business is a way to promote women’s empowerment. However, starting and running a business requires significant capital. That is where business loans (loans for women) come in as the perfect solution for women entrepreneurs.

0 notes

Text

New affiliate program allows you to invest in yourself while helping others do the same. Help people apply for pre-existing and start-up funding for business, as well as other loan and credit products.

#lines of credit#unsecured business loan#fix my credit#get a loan#personal loan#startup funding#business loan#bridge loan#arrest your debt#work from the beach#work from anywhere#work from home#help people get loans and get paid for it#own your story#start a business#startup financing#broker business in a box#self promo#self empowerment#self improvement#self encouragement#self employed#self employment

3 notes

·

View notes

Link

Small Business Loan

Small business loan are provided to business owners to meet their entrepreneurial objectives. This type of small business loans can be obtained distributors, wholesalers, manufacturing units, retailers, self-employed professionals, non-professionals and services.

Under small business loan individuals can get loans up to Rs.75 lakh with a maximum flexible tenure of 60 months. Small business loans are offered by various banks, financial institutions, or NBFCs. However, this can be obtained either in the form of secured or unsecured business loans.

Eligibility criteria of small business loan

The age limit of the individual is ranging from 21 to 65 years of age.

A minimum of 3 years of business vintage is required.

CIBIL Score must be 750 or above.

The individual has ownership of business loan property or residence.

Manufacturing units, Artisans, Trader, Retailer, self-employed professionals, Distributor, Wholesalers, Services, skilled workers or semi-skilled workers are eligible for this loan.

Documents required for small business loan

2 passport-sized photographs

Proof of business stability.

Aadhar card and Passport.

Copy of PAN Card.

Bank statements of last 6 months for proof of business vintage.

KYC Documents

Proof of ownership such as business premises, residence.

Recent electricity bill of business premises.

Cheque for processing fee.

Complete documentation of property with ATS, Chain + MAP.

Address proof required whether permanent or rented.

Permanent address proof required and also if rented.

#small business loan#unsecured business loan#msme loan#personal loan#startup loan#stand up loan#capital loan#working capital loan#business loan#financeseva

1 note

·

View note

Text

GUIDE TO UNDERSTANDING UNSECURED BUSINESS LOANS

Small and medium enterprises (SMEs) in Australia play a crucial role in the national economy. They collectively provide over 65% of the private sector employment and contribute more than $700 billion to the country's GDP. However, despite their economic significance, many SMEs struggle to get loan approvals from traditional lenders like banks. In such situations, they can rely on alternative financing sources for business loans in Australia. SMEs can explore numerous loan products and choose the options that suit their requirements. Some of the most popular loan products fall in the category of unsecured loans. An unsecured business loan allows a firm to secure collateral-free funding, helping it manage urgent expenses and fuel critical expansion plans. Let’s discuss this funding option in detail and understand how to get the best unsecured business loans!

Unsecured Business Loans: An Overview

An unsecured business loan is a financing option that allows a firm to borrow money without providing any collateral. The collateral represents an asset offered as a security to the lender. A firm must submit collateral for secured business loans, allowing the lender to liquidate this asset if the borrower fails to repay the money. Since an unsecured loan does not involve this security, the lender issues it based on the firm’s performance, financial health, and creditworthiness.

Unsecured small business loans are perfect for firms that require quick funding or lack the assets to apply for secured loans. Lenders often charge slightly higher interest rates on unsecured loans to compensate for their risks. However, borrowers often prefer unsecured financing over secured loans when they have an urgent need for cash. Fast unsecured business loans can get approved within one to three days, providing businesses with a much-needed infusion of cash. Firms can get unsecured loans for various business purposes. They may utilise the amount for buying inventory, paying wages, financing renovations, or managing their working capital needs. While the proportion of unsecured loans may be low compared to other forms of SME financing, these options are highly advantageous for new businesses that require quick funding.

youtube

Unsecured business loan interest rates and other terms vary based on several factors. Lenders consider the borrower's requirements, the associated risks, and their internal policies while determining the loan terms. However, typically, the terms for unsecured business finance fall within the following range:

● Amount: Firms can borrow between $5,000 and $500,000 without providing any collateral.

● Interest Rate: Unsecured business loan rates start from 5.5% per annum.

● Loan Term: Firms can take an unsecured business loan for three months to three years.

● Frequency of Repayments: Borrowers can repay the loan on a daily, weekly, or fortnightly basis.

● Approval Time: The pre-approval process takes between two to four hours. Additionally, the unconditional approval and settlement procedures require one to three days.

Types of Unsecured Business Loans

SMEs have several options to get quick business loans without providing any security. The following are the three unsecured business loan types to consider depending on a firm's unique requirements:

● Small Business Loans

Unsecured small business loans allow SMEs to get a lump sum amount without tying up their assets. The application and approval processes are seamless and quick, allowing the borrower to secure funding within twenty-four hours.

● Business Line of Credit

A business line of credit in Australia is a flexible financing option. The lender approves a credit limit and the borrower withdraws the amount they need. The firm can borrow any sum under the limit and pay interest on the amount they utilise. An unsecured business overdraft facility can help seasonal businesses navigate cash flow fluctuations with minimum risk and hassle.

● Invoice Finance

The invoice finance facility allows a firm to take a loan against their unpaid invoices. The lender provides an advance based on the value of pending invoices. The firm can borrow large sums without submitting assets like equipment or property.

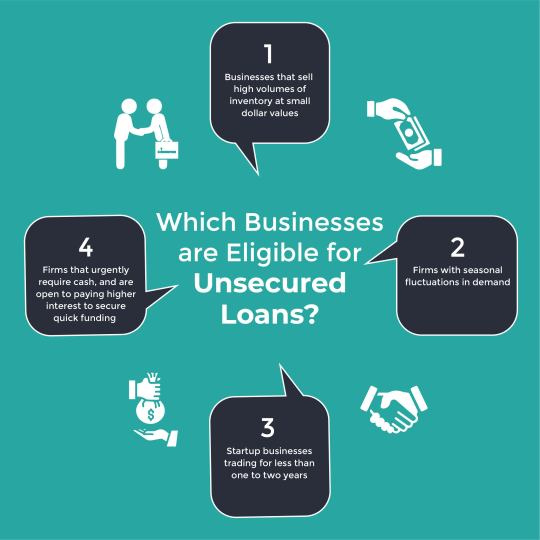

Which Businesses are Eligible for Unsecured Loans?

Firms must meet the eligibility criteria for getting unsecured loans.

The following are the minimum requirements to qualify for collateral-free small business loans:

● ABN: The firm must have an active Australian Business Number (ABN) to apply for collateral-free funding. In Australia, sole traders are not mandated to register for an ABN. However, if you apply for unsecured business loans for sole traders, having a registered ABN is required.

● Business History: The borrower must demonstrate that the firm has been operational for six months or longer to get a collateral-free working capital loan.

● Turnover: The firm must have a monthly turnover of at least $5000. This requirement ensures the business is financially stable enough to service repayments considering typical unsecured business loan rates.

A business owner must assess if they meet the eligibility criteria before applying for an unsecured loan. In addition, they should also consider if this form of funding is suitable for their business. Typically, the following types of businesses benefit the most from unsecured loans:

● Businesses that sell high volumes of inventory at small dollar values.

● Firms with seasonal fluctuations in demand.

● Startup businesses trading for less than one to two years.

● Firms that urgently require cash, and are open to paying higher interest to secure quick funding.

Pros and Cons of Taking an Unsecured Business Loan

A firm can leverage several benefits when they get an unsecured business loan. However, they must also consider certain downsides before deciding to go for collateral-free funding. The following are the top advantages of taking an unsecured loan:

● No Need for Collateral: Unsecured business loans allow business owners to get access to funds without putting up their assets as security. They can keep their property and other valuable assets safe no matter what happens in the business. Startup enterprises with little to no assets also benefit from unsecured business loans.

● Quick and Seamless Approval Process: Unsecured loans require minimal documentation as no collateral is involved. In most cases, firms can get low-doc approvals when they apply for unsecured business loans upto $500,000. The approval process takes less than a day for most applicants, and a borrower can get the money in their account within one to three days.

● Cash Flow Optimisation: Unsecured loans can help businesses manage their cash flow fluctuations more efficiently. The quick infusion of cash allows the borrower to optimise their cash flow and fulfil their working capital requirements. This aspect is especially beneficial for seasonal businesses that experience a lot of variations in their cash flow.

● Flexibility in Use of Funds: Unsecured loans offer flexibility in how you can utilise the money. Unlike certain forms of business lending like asset or trade finance, unsecured loans do not have hard and fast rules about the use of funds. Business owners can use it for inventory, expansion, hiring, or any other business purpose.

● Building a Good Credit History: Many alternative lenders provide collateral-free funding to businesses that do not have high credit scores. Your firm can get an unsecured business loan with a bad credit history and focus on timely repayments to improve the records. When you repay the loan diligently over time, it can help you build a strong credit history to get better loan terms in the future.

Businesses should consider both sides of the coin when they compare business loans and decide on the type of loan to choose. The following are some potential issues that borrowers must keep in mind while taking unsecured loans:

● Higher Interest Rates: An unsecured loan represents a high risk for the lender. If the borrower defaults on the repayments, the lender cannot fall back on any collateral to recoup their loss. That is why they charge a higher interest rate that reflects this risk. However, the interest rates vary depending on the unsecured business loan types and the creditworthiness of the borrowing firm.

● Shorter Loan Terms: Lenders typically want their money back faster when they lend a sum without any collateral security. That is why many unsecured financing options come in the form of short-term business loans. Generally, SMEs can get collateral-free funding for upto three years.

● Cap on the Loan Amount: Low-doc unsecured loans are usually capped at $500,000. Since unsecured business loans carry more risk, lenders are often hesitant to approve sums higher than this cap. However, it is not impossible to get a higher loan amount. Eligible businesses with a good credit history may be able to borrow more than $500,000 in some cases with full-doc approvals with formalities on the ATO portal.

How to Choose the Right Option for Your Business?

If you are a business owner in Australia seeking collateral-free loans, you should carefully compare your options before applying for credit. Making multiple credit inquiries can potentially ruin your credit score. Hence, it is crucial to be selective about the options you explore. The following tips can help you simplify the process and help you get a business loan product that suits your needs:

● Look for Loans Tailored to Your Requirements: As a first step, you should ascertain the business purpose for which you need a loan. Do you require money to renovate your business premises? Or do you need a cash flow buffer to navigate seasonal dips and peaks? In the first case, a lump sum loan might be a suitable choice to fund your renovation project. In the second scenario, an unsecured credit line may provide a better solution. Your loan purpose will help you narrow down to the best unsecured business loans for your unique requirements.

● Evaluate Your Business Performance: Lenders determine unsecured business loan interest rates and other loan terms based on factors like business performance and creditworthiness. If you have been operating for over a year with a high monthly turnover rate, you may find it easier to get large unsecured loans. On the other hand, if your business is relatively new with limited cash flow, the lenders may be more conservative with lending you money. You should account for these factors while choosing the most suitable options to ensure an easier approval process.

● Check Available Government Schemes: Business owners in Australia can check for available government schemes before applying for loans. For example, the Australian government implemented the SME Guarantee Scheme till June 2022 to extend the availability of credit for SMEs in the country. Although this scheme has expired, you can keep an eye out for unsecured business loans with government guarantees. Government-backed loans tend to be cheaper, making it easier for SMEs to get funding for growth. An experienced financial broker can help you discover relevant schemes and select the best loan products to finance your business.

● Consult a Finance Broker: SMEs rarely get unsecured loans from banks due to their strict lending criteria. In such cases, they can apply for collateral-free loans with alternative lenders. However, many business owners do not know which lenders to approach and how to access the right loan products. When such a situation occurs, it is best to consult an expert broker. A finance broker can evaluate your business performance and assess your financial requirements to suggest suitable options. They can connect you to trustworthy lenders and streamline the process of choosing and applying for loans.

Documents and Procedures to Apply for Unsecured Loans

After exploring and comparing various loan products, you can apply for a suitable option. The procedure to apply for an unsecured business loan typically consists of the following steps:

● Finalise Your Loan Requirements: An eligible business owner can get an indicative quote from the finance broker to determine the potential repayments for an unsecured loan. This quote will help you ascertain how much you should borrow, considering your ability to afford the interest payments.

● Prepare Your Business Documents: Typically, SMEs must submit their identification details and banking documents for the past six months while applying for low-doc unsecured loans. However, if the loan amount exceeds $500,000, you may have to complete formalities on the ATO portal and submit additional documents. Full-doc loan approvals require detailed financial statements, ATO statements, and business activity statements (BAS).

● Submit Your Loan Application: You can fill out the online loan application form and furnish the required documents in consultation with your broker. You can expect to hear back from the lender within twenty-four to seventy-two hours. In most cases, applicants get their loan approvals within one day.

● Sign the Loan Agreement: Once the lender shares the approval, the borrower must carefully check the loan terms. You should assess the agreement to determine the interest rate, repayment period, and additional requirements like a personal guarantee. In case of queries or concerns, you can discuss them with your finance broker to get more clarity. If you are satisfied with the loan agreement, you can sign the document. Once the agreement is finalised, the lender will provide you with the borrowed sum.

Do’s and Don’ts for Streamlining Your Loan Application

When applying for unsecured business loans for sole traders or other types of SMEs, you should follow certain best practices. Being careful while finalising your loan application can increase your chances of getting approved. But before we delve deeper into the do’s and don’ts, let’s break down the common issues that can cause lenders to reject your loan application:

● Poor Credit History: An unsecured loan is quite risky for the lender. As a result, they may be hesitant to lend money to a firm with a poor track record of managing credit. If your credit score is low, you should consult a finance broker to connect you to lenders who provide unsecured business loans despite bad credit history.

● High-risk Industry: Some industries are more volatile than others. Companies operating in these industries may find it tougher to raise large unsecured loans. Lenders assess the firm's performance alongside key industry trends to determine whether to accept or reject the loan application.

● Cash Flow Issues: Businesses with inconsistent revenues or long invoice cycles may struggle to service the debt and default on repayments. In such cases, lenders may reject loan applications from firms with high-risk cash flow problems.

● Inadequate Trading History: Typically, businesses trading for six months or more are eligible for unsecured loans. However, some lenders may consider a trading period under one or two years to be too risky for lending a collateral-free sum. Thus, inadequate trading history can be one of the likely reasons for getting rejected when you apply for a loan.

● Existing Debt: If your business already has a lot of debt on the balance sheet, lenders may be more conservative when they evaluate your application. High existing debt is one of the top reasons for rejecting applications for unsecured loans. When you have a significant debt burden, a new lender may be worried about your ability to service all the loans.

The above issues can give rise to roadblocks when you apply for an unsecured loan. However, the following do's and don'ts can help you avoid common mistakes and get approved for a loan.

What to Do While Applying for an Unsecured Business Loan?

● Be Transparent: A detailed and transparent application is more likely to get approved. When you furnish all the relevant documents, it becomes easier for the lender to gauge your requirements and assess your intentions.

● Clarify the Loan Purpose: A firm can use the amount from an unsecured for any type of business expense. Typically, lenders do not impose any rules about how the funds can be used as long as they are utilised for legitimate business purposes. However, a firm can increase the competitiveness of its loan application by clarifying the purpose of the funds. They can explain how they plan to use the money to run, grow, or expand the business. This plan can help convince the lender that the borrower has a legitimate reason for borrowing the amount.

● Improve Your Credit Score: Lenders assess the risk level associated with a loan application by reviewing the applicant's credit history. A high credit score indicates that the applicant is likely to repay the loan without defaulting on instalments. Hence, businesses with good credit records find it easier to get collateral-free loans. If your credit score is poor, you can still get unsecured business loans. However, it is advisable to focus on increasing your creditworthiness to ensure easier approvals in the future.

What Not to Do While Applying for Unsecured Business Loans?

● Avoid Excessive Borrowing: Debt is a valuable source of funding for most businesses. However, firms must strike the right balance when taking new business loans. Excessive borrowing or applying for a sum higher than required can put off potential lenders.

● Do not Submit Multiple Applications within a Short Span: If you apply for business loans with multiple lenders in quick succession, it can lower your credit score. It is crucial to carefully compare lenders and submit well-thought-out applications. Indiscriminately applying for different loan products signals to lenders that you do not exercise discretion while seeking credit. As a result, they may flag your application in the high-risk category.

● Do not Allow Repeated Credit Checks: Business lenders request permission from firms before running hard credit checks. They cannot run these checks without the borrower’s formal consent. Too many hard inquiries within a short span can harm your credit score. Hence, you should be cautious before allowing multiple credit checks. Instead of permitting credit checks, you can get an indicative quote from expert finance brokers. They can help you get pre-approved without any upfront credit checks so you can get the necessary information without compromising your credit score.

Conclusion

Unsecured loans can be instrumental to business growth and expansion in many Australian SMEs. These loans offer incredible flexibility to borrowers, providing them with the leeway to fuel their businesses without tying up assets. You can explore various collateral-free funding avenues and unsecured business loans with government benefits. Contact the lending experts at Broc Finance to learn more about the available options and find unsecured loans that match your needs. Our experts can help you with everything from startup business loans to bad credit business loans to help you steer your venture to success!

Source: https://www.brocfinance.com.au/blog/guide-to-understanding-unsecured-business-loans/

#business loans in Australia#secured business loans#unsecured business loan#unsecured business loan types#quick business loans#business overdraft#business line of credit in Australia#short-term business loans#small business loans

0 notes

Text

Find affordable unemployed loans from us in direct lender facilities. We are a direct lender that can offer you an easy and effective unemployed loan attributing it with easy repayment options and affordable interest rates. Stop worrying with paying your bills and get a loan from us.

#loans#finance#personal loans#small business loans#start up business loans#loans without guarantor#Unsecured Business Loan

1 note

·

View note

Text

In the realm of business financing, unsecured business loans stand out as a strategic and flexible option for entrepreneurs. Offered by various banks and non-banking financial companies (NBFCs), these loans are granted without the need for collateral, making them an attractive choice for running, expanding, or starting a business. Often referred to as signature loans, unsecured business loan from My Mudra come with minimal documentation, ensuring a hassle-free application process.

Benefits of Unsecured Business Loan

Unsecured business loans, in essence, are financial instruments that do not require collateral for approval. Unlike secured loans, which are backed by assets, unsecured loans provide a quick and straightforward solution for businesses in need of capital.

Easy Application Process:

Apply unsecured business loan online at www.mymudra.com with basic details for a straightforward application process

Minimal Documentation: Submit KYC documents, company financial details, and registration details for quick processing.

No Collateral Required: Enjoy the freedom of a collateral-free loan, eliminating the need for additional security.

Shorter Tenure and Flexible Repayment: Benefit from a shorter tenure compared to other loans, coupled with flexible repayment options.

Fast Amount Disbursal: Experience quick disbursal of the loan amount within a day, ensuring timely financial support.

How to Apply for an Unsecured Business Loan

Applying for an unsecured loan for business with My Mudra is a simple three-step process:

Apply Online: Visit www.mymudra.com and click to initiate the application process.

Document Verification: Complete necessary documentation within a day for a speedy approval process.

Quick Disbursal: Receive the approved loan amount in your account within a day.

Documents Required for Unsecured Business Loan

To facilitate a swift approval process, My Mudra requires minimal documentation. Applicants need to provide the following:

Identity Proof:

PAN Card (for Company/Firm/Individual)

Aadhaar Card

Passport

Voter's ID Card

Driving Licence

Address Proof:

Aadhaar Card

Passport

Voter's ID Card

Driving Licence

Additional Documents:

Bank statement of the previous 6 months

Latest ITR along with computation of income, Balance Sheet, and Profit & Loss account for the previous 2 years (CA Certified/Audited)

Proof of continuation (ITR/Trade licence/Establishment/Sales Tax Certificate)

Other Mandatory Documents (Sole Prop. Declaration, Certified Copy of Partnership Deed, Certified true copy of Memorandum & Articles of Association, Board resolution)

Interest Rate and Charges

My Mudra is committed to transparency, with no hidden charges for Unsecured business loan in india. The interest rate and charges are as follows:

Unsecured Business Loan Interest Rate: 15%

Business Loan Processing Fee: 1-2%

Other Charges: NIL

Conclusion:

In conclusion, My Mudra serves as a one-stop solution for diverse financial needs. This article sheds light on the advantages of unsecured business loans, emphasising the seamless application process and quick disbursal offered by My Mudra. Transform your perspective on business loans, overcome financial hurdles, and propel your business towards success. Apply for a My Mudra Business Loan today to experience swift approval and disbursal within a day.

#unsecured business loan#unsecured loan for business#unsecured business loan in india#unsecured business loan online#unsecured business loan india

0 notes

Text

We are here to help your business with personalized payroll financing solutions to keep your business growing. The most business-friendly way to cover payroll. Fast, flexible, low-cost payroll funding whenever needed. Payroll can’t wait. Neither should your funding. Paying timely salary has been the driving force behind employee’s productivity.

#payroll funding#unsecured business loan#payroll financing#msme loan#business financing#Advance Salary#Working Capital#Commercial Loan

1 note

·

View note